Video Cast Webinar Briefing of 6 February 2020

Helping You Thrive in the World's ONLY Vital, Scarce and Recession-Proof Market

In this exceptional briefing CEO Eckelberry applies Geoffrey Moore's proven analysis of product life cycles and technology adoption with a brilliant comparative between today's disruptive trend in transportation and the rising wave of decentralization in water. Why is OriginClear so perfectly positioned?

After Watching: Take quick poll HERE

Transcript from recording:

Introduction

Hi, this is Riggs Eckelberry. Welcome to the replay of 6 February. This is called Water Is The New Gold, and I’ll explain why that is. We have some great news coming out of Spain, with a video which you will enjoy. We then get into, “What is this decentralization phenomenon?” as we are seeing it currently in transportation and how that connects to what is happening in general in technology disruption, and how to spot technology disruption. What if you had purchased Tesla stock 10 years ago at $30 and now it’s $750?

How do you spot these, because that’s key. I give you some good technical insight on that. Then, we get into how OriginClear has this answer to the self-treatment disruption that is happening. And, a great report from Dan Early – live – where he reports from the ground on specific situations he is running into, how this is really happening and how long ago the decentralization process started, before people even knew it was happening. Finally, I end up with some discussion of our offerings, and with that, I’m going to go ahead and let you see the show.

Water Is The New Gold

Riggs: Hello everyone. It's Riggs Eckelberry here and we are on the 6th of February. This is Water Is The New Gold and our motto here is “Helping You Thrive In The World's Only Vital, Scarce, ReCession-Proof Market.” For those of you who are new to this, what this really means is that water obviously is vital. It's life or death and then obviously it's also an increasingly scarce commodity, and finally people keep using water. So, it's very recession proof. Look at what's happening with oil right now. Oil demand is dramatically going down because of an epidemic in China.

That's not going to happen with water. So, water really is a form of gold if you think of it that way and the fact that it is going through under-investment for infrastructure, opens up the OriginClear effort. With that we're going to continue here with the usual safe harbor statement, which basically says that would I say in this briefing of course is fully intended, but may not work out as planned and we simply have to warn you of that.

The other very important thing is I'm going to be talking in this briefing, because of demand, about the offerings that are in progress, that are planned and for that, there's a disclaimer that requires accredited investors, relies on a specific exemption for registration and obviously there is always a risk and various restrictions. I'll be happy to discuss it. Any of our people will be happy to talk about the fine print because we want you to be fully aware at all times. Let’s go on.

Results From Spain

This morning we announced great results from Spain. I'll play a video shortly, but back in October, we went to Spain to witness a system that was very strong. At the time they were going to get these independent lab results and they did. What were the results? 99% reduction of chemical oxygen demand. Chemical oxygen demand is basically all the chemicals in water, anything that's not water, can be oxidized, meaning can be turned into CO2 ─basically the oxygen can bind with the carbon and neutralize it.

So essentially what we've done here is a huge amount of neutralization, virtually all of the organic materials, chemicals and so forth are gone. And then reduction of nitrogen by 96%. What that means is, hog farms, right now, are violating the regulations in Spain's Royal Decree 324/2000 here of the year 2000 and that limited it to 210 kilos per hectare. A hectare is about two and a half acres and we can reduce nitrogen production to 16 kilos per hectare, which is less than 1/10. That's an amazing result. So, with that in mind, we have a video we're going to play for you.

Technology Partners: OriginClear & Depuporc

Riggs: The video was actually from November, just before Thanksgiving. You saw on the last frame a picture of Bill Charneski in the group photo, who was very instrumental in making all this happen. He's a kind of the quiet guy, but he gets it done. So, we greatly appreciate it. I'm going to go back into the share mode now and discuss a little bit about trends and I'm going to be leading up to a point here, if you'll be patient. For those of you who are joining us, we've been discussing how OriginClear is doing with water treatment, our win in Spain which we just covered and of course we gave some disclaimers, which are very important. You'll have some contact information at the end to discuss this.

Decentralization In Mass Transit

I've been talking to you about decentralization and mass transit and that is actually a big deal.

We have a problem in mass transit. What is driving the trend towards decentralization in mass transit? Well first of all, all central mass transit projects in American have massive overruns. Just for a subway in Los Angeles, which is not terribly utilized, we had almost a $2 billion cost, which was a quarter billion over and it makes you wonder about the California bullet train.

The California bullet train is right now not happening fast because of overruns and they’re building small segment somewhere in the Imperial Valley that is going to run from nowhere to nowhere just to prove a point. What's the alternative? The alternative is very simple. It's the self- driving car. The first thing that's happening with self-driving cars is the adoption of electric vehicles, because they are vastly more efficient. They work really well as fleet cars, and tend to be a software platform.

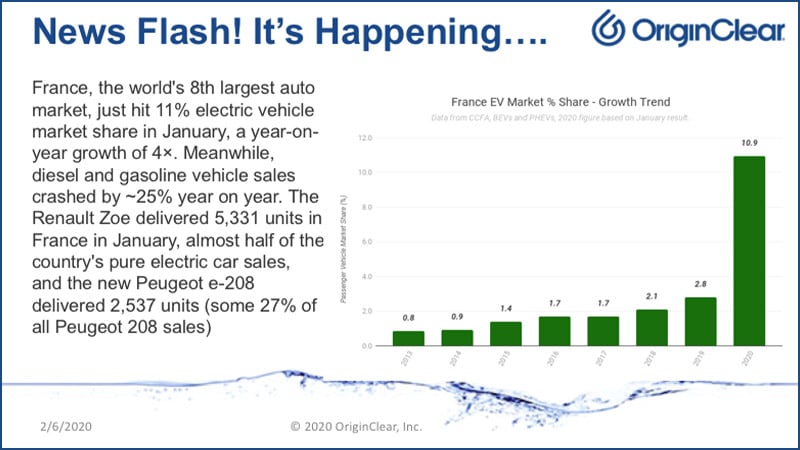

News Flash: It's Happening...

Sure enough, I saw this today, that France auto market has just hit 11% market share in January, growing four times year on year and meanwhile gasoline vehicle sales crashed about 25%. This isn't even Tesla, this is Renault and Peugeot cars. All of a sudden 1 out of 10 cars in France being sold are electric.

A lot of people have felt and have been talking about these adoption things and making these predictions about how we're all going be on electric cars in 10 years and in fact we won't even own these cars, they'll just be on a subscription with costs that people couldn’t possibly beat. Well it's happening and you'd be into it too, if your cost of $5,000 or $10,000 a year for your car or truck went down to hundreds of dollars with much less traffic jams, et cetera.

Because of the reduction of vehicles on the road, we're going to dramatically increase the amount of space available and LA is one-third parking lots, there’s two San Francisco worth of parking lots in LA and the big challenge is going to be what to do with these parking lots, they will be empty. Let’s say you go to the market, your little autonomous vehicle will take you there and drop you off and won’t even stop in the parking lot. That's a trend that is really, really happening.

I totally understand when people say, "Riggs, I don't understand about decentralization of water because I don't see it." When you think that the decentralization in transportation is happening, and yet at the same time people are going, well I don't see it and it's multibillion dollars, I totally get it.

In other words, the early stages of anything are not super visible, but I guarantee you that's when the market starts. I was not into Bitcoin 10 years ago, a lot of us thought bitcoin was a novelty. Well as you know, how differently the results have been on that. So, think about things when they're ridiculous and not to be thought of, that's when you need to invest in these things. Think about that.

Inside The Tornado

I'm going to cover a book that I love and this book is called Inside the Tornado written by Geoffrey Moore and this is a classic about the high tech life cycle. Meaning that there's a product life cycle, it grows, it plateaus and then eventually goes away. High tech is different and there's really good reasons for it, and high tech products, they adopt it like a tornado. It's also true of just technologies. High tech is great, but now it's starting to happen in energy and transportation and so forth. Technology is hitting everything and it's hitting in water, as I’m going to show you. I’m going to show you something called the bowling alley.

What's The Bowling Alley

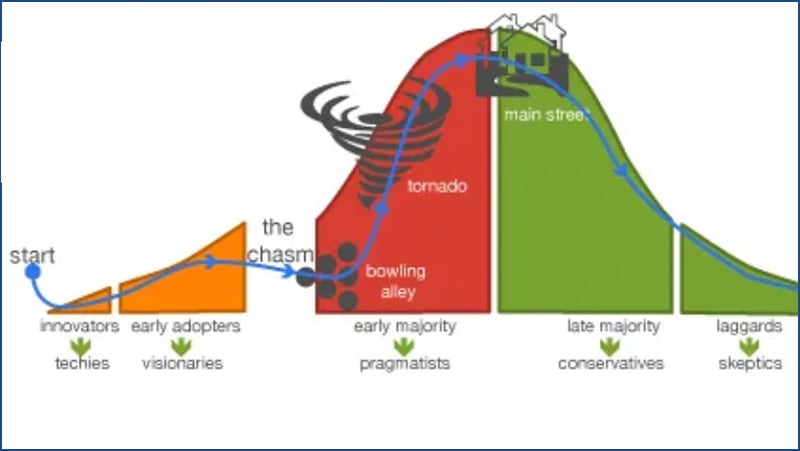

The bowling alley is the most important thing that I learned during the dotcom about how to get technology adoption. Let me show this to you. This is a product life cycle, but it's a product life cycle of high tech and any technology. Technology accelerates adoption. You’ve got to think about technology. At the very front of it, you have what I call “the nose of the Armadillo.” That is what I call the crazy people. The early adopters, the people who, they’ll buy anything wild, they were the people who were doing keto and were like, “What’s a keto?” And they don't do it because they have any particular reason, they just like it because it’s new.

Then there is a strategic adoption phase, which you can see there, these are basically the strategic buyers . These are people who see a reason to acquire the technology, to get a leg up on their competition. And they'll go ahead and they'll create the applications. This is like our partners in India, Permionics, who literally are taking our [Electro Water Separation™ and Advanced Oxidation] technology and creating it into mainstream products. Then there is a very important thing called the Chasm. You have to cross the Chasm. Geoffrey Moore wrote a previous book to Inside the Tornado, which was Crossing the Chasm.

The challenge here is, how do you go from people using your technology, but they have to do all this integration themselves, over into this tornado of adoption. This tornado of adoption is called The Bowling Alley, at the bottom. What is the Bowling Alley? It's basically each one of those “bowling pins” that you see there. There are six of them, but there's going to be a lot more, of course, in an industry. They are applications of the technology. For example, you know we've seen various applications, from the one that you just saw the video on, manure effluent, that is a key one.

What you do is create a complete whole product, that then creates one bowling pin. And then, another pin for another product, and you keep creating whole products until finally you have critical mass and it takes off into what's called a tornado. A tornado is really interesting, because in a tornado people don't worry about whether something is good or right, they just see everybody else doing it and they adopt it. At that point it's a race for market share.

This is why Tesla is so far in the lead of anybody else in the Western world. Certainly, in America, because they have gotten so far ahead that they're grabbing market share. I would argue to say that electric cars in the U.S., for sure, and elsewhere, are in the tornado. Why? Because various electric applications, you've got now semi-trucks and you've got your SUVs and this and that other thing. Just beginning of the adoption of the autonomous vehicle!

So the tornado is where things spin out of control and people just buy. In the late 80's, , I was working at a computer company in New York City and we were trying to use different software, we had one called Ingres which was very good. And then there was Oracle, which didn't work at all. And guess what, Oracle won, why?

Because it didn't work in the late eighties but so many people adopted it and they're like, well, they’re also getting it, this will work. Sure enough, it did. So, Larry Ellison pulled off a tornado with a product that didn't necessarily work at first. Now on the backside of this, you get the conservatives and the skeptics, and in technology you do not market to the conservatives and the skeptics. Why? Because they’ll do it anyway. They're like the caboose, at the end of the train, they will follow.

And so the conservatives will buy when you're doing good. Like laser jet printers. First you start with the regular one and then you have a colored one. You have a small one, you have one in different colors, and so forth. And that's where the conservatives come in. Eventually the skeptics would go, "Well, I guess I'm just going to have to get this". These are people who are getting laser printers three years after you started.

So that is the technology adoption process, and we are now moving, I believe, beyond the early market into the bowling alley for water decentralization. Now I'm going to recap what I did last week, a couple of quick slides, but just again, for those of you who just joined us, we've been discussing the amazing win in Spain and we had a video that was fun, and we've also been talking about how this energy and transportation topic is taking off, as I've been discussing these last few webinars. And then finally, we're talking about this inside the tornado concept, which is Geoffrey Moore.

Centralized Water Systems

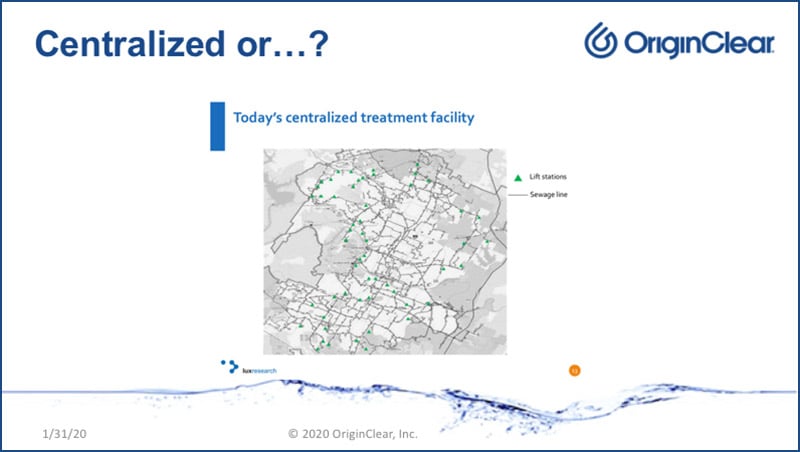

This is from the Lux research webinar of 2016, and they had a very early and brilliant view of what's going on in water, which is moving from these centralized systems. You can see these little triangles are lift stations and all those lines are sewage lines, and water is being pumped to a central facility using these lift stations continuously lifting it up so it gets somewhere. That's the classic view and, you know, it's worked for a long time.

Decentralized Water Trend

However you need a new model, which is because of water scarcity and the need to reuse, that is pushing us into decentralized infrastructure, and the lower volumes of wastewater equals smaller pipes because each place is doing its own treatment, therefore smaller pipes are needed.

Furthermore, you’ve reduced what's called hydraulic loading, to downstream centralized facilities, which no longer have that load. They don't have to be quite so big. And finally, you have advanced treatment technologies, which Dan is going to talk to you about, you get localized reuse, which is not something you get with centralized water treatment.

Why Hasn't This Been Implemented

What are the barriers? They are, number one, scaling down, again, something Dan is going to talk to you about. Number two, you have got to have industrial internet of things. IIoT, Industrial Internet of Things, which means appliances at all these locations with sensors and ways to drive it, because you can't have a water engineer at each location, at most you'll have a janitor. System reliability: you've got to make sure that if you're doing water treatment at your car dealership, like the one we just did, we don't want it to stink, you're trying to sell a car.

And finally there is some regulation updating needed, but that is happening naturally, because strangely enough water treatment facilities are increasingly delegating to all these various factories, agriculture, commercial buildings and such.

Modular Water Systems™ Structurally Reinforced Thermoplastic systems (SRTP) are built with non-corrosive reinforced plastics with a lifespan as great as 100 years. Pictured: a Dan Early design using SRTP.

The Answer

Which brings us, of course, to what we consider the answer, which is the packaged modular systems, so we're going to have a little conversation with Dan.

Talk With Dan Early

So Dan, I wanted to talk a little bit about what you're seeing as a witness to what's going on reviewing these various things. First of all that we have a need for advanced treatment systems, scaling things down, remote monitoring. Tell me a little bit about what you're finding in the field with actual situations.

Dan: Well, thank you Riggs, and it's good to be with you this evening to share some of my insights, some of my background. If you dial the clock back about 25 years when I entered into the engineering profession, working as a consultant, I spent a great deal of my time working with municipalities that committed themselves to the long-term model of regional centralized utility implementation and utilization.

Increased Demand

What I witnessed as a young engineer straight out of college was I was working on projects in the mid-nineties where we were rehabbing and rehabilitating dilapidated collection systems, waste water collection systems, dilapidated water distribution systems, systems that had been in for 20, 30, 40, 50 years, some of them a little bit longer than that. Most of them had been way beyond their life cycle. So, as I worked through the 90's and into the early 2000's with my own consulting firm, I saw an increasing demand for this decentralized need, both on the water consumption end, on the clean water side of things, and on the dirty water on the back end of things.

Crossing The Rubicon

In the early 2000's I was approached by some clients of mine, as I worked as a consultant, and they were like, "Dan, what can we do? We need help here. We don't have public sewer, we can't connect to the regional sewer, it's too far away", and that type of thing. So, what happened is that the need for decentralization has crossed what I call the Rubicon point. It has reached a point where if we don't push forward with decentralization for our utilities, we can't go back. We have to go forward. That is the task that's ahead of us.

The things that I began to see and to experience in the mid 2000's, I was able to participate in some projects where we went off grid. I did some of my very first solar powered onsite water treatment and waste water treatment and disposal systems for some customers that were very forward thinking, I mean, two decades ahead of the curve.

Some clients, much larger clients that were much more well-heeled. A good case in point might be the Primland resort in Virginia. It's a golf club community, got some mixed-use commercial, multifamily, residential and that type of thing. Very exclusive resort. They committed themselves to a decentralized reuse model, and this was 15 years ago.

So, the trend has always been there. The thing that is now happening, and this is the thing I'd like to share with the listeners that are with us this evening, the thing that has happened in the last 10 years, and the thing that's happening even more in the last five years is that technology has reached a point, it has evolved to a point where it is much, much more cost effective and much more readily available to implement cost effective and affordable decentralized water treatment and waste water treatment reuse and reclamation.

Remote Monitoring & Control

The technology is like Riggs was talking about in the decentralized graphic he had on the screen a few minutes ago about the technologies where you do treatment, where you have the ability to do remote monitoring and you can remotely control the efficiency and the efficacy of these technologies. That has become incredibly inexpensive now. Your cell phone gives you the ability to control these advanced treatment devices. That didn't exist five years ago.

Growing Market Demand

There is a demand in the marketplace, so technology has evolved. The demand has been there. The cost of regionalization has gotten exorbitantly expensive. I mean, it's out of control. And so now what we see is that there are locations like communities there in central Florida, on the coast of Florida, there are counties in Long Island in New York where there are moratoriums in place now, where they want to implement decentralized wastewater treatment.

They cannot afford to extend big regional sewer lines to connect hundreds of thousands of individual customers who do not have access to public water or public sewer. What is going to happen is just like Riggs said in his graphical reference there. There is going to come a point where the demand and the technology merge and you have this massive adoption of these technologies, and it will happen. We are there today. We are at the cusp, at the doorstep of that taking place.

I think the places you will see it will be Florida, New York, water scarcity regions that suffer and experience water scarcity out in the Southwest and California and places like that. Those are going to be the places where it takes off first. That is what I am seeing out there in the marketplace.

Riggs: Well, and I appreciate you looking at the overall 30,000 foot view, this is unique to get that kind of view and it blows me away that it started 20 years ago and that Virginia resort was 15 years ago, but those were those people who adopted it because there was some kind of strategic gain that could get out of it. And then now it's happening widely. If you wouldn't mind telling me about a couple of specific instances, sharing the actual, these applications that we think are putting us into the Bowling Alley up the Tornado.

Representative Projects

Dan: I'll be glad to, Riggs. So, the first example that we'll discuss is a project that we most recently were able to execute with the OriginClear and Progressive Water team. We had a project in Pennsylvania, we're working with an automotive dealership. They had a piece of real estate that needed to be developed. It was beyond the normal reaches of public sewer. We were approached by a local consulting group.

They asked us, said, "You guys appear to understand how decentralized works and how to apply it in a small-scale fashion. What can we do, what options exist and what technologies can we deploy that would work with the state regulatory code and provide us a solution?". So very quickly, once we understood the capacity needs for this automotive dealership, we were able to recommend a small-scale decentralized wastewater treatment unit that would collect all of the black water from the toilets, urinals and hand sinks, which constituted probably about 90% of the wastewater generation at this dealership.

So we provided a treatment system where we collected, treated to an advanced level of treatment using a membrane bioreactor technology, and then we were able to store and recycle that water and reuse it for re-flush and reclamation in the toilets and urinals. So, it was a closed loop system. It was a 1,500 gallon per day system, which for those listeners that may be on with us tonight, that might be the equivalent of three or four medium sized homes. To give you some sense of the hydraulic size of it. Very affordable, very effective. It was far cheaper to do that than to extend five miles of sewer line to get to the nearest public sewer connection. So, that's one good example.

Another example is just within the last two weeks, we had a customer down in the deep South in Alabama. They came and approached us and said, Hey, we have this old wastewater lagoon. We've got a residential development. Our only form of treatment here is this lagoon system. It had been in place and had been treating for 40 years. It was out of compliance. It was an old technology. Lagoons have been around for 50-60 years. Their time has come and gone. As regulatory limits and regulatory changes have created conditions where these lagoons don't work.

It's now time to upgrade, connect, change or technology or what have you.

This customer was in that situation. So, they came to us and said, Hey, we are under the regulatory thumb. We need a solution or we are going to be fined excessively or possibly incarcerated. And so what we did is we evaluated their technology, and their system and what we have been able to deploy or what we're going to recommend and what we're getting ready to deploy with them is a modular, advanced, fixed film bio-reactor system, where we are able to use the lagoon as an asset.

We don't have to close it, we don't have to de-commission it, we get to use it for what it was intended to. And that was for storage, pretreatment and partial treatment. We are going to deploy an advanced biofilm reactor system that is basically delivered in the back of a pickup truck. We offload it and we float it in the lagoon. It's got one moving part on it. And, we leverage a very powerful biofilm technology that grows on this porous ceramic media that is a part of this treatment system.

That technology, that system is nominally rated for 30,000 gallons per day. Low energy, low cost, sustainable, durable. So, that is another example of the ability to go decentralized, and to take advantage of an existing asset that's already in place and to remove a burden that would be forced upon that utility owner.

One thing I would add as I close out this example, that customer, that utility customer attempted to connect to the public sewer in the adjoining town. All they had to do was pipe it about 500 feet. The local town did not have the sewer capacity, and they could not accept this customer. So, they had to stay with a decentralized model because it'll take them years to upgrade the public facilities to have the capacity to treat this one utility customer. So, that's a good example there.

Municipalities Forcing Self-Treatment

Riggs: I love what you're saying there because, these municipalities are essentially forcing people to do self-treatment, and it's a terrible thing. But, same time it creates an asset. Now, call it a utility, it’s a trailer park, and this trailer park is now its own little micro utility, just like the car dealership in Pennsylvania we were talking about, they have now created more value for their location.

What's great is that you've created these really elegant solutions that are odorless, that in fact in the case of the trailer park can actually reduce odor, and take care of themselves. They run pretty much un-attended with some remote management if necessary. And, I must commend you for doing this because you're really are kind of the Johnny Appleseed of the decentralized water revolution. So, I thank you very much.

Discussing The Round

I'm going to quickly go back to the PowerPoint because I want to cover something very important to you. What about our funding round and what is going on with that? So thank you Dan, I appreciate it, and we are going to continue here. Keith in fact, sent me, the same Keith who just sent me the question, sent me a note this morning, and I think it's a very good one.

He's saying basically look, mergers and acquisitions are a big deal. What people need to know is that it takes patience. Basically, the M & A process consists of first of all, getting a target that you like and they like you, which actually relatively easy given that, we're pretty dynamic and people like that. We're not just going to get rid of them when we acquired them. But then you need to go in, and put the deal together.

Now, we believe that we have the ability to do this funding in house. Why? Because, we've worked out a way to do it with not millions and millions of dollars, but with a lot less. And, meanwhile our ability to do funding has risen tremendously. So, the next step is, you then get the funding together. The third one is, you go ahead and make the acquisition.

Now, what's very important also is, how you then replicate that process so each time becomes faster and faster. That's when it becomes exciting. Why? Because, we're doing it every couple of years, but now we need to do several per year. And that's our intention to moving forward. So, thank you Keith, that is very much what we're working on.

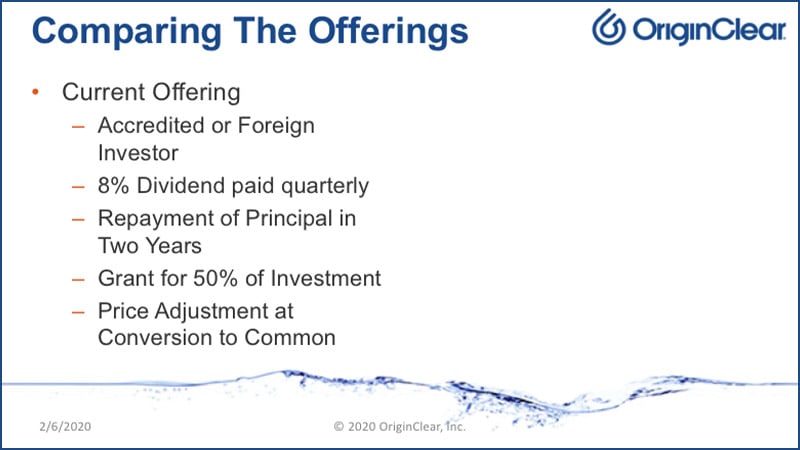

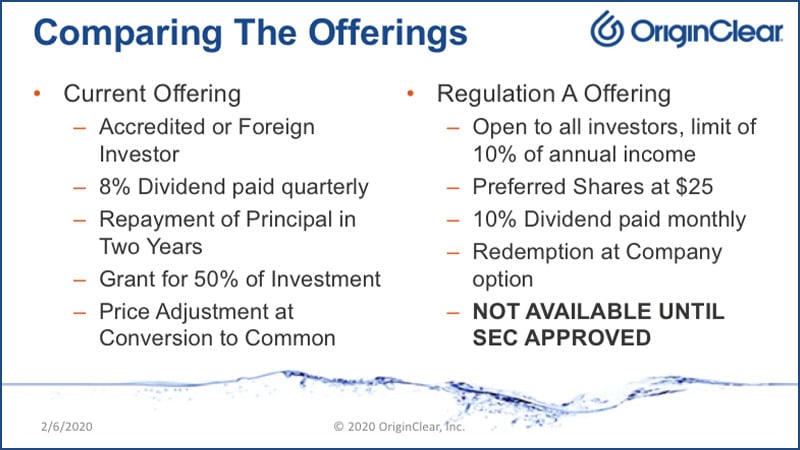

Comparing The Offerings

Okay. Let's talk about the offerings. We've been going on very successfully with an offering for accredited investors only. Or if you are a qualified foreign investor, either way you can invest in this. It's a $100,000 minimum, but we’ll break that down. And what it is, is you invest, let's say $100,000, you are then getting that back in two years. That $100,000 comes back to you. Along the way you get an 8% dividend payed. So, you've got $16,000 coming back to you over the period, and that $100,000 back. In addition, you get stock granted to you, which pretty amazing, huh? And that stock grant is preferred shares, so when you go to convert them to common we also make sure that you don't lose money on conversion. So, it's amazing. Now, one downside to this is, it’s only for accredited investors.

Regulation A

So, what do un-accredited investors get? Well that's the regulation A which I must caution you, is not being offered in this briefing. Let's say you make $50,000 a year, you can invest $5000. These preferred shares are priced at $25. Now you say, “Wait a minute Riggs, you are sitting around $.10.” Well, these are preferred shares. They have a face value of $25. What they generate is a 10% annual dividend paid every month. And the difference between what you see on the left is, we redeem it when we want to. So, theoretically we could take your investment, which is a minimum of $500, and we could just hold onto it forever and keep paying you the 10%. Wouldn't be very smart, because after 10 years, less than 10 years, because of time value of money, we would have already paid out that money. So, it's something we would have wanted redeemed, but, that's at our company option.

There's some other bells and whistles, which we'll discuss at the right time. Remember that this is going through the Securities Exchange Commission approval, which will probably take between 60-90 days. We have no control over the process. But, we will tell you about it. Now, that offering you can tell is not as great as the one on the left. So, I would strongly counsel if you're an accredited investor to look at this current offer.

Contact Us

We're going now talk about the contact information. Ken Berenger extension 201, Ken is the master designer of our offerings, and he's got an amazing business sense.

Michael Mann, who's our VP of sales, who's helping Dan Early sell systems, is currently also helping with some of the offerings. And, finally Devin Angus who's been around forever. And it's a direct way to contact with me, or just send an email to inv est@originclear.com. I hope to see you again very soon on this channel. And with that, I'm going to end the meeting. Thank you so much all. Have a good weekend.

Afterword

OK, that was the show and I hope you enjoyed it! There is a quick poll following that you can click through and give us some feedback. I’d really appreciate that and I pay attention to every single one of these. Do be sure to sign up for the coming week’s live CEO briefing, Water Is The New Gold. Thank you.

Take the quick poll: HERE

Register for the next Water Is The New Gold episode: HERE

Important Disclaimer

The securities referred to in this presentation may be sold only to accredited investors, which for natural persons, are investors who meet certain minimum annual income or net worth thresholds. These securities are being offered in reliance on an exemption from the registration requirements of the Securities Act and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The Securities and Exchange Commission has not passed on the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials. The securities are subject to legal restrictions on transfer and resale and investors should not assume that they will be able to resell their securities. Investing in securities involves risk, and investors should be able to bear the loss of their investment.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)