Insider Briefing of 16 April 2020

Helping You Thrive in the World's ONLY Vital, Scarce and Recession-Proof Market

The USA's economy is teetering in the wake of the Coronavirus and statewide lockdowns preventing most businesses from operating. With financial markets crashing, and the Federal Government throwing trillions of dollars at the problem, is there a sensible, secure and protected avenue for investors and the "average" American to latch onto? Find out in this briefing about The Water Company For The New Economy and what is means for you!

Transcript from recording:

Introduction

Riggs Eckelberry:

Hello everyone. This is Riggs Eckelberry again. We have been shooting things like crazy. Last night I shot 17 clips in a row, and actually the cameraman was me, the talent was me, I was all alone, so, you know how it goes. Anyway, I am going to go ahead and share my screen and play this little video.

Coronavirus Disruption

Hi, I'm Riggs Eckelberry, and I co-founded OriginClear almost 13 years ago, and I can tell you this, it's been an amazing journey. We've learned that the water industry is a huge industry. It is $1 trillion by now and growing, but it's slow moving. And if you want to make change happen as I do, I came up through the internet, the whole .com days accustomed to fast growth and it has been a challenge.

It is not the water industry's fault. It's a fact that it is very, very hard to get water projects done. There's permits, there's designs, and getting everybody to agree, technology issues are enormous, and of course there's capital. That capital probably is the biggest problem of all. I think that if capital was not the issue, things would have moved a lot faster. And so, we feel that we have addressed the capital problem. It was, ironically, the disruption of this Coronavirus that made us go, “Wait a minute, we have to do something different. We can't just imagine that the water industry is just going to magically start growing by leaps and bounds.” It does three to 6% per year. Well, that's not enough, right? That doesn't even keep up with population growth.

Revving Things Up

So, we were forced by the virus to look at what was going on and to go, “Okay, how can we really rev things up?” And we feel we have done it. It is a project called Investor Water™. You can take a look at it, really fascinating. We also really wanted to make it possible for anybody, nearly anybody in America, to invest easily. $500 minimum, we offer a dividend subject to an offering circular, which you must read. I will give you the web address at the end, but for an easy way to invest that would help us do our job and give you better yield than you can get from a money market or whatever.

The Water Company For The New Economy

And so now what have we got? We have got a company that is really designed for the new economy, that's why we say it is “The Water Company For The New Economy™.” We are fast moving. We have solved, we think the capital problem, we have an easy way for people to invest, we are able to move the company in a direction that we think it will become a major player. Now, when water companies become major players, they last. The dominant water company in the world was actually started during the reign of Louis the 14th of France, hundreds of years ago. So these are durable and they do good work.

But we are the company, we think that is fast moving that thinks in terms of internet speed, digital applications and marketplaces and breaking things down. Not these massive municipal projects, but things that a brewery might do or a housing development. These are ordinary sized water projects. We think that they will grow faster. I often say that in California, we won't see the high-speed bullet train, but we'll see the self-driving car. Why? Because freeways are already there and it is pretty easy to do, it's hard but it's not trillions of dollars hard.

So, we think a similar thing needs to happen in the water industry, which is to bypass all the big, heavy, billion-dollar, trillion-dollar water projects and actually get into solutions on the ground, right where the problem occurs. We call that decentralized water. It is a very important trend, we think. So, between decentralized water and Investor Water (which is how we think we have figured out how to finance this and that is an important pilot project we have going) and then this radically new way of giving people a way to make a decent yield with potentially converting to stock if they feel the time is right. They think that we have done our job right, and the stock takes off. Your decision, we would never get in the way of that, but at least the option is there. So, it's a wonderful, simple, elegant way to invest and do better than what you are able to in the economy today.

Water Is The New Gold - Offering

So, I wanted to tell you the link for this particular offering it's very important. It is www.oc.gold/offering. OC, OriginClear, Water Is The New Gold, so gold – right, offering. So www.oc.gold/offering. And to find out about it in a more-folksy way, because you will see a lot of dense, small print, which you must read, go to originclear.com.

At the top there's a big red band, click on that, and you will read about what we have accomplished, where we are going, what we're doing, what kind of company we are. And if you agree with us that this is a good thing we are doing, please invest.

I welcome it, and I would like you to join me every week, Thursday 5:00 PM Pacific, find out about on our website originclear.com/ceo, and I give a briefing. One Thursday out of every month, it is a video webinar, first Thursday, and the rest of the time it's audio. But the audio ones are really interesting because I just get relaxed and don't get into big presentations, so it has its own value. So, I would like you to join me for that too, please. Whatever you do, don't be a stranger, join our Facebook page, we don't need you to invest, but pass the word, okay? Thank you very much. Look forward to seeing you on our site, originclear.com.

Well, that was just one of the shows that I had shot. Like I said, I did 17 of these last night, various, short, long, about Investor Water, about the program we call, Two Million Pools, which is very interesting. So, what's going on right now? Well, we are working very, very hard to roll out Investor Water. That is this amazing breakthrough that really was accelerated by the absolute need to do something about the current situation in the world, and how to get help going for water. Water needs to get cleaner.

Coronavirus In Wastewater

I'm going to cover some issues relating to that and come back to the Investor Water model. So, it turns out that there are interesting discoveries. First of all, we know the coronavirus' traces have been found in wastewater, as you would expect. So, there is coronavirus in the wastewater, and normally wastewater would clean it up, I'm not saying it wouldn't, but there is some concern. For example, as we saw in the SARS epidemic, there was a spread through defective bathroom sewage pipes in buildings. This occurred in Hong Kong during the SARS epidemic and it is of course possible today.

Glyphosate Reduces Immune System Response

There is another issue which is glyphosate, which is Roundup®. Roundup has been shown to reduce immune response to COVID. In other words, it actually makes it more difficult for people to survive the COVID, and that of course is a concern for all of us. Now, the problem with Roundup or glyphosate is that it is very, very hard to take out of the water. It is minute, measured in nano-parts-per-million, and so it is hard to find and it's hard to take out. Typically, municipal water systems don't take it out in any kind of appreciable way, so it does make it into the potable water.

Advanced Oxidation & The Hydroxyl Radical

Back in 2016, we actually had a breakthrough, where we developed what was called Advanced Oxidation™, AOx™ and also AOx Plus™. AOx Plus was shown to create huge amounts of what is called the hydroxyl radical. That's OH, weird symbol. The OH, weird symbol means that it is not stable, it lacks a molecule. Typically, it will take a C. It likes to eat up Cs or carbons, so it will go through the water and eat up carbons. Well, that's great because you want to get all the contamination. We actually found by test, we had to go lease a very high-end mass spectrometer that is currently now in the LA cleantech incubator, and that spectrometer allowed us to actually measure what we were doing and we showed that we could reduce and potentially eliminate this from the water supply.

Commercializing Our Technology

At the time, we were not able to commercialize it, mainly because at the time we were dealing with technology and we have since learned that if you want to commercialize something, commercialize a product. That's what we have moved into. And that is why, for example, we have a great product involved with the animal farms. But at the time we had a limited capability to commercialize these. But as I say, it was later used in the animal farm product, and also my brother took it and some of his own technology and went ahead in 2018 and scaled up in the Permian to disinfect oil wells using this same technology. It was quite successful and we received a large royalty check at the time for that.

So the long and short of it was that, we found as successful application in the Permian disinfecting oil wells, which gets rid of that sulfur, rotten egg smell, which then improves the quality. It basically makes the oil worth more. So that was another proof point. Of course, every time the oil industry has a price crash, they stop spending money on things like that.

We are going through that phase again, but we have proven that this technology works to get rid of the glyphosate Roundup, that herbicide, and as a result it will improve people's immune systems.

Companies Are Repurposing

Now, I am considering, and this is not final, but there's been a lot of companies doing wonderful things to repurpose themselves. My friend Houman Salem, for example, has a company called ArgyleHaus [Argyle Haus of Apparel], a U.S. garment manufacturer, one of the few left in America. He is in Los Angeles and they completely dedicated their production to creating masks, cloth masks.

And I see a newsletter from New Orleans where a number of, for example, breweries and distilleries are making hand sanitizer, hot sauce companies are bottling it, clothing manufacturers sewing masks and gowns, 3D printers who have developed prototypes for protective gear, which had been downloaded around the world. So that's the kind of thing that the businesses are doing.

Doing Our Part

We are currently looking at doing our part, which would be to provide a way for anyone using our technology for the virus to do so without any payment of royalties. That is not a final thing, but it is being seriously considered internally and it's with the board now. So, we will be discussing that further, and we hope to be able to help in that respect.

US Dollar In Trouble

I am going to just talk a little bit about what is going on in the economy and some of the things that are happening. And I am not going to bore you with what you already know, which is that this vast amount of money is being injected into the economy. Unfortunately, mostly benefiting large corporations and not the small ones, but it ever was so, wasn't it? But one of the results of that, of course, is that the US dollar is really going to be damaged. The US dollar has been taking a beating against other currencies and there is even talk that it may end up not being used for oil transactions. Call me a skeptic on that because I think it would not happen very easily, nonetheless, there is that going on.

Headed For Inflation?

What is for sure is that [there is] a huge oversupply of money at a time when it can't be soaked up easily except as subsidies. In other words, it is not being put so much to productive use right now as a potential inflation generator. On top of it, we know that the crops are rotting in the fields and so forth. So, it is not a good situation for trying to hold onto the value of your cash, right?

A Biblical Practice

Now, the additional thing is that there is now talk about what is called a Debt Jubilee. What is a Debt Jubilee? The Washington Post in fact was just writing this on March 21st, and they referred to this. Now, the Debt Jubilee was a Biblical practice that there was basically, as far back as the ancient Assyria. It was normal for new rulers to proclaim a debt amnesty upon taking up the new throne.

Forgiveness Of Debts

For example, interestingly enough, there was a modern Debt Jubilee. Debt Jubilee is basically a forgiveness of all debts. Well, that was done after World War II in Germany. Our own martial plan, our own allied powers in Germany, when we introduced the new Deutschmark, that German currency replacing the Reichsmark, which was the Hitlerian currency. “90% of government and private debt was wiped out. Germany emerged as an almost debt free country with low costs of production that jump-started its moderate economy.”

Okay. It can be a good thing to offer a reset, and of course, critics warn over credit or collapse. But, if the US government could finance $4.5 trillion already in money giveaways, it can absorb the cost of student loans being forgiven and so forth. And of course, for private lenders, only the bad loans need to be wiped out.

So, really, what would be written off would be, late charges, penalties, bad loans and so forth. The problem is that a lot of loans are going bad. We are seeing that in real estate, tremendous amount of people are just not paying their rent, because they know full well they are not going to get evicted anytime soon, which does not lead to a great situation for the large real estate investment trusts and so forth.

Surge In Credit Defaults

I could go on and on, but the bottom line is that whether or not anybody declares a debt Jubilee, and I kind of doubt that is going to happen. Just call me doubtful only because secretary Mnuchin, Secretary of the Treasury is a Wall Street guy. Like Larry Summers during the 2008 recession, he is there on behalf of Wall Street. He no doubt would oppose that. But factually that is what is going to happen, there is going to be a tremendous amount of credit defaults and people going, "Yeah, what are you going to do about it?"

Shares That Return Income

What I am getting at is that being a lender is not a great place to be in this current marketplace. I would say that if you are lending money to a bank or this or that, but it is not as secure as it might seem. The good news is, is that the offering that is doing incredibly well, our Regulation A offering is not debt. A dividend is simply a company sharing part of its revenues. I'm being very approximate and not giving a technical definition. But dividends are not debt, they are shares of the company that return income.

What I am saying is that it is a good place to go with the dividend offering that we have made. And again, I refer you to oc.gold/offering for the fine print, and oc.gold/offer for the cool videos and all that good stuff that you will enjoy.

All right, so that is just to comment on what is happening in the world. I am going to turn to this amazing Regulation A offering that has been going on now for some time, what is it, 10 days now? It seems like it has just been forever, but it really was just Monday before last that this happened. I'm going to open up FundAmerica now and just take a snapshot of the latest and see what is going on in there. What are the current investments?

Well, I'll tell you that this is an amazing thing to see. It is definitely an offering that people like. Screen number one, it's 93,300 and at screen number two, it's 47,000. So, we are about $140,000 For an offering that has a minimum of just $500, that is stunning. I really appreciate your support because even though we are paying a 10% dividend, you have to understand that for us this is not expensive money. For starters, you are supporters, you are better than any creditor we could have on Wall Street because, well, you care and that is important.

It is also going to allow us to get rid of a lot of debt that weighs upon the stock. We have debt that converts to stock. So even though those people to whom we have the debt are people of goodwill, they don't sell a lot of it. Nonetheless, it's there. So, we'll be able to clean out a lot of this stuff. Number two, we will be able to have more working capital. Number three, we'll be able to do some acquisitions with our own capital. And number four, we can get involved as an investor in Investor Water, which I will talk about in a second. I am very pleased with how it's going. There is a lot of work going on in the team, money is flowing through the system and it's greatly appreciated. So, thank you for that.

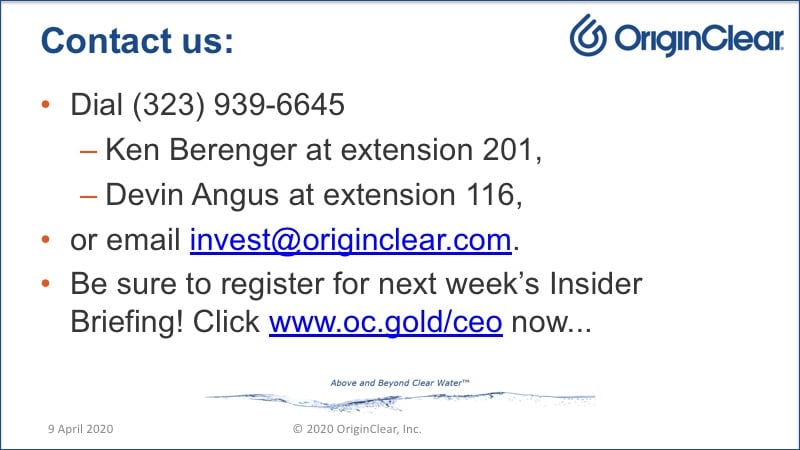

Devin is available to talk about it at any time. He is at 323-939-6645 extension 116 I believe. Also, Ken Berenger is extension 201. So it's 323-939-6645 extension 116 for Devin. Also, it is a way to talk to me because he will three-way me in. Then extension 201 for Ken. Also you can email, invest@originclear.com and it goes directly to both Ken and Devin.

Investor Water

All right. Let's talk a little bit about Investor Water. I think that is really, really exciting. We are busy building a website and so forth. Remember my video from last week where I basically said, look, we are connecting investors with the water projects. By doing so, we're erasing the biggest problem with getting water projects done, which is the money. It's the money, stupid. Well, it continues to be that even more now.

Even though the central government and municipal projects are doing fine, and the corporate projects. They appear to be doing great, because I was super-paranoid about this. Our President and COO, Tom Marchesello went in, did a deep dive with the team and we are continuing to do deals. Looks like corporations and the government are, shall we say, in business. Government employees have not been laid off. In general, large corporations are also leaving people at work.

Stable Base Load

So what we have is on the one hand, a big water business. Those of you who have heard me talk about how bad big water is in a sense of solving the world's water problems will laugh, because here I am saying, "Oh, big water is great." But, it is good on our Texas operation because it allows me to focus on the new stuff, because the existing business is pretty stable. It's what I call a base load. It is going to continue to keep Texas in business and it’s going to be a manufacturing resource for Investor Water.

Okay, now let's talk about this new thing. What is going to be a problem with capital is not the big central government things. In fact, I believe they will get a huge amount of funding from the, what is it, $4 trillion infrastructure bill that President Trump is pushing for what he calls Phase Four of COVID. Don't give me a quiz about phases one, two or three, but phase four for him is pretty soon.

And as always, these trillions, who will they go to? They will go to the big guys, come on. We know who is wired in Washington and a lot of money is being spent to make sure that the outcome favors the people who pay the millions of dollars to the K Street lobbyists. It is what it is.

What About Decentralized Projects?

But, what about the decentralized projects? What about my friends, Steve and Claudia who have a mobile home park, an MHP, trailer park in Alabama? The state EPA won't let them out, who say, "Well, you can't sell your property without solving this problem." It would cost them $500 to connect to city sewage; the city won’t allow it. Can you freaking believe it? So, they have to do it themselves, but they don't have the money.

Then it got into this whole [scenario] where it was like, “Okay, well here is how much it's going to cost, say $75,000, and here is the solution. It's approved by the city EPA and the permits are good, and let's go. It doesn't involve a lot of digging and pipeline construction and so forth.” Well, they didn't have the money so then they go, "Well, can you help us refi the whole trailer park?" I'm like, "Oh God, no."

That is when we realized that we really had to do something. We were able to come back to them. And before I get to the solution, let me say that this problem is across the boards. A brewery, people are drinking plenty of beer. There's not a problem in this economy with people drinking beer. But as a brewery expands, the city is telling it, "Sorry, you can't."

Treating Their Own Wastewater

In fact, there's a lot of case studies about it, about breweries expanding. There is one in San Francisco, I'm just looking it up right now, but it is a fantastic company. That is another company in our space called The Cambrian. They are helping breweries expand themselves, do their own wastewater treatment. The thing about breweries is, it is not that hard to clean the water, it's just a lot of water, right, which tends to overwhelm cities.

And it is also nutrient-rich, which is also a challenge in terms of capacity. The whole problem that these end users have is that they are now being thrown on their own resources. You know, animal farms have to clean their own manure lagoons and so forth. Well, where's the capital? And that is a problem. These people do not see the capital, and that is going to be the crunch. But they will still have to do it, right? They will still be stuck, and that is a bigger problem even than the coronavirus and the water and this and that. It is about literally taking care of big water problems that are getting in the way of productivity and even survival.

Portable Property Assets

That is when we came up with this idea of getting rid of the capital problem, and what we realized was it relies on a technology breakthrough by our own Dan Early, who created Modular Water Systems™, so these compact, portable, drive them in, drop them on the ground, plug them in, put them to work. Well guess what? If it is that portable, then we can just rent them. Keep title to them, because at any time if the end user does not pay his bills, and I'm being equal gender here, his or her bills, we can come in, it is our property. Even if they are being foreclosed on, whatever, "Nah-ah-ah, that's ours," take it away and it's back in the fleet. It is like owning a Hertz Rent-A-Car fleet.

Investor Controlled

Now an investor knows that if they help build this thing, and they are not expensive, as I was saying, 75,000 the typical price for that level and there are other ones, but the general range of Investor Water deals is we think around $75,000 to $125,000. An investor can come in and put money in and have an asset that we control. Number two, because it is a rental, the fees are high enough to pay our management fee plus return to the investor what we think is 17% to 20% annual return for doing nothing. Why? Because we do everything. We get the projects, we do the technology, we have the local people install it and make it work and we take care of it all. Top to bottom.

17%-20% Return

And we take our management fee, which is a fair amount. We are experimenting with the amount, but we know that even after that fee, that investor gets a chunk of money, really good return on his or her investment. As I say, 17% to 20%, passively, no work to be done, and we own the asset. So, OriginClear owns the asset and the investor has what is called a UCC-1 Form, which is Uniform Commercial Code-1 Form, which means they have a call on that asset. They can say, "Okay, I'll take that asset," if for some reason somebody fails to take care of something. So, the investor now has the ability to have a piece of equipment. Very, very important.

Accumulating Tangible Assets

Now, guess what? We ramp this up, it creates a growing asset base when we talk about uplisting the company. I was just looking at the requirements for going onto the OTCQX, which QB is the level that we can be on merely by paying, I think, $10,000, but the QX, which is the highest level of the over-the-counter market, OTC, requires far more than that. In fact, you might as well go on the NASDAQ. It is almost that bad, but they both require tangible assets, right? They require tangible assets. And what we are going to do here is build an asset base that allows us to qualify for these stock exchanges. So that is really good.

“When are they going to deregulate H2O?” This comes from Moses. The answer is, just like these debt jubilee things, it is not going to happen formally, it is going to happen de facto. Meaning, that as municipalities are increasingly unable to do their job because infrastructure investment has been missing since 1960, 60 years now, they are able to do less and less and so private industries had to do more and more. The power is just moving more and more to the edge and they are being allowed to do more and more.

Own Agenda

For example, higher arsenic requirements come in. You are only allowed to have X amount of arsenic, and those requirements become bigger, meaning that less arsenic is allowed. Well the city is just passing on the requirement to the users. They can't do anything about it, so it’s like, "Hey, you bring the arsenic level down or else we will shut you off." Well that is allowing the people at the edge to kind of have their own agenda. They are stuck with the work, then they have more power.

So, Moses, to your question, deregulation is on the way. I love your cynicism. Isn't it funny how in Los Angeles the Department of Water and Power controls even, you cannot even dig a well in this county, legally. Used to be you couldn't even have a rain barrel. You were not allowed to collect the water in a rain barrel. Now that is slowly changing. DWP has begun to allow people to collect their own water in rain barrels, but you still can't dig that well. So, Moses, you are right to be skeptical, but let's take our wins one at a time.

All right, so Investor Water, just to wrap this up is a genuine breakthrough in a sense that now we have investors on one side, end-users are getting what they need, and they will pay a high rental fee but they have flexibility and they always have the option to lease it or buy it out. We'll have that ready for them, so it is fair. In the middle is us making sure the technology is good, making sure that things are organized.

Syndicates Of Investors

As we pull away and start letting other players in, other water companies, et cetera, we are going to do cool things like create syndicates of investors. Just like those old oil and gas limited liability partnerships, LLPs, we are going to syndicate these investors so that maybe a million dollar or a five million-dollar project could be done with a group of investors.

So all that cool stuff will happen in this marketplace, and that is why I say it is a lot like Airbnb, it is a lot like Alibaba and so forth, Zillow, right? This is going to be the cool thing and you are going to see the first steps. First steps first, we are doing the proof of concept. This weekend we are shooting a video, with social distancing, in Phoenix, of one of our machines being put to work in a first specialization, and next briefing will be devoted to that.

I won't get into it in this conversation today, but on the 23rd will be another insider briefing and we will go into this super cool, first vertical. Meaning, like a specialized market that we are going into, with an actual machine that we have that we did something great to get out. I will explain all about it, but it is in market being put to work, generating first revenues. We have to create a bank account for Investor Water, the whole thing, so it is very exciting.

10% Dividend & Conversion Option

It is starting, and remember, we really appreciate what you’re doing because you doing this Regulation A offering by going to originclear.com, click on that big red banner and jumping in and doing what you can (remember you can always come back later) is tremendously appreciated, and there is a 10% dividend, and then there's the opportunity, at some point if you wish, to convert to free trading stock at a discount, so it is a win-win.

Thank you for being here. I really appreciate your being on board. I will end if off now. I love being in these briefings and there is more and more good news, despite all the tough times we are going through. Thank you for bearing up and you are going to be able to communicate with me through Devin, invest@originclear.com, or call 323 939 6645, speak to Ken Berenger at extension 201, or Devin, extension 116.

Thank you all, be safe, be well, and I wish you all the very best. Have a good weekend and I will see you next week on Thursday at 5:00 PM. Goodnight.

Register for next week’s Insider Briefing: HERE

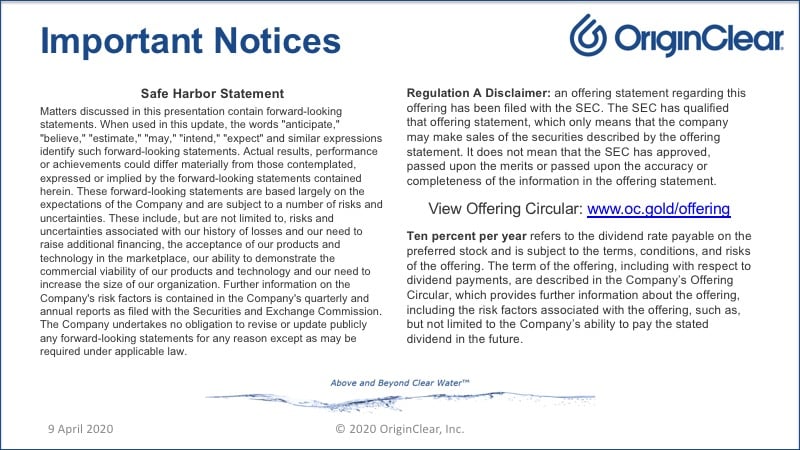

SAFE HARBOR STATEMENT

Matters discussed in this message contain statements that look forward. When used in this message, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such statements that look forward. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the statements that look forward contained herein, and while expected, there is no guarantee that we will attain the aforementioned anticipated developmental milestones. These statements that look forward are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include, but are not limited to, risks and uncertainties associated with: the impact of economic, competitive and other factors affecting the Company and its operations, markets, product, and distributor performance, the impact on the national and local economies resulting from terrorist actions, and U.S. actions subsequently; and other factors detailed in reports filed by the Company, except as may be required by applicable law.

Regulation A Disclaimer

An offering statement regarding this offering has been filed with the SEC. The SEC has qualified that offering statement, which only means that the company may make sales of the securities described by the offering statement. It does not mean that the SEC has approved, passed upon the merits or passed upon the accuracy or completeness of the information in the offering statement. Please read the offering circular here: Get Offering Circular

Ten percent per year refers to the dividend rate payable on the preferred stock and is subject to the terms, conditions, and risks of the offering. The term of the offering, including with respect to dividend payments, are described in the Company’s Offering Circular, which provides further information about the offering, including the risk factors associated with the offering, such as, but not limited to the Company’s ability to pay the stated dividend in the future.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)