Video Cast Webinar Briefing of 2 April, 2020

Helping You Thrive in the World's ONLY Vital, Scarce and Recession-Proof Market

In this Water is the New Gold live CEO webinar briefing Riggs Eckelberry is joined by Facebook Ninja Manuel Suarez. They discuss how the massive paradigm shift to online business that is occurring worldwide will affect the future of water and every human being. Find out here how digital applications are already changing the water industry and why OriginClear's exciting new Investor Water™ business may well succeed at becoming the Zillow for Industrial Water™. All this, and how the company's new Regulation A offering for all investors interconnects these is covered.

Transcript from recording:

Introduction

Riggs: Well hello, everyone. Manuel is going to be with us. In fact, he is right now online, Manuel, say hi!

Manuel: I am here, Riggs. Super, super excited to be here with you tonight.

Riggs: We have 65 people in the room and the number is growing, so it is our biggest yet. Manuel, I have to thank you because you did it. It's you. Thank you sir.

Manuel: Well, we have got an important message. We have got an important message to share to the world, that is for sure.

Riggs: Yes, so without further ado, I am going to go ahead and share this presentation, the slide deck, and then we'll be talking in background. I have chat requests already, which I'll just keep an eye on. Victoria, hello. And then Kushal, awesome.

Manuel: So Riggs for the people that are here, that have not had the honor. I mean some people that are here, don't know who I am. We have [this] on both sides. For the people that are on the other side that I recommended that they join this webinar today, can you tell me your one minute elevator explanation about what the OriginClear mission is and what we are here to do? I know we're going to talk about that more in detail throughout today's webinar, but for these guys right here, just discovering your world and this incredible company that you put together for the last 13 years, can you tell them in a minute, so they can be prepared for the rest of the webinar today?

Riggs: Speaks in Spanish

Manuel: At your service, translation for those of you guys who don't speak Spanish. Riggs has a pretty good Spanish accent himself.

Water Is The New Gold

Riggs: Thank you sir. Okay, even though we are little tiny thumbnails right now [on the video screen], I am going to leave it like that to talk about "Water is the New Gold", and why that is so. We are very fortunate. I am just going to go back a little bit in time. I remember just after Christmas Manuel, when I called you, and I said, "This is it," and we came up with this concept which is that water is the new gold. Okay it is, “The World's Only Vital, Scarce, and Recession-Proof Market,” and we are going to show you not only how it's recession-proof, but how we are transforming this into true gold.

One Minute "Elevator Explanation"

Quickly, OriginClear is a 13 year old company. We have really worked hard to find a way to change the world and water. When we say that, it is not a light statement. Only 20% of the world's sewage is treated, which is pretty scary. In fact, what we have here is a world that is serviced by the water industry that is a trillion dollar industry, but it is only doing a 5th of its job. Think about that for a second. Now America is treating much more than 20%, so is Europe, but places like the third world, various countries, India for example, they have people manually shoveling sewage. I mean it's very, very tough. These are the same rivers that go into the same ocean that pollute the same world. We have a mission here to make water much more safe.

COVID-19 Oral to Fecal Route

By the way, do you know that they realized, just today I saw this news, that the Coronavirus has been found in water supplies? That is how they found it earliest, it showed up long before the infections of people. It was in the water supply already. Water supply is now a big deal.

Manuel: So Riggs, can you literally drink it? Is that a reality that we have right now going on? Like if it is polluted water, is that possible? Because the last I heard, it was skin contact and then eventually going through the pores of the body somehow. Would that be possible? It's an interesting idea.

Riggs: Right so, it appears, and this is just preliminary, it is not in this presentation, but it is an amazing fact. I am going to get really explicit. COVID-19 has an oral to fecal aspect. So, it literally ends up in the poop. Just saying it straight. That appears to be one of the methods of propagation. This is very preliminary, and the reason why I don't want to make a big deal out of it, on the infection prevention route, is because there is nothing you can do about it. We social distance, we don't sneeze, we wear masks, all these wonderful things. But long term we’ve got to look at the water, because that is a big piece of the problem that is not part of handling the pandemic immediately.

Water Infrastructure Matters

What I am getting at here, to rewind a little bit is, water infrastructure matters. I can tell you for years now, I talk to people, and I go, "I'm in the water industry." And they go, "Oh that's super vital. It's really important. Water is so important." And then I start talking about sewage. People don't want to know about the sewage plants down by the Hudson River in New York. They just like, "No thank you very much." Well it matters because we are interconnected, and we are interconnected through sanitation. That is where this starts to be important.

Now in my other presentations which I won't get into, because I want to make this relatively painless and short, is that we know the whole building of big water systems that occurred post war, really started falling apart as early as 1960 and has ever since. There has been a degradation and the cost of maintenance of these water systems has risen. Lately in the last 10, 15 years, businesses have had to take up the slack more and more.

Water Autonomy

We call that water autonomy. Water autonomy is where businesses have to do their own treatment. But guess what, if they are doing their own treatment, they can recycle, they can make the water better. So, you have systems where the water incoming is treated, it's recycled internally. Waters the lawn, waters the golf course, waters the shrubbery et cetera, and then it is treated so that it can be put in the ground water again, sent down to the municipality. Because municipalities, the cities, will accept clean water. They will. It is just the dirty water has overloaded them. So this is a whole trend.

I call it a mega trend. Please stay tuned for my other briefings. I do one every single week. The big webinar one is once a month, first Thursday of every month. And that is when I have celebrity panelists like Manuel on board, but every Thursday in between, I do an audio briefing, where I talk about some of these important trends and illustrate that.

Entering The World Stage

I am going fast forward a little bit into the relationship. At the turn of the year, I said we have got to find a way to, in a sense, enter the world stage. I called the only person I knew who really was a master at that, Manuel. I called him up, and what did we do? We decided to make these briefings the focus of our communication line to the world and then of course, the virus happened, and digital has become the new thing, right?

The Other Gold

Manuel: It's the other gold. We have got water, and then we’ve got digital marketing. We are uniting these two, and if you don't mind me saying Riggs, I have bought into your business. You know that I have myself even though you are a client. I protect my clients, intensely. Aside from that, I believe in the mission so much, that I opened up your business, your brand, to my audiences. I have people that follow me and trust me. These guys know, anybody that follows me, they know I don't promote other people unless I really believe in them. That is just the way it is, but not only that, I have put a little bit of skin in the game myself, because I believe in the mission.

I know one thing, for those of you guys that are from my audience, you can comment here below and let me know. I'm super curious about that. I see some people already that have commented. If you guys came from my emails, we have about 100 people here, which is exciting, so anybody that came from my audience, let me know, I would love to see your name pop up.

Taking Water For Granted

I can tell you that I for one, before I met Riggs, before I understood what OriginClear stood for, what they were all about (which by the way, they are a public corporation), before I understood them, I took water for granted. It was this idea I have been fed my whole life Riggs, that the world is three quarters made of water, so how the heck am I ever going to run out of water. It doesn't make any sense.

It is an area that I never had any concern for. Absolutely no concern, no worry. Then it started to become real. What it is to really have drinkable water, that we can utilize every day. That has started to become a reality and I started to get the big picture about it. I know that, Riggs, for all the content which I have been consuming throughout the last couple of months, I've been seeing a lot of the overall ideas.

The Value Of Water Companies

Water companies, how solid they are, and for how long they last, because they are that vital to a society. What you put together here, just so you guys know, anybody that is here, this is not a pitch webinar. We are not here to make you an offer. We are going to introduce you to this incredible opportunity, that I personally am really passionate about, so if any of you guys in the future want to be a part of this organization, there are opportunities in it.

I don't make a penny for you to be a part of this organization. I do believe in it. As you guys know, over the last several weeks since COVID-19 has exploded, I have been focusing on providing that into the world. That is what I am doing, and I refuse selling things or trying to monetize this market. This is just me. The way that I'm operating is just standing in front of the camera, providing value, giving value, and that is what I'm doing right now.

This is value right here. So, any of you guys that are here that were just introduced right now, you might have got it in a text message, a messenger broadcast, maybe some of you guys, a lot of you guys came from a Facebook ad or whatever, this is an opportunity. This is an opportunity that comes along every several decades and Riggs is somebody that I believe in. You know how it is. There is a jockey that rides the horse. I believe in that jockey. Let's pay attention guys. I'm going to listen to what he has to offer to us tonight. I'm super curious about it.

Opportunities For Wealth

I want to keep on looking for opportunities for us to be able to get wealth, especially in this era. What do we do? What are we going to do? What does the world look like? Is it all "Walking Dead" right now? Are we all going to die because of the COVID-19? No. Opportunities come up in these markets and I think that if you open up your eyes, you will be able to see them. If you keep them closed and just listen to the media, you will not be able to see them. As simple as that. So, I'm going to open up my eyes. I'm going to listen to you Riggs, and then you can ask me. We can have conversations about it and then get deeper into it, but I'm super excited about what you are going to be covering with us today.

Riggs: Thank you very much and I'm honored Manuel. Now I'm seeing Kushal here. He's saying, Kushal Agrawal is saying “I am from India. It is 5:00 a.m. here.” Kushal you know that in India we have an amazing subcontinent. Some of the most talented people in the world are from India. Our major partner, Permionics, is an amazing partner for us, has sent us a lot of business, but there is a problem in India. You know there is a 90 billion dollar hydrological, means moving water, project up in the mountains, which has to happen. 90 billion dollars to just stabilize the water flows up in the mountains.

Moving Sewage By Hand

Meanwhile, people are moving the sewage by hand, the Ganges is terribly polluted, so you know that this is something we have got to deal with. But, here is the thing, where are the budgets? They are being consumed by these 90 billion dollar projects and that is why it’s very, very important that we empower local water users and businesses to do their own autonomous treatment. It is more important than ever in India. Of course, it is all about this being affordable and that is where our partner Permionics will come in. But I just was doing a little thing to thank India for being with us.

Manuel: Juaquin says, "I watched about 20 of Riggs videos today before meeting here.” That's fantastic Juaquin. Absolutely love it. He's somebody from my audience.

Riggs: I love it, darn.

Manuel: Yeah I've seen Juaquin for a long time, that's for sure. Following my content, my training, and stuff like that, so that is great Juaquin, absolutely great.

Riggs: That is so cool. Yes, in fact J.L. Hicks wants to know about the Reg A, so we will get right on to it, and there's a lot of points of interaction. The other day you were doing that famous Facebook video where you decided to give away your Masterclass and up pops Dan Ulan on your Facebook watch, "That's my friend from the 90s, whoa." So, we have got a lot of degrees of connection. I'm super excited.

Bringing Water Into The Digital Age

I'm going to move in to the presentation. We are now at 106 people. This is amazing. Thank you for joining. We have covered that we’re the new gold. That is of course the poster for today. Bringing water into the digital age, and that is, my good friend, Manuel. This is a historic poster my friend. It really is.

The Other New Gold

This is another that the AGM Team came up with Digital marketing has become the new gold. That was a promotion for AGM itself, and now we have the tie in to what we are doing.

Disclaimers

Disclaimers, we are going to be discussing the Regulation A offering which is that an offering statement has been filed with SEC. The SEC has qualified that offering statement which only means that the company may make sales of the securities described. It does not mean the SEC has approved, passed upon the merits, or passed upon the accuracy, or completeness of the information in the offering statement. Please read the offering circular which I will cover shortly. And then Regulation D, that is simply for the accredited investors, which of course Manuel is one. He has skin in the game as he says, and I'm blown away. So that is excellent, and we are going to move on past the boiler plate.

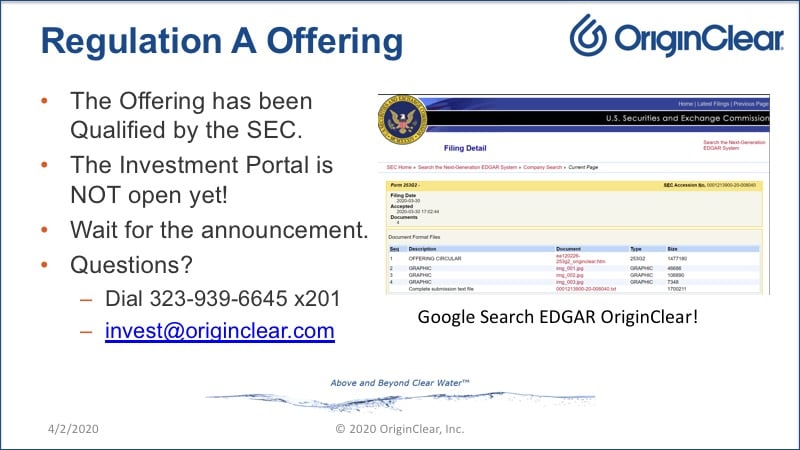

Regulation A Offering

Regulation A offering. This is really, really exciting. Right there you see [it] on Edgar. This is how you find it. You Google Edgar - OriginClear and you end up with the offering circular, which was accepted right here on March 30th, 5:00 p.m. in New York. So that is what it is.

Investment Portal

Now we are not publicizing yet, why? Because the investment portal is not open yet. This investment portal is amazing. You will understand so much about the business. The offering has been qualified by the SEC, so we could take investments, but the investment portal is not open formally, and so here is what is going to happen.

The team that is putting together this amazing, and Manuel you've seen it, this amazing description of the company that really gets into all the things that we have done, and will do et cetera, that tie into the back end and once that is fully tested and running, we are running sample sales right now in the backend, we will have an announcement. I believe the announcement will be very soon, Monday, Tuesday. It's very soon. I am not going to commit to an exact date, but it's eminent.

Questions?

Now, if you would like to ask questions about this, you can talk to us, and there is the number 323-939-6645 extension 201. Delighted to talk to you. Or, send an email to invest@originclear.com, but as I say, the investment portal is not open yet. Let's talk about what the Regulation offering is.

Two Different Offerings

We now have two offerings, and really the Regulation A is an amazing one. So, on the left hand side, you see what Manuel invested in. He was an accredited investor, and what he got was very nice deal with a percent dividend paid every quarter. So it is annual 8% paid on a quarterly basis. Repayment of his investment is in two years. He gets a grant for half of his investments.

So let's say that Manuel invested a full unit which is $100,000. I am not going to say that he did, but let's say he did. Then he would have received $50,000 worth of stock. With price adjustment at conversion to common which means that 50% stock is off in a pool to the side and when he turns it in as stock, it is converted at the price. That is a wonderful offering for the accredited investor.

But we know that most of the world is not. The accredited investor is probably about 1% of America, and I have felt terrible for years now that we have not been able to offer something good to the general public.

Manuel: Now Riggs can you give me 30 seconds to explain something?

Riggs: Yes sir.

What Is Accredited?

Manuel: Just thinking because I know my guys. I know people that are here. I know not all of them are coming from here. You don't have to stop sharing the screen. Very simple, I'm telling you because I went through that. I had to, me being successful, already have generated millions of dollars, very successful, a lot of great businesses. "Hey are you an accredited investor?" "I don't know." Like it's just the way it is. I didn't even know that.

A lot of people that are successful, like a lot of people that are here on the line. I have a lot of people that follow my content, that follow yours, et cetera. They are very successful. They might not know this. So, the long story short of these two sides, the current offering it is accredited investors. Well I'm not an expert in this area. I can tell you as a user, as an investor. Riggs has a lot more experience in this obviously. Especially being the CEO of this incredible company, but you are looking at having to prove that you have made $200,000 a year. You can correct me if I'm wrong on anything. Last two years 200K in income or you can have one million dollars in assets. And one of those is going to qualify you. Is that correct Riggs? Long story short.

Riggs: Long story short is $200,000 last two years, for a single filer. 300,000 for a joint filer, or a million dollars net worth excluding your primary home.

Manuel: Okay so that makes it very simple, that decides whether you are accredited or not. This Regulation A, that Riggs is going talk to you guys about a lot more the rest of the webinar, is one of the big opportunities, because this was impossible before. You could only have people that would have $100,000, and then you get an incredible return. It is a company. It's a water company. These guys are super safe, so you give it to them and compared to what you get with the bank. What does the bank give you? .01% or something like that?

Investment Yields

Riggs: Well that is exactly right. There is a big yield problem. It's wonderful we are being given all this money. You and I Manual, we were both just running like crazy today qualifying for the paycheck protection program that starts tomorrow, and it is a whole big deal. But here is part of the problem. All that money being given away means that if you are trying to get money from your money, it is a zero percent world, so how do you get yield? Well, don't put it on the stock market, please, because I believe that this change over in the marketplace which I'll explain a bit further is going to last. It is not over.

Smart Entrepreneurs

Manuel: It is going to last. Absolutely, it will last. One of the super mega-qualities of a smart entrepreneur, business owner, is common sense. As simple as that. All you have got to do is look around, and see what is happening, and how people are changing their operating basis. And how the laws and the rules are changing and now everything is moving to social distancing and everything, et cetera. So, it is inevitable. It is going to change.

This boost that we got just last week. It's just a reaction to a bunch of fake money being printed out, two trillion dollars, whatever amount that is. I mean I don't understand. I'm not going to get into economics here. We are getting a huge boost in the economy that the country doesn't deserve. For whatever reason, it is happening. We deserve it, the entrepreneurs, but aren't we like in a hundred trillion dollars in debt already? I mean again, this is not my subject, and you know that Riggs, but I am thinking that it doesn't quite make sense that the government just suddenly decides to give two trillion dollars, when they owe hundreds of trillions of dollars already.

But hey, we're happy, and you and I have been talking about this for the last week and we are going to take advantage of it and we are going to use it and I think that we deserve it, because we more than anybody else out there, we're not living off of welfare, we are living off of productivity. The economy usually is fed by us, so it makes sense, but we don't know how long this is going to last, because it has been going on for only a couple of months, realistically.

Unprecedented Times

We have never gone through anything like this before, so it is unprecedented. It might last a very long time that we are going through this recession, that is why I am excited about OriginClear right now. I'm excited about OriginClear, because I believe in the mission. I know what you guys are doing. I believe in you. You are pushing hard with content, education, information. And, I get a paycheck every three months when I give you money, every three months you get a paycheck. It's there in the bank, and I know you have regulations like the SEC regulations that you have to give that money back in two years.

Well Structured Opportunity

It is so very well structured that it is one of those opportunities that if you pay attention, you are going to be able to leverage in a big way That is the current offering right now, but the Regulation A opens up the world.

(Charlene says national debt is about 23 trillion dollars. Okay, so now we are going to be 25 trillion dollars [in national debt].)

It opens up that opportunity to Regulation A, because now you don't have to have a couple of hundred thousand dollars in income a year or a million dollars in assets and you can be a part of this particular opportunity. Just like me and like a lot of us, put a little bit of skin in the game. That is the layman explanation. Not Riggs explanation. My explanation as an OriginClear fan and investor myself. So, go ahead Riggs.

SEC Compliant

Riggs: I am very thankful I am not paying you to do this, because I would be breaking all kinds of regulations.

Manuel: I'm allowed to say right? I'm allowed to say it.

Riggs: 100%, 100%.

Manuel: Okay good. I'm not on your payroll. I am not an OriginClear staff member. We are an external marketing department for you, so I guess that we're in the clear.

Riggs: 100%. I would have hit the button and dumped you if I was like, “This is wrong.” Believe me because I have survived, this 13 year company, 12 years a public company, and we have survived because we did do always the right thing. We have an excellent law firm in New York for which we pay way too much money, but they have kept us unbelievably safe. One of the things that we really rely on to survive is that we are transparent. We say exactly how it is. Thank you Manuel, because you are saying stuff that I can say, but for example somebody that we are hiring to get us leads could never say. So, this is wonderful. I appreciate it, and I know it's totally unsolicited, so I will take it.

By the way, people are raising their hands. You will not be able to speak. You need to chat. So instead of raising your hand, click on the chat button, and we will be addressing your chats. That is how we handle it in this webinar. There are just too many people. We're up over a hundred still. So let me continue, because it gets interesting here.

Offering Explained

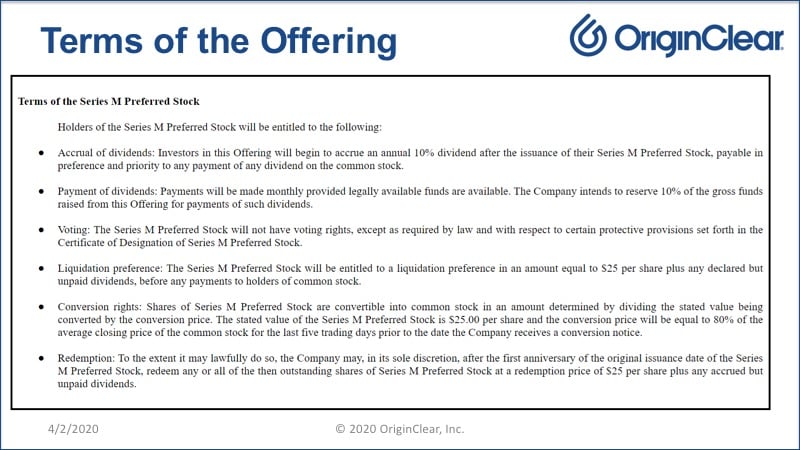

This is just dealing with the backlog of this Regulation A thing. All that is happening here is that the current offering has been going on for a while, and now the Regulation A offering is coming in. Basically, you can invest as little as $500 up to a limit of 10% of your annual income. It's all done online. What it is? Think of it as money in the bank that is $25 a unit. We pay 10% dividends.

On our current offering, we have now made 27 months of dividend payments. Nine quarters. We do a good job of paying dividends. We do it on time. That's our discipline. Obviously, that is part of our culture. Furthermore, on the Regulation A side, the 10% is set aside in a separate account for that. It is redeemed at our option, meaning that we will give you back the money if we want to, but we have to wait a year. So, you make at least your 10%, but how do you get out of it? Well, there are two ways.

Ultimately, we plan, once the offering is over, to list this. It will be called OriginClear Series M on the Stock Exchange, and it will trade at $25. With that 10% dividend. I'm not going to get into what it is… okay, it is a bond. It's a bond, but if you don't know what a bond is, it is a company obligation that is backed by the full faith of the company. What it does is that it carries that 10% and that $25 will not go up and down too much. It is a very stable thing. There is also an option to convert this to shares and it's not something we market, because it is relatively complex, but the option is there. So that is what we are going to tell you, right now, about.

Stay tuned for the offering, the announcement. Be sure to be on our newsletter. Go to originclear.com and click and get on our newsletter because then you will receive our announcements. This is what is on this screen which as I said, it is about the dividends. This is on that SEC filing. There are conversion rights, and there is a redemption. I won't go through it because again, it is getting long and I don't want to lose our good friends.

New Landscape

So, continuing, the new landscape, it is big business, and digital. There is a book called, provided by Dickens, "The Tale of Two Cities." "It was the best of times, It was the worst of times." We have a strange situation here my friends. We have companies that are doing incredibly well in this market. Zoom, Netflix, Amazon, they are going crazy. And then there's a lot of people stuck with the physical, restaurants and so forth, they're stuck in the middle, because they have that model.

And then on the other side is big business, cities, and so forth, they are beneficiaries of huge amounts. Do you think that a lot of money is given out through the paycheck protection program? Guess what? The airlines have a pipeline of money to keep those people paid. So, big business is protected. Those are the two things, digital and big business.

First of all, we have a two trillion dollar Infrastructure Bill being proposed. I thought it was really funny, because this was proposed back on March 31st, on Tuesday. "It remains to be seen if Congress will be comfortable passing another mammoth spending measure after approving the emergency two trillion dollar Coronavirus relief bill." Yes, they will. Yes they will. If they can find an excuse to shovel money out, they will.

Take it from me, this is going to go down, because as Manuel said, this is only the first two months of this. Where are we going to be by Labor Day? So, this two trillion dollar infrastructure package, my prediction is, it's going down. What does that mean? Well I'll give you an example.

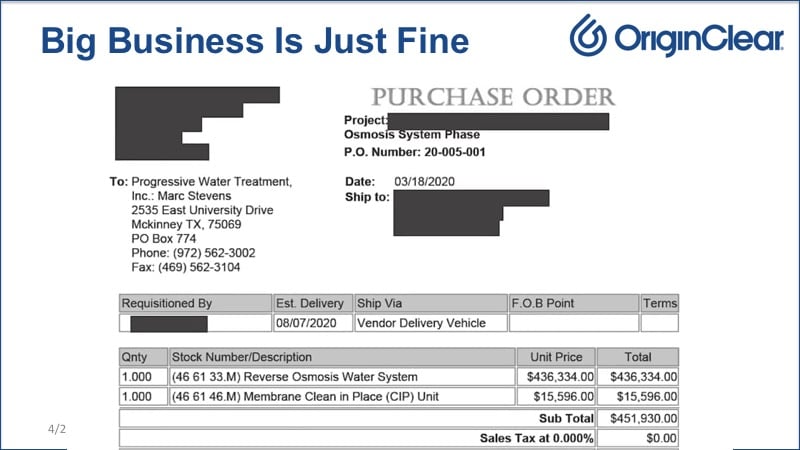

Regular Water Business

Here is a purchase order we received back on the 18th, and this is from a city. A city in Texas. It was a nice half million dollar deal, and these are the deals that are doing really well in this marketplace. On the one side. On the regular water business side.

Now here is what is crazy. We're this like, "Hey we're this small water company. We're doing all these installations for businesses." But meanwhile a year ago, we started building our manufacturers sales rep network and those people work for municipalities and big companies. We are dealing with a very large corporation in Vegas for example, that is actually, more like two million dollars. I am not saying it is going to happen again. Disclaim everything. We can't promise anything is going to happen, but just to give you an idea, this corporation which you would recognize in an instant, knows us by reputation and has told us they want us to be the sole vendor. Fully integrated, one source.

I mean I get it. Anything can happen. You get these people coming in from stage left, and they cut the price, whatever. But the point I'm making is these are the deals that are happening on the big business side, and we are benefiting. Our Texas operation which is about 25 people is doing an amazing job, and they are continuing right through. They are busy and staying on the phone and talking with everybody, and people are on the phone in places like these cities and they're doing deals. They are putting out PO's. So that is what we call a base load.

But here is the issue, this business is not going go 10X in one year. It can't. It is physically impossible. You have got to rush around and do permits, and architects and consulting, and ship the stuff out. We speeded it up, but it is still a pretty slow process, just like building a house.

So what is the route? How do we really ramp up to help the world? Because this is a base load. It pays the bills. I am very happy that my team is doing it, because it is good governance. But at the same time, it is the same old water industry that, we're taking care of this, we're taking care of that. Not saying it is wrong. It is just not going to blow up. So while big business is just fine and it is just going to go along, at the same time, what is the other side? If not big business, then what?

The Other Side

Well online is blowing up. Here is a friend of mine, whose name I will not mention online, but he does this part time. He has a full-time job, and he does this part time, and he was doing half a million dollars a year. He looks like he is going to do a million dollars this year. And he is a regular person. He got into the Amazon business a year or two ago, whatever it was and he has just been steadily doing it. He spends like an hour at night, two hours at night, doing this drop ship, so that is what is happening.

Anybody who is involved with eCommerce knows, "Oh my God, they are rationing." I'm trying to buy stuff, trying today. They are saying, "Well you might get it in five days. Sorry, it's the COVID." So that online is blowing up.

We have our Facebook Ninja who decided to give the Masters course for free. His $2,000 Masters course. If you go to manuelsuarez.com/expansion. Manuelsuarez.com/expansion, you will get this $2,000 product for free. To me this still blows my mind Manuel that you did that. So, kudos to you. I was watching that same video. It was historic for me, I was watching it. And he said, "Everything is going to change now. Digital, the social media, is where we are all going to meet.” Where's Starbucks? Starbucks used to be the third space you know, home, work, Starbucks. No, no, no, home, work, social.

Manuel: Socializing is being replaced by social media. That's a reality and that is going to be. It's just a thought that came to my mind. I actually just thought about that, and I'm like that's just, that's what's happening. I mean the Messenger, the What's App, the Facebook, the Instagram, the YouTube, it's like exploding in usage right now. More than ever. There are more eyeballs right now. It's incredible.

Little message for you guys that are here still, over a hundred of you. I did not pay Riggs to talk about this right now. I did not ask him to do this. I did not know he was going to do it, but it is a mission that I'm on right now, and it sometimes people that are skeptical, which I know a lot of them, will say and have been saying, "There has to be some kind of catch. I bet you there is going be an upsell, a cross sell, a down sell, a whatever sell. He's going to try to monetize this thing.” And man, I'm going to prove them wrong.

It felt like a responsibility for me just because "Hey wait a second, what's the Coronavirus environment right now?” Well, social distancing. Well, what does that mean? Can’t we all just thank God and be grateful for the fact that we are not going through COVID-19 in 1990. I mean imagine that. Imagine social distancing without the internet. Without social media. Without the ability to do Zoom calls and webinars. That would be like devastating to the world.

Riggs:That's true.

Show On The Road

Manuel: The show can be on the road. We can stay on the road, because we have digital. And you know my prediction right now Riggs, now that you mentioned this subject, the way I see it right now. I have gone really, really far in business. I'm just getting started. I'm still a work in progress. I have my good friend, Chick Corea, he calls himself a work in progress. I believe that to be my case too. So, I'm just getting started, but I can tell you that I have come this far, because I have been more right than wrong.

World Going Online

I believe that what is happening here right now, whether you like it or not, it doesn't matter, that is not part of the equation here. What is happening is just basically moving forward at a thousand times the speed the internet evolution. That's what it's doing. This was going to happen. The world was going online. All these businesses were closing down. We already saw an inkling of it. We saw the Sears, the Toys R Us, we saw all these big boys who have been around for a long time, close down. So, it was trickling. It was happening. There were some domino pieces falling. It is just going to happen now.

Digital Will Determine

Are we gonna, just all disappear? No, businesses will continue thriving. But digital will determine which ones do and which ones don't. And that's basically what we have right now. And I think that is the major opportunity with what social media is. So I saw myself as, “Okay, well what are we going to do? Well we have got to unite as human beings right now. That is how we're going to get out of this.”

Helping The Entire World

That is my super power. My super power is marketing on today's modern platform. So, I’ve got to give it to the world, because if you have a superpower and you don't give it to the world, you are being selfish and that's not right. That is not fair, because you have to help the world at a time of need, and that's a reality. At this point, we all just have got to pull together, find opportunities, get trained, get more educated, and figure out how we, together, get out of the situation that we were presented with that nobody expected, nobody saw coming. It's just the way it is, right?

Riggs: Yes, and in fact, you have got a 60 person marketing agency, and with the $2,000 product you were doing just fine, in addition to your corporate clients like us. But here is the thing, you were doing just fine, but your audience was relatively small. What you have done with this concept is you have dramatically opened up. So this super power, you shared it with the world, which now empowers people.

We have the same idea with our thing. I was just talking about how we were doing big water. That is fine. It makes good money. Everything is great. It pays the bills. I'm not complaining, but at the same time, how do we blow it up? How do we help the entire world? And that is where we are going with this.

Before you leave this slide, Manuel I want to say that we pay low five figures for the privilege of working with your organization and when you gave this stuff away, we were happy. I was seeing all the Facebook posts by people like, "I have paid $2,200 dollars for the special Amazon thing, and I applaud this." People were totally in favor of you giving away what they had spent $2,000 for which is how we feel.

Manuel: We have gotten a lot of support. That's for sure.

Riggs: Not only that, what you told us in that Facebook was, "I'm not going to forget my paying customers. You will get extra special things." And we have been feeling it, so I want to thank you again. We began the second quarter, started today. So, we spent one quarter together, and I believe it is only the beginning.

Digitizing Water

All right, now how does that work with water? What does that mean for us? Because I was doing MoneyTV this week, and we have been posting the clips from us, and MoneyTV has been posted. Water is physical, right? Like a restaurant is physical. How do people eat the food? Well there are concepts like CloudKitchen, where the restaurants can propagate the takeout, so there are brand new models for restaurants too. They just didn't do it yet and they got kind of caught. Well how is the same thing happening in water? How do we digitize the water industry?

Those of you who know me, know that in 2018 I was developing a way, called WaterChain™, which is a cryptocurrency. So that, literally a grandmother in Korea, because Korea is very much adopting crypto, could press a button on her Samsung phone, and fund a water project in Troy, Alabama. So that vision, we had to shelve it because something called crypto winter happened, but it is there in the background and this is the concept we are leading up to, but it is not WaterChain.

Investor Water

Let me show you a little bit about it. It is about connecting investors with water projects. When this thing hit, literally two months ago, we went "Oh my gosh, capital is going away." Except for what the government gives you, capital is going away. So how do people pay for water projects? But the truth is it was a problem already. Water sales were incredibly slow, because you go to an animal farm that is in business and you say, “For $500,000, we will create a zero-waste thing that will create nice fertilizer on one side, and clean water on the other,” and they say, "We will see you in a year or two."

This is before the virus. Business as usual. Because you know what? Nobody was suing them. So, “I can survive. So it stinks up the neighborhood. Not my problem.” It was very, very slow, so how do we speed it up? Well, we make these things self-paying. We connect the investors with the water projects. Now one of the keys here is to make the water projects inexpensive. I will talk about that in a second, but what does this remind you of?

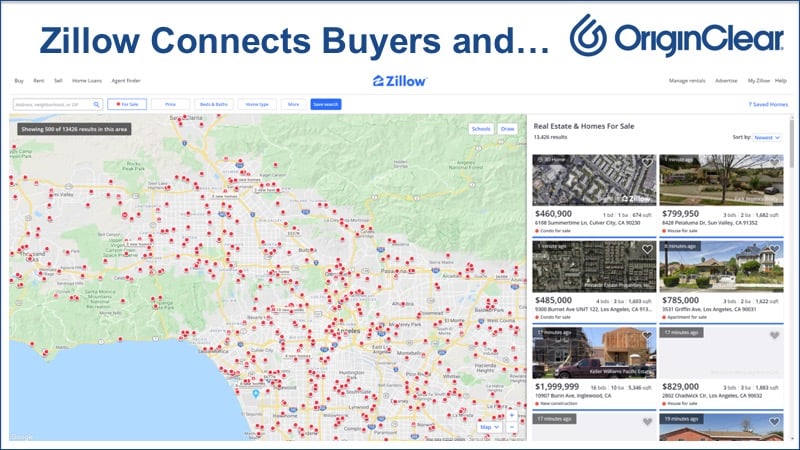

Connecting Investors With Water Projects

Connecting investors with water projects is like Zillow connecting buyers and sellers, but also landlords and renters, and house boats. They don't care what the business model is. But they are there to connect. What are they, 30 billion dollar, they're incredibly high value. But what you can do here is you can go to Zillow and reliably, you will see the price, you will see this, you'll see that and they are making out amazingly well. Now, they are an app. They didn't build the houses, they don't rent them out. They don't do anything. They just connect people. That connection is missing in the water industry.

You, Manuel for example, you might have some money to invest in a water project. Well, you don't have $500,000, but you might have 75,000 or 50,000, especially if it is a very, very profitable deal. It's a good yield. Remember it's a yield market. So, you want to make money on your money. Well how do you do it? Well it is very simple. The project is called Investor Water™. I believe that Investor Water, you are going to hear that. It is currently in our little, what we call Skunk Works.

OriginClear’s “Skunk Works”

They called it Skunk Works, because the people at Lockheed who worked on the new, new stuff, never bathed. They started stinking, but that is where all the amazing, the stealth bomber, and all these things came out of, was the Skunk Works, because they had total freedom to do whatever they wanted, zero budget. That was the rule. Do anything you want, just don't ask us for money. And out of that came these amazing technologies.

So, a Skunk Works is what we've got going. Investor Water right now is in our Skunk Works. I have a team on it and the team is going to be amazed to hear there's a team, because it is literally one guy, Micheal Mann, and then the rest of us helping him. What is it all about?

Let's take for example. I've been talking to you guys about this trailer park. My good friends who have a trailer park. I'm not going to mention them by name, but I know them personally. They have a trailer park in Troy, Alabama. That trailer park has a lagoon. All the poop goes in the lagoon. Those things you drive by on the highway, there's this green, there's these green ponds. That's poop. Naturally, that's not what we do anymore.

And so the local environmental protection division in Alabama said "You need to fix that if you want to sell it," because they want to sell it. And they said, "But we can connect. It's going to cost us $500 to connect to the sewage.” The city said no, no, no, we are not taking that. So, they were stuck. Why wouldn't they take it? There's 50 units or 100 units in this trailer park. Why don't they get the sewage connection? I told you, municipalities are falling apart. We just don't know it, but it's happening every day.

An Elegant, Inexpensive Solution

So, my friends called me up and said, "What can you do?" And I said, "Well gee whiz it's an awfully small project for us, but we'll do it." Well what we came up with was a solution that's less than a hundred thousand dollars. It is a brilliant one. Imagine a diving platform that you throw up into that lagoon and underneath that is a whole iceberg of what they call biofilm, and it is all extremely high-tech ceramics. I'm not going to get into what it is, but it has a bacteria culture, beneficial bacteria. It is like your stomach, and it sits there and it converts all the nasty stuff. Actually, it's more like an intestine really. It converts all the nasty stuff into better stuff.

A couple of months later, guess what? No more ammonia, no more stinky smell, the phosphorous has been handled. And what's called the oxygen level has been restored, so it actually can process the nasty stuff. That water can now be connected to municipality, because it is quote, unquote treated. And you know what? We got the approval of the permitting agencies for this solution. Guess what? No digging, no earth works, no pumping stations, no pipelines. Just put a diving platform out in the middle of it. It is a 20amp connection with a little pump, and just let it do its thing. So now we have an elegant inexpensive solution to a problem these people had that would have cost far more.

Guess what? People like Manuel, are willing to invest in something like that, because what we are going to do is we are going to rent it to our friends in Troy. Because this thing is modular. It comes in on a truck. Well, it can go away on a truck. So now we could rent it. Now it remains our property. Charge Airbnb rates. Short term rental versus the long term. They are happy, because guess what? Their problem has gone away. They didn't have to come up with whatever it is 75,000.

Everybody Wins

Everybody makes money. Manuel makes money. They make money, and also because Manuel invested in our company, we will give him, he doesn't know it yet, a 15% rebate against his investment. We’ll eat 15% for him to come in and so he goes "Oh, that's 15% of my investment I can apply to this rental?!” All of a sudden, you should see the way the spreadsheet works. The ROI is unbelievable. So that is the model. It is the idea of having inexpensive.

Take that idea and now put it in a hog farm. Do you know that in a 2,500 cow dairy farm puts out as much poop as the entire city of Miami, 400,000 people. And by the way, there's millions of head of cattle, of pig, of sheep, of poultry. Think about the poop. The municipal problem is nothing compared to that. This same solution, it can go in their manure lagoons, and now those horrible manure lagoons that overflowed in North Carolina during the hurricane, and destroyed neighborhoods, they'll be clean. Now we're not creating the zero-waste solution with the fertilizer and all that, but that will come later. So, Manuel helps us put that in place.

Now it's not Manuel. We are actually working with a partner in Wisconsin who is doing that. We have an investor already that is moving fast. Then we have another business that I don't have time to get into, but we are testing with three verticals, three specialized instances where we have an elegant inexpensive solution. By inexpensive I mean, $100,000 or less. So, the end user does not have to do a multi-year commitment. Does not have to do a credit check. Doesn't have to do anything. Just first, last, and security. Just like Airbnb. That to me is a revolution.

The Zillow Of Industrial Water

Now we are not going to keep doing these. This is what is called proof of concept. Airbnb started with two apartments in downtown San Francisco. They proved the model, then they went to Palo Alto and got their millions. What this is about is proving the model and then letting all the water companies out there, and there are tens of thousands of good water companies in American and elsewhere that will happily do this and we find the investors. We connect them up. That is the beauty of the model. So that is what we call this Investor Water which is how we digitize the business. Again, it goes back to the Zillow of industrial water.

Contact Us

Basically, I wanted to open up a little bit for discussion. As I say, I am just going to tell you guys right now that you can always contact us if you want to invest as an accredited investor. Here are the numbers. 939-6645 extension 201, the brilliant Ken Berenger. Michael Mann who is working on Investor Water is also helping out, extension 206. My assistant Devin Angus, extension 116, or just send an email to invest@originclear.com. Please make sure you are registered for next week's briefing because more exciting stuff is coming. An hour is not enough to tell you.

Discussion

So back to discussions. I am going to stop the share. I'm going to go into personal mode here, and we are going to take a look at some of the chats. So Manuel, what do you think about that huh?

Manuel: I'm super excited about it. I got Robert Castillo asking a question there. It says, "Your minimum investment amount is $500?"

Riggs: Correcto, so here is the thing. Once the portal is up, you will be able to click on it, and you say yeah, whatever I'm going to invest, is less than 10% of what I make in a year. So, if you are making $5,000 a year, you can invest $500. It's pretty easy right. By the way, if you're an accredited investor, there's no such limit. Let's say you are making 200,000 a year, or you're accredited, well you can invest 100,000 in the Regulation A. But for everyone else, it is $500, and going up from there to whatever you want, but there's a limit of 10% of your annual income, unless you're accredited. So that's that part.

Manuel: They do that, they do that, the limit of the 10%, because the SEC is trying to put some regulations, so people don't go too invested in a particular company, or what is the idea behind that?

Riggs: Right, so in 2013, when the Jobs Act was implemented, that was a rare time when President Obama and the Republicans worked together, and we can forget that, it's over! Collaborations with Twitter is gone, but anyway we won't go down that road. So, what happened was Congress said, “You know, you are going to open it up to non-accredited,” but then the SEC went, “Okay wait a minute, that's all great, but we’ve got to make sure that…” and so they put these rules together, and this is one of them to make sure people don't go completely nuts.

Not Open For International

All right Kushal, right now the Regulation A offering is not open for international. You are going to have to have a US address at this time. We hope to change that in the future, but that is where that is. "Can you send out notification emails to all attendees when the portal is up and running?" Yes. If you were registered for this webinar, you will get a notification that the Registration A portal is up and running.

When Will The Reg A Portal Be Up & Running?

Manuel: Do you have an idea Riggs as to when do we expect that? Because I'm like okay good, so when?

Riggs: Well okay.

Manuel: I know you can't say much.

Riggs: No, no, no, we have been testing it. There are a few people who were stacked up for years literally. We have a backlog of people like, “I want to invest,” and they were not accredited, but we kept a file on them, and we have been telling them "Okay you can do it." So we've been testing it with those people. So it is not publicly available, but we are testing it with people who have been around forever and are our friends.

What I can tell you is that it works now. FundAmerica is the backbone of this. And the Fund America process, the payment processing works great. It's fully compliant. You go through proving who you are. Doesn't take long and it will take credit cards, debit cards, wires, or automated clearing house ACH, all that stuff. Send in a physical check. It is all good. So that works great already.

And we have a great front end that you will be blown away by the frontal, because it explains everything about the business, what we do, all the videos. My brother drinking the water that came out of an oil well.

Manuel: I've saw that video.

Riggs: You've seen it? Oh my God. It's all there on that funnel. What we haven't done, is we just needed to hook it together. We just don't want this thing to break. So, my opinion, it will be Monday or Tuesday when this thing is up and running.

Manuel: Well, so it's around the corner. It's around the corner.

Riggs: Exactly, well on the internet, that's like years!

Manuel: That is going to be around just in a few days. That would be super exciting. You have a good marketing team. Your marketing team is going to make sure that everybody finds out?

Riggs: I've heard that AGM has a little thing going on.

Manuel: You have Coronavirus breakout? No, we're okay, we're okay.

Riggs: I have to say we are incredibly bad, we use up AGM’s bandwidth like crazy. We get the CMO, Jorge Rodriguez, the CMO of AGM is working for us. So, I'm like, “I'll take it. I'll take it. I'm good with it.”

Manuel: You are getting the best of the best. We're all in it with you. There's a great question here from Kevin that we missed which is higher up. It says, "Can you break down the general public offering again?”

Breakdown Of The Public Offering

Riggs: Absolutely, it's very, very simple. You invest whatever it is. Call it a thousand dollars. A thousand dollars will earn you 10% a year. So, a thousand dollars is $100 dollars a year. Now it is broken in monthly payments. You get 12 monthly payments, add up to 10%, and then it comes automatically, so we are showing it to our people, professionals in the industry, and they go wait a minute. Nobody is doing 10% for Reg A, now why would OriginClear do this? It's because you think that rates are low. Sure, they are low, but I'll give an example of the deals that we were handed.

We were trying to buy out another company, and these Wall Street guys said "No problem, we'll furnish the two million dollars to buy the cash part of the company, but you have got to repay it in two years. Two million dollars, two years, and we will take 30% of your company anti-dilutive, forever. We'll own 30% of your company.” I went, "No."

So instead, we are willing to pay 10%, because for us, that is inexpensive money, because these are our supporters. And it is not these Wall Streeters that want to take everything. They are so greedy. You know what they're justification is? “Gotta take care of your own family.” So with that said, Kevin, it is 10% that is paid, and that's like you invest money with Ford. They have what is called a bond. Full faith in credit of Ford, is behind that bond. But they are not going to give you 10%. They are going to give you half a percent these days.

Manuel: And is that every month or every quarter, how do you guys do it?

Riggs: It goes every month. What we do is, we have disclosed it in the offering, that we are going to set aside that 10% right off the bat. It just goes in a separate place and believe me when we say we do it, we have to do it, otherwise--we get in trouble.

There's a thing called Sarbanes-Oxly which is, I get to go to the big house if I do stupid things, so I don't plan to do that. So, what that means is that we do set aside the 10%, at least for the very first year, and after the year, we can redeem it. Which we may if we get cheap money. Or we will let you keep earning it. And as I say, you can convert.

What Are The Exits?

Now what are the exits from this. Number one is we would repay you what you paid originally, and then you stop getting the 10%. You got your cash that's good. Or we intend to list it on the over the counter market and you can sell it if there is a buyer, and that is totally subject to the stock market. We don't guarantee that. The third way is that you can convert it to shares in OriginClear. We are paying you to wait, is what it is. We are paying you 10% to wait. One day you say, "You know what? Riggs was talking about that stupid Zillow thing, I'll be darned if he didn't do it and the stock is going crazy. Well, I think I'm going to convert this, thank you very much." And you convert, or not, it is up to you.

If you convert to stock, there are no guarantees, so we are going to give you the 10%, that's solid. That is backed by full faith and credit. At the same time, and we have been in business for 13 years, we know how to stay alive. I have all kinds of tread marks from staying alive, but we have done it. So, we've proved that we can do it. Then, if you think one of our cool things is happening, and all of a sudden, you go, “Whoa, Investor Water has turned into the new Airbnb for water. Okay, I'll think I'll jump, I'll turn it into stock.” So that's your option at any time. That's it. It's as simple as that.

Okay, Frandy wants to know, email: invest@originclear.com. Robbie wants to know, "I have invested in this years back and it went South. What is the guarantee, it will go North?" Well you are not buying our common stock. Here is the problem, we were like a biotech. Years and years, the water industry takes 12 to 15 years to adopt a new technology. Oh my God, and we didn't start in the water industry until 2015, or 2014. Anyway, we had not been in the water industry that long, maybe five or six years, and I did not want to spend another 10 years trying to get our wonderful technology in use. So, we built a nice little business that works okay.

Preferred Share, Not Stock

Now we are doing this connection thing. Meanwhile you don't have bet that we are going to succeed as a stock, because the stock has been feeding that development all these years. Maybe it will take off, maybe it won't. We don't guarantee anything. We don't think you should look at the stock frankly, but you are not getting stock.

You are getting a preferred share that has a liquidation preference over common stock and over dividends paid to common stock which we don't have. So, you are in a relatively strong position. And like I say, you do have a liquidation exit, liquidity exit rather, excuse me, liquidity. You can turn it into money, in those three different ways that I told you about. One of them is passive. We have to do it. The other two eventually will happen. So that is why we think it is a good thing.

Exit Strategy?

"What is the exit strategy? "Do you have plans to go IP in the future?" We are a public company already. Our version of IPO is sent to end up on the NASDAQ, and to uplist. And I can tell you that I could financially engineer an uplist to the NASDA right now, but we wouldn't last. We would crash right back off. We have to have all the support. We have to be cranking as a business model for it to happen.

So, the exit strategy frankly is to continue to build a solid company on the big business side, with more and more. We will acquire other companies, do all that good stuff. The other part of it is, this very interesting direction where we hook up regular main street investors. Instead of being a real estate investor, and by the way, oh my God, I feel for you if you are a real estate investor, because every tenant in America, April 1st decided not to pay their rent. Lord have mercy. Subway just told every single one of its location's landlords, "We're not paying you. Sorry. Force majeure." Force majeure, that means we can't. It is like nuclear holocaust. It [this offer] is not like real estate.

Manuel: Yeah so the tenants, the tenants, whether that is corporations or actual homes, family homes. These guys are not getting any income, and they are not able to pay the rent. So, I would imagine that part of this gazillion dollar bailout has some kind of help for these people, but still I can imagine the nightmare that it is for the investors that have properties that they were renting out. They have mortgages. That is a challenge all by itself. That's for sure.

Not Like Real Estate

Riggs: It is going to ripple through for sure now, so what we decided to do was when we do something, it's not real estate or anything like that. You know the Rent-A-Center model, which is renting out TV's and people pay I don't know, $12 a week or whatever it is. Well, they could have bought that TV. Oh my God, but they don't have the cash, so they rent. That is kind of what it is in the water industry. Either you have got big money, you take forever, because you’ve got the money, you are not in a rush, or you don't have the money and you just somehow deal with the stinky pond.

Q&A

Yes, Byron thank you for wanting to invest. Would you please call the number which is 323-939, I'll put I right here 323-939-6645, and it's extension 201. All right now that number, you will not be sold on the Reg A. Our people do not sell. We are not allowed to. We are only here to inform. So that is informational. Or, send an email to invest@originclear.com. We record, it's very important, we record all these interactions or we will, because we want to show the SEC, that we are not trying to sell you. That is very, very important.

Thank you Stevan for stating there is a deferment policy in advance, beautiful. Other claims, "I hope your other claims are not exaggerated. I'm already invested." Well Stevan, thank you for being an investor and if you are accredited, come on over and get your price protected deal. We don't sell stock there. Again, it is secured. Manuel invested in a secured note that had free stock attached. Don't buy stock. Don't buy stock. Don't buy stock. Become, a creditor of OriginClear. We have made 27 months of payments on our credit investor thing, We know how to do it.

Manuel: So, the CEO, the CEO of OriginClear is telling you to not buy stock. That's not the route. So just mark those words. Important words right there.

Riggs: When OCLN is on the run, do what you want, but you are better off going into the Reg A. Okay we are going to wrap this thing up. "Are you currently working with major states that have clean water problems such as CA municipalities?"

We have a business in McKinney, Texas that is amazing, that does large projects, small projects, medium projects. We have the half-million dollar projects. We've disclosed them before. What we have here is a business that is very solid, but it does not explode. And that is why we are getting into the investor backed water projects which are very exciting. You will hear more about it.

Watch For Updates

Guys I'm going to wrap this up. It has been amazing. I love you. Manuel, thank you for making this so interesting, and exciting and being such a champion of the Reg A, which is going to happen. Make sure that you check your spam folder. In Gmail, go over to promotional, and make sure that you move that promotional over into regular, because all our stuff, because it's promotional, goes into promotional. So just make sure you are getting it, because you will get updates. And if you somehow don't hear anything because it went to spam, you could always go to www.originclear.com and there will be announcements. They'll be on the web. They'll be lots of communication,

So thank you all very much. Thank you Manuel. It's been amazing. Please join me next week, same time, 5:00 p.m. PST. I guarantee it will be shorter. The audio ones are more like half an hour, but I give you the minute to minute updates and it is interesting. It just won’t have my face with this weird blue background and this weird kind of green screen thing. So, thank you and thank you Manuel. Everyone, stay safe, be calm in this, remember it'll all be over.

JL Hicks says, "Thank you I enjoyed it."

Riggs: Likewise, been a great pleasure. Talk to you soon.

Manuel: My pleasure. Talk to you guys next time.

Riggs: Be safe.

Register for next week’s Insider Briefing: HERE

SAFE HARBOR STATEMENT

Matters discussed on this page contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this update, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein. These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include, but are not limited to, risks and uncertainties associated with our history of losses and our need to raise additional financing, the acceptance of our products and technology in the marketplace, our ability to demonstrate the commercial viability of our products and technology and our need to increase the size of our organization. Further information on the Company's risk factors is contained in the Company's quarterly and annual reports as filed with the Securities and Exchange Commission. The Company undertakes no obligation to revise or update publicly any forward-looking statements for any reason.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of these securities in any state in which such solicitation or sale would be unlawful prior to registration or qualification of these securities under the laws of any such state.

Important Disclaimer

Disclaimer: The securities referred to in this advertisement may be sold only to accredited investors, which for natural persons, are investors who meet certain minimum annual income or net worth thresholds. These securities are being offered in reliance on an exemption from the registration requirements of the Securities Act and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The Securities and Exchange Commission has not passed on the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials. The securities are subject to legal restrictions on transfer and resale and investors should not assume that they will be able to resell their securities. Investing in these securities involves a high degree of risk, and investors should be able to bear the loss of their investment. Any investment in such securities will be subject to the terms and conditions of the offering as set forth in the definitive offering documents and agreements. Risks of investing in these securities include, without limitation, the risk that the Company may be unable to make any required dividend or redemption payments

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)