Insider Briefing of 1 October 2020

Helping you thrive in the world’s ONLY vital, scarce and recession-proof market

NY based real estate and restaurant specialist Paul Fetscher shocked us with the numbers, how can we help? Mr. Real updated us on how it went in the Third Quarter just closed… Find out how the acceleration in decentralized water is driving company success and exactly what IS a Waterpreneur™?

COVERED IN THIS BRIEFING — QUICK LINKS

- Who is Paul Fetscher and why is he on the show?

- Real estate expert, Paul Fetscher's take on what's happening with New York RE from ground zero in NYC.

- An inside look at how restaurants, viruses and vaccines interrelate.

- The fat tail of risk and NYC business closures.

- The 2021 outlook for commercial real estate.

- How these real estate shifts and uncertainties are generating a groundswell of manpower for our Water As A Career initiative.

- How really DOES just-ended Q3 look for OriginClear?

- What about product demand and sales performance?

- The growing consumables business we are doing and what this leads to.

- How the acceleration of the decentralized water treatment trend is affecting OriginClear's operational activities.

- Our competitive differentiator in the hospitality industry.

- How OriginClear gives hotels a unique selling proposition to attract guests.

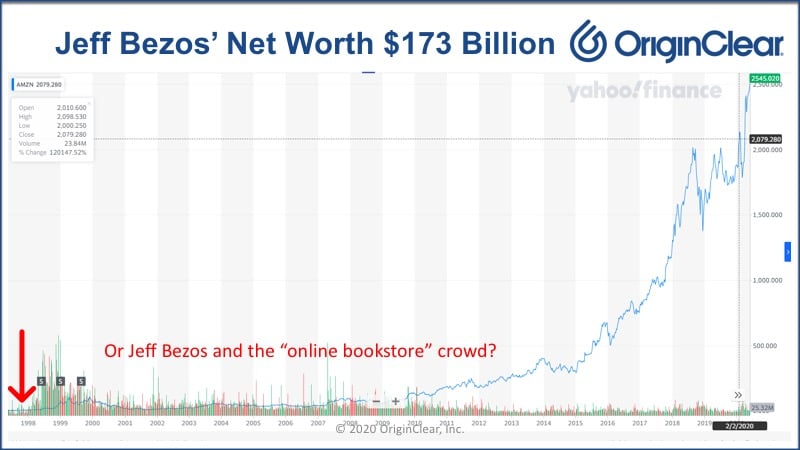

- Could early investors in Apple, Tesla and Amazon been less uncertain and made out more like Steve Jobs, Elon Musk and Jeff Bezos?

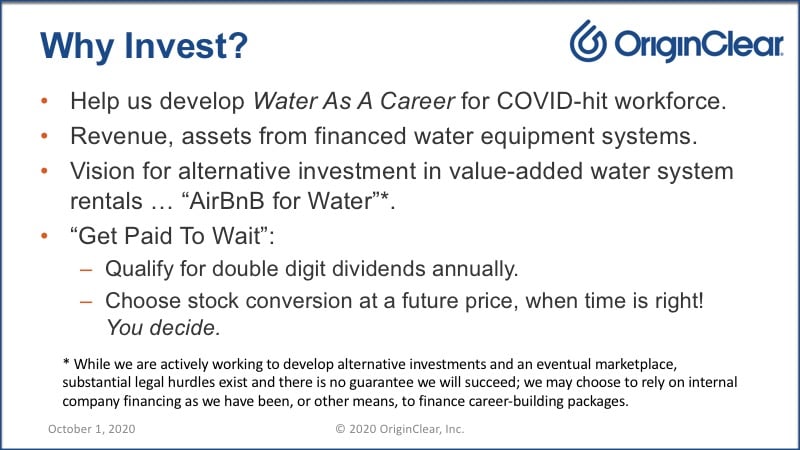

- Why OriginClear's "Get Paid to Wait" offering has the right balance of high yield and conversion upside potential.

- How water philanthrovinvestors are supporting and enabling Water As A Career's Waterpreneurs.™

Transcript from recording:

Introduction

Riggs Eckelberry:

So, Our participants are coming up to speed. So I want to welcome everyone to this briefing and I will get into the slideshow shortly. But with me, our two distinguished guests, we have Paul Fetscher. It's misspelled on the screen. That's FET, S C H E R. And he is an old friend, a long time friend from the eighties. And he knows all of my kaleidoscopic history. And he's also a long time investor in the company. And he is also a restaurant expert. Been that for what? 30 years? Something like that.

Paul: A bit more. I've been in commercial real estate for 50. And I started my first paycheck job was flipping burgers and cutting potatoes into French fries in 1963.

Riggs: So you're not 13.

Paul: No. God, how did that happen? I'm not sure. But I got to say Riggs did teach me how to make the best risotto.

Riggs: Man. I love risotto.I love how it just comes together slowly, right?

Paul: Oh yeah. Yeah.

Riggs: Thank you for that. So Paul Fetcher is of course, a restaurant expert in the middle of New York, which is the ground zero of the real estate implosion. He'll be telling us about that. And then we have Tom our COO Mr. Real, as I call him. And he will be talking to us a little bit, giving us non-material information about how we did, because we're before, basically the official reports, and we're a public company. But we're going to give you a flavor of how it's been going.

Here I am, I'm going to welcome you all to the show. And without further ado, I am going to share.

Water Is The New Gold

"Helping you thrive in the world's ONLY vital, scarce and recession-proof market." Why is water recession proof? Because there's never enough of it. Especially the clean stuff. It is October 1st, yesterday was the last day of Q3 in the public world. That means a lot. And we are excited about what happened in the quarter basically. I'm going to tease it because I know that Tom has a lot to tell us briefing number 81. How the time flies.

Important Notices

I'm going to run through a couple of things. First of all, of course Safe Harbor statement, meaning that what we say is our best effort, do not consider us to be on the order of profits, but we do our very best.

Paul Fetscher

All right. Now, introducing Paul Fetscher. Now, who is Paul Fetscher? Well, I took a snapshot of his website and Great American Brokerage is his company, the website is restaurantexpert.com. And he represents both the landlord side and tenant side, and he's written a couple of really well distributed articles, How to Deal with Landlords in the Age of COVID-19. And, Are You Ready for the New Normal? His articles are all over the restaurant industry. So welcome Paul. And I'm going to let you have the stage and talk for a little bit. What are you seeing in this market and just what's your overall take?

Tremendous Uncertainty

Paul: Uncertainty, more than anything else it's the uncertainty and wall street hates uncertainty. But if I go out and I'd take a look at some of the real estate investment trusts that are out there right now, it's no question in my mind that if I see something selling for 50% of what it was selling for seven or eight months ago, that South Coast Plaza or Roosevelt Field is not worth half of what it was seven months ago.

So I think that's something to jump on, but what has happened in the marketplace is tremendous uncertainty. When we got shut down, and New York got shut down pretty early, we got shut down on March 16th, a hundred percent. Don't go to work. Don't go to any stores. Stores are closed, restaurants are closed. You can do carry out and drive through, and that's all for restaurants. So that was what was performed and given to us as a...

Riggs: As an appetizer!

Paul: As an eat it, right. Now, if that happened on March 16, how many people thought this would go beyond the end of April, the pessimist thought it might go till the end of April, no one thought it would be lasting this long. And we have to sit here now and say, where is the light at the end of the tunnel?

54% Won't Take Vaccine

And if we're moving into flu season and if we don't have an effective vaccine, and if you've got to make a couple of million copies of anything other than the Apple 17, what do you do? And the answer is we have a very difficult time in terms of how many people will have it. Some of the things that scare me, other statistics that are coming back, if there was a vaccine today who would take it. 25%, 26% of the Anglo population would not take it. 46% of the African-American population would, meaning 54% would not.

Riggs: Wow.

Paul: Now, if you look at it, we're getting exposure of about 3% of the people. I live on a relatively small Island. We have 44,000 people. We've got over a thousand cases. So we're at a 2.5% in terms of what's happened here and people are behaving moderately well. Now, if you get a bunch of people around a bar and they get a couple of drinks, are they going to be more or less compliant in terms of wearing their masks? And in terms of social distancing,

Riggs: The more they drink, of course.

NYC Mayor Approves Indoor Dining

Paul: And that's what is happening and that's where we're getting these things bubbling up. So New York city, in the infinite wisdom of the mayor of New York city, came out and today was the first day you were allowed to dine indoors. Now, if you look at what they did, they said, first of all, we're going to waive all fees on outdoor dining, but there are people that have 120 seat restaurants and they could put about a dozen seats outside. How does that help them?

Riggs: Sure.

Paul: If I look at what else they do and the city says, okay, you now can go out and into the curb and the parking spaces in front of your restaurant, you can serve in that space. So if you set that up for dining in a parking space, I thought of it very much like a NASCAR race. The question wasn't if, it's when. In a NASCAR race, you don't ask, "Gee, is there going to be a wreck?"

When you have people dining curbside, you got to say, when is somebody going to drive into them? And while it took a while, we were about three weeks down the road, but in two days we had two incidences of people driving into those. You know, somebody does a fender-bender with another car, caroms off and boom into the sidewalk dining. Now, fortunately, there's been no loss of life.

Can't Open at 25%

The city then has some other challenges. You see if you're going to open at 25%, if I look at Boston at 50% and they're not having outbreaks, then why can't we open at 50%? The challenge with the restaurant industry is it's not scalable. I can go into a Marshall's and in a Marshall's, if I can have 25% of the occupancy, I have 25% of the salespeople and everything's in scale, it'll work. But in a restaurant, I don't know how to hire 25% of a hostess, 25% of a bartender, 25% of a dishwasher, 25% of a grill man.

Riggs: She's no longer "the hostess with the mostest," in other words.

Paul: You've got to be out there, and at 50% some people, the owners, are working more than ever before. They've cut their payroll, having fewer people and doing more to take phone orders and wrapping it up to go or delivery or third party delivery services. That's a lot of what's happening, but the cost and the ability to clear the hurdles at 50%, they're just about breaking even.

The Fat Tail of Risk

Riggs: So let's take that because, this is such an honor for me, but let's, fast-forward. You painted the picture. Now, what does this mean? You know, we get to the, what one analyst calls the fat tail. All the way at the end of the big fat tail of risk, we're talking about not only of course the restaurants shutting down; many, many permanently, but then of course, because there's no restaurants why would anybody come into the office? And, and it turns into a problem for New York itself doesn't it?

64M Visitors Drops to 2M

Paul: New York had last year, 2019 had 64 million visitors in the six months prior to September, they had 2 million visitors [in 2020]. And I remember March 12th, I was invited to dinner at the New York athletic club. And during that dinner at the end of the dinner, the president of the club asked me to come upstairs. They were having a final in their snooker contest.

Most of the folks had gray hair there, but there was a young man and a young woman. Well, they were from Broadway and it was shocking at that time on March 12th that they said, we're going to close for the rest of the month. And they went back home to Midwest and they close, ready for the rest of the month. Broadway is closed for the rest of the year. The Lincoln center for the performing arts has already announced, there will not be a 2021 season.

Riggs: Let's take that thought because Paul, you know, I'm, I don't want to use up the entire show.

Paul: I want to hear from Tom. I want to know how we did last quarter.

2021 Outlook for Real Estate

Riggs: Yeah. Right? a shareholder, but really fast where I'm getting with this. The reason why you're on the show aside from being a long time investor, is that what this means really for real estate, as an investment for the real estate investment trusts for the people who thought this was very, very stable. Look at the ARI, the Apollo stock graph — flat, pretty stable, stable, stable, and all of a sudden for the first time ever, [downward hand motion] it's kind of like how a bond, all of a sudden you break the bond. Where do you, what is the outlook do you think in 2021, just generally with the real estate investment market,

The Time to Buy

Paul: I have to go back to 1897 with Baron Rothschild and say the time to buy is when there's blood running in the streets, when everyone has tremendous fear and think we're going to hell in a hand basket, that's the time to go in there. When I'm looking at real estate investment trusts stocks that are selling for 50 cents on the dollar of what they were seven months ago, then it's time to throw some chips into that bucket because the value of the bricks and mortar and enclosed regional malls, I'd only invest in those who have "A Malls," Class A malls.

Too Much Square Footage

We have far too much square footage in America, simple as that. We have over 26 square feet of retail space for everyone in America. Nobody else, no other country in the world has more than 18 square foot per person. And if I go to Europe, I am looking at fewer than 10 square feet of retail for every person.

Riggs:That's scary.

Paul:We're at 26. That's why we're looking at taking some of the big boxes and the Macy's that are vacating and let's turn them into Amazon Fulfillment Centers. Let's turn them into office. If I look at the real peak of the mountain, the real peak of the mountain is Hudson Yards. A $2.3 billion project on the West side of Manhattan. It's a city unto itself in terms of the sheer numbers of what's there.

Retailer Space Converting to Office

It had the flagship for Neiman Marcus. Neiman Marcus operated one year, they have closed the doors, they put the keys on the table. What happens to that space now? It is going to be converted into office space. Office space you're going to have the same people there every day. You'll have more people there.

When was the last time you went out to buy a suit and how often do you have to do that? Food and beverage? I ate yesterday. I ate today and I'm probably going to eat tomorrow. Those are some of the positive things that happen for high frequency of customer visit.

But the people that go to Neiman Marcus once every three months or two months, or even once a month, those are the people that will benefit the other retailers, the other soft goods, the other fashion retailers. The people, they go there to work every day. Those folks are not going to be able to support the adjacent retailers who I assure you are paying the highest retail rates in Manhattan other than Times Square and Fifth Avenue.

Manpower Resource

Riggs: Our theme is that the manpower, the person power that's being released from all of this realignment is the water business has said officially, it needs three million people this decade and that doesn't even count the entrepreneurs that we want, the Waterpreneurs™ that we want to create.

Paul: Sure.

Riggs: Its bad news for those legacy industries, but there is an opportunity here to realign them. Thank you Paul.

Third Quarter, 2020

I'm going to now turn to the Tom Marchesello report. The report basically says in Q3, how'd we do?

One of the Better Quarters

Tom: Well, we did pretty good, actually. The team was pretty productive. Honestly, we had probably one of the better quarters that we've had of all the last three quarters. We've had three growing quarters in a row, and this quarter is no different. We were actually surprised by the increase in volume that we saw, but we really, really pushed pretty darn hard.

This last week in particular, we have been pulling in that accounts receivable and getting those purchase orders. As of yesterday and even this morning, we got two more, which was awesome. I'm looking at my sheet and the numbers are running off 154,000, 50,000, 105,000, 143,000. These are projects we're booking in, one after the other. And that's basically bringing the September total in very strongly. Granted, when we do the accounting, there's the issue of what can we book on the books versus what do we book in the sales channel?

Solid Performance

Our sales channel looks good. Then it's an issue of when we realized the revenue, which is always the accounting aspect of this. But for the most part, we had a really very solid performance and it came out of a couple of different areas. It was a couple of different product lines.

Traditional Industrial Products

We continue to do more reverse osmosis machines, our traditional industrial products. We continue to do a lot of membranes and filtration equipment. We had a lot of specialty equipment that we did, a lot of customs on some custom fabrication for some specialty industrial platforms. We had a couple of things for the agriculture industry, for animal farming. We had a couple of things that were related to industrial oil and gas refineries and chemical plants.

Riggs: Wow. That is super, wow.

Tom: Yep. We also had the hotel project as well. We are getting nice variety in the sense of we're having good industrial commercial client end-market. And we're getting a good aspect to the types of products we're doing. They all fit within our spectrum of five or six different machine-type end-markets that we're doing, but we're getting repeat orders as well. And I also see we did get some retrofit and upgrade work as well, which is always good for us.

Consumables Doubles

Riggs: As you were saying, the consumables, which is normally around $50K a month, the new level is what like $100K, $100K plus?.

Tom: We're definitely picking up that level. We're consistently knocking in the $100,000 plus range whenever we're doing the consumables. That's intentional as well, because we really want to pick up that piece of the business. And we're also selling things like tankage and other materials and pumps. So that's another extra thing that we can do in consumables, not just the filtration and media aspect.

Riggs: The consumables are important because they are a business builder for the largest stuff, right? The more relationship you have at the low level, it creates that future thing, right?

Opportunity Door Opener

Tom: Absolutely. Whenever you have the basics of the industry, that just opens doors to a lot of places, because then people can ask you for other things that they need. And then they open the door to, 'If you're buying a lot of filters for one of your pieces of machinery, sometimes the machine's not working great, right?' That might be an opportunity to replace that particular machine. Or it might be an opportunity because they're at capacity and now you need to expand your system.

An Accelerating Trend

The matter of fact it brings up the discussion that we often have with the team, which is why are the sales coming in? You would've thought during a time of coronavirus, we got worried that maybe the market would freeze up a little bit, but instead we ended up seeing this expansion for ourselves.

And the easiest way of explaining it was that our fundamental market was growing in general. And statistically, I was looking up industry resources and asking our teammates 'What's going on? Why are people placing orders with us?' And what we got as feedback was a couple of different answers.

Number one, people needed to do the work. They had to, because it's not going to stop. Municipal platforms are really working hard to provide fresh water, clean water, sanitized water for all people, whether they're at an office building or at home. That's not going to stop selling. The people went away. And the truth is we have populations growing. We also have populations moving around to new areas. And so water needs are continuing to grow.

Riggs: Sure

Tom: And then the report I'm reading basically says is during this time of coronavirus, interestingly, they're running into some budgetary issues at the governmental level on budgets where maybe they're clamped down on the budgets. They're not going to improve the local muni-site. So instead, industrial sites and then commercial sites are saying, "I'm going to have to pay for this myself because I have to do this."

Riggs: Which is us.

Tom: "I have to take care of my people."

Riggs: That's us.

Tom: Which is great.

Riggs: Totally, wow. So decentralization is actually ramping up and all the old trends just accelerated in this COVID, right?

Tom: It did, it accelerated for us. We were in a good spot to lay into the trend that was already in place. And then it accelerated and boosted us. And at the same time also killed off some of the international competition that was contaminating our market with low pricing. So all of a sudden, as a domestic USA company, sitting here operating out of Texas, we had a strong footprint to getting things done. And that real experience of real guys getting it done in America, played well for us.

Hospitality Industry — Competitive Differentiator

Riggs: Wow. It's interesting that the hotel business, I'm going to ask Paul to turn on his video again, because he has some thoughts to give us. This is an amazing thing. We were introduced to a hotelier two weeks ago. You spoke to him, Tom. Told him about our hotel purification system and yesterday, he invested in OriginClear.

Tom: That is awesome.

Riggs: Crazy

Tom: I like that guy.

Riggs: We're going to hear much more about him as the thing goes forward. Amazing guy. I can't get into details right now, but this means that people are turned on to the idea. Look, if you're going to travel now, you want to go to a hotel that has incredible water, because guess what? Viruses live in water, right? This is one of the vectors, as they say.

And so this is a competitive differentiation. So, literally for someone to make a large investment, because we have a great offer, but most more importantly, they love what we're doing and it's changing the planet for the better. The hotel industry needs every angle it can get. So Paul, you had some thoughts.

Paul: Yeah, two things. Number one is piggybacking on what you just said. It was absolutely no question. People are more concerned about their environment than ever before. If they're going to go sleep on another strange pillow, they want to make sure that things are as pure as they can be. We have people putting in HEPA filters that couldn't spell HEPA six months ago, seven months ago, but now can. That's part of what's happening.

The other thing that's happening is right now, when they're getting whacked, it's no longer the lucrative business. Like, "Hey, I can rent a room for 150 bucks a night and it costs me 12 bucks to have somebody clean it. Look at my gross profit on that."

Riggs: Right.

Paul: Today, they're not getting that. They're not filling the beds. This is what has happened in New York City. 60% of the hotels are dark. They've closed it. Something even as large and powerful as the Hilton in Times Square has turned the keys over to the lenders. They're not going to be able to reopen.

Riggs: That's like a 2000 room hotel, right?

Paul: Yeah, it's rather substantial.

Riggs: Wow.

Paul: The other thing now is what else do you do with the ones that are open? Answer, they're running a 40% occupancy.

Paul: Now, I sat two weeks ago with a hotelier, he's got five hotels. He took all of his reservations from five hotels, moved them all to one of his hotels and he's running 50% at that hotel.

Riggs: That was smart.

Paul: Look at what he's getting. New York City, right now, the hotels are running at about a 40% open, 40% occupancy. 16% Occupancy rate of New York City capacity. If I look at Long Island City, 10 years ago, had one hotel. Today, they have 23. How many of them do you think are open?

Riggs: 10?

Paul: Four.

Riggs: Oh Lord, have mercy.

Paul: That's it.

Riggs: Wow.

Unique Selling Proposition

Paul: These folks that are in that industry, they've got to watch every single nickel and dime. The ones who get aged, what happens to all the crud you're putting into your pipes and the calcification that takes place with, from the hard water? Can we eliminate that? How about the purity of what you were delivering to the guests? And do you think that becomes a differentiating factor, unique selling proposition when you want someone to stay in your hotel tonight as opposed to the guy down the street?

Riggs: You just told us enough about that. You are blowing my mind and it's telling us that we can look forward to an amazing run with hotels for that marketing reason, because sanitation is amazing, right? Thank you

Tom: That's been a big piece. I was going to say Paul, that's fantastic because it matches everything we were hearing and being told by the end-market client. The markets are so different by state too.

I'm in Florida and we didn't have the shutdowns in the same way that New York did. One of my friends owns a hotel here. And he actually is pretty good. They just couldn't wait to open their hotels. But even during some of the times they were running about 70%. So they didn't have anything close to like a 40% drop off for their properties.

Riggs: I know, It's amazing. But I think out of it, all these smart people, as you say, Paul are going to invest in better water. So, amen to the that. I'm going to move it along. Just thank you everyone.

Just to recap, we've heard from Paul Fetcher, an amazing restaurant expert about the tough times in New York city and what people are doing to survive. Tom Marcelo has told us about Q3, which is we think pretty solid. Of course, you'd never know until you do what's called recognized revenue, which is some mystical thing that has nothing to do with cash.

Paul: It means the check cleared.

Riggs: Well that, but also there's these milestone. It's a totally weird thing. I'm not going to get into it. But all I'm saying is that subject to the final report that will be coming out at 45 days. We are looking good. So thank you, gentlemen.

They Weren't Paid To Wait

I'm going to jump into some slides really fast here that are fascinating that I grabbed from Ken because you know, amateurs borrow, professionals steal. Let me show you what I stole from Ken Berenger. This is some fun stuff.

Will It Double?

All right, so Ken is building this whole rationale, which is, today's Apple investor is right around what? $116, something like that. And people are saying, "Well, is it going to double? Well who the heck knows."

The Original Apple 300

But do you want to be that investor, that maybe may or may not double maybe you just 10%, who knows. Or do you want to be Steve Jobs in the original Apple 300, the 300 people who became millionaires in the early days. Paul will know that we were in 1984 when the Mac was launched in New York and people were mortgaging their homes to buy Apple stock.

Now those people, when did they sell, did they sell, do they still own this stock? No, I suspect they sold when their stock went from $5 to $80 and you're going to sell, right. So and of course there's been a bunch of splits. So, the point is it's very, very hard to hold on because you could lose everything if you have stock.

Tesla Pioneers

Let's take a look at Tesla. Tesla's today, investor at 400 plus dollars. Is that the person who was in there in the early days, very few, very few have held on. And that's reality. Just you can take your gains. But what about if you'd been one of the early pioneers along with Elon Musk and started in around $2 or whatever it was that, that he came in on.

And Amazon?

So now what, let me do it, give an exceptional example. I'll tell you where I'm going with this. Amazon, today's investor 2000 plus. It's actually more than that figure because we're literally six months have gone by.

I was there in 2000 with stock from a company that I had sold. And I had this public stock and I was literally looking at Amazon at $23 in early 2000 well late 2000 early 2001 and going, "Should I buy the amazon stock?" Well, the fact is that even then the Amazon stock did not go anywhere for a while for very long time, all the way until 2010. So again, you could have lost everything.

So you could have been of course, early on with Jeff Bezos back in the early days. And was that a good idea? Probably was right?

The Right Balance

So, how do you get paid to wait? How well would the early equity investors in companies like Apple, Tesla and Amazon have done if they got paid to wait, right? What about if you would been an employee without having to work. In other words, you're just a passive investor. You get dividends, you're being paid to wait.

And that's why we believe this is people are buying into this and it's enabling us to right now, we are now able to buy those, that equipment that I've been talking about for the water as a career entrepreneurs. For people like Ryan Koistra, who's ready for a second and third machine.

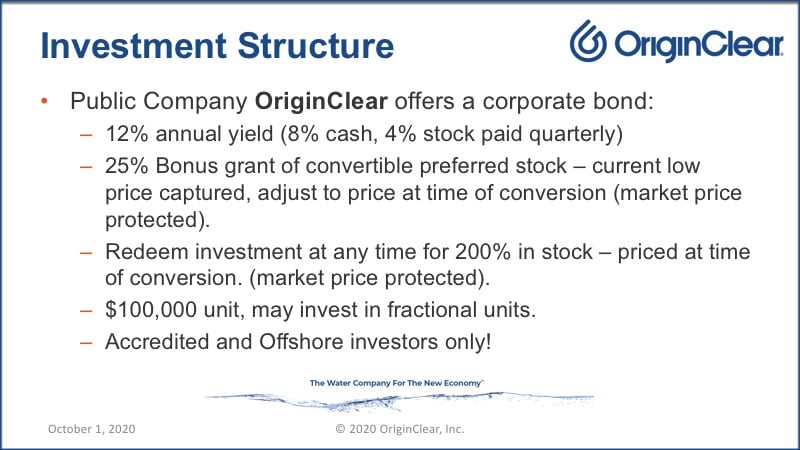

High Yield Plus Double at Conversion

We know the money is now coming in because of this amazing structure that we have, that it really, first of all, delivers a 10% plus yield 8% cash, 4% stock. In other words, 1% stock every quarter. And then the 25% bonus grant. So you invest a hundred thousand dollars, you get $25,000 of stock completely free. That is safeguarded until the day you convert it to common stock.

Now, your investment? You can turn it in for twice its value in stock at the later price. And you may invest less than a hundred thousand, but it's only for accredited and offshore investors.

So that is the offering that is on the table. Of course, you know about our unaccredited investor offering, but that is a separate matter that we will be covering in future shows.

Help Develop Water As A Career

You'll be helping us to develop Water As A Career™, literally helping us finance these machines, and we get revenue and assets, which ultimately I believe will land us on the NASDAQ. That's my personal goal. I'm not representing this as a company goal yet, but that's my personal goal. And eventually develop this alternative investment marketplace that we will see what that does. And then of course, you get paid to wait through the double digits dividends and choose your conversion.

Just Call Ken!

So here's the contact number I'm not done. I have a short video to play, which I think you'll enjoy, but here's where you're going to be contacting Ken. Who's just an amazing guy. He's smarter than me. Bill Gates has said this. He says, "Always hire people who are smarter than you." And I think that's very, very true. Devin Angus at extension 116. Just email or do the easiest thing is to put in your browser, oc.gold/ken and that instantly schedules a meeting.

Big News Next Week

All right, next week we have big news from our friends at Philanthroinvestors. They are really, really, really, really, really, really, really, really, really doing amazing things. And they have restored my faith in partners, because it's very hard as everyone knows who's ever had a partner.

So what I'm going to do now is I am going to turn on the share screen again and play this short video, which I think you'll enjoy.

Start of presentation

Eric: Environmentally, we need to clean up our water and the United States should be number one in having it as pristine as we can.

Bob: Doing something that is positive in taking care of a situation in Flint, Michigan and in Los Angeles and numerous other places that don't have water problems.

Keith: We started giving to a church that dug wells for people who had no drinking water. So when, when I saw how OriginClear is cleaning water, it seems like the perfect match.

Eric: I mean, a lot of people have water in the refrigerators and that make ice, well, that's got to be clean or else we are going to continue with the health problems that we keep running into.

Bob: It is time to do something about it. It's time to be really effective. And I'd like to be a part of that solution by investing in OriginClear.

Eric: I am also a CPA for the last 40 years, very much in tune with changing economics. And one thing right now is with low interest rates and that, what we need to do, is get regular cashflow coming back because it's getting very hard to put money at risk for time.

Keith: My lovely wife Linda here, is so tight, she's not going to jump into anything. She looks it over very carefully.

I was a little skeptical at first. I had to see everything, really look at the numbers and that. We really believe in what you guys are doing.

Eric: And I was excited about it when they showed it to me is the fact that you're getting a regular return of principal and interest on an ongoing basis. Plus the participation in value growth, an ongoing revenue stream.

Bob: I've been amazed at what you guys have done in the past. And I'm really, really excited about what the future is going to bring because OriginClear is probably one of the most innovative and interesting companies that I have ever been involved with and I think sky's the limit for the future.

It's been consistent. It's been very lucrative and it's been very fulfilling because we actually feel like we're doing something for the economy.

Eric: It allows you the flexibility to start redirecting things and adjusting. If there is a new lifestyle or something that needs to be addressed.

Bob: It's a way to make money. And in this time of uncertainty and with the market's going up and going down and everything else, and you guys have been steady for the last two years with regular payments. And so I'm betting on the future. I think it's going to be great.

Eric: I am Eric Keller, a CPA and I'm a water philanthroinvestor.

Keith: I'm Keith Rutan. I'm a water philanthroinvestor.

Bob: Hi, I'm Bob Roos and I'm a water philanthroinvestor.

End of presentation.

A Water Philanthroinvestor?

Riggs: Now, why are these people saying I am a water philanthroinvestor? This is something that we'll be discussing next week. The philanthroinvestor concept says that you will invest for good and you will do good while doing well. And I try to get that straight Ken. And I think I did, but the truth is, is that we want to make money, but we want to make money in a way that's going to help the planet. And these investors are extremely happy with that.

I really hope that you will call Ken, just book a call with him. And please come back next week because we are going to have an amazing show, giving news about how things are breaking on the water philanthroinvesting front.

Disclaimer

And I'm required to end this thing with a disclaimer, which is why we're back into share mode right now. And that is that we have a regulation D offering, which is unregistered and subject to risk, and you should always be able to bear the loss of your investment. I want to thank everyone on the show and thank you everyone for sticking around so long.

Chats — Comments

Paul Fetscher said, "Very true, if Apple found a cure for cancer tomorrow, it would double the stock price.The world is full of overnight successes that only took 10, 15 to 20 years and then exploded." Well, from your lips to God's ears, as I say.

So thank you. Ken calls it organic decentralization, which is a beautiful thing, because of course the world is decentralizing.

Thank you all for being on-board for this show. It's been fascinating. I appreciate Paul Fetscher's input on what is happening, the tough times in New York City and how a lot of really, really talented people are going to be looking for new opportunities.

That manpower combined with our Water As A Career, Waterpreneur™ concept is going to really be an amazing conjunction of opportunity and also making a difference for the quality of water.

Thank you again, everyone have a nice weekend. See you next week for an amazing show involving philanthroinvesting.

Thank You!

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)