Insider Briefing of 3 December, 2020

Helping you thrive in the world’s ONLY vital, scarce and recession-proof market

What a powerful briefing. Does Dan Early really have $9 Million in his pipeline? What's at the core of his success? Hear from the man himself, Arte Maren, CEO Philanthroinvestors® why he describes OriginClear as "a marriage between integrity and innovation." And I covered the exciting development of OriginClear Financial™. Find out where it's all leading!

FEATURED OR COVERED IN THIS BRIEFING — QUICK LINKS

- A sneak peek at the documentary video interview with CEO Philanthroinvestors, Arte Maren, on why they chose OriginClear.

- What kind of people make up OriginClear?

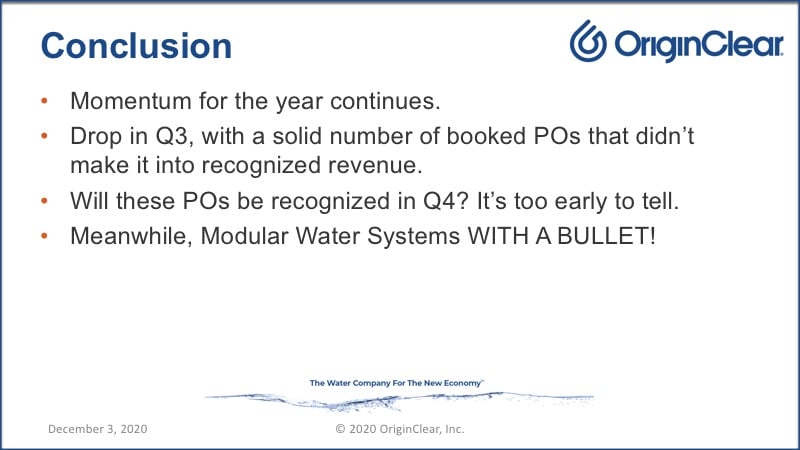

- OriginClear's Q3 report and how it compares to last year.

- Summation of the quarterly report.

- An inside look at Dad Early's Modular Water projects and sales pipeline.

- Dan Early reports on Modular Water Systems and its progress.

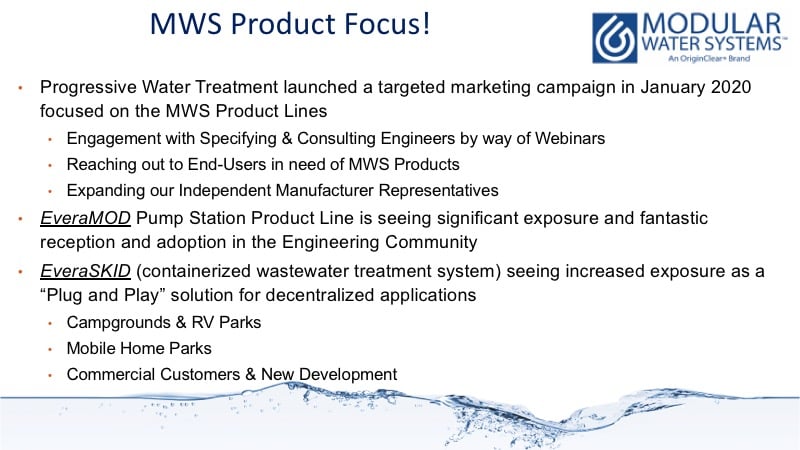

- The targeted marketing campaign at the core of Modular Water's sales explosion.

- The standardization and productization that has been implemented in the Modular Water Systems.

- The peerless EveraMOD wastewater lift station and why it is rapidly becoming the new industry standard.

- How the water industry engineering world is responding to the EveraMOD.

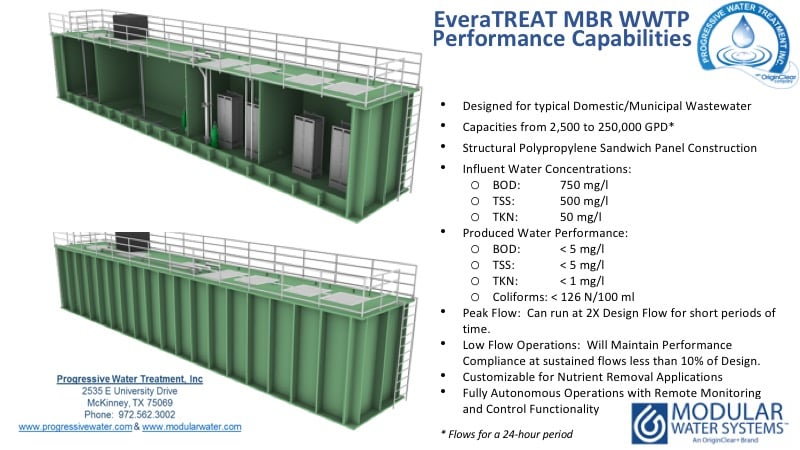

- The newly standardized Modular Water EveraTREAT MBR (Membrane BioReactor) wastewater treatment systems.

- How the EveraTREAT MBR is a living machine and why Dan Early is so passionate about them.

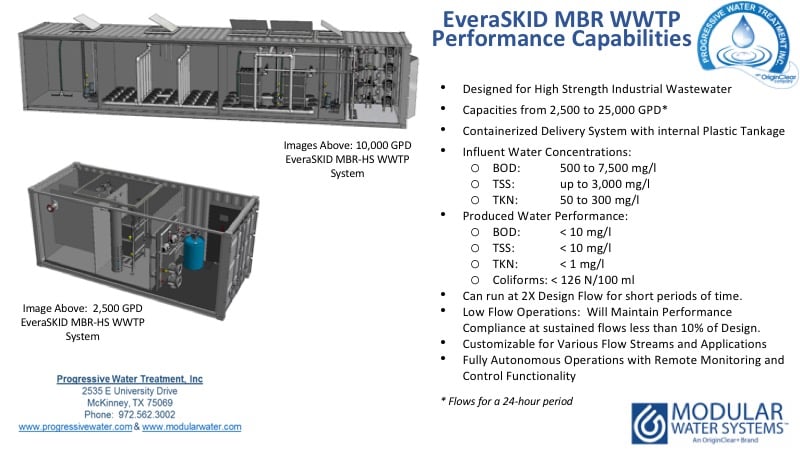

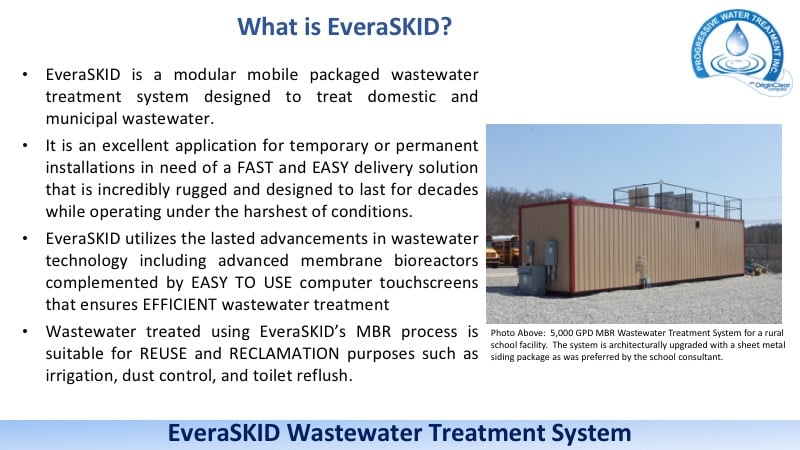

- The EveraSKID MBR containerized systems and why they are the total plug 'n play "instant infrastructure" solutions needed for the decentralized water movement.

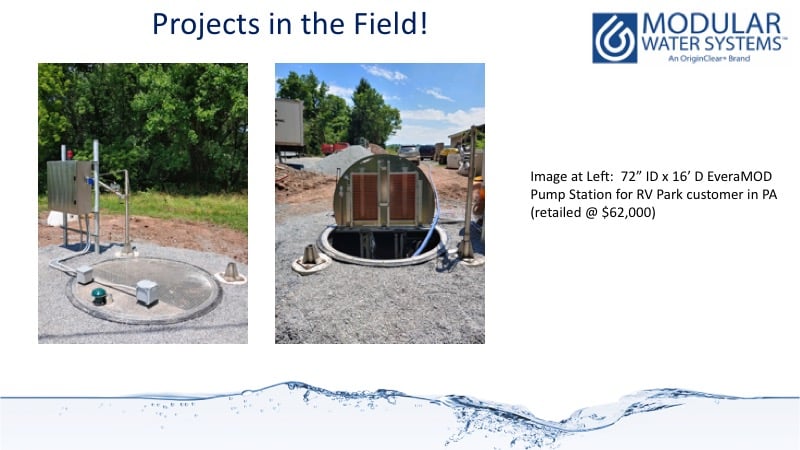

- A full awe-inspiring review of Modular Water's completed projects in the field which utterly demonstrates the capabilities, breadth and potential of the Modular Water product line.

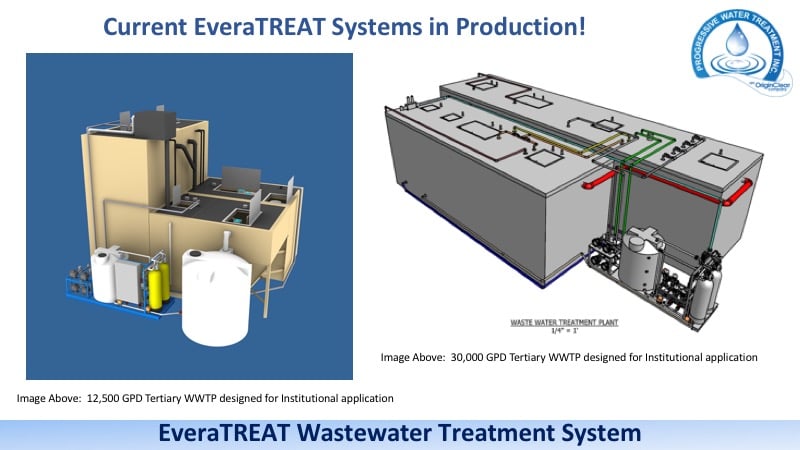

- A glimpse at the future of wastewater treatment — 3D Renderings of a few of the EveraTREAT and EveraSKID systems mid fabrication.

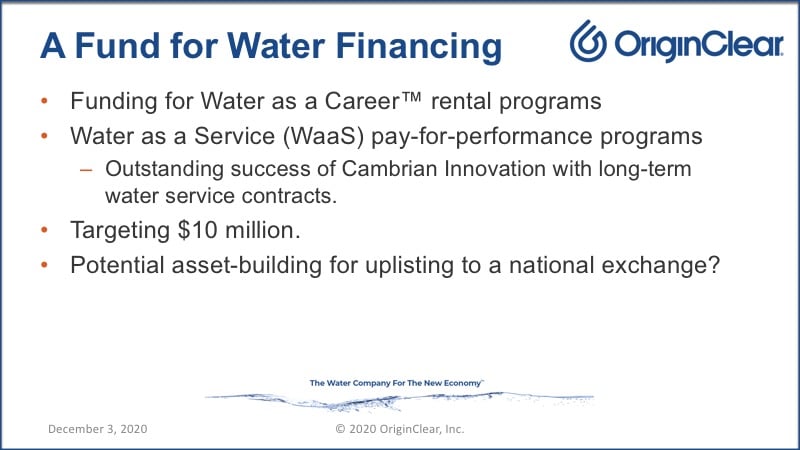

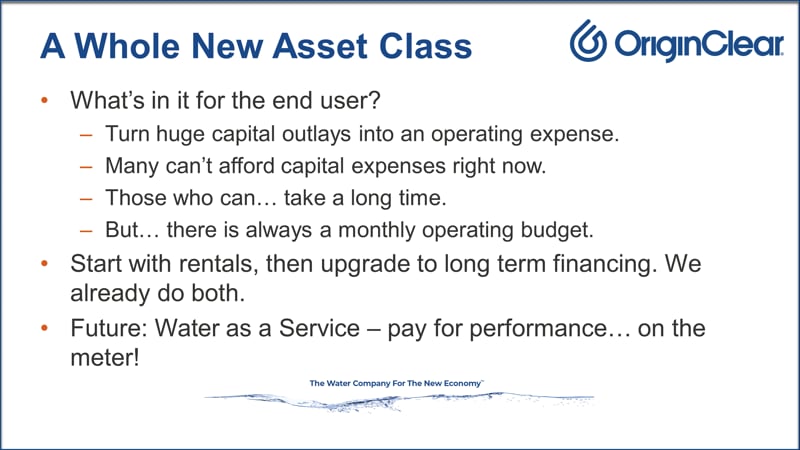

- A presentation of OriginClear Financial™ from our CEO demonstrating our water project funding strategy is clearly dead-center on the money.

- What OriginClear Financial could mean to the company in the near future.

- A must-see presentation from Ken Berenger with a thought-provoking analysis of the Telecom boom and how that relates to OriginClear's current offering.

- Why we think we have found the right balance with our current investment offering.

- Can we really create a whole new asset class?

Transcript from recording:

Introduction

Riggs Eckelberry:

Good evening everyone. It is the first presentation of December. It's going to be a very short month. It already feels like, "Oh my gosh, got to get the Harry & David going!" This is an action-packed briefing. I think you'll love it. You will absolutely love it, so let's get right into it.

Of course, water's the new gold, and remember that this is the industry that is not going anywhere down because water demand is only increasing. Water's only getting worse. This is an industry that benefits from people being irresponsible, right? And so there's a lot of that going on; a lot of need for clean water. So, it's a great space to be in and we are loving what we're doing with it. It is December 3rd, briefing number 89.

Safe Harbor

As usual, we have our safe harbor statement, which says that we are not gods. We do our very, very best, but all our statements, of course, depend on the outcome.

Definition of the Company

All right. Now, Stephen Schnitzer wrote in and he had just a great definition for the company. "We're pioneers in the private wastewater treatment business, which is a great statement, from sanitizing a family pool to designing a building wastewater treatment plants for businesses, as well as real estate developers and/or existing developments, communities and municipalities," and

"We specialize in fast, efficient and economical solutions to your water treatment needs, as well as providing the financing to get your project done on time or ahead of schedule, and under budget." So that's really neat. Now, thank you, Stephen. That's excellent.

Documentary Series

So, without further ado, I'm going to get into the next sneak peek from our documentary series. It's being shot by the man with too many cameras, Stephen Eckelberry, my brother.

Unique View

The story behind this one is that back in June, long story, but we ended up in a relationship with a group called PhilanthroInvestors and this has been amazing for us. In this clip, Arte Maren, the CEO of PhilanthroInvestors, and an old friend of mine actually, tells the story of how it came about from their point of view and I think it's really unique, so let's check it out.

Start of Video presentation

Transcript from recording:

Saving and Sanitizing

Arte Maren:

With all the resources we have we can put a guy on the moon, but our water is horrible. The state of the cleanliness and their scarcity, it is scary. After all, we can't live without it, that's part of what we're embarking upon. And that's what OriginClear is doing in terms of both saving and sanitizing water, and on a much bigger scale.

From top L to R: Marc Stevens - President, Progressive Water, Ken Berenger - VP Business Development, Daniel Early - Chief Engineer, Tom Marchesello - Chief Operating Officer

From top L to R: Marc Stevens - President, Progressive Water, Ken Berenger - VP Business Development, Daniel Early - Chief Engineer, Tom Marchesello - Chief Operating Officer

Fabulous People — Believers

OriginClear has great bones. We looked into their plans; we looked into their current activity, their current fundamentals, in the sense that they have not only earning capacity, but they are earning and that earning is growing. While there was a lot of hope and a lot of intention, there was also a lot of activity backing it up. We have that marriage of motivation and mechanics. We were looking for, who are the other players? It can't be just all Riggs, and it wasn't. They have some fabulous people and these people are believers.

Faith, Confidence and Belief

If you're an entrepreneur, if you're an investor, you know that there better be a whole bunch of believers because there's obstacles, there's challenges. And only with the... what we call FCB, only with the faith, confidence and belief, do you get to drive over all of those barriers or challenges.

Integrity and Innovation

I must say something also about OriginClear, incredibly innovative. Riggs Eckelberry, the CEO, is not only innovative and very disciplined, but ethical. It's one thing to be innovative and say, "Well, we can cut a corner here. We can cut a corner there." No. When you have this marriage of integrity and innovation, now you've got something, and that's why we've done the licensing.

End of presentation

How it Happened

Wow! That is such a cool testimonial. Arte Maren is an amazing guy. In short, here's what happened. We were creating this whole new funding angle to the company and we were figuring out this, Water As A Career™, and Investor Water™ and the marketplace, and all these amazing things. And Ivan Anz, who is the brilliant founder of the real estate side of PhilanthroInvestors®, which is on the INC. 100, et cetera, happened to be in one of my briefings.

We don't know how, but there he was. And he said, "Oh my gosh, this is the water company we're looking for," and he says to Arte Maren, "There's this guy, Riggs Eckelberry," and Arte goes, "I know this guy." The rest is history. So, a lot of great things are coming from this relationship, including the really, really important fund development that I'll be discussing further with you just in a minute.

Quarterly Numbers

The important thing now is to get into, I'm going to get right into the quarterly numbers because that's very, very important. And then we'll continue on with some other important stuff. So, let me just review the year so far.

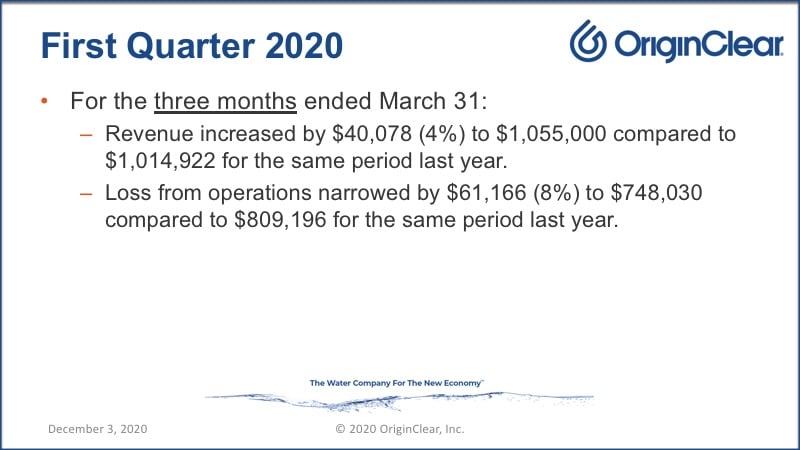

In the first quarter, we were just a little bit up. Remember that was COVID, right? Three months ended not June 30th. That's a mistake. That's a typo. It's actually end of March: January, February, March. Revenue increased by just 4%, but we felt lucky because we had a full month of lock down.

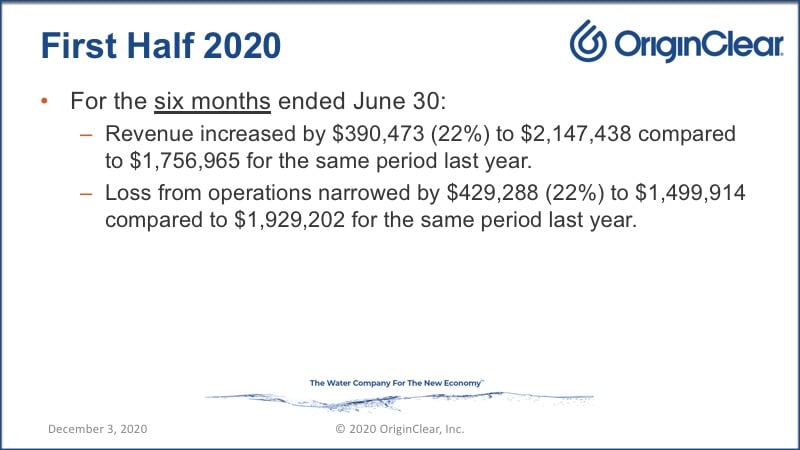

And then, we got into the first half of 2020, which... there we go... and that, all of a sudden, there was a boost in Q2 that made the entire six months now 22% up. And loss has continued to narrow tremendously, so that was excellent.

Why Run Losses?

Now, by the way, why the heck do we run losses? The fact is that we have gross profits. We have gross profits, but we don't have net profits. The reason is that we are working hard to become this huge disruptive player. I think we have a billion dollar opportunity. Where that goes? We don't know.

We know that, for example, Tesla went on for years and years and years in the red in order to become the largest water [electric auto] company in the world. So, as long as we're making progress and development, I think it's a fair thing to run a deficit, but the numbers have to improve and we have to conquer the market.

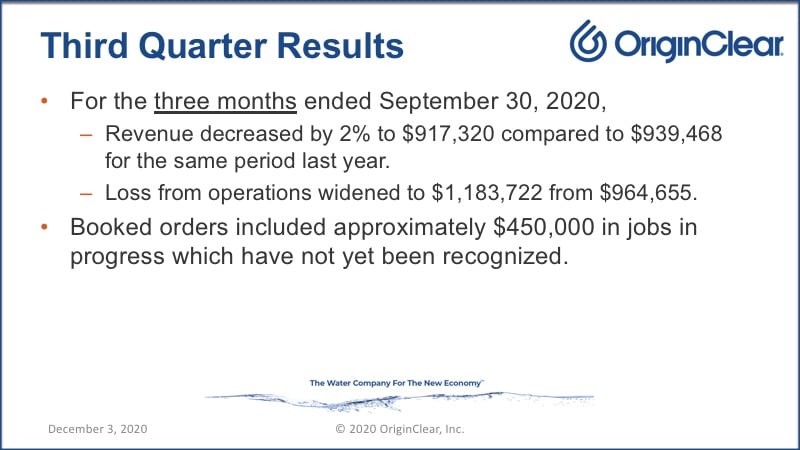

So, let me continue here, the third quarter, that was a pullback. Revenue actually went back down 2%. We had a lot of booked orders, almost half a million dollars that did not make it into recognition because they were right at the end of September.

So then, how does the entire 2020 look? Well, overall, we're up by 14%. And so, we're solidly back in the million dollars a quarter range, which is what we expect. Last year, it wasn't quite that much. Gross profit increased by 20%, so that's excellent and the loss from operations decreased solidly, so we're doing okay.

Now, what's happening? Well, again, we got momentum. That's good. There was a drop in Q3, but a solid number of booked POS that didn't make it into recognize revenue. Now, will these POS we recognized in Q4? Hard to tell. Q4 is a tough quarter because of holidays, and of course, states keep going back into quarantine, but we have a lot of action.

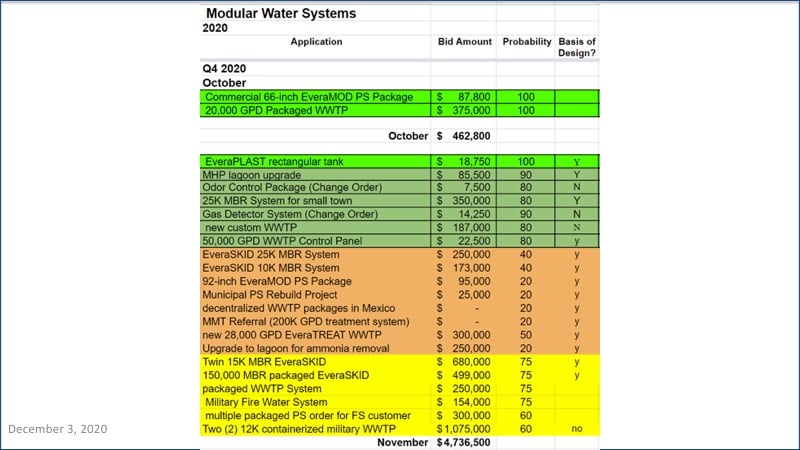

Inside Look at Modular Water

Now, I want to show you what until now has been only internal company numbers, and that is Modular Water™, Dan Early's division. What kind of action do they have? This is an inside look at what we've got here. In October, Modular Water took off with almost half a million dollars, which a beautiful thing, and that was really heartwarming.

We're omitting all the names of these projects, obviously. What you've got is pump stations, wastewater treatment plants, tankage, a lagoon upgrade, MHP means mobile home park, so that's that trailer park project that we've been talking about and you can see the percentages here by colors. So 100% means it's closed, it's done: contract, everything, and on down.

Types of Systems

So then we have Membrane bio-reactor system for a whole small town at 80%, beautiful. Custom wastewater treatment plant, so there's a bunch of stuff here. EveraSKID™, that's a Membrane bio-reactor system on a skid, and 25,000 gallons per day. These are starting to get done in the numbers in terms of likelihood until we get to the bottom. But almost $5 million, they won't happen in November but here's what's interesting, basis of design.

Basis of Design

Remember Dan Early, he designed stuff that bakes in Modular Water Systems™. If you are the basis of design, it's very hard for the carpetbaggers to come swooping in, which they do. This is the big bane of our existence, is people stealing business. But with Dan Early, he's got a tremendous amount that really belongs to him.

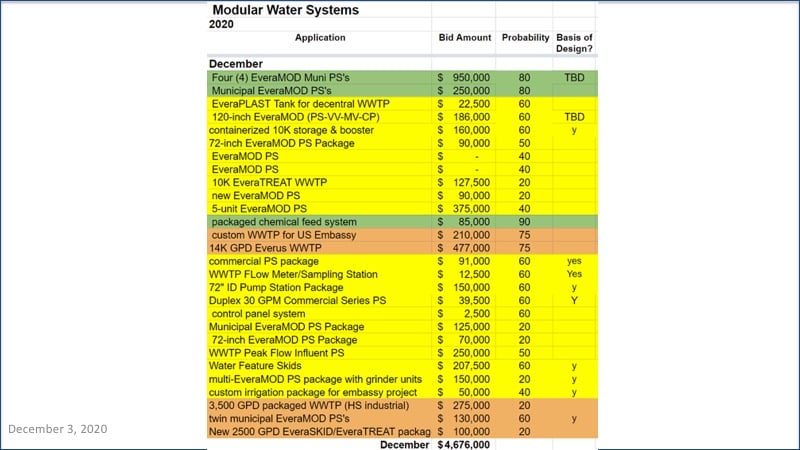

Another Four Million

All right. Now, let's take a look at... That was October and November, right? Now we look at December. Now, in December we have some municipal pump stations, a lot. Almost $1.2 million worth at 80%, that's very nice. A bunch of action at the 60% range, decentralized wastewater treatment plant, all kinds of good stuff.

We have a U.S. Embassy. We do a lot of U.S. Embassy work all over the world actually. A sampling station, another pump station package here at 60%, so 30 gallons per minute commercial series pump station, et cetera, et cetera, et cetera. That's another four and a half million dollars. Now, that's $9 million, but of course, a lot of it is in the low percentages, but it gives you an idea.

Every one of these deals is a deal that Dan Early has quoted, or is talking to, or is actively involved with. And he's doing these amazing webinars that he's a guru for he'll be able to tell you about that. Let's have Dan in fact, give us a status report. The man, the myth, the legend. How you doing, buddy?

Report From Dan Early

Dan: Hey. I'm good. Good evening to be with you.

Riggs: Right on. Right on. Well, you've created an amazing status report. And so really I appreciate this amazing pipeline you've got. It's just so cool. Now the world knows what you got going, so you can't hide it under your hat anymore.

Dan: Right. Right.

Riggs: Without further ado, I'm going to let you do the little presentation.

Progress

Dan: All right. Very good. All right. Well, thank you, Riggs. Really i'll tell you and I will share with the audience that I am just overjoyed with the progress that we have made with Modular Water this year. A lot of the things, a lot of the groundwork and a lot of the effort that we're putting into last year, it is really starting to bear fruit now, really starting to come to fruition.

Really super pleased with the progress we've made and super excited with where the future leads. Especially as we trail off in the tail end of Q4 here in 2020 and head into 2021. So with that, let's move on to the first... Move on to the next slide real quick, and I'll sort of jump into this and give everybody a quick overview.

Targeted Marketing Campaign

Some of the things that we did get accomplished successfully this past year, and things that continue to progress, and continue to evolve as we continue to perfect things, is we really launched a very targeted marketing campaign early this year going after and networking and partnering with specifying and consulting engineers.

The packages that we sell, Modular Water Systems and Progressive Water, there's a little bit of a nuanced method to promoting and marketing these things. This targeted program and these presentations that we lead with continuing education series programs, all of those things are at the core of the success that we're starting to have now. That's one huge thing that has changed this year.

Reaching End Users

We're also reaching out to the end users. These are the people that need our products, whether it's a treatment plan or a pump station, or some sort of a solution, infrastructure solution, or what have you.

One thing that I'm really, really excited about is the EveraMOD™ system that you've probably have heard me talk in the other times that I've participated in these presentations, talking about our heavy plastic manufacturing, and sustainability, and durability. That message and the way everything is starting to come together and starting to coalesce, that message is now really resonating with the specifying engineers and the consulting engineers that work with clientele that need our products.

Riggs: It looks like you've about a third of your pipeline is these pump stations, right?

Dan: We do. About a third of it. We do.

Riggs: Wow.

Standardization and Productization

Dan: Then the other products we have are the, EveraTREAT™ and EveraSKID™ systems and those things are the productization and standardization have really come about. I'm really, really super excited with where that is going. The success that we're having is about, is really related to the productization and the standardizations that we created.

All of that is a function of the manufacturing model that we continue to grow and continue to evolve. All of our products, EveraMOD pump station, the EveraSKID containerized system and the EveraTREAT heavy structural plastic tankage based system, all of those things are very programmed, they're very standardized in the way we put them together.

So all of that lends itself to the ease of adoption at the consulting engineered level specified on an engineering level where they are agents acting on behalf of their clientele. So those things just tickled to death, the way those things have come together. If you will, next slide please if you don't mind.

EveraMOD Lift Station

Dan: All right. So the next slide should be showing and I'm waiting for it to catch up.

Riggs: I was seeing the EveraMOD wastewater lift station.

Dan: Yeah, the EveraMOD wastewater lift station. Okay, well this one, this right here, just for the audience, if you're familiar with wastewater infrastructure, pump stations are everywhere. We have to get the wastewater from point A to point B, and typically a pumping system is involved with that.

There's a lot of corrosion issues that are involved with the pump stations and wastewater infrastructure solutions. The EveraMOD system that we have created that we've perfected. That is really a next-generation technology.

Feedback from Engineering World

I was giving a presentation to a fairly large consulting firm earlier this week, one hour training session, continuing education session. We introduced the EveraMOD system. And the feedback that I get from the engineering world is two things.

First off they're like, this is the solution we've been looking for. The second thing is that they're like, this is so easy for us to adopt. You've really standardized things. It's like ordering a car at the dealership. You just check the boxes as to what you want. So this is what the EveraMOD system is.

EveraTREAT Membrane Bioreactor

If you would, if you move on to the next lot, I think we'll talk about some of the wastewater treatment systems that we've standardized. So this, this one right here for the audience, this is the EveraTREAT MBR wastewater treatment system. Now this...

Riggs: What is an MBR? Excuse me.

Dan: An MBR system stands for a Membrane BioReactor. This is an advanced wastewater treatment process. That is a biological process. This is a technology that you typically see used with reuse and reclamation. When you're working with decentralized applications like we do, it is very common to see customers and clients that have needs for very stringent effluent limits. The Membrane bioreactor allows us to do that.

It's a filter of sorts. It's also great for reuse and reclamation for toilet reflush and irrigation and those types of things.

Living Machines

Riggs: You really are a very strong with the biological treatment. Aren't you?

Dan: That is my specialty. That is it actually truly is my passion. That's the one thing I do like about the water space is that when we get to promote these bio-reactors, these are living machines and it is really, it's really cool for me at a personal and professional level, to be able to design and deploy these types of technologies and watch them do and perform the task that was intended.

So this is our EveraTREAT. It is a rectangular structural plastic system. It is cutting edge. And the approach that we're using in delivering these systems that this heavy plastic model really is overcoming durability, sustainability issues that you see with concrete and epoxy coated steel. When you're dealing with wastewater, those types of materials, which were most common, tend to have much less reduced surface life. The heavy plastics, the Polyethylene's, and Polypropylene's, we're looking at the infrastructure solutions, with a 100 year anticipated service life.

So if you would move to the next slide, which will, I think talks about the EveraSKID system, and this is a sister product. It is complimentary to the EveraTREAT System.

Plug 'n Play Solution

And that the EveraSKID system is a truly our plug and play solution. The EveraSKID uses a containerized delivery model. This is where we take standardized shipping containers, up fit them with a rectangular structural plastic tankage system and the simplicity of this one is basically a pipe connection coming in, pipe connection going out and a power connection.

We can deliver a 25,000 gallon per day advanced treatment system to a customer. And within eight hours they can commission this system and it is ready for operation. This is getting to that delivery model that is so important for the decentralized water and wastewater world. You have to deliver technologies that you basically flip the switch without this cumbersome long protracted construction time. That's what the EveraSKID system is.

Strong Product Line

So this particular product line right here, our pipeline of opportunity where we are either basis of design or near-term signed purchase orders, are very, very strong, very strong product.

Riggs: Yeah. I can see the EveraTREATs and on December here, there's the 10K right there.

Dan: Mm-hmm (affirmative).

Riggs: And we had some action in November as well.

Dan: Right.

Riggs: And of course there's a bunch of stuff that's of course in 2021.

Dan: Correct. The groundwork, the foundation work that we've laid here in 2020 is really setting us up for a very, very big 2021. I'm so, so excited. I know Robb Litos, who's my counterpart and Marc Stevens and Mike Jenkins and Tom and those guys down in McKinney were wondering how we're going to keep up with progress!

Completed Installations

All right, well, let's talk a little bit about projects in the field. So we talk about all these ideas, but what are we seeing in reality? So here's some examples of projects that we actually have delivered. What you see here are either completed or partially completed installations for the EveraMOD pump station.

This is a wastewater infrastructure which is so crucial to a modern society and urbanized society that we live in. A 72 inch diameter, 16 foot deep for an RV park customer. They wanted a turnkey plug and play solution. And this basically was the preferred solution on the part of the engineer working for that particular client.

Heavy Plastics Solution

The next slide shows our first twin delivery. Earlier, actually this was real, real early on in the EveraMOD system. We had an opportunity to deliver a twin EveraMOD pump stations to an industrial customer in Ohio. So this gives the audience some sense of what these things look like.

But the one thing I would like for everybody to look at is the heavy plastic manufacturing. This is so critical and so key to the fundamental success of the EveraMOD system and the Modular Water System product lines.

4X the Service LIfe of Conventional Materials

The next one I believe is another pump station that we delivered for a customer in New York. Yes, that's this one. Again much like the previous slide where we delivered twin industrial pump stations, this particular project was a municipal customer, a small rural utility in New York, and they needed brand new stations to service unsewered district.

We delivered two EveraMOD systems. Very pleased with the way this one turned out. These are total solutions. The intent for this delivery is that once these stations are installed and commissioned the utility owner, and the customers that derive service from these should experience a system that has a 100 year service life. Four times longer than what we typically see out of concrete and steel.

Closed Loop Zero Liquid Discharge

Moving on to some of our wastewater treatment systems that we have underway. Yeah, so this next slide talks about a closed loop zero liquid discharge customer that we commissioned late last year, that we are now well into the second year of operations for that one, I'm very pleased with it.

Containerized

The next slide is the EveraSKID system. That one is our containerized system. So you'll recognize the container shape and some of the architectural detailing that goes with that. Both of these are perfect examples of the EveraSKID system and the EveraTREAT system and the way we deploy our decentralized package wastewater treatment systems.

Projects in Fabrication

So if you want, move on Riggs to the next slide, and I think we'll talk a little bit about some of the other things we're doing. So Riggs mentioned that we are working with a number of department of state applications overseas. And the slide that was previously on the screen shares a couple of the projects that we're currently in the process of fabricating and delivering for institutional applications.

There you go. That's showing the 12,500 gallon per day tertiary system on the left and a 30,000 gallon per day tertiary system on the right. Those are for reuse and reclamation, fundamental to the decentralized program that is the EveraTREAT system and the mission that we have underway with Modular Water Systems.

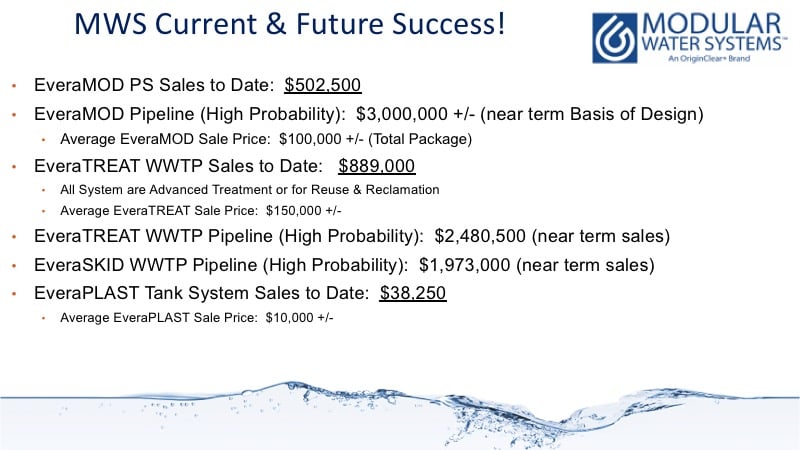

EveraMOD Summary

So I'll go ahead and wrap up this real quick with what we've done relative to installations, sales to date. If you'll bring that slide up for me. Talking about some of the things we've done, so looking at the EveraMOD sales, sales to date, we did over a half a million dollars in booked orders that have either been delivered or currently in production heading to the field.

Our pipeline of high probability near term where I'm involved with these projects and Robb Litos and I are working with the end-users, consulting engineers, our high probability near term basis of design pipeline is about three million on the EveraMOD product line. So very, very excited about that.

Watershed Year

So if you look at the EveraTREAT, our sales to date, we're just a shade under 900,000. So we're making really, really excellent progress. The 2020 has been a watershed year for us, as we have turned the corner and really are starting getting some adoption in the marketplace.

And then if you look at EveraTREAT, EveraSKID pipelines, you can see that just high probability, near-term opportunities, easily we're looking at about $6 million worth of potential sales that I would say in the next six months or so.

That does not include a lot of the other work that is being laid, new reps that are coming on board, new projects and new opportunities that are coming into the pipeline at various stages of development. And if you would, I believe that pretty much wraps up. I don't know if I've got one more slide or not, but I think that pretty much wraps up everything on this end

A Conquest

Riggs: Yes. That is it. I'm stunned by the things you've got going here. What I really get from all this is that from all this missionary work, the evangelism you're doing with these webinars and really getting your design philosophy out there, is that these are conquest sales. We own these customers because then they don't just buy into, oh, it's just another widget, no. It's a Modular Water Systems branded design and they buy into the philosophy. And I think that's huge.

Dan: It is, Riggs you're totally, totally spot on with that. It is a conquest. It's a conquest that I love and we will be attacking and conquering many, many customers and mountains of opportunities as we continue to progress down through. 2021 is an exciting year ahead for more Modular Water and OriginClear.

Riggs: I love it. Well it's been about two years and great things take a while, but man you got momentum. I appreciate it, my friend.

Dan: Yeah. Thank you. You're very, very welcome.

From a Sales Company to a White Knight

Riggs: Okay. So go ahead and turn off your video. And I'm going to continue with the status report. And now I'm going to cover something very, very important for our future, which is the ability to finance things. Remember that the company really changed when we realized we needed to deal with the funding.

So you from being a sales company to a white knight, like, "I bestow this solution upon you." And that's all about the funding. We've done all these developments of the whole Pool Preserver™, Water As A Career™, Waterpreneur™, all that stuff's very, very important, but how do you scale it up? Well, it takes the money and that's where we've started to work on a fund.

Now, what is this fund about? Obviously it's to fund the Water As A Career rental program. People like Ryan Kooistra need machines to be rented to them, they don't qualify, otherwise we can rent it out to them. The new one is this, Water as a Service pay for performance programs. And remember how I was telling you guys about Cambrian Innovation, which is a big success in the space.

About WEPA

And I'll just show you what that website looks like. These guys are just on fire. And they have something that they call the WEPA, the Water Energy Purchase Agreement. They put energy, they also... They're not content to do just clean water. They also do energy, which is interesting but that's beyond our scope at this time, but there's always that possibility.

Remember that we came out of algae for energy. And so we love that space. And our partner in France built a system exactly like this in the UAE, United Arab Emirates that still runs to this day. Amazing, but not to get into the energy thing.

Pay for Performance

What's important about this is that Cambrian charges on a per gallon basis. And that's called pay for performance. And they to back that up, they've continued to raise money, $18 million right here, this year alone, or end of last year. They're continuing to run very, very good funding. So it's about the money, but if you have the money, then you can do these pay for performance deals.

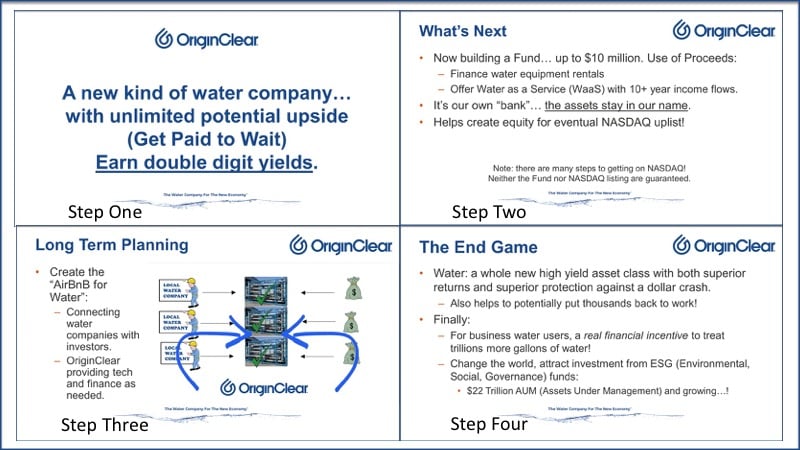

Capability to Uplist

We are targeting at $10 million. We potentially could do more, we could do less, I mean, we could do as little as a million and do fine, but we're not accepting investments of less than a million dollars. These are special vehicles that we're doing. This is not an ordinary private placement. You got to be able to come up with at least a million dollars.

But what's important is, is that once we get this kind of fund going with the money or the equipment, we've got the ability eventually to uplist to a NASDAQ. Again, I'm not saying we will, but I'm saying this gives us the capability.

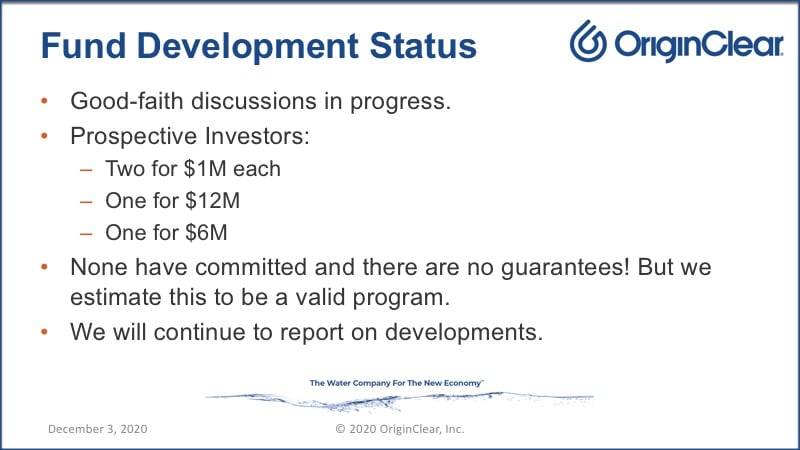

Valid Program

Okay. So what's the status of this fund? Where are we at? So we are in good faith discussions. We have four prospective investors, two of them are for a million dollars each. And one of those million dollars is actually a strategic partner that I will be discussing once things get more serious. One is for twelve million, that's ongoing and one's for six.

None have committed. There are no guarantees, but we estimate it to be a valid program. In other words, these people are serious. They have the ability to pay for it. We're now putting together the agreements, the letter of intent and so forth. But this is to let you know that we have the action.

Presentation from Ken Berenger

Okay. So now I'm going to play something very cool that Ken Berenger put together that is really worth watching because he's a hell of a talent.

Before I do that, however, I would like to see, I've got some chats here. And we have Craig here, "Love to get involved, let me know." And he's got a phone number and we'll be happy to follow up on that. Okay, good.

Now let's continue. So let's take a look at what Ken's cool presentation is. Really, really love it.

Start of presentation

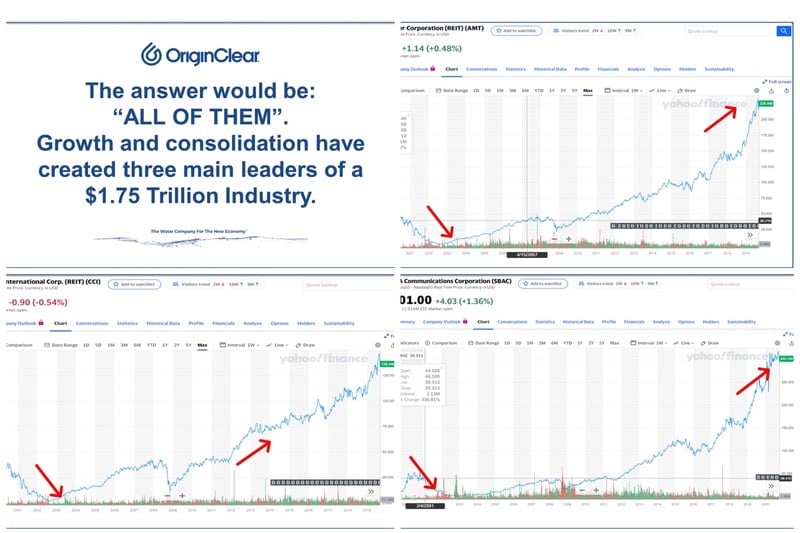

Ken: Okay. So if you could recreate the telecom boom from 20 years ago today, which company would you buy? Which one would have been the best? The great answer is it really didn't matter.

Any one of those companies that were involved at the dawn of that innovation really did phenomenally well and now are part of a $2 trillion telecom market. Now, of course we know today that everybody who invested early killed it, but in the beginning, the first two years were very rough for investors. Right?

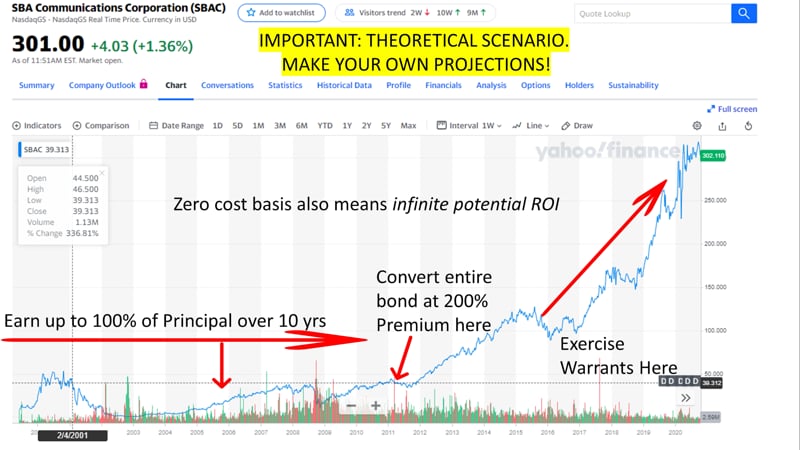

Perfect example, AMT in 2000 and you bought, you were down big by 2002, and then of course, a hundred fold rise in the next 15 or so years. Again, Crown Castle in almost identical situation, and oddly enough, the turnaround happened almost to the day as it did with AMT. And rounding out the top three is SBA Communication, yep, the chart is almost identical.

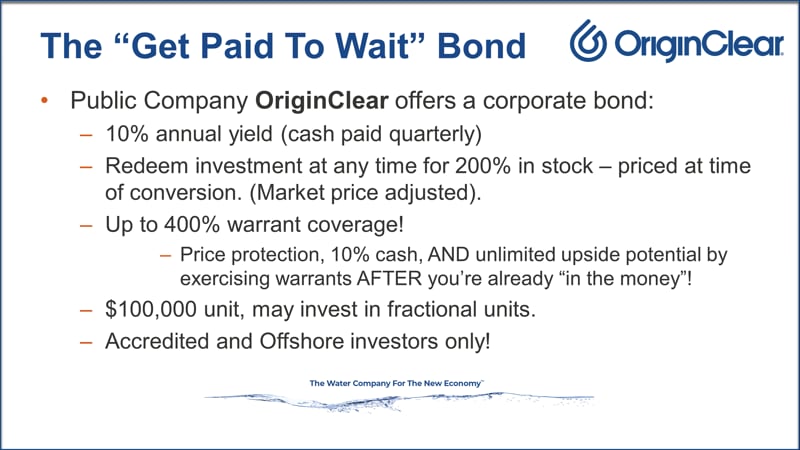

Get Paid to Wait

Most of the early pioneers cellular telecom investors, if they were getting paid to wait, probably would not have sold too soon. We think the investment structure getting paid double digit yields to wait, could make all the difference in the world.

Double-digit Yield and Double at Conversion

So we think we found the right balance. We're a public company. We're offering a corporate bond that pays you 10% annual cash yield to wait. Now, when the stock takes off, you can redeem that investment at any time at double your investment amount price at the time you make the conversion. And depending upon the size of your investment, you may have an additional 400% warrant coverage that you can exercise as the stock trades higher.

The Right Balance

So if the early SBA Communications investors, for instance, had our corporate bond, it would have made all the difference in the world. Because you can see between 2000 and 2011, common stock didn't move at all. They made no money.

With our bond you would have actually recouped your entire principal amount and you, at that point could simply convert the whole thing into double your investment in common stock so you enjoy the full leverage as we start to see the stock climb. And of course, you could also exercise your warrants along the way.

Reliable Alternative

We finally built the ability for investors to own these micro utilities everywhere. Recession, no problem. Inflation, no problem. You want to depreciate it, we can do that too. But you're not banking on real estate and you're not banking on the oil commodities market.

Now we're going to own these at first. We're going to build a fund, we'll launch it, we'll figure out what we need to know. We'll have this great income generator, which is great for the investors. And then when we're ready, we'll launch a worldwide marketplace.

No More Selling

So the launch of the marketplace was created to solve water company problems that we were experiencing we think everyone will join. Why? Longterm service contract income from water companies, dramatic increases in margins and the ability to simply build in place systems anywhere they're needed with no selling necessary. And the reason it's easier for water companies is there's no more selling. You're simply supplying a need.

Water as a Service

Everything is turned into a very manageable, operational expense. They can start with short term rentals, they can finance it later. We can handle it all. The really exciting part longterm is that these assets will be available to simply pay the meter by the gallon or the ton very much the way you pay for electric service now.

Building a Micro Utility Asset Class

So let's look at the next couple of years and where you come in. So step one, invest in a brand new kind of water company, have all of the unlimited potential this presents, but get paid the entire time. Step two, launch the fund. We've got numerous investors standing by who really want an alternative to commercial real estate next year. We'll split the very generous yields with them, but we'll keep the asset with the hopes of utilizing that to help us uplist the company to NASDAQ.

So step three, a little bit longer term is launch that Airbnb for water, just connect water companies, investors, and kind of perform more of a managed services model, which becomes just a cash cow that Wall Street absolutely loves.

So what we build in the end here is a worldwide micro utility asset class. Metered billing means that the more water that is treated in the world, the more money is made. That's the first time that's ever happened. We also think that, that could make us really attractive to ESG funds in the future.

So this is why we think we can do to water what cell towers did to telecom. We can change everything and we'd love for you to join us. Would you book a call with me?

And of course, I'd have to mention our Safe Harbor Statement, which is here. And once again, the disclosures for this specific offering.

End of presentation

Riggs: Beautiful, that is just a beautiful presentation. Of course, this is just the... These are bookends, there's the intro and the outro, but I thought that it would be very, very cool to show. And again, I really appreciate the good work that Ken is doing here.

Contact Us

Here's your contact information. Ken is brilliant. These are concepts that he's come up with and he and Devin are really running the show here while I work on things like the fund and much more. Call Ken to get briefed on this new offering. It's really, really good. Everybody wins. It's very popular right now.

Just type oc.gold/ken in your browser and it'll automatically schedule you. It's a great way to go. And of course, I've got a disclaimer, which we saw in the video, so I don't have to get into it too much, but the offering is not backed by the SEC. The Securities Exchange Commission has not registered this. That's the only disclaimer that really matters here.

Next Week

Now, what's happening next week? Well, we have some very good stuff in store. Tom Marchesello is going to give us a major report on things in the offing that you definitely should listen in on. So it's been an action-packed briefing, lots of fun having you guys on board.

I'm just going to double-check to see, Rick Garcia says, "Love it. Short, concise, informational, and inspirational." Well, you're a tough audience. So thank you, Rick. I appreciate that. And we'd love to talk to you. As you can see, this thing is coming together. I'm so excited about how things are going.

Thank You

So as we're closing out the year, stay tuned, join us every week. There's big stuff happening, and we think we're going to go powering into 2021 with a lot of momentum. So thank you all. It's been wonderful. Join us next week. Have a great weekend.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)