Insider Briefing of 20 August 2020

Helping you thrive in the world’s ONLY vital, scarce and recession-proof market

In this briefing CEO Eckelberry covers the latest developments on Water as a Career™ with an enlightening sneak-peak into some of the program’s mechanics. Chief Engineer, Dan Early, cohosts and drops a wow-bomb into the program even the CEO wasn’t expecting! Watch cool new testimonial videos and see why OriginClear is thriving during these COVID times.

COVERED IN THIS BRIEFING — QUICK LINKS

- A turnkey marketing program as part of the biz-op package.

- The Water As A Career entrepreneurial university.

- What is the Water As A Career pilot program?

Transcript from recording:

Introduction

Riggs Eckelberry:

And hello everyone, welcome to the somewhat delayed courtesy of Zoom briefing. And as I see people coming in, it's excellent. Tonight, we have as our co-host Dan Early, the inimitable bearded man from Virginia. It's the good luck beard. We're stuck with it.

Dan: Yes.

Riggs: Water is the New Gold. And we've been making the point that we are the world's only vital scarce and recession proof market. I don't think I have to overdo it for this audience. We'll be getting into it a little bit later.

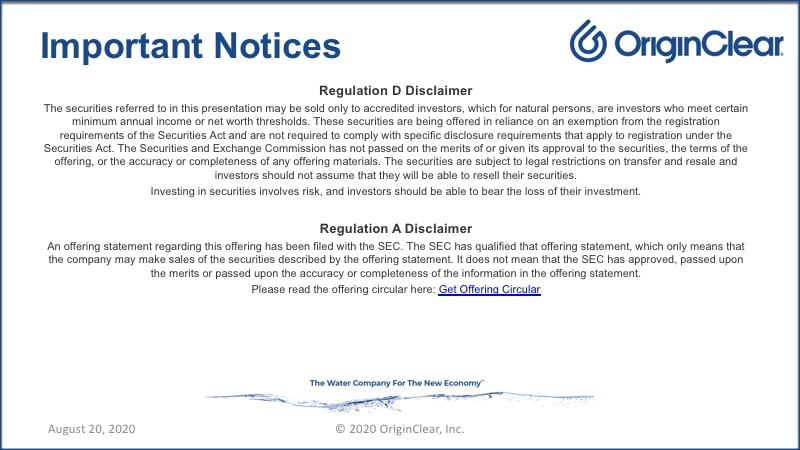

Important Notices

This is important, as a public company we have to couch our forward-looking statements with all kinds of conditional statements. And all that means is that we have to make sure that these things are accurate as we know, but of course we don't necessarily know the future. We do our very best however.

Now what I'm going to do is I'm going to play a little video. This is a draft. This video is a draft that's been created just to give you an idea of where the messaging is going. So please excuse the fonts. They're not there where they're supposed to be, but I think it's pretty cool anyway.

Video presentation

Transcription:

Frame 1: Every day 6,000 children die of water-related diseases.

Frame 2: More people die from unsafe water than war.

Frame 3: 80% of wastewater worldwide is releases untreated.

Frame 4: And the US recycles only 1%.

Frame 5: Current water infrastructure is crumbling.

Frame 6: Our US water industry needs 3 million people.

Frame 7: And there’s the answer.

Frame 8: All these businesspeople shut down by COVID?

Frame 9: Let’s retrain them for Water as a Career.

Frame 10: To speed up sanitation worldwide.

Frame 11: And earn stable income…while improving water quality.

Frame 12: This public company is building it with a high-yield corporate bond.

Frame 13: That’s tailor-made for these times.

Frame 14: Get your own personal briefing.

Frame 15: Enter this, OC.Gold/Ken, in your browser (accredited investors only, please)

End of video presentation

So as you see, we are still working on the fonts and the spacing and so forth, but it gives you a basic concept.

Second Quarter Numbers

Okay, well, yesterday we filed the second quarter numbers and of course we also reported on the entirety of the second half of 2020.

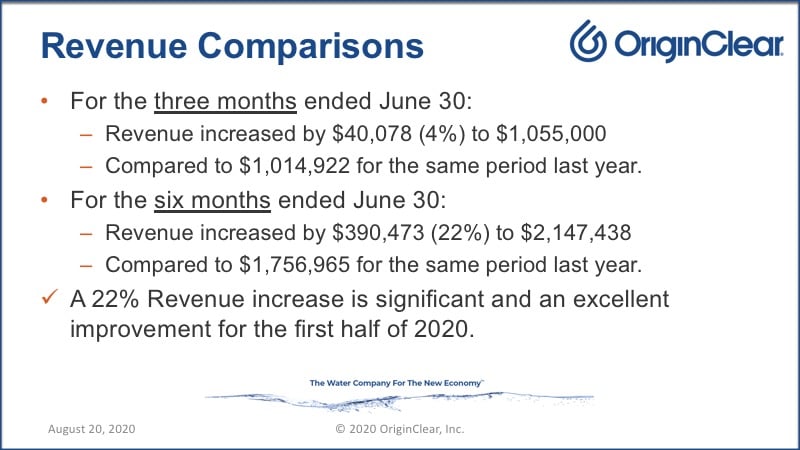

An Improvement

So, what's all this hard work been adding up to? First of all, for the three months ended June 30th revenue increased by 4%. So just over a million dollars. A million dollars is our magic number. So that's really roughly where the second quarter was for last year, 4%, not much of a difference. But here's the great part is it's this entire six months of 22% up, and this didn't necessarily reflect right off because revenue is a very special thing in a public company. It's recognized not when the cash comes in, but when certain milestones are met.

And so this is a very voodoo thing, which unfortunately, a lot of us don't even learn until the quarter is over, but 22% revenue increase is significant. Also, a very good improvement for the first half of 2020. Dan, I think you're part of this success story. So, thank you.

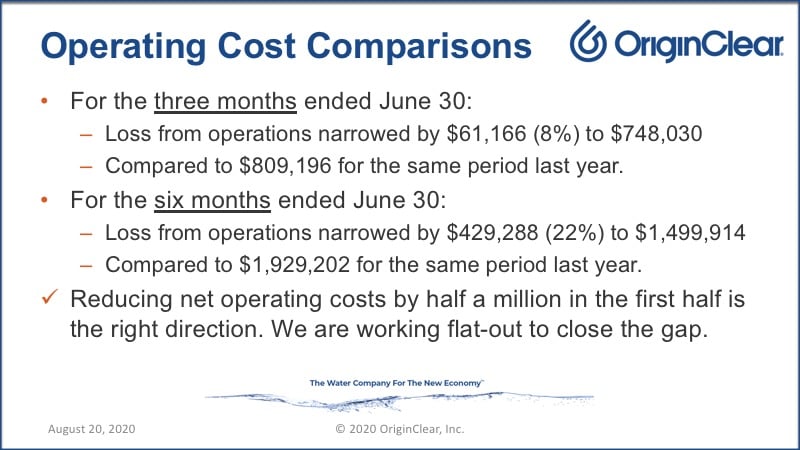

What About Operating Costs?

Also, I'm never allowed to mention revenue without talking about operating costs. We are still negative. The good news is that loss from operations has narrowed and essentially, we reduced operating costs by half a million dollars or a full million dollars for the year if you do pro-rata, which is wonderful. That cuts it by about a third. And at this rate, we're going to be in great shape at the end of the year if the trend continues.

So, that's really good news. We've been spending money to develop new programs while the guys and gals in Texas and in Virginia work the day to day and they're contributing the revenues, but it's wonderful to see that operating costs are dropping at a pretty significant rate. That's not quite half a million, but it's pretty decent.

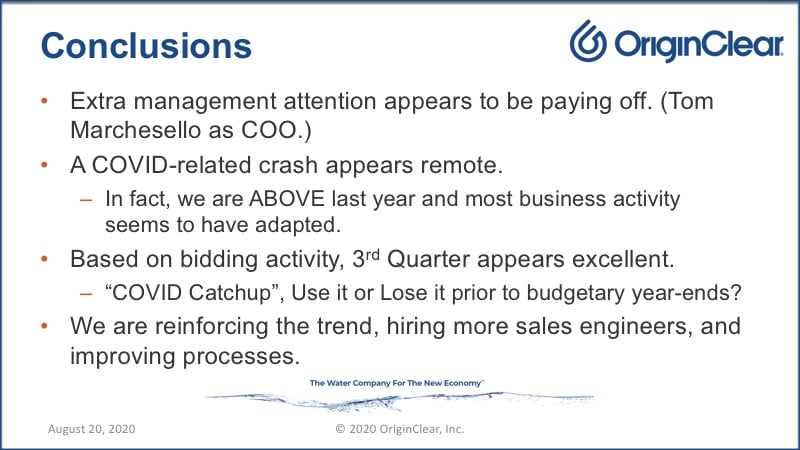

Management Attention Is Paying Off

Okay. So, that's that picture. Now, conclusions, extra management attention appears to be paying off. Dan, what is your impression of the effect that Tom has created by his involvement last year, year and a half?

Dan: Tom's been very instrumental in really helping bring organization to the operating systems. His focus on the day-to-day minutia, that's all part of running a water business, all of that has been just absolutely instrumental in making the company work more efficiently, working cohesively as team members, admin, finance, all of those things.

Riggs: God, it's too bad he's on staycation right now because he could hear all this stuff. But sorry, Tom.

Dan: He deserves a vacation. He's worked very hard for the last eight to 10 months.

Riggs: No question about it. He's been really dedicated. So, from our point of view, a COVID-related crash does appear remote, which really concerned us for a long time as it should everyone. We're above it last year and most business activity that we're seeing in Texas and elsewhere, seems to have adapted. , third quarter is looking good based on the bidding activity. COVID catch-up seems to be a factor. Just tell me a little bit, Dan, just about what you're seeing with bidding activity what's happened in the recent like this week, for example?

Highest Demand in 25 Years

Dan: So, this week's been very, very positive. Over the last two days, I've had the opportunity to participate in a number of new-opportunity calls with consultants, specifying engineers, working with some very substantial water projects. One particular customer today, was in Florida, I had a lengthy conversation about a project that for us would have an equipment value, somewhere between half a million to three quarters of a million dollars

Riggs: Nice.

Dan: The frequency of those conversations that I'm having is increasing and it increases month over month, week over week. So, I'm very pleased, very positive. There is absolutely no lack of opportunity. Demand for water equipment, it is as high as I've ever seen it in the last 25 years.

Riggs: Wow. For a chief engineer to say that, if I say it, of course, I'm the CEO and you have to maybe say, "Well, he's being optimistic," but that is amazing because you've been around for quite a while.

Dan: Yeah, I have been, and like I said, there's no lie to this. There's no fib to it whatsoever. The focus on decentralization, it's two things. Water is absolutely totally essential to everything that is in a modern environment, at a modern civilization, like what we have here in the United States. That and the drive towards decentralization, that continues. Every year, you're seeing it continue to increase and increase and increase. You put those two factors together and that's why we're seeing so much demand. Even in light of the COVID issue in the last six months, it just continues. The demand in inquiries, the interest and the need for it just continues to grow.

Riggs: Yes. And I think you can also, if you've been watching some of the traffic about the Pool Preserver™, that's generating some traffic from the outside.

Pool Preserver — Wholly Water-Related

Dan: It has. This week, I do know that we were able to interview and meet with several very, very interested prospects. Tom, if you were with us tonight, he would be able to comment further in more clarity, but it does look like we have a couple of pending purchases for the Pool Preserver™ technology. And even though that is not a mainstream fundamental type water technology, it is wholly water-related, wholly related to the real estate industry and the demand and the interest in that product is really taking off. It's increasing week over week as well.

Riggs: Yes. And the sole method of promotion has been this briefing, which is pretty astonishing. We've had some good people come on board. Ross Lysinger who has been a 10-year fan of the company has received a quote this week. So, that's amazing. So, I'll talk more about Pool Preserver, but we are reinforcing the trend, like we're discussing. I think we all know that we're getting more sales engineers at McKinney and Tom is working on processes like the customer relationship management system, sales force automation, etc. We're also working on improving the accounting processes to be more efficient. So, overall, we're just going as fast as possible. So that is great.

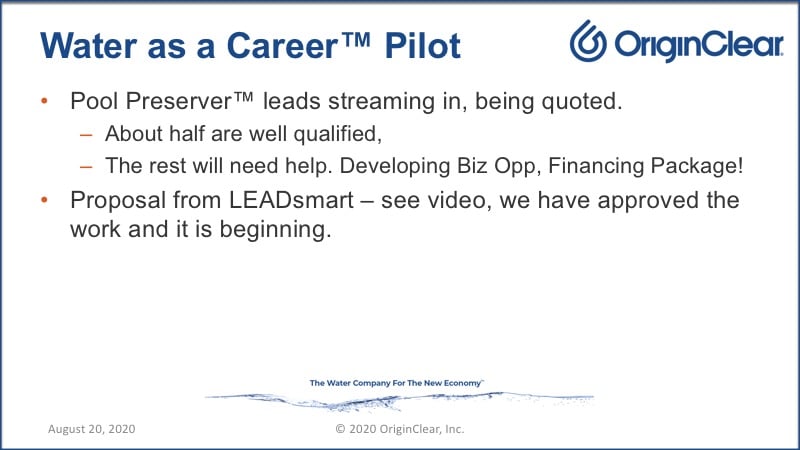

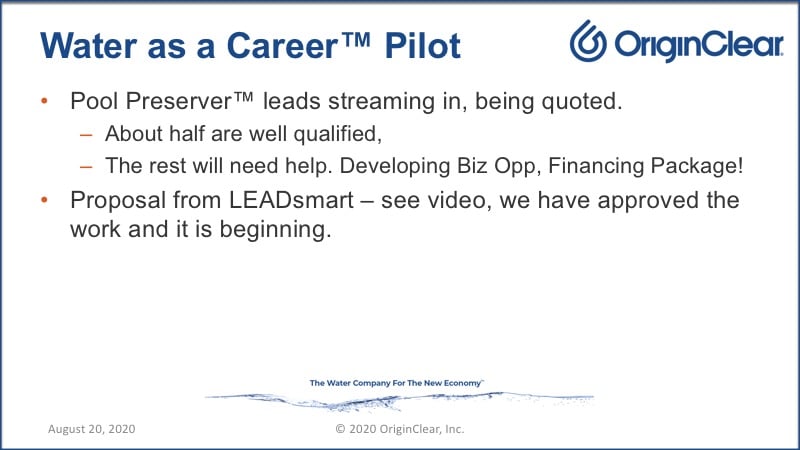

The Pilot

Now, speaking of Pool Preserver, the leads are streaming in. About half seem to be well-qualified, so they get a straight quote and they go straight into it. Now the rest need help, and I'm going to play a video to talk a little bit about what we've gone ahead and approved. And so this will give you a visual a little bit on what Tom Burton of LeadSmart, Tom Burton and Kevin Brown, proposed that we're going to go ahead and do because I went ahead and approved it today. So here we go.

LeadSmart Presentation Video

Transcript from recording

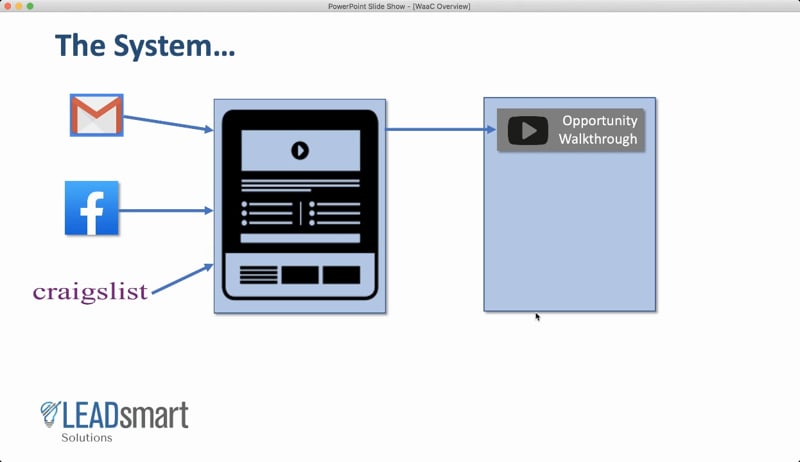

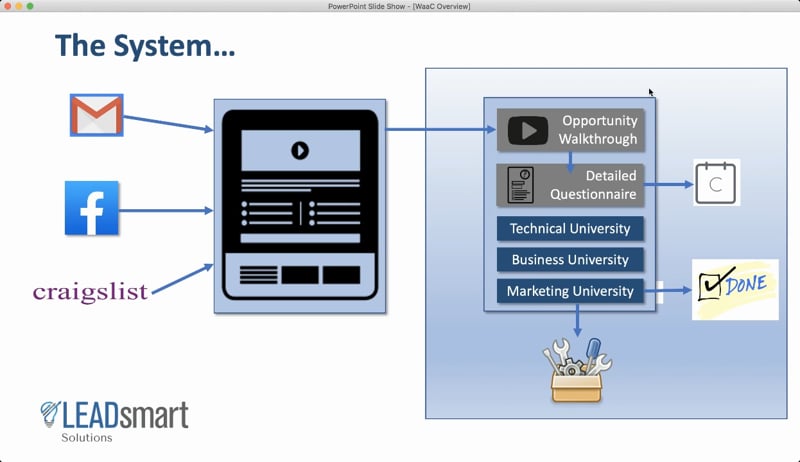

Tom: But to walk through a little bit of what I'm looking at here, bigger picture. Because I think it's important if we're going to look at kind of the Water as a Career, as a funnel, and then what we would need to do. And then I'll lay out some of the projects that we need to get done and who we would want to have do them.

A Landing Page

So, first of all, we're going to need a landing page that any of the candidates that we bring in, whether it's through email or Facebook. Also, Craigslist I have found to be a good place for business opportunity leads if the ad and everything is framed right. So anyway, however they come in, they come to a landing page and there would be some simple basic overview of what the opportunity is, and then just the ability for them to enter their name and so forth.

Do They Qualify?

Then we would actually want to take them in to a... it's kind of the step two of the funnel. Is log them into our portal, and I actually look at this as kind of an LMS, or a learning management system, or a learning portal. And the reason is, is that it's going to qualify, and I've learned this from doing quite a few business opportunity campaigns. Is there's a lot of people that are just kind of looking for jobs so you have to constantly be qualifying who's willing to take the next step and before you try and get people on the phone and waste people on phone time.

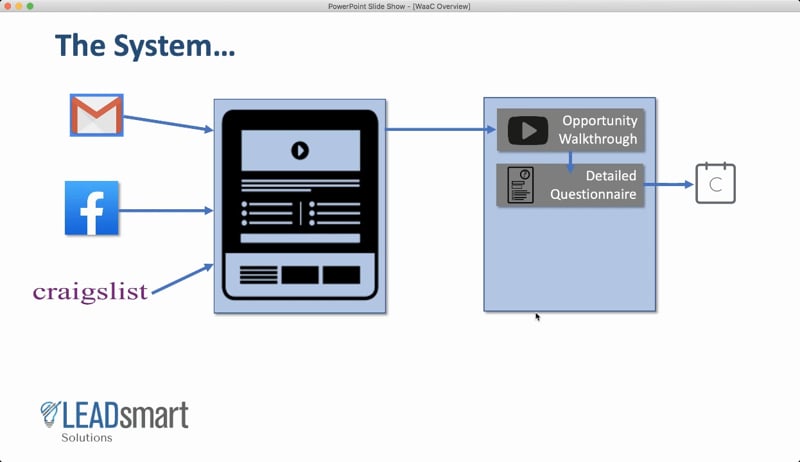

The Detailed Questionnaire

So, the next step would be to get them to log in to our portal and then walk through a more detailed video of the opportunity, and then fill out a detailed questionnaire about themselves and their qualifications and so forth.

So again, step two on the funnel here from this first page, which is just a landing page. If everything looks good on that questionnaire, then we would have them schedule a Calendly call. And at that point it would make sense for somebody to have a conversation with them, but we don't want to do that until they've gone through these steps.

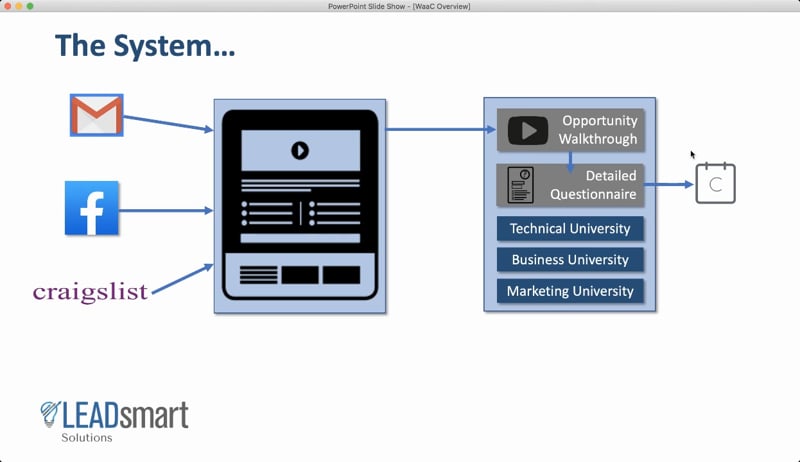

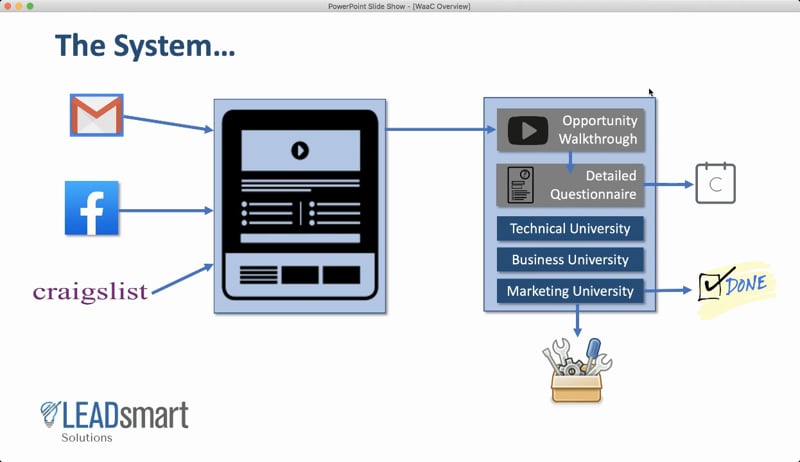

Back to School

Assuming that they pass and that they're qualified, then there's three other basic areas that we would want to get them trained on once they get signed up. One would be just the overall technology, how did they use the technology, the system, and so forth for doing the cleaning. The second is how do you run the business and just set up a business, whether that's part of their own business or they're doing it somewhere else. And then I separated out marketing just because it's as big enough of its own category in and of itself to warrant its own university.

And that would be how they would get clients and tools and best practices and so forth and so on. So this would all be part of the... This box here is basically a learning management system. I like Teachable. I've used that a lot and it can be set up quickly, and I think it would facilitate very nicely what we need to do here. Then if they really go, "Well, you know, I want this done for me so I don't want to do the marketing myself", then we can have an option for them to have the marketing done for them as sort of a service, or again, the marketing university would teach them what to do.

Grads Get the Tools

And also, we would provide them links to tools and some discounts possibly on marketing automation tools, CRM, through my company LeadSmart. Which by the way, LeadSmart Solutions and LeadSmart acquired my Social Marketing Noise company a year or so back. So that's why you see that there. I do my business under LeadSmart now.

Anyway, we have some tools and capabilities that we could provide to them as well if they wanted to buy those as an add-on, or if they don't and they already feel like they know what they're doing, they would just go through the university course and go from there.

Oversight & Mentoring

And then all of this we would want to be able to have visibility on, be able to track what they're doing and obviously look at how we're growing the business and having oversight as to how they're growing the business and so forth. So, all of this we would want to have our ability to view and have access to.

From a Landing Page to a Community

So the number of the different projects that come out of that picture is one, the landing page, so we have to create the landing page. Two, we'd have to set up a learning management system. Again, I use Teachable, but we don't have to do that. But I've found that to be quick and easy and works really well for what we're trying to do here. We set up the questionnaire, opportunity walkthrough and questionnaire. Set up of the business and technical universities. Set up and build out of the marketing universities including the content. So the content for the business and technical universities would obviously have to come from people on your end. The content on the marketing side can come from my end.

And then the done-for-you service catalog. So, what would be the catalog of items that we would offer to them. The marketing toolkit, what would we offer to them there if they wanted to add on to those. And then overall what we would do to drive traffic and lead generation into the landing page. So that's the traffic that we're doing on our side. And then the overall, as I said, kind of that blue box, the community management, where we're managing that community of people that have decided to embrace the Water as a Career path, and how do we build that community and really make sure that they're thriving and doing what they need to do.

End of LeadSmart Presentation video

Enabling the New Water Economy’s Development

Riggs: And just to let you know, we have in fact approved this. So, when we ask you to invest, you're really funding this kind of activity because this is capital that allows us to develop not only this business opportunity, specifically with Pool Preserver, but the template for all the future ones. You know about the animal farm treatment systems called Pondster™ , the trailer park, all that stuff. These are all going to be future business opportunity type, Water as a Career templates.

They will sell systems. So, Dan and the team in McKinney, Texas, will benefit from the sales of equipment. And of course, there'll be revenue to OriginClear for all of this university stuff and so forth. And so, investing in this is key and you make it possible. Again, I really appreciate you guys who are in there investing and making it happen. It is beyond cool.

So now we're going to play a video montage with Ryan Koistra. I misspelled that, it's K-O-I-S-T-R-A, as the pioneer. And then we've got a couple testimonials. This is just our videographer who happens to be my brother, Steven, who's a world-class Hollywood editor and director and did a field trip this week, and this is a quick montage from what he did. So, without further ado, I'm going to play that for you.

Video Montage Presentation

Transcript from recording

Ryan: I was profitable my first month.

I was making money before even my first lease payment was due. I had more than enough in reserves to make that payment, and pay myself back, and buy supplies, and pay for gas, and go to dinner, and if this COVID wasn't here I'd go to Disneyland.

Eric: They're doing a lot of right things and they're making it easy for the regular investor to take a stab at getting involved at a time that water all over this world is getting to be looked at as a very necessary commodity.

Keith: My lovely wife Linda here is so tight, she's not going to jump into anything. She looked it over very carefully and it's just been a great match for us so far. It's been consistent. It's been very lucrative and it's been very fulfilling because we actually feel like we're doing something for the economy.

Eric: Ongoing revenue stream allows you the flexibility to start redirecting things and adjusting if there is a new lifestyle or something that needs to be addressed.

Ryan: where OriginClear got involved, and made it extremely easy, rather than me spending well over six figures to try and come into this industry, purchase something. I got a bullet-proof process. Jumping into it, understanding it. Have all the right tools and equipment makes it very easy, it takes the guesswork out of it. Training was awesome, I loved it. You get to talk to customers. You get to talk to people, even during this COVID time. It's just been a great experience.

End of video presentation

Philanthroinvestors

Riggs: As you can see, our investors are very happy now they’re being tagged as Philanthroinvestors as you saw, because this is part of our program to expand internationally into the Philanthroinvestor Ambassadors. That's that wonderful group that has ended up on the Inc. 100 now, because almost 4000% growth and we're tapping into that. So that's why you see that particular branding. I love the name anyway, it's really doing, I better get it straight, “Doing well by doing good.” Right, Ken? I got to get that stuff straight. Anyway, let's go ahead and take a look at the rest of this.

Developing a Marketplace

You know, what are we doing here? The important thing, because as you saw, about half of the leads that we get are people who need help, who don't have great credit. They can't just go ahead and lease or buy the unit. So, what do we do? And that's where we set up a marketplace, and this is what we're working on continuously in background, which is so promising, right?

First of all, I just want to make it clear that this water investment per se, is not being made as an offer right now. We are internally funding pilot projects, but also exploring partnerships. And we will be rolling this out, but it's not a current offer.

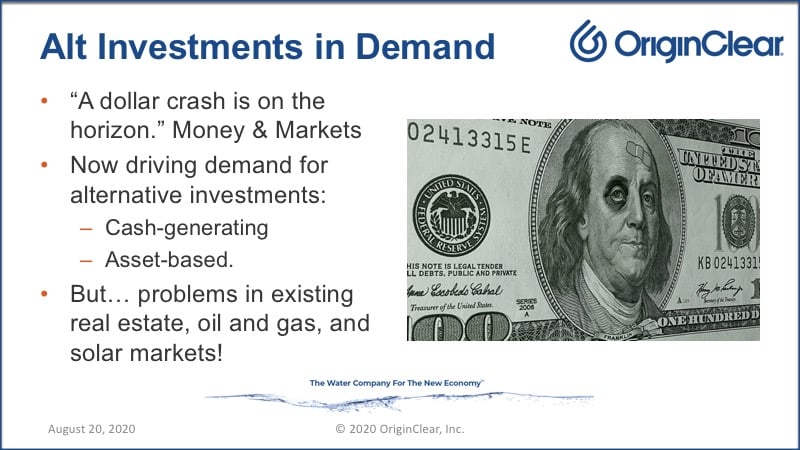

Again, why do we have-in general- alternative investments? But right now me as a stock market investor, I'm not selling my OriginClear stock. It's sitting there at the transfer agent and I'm happy for it to stay there, but I'm very paranoid about everything else. And I sold out of a couple of other stocks this week, but Money & Markets and other people are claiming a Dollar crash is on the horizon.

Timing tip, we believe that it will happen after a Euro crash so it won't happen right away, but it is driving demand for these passive alternative investments, where the investor gets cash and can look to an asset for protection. But this hasn't worked out so well lately in real estate, oil and gas, and even solar, which all have had problems.

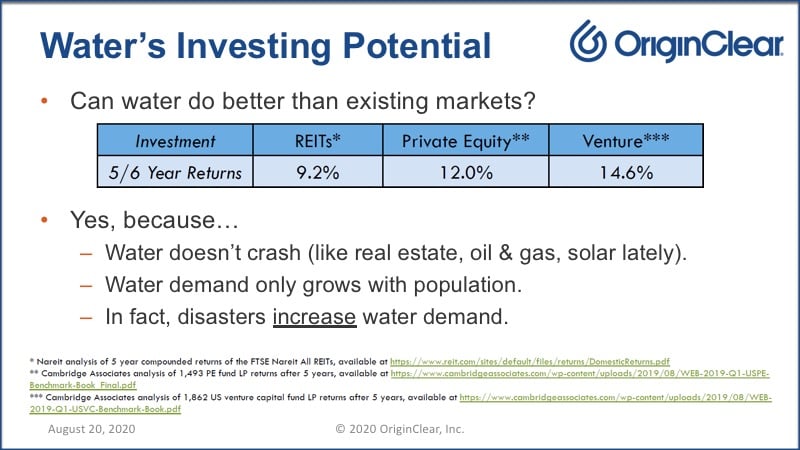

Demand Only Grows

Water is not the same. Can water do better? Absolutely. Here's a few percentages. And we feel quite sure that we can get right up there in the double digits if we have the right package. What we learned in the last month or so was that if we tried to offer financing at a high return for the investor to someone who could get good financing in the market, we would end up being shaved. It just wasn't worth it. We're not a Wall Street player.

So what we really are there to play in is these special situations as they're called, where you finance something that's part of a business opportunity. And for example, Ryan Koistra in his video was really talking about how he didn't have to come up with six figures upfront to finance the thing. It's not a cheap unit. And he got a good rate. He could have perhaps gotten lower, but he got all this training and setup and so forth. He got put into a career, and so it was worth it.

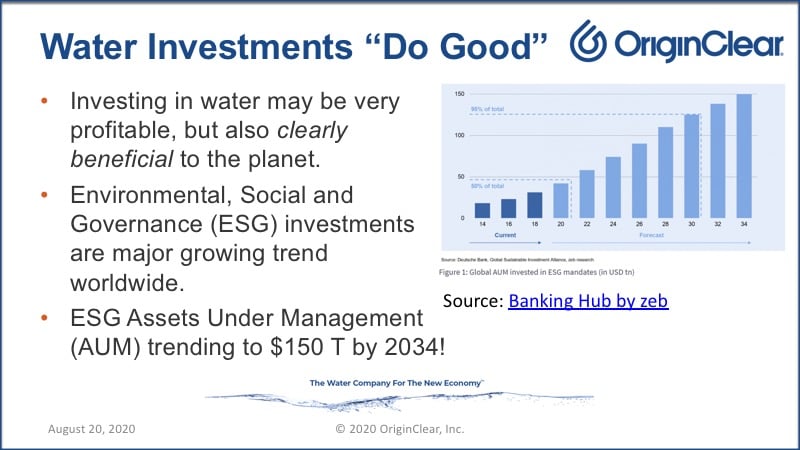

ESG Investments

And that's where really we can play with these investments. Also, water investments do good. It clearly is beneficial to the planet. There's this concept of environmental, social, and government governance investments (ESG), which is basically a company achieves that rating. And they become much more attractive to investors. Currently it's about $18 trillion marketplace of assets under management. It's growing to 150 trillion. Amazing.

So this is a huge marketplace that we are stepping into, but we're making very sure that we're not in the commoditized, just general good finance market. We're really talking about helping people develop Water as a Career, and that justifies the higher returns for us.

Program Potential

Potential, is of course that the investors in this Water as a Career program could benefit from retained ownership. So, they get this first year accelerated depreciation, which is known as Section 179. That means that they can take a tax write-off in the first year of their investment. It does wonderful things for the returns on investment. Of course, these are generally mobile systems so that you can actually take them back. They're not stuck in the ground like an apartment building. And of course, the “Biz Op” value add program where we add value through creating the business opportunity creates a potential for double digit capital rates.

A capital rate of course, you divide your net income by your original investment, and you get a percentage which should be in double digits for it to work. Now we're not making an investment offer. Right now, you can only invest in the OriginClear company offerings. What are these? Well, let's talk about it.

First of all, tying it all together is us.

The OriginClear Wave

We have invested a lot of money over the years to create an international network of partners. Very select. We've got primarily Spain. We've got a couple of partners in Europe, Spain, Romania. Then we have middle Eastern, the largest oil service company in Middle East as a partner for that area. In addition to our partnership in Oman. And then we've got a wonderful partner in India who is in charge of Asia. We are pulling out of China in terms of a direct operation, and relying on India more.

We have the ability to develop product lines, for example, this Pool Preserver thing. And now we're piloting this Water as a Career and these potential alternative investment vehicles. Okay, we call it the OriginClear Wave.

And here's a picture of our manufacturing. On the left is the man whose beard has only grown. This is back when he was relatively clean shaven. Now he's turned into The COVID Recluse, then in the middle is Marc Stevens, who is just a wonderful, wonderful [person], does amazing work, and then myself showing off for the camera.

And then this is the great patented technology that Dan has brought to the table. This is a pump station. Am I right Dan?

Dan: That's correct. That is the EveraMOD™ Pump Station product Line.

Riggs: EveraMOD is what it's called. Exactly. So there it is being delivered and people chatting. So, let me just check here.

Make it Open Source

”So, China has our tech?” Fortunately, China did not do a great job of stealing our tech, but we found, as Kenneth Bogert was saying, “China has our tech.” And I would say that it's something that we feared, but that, here's what we did with our technology: All the early technology, we decided because of the rip-off potential to simply make it open source. And then we pulled back so that everything we do now is what's called trade secrets. And we feel that it's much more defensible than the patent system with China being roving around.

Now not being in China does not prevent China from stealing our technology, right? It's still out there. They are able to look on everywhere. But really what we found in China was that it's not a very great environment for us. And we've had better, we've actually made a lot of money from our relationship with Permionics. They've given us business that we've built in the United States from their own work. So, all in all, we like the relationship far more.

Now, Darryl says, "Have you thought of LinkedIn with reference to the biz op promoting?" Absolutely. LinkedIn is fantastic. The one thing you need to know about LinkedIn though, is that you're just as liable to be pitched as to pitch others, but there's ways to filter that out. Darryl, I think you're absolutely right. So, moving on here.

How Can I Invest in OriginClear?

How do you invest in OriginClear? Because remember, you're making all this stuff possible. Well you'll help us develop Water As A Career for the COVID-hit workforce. Which 80,000 businesses have gone belly up permanently of which 60,000 are small businesses.

Our Vision

We have this [vision] developing alternative investment in value-added water system rentals. Value-added means we do more than just rent the water system, we help people succeed. That's really the goal here is so when an investor comes in and says, "Okay, I will finance this." And remember, there's a big footnote here about “no guarantees, blah, blah, blah.” But basically, once we develop the legal side of it, which is really why I keep disclaiming this, then the alternative investor can say, "Okay, I'll go ahead and invest in this machinery, which I'll retain et cetera. And I'll be able to get good double digit returns because OriginClear is making sure that this thing works, that this person, this business entrepreneur is trained, et cetera." As you saw. You'll see that in this investment, you get paid to wait and you qualify for double digit dividends.

I'll show you that. And for accredited investors, you get to choose your stock conversion. You will also join the growing international Water Philanthroinvestors™ network. I can tell you that we have been flooded with interest. Ken just spoke to someone in Spain, for example, today who came to us through the Philantroinvestor network. That is moving very, very quickly.

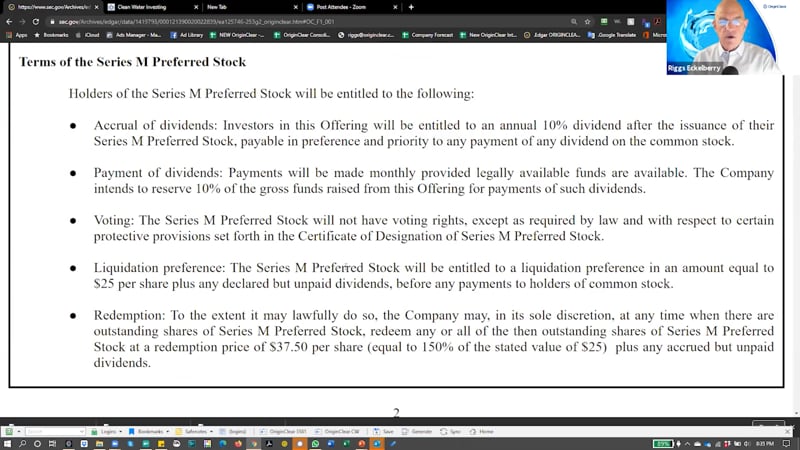

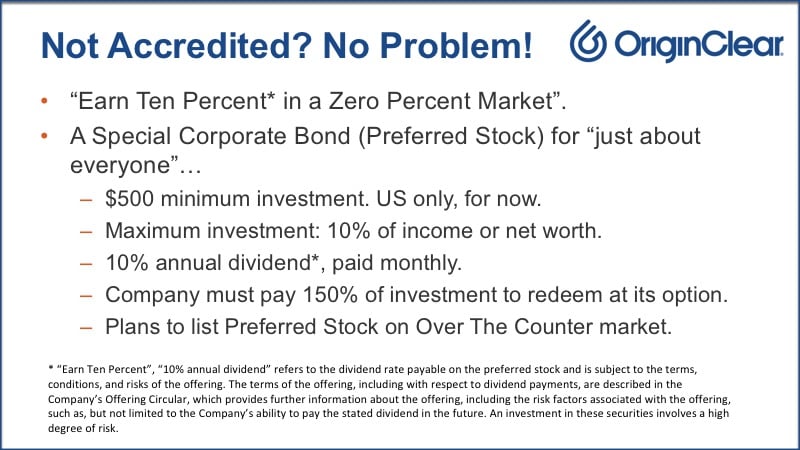

Earn 10% in a Zero % Market

Now if you're not accredited, we just relaunched this offering and I will show you the circular momentarily, but basically, it's 10% per year and you invest $500. It's all done online, and you get, you can only invest 10% of your income or your net worth. Accredited investors don't have a limit, but this is not perfect for the accredited investors, and I'll show you why. But for people who would like to just make a nice, simple investment, not risk a lot of money, this is great.

They make their 10%. And when we redeem at our option, then we have to repay you 150%. So, if you put $1000 in, we have to repay you $1,500. Now, how can you get out of the stock? Well you can sell the stock. And to help you do that we do plan to list it on the over-the-counter exchange. And that would be after the offering is over and while it's not guaranteed it is definitely something we plan to do.

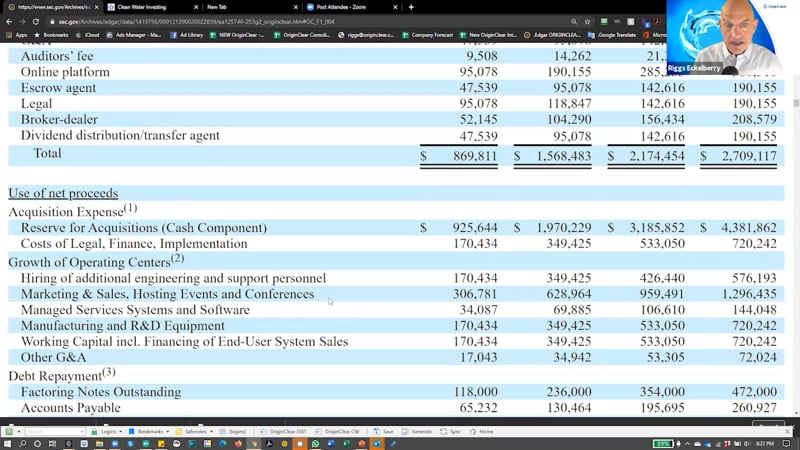

Regulation A Revised

Let's take a look at the offering circular while we're at it, because I think that's worth looking at. So here it is, this was filed and it was actually yesterday. It was up and running. And what are we offering? It's about $20 million. And I'm going to go ahead and roll down to, well, first of all, the summary, so what are we doing here?

Summary

10% dividend repayment at 3,750, which is 150% of the stated value. That's basically, it's a very simple offering.

Now what we did remove and why we were not in market for a while was, there was one time an ability people were only being repaid 100%, not 150%, but they could turn it into common stock. Well, we started to realize that people were starting to use it as an ATM. They would put the money in and then, because it was free trading stock, they were then able to sell it. And I was like, no, we agreed very much with the SEC that this should not go on. SEC has been extremely helpful. This thing was, I think it took them only about a couple of weeks to look at it. So, they are been very, very helpful.

Intended Use

Now, the other thing that I wanted to show you was the use of proceeds. What do we plan to do with this? Well, assuming that it's 100% subscribed, you have expenses of about 2.3 million. In other words, about 15% of the total, and then we want to make some acquisitions, we want to hire more personnel, do events and conferences. I guess that'd be virtual for a while. Put in software R&D et cetera. This is the financing of end-user system sales, this Water As A Career thing. And then clean up our debt, which is going to be fantastic for the balance sheet and do some redemptions of some of these notes that have been out to investors. So, this is going to be very, very productive for the balance sheet overall. So, that gives you an idea of what's going on.

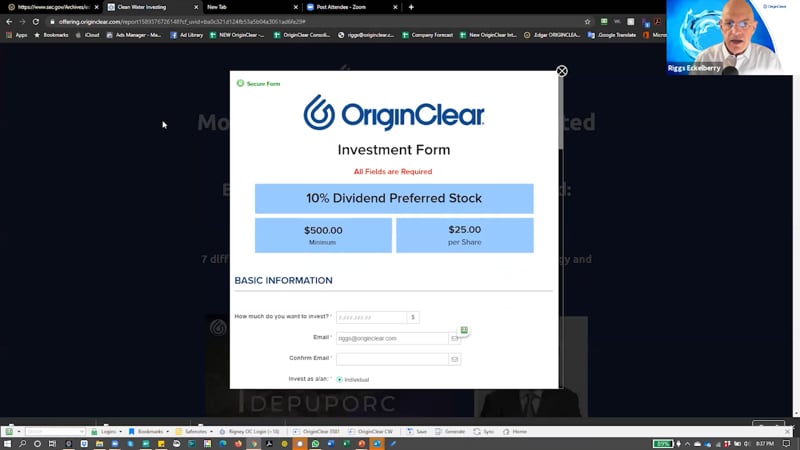

Simple Process

Now, this is all online. I'll give you an example what it looks like right here. This is what the form looks like.

You go ahead and it's just very simple, 10% dividend. You put in your basic information and then there's anti-money laundering requirement and then financial qualification to ensure that you are allowed to do this. You can invest by credit card, debit card, whatever, and that's it. It's very simple. And when you're done, you're done.

And we have an excellent team in customer service. In the first month that we did it, in May, we learned a lot. We raised about $200,000 and we learned a heck of a lot about how to do this. So, this is technically launched. We're in the middle of putting together the marketing funnel and you'll hear a lot more about it.

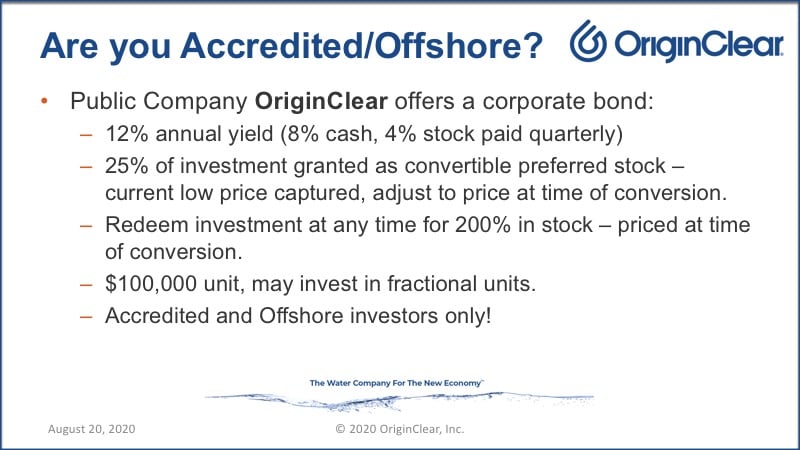

Regulation D Offering

So that is the picture there. I'm going to go back here to wrap up. What about if you're accredited or a non-US investor? Remember the unaccredited round is not for non-US, it's only for US at this time. What does that mean? That means that you can invest in this one without having to prove you're accredited if you're offshore. There are rules about that, which Ken Berenger will be happy to tell you.

Public company, so you get 12% annual yield, 8% cash, 4% stock, paid quarterly, and we've had more than 30 months of dividends paid, so we're very good with that. 25%, if you invest $100,000 more or less say, $20,000, for example, if you invest $20,000 because we'll break the $100,000 down, then $5,000 of it you get as additional stock.

Now, here's the interesting part. Your investment can be redeemed at any time for twice the value in stock at this price then. Now the stock price has been very stable lately, and we're very happy with it, but let's say it went down, well, you would be adjusted for that. You'd receive more stock when the time came to sell. So it's relatively protected. All stock investments involve risk, but as you saw from the testimonials, we have some very, very happy investors who have been doing this for years. So that's the offering there and it's extremely popular.

Now, how can we possibly offer to redeem 200% of stock? Well, the fact is that we have seen the stock price rise. In fact, I'm going to ad lib quickly and show you what we call the trade value graph, which is very interesting, the stock liquidity. And it shows you really the trend of what's going on with this stock.

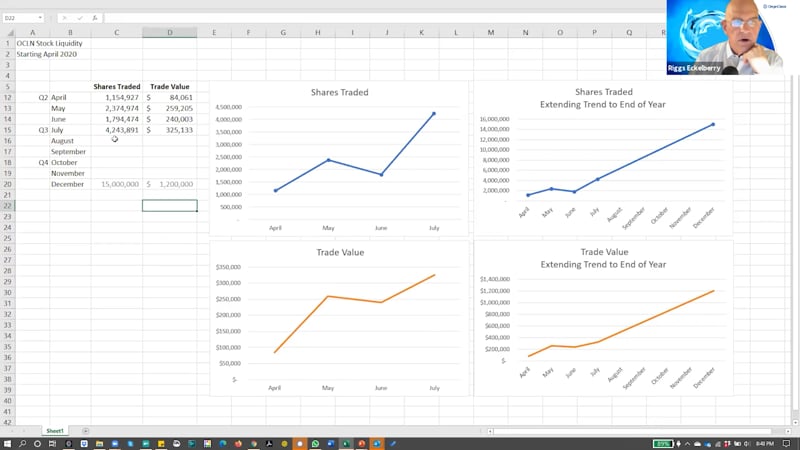

Trade Value Increasing

I'm jumping out of the PowerPoint, but you'll find this interesting. There we go. Open it up for you a little bit. Here's what we see, look. Shares traded in the second quarter and July of the third quarter. And we have here, the shares traded is rising, but importantly, the trade value is increasing.

In other words, shares times the stock price. And what it is, is that the stock price has been stable because the volume has been increasing. So, we're up to four million shares a month, about a million shares a week. This is really a lovely trend. And if we extend that trend out to the end of the year, now that's strictly speculative, right? I'm going to type this in right here, speculative.

Just so you know that I'm not trying to pull one over you, but if we continue the trend, then we'll be at 15 million shares being traded or $1.2 million per month. Now you're starting to have the kind of liquidity you need and that's on the current trend.

Now we believe that trend to accelerate because as we start, for example, demonstrating that this Airbnb for water concept works, well, Airbnb is a $35 billion company. Again, we're not saying we will be, but I think we'll be more than a million dollars, which is the current range we're in right now.

Current Market is Commercial

So, that's what that's about. And I've got some chats here. Let me see. Okay, Caitlin Reynolds wants to know, "I know this is all about investment, but where can I get the information to order a water for personal use?" We currently don't sell personal use water, but we work primarily with commercial. For example, we've been talking about this premium hotel chain while we've been making sales to that chain treating their water in the hotels. Can't talk about specifics yet.

Not OCLN Stock

Trevor wants to know, "How is this part of the company and stock offering associated with OCLN stock listed?" Okay, he's talking about the unaccredited or regulation A offering, and that is a special series and preferred share, is not OCLN stock. It's $25. Well, we know we're not at $25. Why? because it's strictly a bond.

When we do list it as we intend to, assuming we do, it will be listed as OCLN-M or whatever, right? It'll be a special thing. So, that's what that is.

Contact Us!

Here's your contact numbers to dial, but the easiest way is type oc.gold/ken in your browser and you will magically end up scheduled for an appointment with him.

Disclaimers

Remember that there're disclaimers, that these are not regulation D, is not a registered offering and it does involve risk, of course. And the regulation A disclaimer, you must study the offering circular, which I showed you, which is on the SEC site called Edgar. And if you look up OriginClear Edgar, in Google, boom, you will see that listing and you will look up the offering circular.

Well, that is it. I wanted to thank you all for joining us. It's been amazing. Dan, thank you for joining us. I'm very happy with how things are going. We're cooking along. So join us next week. We're going to have more to tell you about developments. And as Ken says, accredited investors should go to oc.gold/ken.

If you're unaccredited, we will be sending you links, next week I hope, to open up that marketing to you. So again, thank you very much for joining us. It's been wonderful. I think we're going to end up with a great Q3, and I love your support. Have a great weekend. Dan, stay cool, calm and collected. Bye, bye now. Take care.

Thank You!

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)