We went deep into blockchain and our cryptos… But meanwhile, scarcity of water…GRIM! So why are our sales totally booming? And mainstream industry mags like Hart Energy quizing our CEO on crypto? When you see the interview clip with an investor and our own Dan Early you'll have your answer…and probably thrill-chills over what is taking place!

Transcript from recording

Introduction

Riggs: Welcome to our webinar, the Water is the New Gold CEO briefing. Our mission is to transform the water industry.

Dan Early: Decentralization offers us this opportunity.

Financier: The plan that you've built here is super impressive.

Investor - Ken: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Investor - Larry: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Riggs: Welcome everyone to the CEO briefing, and we're going to have right away get into the thing and from Keith Roeten: "A good evening to all of our OriginClear family." And likewise to you and yours, Keith, thank you so much. All right. Let's jump right in here as people arrive.

Water is the New Gold, and it is truthfully from what we know of the water rates. It is clearly recession proof the water rates keep rising and people think it's regulated, but it really is not, especially in the states. And so there's places where water rates have gotten really ridiculous in terms of a percentage of people's pay. It is, of course, vital and it's increasingly scarce. And I'm going to have a shortly. I'll have an article about that, which is pretty grim.

Remember that you can listen in Spanish. Just click on the globe symbol and select Spanish, and you're off to the races and thank you, Heather for interpreting tonight.

Safe harbor statement, of course, we do our very best to tell you how it is, but it is always subject to risks and uncertainties.

Climate Change — Deforestation

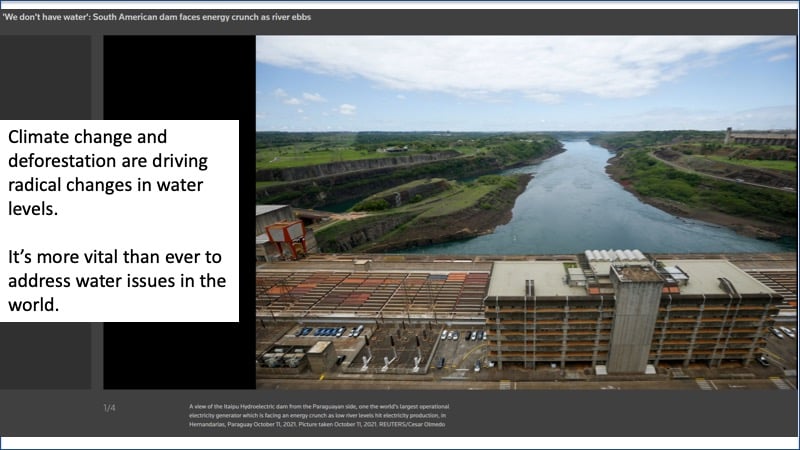

Ok. This is the story that I saw that a very good follower of ours posted. This is a gigantic hydroelectric dam, one of the largest in the world, and it is about to run out of energy. Look how look, how tiny those cars are. I mean, this is how big this thing is. It's vast.

But they are dealing with deforestation and they're dealing with climate change, which is, and don't get me into the debates about climate change, but clearly there are changes in rain patterns where there used to be drought and now there's rain, where they used to be rain. and now there's drought, and this is throwing things off. People build multibillion dollar dams like this and then all of a sudden, there's no water. So we've got to address water issues in the world. That is, of course, our mission. All right.

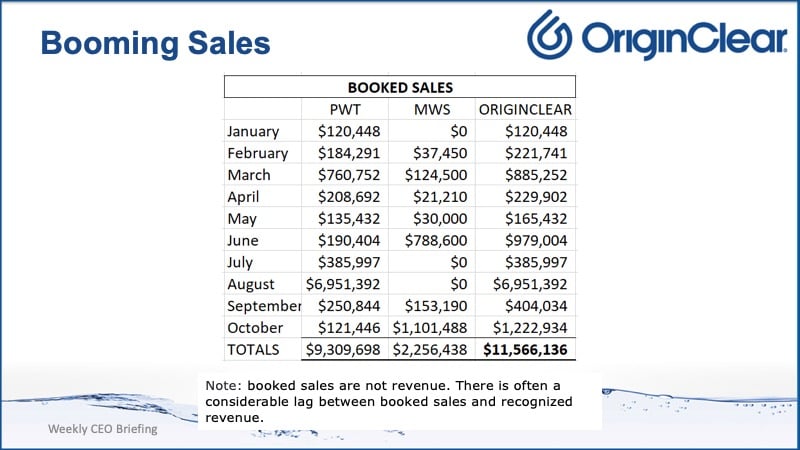

More Than Triple

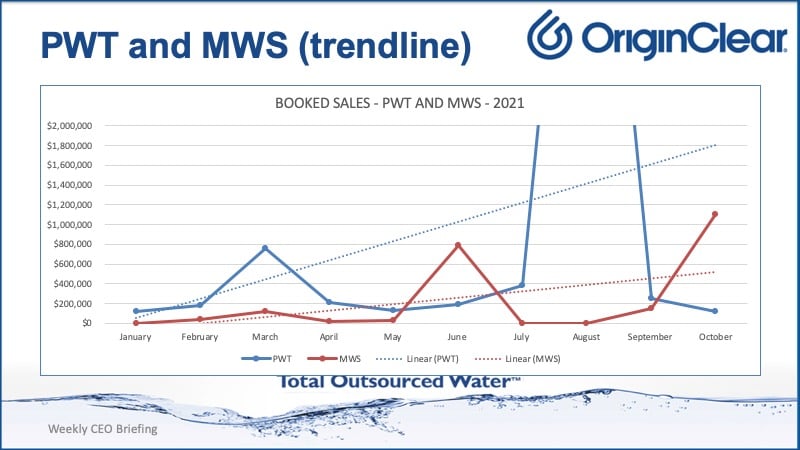

Well, sales are booming. Oh my gosh. Check it out. We're not even done with October, and already we're almost at $12 million in booked sales. Now again, book sales are not revenue because you book the sale and then typically involve... it's a PO. You get a PO, great. Now people have to start paying money and you have to start delivering. And for example, if you take a look at August, there under Progressive Water Treatment almost $7 million.

Well, that, a big chunk of that five million was was a single client with three power plants that will take two years to deliver. So there's a lag to all this. It's just how it is, but it is amazing to see. Even looking at booked sales last year this time versus this year, this time we're still triple, more than triple. All right, let's take a look at what it means on graphs so we can understand what's going on here.

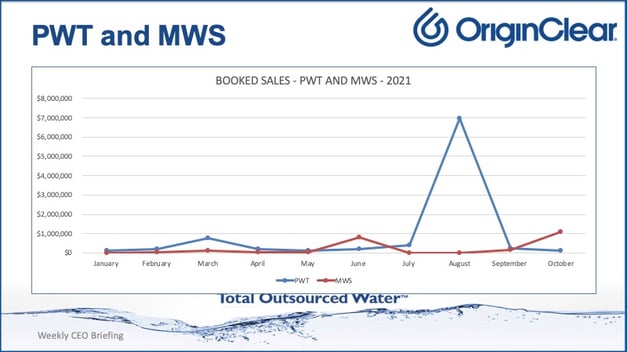

Here is a picture of book sales. And, of course, August dwarfs everything, so I've gone ahead and cut off that peak to give you an idea of the trend line.

Here it is, and it shows you that there's a really good trend line on PWT. That's the blue part. Modular Water Systems™ is trending beautifully as well. And you know, this Modular Water Systems did a total of, I think, seven hundred and thirty two thousand last year. And if you look at back here, they did that in, more than that in. June, right?

And now in October, look, they just scored another million plus, so they are really, really rocking. And this is a big reason why we brought on board Modular Water Systems. We needed a new technology, which we got the five patents for the modular systems and number two. We wanted to complement Progressive Water, basically acquire another product line and as opposed to buying a company where you get the revenue right away.

We had to build the revenue and it took us from the last week of June, 2018, all the way until now for things to really take off, so good things happen to those who wait. And thank God, we have some great investors who helped us through this, but now it's paying off.

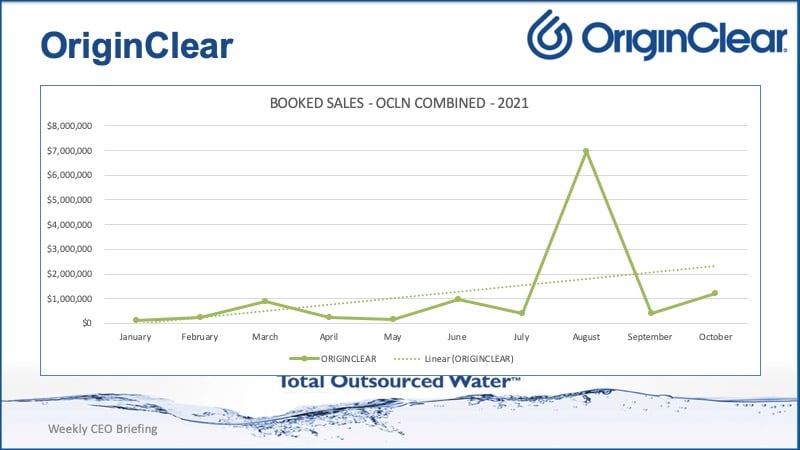

So now let's take a look at the overall corporate thing and once again is dwarfed by that big peak.

Driving Fundamentals

So let's take a look at the trend line if we cut that off and very nice. So we're seeing, if I were a stock analyst, I looked at this I would see my bottoms are rising, right? So my bottoms are getting less and less and my tops are rising. Exclude this August peak. You can see that the tops are rising, the bottoms are rising. So this is a very, very good, very healthy trend. And if I was book, if I was looking at this as a stock price, I would say, Wow.

Now, I want to talk briefly to the stock price. We don't manage to the stock price, but we're well aware that there's some weakness in the stock and that is for one reason only short term. And that is because volume is still growing. I'm very happy that volume of trading has basically doubled in the last month or so, but it needs to do more with more volume. We get more ability to absorb sales.

Now, how are we going to drive fundamentals, which in turn will naturally drive stock price? I've learned from 14 years of being a CEO of a public company that you cannot drive the stock price directly. It's like pushing string, and a lot of people will help you waste money trying to do it. And it is just — sorry it doesn't work. What does drive it is fundamentals. So this is one big piece of fundamentals, and we're about to get into the other big piece, which is these pre-funded systems, which have a huge effect on us.

Bitcoin and Inflation

But let's continue now because the next thing I want to get into is what's up with Bitcoin Lord? Well, it's at an all time high. You know, a lot of people in the last six months were, they didn't hang on, you know, there were crashes. I think it went it down as low as in the high 20s. And so a lot of people gave up on Bitcoin and Ethereum and so forth. I was too busy to sell, so I just held on to it. But the also an exchange traded fund has launched, which is very just blowing up.

Essentially, bitcoin is a mainstream currency. It's it's time to recognize that whole countries are adopting it now. One big reason why this is going on is inflation. We have a big inflation problem already, the trillions of dollars being thrown into the economy, we're creating inflation.

But now we have supply chain disruptions and apparently the government finally convinced the Port of L.A. to go 24/7, which of course, other ports in the world say, "Yeah, that's what we do all the time. What are you talking about?" But apparently it's not what we do in L.A..

Nonetheless, all this adds up to inflation. I'm hearing, for example, Procter&Gamble got very creative and solve problems by raising prices. I'm like, OK, they the stuff will be on the shelves. I believe that that these these problems are, are, you know, we'll move on past these problems, but prices will rise dramatically. Now what does this all mean for new cryptos?

Broad Rise Helps All

So a rising tide floats, rising tide floats all boats. I learned that when I first became a Series seven broker back in the eighties, and I was asked to market a small company called Societe Generale in New York that was just arriving, and in order to market them, I had to become a broker and I learned this rising tide floats all boats. Also, I learned that a that past performance is no indicator of future performance.

But what this means here is that the broad rise in the market helps all crypto instruments. Another major factor is investor regret. I know that I'm like, You know what? I really could have bought bitcoin at $100. I knew it was there. I blew it off. And how many people did that right? I even, you know, sold off in early twenty eighteen and waited. And so, you know this, this creates investor regret and then people would like to get in.

Now. Cryptos, there's there's way to get. I won't get into how you get get into them, but for example, ClearAqua™ as a utility token would start out free or participant, participation based rewards for participation or for various roles in the ClearAqua network that's still being worked out.

I have a top one of the world's top crypto lawyers who was headlining a crypto conference last week in Dubai, and he's now in Lisbon, and he promises me that he's going to be helping me figure things out the next couple of days, and that will help us move forward. Now. Remember $H2O™ or that we kind of put it aside for a bit, but there's some factors that make this important.

And Clarence Denison, if you're raising your hand, we don't, we don't open up the participation, which you can just do as drop in a chat and I will read it on the air. All right.

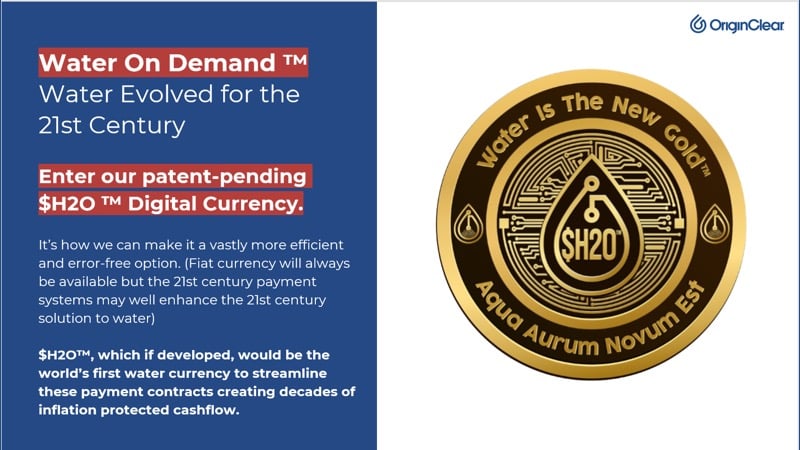

Programable Money

So what about $H2O? Let's just go back to a presentation that Ken made. And basically, it's a digital currency, and it's how we can make payments more efficient and error free. And it's the world's first water currency to streamline payment contracts, creating decades of inflation protected cash flow.

And furthermore, this uses these smart contracts that Ethereum has. It can be programed to pay royalties, et cetera, and it can be either a token, meaning a token with a serial number or non-fungible means none. Switchable token. Fungible means you can change it. If I take two one dollar bills in my wallet, I can use them equally. They are fungible, right?

Crude oil is generally fungible. Crude oil from the North Sea or from Texas, you can use it as gasoline eventually. Anyway, so, non-fungible means it's unique. All right now, it's completely swappable and. It's very much like the JPM coin that JPMorgan built to streamline payments. It is programable money and is again, this reminds me... this takes me back. This is earlier this year, but it's still very much on point.

NFTs

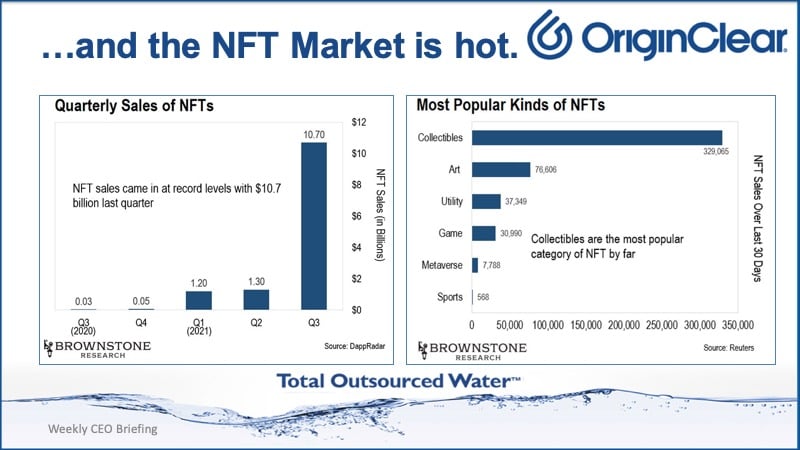

Programable money is being called the most valuable segment of the cryptocurrency market, and let me show you why. Boom, NFT market blows up. Q three is already at ten point seven and, for, you know, through the end of September and like literally 10X, it's ridiculous. Now let's take a look at the categorization. Collectibles by far the most popular meaning, you know, baseball cards, that kind of thing.

But the third row utility, that's where we fit. And that's, you know, that's not a mean amount. Thirty seven thousand NFTs. These are sold NFTs sold over the last 30 days. So it gives you an idea of the market.

So what's happening is that NFTs are being used to hold assets like, let's say, a house. You people have taken an entire house, turn it into an NFT, packaged it as a non-fungible token. Why is it not fungible? Because you're not going to switch that house with the other house down the street? They're unique, right? So that's non-fungible. And then when we sell the house, we just transfer the wallet address. Thank you very much, right? And that's it.

So it creates eventually a market. I believe all assets of all kinds will end up being packaged either as NFTs or as just plain unique tokens. I know it's a kind of an insider difference, but we're not wedded to NFTs, but they are very, very handy.

Ok? Conclusion, then, is that both ClearAqua and $H2O are promising. And remember that we have to make sure we get regulatory approval and develop these tools.

Ok, now. I had a wonderful opportunity to do an interview in Hart Energy Publishing, and Madison Radcliffe came along and said, I'd like to cover you. And this is completely editorial and this is a major, it's a major energy publication and they have, you know, two one, five million page views this year alone, et cetera. And so they're serious.

Blockchain Impacting Energy Industry

She authorized me to play an excerpt from the interview that this interview will be put in print, but you get to hear some of the questions, she asked. And remember, this is about blockchain technology, how blockchain technologies are impacting the energy industry and the environment.

Now, just blockchain is very simple. It's a way to streamline data, right? It's called Worldwide Web three. The third wave of worldwide web. And it's just a way to make things flow in a error tolerating way. I won't say more than that, but you can have problems with getting things approved and they'll still go through. It's very good for chaotic environments such as we do have. Ok. Without further ado, I'm going to go ahead and turn on the video here. All right, let's play this thing. I think you'll enjoy it. It tells us a lot about what's going on.

Start of presentation

Two Token Structure

Madison: So let's go ahead and get started then. Are you ready?

Riggs: Yes, I am.

Madison: For blockchain, how would you say that it is different than other technologies?

Riggs: Well, let me take it sort of 30000 foot view. We have created a two token structure. On one side is a what's called a utility token, which is simply a community coin called ClearAqua, which is intended, we're still in development on this, it's, with many, many mainly legal issues to work out on that, you know, if it's going to be a utility token, et cetera, et cetera.

But our vision is that it is a way for people to participate in a community to alert the higher delegates about a water problem. Let's say there is a water problem. You know, brown water in Compton, California, OK. That gets goes up and the delegate layer puts together proposals, which goes to the governing body. So that's ClearAqua, and that's just a a way for people to participate and be paid for helping out. Ok? It's only secondarily a blockchain thing in the sense that everything runs on blockchain in crypto, right?

Ok, now on the other side is a a way, another coin we call $H2O, which is intended to be a wrapper for dividends on these pay as you go systems. Because, let's say, I'm currently building right now a subsidiary that is being funded by investors. And now the subsidiary is investing in water equipment that goes out on these, pay for performance type programs.

We retain ownership of the equipment and the investors get dividends as well as it scales up. Because this is not just intended to be for our water company, but it's a financial play for ultimately all water companies. There's going to be a lot of investors and we realized we needed to streamline payments. And so we said, OK. Now, do you know what an NFT is?

Madison: Yes.

NFT or Serialized Token

Riggs: Ok. So initially we thought of it as a non-fungible token, or you could just call it a serialized token. But what it is is a unique token, and it's got a smart contract that embeds all the future revenues from that share of that equipment for that investor.

It's kind of like that NFL player who created a coin and he put his contract on that coin and people could buy pieces of his future earnings at a discount so he'd get the cash now and they would get their future earnings.

This is a way for this. This token, therefore is great because it's it doesn't have all the ACH issues. If I want to transfer my, not only my share, but all my future revenue from that share to you, all I got to do is do a wallet transfer.

Managing Water Costs

That's a beautiful thing, because there's no separation, I can do it with Singapore. I can do it with anybody. It's just a matter of sharing a wallet address, right? And what's interesting about that is that you then potentially create a water marketplace.

Now the big problem with water is that it is local, right? You can't trust it's how are you going to truck water from Atlanta to New York? Not going to happen? And so places like Northern California, they're suffering a drought and we can't really help them. We can't send them water. It doesn't work that way.

But. There should be a market where if you have a very high cost of water in Northern California, you can buy water options on Singapore, for example, and you know, at least your costs are managed.

Streamlined Payments

Well, that doesn't exist in the world today. So back in twenty eighteen, I started working on this and I created a coin called WaterChain™ is our first effort to do this. And ultimately, we had to give it up. Why? Because we couldn't figure out how to attach that coin to money. Now, now that we have water as a managed service, every single gallon in the system is has money attached to it. It's being paid for on a service contract. And so you can monetize that and say, OK, this thing has real value.

And all of a sudden we have something where there's a contract and an investor and dividends and so forth, and it's actual money attached to water. And eventually that's tradable, swappable, just like they have in the NFT markets. Down the road, we can look at people being able to swap water futures using this vehicle. So that's the really interesting thing about it. It's going to take time and we're not trying to rush it. It's kind of an organic thing, it'll happen over time.

What we're interested in is basically to streamline payments. It's very much like there is something called a JPM coin, which is JPMorgan's coin, and they use it to streamline payments. Well, that's our purpose here. Is this to make it easy because, you know, we pay dividends to our investors currently, and it's a pain that you know, there's a wrong routing number, ACH this whatever, and it becomes escalated to the highest levels like where's my payment? Well, that's fine if you have 200 investors, but if you have two thousand, I don't think so. So, that's why we do it. But that's also the potential for it.

Madison: It's very cool. I haven't heard of any technology like that.

Riggs: Well, if I may say so, Madison, this is a trend. I believe it's a mega trend of all assets being tokenized. Right? And it's already happening in energy as we know, right? Oh yeah. Tokenization of of all these, as long as there's revenue attached to it. Revenue stream attached to it, then you can tokenize it. And I think it's going to happen with everything.

Benefitting Oil & Gas

Madison: I think you're probably right. Yeah. How can your blockchain technology benefit operators in the oil and gas industry or how is it currently?

Riggs: Well, OK. So thinking stepping away from OriginClear, really, what you're talking about is one level is for all exploration and production. You've got a lot of oil, well, LPs. That could be operated more efficiently using a tokenization, so the investor side, I think, is very interesting because, you know, you have the big, you have the majors and that's fine, but you have a lot, a lot of small operators with their own investment systems, you have oil and gas LPs, that of which there might be tens of thousands. And this is how you can streamline it and ultimately create a kind of a barter system.

Because let's say that you're stuck with a nonfunctioning well in New Mexico, but there's an opportunity to aggregate that with other wells that are functioning better. And, you know, in Texas, so there's ways to create a sort of a natural marketplace. So I think the idea that we've come up with for water could be applied to the exploration and production space specifically as regards, you know, managing investments.

Asset management, revenue streams, all of these things are really well, you know, they're appropriate for blockchain because they deal with... The great thing about blockchain is that deals with the chaos issue like, sure, you can do everything on a database, but then databases break. They they get hacked. There's issues with deliverability, especially on money.

Well, that's where the blockchain gives you a very clean environment that is does not require a hundred percent consensus to operate that is secure and that also deals with the money delivery issue. So that's that's one thing that I can think of right away we can do.

In other words, we can democratize investment. On my side, I'm looking at being able to literally let a grandmother in Korea on her Samsung, you know, invest, you know, $1000, and it goes into projects that are pretty big. And so I think this is a way to democratize oil and gas investment so that more people have a shot at it. It's sort of an alternate market, you might say.

Madison: All right. Thank you.

End of presentation

Riggs: So that just gives you a quick, you know, obviously it was much, much longer, and the the article will come out in November and. Yeah, the replay. But we have lots of good stuff and I'm going to keep going fast because there's really good stuff yet to come, the meat of this. Dave Johnson, I apologize if you're listening because I had to cut your interview and it's going to go next week because we just ran out of time.

So I'm going to play a fantastic interview. This is the day. Brad Waller, one of the very first investors in Water on Demand™, just committed this week, and Daniel Early, who's been, as you know, putting together all these design, build, own, operate. Let's listen to them talk.

Start of interview

Design, Build, Own and Operate

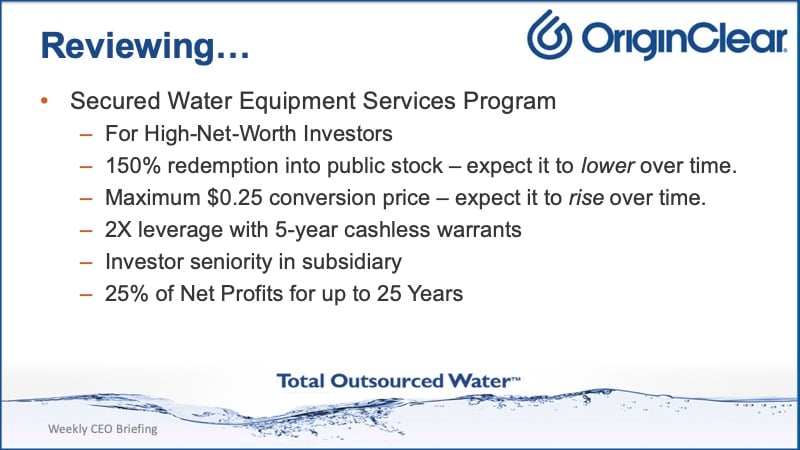

Riggs: Good afternoon. Brad Waller, Dan Early, it's a pleasure to bring you guys together. And the reason we're bringing you together is Brad is a long time investor in OriginClear, and he just committed some funding to the Water on Demand program, which is a way to get equipment prepaid and put out on these long term service contracts we call water purchase agreements.

And over here, Dan Early is our chief engineer, and he's been the one who has been most aggressively discussing various projects that could fit that, that mode, and we call this design, build, own, operate, DBOO. Design and build is what the company currently does. We build it. We ship it, collect and goodbye. And of course, there's consumables after that. But there's not a lot of service goes on after that.

And then there's D,B, Operate, which would be just to be the operator, outsourced operator on behalf of the customer. But the ultimate is all four letters where we also own the equipment and the client treats us like a utility, like we're the city and there's a meter, and they're paying on the meter. And there's also, on top of it, a certain requirement, certain level of quality be reached.

So this is potentially a big win for the client because they can kind of wash their hands of the whole problem. Don't have a capital issue, but it's also very rich for us because we get this ongoing services revenue. So it's a beautiful vision and I'm so happy it's finally coming to fruition. So, Brad, I just wanted to ask you, just a few days ago, you made a commitment to our famous Ken Berenger, to invest in Water on Demand.

Investing in People

Brad: I did. I had a good conversation with Ken, and he explained to me, generally what you were doing, maybe not as much detail as you just went into about the DBOO. But I've been a long time investor, a long time believer in your visions. And I, you know, I invest in people. So Riggs is the reason I'm here from the very beginning, and he's the reason I'm still here.

Riggs: Yes, and I and I'm still here, probably because Dan is still here, so it's kind of a circular thing. For purposes of matching this to a potential projects, do you mind telling us how much you committed to for this?

Brad: I committed to a $100,000 investment.

Riggs: All right. Hundred thousand dollars. All right now, Dan, we know you have a roster. We've been we've been reporting on this almost every week where it's going and so forth. Now, I don't think 100K quite buys a full project, but tell us a little bit about where this money might go and flesh out what kind of projects it might go to.

Residential, Onsite Wastewater Treatment

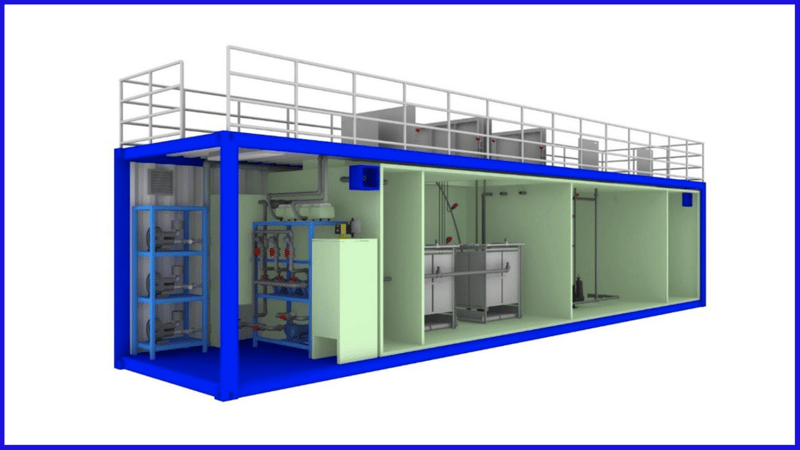

Dan Early: The good news is just earlier this week, we secured purchase orders for two projects that have been in our pipeline for the last six months or so. They are both systems are 10,000 gallons per day, wastewater treatment systems. They are what we refer to as the EveraSKID™. The treatment system are above-ground, containerized, plug and play advanced treatment solution.

The two particular customers that we are working with and will be servicing and delivering equipment to, they are both residential opportunities. They are a single family, decentralized applications where these customers are not connected to public sewer, they're off the beaten path. And these customers have a demand and an immediate need for onsite wastewater treatment. One of them is an existing well, both of them are existing customers. Both of them are kind of similar and in unique all at the same time, a little bit of difference between the two.

We Own and Operate

One customer has to upgrade and provide additional treatment for more stringent effluent permitting limits. And in doing, in committing to an upgrade for their customers, their current customer base, they are very interested in a future ownership and operation capacity where we could come in and can assume that level of ownership and operations.

The other customer, existing single family residential development, and they are in an area that is under the pressure, under development pressures. It's located in Texas. Huge demand for real estate.

Riggs: In fact, not far from our own headquarters, right?

Dan Early: Very, yes. About 30, about 30 minutes away from our headquarters in McKinney, Texas, there in North Texas. This particular project is really the one that I like the most of the two that we've picked up this week, and there's a couple of reasons for that.

Existing 10 units subdivision, currently 10 customers connected to an existing central utility. The board is going to commit to an expansion. They're going to add one of our decentralized wastewater treatment systems, our EveraSKID system, so that they can add another 30, another 20 additional customers.

So they're going to go from 10 customers to 30 customers. Decentralized utility and they very much want to explore the double-O portion of the DBOO. They want to look at the operations where we can provide the service, the ongoing service. But they are very interested in the ownership aspect of it, where after they build out as a developer, they make their money, they hand over the title and the keys to the utility. And we assume that asset, we take over that asset.

And what's really cool about that is that you've got new equipment, new infrastructure. We brought it in. We know what quality and the condition it's in. And now you've got a continuous, you've got a revenue generating model, a utility model.

So that customer right there, they committed to a purchase order this week. Give you some, Brad, just to give you some sense of the price tag of these two systems, both of them are in the low $200000 range. One of them was about two hundred and ten thousand. The other was about two hundred twenty five thousand. So it's a very typical of our smaller treatment systems at ten thousand gallons per day.

Riggs: One of them is the the 10 home residential, moving to 30, adding 30 right,

Dan Early: Adding 20 for a total of 30.

Speed of Plug and Play Delivery

Riggs: Ok, good. And the other one is a mobile home park actually right?

Dan Early: It's an existing mobile home park. I think the total connection count on that one is about somewhere about 50, about 50 connections and that one's located in Pennsylvania. Existing utility permitted and they just need to commit to a new infrastructure system. And that's what we're providing for them.

The engineer, the consultants that work for that, that have worked for the mobile home park really loved our containerized plug and play delivery. It is so fast. That's the key to it is it delivers, it plugs in and it goes into operation within a matter of a few days.

The old tried and true model usually would take 30 to 60 days. Really extensive, long, drawn out. Very expensive. So we are we're focusing on a much more efficient delivery model when it comes to delivering decentralized wastewater. Any questions does that make sense?

Leverage of Ownership

Riggs: And in fact, what's great about that is being able to repossess the unit in case of nonperformance, which makes it easier for us to be in the rental business without, you know, extracting personal guarantees or whatever. You know, it's look, rent it, you know, pay first and last. Whatever you got it, you don't pay well just stick it back on a semi trailer and take it home, right? So that that is a very attractive, very attractive.

Dan Early: But there's a leverage you have with the ownership, with the ownership offer and the ownership and operating capability that we have. That is a huge leverage point. It really is.

Brad: And how permanent or semi-permanent is the installation? Is it the kind of, Riggs just did say, you know, you hook up the semi, take it away? Is it like just on a cement pad and ready to go or enclosed? How does it look?

EveraSKID System

Dan Early: It is, the EveraSKID system, and we'll be glad to share brochures and technical documents that really describe the product in more detail, but the EveraSKID system is containerized and it shows up and it basically bolts down to a concrete pad and it's a pipe and a pipe in a pipe out connection and a power connection, and the system is ready to go. It is an extremely fast delivery model. It is very unique to this industry, and it's quite frankly, it's where the industry is needed to go for the longest time.

Riggs: Well, in fact, I can show you a picture right now. Here it is. This is the EveraSKID™, so it is a rigid structure. Permanent. And as you said, Brad, it'll go on a concrete pad and, you know, but it is still can be lifted off because it is a, it is a container, so it's the best of both worlds.

Anticipated Life Cycle

Dan Early: As far as the permanence of it, Brad you asked a good question, "What is the anticipated life cycle?" What is unique about the EveraSKID system is that while it does use an external metal steel container system for the box, we use a structural plastic, rectangular plastic water tank system compartment with water tank system on the inside of the average skin unit.

There is no wastewater that comes in contact with the steel structure, so the plastic the the structural plastic system will give us a continuous duty lifecycle of the structure itself equal to 50 years, if not much, much longer than that. If you keep a decent coat of paint on the outside of the container unit or dress it up as a sheet metal architectural detailing, it'll last equally as long.

Decentralization is the Future

So really, that is the approach that we are promoting into the industry around this decentralized plug and play model is radically different than what you've seen in the old conventional steel and concrete delivery models of the past half century.

Decentralization is the future when it comes to, if you're not in the public, if you're not in a big metropolitan region and you don't have access to public water and public sewer, you have to you build your own and this is the way you build your own.

Advanced Treatment and Reclamation Capability

Riggs: So I can see that the performance here, we're moving from almost non-recordable levels of suspended solids and biological oxygen demand, which is basically a measure of how polluted it is. So and you're talking clustered residential development right here. There we go. So for an RV park, et cetera. So this seems like it's we have a product line the five, 10, 15, 20, 25, and this is a 10k and the equipment is, you know, a full container, a 40 foot container. And what is this submerged unit? What is that?

Dan Early: Those are those are those images right here on the screen are images of flat plate membrane modules. Those are the those are the filtration modules that provide the the final filtration before we discharge. These are tertiary treatment units. These are advanced treatment units. These are, these systems, and another thing, Brad, that's really unique about what we do and what I'm really pleased with is we have focused on advanced technologies taking the most capable treatment function to the customer.

This allows us to provide re-use and reclamation capabilities instead of treating your waste water and just dumping it out in the environment. Goodbye, see the water later. We have the ability to recover and to reuse this water.

I know that we are. I've got another customer out in California just earlier this week. Exact same same model. Brand new development. Twenty five units. They want this plug and play model and they want to reclaim the water because the water scarcity issue that they have out there in California, right?

Brad: Very familiar with the ongoing mega droughts.

Riggs: Where are you based, Brad?

Brad: I'm in Redondo Beach.

Cost Savings from Water Reuse

Riggs: Bingo. So you know the feeling and I feel you. But the issue is really that this is one of the great benefits of decentralization is now the customer can, they're paying for the water being treated so they might as well reuse it and get a free ride. Now there's practical limits to how many times it can be recycled, but at least once I think is it fair to say, is a fair amount of recycling? You'll get about 70 percent reuse out of out of the water.

And I saw the figures, for example, for a brewery. They can reuse if it's just for wash downs and and so forth. Not not for reuse as beer. They can still reuse 50 percent of the water for those purposes. So there's definitely, definitely a advantage in doing so. That's really interesting that we're doing these skids and that you have a product line.

Standardized Product Line

Dan Early: It is now the EveraSKID unit, and as you can see through our website, is Riggs was showing you there. We have what I call our five standard models and I always compare this. Our our selling model is almost like going down to automobile dealership when of the local Ford dealership and you want to buy a Ford F-150 f 250 f 350 f 450, you just pick the the unit that suits your needs. Suit your capacity needs, you select the options you need.

For whatever your permit requirements are and we deliver that system. It is, we have tried to, we are commoditizing and streamlining and simplifying the engineering, the permitting, the fabrication and the delivery. Breaking all of, breaking and getting, breaking away from all of the old manufacturing and fabrication models that have basically been the mainstay for the last half century when it comes to decentralized water.

Clean Water Applications

And while this is the wastewater side of it, what is really cool, is that we have our clean water side and we can do the exact same thing. We can do turn key, closed-loop, water, potable water and container systems, or even more sophisticated delivery models. And we can have our decentralized wastewater packages on the back end and we can complete the water cycle.

Riggs: So that's really interesting because, you know, we a lot of people ask us about clean water, you know, treating water to make it cleaner. And and we're actually getting a lot of deal flow in that area. It's starting to really pick up, isn't it?

Dan Early: It is it is Riggs, the case in point would be the hospitality customer that we've most recently been working with. We just successfully commissioned a point of view advanced drinking water filtration system.

And what is the ugly? The ugly secret? The ugly reality that we deal with is is that while public utilities are out there to provide safe drinking water for the for their masses, for the customer base, most of these utilities still struggle to provide clean water for their customers.

And we've got a number of savvy hospitality clients that recognize that, hey, we probably need to protect our investment in our major resorts and our hospitality facilities, and they will invest in point of view water where they take city water, and they will make sure that they treat it to an advanced standard before they send it on to their customers and the clients they use their hotels and resorts. So that's just another example of the ability to provide Water on Demand.

Self-fulfilling Prophecy

Riggs: It's a beautiful thing. So what's going to happen next, of course, is once, once Brad is funds end up in the Water on Demand number one Inc subsidiary, then what's going to happen is is to be aggregated with other people's investment. This is what's great as it's a pool, because early on we saw that there were regulatory issues with Brad investing directly in a piece of water equipment in Pennsylvania state regulations. It was very complicated, so we solved it by basically having a pool.

And so his his money comes in. We then package it up, put it under contract, and then implement the full managed services. And then Brad sees 25 percent of net profits over a period of 25 years or whenever the fund is wrapped up, whichever comes first. In addition, of course, to all his stock and warrant benefits, which are. Really nice.

What's great about this is, Brad, is you are ensuring a self-fulfilling prophecy because the beauty of it is that this is a pre-load of cash into OriginClear coffers, right? It's not going to pay salaries, it's going to pay directly for equipment. And that results in direct revenue and profits, which shows up on our quarterly and annual filings.

So what you're doing is you're directly driving the fundamentals of the company and you're making sure, darn sure that that we're going to succeed. So I think that it's probably a big part of why long time investors like you are saying, Yeah, I think this could be, you know, doing a good thing for myself and also for the company.

Brad: Yeah, it's nice to do that and not be depending and say, OK, now that I've done that, we're hoping that Series A comes in or Series B comes in and then the company will be great here. It's we're doing it and it's going to go directly to the bottom line.

Riggs: It's a beautiful thing. Well, we're grateful to have a deep bench of longtime investors like you, Brad. Thank you. Thank you for being on board all this time and then I love your what you're doing here. It's dynamic, it's brilliant. And we are with this, this call. We're entering a new era and I'm super excited. So thank you both to you and let's have some fun, right?

End of interview

Audience Questions

Riggs: So that was just a fabulous interview, and we've gone a bit long. Ok, let me just ask for a couple of questions that came in on chat.

What Brad says, "What is the upper end of the capacity?"

That's a really good question. I think it goes up to about, what from what I saw, the average ticket is 50 K per day, 50000 gallons per day, I think. But you can gang them up, you can put them in parallel. So it's really intended to be a point solution where you don't have huge, huge volume, but rather you're solving a point problem.

Ok. "DBO, how does it cost compared to aerobic septic systems that could be sold to developers as a residual income stream via HOA dues?"

That is a really interesting question. DBOO is technology agnostic. It can be used for aerobic, et cetera. It's a way to price things. And what's great about it, Daryl, as you figured out, is that we could have channel partners who then market it and they share in the revenue stream. We already have that with PhilantroInvestors®, who are bringing us Water on Demand investors. So it's super, has tremendous potential.

Let me just quickly take a look here. Ok, good because it's gotten very late. It's much later than normal, but I think it's been really fascinating and I see that people have stuck around, which I so appreciate.

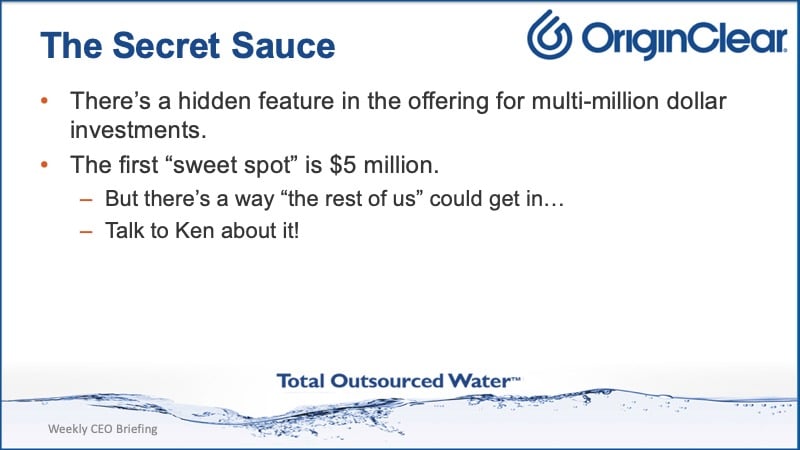

The Sweet Spot

So a couple things more to discuss here. The reason why people are coming on board is we're calling it the five million dollar club that is we are putting together at aggregating and why is it five million?

It's because it is, there is a five sweet spot because there is basically a table where there is a special price for five million and we were not having much success getting $5 million investors quickly. We are getting them, but it's a slow process. We're speeding this up by through aggregation, and there is a way that people like you and me can get in and Ken will know all about it.

So the features are not going to get into because it's gotten late. But it's a beautiful thing with excellent stock warrants and percentage of net profits and security in the subsidiary, so it's definitely worth talking to Ken about.

Call Ken

Just book him at oc.gold/ken or call him on ext. Two zero one at OriginClear or invest@originclear.com. Well, there we are. Thank you for sticking around.

Next Week

If you're not registered, please do. Okay, I'll see you. Next week, you will meet the general manager of Water on Demand. We have named that person an amazing and not going to tell you ahead of time. An amazing, amazing, brilliant executive that I've known for many years and is perfect for the job. Lots to do there and I think you'll be very impressed. So we'll meet him next week. Please do be there. I think you will love it.

With that, I'm going to wrap it up. Thank you very much for being on board and we're going to have a wonderful one next week. So thank you. I'm not going to turn off the video. Have a good night and a great weekend.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)