Insider Briefing of 5 August 2021

VP Ken Berenger gave us a first look at our LAUNCH/EXPAND/GLOBAL phases. How Fully Outsourced Water™ could place a Micro-Utility anywhere it's needed…See how our planned Decentralized Autonomous Organization (DAO) could democratize water for all!

Transcript from recording

Introduction

Riggs Eckelberry

And good evening everyone, welcome to our Thursday night webinar. And there's talk about changing the time to be a bit earlier, because we are starting to get fans in Europe who resent being six hours later, having to come in at 4:00 AM or something. Well, no, it's 2:00 AM. God forbid they should be in Russia so we may be changing. You'll have plenty of notice as we move forward.

All right, well, I'm going to start right off, while people are coming in, I'm just going to do the basics and here we go. This is the Water Is the New Gold and it's interesting because the brokers, the compliance department of the brokerage firm said, "Hey, you can't say that," and I showed them about five articles where everybody says, water is the new gold. I said, "It's not us," Fortune and everyone else, Market Watch, they're all saying, water is the new gold. They let me off the hook, they allowed it. All right, so it is increasingly a vital scarce and recession proof market and that matters. Today is Thursday, August 5th.

(click here for Spanish replay video)

(click here for Spanish replay video)

All right. Now, of course you can listen to Spanish, there's a globe sign at the bottom and we'll be all set and we may even add more languages such as French. Who knows, we may end up with a lot of languages, which is all good.

All right, usual forward looking statement. Obviously many things we say here predict the future, they are all estimates, we do our very best, but the final result could differ materially. Okay.

Quarterly Filing

Good news, we filed yesterday. The longest delay, these things kill me now and I'll show you in a little bit how come that was because I have the auditor's report to show to you. And the Q2 filing is looking very good, the auditors feel it will be on time, we're saying on time or close to it. Definitely Q3 filing on time, there's been a lot of streamlining of what's going on in finance.

Review of Auditors Report

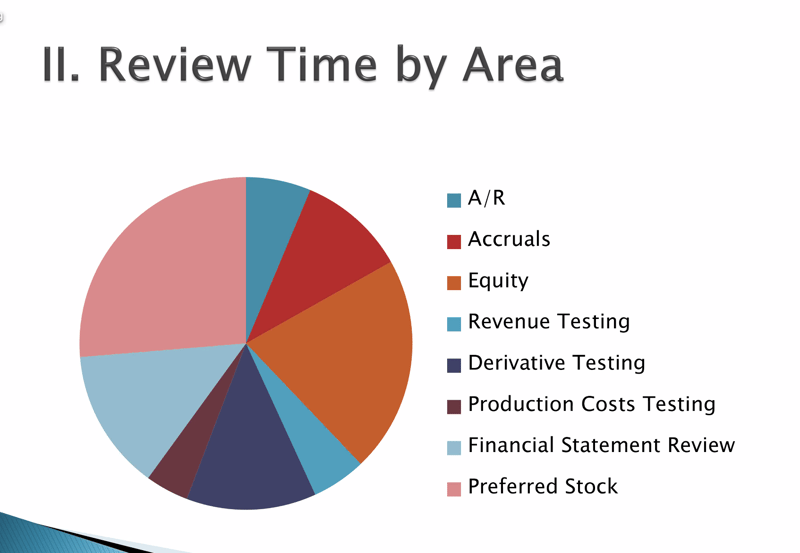

I'm now going to do a review of the auditors presentation to the board. This is a rare insider look but I thought you might enjoy it. All right. I'm going to flip through the less important stuff. No illegal acts, fraud, et cetera, obviously. We would not have been able to file if anything was wrong. These are all the things that they did, which is a long list of things.

But here's what's important, if you look at equity, which is the orange on the right and the pink top left, preferred stock, those two items were the items that really bogged us down with 18 classes of preferred stock. And I blame Ken, basically, that's who I blame. I blame Ken for everything. But seriously, it was a big challenge, but that is behind us.

Considerations

All right let's see. Financial statements appear to be properly stated in accordance with the US generally accepted auditing accounting procedures, and basically the usual stuff, nothing special here and it's all consistent, et cetera, et cetera.

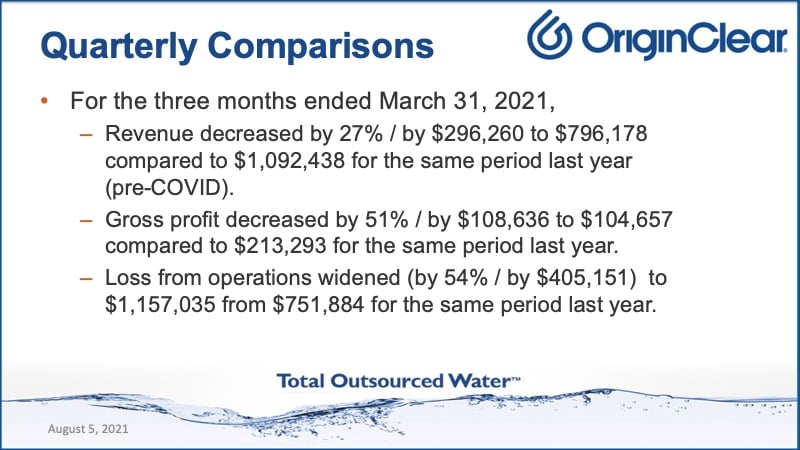

Comparisons

All right. I'm going to go over the... I'm going to share a screen again. I'm going to review the results and they were not great. The first three months compared to... Remember that the first three months of 2020 were pre-COVID and we were on a roll, then we hit, and I would say that we were still in recovery mode here in the first three months of this year. Reductions in revenue, gross profit, loss of operations widened and basically there's nothing much can be said about it, we just did less business.

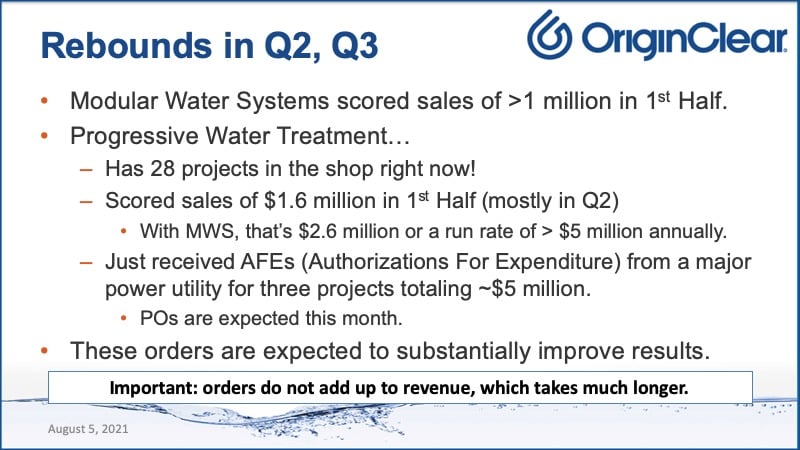

Rebounds

The good news is of course that we've had rebounds in Q2 and expected for Q3 where our Module Water Systems™, literally in June, did almost a million dollars in the last week of June of orders and then Progressive Water Treatment, mostly in Q2 did a ton more. If you look at the previous slide, which had revenue of only $796,000 well, that means that they did a ton more, over a million dollars, bit less than a million dollars and this is just orders.

Now, with MWS, that's 2.6 million, which means that almost 2 million were done on top of Q1. We'll see how it goes but that... And when I say we'll see how it goes, remember we're dealing with revenue, which takes much longer than sales. And of course there was that big order that the POs are expected this month and that will boost revenue over time. Not great for Q1, but we have definitely rebounded into Q2 and Q3 looks really good.

All right, with that, I'm going to flip to our new strategic presentation and Mr. Ken Berenger is joining me and hopefully my NBC video won't start playing in the middle of his presentation or else he'll probably shoot me.

Ken Berenger: It's okay, I could use a little distraction with my cold and all. I'll muddle through. Good evening, how are you?

Riggs: Well, I'm glad you're there anyway.

Ken: Yeah. I'm here in spirit anyway.

Riggs: Okay. I'm going to stop share. Basically this is something you and I have been working on, which embodies all the new Second Water Revolution stuff and I'll let you show it off.

Ken: I'm going to share it from my screen now, correct?

Riggs: Yes.

Ken: Okay. And are we good?

Riggs: We are good.

Ken: Okay. I don't have any windows running, so I won't get any embarrassing ads. Nothing-

Riggs: Unlike me.

Ken: Yeah, nothing too... Maybe, I don't know. Anyway. It opens up too many jokes, I'm going to leave it alone.

Riggs: Yeah, right.

Ken: What you and I have gone to is back into the lab, we've had the idea for months, our audience knows the idea, it was how to articulate it and how to organize it where it wasn't bouncing all over the place. And I think we've done that.

What I'll do is I'll turn off my camera and really what I want to basically do and I think we can make this case very powerfully now is how water on demand with the duel coin strategy not only solves the global water crisis potentially by decentralizing water the way cell phones decentralized telecom.

With the addition of our duel tokens and so forth, it creates a globally adopted digital currency around a brand new asset class. And I think that'll trigger, potentially, the largest wealth creation event in a generation. And it also has that secondary wonderful effect of potentially saving millions of lives.

Not the Solution

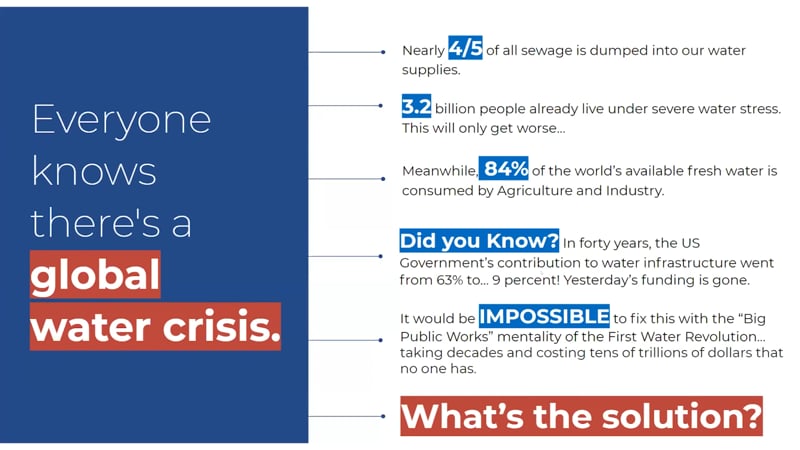

We've done this before. No one needs to be told that there's a crisis, the water's really bad. It's getting worse by the day. Like the broken water report that we send out tells you, I can highlight a couple of pretty disturbing statistics.

80% of all sewage is dumped into the world's water supplies. 3.2 billion people live under severe water distress. Remember this number because we're going to call this back later. 84% of the world's fresh water is consumed by and polluted by agriculture and industry.

Water infrastructure spending is almost no longer being handled by government. The spending has cratered, it's now fallen on the private sector shoulders to take up the slack. 40 years ago it was 63% of all water infrastructure was funded by government, now it's 9%. I heard last it might even be as low as seven, we'll just stick with nine. But now it's fallen on the private sector to take up the slide.

Now that's exactly where we operate, that's where this massive opportunity comes in, okay? So it's impossible to fix the world's water problem, even though the U.S. has water problems. It's impossible with an existing infrastructure with the Big Public Works mentality, that First Water Revolution that took place in the early part of the 20th century, because it would take of course decades, it would cost tens of trillions of dollars that no one has.

So we know that the old public works utility model is not the solution, it requires this constant capacity upgrade, millions of miles of pipes, which of course the cost overruns would be insane. New York City, which you featured a couple of weeks ago, Riggs, that one tunnel took 50 years and it was a $6 billion cost. So imagine trying to globalize that. So obviously that's not the solution.

What's the Solution

So what is the solution using modern technology, using privatization, using FinTech. We think that we've, in fact, crack the code. So remember agriculture and industry? Well, remember 84% of all fresh water is consumed by them, okay? So that presents an opportunity.

Scarcity of fresh water, rising water rates, a burgeoning need, and a massive privatization, a massive shift to privatization. We think creates a once, maybe in a century, opportunity. And opportunity from a water standpoint, to cut the cord, to use kind of a Netflix term. So local corporate self-help we think can spark a global water gold rush.

We want to make each system privately-owned, in this case, investor-owned micro utility. This triggers a global water revolution and it centers around a build at home self-help, all right? Now remember the term build at home, because the question will arise later, well, where is home? Build at home is exactly how we scale this globally later on.

So this is new. There's no capital to fix water projects, how do we fix it? Well, what if we already have the fix? The final ingredient to spark a global gold rush is to make each system privately-owned, privately-funded micro utility that actually solves the problem. We've already unlocked that in previous iterations of this concept, all right?

Accelerating the Process

So the 21st century version of the modern world is already built. We just needed to capitalize it and we need to connect it. That triggers that second golden age of innovation through water, okay?

So what if connecting at all could spark a building revolution like we saw in the previous century? What if it required somebody outside of the water business to work entirely around the limitations of a century old school of thought? I think that's what we've done, what we've accomplished.

So we've already described Water on Demand™ as that answer to the problem. Now, we fully expected one analogy to do to water what cell phones did the telecom, what streaming did to entertainment, et cetera.

But digital currency, fintech, these things didn't exist even 20 years ago. That can accelerate this process to a fraction of the time of previous global disruptions, and that's the exciting part.

Water on Demand

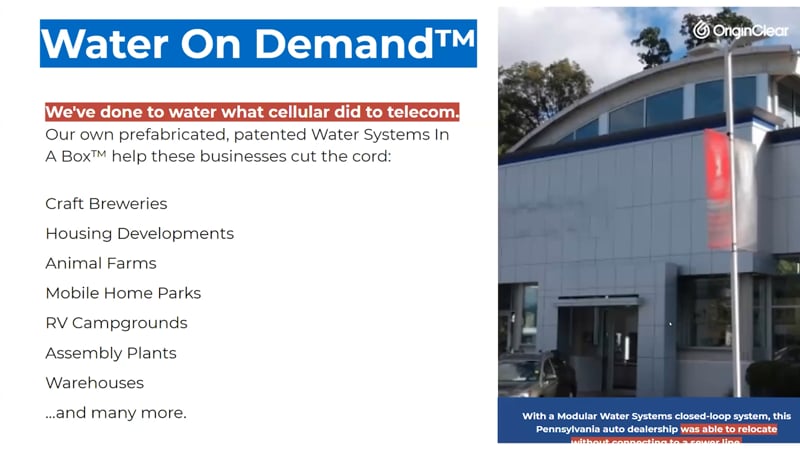

So think of it as a global revolution of privatized investor-owned micro utilities that specifically cater and empower small to mid-sized businesses, even small to remote communities. This is the exact place where water is badly neglected due to their remote location, due to their lack of capital or due to both, okay?

So we've done this kind of cellular telecom shift, small businesses, housing developments, animal farms, campgrounds, you name it. That's where we exist and that's our strength.

Access to Clean, Safe Water

So what we're doing right now is we're catering to small businesses. Small businesses, mid-sized businesses, half the U.S. economy, and water on demand creates a globally scalable, totally painless water treatment model by subscription, and no one's priced out of it, okay?

So remember when I said if you fix water at the point of discharge in areas currently doing nothing due to lack of credit, lack of capital or by nature of their remote location, if you fix it there, it gets better everywhere by leaps and bounds. Well, that fixing it there encompasses 80% of the water pollution and a $4 trillion untouched market. That's our opportunity right now, okay?

So think about it like this. If you knew for a fact there were massive population centers where millions of people needed shelter, but could not afford to buy homes, this kind of would appeal to Ivan, right? But they could easily afford rent, and in fact, had the money to rent right away. Well, how quickly would you want to build or invest in already built high density housing in those locations? That's exactly what Water on Demand enables, instant access to clean, safe water with no upfront expense.

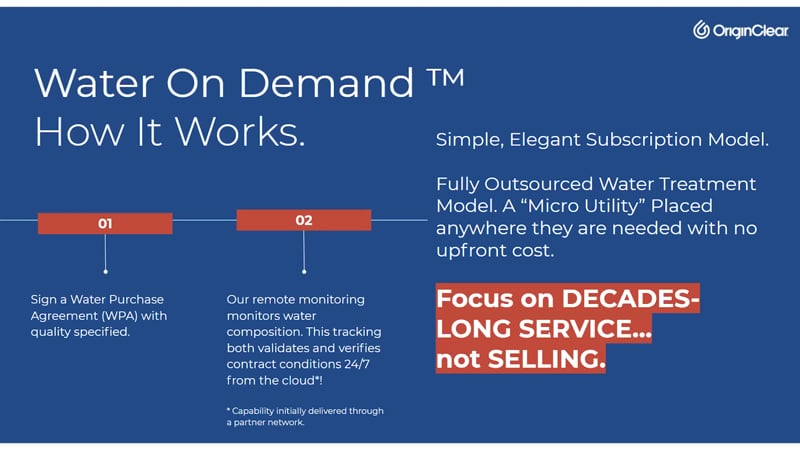

So how does that work?

Well, I explained it to a lot of people. They're going to sign a water purchase agreement at some sort of contract to basically basically buy the milk without the cow. It's almost exactly like the current arrangement that most folks are engaged in for their internet service, their telecom service, electric service, water service. The only difference is that those facilities deliver that service to your location from some offsite location. So you're buying the milk and they own the cow.

This service will be delivered entirely onsite, but from an onsite apparatus because all water has to be solved at the point of discharge. So we're going to continue to retain ownership of the cow and they pay for the milk, only the milk that they use. And it must be contracted [delivered] to the quality that is outlined in the contract or they don't pay, which is the next part of the equation.

Remote Monitoring

Remote monitoring, 24/7, guarantees every drop of water passing through the system meets the standard that's in the contract outline or they don't pay for it. So I'll give you an analogy. We're doing this Zoom meeting and we're all sitting on our computers and we all pay our internet service provider whatever we pay for a thousand megabits per second. That's our broadband, our high-speed broadband. We all pay for a thousand megabits per second, none of us get it.

At times it's close enough where it functions well, and at times when it drops off we know. We lose signal, the packets get lost and it's a mess. We never, ever, ever get the thousand megabits per second that we pay for.

Simple Subscription

So here's the thing, if I created a meter that went on your modem, and you got to see that modem and you got to see that meter and you only paid for the minutes, hours, days, weeks, whatever, that you received on a monthly basis, the thousand megabits per second, I would be the only internet service provider in a year, or more realistically, I would force the rest of the industry to be as accountable. That's what we already have with our remote monitoring capabilities with water, okay? And I think that that's a game changer.

So here's what happens, we have a simple, elegant subscription model, fully outsourced water, a micro utility placed where it's needed. The end user goes about their life or runs their business, they never have to worry about their water, we handle everything. So it's total outsourced wherever it's needed. The benefit to them is obvious, and we go from a salesman to focusing on decades of service, where the margins are many, many, many times that of a one-time sale.

Hardware and Service

So the benefits of the client, obvious the benefits to us, our shareholders, and to the water industry more broadly, is the model is a phenomenally profitable one. So that's the hardware and service layer, okay? And that's where this is kind of concluding.

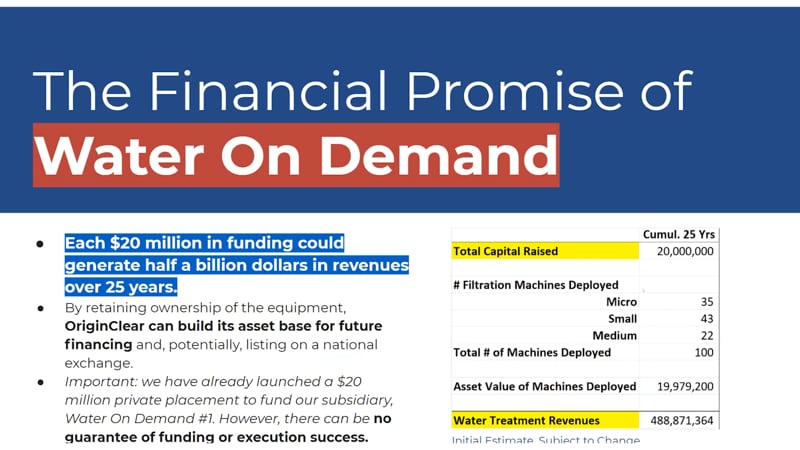

We've got a $20 million fund, we believe it'll generate our pro forma shows $488 million over a 25 year period. That same $20 million of equipment if we simply sold at once, would generate some tiny fraction of that, Riggs, I'm going to get somewhere on the order of 5 million. So imagine being able to take something from 5 million and generate 488 million, that's what doing it as a service does.

A New Deal

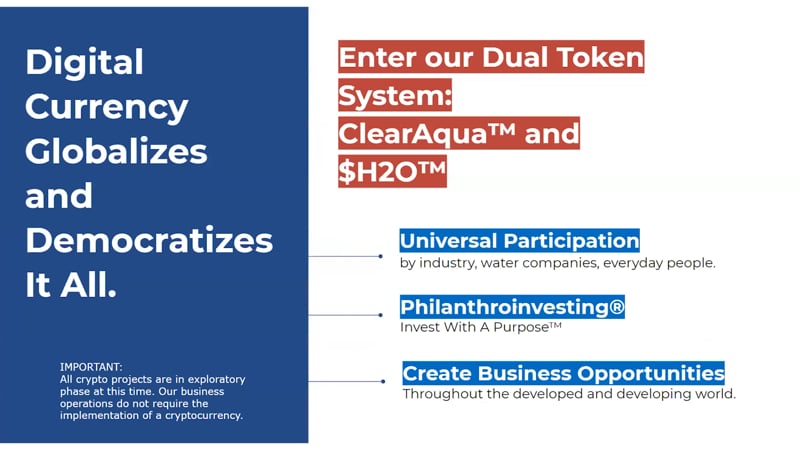

Now, that's the hardware and service layer. Here's the fun part, digital currency, it enable us to globalize and democratize everything. We do our dual token system, ClearAqua™ and $H2O™.

So here's the concepts, universal participation by industry water companies every day if PhilanthroInvestors® can actually earn money on their philanthropy, okay? And you're going to create tens, hundreds, thousands of business opportunities all over the world, particularly, in the developing world.

So let me explain what these concepts mean. It allows for any quality water company, anywhere on the planet to participate in this process. It creates almost an instant global community. It allows a philanthropist to actually make money.

It puts second and third world companies to work building on the new modern world. It lifts those companies and workers into a global middle class, like we had in the turn of the century last century in the U.S. It removes governments from the equation, generally a good thing, but it also helps spark. And I think I want to go back to it because it's important. It helps spark a true global new deal. Now the new deal of the previous century created, helped create infrastructure and also helped create the American middle-class.

Isolating and Selecting Water Projects

The difference is this will not be funded by taxpayers, it will not be funded by printing money it's all investors participating in profits. So the new deal reference was just to describe the scope of it, okay? Which is massive. But the last part is this also clean water has the potential to save millions of lives.

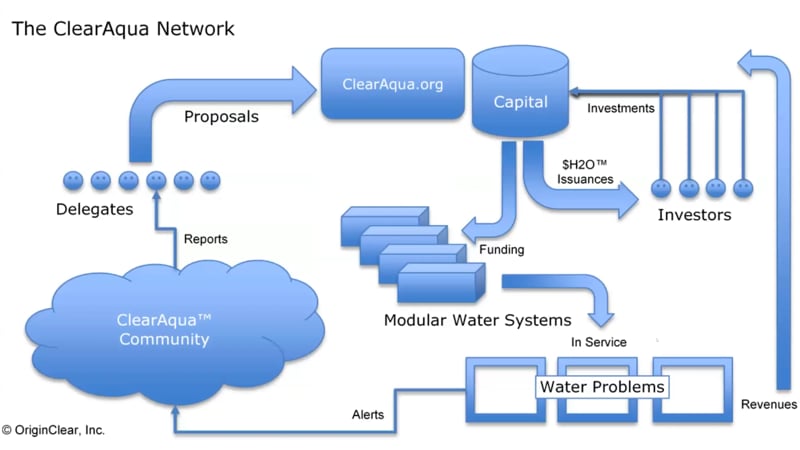

Riggs you've gone over this. Previously as the guy who designed it with the designers, you had a high level... I'm going to describe it as somebody who kind of came in after and describe my understanding of it. The ClearAqua Community here, our token holders.

So we launched the ClearAqua token, they're going to be some way incentivized to report or suggest water problems that need solving. Now a good model to look at as kind of an analogy for this is something called Stemit, S-T-E-M-I-T, model Dan Larimer was the creative, it works beautifully. It compensates social media posts, so it's the same idea. This will incentivize people to report water problems. So maybe there'll be 10,000 reports or suggestions that are sent up to the delegates that are filtered by these delegates. This is more like your Congress. Okay.

Neutral Arbiter

So what they do is they filter them and they send a reduced number of proposals to clearaqua.org. Now clear aqua.org, we will own that subsidiary. There'll be an ombudsman, a neutral arbiter of ClearAqua. He will be a water expert, of course.

He'll use his expertise in the feasibility of the job to decide which of the final projects to be put down. And they'll be using the capital raised on the other side by investors. So these fully-funded projects are then manufactured by Modular Water for now, okay? But eventually companies all over the world.

Modern Construction Era

Now, remember when I said build at home, is home Africa? Is home Asia? Is home Europe? Is home South America? The answer is yes. Okay. And that's kind of the virtuous cycle part of this thing. But home is everywhere local problems exist.

Charity becomes capitalism and it creates jobs. Water problems are then solved on site. Revenue-generating vehicles, which then return dividends and capital to the investors. So we see this sparking a modern world construction era each on a scale similar to what the U.S. saw in the earliest 20th century.

But in this case, this could be happening on that type of scale in dozens, perhaps hundreds of locations, eventually around the world, the developed and the developing world. And the wealth creation that 10 or 20 or 30 of these occurrences could create is absolutely staggering if history holds true. Here's what I mean.

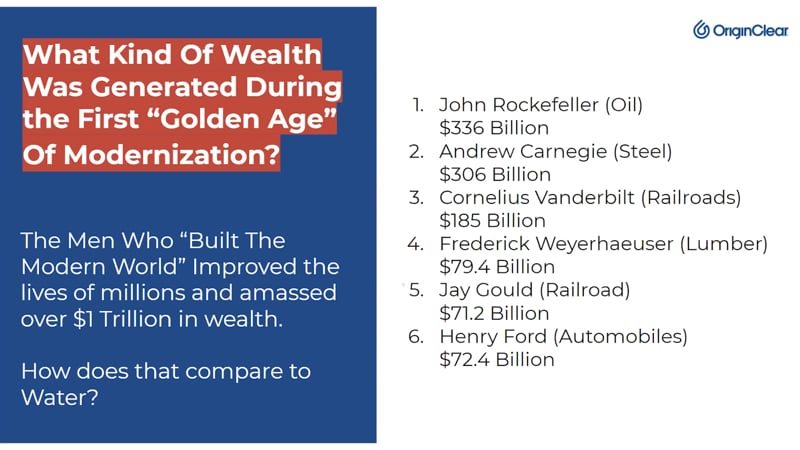

The Other 80%

We had a golden age of modernization that took place in the previous century. Okay? 100 years ago, a handful of what we refer to now as robber barons essentially built the 20th century as we understood it. They created more individual wealth than at any point in human history, even by today's standards, Bezos, Zuckerberg, Musk, they don't even compare. The top six alone amassed over a trillion dollars in personal wealth.

There were a dozen more that I don't even mention in this list here, but the wealth was concentrated in a just a handful of people not the employed tens of thousands enabled companies. But this was happening almost exclusively in the U.S. and Europe.

What we are proposing is a modernization everywhere else, including the U.S. and Europe. If this sort of wealth could be amassed in the U.S. in Europe alone, what could be produced in the 80% of the world where no systems exist. Remember no upfront cost to create this.

Building a Middle Class Anywhere

So we think we can create adoption around the world in a fraction of the time using these dual tokens. Places like Africa and Asia took decades to introduce fully-cellular technology. Carlos Lim is a billionaire from doing just that.

So instead of creating two or three trillionaires from this opportunity, digital currency can democratize this and create the potential for tens of thousands of millionaires to build true middle-class in parts of the world where it was never going to be possible before, or maybe since. And it's going to be very similar. I think hopefully God willing to what we saw in the U.S. in the early part of the 20th century.

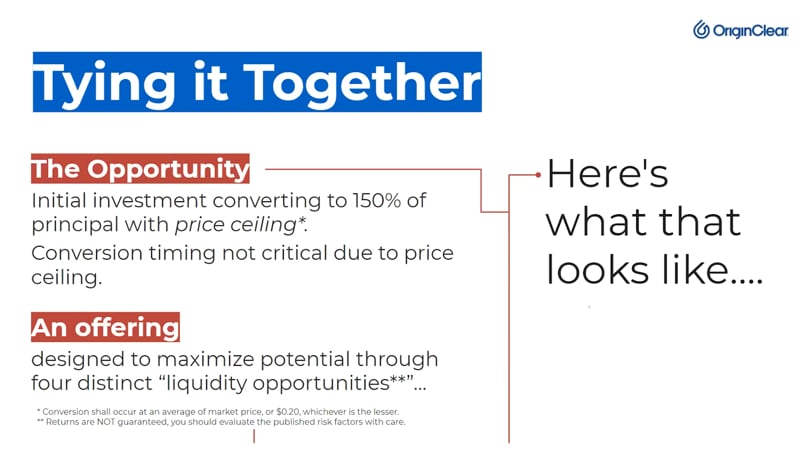

Liquidity Events

So when it comes down to is I'll lay out kind of four liquidity events that we're planning, Riggs, through our efforts and with our partners to drive the underlying common stock to higher levels. And before I do that, understand that we've created a financial instrument that bends over backwards to assure that the investors are in the best position to make money, not just when the stock does well, of course, that's easy, but also if it's just holds its own, or even if the stock doesn't perform or even goes the wrong way.

Everything we do is price protected. So the principle amount of your investment stays the principal amount of your investment until you convert to common. So up, down or indifferent, price protection holds the value of the investor's investments, okay? So we're going to have a ceiling and we'll have a number of liquidity opportunities that take place through warrant exercise. Let me explain.

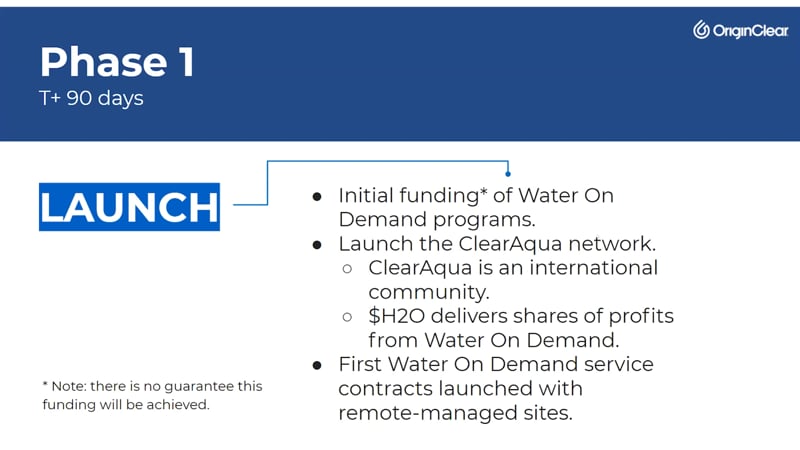

The Launch

So private placement shareholders we've going to have this initial funding of Water on Demand, that's going to be funded by private placement. Okay. We're going to launch the ClearAqua Network™. This is T-plus 90 folks. So between now and before the end of the year, we expect to fund Water on Demand, launch ClearAqua, launch $H2O, start to deliver some profits from the Water on Demand concept. And those first service contracts will be launched and with remote managed 24-hour a day monitored sites.

So the private placement shareholders will have price protected positions where the stock right now is eight or nine cents. We could see significant movement before years end with the creation of this event. So the first liquidity event is in the common stock T plus 90. If the stock is higher than it is today, you can convert to common stock.

Riggs: No guarantees, of course?

Ken: Of course not. But you could either hold or sell your stock, it's the investor's choice, okay?

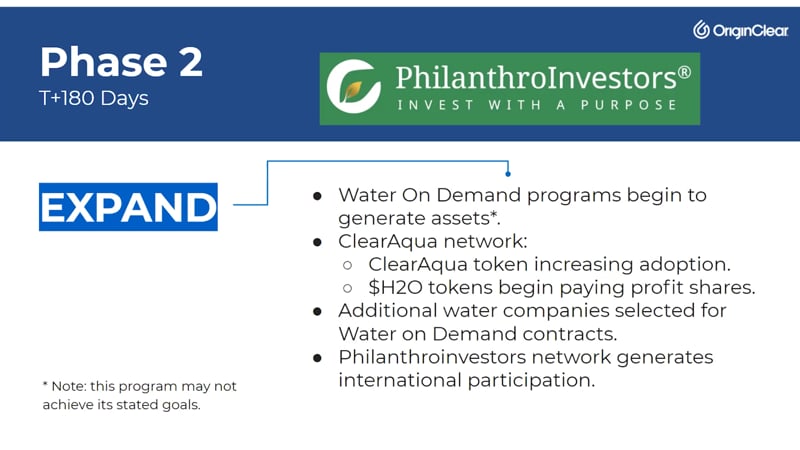

A Second Bite at the Apple

So T plus 180 now through the end of the year into early next year. So our asset paves the way for a potential NASDAQ listing. We've got the ClearAqua Network, it starts to have some valuation. The model begins to pay stakeholders and lo and behold, a new asset class is born.

We might even have an early indication next year of if/or when a NASDAQ listing could be a reality, and give some sort of indication in that. Now we think that if that happens, okay? And that's what we're working towards, I think that can also create secondary what they call arbitrage, buying people, buying an anticipation of a new listing.

Regardless of whether you've sold the stock at this point, or held the stock, we anticipate a lot of value being created there. And so the stocks got some value, but now these underlying warrants are now potentially in the money. So what you'll essentially be able to do is get a second bite at that apple, whether you sold the stock or not, okay? And, of course, this is our best efforts, there's no guarantee, but we think we'll get there.

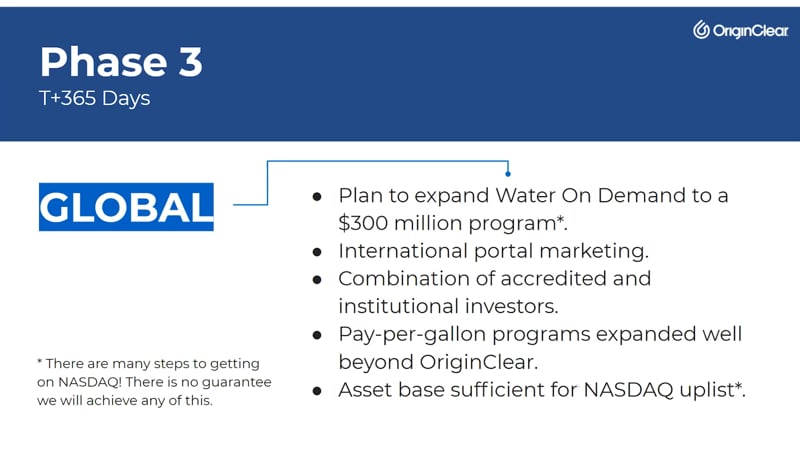

Projected Potentialities

Projected Potentialities

Now, this is going out late 2022 to early 2023. The modernization of the world's water is well underway. Hopefully by this point, NASDAQ has happened. We're working with a firm right now already to expand that first $20 million raise to kind of launch the pilot to go to $300 million, okay?

So that goes from 100 systems generating almost a half a billion dollars to approximately over 25 years, to approximately over a thousand systems generating estimated over $7 billion proportionately over 25 years. So instead of potentially paying out 43 million in anticipated deals to the stakeholders, it's closer to 650 million.

And we're now working with potentially at this point, dozens of water companies, both here in the U.S. and around the world to produce these worldwide systems. They employ tens of thousands of people in a new micro utility asset class, and they're doing this in both manufacturing and servicing. So where our stock is at this point, I couldn't even speculate, but the instrument I'm about to show you clearly shows how now may be the time, okay?

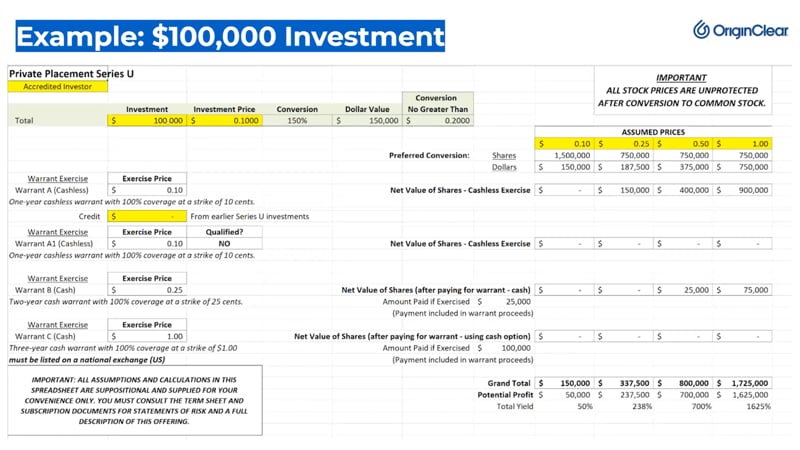

A Collar and Warrants

So here is our series, some of you folks have seen this, so it's $100,000 investment. It's tagged at 20 cents, it's collared at 20 cents. So what that means is that if we get these types of growth which we certainly hope for people aren't going to be jammed to try to convert quickly, right? I talk about converting either holding or selling, you won't be in a rush. No matter where the stock is higher than 20, you'll be able to convert at 20 cents.

So let's just say that this thing bounces along over the next year, and we do achieve a dollar a share, which again, no guarantees $100, 000 investments already worth $750,000. Now you can take that money off the table, and here's why that's perfectly okay. The warrants come in. So now you have an opportunity to exercise a warrant if the stock is here, you're exercising at 10 cents, that creates another $900,000 potential profit in a secondary instrument that you didn't pay for. It was an added bonus inherent in the private placement above and beyond the common stock.

So you'd have a second bite at the apple, which could even generate more potential profit at the same price point than even the common stock. So I can talk about NASDAQ listing and where the prices of the stock could be at that point. The point is that gets a little bit in columns beyond here, and it may be a little bit soon to talk about that. If all of this just manifest itself at a stock between 50 cents and a dollar, $100,0000 investment, As you can see is very, very significant over the next few years, okay?

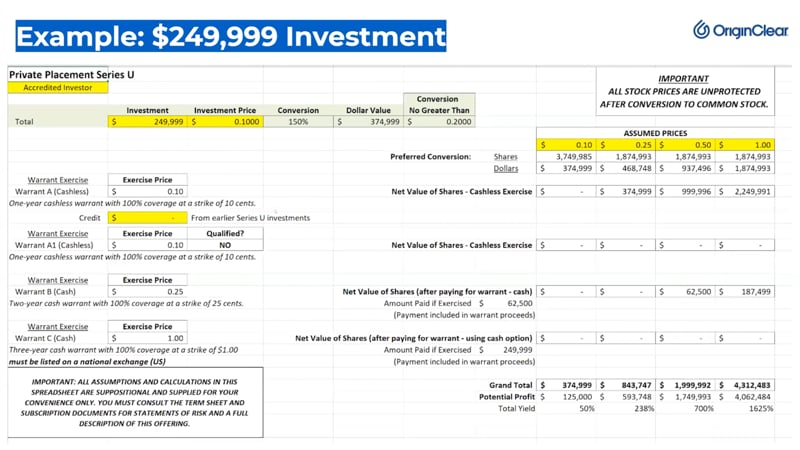

A Second Warrant

Now this is our series U, and there's a little magic that Riggs and I sprinkled in here, and it's a second 10 cent warrant. So that gets activated at $250,000, right Riggs? So here's what I did just to be a wise guy, I said, "Let's do one at $249,999."

So if an investor invests $249,999, stock reaches a dollar, it's tremendous. It's $4.3 million. Again, no guarantee. I'm saying if then at $1, a $250,000 investment is worth $4.3 million. If he invests an additional dollar, here's when the magic happens. It activates the warrant. And look what happens.

Riggs: I apologize.

Ken Berenger: You want to let him talk first? That's fine. I'll go after.

Riggs: I apologize, go ahead.

Ken: That's okay. So we add a single dollar to the investment. It activates the second warrant. So where you are $249,999, you're at $4 million of profit. Again, no guarantees, but that's the potential at a dollar. At $2.50, it's 6.3. So it's very, very powerful.

And we did this because we really believe the faster we can implement this, the faster it becomes a reality. Our confidence level is we think that this is a when, not an if, and we're going to work very hard to make sure that we do everything we can to make that a reality.

Call Ken

So anybody has questions, you can call this funny looking guy. I will not be wearing a suit and tie, but you can contact me at OC.gold/Ken, or you can just clip that on my calendar, or for those of you who have my phone number, you can dial me direct and we can set up a call. And that's pretty much it.

Riggs: Wow. Well, fantastic. Ken, thank you so much. I think there's a couple more slides that talk about the CEO briefing and so forth. [crosstalk 00:35:09] You're so in the dark.

Ken: I'm at work guys, just so you know.

Riggs: It was like ghost town, it was cute.

Ken: My children asked me to send a picture, so they remember what I look like.

Riggs: Exactly. Well, listen, it's good. It was a lot of work today and last few days, but well worth it. And we're going to start sharing it. Of course there'll be the replay as well.

DAOs and ClearAqua

So I'm going to quickly get on because we're already at 8:37 and I don't like to go much beyond 8:40. I wanted to quickly cover an article here about DAO. What is a DAO? DAO is basically it's an organization that allows for decentralized finances so that people can vote and so forth. The beauty of this is this is exactly what we're talking about doing.

There's all kinds of interesting things about this. Again, I'm not going to spend much time on it. In fact, I think I'm going to pull up the article here. So this Decentralized, Autonomous Organization is what we're talking about doing with ClearAqua. It's proving to be very, very powerful.

If it hadn't been for some glitches a few years ago, DAOs would be everything that people did, but it's now starting to take off. So it is something that you can look forward to. What's great about it is a lot of people are involved. I think something like 64,000 people are involved with working in DAOs, so great. Very interesting stuff.

Overriding Water Rights

All right, now I'm going to move on to another quick story. This is the video that kept intruding on our day. And the reason I bring this up is because California decided to override the rights of water holders. This is a problematic thing because we've had a lot of things happen with government mandates, obviously. I'm not going to discuss these, but this is another example of that, where there's water shortages and the Water Board approved emergency regulations to stop landowners from diverting water.

It would have been much smarter to work with these farmers to basically manage their water better. And the lack of foresight here has created this crash emergency. We knew this, it's been years. We've been doing documentaries about the water drought for years, and here we are. So here's the thing, it's one of those moral hazard things. If water rights can be overridden, then there's a problem with the water right. So it's very destructive. I even this Democrat said it was the one of the most destructive measures as possible.

Fast Action Needed

So now the reason I bring it up is that we have got to take control of our water. Water is becoming a political football here as droughts start to kick in and so forth. Because people are being reactive and they're showing up way after the horse has left the barn, they're doing all these really repressive activities, and this is not good. We need to engage the Second Water Revolution in my opinion, really fast. So that's just my little editorial for the day.

Series U

I just thought I'd mention that, and I'm not going to spend any time on this because Ken spent time on these offerings, but he has a full picture.

Call Ken

Please talk to him, as you can tell, he's very, very knowledgeable. We are going to have another fantastic briefing next week. It's really a lot of fun doing these presentations.

Chats

I want to just quickly scan the chats to make sure we covered everything, because people were just speaking up. Yeah, so JRW. Obviously, you know that people have money and power to solve the issues of water, but they have other agendas. That's a political issue.

But Ric Garcia said, "I like building at home and then enabling the creation of local manufacturing, which would help overcome trade and regulatory barriers and would enable populations to be distributed away from already congested cities, such as India and China." Bill, who was joined us through the HighChloeCloud network on LinkedIn says, "Great presentation, thanks for sharing."

Ric Garcia calls it a new blue deal. New blue deal, I like that. Like that very, very much. Ivan is chiming in about PhilanthroInvestors, which we feel as you can tell is a critical part of the overall strategy. Well, that's where we are.

Davis, how do I start investment? That's a very good question. Benjamin Davis, just go ahead and talk to- I'm typing in OC.gold/ken. Talk to Ken about investing. Of course you have to be accredited or non US. We will have unaccredited investor options coming, but it has to happen still. All right.

About Crypto

Now also, Jim says, you mentioned crypto, where do we find out more about this? That's a very good question. Last week's briefing. If you go to originclear.com/ceo, and you look up the briefing that I did, there's a video that that I played, I'm not going to play it again right now because we're out of time, where I talk about this and also walked through that whole chart that can briefly show it on screen.

There'll be much more about that. Make sure that you're signed up for our newsletter. I definitely look forward to keeping you briefed. It is going very, very fast. We met this week with the development team. Technically could have been in like three weeks, but that's not realistic because a lot of other things have to happen. But the code is not the problem at this point.

The problem right now is making sure all the websites are up and then to make sure that the regulatory issues are taken care of. Benjamin Davis, what's the link? I think I gave it to you www.oc.gold/ken, and talk to Ken. Or just send an email to invest at originclear.com, and we'll be happy to talk to you. Or, you know what? Send an email to CEO, me, CEO@originclear.com, and I'll be happy to respond.

It's a little known secret that every single newsletter that goes out from me, you can reply to and it'll come in my inbox. I will do my best to answer. With that, we have gone over long, but I think it was very constructive.

Thank you very much for your time, everyone. And I look forward to talking to you next week. It gets more exciting all the time. As you can see, we have a heck of a strategy to really change things, starting with our basic building operation, moving into Water on Demand, and then ending up with this water coin for the world. Very exciting. So thank you very much. I'm going to now tune out to allow Heather to catch up with her translating, and I'll see you next week.

Ken: Good night Everybody.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)