Insider Briefing of 27 May 2021

Can private business handle "broken water?" The well-connected Jeremy Ryan Slate interviewed our CEO, who also appeared in a major mag! See why we think that $H2O may have the potential to enable a new global marketplace, someday…

*Por favor haga clic aqui para la versión en Español.

FEATURED/COVERED IN THIS BRIEFING — QUICK LINKS

- Our CEOs interview with and news coverage from Authority magazine.

- Important content that "got left out" and was missing from the Authority article.

- What the CEO has to say about Ken Berenger and his performance in OriginClear.

- Riggs awesome, insight filled interview with Jeremy Ryan Slate.

- How private business factors in to handling the water crisis.

- The DBOO megatrend OriginClear is riding.

- The potential of NFTs and a self-building marketplace.

- Water on Demand and a parallel economy.

- Restoring economic control and creating an exchange system that preserves value.

- Our press release and the $H2O water coin.

- The CEOs deep dive into the 10K annual report filing.

- The Broken Water presentation and the company's story.

- How the Fed balance sheet is tied to the Commodities index and where our proposed $H2O coin fits in.

- The small landlord crisis in real estate.

- The weekly update on Dan Early's outsourced water projects.

- OriginClear investment offerings.

Transcript from recording:

Riggs Eckelberry:

And good evening everyone. We're now live and really, really excited it's happening and of course it's important to recognize that we are also real-time being translated into Spanish. So, you just hit that globe sign at the bottom of your interface and you'll be able to switch then language you want. Straighten out my [glasses].

Introduction

Let's go ahead and open up. And while people are arriving, the usual opening, Water Is the New Gold and it has a special meaning today, you will see what I mean. "Helping you thrive in the world's ONLY vital scarce and recession-proof market." And it is Thursday, the 27th.

Forward Looking Statements

As usual Safe Harbor Statement means that we are always doing our very best to say what's going to happen. But of course there could be... Things can happen is basically what it says. And there's always risks, which are in our quarterly and annual reports.

All right. As I mentioned, we have a Spanish interpreter, which is wonderful.

How to Shake Up Our Water Industry

And now just yesterday, an article appeared in Authority Magazine and Riggs Eckelberry, OriginClear on the three things you need to shake up your industry. And it's a nine minute read. It's well worth reading. Cause I go into depth into well, how to shake up our water industry.

Incredible stats with this thing. 37 million visitors per day, 77 million page impressions per day. I literally had to go check that stat. They thanked us for a fantastic interview. They're just great, great people.

Best Advice

So, but I want to share with you what was not published, that didn't make it in and so let's go into that. So I'm going to flip over to a word document. So can you share three of the best words of advice you've gotten along your journey? Please give a story example for each and of course this part is in the article.

Amazing Partners

I've learned more about watching great people. We've got a partner whose real estate venture is high up on the Inc. 5,000 and advising us how to do the same. Ivan Anz is always upbeat, always predicting success and turns every problem into a solution with a huge upside plus he's relentless. I think I'm good that way, but he takes it to a whole new level.

And again, he had a wonderful reaction to this lateness that we had with the 10K and he came up with a solution and just together, we always win. Fantastic. He's an amazing, amazing partner.

I've got a chat here. Let me just check who's saying what here.

The Missing Part

Of course, I had to mention my wife and she is amazing. She's a child whisperer not because she speaks a special language, but because she always has their back and she's amazing that way. A little story about a kid that she turned around...

But here's the part that was missing, only the first line ended up in the article, like this, "Ken Berenger the finance veteran working with me to fund our outsourced water model," that's it.

Wouldn't Have Been Possible

Well, the rest of it that didn't make it in represents my ideal of a tough resourceful, fast moving exec who knows how to synchronize with a fast moving situation. But he is really a nice guy. Now this tells a story about how, when he joined us, we were in a tough place. Our early investors were in... It was a tough time. A lot of people had invested were my friends.

And we came up with a program to make them whole, and Ken went in there like a soldier. Amazing. And I'm hearing more and more and more that many of these investors who just took one more shot are now well up on their investment, which as I say is right here, it would never have been possible.

Sharp Wit and Unstoppable Ways

Now here's the story about how the first week of February, 2020, literally at the very beginning of everything, we looked at the crash in oil prices from just Wuhan closing down. We buckled down and after more than a year of intense work, we are now emerging into this new vision. So I owe Ken, thank you, Ken. And he's not hearing this because he's at a graduation, but I owe Ken Berenger a huge debt of gratitude, but most important to me are his sharp wit and unstoppable ways. So thank you, Ken.

Ken Berenger: The pleasure is all mine Riggs.

Riggs: Oh, shit. You're here. Well, good. I'm glad you heard it. So I have a video. So I'm going to go into... Paul says, Paul Fetscher says, "You always give good interview." Thank you, Paul. That's very kind of you. All right. So I'm going to go ahead and re-share with the video optimization. And here is, this is a show.

Command Your Brand

So Jeremy Slate is an amazing podcast promoter, and he has a thing called Command Your Brand. And he covers everybody and we have a contract with him. Again, we did this last year. It was very successful. They're going to book us on 24 of the top podcasts in the world over the next six months. And this was the introductory interview that he does with every one of his clients. So let's hear, this was just today.

Start of video presentation

Jeremy: So I'm very excited for today's guest. As we have Riggs Eckleberry back with us. He is the CEO of OriginClear. So Riggs, thanks for coming back on the show today, man.

Jeremy Ryan Slate Interview

Riggs: Jeremy it's such a pleasure again. And yeah, it does take me back.

Jeremy: It's wild because you and I actually chatted before the pandemic even was the first time we did the interview. So I wanted to kind of highlight the interesting thing cause you sent me some notes beforehand, which I got a chance to go through.

Infrastructure Spending

And one of the interesting things I was taking a look at, because I know we hear things being talked about in infrastructure spending, we're going to do rails and bridges and all these different things. And water treatment has been a problem a long time like we need to be spending more on it. We need to doing things like that but at the same time, we have this problem of money being spent in the infrastructure and not a lot of it's even addressing water. So let's talk a little bit about that problem first. Like how big is the global water problem and how little are we actually even doing about it?

Problem is Getting Worse

Riggs: Yes. Well, there's all kinds of scary stats. You know, 6,000 kids a day die from waterborne illnesses, et cetera, but actually 80% of illnesses in developing countries are due to water. So it's a big problem. We tend to think we're okay in the US, there's Flint, but otherwise we're fine. And the truth is, is that the water you drink will not kill you immediately, but it's got a lot of toxins in it. And the problem is, it's getting worse. We have not been investing in our water system since 1960.

Jeremy: Wow.

Riggs: And it's catching up. Now the backlog of undone work on infrastructure is coming up to $100 billion a year.

Jeremy: Well, and I think part of the thing, people don't consider as you mentioned, 1960, you know, that's the last time a lot of pipes were laid. It's the last time a lot of technology was put in. So things corrode, things get worse and it actually makes the water problem worse if I'm correct.

Riggs: Unquestionably, it only goes downhill from there. They actually have sensors on these pump stations to track... That have been allowed to be 50 years old and falling apart and they put sensors on them to like tell them, we get to a certain leakage point beyond which they can't tolerate it. You know, it's like putting a bandaid on a hole in a boat.

Can't Keep Up

Jeremy: Well, and the problem too as well, and once again, this was highlighted in some of my research is we looked at the inflation numbers, came out a couple of weeks ago. And the consumer pricing index doesn't consider a lot of things like lumber and things that are actually skyrocketing so the consumer pricing index is way off. So we're not allotting enough money to handling this problem, but the money we are allotting is worth a lot less. So, we kind of have this interesting quandary right now of like, what do we even do about the problem?

Riggs: Right, so the Federal government over the years has gone from well over 60% contribution to 150,000 plus city systems all the way down to about 6%. And now there's a big, big bill being considered, not big enough because it's water, but they're... Okay. $111 billion is in the Biden infrastructure plan.

As you say, though, the problem is, is that prices are doubling and doubling again and you can't do long-term... I mean, Argentina, which has a 50% inflation rate does not have any major public works going on. You just can't keep up. You just can't keep adding more money, fast enough to get it done. These things just stall and there you are.

Up to Private Businesses

Jeremy: You know, it's interesting I was talking to former Congressman Vernon Jones about this the other day. I find that a lot of times it's people in private business and people in the private world that fix a lot of this stuff. And that's a lot of what you guys are doing at OriginClear, you actually created a new product line and new business to handle this. So I guess why is it up to private businesses then to do something about this? You know, why is it not up to the public works in this case to handle it?

Riggs: Well, first of all, as a practical matter, you're going to start fixing public works like Miami-Dade has got a hundred plus thousand septic tanks that have to be fixed. We start running sewage out to all of those. You'll tie up traffic for 20 years, destroy quality of life.

Treating Your Own Water

And it's going to cost eight billion dollars that's before inflation so it's just pointless. Better for those homes to cut the cord and have their own self-sufficient system. And that's what businesses are doing. They're, they're not waiting. First of all, water rates are skyrocketing. So it pays to do your own water treatment.

You're a brewery, treat your own water and now you don't get charged by the municipality for the treated water, and you can actually recycle, which America doesn't do, so this is a really beneficial thing to cut the cord.

Paying on the Meter

The technology and the special roll-in, roll-out technologies called Modular Water Systems™, which is, an amazing guru came — joined us in 2018, Dan Early, and he's got a bunch of patents which we've licensed for a long time.

Okay, so that's the technology. Water on Demand™ is the way to pre-fund these water systems so that customers just sign on the dotted line and then start paying on the meter, like they're accustomed to, and these units are good because if they stop paying, we take them back. Thank you.

Recycle and Reuse

Jeremy: So the thing I wanted to understand about this, and I couldn't quite wrap my head around this, is when we're looking at water treatment. I guess, where does the water come from in this case? Is it water you've used in your own business that we're recycling and re-cleaning? Or have we, I guess cut into the public line somewhere and we're bypassing water treatment. So how does this work and how does this system work in with that.

Riggs: Okay. So the clean water has been delivered by the city.

Jeremy: Okay.

Riggs: To the brewery, let's say you're a craft brewery, now you make the beer. You've got a... Breweries have got a lot of organic effluent. That's a lot of water. It's not super dirty, but it's a lot of it. And so now you've got a lot of it coming out, treat it, and now you can reuse it. For example, for wash downs, you don't have to use it for beer, use it for steam cleaning, all that kind of stuff. You can use up to 50% of it again.

And then of course, when you finally get rid of it, the city considers a treated water, which you don't have to pay for it. It's all good. It's for that brewery... And this famous case studies with Russian River Brewery, up in Sonoma County, did exactly this, because Sonoma was just driving water rates way up and they said, "Fine, we'll just do it on a system." All good.

DBOO Megatrend

Jeremy: That's really interesting then. So this is really your own wastewater that you're figuring out how you can reuse in your business. And then I guess it's, you're paying per gallon or how does that structure then work?

Riggs: Correct. So the customer then pays on a service contract, per gallon. We say per gallon, but it's more like cubic meter, or whatever. This, in the industry, is well known. It's called Design, Build, Own, Operate, DBOO. It's been going for a long time, but only at the very high level.

A company called AquaVentures, which was sold to Culligan for a billion dollars, was doing exactly this, but it was doing it for islands an entire island would get a desalination system on one leader. But now we're dropping down into these quarter million to $2 million systems. It's too small for the big water companies to handle.

And you've got to have that portability, which the modular systems allow. So we feel we're dropping into kind of a mega-trend of everybody else finally doing it. And we're serving that. It's very exciting.

Economic Shift

Jeremy: And as well, you mentioned this being something that people pay for monthly, and the unit can be repossessed if it's not working out. And I think at the same time, that's also a big shift in the economy that you're hitting on as well. Because the economy has become less about ownership and more about access, right? So, I want to be able to use this, but I don't want to have to pay for all the maintenance, and pay for all those other things. So, it's also a big economic shift now at the same time, too.

Payment Efficiency

Riggs: You have transportation as a service, is emerging. All these things are happening. This is simply water as a service. Now, the next complication, of course, is you've got a ton of small customers with tens of thousands of payments happening. And then we get to the efficiency of the payment stream, which is the next big topic.

Jeremy: So, I guess then, how does that fit into the payment stream? Cause I know as well you've taken a look at crypto technology and the NFT market out there, as well. Which I will say, I do want to get into the explanation of what that was because I've... I like to say, I think I'm pretty hip, Riggs, but you actually helped me to really understand what this was, by just breaking down the definition. So, let's talk a little bit about what that is, and how that whole crypto market fits in with this.

Blockchain and NFTs

Riggs: Correct. Fungible means you can swap it. So, a dollar bill, a dollar bill, you can swap them. They're equally good. Bitcoin is fungible. One bitcoin is the same as another. You don't care, right? But then you have, what's called non-fungible where you make... You take that Bitcoin and you attach it a little tag to it that says this is unique.

And you've just created a non-fungible token. Now, nobody does it with Bitcoin. They tend to do it with the ethereum type tokens. That's just a detail. But what you've done is you've taken something generic, and you've made it unique. And this is called non fungible tokens.

Secure Payments

And they did $2 billion worth of business in the first quarter. It's a booming marketplace. Yeah, baseball cards, a lot of trivial stuff, but they've started listing houses as an NFTs that you literally would pay with crypto. And you can pay securely with crypto because you know, it's that house and no other, that's the key.

Jeremy: So are you like investing in that thing then? Do you have ownership rights in the thing? So how does that portion of it?

Riggs: Okay, so, let's imagine now you've got payment streams going out to the investors, the contractors, partners, everybody's getting money. I built a schematic of it once, and it looked like a fricking Picasso.

Jeremy: Well, that's why I asked you for explanation, because I like to think I'm a smart guy and I'm like, cool, I'm a little confused here. So, let's chat about this.

Riggs: So, going out the problem with the payments now, as we know it, because we paid dividends all the time is, the ACH has changed, or bad routing number or the PayPal notice went to spam, or it's just endless. And we have people working and they're delivering $4.35 payments to people. And they're going through all this hassle. That's got to end.

Packaged as a NFT

So what we do is, we take the payment and package it in an NFT. And the NFT has, what's called a smart contract. It knows who to pay when, and inside that NFT, as we envision it, is the entire future stream of payments for that one slice. Okay, think of that one slice being all the payments into the future. And that if NFT now, I can swap it with you, Jeremy, how would you like this NFT?

Yeah, I paid X amount for it, but it's got all this future revenue, and built in inflation of the contracts. So, maybe it's worth 50 times as much as the original value. We don't... Off the top of my head, I wouldn't know, but it's a lot, because it can last up to 50 years, right? Continuously in service.

It's the Wallet that Matters

So this becomes kind of... Think of it like a bond, right? It's got all this future payments built in and so forth. But the beauty of it is, is that no muss, no fuss. If I transfer it to you, OriginClear doesn't have to update the address. You just start receiving the payments in your wallet yourself. It's the wallet that matters. And that's the beauty of it.

Self-Building Marketplace

So there's a next layer of this, which is, guess what? People start transferring, once you've started swapping, you get, what's called an organic marketplace, a self-building marketplace. And we're seeing that in NFTs a lot. So now we... This is very early to be talking about it, but it's definitely feasible.

Water on Demand

Why is there no global water marketplace? Why is the Chicago mercantile exchange, not trading water futures, except very limited in California? Because water is local. But when we extract the...

Jeremy: Now water is global based on what you're saying.

Riggs: We extract the... And every gallon is attached to a payment. You see in 2018, I did a... I tried to launch a crypto, and it didn't work. Why? We didn't have the underlying pay per gallon. Once, you have to pay per gallon, now, that's money attached to every single gallon. You've monetized the water, and then you can transfer it around.

You've created a global marketplace. And that NFT ends up in Singapore. It doesn't matter. This is now trading worldwide in these water... Water on Demand as we call it. And this is NFT, we call $H2O. It's the H2O coin. And we've now trademarked that. And, and it's a beautiful thing because we... Water needs more of... More trading, it needs a market, right?

Jeremy: Like everything.

A Parallel Economy

Riggs: And then here's the cool part. We plan to then the take in coins to fund new water systems on a kind of a virtuous circle. And they get tokens funding, more systems, which then push out tokens, which is a... Could be fun and wild. But the important thing is, we then start to solve on a self sustaining basis, the water problems in the world. How exciting is that?

Jeremy: By doing something like this at the same time, you're also detaching yourself from the value of a single currency. You're attaching yourself to the value of the product. Is that correct?

Riggs: Correct. So, whatever the cost of that water is to... And it's inflated, inflated, inflated. And it's important that all those underlying contracts are inflation indexed, so that there's a natural adjustment. And then you just.. You know?

I once read that the cost of a haircut in Paris has not changed since the French revolution. But the Frank's adjusted. The actual cost of cutting that hair never changed.

So, the actual cost of treating that water doesn't change. But now we free ourselves, as you say, from... And it can be any currency, whatever. And that's really the promise of cryptocurrency, which is, it's a secure way to run a parallel economy, regardless of what wackos are trying to decide to do with our money. Right.

Consumer and Business Person Control

Jeremy: It's quite interesting. Because I think in actuality... And I think this is why sometimes, banks and financiers, and governments, and things freak out a little bit, because this is detaching the economy. Where it's putting it back in the control of the hands of the consumer, and the business person, and things like that. So I think it's quite interesting, because to me, it seems like it's a little injection of sanity, right? Cause it gives you a little bit more control.

Riggs: Well, personally, I feel that it's going to actually save us. Because, if we just had what's called Fiat, which means printed money. Then it would be out of control and it would turn into another Weimar, with the wheelbarrow full of money for the bread.

Jeremy: You're trying to go get it. And by the time you get there, the wheelbarrow isn't enough. You need a second wheelbarrow.

Exchange Systems that Preserve Value

Riggs: It's ridiculous. Okay. So that's where it's going, but this is an opportunity to actually save it, because you have a point of stability. And what will happen is, it'll calm the dollar markets over time. It's actually, I think, beneficial because people will be able to continue to do business.

You know, people in Venezuela, that they use crypto, right? Just to stay alive. Now it's actually making Venezuela healthy again over time. So I think we've got to look at it as something that is yes, revolutionary, but in a positive way.

It's a way to create exchange systems. They always come back to a currency in the end. I mean, at the end of the day, you've got to go and buy your bread at the local store, and you're not going to use $H2O is your coin. Right. So it's all good. It is going to co-op that to cash, but this is a way to preserve value. I think it's healthy.

The Future — Decentralization

Jeremy: I guess, do you see this when looking at the future of economics and where the economy is going, do you see this being not just with water, but with other utilities and things like that, and them also being traded for each other as well? Or, is that something we don't quite have an idea on yet?

Riggs: That's difficult to say. Because the problem is, essential utilities have their own funding systems, called municipal bonds, and the big water companies service them. But here's what happens, as more and more businesses start treating their own water and agriculture and so forth, the load on the central system becomes less. You need less and less central.

It's like back in the day, the mainframes are huge. And then we had PCs, now mainframes are just as big as they need to be. They're still there, but they're not being overwhelmed. I mean, I'm old enough to remember when you had to book time on a mainframe ahead of time. On the time...

Jeremy: I still remember the America online discs. They used to send in the mail, which we actually use for target practice, by the way. But like, that's how we used to get our internet. So I get it.

Riggs: So the... All that central stuff is actually relieved by decentralization. I like to say that in California, we'll never get the high-speed train because government's incompetent in general, but we will get the self-driving car because there's already freeways, right?

Jeremy: Yes. And that's driven by technologists and people creating products and that happens a lot faster than... I think it was Ronald Reagan that used to... That made the statement. The 10 most troubling words in the English language are I'm here from... I'm from the government and I'm here to help. But private business can actually fix things, just like you're saying.

How to Disrupt the Water Industry

Riggs: Yes, and then government has its place, but it will naturally evolve to what its place is, which is to make sure we don't hurt each other, generally. It's really its core reason. And to take care of international relations and stuff like that. But we can operate commerce and do good things. At the end of the day, water is in a terrible place. The Oglala Aquifer, which is the Midwest, is running dry. And once it runs dry, it will take 6,000 years to replenish itself.

Jeremy: So, rather than just burning it out, we need to start... Continue using the water we're using. I think that's a really great point because to a certain extent, there is... There's always going to be more water in the world, but clean water is very finite because we can only clean so much of it.

Riggs: Exactly and the people wanting desalination is great, but that's very energy intensive. That's a whole other issue. It's kind of like people wanting to defeat global warming by sort of dimming the sun. Well, it doesn't deal with the problem, right? It just dims the sun.

Jeremy: Right.

Riggs: You still got a dirty atmosphere. So, bottom line is I'm really excited about it. We feel that this is... That the deck that I sent you, the one that's on our homepage now, OriginClear.com. It is what we could do when we grew up because we've spent years trying to figure out how to disrupt the water industry. And we've now over the whole COVID period, I think figured out it's the funding. Fix the funding, everything else happens. And secondly, you can do it with technology.

Jeremy: Absolutely. Well, Riggs I've really enjoyed this conversation. As I said, I'm really excited about the direction you're going with things.

Riggs: We're very excited about this and we can't wait for people to jump in and participate.

Jeremy: Very cool, Riggs. Thank you so much for coming back on the show today.

Riggs: Oh, it was a pleasure, Jeremy. Thank you.

End of video presentation

Riggs: That is super cool. Jeremy is such a nice guy and what's... I played this longer segment more than I usually do because this... Only a tiny, like a minute of it is actually put out. He uses these meetings with his new clients to really refine the pitch so that when they go to book it, they really get the top, top podcasts because it's so well focused. So, it was a lot of fun too. And I think I got a chance to really explain a lot of what's going on here.

Audience Chats

Before I go on, I'm going to... There's lots of comments. Fantastic, I love it. So, JRW, "Greeting to Riggs and Ken." From Thomas, "Energy and Water are the two most important industries combined. 3.9 trillion a year." Exactly.

And then Omar says, "Gracias Riggs por hablar hoy mas pausado y te pueden traducir mas correctamente." (Thanks Riggs for speaking more slowly today and you can translate more correctly) That's fantastic. And then Keith wrote and says, "If everyone could see this interview, you would have more business than you could possibly handle." From your lips to God's ears, Keith.

NFTs and Crypto

JRW says, "As far as NFTs go, CNBC just did one for the late Mark Hines and Tillman Fertitta, was the high bidder on it." I don't know, recall for how much, there's a lot of celebrity stuff going on with it, with NFTs. My point is it's also very constructive. It always starts with these wacky things, right? Crypto kittens. Crypto kitties were actually the forerunner of NFTs and they got up to about a hundred thousand dollars.

So, ah, Khadijah would like to know, "Thanks for this conversation. So is the company going from OTC to crypto and bypassing the IPO?" No. We're using crypto as a tool. Kind of the same way Kodak ended up with a Kodak coin or JP Morgan has the JPM coin that they used to streamline payments. JP Morgan didn't become a crypto, they just started having one.

Committed to Uplisting

So for us, it's a tool. It's perhaps marketplace someday, it has tremendous promise, we love it. But we are committed to uplisting to the NASDAQ, which is what I can consider and you do too, Khadijah, our IPO. Living here on the OTC is tough because you know, penny stock, et cetera. So it' really, really interesting what's going on and thank you for listening through that. I'm going to keep on going here.

![]()

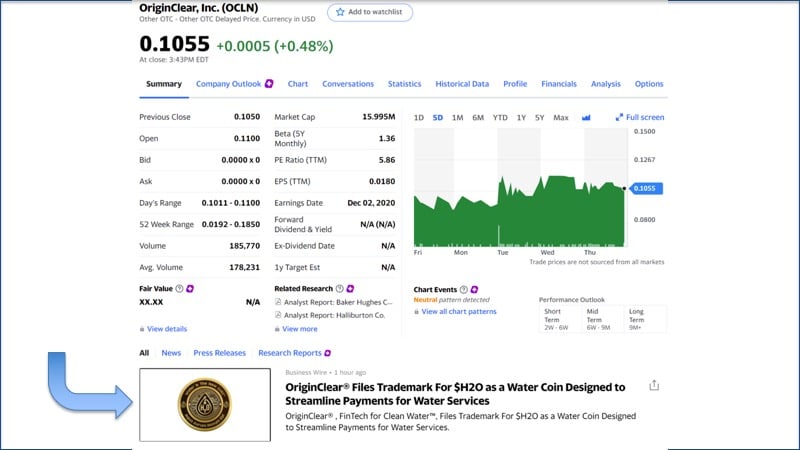

Press Release

Today we filed a... Well, we did a press release on something you already know, and that is the filing of our trademark, right? So sure enough, here it is, that we filed the trademark for $H2O and we can never call it H2O. We have to call it a $H2O because there's H2O is already trademarked for other water stuff.

But... So with the handle, the dollar. That really is the customary, a dollar sign for a prefix for cryptocurrency. It represents this blockchain system. Blockchain being that structure that people have. And of course, we still need to invest in it, It's not done, there's a lot of work ahead.

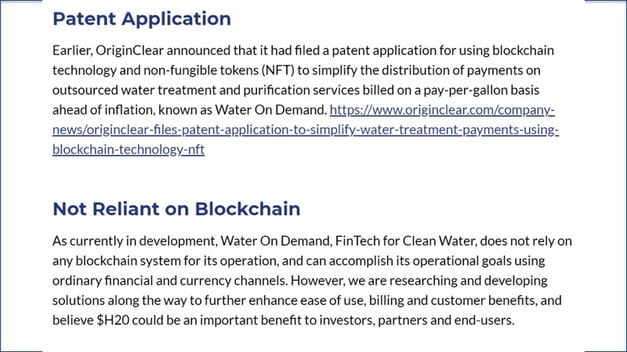

Not Reliant

And then it let us just go on a little bit here. The actual release, which you just saw that statement there. Earlier, we'd filed this patent application. Now, we're not relying on this. We don't rely on a blockchain system.

This FinTech for clean water we're building, with the pay per gallon and so forth, does not require crypto. We can do it with ordinary, financial and currency channels. It's very important to remember. So we're building thing, but we always have the everyday banking fallback and that's important to remember, because you don't want to be in a high risk situation with something like crypto.

Yahoo Finance

So let's take a look at what happened. Well, there we are. We're up on Yahoo and what is that gold coin? What the heck is that?

$H2O Coin

Aqua Nova Este, water is the new gold. So this is the coin. And I think it's kind of jazzy, I like it. But obviously it's just a coin. It's just for fun. I don't want to say that this is substantive, but it really says something, right? Okay, so let's now move on to a more serious topic. Oh, I've got three more chats, so let me just catch them before I go on.

More Chats

Ah, Paul Fetscher, "Tilman Fertitta uses over 10,000 gallons per month in each and every one of his restaurants. Now, should we talk about his water consumption in his hotels?" Paul, as you know, we are in the middle of the installation of a water purification system in a major hotel in construction, in Nashville, and that's for the incoming water. But they also, the same system can be expanded to have the recycling and the water treatment. So, absolutely. That's where we're going with this.

And then, oh, Thomas says, "A direct listing through Robinhood and SoFi and Reddit's Wall street bets bypass the bank." Well, yes you can. That's called filing a form 10. You can file a form 10 and do a direct listing. But we're getting way into the weeds here. We're just going to keep doing what we do and we will get somewhere, I guarantee. And Khadijah, thank you very much. "The corner is beautiful." Very nice of you to say that.

Okay. So, let's keep on going here. Why were we late? Oh my God. Kill me now. So this was very, very painful. And fortunately we did file and we expect to file the quarterly filing, within the limits. But let's take a look.

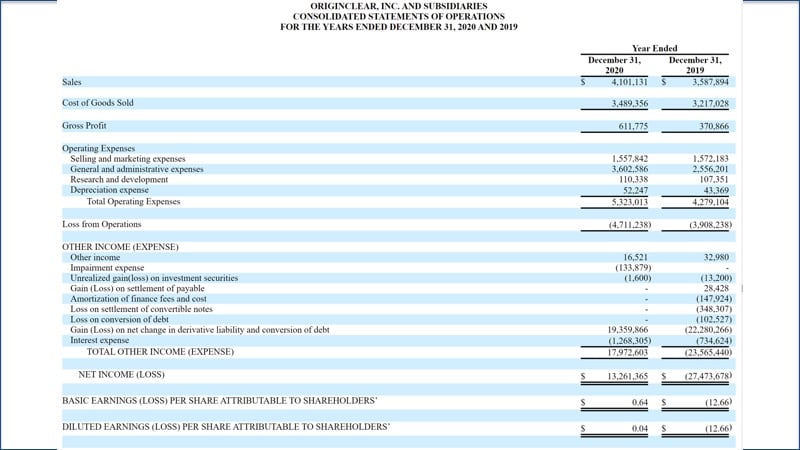

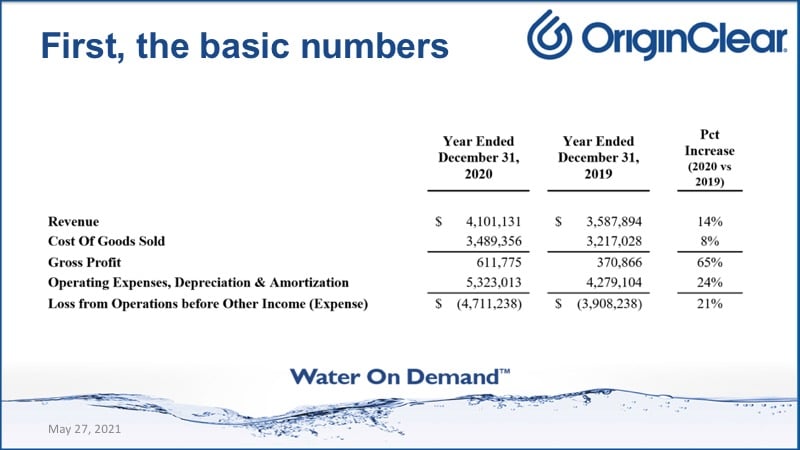

The Basic Numbers

The basic numbers that we showed, in the press release, showed that we made more money, revenue top line and cost. There was a greater increase in sales than in cost of goods, which means that the gross profit grew, which is great.

Now, operating expenses grew. What the heck happened there? Well, here's the story is that we are... I mean, when we purchased progressive water treatment, we could have just been a little water company in Texas doing $4 million a year and been profitable. No question about it.

What are we Spending On?

We decided to go and build a big company. And that is where you get this sort of biotech type spending that goes on. So, what are we spending money on? We're, for example, the CFO, for example, we're starting to invest money into the crypto development. We're spending money now in the design, build, own, operate that I'll tell you about. All these things are things we're spending on to get capability. So yes, we have had loss from operations and it was greater than a year before because it was something we chose to do because we are actually expanding and stepping into this, what I think it's very big shoes.

So, let's take a look at how that expands out. Now, the reason I'm showing you this slide is because you have... There is a profit, which is like, huh, what? And the reason there's a profit is because of this crazy number. That's sometimes is super negative and sometimes super positive. And as you see, the... In 2019, it was... That number was 22 million negative. So it made us, 23 million, overall negative. And then, in that part, the overall was larger, of course.

And then looking over in 2020, we have woo-hoo! We have a profit all of a sudden, and this is because we have our backers, who are wonderful people, they don't actually have not been actively converting their debt, so it's been wonderful for us. But nonetheless, they are paid relative to the stock price. Stock price goes up, it's actually good for us, right? So this is actually helping us, but it's completely fictional number. It's nice to see. And one day we'll actually get that in the fundamentals. And that is my goal.

Complexity of Issuances

All right. Now what really held us up was these issuances. And I'm going to flip over here to show you a little bit about what... Oh, I'm going to try and open this up a bit for you because this is very, very small. There we go. Hopefully I just went somewhere weird because I don't actually... I was in control and allow me to just, okay. I'm not going to try and widen it because it takes me somewhere else.

But these are all of the preferred series, series C and D one, which were 2018. Series E and F, same also. Then we went into G, I, H never happened, at J, K, L, M, which that was the unaccredited investment, the Reg A. And then series O, P, Q, and R, which we're just wrapping up. All of these series had all of these intricate things happen to them. Now, why did we do these? What the heck? What was it all about?

Improving Positions

Well, it's because we were taking people, and we're basically improving their position. And so, as I discussed in the article, we had people who were willing to pay a little bit more in and get a better position. And this was unbelievably complex and we simply hit the wall in Q1 of this year.

We should not have. There's no question that we should have had a better control, but here we are. Okay. So that's kind of what's going on with the 10 K. And so let's move on a little bit because I have an update on CFO situation.

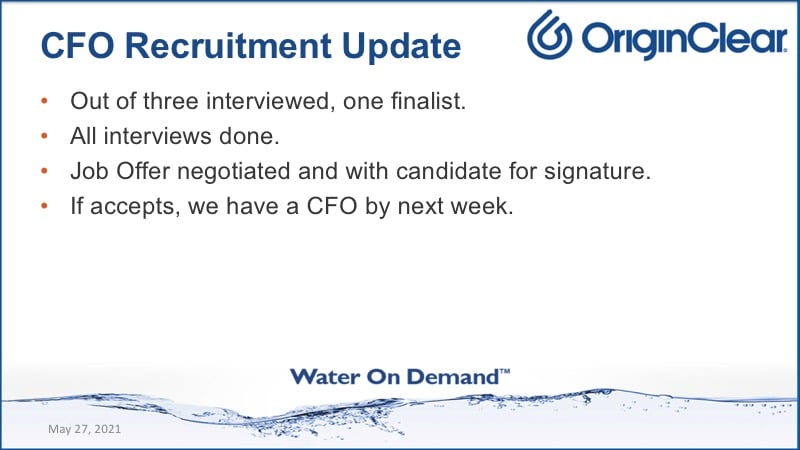

We Have a Finalist

So we have that one finalist. All the interviews are done. We've negotiated the job offer, and it's now with the candidate right now as I speak. And if the candidate accepts, we will have a CFO next week. And we're extremely, extremely happy about that because in fact, Tom Marchesello, our COO, almost broke down in tears. He was so relieved. So it's going to be much, much better.

Broken Water

Okay. Now, in other good news, that slideshow you saw, well we just went ahead and put it right up on the homepage. And well, I just... Where is it? Unfortunately it gets hidden by that top... Here it is. You can see right here.

On Our Homepage

This is our actual homepage. So people are going to be able to cycle through this deck, which says exactly. And what's cool is that as we update the deck, for example, we'll put the coin in it. Boom. It'll show up on the homepage.

Now this is temporary. We have a wonderful home, a new homepage in the works, but I wanted to get our real story up there right now because people are interested. And you know what? Let me just come back here. And want to make sure that I'm, yeah, I'm still screen-sharing. Good. So that's what that's about, so that's great. Now I wanted to do a couple comments.

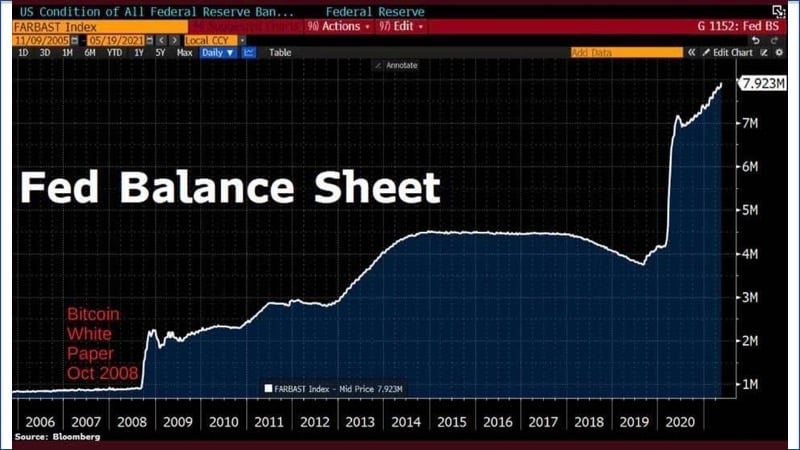

The Reverse of Inflation

The first thing is... This is interesting. Bitcoin white paper comes out October 2008. As if in concert with it, the Fed balance sheet just takes off. Ridiculous, right? That was the crash of 2008. And so people go, they sit there and criticize Bitcoin for being fake. I'm like, "Excuse me?" Because of course, Bitcoin has done the opposite.

Bitcoin is the reverse of inflation. Actually, its supply, relatively speaking, reduces over time. But you see here really, what did I hear? 40 percent of our total dollars in circulation were issued since the first of this year. So that's tough.

Price of Commodities

And now here is a graph called Elements Linked to the Rogers International Commodity Index, RJI. And since June of last year, this has just been going on up and up. This is commodities. These are commodities that are rising. This is actually RJI is a good exchange traded fund to own, but it really parallels. Fed balance sheet, price of commodities. Fed balance sheet, price of commodities. This is how it is.

Next Crisis Point — Small Landlords

Now there's one outcome that is really, really tough coming out of this, and this was just reported today in the Washington Post. The next crisis point, of course, has been all this forgiveness. And of course, the tenants are in a very tough place, but the landlords and here's something that I did not realize.

Half of these rental properties that are behind on payments, 4,000,000 rental properties, are owned by small landlords. These are people who sort of clawed their way into the middle-class, and they're stuck. And a third of all small landlords, meaning a sixth of all of these rental properties, are at risk of bankruptcy or foreclosure.

And unfortunately they're not getting a lot of respect, but it's very tough for real estate. I think that the story on real estate is not over. And there's a term called fat tail, which is basically the tail of the whole problem. It kind of hits you. It kind of hits you on the way out. And so this fat tail, this is the stuff happening at the very end of all this.

And it's, I can't say it's wonderful, which is why we're getting a lot of real estate investors want to diversify. Not they're doing badly, but they would like to have maybe their hands in some other things. And so that's kind of what's going on.

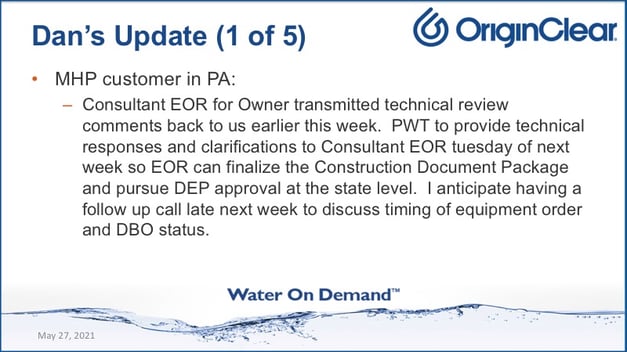

MHP

Okay. Now a quick status update before it gets too late. I know I've gone on for 40 minutes, but you've been a great crowd. Quickly, Dan's update. The mobile home park customer in Pennsylvania, the engineer of record, anticipate having a follow-up call just... Okay, so that's continuing. That's fine.

Design - Build Firm

Craft brewing customer, working with the customers DB firm, design-build firm. And our first scoping and pricing follow-up meeting next week. That's good.

RV Park

We didn't have any news last week. Now we have news. Final engineering should begin immediately. Now they would like us to provide a design-build-own and operate, turnkey basis, full outsourcing. That's very, very interesting. And we may be able to do that soon, given some of the real estate that we have that is turning into cash in the background.

A New DBOO Prospect

This is again, remember design-build-own and operate, DBOO. And so this is a new one and that's... Okay, that's just starting.

Network is Building

And we have two established design and build partners working with us to collaborate on this DBOO. So now the network is starting to build. I'm super excited about that. All right.

Reg A

Not to spend too much more time. We have the three offerings that I was... We have the first regulation A, which expired and it's being refiled. Stay tuned. It's happening. Work is being done.

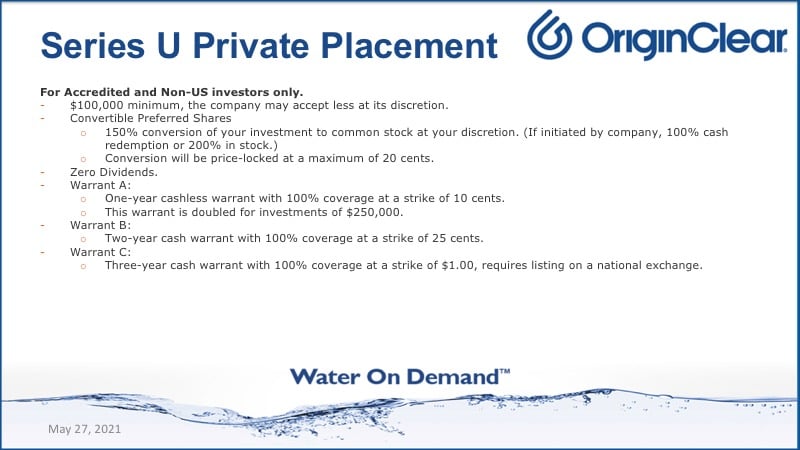

Series U Private Placement

I'm going to breeze through these because as I say, and you guys are hanging in there, I really appreciate it. But the series U is basically... What's really great about this is that we're dealing with the fact that the stock is going up. Now I'm not promoting that the stock is going up, but it's a fact that it's been going up now for ever since December, really.

And so what we have here is a situation where we want to protect investors from stock going up. Imagine you're sitting there in preferred shares. You want to convert, and the stock price goes up. Well, you're going to get less and less shares as you convert. Before, it was good because if the stock was going down, you got more shares. So you were good.

Well, unfortunately, if the stock goes up, you don't lose money, but you lose opportunity. Well, there's a price lock, that maximum ceiling of 20 cents. And that we believe is more valuable than dividends, which is why the new offering does not have dividends. And then warrants. Won't get into those.

Now here's another thing. On that first line you saw, if the conversion is initiated by company, could be 20 percent in stock. So that's something that could happen. For example, if we want to clean up the equity landscape, and we would just go ahead and do that. So it's a very, very sophisticated offering that Ken can tell you about.

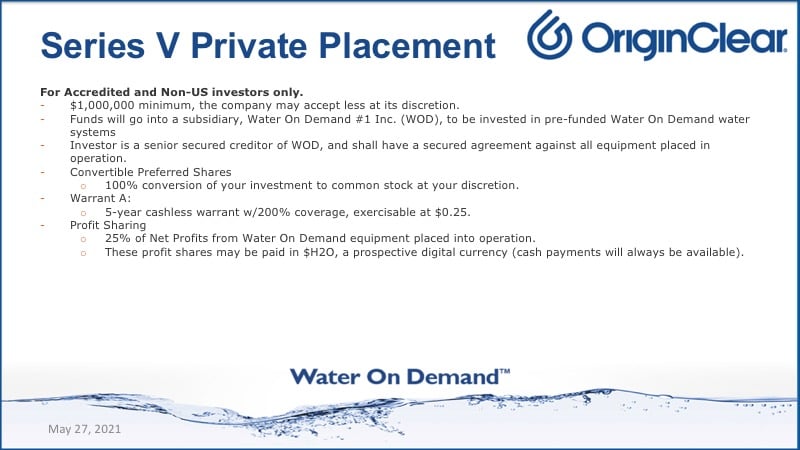

Series V Private Placement

And the series V is for senior secured creditors. And the only thing I want to mention about this is these are the people who get percentage of net profits from the Water on Demand equipment, basic operation. And these shares are the ones we're talking about being in $H2O. That is where the rubber meets the road.

Call Ken

So I'm not going to spend more time on this. Ken has the full picture, and he's available to discuss it. So schedule a call. www.oc.gold/ken. You've been a wonderful audience. You have hung in there. So much to tell you and I'll have even more next week. Believe me, it's moving fast. Stay tuned.

Thank You and Final Comments

Thank you. Have a wonderful Memorial Day weekend. Catch up, have a staycation, et cetera.

Let's see, Thomas says, "We're in Texas, the wind capital of the world." Yeah. Our operations are in Texas. That's correct. He says, "Energy and water make Bitcoin look like tiddlywinks. By the time all the coins are mined by 2025, energy adjusted for inflation will be 5,000,000,000,000." Absolutely.

And he talks something about water harvesting from the air, which is wonderful, but he loved our plan and strategy. So thank you very, very much, Thomas. Okay, well again, have a wonderful Memorial Day weekend and we'll see you next week. Thanks again for joining us.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)