Transcript from recording:

Riggs: Good evening. And it's Thursday, December 5th. And it's great having you on board after an interruption of a couple of weeks as we went through first this amazing trip to Spain and then, of course, the US Thanksgiving. Most of you have seen the press release, the video and so forth. If not, I recommend that you watch the super cool video that has been presented on our Facebook page, facebook.com/OriginClear. That's also on our website and we'll be publishing it very shortly in the MoneyTV that I just did today.

What basically happened is that three years ago, a company called Montajes Longares decided to create a dedicated company to develop a system for treating pig manure effluent, and that's called “purin” in Spain. So they called it Depuporc. De means reduced, pu for purin, obviously poop and porc for pig.

So Depuporc is the name of the company and they decided to create this system. They reached out and became licensees and they've worked very diligently to create this first commercial system. They call it a pilot plant, but in fact it's a commercial scale system. 30 tons per day is at the low end of a mobile commercial unit.

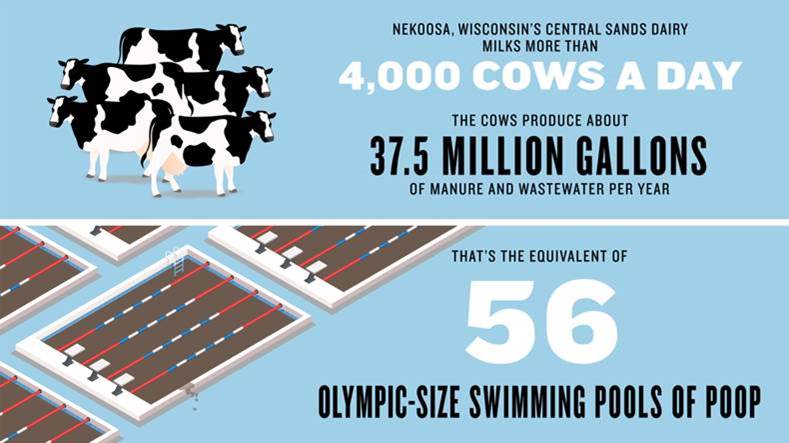

Just to give you an idea, the Central Sands Dairy in Wisconsin milks more than 4,000 cows a day. They produce about 37 and a half million gallons of manure and wastewater per year. Which by the way, it's 56 Olympic sized swimming pools of poop every year. And what does that translate to? I won't go through the math, but basically translates to about, almost 42,000 metric tons per year, or 389 tons per day. The system that was built here is roughly a bit less than a 10th of the size. So, 30 metric tons per day.

Now that is a huge dairy - the 4,000 cows in Wisconsin - but remember that everything's becoming very, very large.

When we were touring the Spanish countryside, I saw all these pig farms that were closed. And our host said that if you have less than 2000 pigs, you can't survive. You can’t make the money. That's happening all over the place. There's a huge concentration of these things. So in order to handle, for example, 4,000 head of cattle, which I don't know precisely how that translates to pigs, but let's say it's roughly the same, you'd have to have something 10 times as big as what they built here.

Which is fine because there's a rule of 10 in pilot plants where if you've shown that something can be done at let's say 10 then you can safely assume it can handle 100. But, you can't necessarily handle 1000. So, they have something scalable to potentially one of the very largest operations, 4,000 cows, dairy cows for example. The reason I mentioned dairy farms is that we have an enormous opportunity in the northern tier, the Wisconsin area, with dairy farms.

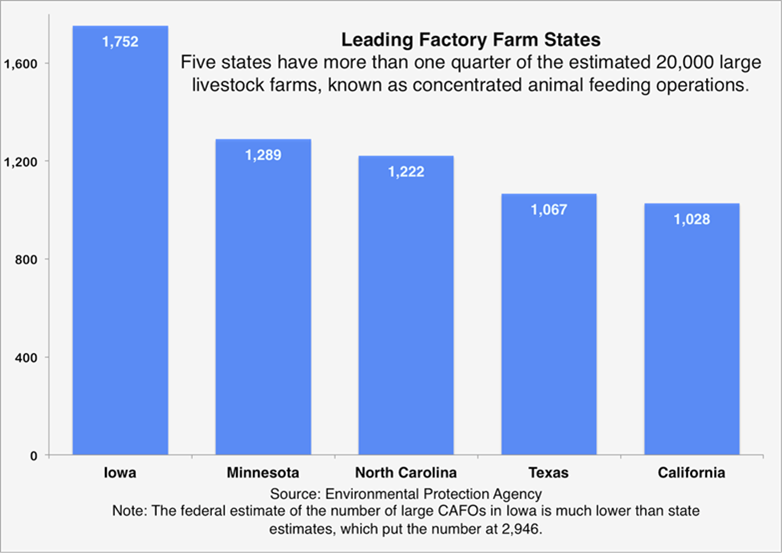

Just to give you an idea of what these factory farms are about. Five states have more than one quarter of the estimated 20,000 large livestock farms known as concentrated animal feeding operations, CAFOs. Iowa has almost 2000, Minnesota about 1200, North Carolina about 1200, Texas about 1000 and California about 1000.

There's many more throughout America but that just gives you a flavor. Imagine that you have 20,000 of these and each of them needs roughly 10 times what was built there. You're talking about a vast number of farms that need it and they would each pay. I've seen prices quoted for the Wisconsin area of around $300,000 for a dairy farm.

So maybe a quarter million to $500,000 would be about right. And obviously we wouldn't get all 20,000 of the large ones, but you get an idea of the size of the market. There's a lot of these. Let's say there's just 10,000 of these farms that we get. And each farm averaged $250,000, then that's $2.5 billion for these farms.

And that is less than half of the farms in just five states of America. So, the size of the market is huge. Up till now we've really operated on the licensing basis, which means that we collect, typically, 5% of the total.

So, with Depuporc, we are one third of the total system. We collect 5% of the total sale because it's impossible to say what was our part in terms of value. Depuporc is a licensee, they pay us that royalty. They pay us also for the components we sell them. So, a quarter million dollar unit would have the 5% royalty, but about one third of each system would be components that we supply. So roughly $100,000, plus the training. It's a pretty good chunk of money, but it's nothing like selling the whole system.

So Depuporc is going to continue to pay us whenever they sell one of their units in Europe, they'll pay us for the components, they'll pay us the royalty. That's all good. But in addition, we're busy agreeing on a deal to re-market that and let our licensees have it, the Depuporc system that is patented. And then we sell it ourselves, directly and through sales reps and so forth.

So it's a very large business and we're positioned to do more than just get royalties off of it.

So, what happened? Well, as I said, they got to where they had this pilot plant running and they let us know that it was working pretty well so we came out and we viewed it.

First of all, these farms are super clean. The Spanish and most of the European operators have learned that a a focus on animal welfare makes a dramatic difference in terms of productivity. In other words, it's cheaper to spend a little bit more money on animal welfare. For example, we were shown a hog farm for breeding and they showed us that just adding proper ventilation, well they take the number of piglets per sow from 30 to 34 per year. That's more than 10%, just from proper ventilation. So, there are a lot of reasons to do this.

By the way, there's a huge issue in China where they have not taken good care of it. Of course, they have a terrible problem with the swine flu. They're having to kill off all of these swine because of the swine flu. This is actually leading to an enormous amount of business for the Top 10 pork producing countries outside China. Top 10 top producing areas of course are China, then the European Union, then the United States and then Brazil, Russia, et cetera. As we see, China really took a huge hit. It's called the African Swine Fever and though most of the world’s pigs are in China, that production could be cut in half. That's roughly 300 million to 350 million pigs lost in China, almost a quarter of the world's pork supply. It's a massive number.

So what the Spaniards are looking at is an enormous increase because other players are not increasing. Holland, for example, has totally gone out of the pig production business because of environmental problems. But Spain has been willing to increase its ammonia pollution. It's the only country in the European Union that has dramatically increased, rather than decreased its ammonia and they want to do more production. They are aggressively grabbing the share from these Chinese losses, these killings that are occurring and that are not likely to end soon because the Chinese have these terrible practices. What the pork producers in Spain are looking at is a dramatic increase.

Now here's the problem. You can grow pigs on your lands, if they are sufficient to absorb the manure and you just spread the manure on the land and everything's fine, but when you turn it into a factory, now you're going to greatly outstrip the ability of the land to absorb that. We were shown all these lands and they are completely saturated with manure and in fact they have to be at one kilometers from each other. And they're literally making sure that they put a farm, a large, large farm every kilometer. They measure it off and they do it. So that's their strategy is to put a large farm every one kilometer of radius around and then to maximize the size.

But since they now have way too many pigs for the land to absorb they have to treat the manure. They have to: number one, separate out the good fertilizer and with the remaining water they have to neutralize the ammonia, which is very, very important. Now if they don't do that, the opportunity, goes away due to the strict regulation. So these guys are serious as a heart attack and this is why Depuporc is working on this in Spain because it is a huge commercial opportunity caused by the life or death need for these, for producers to grow. We saw a number of them when we were touring, farms that were being built still and they're amazingly sophisticated and they're huge. And what amazed me was how much the principals of Depuporc stressed that our technology is essential.

Basically what we do, and it's part of a three stage process. Quoting from our announcement, “Occurring after mechanical solids separation and microfiltration with chemical flocculation, OriginClear’s Electro Water Separation™ technology completes the removal of suspended solids while its AOx™ Advanced Oxidation achieves the all-important ammonia reduction.”

Ammonia reduction is huge. Of course it is nitrogen plus hydrogen and the maximum nitrogen production is 210 kilos per hectare for a year. A hectare is about 2 and a half acres. Our system helps Depuporc get the 210 kilos down to 16. Less than one tenth of the limit that is in the law. That is an enormous jump because what it means is obviously it enables you to can dramatically increase the size of operations.

The agreement that we have is to continue to supply components, these electrode racks to Depuporc. As they sell units, we'll get the royalty, then even more interesting is we get to resell them worldwide outside Europe. We’ll be able to announce that soon and move forward there. Also, there was a new licensee who joined us from Romania. These are wonderful people and they are very, very aggressive and not only do they work in Eastern Europe but they also work down in the Middle East.

You wouldn’t know it but Morocco is a huge producer of pork, and so is Israel. Despite the fact that none of them can eat the pork but they do produce it.

Anyway, Aqua D&P. - the Romanians, our new licensees, were there. Bill had gone to Romania and toured these sites that they build and they're an extremely strong licensee. But then outside of Europe we pretty much have the run of it. We expect to have the licensing of this Depuporc and we’ll be able to remarket it as a complete system with references in Spain.

So this for me is a big win because it's really the very first time in our history that someone has built a unit at this scale and so apparently, completely solved the problem. It has been really an issue of having partners who had the ability to integrate our technology and these guys have done it. It's also a massive market. I was telling you again, you do 10000 farms in America and a quarter million each and you're talking about $2,500,000,000 in sales.

So now you know if that all by itself is just royalties, then that's still $125 million and that's without counting the 30% that is in components. So now we're at 875 million by getting 35% of the initial sale. Now these numbers change, but that kind of gives you an idea. Since the profit on these deals is often far less than 35%, we're getting the lion's share of these initial sales by providing the innards of these systems. Really interesting that, and I think it's very, very promising for us.

So that's the situation in Spain. I encourage you to stay tuned, watch the videos and there'll be a series of announcements. I believe that Depuporc has been selected for the Madrid climate change conference that's happening right now from the 1st to the 11th of December in Madrid. As one of the 101 Spanish technologies that most influence climate change for the better. That's not confirmed, but it was something that they thought they had when I was there. So stay tuned, this is extremely good news.

For me it's kind of like a biotech. It goes on for years and years and years trying to get approval of a drug. And finally, they get the approval and all of it pays off. I kind of feel that it's that way because just like a biotech where you've got something that you have patent rights to, so you created something that is validated, it's patented, and that you can make money from. Well that's the position we believe we are in.

So, the plan then is to continue with that and really to make that application a huge tent-pole of our technology division being run by Bill Charneski. I think that covers the animal farm story. I'm super excited about it, and I think we're going to have a lot of fun with it. I’m not going to bore you with a lot of numbers, but more numbers are coming out. There's going to be a case study done, a whole website of course, but it's more for the water people to understand than for general investors and consumers.

Now on other fronts we are continuing to make the operation more efficient. You know, it was crazy because in Q3 versus Q2 we had a small decrease in revenue, $75,000 on $1 million in revenue. And that to me was just not appropriate. So when you have that small a number that you're down, then it means that your systems are off because we booked a lot of business in Q3, but there's this thing called recognized revenue, which means the way the accountants measure it, it's when you've reached certain milestones and it does not necessarily mean you've collected the money.

Now, we have fantastic managers in Texas and they are brutal about collecting money and being profitable with cash. But unfortunately, that is not a measure for a public company. The measure of a public company is this recognized revenue number and the fact that we missed this number by so little, given how well we've been doing and continuing to bring in new big deals, I think was ridiculous. That is something that we took very seriously and Tom Marchesello, our COO is working with the teams to make it much more efficient.

We’re basically integrating Modular Water Systems™ into Progressive Water so that they are one, and able to operate with economies of scale versus trying to make them separate. Then also putting in place a much more sophisticated CRM, customer relationship management system, to track all the projects to know exactly what's going on minute by minute and to not have these fairly foolish outcomes for a quarter.

I can tell you that I was basically not happy with it because, like I say, the amount was so tiny, we could easily have had a win if we had managed for it. It's kind of like when presidents win in the electoral college, then the people who don't say, "Well, we had the popular vote," and it's happened with a couple of these elections. It's happened with Bush and it also happened with Trump, and the answer to that is hey, the rules of the game are that it's the electoral college. Well, similarly here, people can say, "Well, we're doing so much business and..." Yeah, but your recognized revenue number, which is the one that matters, is down by 75K and you know that you could have focused on that. You get what you focus on, and my commitment to you is that the operation is going to be much more focused on that.

Meanwhile, what we think is the most promising thing that's going on is the prospective acquisitions. I cannot tell you a word about any of it. I cannot assure you that there will be acquisitions because I would be conditioning the market. So, I'm not going to say anything about that. Only that we're working very diligently on it, that these are very doable deals with the financiers in the picture, et cetera, et cetera, and we think we have found a new formula for acquiring companies. We've basically made this our highest priority for Q4 and going into Q1 of 2020 is get these acquisitions done.

So that is what I am focusing 100% of my energy on. So is Tom, our COO, along with the other stuff that he's doing. I'm confident that things will come out well, but again, I cannot tell you that we're going to get anything. I can't guarantee an outcome at this time. So now if we were to get acquisitions done, it would dramatically change the profile of the company versus what you might call organic growth. One of the things I've learned about the water industry as opposed to faster industries that I've been in before, is that the transactions are extremely slow. That's even true with these prefab modular systems that are rolled out. It still, for some mysterious reason, takes a long time. We had this almost $700,000 dollar unit sale that we announced back in January, and there's still little bits of it being completed. Most of the money's come in already, but you still have some percentages left to go, and, as those of you know who are in accounting, that's the part that makes the revenue recognizable.

So, these things are slow, which means that it's very hard to put the pedal to metal with individual water companies. You can do it, but what's better is to get more companies and then be able to have more of an effect, you grow through acquisition and then make the acquisitions more productive. That seems to be the way to do it. So, as I say, this is a huge a priority for us and you'll be continuing to hear about it. Please don't take this as any kind of representation at this time.

OK, we have a bunch of announcements teed up that are very, very good, and there's a bunch of stuff related to Depuporc and animal farming, and there's a bunch of other stories relating to sales that we've made or are making now, patents that we believe we can get filed on new technologies and more interesting stuff.

Also, we're making it a policy of issuing a case study every other week. That is very, very important because we have great technology. I'll give you an example. Back a few months ago, I was touring our operation in McKinney, Texas and there was this trailer fully equipped with water treatment systems inside. I said, "What is this thing," and Marc Stevens said, "Well that is actually a very interesting system." I don't know if you guys and gals who own pools, there's only so many times you can shock the pool and eventually you've got to drain it half or more and then refill it with fresh water. Well what this pool company did is they said, "Okay, why don't we just run the water through a proper water purification system and put it back in, and that way it's kind of like a kidney dialysis. That way you've got yourself some clean water." So, we built one of these and I believe we've gotten more and I went, wait a minute, that's just one city. This is a great market.

So we're going to take that, create a case study and then be able to market these things because what I found is that we have all these gems inside of the company that the guys who are used to delivering brilliant things, but what we have to do, Tom and I and the marketing team, is pull these jewels out and turn them into real products.

This is actually our overall strategy as a company, which is to make acquisitions, and then, obviously, run them for revenue and so forth, but also extract from them these pearls. These are companies that they're so busy trying to get the next sale, they don't have time to think about, well what about this pool cleaning system, can I turn it into a product? They just don't have that luxury. This is our job as corporate, and this is why it's very important for these companies to become part of a bigger whole because they will see their cool things commercialized while they keep doing their sales of these custom systems. That's, I think, what's going to start working.

At one level, you have to sell water treatment systems to users. Business users is what we do mostly, but we also do some municipal work. You're going to make those sales, it generates the revenue, et cetera. But then you also have to generate the product line that is going to be repeatable and that you can scale up, that is actual devices, equipment. That's the difference between a complete system and perhaps a pump. Well, you could sell a lot of pumps. It's a little harder to sell a bunch of half-million dollar systems. So you need both. You need to have the exposure to the market from these water systems, as we've been doing, but you also need to create a product line for the cool things that are invented to solve problems in every one of those cases. That's the combination that is so exciting that we're putting together here.

I can tell you that strong profitable water companies are lined up to get acquired. We have lots and lots of excitement and there is no problem in terms of the people wanting to be acquired. They get it, they're excited, and what we simply have to do is get the mechanical part of the M&A. Now, this is where we have a real strength in Tom Marchesello. If you look at his bio on OriginClear, you'll see that he has a background in doing mergers and acquisitions and buy-side investment banking. Buy-side means working for the buyer. He demonstrated that in a meeting with the finance people just a couple of days ago, and they were blown away by his ability to understand exactly what they needed. So, we have a very strong COO and it really is a welcome change.

So that kind of gives you the outlook as to where we stand. I will be continuing to brief you every week until the end of the year. I'm sure there'll be a break for the holidays, but that kind of catches you up a little bit. Like I say, it was a lot of fun being in Spain, and I'm glad I went and we're going to see a lot more of these wins now because, I can tell you this, there's interesting things happening in other countries.

So that's the picture for tonight and I strongly recommend that you give a call to the team and the number again is (323) 939-6645, and there's three of us working for the company. They're not paid a commission for what they do, they're just very dedicated and they have a lot of other duties, but they're here to help you. (323) 939-6645 is the number. You can talk to Ken at 201, Devin at 116, and the incredible Michael Mann at 206. So again, (323) 939-6645. You can participate in our company on a preferred basis by jumping into the current offering which we are definitely wrapping up. That's fair warning. (323) 939-6645, 201 for Ken, 116 for Devin and 206 for Michael. Thank you everyone for listening. It's been a pleasure talking tonight, and I look forward to talking to you next week. Good night.

Important Disclaimer

The securities referred to in this presentation may be sold only to accredited investors, which for natural persons, are investors who meet certain minimum annual income or net worth thresholds. These securities are being offered in reliance on an exemption from the registration requirements of the Securities Act and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The Securities and Exchange Commission has not passed on the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials. The securities are subject to legal restrictions on transfer and resale and investors should not assume that they will be able to resell their securities. Investing in securities involves risk, and investors should be able to bear the loss of their investment.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)