Insider briefing of 3 June 2021

Riggs takes us right into the financial model that creates wealth and can also help so many. Ivan Anz stars in Puerto Rico, and Tom Marchesello gives us the rundown on Subscription Water™. Catch the replay here and see how it all adds up.

FEATURED/COVERED IN THIS BRIEFING — QUICK LINKS

- COO Tom Marchesello presenting OriginClear's DBOO model with beautiful clarity.

- News from Ivan Anz starring in Puerto Rico!

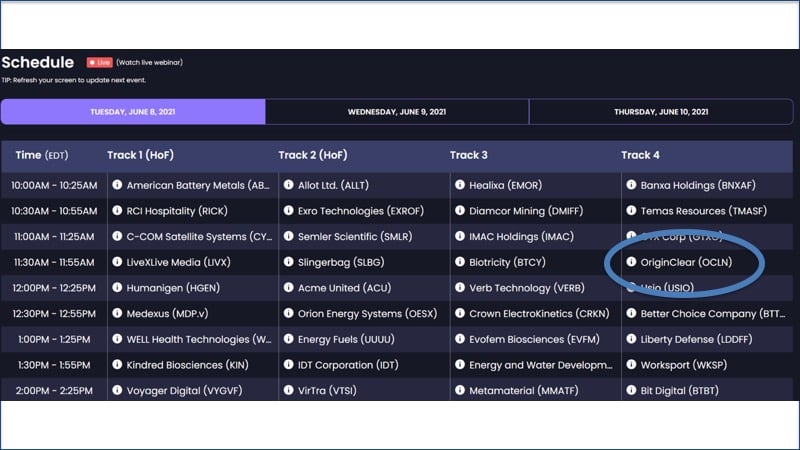

- The announcement of our CEO presenting at the LD Micro Invitational XI.

- A first look at our new CFO Prasad Tare.

- The pre-fault pandemic and why real estate investors are looking to diversify.

- The 3.8 million mortgages that are in forebearance and what this means to the real estate market.

- CEO OriginClear presents the Water on Demand forecast and how $20 Million could turn into nearly half a billion.

- Where $H2O™ comes in and how it becomes a "futures machine."

- How Water on Demand could become a series of subsidiaries and the major players already lining up to participate.

- Update on Dan Early's outsourced water projects for Water on Demand financing.

- OriginClear's offerings for accredited and unaccredited investors, and senior secured creditors and how to participate.

- The revolution in converting future income and where NFTs and smart contracts fit in.

- How the game has changed to a whole new paradigm and the industry-wide "promise" of the $H2O coin.

Transcript from recording

Introduction

Riggs Eckelberry:

Good evening everyone. It's a pleasure to be here on June 3rd. So much is happening and what I really like is how things are starting to take off. Water is the New Gold, "Helping you thrive in the world's ONLY vital, scarce and recession-proof market" and it is Thursday 3rd , 2021, briefing number 113.

Forward Looking Statements

As usual you have the safe harbor statement, I don't have to get into it much, it's the usual. So now I'm going to go into share mode and play you the video I was going to play. It's an excellent video. So I'm going to share now.

Start of video presentation

Subscription Model

Tom: I'm Tom Marchesello. I'm the Chief Operating Officer, and we run OriginClear Tech and make products for the water treatment industry. So OriginClear made a pivot because we saw that the markets were changing. There was a need out there, so especially our small, midsize corporate clients.

They struggle sometimes with cashflow and the need to buy capital equipment. Capital equipment is expensive. You've got to buy a machine that's not some expense that you really want to lay out a bunch of cash for, and there weren't great financial programs from the bank anymore, because the bank wasn't lending. So we looked at it and said, "We hear you. You want my machine, but you need some financial method of getting it out there."

So that got into leasing programs and renting programs, and those are always available for people. But then there's different programs which say, "Wait a minute, why don't you just sign the dotted line here and receive a subscription model where you just pay for it incrementally as you go?"

Design, Build, Own, Operate

So that becomes DBOO, which is design, build, own, operate. So it's a business model where OriginClear can execute saying, "We're already very good at design and build." And then we are now willing to own the machine, and all we're going to do is deploy it at the customer site and then we'll operate it, which is the last piece. And when we operate something, we intend to operate that piece of equipment for 10 to 25 years on site, which is pretty cool.

Getting a Better Return

So now I'm basically going to take, instead of receiving a lot of money upfront in one time, one quarter, I'm just going to stretch out receiving my money now over 10, 20 years all the time.

The reason why that's good for me is because now I build a new income stream and I get to layer my returns over time, and I get to actually get a better return on that initial piece of equipment, because I'm basically managing the full life cycle of it.

And I can work with internal staff to handle it or I can place it in the field and work with partners in local jurisdictions to do some field servicing. And over time we just continue to receive benefit from it and we continue to operate a network of machines that get deployed.

Smaller Scale

So that's really where the model's going, is to say, "Let's make this easier for everybody." Now, DBOO had traditionally only been deployed by very large corporations, like General Electric, Suez, Veolia, somebody big at that level who was doing $1 million to $10 million projects at really large municipal production facilities or power plants or large sites like that.

We're coming into it saying, "Hey, you can do DBOO, but you can do it at the small, mid-size level where our machines go out." Now, instead of doing a million gallon systems as that, you can start doing 10,000 gallon systems and they can be really affordable for people.

Real-life Example

And so, case in point, we have a bunch of different sites, but we'll use one of the markets. One was in the real estate community where basically the real estate operators, whether they were managing a community of properties, needs to put onsite wastewater treatment.

These are perfect ways of they're already making rent and lease money so for them to pay for a piece of equipment as a monthly bill is more efficient for them rather than have a big cap ex upfront. Let's assume here's a machine that has a certain amount of cost value. I've got to pay for the machine to put it out in the world.

Operation and Maintenance

So after the machine is paid for, now we're really just talking about operating it. How much does it cost me to operate this thing? I've got a piece of machinery sitting here at the brewery that I need to just come through, make sure it's clean, replace some filters, come through and make sure it's managed. So I'm remote monitoring it. I have a piece of software I'm watching it. So I'm going to pay for all that basically to maintain this thing.

So, that's my cost. So let's assume that's some amount of money per month. Now the rest of it is just the cost of the water coming through and profitability. So what I'm going to do is I'm going to take that pure net and I'm going to split it between our company and the investors, because the investors are fundamentally supplying money to get a return.

Subscription Water

So it's a subscription to water. I subscribe to get clean water just like I subscribe to get Netflix right now or movies on demand. Now I'm going get Water on Demand™. I just want the water. I don't want to pay for the machine. I just want to pay for the water. Now, granted, you probably could have bought the machine for 100 grand flat or 200 grand flat, but you'll probably pay 300 or 400 grand for the machine now technically via paying for the water instead.

But it's still a win-win for everybody, because cap ex, they don't have to spend money out of their operating budget, and we make more money fundamentally over time. So we just basically, by offsetting time, I make more money.

End of video presentation

Riggs: So that is our amazing Tom Marchesello, and he went into a great deal of detail about how they're dealing with this, which is amazingly exciting. What we're really seeing is that this model is very, very much in demand.

News from Puerto Rico

Last night, Ivan Anz, the amazing founder of Philanthroinvestors®, who has put his huge energy behind helping us achieve the same kind of success that he has achieved with Equity & Help, which has ended up, I think, number 83 on the Inc 5,000, and he's now in Puerto Rico and he spoke at a high net worth investor meeting there.

Vendi Rios flew in from Florida to take care of that, all the follow-ups, and there have been many reaches. So that was super cool. You can find that on the OriginClear site the actual video and watch it. It's great. It's a bit long, so I won't play it now, but you'll love it.

Today, a few hours ago, we announced that I'm presenting on the 8th of June on this whole new model, the total outsourcing of water and the dollar H2O coin.

It's three-days, 180 companies. It's a big deal.

Join Us!

Here we are on Tuesday, June 8th at 11:30 a.m. Eastern, and it's about a 25 minute presentation. So, again, if you look on the OriginClear website, you'll find that there is a registration link in the announcement. I'd love to have you guys join me and watch.

Prasad Tare

Okay, big news, we have a CFO. Yee-ha! Let me tell you how relieved I am. He starts on 14 June and let's go ahead and review his resume. That's cool. So here he is. Prasad Tare, well, let's just start from the bottom here. He had a bachelor of science and accounting at Nagpur University, went on to get a CPA, and a chartered accountant.

Starting in the beginning, he has worked in doing a lot of audits, which is very important. Also, managed a great deal of companies with Sarbanes-Oxley Compliance Programs, et cetera.

He was a director of internal audit for a number of clients, and then he moved to Florida where he was responsible for growing a practice of a company called C-Biz Risk Advisory Services. And then he joined a fund called Vertical Global Investments, so he knows a lot about working on the buy-side with funds.

So his skills obviously, the most important thing for us, is to make sure that we meet these filings. It's super important. Also, that we put in GAP accounting, generally accepted accounting practices, which is very, very important because we tend to still operate on cash, but that doesn't work for a public company.

He has been a CFO himself, and he has also done risk assessments for companies up to $1 billion. So he's going to be able, I believe, to encompass both the basic regulatory needs of the company as well as the more creative stuff that we had hoped to get into, especially this fund that I'm going to show you the amazing stats for. I think that he's been through exhaustive interviews and we think he's great, so this is really great news.

Pre-Fault Pandemic

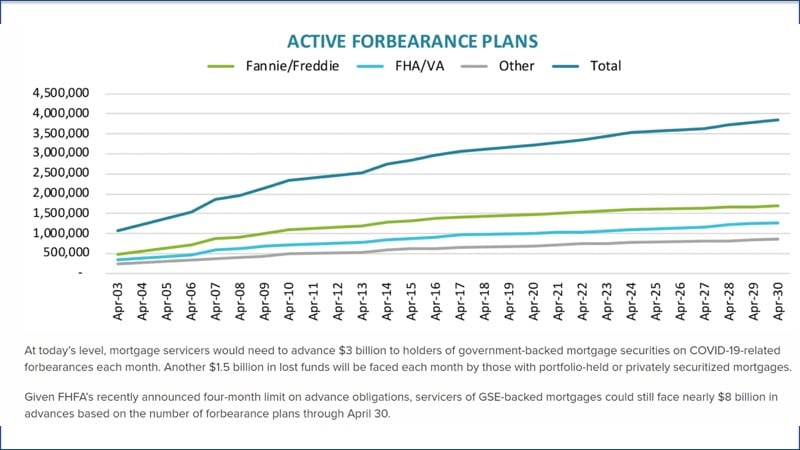

All right. Now I wanted to also look at this coming pre-fault pandemic because we're seeing a lot of real estate investors be really interested in getting into water. And why is this? Pre-fault means pre-default, right? And what's going on here?

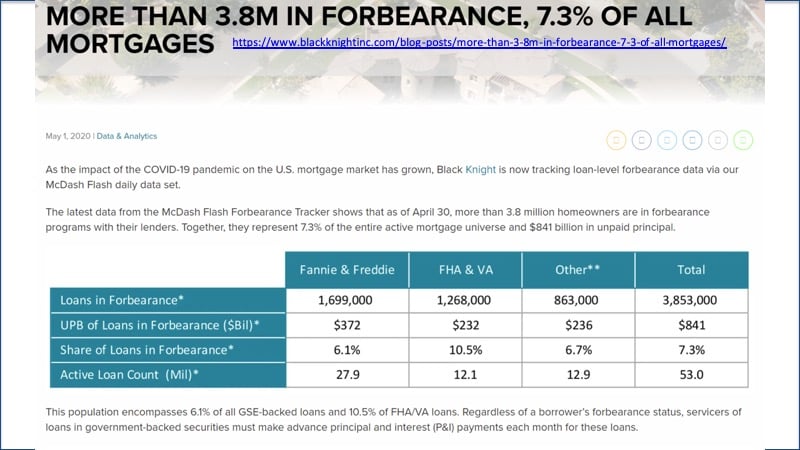

More than 3.8 Million

Well, on the Black Knight's site, you've got it spelled out where there's more than 3.8 million in forbearance, 7.3% of all mortgages, which is huge. The unpaid principal balance of loans in forbearance is almost a trillion dollars between these various categories. And so FHA and VA is very high at 10.5%. So these are the ones that are subsidized, like veterans and so forth. 53 million in loans are in this forbearance mode. Forbearance is great up to a point, but when everybody gets forbearance, at some point, the dominoes start to fall.

Why Real Estate Investors are Interested

At today's level, mortgage services would need to advance $3 billion to holders of mortgage securities, and another 1.5 billion in lost funds will be faced each month by those with portfolio held or privately securitized mortgages. And servicers of government-backed mortgages would still face nearly $8 billion in advances through April 30th. These are big numbers.

So I don't think anybody can say that they're comfortable with the state of real estate. I think that the weak spot is the mortgages. You may have a real estate boom in many places, but you also have the actual mortgage portfolios are bleeding and this is tough. So this is I think a good reason why a lot of real estate investors are very interested despite their being really strong themselves.

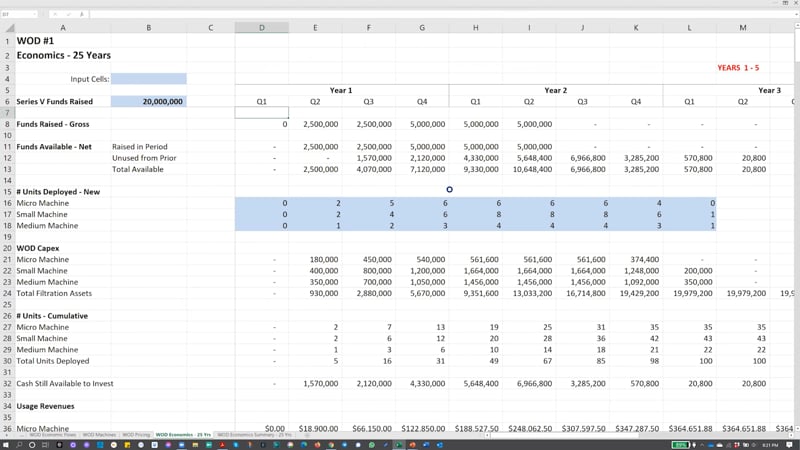

Water on Demand Forecast

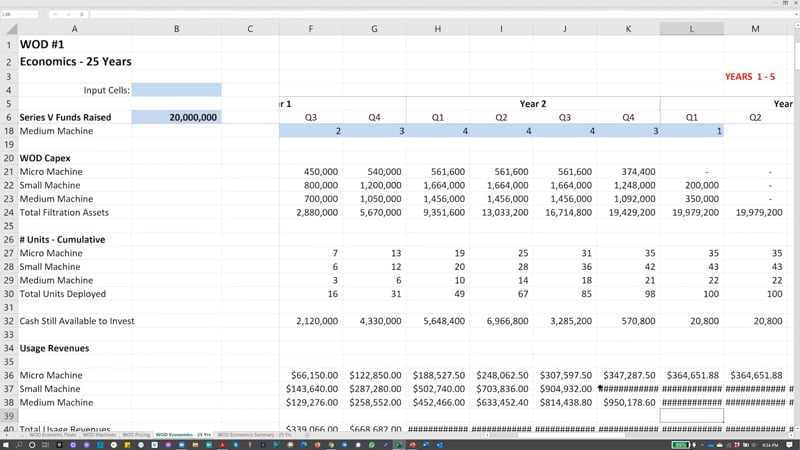

Okay. So I'm going to flip now to this spreadsheet and talk to you a little bit about... Before I get into the status update with Dan Early's stuff, I want to get to this amazing story. Ken and I were shown a model that's been developed by... We have an amazing investment bank-capable resource who pulled this together. So let's take a look here.

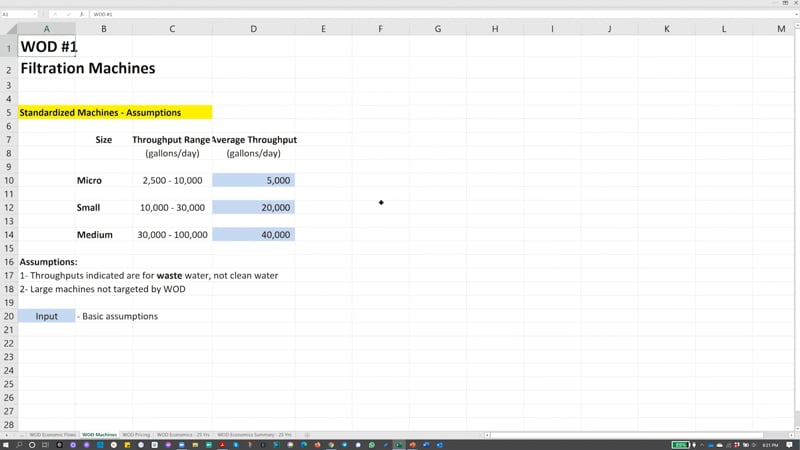

Micro Machines

We have a... Let me just pull and get rid of the ribbon here. There we go. So let's assume that we're raising $20 million. Well, let's take a look at some of the underlying assumptions. We assume that micro machine is one that does up to 10,000 gallons per day. It's average super's 5,000, small, 20,000, medium, 40,000.

We're only, for now, talking about wastewater throughputs. Clean water purification is actually easier. And at the moment we're not targeting larger machines than our hundred thousand gallons per day. We're specifically going with the small to medium systems because we think that's where the opportunity is.

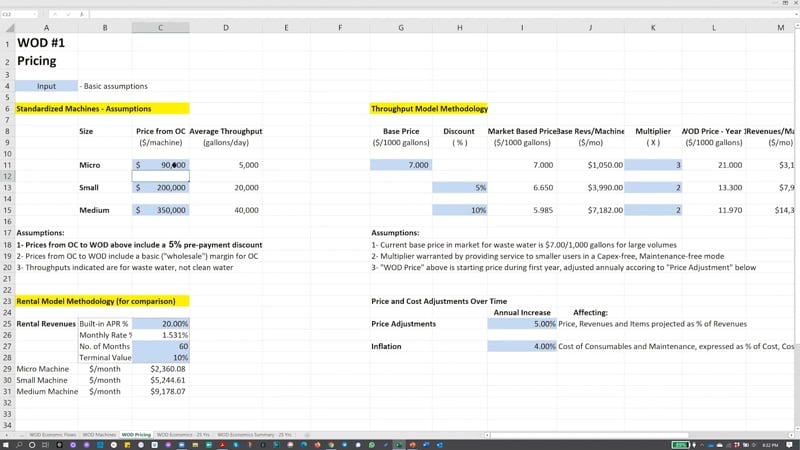

Equipment Pricing

Okay. Now the pricing here, let's take a look at the pricing. Water On Demand, which is a wholly-owned subsidiary of our company, will act as the client purchasing machines from OriginClear, our Dallas operation, and these are the prices we assume that it would pay.

It's actually because it's pre-paying it would get a discount. So it would drive a bargain. And this is just some of the methodology for working out the pricing of throughput. And so, I'm not going to get into all the details, but basically we're talking about a micro machine being about $3000 a month, and this is fully serviced. This is the cost of the machine, the management, the filters, just making it run, right? No muss, no fuss. It just happens, right?

I was hearing about a head of a brewery who was literally talking to one of my people, and the refrigerator guy came in and he said, "What are you doing?" He said, "Well, there's an alert on your fridge." The brewery owner didn't even know that his refrigeration unit had an alert, but the service company came in and fixed it. So, that's what we're talking about. Full service. Then it goes out to about $8,000 for small, and then 14,000 for medium.

Now, this is very, very important here. We're, right now, looking at a 5% annual increase in prices of various items outside of the cost of consumables and maintenance, which is 4%. I think it's much higher, but we're being very conservative for now.

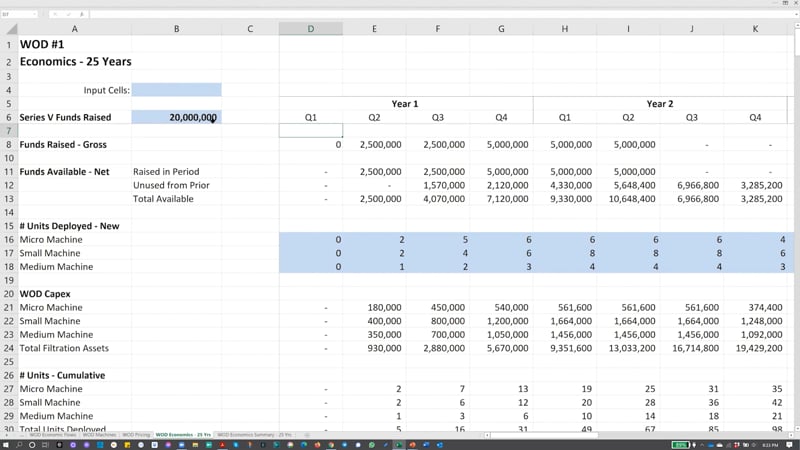

Economics

Now let's take a look at the economics now. We're assuming then the $20 million are raised. The board has authorized a $20 million raise, which I will talk about the terms in a little bit. And we assume that these funds are raised over a period of roughly a year, and that...

We kind of threw it out there how many machines, but let's say that between now and 27 months from now, a bunch of machines are basically, it comes down to a hundred machines. Right there, we have cumulative, a hundred machines. And then we go down, so now we basically run out of money. We've spent the $20 million as you can see on L32, we're down to $20,000.

Revenues

Now let's take a look at the revenues. Revenues have started to take off here from the micro, the smallest, et cetera. I'm not going to bore you with these numbers. I am going to make them visible. There we go. But if we scroll down here to total usage revenues, very quickly, we're starting to look at stuff that's in the two and a half million dollars per quarter of revenues.

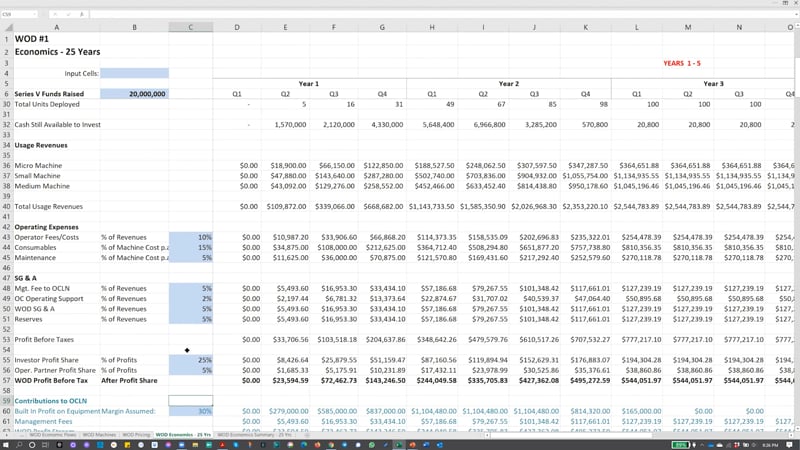

Op Ex and Profits

So let's see what that means. I'm going to zoom out so I can fix these hash marks here. All right, now, so then we have the usage revenues, and then we have various operating expenses. We assume that we're paying an operator, that is the company that's going to actually show up and do the servicing, 10% of revenues. Consumables will be 15% and maintenance will be 5%. So, there's a total of 30%, which I think is high, but we want to overestimate expenses.

Same thing for the SG&A, which is sales general and administrative. We have management fees. We have the internal costs of Water On Demand, the fund, people. Because here's what happens with Water On Demand. Number one, it's got a bunch of money. Now it's got to spend it, but it's got to spend it in a diligent way.

Okay. What kind of company is this? It's a brewery. Fine. How's their finances? Are they going to go out of business? Can they sign a 15-year contract? And is this the right application for them? So we have to have sharp people inside Water On Demand.

So we actually have to make sure that we cover that in the budget, because it's not just a pile of money. It's also an active contracting operation. Get down to the profits. We are paying 25% of profits to the investors.

And then we have an operating partner who could be anywhere from five to 15%. That's something that's being worked out. But we come down here and I'm going to fast forward now to the 25-year summary.

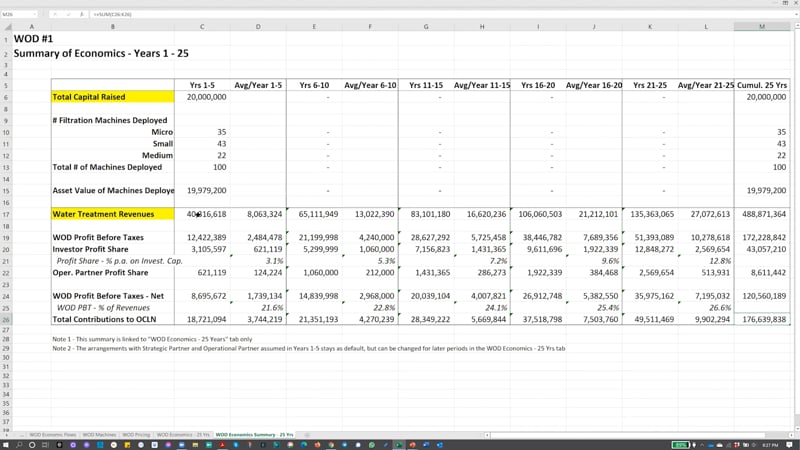

Half a billion from 20 Million

So in the 25-year summary, we've got, again, a hundred machines with this asset value of 19 million. Now at the end of 25 years, a net worth 19 million. Obviously there is depreciation, but that's not an important factor right now. And so we have revenues. Years one to five is 40 million. Look how they rise. Why?

Compounding price inflation built in to these things. And we end up with a half a billion dollars from a $20 million investment. Not half a billion, but a hundred million, 112 million short is not peanuts, but I'm saying the order of magnitude is in the half a billion dollar range, which blows my mind. And the total contributions after paying out all these profit shares, et cetera, you end up with 176 million to OriginClear.

Where $H2O™ Comes In

Now you say, "Wait a minute, Riggs, this is 25 years. Who wants to stick around for 25 years?" Ah, that's where this coin, $H2O™ , comes in. Because remember the coin is a way to package, in a smart contract, all the future revenues for that share of the fund or the equipment.

You can take that, and now you can leverage it. You can say, "Okay, this thing has... I invested 10,000, but it's actually got $200,000 worth of future revenues." Packed into that 10,000 initial investment, it's got 200,000 prospective profit share. Now, the thing has value, provable value. And eventually not overnight, this will be a financial instrument that can be transferred and eventually turned into a market.

Futures Machine

So this is how people can... Well, for example, I read about an NFL player who went ahead and put his player's contract. It created a coin for his player's contract and people bought his future earnings at a discount. They took a risk obviously because what if he gets hurt, et cetera.

They took a risk but basically, he was able to get money now from his contract, kind of a futures concept. Well, think of $H2O as a future's machine. So that if we were looking at being able to see these revenues accelerated now, by the way, these machines lasts longer than 25 years. They're literally capable of lasting for hundred years, but we're just taking 25 because that's the timeline we can live with.

Series of Subsidiaries

So that's the thing that really blows our mind right now. And this $20 million Water on Demand #1 is only the first. I have Wall Street money lined up. We have major private equity partners who are excited about coming in. I've got a portal that is ready to do a series of accredited investor offerings with a series of subsidiaries like this, and there's more. So what I'm saying is with these kinds of numbers, this is very doable. This is something that is marketable and it has tremendous appeal. So that's what I'm going to leave you with on that.

Substantive Negotiations

Let's get back now. I just want to make sure that... No. No questions. This is cool. Let's go back to what's going on now. Because now, we got all this money, how do we spend it, right? So let's assume we get the money, and that's not a minor assumption. You should know there's no guarantee that we'll get the money, but I can tell you right now that we have substantive negotiations with real investors who are intent on coming in on this. And so, there's no reason why it wouldn't happen. But again, it's not guaranteed. I must make that clear.

Mobile Home Park

Okay. So let's assume you have that money. Well, how do you spend it? And so, I've had the team, Tom Marchesello and Dan Early, our chief engineer, look at who can be lined up to start with these outsource water projects. So remember that mobile home park customer in Pennsylvania, discussions are continued. It's just continuing. This is, by the way, what happens if water is endless, endless engineering consultant. Everybody gets a fee for doing this stuff. It's amazing, but that's continuing.

Craft Brewing Customer

Expect to talk with the design build firm that is working with the owner, et cetera. There was a purchase of pump station, which is... So this design and build firm elsewhere purchased something from us, a pump station on decentralized wastewater treatment system in Maryland.

So what that says is that we have a good working relationship with the design and build firm that is now working with the owner of the craft brewing. Then this relationship, we are feeding a design and equipment to the design and build firm that builds it, and then we do the own and operate, kind of a circuitous thing, but it's an interesting picture.

RV Park

Okay. Let's take a look here. RV park. Now, no big change. Following up. So things are moving along there.

Meet in the Middle

New design, build, own, operate prospect, and they're excited about getting these. Obviously, we don't want these guys to go too fast because we need to have the money to fund these things. So the things have to meet the money and the contracts have to meet in the middle. That's the timing we're working on here. Okay.

Basis of Design

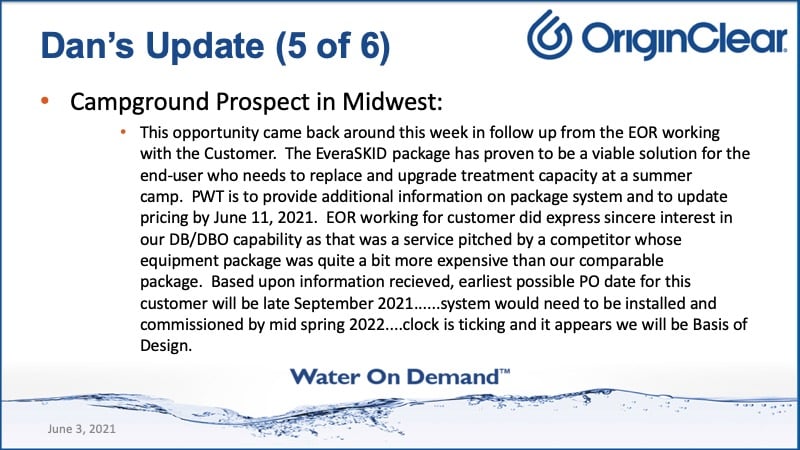

Campground prospect in the Midwest and this kind of... The earliest possible PO date is late September 21. They said the engineer of record, EOR, is working with the customer, et cetera, et cetera. It appears we will be basis of design. That's very important because it means that we are the only provider because our design has been approved. It's very typical of what Dan Early does.

The Capital = The Talent

Okay. We have the DBO partner. This would be a strategic partner. Nothing much happening. That's the update there. It's kind of bumping along. And I can tell you that assuming we were to raise $20 million to get 100 machines built, we have the pipeline, but it would require a dramatic increase in the number of people just doing deals to get 100 deals done. It's a massive amount of work, but the talent's out there. If the capital's there, the talent's there.

Regulation A — Unaccredited

All right. So which comes around to, it's all about the money, right? So let's take a look about it. Sure enough, we have, again, the three offerings. The first one being the Regulation A offering unaccredited. And I just got an update from the attorneys today and they expect to give me a first draft sometime mid-next week.

I think you're going to like this offering very much. There's many, many people who would like to put... Oops, I apologize. That was my fingers. Many, many people who would like to invest in OriginClear with a good leveraged offering, but they're unaccredited. So that's important.

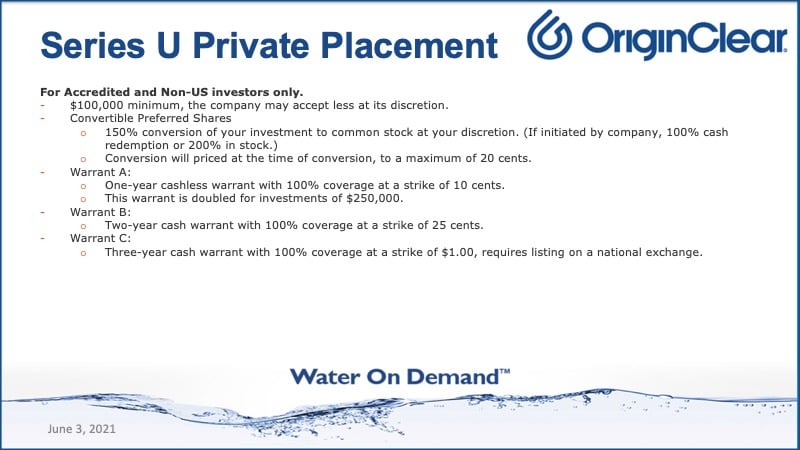

Series U — Accredited

Secondly, this is the Series U. Now, what this is is for people who are accredited and invest, I don't know, $35 million [thousand] to $100 million [thousand] or more and that converts at a multiple of your investment. Now, this is very... Conversion would be priced at the time of conversion to a maximum of 20 cents. Now, why is that so important? This is actually a huge thing because the stock right now is about 11 cents. All right.

Price Lock

Now, down the road, first of all, let's say the stock goes down, fine. Stock goes to half of 11 cents, 5.5 cents, then you get double the amount of shares that you would get if it were 11 cents, fine. You're covered there.

But what if the stock goes up, which is what it's been doing? And people who've invested in these things have been worried that as the stock price goes up, they're going to get less and less shares, right? So we've put a price lock here, which means that they can never convert at more than 20 cents. So they can relax.

They see the stock price go to $1, they're not concerned about that. This is good because it's going to keep people from jumping into the market, trying to convert quickly and maybe sell some stock. It keeps them relaxed, and this is what we want so that we don't get a lot of pressure on the stock price, which I think it's been doing okay. So why damage the trend?

Warrants

And it is three warrants, which is a warrant basically as a way to guarantee the price of something for the future. It's a way to do up to four times here because you get a doubled warrant on A, so you can up to four times your investment in addition to the conversion. It's a very nice package and I recommend you look into it further with Ken.

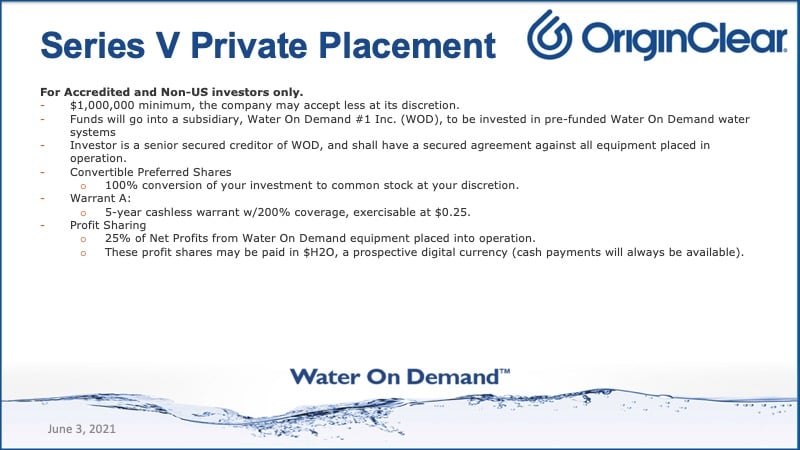

Water on Demand Subsidiary

Now, Series V is very important. Why? That's the Water on Demand subsidiary. This is $1 million minimum, and the funds go into the spreadsheet that I talked to you about right there that was showing you.

The investor now is a senior secured creditor, cannot be undercut by their creditors, and has a security agreement against all the machines that go into the field. And then, there's warrants and et cetera, et cetera. There's this net profits. And finally, the potential for getting this Water Coin. This is a very, very interesting thing.

Call Ken

So that's what we have on offer right now. I'm not going to get further into the weeds on this. Ken is by far the most knowledgeable about all this. So what we're talking about here, Ken made a comment about buying future revenue without this coin almost looks like structured settlements, very clunky. And he's right.

Converting Future Income

If you're trying to go, "Okay, I want to sell my future income from something," you have to do this. Do a structured settlement, which is hard, or you have to create a bond, which is even harder.

Well, what we've created is this coin can easily go into a market and be swapped privately or eventually in a public market subject to regulation, and that is a no muss, no fuss. So we've basically created a revolution in converting long income streams into something you can sell today. That is, I think, the brilliance of this concept.

Chats

Okay. So I'm just going to come off of Share right now. Tariq Ruffin says here, "Hear what Captain Planet has to say." Well, that's cool.

And Thomas says, "NFT for non-fungible token." Yes.

NFTs and Smart Contracts

Again, what is a non-fungible token? Fungible means you can swap, to funge. To funge is a Latin word means to swap, basically to switch. It means they are the same. I can take two Bitcoin and I can switch them and so that's great.

Now, if I want to make Bitcoin unique, I can attach a little tag to it and, all of a sudden, it's no longer... I can't switch it. It has unique thing. Now we don't do it as Bitcoin because a Bitcoin has no smart contract capabilities. So fine. You do it with usually the Ethereum class coins.

So, an NFT, non-fungible token, is basically sits on an Ethereum standard and it's enabled with smart contracts. And what's great about it is you don't have to go invent a whole token. It already exists. If you go to opensea.com or to the Proton Market or any one of these, you'll see how you can just go ahead and create an NFT yourself, by yourself. Boom.

In fact, maybe one of these days I'll do it live on a show. That'd be super cool. I think I'll do that. I'll practice first. So it won't be Riggs trying to deal with Control-Alt-Delete on the Excel. But what this means is that we don't have to do a whole initial coin offering. The platform, the marketplace already exists. You can buy and sell NFTs right now.

What it does mean is we can then use a smart contract capability to then embed these payment streams in there. We push it out to the investor and the investor can then do whatever he or she wants with it, put it in a market. Or, ultimately, we want to be able to accept it back in to create new water systems and kind of create this cool loop.

Now I want to tell you that nobody is forced to have a token. We'll always pay cash profit shares, but we will incentivize people to hold tokens because that's the smart thing to do. Okay. So that's about NFTs.

More chats

I'm just scanning here because there's some great inputs. JRW says, "I'm definitely waiting on a non-accredited investment option." It will come.

Then Ivan says, "At the same time, you improve millions of liters of water with your philanthropic investment." Ivan really, really, really has understood that people want to do more than just make money from their investment. They want to make good money, but help.

That $20 million that was invested in that spreadsheet I was showing you, if it ends up making revenues of half a billion dollars, that's a huge amount of water that it cleaned. It did a lot of good in the world. It enabled things that would not have happened otherwise.

Okay. JRW says, "Would really like to be able to bring a customer to you who needs a system." Excellent. JRW, send the lead to invest@originclear.com and Devin will take care of that.

Thomas, "Does the technology, the processes you're proposing have a specific application facing a massive PFASs so those Teflon-type nasty toxins and the classification level of purifying systems meet and exceed, et cetera, et cetera?" The answer is yes.

Technologically, I'm very proud of our capabilities. Dan Early is a guru in the industry. The problem has been is that it takes forever to ramp things up, and the dirty little secret of the water industry is that water companies grow by acquisition, not by expansion because the water industry grows 8% a year. It's nothing. American Water Works has a billion-dollar-a-year acquisition budget, and that's how they grow. So that's the exciting part.

And, of course, Ivan say "money for money is less happiness," very true.

Victor, "How do we get the technology/machine that purifies the water?" Again, just drop a line, invest@originclear.com. We'll be happy to take care of you.

Finally, Ivan says "Tomorrow, we are presenting OriginClear in another event in a private mansion in Yunque rainforest, Puerto Rico."

If you're in Puerto Rico and you're interested in being there... Well, I think it's a private mansion, so maybe you can't, but if you'd like to hear about these events or talk to Ivan or Vendi just simply again, send a message to invest@originclear.com. Devin will be happy to take care of it.

Ivan says, "50 high net worth individuals will be there."

The Game has Changed

At this point, the nature of the game has changed where, we love our accredited investors who've done amazing things for us, but now there's a whole new class of investor, which is able to put in a million dollars plus and likes the fact that it's a very conservative investment, but with huge long-term rewards. This is generational money. To a high net worth investor 25 years is nothing because, of course, they're trying to take care of their family.

Ken is especially excited about talking a whole new strategic level here, and what are we doing? We're taking all these dammed up projects that we want to do, and until they do it, they have to truck the water, or they have the fines or this or that. And we release that dam and we get all this good stuff done.

The Promise

That is to me, the amazing opportunity here, creating a financial vehicle that has such great annuity money with the ability to collect it earlier through the $H2O coin, a $H20 coin, and the ability to scale up well beyond our company.

I don't want our funds, I'm saying funds, they're not really funds, they are subsidiaries that have money to spend. I don't want those subsidiaries to just give business to OriginClear subsidiaries because we won't grow fast enough. We won't be able to deliver fast enough. We'll give it to our colleagues in the industry, and that's the promise.

Thank-Yous

Anyway, I've kept you guys long enough again. Thank you all for being here so long, and I apologize for the missteps early on. But we got out of it, so that's good news. And thank you very much to our translator, Heather, who does a marvelous job. Again, we always will have the Spanish interpretation now, and perhaps we'll add more languages as we go forward. So, again, everyone have a great weekend.

You know what, next week, I think I'd like to get Prasad onboard and interview our new CFO. That'd be a wonderful thing. Then I'm going to create an NFT on this show. That could be fun.

Okay, everyone, have a great weekend. Thank you all, and I appreciate your being onboard with me.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)