Water Is The New Gold: Insider Briefing of 17 December, 2020

Helping you thrive in the world’s ONLY vital, scarce and recession-proof market

Wow - the panelists at the LD Micro 13th Annual Event LOVED our business model – check it out! Sure enough, water industry professionals AGREE in a major survey that infrastructure is very broken. You'll hear about all that and our Career Builder program in this briefing!

FEATURED OF COVERED IN THIS VIDEO — QUICK LINKS

- Our CEOs full video presentation at the LD Micro 13th Annual Main Event.

- How the Career Builder program and Water as a Service tie together.

- OriginClear Finance™ — our internal vehicle.

- A graphic look at the structure of OriginClear's current investment offering.

- How the LD Micro event panelists LOVED our business model.

- What a survey of America's civil engineers reveals about our failing infrastructure!

- The latest developments building the fund for OriginClear Finance.

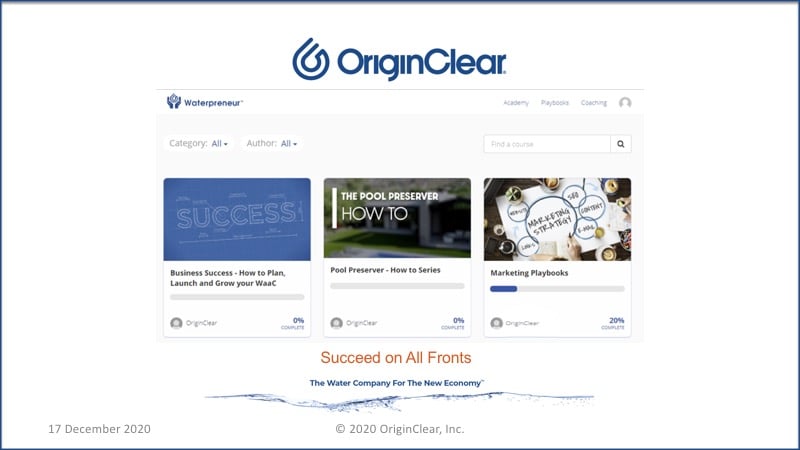

- The introduction of and a look at the new Waterpreneur Academy™.

- Up to date economic factors reported on by the CEO.

- A great presentation from the CEO: What is a Warrant? And, how they work.

- OriginClear's "Get paid to wait" offering.

- A way for existing investors to double their investment without investing more capital.

Transcript from recording:

Introduction

Riggs Eckelberry:

All right everyone, and good evening. It's 8:00 PM on the 17th. And those of you who were here earlier, got to watch Alan and I, chat at length about pretty much nothing. Alan has been with me in many PR assignments before, and he's done some wonderful things.

I've rewarded him by not letting him do PR and instead do marketing, which is a fate worse than death. And he is going to join us to show us the Waterpreneur Academy™. So, without further ado, I'm going to go ahead and share a screen and show everyone what's going on.

Why Recession-Proof?

All right. Water Is The New Gold™ and why is water recession proof? One reason is that, water rates are not regulated in America and so, they are the most likely everyday commodity, unlike things like energy, it's not something that has limits. And so, water rates, we believe will rise and it's going to be something that is going to put the emphasis on recycling, on water treatment, all kinds of interesting things.

Safe Harbor

In any case, it is December 17th, briefing number 91. As usual, we've got our forward looking statements, according to which we are not prophets. And the first thing I'm going to show you is, the LD micro event that we did on Monday.

As you know, we announced that we would present at the 13th annual main event on December 14th, and we did that. And so, without further ado, I am going to play the video.

Start of Video Presentation

LD Micro Host: Hi, everyone. I am here with Riggs Eckelberry, the CEO of OriginClear. Riggs, take it away.

Pioneering Real Change

Riggs: Thank you very much. OriginClear is The Water Company For The New Economy™. And I'll explain why in a moment. All right. Of course, the usual safe harbor statements, you know the drill. We are not prophets, we try our best to tell like it is. We're also going to be discussing a Regulation D offering, that of course, is not SEC approved. All right, let's get on with the video and then we'll get on with the presentation.

Depuporc Video Presentation

Transcript from recording:

Translation from Spanish:

Riggs: Dear friends and colleagues, it is a great honor for me to speak with you on this memorable day. Three years ago you made us a promise that you would integrate our technology into your complete system for the treatment of manure.

About three years ago, Depuporc went to research the treatment of hog manure, and they came upon our technology, reached out and we negotiated with them a license. Now, three years later, they've built a working commercial system. It's proven and it's working amazingly well.

Eduardo Chopo, Co-owner of Depuporc

Translation from Spanish:

Eduardo: OriginClear technologies was the support that we needed to bring to fruition our 20 years of work. The participation of OriginClear was very important to the success of our startup pilot plant. OriginClear's technology has simplified the most complex part of our system. Our reactions have been: "Wow, this is incredible!" We can take manure, separate it into solids, that can be used for composting and clean water safe for irrigation. Our association with OriginClear was like making the winning final goal in a game of soccer.

Riggs: I believe that together we will make significant changes in the livestock farming industry. We can change a real problem to a solution that eliminates waste and also contamination of long-lasting manure lagoons. Thank you very much again to you and may we have much success together in the future.

End of video

Changing an Industry

Riggs: Well, that is a video that essentially demonstrates how strong our technology is. And as Arthur Clark said, any technology sufficiently advanced, is indistinguishable from magic, and that's precisely been our problem because the water industry does not love magic.

So, what have we been doing? This was late 2019 and we hit 2020 and COVID, and things got very, very interesting. Let me tell you more about that. So, we're working to transform this enormous industry with two major things. We have our modular endpoint systems for the new decentralized water, and we have managed services. What does that mean?

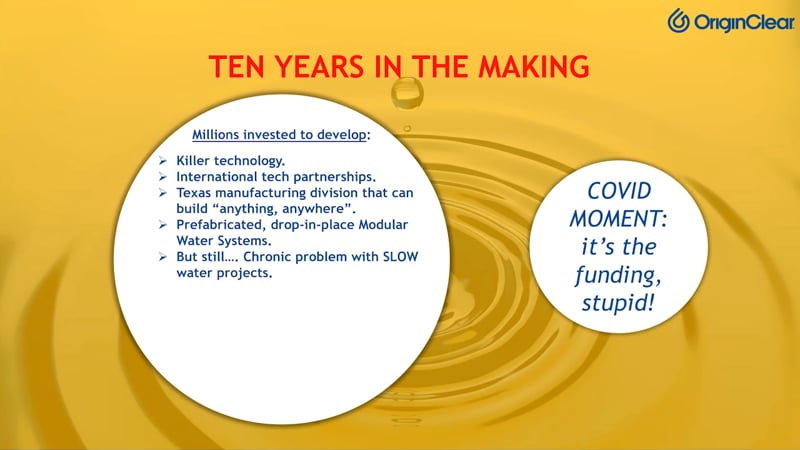

Comes Down to Funding

Okay. First of all, we have built this incredible technology, as you saw in the video. We have these great technology partners, we have a manufacturing division that is extremely sophisticated, and we have this patented Modular Water Systems™. And this was where we stood early in this year.

But there were still chronic problems, we just could not get past the slow water projects. What to do. And of course, this was our COVID moment and we realized it comes down to something very, very simple, which is, if you can fund it, they will come.

Water As A Career

So that's what we started to focus on. We developed something called Water As a Career™, and to take all these entrepreneurs and put them to work. And now we're working on Water As a Service™, which is basically, sign a piece of paper and you've got your system and I'll be discussing how we're doing that specifically.

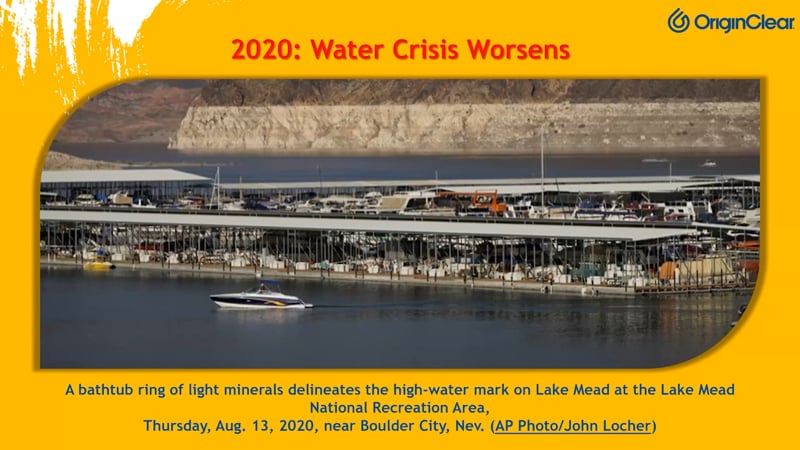

What is the reality of 2020? Of course water is not getting better. It's getting worse. Climate change and many, many issues, including lack of infrastructure.

Sewage Not Treated

But not just in Africa, but also in the US there's lots of issues, and remarkably small amount of sewage is actually treated. US, we have these safe drinking water act violations and the economic disaster of COVID, which economically is worse than the Spanish flu, which killed more than a 100 million people.

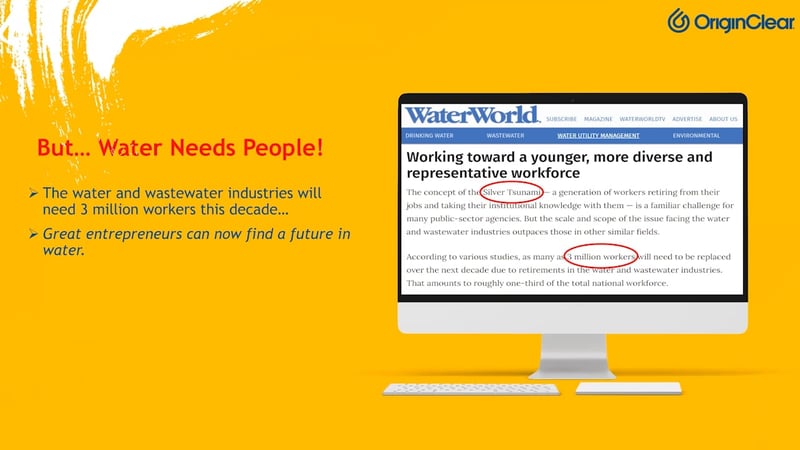

So, that actually created a situation where small businesses were destroyed and continue to be, as I speak, which means that we have people available to join us in the water industry, which needs them desperately. We've got a silver tsunami as well.

Can the Government Help?

But now, what about the government, the infrastructure bills, et cetera? Well, the short answer is, they haven't done it and they're not about to do it now. Since 1960, they have continued to fail to put in proper infrastructure, federal contribution to water systems has been dropping for decades. And it's like your old Toyota Celica that you keep adding oil to, but it's just becoming more expensive to run all the time and it's getting worse. And the investment gap is $100 billion a year.

Answer is End Users

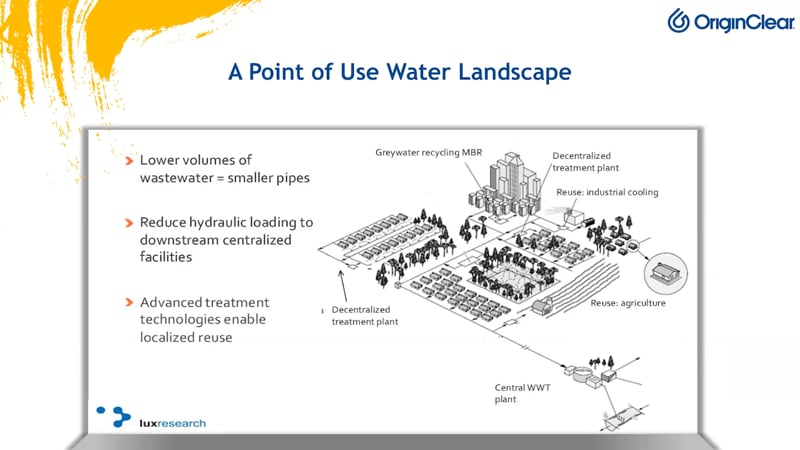

The answer is end-users. Because, just like cell phones and energy and so forth, you can do it at the point of use. And we have here a landscape brought to us by our friends at Lux research, which shows you all these satellite water treatment systems, and they require advanced treatment technologies for localized reuse, which is very important. And that's what we have.

So, the good news is, less load on the central systems and also lots of interesting technologies at the edge to make it efficient and to enable recycling, which in the United States, is historically low.

Capital is a Problem

But, capital remains the problem. Remember that municipalities can raise bonds, Wall Street loves them, billions of dollars, everybody loves that. But, individual businesses do not have that luxury. So, capital is an issue. And that's why we're developing these things we call, Water As a Career and Water As a Service.

Pilot Programs

We have completed a first major pilot program in operation in Phoenix, to purify pool water. We're also working on projects to clean up trailer park lagoons, and believe it or not, trailer parks have their own little manure lagoons. And finally, we're working as you saw in Spain, there with farm manure lagoon treatment.

Pool Preserver Pilot

This is that successful one called, the Pool Preserver™, where we put an entrepreneur into business very successfully and it is now a model.

Career Builder Program

We've also built a career builder program to help these candidates, of which there are many, build their business and market it. So, that's going very, very well.

Water Managed Services

Now, water managed services. What do we mean by that? Well, we start with, we have a wonderful capability to do custom systems. That's great. It may be worthwhile being a product and also a career builder. So, that's where we move past the evaluation into a standardized product and develop the career builder package.

Fund Equipment Rental

Of course, we're not going to compete with regular leasing companies because they of course are very, very competitive market. So we put qualified people into standard leasing packages, but we are now funding equipment rental and career building for people that don't qualify.

Retain the Title

And most people don't because these days there's lots of money, but it's very hard money. And it takes two years of P and L's to get a lease. And most people are starting new, but we retain the title so that we can do a Rent-A-Center kind of model and retrieve the machines if they don't work. And of course our machines are portable.

Water as a Service

Now we are working to pre-fund industrial water systems as Water As a Service. This is very exciting. Another company in the industry called Cambrian Innovation has done a wonderful job of that has raised a lot of money to do it and has really paved the way. And we're now moving in that direction too.

Double Digit Returns

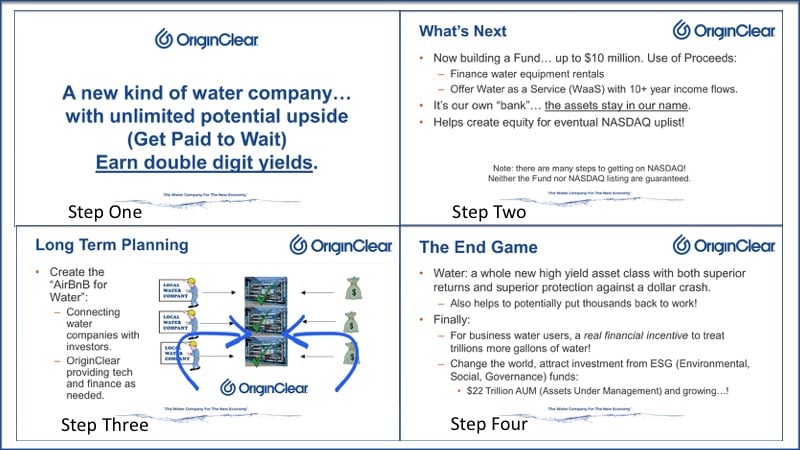

Of course, with managed services, you manage everything. You are taking care of every detail and you end up with double digit returns and we are now busy building a capital fund. Okay.

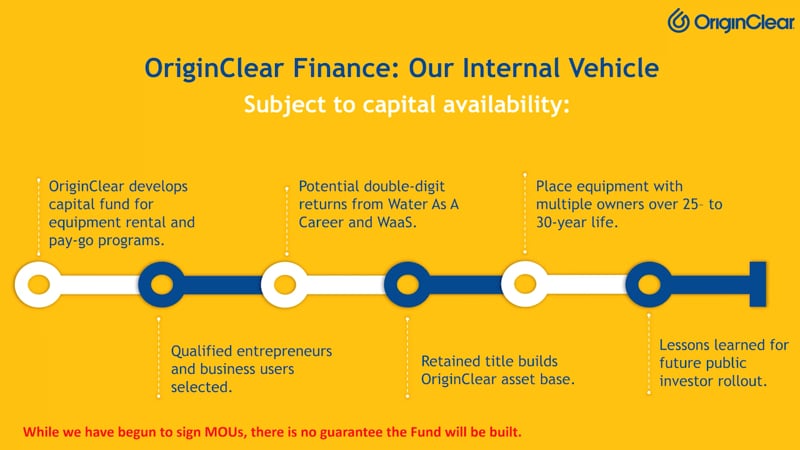

Internal Vehicle

Now, this internal vehicle is basically the capital fund for the rental or PayGo, pay as you go, type programs. And the selection occurs. We manage that with double-digit returns for ourselves initially. Builds our asset base, which points to a future potential listing on a national exchange. Place your equipment with multiple owners, these machines last a long, long time. So their ROI is superb. And we learn lessons for making a public market, which we think is the future.

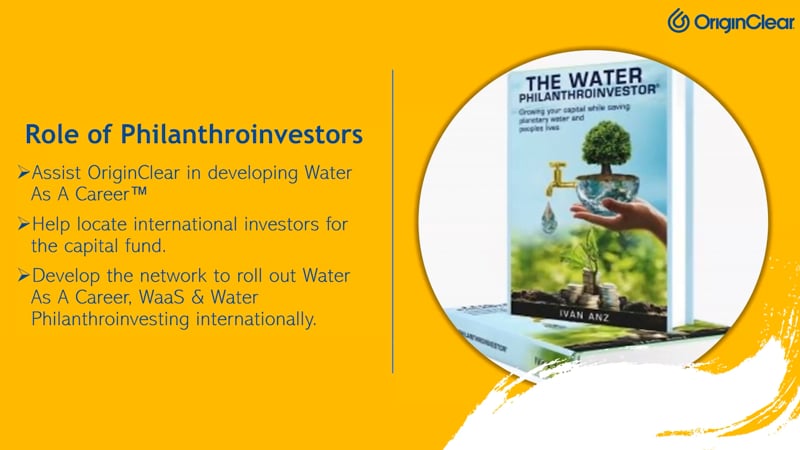

Our Partner

And we have a partner called Philanthroinvestors®. They are an Inc 500 leader in real estate who is not done, turned its attention to water, and they are... They have a secret sauce that they put together and they are in 19 countries.

And this kind of gives us our international growth. They are also helping us develop Waters As A Career, locating international investors, especially for the capital fund and developing this network for international rollout, which is great news.

Participating in Our Future

So in short, you have the ability to participate with us in our future, as this Water Company For The New Economy™, meaning employing the people out of business, pre-funding these systems, putting them on pay as you go type systems, which is the wave of the future.

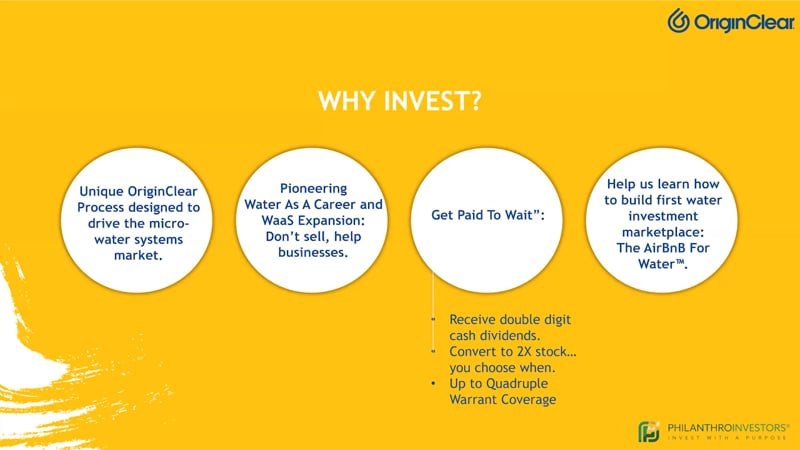

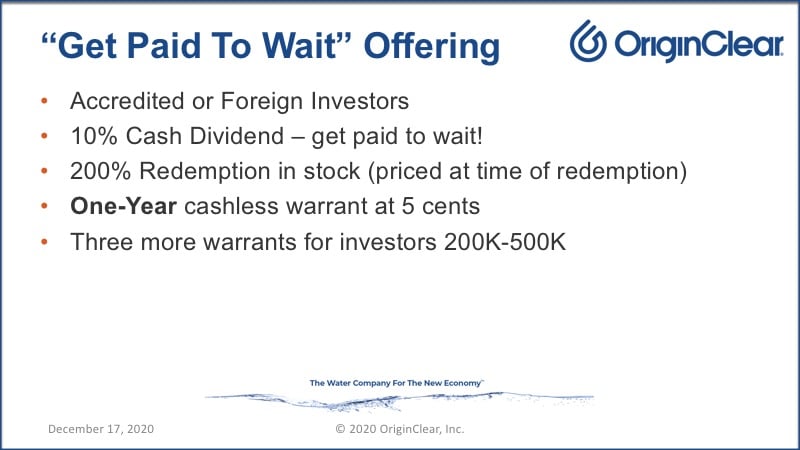

How do you participate? Well it's very simple. We have a convertible structure with double digit dividends. You can redeem it at any time for double and stock priced at the later price, which is a measure of protection. There is up to a quadruple warrant coverage, depending on your level of investment.

The unit is a 100,000, you can invest less. And finally, this is for accredited investors only. You can invest in the planned capital fund, but that is a minimum a million dollar unit, and it is a secured asset investment.

Why Invest?

Well, why would you invest? Of course, we've got this unique OriginClear process. We've got this, Water As a Career, don't sell systems. Instead, help them be a White Knight instead of selling, help us learn how to build the first water investment marketplace, what we call the Airbnb for water, which is very, very promising, but it's in the future. And so you get paid to wait, you get your double dividends, cash dividends, you convert to stock. And that one of full warrant coverage.

With us and the audience is Ken Berenger and Devin Angus. Ken is an amazing strategist. He helped me build this strategy, just book a call with him at oc.gold/ken. And I do a weekly CEO briefing is very, very popular simply book at oc.gold/ceo. I'd love to see you on Thursdays at 5:00 PM. And thank you very much.

Q and A

LD Micro Host: Thank you so much Riggs. We will now move into the Q and A portion if panelists would like to come to video and also unmute yourself. So you may ask questions for the next seven minutes

Hamed: Hey, Riggs. This is a Hamed Khorsand. Could you just talk about what the qualification process is as far as you're hiring or approving of the people that you lease out the equipment to?

Qualifications

Riggs: Hamed this is a really good question because what we found is that ordinary FICO style credit, excludes a lot of people who could otherwise make it happen. Our partner Philanthroinvestors has ended up, number 85 on the Inc 500, by in real estate, putting people into homes they could never get otherwise. And their default rate is around 6%. It's extremely low.

And we found that as you know, with micro-lending in places like Africa, that what you have to create, of course, is a relationship, and you have to really, the number one of the thing is to know that they will be proactive, especially as Waterpreneurs.

You can figure out who's going to be like, Oh, I think I'll do this. And what's this machine. Oh, well, whatever. So you have to find out if they will be go-getters. And that's the number one requirement.

We are learning from the real estate side, the Philanthropicinvestor partnership to determine exactly that profile.

Whose Equipment?

Hamed: Are the equipment yours, or are you leasing someone else's equipment?

Riggs: We build all our own equipment. We have a wonderful shop in Texas with about 25 people. It's the basis of our revenue. This company does about four plus million dollars a year, and that all comes out of Texas.

What is good about that is we can pretty much tell them to build anything from a $50,000 system to a $2 million one. And we have this also these proprietary Modular Systems. So there is these long lives pre-packaged drop and go type systems, which is a revolution in water systems.

Proof of Concept

Hamed: And my other question was how many people do you have on the platform right now?

Riggs: So what we did this year is we funded the first proof of concept with this machine called the pool preserver. And we have the initial, our first test case with a waterpreneur called Ryan Kooistra. It's worked very well and we've been building the Waterpreneur University with him.

So we've now wrapped up building the Career Builder package. In addition, we have conventional leasing going on. Of course, we just did the first trailer park deal, for example, but the pure Water As a Career model has been done with one proof of concept.

Host: We have about three minutes left, if there are any other questions.

Ramp Up

John Cassarini: Hi, this is John Cassarini. How do you see the amount of people on the system ramping and how are you getting garnering attention to the system to allow these people to come in and ramp?

Riggs: John thank you very much. We found that the first Facebook video we put out on this got over a million views. It's extremely popular concept. We are frankly overwhelmed by people who want to do this. And so there's really a no problem with getting people into it. It's definitely a viral type phenomenon.

Export the Model

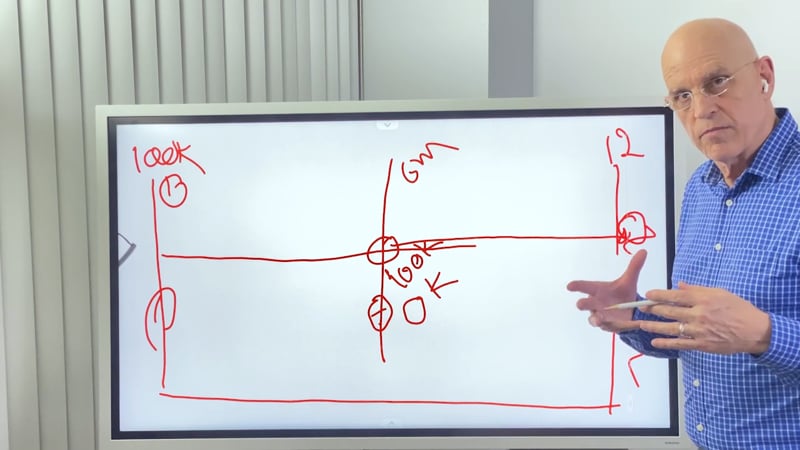

What we are basically inviting people to invest in a $10 million capital fund called OriginClear Finance™. And we intend to put in place 74, small, medium to large systems as part of that fund. And of course, then we will be done. We don't want to keep going with it because our next stage is we want to export this.

Company Store

Riggs: We think just like Airbnb only did its own apartments for a little while because you want to put other people in the game. You want to create a marketplace. That is our goal is to create a marketplace, but we really want to learn it ourselves. And so for a time, we're going to do it, as a company store, so to speak. And then our plan is 2021 and beyond is to create this Airbnb for water, which I think is super exciting.

John: It certainly sounds it. How easily do you think the next phase of your growth? How long do you start implementing that?

Riggs: Right? So it's, it's very much we do a good job of maintaining, excuse me, maintaining our drip financing, but really it's all about capital. Fortunately, we've started to receive MOUs [Memorandum of Understanding] for the capital fund and we believe that we're going to be able to deliver systems in the new year. Both Water as a Career for waterpreneurs, and also Water as a Service for these individual businesses. And we will be actually able to do it. It may only start with a million dollars or two, but I do believe we can get the momentum going.

Host: All right. Thank you.

John: Sounds promising, Thank you.

Riggs: Thank you, John. I appreciate it.

Host: Thank you so much, Riggs. Thank you all for being here. I am going to end the meeting and I hope you enjoy the rest of your day.

Riggs: It's my pleasure. Thank you.

End of LD Micro presentation video

Infrastructure Issues

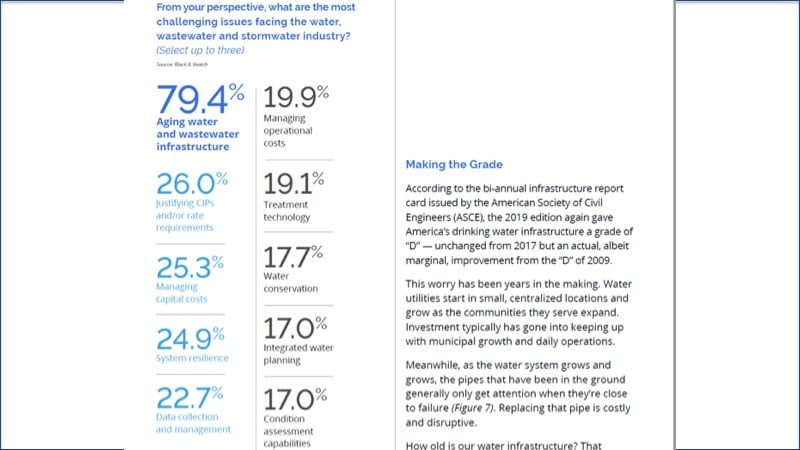

I brought up in the presentation with wow, lots of people here tonight. I'm super proud to have you guys on board. Thank you for joining us. I mentioned that the government could not help. And there was problems with infrastructure.

Well, that's just been confirmed by the Black & Veatch, Black & Veatch is a major, major water equipment company and their Water Report, 2020 Strategic Directions confirms the situation. This is what's going on.

80% !

Take a look at this, this is a survey that was done with the American Society of Civil Engineers. And it gave a seriously bad grade. And look, 80% see as the most challenging problem, aging, water and, excuse me, wastewater infrastructure. Now also, meanwhile, see at the bottom there, as the water system grows, the pipes that have been in the ground generally only get attention when they're close to failure and this we know, and sure enough, there you go.

When to Fix

How do you know when to take the next step when something is about to break or fail? Oh Lord, that is a problem. So we can see that. And then the second is regulatory bodies demanding action, but the number one thing is, things about to break, which is pretty much par for the course.

Update on the Fund

Okay. Now I want to quickly be up to date on this, the OriginClear fund, our capital fund, there's been some good progress. Update of today, as I said last week, we had that first MOU in hand for $1 million. And we thank that investor. We are in discussions for the second one.

An MOU is a memorandum of understanding and it is a good faith, but non-binding commitment. Now the big news is the $12 million potential investor has agreed. He is foreign, he's from another country and he's coming to Miami to meet with me and to put this deal together.

And then the $6 million one is considerably more conservative, so he may follow the $12 million one. That's where that stands. So things are moving fast on this. Very exciting. With that, I'm going to let Alan have his day in the sun. So tell us what this is about.

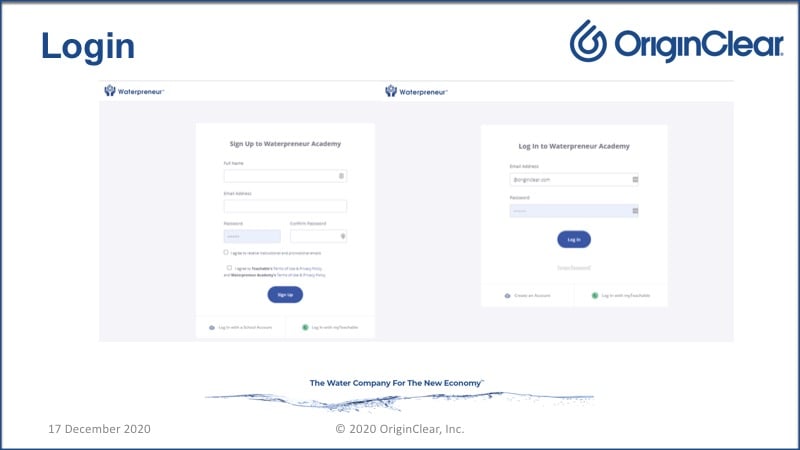

Introduction

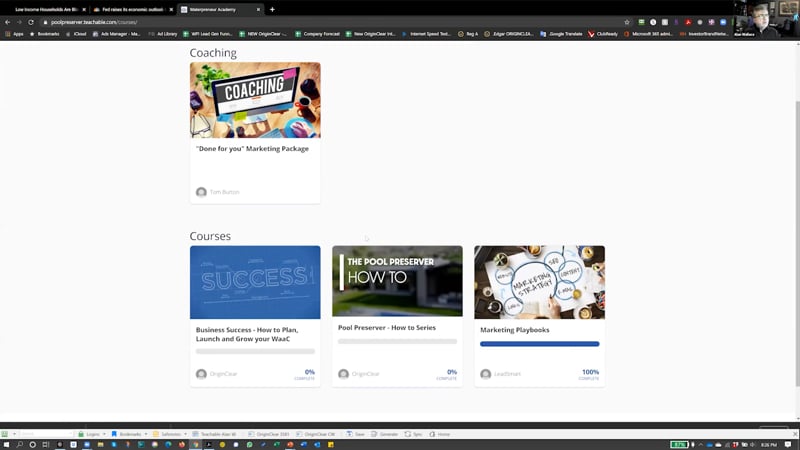

Alan: A day in the sun would be very nice. Right now I've got a day in the snow outside. But, to introduce our Waterpreneur Academy, what we want to be able to do is when we get folks on board, we not only want to teach you how the equipment works and everything that you need to know behind that, but also how to take and market it.

So if you've not really been in this business is before, we've pulled together the lessons that are going to get you there, both online and handling the customers and handling the equipment.

Cybersecurity

So if we go to the next slide, when you log in, you have two choices. If you haven't been here before, you want to go on the left, figure it all out, register. One of the nice things that I like about this and with a past in cybersecurity, you put your name and email address in here, You get a confirmation email. If you type in, and it accidentally goes to someone else, you're not going to be having your information go everywhere else.

So if you sign in, that goes, you confirm, it comes to you. Once you're there, you'll see the screen on the right where you'll log in using your information, when you come back.

System Knows You

So since you'd set up that account, it knows who you are. And whenever you come back, it will know where you are in your classes, with the playbooks, with all the other programs here, it will know who you are.

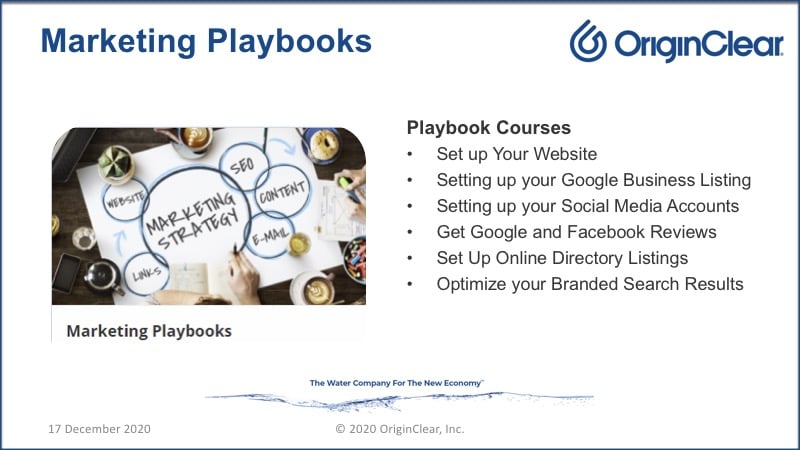

Marketing Playbooks

So from there, what I want to first show you is the marketing playbooks. And that'll be the next slide. There we go. So we'll teach you how to set up your website, how to do everything from Google listings, to your social media, your individual Facebook reviews, and your Google reviews, as well as the online directory listings.

Riggs: And Alan, this was piloted with our first Waterpreneur, right?

Alan: It absolutely is. And we've been going back and forth with them. We want to make sure that the things we are doing are helping drive his business.

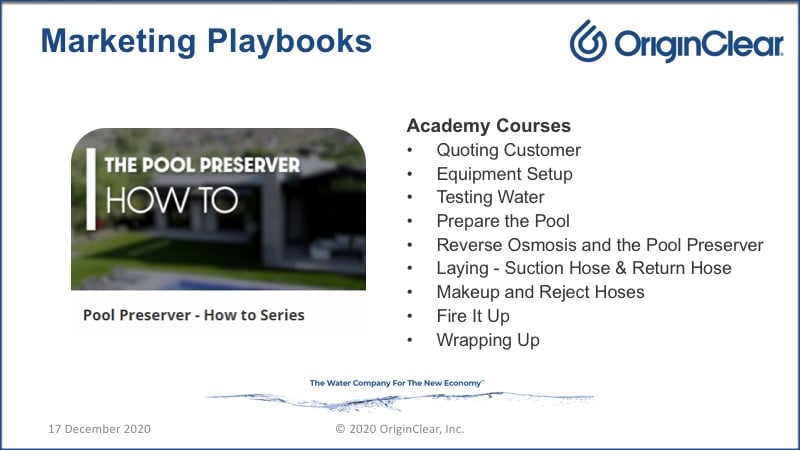

How To

And in fact, what I'm going to do when we go into the next part of the program, which is showing you the how-to on the next slide, and this shows you all of the things that we've gone out, and we videotaped, our team go into the customer's house, setting everything up, and it's all right there to help you understand.

Videos

So on the next page, we have a link that will take you straight into the videos. And if we can go ahead and click right on that.

Riggs: Okay. So we're actually in the Pool Preserver how-to, so here's the live screen.

Alan: And we're going to be doing this on all of the products. So the pool preserver's the first one we're testing out. Once we have this done, then we're going to go down our other product lines and do the same thing. So if we click there on how to video for number one.

The Platform

So, this goes into a section of the screen where we've got the videos that show you, here's how wonderful our equipment looks when you drive it out. And then we have a series of questions that we'll have you tested on. And at the end of your answering the question, we'll let you know if you're right, or if you're wrong. And at the end, we'll let you know your percentage. In fact, once you finished it all, we'll even give you a certificate saying that you finished it.

Riggs: Here's these multiple choice quotes, in fact, right here.

Alan: So should you provide a quote over the phone without doing a site visit, let's just go ahead and click, if it is easier, and we'll see... Okay.

Riggs: No, you should do a site visit. Okay, good.

Alan: So, I am not the one setting up the equipment.

Riggs: Yeah. It looks like we're not really-

Alan: Apparently Riggs isn't either. All right. Three out of three.

Riggs: Anyway, this is excellent. So I'm not going to spend much time going through it, but we've got a nice long... Well, not excessively long thing, but it gets people understanding what they got to do, we can go a lot deeper. So there's quoting, setting up, testing, preparing, how the process works, etc. All that good stuff.

Alan: But, if you're heading out to the client's house, you need a little refresh before you get there, you can access this on your phone. Whatever you need to know, it's going to be right here.

Riggs: And then the playbooks and Business-in-a-Box are also there. So, that's excellent. I'm going to wrap that up just because we have a couple more things to show, but it looks good so far, Alan. I'm loving it. Thank you.

Alan: Thank you.

What About the Economy — Some Trends

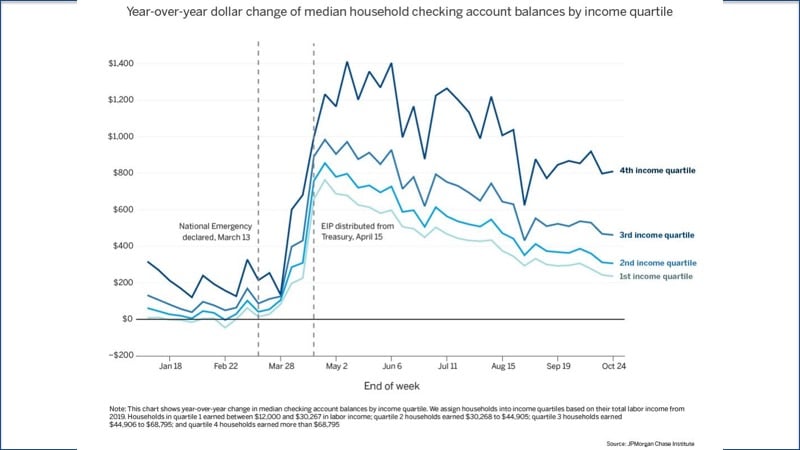

Riggs: All right. So let's move to the next. Quick thing about the economy. I'm interested in the trends that are going on. We know that the Fed thinks things are going better, and a really very good unemployment rate and a 4.2% growth. So, that's excellent, but the issue here is that according to Zero Hedge, low-income households are not in good shape.

Average Balances

We found that the median household checking account went way up with the stimulus, but then here's what's been happening with checking account balances. And in general, if you're in the fourth highest quarter of the economy, you're surviving okay. It's very tough situation for the bottom half of all consumers. And that's an alarming situation.

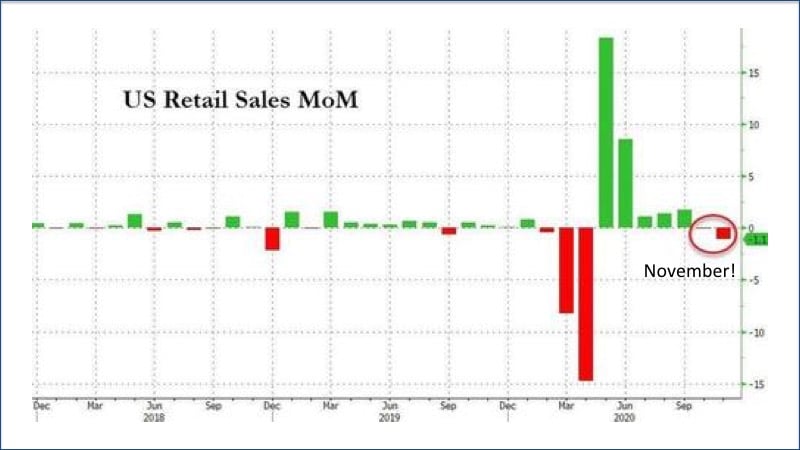

Down Month

We also see November printed a down month, which was unexpected. So what can we learn from that? Well, what we can learn from that is that this is an uneven recovery. And you want to be making sure that you're investing in a way that is not going to be dangerous for you. And it remains, last week we covered the inflationary situation, we think that's still going to be a problem.

So making money on money in a way that does not depend on the consumption by the bulk of the population is, we think, a smart way to go. And that's the most I'm going to venture as an economic expert, which I'm not.

What is a Warrant?

Now, there's a quick video here, because we were talking about this new offering, which I covered in the LD Micro event, so I'm not going to go over it again, but what's a warrant? Very important question.

So here's a quick video I shot two nights ago, which gets us into the, what is a warrant situation. So, let's re-share with optimized for video clip, and let's see what this thing looks like, it's fun.

Start of Video Presentation

Transcript from recording:

Introduction

Riggs: Hi. Riggs Eckelberry here with a quick briefing about warrants. OriginClear has now launched a new offering. We call it Series R, which has up to four warrants. Now, what that means is an opportunity to multiply your investment without having to pay for it upfront. You're basically investing your basic amount. And then as the stock price changes, you're able to purchase these warrants and end up with more stock. The good news is you don't have to risk it now.

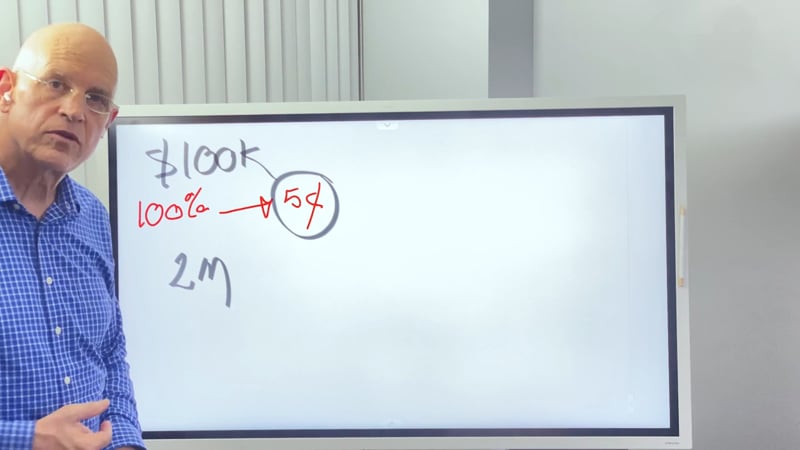

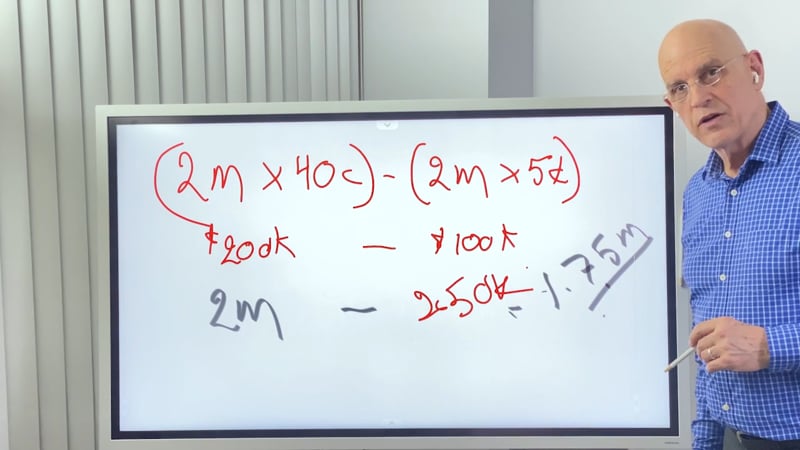

How it Works

So let's take a look at how that works. Our basic warrant that we have is warrant A, and it is simply five cents, 12 months, and cashless option. And I'll explain what that means in a second. So let's take a look at your typical investment. Now remember you can invest less than that, but that's the normal investment.

And you have 100% coverage, which means that for this warrant, you can invest up to $100,000 or any part of it, right? So, that's 100,000, you have a 5 cent strike as we call it. This is a strike or exercise price, it's what you pay for it, which means for $100,000 you get two million shares.

Exercising the Warrant

Very simple right? Now under that, let's say that the stock price goes to 10 cents. Now you have an opportunity to go ahead and exercise the warrant. Well at 10 cents, you're two million shares would now be worth $200,000. You can afford to do it. You pay the $100,000 and you end up with $100,000 profit. Great.

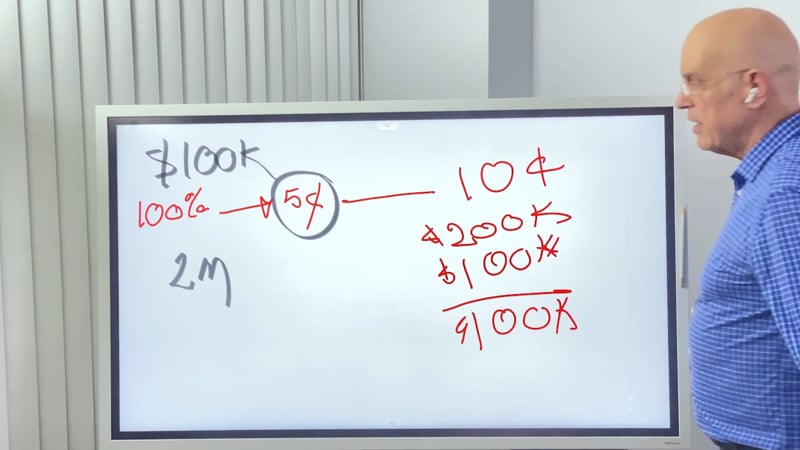

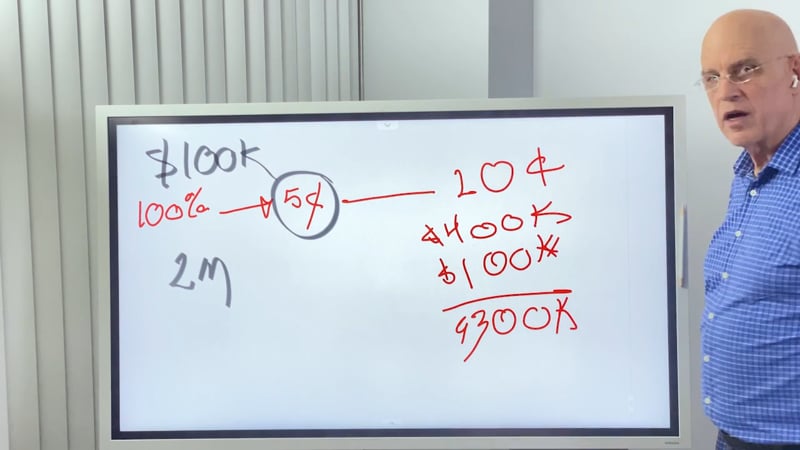

Another Scenario

Let's say now that the stock price goes to 20 cents, right? Well, this becomes $400,000 and this becomes a $300,000 profit. Not bad, huh? Now this assumes that you paid cash for it and you have a cashless option with this warrant, but you can always pay cash. Which there's pros and cons, I'll explain how that works in a second. Okay.

Cashless Option

So let's take a look at what a cashless option does. Well basically, you're looking at your two million shares multiplied by the later stock price. Let's call it 10 cents, right? And we subtract from that again, 2,000,000 shares times your cost, which is five cents. And let's see how it works. Well, it's $200,000, right? Minus $100,000.

And how do you pay for that? You pay for that with stock. Well, that's basically half. So here's those 2,000,000 shares where the 2,000,000 never changes and you deduct 1,000,000, which is half.

And you end up with 1,000,000 shares. Not bad, but listen to this. Let's say if we go to 40 cents here. Now, you didn't have to give up 1,000,000 shares, right? Because you're only giving up one eighth of 2,000,000, not one half, which is 250,000 shares, which means here, you now have 1,750,000 shares for shares, right?

So in general, cashless works best if you have a nice, big difference because you won't have to give up so many shares. A lot of people don't even like to give up this many shares and they pay cash. If you can do it great, if you can't do it, then you can't do it.

Unknown Benefit

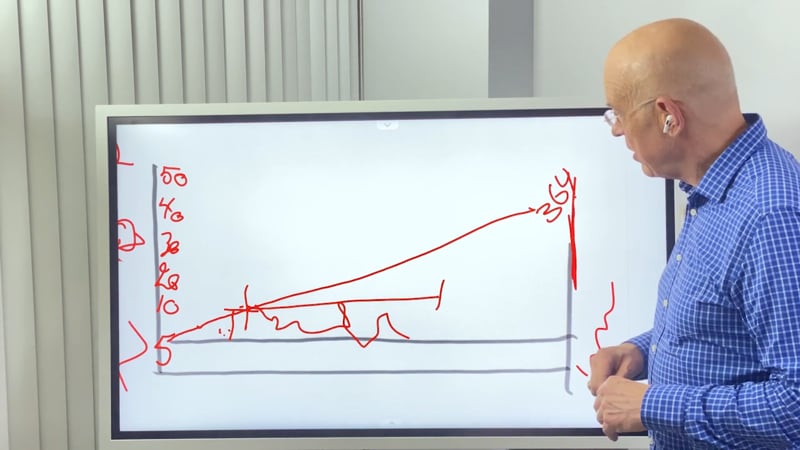

But there's one benefit to cashless. And this is an interesting one that not a lot of people know about this. And that is that, let's take a look at passage of time. Here it is. Okay. And I make my investment here at a $100,000. Month one and it goes along here. And month 12 is when the warrants no good anymore.

Well, let's say at the six month mark, I decide to exercise the warrant. And remember that six months is when you can sell shares that were issued by a company. And if you do it with cash, so you pay your a $100,000 right here. You're going to have to wait another six months to be able to sell it.

But interestingly enough, if you do it with $0 here, guess what? You can sell it right away. And that is because no money changed hands. Therefore, the last, the only investment that the only monetary transaction that occurred was here. And so right away you exercise and you're able to sell, which is good, because if you have a cash warrant and you have to wait six months, well you're going to be conservative, aren't you? Right.

Don't Exercise Too Soon

So here is again, that time graph. And we have 50 cents, 40 cents, 30 cents, 20 cents, 10 cents, 5 cents. So here's our 5 cent warrant. It dies right here at 12 months. Okay. So if I have a cash warrant, stock price, hypothetically, goes up here and does this business. Okay. If I do it at 10 cents, well, I'm going to have to wait six months, right? And so during that time, there's not a lot of difference. Things could happen. This five cents is not a lot of buffer.

So with cash warrants, you want to do it as high as possible. Another important rule for all warrants is: do it at the end. Don't do it any, you don't get anything by doing it before the very end right there, day 364, exercise your warrant, why? First of all, the no cash, I mean, there's no tax penalty, right? Long as your warrant, you don't have a tax on it. Number two, you have the least risk possible. So you wait. Don't exercise too soon. Nothing gained by it.

So that's in short, what warrants are all about. They're fun. They really make investing more rewarding by giving you multiples of your investment. And they can also sometimes be cashless, which is good if you don't want to put out money.

Contact Us

To know more about it, please feel free to email invest@originclear.com. You can always talk to Ken Berenger just oc.gold/ken in your browser or of course you can call us and the number, I remember it well, it's the old LA number (323)939-6645. And you can get Ken Berenger at extension 201, Devin Angus at extension 116, but invest@originclear.com works great. And that email will eventually get to me if you want to talk to me. Love to hear from you about this. It's an exciting time for the company. Do join us. Thank you.

End of Video Presentation

Cool. That was fun. And hopefully that was helpful to everyone and feel free to give me chat feedback if you think that I missed anything there. We're just about done. I'm going to just move on here and a very important message to existing investors, which is, and I'm going to turn off the video optimization that boom.

Double Your Investment

How to double your investment without investing more capital? So if you're an existing investor, please call Ken. I sent you all an email, but this is a very, very good program that you really need to know about, and it is quite reliable and I think you'll enjoy it. So do call him.

No Show Next Week — Dec 24th

Now I'm wrapping up and I'm going to tell you that we're not going to have a show on the 24th. For those of us who were brought up in the Christian persuasion that's Christmas Eve. I don't want to play favorites, but the 24th is, well, if I play Santa Claus, I don't want to be on this show, but we are going to do New Year's Eve. So there'll be plenty of time before midnight, so please do join us on New Year's Eve.

Thank You!

Thank you all for being with us. It's been fun. And I would like to wish you all again, happy holidays and really remember that. Well, remember to stay safe. All right, I'll see you in two weeks, Alan. It's a pleasure having you on board.

Alan: Thank you Riggs.

Riggs: And thank you, Keith. He just wished us all a Merry Christmas. I appreciate that. And again, everyone, thank you and good night.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)