Water is the New Gold: Insider Briefing of 21 January, 2021

Helping You Thrive in the World's ONLY Vital, Scarce and

Recession-Proof Market

How can we help? How does creating our Finance Company give us the resources we need? Is this a strategy for going onto the NASDAQ? What do the numbers look like?

FEATURED OR COVERED IN THIS BRIEFING — QUICK LINKS

- World Bank blogs enlightening article on inflation and water tariffs. Great graphs!

- CBS News story on rising water costs and startling graphic evidence of a dangerous situation.

- What's back of those rising water costs and what we can do about it.

- OriginClear's pioneering actions in Water as a Service and how they improve the dire infrastructure situation.

- How we are building the OriginClear Finance™ fund and who's helping us.

- How the OriginClear Finance models are structured and a look at the numbers.

- The OriginClear Finance pro forma.

- What's the strongest thing we can do in our strategy?

- The company's three different investment offerings and how to access them.

- How to contact Ken Berenger for a personal briefing or find out how existing Reg D investors can double their investment without adding more capital!

- Getting on the NASDAQ.

Transcript from recording:

Introduction

Riggs Eckelberry:

Good evening everyone, and it is the 21st of January. It's a pleasure to have you here. It's going to be an amazing briefing. These briefings get more and more exciting as we start to get into what I think is just the most amazing year for us. And I'm not biased in any way. Okay. Here we go.

Some History

Water Is the New Gold. Vital, scarce recession-proof — that's becoming clear more and more. I'll be discussing this in this briefing. It is briefing number 94. There's actually been more of them, but this was when we started getting really serious with these video briefings. Before that, we used to... every Thursday, I would sort of get on the phone, and this was an overhang from actually several years ago when we were doing weekly broker briefings back when there was a whole broker-dealer network, and those were fun.

Safe Harbor

But of course, that broker network is very minimal these days on the over the counter. So we ended up doing this, which is kind of fun. Okay. So, safe harbor statement, of course, that all our statements are qualified by various [statements] — "anticipate believe, et cetera." We do try to do our very best, but of course, things might have risks and uncertainties. As I say, we do our very best to tell you exactly how it is. I believe we're the most transparent small company in America, maybe the most transparent public company there is because every week I tell you what I know. All right.

Inflation and Water Tariffs

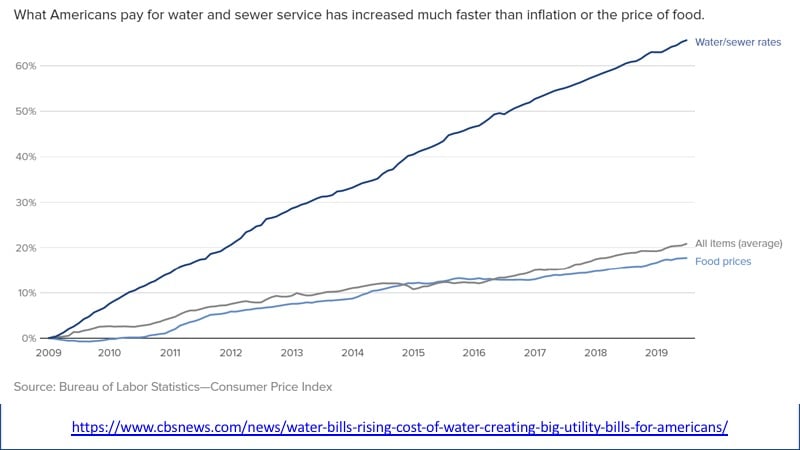

So, if you caught my CEO update today, I talked about water rates. So, first of all, there's a great little article by the World Bank published on The Water Blog. And it has this really cool graph and looks more complicated than it is.

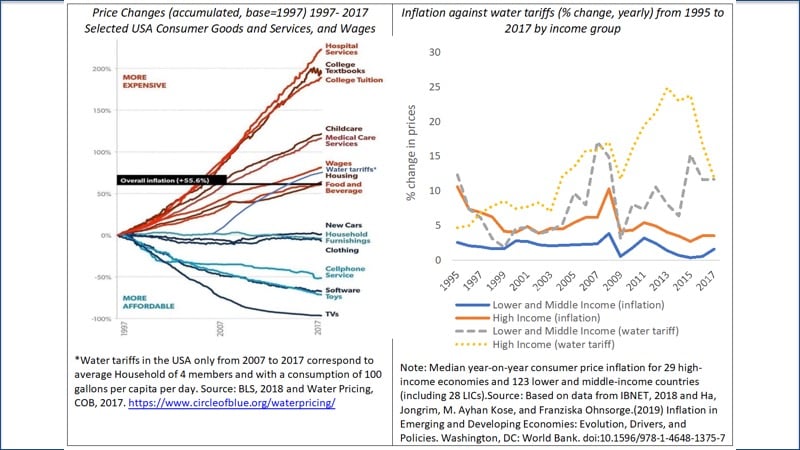

Comparative Graphs

On the left-hand side, you have what has become more expensive or more affordable. And of course, what's could become more affordable? All the things that we get from China and things like cell phones, et cetera. Clothing, household furnishings, all of these things have tended to stay flat. Food is high. The way highest hospital services. You know that if you're paying for your healthcare. Anything that involves a lot of human services.

Oddly enough, water tariffs are right up there. Now, it's weird because water tariffs should not be... this is infrastructure. It shouldn't be on a tear. Why wouldn't it be becoming more affordable? It's weird.

On the right-hand side, we have very interesting changes. You see the core inflation for lower and middle income, which is in the blue, and for the high-income. And that's probably because the high-income people tend to spend on more discretionary type items.

And then the water tariffs are very interesting. Look at the gain in lower and middle-income rates starting in 2009, basically the last decade. And it was considerably higher for the high-income, but it's actually, in the last five years has tended to drop, which is very interesting. So this is for a lot of countries. This is not just the US. 29 high-income economies and 123 lower and middle-income countries. So that is really interesting 30,000-foot view.

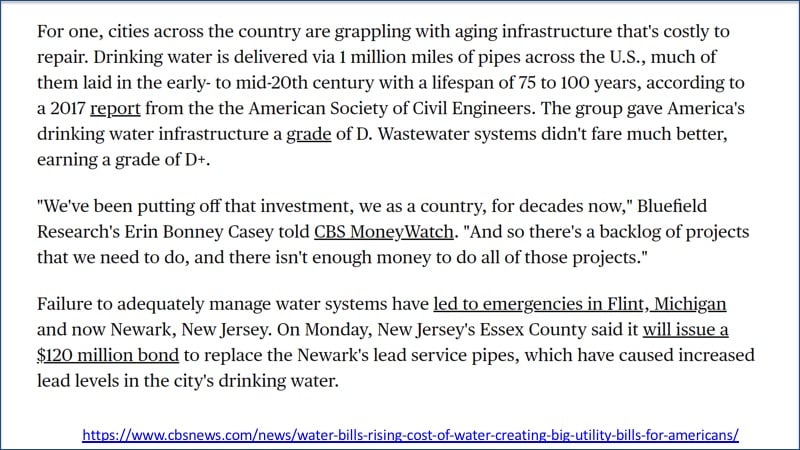

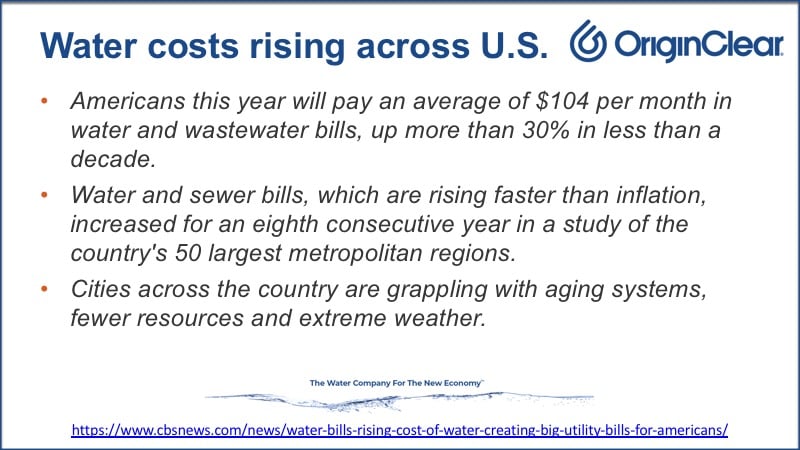

CBS News is the story that I pulled. This is actually a mid-2019 story, but it's still very, very valid. And this is that graph that I was texting around today.

70% Rise in Prices

This is an astonishing graph here that shows since 2009, basically 10 years, a rise of about 70% in prices, whereas the overall rates of rise added up to about... we went from zero to 20%. That is crazy.

So what's up? What's up with water and sewer service. Well, what's going on here? This is crazy. Now, on the flip side, this is interesting because this means that it's actually one of the things that's increasing, you might say, in value, right. It's basically the water and sewer services taking a bigger piece of the personal and business, the family and the business wallet, you might say.

30% in a Decade

All right. And here's a quote from this article that the average is $104 per month. A lot of people tell me that water should be free, but of course, water treatment is not free. Somebody has got to actually pay for treating the water. And of course, if the government pays for it, then you're paying for it. So up more than 30% less than a decade. And they increased for an eighth consecutive year with, and here's the problem, aging systems, et cetera.

Aging Infrastructure

And so there's a great quote here that echoes what I've been saying, which is, "Aging infrastructure that was laid in the early to mid-20th century." And guess what? It now has a grade of D and wastewater systems that have a grade of D plus. Backlog of projects. Nobody's getting around to them. Emergencies. Various things, lead everywhere, which these counties and cities do not need. These are disastrous they don't need.

There's a graph I showed a couple of months ago of the federal contribution to these costs. And it's been dropping and dropping and dropping. I think it's around less than 30% now, perhaps as low as 20%. I'll bring that graph up on the next briefing. You'll see, it's shocking, really. So counties, cities are on their own. And of course, businesses are. Here's that gap. $105 billion per year of gap.

And it's actually by 2040 it will be $150 billion per year of a gap. This is not good. Because guess what? The gaps there. You don't spend it while you still should have spent it, right. And the gap in 2010 was only about 60 billion. So it's really speeding up.

Water as a Service

Now, what can we do to fix it? Well, businesses are stepping in, as I've been saying, it's the privatization of water, and businesses have to do it themselves because the cities are going well, you're... let's say you're Intel and you're making chips, and you're generating something called fluorine. Well, they say, "You take the fluorine out of the water, we don't want to." And so, all of a sudden, Intel is in the water treatment business, didn't use to be that way.

But what we can do is we can do basically create... become a private water utility ourselves, put them into a water equipment, have them sign a long-term agreement, and pay on the meter and that's what is this Water as a Service (WaaS) concept I've been talking about.

WaaS Pioneer

Now we are a pioneer on this. Why? Well, we've started to do these programs last year. We did a very successful pilot with something called the Pool Preserver™, which where we funded the equipment ourselves. And we also did this thing called Water as a Career™, which put somebody into the industry. And we do dozens of large installations every year, of course. But this one was funded by us. And it was our little proof of concept.

Based on that, we decided to go ahead and build a fund that'd be a finance company that would get up to $10 million, perhaps more. And we have, as I've been reporting, signed memorandums of understanding, MOUs, for $3 million. Okay. Now, there's only going to be one fund. I'm going to run through it in a minute.

Marketplace for WaaS

You'll see the spreadsheet should be a lot of interesting stuff there. Because after this, what I really think that we have to do is not ourselves try to be the company that does everything. There's a rule about what we call the tornado. A tornado of adoption is what everybody's trying to adopt. And generally, one company cannot be the only people that do it.

So if we can make Water as a Service, something that is a marketplace that brings investors and water companies together, then we can be the common marketplace for Water as a Service. And I think that's something that is really, really worth doing. And so it's a key driver for our strategic plan. But of course, it is not a done deal, and you should not be banking on it. Never the less it's going really well.

Building the Fund

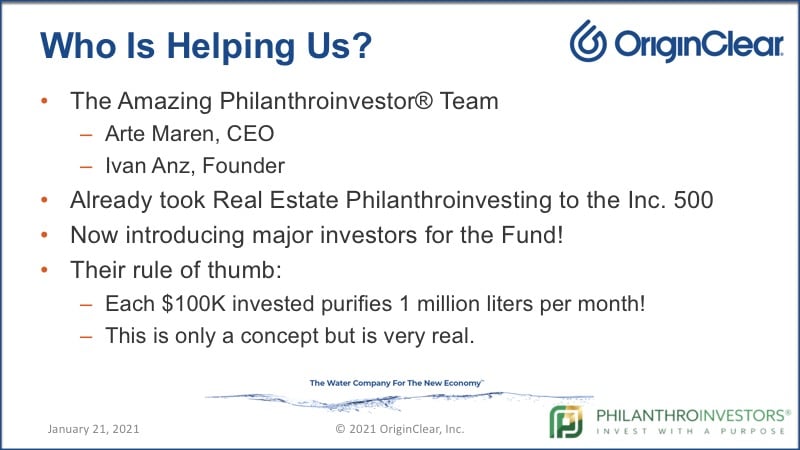

Okay. Now, who is behind the scenes helping us? There's a group that you know called Philanthroinvestors. Their motto is, Invest With a Service, sorry, Invest With a Purpose. And they've done a wonderful job of taking their real estate philanthroinvesting venture to number 83 on the Inc 500. And this is two years in a row now that they've been on the listing, and they have been introducing the major investors they have already.

Arte Maren is the amazing CEO. And Ivan Anz is the visionary founder, and they have a rule of thumb. It's a concept. It's not something that is baked in stone. We hope to do some lot more studies to back this up, but this is a pretty good real concept, which is every 100,000 dollars invested in the fund or in these Waterpreneur projects, et cetera, purifies a million liters a month, which is about a quarter-million gallons a month, right. A liter being about a quart. I'm so grateful because they're the ones actually making it happen.

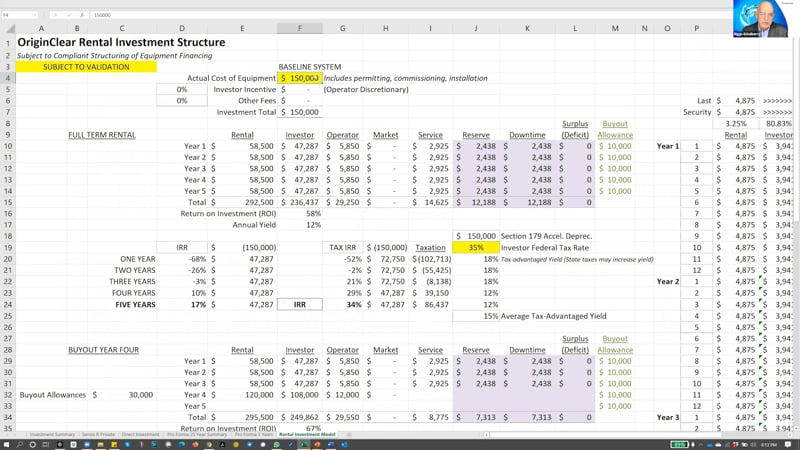

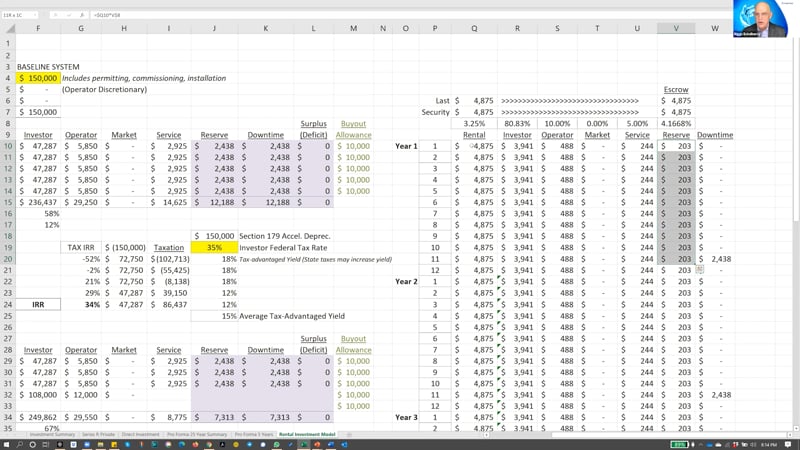

Rental Investment Structure

So, I'm now going to go ahead and flip to the spreadsheet and review that a little bit because I think that's going to be fun and worth doing. So let me just pull that up.

Now, at the base of all this is a structure for a system, a baseline system, which is, say $150,000. And that, for example, is that big hotel deal we did a few months ago that we're planning to actually deliver this quarter. And it was around that price. So that's a pretty good baseline commercial system.

And this model is a rental model. Now, there's another model, which is pay per gallon, which is more complex. But let's just take this rental model. And we have here all of the costs month by month, the overall rental price for this $150,000.

Rental is Great

Now, rental's great. Why? Because the renter doesn't have to put up all kinds of guarantees, et cetera. It's very easy. It's a bit more expensive, but they can walk away, right. And it allows it to charge a good price close to $5,000 on 150,000, which is higher than leasing would be. Now, if somebody wants leasing, we can do it. I'm not saying that we don't. But this is where this... they pay first, last, and security, and they're off, right. They're good.

Reserve

Now, this model has a fund for service, a fund for downtime. So this reserve here adds up to that 24, 38 per year. So we allow that much, basically about half a month's worth of downtime per year. Let's say, the machine comes back, and we have to refurbish it and put it back out again.

Four Revenue Streams

And then the operator is... you remember the investor doesn't want to operate these machines. So we have a company operating it, which is, of course, OriginClear. And may I add that somebody is building this, and it is, of course, our Texas company. So for us, there's the fund itself, which we're building, and which will have its own profits. I'll show you that in a minute. The building of the machine, and of course, the operator fees right here and the service contracts.

So it's actually four revenue flows. And so these things have a yield, which is a good standard return on investment. Very nice. We've done all the taxation stuff here. You can see where they get to buy it out, and it still looks very good. So this is extremely viable as a model. And so, then we rolled it up into what's called a pro forma.

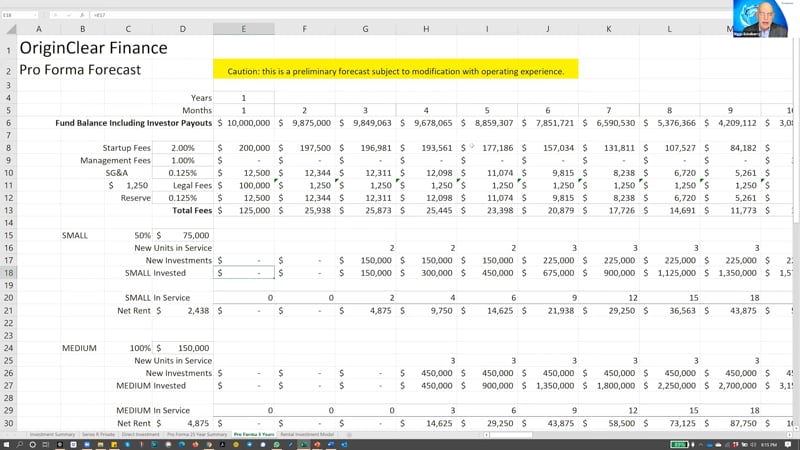

The Pro Forma

A pro forma is basically a... some basically theoretical numbers, right. Okay. So we take the 10 million, we have certain fees here, and we go down. And the plan that I envisioned was basically to put in all the machines, spend the entire $10 million in one year, bang. End up with as little money as possible at the end of the year one.

In this model, we actually ended up with a little bit over half a million dollars. But we have now put in place all these machines. We have that baseline machine of 150,000. Then we have one that's half that price, 75,000. Those are like that little trailer park lagoon cleaner. That's what that's for. And then we have large units. And then, of course, there can be even larger ones.

And this is build so that we can go, "Well, let's take a look at what's a 500% one," and the whole thing would ripple through. But so we go ahead, and we do a total of, here we go, 74 units. And that's also when we start to turn cash positive, and we start paying 25% of that profit to investors.

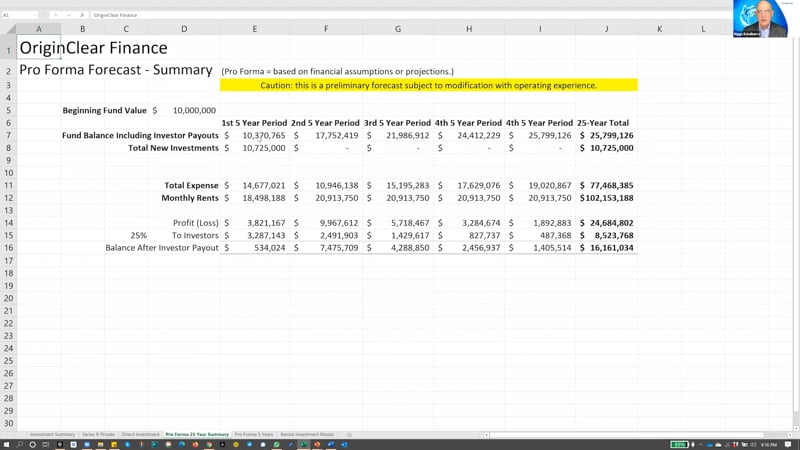

Longer Timeline

So let's take a look at it on a longer timeline. Here's that first year, first five-year period. And this is 25 years. Again, we only do investments in year one, and then we just let the fund run. And for that period we have roughly a 10 to one in rents. The expenses, I believe, can be lower.

But we've been careful to overestimate them to make sure that we don't get in trouble. And the fund pays out about $8 million to investors over the 25 years. And this left roughly 60% more than it was when we started, so that's pretty good. Again, I've put a lot of fudge factors into it, but this is a good model.

Strongest Thing — a Market

And as I say, "We only want to do one." Why? Because I believe that the strongest thing we could do would be a market. Think about Airbnb, they could have just done apartments themselves while they would have gotten up to about 50 apartments, and that would've been it. So instead, what they did is let other people rent out apartments. That was a revolutionary idea.

Uber didn't try and build a taxi fleet. They just let other people use their own cars. This is very similar. Let people do it, and you run the marketplace. So that is the power of it. And I spoke a lot about it last year, but we realized we really needed to learn the lessons. And also, this gives us 10 plus million dollars in assets that we can then use; very, very important for the purpose of our balance sheet.

Direct Investment

Okay. Now, at the bottom, we have tabs for the direct investment into the fund for what we call the Series R private placement, which is now in progress. I'm not going to show these numbers. They're actually very, very encouraging. They're really exciting numbers, but you're going to have to talk to Ken to see those.

I'm not going to do them on the air because I'd have to do endless disclaiming. And it's better if you have a proper discussion with Ken, who really knows what he's talking about. So this is basically what the fund looks like. And it's a good, decent penciling out of the model.

Participating

Okay. So let's come back then to what we can do. So as I was saying, there's basically three ways you can participate in our future. There is an unaccredited investor offering. There is the regular investor offering that has excellent returns from a combination of conversion of your investment into stock. And also warrants, which is basically a free option to buy stock. And then, there is this opportunity to invest directly into the fund, which is reserved for people investing a million dollars or more.

Call Ken

All these terms you can discuss with Ken at length. And in fact, here is his information. You just go schedule the call, oc.gold/ken or email, or you can call 877 or 727 440-4603, extension 201. So that is very important.

And there's one more thing that you need to know, which is that if you're an existing investor, you will have a chance to double your investment without investing more capital.

Open Forum

Now, very important. I'm going to talk briefly about something that I was not going to talk about in this call, but I believe that we should have what I call a trusted investors' conference. What's a trusted investor? We define it as any investor who's invested more than once in a company private placement. Why more than once? It's because you really showed your grit. You went to bat more than once now.

I'll talk about it more next week, but I'm looking at having a trusted investor conference online mid-March around the 15th of March, and this would not be a webinar. It would be everybody in a Zoom meeting and able to interact. All those little thumbnails on the screen and able to speak up, and it would be an open forum. It'd be one of these cool conferences. I think that'd be so exciting.

What You Want

You, the trusted investor in the company, are the pillar of the company. You have brought us to where we are today. We want to get your feedback. This is not about trying to get you to invest more. This is about learning what you want. Of course, briefing you. I'll have you sign a non-disclosure agreement so that you basically will be able to learn things that you might not know otherwise.

And that's why it's important that I'm not trying to fundraise because when I try to fundraise, then, of course, the information has to be shared with everyone. But in this case, we can make it private. So if you are a trusted investor, then you will want to join this. As I say, it's around the mid-March, we'll put out the call. But meanwhile, do talk to Ken because there's this cool way to double your investment without investing more capital.

Getting Stronger

All right. So what about next week? Well, next week, I want to get into what's it going to take to get on the NASDAQ? This has been a pipe dream for a long time. We have not been strong enough to get on the NASDAQ. Every day we are stronger. Ever since we did some amazing interventions with some people who we believe were harming our stock. The stock has improved gradually. We're not out of the woods yet on that, but it's going extremely well.

People Believe

I'll be able to report on that more. If you're very curious, you can check out our... it's right there in our quarterly filings. If you look under legal proceedings, you will see the disclosure, but we've had some good news. And the good news is reflected in the stock. So people believe in this stock. And for the longest time, they couldn't understand why it kept going down. Well, there was a reason it was going down, and that was that there were some very potentially harmful people hurting the stock.

Getting on the NASDAQ

And again, we don't try and tout the stock, but it's a wonderful thing that we have it, solidifying stock, but it takes far more than that. Oh my gosh. The things it takes. You can get on the NASDAQ. We could do it right now, where you can engineer a NASDAQ listing, not a problem. The challenge is staying there, and believe me, I don't want to be worried about delisting off the NASDAQ three months after we get on it. I don't think so.

I want us to be a textbook process because we need to become this marketplace for Water as a Service eventually in the world, but certainly starting with North America. That's pretty much it. It's been relatively short today. But do join me next week because we'll get into the nitty-gritty on this NASDAQ process. You'll understand what the team's going to have to do. What personnel we'll need. For example, we'll need a CFO, all of these things, and these things are all very interesting.

Questions and Answers

And Darrell Polson has a question. "How are your products tied to the cloud for remote monitoring?" Very good question. All of our products can be managed remotely through the internet. The Modular Water Systems™ technology includes very sophisticated controllers that are automated controllers.

That's actually very, very standard these days, and there's really good software. We don't actually write the software ourselves. It's not even worth doing. But that's been around for some time now, and people can go around with their phone or their iPad or their computer and control their systems. And there's also, of course, automated controls. So, that's actually a really good question, and it's part of the stuff that we do on a routine basis over at Modular Water Systems.

Acknowledgements

I'm very proud of what Dan Early, chief engineer, is doing with Tom Marchesello as chief operating officer. Marc Stevens as president of our Texas operation and Mike Jenkins, who's the president of sales and his son, Derek Jenkins, who's making our consumable sales take off.

As I said, 2020 was well ahead of 2019 on cash, something like half a million dollars ahead, which is fantastic. But we don't yet know what it is on the recognized revenue because that is a deep, dark secret that comes through in the process of doing the audit.

So, we're doing great. I'm very proud of the team. And now we are embarking on what is the most ambitious thing we've ever done. Thank you. Let's catch up with each other next week.

Gina Lo raised her hand. Well, Gina, if you have a little chat thing... Oh, Rick Garcia says, "Thanks for the reminder. Set up my call for next Tuesday." Ricardo Garcia is one of our cool dudes. He's one of our testifiers. He testifies for us, and he's also been a happenin' dude. So guys, thank you very much. We'll see you next week. Enjoy your weekend. Good night.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)