Insider Briefing of 4 June 2020

Helping You Thrive in the World's ONLY Vital, Scarce and Recession-Proof Market

In this Insider Briefing OriginClear CEO Riggs Eckelberry is joined by Chief Operations Officer Tom Marchesello and VP Business Development Ken Berenger for an action packed Water is the New Gold episode that demonstrates the importance of high-tech water treatment systems and explores alternative "Outside the Stock Market" investments. This briefing includes essential insider information on Self-Directed IRA, Alternative Investments from Tom Parker of Millennium Trust.

Transcript from recording:

Introduction

Riggs Eckelberry:

Riggs: All right. We are live and joined by two fabulous people. I've got Ken [Berenger] rolling his head. “I get knocked down and I get up again.”

Ken: Well, you said fabulous people. I went, "Where?"

Riggs: And I've got Tom Marchesello on screen as well. Welcome.

Tom: Thank you.

Company Tripod

Riggs: So, really Ken and Tom are, well, they're the two other legs of the tripod of this company, and I'm really happy they're on board, so welcome guys. Water Is The New Gold. You know, we say this, “Helping you thrive in the world's ONLY vital, scarce and recession-proof market.” Why is that so? Well, the vital and the scarce, we're not going to go into that. Recession proof's very, very important, because no matter what, water has to be treated. Now, what Ken and I realized back in January was that the under-capitalized water treatment was going to suffer. And we're going to show you some progress with that right now today.

Important Notices

Of course, we have some disclaimers. As usual, anything I say in this, I'm doing the best I can. And I will say, plan, expect, intend, and that's meant to say that this is not a time machine. We do our best to tell you exactly what's happening, but it may not happen the way we say. I won't be specifically talking about offerings today, but these disclaimers basically tell you that Securities and Exchange Commission does not actually have an opinion about our offerings. We do, but that's a different thing.

Best Kept Secret

Riggs: This where I wanted to bring up a very important announcement that we made earlier, in fact last week. Tom became dedicated to working with Progressive Water directly and part of the reason why I think you're focusing in on it is because in many ways, Progressive Water is a best kept secret. They work super hard and they get things done, but it takes a corporate overview to go, "Hey, wait a minute, this thing's golden." Right? Tell us a little bit about how your action plan has been going with this whole process.

Tom: Yeah, well, obviously we've had a lot of interactions with Progressive Water for some time, but what we discovered as you said is that, it's a diamond in the rough, right? Progressive's been doing business for about 39 years. And what's interesting about them because it was a father/son owned business, which is a typical small midsize company in America, you know, hoo-ah America, but strong made in Texas. That's kind of our pitch there with Progressive Water, but what's happened now is we're taking our experience, the new understanding of how to do Modular Water construction, which came from Dan and some of the things we did.

More Agile Model

We infused it down there to basically make the entire operations a little bit more-nimble, and in the way I like to think of it, more agile. What I was trying to do there is, I was trying to move the Progressive business model a little bit, not just the products, because we have great products. But I also want to move the business model a little bit towards the agile manufacturing concepts, which you might've seen popularized by the software industry, then adopted by people like Elon Musk with like Tesla and SpaceX, which is the idea that you can make really awesome machines, really awesome manufacturing, fast, iterative. Learn from the last one you make and make the next one better.

That's actually what they really do down in Texas. Our Progressive Water treatment guys actually do that all the time. Every piece of machine that we make is slightly better than the last one, because we learn the lessons that we learned last time. And then the next one, we make it, we tweak some extra pieces to make it stronger. We cut some expenses out of it. We make it faster. That's actually the whole concept of an agile iterative process. And because we're a small team who really works very closely together, we're going to implement more of this kind of project management methodology across our production lines down there. So we can get projects out the door faster and then have a quicker turnover, which will allow us to basically do more business, collect our accounts receivable quicker. And then of course basically turn the product out and get it out to market faster, and that's really the initiative.

New Corporate Chief Engineer

Riggs: I love it. And to support that we have Dan Early, really excited about this to compliment and support what you're doing. So at the corporate level we have, of course myself, you, Ken, but also now Dan, who was building the Modular Water Systems™ product line. And now, basically, that job is done, is fully integrated with Progressive. And he's been elevated, he's going up into the corporate cloud and he's going to support of course what you're doing with PWT, but also what's happening with our technology licensees and the cool thing, Investor Water™.

Tom: Yeah. It's actually great working with Dan. He's bright, I mean just insanely bright actually. And this, in an interesting way, frees him up because when you think about it, we talk about what's the highest and best use of somebody and their skills? The truth was this actually elevates Dan to a better use of his skills, right, and allows him to really shine in a way that really frees him up. And he's excited about it, so it's a lot of fun.

Riggs: Well, that is great news, and I'm loving how things are developing. Before I go on, we have a great video. It's relatively long. It's 17 minutes long, and I don't want to take up this whole time, but I'm going to play it briefly and then we'll make it available for everyone on the site. But it's really, really vital. I'll play this briefly and we can get back to some other of the current news, so as not to take up the entire briefing with this.

Presentation Video

Transcription from Video

Riggs: I’m on Zoom with Ted Parker, who's with Millennium Trust. It's an IRA organization we've worked with for years so that investors could invest out of their self-directed IRAs. And this is an amazing time to talk about IRAs because of the COVID related forgiveness plan. First, Ted, I wanted to welcome you to my briefing and to thank you for coming on board, do you find you do a lot of these, helping people into a more flexible kind of structure?

Ted: Riggs, thank you. And thank you for inviting me into your talk today. And yes, I work with a lot of advisors and individual investors who want to take some of their risk out of the stock market, which has been so crazy this year, and invest it in these alternative investments that are not marked to market. And when I say marked to the market, what that means is look at any stock that's traded on the market, Google or Amazon or any of them. And when our presidents tweet something, or when there's a new update on the COVID virus, those things can go up or down. And for a lot of people that aren't in the business of the markets, it can be nerve wrecking to say the least. But these private investments, like what you have are not marked to the market. So, what that means when everyone else is turning red, losing value, yours is sitting there at the money I put into it. And then something happens in the future. Hopefully something good. Hopefully you get bought up by a bigger competitor or you go public.

Riggs: From your lips to God's ears. Thank you. Yes. So that's fantastic. And so, my assistant, Devin Angus, works with you guys, and he says this is a very smooth process. You guys are very, have very good customer service, concierge type attitude, which we greatly appreciate. And so, I guess what you're saying is that they should speak to Devin who put them in touch with you and who'll organize the whole marriage.

Ted: Yes. And Devin's been very good to work with and Millennium Trust. We are one of the largest custodians in the space of these alternative investments. We're founded in the year 2000 to help investors who wanted to invest in these things using their retirement account. And we've grown to about $27 billion of assets and a mind boggling over 21,000 unique alternative investments, like your investment. You're one of the 21,000 that we custody.

Riggs: So we're just a little fish in the sea?

Ted: Well, no, that just shows you that there's growing interest in these alternatives because when you look at the typical individual investor, they think the only way they can invest is through the stock market and the public bond markets. But when you look at the typical foundation account or endowment account like Harvard and Yale and Stanford, do you know how much they put in these alternative investments as a percent?

Riggs: No.

Ted: Take a guess, five, 10?

Riggs: 40%?

Ted: 52%.

Riggs: More than half.

Ted: More than half of Harvard, Yale's endowment. And they're huge endowments. They're not playing, they're not putting that 52% in the public markets because they have to manage money for long-term. And they're looking at things that aren't that volatile and these private things don't move when the market moves.

Video Presentation Ended

Get The LInk

Riggs: So, in the interest of time, I'm actually going to go ahead and just pause that. But what we'll do is we'll make it available. Millennium Trust has been very, very good for us over the years. And Devin will repeat the email address to get the specific link. Now in this video, he goes on to say, "We don't just accept anybody. We review every offering to make sure that they are copacetic and so forth." And we got into, and Ken you'll like this, we got into Investor Water™, right? So right now, we're doing funding that Ken organizes for private placements, which is very valuable to build Investor Water. But then there's the actual planned investments that people can make in water equipment. And with Millennium's health, they could do it from their IRAs. And here's what's cool. Right now, you could pull up to a $100,000 out of your IRA for up to three years and return it within the three years no penalty. It's kind of like a holiday, which is amazing because this is short term rentals.

High Degree of Safety

We can literally make this work with a high degree of safety. Now, I just want to make it clear that we are not in market with these investments. I was meeting with a lawyer this week, he's like, "Okay, there's a few things to handle." So, it's what we call non-trivial in the tech industry. Tom you know that term. It's nontrivial, meaning it's hard as heck. So that is where your funding really, really helps. Now, Ken you have an amazing, people who are accredited need to speak to you because it's not a hope and a prayer. It's an alternative investment like Ted Parker said, and it's what the world is doing. And then we have a special twist and without going into too many details, would you like to tell us a little bit about it?

Ken: Yeah, and thanks Riggs. Thanks Tom. The strategy that you and I crafted in the lab, so to speak, was the ability to use a kind of a short-term pullout of retirement funds, IRAs, 401ks. So, we've created a strategy within our private placement that will allow a commitment of funds for a year while you earn the interest paid by these instruments. You can actually withdraw the principle after one year. What you'll essentially do is you'll convert into common, you'll take your principal off the table. Then you can reapply the profit back into the instrument, continue your dividends now with pure profit money and take the principal home.

Riggs: The way we've crafted this private placement is so that it's not just waiting forever for the stock to get somewhere. It's an ability to monetize as you need without overwhelming the stock's ability to absorb sales. So that investors aren't just forever waiting. One of the benefits of investing in OriginClear after all is the fact that we are a public company and we do have a liquid stock. We have a currency, right? So, you have a very well crafted, highly compliant way for investors to do our private placement and to, without going overboard, you show them how… One of the things people say to me is, "Riggs, I've never sold a share." Well then why'd you invest in a public company? What's the point, right?

Sell a couple shares, take some money off the table. And that way you're not exposed as much. I guess what I'm saying is it's a hedging strategy, right? So it hedges your investment with some present cash and also keeps the future, right? Because otherwise, if there's no future you might as well just put it in gold and just sit on it, right? So, but if there's a future, you want to preserve it while also pulling out some cash. And there's a balanced, conservative hedging strategy, which is what Ken I think you're talking about? So I think that when people talk to you, they are really cognizant of how important strategy is. So accredited investors need to speak to you immediately. All right. And with that, I'm going to just quickly review the Investor Water site.

Investor Water & Sanitation

Now this is the last you'll see of this is a home-brew site that I created because, well, yes, it's a home brew. I did this while the team at Rigney Graphics was building a system. And so here is first is going to do it without any kind of video clip stuff, but this is the website, and can we do better? Well, here's the thing. People just don't realize that sanitation in the world is in a very bad place. And you think everything's fine, but in fact only about a fifth of all the water in the world is ever treated. So that's an issue. We have a couple of videos there and I'll play a brief tease of one of the videos, but the story here as I tell it is that back in 1918, the Spanish flu killed a lot of people. It's not going to happen this time, we're quite sure, because of better sanitation. But it's still a problem.

Connecting Water Companies With Investors

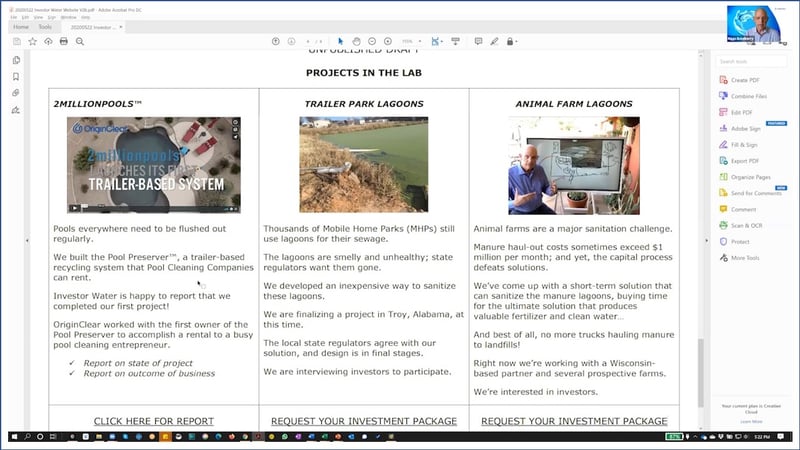

We can do better with the virus. Obviously OriginClear cannot solve the whole virus waves by itself. It's the entire water industry. And so that's why you and me Tom are very, very excited about this marketplace concept because I lay it out right here. There is this concept of a water company bringing an equipment project in, and then investors bringing money in and Investor Water monitoring it all. And so that is that story. And then the stuff we got going in the lab, you've got a project that is just wrapping up, if I'm not mistaken Tom, which is the 2 million pools project.

Tom: Yeah. We're pretty good on that actually I've been communicating with our tradesman over there the last couple of days. Matter of fact, I was just approving his trailer wrap for the rental he just did. And he actually paid us today too, our second month on that trailer, as a matter of fact. Yes, that 2 Million Pools project is moving along and I've got a couple of new referrals for other gentlemen that are interested in a similar program.

Riggs: This is very important because what Investor Water is doing is it's jump-starting these lines of business, which then OriginClear's manufacturing division continues to operate, as you're saying. Investor Water's only doing this one and we plan to have an announcement soon because things are basically ... Tom, you made sure that everything was wrapped up properly, and that was our first use case of the Investor Water model. The reason why it was so easy to do is OriginClear cash-flowed it, and we already had ... We basically made the product happen. We had a relationship, it was all built up. Now the next one is this trailer park project in Troy Alabama. Again, we have the project, we have the people, et cetera. We know what to do. Dan has built a solution, and we have some candidate investors. We're preparing a package. Finally, Animal Farm Lagoons is really interesting, and I'll take a moment to play this video, just for a few moments, as a tease.

Video Presentation

Hi. Riggs Eckelberry here, OriginClear CEO, and I love where we're going with Investor Water. It's a breakthrough marketplace to get rapid funding of badly needed, local water, sanitation projects. It's fast. It brings in a whole new class of investor, main street investors. I think it's a solution for so much that is not happening right now, but must happen if we want better sanitation in the world. The real question is how do you scale it up? Like an outboard motor pulling on the cord and things starts, but then it can go bigger. That's what this presentation explores take a look. And I think you'll like it. Let's talk a little bit about...

Video Presentation Ended

I won't continue because it's on the site and people should play it. That was this situation where, Tom, you've been talking to these players who have huge problems, million dollars a month, two million dollars a month, hauling, and how can they break the back of that vicious cycle to get a solution in? And that's where we jump start it with Investor Water, right?

Animal Farming Contingencies

Tom: Yeah. The animal farm's a really peculiar business model, right? They got to make money from their animals obviously, that comes out to the selling the meat, but during the entire process of growing animals, I mean, they poop a ton, and then there's seasonality to their business too. So, they have a lot of animals. Sometimes it goes up and down, so, the pig farms end up with a lot of contingency, but we figured out, as you did, that what you have to do is you first got to get like, almost like a doorstop, you got to get your foot in the door and you got to be able to first contain a couple issues. One is the smell, just the odor alone gets a lot of these guys in trouble, because they might not actually be breaking the law on any of their contamination issues.

It's just the neighbors get really annoyed, and then they call constantly and complain. So, first reduce the smell, that basically makes your neighbors happy. Then actually deal with the actual materials that are going on in your lagoons, which is try to reduce the load, try to reduce the bacteria, try to reduce the contamination and actually get the nitrates out of there. And then, so you're basically reducing the actual fundamental wastewater load there. Lastly, then you're dealing with, well, what do you do with the water at the end? Do you recycle it? Do you basically turn it back into the city, put it down the sewer. Do you take the materials, the hard materials and make fertilizer out of it? So, in this way, we can actually start with a one, two, three step approach and at least move people all the way to the first step with a couple of simpler products, before they need to go into full waste management mode. So, it's kind of a good way to get people introduced to it.

Riggs: You and I have been very frustrated over the months with these classic long-term capital projects, and this can kick it up. Ken, how's Investor Water concept playing for investors you're speaking with?

Real Property Asset Plus Returns

Ken: I will tell you that I've spoken to a lot of people that have invested in real estate and oil and gas, and their experience from there, it's been very, very well received. It has a lot of the features that they like in those instruments, but without a lot of the potholes, especially now, considering that a lot of these multifamily properties aren't paying rent, that's becoming a concern, we’re in month three, month four, of that, and they see some very soft, a lot of softness in that market. And of course, with the oil prices dropping, so, if they can take that kind of investment mentality, have a real property asset and get the kind of returns that our model looks to give, they have been extremely receptive to it. So, I think that we'll have, while we will have a lot of traditional stock market investors interested in those properties, I think that, when speaking to real estate investors, especially, it's a concept they already fully understand and embrace.

Riggs: Well, this is excellent, yes. Again, I want to emphasize that Investor Water is a project that's going to take some time. And I want to tell you all a little bit about how it's, how it's going to expand. Right now, we're in this nice safe zone of doing our own projects, three lab projects, I told you guys about. They're defined, we know who the players are, everybody's knowledgeable. Basically, each one of those was meant to teach us a lesson. We learned some lessons from the pool project. Am I right, Tom, a couple of lessons learned there?

Tom: We learn lessons, but then we move on.

Market Launch For Real

Riggs: Exactly. Fail early fail often. Number two is this, the trailer park thing, it's going well. And then the number three is the hog farm one, and that hog farm one, as I was teasing in that video is a way to use it to jumpstart a much larger project. So that's current phase one. Phase two is where we launch the market for real, but only with OriginClear as the water company. Now yes, we're feathering our own bed. I'm sorry. It's how it is, but it's how we can control the players. Over on the other side is investors who are the people we know. Now, you can invest in an Investor Water project without investing in OriginClear. But I'm just saying that, we don't, we don't want to play favorites, there's no quid pro quo, but we're going to work with the people we know because they're the people we know.

That's going to be phase two, then phase three is when it's done in the wild. Any water company, any water project, any qualified investor, and there will be structure because of course all the parties have liabilities, and how do you deal with that? Right? What if there's more downtime than you expected? Last week? I showed you all the spreadsheet from investor water had downtime. Well, what if that downtime is not enough? These are lessons learned and we also have to handle the risk. There are also regulatory issues, state-by-state which is why you have structures like oil and gas limited partnerships that deal with this appropriately. We will adopt. There's plenty of lessons learned, we're not reinventing the wheel here. What we are doing is for the very first time, allowing everyday investors to invest in water projects, which is weirdly enough, they've never been able to.

The Ah-ha Moment

That's to me, stunning. It's like, "Wait a minute." Ken you and me, that was our aha moment. It's like, "Wait a minute. They can't do it, and yet they're very interested. How many people have invested in OriginClear because of they’re like, "I want to help water." It's a mission. It's a cause. But basically, without getting too deep into it, the way we're going to solve water problems in the world, we, as an industry is by allowing people to invest directly. We're basically crowdfunding a solution to these waves of viruses. People have been noticing, they started cleaning their hands more and this and that, and yeah, they didn't get COVID, but they also didn't get a whole bunch of other things either. People are healthier in general. I haven't had a cold all year.

Sanitation Means Something

It means that sanitation means something, and if it's not Coronavirus, it'll be something else. There's always something going on. We've decided that we can't let large amounts of fatalities happen. I think that's a good decision, but we also need to do something about it as a water industry to make sanitation wonderful. In that brave new world, we all would be able to maybe not be in lockdown, but have great sanitation, and therefore we don't have the problem. That's the ideal that I'm looking for. A ways away and we'll need the water industry. But the key is you guys, is investors, is the main street investors and you don't all have to invest in an OriginClear. We could really use it because I'm going to have to start paying lawyers and so forth, but participate in these Investor Water projects when they're ready. All right, that's my little pitch.

Another Great IRA Trust Company

I'm going to just review the chats here that Devin has been answering. In addition to Millennium, there's another great IRA trust company called Strata Trust. And Strata is excellent. There's a very good experience some people have had with that. And Harry here is telling us that he's very happy with the investments he's made in the stock market. And if you did the right thing this year, you certainly did the right thing, for sure. I mean, I did okay with Zoom. Seemed obvious at the time, but then I sold ... I'm not going to get into my experience, but I sold. I bought OriginClear, which I received my dividend check today. It was great. So, the investing directly from the IRA is good. And Harry says sold too soon. That's the truth. I'm out of Zoom and probably I shouldn't be, but it was ... You should never worry about selling too soon, but it's important I think to have a piece of your portfolio have that explosive future capability, which we think we have. Why? Because a very small company is building potentially a very large thing. Look at what happened with Airbnb. Their first round was what, $20,000?

Ken: Yeah.

Like Airbnb?

Riggs: $20,000. And the return on investments is something like 125,000% or something ridiculous. Why? Because they were two guys in San Francisco putting air mattresses on the floor. Airbnb. So, these things always start small and the key is, is catching them while they're small. And that's where OriginClear has a modest market cap. We're very ambitious and we think we can get there. And I'm just going to check this one more message. And Harry says, "You made money still." I did. Thank you very much. I'm now in three things. I'm in Gold GLD, I'm in Blockchain BLOK, and OriginClear. Those are my three investments. So I think I'll just sit on that for a while, maybe invest some more in OriginClear. All right. Well, I'm going to wrap it up. Ken, did you have any last words for our audience?

A Major Difference

Ken: The one thing when you mentioned Airbnb, I think one of the main differences with, and what makes me excited and the people I speak to get really excited about it, Airbnb didn't kind of fix any problems in the, the hospitality industry wasn't broken. This was just adding a new kind of eCommerce platform to the hospitality world.

What we're doing with Investor Water essentially fixes the thing. If you ask people in the water business all the things they could change if they could to make the business more efficient and help them grow faster, this addresses. And I think once people really understand ... You can speak to water guys about it all day, they go, "Uh-huh." But when you speak to people outside of water, they don't realize that these are fixing major fundamental problems and I think that's one of the most exciting things we're doing. We're going to allow all water businesses to potentially grow much, much faster than they're able to right now, because they're not chasing money for two years.

Riggs: Well, is it fair to say Tom, that you as a water company operating a water company, would not mind a little funding, a trump card to get things funded?

Working Capital – The Biggest Issue

Tom: Absolutely. Yeah. It helps because working capital's always the biggest issue with the water manufacturing industry guys. So helping to accelerate the ability to get the products completed and out the door makes it easier.

Riggs: Amen. And in fact, I love that. I get mail from my friends in the water industry and they're like, "Dude, good luck. We want this." So, lots of people are on our side. A good friend of mine over at Dyadic, Mark Emalfarb, and he's also a CEO of a water, not a water company, of a technology company that has a platform for vaccine development. And so, I was talking to him and he's the other leg. He's the immunity leg, we’re the sanitation leg and he's interested in being on this briefing and that'd be fantastic.

Tom: Could I share a story with you? Actually, you might laugh.

Riggs: Go ahead.

Opportunity For Disruption

Tom: Do you realize, I did the calculation, our industry in general, the water industry, the old school thing, the time for contracting is now currently longer than the time for building and delivering the actual products. That's messed up. So, when you have that amount of imbalance, you have the opportunity for disruption, because think about it. The number one problem in our industry is their insanely long contracting period in selling cycle. And actually, now because we're modular, we have the ability to shorten the entire timeframe of bringing the product through factory and delivery and install.

So now all of a sudden, there's a major opportunity for us to shift the way the industry works and that's where your disruption's going to come from. And you can see it in lots of other industries who've had those awful selling cycles, awful consultative selling cycles. And then, software is a good example of it. I mean, like when IBM used to sell these endless consulting opportunities, and eventually it just became cloud. "Just sign up for a hundred bucks a month." "Oh, that's easier. I can buy that today. I don't need you to tell me to buy it for three months and I could just use it?" That's kind of what we're about to do now for the water industry.

Contact Us

Riggs: Water as a service is very, very exciting. It's true. Well, thank you, Tom. And thank you, Ken. I'm showing you guys the end screen. This signals the end of this briefing. Thank you all. I noticed that most of you have stuck with us and I really appreciate your interest. And please speak to Ken. I think you'll be amazed at his hedge strategy. And Keith wrote and says, "Ken is right about solving the water industry issues. Both investors and the public are keenly interested." You can click on oc.gold/ken and instantly schedule a call with Ken without talking to him, which is great.

So that's nice and automatic. Don't forget to register for next week's [briefing]. If you need me, email invest@originclear.com. It will come to Devin, who will bring me in, and I'm happy to talk to anyone who has thoughts and interests and so forth. So that's it. Thank you all. It's been a great, great show. Thank you to our panelists and everyone have a good weekend. I love where we're going and I love your support. Thanks again.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)