Good morning!

This was last week's headline on CNBC:

MONEY FROM SOCIALLY RESPONSIBLE INVESTORS FLOWS INTO US WATER STOCKS

Yes, it seems there's a shortage of publicly traded water companies in which to invest. These utilities are popular with funds that focus on environmental, social and governance (ESG).

With $22 trillion dollars or a quarter of all assets under management, ESG has seen a remarkable rise. And so, "Thousands of professionals from around the world hold the job title 'ESG Analyst'."

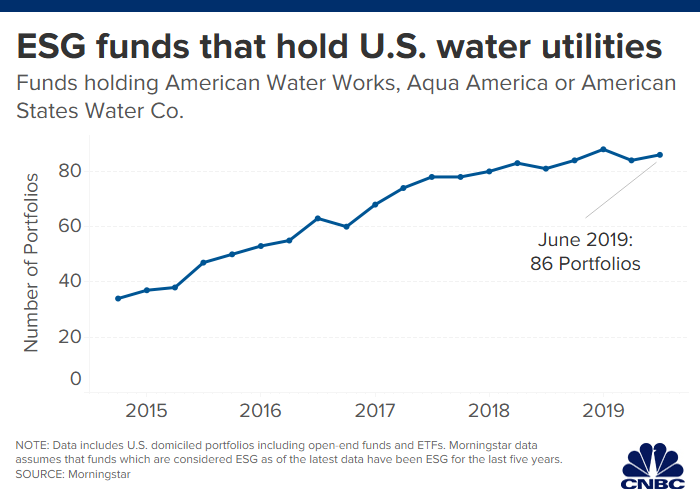

The shortage is obvious from this graph:

More than 80% of ESG funds have invested in water stocks.

What does this mean?

- A lot of ESG dollars are chasing a very small pool of huge water utilities (regulated water companies).

- Meanwhile, there is a new class of businesses that do their own water treatment. As Network News Wire reported recently:

"OriginClear is a key enabler of ESG water management for corporations that are increasingly responsible for what was once delegated to central utilities."

In short, OriginClear is helping to greatly expand the pool of ESG stocks—beyond the big water utilities and into everyday businesses that are increasing their value by managing their own water.

How we did it for an automotive dealership

On Thursday's CEO Briefing, I interviewed Mr. Dan Early, our Senior Engineer, about a recent closed-loop water treatment system for an automotive dealership.

If you missed the Briefing, here's the transcript.

This dealership expanded into cheap rural land that became worth many times its value once they created the water treatment!

This week i will be interviewing our COO Tom Marchesello, a "fintech" veteran, about ESG and OriginClear.

Be sure to sign up here now—limit of 100 listeners!

Will OriginClear be an ESG investment?

Right now, the ESG funds invest only in huge companies. That's easy work! But as you can see, that is becoming a crowded business.

OriginClear is still very small. But we believe that our continued expansion into modular water systems for businesses can help make us ESG investment-eligible.

On Friday, we took steps to streamline our capital structure, which is a major step to make us more investable.

I want to emphasize that we have a long way to go and of course, may never achieve ESG investability ourselves.

Meanwhile, we are definitely helping other companies become attractive for those all-important ESG guidelines.

What happened to OCLN?

As I was saying, on Friday we took steps to streamline our capital structure, in what is known as a reverse stock split.

For about 20 days, we will be on the temporary ticker symbol OCLND. After that, we will be back to OCLN as before.

We believe it is a positive and necessary move.

However, if you are concerned about your investment and are an accredited investor, please contact my assistant Devin Angus at (323) 939-6645. His extension is 116. You can also email invest@originclear.com. We're here to discuss your options.

Meanwhile, see you on Thursday's Halloween call!

Riggs and Team

Riggs Eckelberry

President & CEO

OriginClear, Inc. (OCLND)

PS: don't forget to Sign up for my WEEKLY CEO Briefing at 5pm Pacific, THURSDAY. Maximum 100 listeners!

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)