Insider Briefing of 18 March, 2021

It may be late in the game to win big on bitcoin...but what about water? We covered how real estate investors are moving assets to it and why we believe Water on Demand™ is just starting its run...Watch the replay to learn why it is now the company's single focus and just what it means to our founding supporters.

FEATURED OF COVERED IN THIS BRIEFING — QUICK LINKS

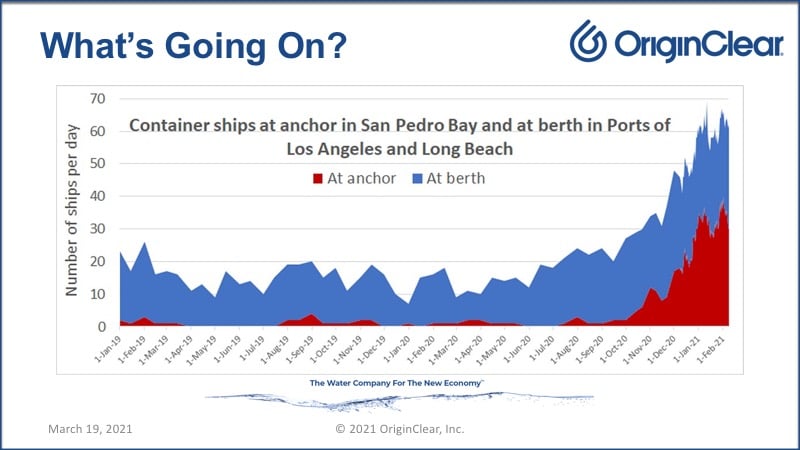

- What's going on with all the cargo ships stacked up in Los Angeles Harbor?

- Thousands of containers of backlogged goods from China are piling up at the San Pedro docks.

- Dan Bongino giving the lowdown on his show — "You can't get a house in Florida!"

- Businesses are booming in Florida as if the pandemic never happened???

- Will bitcoin go higher? It and other markets are high...

- What is making the economy HOT and the planned infrastructure spending

- Why we say "water is early" and the opportunity that presents investors.

- Why real estate investors are migrating to water and an update on OriginClear's activity.

- The features of Water on Demand™ as the next generation of water as a service.

- OriginClear new website and single focus strategy.

- How our plan for certification of the machines to be financed will work.

- The new look we have planned and company focus.

- A report from Ken Berenger, VP Business Development, on how legacy investors are doing.

- The prospects and opportunities for new investors in OriginClear's offerings.

- Why Ken Berenger feels OriginClear is in the strongest position it has ever been as a company.

- How future plans for WaterChain™ relate to immediate real world objectives.

- Getting on and staying on the NASDAQ.

Transcript from recording

Introduction

Riggs Eckelberry:

Welcome everyone to Water is the New Gold™. It's a pleasure having you here. Lots of things happening, so let me get going. Here it is, Water is the New Gold and this is a vital, scarce and recession proof market, which is still not at the top, as I was telling you guys, when compared to Bitcoin. It is the 18th and briefing number 102.

All right, so let's move it right along here. We have the usual Safe Harbor statement.

Ships Stacked Up

Now I was struck by this today. What is going on with the ships stacking up in harbor? Oh Lord. There is a huge influx of these ships. In fact, let me show you some footage that was shot by a US coast guard.

This is right outside the port of Los Angeles, Long Beach. In the background, you can Palos Verdes Peninsula. It's pretty amazing.

Backlogged Goods from China

So, what's going on here? Well, there is a huge backlog effect of goods coming from China as the economy comes back and people are tending to buy more goods than going to restaurants and services and movies and so forth. So they're buying things and those things are generally coming from China. So it would appear that China is the beneficiary for what's happened for the last year.

Look, there's a cruise ship. Of course they're not running. But now look, oh my God. That port is stacked with 20 and 40 foot containers. Amazing. So hopefully, there we go. Look at that. That's pretty amazing. And they're just sitting there waiting. They've had some COVID in the longshoremen, but only about 800 out of 15,000. So that's not really the issue. The issue is just a huge amount of incoming business that is just stacked up.

And now it's causing fashion retailers to miss their spring season and so forth. Pretty amazing. Pretty cool, actually. So, that's the commercial situation. That's very, very interesting.

So, well, let's take a look at what's next. Now this is a show. Dan Bongino is right wing. This is not a political excerpt. This is an excerpt about business. You'll see, in a second.

Start of video presentation

Show Commentator: Get ready to hear the truth about America on a show that's not immune to the facts with your host Dan Bongino.

Can't Find a House

Dan: Hi, updates from sunny Florida. I talked about this yesterday. Folks, we're in a little bit of a mini crisis here in Florida, not kidding! The place is blowing up. You cannot, I live down here . I have to move because we need to expand our studio and I don't have enough space.

You can't find a house dow here. You Floridians listening, well, you don't wanna be ridiculous. You can find a house, but you are gonna pay through the nose. I bought our house in Palm City, our first studio, for about what, $500,000 or something? The house now is fetching like $700,000. I've only been in Florida for six years.

Lottery for Bidders

You can't find a house. People are, the bidding wars are insane. I have a friend who moved to Boca. She bought her place I think five or six months ago. It's an expensive place. The place, the same exact model home is on the market down in her neighborhood for $400,000 more than she bought it, just in the fall of last year.

And to get into the neighborhood, real estate people aren't even taking new clients unless you're gonna buy that day. I'm not kidding. There's a lottery to get into the neighborhood, to bid on the house. It's turning into a little bit of ma mini crisis down here. You can't find a house.

Businesses are Booming

I took an old...did you ever eat Blaze pizza? It's like the Chipotle of pizza. I take my daughter there, she loves it. They get a little dough and you like...It's like the Chipotle of pizza, "Gimme some meat balls ," and they put it in the thing. Who ever thought of it it's a great idea.

I took my daughter there to a Blaze pizza...What does that have to do with anything? Ladies and gentlemen, we're supposed to be in the middle of a pandemic. Florida is so hot, it's like the pandemic never happened. The place was packed, and we couldn't even get in the joint. You couldn't even get in the joint.

I ran into my financial advisor there, great guy, he paid for my pizza. You couldn't even get in the joint. Florida is smoking hot right now, smoking hot, inflago. You can't find a house, businesses are booming. But, it is turning into a little bit of a mini crisis because, we're not use to this down here.

I'm not a lifetime Floridian but I've been down here six years. Snowbirds usually leave right around Easter because it gets hot in Florida and they go back. The snowbirds aren't even leaving anymore. The traffic down here is getting pretty heavy too.

End of video presentation

Will it Get Higher?

Riggs: I thought that was really funny. Bitcoin, oh Lord. Now this is an example of, I missed this and I know a lot of people who did, and somebody emailed me tonight saying, why are you putting in your own two cents? I bought at $10. I'm like, well, then if you bought at $10, then you're a whale.

But from just over one year as a 10 X, almost 10 X increase, six years ago, you would have taken $10,000 to over two million. And there are people I know who have done that and much more besides. So does this thing have anywhere to go? Is this going to get higher? Perhaps, but I mean, it's already been such a run, right? It just drives me crazy when I come in late on something like this.

That's what's going on with a lot of things. They're already up, right? Real estate in Florida, already hot. If you're in Manhattan, you're in tough luck but in places that are desirable, it's already up. We just put in a bid for a condo and we were super happy just to get in before the thing went nuts. All right.

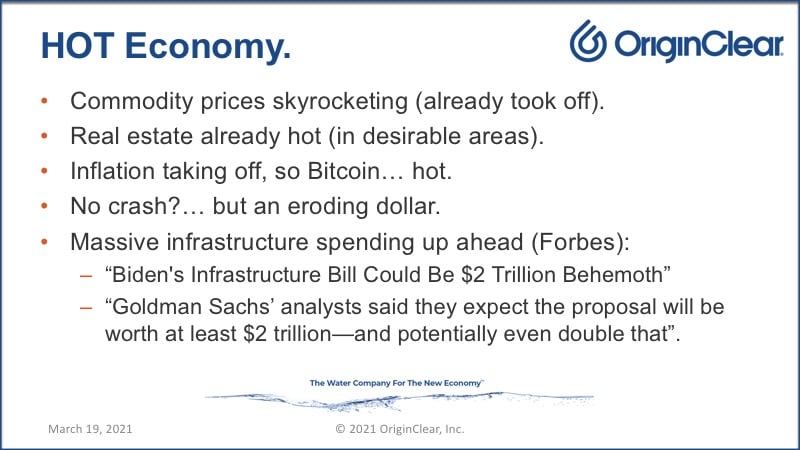

Economy is Hot

So let's take a look at this economy, okay? So commodity prices are skyrocketing, cost of crude oil is way up and nobody's really driving, but 80% up, real estate, of course, as we've seen is already hot, inflation taking off. So I think Bitcoin is hot as a result of that. There's been talk of a crash and I know that SEC got very angry at Michael Burry, the 'Big Short' investor. He's been warning about market bubbles for months, is probably right.

Massive Spending

But, I think they're just going to keep funneling money into the system, but the dollar will continue to erode. That's just the way it is. Now, that's really bad because of course inflation hurts the poor and the wealthy who own assets tend to do well. It's exactly the opposite of what's supposed to happen, but there it is. So I don't think we're seeing a crash crash, but we'll see a loss of tangible wealth.

All right. So then, where to go from here? Well, there is massive infrastructure spending for this fall. Some people say September $2 trillion, some people say as much as double, $4 trillion.

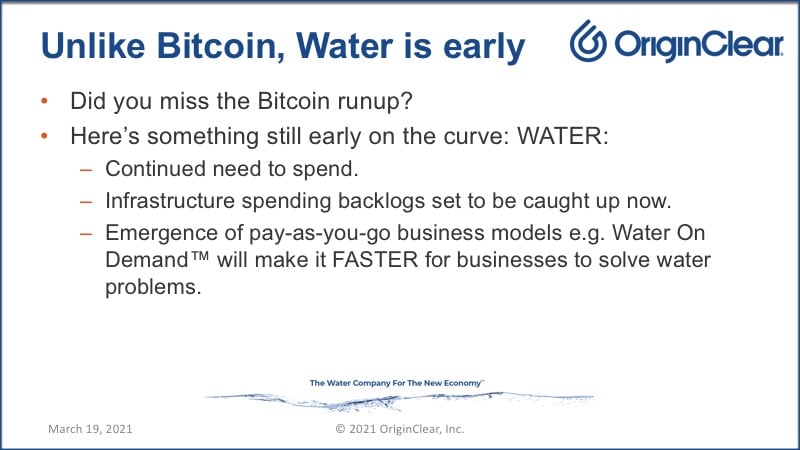

Water is Early

And what does that mean? Well, if you missed the Bitcoin run-up, then here's something that's still early on in the game, and that is water. Why? They have to keep spending on, people have to spend on water. And furthermore, the water rates are going up. So they're costing more and they're priced in inflating dollars. And then now they're presumably going to be catching up the infrastructure spending.

And now this last one is really important because it's how does it speed up? Remember that even though there's money everywhere in the system, credit is actually tough. It's hard for businesses to get loans. It's called hard money.

Pay as You Go

We saw that in the Bush-Obama recession, where there was a lot of money, but nobody could borrow. Very similar here. So pay as you go is the key. And that's our version of it of course, as you know, is Water on Demand™ and that is going to enable it to happen fast. That's going to create the adoption curve.

Real Estate Investors Migrating

All right. Here's, what's interesting is we're seeing real estate investor migration into water as an asset. Why? Because they actually see this as a better opportunity for themselves. You know, that Alfredo Guatto, who was interviewed on this show, he's come in for $2 million. And he working on his paperwork, he signed a definitive agreement, but it's still subject to approval of the board, but he's committed.

Previously, we took $630,000 also in real estate. These are not intended to be spent on pay and so forth. They're intended to be spent on these pay as you go, prepaying, these outsourced water systems.

And then there's a very large investor who's very excited. He's got a hotel he wants to bring in. It's very, very preliminary, but I just heard that that is actually happening. So good news, there's movement here. So it's really interesting that real estate investors are going into it because it is 'a new asset'.

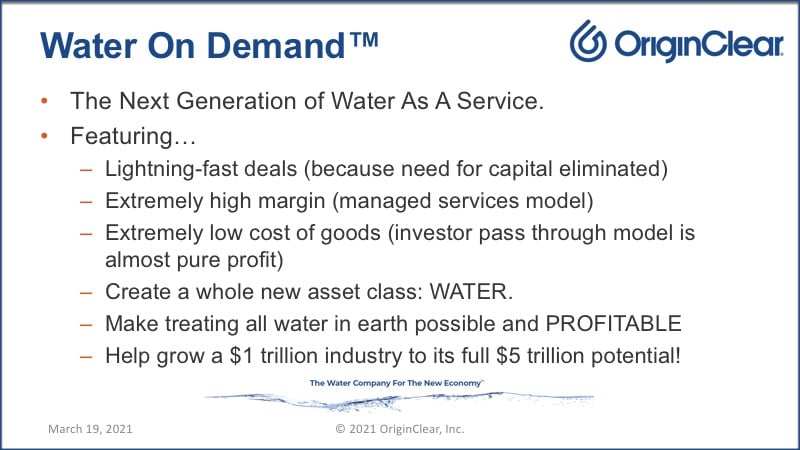

Water on Demand

So Water on Demand is, and I want to just summarize this before I go on, the next generation of water as a service. It features high-speed deals, very high margin because lots of services we take care of it for you almost a concierge model. Low cost of goods because when the investor invests directly, then for us, the pure money play is very low cost of goods.

It creates a whole new asset class, and it can grow this 1 trillion industry, which is only treating what 20% or one fifth of the world's water to its potential. Very, very cool.

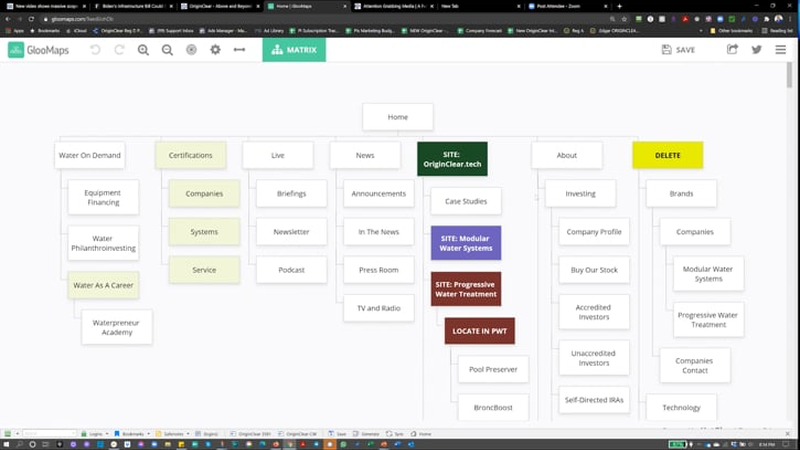

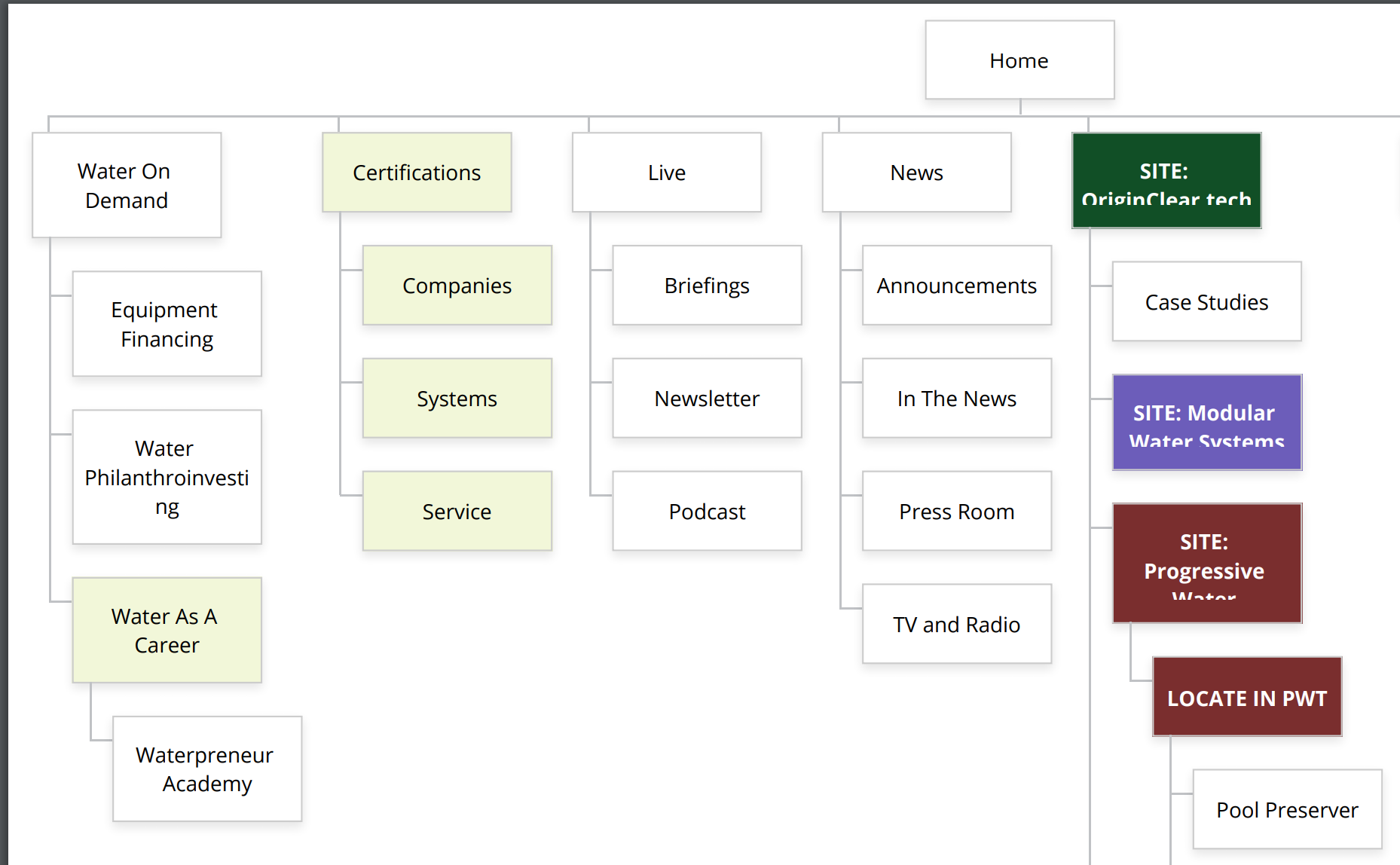

New Website

All right. Well, I'm going to share with you the new website that we're designing and pull that right up here. So presently, what we have is if you look at what we've got here, we've got water on demand. We've been changing things rapidly, just moving a bunch of stuff over. And let me show you where it's all going.

So we created this new domain name, originclear.tech, and that is going to hold all of our technology, Modular Water Systems™, the website, Progressive Water Treatment, our Pool Preserver™ and BroncBoost™, which are two new products that we've carried at corporate are going to go into Progressive \Water.

We've got the lab going on here. We've got our network of licensees, our intellectual property, all that is going into originclear.tech. And then we're deleting a bunch of stuff that's excessive. And here we go. And the About is unchanged, but let me zero in on what is coming here.

Certifications

All right. So over here we have Water on Demand and a whole new tree, which has certifications. When we have money to spend, to prepay these systems on a pay as you go basis. Well, we want to know that certain machines, companies and service providers are reliable for that. So we will be certifying them. Of course, we'll start by certifying our own, but OriginClear as Water on Demand wants to bring in any water company that can meet the requirement.

And the subsidiary that is taking the money in is now being called Water on Demand Number One, with the one in the first one of several of the subsidiaries that their only function is to capitalize these things. The briefings, newsletter, et cetera, we call it Live. And then the News is unchanged. So that's where things are going very, very quickly.

New Look and Focus

And you're going to see it look a lot. The new look is going to be a lot like my friends over at Attention Grabbing Media, AGM. Manuel Suarez just has amazing agency. And the same people that built this website are going to, we believe, are going to build this other one, this, our own that is. So this gives you a sense it's going to be much more marketing-oriented, shall we say, right? So that is where things are going

All kinds of good stuff. All right. So with that having been covered, so just to summarize before I go on and welcome Ken Berenger into the call, because he's got some very important things to say. Commodities are going crazy. The dollar is going downhill. There's been a run-up already. Stock market, Bitcoin, real estate, you name it.

What's at the early stage? Water, and the key is Water on Demand. Now, you're seeing how we're converting our website into this new look, and you'll see a highly focused, very easy to understand website. Our website has been like people go to it and go, "Well, what do you do?" No. It will no longer be a question.

Report from Ken Berenger

Riggs: Okay. So, I'm going to welcome Ken. Are you with us? Hey, buddy. Well, thanks for taking time.

Ken: I have a face for radio. (laughs)

Riggs: I will not accept that. Anyway, so the next slide, will introduce the next topic, which I think is very, very important.

Key Investors

Riggs: "They took a leap of faith two years ago. How are our key investors doing? I'd like you to give me a report from the front.

Ken: From the front line, with bullets whizzing over my head? I can radio this in. So I said this to you almost incidentally, right? I've had about two dozen conversations in the past, maybe week. And the common theme was, in our conversations, I don't want to get too much into the strategy on a call, but I'm kind of talking about what were doing and how our kind of early supporters can help.

When we came into this two years ago a lot of folks had basically on the strength of just their faith in our tenacity alone they continued. I had one fellow, and I'll paraphrase, he said, "You know, a couple of years ago I did this just because I was so far in I wasn't going to let you guys fail."

OK, and the conversation I had with him more recently is I said look if I told you two, two and a half years ago that standing here today, you know here's your analysis, you'd be up $280,000 in OriginClear in your position would you have ever believed me and he said, "Absolutely not."

And they said, "I don't know how you actually did this, and I've been part of it, but I'm really, really happy you did it."

Wow! How Did We Get Here?!

It has been a very gratifying experience in the last couple of weeks to hear investors go, "Holy cow." The past is no longer talked about. It's basically, "So what are we doing tomorrow?" It used to be, "How did we get here?" Now it's like, "Wow! How did we get here?!" You know it's just a change of vocal inflection but the mood is really, really positive.

And we've got a lot of exciting things that I'm kind of dealing with kind of individually with our investors. When I lay out where we are right now, what we've been able to accomplish in terms of a company and what we plan on doing in the next twelve months their eyes light up. And I know this now because I do it on zoom!

They actually, you can see the eyes light up and that's a lot of fun. We spent two years working really, really hard. I remember the first day when I joined, we said, "OK, how do we make everyone who got us to this point whole." And literally we spent a year doing that.

I'm happy to say that everyone who hung in there with us and continued to help us grow are now sitting in a very, very strong position. And with just a little bit more forward momentum can be just...I mean some of these positions have the potential to be life altering. if we get a couple more things right. And so far, we've got a pretty good batting average in the last year. So, lots of happy campers, thankfully.

Riggs: So, those are the, what I call, the founding investors.

Ken: Legacy investors.

What About New Investors?

Riggs: Exactly, but can a new investor do well in what we're doing?

Ken: The new investor has probably the most...it's an enormously generous deal at a time when we don't need to be generous. We're growing so rapidly, we're becoming so strong, we have interested parties that are talking to us for the first time that would never talk to us.

So yeah, the answer to your question is this, the new investor has just as big an opportunity now as the folks that have really kind of, shored up their position. The reason that they're in a better position is for one reason only. They may not have as large a position because they haven't bee doing it for years but there's not going to be this time loss. This opportunity loss like when they're sitting in a kind of a zero sum game for a couple of years.

All of our investors for the past two years have been earning eight or ten or in some cases twelve percent. So there's never been any dead money, but it's not that life-altering, WOW! What we're setting up now can put the today investor in a position in a year that is, you know, the kind of thing you invest in a growth company like ours for. So the answer is yes, absolutely.

Riggs: So, you think it's not too late?

Strongest Position Ever

Ken: Well no. I think where we are right now, at a ten million...I look at a company like AquaVenture who had a great idea, basically followed almost in line with what we did, they had a lot of tings we didn't have, not because they weren't smarter, it's simply because they were generation one, right? Those things hadn't yet come up. We've got advantages that they never had, and they got bought out for a billion dollars.

We've got technology, we've got technology that they don't have. And the software component of that got bought out by a billion dollars.

Riggs: We don't believe in Ms. We just do Bs now.

Ken: Oh yeah no, millions are rounding errors. I mean, you write a check, two million dollars, on your way to the deal. But that's also a symptom of just how awash in money Wall Street is.

Riggs: It's true.

Ken: I think I know where about a trillion dollars of the EIDL and PPP money went. I'm pretty sure it didn't go to the guys who haven't fed their kids in a month right? Unfortunately, it went to a lot of folks who were able to kind of use the system to eep themselves flush. Moving beyond that...

Riggs: But they can fund Water on Demand.

Whole New Phase

Ken: Absolutely, absolutely. And we strongly encourage that. But all kidding aside, I believe right now, we're in the strongest position of a company that we've ever been. But also, we're at the end of the beginning. We're literally pivoting to a whole new phase. When this Water on Demand initiative is truly launched and truly formed, we're a completely different company. And I think that if we get to a hundred or so million dollar market cap, I think that the people that change lives, start to look at us. I really think we become something that catches their attention. And I think we're ready for it.

Riggs: And I'll be fending off private equity firms trying to take us over.

Ken: You'll be having them call me, "Call my guy Ken."

Talk to Ken

Riggs: Well, that's wonderful to hear, and I'm going to go ahead and put up your contact info on screen because you've got some very specific things to say to people, they need to be accredited. Now, we are able to work with unaccredited investors and that's where your team, Gary and Charles, are able to step in and help.

So, unaccredited will be taken care of and it's a very good deal. But you have some very specific things to brief people on. We won't be discussing them in this call. And nobody can get on your... Right now, I think you're scheduling Tuesdays and Wednesday for next week, the way it's looking.

Ken: No, Tuesday is gone. I think that's a rock band, Tuesday's Gone, I think.

Riggs: Oh my God. Yeah, I think you're right. So, bottom line is people should just put oc.gold/ken in their browser and book a call.

Various Chats

Ken: Interesting panelist comment from Rick.

Riggs: Oh, Ricardo Garcia, "I'd like to vouch for the fact that it is possible to start as an unaccredited investor and become one." Yes, Ricardo Garcia was not quite accredited, but he worked his way through the regulation A offering, and then managed to become one of our accredited investors, a real success story. And that, Ken can tell you about if you're an almost accredited person.

JRW, "Good evening." Alexander, "Thanks." Darrell Polston, thanks for jumping in Darrell. "Interesting dynamic coming for water. Ramp up is coming for hydrogen using electrolyzers." And of course, when you talk about electrolysis you're talking about water, it's true. Frankly, I see that as a secondary opportunity for water just by volume. People forget that most of the water being used is actually agricultural. Bruce Ferguson? I'm not sure which Bruce that is, but he's saying, "Hey, Ken." And then JRW says I have a face and voice for text. At least you got the radio voice there, Ken. So, phone numbers, there's the 800 number. Call Ken, or just email invest@originclear.com. Click on oc.gold/ken.

About WaterChain

All right. Now, Rich would like to know if there's going to be anything in the future for OC regarding WaterChain™. Very important. We need to focus on the real world implementation of outsourced water treatment on demand. and that is what we're focusing on. Having put in that layer of reality, we can then abstract that activity into a smart contract environment.

I showed you on a few shows ago, how complex the ecosystem is in the water world. Well, all that can be turned into automated smart contracts, Ethereum style, using a crypto-like WaterChain. So, all you got to do here is, implement. We want to implement, not just in the US. And then of course, I do believe we will do the crypto, but you won't be hearing me go on and on about it because we want to keep our focus.

Getting and Staying on the NASDAQ

Wayne wants to know what will it take to get on and stay on the NASDAQ. And stay on is a very good point you're making, Wayne, because we could get on the NASDAQ today with a little bit of financial engineering, but we wouldn't last. What we need to do is to gain assets. It's an asset game. We need at least $4 million in assets. And that's after accounting for our liabilities.

Well, how do we do it? By these machines that we don't sell. We put them out there on a rental or paper use basis while they remain our assets. And so, the more money we raise into these subsidiaries, Water on Demand number one, Water on Demand number two, Water on Demand number three, each of them being multimillion dollar accounts. We're going to be able to count these things as assets and that's key to the NASDAQ.

The second part, of course, will be the fact that pre-funding water systems is going to make our own sales take off. Last week, Dan Early, our chief engineer told us that one-third of his deals at Modular Water Systems could be done almost right away using a prepaid option. And that means he's got about a $12 million forecast of prospective business. So, that's $4 million. So, it basically doubles our revenues very, very quickly. So, that's pretty interesting.

VIP Position

Now, great. What is the cost of the share when you start to date? I'm not sure I understand that, Alejandro. But I think I know where you're going with that. Alexander, if you could call in, it'd be wonderful. And we can discuss that specifically, because I think I know where you're go- We structure it differently. We don't sell you a cheaper share at all. We haven't done. We haven't sold common stock for years now.

We put you into a preferred share with a 200% redemption. You get double your money back, et cetera, et cetera. And the price is the price later on. If the price is 5 cents, 10 cents, whatever it is, that's how you get your conversion. I think I've answered the question, but Alexander, please feel free to schedule a call. Okay.

Ken: I often over-simplify it by saying, "Your investing as an insider investor with tremendous advantages, with a lot of kind of perks and benefits, built into the unit offering."

Riggs: Well, you're getting a VIP position because you're sitting on the side, earning dividends and you can jump in and grab stock anytime you like. It's the best of both worlds.

Next Week

Okay. Next week, Modular Water Systems is on fire. I got a briefing earlier this week. The amount of deals they have cooking. Dan Early is worried about the ability of Progressive Water, our Texas operation to process all that. Now, not to worry because we have other water companies we can put business on to. And besides which, Marc Stevens is a fantastic manager, but this is good news. And we're going to cover that in greater detail next week.

Thank you everyone for joining us. Thank you, Ken, for jumping on. I have another chat saying, "Here we go." JRW has been following along for a while and he'll be talking to you, Ken. Everyone, it was fantastic joining you again. I'm loving every single one of these weekly briefings. Do join us next week. Thank you all. Goodnight and have a great weekend.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)