We welcomed Water on Demand's new General Manager, Manuel Vianna… He's not only extremely qualified but brings a wealth of experience! And just in time…Global water scarcity is accelerating decentralization. Is Water as a Managed Service the new Frontier? Find out here!

Transcript from recording

Opening

Show Host — Riggs: Welcome to our webinar, the Water is the New Gold CEO briefing. Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

Major Financier: The plan that you've built here is super impressive.

Investor: The world is seeing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

Welcome everyone to the CEO briefing, and I see people are still arriving, so that's good. And I'm just going to a couple of people with chat requests. I'm just going to take a look here. See what people have to say this morning, this evening.

Ron, "Good evening, everyone."

And Jing Yun, "Good evening." Uh, Jin Yun Yang, excuse me.

Keith Roeten gave me a one of those things (Emoji "OK" hand sign)

And Don Gauden says, "I'm finally able to come after months and months. Thank you. Here I am."

All right. Well, welcome. Without further ado, let's get let's get this party started. . And Water is the New Gold. "Helping you thrive in the world's ONLY vital, scarce and recession-proof market."

Of course, you can watch this in Spanish. Just click on the Globe symbol.

You know, the Safe Harbor statement, we do our very best to tell you how it is and if it works out differently, we'll tell you so. I've got two people raising their hands. Please use the chat function. Raising hands will not work for you. All right.

Lack of Tech Implementation

There's a very good story. I was sent in Bloomberg from yesterday and it's the global water crisis. And you know, this is really, you know, the story. More than 10 percent of humanity lacks access to it, while 90 percent of natural disasters are linked to it.

And major cities have nearly run out of it. So this water crisis has arrived. A combination of warming climate and growing population mean dwindling supply of fresh water. Actually, we like to say that it is a lack of technology implementation that's led to it.

And Jing Yun says, "This is the first time I joined the the webinar, very excited." Well, thank you, sir. If you're a gentleman.

Groundwater

All right. Now. Interestingly enough, that there is a great deal of farming that relies on groundwater, a third of all farming. Think about that and the groundwater is is going down. So what did we learn from COVID 19, from the need for increased global cooperation, et cetera? So what about all these things? So, there's six people who were interviewed for this article.

Water Rights

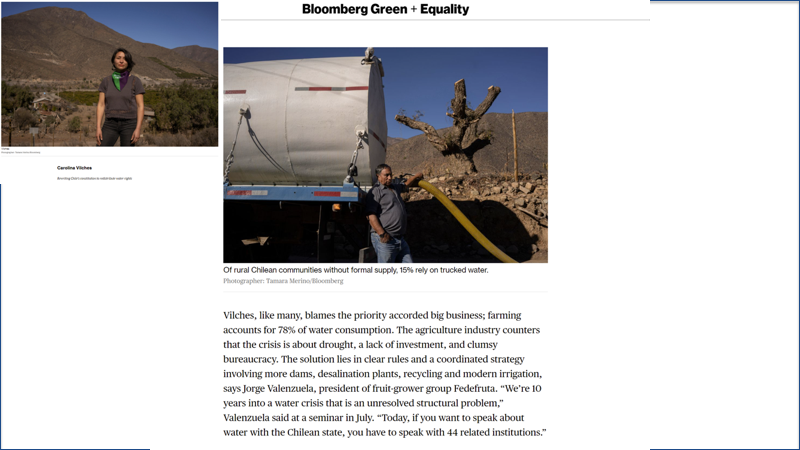

This Carolina Vilches in Chile is rewriting Chile's constitution to redistribute water rights. And in her country, which has been a huge farming success, farming is 78 percent of water consumption that's pretty much across the board in most countries. That's kind of how it is. Agriculture takes most of it.

The problem in Chile is that if you want to speak about water, you have to speak with forty four related institutions and this is a problem in water treatment and recycling as well. In the United States, for example, it's all down to the city level and I will deal.

Water Management and Sanitation

I have an interview later about that. Peter Gleick created in the field of water management, and he built a fascinating organization, and here is a very good term, "soft water paths" to manage demand and improve efficiency. So he's defined peak water when things such as pumping and contamination make the cost of use prohibitive.

Well, contamination is a big deal and we are here to deal with the contamination issue. Ok. The failure to provide sanitation to people is not about a lack of technology or money. It's about corruption and inequality.

Reducing Waste

Ok, Alison Wedgwood bringing water to remote areas through cell phones and now she has launched e-water services. And here's what's interesting "even a tiny sum charge vastly reduces waste if it's not free," so it's very, very important. People say water should be free.

Well, yeah, water is a human right, but transferring, delivering it and making it safe to drink has a cost. So somebody's got to pay for that. So it's all about access. Economists say trillions of dollars of value could be unlocked in developing economies if clean water, toilets and hygiene were widely available.

Leasing Water Rights

And here's Peter, Ed Peter, who buys up water rights and leases them to farmers. And that's he made a huge amount of money in Australia when a drought came along, and technically he's a speculator. The way he looks at it is, it's a way to allocate water where there is the most need.

Unfortunately, there's lots of bad things happening with toxicology and so forth. And so when it's a when you lack a general regulatory framework, you have a problem. So that's not great, but that's what he does.

Front of the War

Ilya Espino de Marotta is the second in command at the Panama Canal. And do you realize that the Panama Canal is running out of water because the rainy season is starting later? In addition to droughts, eight of its 10 greatest storms have occurred over the past 21 years, and the reservoirs they've got are not enough during the rainy season to keep it for the dry season. So there's a whole problem with that.

So I'm not going to go into it further. But the point I'm making is that climate change is inescapable. There is always a fight between population and industry in this case, literally allowing enough water for vessels to go through versus what the two million people need from these artificial lakes. So this is really we are at the front of the war.

Ok, I had a great conversation earlier this week with Omar Hamdi. He is builds editorial stories and he is writing a story. He was responsible for the Newsweek article we had a few weeks ago, and he's making a parallel between energy and water decentralization. So that was something that he really wanted to understand better.

So let's take a look at what he had to say in our discussion, because I think it was very it's kind of inside baseball because it talks about concepts that are sort of insider, but I think you'll enjoy it.

Start of presentation

Accelerating Decentralization

Riggs: What I'm seeing here is because now we are in, we are we're in payoff mode, we were talking. I've talked decentralization since 2016. Now we're doing it. Just as with this, these energy phenomenon that's happening that we just discussed, it's happening in water and a very innovative company has leapt forward to actually pre-fund all these things to make them happen virally. Almost a viral implementation of water decentralization, right?

Because Omar, if you happen to have a brewery, as in my example last night and you've got a water problem and a million dollars, I don't have, I say, Well, don't worry, just sign here. The deal is done. You know, we'd like to say it goes from selling to blessing and blessing you with a solution as opposed to trying to sell you one. And that it's a huge accelerator.

So it's actually an industry wide trend, but there's only a few players still in it. It's pioneers. And so the whole idea of pioneering decentralization by making the buying experience frictionless is kind of part of decentralization. I mean, that's that's the whole deal, right? There's not a lot of capital required.

Paying as a Utility

Omar: So would you say that water decentralization is further along than an energy decentralization? Or which one is the leader? Which one is the primary case study and which one is the parallel where we say it can work here, too?

Riggs: We saw in America, we saw SolarCity do the same thing. We'll pay for the solar panels. You'll just pay the utility bill to us. It's a direct analogy to. To what we're doing. The solar panel on your roof is a reality in America, and I think more and more in. Europe, despite the lack of Sun.

So we're seeing a lot more penetration of decentralized energy than decentralized water, like, for example, one of our deals that we're putting on this Water on Demand is a housing development near our center in Texas that is going from 10 homes to 30 homes. And they could they need to have build their own water system now.

It's no longer the city won't take their water. Oops. And they didn't have the capital because it's a homeowners association. So we just said, Fine, you go, just pay us by the gallon. Thank you very much. It seems so natural. You like, Well, that's not news. That's like normal, but it's not being done in these smaller sites.

It's being done a big deals like desalination for entire islands that's being done on a service basis, right? Like this company told this... I don't know, Jamaica, "Don't bother paying for the system, we'll just charge you by the gallon." Those are big, the small is harder and we in a couple of others, like Cambrian, are innovators in that area because at the end of the day, there's many more small people than big people.

Centralize vs Decentralize

Omar: So I think that's incredibly helpful. So thank you. I think there's a lesson here for everything else. Let's decentralize all public services. And best example is water. Here are some case studies, just like we've done with energy. Here are some case studies.

This is real, and let's embrace decentralization because that is and that is a premise to your argument. Someone can be completely sold on water shortages and completely sold on crypto. But no, I don't like decentralization. No. And I think also just to put the British and the European context on this, Governments tend to be bigger on this side of the Atlantic, so it's very acceptable in Britain and certainly in Europe to talk about centralization as the solution.

It's public ownership and people are talking about even transport systems, public ownership in certain circles, including probably in my circles. It's quite intuitive to say that decentralization is great and empowering and efficient. That's that's not the case everywhere.

Riggs: Well, I think you're saying from across the pond that America, because of its very fractionalized governance, because literally we put water treatment in the hand of the cities, right? And so this is opposite to what we see in Europe, which is, you're right. I mean, look at Israel, they've achieved 90 percent recycling rate because it's a very centralized. They're like, mandate, know you're going to do it and it works. America for better, for worse is a very decentralized country.

Omar: How would you respond? Because the Israel case study seems like a counterargument to what you're saying. Sure.

Riggs: But Israel, population wise, is the size of an American city.

Omar: Well, here's a city. Yeah, yeah, yeah. We forget that. Don't read. I think we forget that a lot when we say it works in Israel, it works in Finland, it works in Iceland. You're talking about, you know, a couple of zip codes of New York City or London or something.

Riggs: Ok. But also we've seen look, we have inherently a more inefficient model in America, and it it's really coming to light with all this drama about certain states being totally COVID-pro a certain COVID-anti. And they're radically different. You wouldn't even think it was the same country, right? This is the nature of the beast now.

It's inefficient, but it's also really good for it creates labs. We have laboratories like how well did Florida do with COVID, how well the New York do, and we can look at it a few months later and go, well, OK, learning lessons, learning experience. The point I'm making is perhaps what's happening in America as a harbinger of what might happen in Europe? Because why may I ask you, are we doing decentralized energy in Europe if everything is so good? Is it being government sponsored? How's it working?

Omar: I don't know. I think I know in Britain they had a scheme that it was government led, but it was decentralized. So there was there was a sort of gold rush about 15 years ago. I don't know if it was British or if it was European Union, and it would say it was a subsidy for anyone who wanted to put a solar panel on their roof.

And all of these companies emerged as a sort of middlemen or brokers for their saying. There's a little bit of government money you can get your hands on and you'll get your solar panel and eventually you'll break even. So I think it's government putting a bit of money in. So the financing is centralized, but the actual physical infrastructure is decentralized, right?

Riggs: Look, I think that we can get away from the policy issues and just say, look, one big reason for decentralization is to reduce the load on the central system, right? It's ecologically we wrote a white paper which I can send you the link, but it showed that this carbon savings by treating at the point of use rather than sending it through pipelines and treating it down the road.

And so the whole idea of shipping your waste to a central location is inherently wasteful because you could just treat it right there. And then the central location is treating is treating just treated water. They're just doing the last bit and so dramatically reduces the load. Very similar to energy.

That's what we're trying to do with energy is reduce the load on the central energy plants. It's not that decentralized is bad, it's that it's good to do the mainframe versus PC thing, not push things out to the edge. Seemingly inefficient, but actually good because it reduces the traffic jams of the center.

The other point, Omar, is that is that today you can't build giant central plants anymore because places are built up. And there's also environmental regulations. And so we have to use what's there. Try and build a large plant anywhere, even in Europe. No, because of the reviews that go on, it takes 10 years. It's horrible. So instead, just do stuff at the rim, and I think that is a good argument. There's a couple of arguments there.

Omar: Yes, I agree. I'm very grateful for this conversation. And I think I think we've got a good plan to get you what you need commercially, whilst at the same time keeping it very closely intertwined to what's going on in the news. Certainly in the UK

Riggs: I really appreciate your spending the time on this.

Omar: Thank you, sir.

Riggs: Thank you. Have a great evening, Omar.

Omar: You too.

Riggs: Bye bye.

Omar: Cheers. Bye bye.

End of presentation

Parallel with Energy

So that was good I'm seeing here, I'm going to move right along here to Dave Johnson's interview. I just wanted to say that. There's a real mission here to explain to people why decentralization is happening, which it clearly is. But the public is not really being kept up to speed on it. But businesses know, and so the parallel with energy is a good way to explain it anyway. That is, you'll probably see a story come out on that in a major publication soon.

Let's see what we, uh, a quick interview with Dave Johnson, one of our great investors. Here we go.

Start of presentation

Riggs: Dave Johnson, welcome and thank you for taking this meeting with me. I understand that you're a longtime investor in OriginClear. Oh yeah.

Dave: Actually started in 2009 with Origin Oil.

Riggs: What do you think of how we've done moving into the water space?

Dave: Originally about that time in 2009, I had picked like a half a dozen companies that I put a little bit of money into all of them as purely speculative kind of investments. And I think there's only two remaining in OriginClear is the one remaining in my portfolio, but the one that I've continued to add more money to as the companies progressed.

Riggs: So yes, my experience has been the same as like, well, OK, if I get one out of 10, I'll be super happy, right?

Dave: Yeah, exactly.

Riggs: So but it's hopefully that makes up for it. I mean, that's the whole idea is that, you know, this is not your conservative investing strategy. This is for a portion of a portfolio which has the upside. First of all, I just want to ask you, how's in general? How's your investment doing? I'm not asking for numbers or just how happy are you?

Dave: Yeah, well, I'm happy. You know, I have about half of my OriginClear investment in an LLC that I do a lot of trading in. I trade options every day and the other half is in a Roth IRA, so I'm collecting some dividends, which I'm thankful for. And because my most of my investing now is not for, you know, long term growth because I'm getting older and it's more about income at this point in time.

So but I do want to tell you that my interest in water and wastewater go back to the mid-70s. I got a master's degree in water and wastewater engineering from the University of Wisconsin into a wave. Back then we called it sanitary engineering, but it's, it's changed a lot since then. And so I had some some kind of genuine interest in the whole field and that I actually, as my career went on, I didn't do much engineering. I went into management of the company, but I've always kept in tune with it, and that's why I'm still an investor.

Riggs: Of course, back then it was everything was centralized. You know, municipalities, but that was the game. What's your take on how things are becoming more and more decentralized going towards the actual owner operators? What's, do you, are you in touch with that trend at all?

Dave: Well, absolutely. And I'm, I mean, this is the reason that I've continued to invest in OriginClear and keep keep track of it because like you, I believe that this is the way the industry is going to progress. And in fact, you know, on a on a worldwide basis, not just in this country

Riggs: Where we're now starting to not just raise money to to operate, but also raising capital for these water equipment purchases. The whole Water on Demand idea. First of all, requires us to be much, much better at our job because we're not just selling widgets and delivering it. We have to keep operating it, and it's almost like a high tech kind of job. How many companies have the capital to fund a machine that they can just put out for 15 years on the services, right?

Dave: Riggs: Well, I have a meeting with Ken tomorrow morning, as a matter of fact.

Riggs: Meanwhile, as you know, from watching the CEO briefings, Dan Early has been prepping a bunch of what he calls DBOO, Design, Build, Own, Operate, type things and he is, he is ready. I mean, he's like, OK, let's do this thing. So I think on both sides, we've got investors excited about jumping into the asset based investing, which carries a solid set of protections.

And then, of course, Dan is prepping the the pipeline because he's eager. He's got so much business lined up that he's worked hard to to quote and design. And then it just sits there waiting for what permitting funding, whatever, right? But typically, funding is a big, big factor, and he can't wait to just, you know, just say, here, don't worry about the capital, just just sign here.

Dave: Something that leverages the, you know, the whole concept of Water on Demand with with other companies that are, you know, have similar capabilities.

Riggs: Potentially very scalable. I mean, right now, McKinney, Texas we're so overloaded as good. I mean, there's been a lot of sales, well over 30 projects in the shop. And you know, we're trying to do, of course, is to unload things to subcontractors and just do final assembly. And McKinney, that's a whole thing that Tom and Marc are working on.

But meanwhile, as pure fund administrators, we can deploy money to another company, make sure that they meet requirements and will have. In fact, we already have a person lined up to do all the due diligence and contract awards, and that's a whole game and it's very scalable, you know, financing is much more scalable than operations. Oh, yes.

Dave: Yeah, for sure. You know, I've been an investor for many years and even speculative stuff I think has to, you know, has to have some kind of real foundational business. And I'm glad to see that that's happened for OriginClear. That's one of the reasons I keep investing,

Riggs: So thank you. And you know, Ken is confident that he can put together a five million dollar package of water investing, water asset investments. And I'll tell you $5 million done, let's say, over the next three to six months is going to be transformative for the company. Right. Because not only, you know, A. it's $5 million B, for the operators, the operating side, it's money up front. And C is this incredible tail of ongoing annuity revenue.

I think it's going to, you know, create a whole new company and I can't wait for 2022 and the fun we're going to have. I can't wait to hear the postmortem on your discussion with Ken, like, Oh my god, Ken killed me, but he he'll be gentle.

Dave: Yeah, I know. I consider him a good friend now. So we've talked many, many times.

Riggs: So yes, likewise, he's an amazing friend and we're so happy to have him in the company. Frankly, you know, in 2020, when we were reinventing the company he and I were just day and night, you know, 11:00 at night. What do we do?

And I think what we have today is in great part due to him. So I'm glad you'll be talking to him. And Dave, I want to thank you again for for being such a long term investor, for believing in us, not losing faith and and you know, we really are going to succeed in great part because of investors like you.

Dave: Well, thanks. It's my pleasure to participate in the call, and I look forward to a great future going forward. Well, keep it going.

Riggs: Thank you, Dave, and best of health and luck for the balance of the year. And let's let's get prepped for an amazing twenty, twenty-two.

Dave: Mm hmm. I'm looking forward to it.

Riggs: Thanks.

Dave: Thank you, sir.

End of presentation

Great News

It's a great investor. We just love him. I've got a couple chats here to check in on. So. I'm going to we have some great news coming up from the PhilantroInvestors® team who highlighted OriginClear. One event with high net worth individuals in Rincon PR, Puerto Rico, and also the Real Estate Investment Association Puerto Rican monthly meetings. That's very cool. Thank you Ivan Anz and Vendy Rios for making that happen.

Ok, now . This is what you've been waiting for, is the interview of the new general manager of the Water on Demand. Manuel Vianna is has a Harvard MBA, which is the least of his qualifications. So here we go. Let's play the video that was that was shot just a couple of hours ago.

Start of interview presentation

Riggs: Manuel Viana, good evening, and how are you, sir?

Manuel: Very well, thank you. How are you Riggs?

Riggs: I'm fine. I'm fine. I'd love to speak a little Portuguese with you because of course you are one of my Portuguese friends, so Boa Tarde. Good afternoon in Portuguese. I wanted to talk with you about this new assignment that we've nominated you for. And you've been now with the company for, I think, over six months working on a number of of key tasks. And one of them has been to help to create the the financial structure and model for what we call Water on Demand and a 25 year model that encompasses an amazing number of variables. It's fine job.

And so now, of course, we're starting to receive funds into this Water on Demand Number One Inc. The subsidiary that's been created and we need a competent general manager. So that is our intent is to bring you on as general manager. Now you're not in full time, you've got some other things going on, but ah, hopefully we will make all those things irrelevant.

And you'll you'll be like, throw it all away because this is exciting, but we're very happy with the amount of dedication you're able to give now. And for our listeners and shareholders, I wanted to just go over a little bit what your qualifications are, why we think that you will do why we know you will do a wonderful job. So let's just tell me a little bit about, you know, your schooling, your background, what, what kind of stuff you've done over the years?

Manuel: Well, OK. Thanks, Riggs. Well, you know, I'm a production engineer, so I've dealt with a lot of capital deployment projects and designing and balancing production lines, distribution systems, all that kind of good stuff. And I've also been an MBA from Harvard Business School, and I worked, you know, I have worked as a consultant. I have worked as an investment manager and I've had several line management responsibilities. I've been CFO of a advanced diagnostics kind of a biotech company. I've been a COO and CFO of a stem cell therapy company.

Riggs: One of the first right.?

Manuel: One of the first. And it included, you know, developing a whole new facility kind of state of the art world class at the time when there were no blueprints. So we had to really figure out what was needed. And I've also worked, as you know, a CFO of a software company, in high tech world. So I've done a lot of that.

And importantly, I think very relevant to Water on Demand program is I've worked as an investment manager, private equity, starting my days at Monitor in Boston, where I evolve towards working on the investment management side of the house. And we had over a billion dollars under management of various asset classes.

And more recently, I worked in a private equity fund based in New York and backed by them, and developed several businesses, including waste management, business and, you know, a physical therapy network. And this was a fascinating business.

We started with the first acquisition of first clinic, and in two years we were over 150 locations, so there was a lot to think in terms of capital allocation and managing the system as we grew that fast. So I'm excited and the first few months working with you, I really got involved with with the design of Water on Demand with you, and I'm looking forward to making it happen now.

Riggs: Well, it's an amazing honor because you literally you have been working in the B's, the billions. And as you know, it's my personal ambition that that we one day could become a unicorn and be worth a billion and you have an idea of what that means. I wanted to backtrack a little bit about you mentioned Monitor Capital, Monitor Group, Monitor Capital, which now is a unit of Deloitte. One of the top three CPA firms in the country.

Manuel: Right, right, right. Yeah. I mean, I joined just off of my MBA working with Professor Michael Porter, who developed a lot of things about evolution of industries and how you create new business models and how you become more competitive over time. And so I started there after my MBA and I grew through the ranks and ended up being, you know, the board of directors and the global operating comedian. And then I moved over to the investment side to put in to actually try to leverage a lot of that thinking in terms of making more money and structuring businesses for great for better return on capital.

Riggs: It's wonderful, and you're being very modest about that physical therapy network, because it from what I understand, you basically grew it tremendously through consolidation.

Manuel: That's right. Yeah, we did. We actually went from zero to one of the top 10 in the country in less than two years. And it was a lot of work not just negotiating the deals, but then integrating them all and making sure that they were all the same technology platform and customer contracts and pricing. There's a lot of moving parts that you got to pull together, so it was kind of hair raising, but super exciting.

Riggs: Well, hair raising is probably the least of it, because from what I understand, it got kind of ahead of itself and sort of kind of hit the wall in terms of its expansion. Tell me a little bit about that and and because I have to tell you, well, that I often on almost every podcast I'm on these days, they say,

What did you fail at, right? Because the conventional wisdom these days is that you, you know, you don't necessarily learn from your successes, you learn from the failures. And I. Had a talk about a failure that I had in the 80s, which was very distressing and learned from that my own set of lessons, which I've applied since. But tell me a bit a little bit about what you might have learned from from your experience.

Manuel: Well, I mean this, as I as I mentioned, this company that I spearheaded was backed by a private equity fund and the company, the physical therapy company itself did not hit a problem or hit a wall. But the private equity fund was growing very, very fast and did get ahead of itself. They ended up having some compliance problems on the fundraising side, and it really affected us.

And for me, you know, I felt a little bit like we're doing a great work, achieving great results on the investment side on the management of the capital. But we felt a little bit let down by the failure on this other side that they had legal problems and that of course, affected the business, affected the business I was doing.

I think the lesson Riggs is that details matter a lot, and particularly when you're dealing with other people's money, you know, there's a fiduciary attitude you have to have at all times and not get overexcited and not cut any corners.

And one thing I guarantee you is that in this capacity, working with you and doing going to do my best to make sure there's no trouble, you've done a great job over all these years with OriginClear, you know, no problems with the SEC or anything. It's a very regulated business these days of running a public company. I intend to make sure that we don't get blindsided by anything.

As I said, details matter a lot. And I think keeping in mind what the goal is, which is create value for the shareholders and service the customers really well. Those are the those are the overarching goals. But it's a matter of making sure that we cross all the t's dot, all the i's and, you know, structured the business for sustainable growth and in a way that some administrative issue that we're not even pay attention now does not come back to bite us later.

Riggs: Well, you know, this is in fact what I also perceive in sort of reading between the lines is that you were frustrated that you didn't have the power to change what was being done by these people. In other words, they were just going full speed ahead. You were like. But. Well, excuse me. And and literally these people were, you know, this sort of like, you know, gung ho, you know, over the ramparts kind of point of view and what I take.

You know, this is a major, major critical reason why we designed Water on Demand to essentially be organizationally independent. Obviously, it's a subsidiary of OriginClear. But from a management point of view, we want you to feel that you are in charge of, you know, it's going to be an interesting process where we bring in money from investors. We purchase water equipment and we deploy manage services so that they then pay us by the gallon.

Well, the water had better be cleaned to the contractual level. The machinery has to be kept running. The collections have to occur. There has to be an inflation indexing because we know what's going to happen with inflation. And of course, money proceeds have to be returned to the investors and the stakeholders. It's going to be quite an interesting Swiss watch. And I think without you having autonomy as obviously responding to the board of directors, but being yourself able to say, you know, we're going to do it this way and this is how I feel and this is what we're going to do. And here's why I think it's critical.

Manuel: I agree, and I actually am. I think that's is very, very important. It contributes to my not just, you know, confidence but excitement taking on this mission because I think, you know, we were talking about some of the lessons. There are lots of good lessons as well that I learned over the years, and I feel like it all comes together now.

And I see how a lot of the good lessons and the bad lessons they all apply. And you know, I'm, it's a job of precision, of perspective. As you said, it is a Swiss watch, you know, many moving parts. It's also a labor of love in the sense that you know, we're going to. We have a unique opportunity here to cause a huge impact in the water industry. And so we're going to go for it.

Riggs: Wow. Well, that's a wonderful thing. And I agree that, you know, coming in at the small to mid level business sector, which is still relatively untouched by the big guys, only a few people like us and a couple of others are really doing it. But you know, there's, I observed on a on an interview that there's many, many more small people than there are big people, and so there's a strength in numbers. So I think it's going to be complex, but I think it's also going to be the, you know, the future.

And then what's interesting is this eventually when when we feel we can do it is to deliver the dividends with this new, you know, cryptocurrency. In good time, because we don't have to have it in order to operate, but eventually it's going to become a very attractive way to then create the ability of people who are getting a twenty five year residual.

Well, maybe they can accelerate it by, you know, selling it at a discount and things like that create a market. And that's going to be very interesting, too. So that whole combination is going to be really, really exciting. I think it's something that the market is going to sit up. The market is going to sit up and take, you know, pay attention to. And I think that you will be a rock star and you will you will demand to work full time and we may even let you.

Manuel: Ok, that's good. I like that

Riggs: Anyway. Well, anyway, Manuel, many, many thanks muto obrigado. And I look forward to many great things with you. And let's let's have a very successful engagement and I'll be playing this tonight. I hope you'll be on the on the show listening in with us.

Manuel: Well, I will thank you for having me on your briefing tonight.

Riggs: Well, you know, what we'll do is we'll have you as a co-host in background in case questions come up. People want to, you know, they can put things in the chat and you can help answer them so that we really what I want is, is for everyone to feel that they really they know you and that that you are really the person, the right man for the job. So thanks again and I'll be seeing you later.

Manuel: Very good Riggs. See you later.

Riggs: Ciao.

End of interview presentation

Audience Comments and Questions

Riggs: Ok. Well, we have wow, we have a ton of chats here. There's a bunch of responding happening here:

From Jin Yun Yang, "We are helping a leading Japanese water technology holder to find potential collaboration partnerships. And so one company we reached was concerned about the small scale we have. Does the water decentralization really the future of water, US water environment?"

And I would say, absolutely, you're right to be being small is not a bad thing. As we were learning. It makes us very nimble, right? We're able to bring on a person, an amazing person like Manuel, and put him straight to work on this.

So Pamela, there's a conversation going on between Pam and Ken. I'll let that go on. And also, we have Chris Whitt, "What is the least amount I can invest and get in the meeting with? I want to get involved."

I'm sure Ken will handle that too. Ok, excellent. And JRW, "Greetings to everyone."

If anybody has any questions for Manuel while I continue, I'm just wrapping up. We're almost at the end of the show. So if you have any questions or concerns or statements, put them in the chat, please.

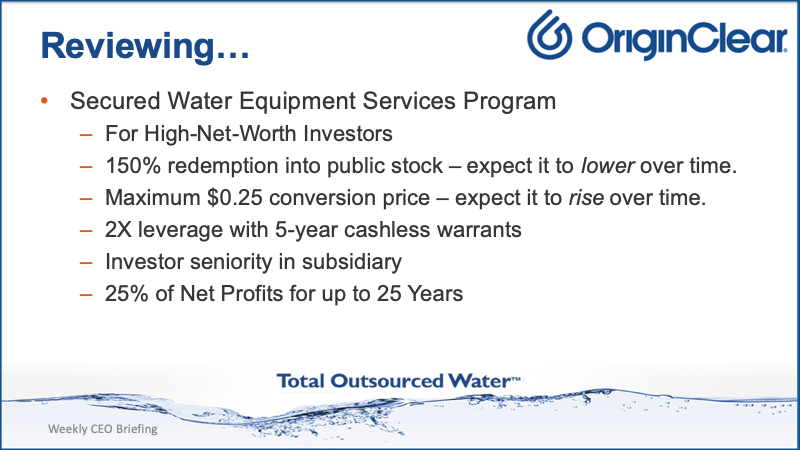

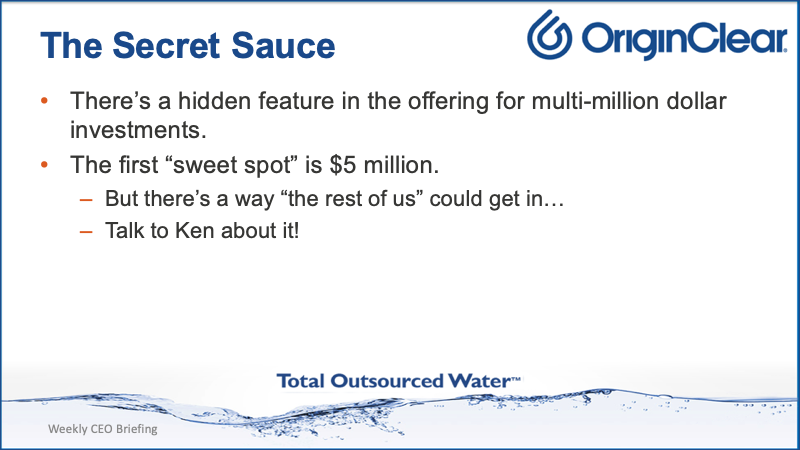

$5 Million Club

Ok, let's let's move into the final stage, the wrap up stage here and I'm going to share a screen again. And this is. We've been talking about Water on Demand, well, what does that mean from an investing point of view? So essentially what we're doing is we're building to the $5 million club. That means that we intend to raise $5 million from our existing investors with an excellent, very leveraged opportunity that has seniority in the subsidiary. So you have a measure of protection and a percentage of net profits.

Sweet Spot

Now there is a secret sauce that makes this possible. That is very special and that is the $5 million sweet spot. But the rest of us can get in on what we're doing here. We have a major partner coming in with a portal that's coming together that is going to be raising a ton of money from institutional and lots of accredited investors. But you get a beautiful first front row and a the better offering right now.

Call Ken

So that is what Ken offers. Get your your briefing from him. And by the way, you don't have to invest in Water on Demand, there is the other offering we have, which is even more leveraged.

I will let him discuss it. Simply schedule a call on oc.gold/ken or call him on ext. Two zero one and the email is Invest@originclear.com. I got another quick chat. Chris Whitt, please? Oh, from Ken to Chris Whitt. Ok, good. And that will happen as well.

Quickly, be sure to register for next week. As you can tell, these are exciting events, lots going on. We are moving into high speed and we've been, you know, we do wonderful things building systems. But moving into water as a managed service is a whole new frontier.

And our investors are making it possible. So that is what I love about what's happening right now is the potential for really making change happen. JRW wants to know if there's any news for non-accredited investors right now. No, but we hope to change that soon. I unfortunately cannot discuss our plans at this time, but we really want to bring on the unaccredited investors for sure.

So join us next week and we'll be happy to tell you more about what's going on. We've had more people raise their hand. Please drop, just type something in the chat window because I'll give you a few more moments. JRW says, "I guess I'd better buy OTC stock for now." And that is absolutely, I think, the thing to do, but of course, I don't make stock recommendations.

Thank You

All right, everyone, thank you so much. It's been a very productive. I hope you enjoyed listening for the new general manager, Manuel Vianna, who has brought a wealth of experience, including some of the storms he's gone through over the years. And he will be available also to talk to you in future weeks, both on this show and in his job because he's doing super important work.

All right, I'm going to wrap it up and I Don Gauden says, "Thanks. I hope to hear from you soon." So with that? Have a great evening, everyone. Enjoy your weekend. Do come back next week. I promise you. It will be more exciting stuff. Good night.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)