With Andrea d'Agostini talking major crypto players and key influencers… And discussions under way with a 10-years-experience key partner to operate our pay-per-gallon projects, Is our noble mission for clean water starting a movement? Find out in the replay!

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Ken Berenger:

I'm saying good evening to our guests

Andrea: Ah, good evening guys!

Ken: We had some technical difficulties. Riggs looks like he's dialing it in from a plane, right? An airplane.

Riggs: What I'm doing is I'm on the phone right now, you can see my green screen behind me. My machine is doing "blue screen of death" right now. So, here's what we're going to do because I have a wonderful presentation. But actually what I'd like to do, is you and Andrea, while I debug this tech stuff, you and Andrea should get into it about the latest stuff that you and I discussed today.

Ken: As long as you didn't say, "Sing a song or tell jokes." For it and I will go off video and keep debugging this.

Andrea: Ok, so Ken.

Ken: Yes, sir. How are you?

Andrea: Very good. I thank you so much. It's very exciting all the things that are occurring right now. You want to start? You want me to give an update?

Water on Demand

Ken: So we had a.. other than the fact that Andrea's and my wife both dressed us the same. So. we had a we had a great, so Riggs and I...this whole Water on Demand™ thing happened on a series of, "You got a minute, you got a minute?" You know, and we would do these. We would do these strategy sessions that usually went into the late hours of the night, but ideas were formed. So what Riggs and I, kind of we had, we had a brief one today. Riggs has been doing a lot of, you know, kind of work and certain blocks, certain mental blocks kind of cleared for him recently, and he's like, "Oh my God," you know?

Scaling Down for a $Trillion Transition

And so a couple of exciting things and I'm going to talk about, so we have a, we've got this beautiful model of Water on Demand that was going to be set up as something that could literally facilitate a trillion dollar transition into water super infrastructure, it could replace water super infrastructure. That's gigantic and bold, and so you have to start somewhere. So the idea was to take our expertise in building small containerized systems, scale it down to its smallest possible denominator and basically go everywhere in the world.

Now, the advantage to doing that is, for every guy who takes the system that's $100000 and he's paying by the gallon, it's enormously profitable. But there's $10 million business at that location then over the next 10 or 20 years. That makes you irresistible as a potential acquisition for a large water company, right? They want to be everywhere where infrastructure doesn't exist. So that's how the Water on Demand thing happened.

How To Design, Build, Own AND Operate

So recently, we came to the realization that we've got an incredible capable, ready, willing and able partner ready to... So because look, Design, Build and Own [DBO], we can do that. We've been doing that for decades. But the great part was going to be kind of the tricky part. So our partner in India, Permionics®, is a terrific partner, as you know, and they've been doing this now, the other O [Operate], you know, that last O, in the equation, they've been doing it for over a decade.

Andrea: For a long time, yes.

Ken: So we wanted to build these things in Texas. Texas is so bombed right now they can't take any more business. So why not utilize all of this expertise and just have them build it? Look, what did we want to get to? We wanted to "be GMAC." We didn't want...

Andrea: Exactly right.

Ken: We didn't want to be GM motors, we don't want to make cars. We want to finance cars. That's where the money is, right? So, you know, other guys will build it. Well, why not have the first guy that builds it, be a guy who is an expert already at all the other stages, right? We own the contracts, we own the client and we own the asset. Right. This is literally what they've been doing. Now, the other miraculous part of this thing is will now go to we'll go to a much larger scale system three, four or five million dollars starting out, right? It's a lot easier to actually to do those. From a logistical standpoint than it is, you know, dozens and dozens of smaller systems. You need one guy.

Andrea: Exactly right.

Ken: When the phone rings, you need one guy to go, OK, I got it. It's, you know, a sensor went off. I can fix it. Not dozens of people mobilize. The logistics of it are infinitely easier. I know you're in these negotiations on this part now, these discussions now.

Andrea: That is correct.

Ken: Here's here's what's also, I think miraculous, about what kind of came to me, so basically what this becomes is this becomes you can have your first system on the ground in a couple of months. And it's a fully functional Design, Build, Own, Operate [DBOO] Water on Demand model. So what we've been doing is we're preparing to go to institutions and institutions.

Solving Adoption

So years ago, what we did in the oil patch, we had this electro water separation technology and it really was going to solve, was going to solve $100 million problems for the oil business. You know what they said? "Great, come back to us when you've been doing it for five years with somebody right in the oil patch and we're interested." Right? No one wanted to be first. No one wanted to integrate. So it would have, we might have... We might experience a similar paradigm with institutional players coming in now. Look, the asset class market is so distressed right now because of the COVID, the lockdowns, the policies that I don't think it's going to be a quick turnaround. I don't think these things will yield very well.

The assets will do fine, but folks that rely on this for income: institutions, family offices, they're going to be very lean and mean for a while. What Riggs and I discussed today, and I had that, you know that crazy, "Oh my god!" moment was, we could now go to these institutions and say this is not a pro forma. We have a 10 year history of the the guys that are building it and the guys that, servicing it, have been doing this with other systems or other people, and for themselves for a long, long time. So yeah, so a company like them? Right. It may not necessarily have to be Permionics, but a company like them, with that expertise, should be our partner, day one. Ok?

Andrea: Agreed.

The Huge Potential of Tokenizing a Pay Stream

Ken: And I think that that's what we would like to set up. The other part is that the tokenization of the pay stream has never been... So right now, folks that are stuck in asset classes like, let's say, commercial real estate, for instance, or let's just say, an apartment residential real estate. Guy buys a million dollar apartment because he knows inflation is going to destroy the dollar. Ok, great.

Andrea: Yep.

Ken: The thing will be worth two million bucks in five years. If he figures it all out, Water on Demand offers a million dollar investment to pay out 1.8 Million dollars over a twenty five year period. That's what it's figured out. Now, we know now that it's less a pro forma than more based on what the industry is able to do.

Andrea: Yes.

Ken: You can't go to a bank and say, look, I got an apartment building and I've done all the math and I'm going to get one point eight. I'm like, I'm going to get one point eight million dollars in future income.

Andrea: Yeah, how does that work?!

Ken: So, what I'd like you to do is I'd like you to lend me 50 percent of that right now. They'd say, you can't do that. The tokenization of this pay stream literally facilitates the ability to factor it, to borrow against it or to just sell it at a discount. So what asset class in the world is going to allow you to enter where you're going to get a major portion of your pay stream accessible today, plus the asset plus one and a half times your investment in stock?

So the way we figured it out is a million dollar investment will actually be an asset that will be something in the neighborhood, if you factor in a discounted pay stream, like two and a half million dollars. What asset investor is going to say no to? So let me get this straight. I come in at a million dollars today. And this I literally have my hands on assets that within six months because we're going to give the time, we're going to give the stock time to come out of restriction in six months. This is, this has got actual asset value of one point two point five million. I don't think there's an asset class out there that can boast that.

Andrea: I don't think either.

A Powerful Asset Hedge

Ken: And, the beauty is, is that that stock that they're getting, that's if it does nothing, right? If it performs the way our trajectory might allow. The sky is the limit on it. So, we want to really we want to gear up to be able to speak to that investor. The folks that are stuck, because here's what's interesting, if you have $100 million family office portfolio and 40 percent of it is locked in these properties, now you're not they're not going away, right? But the income is dried up or virtually stopped.

How how great would it be to be able to acquire an asset, get a twenty five percent royalty and have access to be able to monetize. You could you could monetize that. You know, $10 million investment is 18 million bucks. You could monetize half of that 40 percent right now to deal, to take care of other opportunities, which actually helps activate the money that's dead right now. In other words, it's not it's not as dead, right? It's going to give these larger institutional asset investors the flexibility that they just don't have right now.

Refinancing commercial properties with an interest rate environment that's starting to head up, with occupancy levels that are very low and renegotiated leases? That's going to be a that's a big ask. Right, especially if values start to fall. So they may not have access to their capital. This could provide again, this is very early stage. This is not something that you know is a thing yet, but this truly becomes.

Andrea: Powerful, a powerful new...

Ken: Powerful asset hedge, this becomes the thing you do to hedge your other assets. There he is! Riggs is back. Now I'm paraphrasing our earlier conversation. Um, but I think I got to the spirit of it. I don't know if Riggs is able to join us yet, but do you have any questions on that?

Solving a Real Issue

Andrea: Me myself, no, it's is really. I love to see how much energy we're putting in Water on Demand and the fact that we are gearing up to really build these assets around the company. And because I don't know many companies that do that and in particular our market, our industry, it's quite a unique industry with a lot of room for growth, like if you just look at what is happening around the world and how much demand for something like our product there is, it's quite special.

I also love the fact that, well, yours and Riggs vision is really a solution for a real problem. It's not just an amazing business that we are building, but we're also really solving an issue. So the two things together makes it makes it wonderful to build. On top of that, Riggs is really what, with you, we are really pushing to make Water on Demand like really a sensation, not just a KC story, not just a project, really producing machine. And we have some amazing deals lined up.

Revolutionary Crypto Applications

On top of that, I think Riggs anticipate, like announced the last time that it was alive. He mentioned the fact that we are also really expanding on the crypto space and the blockchain technology. That I believe is one of the most exciting things that are occurring because most of the time, the way blockchain technology and crypto is used is airy fairy, and it's like, it's like this thing that exists in ether. And they're just now starting to, for instance, accept cryptocurrency payments for real estate, for instance.

What we are planning to do is really revolutionary. So I feel I can say at least I can say that we are currently in conversation with an amazing player in the blockchain space. Very, very big, renowned. They loved our projects and I hope in the upcoming weeks we will be able to announce really something revolutionary in the asset class, as well as in the way we are deploying it is going to be something really that will bring real innovation to the market.

You're going to be so happy, Ken. You're going to love it. What's coming out? He's going to love it. But our investors will be very proud, not just loving it. No, just see the potential of it and how we are driving the company. But also like, really, be proud of what we are building like, it's going to be something that leaves a mark. And I think that we are all here for that.

Ken: And again, to expand on what you said, the crypto space has been airy fairy, meme stuff, right? The tokenization of actual long term pay streams has never been done right. So you had a football player recently who tokenized, he tokenized his contract.

Andrea: Yeah, himself.

Ken: Yeah, like $100 million contract. So what he did was he allowed people to purchase pieces of his contract. Right? And it could be a $500 piece. So basically what he's getting is he's getting his $100 million. He's getting the vast majority of that upfront, isn't he?

Andrea: Yeah.

A World-Changing Financial Instrument

Ken: Isn't that what a Water on Demand twenty five year payout could look like in an NFT, right? An actual real life business application for something. It becomes a financial instrument, not just something that's tradable, but it has, it has tangible intrinsic value, like like a, you know, I mean, maybe it's going to, but you know, like metal has, gold has an intrinsic value where it has a tangible asset.

This can become a tangible asset. That's never been done before, something that can be traded independently of the actual project itself. That's world changing, you know, and I think that and I'm kind of aware of where you're going with this. I think bringing that element to it. Like you said, this isn't just a great business success. The fact that your success also leads to preventing millions of illnesses and deaths around the world. I mean...

Andrea: That's something to be proud of.

Ken: Right, right. It's, there's a moral like, almost a moral imperative.

Andrea: There is a mission connected to it. Yeah, there is a mission connected to it. And it's something that's very near and dear to my heart. And when Riggs presented me the idea, what was the direction? I was like, Well, that's something I can actually. I can get behind this and push it and make it happen.

Ken: You've been pushing that's for sure. Are you the Clearwater home tonight, You're not in LA?

Andrea: Yes, I am in my home office today, in my home office. Oh Riggs, you're with us.

Riggs: I joined in. Thank you.

Ken: I just, I just finished Elton John's Candle in the Wind.

Riggs: I just thought you were doing wonderful. I thought it was a Tiny Dancer, actually.

Ken: It was funny, but I started with Tiny Dancer.

Riggs: But listen, it is. I was listening with rapt attention because, you know, this was going to be at the end of the thing and thank you for filling in. My zoom, I'm joining via of this very low tech browser because the Zoom client is crashing my machine. So but you know Andrea and Ken, which who is currently labeled as Riggs on the screen. But Ken, you guys have really, you know, the last topic was this is going to be the first, one of the very few true asset coins. So a dividend token that represents actual water treated connected to money. This is a dream we've had since 2018.

Andrea: For real.

From the Audience

Riggs: And it's now happening. So what I'm going to do quickly. And thank you guys for jumping in. I'm going to go ahead and and do the rapid. Guys and gals feel free to chat because I just saw, "Is it a collaboration with crypto.com? Regardless, Congrats, and I'm in." That's from Khadijah.

Andrea: Oh, thank you Khadijah.

Riggs: And Joseph says, "Are we allowed to take part in the discussion?" Joseph, what we do, we repeat your chat, in fact, yours went to everyone because we're in this crazy browser mode. So what we're basically doing is, yeah, people are chatting to everyone. This is like a whole new world, but feel free to go ahead and chat.

Ken: Hello, Bob. We won't use last names to protect your identity. How's that?

Riggs: We will cover the hotel launch. It's very exciting. Just in a nutshell. This thing, actual hotel has not launched yet. Our system is there and is operating. We're going to send a video team up there and with one of us execs, and we're going to be involved in the launch and we plan to have a presence in the lobby, perhaps some branding. This is all being worked out with the chief engineer of the chain. You guys will love it. Let me go ahead and swing over to the presentation mode and let's get this party started.

Ok, so here we go. It is February the 10th. Two days ago was my birthday. At first I was I was being 21 and then somebody outed me as 37, which is a problem. But nonetheless, I feel like 21 and I have, my son gave me a T-shirt that says, I know I ski like an old man, so try to keep up then! Boom! So I'll put it on my on my Facebook. I'll make it public on my Facebook so people can go to my personal Facebook and see that photo. It's kind of cool. All right.

Moving on here, of course, this is Heather is coping with this in Spanish. So she's a heroine. Thank you.

And of course, you know, the forward looking statements, you know, the drill. We do our very best to say, tell you how it is. You notice the branding Water on Demand we have moved to Water on Demand is the is what this company is doing. We have wonderful divisions that are doing the old fashioned design and build, but they are maxed out currently.

Exploring Operation and Maintenance Partners

And so literally, this is why we are talking to our long, long time partner who already is doing operation and maintenance. I would show you the table of all of their projects, but it's early and we need to get their full buy in. But they're very excited and we are going to work with them to get this going because Progressive Water Treatment and Modular Water are completely slammed. They're doing incredibly well. I'm very proud of them and we're not going to make them do something that they have no bandwidth for. Instead, we're going to use a partner who is already doing this pay per gallon thing very successfully over 10 years, and that is going to be a major development.

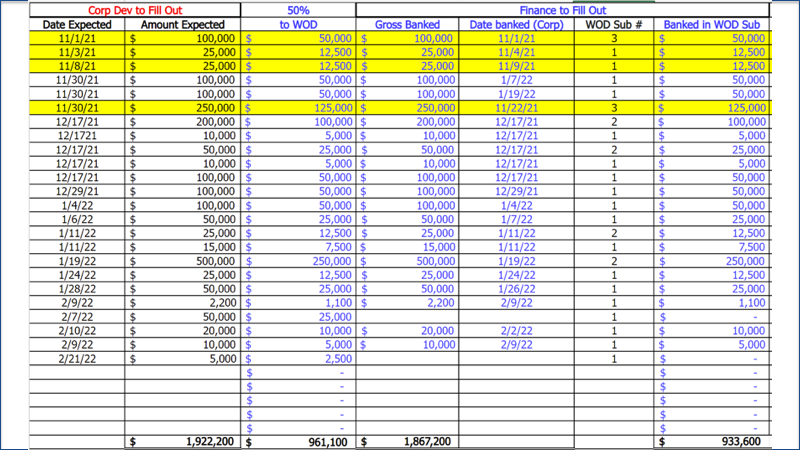

WOD Current Capital Status

All right. So where are we at with Water on Demand? Well, we are edging into the $1 million mark. Here it is. Nine three three six zero zero. Click Click, Click, Click Click. Ken is on fire. I'm quite, I feel quite confident that we will get to the million banked within, perhaps as early as next week. Now you notice that again, the gross banked is almost two million. So this is the formula is that for every dollar we raise, 50 percent of it goes to the asset. And, now we put, the investor makes 25 percent on the net profits overall by getting 50 percent on the share that goes to Water on Demand.

So we get to use half of it and we're basically giving up our profit share, basically half of our profit share in order to make the investor able to get the 25 percent. This is an innovative model that is working very well. It's ensuring that we're able to continue to fund the company and to build this Water on Demand stuff while at the same time continuing to build a capital fund. This is the $300 million round. It will be with us for a long time as we move up to institutional. And as we move up to institutional, it is designed so we can be, you know, we can change how desirable it is.

Inventory Domination

So currently it is very desirable. We're converting at a very high conversion rate. This will change. Ok, today I was, or yesterday I was talking about super backwardation. Now what is backwardation?

Backwardation is basically when the prices of, spot prices, are higher than the future price. Now sometimes it's normal like, you know, winter coats. Spot price for winter coat in December is higher than the futures price for a winter coat in June, of course. But when you're talking about commodities, which are pretty much year round, when the spot price pops, it really means that people are trying to grab up every bit of the inventory..

Demographics and Deflation

Ok. Activist Post, "I've never seen a market like this. Shortages of everything. You name it, we're out of it." And it's not probably not, the Biden administration is, I think they're going to zero on their popularity, but this is a molecule crisis. Molecule, meaning any molecule, oil, gas, et cetera. You name it, we're out of it. This is kind of wild. All right. So that was that Bloombergs. But here's the interesting thing, diesel futures, look where they're going. This is wild, we're already, you know, many parts well, California is a $6 right, Andrea. Six dollars, six fifty, something like that.

Andrea: Unfortunately, it's true, it is.

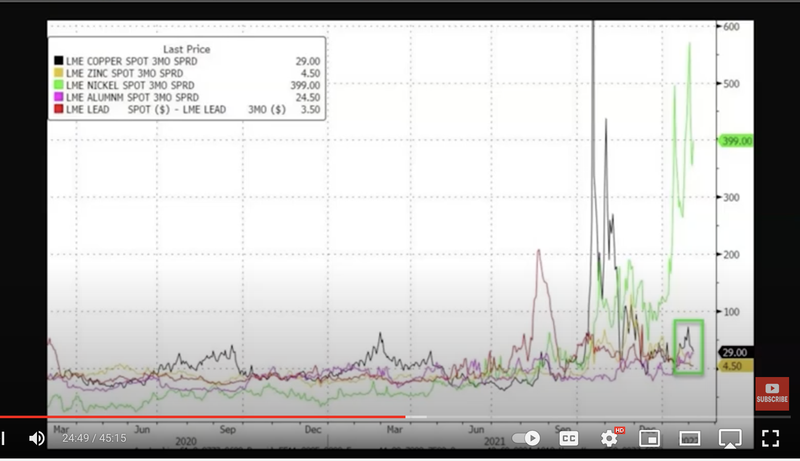

Riggs: So then all six of the main industrial metals traded on the London Metal Exchange, and for some reason, this let me see if this. Yeah, this is the London Exchange.

Andrea: Yes, I can see the other chart, yes.

Riggs: All right, so you've got crazy things happening. Look over here at. Numbers are just popping out all over the place, so that's what's going on here is a really crazy situation, and I was scrolling through a story that you guys were not seeing, which is basically now here's what's wild. The people are still talking about a global tax on carbon to reduce emissions because ESG measures environmental, social and governance are actually pushing fuel up, prices. At this point, we just need to, you know, high fuel prices may be wonderful for climate change, but they immediately hit the people who are the most in need.

They don't hit the wealthy. You know, we can. We can survive the price of fuel. But some you know the housekeeper who has to drive 10 miles or 20 miles to to get to a to a home really gets hurt. So this is the story that I was talking about that I didn't realize I was sharing. It's very good, Activists Post, but let's go to his conclusion, the very end of what he's saying here.

Start of presentation

Lacy Hunt: So in conclusion, I would like to add one other element that is in the economic picture that I have discussed in the past and numerous situation, but is really quite critical to assessing how the U.S. and other economies of the world are going to do, and that is that the demographics are continuing to deteriorate. We don't have the final numbers for the rest of the world for twenty twenty-one, but we do for the United States. Last year, our population increased by just 0.1 percent. This was the smallest increase since the founding of the Republic in the 1800s, in the 18th century.

There were a couple of noticeable firsts. The natural increase in population last year was less than the immigration. And second, the total net increase in the population was less than a million for the first time since 1937. Now, COVID explains the jump in the death rate, but we had another precipitous decline in the birth rate, which is contrary to what many demographers predicted. They thought that bringing people to close proximity would lead to an increasing birth rate, but it did not. The early evidence is that the demographics are deteriorating even faster outside the United States.

Now, why is demographics a problem? Well, because it retards investment. Household investment business, state, local investment. Families are expensive, not only for the families that raise them and birth them and train them, send them to college, but the businesses that supply them and the state and local governments, it comes through the investment account.

And so when you have less demographics, it actually feeds into the deleterious effects of the death. The death brings down the standard of living growth, which contributes to weaker demographics. And then the weaker demographics contributes to the deterioration in the economic growth. I want to to quote my friend William Stoll, professor of Economics, who likes to make the case that for nations, demographics is destiny. And he does that because of the importance of highlighting this critical variable for the secular growth in determining economic activity. So in actuality, we have three challenges to a restoration of normal. We have a considerably worse debt overhang. We have the perilous task of trying to restore the economy to normalcy from a theory of grand design for which we never tested. And third, we have this continuing on onward deterioration of demographics. Adam that concludes my remarks.

Adam Taggert: Don't look away just yet, folks. If you enjoyed this excellent presentation, you definitely don't want to miss the twenty five minutes of audience Q&A we recorded with Lacy right after his presentation aired at our conference. To watch that right now for free. Just go to wealthion.com/hunt. But before you do help support this channel in bringing you more top notch...

End of presentation

What it Means

Riggs: Ok, so this is really, really interesting. And I played that so that you yourselves could go in and enjoy this. But this is this is what's really, really interesting about this. So what this speaker was speaking about in that presentation, which is very technical, it was number one, we know there's a big debt overhang that's the debt gone crazy. Number two, it talks about restore normalcy from a theory of grand design, meaning that things were done that had never been done before and it is completely upset. The normal I used to drive in Los Angeles and go, well, that can never be a depression because his car is driving in the road. And then one day there were no cars driving in the road and we never expected that. And the third thing is it's demographics. Now this brings me to my next point. Which is, and I'm going to pop back into the presentation.

We have deflation, too, and this is what we just covered. Just go, you can go to goldsilver.com in this case or Wealthion directly. But what's the conclusion? Growth is key to asset value. Ken has been talking about how not all assets are the same. And this has got to be a concern for people investing in all conventional assets.

For example, the speaker in that Wealthion presentation was talking about demographics are flattening, historically flattening. It should concern us all for a number of reasons because you have an aging population, but you also have fewer families, less consumption. And this hits ultimately, it hits real estate. We've seen offices, you know, office empty out because people are working from home. And now what about, we have a boom in real estate, for sure, but who is going to consume the real estate? That's going to be a problem. So we have to I think we have to look at what assets are going to be strong in years to come.

Why Water is Strong

Now, obviously, I'm giving you my bias towards water. Why is water strong? Because water in its current state does not depend on demographics. There are currently there's far too much dirty water out there, it's way too much unhandled problems already and so we can be soaking up the pent up demand for decades through Water on Demand through a direct investment of investors into Water Like an Oil Well™. And we will not have the same rubber band effect that you know you'll see in oil is because again, you know, with deflation, I mean, this weird thing where the dollar is going to hell. Excuse the language. But at the same time, consumption is going down.

Are Your Assets Performing?

So you end up with stagflation, as it's called, that if you remember the late 70s, early 80s with Carter, he was the unfortunate inheritor of a very static economy and at the time it was high interest rates that caused a lot of it. But we have an unusual situation, and I was talking with Ken about this earlier today, and it's really at a time for everyone who has an asset portfolio to do something like jump into Water on Demand. Why?

Well, if you do the math on Water on Demand, it's got it's got internal rates of return. If you include the stock and the warrants of, I think it was 388 percent, that overcomes a lot of non-performance in your conventional assets. So we're not saying sell your assets. We're not saying get rid of your real estate. We're not saying don't get out of your master limited partnership of oil, all those things, you know. It's any it's better than no asset at all.

But you're going to start seeing some slowing growth in asset performance, asset income, how assets actually give you, you know, annual revenue, which you have, we need to have. You can't just rely on asset appreciation, which is a good thing, but to get to get the benefit of asset appreciation, you have to sell it. Or borrow against it so that that doesn't really, you know, you need to get present income from an asset.

A Virgin Asset Entry Opportunity

So what we've really proposed here is to get you into Water on Demand. Why? Because it is an asset that is essentially virgin. It's the first time regular investors are able to get into something that is like an oil well but beneficial. First time they can get into a water equipment program directly through this Water on Demand subsidiaries that we've set up. So you get you get your your dividends and ultimately it goes to, you know, maybe asset coins, whatever. That's a whole cool thing, but you get this extraordinary, because you're a founding investor and Water on Demand, you get this extraordinary participation in the stock of the company. And that is very, very powerful.

With that, I'm going to give you Ken's link. You really deserve to talk to him. So I would schedule with him and have that conversation. And in fact, I want to bring in Ken again next week.

Company Direction - This Minute!

And we're also we're going to get a bit more specific about the crypto. We're being kind of vague about crypto because so much is happening. But I can tell you this. One realization that we've had is that the number one priority is to go from raising money to Water on Demand to spending it on actual pay per gallon projects. And that is what the highest priority for management in this company is.

Now, Andrea has come to Clearwater. We're going to have a lot of meetings with him and what he is here for is to help us basically shed our old skin and become the world class company that will hold the this wonderful thing called Water on Demand. Essentially, we're a company that has a thing that's much more valuable, like we're this "little penny stock company that could," and but we've got this wonderful Water on Demand. And so now, Andrea, with some of the people he's bringing in is helping me recast the company to be that real player.

And Galaxy Note 10, who I guess is Bob, says, "It looks like the chats were sent to everyone by default, was not like that previously." And I just want to point out this is a wacky thing having to do with this browser mode and it's, I will solve it by the next time I had to remove it. All right.

The Future of Earth's People and YOU

Andrea: I wanted to say something, if I may Riggs.

Riggs: Yes, sir.

Andrea: Thank you. Oh, I'd say that I've seen many businesses and many teams. I think this particular team under the vision and the guidance of Riggs is a team that is accomplishing and it will accomplish things that will leave the world in awe. And I really know that and I play games to win. And I know Ken has the same viewpoint, and I know for sure Riggs has the same viewpoint.

So obviously, when you're playing a game that is a big game, one needs to have a team to play the game right. So we are building our internal team, which is me can Riggs and a few other players. We just got a VP marketing, which is wonderful. His name is Josh Summers. We're going to introduce him, introduce him to you very soon. But I also would like to say that you guys that are there are investors.

You are part of our team. It's important for me that you spread the word to your friends. So the people that you have around or what it's happening and you involve them because this is not just the company, it's also a mission. So you're part of it, you're putting your energy in it. And I would like you to share it with your friends and family and those that you know, that could participate to our game.

Ken is always available to communicate, to give information. And if you create the opportunity you know, Ken, Ken is clear as the water that we are talking about, like you can see through him and he will give you any information you need and he will and he will help your friends to become part of this mission. Treat it as a mission. And of course, it's going to be, the outcome is going to be incredible, but it's a mission. First and foremost. That's all I wanted to say, and I need that. We need your help, guys. This company will do amazing. He's doing amazing and will do amazing because you are part of it and your input, your energy, your participation. We need it to make it happen. That's all I wanted to say.

Dare to Share and Involve?

Riggs: Wow, this powerful, you know, it's interesting because Ken, who just got a text from a Mr. Mark who wants to invest. How nice is that? I guess, Andrea, you were persuasive.

Ken: Your impassioned speech brought about a reaction.

Andrea: But it's true we are going to win. And I got to say, you should tell your friends that if you don't come on board, this game is not going to be good for them. They will. They will be sad afterwards. I built companies for over $300 million and one even bigger, and we can share the names and so on and so forth. This one is going to be one of the biggest that I've ever built that I've ever participated to is going to be amazing. You should definitely be smart and jump on board because we're going to win. That's all I want to say.

Riggs: Andrea, we should have a next CEO briefing. Let's have you and let's talk a little bit about your background and what motivated you to come on board. We really haven't covered that properly. And I think it's worth doing. Andrea is a bit of a known quantity here, and he is an absolute rock star and is a sign that Ken and I have recognized that the company is attracting real talent. We'll also bring Josh Summers on the show. He is amazing and there's more to come. This is not the end of the rock stars coming on board.

You know, Ken, it's a wonderful thing that, Ken is very, very connected to management, and this is one of the things that he said was special about this company is he is part of management. He's not just the guy. Hey, raise some money, Ken. You know, he is part of management and he contributes to and here's everything. And when he talks to investors, he's getting the he's giving it as it's really happening in this company.

Ken: In real time very often.

Riggs: Josh Summers says, "I'm here Riggs are very excited to be part of the team." Right on, dude. Thank you. We will. We've run out of time. We're almost at nine o'clock, which is very long, but we will bring you on. Absolutely. And. Andrea, thanks. JRW says, "Andrea, thanks for that. If there could be a mission minute message to maybe explain what word you really precisely wish us to spread out." So what is the word you want them to spread out Andrea?"

Growing the Movement

Andrea: Ok. I can tell you very simply, OK. So what I would like you to let people know is that this is the this mission of helping the world as far as water is concerned is a real. It's a real thing. It's happening. But like them to share, I would like you to share with your friends the investment opportunity because guys, in order to accomplish the goals that we have or we will need energy and the energy is represented by you participating with your investments to what we are doing.

Because we are creating a snowball effect and and sharing the excitement that you perceive in our making, sharing our stories, my story, Ken's story, Riggs story. The story of our company is what you need to do. You need to tell people, "Hey guys, you need to see this thing because because it's happening, you need to jump in right now because in a very short period of time, you will be you will be eating your elbow because you didn't do it." Right, which is an Italian expression, because he didn't do it right.

And it's happening. I can tell you, I can tell you, you will see, you will see in a very, I'm very strategic when it comes to expanding a business and you will see in a short period of time. But I can tell you some major names that you all know. If you use Instagram, you know, they are coming on board, they're going to become our ambassadors because... Come on board now, share with your friends, get them appointments with Ken, participate to the appointments, become part of the movement. It's going to be great and we're going to, we're going to start, create events where we're all going to meet.

Guys. Let me do my job. Research my story, see what I have done and know that we are accomplishing to accomplish it together. So get appointments to Ken. That's what I need from you right now. And then there will be other tasks that I will share with you. But this is the first one

Ken: I could, I could add as someone who kind of communicates this message every day, if you want to have a very simple, you know, why should I call them? You could just say,

Look, I know a company that is literally changing the world in a more important way than cellular changed telecom.

And if they're successful, it will mean preventing millions of illnesses and deaths and will probably be one of the largest wealth transformation events of our lifetime.

It's 30 seconds, right? But it encompasses our mission. In a way that at least they'll understand that we're deadly serious and we can't do it without you.

Riggs: I love it. Thank you, gentlemen, I appreciate it.

Andrea: Thank you everyone.

Future Briefing Topics

Riggs: One quick note, ValueTax Financial said, "Please address how the fundraise, token etc affect owners."

Ken: I addressed that. I answered, Okay.

Riggs: Did you do it to everyone, or just to him?

Ken: Just to him, I'm sorry.

Riggs: Ok, well, I will actually make that a topic of because we're out of time. We'll make it a topic of a future one so can just share share your answer with me offline and we're going to get into that because it's really, really good, believe me. Here's what's wonderful about this fundraise. It builds capital and assets. We're no longer just raising money to pay for the company's operation. 50 percent of everything we raise goes into assets, which automatically builds value. You get to $30 million in assets. I think you're a multiple of a $30 million company.

Secondly, the token strategy is another asset thing which I won't get into either. We will discuss this next week. Thank you, everyone. It's been wonderful having you. I appreciate your patience as I dealt with this insanity. And we're going to go ahead. Oh yeah, Ken, just put that in there. But we'll be specifically covering the value, "What this asset building means for the company and you as investors," in the next one. Thank you, everyone. You guys are rock stars and so many people stuck to the end. I really appreciate it.

Andrea: Well, thank you, everyone. And write us if you have questions, write us. If you need help talking with your friends, write us. OK, be in communication. We love you. Bye guys.

Riggs: Thank you.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)