We are changing Water the way Oil was changed in 1981, and this got national TV coverage! A Toyota veteran exec showed us how Water on Demand™ is paralleling Transportation As A Service... And bringing Water into the 21st Century! Find out how in the replay!

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Riggs: And hello, everyone, and every time I see that it reminds me of the last two years and all of the wild and crazy times we've had leading up to what I think is a defining moment in our industry. So welcome aboard and I see we have a ton of people here, so I'll get going right away and I promise you lots of exciting developments. So without further ado, let me pop in on the share screen. There we go.

And this is December 9th. We have just one more briefing this year in 2021. And water is really not just these, these are great slogans, but really is turning into an investment vehicle, which it's kind of blowing our minds when we realize what we're doing and we're moving as fast as we can to really deliver on the promise that is making investors flock in. So really excited there.

Now, as you remember this, you can listen to Spanish and just click on the globe symbol in your little Zoom interface.

As usual, we try and do a very best to get it right. If we don't, then we fix it. And the SEC, the Securities and Exchange Commission, has not blessed what we say, but we have gotten very good at saying as much as we can without my having to move to Costa Rica anyway,

So Sunday, you guys might have seen this, but it's worth a quick look. We were on Newsmax TV. The Wake Up America show it was nice and early on the 5th of December.

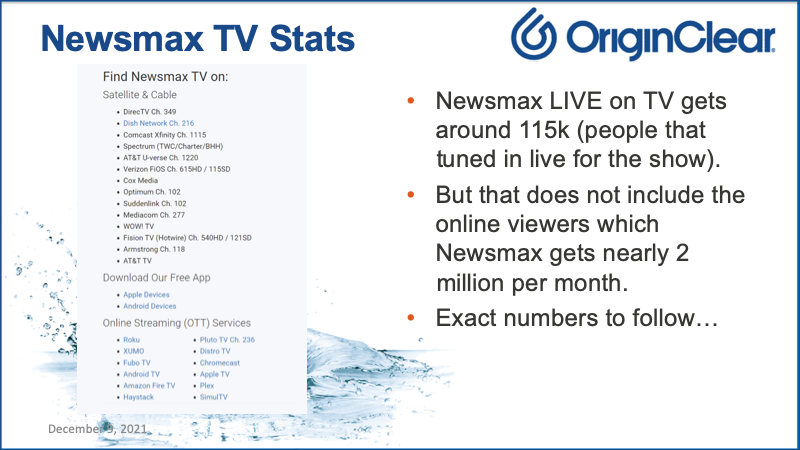

Now what is Newsmax? Well, it is a TV channel that isn't a bunch of satellite and cable channels. It's also on online streaming OTT. Ott means over the top. That means that this is content that goes over the top of existing channels through devices like Roku and Apple TV and so forth. It looks like it gets about one hundred and fifteen thousand people live on that show, but they get about two million per month. We're going to be getting the exact numbers. Of course, this is symbolically very important because we are building a lot of momentum here on the shows and we sort of going up a ladder and a bit. I'll also play to you, the Newsy show that I did a bit earlier. That hasn't appeared yet, so I'm going to go ahead and cut into the fully optimized mode and which then blurs slides. I have to flip back and forth. But let's go ahead here.

Start of video presentation

Newsmax Host 1: And welcome back to Wake Up America. I'm Allison Maloni alongside T.W. Shannon. Did you know that one out of every 10 people in the world live without clean water? Well, our next guest is helping to fix that problem.

Newsmax Host 2: Joining us now, the founder and CEO of OriginClear, Riggs Eckelberry. Welcome to Wake Up America Weekend!

Riggs: It's a great pleasure. Thank you very much for having me.

Newsmax Host 1: And of course, Riggs. You recently wrote a fascinating op ed for Newsweek, saying A water shortage is coming and we aren't prepared. What's your plan to rectify that?

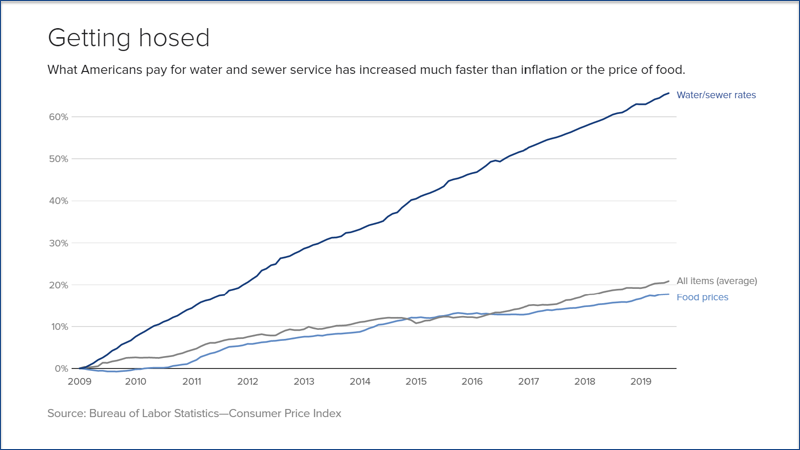

Riggs: Well, it's very simple. You know, there's an infrastructure bill. Unfortunately, it really only gets us one year of backlog caught up in our terrible infrastructure problem in water. And of course, we know that groundwater is being drawn down and in fact, the most in California, which has the most drought. So all kinds of problems and the federal government has been reducing its annual contribution to city systems all this time. So what's the solution? Well, we've found a solution, which is to bring America's investors in to invest in water systems just like oil wells. And this is proving to be extremely popular. And it's bringing a whole army of investors, frankly, because water rates inflate three times the rate of inflation. So it's a win win for everyone.

Newsmax Host 2: Riggs you bring up some really important points about how clean water really should be something that we can all agree on. Just tell us some of those statistics so our audience can understand, you know, why this water crisis is occurring and why we need to act now.

Riggs: Well, do you know that in the world, 80 percent of all dirty water isn't cleaned at all. It's thrown into our lakes, rivers and oceans. And this is a scandal. So we have this disposable society where we just use the water and throw it out, you know, Israel recycles almost 90 percent of its water America one percent. That's ridiculous. We should be able to do that, but we can't do that with the antiquated central utility systems. We've got to do it where people are making it dirty, whether it's being polluted, obviously that's where it can be recycled. And so we are finding a huge mega trend towards breweries and housing developments and car dealerships doing their own water treatment, and we're here to help them make it happen.

Newsmax Host 1: Riggs, you mentioned that you have investors who are interested in a lot of people are taking on board with this. What is next? How do you actually get this going and get clean water to everybody who needs it?

Riggs: Well, we you know, let's look back in 1981, where Apache Corporation created the first oil well master limited partnership, and it blossomed. Today it's huge, and it doesn't compete with Exxon and Mobil. It complements it. So we have a complementary idea of doing the very same thing for water that was done with oil. And potentially it is a multibillion dollar activity because everybody wants to invest in water. They just don't don't have a way. They can only, you know, buy bonds or buy big company stocks. This is a way to directly invest in water equipment, and we're so excited that you know, America's investors who are looking for something stable and inflation friendly have a way to do this.

Newsmax Host 2: You know, I know you put on recently a presentation just this past week where you suggested that water is the new gold, water as an oil well and several other strategies, really? What's the endgame here?

Riggs: Well, look, the endgame is we've got to do everything right. There's all the weapons come in to bear. We've got to clean the dirty water. We've got to recycle desalination as a weapon. It's all of the above, and we need to stop the groundwater depletion. Do you realize that the Ogallala aquifer, which is the Midwest, is 30 percent of all water for produce in America, is now down in some places, 150 feet down, and it's going to completely deplete. This is very irresponsible, so good policies for groundwater management. All these things are essential, but we need to bring help from all corners and we can't rely on the federal government anymore.

Newsmax Host 1: Yeah. Riggs. It is safe to assume that you have been probably met with some skepticism, if that's the case. How do you deal with that? What do people have been saying?

Riggs: Actually, people, it's a lot of pent up demand for, "What do I do?" "How can I..." I get in emails constantly in my inbox, "How can I help?" "What can I do?" I know this is a problem. You know, Flint, Michigan, all these places. There's a lot of canaries in the coal mine and people know that their local water is not great. It's not going to kill you today, but it's, you know, it's got toxins in it and they keep asking, "How can I help?" And we think the best way to do it is really go into a decentralized mode and not just wait for the federal government to help us out because it's just not happening.

Newsmax Host 1: Yeah. Being proactive. I love it. Thank you so much. Riggs Eckelberry we appreciate it. Keep us posted on what you're doing.

Riggs: It's my pleasure. Thank you so much.

Newsmax Host 1: Of course.

End of presentation

Riggs: So that was super fun. You know, most of you have seen it, but I'm replaying it because it just, they ask the right questions, and for me, it was, I'm going to look back on the early in the morning on the Sunday, the 5th of December, long before brunch when I got to this show because really we feel that this is what is going to be our defining moment.

So without further ado, I'm going to now go into the quick excerpt of a coming show that expands on that a little bit. So this is, this is not the actual show. This is what the reporter was using to do her own basically her own report. So I just want to make that clear.

First of all, I'm going to just show you some of the stats for newsy. They are tend to be a left of center, slightly liberal network. They were bought by Scripts for a $65 million back in 2008, I believe. And they they are very factual, medium traffic. So they get they get decent traffic and they are, basically they do video pieces that get out there on the mobile and web platforms. So that kind of gives you an idea of what to expect from this show. And now what I'm going to do is I'm going to tee up the reporter and see what questions she had to ask. Remember this happened before the Newsmax show.

Start of video presentation

Newsy Host: Can you tell me, just like in a few sentences, what your company does and your be your mission statement?

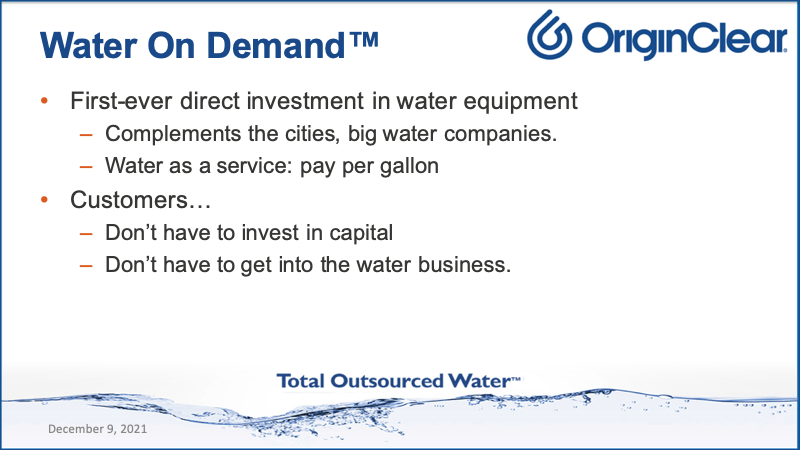

Riggs: So OriginClear is focused today on what we call Water on Demand™, which is really the innovation of investors for the first time being able to invest directly in water systems, which they haven't been able to do up till now. It's kind of like oil wells, so we like to say that we're making water like an oil well, that you could just literally help the water gush and you get paid for the gushing water. That is a very popular thing. We're building a network of financed systems that do this, this sort of pay by the gallon thing. Investors are delighted and what we think is we're bringing an army of new investors of new money to help sort of buttress the existing efforts, such as the infrastructure bill. We're bringing everyday investors, Main Street investors to help invest in water. In addition, of course, we have all the classic. We know how to build machines. We're doing really well with that. But really, what we think is going to transform the world is this financing of water systems by the world's investors.

Newsy Host: What do you think caused this bill to come into action and what would you say that maybe your company has done to maybe play a role in that, in the positive change?

Riggs: Right? Well, we actually are dealing with the Plan B right? Plan A is funding infrastructure. There's some action, but it's inadequate. It doesn't solve the problem, just a Band-Aid, and it's a one year Band-Aid. So what do we do? Well, we need to raise, only one thing we can do, and that is to deal with the fact that the city infrastructure will be underfunded. So why not just reduce its scope, give it less of a hard, you know? Right now, it tries to do everything. It's the central system for everything. Well, why not take the load off and start doing more treatment at businesses and farms and industry and so forth, so that the central infrastructure is the load is lightened?

California tried to build a high speed rail system not going to happen. What's going to happen instead? The Google self-driving car? Why? Because we already have freeways, so you can just use a little bit of software and you're done. It's similar things going to happen in water. We're going to use what's already there. You know, we're not going to have trillion dollar water projects anymore. We're not going to build more Hoover dams. Not going to happen, right? The the environmental permitting alone would stop it. So no more central big systems, the money is not there. And so we just got to pull back, small is beautiful, treat locally. And now and then we do all kinds of good things like more recycling. Its more adaptable. If there's a big failure, it doesn't affect the entire county or state. It's localized to each point, and I think that's the way to go.

Newsy Host: How do we avoid having like the Colorado River Basin being something that is very like could be something that happens very similar? How do we avoid things like Flint, Michigan and the Colorado River Basin possibly happening in our future?

Riggs: Ok, well, those are two different problems now. Flint occurred because the failing infrastructure and some very stupid moves that were made. But but really underlying it all was just very old pipes and so forth. We have so many old pipes in our country. For example, our energy grid has been around for a century. And its big problem is it's a one way it doesn't have a conversation, right, it just shoots electricity.

And so the new players, you know, people like Google Nest and and, you know, Tesla Solar Power and so forth, they're just doing an end run. They're not even trying to use the grid. They're just, they're just setting up their own Internet of Things IoT directly. And that's really what needs to start happening in water.

How are we ever going to, you know, update the entire grid? We'll just leave it there, let it do its thing. And then the new stuff is kind of a whole different network, a lot like, for example, in Africa, instead of installing landlines, they just went straight to the cell phones, right? So we can do that now.

And what we strongly believe in, what we're seeing is is a tremendous demand by people who have water problems. Let's say you're a brewery...There's a very good example of a brewery and Russian river. It's called the Russian River Beer Company in Sonoma County, and they were finding themselves, the water rates were skyrocketing, the local municipality wasn't handling their water. So they commissioned their own water system and they were lucky enough to work with one of us. This new generation of companies that provides a machine without requiring you to pay up front. So we're basically substituting for the city.

Like, You know what? We're going to give you a water treatment system that's going to be in your brewery. It's going to take care of your water, you'll pay less and water rates and we'll fund it and you pay by the gallon and they're like, OK, where do I sign? So this is a new era of water as a service that is bypassing the whole dysfunctional infrastructure problem. And we're going to see that happen more and more where there's going to be self-help force for businesses, for industry, for agriculture and ultimately for homes. If you're doing your own water treatment in a home, then you don't have to have a septic tank, which are very problematic and so forth. So there's really a lot to be said for decentralizing water treatment.

Newsy Host: I think that's amazing, and it reminds me of like people putting solar panels on their homes, you know, like, it's almost exactly the same thing. So let's talk a little bit about climate change. How is it affecting our need for water and how can recycling our water really help?

Riggs: You know you're so right? Listen, we have a real problem with climate change because it's redistributing the precipitation in places where it used to rain don't, and in places where neither some places have too much someplace that don't have enough. But in terms of water, you bring up recycling. Now, Israel recycles almost 90 percent of its water. The second one in the world is Spain, with 20 percent.

The U.S. is at one percent. Now, why? Well, again, it's because of this ancient infrastructure that only thought of going one way. We treat your water and we dump the rest in the ocean or the river, right? How do you go back upstream? Now there are. There are efforts, for example, in San Diego County where they're trying to do that, but it's going to take 30 or 40 years to do it at the municipal level. Once again, if people are treating their own water, they can recycle their own water because they're right there with it, right? I've got my water made it dirty, reuse it.

A brewery, for example, can reuse 50 percent of its water without even using it to make beer just for wash downs and steam vessels and so forth. And so if we think of self-contained water treatment, then people can recycle and we get one, two or three more turns of the water. And that is, I think, the cheapest way to solve the problem. There's other solutions as well, but we strongly believe that if people do their own wastewater treatment, then they can do their own recycling because it pays off. They paid for the water once they're going to run it again, right? So it's going to it's going to make economic sense for people.

Newsy Host: Why should we get away from the Americas centralized water system? Why is it important that we begin to implement locally, recycling water locally?

Riggs: Let me give you a concrete example. In Miami-Dade County, we have over 100,000 septic tanks. And so the county says, Well, we're going to run sewage to everybody. Well, that's over six billion dollars for a bunch of sewage lines. And guess what? It's going to tear up the streets for 20 years and it's going to take forever. And meanwhile, it's still going to be a problem with the septic tanks.

What we can do instead is just put in a rebate program to let them put it in a closed circuit system, a proper sewage system that that, you know, everything goes to a little tank and the tank is emptied once a year by truck and everybody's happy. That is a quick solution. Self-help, self-reliant, and we must do that. What we're trying to do here is is is accelerate the process of enabling decentralization and because it's happening anyway.

So bottom line is, you know, central infrastructure is failing. Decentralization is a fact. It's happening, whether we like it or not. And it's actually makes a lot of sense to take the load off the center and start taking responsibility where water is being polluted. OriginClear does not work in residential, yet. We really work with industry, with business because eighty-seven percent of all water that's made dirty is made dirty by agriculture and industry. So why don't we focus on that and not on the 13 percent that, you know, is a lot of hard work? I mean, home, by home, by home. I would have to build a whole other company for that.

Newsy Host: Thank you so much for talking to me.

Riggs: Thank you so much for your time. It was really fun talking with you. I appreciate the questions. Absolutely.

Newsy Host: Thank you so much.

End of presentation

Audience Participation

Riggs: It was a chance to really say these things, you know, in detail and discuss it and and I think it's set a lot of the tone for what we're doing here. I've got a lot of chats and I'm just going to quickly visit these chats because exactly.

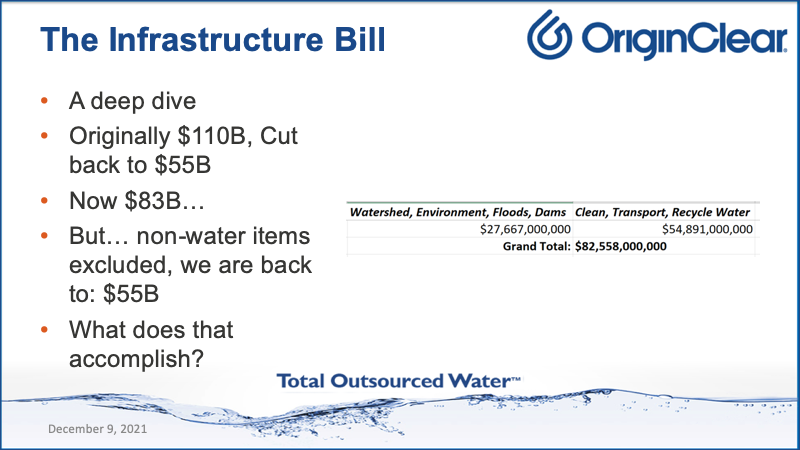

So Rob Powelson says, "Water funding total is 55 billion." And I'm about to do a deep dove on that, in fact.

And Jerry says, "Are there any current career opportunities available now?" A good question, and I can't answer that in this call. But the water industry actually is in dire need of people. They're going through their, you know, silver tsunami, like people aging out. Well, I don't even have the silver hair, but people are getting old.

And then Rob Powelson says, "American Society of Engineers has called for a trillion dollars of needed investment." Well said, it's absolutely the case.

And Jerry would like to have an email address, so that was provided. Good.

And then Rob says, "Let's be intellectually honest, water utilities, public and private will still be the primary service providers." And that's 100 percent true. I want to make it clear, when we're talking about water like an oil well, remember, the master limited partnerships have always been complimentary to Big Oil, well, in the same way we're building something that's complementary to Big Water. We don't want to lose big water. Where are we going to get our water, right? It's how, how are we going to do it. So, we see this as a crucial way to take some of the load off some of the critical load. It's a trend that's happening anyway, and these people need the funding. So that's where that's at, so well put.

Neal asks, "What risk are there to investors?" And this is a really good point. Neal and Kimberly, you guys really need to know that this program is very appealing because it's secured by the assets and by the company. Ok. So it is it is like an oil well partnership, literally. And if you learn more about it, you will see that this is not the high risk, high reward stuff we've been doing over the years, which, you know, investors have ended up ahead, but they're generally been investing their crazy money like, OK, fine, I'll throw a little bit of money at this. And who knows? And then if it goes somewhere fine, if it doesn't, then it's not the end of the world.

Now it's their asset portfolio and people are concerned about, for example, their real estate investments. My rents are not going to keep up with inflation. Well, water rates, if we peg to water rates, then we will keep up with inflation and still give a good deal to the customers.

All right. 18593 says, "What is done with the solids in the wastewater with your systems?" Ok? That's a very good question, and it varies. We're not in charge of that. The solids can be disposed of, for example, let's take a home if you have a, Fuji water sells a very good home, closed water, close circuit system and it has a little sludge tank. And once a year you empty out the sludge tank, so there's various ways to do it.

All right, and then Edward Manoukian says, "I'm getting my master's in blockchain and digital currency and for one of my classes that talked about decentralization of fresh water and found you are already working on this and one of the only ones. Very impressed and glad I invested in OriginClear. Thank you for having me." Well, Edward, that is a wonderful thing to say. And with that, I'm going to keep on going because we have so much more good stuff that you're going to enjoy.

So that's it for the clips. But there is I'm going to cover some other stuff quickly. I want to cover the infrastructure bill. What's up with the infrastructure bill?

Ivan in Action

But meanwhile, I also want to report that our very own Ivan Anz of PhilanthroInvestors® was on a show called, here, I'm going to put right up on screen here and its Founders Club. And this, this Oliver Graf is an amazing personality and Ivan had a long, long discussion.

Waterflix

Unfortunately, I don't have time to put it on tonight, but one of the cool things that Ivan came up with was... Waterflix™! He called it. What we do is Waterflix, we, kind of like Netflix, Waterflix, right? That is a super cool concept and we're literally streaming water. Uh oh, it just made a really bad joke. Ok. Anyway, thank you, Ivan, for representing. And Oliver was super impressed with the whole concept. So thank you.

Infrastructure

All right. Now, what about this infrastructure bill? Originally, it was $110 billion. It was cut back to fifty five. Now it's gone up to eighty three billion, but non water items excluded. We're back to fifty five billion.

Oh, wow. So Chris Wirth has a 25 unit, one bedroom, one bath apartment complex in South Nevada. Estimated water usage sixty six thousand six hundred gallons per month. Need engineer point of contact. Boom, this we will be happy to help you, you will see. So, the team will take care of you with this, with your need.

Two Categories

Ok, let's take a look at this. So we have two categories. One is watershed environment, floods and dams, and the other one is ours, clean transport and recycled water. And as you can see, there's a ton of stuff that has to do with watershed, and this is important stuff. Don't get me wrong. National oceans, restoring habitats, data acquisition for water resources, wildfire prediction, snowpack monitoring marine debris. All these important things. But none of these really are, you know, deal with the dirty water, right, themselves. So that got kind of thrown in, which is all well and good, but it does obscure... Restoring fish passages. I am very passionate about these things. I think that the fish need to be taken care of the Pacific coast. Salmon recovery, all these things.

Aquatic Rehab

U.S. Army Corps of Engineers got a nice budget to rehabilitate rivers and harbors, aquatic ecosystem restoration, coastal storm risk management, very important. Inland flood risk management projects, et cetera, et cetera. So you can see a lot of important things happening, but they are not wastewater treatment. Now we get the beginning of something. The Department of Interior has something for water storage, groundwater storage, small scale storage and groundwater, et cetera. Also, rural water projects very important water recycling and reuse.

And let's see what else we got. Water desalination not a heck of a lot, but OK, it's a start. Water desalination is not cheap, let's put it that way. Then we go back to non water treatment items. And then... I was generous, I didn't know what central Utah project completion account, so I threw it in water treatment. We don't know. But, you know, I'll assume it was OK. Construction, repair, improvement, maintenance of irrigation and power systems, et cetera. Definitely our territory.

Focus on PFAS

A bunch of stuff to to restore the Great Lakes. Then we got back here. I'm not going to bore you with this, but you can see. Very important here. Focus on PFAS as it's called, which is the substances which are very toxic and don't easily get out of the water. So that's very important. And that's right there in our column.

Underserved communities, which like Flint, Michigan, for example, and Federal Safe Drinking Water Act, there's many, many violations of the safe drinking water. So here's the bottom line. Fifty five billion, sure enough, for the water treatment to clean transport and recycle water, whereas watershed environment, floods and dams gets the other.

So that's kind of where it's at. Just to give you all a feel for for where it's at. It's as I say, it's a good program, but it's basically 55 billion. So what does that accomplish? Let's, let's just figure that out.

Well, here's the issue. There was a key webinar back in 2016 which if you look up "Closing the Loop: The Future of Decentralized Water," you'll see the listing. And this was one of the very first, this alerted me, to this... At the time, we were doing a lot of pure technology, but this alerted me to decentralization.

Closing the Loop

And this is a couple of slides, "Closing the Loop: The Future of Decentralized Water."

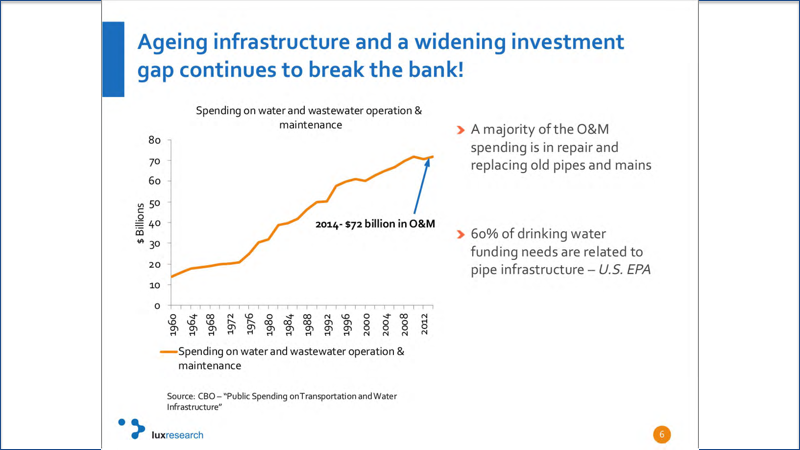

And look at this since 1960 steadily growing operation and maintenance costs. Well, that means that, that's like, you know, never replacing your Toyota Celica and just throwing more water in the radiator. I mean, it's ridiculous. And so pipe infrastructure very damaged and we hear about the water mains breaking and so forth. So that's not good news, right? In 2014 dollars.

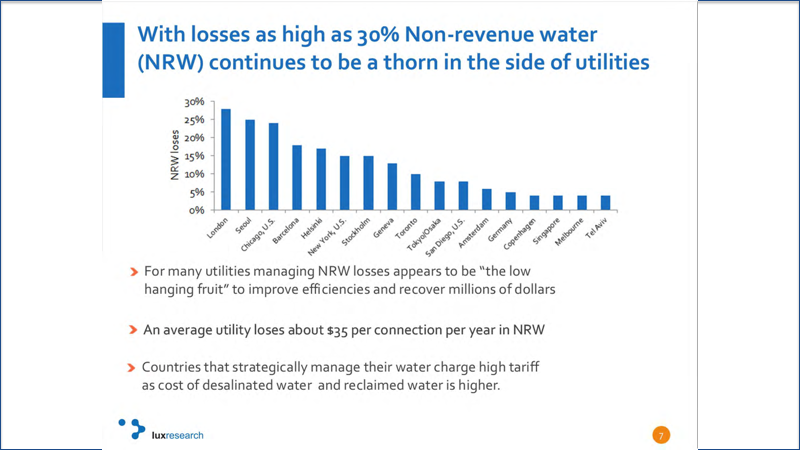

Also up to 30 percent of water is lost and it's not money. Look at Chicago. Twenty four percent. It's ridiculous. That's. Every time they lose a connection, quote unquote a customer, it's about thirty-five dollars of lost water. This is very bad because they got to make it up.

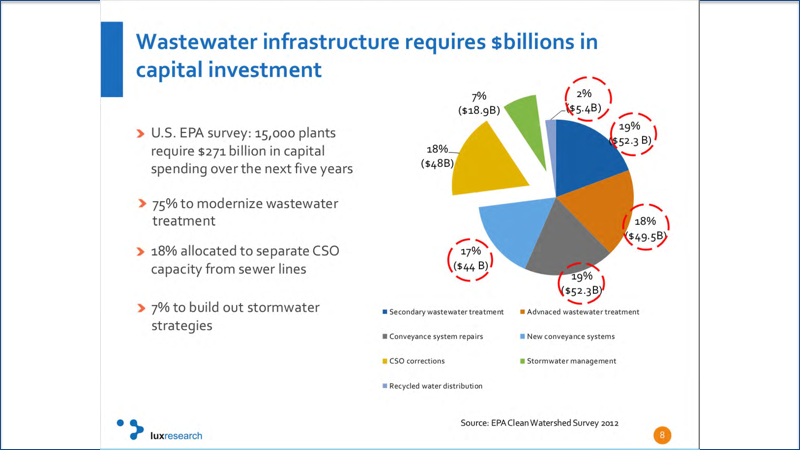

Ok, now EPA says that fifteen thousand of the water plants require a quarter trillion dollars in capital spending. And you can see the different allocations. CSO is combined sewer overflow, meaning when like a hurricane comes or some kind of heavy flood, it overflows and there's a lot of those happening.

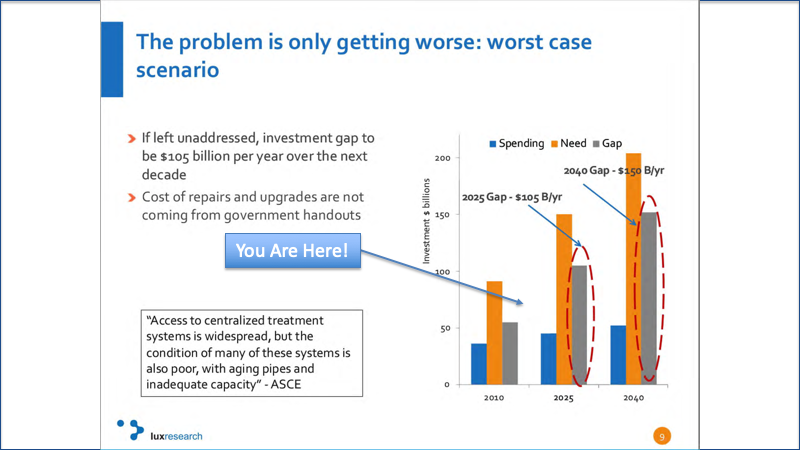

Ok, so then here's the biggest problem you are here. Where are you? You are at a roughly if I'm looking at this right about $70 billion a year gap, going to one hundred and five in 2025. That's just three years away, right? So this investment gap? Is not being covered by the government, and the Biden administration is only giving us 55, hello! There's a disconnection from reality here.

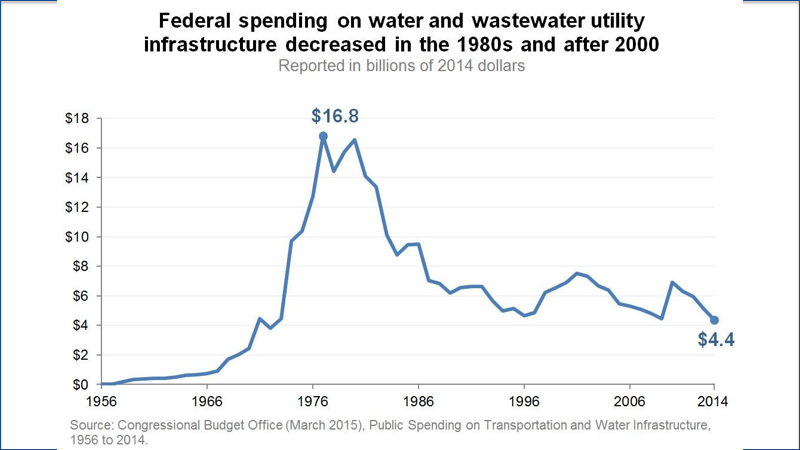

All right. And we can see that in the federal spending and water infrastructure which has dropped. And guess what? The stuff that in the later years is not grants. It's loans, not nice.

And of course, this is resulting in water rates skyrocketing. And this is a big reason why we have to help. We've got to jump in and help because this trend has not stopped. Look at it. It just goes and goes and goes. Since 2009, and of course, we know it's going to get worse.

So anything we can do to help. That story, I told you about the reporter about Russian River Brewery. They achieved lower costs on their water rates, even though their contract allowed for index water rates. So, you know, it was it was a win win. It was water rate inflated, adjusted so that the investors kept pace with inflation. But it was less than what Sonoma County was charging the Russian River Brewery.

Let Investors Help

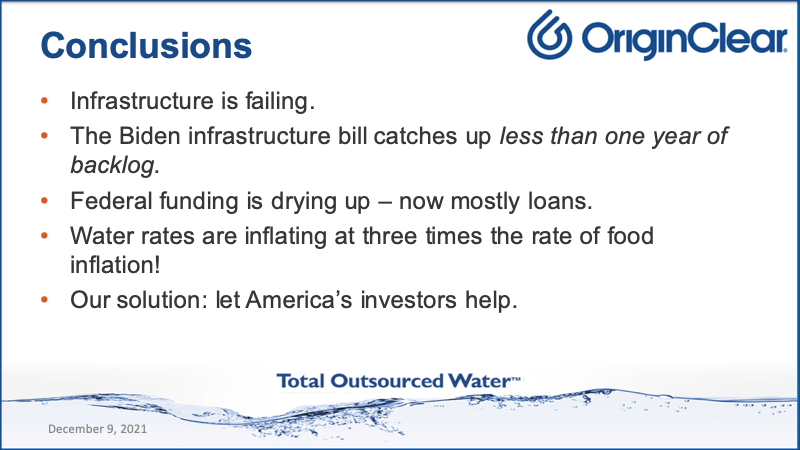

Ok, so conclusions: Infrastructure failing, the Biden infrastructure bill is less than one year of backlog; federal funding drying up, water rates inflating at three times, the solution is let America's investors help.

Complementing Big Water

Water on Demand is the first-ever direct investment program in water equipment. It complements the big cities and the big water companies. It is water as a service, customers don't have to invest in capital. And because we manage the systems or are our subcontractors manage the systems, we don't have to get into the water business. That is, the customers don't have to. They're in the brewery business or they have a housing development. I mean, why would they get into the water business?

Benefits

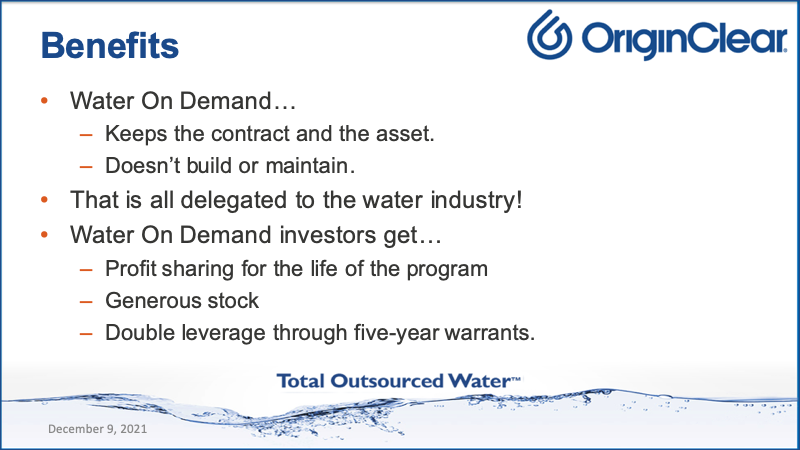

The benefits we keep the contract in the asset. We don't build or maintain, that's delegated to the water industry. So as this thing expands, I mean, our team in Texas is already completely overloaded. Their sales tripled this year. There's huge demand. Well, I can't wait for them to staff up.

We have, you know, I don't know, fifty thousand more water companies in America that can take care of things. They're mom and pops, but they can take care of the business. Water on Demand investors get profit sharing, generous stock and double leverage, which Ken can discuss with you. And of course, it is secured.

Changing Water

In short, we are changing water the way oil was changed in 1981. So that is the end of that. And I think it's very, very I think very, shall we say, life changing for OriginClear, because we don't have to build everything that we make money from. We can do it by doing funding programs; owning the contracts, owning the assets and letting water companies build the machines and manage the customer sites. Ok.

Without further ado, I would like to welcome our good friend Steve St. Angelo, who is an OriginClear investor.

Riggs: My main man, how are you doing?

Steve: I'm just peachy, yourself?

Riggs: You know what? I'm so excited. I watched myself on TV. I'm like, this guy. He's got the right thing. Oh, that's me. That's right.

Steve: Yeah. Good job so far.

Riggs: Yeah. Isn't it exciting? I mean, you know, for many years, people have said, What do you do? Why? Because we were trying all these things to try and move the needle in water. This and this and this, and it turned into this big old spaghetti. And but it wasn't even good spaghetti, it was gluten free. So that's terrible, right?

Steve: Mama mia, what's wrong with you?!

Riggs: What's the, what's with the gluten free spaghetti? Come on. You know? But anyway, what we've got here now is something I think very, very focused.

So let's discuss. First of all, Steve, we're so grateful that you're here tonight. And let's take a look at who you are and what you... So I'm taking a look at. Here we go. So feel free to just jump through these slides and I'll stand back.

Start of presentation

Steve: Well, first of all, hello, fellow investors, it's great to be with you today. And I retired from Toyota. In fact, I have a consulting company now called American Kaizen, but I retired in mid 2019 as an operating officer at Toyota Motor Corporation. In fact, I reported directly to Akio Toyoda, the president and CEO. In my last assignment, I was the CEO for Toyota Latin America, which encompassed 40 countries and six plants. I headed up through North America operations prior to that. And I was a champion of Toyota Mobility for Latin America. And now I'm a OriginClear investor and proud of it.

Riggs: Right on, right on.

Steve: So today my topic is talking about mobility and how maybe some of the aspects of mobility are similar to OriginClear's mission. But now there's a lot of talk about mobility and wondering what is mobility really about. On the surface, mobility involves transportation. It's about moving people from one place to another, whether it's across the room, across the town, across the country. Mobility needs are both greater and more complex than they've ever been in. Our old technologies are not capable of resolving new problems. Get this! The global population has doubled since 1950 and 2007, doubled.

That's that many more people on the roads than many more people drinking the water, using the water. It's unbelievable. However, current generations are less likely to own cars than the generations before them, while application based car services are on the rise. These new generations are choosing to spend their money on lifestyles, on conveniences, and not so much on cars and homes. All solutions are not going to work in the future. And this is why we are reinventing our industry to bring about the future of mobility and help drive the process.

There are some important characteristics and fundamentals to mobility that must be made. First of all, convenience, mobility must be convenient on demand and close, close to where we work, where we play, close to where we live and close to the places we need and want to go. Secondly, it has to be simple. Mobility also needs to be so simple anyone can use it. It needs to be easy to use and easy to access. This is the only way that mobility can truly be a tool of social inclusion, and not something exclusively reserved for the few fortunate people.

And finally, sustainability, mobility needs to be sustainable. Our ways of moving needs to be in harmony with our environment. They need to allow both society and nature to thrive together without contaminating or depleting our natural resources. But how do we convert these values and principles into new forms of mobility? What will all this really look like?

So many people are talking about an acronym called CASE. You see, CASE are the four pillars of mobility that the auto industry is using. CASE refers to solutions that are connected vehicles, autonomous vehicles, shared vehicles, which I will come back to, and you hear a lot of talk about electrified vehicles. In Toyota, it does not end there. CASE alone, is not enough. In addition to CASE, there are four additional pillars that Toyota included. One is artificial intelligence, personal mobility, robotics and aerial vehicles. Yes, that's right, flying cars. Can you believe it? The Jetson's time has finally arrived!

Today, I would like to focus on the third pillar, which is car sharing. It truly parallels Water on Demand. The future of mobility is a shared future throughout the 20th century. Being mobile was synonymous with owning a car. Did you know that today there are nearly 1.2 Billion cars throughout the world? That's roughly one car for every six people. But did you know that all these cars are parked 95% of the time?Think about your car and how often during the twenty four hour day that you actually use it.

We have an abundant amount of resources available that are not being used effectively. Car sharing will allow us to make the most of existing resources at the same time, remove the economic barrier of car ownership. Hmm. Similar to Water on Demand.

Toyota has already made great inroads in car sharing together with its IT platforms developed by Toyota Connected it has already launched car sharing services in many cities throughout the world. For example, My Route service in Japan connects users with multimodal transportation, combining public systems like busses and subways with other options like taxis to maximize resources and make traveling more efficient than ever before.

Also, Toyota has the HUI program in Honolulu that offers hourly or daily rentals of Toyota Lexus vehicles. You see, reservations of payments are all done via smartphone, and vehicles can be picked up or dropped off at twenty five strategic locations throughout the city. Mobility on demand pay as you go, sound familiar?

Toyota's Kinto service in Argentina. Toyota's first car sharing service in South America works in a similar way via a smartphone app. You can reserve a short term or long term rental that are delivered to your home. Choosing a fleet of Toyota vehicles with options with equip heavy duty vehicles, off road vehicles, even vehicles for handicapped people. What if we took this idea of an app and brought it to Water on Demand?

Folks, the future is coming, it's already arrived in Japan, the United States and honestly around the world. These car sharing services are a prime example of how at Toyota, we are taking the initiative to meet new demands and offer new solutions.

Think about Uber. You know, it's just a software company. They have a software tool, it doesn't own any cars, and it's now the biggest taxi company in the world. Ask any taxi driver if they saw that coming. Airbnb is now the biggest hotel chain in the world, although they don't own any properties. Ask Marriott or Hilton if they saw that coming.

You see, software has disrupted and will continue to disrupt most traditional industries in the next 5 to 10 years. When you look at Toyota dealers and most dealers in North America, they make very little money on selling cars, but they make a lot of money on financing. Leasing, servicing parts, insurance, accessories and many others.

Just think about if auto make automakers sell millions of cars each and every year. But if they didn't finance these cars, if they didn't lease these cars, if they didn't have the capability, could they sell nearly as much? At the heart of this change is our constant and unwavering desire to meet the demands of society, to fulfill the needs of our customers and the communities that sustain us in order to make their lives better. Thank you so much for your time. Back to you. Riggs.

End of presentation

Serving Everyone

Riggs: Wow. I couldn't help but notice that you were talking about not just serving the elite and I thought, that's Tesla right there? You were doing a little bit of dig on Tesla who are doing a fine job, but they tend to be higher end, right?

So I think you guys are really with like, for example, the handicapped mobility and also, you know, working people, you know, so many, you know, I was in L.A. for many, many years and who had to drive the most? The gardeners, the housekeepers, the people coming from East L.A. and they were spending huge amounts of gas. And this and that and the rest of us are like, No, we don't care.

Parallel to Transportation

So I think that what you're saying is this is a way to be more equitable and also to get the cost of capital down. And I'm so tickled that you, you've sort of thrown this parallel universe right to what we're doing. And like you say, if it weren't for the financing, you know, this is how Henry Ford took over the world. He started financing those cars, right?

So today it's an accepted thing. I mean, I could probably afford to buy my car. But what the heck? I just I just pay, right? It's just a bill. And I think that this goes the next step, which is just pay for use. Now, you, you seem to like this concept that OriginClear.

Focusing on Core Business

Steve: Well, I would tell you this. I had responsibility of many plants and many, many dealerships. And you need to be focused on your core business building great cars for your customers at the the highest quality and lowest cost just in time. And there's many aspects of any business that take you away from your core business, like your payroll, your security department and in cleaning your water.

So what I like about this instead of spending millions and millions of dollars on purchasing a water purification system that I have to maintain and take care of all, all this stuff; I'd rather use those assets, that money to provide better vehicles for my customers faster, more changes.

And let the experts in water cleaning and water purification; let the experts in payroll, let the experts do things that are not core business so we can focus on being the best of the best. And I think that's true of any CEO of any kind of business. And I see the direction going more and more that way.

Rather Invest in Water

Riggs: And for us also, it's a focus on, wait a minute, we're not going to do everything in the water industry. If we can do this one thing well, then the water industry can do the fulfillment of the water systems and the maintenance, right? Why would we run around and do that and buy a bunch of companies?

And then, you know, I was taught during the dotcom to never compete with your natural partners, right? So let them do all the work and they'll be grateful. And we, attract this, you know, hopefully a ton of investors like you, to benefit from this cool investment that beats inflation, but is, you know.

I think people would rather invest in a water well, quote unquote than an oil well right, because given a choice. So and there's a hidden part of oil well investing, which is what happens when the oil industry caps your well? It's like, oops. A lot of people are like, Oh, I don't know about that, royalty is not happening.

Why? Because demand crashed in 2020, and the reason the way they're making the oil prices go up is by restricting supply. Well, that's hurting people who are not able to make money from that. Water will never have that problem. They'll always be plenty of dirty water. And it's a growing amount.

87 % of all Water Pollution

You mentioned, for example, the doubling of the population and how we haven't kept up. Well, that's true. The same 3.2 billion dollars, sorry, the 3.2 Billion people that were have bad sanitary systems 20 years ago, they still have the same problem. The problem has remained unchanged in the world. We've got to do something. We have to do something. And, you know, eighty seven percent of all water pollution coming from industry and agriculture is a great way to start.

Well. Steve, it's been so helpful, thank you, and we hope that you will advise us as we go forward because you're definitely one of our star investors in terms of your experience in a very comparable business.

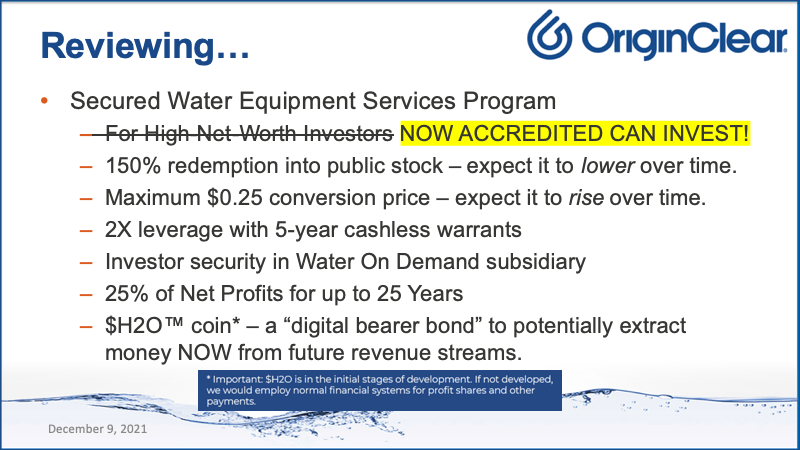

I'm going to wrap up here with a quick review of Ken's little $5 million club, which is basically, you know,

It was a bright idea that where we made it possible for you not to be a high net worth investor, you have to be accredited. But remember, accredited starts at $200,000 a year, so it's not impossible to reach, especially with inflation these days. I hope that, I hope that you're making more money with inflation because that's one of the tough things these days. But nonetheless, there's a whole raft of things here I won't go into that are fabulous.

And that we are offering the same deal as if you were investing $5 million and that's for the rest of us.

Call Ken

So talk to Ken. oc.gold/ken, email him, call him on extension 201 and he will tell you where it's at.

Thank You

And I we've taken a little bit long here, but I think it was worth it. And. The last briefing of the year is next week. So do join me, we're going to I'm going to cover some really important things I haven't been able to, especially about the economy. There's some, Moody's had a very important presentation this week that I was not able to include. That is an insider view on what's happening to the economy. Let me just say this it looks a lot like 1929, so you need to be in productive asset bearing investments that are pegged to inflation. That's my last word for tonight.

I want to thank you all for coming tonight. Do join me next week. You'll get the deep dove and I think you'll enjoy it. And as always, I greatly appreciate your coming. And thanks again to Steve for having done a great job of showing how we are like Toyota. So cool. I love it. Thanks again and good night.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)