We've seen in just the past few weeks how hot the water space has become with events like Gradiant water company's $billion valuation and VC backing. So, If a new startup solved how to make ideal water infrastructure for almost any business class end-user, with virtually no capital expense and easy access well into the future… How appealing would that startup look to those VCs and other big private equity backers? You're right, VERY! But what could that mean to you if the startup only accepted investments from everyday investors? Find out in the replay!

Transcript from recording

Opening

Riggs: Dan, I got to tell you, I'm so happy to have you on board as the inspirational designer vision of all this. One last mention I wanted to get into about Water On Demand™, which of course, is this, you know, water as a service concept is that we're excited about deploying your standardized modules as technology so that when we have these other water companies do the installation, let's say in Seattle, Washington, and they're going to install it and maintain it, we want to let them license your tech so that the whole fleet that we build through Water On Demand is more standardized.

It seems to me that the golden opportunity to let your patents and your trade secrets and your knowhow become exported to the water industry and from what our experience so far is, people are excited. Like, "You mean we can have that technology?" Yes, you can. We're not only going to give you the business here. Here's a check to pay for this machine. Here's a check to pay for you to maintain it. And by the way, you get to use the Modular Water tech. And I think that's triple winner.

Welcome, everyone. Thursday, June 1st. And it's briefing number 213. It is The World's New Water Network™. Exciting things are happening and there is so much going on. I'm going to jump right into it.

Okay. The usual safe harbor statement.

And regulation disclaimer.

Ken in NY

Now I want to play this. You know, we might have played it before, but it's a longer version. And I think it kind of tells our story really well. So here we go with Mr. Ken Berenger. Here we rock and take care of myself.

Ken: So we're in the heart of Times Square, as you can probably tell. Can I take a picture? Say cheese. Okay. Now say OriginClear. What's up, brother? We're going to head into the studio. We've got an interview with New To The Street coming up, which we do monthly, and it's going to be airing on Fox News, on Newsmax and on Bloomberg. We're going to be breaking a little bit of news. So really exciting stuff. And I'm looking forward to it.

NTTS presentation

Jane: OriginClear is doing some very innovative things with water and it involves decentralization of water. And with me is Ken Berenger, the executive vice president of OriginClear and also co-creator of Water On Demand. So let's start with, I saw that you had a nearly triple revenue increase year over year.

Ken: Thanks for having me.

Jane: Great to have you back.

Ken: Great to see you again.

Jane: So, I mean, that's something to be commended, especially as the economy slowed down a little bit.

Ken: We released a couple of different numbers. Our revenue was nearly tripled at 250%, which in the water business, I mean, they're popping champagne if you're up 10% year over year.

Jane: Right, it's a very steady —.

Ken: Right. It's very slow moving business.

Jane: Right. It's utility.

Ken: Right, Exactly. So that's kind of a stunning number. Our gross profit for the company was up 262%. Again, another near triple, so.

Jane: These are year over year numbers,

\Ken: Year over year 21 through 22. We just released the final year end numbers. So what we're really proud of is the team. They have consistently delivered results for us. And what I think is probably the most exciting part is we just announced the transfer of our Modular Water Systems to our holistic water as a service division Water On Demand. And what this allows for us to do is combine both the technology and the finance to deliver unlimited scalability in the water business.

This is $1 trillion problem. Okay? So trillion dollar problems are not going to be solved by any one single company or probably any 100 companies. The ability to integrate finance, total service, kind of a holistic view with actual technology that is kind of drop and go and can be removed. We think that's the key to being able to scale this globally eventually.

Jane: Right. Okay. So let's back up for a second and talk a little bit about what OriginClear does. So and I mentioned decentralization. So you're essentially providing small businesses, other entities, their own water system where they can recycle the water. You provide financing for them if they need that as well. So explain the business.

Ken: Well, it's more, it's more than finance. So, yeah, that is the core of it. And that's, that makes it very easy to kind of digest. But 90% of the water in the world goes untreated. Most of our polluted water is not coming from Nestlé. It's not coming from Pepsi, it's not coming from Anheuser-Busch, who are massive companies who can install $10 million systems and basically staff them on a 24 hour basis. Okay.

Most of the pollution is coming from the edges, from kind of the outskirts in smaller businesses, businesses that are extremely capital limited, people that don't have access to — And I mentioned to you in a previous interview that if you're Anheuser-Busch or you're Pepsi, you have the money, you have the staff, you've basically got your own private utility.

99% of small businesses don't have the capital. They don't have the expertise and they don't have the bandwidth to be in the water business. Okay. They need to make beer. They need to be a farm. They need to manufacture chips, whatever it is. So the total outsourcing of water treatment allows us to say to a end user, chip maker, don't worry about the million dollar system. We're going to put it right on your site. Okay?

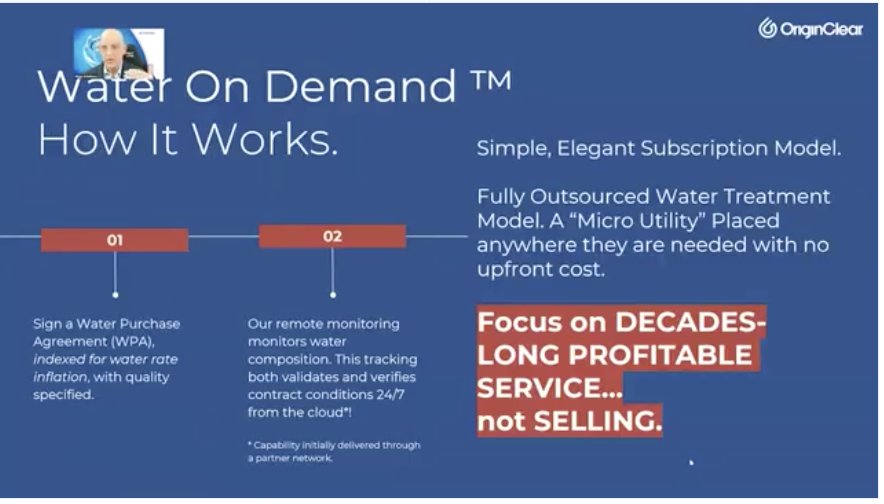

Now we're going to provide expert 24 hour a day monitoring. We're going to service it. It's all in your pay by the gallon. It's $1 million system that you now do not have to pay $1 million for. We'll take care of it. The business model is exciting and we think that the street's going to be very excited about it because Water On Demand owns the asset, that 20 or 25 year contract. We own that.

And instead of having a one and done type of, you know, great, I sold $1 million piece of equipment, now I'm out of business again type thing. It's now a 20 — It's a multi decade relationship to the end user and the revenue generated off a system is many, many, many, many times that of a one time sale. So it's a great model. It's almost like owning real estate in a way. You're going to get rent rolls, you're going to get turnover on property forever. Yeah, very attractive.

Jane: And you're investing $500,000 a month.

Ken: We had great revenue growth, great profit growth. We're still investing about a half $1 million a month in the company. But those investments, as you can see, are paying off. So we're really, really happy about that.

Jane: And then also, you've just incubated your first water company. Explain that.

Ken: Right. So what OriginClear did was it fashioned itself as a clean water incubation hub or a Clean Water Innovation Hub™. What we wanted to do, we had a bunch of really valuable properties, Modular Water Systems, Progressive Water Systems, Water On Demand. What we wanted to do is, is nurture them, get them strong enough, and then have them also, you know, maybe go to a national market or whatever.

So our first successful incubation is Modular Water Systems. This is a company that we started from scratch five years ago, I mean, literally. Dan Early walked in the door and we built a company around him and his patents and his ideas. So from literally zero, we were able to transfer Modular Water Systems to the, to our other division, which is the whole water as a service model. Right?

We transferred the — and this is the synergy between this technology and the ability to scale. It can't be understated, but we were able to transfer that property, if you will, to Water On Demand for many, many times what our investment was. And that is essentially the — I would call that the benchmark for a successful incubation. Buy it cheap.

Jane: Yeah.

Ken: Sell it or transfer it for a lot more.

Jane: Well, that's an interesting aspect of your business. As you grow, you might be able to also incubate other water, innovative water companies.

Ken: Our hope is to be able to kind of raise the kids, get them off to college, get them, you know, pay for Harvard Law, pay for Harvard Law, and then the kids can, you know, pay us back. Water is a technology based business. It's not pipes and valves. This is a highly technologically advanced business. And there is no incubation or incubator for for water technology or aquatech as they refer to it.

Now, we set out to be the world's first incubator for water technology. And happily and I'm very proud of the team for this, we've successfully incubated our first, with the only meaningful benchmark that makes any sense, right? We started out with virtually zero and was able to transfer it for, like I said, many, many fold our investments.

Jane: Yeah. Interesting. And such a problem with water and cleanliness of it and lack of it and you're really trying to address that.

Ken: It's an upstream problem right now. We treat it downstream, right? Everything flows downstream to a centralized water plant here in New York City. You know, I grew up in New York City. Water was the best water. Not so much anymore. Right. Because everything's coming up from upstream down to downstream. They're doing their best. But you've got 80 million different contaminants in your water. How can one centralized system possibly address that? If you treat the water at the place, it's being contaminated and you address those specific contaminants with a private decentralized water utility, the quality of that water coming to the centralized system is better.

And if you charge the polluter right, you and I are paying for water. Okay, We're paying the same as the guy who produces millions of gallons a month. Okay. That's crazy, right? And he's the one polluting it. We're not. Okay. So if you charge the end user, you're actually saving that business a fortune. Okay, so he's happy. But the quality of what comes down to the the end user is much, much better. And potentially we can start to deliver water in decades to come. Cheaper or even free.

Jane: Yeah. Interesting. Well, thank you so much, Ken. Thank you for the update and look forward to the next one. Thank you.

End of presentation

Ken: Thank you. We're going to be heading up to Neuehouse. I'm going to be going into the studio and I'm going to be sharing some of the items that we can now talk about with respect to Water On Demand.

Neuehouse presentation

Vince: You just recently announced Modular Water Systems merged with Water On Demand? Is that correct? That is correct. So what does that mean to the parents or the whole company? So I'm a little confused. I love I love it all. I love the story. But why did that happen?

Ken: We're old enough to remember when GM sold cars for 15 years, never making money on a car, right? What kept them going? GM Finance. It was the money, stupid. So the ability to finance a commodity, in this case cars was what kept them. Not only kept them alive, but really thriving. A car, a $40,000 car, if you look at what you pay out over time is what, 60, 70, 80? And now with these eight year financing is even more.

The financial end of it allows you the ability to really sell a car to anyone. How many people would buy cars for cash? Not many, especially with the average car today being $45,000 or $100,000 cars. So we had the same issue. Modular Water Systems was crushing it, tripling its revenue each year. We just announced a triple in revenue and a triple in gross profits, okay? And that's literally just selling to the people that have the cash. We found.

Vince: End users.

Ken: The end users.

Vince: The businesses.

Ken: The businesses that had the million dollars or the half a million.

Vince: And you're growing either way just with that.

Ken: Yes. But you're only addressing 10% or so of the market. How many people would buy a car for cash? Car salesmen would all go bankrupt. Okay. So the the idea is and this was this was the the aha moment. It's the money, stupid moment. Okay. During Covid, we came up with the idea that we didn't think anybody was going to have money. Okay? We didn't know the government was going to hand out $6 trillion. It was very nice of them. Right. But we thought businesses were going to really struggle. The truth is a small business is not going to deploy $1 million of capital if it doesn't have to. He doesn't want to be in the water business. Okay. So the you ask me, what the what is the synergy do?

Vince: Well, it's what does that do?

Ken: Water On Demand is the GM Finance, while Modular Water Systems is the GM. Now, you can't have you can't have a GM Finance without a car.

Vince: Right.

Ken: Right. You can't just be a bank that finances nothing. So what we're doing is there's $1 trillion existing deficit in American water infrastructure. That's today. The opportunity to literally finance that is astronomical. It's phenomenal. So what this merger, this marriage is, it's really, it's the final blending of technology and the total finance package, including all about water as a service. So what it enables us to do is to reach the other 90%, perhaps of the market that says, "Look, I need this system, but there's no way I can deploy $1 million."

Here you go, Mr. Jones. Here's your million dollar system. We're going to monitor it. We're going to fix it if it ever breaks, you're only going to pay by the gallon. Oh, by the way, this has nothing to do with you. I solve your problem with zero capital expense. If you've got really crummy credit, we'll put some additional security deposits like you would any troubled borrower. Okay, so the problem gets solved.

If they don't pay, we take it away. Here's the part that has no effect on you and you don't care. We own the asset. We own the contract. And we now have a multi decade relationship with you where a few hundred thousand dollar piece of equipment can generate millions and millions of dollars of revenue over the long run. So if you look at it as a pure fintech play, yeah, that's cool. Okay, Tech is going to love this because it monetizes an asset, right? But this is also about infrastructure. This is also about utility income.

So even water analysts will look at this and say, wait a minute, you guys can drop a piece of million dollar equipment on a location that investors have essentially funded. And that's going to throw off many, many, many times that in revenue over 20 years. Well, that's kind of an idea I can get behind. We think, we think both the tech analysts and the utility analysts will love it.

Vince: Wow.

Ken: The the other part is it's about the parent. So OriginClear set out to become a Clean Water Innovation Hub™, right. To be a clean water incubation hub. Okay. Within a year of making that determination, we have successfully incubated. Now, look, we started Modular Water from zero from scratch. We had Dan Early. That's what we had. We had this genius. We had to build everything around him and we made major investments in him.

Vince: Right.

Ken: But we were able to transfer that technology and that whole package, the patents and everything, that company. We were able to take it from zero and transfer it to Water On Demand for many, many, many times our investment, that is the definition of a successful incubation. So the marriage is good, the marriage is yin and yang. They become extremely, very synergistic because it allows for the almost unlimited scalability of this decentralized private utility marketplace.

Vince: So let me ask one thing. This is, so this enables me as an investor to buy the stock and if a business wants to use the system, they'll be able to get financed. And me as an investor owning the stock I make, no matter what, every time they use water I make on fees for the machine, for the machinery to stay out there. And even if the business gets sold and the unit stays with the new owner, we still get paid.

Ken: Or if we take it back and give it to another owner. Okay, so the answer is yes. So in the very the earliest offering that we had for the company, a private offering, because again, you're not buying stock right now. Company is not public yet. Okay. So you're a private investor. So the answer is yes. But with recent events and with the events that we're going to be talking about in the coming weeks, okay, that's not going to be available anymore. Okay. We're going to change how we structure the financing of this company as we're graduating to kind of a bigger arena.

Vince: Wow. Yeah, exciting, exciting, exciting stuff. So, Ken, if I get this straight, you figured out a way to monetize what people need for life, water. You figured out a way to make a profit forever on water.

Ken: The answer is yes. People have been profiting off of water. Public utilities have been charging for water forever. Okay, think about this. The pollution comes from upstream, so some farm is polluting water. That's how they, that's how they conduct their business. And they're paying the same per gallon as the guys who are trying to drink it here. It has to go through the system to be filtered and it can't really be treated to full effect. There's millions of contaminants.

So the answer is yes. We figured out how to monetize the commodity that's necessary for all life on earth. Water On Demand now becomes the full package that can help every business, everywhere, regardless of what their financial condition. Right. Or the quality, how bad the water is. We can help every single business theoretically in the world that wants it and create a revenue stream for life.

Vince: So you're turning water into money.

Ken: We're turning water into money or also leaving it better than we found it.

Vince: That's what's Beautiful. Yeah.

Ken: Why is water such a mess? Because there was no money in treating it right. It was a pain point. It was a burden. If we unburden what's behind water treatment and we make it really viable for investors to participate, you turn a negative into a massive positive.

Vince: SO Basically, I come into the deal and people come into the deal and we start sharing the story. You're going to have these water machines everywhere, so we're going to be self fulfilling the prophecy of cleaning water across the world.

Ken: You're hired.

Vince: Making money.

Ken: No, listen, you got it exactly right. I mean, look, we're going to do our job to tell the story, but it's also going to be a viral it has to be a viral thing. What we've tried to do here by combining the two companies, by creating this synergistic thing that can be infinitely scaled, we've truly figured out a way to turn water into the next global asset class.

Ask yourself two questions. If you could be one of the earliest investors in that in that asset, I'm talking about not buying it at 10,000. I'm talking about buying it at ten, right? Would you? Okay, if you could be if you could go back centuries and be the first to monetize real estate, would you?

Vince: Yes.

Ken: Okay. Everyone feels that way.

Vince: This is even better, though, because real estate, there's only so much of it. But with water, people have to keep using it. So as long as people are alive, you're going to be making —.

Ken: Water recycles, water recycles. So the same water will have to constantly be treated over and over and over again. And all life on earth depends on it being done right. If you remove the pain point and you create an actual long term revenue bearing asset. Okay. What investor, right — there's trillions of dollars sitting on the sidelines right now of professional money. They're going, what do I do? Right? Interest rates are high energy costs are high. We don't know what's going to — timing the market. Once the professional money starts to eye this thing and sees it for its full potential, I believe they can take it to the next level. This is our opportunity to be in front of them for a change.

Vince: I love it. It's so exciting. Serious. Wow.

Ken: That's it. Thank you, Vince.

Vince: Thank you.

Ken: Thank you.

End of presentation

Riggs: Yes, portions of that happened before, but there's a reason why we're repeating some of this. It's, well you're going to see in a second, it's to show the reasoning behind what we've done here.

Okay. Another repeat that I want to briefly look into, because it's going to set the stage for the discussion. We're going to have is —

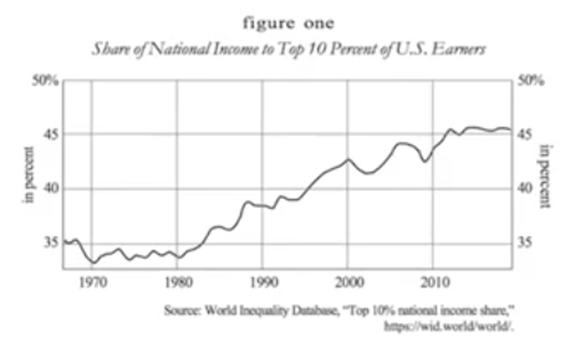

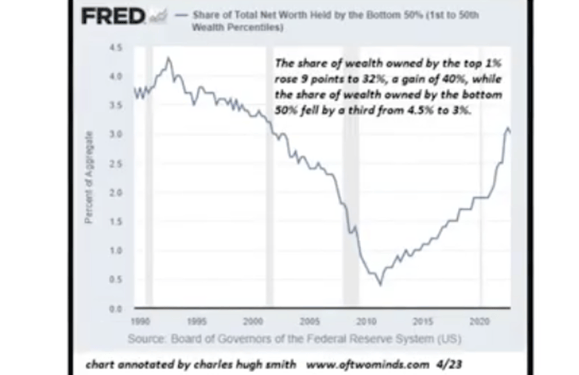

Remember how I posted this a couple of weeks ago about hollowing out the middle class? And this is a real issue. So, again, share of national income to top 10% of US earners continuously growing. Not since 2020. Since 1980, right? This has been continuous, a constant trend. The top 10% of US earners have gotten a growing, growing, growing share of national income.

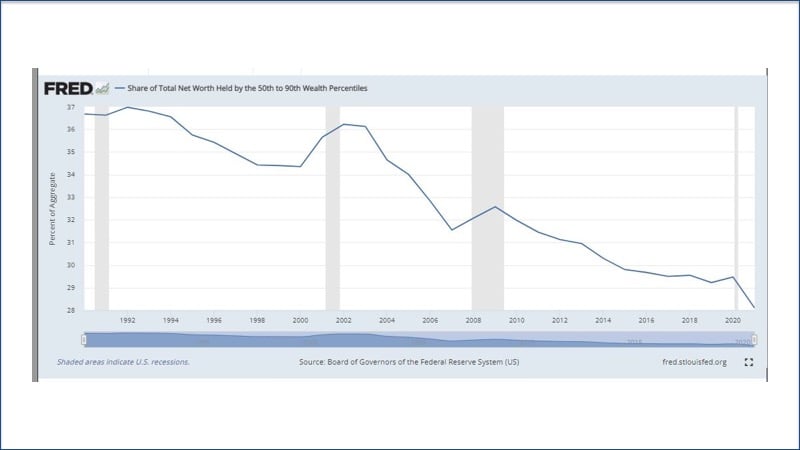

While at the same time the share of total net worth held by the 50th to 90th percentile, which is basically the middle class, has dropped dramatically. Okay.

And this one looks really good for the lower class until you realize that it basically is hovering around 3%. In 2010, it got really low. But so the bottom 50% has virtually nothing, basically. Right. Okay.

Now, we can't be complacent about what's happening. You know, hey, I met my rent or my HOA payment. Middle class is going extinct and investors need to upgrade into the upper class. So that is where — what are we doing about it? All right.

Now we have come up with a new positioning and a decision that we made. So what is it? It's summarized in this Water On Demand is the People's Asset™. As long as you support us, we will NEVER make big money deals™. The reason I bring this up is because we intend to get on the Nasdaq. And how is the variety of ways, for example, our Regulation A offering other ways that are not going to get into, but eventually we intend to trade on on a on a major exchange? Why?

Well, originally it was in great part because of the ability to make big money deals. But here's what we realized this week. Whoever you get your money from, that's who you owe favors and fealty, fealty. You remember that's an old fashioned word which comes from, you know, the Middle Ages. Fealty was when the noble owned everything and everybody just owed him obligations, right? They didn't, nobody actually owned any land. And that's kind of how it is these days. So why not owe everything to the regular investor? So instead of hedging our bets because we were going, okay, you know, once we're on a big exchange someday, then we want to be able to get inexpensive money.

Well. But then, of course, that's who you owe favors too. And these days, by the way, I don't know if you've noticed, but major companies are being forced to do things they don't want to do by certain vested interests. And so it's a very real problem. And major companies don't know what to do about it. I can tell you this. It's companies like Target are not happy about what's happening, but they're kind of stuck because the system's been basically hacked by activists. And now, you know, this requirements put in place.

So it's not a great idea to end up on on big money, you know, owing big money. So instead of hedging our bets and planning on taking big Wall Street money to fund our assets, we can instead work with the regular investor who is well aware that the big funds and VCs and celebs get all the sweet deals and is getting worse. Wealth disparity is getting outrageous. Regular investing classes know nowhere to go. But now where can a regular investor find generational wealth anymore? Water, tech, water tech is just starting. And it's the good news is it's it's early enough for regular investors to come in.

Just for those of you who weren't there when when we announced it, the gradient became dominated. This was the 14th of May. The week of the 14th of May dominated the news by becoming the first unicorn in more than a year. This funding of 225 million. And obviously now what do they do? They're not they're not even that sophisticated. They simply building water treatment systems for sectors that use a lot of water. And in fact, we have customers in most of these spaces ourselves on our Progressive Water Treatment side. Unfortunately, because they are custom customers, we can't really disclose them. And it's always been a problem on the custom side, but we have those customers. In any case, this was a major indicator that things are heating up in the water tech space.

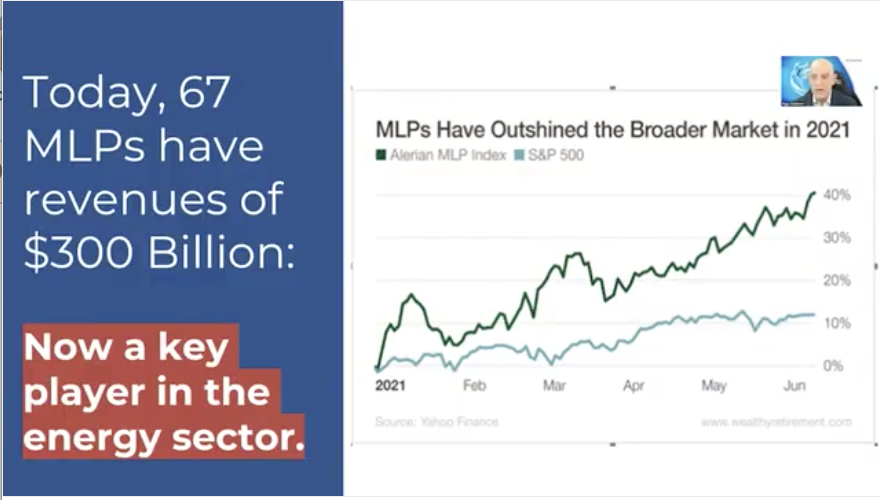

So. What's the real world model that we compare to? And it's master limited partnerships. I'm going to flip over now to the presentation that was built by Ken Berenger and myself a couple of years ago back in 2021, and this is to review the model that we based Water On Demand on, and it's still quite valid.

So Water Like an Oil Well™ duplicating the most profitable energy model ever invented. And so we're putting it to work to transform the most valuable commodity in the world. The video here is I'm going to go ahead and play it. I'll tell you why this is interesting.

Start of presentation

Dan Early: We are on site at the mobile home park and we are installing the Pondster™ 30K biofilm bioreactor system as part of an upgrade to the lagoon treatment system that's been in service here for over 50 years. This is a classic example of what decentralized wastewater utilities look like 50 years ago. Not much has changed. If you don't have access to public sewer, you have to provide your own on site wastewater treatment.

Riggs: Back in 2020, while we were working on rolling out the Modular Water Systems product line, our good friends told us that they had a problem with their mobile home park in Alabama. All through the south, trailer parks have very crude sanitation. Basically all the poop goes into a pond and that's it. It just sits in a pond. And if you've ever driven by one of these trailer parks in the south and you see there's like a green pond over there, that's what it is.

Dan Early: The lagoon system is a passive treatment system that's been in operation for about 50 years. Recently, the state of Alabama has imposed certain permit improvements and permit requirements.

Riggs: The Department of Environmental Protection in Alabama and elsewhere are trying to upgrade everything, and they're requiring landlords to do something about it.

Park Manager: Well, the last four years it has been really difficult for me to maintain the proper discharge, and it's tested once a month. We have not been able to meet the demands of ADA, Alabama Department of Environmental Management.

Riggs: So they were going to have to build something themselves. This is what I mean by forced decentralization. More and more businesses are being forced to do their own treatment because the central infrastructure is totally overwhelmed in this country and elsewhere. And so they needed a solution. And it so happened that our brilliant Dan Early, the chief engineer, has a great technology.

Dan Early: A porous, low temperature fired, highly porous ceramic. It can hold 80% of its volume in water.

Riggs: Think about putting a coral reef, all these surfaces. Right. And the dirty water comes through and the bacteria just eats it away.

Dan Early: So if you had a 12 inch by 12 inch by 12 inch cube of this material, which is very lightweight, it would have an effective surface area of 900,000ft²/ft³.

Riggs: This product is called the Pondster — Pond Monster. Over time, you just park it by the side of the pond and run a tube through And over a period of weeks or months, the pond just becomes clear.

Dan Early: The Pondster system, the treatment methodologies and the treatment capabilities that we are promoting. These are going to be next generation technologies that are going to allow us to deliver much more cost effective treatment solutions and equipment packages to those decentralized customers that need it. The decentralized world is the future when it comes to wastewater, the large centralized municipal public utilities, they are committed to the path that they started down 100 years ago.

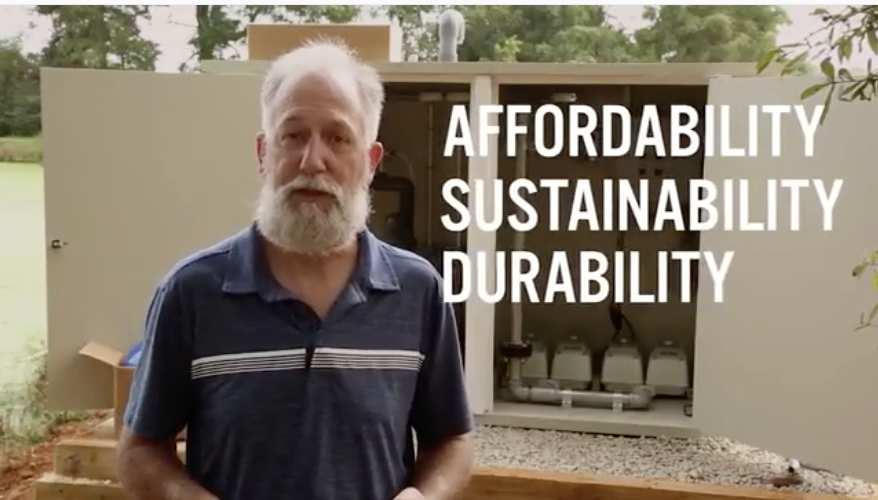

But when you get into regions where they don't have public sewer but there is a need for a wastewater utility, well then decentralization offers us this opportunity to deliver these technologies so that you can accomplish the three things that are most important to decentralized wastewater. First off, is affordability. Second thing is sustainability. And the third thing is durability.

Riggs: I can't wait to showcase this for the rest of the mobile home park industry. And then looking at really heavy pollution, you're looking at animal farms and so it's becoming a really interesting product of Modular Water Systems.

Dan Early: When you commit to a decentralized wastewater utility system, you don't want to be thinking 5 or 10 years. You need to be thinking 50 years, 75 years, 100 years. And that is the vision and the mission that we have with the Modular Water Systems program. And in products like the Pondster 30K system.

End of presentation

Case Study

Riggs: Reason why this is such an important video. We worked long and hard on the trial of our project. In fact, that pilot project, I don't think we cleared a profit. We had a lot of learning experiences to do. Lessons learned about all kinds of peripheral issues to our own technology.

Often when you drop into an environment with something new, you have to. It's the things that you don't control that that mess you up. The good news is that we persisted. The client persisted and successfully. We carried off the this Pondster installation in Troy and the client was able to get the permit from the Alabama Department of Environmental Management and in fact sold their property.

And the new owner has this incredible system. But now what's important is we've since done we have at least one other case study of a mobile home park and more to come. And now this Troy, Alabama, installation is becoming a case study. And the client herself has agreed to a testimonial. So did that was such hard work and Dan of course was hard at work Tom Marchesello, Chief Operating Officer, was very instrumental. A lot of people pitched in to make this happen. But basically Modular Water Systems has been developing great technology like this and of course it's now part of Water On Demand.

Start of presentation

Water Like an Oil Well™

Let's come back here to this master limited partnership model. It's a 300 billion plus marketplace. They've done really well. This was a 2021 presentation. So that's why you're seeing a 2021 chart and it's a key player in the energy sector. It does not replace the big oil companies, but it complements them. And regular investors can invest in one of these 67 MLPs, which primarily these days actually are in gas pipelines, not oil wells.

Key Facts

Okay. And of course, we've got the global crisis 4/5 of all sewage dumped into our groundwater and oceans and so forth. 3.2 billion already under severe water stress, 84%. Actually closer to 90% of the world's available fresh water is consumed by agriculture and industry, and the US government is contributing less and less. These are facts that you know, but we cannot fix it with the big public works mentality of the first water revolution.

Those of you who were around, I don't know, 3 or 4 weeks ago you saw a presentation of a housing development in Denison, Texas, just just on the Oklahoma border and Dan Early pointing out that the whole of North Texas is growing so fast they don't have time to put in sewage systems. And so they're literally putting in these self-sufficient water systems. So that is becoming the norm.

A Better Way

Of course, master limited partnerships. And in 1981, Apache Corporation invented this by bundling oil and gas properties. And that's how MLPs became a way to earn these generational royalties. And of course, water assets, unlike oil assets, are continually nobody's going to stop using more water. Water is going to be constantly be reused.

And as you know from De-globalization, factories are coming back to North America. It's happening already. And they're coming back so fast that there won't be time to build again the central utilities, it'll all be integrated water with these state of the art factories that are coming back from China and elsewhere to North America. So that's only going to increase the water demand in the United States, Canada and Mexico. But we don't eliminate big water. We complement it.

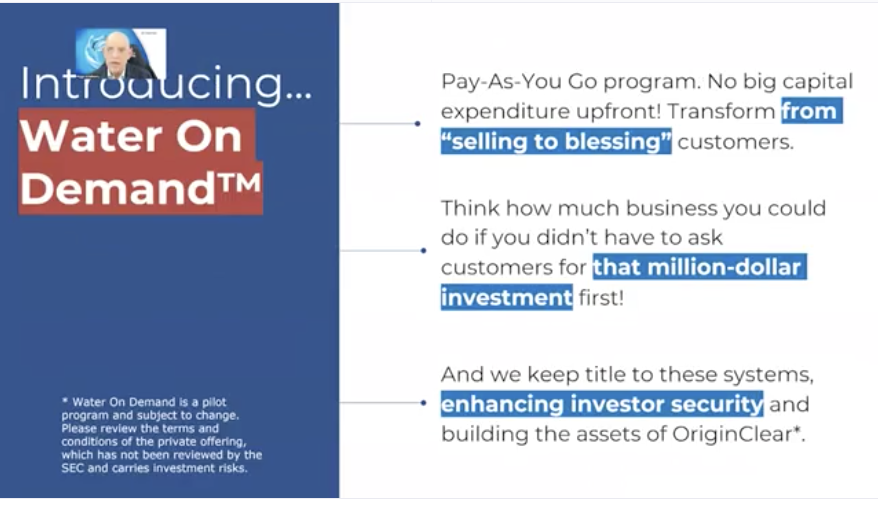

All right. Pay as you go program, as we've been saying, and we keep the title, which means that investors can place a lien on the equipment to enforce their royalty rights. All right. I'm not going to go through this.

It's simple subscription model, basically direct investment to solve the global water crisis. It's inflation friendly. Why?

Because these contracts are locked in for a certain inflation index, unlike the water utilities that can charge anything they want. Et cetera. Et cetera.

Features

All right. And then so here's what we have. This direct water investment, which is 25% profit sharing for the life of the program, and you get shares as part of this deal. But even after you sell the shares, you still get the 25% profit sharing that you can find out about more from Ken.

And it's basically recreating what cellular did by bypassing current infrastructure. Again, I'm not going to spend too much time on this, but the point we're making here is that master limited partnerships and Water On Demand are very similar. On the right, you see that a credit investors are feeding the Water On Demand subsidiary and that is fueling water properties. And furthermore, we have Modular Water in there now. Okay. So that that just takes us to, you know, the MLP model was definitely worth reviewing.

End of presentation

Freewheeling Discussion

Okay. Now moving on here, I think we should have a freewheeling discussion. What do you think, Ken?

Ken: I was having deja vu, right. You know, I was like, wow, Um.

The Big News

Riggs: The big news and I don't want to drown it out in all the other stuff we did is that we decided to commit, like, to not keep dating around. Oh, you know, I might get some money here. I might get some money there. No, we are committed to getting money from the regular investor. That is our model. And by the way, you can raise big money. Look at Knightscope with a K, knightscope with a K, which raise $140 million from regulation A crowdfunding.

Get in Early

Ken: I was going to say that's not even that's not even the — So you described the wealth disparity and you were describing mainly kind of the average guy like my mom and dad, right? Not super affluent. Not rich, right. But even the wealth disparity between the elites and the rich is expanding dramatically. Nobody who wanted to invest early in Gradiant, who's an individual investor can do that. It doesn't matter how much money you got. Unless you're a VC fund, you're out, right?

So they tend to gobble up these tremendous assets and really kind of over inflate them. So eventually they go public, right? And guys like us buy the shares and what happens? They go down. Right. So in other words, the big, big, big, big guys make money off the what? I would say rich guys, you know, rich and affluent people. Right. And that is something that anybody who's run a business and has been investing for years already knows that. Right.

So the idea that, look, there are tens of millions of affluent, what I would, you know, accredited investors or affluent, you know, affluent to people that are relatively wealthy or rich. There are tens of millions of them. There is more than enough capital, tapping into that, to do anything we need to do right.

Now, what we have to do to enable that Riggs is to we've got to be able to communicate it effectively. And we've got to be able to make it go viral if we can create virality and really appeal to that, to that group, that this this is the only chance you're going to have to invest in water tech at this early stage. Remember the statement that David Lynch said, "The world's first trillionaire will be an investor in water." Only, first of all, that has to happen at very early stage, right? That investor has to come in and you probably agree.

Riggs: Be a founder.

Ken: Round A, round B, you know what I mean? Like really, really early, right? And that'll only happen if the VCs have complete control if they completely take hostage of this asset. Okay. What we've basically done is we've gone the other route. Okay. Instead of making one trip, like, what the heck is the what? What the the world's not going to benefit from 1 trillion. It's just not right. He could become Dr. Evil, right? I mean, he's got that kind of capital, but. 100,000 multi-millionaires or 100,000 affluent people whose net worth doubled or tripled as a result of this. Now, that has, if you believe in trickle down, the effect that has on our economy. Is, it can't even be overstated.

Favoring the Individual Investor

Riggs: Well, here's the thing. It is a vast market. And by leveraging it in the way we're doing with Water On Demand, with the financing help, it can move quickly. And if we fully allow the regular investor to be the exclusive investor, we are going to we're going to have an effect on the investing middle class. Absolutely.

Ken: I was communicating today on Facebook with a friend of mine. They were commenting on that post. You know, why would Target do this to themselves? Why would they set themselves up to be boycotted like this and wiping out $12 billion of — Well, look, when Target loses $12 billion of market cap target doesn't really get hurt. The people that are invested in Target get crushed. Right? Especially the guys who bought recently. So why would they let their investors — And I explained to them that a lot of times you're right; Who you borrow money from depends on is who you owe favors to and what are those favors going to cost, Right?

In other words, what kind of dictates or mandates are you going to be tied to that could be unhealthy for their overall business? And I wrote to him, I said, you know, my company is positioning to be the only aqua tech company in the world to offer investment opportunity to individual investors.

So we could do this with institutions, institutional money. But it comes with conditions. You just don't want those conditions. Right? Who do you want to be beholden to? You want to be beholded to the people that believed in you and helped you build your company into potentially $1 billion giant? Or do you want to be beholden to the institutions who will hold that, those sort of conditions that can be extremely unhealthy for you right.

Large Market Segment

So. The affluent business owners, what we refer to as accredited investors that built themselves a life one day at a time, building a business. They are categorically against this sort of hostage taking of businesses, especially because it hurts their portfolio, It hurts their 401 seconds. Right. And they number in the tens of millions. And as I wrote to him, there's way more than enough capital to build anything you need. You need to create a movement and you need to organize that movement and speak directly to that audience. Okay.

These guys know they're never going to be first. They're never going to be first If unless we make a concerted effort to make sure you're first. And here's why. They just want the business to run. They don't want to deal in our politics. They don't want to deal in any of those other issues. Make the business work. Make. But leave the water better than you found it and allow this to start to bend the curve on human health like sanitation did 100 years ago. That's all they care about. Anyway, I'm done.

Riggs: No, I love it. Now, here's here's the insurgent part of the story.

Ken: I love insurgencies.

Riggs: Well, there is some serious insurgency going on which has led to a whole alt media environment. Ken you've been exploring with a very, very savvy new partner of ours, the Rumble space.

Ken: Yeah, Hi, AJ.

Riggs: The Rumble space is — here's the thing. It's not that it commands all the eyeballs that Bloomberg does or whatever, but it commands a lot of passion and are looking for alternatives to what they're being fed. You know that term gridder, a gridder, is someone who's 9 to 5 and they do exactly what they're told. They watch regular TV and so forth. That's a gridder. Well, these people are going, "Well, this isn't working out for me. You know, I invested, you know, 8% in the S&P 500 every year. That looks great, except inflation is at 12%."

Ken: I was going to say, except when. Except when. It doesn't do that. Exactly.

Riggs: But the point is, is that over time, you know.

Ken: Yeah, yeah. Over 30 years, you're going to get 8%. Sure.

Riggs: But inflation grows faster and people go, well, wait a minute, You know, I don't I can't retire. And people are literally they're going to keep working till they drop. That is BS. So we have a boiling mass of anger. You know, remember that that network TV movie, I'm mad as hell and —

Ken: I'm not going to take it anymore. Right. Right. And it was 12 Angry Men. Was it a 12 Angry Men?

Riggs: Oh, it was a Network. It's called Network.

Ken: Okay. Mad as hell. I'm not going to take it anymore. But I do remember that he starts.

Riggs: He starts shouting it and then everybody else puts their heads out the window and starts shouting it. Well, that's the social media equivalent of that is, you know, alt media channels like Rumble. In order to serve these, we cannot betray those these angry "not going to take it any more people" who have some money and they do not, you know, the standard model.

Ken: They have capital and they have passion.

Riggs: Right? Well, but the standard model has always been get money from those people and then graduate to the big exchange and then you get the big money and whatever. Right.

Ken: But recently they flipped it. They went right to the — So what did gradient do? I need $400 million to make me a unicorn. Sure. Here's 400 million. Okay, look, we absolutely need to make 50 to 1 on this, guys. So what does that mean? That means there's going to be multiple rounds each with a diminishing, you know, outcome to the end user because those original guys, in order to even come in because there's total risk in that first round.

I mean, just, you know, here's why they have to make 50 times their money. There's a nine out of ten chance they're going to lose everything. So they have to do ten of these deals. Right. One's going to work. They make 50 times their money. They make five fold their money. But here's what happens. Now this thing hits the market as this bloated, over capitalized Leviathan. And the minute it goes public. The folks that we're talking to, the people that want to be involved in something beginning, something that makes the world better. They buy the shares and what happens? They go down, right. And they get hit again. Right.

Integrity

So we made a conscious decision. At first it was due to necessity because of the space that we were in, but now it's due to choice. We're having conversations with folks that can solve all our problems. But then you go, okay, what's that going to cost me? Right. And it's not worth our integrity, right? Where the the accredited investor says, keep your integrity, Just build the business. Right. I'll help you. And like I said, those people, that's an army. If they number in the tens of millions. And when we open it up to the — go ahead.

Riggs: Why we and I'm going to play the clip in a second that's why I was offline. But the other thing is we realized, Ken,

Ken: You found the clip?

Riggs: How amazingly faithful —

Ken: Unbelievable.

Riggs: Investors are if you if you treat them right. And that's really what we learned is like, wait a minute, these investors, and you know who you are —.

Ken: They're patrons. They're more than investors. They're partners. They are absolute partners.

Riggs: So we can grow that. And then with our regulation A offering, we can go all the way down to $1,000 investment. Now it's everybody. So now I'm going to go ahead and play this just for fun because.

Ken: Okay. All right.

Clip from Network

Commentator 1: Garbled.

Commentator 2: The 13 nations of OPEC have still not been able to decide by how much to increase the price of oil. Saudi Arabia...

Show Coordinator: How much time we got?

Commentator 2: Yesterday for further consultations with his government, He returned to the Vienna. This is Ed Fletcher in Vienna.

Show Coordinator: Two Cue Howard.

Howard: I don't have to tell you, things are bad. Everybody knows things are bad. It's a depression. Everybody's out of work or scared of losing their job. The dollar buys a nickel's worth, banks are going bust. Shopkeepers keep a gun under the counter. Punks are running wild in the street, and there's nobody anywhere who seems to know what to do. And there's no end to it.

We know the air is unfit to breathe and our food is unfit to eat. And we sit watching our TVs while some local newscaster tells us that today we had 15 homicides and 63 violent crimes, as if that's the way it's supposed to be. We know things are bad. Worse than bad. They're crazy. It's like everything everywhere is going crazy. So we don't go out anymore. We sit in the house and slowly the world we're living in is getting smaller. And all we say is, please at least leave us alone in our living rooms. Let me have my toaster and my TV and my steel belted radials and I won't say anything. Just leave us alone.

Well, I'm not going to leave you alone. I want you to get mad. I don't want you to protest. I don't want you to ride. I don't want you to write to your congressmen because I wouldn't know what to tell you to write. I don't know what to do about the depression and the inflation and the Russians and the crime in the street. All I know is that first you've got to get mad. You've got to say, I'm a human being, God damn it, my life has value. So I want you to get up now. I want all of you to get up out of your chairs. I want you to get up right now and go to the window, open it and stick your head out and yell. I'm as mad as hell and I'm not going to take this anymore. I want you to get up right now. Get up, go to your windows, open them and stick your head out and yell, I'm as mad as hell and I'm not going to take this anymore. Things have got to change.

Producer: How many stations does this go out to?

Howard: You gotta get mad! You got to say,

Show Coordinator: I know it goes to Louisville and Atlanta.

Howard: I'm mad as hell and I'm not going to take this anymore. Then we'll figure out what to do about the depression and the inflation and the oil crisis. But first get up out of your chairs, open the window, stick your head out and yell and say, I'm as mad as hell and I'm not going to take this anymore.

Producer: Who are you talking to Herb?

Herb: KCGB Atlanta.

Producer: Are they yelling in Atlanta, Herb?

Show Coordinator: Are they yelling in Atlanta, Ted?

Howard: But first you've got to get mad. You've got to say, I'm as mad as hell and I'm not going to take this anymore.

Show Coordinator: They're yelling in Baton Rouge, God damn it.

Howard: Get up, Get up, Get up out of your chairs.

Producer: Son of a bitch. We struck the mother lode.

Howard: Stick your head out of the window. Open it and stick your head out. And keep yelling and yell. I'm as mad as hell. I'm not going to take this anymore. Just get up from your chairs right now. Go to the window.

Mother: Where are you going?

Daughter: I want to see if anybody's yelling.

Howard: Everybody go to a window, open it and stick your head out and yell and keep yelling.

Man yelling: I'm mad as hell and I'm gonna take it anymore.

Lady yelling: I'm mad as hell I'm not gonna take it anymore.

Lady yelling: I'm mad as hell and I'm not gonna take it anymore.

Man yelling: I'm not gonna take it anymore.

Multitudes yelling: I'm mad as hell and I'm not going to take this anymore.

End of clip

Social Media is the Window

Riggs: Is that relevant or what?

Ken: AJ wrote me, "I can't believe..." And I wanted a comment. Like if he hadn't done it, I was going to comment. I was like, "Did they film that like three months ago?"

Riggs: I know.

Ken: So I feel better knowing that the world has been a shit show for a very long time. And the same thing, like mankind has been angry about the same thing for a long time now. Yes, With the 24 hour news cycle, I think we're more keenly aware of things that happen in real time in areas that we'd never had access to. But the fundamental, the fundamental wealth gap. Is changing like it is. This was what? This? That was Faye Dunaway. That was, what, 70s?

Riggs: That was 76.

Ken: Yeah. Okay. Um, my dad worked. My mom stayed home in 1976. They didn't have to both work. Right. It was only later in the 80s that they both had to go to work and to support the family. And now very, very few. Families have only one working parent. Sometimes it's out of necessity and sometimes it's out of desire. But my point is, it's really no longer a thing, so. That energy, that idea. Now, of course, I'm not recommending anybody shout out the window.

Riggs: No, but it's not, the window is now social media.

Ken: Yes. The window is now.

Riggs: And now that we're you know, with our friend AJ, we're taking a step into this alt media because I can tell you, for two years, Ken and I have been told by media buyers, oh, don't go to rumble, Don't go to this, don't go to that. It's not worth it.

Ken: They don't know how to make money on it.

Riggs: Instead, they want to go to Quora. Quora? Yeah, because Quora is very important. Well, it was it was a dud. Now people are flocking to it. And speaking of media placements, because it's 902 and I don't you know, I want to preserve your evenings, my friends.

Airing Schedule

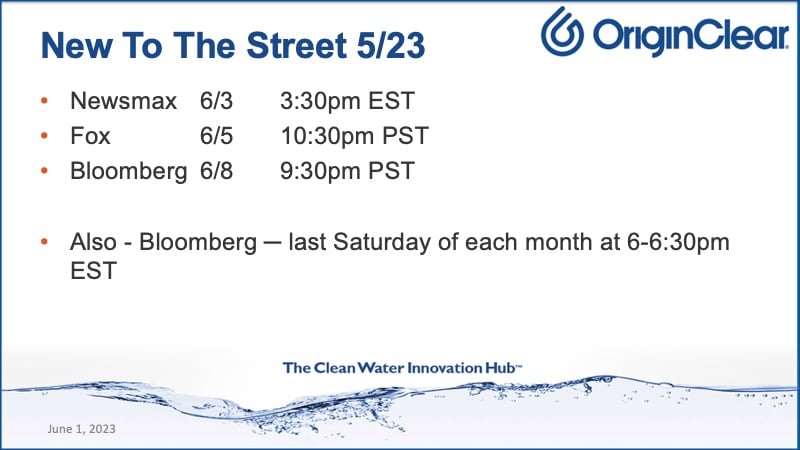

I'm going to show you the airtimes for the show that I recorded virtually on the 23rd. So Newsmax on 3rd of June, which is this Saturday, 3:30 p.m. EST. And then the Fox and Bloomberg spots are only really good if you're on the West Coast. Otherwise they're pretty crappy. But as a Bloomberg slot last Saturday of each month is 6 to 6:30 p.m. EST. So these are good times. But the Newsmax one again, people underestimate Newsmax because it's not thought of as a major network, but it gets a lot of alternative investor, right? So with that and —

Ken: Also people that are viewing the world for what it really is and not what the, you know, kind of the news is telling them, they're very critical thinkers. Most of them are business owners or executives. And they they see the they see what's developing in the world for what really is.

Riggs: Exactly. All right. And so I'm really excited about this. First of all, I'm excited that we've made this commitment to stick with the people who, the dance partner, you know, the partner you brung to the dance,

Ken: Right. Dance with the girl who brung ya. Right,

Riggs: Right? So that's for starters. And we think it's very powerful because the middle class investors running out of options seriously. And excuse me. Secondly, the commitment to go more and more into the alt media is going to be a lot of fun and it's going to give us a lot of visibility because, again, our message is a counterculture message, right? The pro culture message is big investments, you know, blah, blah, blah.

We're like, hey, no, we're going to, you know, get our money from the regular investor and we're going to feed it to businesses that have to do their own water treatment. This is a people's asset. Water is the people's asset.

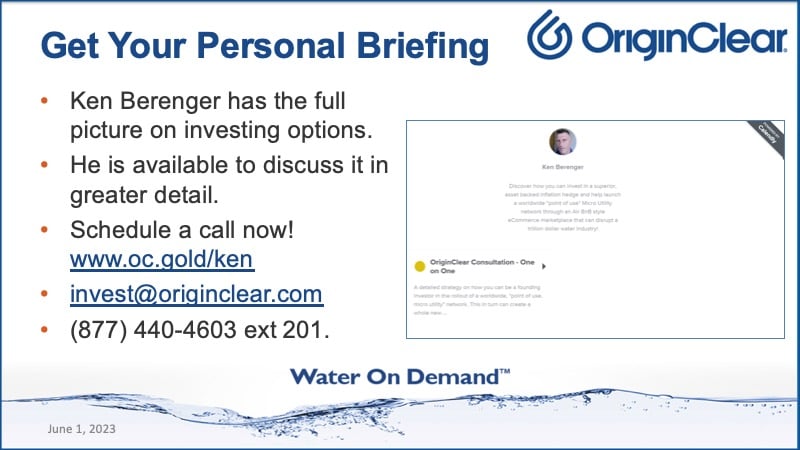

Call Ken

I'm going to show you this screen, which is that you need to talk to Ken. And he is available to discuss, of course. And if you're interested in some real inside story and you are qualified, you may find out some really, really interesting stuff. But I will leave it at that. And please fill out your Zoom survey at the end. It helps us understand what's going on in your feedback. We really appreciate everyone tuning in. We had a good audience tonight and we want to keep that up.

Ken: And George. George, you you had raised your hand and then you did ask a question. Just reach out to my staff at Oc.gold/ken. And you were asking you were asking about investing in the company and they'll get you on my calendar.

Riggs: Oc.gold/ken is the easiest way you'll get your appointment set and we can't wait to welcome you into our exclusive club of the rest of us. There are many, many comments. Super positive. We appreciate you guys and gals so have.

Ken: Well, these are the guys, right? I mean, they're like, Yeah. They're like, yeah. Right, right. You know, power to the people, right?

Riggs: To me. Yeah. I'm the guy.

Ken: No, listen, these guys have been getting hosed by big money for forever, right? So we want to we want to continue to dance with the girl that brung ya.

Riggs: There we go.

Ken: All right. I'm not assuming anybody's gender. I'm just saying.

Riggs: He's just using a hackneyed old expression.

Ken: Right. Okay.

Riggs: All right. Everyone, have a great night. Remember to book with Ken if you're interested in hearing more than we can possibly discuss publicly, have a great night.

Ken: Good night.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)