Investors can invest directly in oil wells – why can’t they invest in water systems? Water On Demand fixes that. We’re not planning to REPLACE the big water companies, but COMPLEMENT THEM. Check out the math on how we can “move the needle” with billions of gallons of clean, blue water. Find out here in the replay!

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

And welcome everyone to Water is the New Gold, I'm glad to see that a bunch of people are showing up. This is going to be a great briefing, lots going on. So as people are arriving, I'll I'll do the technicalities as they say. So there we go. And let me reshare in text mode.

Timothy Melton's "Hey bro." Nice. Nice to have you. Timothy.

Keith Roeten, "Amazing intro." Yes, my brother Stephen once again made history. The man with too many cameras. And he's got an amazing style, for sure.

All right. Water is the new gold. Thursday, December 2nd and we have just three briefings this month, so we will not have any on the twenty third and we will not have any on the 30th. So enjoy what you can. So the 2nd, the 9th and the 16th, those are the three. So we are in the world's only vital, scarce and recession-proof market. And what's really exciting is what's happening is we've now worked out how we're going to complement the Big Water companies and the government operations just the same way that oil and gas partnerships complement Big Oil. And that is amazingly exciting. You'll get some more about this in this conversation.

As always, we have Heather recording in real time, translating in Spanish. All you have to do is click on the globe and you'll be able to listen to Spanish. And of course, we do the replays in Spanish as well.

As usual, we always do our very best to tell you exactly what's happening and we correct it when we get it wrong. But we actually are doing pretty well with getting it right, so I'm actually proud of the team.

Now, I wanted to go back to the news of the last few weeks where we saw the sales triple booked orders in Texas and in Virginia. So what are the actions that led to these, this success, right? So let's take a look here.

Sales Rep Network

First of all, in early 2019, we started building a sales rep network, and that was very. We added like a dozen reps. And as usual, you know, only a few of them really worked out, but the ones that did are really rocking so. And then they're supported by these webinars that Dan Early does. So that's promotion. We do a lot of that. These webinars are incredibly successful. They're really geeky engineering webinars, but that's what these consulting engineers love, right? And these are the people who specify the jobs and Dan is a guru for them, right? Which is super cool.

Repeatable Process

More and more, especially with Modular Water Systems™, we've locked down a process that you know is is not being invented every single time, which is good for profit margins, but also good for expansion and quality.

Strategic Partners

We have strategic partners out there that have been bringing us business and who have been steadily relying on us more and more.

Products

Our products. You know, you saw the Pondster™, an outstanding product that is best of class, the BroncBoost™, which is a booster pump. These are standardized products that can be replicated and distributed into channels not just sold by Texas or Virginia.

U.S. Manufacturing

Now that's a big deal. We have these problems with supply chain and so forth, and the fact that this is a U.S. manufacturing operation today is a real benefit. And I think we're going to see much more and more of that as problems multiply with China sourcing.

Staffing

We've been adding some expert people, project managers and primarily and we're adding more. Project management is our biggest, biggest challenge. We got no problem with sales and we got no problem with actually building stuff. But that interface between the selling and the building project management is key. And we we added John three weeks ago and he's being trained up and we have another one coming in 1 January. So that's continuing.

Conferences

And we have been going to conferences showing up again, showing that we have, you know, a lot of expertize. Getting the word out.

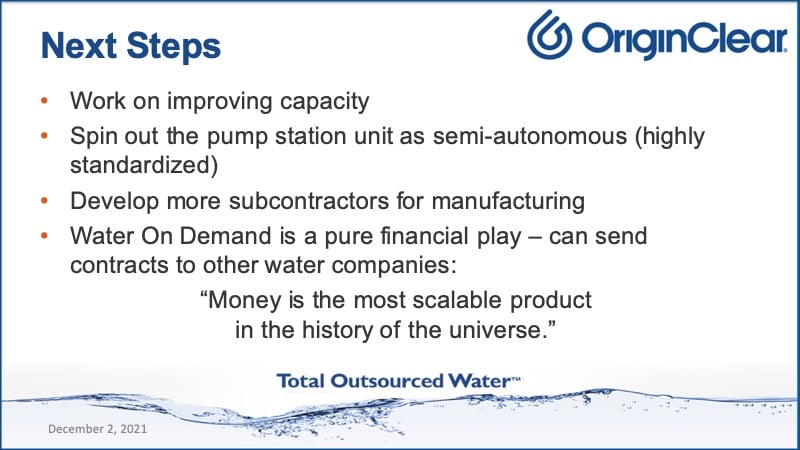

Improving Capacity

So what are the next steps we've got to keep working on improving capacity right now? With thirty two jobs in the shop, we are maxed out. This is a problem because I'm, you know, seeing a lot of funds go into Water on Demand™, and that means that Water on Demand really has to think of itself as not just giving business to Texas, but to any water company and as a result becoming a pure financial play. I'll talk about that some more.

Pump Station Spin Out

Building pump stations has become highly standardized and so we're working with, Tom Marchesello COO is working with Dan Early, the chief engineer, to create a pump station unit. That's all it does. Pump stations are unusual because even though normally you think of us as working with private businesses, pump stations tend to be more municipal. It's a very good product for us because it's basically a tube with a pump in the bottom. But we build them so durable that they're highly popular.

More Subs

We want to have more subcontractors to manufacture things so we're less reliant on manufacturing things in McKinney, Texas.

Outsourced Contracts

And finally, with Water on Demand being a pure financial play, we can send contracts to other water companies. We want to be in the business of money because it is, this is a quote by me, myself, is the most scalable product in the history of the universe. I think we can all agree on that as the current administration revs up the money by simply adding zeros. Apparently, that's all you've got to do.

Money for Money

But if you can do a money for money play, think about it. Water on Demand, you know, puts out, you know, negotiates contracts with customers to finance these machines. So it owns the contract and then has the machines built and owns the machines. So the water company that builds it, you know, gets money one time and then might get a maintenance contract. But Water on Demand has both the client and the machine the asset. So that's really, I think, a power position.

PI Network

Ok. Quickly, before we move on to more good stuff about Water on Demand, our friends at PhilantroInvestors® have been doing some great work. We've seen our ambassadors in Latin America relaunch their efforts. Excuse me? To market to investors, there is a podcast that was booked called Purpose Driven Entrepreneur, and OriginClear was highlighted by Ivan Anz, the founder, and of course, also was it last night? Yeah, last night, Big Puerto Rico event.

You know, Puerto Rico has a lot of crypto heads and a lot of people have moved there to for the quote unquote tax benefits. But also it's a great place to live, frankly. And so they have had 70 people at this event, and Ivan discussed our new asset coin, which is super exciting. I'll discuss that briefly. And finally, this founders club is a very important organization, and we were highlighted in that podcast, so thank you very much to PhilantroInvestors and Ivan Anz.

Audience Interaction

And I see I have a bunch of people speaking up. All right. Let's see if we got here. All right. So Timothy, Timothy Melton's, "You were most definitely built in time for this project created for this good job. This coin thing has me interested because you all doing all works into one Puerto Rico. Wow." OK. So he, Timothy, here is is mining like crazy, that's super. That's great. All right.

Complementing Big Water

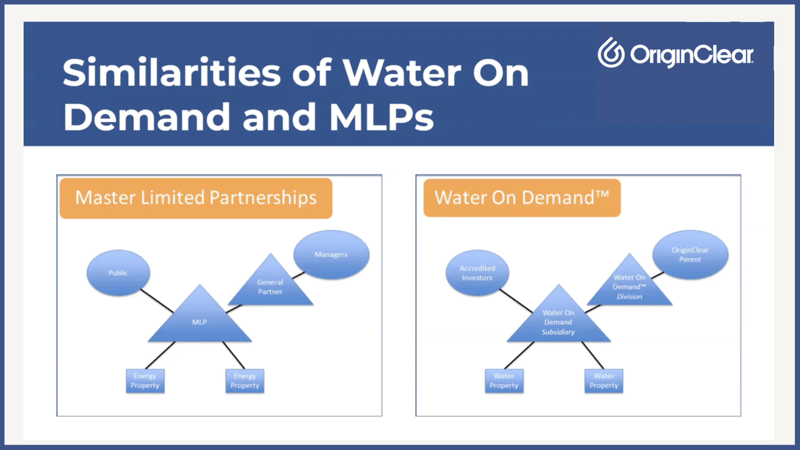

Now. We have this concept of water as an oil well right now. Really, this works really well because in the oil industry, starting in nineteen eighty one Apache Corporation built, it was called the Master Limited Partnerships, where it took a bunch of oil and gas partnerships and combined them under one roof. And today there are 67 such partnerships with, it's a $300 billion market and it complements Big Oil. It's not trying to replace Exxon and Mobil and so forth, but it's providing a lot of flexibility for exploration, for building pipelines and so forth.

We don't have that in water. There's no way for, you know, direct investing into water systems. You have to either invest in a bond or buy shares and a big water company, but there's a need for that same kind of thing, which is a not a majority by far a relatively small piece of the water industry, which is a trillion dollar industry per year. But an important one because it fills in an important gap.

So let's let's visit here with Ken Berenger. He's I'm going to I, we did a very good run through. That's why you got a picture of me in the top right in this run-through and.

Oh. Timothy PI Network, PhilantroInvestors. Philantroinvestors go to philantroInvestors.com/water. All right. Timothy was wondering what this PI network is and there actually happens to be a PI or PI coin. So that's that was the confusion, and I understand that. But anyway.

Start of presentation

Millions of Gallons Clean Water

Ken: Breaking it down like this you...So what Water on Demand is intended to achieve, and we believe it will is it adds a direct investment to directly solve a direct investment to directly solve the global water crisis. Very inflation friendly. Much more price stable than oil. A whole new eco friendly. It's an eco friendly asset class.

Ok. And like an oil well, you'll be able to track every drop of every drop of water that comes out of this thing. More importantly. One hundred thousand dollars invested in this in these systems broadly is designed to create thirty one million gallons of clean water over a twenty five year.

You want to talk about transparency. All these carbon credits, "Ah we're going to save this many tons of carbon..." That's all bullshit. There's no way of really tracking that. Because this is how we bill the end user, we will be able to tell you to the drop how much water your investment saved. You are the quintessential impact investor at that point, and I think that makes us absolutely irresistible. Our common stock could be a target for the $36 trillion ESG market once we graduate to Nasdaq, which I believe.

Riggs: One third of all assets in the world.

Ken: What?

Riggs: It's one third of all assets in the world,

Ken: One third of all assets in the world, Ok. Now the financial model, here's what's even better about it. This is where it becomes very Amazon-like. It's not dependent on us, we don't intend to be the main manufacturer for this. In fact, a hundred companies eventually couldn't do it all. So, the idea is this goes from a manufacturing play, we're a money play now. We're simply the paymaster, we're the facilitator. Amazon does not care whose coffee you buy. And that's when their eyes light up. They get it. So if you had one hundred thousand dollars invested in Amazon stock in ninety seven like I did and you didn't sell it early like I did, you'd be all right, OK? And what you're essentially doing is creating a brand new asset class of actual eco friendly water assets.

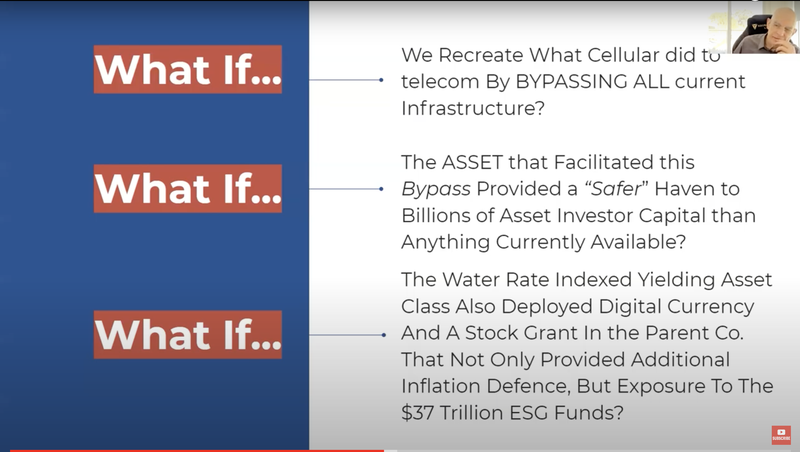

$100,000 Worth $33 Million

So by bypassing traditional, we're going to do what cellular did to telecom, right? By bypassing traditional infrastructure. Well, what does that bring about? Well we already know, it's been done. It created a trillion dollar market like the entire telecom market in Africa and Asia. Two billion people are using that network. There's not a telephone wire to be found anywhere. That is a proven model and we know the results. We know the expected results. That's what we're doing, Telecom. So the asset that facilitated the bypass is actually going to be a safer haven to the billions out there looking for a place where they're not going to lose their money just by keeping it safe.

Telecom invested billions of dollars of their own capital to own those cell tower pay streams in perpetuity. Right? So ,that's why $100,000, 20 years ago in Big Cell Tower Companies, is now worth $33 million. They kept the asset, they kept the pay streams for themselves, and they created a giant capital gains play for the stock investors.

Now, MLPs did the opposite. They removed the capital risk to the investors. They shielded the MLP investors from inflation and protected their wealth for 40 years, and in exchange, they didn't give them any major upside. And if you look at Apache stock today, it's the gains are great, but they're much, much smaller than the massive gains in the cell tower stocks. The real wealth to the MLP players was the asset protection, the inflation protection for decades. So those are the both sides of the coin. Are you with me?

Riggs: I'm with you.

Ken: what if we combine those two ideas? We gave investors the best of both worlds: Immediate, real time inflation indexing, yields paid in digital currency for a second powerful layer of inflation defense. That's where most asset classes would say, OK, here you go, we're done and I'd pour my money into it, wouldn't you? Well, what if we also grant the early investor the unlimited upside potential that the early cellular telecom stock guys got, but without the same capital risk.

Here's the thing. The early telecom guys, it took them 20 years to make one hundred thousand into thirty three million. Do you think any of them hung in there? Because, now the reason it became such a massive thing is they globally bypassed all infrastructure. We're doing that in water.

The difference here, though, is the effort can prevent millions of illnesses and deaths. But instead of asking the capital investors to just hang on tight for a couple of decades, right? For insane returns, they get paid the entire time and they shield their wealth and their asset better than anything oil and gas or real estate could do. Now, wouldn't that? Wouldn't you be more likely to hang in there for the big returns on the stock if you're getting paid? That's what we're doing.

Water like an Oil Well

So. The model starts out as virtually identical to an MLP. Again, don't reinvent the wheel on the parts that are proven. So we start with all the great inflation protection and cap rate of an MLP, right? As you can see, they're virtually identical. And then what we do is we also provide the unlimited upside that the royalty partners have by getting a stock grant in the parent company.

End of presentation

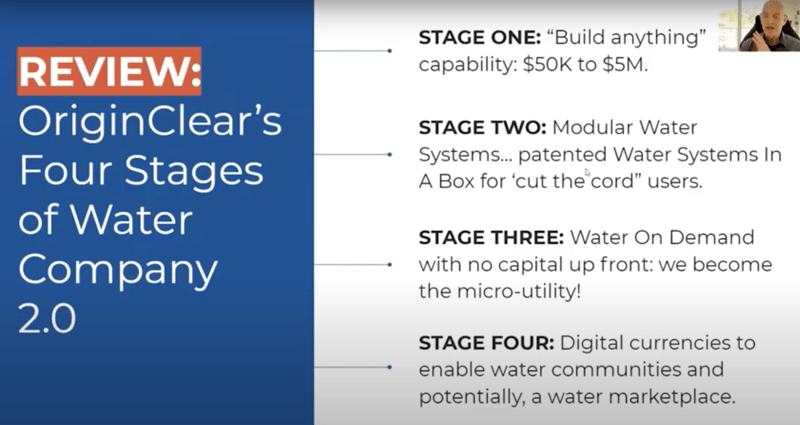

Core Business — One Focus

Riggs: I'm going to stop it here because I want to, I want to cover this particular slide that as Ken said, we're pulling it out. Here's why it's no longer really four stages. What it's about is Water on Demand is our core business. You know, we like to say, you know, "Water like an Oil Well", complemented by delivering dividends with a future digital currency and potentially a whole network, crypto, all that future stuff.

And then the 'build anything' and the 'Modular water', those are capabilities. So rather than have four stages, we really have one focus, which is a pure financial play. And that, I think, is the exciting story that's developing here. I'm literally busy modifying. We keep trying to build a new website and I keep modifying the story. And today the developers had to watch this video and get up to speed and and we're tweaking it again.

$61 Million Dollars

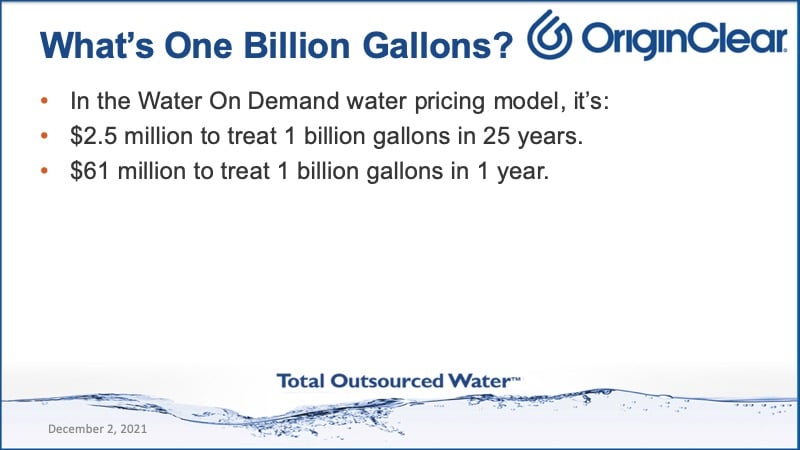

But basically, we have one mission. And let me discuss how that works in the grand scheme of things. And it's a concept that I call one billion gallons. What's one billion gallons? Well, let's take a look at that in one billion gallons we have here in our in our Water on Demand pricing model. It's two and a half million dollars to treat one billion gallons in twenty five years. Ok. Twenty five is a long time, but in one year it's sixty one million dollars. Remember, we are raising three hundred million through Manhattan Street Capital.

Complementing Big Water

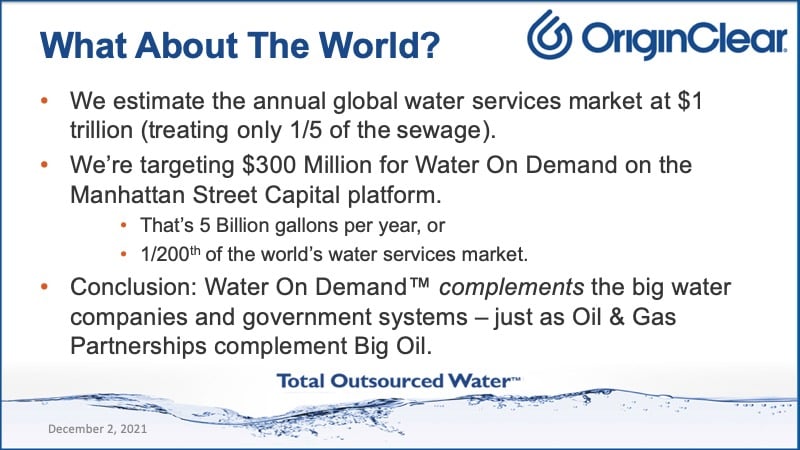

Now we estimate the annual global water services market at one trillion, which treats only one fifth of the sewage, but OK, we'll get to that. We're targeting 300 million dollars on the Manhattan Street Capital platform and you know, they're good because they did a pre-IPO raise for investors in Impossible Foods. Well, that's five billion gallons a year. If you do the math right, sixty one million was one billion. Or it's 1/200 of the world's water services market. Now that's not dominant by far, right? But it's, again, complementary to the big water companies and government systems, just as oil and gas partnerships complement Big Oil.

And I ask you if we do manage to raise $380 million for Water on Demand, of which, you know, a large portion will be actual assets. What do you think the value of the company will be? That's something we like to say to people investing in water demand that there because we're purchasing assets with this money, water assets, this improves the balance sheet, makes this Nasdaq, eventually Nasdaq compliant. So they're literally driving the future of the company by going into this asset class.

Being a Founder

And of course. Some of these large water companies, I mean, American Water Works budgets a billion dollars a year just for acquisitions, and that's how they grow. Well, you know, as we are now developing this innovative model that exists nowhere else in the water industry, this is brand new and is so needed and it's popular with investors like crazy because as Ken was talking about it's a combination of the profit share and also a grant of stock and warrants an amazing package, why? Because you're a founder and founders get treated better than people who come along when it is just being a fund.

Royalties and Security

So, you know, master limited partnerships are just the royalties. Well, because we're starting Water on Demand, you're going to get the royalties, but also a piece of the company and leverage with what we call warrant's, which is a way to have guaranteed priced future stock. So the bottom line here is we have an important new actor in the water industry that is stepping in to the business of complementing the Big Water companies and the municipalities, the same way oil and gas partnerships complement Big Oil, and that is unbelievably exciting.

And remember, we're not relying on the guys in McKinney, Texas, to build everything because we can give the contract to anybody because it's a money play primarily, and we've detached ourselves from having to do the brick and mortar. Think about how attractive that might be for a company like American Water Works, which has all the capabilities of building stuff. They've got a huge network of water companies. That's not their problem.

They're looking for growth. And you can get growth by attracting for the very first time the everyday investor into water equipment investments. That's the amazing promise of it. So Ken and I are super excited about it. We've been collaborating on this for months and as you know, and it's really just sharpened and sharpened, and we now have a new offering, which is is actually I can't get into it today because literally we literally had this subscription agreement built today, but it's actually a fantastic package and I will not steal his thunder. You will have to talk to him about it.

Inflation Greater than Proceeds

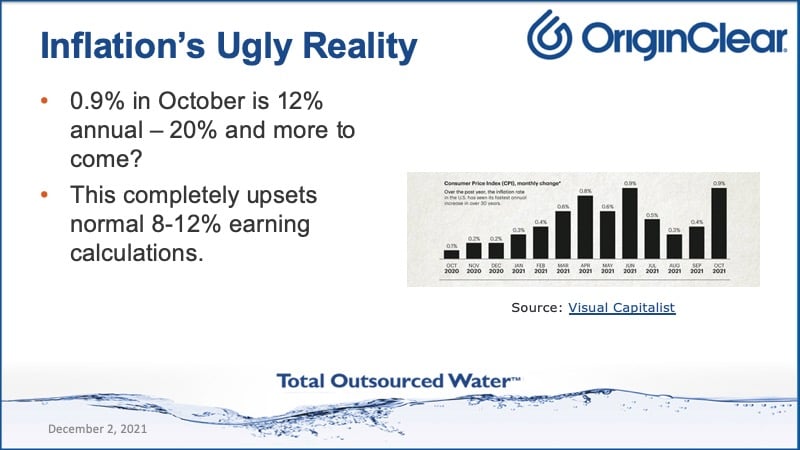

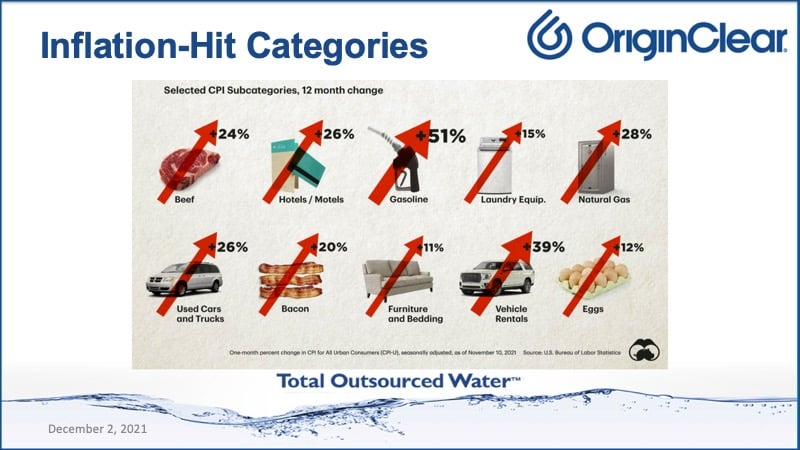

Ok, now let's talk about something really important to everybody — Inflation. inflation in October was zero point nine percent, according to Visual Capitalist. And that is really 12 percent per year if you compound it more, actually. All right, now, this if you're if you were relying on making eight percent a year in the stock market, that's like forget it, 12 percent is high for real estate rents, for example, right? No, you're going to be underwater. Right now, the underlying assets, you know, real estate itself is going to continue to rise. I'm not saying that real estate investors are screwed if they own the asset, but if you're just living off of rents, you've got a problem.

There was a development in Tampa that I heard raised rents 25 percent in one day. Boom. Well, first of all, they annoyed everybody. But secondly, how many times are they going to be able to do that? That's like a one shot. Pretty soon the government gets involved. And has the government have been involved in landlord business in the last couple of years? I think so. So what we have here is a problem of inflation hurting the people who are trying to make money from rents of various kinds.

Wells Closed

Ok. And by the way, there's a problem with those oil and gas partnerships because even though oil and gas is doing well and we have it right here, gasoline up 51 percent, they should be doing great. There are many, many owners of shares of partnerships where the wells have been closed. You know, I drive very little these days. Many, many people are using much less gas than they used to.

So what did the oil and gas industry do? They closed wells and the price of oil and gas has been going up. But what if you're an owner of a closed well? You're in trouble and there's nothing you can do about it. And so there's a lot of unhappy people in the oil patch. This is the problem with oil, is that it goes through crashes. Supply and demand crashes and so forth. And what we have similar to real estate, actually real estate also crashes.

Water Doesn't Crash

What we have here is water does not crash water. There's always more dirty water. There's never going to be less dirty water. We're always going to make more. And that's been the problem for the last 20, 30 years is we've kept up with population growth, but we still have the same three billion people in water stress and it's not going away. So water is continuous. It's a gift that keeps on giving.

Internet Searches

Ok, now here's guess what? Everybody knows inflation is a problem. Look at that, search interest in inflation is at its highest point in the last 30 years. So people know it and they're looking for solutions and water is inflation friendly.

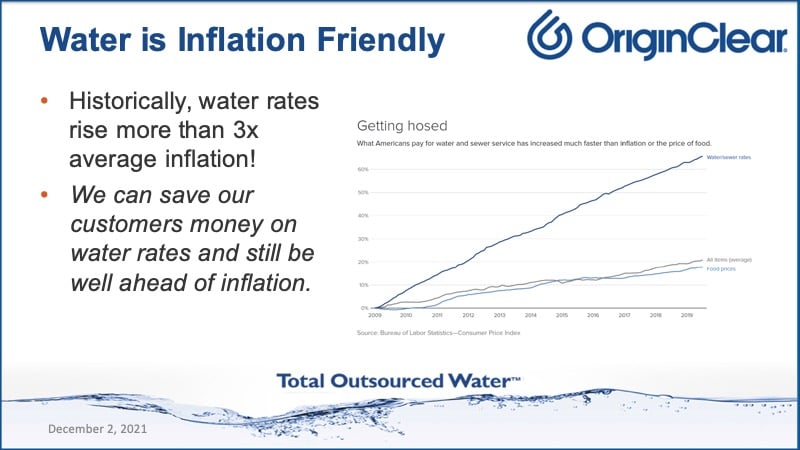

Inflation Friendly

Historically, you can see from the graph water rates rise more than three times average inflation well. That means that I can give a great deal to a brewery that wants a water system and say, OK, we're going to give you water rates that are below what you're paying to the local city.

For example, there's a famous case study of the Russian River Brewery that worked with a another company in the space, a very good company called Cambrian, private company. They do something very similar to what we do. And they brought Cambrian in for a water as a service type contract because Sonoma County was charging so much and so Cambrian charged a little bit less and still is making money.

And so we save customers money on water rates, but we're still doing really well with inflation. So it's a win win. The customer is happy and the investors happy.

Join The Club!

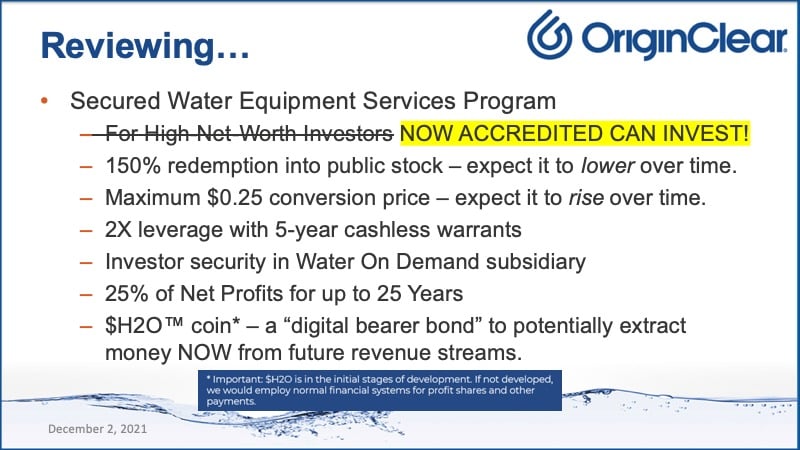

Ok, so. There is this really cool thing we call the five million dollar club, and this is how we launched the, I think we're up to $600,000 so far, but we believe that we'll be solidly at a million dollars in Water on Demand by the end of the year. And that was because of certain features.

And now this, what you're looking at is actually not there anymore. It's. It will be fully updated next week, but also Ken can brief you. What we have is even better than this, but nonetheless, this gives you an idea what this looks like.

Sweet Spot

Now you don't have to be a high net worth investor. Why? Because there's a hidden feature in the offering that normally rewards $5 million investments. And we have managed to make that possible for even $100000 investor or $20000 investor to get that $5 million sweet spot. And this is for a short time only to get this thing kicked off.

It's working great. People are running in to do it. So, you know, people are falling in love with Water on Demand because it's got that great combination of the the the royalties, but also the upside. It's something like four hundred percent on your money. I don't know Ken if you're here. I'm not exactly sure I think I have the graph somewhere, but it's an amazing upside from your investment.

Call Ken

All right. So with that in mind, Ken has a full picture. So instead of making 12 percent a year, you're going to make much, much more. We think in terms of the royalties, but also you have this huge hit from stock and warrants, which gives you something like a 400 percent return on five years. I'm just throwing out a number that I'm not exactly sure, but it's in that range contact.

Ken: With very modest, Riggs. Sorry, that's a Very modest performance in the market, by the way. Very modest.

Riggs: So what would you say? Like, what do you mean by modest?

Ken: A if in five years the stock has made it to 75 cents a share. These guys are looking at it like a four hundred percent cap rate.

Riggs: Wow, OK. Darn. So we don't have to speculate further, obviously, than that, because that's already pretty darn good. So there's all kinds of good graphs you can get when you get briefed by Ken. And also remember these are secured investments. One hundred percent of your investment is secured in the Water on Demand and and a specific way is secured.

Essentially, your, if there's a liquidation or whatever, then you have a guarantee to the 25 percent proceeds and of any wind up as well, it's fully detailed in the security agreement, which Ken can walk you through. It's very nice. So you get very nice security, you get the royalties with this asset coin called $H2O™, with the potential of accelerating your earnings so you don't have to wait twenty five years and you get the stock and the warrants.

Asset Investment

All right. Well, it was comparatively short. This time we're at a thirty two, but I think we've said so much that's exciting right now. I'm loving how it's going. We are racing to complete the year and we are really taking care of the early investors in Water on Demand. It is for the first time. I'm so happy that we're doing asset investment as opposed to, you know, money to pay salaries and so forth, even though we're raising money for that. We are absolutely putting people into water asset type instruments and securing all of it with an excellent royalty and a security.

Ok, so the next briefing is nine December. Be there. It will be the next to last for the year. It's been great having you all, and with that, I am going to tune out.

Chats

I think, what is this chat? "What is the difference between high net worth and accredited?" High net worth is the same as accredited, but high net worth would be somebody who invests like a million or two million, right? Whereas accredited, as long as they meet the accreditation requirement, they can invest twenty thousand. We don't care, but they have to be meet the accreditation.

So accreditation means you make $200,000 a year or three hundred thousand dollars as a couple or you have a million dollars asset outside of your primary home. That's what that is. And then but what we said is instead of having to before we, you were having to invest a million dollars. We've broken that glass ceiling and now we're giving you a $5 million multiple on an investment that could be as little as twenty thousand. So that's not going to be for long, but it's revolutionary. And we're doing this ahead of Manhattan Street Capital doing the big raise in January.

That's when we're planning to launch with them. So if you get in now, we're taking really good care of you. So do come in. It's going to do wonders. And I look forward to talking to you next week. I'm going to talk to you about some of the interim uses of Water on Demand, such as, you know, if you have money idle, what do you do with it? Well, we have the solution. So thank you all. You've been great.

And. You know, OK, I'm talking to J.W. here. "I did not know there was another set of specs to high net worth." High net worth is just casual. It's like, hey, your high net worth, meaning that you've got, you know, you're worth $10 million or whatever, right? Or more and so for you, a million dollar investment is, it doesn't make you blink. For me, it makes me blink, OK, I'm just I'm accredited, but I'm not a high net worth. I'm just saying.

All right, guys. Thank you so much. It's been wonderful having you. And please come back again next week, and I'll tell you more about the money machine that is Water on Demand that we're designing now. Thank you all and have a good night.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)