Ken (our EVP) came to Clearwater! We delved into some important points in our dockside discussion which you'll see in the replay. With overworked assets beginning to fall, analysts forecasting further supply chain disruptions and trouble for the US dollar investors are seeking stability. What if a $100K investment in water could pull an upside-down, $1M portfolio back upright and at the same time help lift the overload off water's failing centralized infrastructure? Well, our test-run of Water On Demand's portfolio calculator (alpha) on the show demonstrated just how that might be possible… See how in the replay!

Transcript from recording

Opening

Riggs Eckelberry

And we realized, "Wait a minute, we're good at doing this. Let's let the ordinary investor invest in water systems." And the structure is very similar to what the oil industry calls Master Limited Partnerships, which is a basket of energy properties — pipeline, oil and natural gas production. And that basket of assets generates royalties. And so it's a sophisticated investment, but we're free to invest in MLPs. There's about 60 some MLPs, and it's a big market, about $300 Billion value, and it complements big oil. It doesn't take it away.

It's a it's an alternative source of innovation, of financing, etc. We adopted that idea by creating this Water On Demand capital and letting people invest directly in it. And thus all of a sudden it's no longer just a high risk micro-cap investment, high risk — high reward. It's actually, to a great degree, an asset, a productive asset. And not only that, it's as opposed to precious metals and oil and gas and real estate. It hasn't had a big run yet. Why? Because people have not been able to invest in water systems except by getting, you know, an exchange-traded fund or buying shares in Veolia. There's been no direct investment in the asset, and that is a first. And we believe we're really pioneering new ground.

Introduction

And welcome everyone to the webinar, Water is the New Gold. And I see we have a ton of people showing up. Robert Baxter says, "Hello, gentlemen." Hello, Robert. Any time you want to ask a question or say something, put it in a chat and I will address it. All right. It is Thursday, October six, briefing number 181. And by the way, there were a number of briefings before that. I was doing briefings in 2011, 2010, but they were more these broker calls. And so things kind of evolved. And it's been a really interesting road because we try very hard to have a big a lot of content each week. And it's actually been very interesting. Yeah.

"Did you have a good hurricane?" Says Paul Fetscher. Well, we feel for the people down south in Fort Myers. I don't know if you've seen the photos of what happened on Sanibel Island, Lord, and very proud of the response that we've had. That bridge got rebuilt temporarily in three days, so amazing. Over here in Clearwater, it was a tropical storm. Yes, Clearwater, CW is Clearwater. That's, the insiders say "CW baby." But you'll know why Ken says CW shortly. Anyway, there's a new beneficial income asset water.

These are our usual disclaimers that are very important.

And now let's talk about a situation we've got with manufacturing, now lowest since May 2020. What's going on with this? And let's go ahead and play the video. I think it should be interesting.

Start of video presentation

Guy M: How should I read the numbers? Give me the takeaway.

Timothy F: Well, a complicated report. I think the situation here is we underperformed. We disappointed a bit, but I think a lot of it had to do with timing. The timing from the standpoint of manufacturing inventory aside more than I would have thought, and especially timing from the demand side. I think the demand side really was stronger except for new export orders. Our backlog is still 85% of the comments are growing or the same level of backlog. So I think the real story this month is around employment and the fact that because we couldn't really hire enough people on the factory floor due to a lot of turnover, primarily because of quits, we weren't able to see that production number come out. And I do think that the month of May, we'll see inventory come back. I think that you're going to see that new order number come back. I'm more concerned about employment and production.

Gina A: Dig into us a little bit into that employment number with us a little bit, if you don't mind, Tim. You know, I think it's really key that you highlight, this is about not being able to attract enough laborers as opposed to cutting jobs available on the market. Talk to us about the comments and some of the details that you're getting in your survey with respect to that.

Timothy F: So we have an overwhelming amount of people who are hiring versus trying to manage your headcount through attrition. No comments really around firing. And in the month of April, we actually saw 38% of the employment comments saying that they were having difficulty in hiring versus 31% back in March. So it's kind of going the wrong way. And if you dig into the detail, it's really around the turnover level. And that's really people quitting for other jobs.

Guy M: Walk me through the prices paid number.

Timothy F: Well you know, we were coming down until the Russia-Ukraine conflict and then we started to turn around, primarily driven by energy numbers. I mean, that's really what's happening, is that the, you know, the price of a barrel of crude is worldwide very high. It's hurting our natural gas prices here in the US as we export more gas into Europe. And, you know, crude oil gets into everything plastics, steel, transportation. So most of our panelists saw an immediate impact on transportation. And people didn't wait this time to actually see it. They began to pass it along immediately that's what you learn when you finally, in 2021, when we finally passed along increases, we probably wait a little bit too long. The second time around, nobody's going to wait.

Guy M: Just in terms of, in terms of how manufacturers are sourcing product, though, are they getting better at it? As you say, this is something that caught a lot of people on the hop. Maybe they got the timing wrong when they passed prices on, if I can spit those words out, but are they getting better now? Are they getting more creative in terms of being more flexible, in terms of what they put into the business and the prices they're paying for the stuff they're putting into the business as well?

Timothy F: So our investment sectors are really strong, our capital equipment sectors, computer electronics, machinery, those numbers are really strong. And that's, that's a, that's obviously what you really want to look at is what's happening in that area. And I think that the biggest issue here is really, we have really long lead times. We have record capital equipment lead times and raw material lead times have never been this long.

And we're sitting here at the highest price point that we've probably seen in the last 35 years. That's causing buyers to pause and wait and I think they have orders laid out much longer than they normally do, and they're probably at much higher prices than they would really like to pay. So, I think in some respects that's why you saw the new order number come down a little bit, because they've got orders probably out all the way to 2023 at prices that they really don't want to pay.

But, you know, I think the month kind of indicated that we're starting to see some kind of price easing. 4% of the comments were lower prices compared to 1% in March. I think that's a positive move in the right direction. On the supplier delivery number, I think we're going to continue to move closer to a 62-60 kind of level. And the big concern here is production and just getting enough people on the factory floor to really convert that product because as you saw in the first quarter, durable and non durable goods are still very positive, as we've been indicating in the PMI number.

Gina A: Any detail you can provide on that net export number? I mean, I think that most investors have a sort of gut check reaction when they see the net export number deteriorate. They think, oh, dollar, it's all about this dollar strength. Is there any evidence in the comments that this is currency related or is it just a slowdown and a lot of friction still in supply chain?

Timothy F: Well, you know, I think in Q4 of last year, we had a lot of difficulty getting containers into the US ports. We struggled with that all the way to the Lunar New Year and in the February timeframe. February and March we kind of freed that up. So we had a lot more imports coming. I think it's more of an import story and it's really timing between Q4 and Q1. So we had a really high GDP in Q4, but we weren't able to unlock that import number. So, I think a bit of that caught up to us in Q1.

But I'm really concerned though about the future here because now you've seen the amount of liners piled up outside of Shanghai in Ningbo and the major ports in China. They've had the ports shut for about a month. There's difficulty in transporting product to the ports inside of China, and all that's going to lead to is a big tidal wave of container ships sailing to the US. And we're going to be back in the September-October timeframe of last year when you have 100 ships waiting to be unloaded.

That's going to put strain on the on the road freight situation in the US. You're going to see spot right rates go back up. And then on top of that, we have a labor union negotiation going on on the West Coast in July and then when that's over, you've got the season rush. So, you know, I think the only only seasonality that we've really had in COVID is the holiday season. Now, everything else has been dealing with long lead times.

Guy M: Tim, just to kind of start to wrap this conversation up, the market's initial knee jerk reaction was that this was a negative number. I've listened to you and I'm hearing that this is an economy that is still humming along. It's got shortages. Those are the bottlenecks that are providing problems right now. How would you characterize, just in a few words, what this number, these numbers should tell us about where we are with the US economy?

Timothy F: I think we're still really strong. You know, your last guest really commented about no sign of recession inside of next year some time. We're 23 months into what typically is a 34 to 35 month manufacturing expansion cycle. And we think we've had a governor put on because of the supply constraints, which means this is probably a 40 to 42 month expansion cycle. So we're really not seeing any indication of weakening demand here at all today and not expecting anything really until the end of next year. I think the 2024 discussion, if that.

So we had 3 to 1 positive demand comments to not so positive. But the number of comments is really hard to figure out these days because I have a lot more people talking about price increases and late deliveries in the general comments. But no, no indication at all that there's any easing of demand. Like I said, the backlog number, 85% are the same or better than it was in the prior month. Customer inventories are still well below 40. And you can explain the new export number because of what's going on in Europe and Asia. So, you know, I think we're in for a strong run. We're continuing and continue to be in for a strong run.

End of presentation

Ken in Clearwater!

Riggs: So that is interesting because in fact, Ken and I will discuss this a bit later because we have a mix of really bad and bad data, you know, stocks and so forth, and then high demand and then a real difficulty in getting product through the supply chain, you know, So it's a very mixed situation. In some ways, it's not as bad as people think, but there's all kinds of variables that are in the picture. So we're going to have to leave it at that because this is about as good a prognostication. I dare you to make me say that twice.

All right. Ken was down in Clearwater. And this week. And so we had a conversation on the dock of my condo and let's go ahead and play it.

Start of video presentation

Ken: I'm here.

Riggs: You made it, Clearwater. What brought you, dude?

Ken: So real estate buying real estate.

Riggs: But is it, aren't interest rates crazy? What's going on with that?

Ken: Huge, and I don't intend to make money, but I'm trying to just protect from losing. Right. You know, freeze dry it a couple of years. You know, as the dollar weakens real estate, you know, even in high rates, this is a good market. I think there's a lot of good markets. We're going to get to a place where it's going to get kind of funky, and I won't be smart enough to figure it out. But right now, I think I think I got a line on it.

Riggs: But, you know, here's the problem right now. This, what's up with the portfolios, Right? It's crazy.

Ken: You know, and if you listen to some of the people that have been kind of jumping up and down about this for a year, they're kind of like, "I told you so." I think that, I think that the trance is broken. Your average investor who doesn't have the benefit of speaking to major portfolio managers are going, okay, they're telling me not to panic. But there's some feeling I have here that I'm not I'm not really comfortable.

Riggs: Yeah, so sentiment is driving stocks and bonds down, of course. Right. The US dollar we've heard is potentially in deep trouble.

Ken: China has signaled that they're going to sell trillions of our greenbacks. So it's a lot of pressure.

Riggs: So currency, who knows, Right? So, let's talk assets right? Now, you're saying over long, the long term, real estate could work out for you. Right?

Ken: If I have income right now, which I do, real estate's okay. If I had no income, I couldn't come to Clearwater, buy a condo or two and say, "Hey, I'm going to, I'm going to collect these rents and make..." And that's not going to happen. It's going to service debt only because the debt service is very high right now. And I don't know when that's going to come down.

A couple of months ago when I talked to you about buying condos here, real estate agent told me, "Well, you have to make an offer as soon as you see it, because it's going to get sold tomorrow." And he was right.

Riggs: Right.

Ken: I went through these places that he said, "You don't want to pay the offer. Make an offer. They'll take it."

Riggs: Wow.

Ken: I know. And that was like a that was a whole balance change thing. He says. He goes," Not everyone yet. Not everyone's kind of woken up to the fact that..." But there were plenty of people that he's speaking to that are a little nervous. They get that little butterflies in the belly because, look, we don't know it's going to get worse. But they're worried. What if it does?

Riggs: Well, here's the problem. We have basically overworked assets. Energy is overworked. Real estate is overworked. Right.

Ken: Both are at the mercy of events beyond the investor's control, global events. Right. So there's a war, it's oil. Interest rates really hammer your returns on real estate.

Riggs: Well, you're talking to investors, right, every day. And what, what gets them interested in the water asset?

Ken: When I say it's "Water Like an Oil Well," they go, oh. When you say, "Look, you know how oil wells work? What if you had instead just instead of earning generational royalties off the production of energy for the rest of your life, now just replace that with the word water. It's it'll never be subject to demand destruction."

Riggs: There's always more water. The other issue is with energy, of course, is the suppression of exploration and production and, you know.

Ken: Political reasons.

Riggs: Exactly. So politics plays a big part in energy. Water has a different problem. Water is just underfunded. Central water's underfunded, which means this is the whole, this is why you and I have been working on this now for years, which is wait a minute, because of underfunded central infrastructure, it's falling apart at the core. It's all moving to the margins. There's no capital to do it.

Ken: They built it 100 years ago with a 20 year vision. Isn't the deterioration rate accelerating.

Riggs: Of course it is.

Ken: So the idea that we're going to be able to suddenly find the money to, not only fund everything that's breaking, but catch up to what we fall behind, when we can't pay our own bills as a country. But it's also trying to treat a 20th century problem with a 19th century solution or a 20th century solution. This was a 19th century infrastructure, right? Trying to treat it with a 19th century solution isn't going to work. They've been trying that for 50 years.

A 21st, the technology to completely decentralize this, to do this through the Internet of Things, to have remote monitoring, these things didn't even, they didn't even exist ten or 15 years ago. Many, many years ago, as a broker on Wall Street, you were explaining to people Internet telephony and they went, "What?" It's telephone, but it's going to use the Internet so you can call around the world. It'll cost a penny a minute. [raspberry] You know, because it was it was not. It just wasn't, it wasn't a reality. Yet. Now, all of our all of our phones are Internet telephony.

This technology has existed and people are familiar, in their house. In their house. If the temperature goes to high, their Google thing or their Amazon thing knows and it shuts it off, you know, if a window breaks, their Alexa hears it, and it sends them, it sends them a text on their phone. You know what I mean? So these are technologies that are already a decade along.

I think that the big wealth creation event of the coming century will be in capitalizing, decentralizing and pulling water away from the folks who monopolized farmland. Right. From the folks who took control of central infrastructure. I think by actually handing this to the public and saying you be our partner. I think it creates, I just think, I think it's going to be incredibly well received.

Riggs: Well, let's talk about the social justice aspect, because we know that municipal systems are overworked. Water districts can't take it. They're running $75-100 Billion behind every single year. And we can't ramp it up. But wait a minute, agriculture and industrial in our country is 89% of water demand, roughly even in this country. What if we remove them from the load? Now we're at 1/10 the load. Can the water districts cope with it? Yes, they can keep the price down because water rates are skyrocketing for the poor.

Water infrastructure was created for household waste anyway. That's what it was built for. It's not built for this stuff. I remember asking folks at an event, how many people here drink water from the tap? Raise your hand. Not not a single person. So you want to tell me how you think water is okay And you know, the kind of, the light goes on.

The social justice aspect of it is this, the people who pollute the water can clean the water. We can actually reduce their cost in doing so. And the payments they make can go to investors. That's full circle. And now you have these poor and marginalized communities that are outside of the cities. By being able to distribute these systems to individual neighborhoods, these are not going to be home systems, but a system that can handle 100 homes.

Riggs: Here's the thing that is so interesting is that if all of a sudden it's not going to be all of a sudden, but let's say if we imagine a magical moment when the load on the water districts is 1/10 what it was. Now they can give superlative service, really clean the water and keep the rates low, perhaps even free, as Ireland has it. Because how many people have told us water is a human right? It should be free. They say it all the time.

Ken: Well, yeah. I mean, it's almost like charging for air. I mean, it really is, right? It's almost, it's I mean, it's, you know, it's almost like charging for air. Unfortunately, society. I won't say we, society has made such a mess of it that you can't drink it in its current state.

Riggs: Why? Because corporations are being served. So, you know, you don't have to go far to find the heavy hand of corporate America saying, "Oh, we'll take advantage of that. We'll take advantage."

Ken: And they were doing what was right for them, Right? So they were trying to save as much money for their shareholders or for their, for their profit line. So this isn't pointing fingers. It's saying, look, we know what the problem is. By simply going to the end user and saying, look, right now it's costing you X, pay this, pay Mr. Jones, the investor.

Riggs: We'll be the water district.

Ken: And you know what? You'll have a, you'll have your own quarter million dollar a year water expert on demand, right? It basically, on a monitor. Water was a monopoly until maybe I don't know, 20, 30 years ago when big giant companies like Pepsi and Anheuser-Busch, they had the capital to put a $10 Million water system inside their plant and hire all the talent they needed. They're not they're not the problem.

It's when that when that starts to scale down to, when you talk, when you talk to a, like you use the word brewery, a brewery, a farm, a manufacturer, anybody who's trying to balance a checkbook, make payroll, pay his taxes and turn a profit. When you tell them suddenly there's $1,000,000 expense, he's going to do anything. He's going to do what big businesses did, do everything they can to avoid it, not because they're bad guys, but because they want to feed their kids and pay their mortgage.

So when you when you remove the financial pain point to treating and that's what water on demand does, it removes the, there's a financial pain point. If you unkink that hose, I hate to use water water analogies, but if you remove the financial pain point, you actually eliminate the barriers for guys going, "Okay."

Riggs: A place like a brewery was being told literally, "You can't expand, we can't take your water." Right. That happened again and again and again. And so the point is, okay, we have to get our own water system. But wait a minute. As you said, it's $1,000,000. What do we do? I have to invade my, I've already got SBA loans, so I can't invade that. It becomes a big problem. We go, sir or ma'am, sign here. Problem goes away.

Ken: What if you do? What if you do have the money? What if there's a slow down in business? Oh, boy. I got this million dollar water system that I'm not utilizing. I mean, that is, that strikes fear in the heart of every entrepreneur, every business owner. The term "Water as an Oil Well™" is, it's not perfect, but I think it really well... I can,I can say it in one sentence and people get an idea.

Riggs: Yes.

Ken: You know what I mean? And I think that's why it's caught on so well.

Riggs: Well, Ken, this is going to get more and more exciting. You know that, right?

Ken: Yes.

Riggs: Because as the fund grows and, you know, out of the $75 million that we're looking to realistically raise, roughly 56 million, something like that we think is going to be allocated to these water assets. Now, that is going to be a heavy, heavy weight. It's not a lot of people doing that. And so, you know, it's kind of the mouse that roared. We're this little, spunky little microcap that says, "I can do it," and we got a tiger by the tail.

Ken: The good news is "I got the order." The bad news is, "I got the order," right? Yeah. What we've put together and the team that we surrounded ourselves. They've helped us find our. Our note, our voice. And we're getting good material out there that helps the average person who goes into this thing. Absolutely no idea what we do. Leave that four minute video and maybe a five minute presentation going, okay, I get it. Now I've got a bunch of questions, but I get it.

We're going to turn the volume up to 11. We're going to have this large megaphone where we're going to be able to expose this message to very, very sophisticated people who are all thinking the same thing we are. I'm thrilled. I, hopefully very soon, we'll be able to give more detail on that when it opens up to the general public.

Riggs: Ken, thank you for coming down.

Ken: My pleasure, sir.

Riggs: Pleasure, and...

Ken: All right.

Riggs: You know, keep up the good work.

Ken: Thank you, sir.

End of presentation

Riggs: It was a little windy, but it's kind of fun that way. You know, I thought it was a good little discussion about how things are going. James Wright says, "Hello, Riggs. How are you feeling? You sound like there's something weighing on you tonight. I hope all is well." Yeah, I actually am having an allergic reaction to some, this cleansing program, and it got me talking like this. But that's about all that's going on. And I hope it kind of makes me sound like a deejay, You know? I got that voice, so it's kind of cool.

Freewheeling Discussion

All right, So with that, we're going to jump right into a very interesting discussion right away. We're going to bring in Ken and we're going to jump into the freewheeling discussion. And right away, we are going to do a portfolio comparison.

Alpha, Beta, Gamma

Riggs: Now, this is what I would call an alpha. What's an alpha? You've heard of beta as well. An alpha is the first version of a program that acts like it may be okay, right. But it's not really functional. A beta is pre market. It's got basically all the functionality. It just needs more testing and of course release or what you might call gamma is the public release. So Alpha really is the very basic thing.

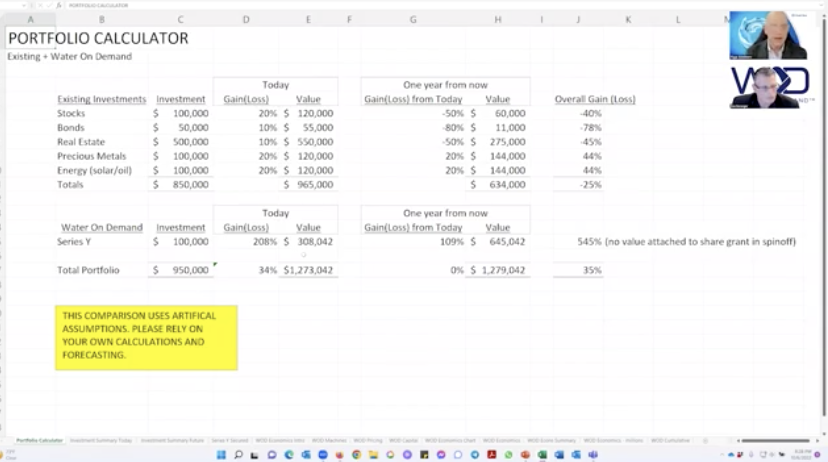

Hypothetical Portfolio

So what I'm going to do is now is going to switch over to the spreadsheet here and we have a portfolio calculator that I built. Now, what we have here is we've made some assumptions about somebody's investment. Total portfolio here, close to $1,000,000 in original investments. All right. We can play around with that. But let's say that today, since they've had their investment in some fictitious previous time, they're up 20%.

Started 20% Up

Bonds are up somewhat. Real estate is up nicely. Could be more. We could call that 20% or 40 or whatever. Precious metals, they go up, they don't earn money, but they do go up. And then perhaps the person's invested in a an energy pool like solar or a master limited partnership. So that's sort of the categories that I chose pretty arbitrarily. And then one year from now is the gain or loss from today. So here I'm making some assumptions. We can discuss these assumptions.

Ends Up 22% Down

Stocks, I think, are going to take a hit. Bonds vastly more, I mean for reasons that we know, currency really being a problem. Real estate, I think, is going to go very, very soft. And then precious metals are going to keep on going up. And I think energy, solar is going to be favored by the administration. And oil, I think, is benefiting from what that purchasing manager was talking about. So you end up overall about 22% down from your original. If you look at these formulas, they are basically take the current value and divide it by the original investment. So this is the overall value.

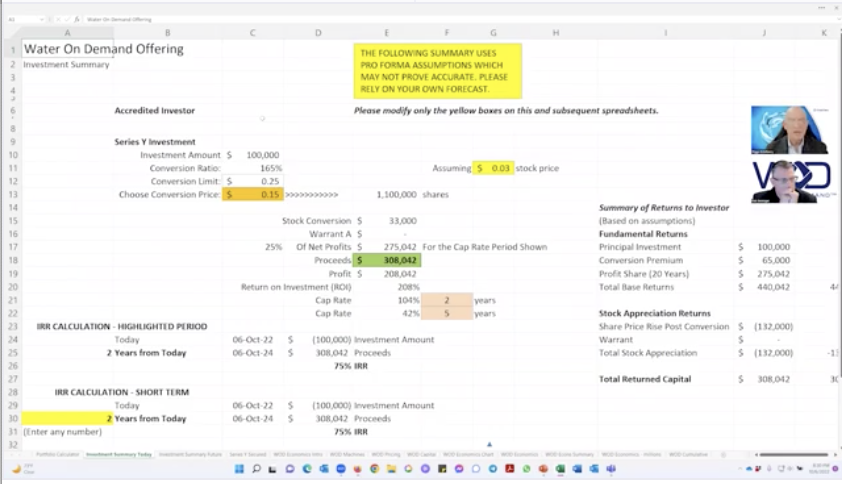

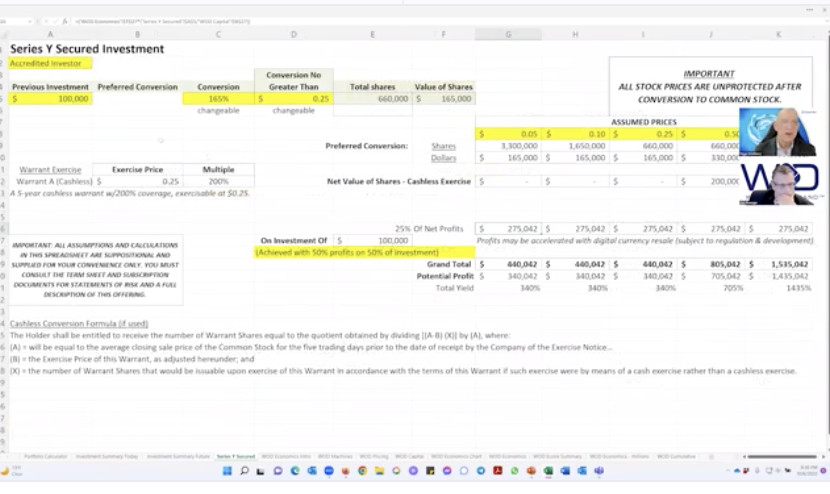

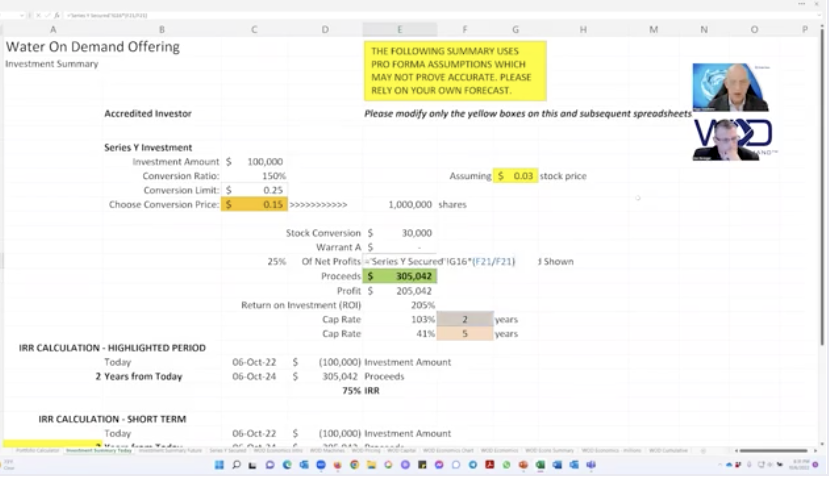

Water On Demand Summary Pages

Now, I took the Water On Demand investment and we have two summary pages here. One is investment summary today. Now, these things I encourage you, if you are interested in this, talk about it with Ken, because I don't have the time to go deeply into it.

Conversion Ratio Lowering

But here's, again the person invested 100,000, there's a conversion ratio that's actually should be corrected here because it's no longer in 165%, right?

Ken: No, it's 150.

Riggs: And it's going to keep on going down.

Ken: Maybe shrink that first screen just like tiniest, tiniest percent, which you can't see over on the far right corner and on the far right of the... I don't know if you have a way of shrinking that just a tiny bit, because I can't see what those fields represent in K, that field K. Yeah, there you go, very good.

Riggs: Anyway, but I'm not trying to show these fields.

Ken: Oh, Okay.

200% to 500% Gain

Riggs: Yeah, just basically, I don't I want to keep it as simple as possible. So this assumes the current stock price. So this is the, how you're monetize today. You've basically tripled your money, right? Now, this is for the cap rate shown. And so perhaps it's well, I can't do that. But we're making, we do a very short period of time, 0.1 years. It's of course, a very high cap rate return on investment is roughly you've gone up a 200%, which means.

Ken: I think honestly, I think 0.3 years, you know, it's from three months ago till now. It's a pretty good side by side comparison with the rest of the market is done versus where we are.

Riggs: Okay, good. Yeah, totally. So this is 3%. And then this one here is $0.30, $0.03 and $0.30. Now, why do I say that? Because $0.30 for a year from now is not unreasonable. I'm not advertising that it's going to be that way. But this is one year. And so what I'm saying here is that, that's that future thing.

So, if I look here, I've got the value today, quote unquote, and you've basically tripled your money. And then we have a year from now, it's doubled again. Total overall gain, 515%. Why do we have those gains? It's because of the very rich conversion of the stock and then going to a 30% price so that $0.03 to $0.30.

You can see all the the fields that change the warrant is now in the money, double warrant and so forth. So, so now let's take a look. What have we done? We've we've taken it versus overall portfolio from -22% to a positive 34%. So that's nice. So this has extraordinary leverage. $100 thousand added to an $815,000 portfolio with these kinds of gains, which if you're interested in getting into the nitty gritty with this, can, we'll be happy to get into it.

But let's take a look here. For example. Even if we only stay at today value like that. Well, overall gain is, we've tripled our money and we're still positive. So even saying we don't get to $0.30, but we stay at $0.03. In other words, no change from today to one year from now. Then we've tripled our money, 205% increase.

Real Estate Factor

And we now have overall, the person's come out pretty nice, which is really, really great because they were looking at and a lot of people are in that position at having gone from an 850,000 investment to less than 700,000. And that has got to hurt. I think the big factor here is real estate bonds, stock market.

Ken: Now, commercial real estate is a different animal, right? Because that's cash that's supposed to be not dead money. It's supposed to be paying a rate of return. And that's so soft. So I think that that hit could be exacerbated if it's largely in commercial real estate. Just my $0.02.

Riggs: No. Well hey.

Ken: That's why I went to Clearwater to buy residential real estate. Incidentally, to give you an idea of the softening of the market, remember I had that story where the guy said, you know, make an offer. Well, they took an offer over 10% below asking after three reductions. So, I think there, I think that some people that have a profit in their real estate are getting a little spooked. I shouldn't have been able to get away with that.

Riggs: The commercial is from a lot of factors, is going to be way down. But I don't think residential is going to take as huge a hit.

Ken: No.

Riggs: Because of rents and so forth. So maybe negative ten. So now I've, I've made it, I've kind of sweetened the pot here a little bit. And this will go back to the investment summary future. Here we go. And now we end up from a minus 25% to a positive 13%. Do these estimates look pretty adequate to you?

Pulling a $1M Portfolio Out of the Fire

Ken: Yeah, I mean, you're talking about this is a 30% value. All, I see, just for Water On Demand. Okay. Yeah. I mean, basically at $0.03 value of the position is $305,000 and you're talking about, what was our end price here? What was our end price on the one year from now? Do you have it at 30?

Riggs: This is $0.30 now I've gone back to $0.30.

Ken: Yeah. I mean you've essentially pulled $1,000,000 portfolio out of the fire with $100,000. So $100,000 pulls $1,000,000 portfolio out of the dumpster.

Riggs: Yeah.

Ken: Right. That's powerful.

Riggs: In fact, what I'll do is why don't we make it here? We'll make it.

Ken: Make it a million.

Riggs: Exactly. A million.

Ken: Right. Nice and clean. Right?

Riggs: Right. So you're, you're up 22% overall, down 28%. And just by adding $100,000 to $1,000,000 investment.

Ken: 10% Of your overall asset, overall asset position in series Y could take $1,000,000 portfolio and upright it. You're also averaging down into an asset class that, you're basically cost averaging your entire asset portfolio lower in something that hasn't even been monetized yet. So all of the additional bells and whistles attached to series Y, I like the WOD spinoff and all that stuff, we don't even know yet.

Non-Dilutive Founder's Shares

Riggs: Right. So, because people don't necessarily know what we're talking about here. The note value attached to share grant and spinoff. OK, we are, outside of the formal offering, we are giving a non-dilutive share in the new spinoff Water On Demand Inc, which is going to go through a regulation A process and we think eventually become a public company. 10% is going to be shared between the first $20 million raised and we're about what, $5 Million into that right now? Yeah, the $20 million. We're about $5 Million into it.

Ken: We just passed six, I believe.

Riggs: Okay, So there's only 14 million left to go on that grant. So if you're interested. Now that is a complete wild card. We have, we obviously can't attach any value to it, but it is the spinoff that will handle the Water On Demand business 100%.

Commercial RE and Water4Us™

Paul Fetscher says, "Office real estate is shrinking. People aren't going to the offices. Half the available space in New York City is on sublease of firms shedding square footage." Yes, and I think that's why, Paul, I think saying that down 80% on commercial is fair overall 76%. I mean, it could be a lot more. But I mean, let's, not all commercial real estate is bad. I mean, there's some that will survive.

Ken: Big conversation today. They were talking about how to turn these empty offices into living spaces.

Riggs: Condos.

Ken: Bring, and to bring, how that will bring costs of, cost of housing down in Manhattan, you know, all that stuff. One might want to ask excuse me, how did office space get empty in the first place? So the same lunatics are going to run that asylum now.

Riggs: You know, the condo conversions are going to take years and require huge amounts of budgets. And you have the problem that New York is emptying out because of of lifestyle reasons. And that's where we have the, just the amazing Water4Us™ project where we're going to help. And we're currently in discussions to help finance the water services for these off the grid communities that are starting to happen. So very exciting direction.

Portfolio Calculator Plans

So what do you think? Alpha Tool. Not too bad, huh?

Ken: No, that was I was impressed with how far it had come.

Riggs: So this now, what my vision is to turn this into a web calculator that people can anonymously put in numbers. Sure, they can fiddle around all they want and it will tell them what's up. And Paul has another interesting comment. He says, "Office to residential makes sense with 5000 SF footplates, not larger." Yes, unless you subdivide the floors. But then again, that's big expense and billions.

Ken: Yeah, it's billions of dollars to make it happen anyway. Sure.

Supply Chain and High Prices

Riggs: Wild and crazy. All right. Did you want to make any other comments while we're we're here because, you know, it was interesting what this, the head of the Purchasing Managers Association who was dialing in from Jupiter, Florida. So he hasn't done bad for himself. And he he seemed to think that it wasn't all bad. But the problem here is, like you say, there's idiots running our supply chain. Who knows what's happening in China, etc., etc.. And so you have this stop and go business.

Now. We are very happy with how we're doing with Progressive Water Treatment and Modular Water Systems™. It is a very good time for us. That purchasing manager was talking about how customers are accepting high prices because they have to. And so we're finding that it's a very good time. Not only that, the team is hard at work delivering. When you deliver, you get to recognize your revenue and you start looking good.

And I believe, I'm not going to say more than this, that our Q3 results, which come out November 15th, will be something to be proud of. So on our side, here's what we're seeing: lots of business, lots of orders, real problems with certain parts. Certain pump parts, you know, 6 to 8 months out. Anything involving electronics is often a problem. These were products that weren't being made in the US or Canada and got exported from China, and there we are.

Water4Us and the Future

And a final comment from Paul, "If you're in an office or at home, you will need water." Bah-dah bing, bah-dah boom. So this is the Water4Us, basically people flocking away from megacities into less dense locations and they want self sufficiency more and more. I know I did, especially when that hurricane was barreling in. I had my battery generator set up and all that stuff, and I would have done more now because people are moving to places like Florida, the Carolinas, in Texas, Arizona, etc. the price of of ordinary land has gone up.

And so now developers are looking for land that is not connected to sewage. And we are already helping these clients with their conventional programs. But now, of course, they can get their metered connection. And it's not just sewage, of course, it's the fresh water demand helping businesses do their own water treatment.

But in addition, getting the clean water and this is where we have the three part benefit that we will soon have a major announcement about water purification related to that hotel that we've been talking about very cryptically. And we may have to remain cryptic because it's a very, very shy operation right now. But we'll do one disclosure at a time. It's going very well.

So with Water4Us, a homeowners association can simply pay for their water on the meter. Like any other utility. We are working to take care of all of the maintenance, etc. So that is the goal and it's kind of exciting. That will be in the new Water On Demand website.

PhilanthroInvestors Update

I've got an update from Arte Maren here, CEO of PhilanthroInvestors, 15 Entrepreneurs and PhilanthroInvestors ambassadors were briefed by Ken today. And were all enamored with the vision, the implementation and the practical efforts being done. So good feedback from the time you spent with those ambassadors. It's always fun having 15 people to talk to, but at.

Ken: Once, yeah, it's a blast.

Riggs: But you survived.

Ken: Yes,

Riggs: You survived.

Ken: So yeah. Remember when you sent me to London on one days notice?

Riggs: Yeah, And?

Ken: You should do that Ken. I was like, it worked out fine. Yes, it's all good. It's all good. Look the, so in my conversations with the guys from PI today, once they got out of the, once they get out of the sand, you know the rough or the weeds, and they understood just the high view vision it became instantly clear. It's basically using fintech and our own proprietary methods of dealing with onsite water treatment and essentially running it through it as a managed service. Once I started using things like managed services, they immediately got the vision because that's what's scalable and it was, yeah, it was a lot of fun.

Riggs: Yeah. I mean it's very, very important to realize that for Water On Demand, we are choosing to not be the machine builders because that's hard to scale. We've learned that. I have lived this for the past few years since we bought a conventional water company in 2015 that, you know, "Oh, we made a big order." Takes forever to deliver.

Call Ken

But with that, I just wanted to quickly say, if you want to discuss that portfolio model the details of all these offerings, please feel free to talk to Ken. Just put oc.gold/ken in your browser and you can talk to him or email invest@originclear.com or do this very hard to remember. Phone number 8774404603 ext 201.

Stevan Davis says, "Great report." Thank you Stevan for great feedback and thank you to PhilanthroInvestors for really going all out to get the word out about Water On Demand. So with that, I'm going to go ahead and call it a night and we will be covering more interesting stuff next week because literally we have a schedule of one announcement a week leading up to the quarterly filing on the, on the 15th of November.

We have a series of great announcements all planned out. It's excellent. We'll get into that next week. Do join me. These are fascinating times. I love that we are building the decentralized water system that will really help unburden the central water districts so they can serve the populations and do a better job than they are today. Thank you all. Have a great night. And...

Ken: Goodnight.

Riggs: Be good.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)