We drilled down on our announcement of tripling our revenue in the first nine months of 2022, but perhaps even more interesting was the sneak-peek at one of Water On Demand's actual system proposals. This trend is so legit! Even that wasn't the big news… We filed the Water On Demand Regulation A offering! Don't miss the prelaunch scoop and details on the early reservation system. They're here in the replay!

Transcript from recording

Opening

Water On Demand™ is the only one that is working with the bulk of the future business, that is delegating all of the execution to an operating partner network, which is kind of our supercharger network, creating a barrier to entry for other people trying to get in the space. They'll try to move in and sure enough they'll find out, Oh no, we work with Water On Demand, which is great. Of course, we handle all phases of water treatment, clean water, dirty water and water re-use. We have the modular technology, six patents that we have master licensing to. Of course, we're connected to the cloud. And most important of all, we are bringing this as an asset investment to the investors of America and eventually the world.

Riggs: That's one of these cool clips that the teams been making. Very, very cool. All right. Water, The Blue Gold™. Remember that Water is the New Gold. Water is the New Gold, we found out was a registered trademark. We actually think this is cooler. All right. It is November 17th, the week before Thanksgiving, and we are not going to have a Thanksgiving briefing. Sorry. I will be eating, I'll be getting way too much tryptophan in my body with that turkey. So we'll see you again two weeks from now. Water, Like an Oil Well™ is the emerging income asset. Okay.

So here's our disclaimers and so on.

Well, what's the big news? What I call the whole new company.

Here's a cool graphic that Kevin put together, and he sneaked in a new logo here. You can see that little droplet with pure. That's a that's our InfinityPure™ brand that we're preparing to launch around that that hotel that you keep hearing about. Well, it's actually turning into a whole rollout and more to come soon.

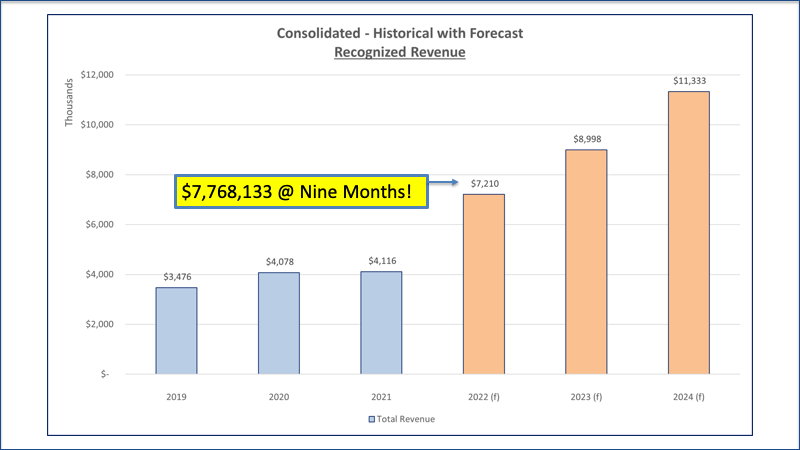

But the real news here was that year over year, the three months were triple. People, when I say revenue increased by 200%, people think it's double. No, it's triple. So our revenue tripled and then gross profit more than doubled. And then we have for the nine months, 173%, ordinarily triple for the nine months and gross profit more than double. So what does that mean?

Well, first of all, it means that revenue for just the nine months of 2022 is already nearly double the entirety of 2021. And we're not done, that's for sure. Loss from operations decreased nicely, even though we're spending a lot more a lot more energy on setting up our new initiatives. We actually spent less money, which was good. And finally, our gross margins improved by 3% to 24.5%, which every little bit helps.

Let's take a look at the graph. So this is the forecast that we had built a few months ago based on fundamentals, based on what we thought was really going on. Well, we have blown through that.

\We are ahead of our forecast for the entire year, 2022. So almost 7.8 million. And I'm not going to say we're going to get to that 8998 number that we have forecast for 2023. But we'll certainly get within shouting distance of it, which is, in my opinion, going to happen. I have to keep qualifying these statements, but, you know, it's going to dramatically increase that curve, right? So it's really great news.

What Caused It?

Well, first of all, really, as you know, lots of sales were taken by Progressive Water last summer. They had this huge, huge deal that got done in August, which we publicized. It was a major utility and they've been chewing through that. Meanwhile, Modular Water™ has been booming, so basically Progressive Water grew. But then Modular Water finally just got into its inflection point. And as we announced back earlier this year in May, they had in one month more or a roughly, roughly the same sales as the entirety of 2021. So they are contributing as well.

And Modular Water Systems™ is more scalable because it's standardized products and it's built for that on demand game where we're putting systems in to remote businesses. So it's really well suited for that. Whereas progressive water tends to be custom work. Both are brilliant, but one tends to be more product based and the other one more service based. Okay, a current quotation that is a cool idea, but before I do that, I wanted to thank everyone in the OriginClear team, Progressive Water On Demand because you guys and gals are just amazing.

Water On Demand Proposal

So what I'm going to do now is obviously we had to redact it, but this is a proposal. It's actually been updated since October 18th when I redacted it. But what this is, is a proposal for a system. Basically, this is multiple warehouses that need to have water treatment. And this, they're phasing in to a 20,000 gallon per day system. And so both a membrane bioreactor and reverse osmosis. And then these are the specs of what's required. Let's keep going here because obviously those specs. Here we go.

System Components

There's a pump station. EveraMOD 66 inch well diameter. There's an EveraTREAT, which is a skid based 5000 gallon per day membrane bioreactor. It's basically a way to use biology to make the treatment happen. And it has effluent pumping station phase two takes us to 10,000 gallons with an EveraSKID 10,000 gallon per day and an EV, EveraBOX. There you go. It's a EveraBOX. There we go. And finally we get to 20,000, adding a EveraSKID 10,000 membrane. So essentially, we keep growing the system here. Here's the, so it'll be a combination of the the pump station, the EveraTREAT, which is it's actually a more permanent system, EveraSKID is container based. And then we have a storage tank, the 50 gallon per minute reverse osmosis system to clean the clean water 40 foot container. And that's kind of the thing.

Here we get into the pay per usage services and here's, you can see the price $75 per 1000 gallons. But we do charge engineering services, as you can see, phase one, 50 K, and so roughly $100,000 worth of engineering services. There's of course, additional things relating to the influent pump station. Bottom line is, is that there is a variety of services required. So that is the basic service at this point. It turns into a lot of terms and conditions, etc., etc..

But that gives you an idea what these things are looking like. We have to pay a lot of attention. When you're selling a service to make sure that neither party gets hurt because you can end up with a lot of very tough situations where things weren't covered and all of a sudden you have kind of a flap. So that was, and so the news I got today about this was that it's well along. We keep asking for more varieties. What about this? What about this. What about this. What about this? What about this? What about this standard pre deal stuff. This is the what industry, it's how we roll. But that was the current quotation. Let me get back in to share screen.

Regulation A

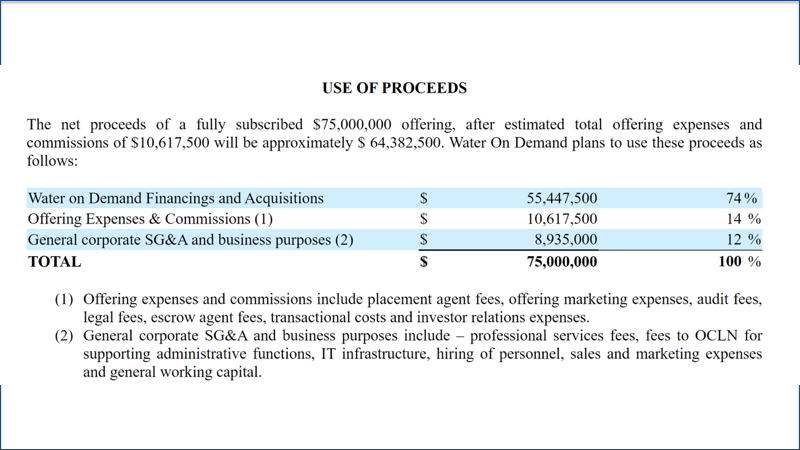

We filed for the Regulation A offering. And by the way, Marcus Walker says, "Please, Long Island, New York, needs you to clean up the water." Thank you. And I agree. Ken Berenger escaped the Long Beach, New York, not for the water, but certainly that was probably part of it, especially after Hurricane Sandy. So here we have what is it Form 1A? Well, it is when you file for the Regulation A offering, and here it is just showing you samples of it. And so I'll show you how to how to find it, because you're not expected to write down this long link. Basically it's $5 a share, $35 million maximum, which is the maximum you can do in one year of what's called Regulation A plus, minimum investment. $1,000.

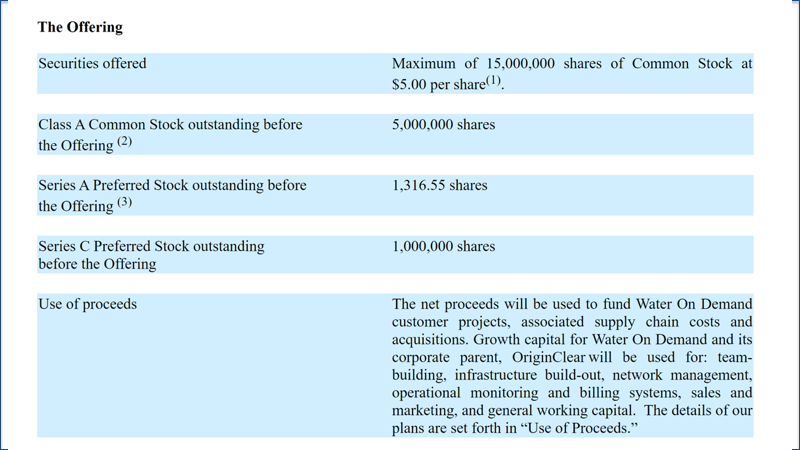

The Offering

Here's how you do it. You go to Google, Edgar Search. Edgar is the database and you just input Water On Demand under the company and you will get this and you can look at it more. What's the offering there is how much it is. And there's some existing stock. As you may know, Class A is the stock that we've allocated for our offering over in the OriginClear side, which Ken is managing, which involves investing in Water On Demand. And these investors also get a grant of non dilutive shares in Water On Demand. So that's class A right there, Water On Demand financings and acquisitions. We obviously want to use this for capital to do the Water On Demand, the pay per gallon.

But we currently have delegated all the building of these systems to partners and that's a valid strategy. But we think it's also useful to snap up companies that will do the delivery that are part of us. Why? Well, you know, you don't want to leave money on the table, so we make it highly scalable so that we don't have to have a company, our own company, to do it. But to the extent that we can, we will start collecting companies out there, mostly water service companies that can deliver these systems. And then the sales and general administrative costs, there's OriginClear does the supporting administrative functions for Water On Demand. So the Water On Demand only will have the specialized personnel.

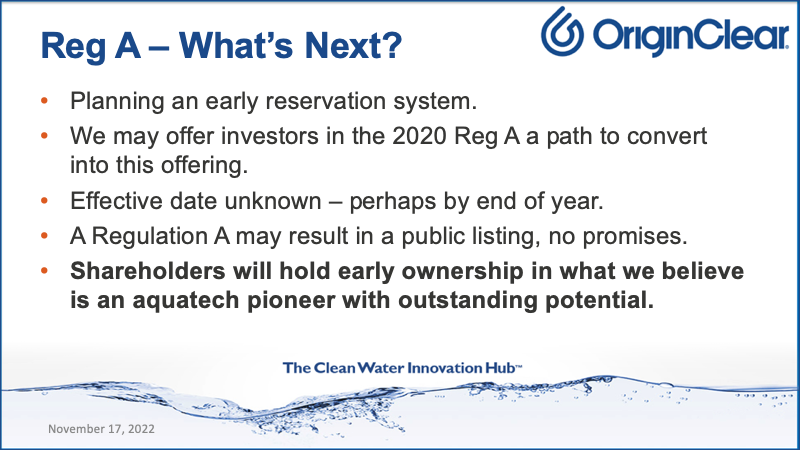

Early Reservation System

Okay, what's next? So we're planning an early reservation system by which anybody can just input their name and they can get in the queue to get the stock once it's available. It is not, it's not binding and we don't want money, but it's an opportunity. As you as some of you know, we had a regulation A back in 2020 and these investors will be given a chance to convert it to this offering. Why would we do that? Well, the 2020 Reg A only had a cash redemption. And so we keep paying 10%, 10%, 10%, 10%, 10%. It's very nice. Eventually we cash them out or we let them have a stock deal. More on that to follow.

The effective date of this regulation A offering is unknown because it's in the hands of the SEC perhaps by the end of the year. And again, Regulation A's are designed to result in a public listing. Some, very fortunate, get on the Nasdaq, but we can make no such promises. What I can tell you is that I believe shareholders will hold early ownership and what we believe is an aquatic pioneer with outstanding potential.

Aquapreneurs

What the heck is this aquatech term? Well, it's now a thing. And here's an article in GreenBiz Aquapreneurs are thirsty. And actually we registered the term "waterprenuer" hich we came up with. And in fact, Ivan Anz is a big champion of waterpreneurs and that's becoming a worldwide registered trademark. But besides the point, water technology startups, and this is what's interesting, recent wave of interest has been more obviously centered on the concerns of industry rather than municipalities or the utilities. Sound familiar? That's our business. It's exactly what we do. So that's very cool. And also, this method allows for a higher rate of reuse and also a fear now rapidly growing reality that getting water to a facility is a challenge. Here's why Businesses are putting in their own systems. Here's a good saying "Climate change is water change." I like that.

Upfront Capital

Now, finally, they say the challenge in the past has been the upfront capital expenditures that can be involved. And here he's basically saying that they're going to try and be more sophisticated about getting the model right. Well, we're just going to get rid of the capital. That's our job. And that, of course, is why we are superior, we believe.

Software Applications

Not just hard tech. What does that mean? Not just building water machines, but in this case, they talk about Waterplan, which is a dashboard company, software company. But we are a player. And it's interesting, they received funding from Leonard DiCaprio and Branson because they were part of Y Combinator. We claim to be the Y Combinator for water, right? So they do software. That's wonderful. All good. We'll probably use them, I'm sure. But we're part of that, not just hard tech situation in that we are doing the fintech. And this guy Glinda said a very good thing, "Climate change is the problem, but water is the messenger." Why is that so? Because the water levels, the droughts, rising sea levels at the same time, major droughts. These are the messengers of climate change. Okay.

All Time Low

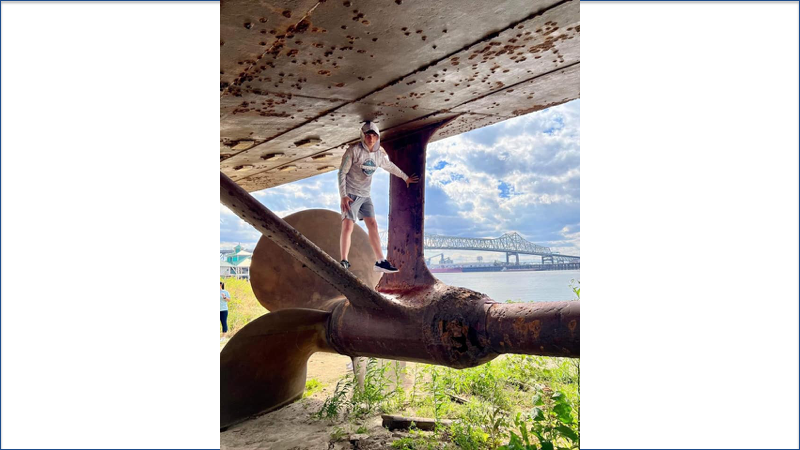

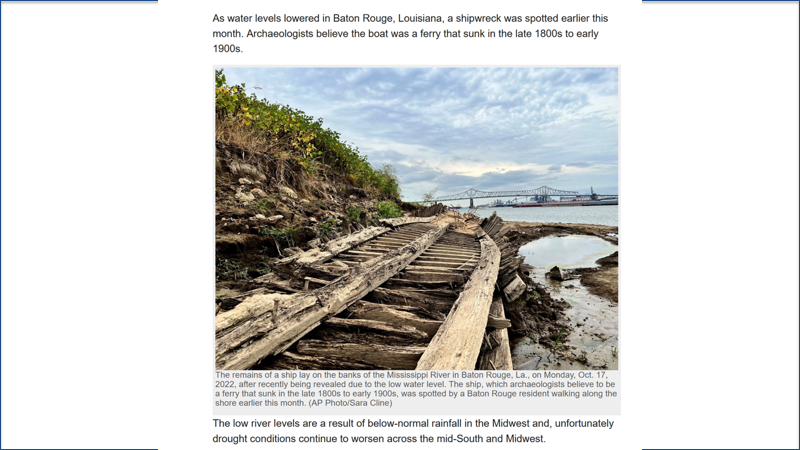

And sure enough, Mississippi River levels so low you can walk under the USS Kid, Check this out. Oh, Lord, this was a ship that was, Well, it was in the water, right? No longer. No longer. All time low of -11 feet and average levels plus four.

So it's a, that's a 15 foot difference. That's huge. So they're having to release water from the dams. But still, it's really hard. It's ridiculous. Look at that shipwreck was found. It was a ferry that sank late 1800s, rather. And there it is, the bones of a ship. Unfortunately, drought conditions continue to worsen across the Mid South and Midwest, and this is why we need the solution. Eugene Tulley "Ya'll are geniuses, your model is very interesting and it's fun to see you bring it all together." Thank you, Gene. All right.

Investing in Decarb

And here is another investment story. Investors pay up for decarbonization deals. Decarbonization, basically is anything that improves the carbon footprint. And we have a case study that shows that, in fact, we dramatically help reduce greenhouse gases while the broad VC ecosystem has been going down. Not so for carbon and emissions tech. Here's where it's all been going.

So very nice increases in 2022 starting really from 2019. Why? Because of the Inflation Reduction Act signed in August, which provides funds for this kind of thing. So that is something I think that will rising tide floats all boats and I presume it will float our boat, too.

Markets — What's Going On?

What is markets? This has become a regular feature. Well. If you were awake this week, you heard about the crazy FTX. So is it the end of the world for FTX? Is FTX the end of crypto? Well, this writer here, Nomi Prins, is actually a an investor herself. She talks about all the craziness. She says, "What does it mean for the crypto industry?" All this stuff about FTX. The noise is only just begun because on top of it is political, right? Oh Lord. So FTX has enough to cover our client holdings, "We don't invest client assets." Not True! But she sees it as, of course, a very bad problem with a custodian.

She believes that crypto is an evolving disruptor. I agree. And it's important to separate the bad apples from the orchard. And for sure, FTX is it. Just like how Lehman Brothers and Bear-Stearns went down during 2008, this is very similar. Bitcoin will survive and Coinbase, I think is is absolutely a survivor. I keep my my, my, my crypto on Coinbase. I'm not going to fiddle around. I've played around with those off exchange wallets and it's a pain. I mean, I'm not a crypto trader anyway.

What her point was Uniswap and Curv for example, a decentralized Coinbase is regulated. I don't think it's the end of the noise, but we can certainly see that there's going to be, I think, a long term good game for the major brands in crypto. So that's what I'm reporting today, but it's certainly going to make a lot of people scared. All right.

Start of presentation

Part two of the Kelly Cardenas show, which I will play now.

Kelly: So, Riggs, what about this, though man, is you're a genius, you're an incredible, incredible human being, phenomenal heart. You've made tremendous difference in this world and you're continuing to. But I can guarantee you. Growing up, you drank out the hose. What about the people out there that are like, Well, if drinking out the hose produces Riggs, I'm a drink out my hose now.

Riggs: There were far fewer pollutants back then. We did, we had not discovered Roundup®, for example. Right now is a terrible, you know that the farmers, one of our investors came out of Wisconsin and he's a doctor in that area and he says "Riggs the people, the farmers that come in with brain cancer because they're exposed in industrial levels of roundup." Right. And this is not okay. So we are it's just the number of of of pollutants of toxins has exploded in the last 50 years. And, let's just say that we have an endemic problem with water that is primarily related to the underfunding of what we consider should be handling the problem, which is the central monopoly. These people we've delegated it to.

And there's a classic story of what happened in Compton a few years ago. Compton Water started running Brown and the people in Compton said, What's up? And the Compton Water District said, "Well, first of all, it's safe. It's just magnesium. You can drink it." Which, I don't think they appreciated that, they wanted clear water, which they had the right to.

But more importantly, the district said, "Listen, for the last 15 years we've been asking for money and your city council has not appropriated it. Therefore, you got what you got." And that was the truth of it. In other words, the city council was not allocating the money. Compton, that water district, the Compton Water District, immediately got absorbed into the Metro Water District in LA, and the problem, quote unquote, went away. But what I'm saying is that the cities are kind of on their own.

Give you another anecdote recently in Jackson, Mississippi, the water ran brown again. Why? Because there was a sewage overflow and from the rains and the system couldn't cope and boom. I went to a friend of mine who is in the Mississippi, the Mississippi Assembly in the House of Representatives of Mississippi, and which is based in Jackson, Mississippi. And I said, I'm not going to say his name, "Dude, we can help." And he said, "Oh, that's not a state problem. That's the city's problem." And literally, he was in Jackson, the city that was having the problem. But it was a city problem, not a state problem. Right.

So what you have is you have the cities at the very bottom of the pecking order having to handle this vital health thing, and nobody else much cares. The federal government has gone from allocating, I don't know, $16 Billion a year or more to like four. And it used to be grants. Now it's loans. So the federal government is not helping. The state doesn't want to know. And the cities, how much can they charge? Right. They've got a lot of other things to worry about, like potholes and so forth. And so you have a problem that's not going to go away. And this is why Lux Research in 2016 said you've got a backlog and it's going to be over $100 Billion a year by 2025. So that's why we say $75 billion today and that is not being addressed. So what's the solution now? Get to if you have too much of a load, you have two solutions. You either increase your ability to carry the load or you reduce the load.

Kelly: So help us with this because I think a lot of times when people hear it again, they hear a global problem or a huge challenge and there are some people that and and justifiably Riggs there's a lot of people out there that just almost kind of tap out of these things. They're like, Oh, it's such a big challenge. And if I'm going to wait on the government and I could tell you this, if I'm going to wait on the government to do something, I'm going to be waiting a long time, right? And so if I'm going to wait for legislation or I'm going to wait for that, yes, I can vote and I could do those things and I want to do it. But how can we make that difference now?

What can a person that's listening right now, not only I mean, number one, you need to change a showerhead. Number two, Riggs said it, you don't have to get bottled water for your dog. I ain't giving my dog Carlsbad water, but maybe you could do the filtration part of it if you don't have it. We're going to give you some solutions because there's a lot of families out there that maybe can't afford. I remember growing up, we couldn't. I mean, that filter system, what it cost more than our single wide mobile home.

But what can people do now? And I love this concept because with Ivan, when I met Ivan and he told me the thought of PhilanthroInvesting, it blew my brains, because most of the time people see it as buckets. I'm going to invest, get a return, I'm going to do philanthropy, maybe I get a tax write off, but I feel really, really good, right? And he took the two of them and said, Why don't we do PhilanthroInvesting invest in things that are, that have a philanthropic feel, but also you get a return. What can people do to make a difference?

Riggs: Okay, putting aside the stuff we can do in the home, which we'll give you the links and that'll be good. Here's the solution. 89% of all water usage is by industry and agriculture in America, roughly 50% of each. Which means that the individuals only residential users only draw 11% of the water and generate only 11% of the sewage. And yet we are the people who are being told take shorter showers. You know, you've got to watch out and be charged the big water rates for sprinkling the lawn and so forth. When in fact it's the people growing avocados and almonds and the Imperial Valley who are using up all the water, right?

So the solution then is very simple and businesses love it. Let businesses do their own water treatment. Let them take care of themselves, take the load off of the city. And now the city only has 11% of the burden and it can easily handle that. Do you know that in Ireland people don't pay for their water? It's free. I don't know if you know this, but the water rates in America grow at a rate far exceeding inflation. Why? Because it's not regulated. So water and sewage rates are rising fast. They're hitting the pocketbook, in some cases way above where they should be like 14% of people's take home pay. I mean, come on for water. That's ridiculous.

So it is possible. I believe, social justice says that water is free and we should all have, water is human right. Fine. But it's not going to be human a right if you've got corporate users glomming on to all those resources and using them. Well, these people can simply start doing their own. Now, why would they do that? Well, it turns out that by doing it themselves, they can control their costs and they can recycle that water, get more than one turn out of it, which is economically good for them. And guess what?

This country needs to start recycling. We don't do it. You know, Israel recycles 90% of their water. The second in the world is Spain, with 20%, US 1%. Our systems are completely wasteful. Now, the minute you start letting people treat their own water, of course they will use it because there's a financial incentive in it. And so it makes financial sense for these businesses to start doing their own water treatment. And it's happening right now. So we did two major things to enable this trend because this became obvious back in 2016. I got religion. I was like, Oh my gosh, this is, I read this Lux research paper in 2016 that was talking about decentralized water. And I said that's it! Well, nobody believed me, nobody listened to me.

But by 2018, I had found a technology for these compact drop in place water treatment systems that fit businesses perfect for that new distributed era that we were moving into. And it's called Modular Water Systems, and we call them Water Systems in a Box™. They're great. But still, things were not moving that fast. It was good. But by end of 2019, we were looking at each other going, "Oh, this is nothing much." We're still growing at this organic rate.

Organic rates of growth in water are like ten, 15% a year for a tech guy that's kill me now, right? I have to go ten X at least. So what do you do? Well, then COVID hit. And then we really had to focus on the problem because they became life or death. Every single problem that we had prior to COVID became an acute problem during COVID, and we had to solve it. Look at what happened to Airbnb B they go into hyperdrive and they fix their problems. We did the same thing and we figured out that the reason why this slow uptake of these systems is because, "It's the money, stupid." And so we decided to make these systems essentially free. People would just pay for usage, right? Water as a service.

And so because guess what? They're used to that already. These businesses are paying on the meter. They don't pay for their water systems. Now they bring one in house. They, if you're a brewery, are you are you capitalized for $1,000,000 water system? No, it's not in your business plan. You get water from the city and you dump it. You give it to, give it to the city. It's all good. But then when the city says we can't take it anymore, now you have to put in a system. Where is that million dollars?

We say, No, no, no, sir, ma'am. Sign here. 15 year service, contract, pay by the gallon, and we'll handle everything. We'll get the water expertise. Just keep paying on the meter like you're accustomed to. And it's like, okay, that's simple. And so water as a service, which we call Water On Demand became our thing. So now we have this company that is helping businesses and we don't go down to the single family home because that's a very commoditized it's a super mass market space. But housing subdivisions, definitely, and agriculture users, we help them achieve water independence so that they can treat their water, re-use it, whatever, and they do great. It burdens the central municipality, and now the municipality can focus on the people and now you're achieving a measure of social justice.

Kelly: So Riggs, like why wouldn't someone I mean, I'm listening to this and my mind is going "Well, I mean, that's a simple..." Like you see a challenge, right? You saw the challenge. And most of the time people are like, I got this solution, but there's like 17, I mean, this is really like I mean, I wish my son was here. My son's 11 years old, and you know what he would do? He would do the same thing. All of you listen out there, you know, Maddox, my son, and Maddox, we went to we went to buy a truck. We looked at a bunch of different ones, and he got in the truck that it was it was a Titan. And we're a big Tennessee Titans fan. You see the Oilers helmet behind me, Big Titans fan. You're not a sports fan at all, Riggs, So you won't get this one.

But we drive this truck, we walk in and sit down with the general manager. He's a good friend. And he was telling me all this stuff, and I said, "Well, son, do you want to go and look at the truck again?" My son is seven years old, looks at me and it's like. I already saw it dad. Why don't you just buy it? And it's just his mind, right? And the general manager also threw him his own key, So I was done at that time. But. But I'm saying, like, if my son was in the room right now, and every one of you listening is like, Wow, okay. Riggs saw a challenge. He then created a solution. But the solution had some challenges because most companies are not going to be capitalized for $1,000,000 water system. But here we can deliver it. Okay, Why wouldn't someone do this?

Riggs: See, most of the water industry is servicing the monopoly, right? The big guys, Veolia, American Waterworks, Evoqua, all these guys, they're servicing the cities which are funded by municipal bonds. And it's a great racket, but it's a an underfunded racket. And it's limited. Not a lot of people are doing this. Some there are pioneers. There are pioneers who are doing this new thing with decentralization and self sufficiency and even the waters as a service gig. People are doing it.

What's special about us is we're the only people who are enabling regular investors to do it. And that's why I compare it to oil and gas, because in 1981, Apache Corporation invented something called the Master Limited Partnership, which is a bundle of energy properties that you can invest in and regular people can. It's on the stock market. Today, there's something like 60 of these MLPs. The market is $300 Billion in size and they complement big oil. And it's a way to invest in productive water systems and get a royalty.

So we said, "Well, let's do this exact same model. Let's let people invest in a bucket of water properties and get a residual." And that's what we put together. So that's what Water On Demand is today, and it's unique because for the first time, ordinary people now, temporarily it's accredited, but soon we will have unaccredited as well, but in general, regular investors can invest in this water as a service concept.

Kelly: Riggs How long until the accredited, unaccredited investor is able to to be in it?

Riggs: It'll be this quarter. We expect to, now the the unaccredited investor is not going to get royalties, because it's very hard to pay out royalties on $500. Super difficult. But they'll get stock in the Water On Demand spin off so they will benefit from the health of the Water On Demand spin off. The accredited investors, for a short time, we're allowing them to buy into this. And as I told you before the show, it's super sweet right now because they're founders.

So it does, you know, a lot of us, our spouses are not happy with our management of our portfolio currently. It's just not a happy time. And this, this helps. Investing in Water On Demand helps. Let me put it that way, because it's so rich. You know, any founders position in anything is highly leveraged and is the way to go. So if you want to make your spouse happy. Then you might want to check out Water On Demand.

Kelly: I, Riggs said that. I didn't say that. If you want to make your spouse happy, write her a note every day and tell her how much you love her. That's what you need to do. But this will be some added fun.

Riggs: Yes. But still, she knows about her 41k every single day.

Kelly: Do me a favor, Riggs. I need a, I need a favor here.

Riggs: Yes.

Kelly: Can you speak to Uncle Lou, My Uncle Lou? I love him. I live with them. He helped me to be able to start my career. If it wasn't for him, I wouldn't even be here. I moved out to San Diego, and I got a chance at the time to just live with him, live in his house. Now, he had a rule, and that rule was that you turn on the shower, jump in, soap yourself up, turn off the shower. Do the rest of your soaping cleaning with the shower off. Turn the shower back on. Once you're done with all the washing, rinse yourself off. Turn it off really quick. Another rule he had in his house was if it's not brown, don't flush it down.

Riggs: If it's yellow, let it mellow.

Kelly: Yeah. Yes. And so help me with this Riggs and come from Uncle Riggs to Uncle Lou. Only 11% of the water is coming from residential, so a brother could have taken a shower and flush some stuff down then? Yes.

Riggs: Well, you know, look, first of all you guys do, I was living with my wife in California.

Kelly: Riggs, help me out here. I don't know if you're helping me here. I think you're going down. I don't. I think you're going down a road where you're going to help Uncle Lou to keep this rule in place.

Riggs: You know that I spent one of the untold stories of this podcast is I spent years at sea, and you're talking about a seaman's shower, basically, right? Is what it is. But here's the story. Look, you live in a desert and it seems only right to behave like you're living in a desert. But what I'm what I'm saying is let's not stop conservation efforts. There's been a lot of progress. The Department of Water and Power in LA has made progress, and it's a good thing. More importantly, they're allowing things like rain collection barrels, things like that that used to be illegal. Right? So all these things are starting to be done. Gray water systems, these things are all good. Nothing wrong with them.

But we can't forget to keep the pressure on the industrial and agricultural users to do right by us. And they they are almost 90% of the demand and they need to start doing their thing. We are in the middle of a huge drought, not just in the West, but also in the center of the country, the Ogallala Aquifer. It's, they're saying it's a 1200 year drought and that's, that happens. I'm not going to, climate change and no climate change. Droughts happen, but we're not ready. Why?

Because we are profligate in our water use. In that wonderful book, Dune, where they literally, they were on a desert planet and they they would reuse the water from their bodies in this little sippy tube. That is an extreme version of that. And I think we should be thinking that way, if only because it puts a proper value on water. But what I'm saying is let's focus the proper target, if we want to really make change happen then we've got to focus on the industrial and agricultural and get them to start managing water better.

End of presentation

Freewheeling Discussion

Riggs: Yes, indeed. More to come. We had to break this thing down because it was an hour and 45 minute interview. Hopefully you enjoyed that. More to come. Let's take a look now at all important freewheeling discussion.

Ken: Hello, Hello,

Riggs: Hello, Hello. Kelly Cardenas was so much fun.

Ken: He's a cool guy. You can you can tell he's very engaging and he's forthright. So that's got to be so fun talking to a guy who asks smart questions, right?

Riggs: Sure. Sure. You know, we have a really ironic situation, which is that Water On Demand is this huge thing that's rolling out. We did Water On Demand at a time when things were not taking off. And of course, then the conventional side of the business did. And it got really exciting. So it's good because we then turn it into an incubation business.

Next week, in fact, I'm going to go ahead and show our current corporate presentation. I think it's well worth reviewing. Again, we've improving it and the story gets more and more exciting. The last thing I want to I want to not say is that I'm not going to be commenting on this Special Purpose Acquisition Corporation (SPAC) idea. That's really all I can say about it.

If you really want to talk to Ken. This is how you reach him. Just go to oc.gold/ken, Talk to him about what's going on. Everyone, thank you very much. I can tell you things are very exciting right now. We're having a wonderful time and have a wonderful Thanksgiving. Don't hesitate to send an email to invest@originclear.com or book with oc.gold/ken. December 1st is our next date. Thank you all.

Ken: Good night, folks.

Riggs: Night.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)