It was fascinating to learn how the Water Features market requires the same technologies as clean and wastewater treatment, and how once again, Dan Early's Modular Water Systems are uniquely suited to fill the role. But with a snowballing infrastructure crisis impacting our water supplies, the urgency of finding an embracive solution is increasing dramatically… Is there something we can do about it? Find out in the replay!

Transcript from recording

Opening

Riggs Eckelberry:

Dan, I got to tell you, I'm so happy to have you on board as the inspirational designer vision of all this. One last mentioned I wanted to get into about Water On Demand™, which of course is this water as a service concept is that we're excited about deploying your standardized modules as technology so that when we have these other water companies do the installation, let's say in Seattle, Washington, and they're going to install it and maintain it, we want to let them license your tech so that the whole fleet that we build through Water On Demand is more standardized.

It seems to me that the golden opportunity to let your patents and your trade secrets and your knowhow become exported to the water industry. And from what our experience so far is, people are excited like, you mean we can have that technology? Yes, you can. We're not going to give you the business here. Here's a check to pay for this machine. Here's a check to pay for you to maintain it. And by the way, you get to use the Modular Water tech, and I think that's triple winner.

Introduction

Hello, everyone. And we have a new format tonight. That's going to be a lot of fun. Ken is going to be the emcee because we like redundancy and also we have a team. So what we're going to do is Ken is going to take over the presentation that we've built together, run it, and then we'll be back together in the freestyle discussion at the end. With that, I'm going to let you take it away, my friend.

Ken: Welcome. I'm Riggs Eckelberry. Water is the New Gold. September 29, 2022 Briefing 180. And I'm very, very pleased to be here. So what I'm going to try to do is while folks are filing in, we'll cover some of the essentials. Given what you've seen this week, rather than talk about the oh, my goodness, the message we have is very positive. Yes, there is a really beneficial income asset that I think can be a real safe haven and a saving grace. And it is known as water.

So what we're doing now is the normal safe harbor statement while folks come in is to summarize this description. We're going to talk about things and we really go to a lot of trouble to make sure that we are accurate, we are transparent, and that we're careful in how we represent things to the public. Occasionally we're going to do our best and maybe not get it entirely right, but when we do, we're going to promptly fix it and correct it.

And a quick look at our disclaimer for our Regulation D. This was the week that Riggs was supposed to be in a bunker trying to survive the storm. Thankfully, thank God the storm passed south of him and he's able to be here today. But we thought it'd be a good opportunity for me to start to carry some of the water.

Interview with Dan Early

So he presciently put together a really wonderful video of Dan Early, which we will see in a moment. And Dan is, Dan is great because he comes at these things and he explains these things the way only an engineer who's also an entrepreneur can. And I've always, I've always delighted in his interviews because he has a very common sense centric type of approach. But I think he has a better understanding of the exact size and scope of this market than, probably better than anybody. So without further ado, I'm going to start a recording that was recorded, I think, two days ago between Dan and Mr. Eckelberry.

Start of presentation

Riggs: Good morning Dan and how are you on this, down here a hurricane week for us in Florida.

Dan: Good morning, Riggs. I'm doing, I'm doing well on this end, on this end, probably a better than you're going to have this week.

Riggs: Well, there's a lot of people overreacting. They're flying out of state. Doing all kinds of, like, no, this is going to be fun. I've got my battery back up, all set up. You know, we're going to forge on through. It's good.

Dan: It'll be a true test of decentralization is what this is going to be.

Riggs: It's the truth. Yea, off grid life. Fill the bathtub.

Dan: Exactly.

Riggs: Well, Dan, yesterday morning at the management meeting, you discussed how a particular very, very good manufacturing sales rep organization of ours is starting to turn us on to a new vertical, which is water features. So what's happening and why and how come we're, we're hot.

Dan: Well, the water feature market is it's this industry in the, in the water sector that people probably just don't pay a whole lot of attention to. So whenever you're out in in an urbanized area, if you're in the downtown metro region of any any major city, you'll invariably you're going to see water features and it's going to be fountains and landscape features and they'll have fountain water sprays, lighted features and those types of things.

Those things actually require all of the technologies that we provide with Progressive Water Treatment and with Modular Water Systems. What is, what is unique about this industry is that it's a water feature, but it requires advanced control systems, it requires pumping systems, monitoring systems, chemical treatment filtration systems.

It requires just as much treatment and and integration as just about any advanced drinking water or wastewater treatment. And what we have found is that this is just an underserved market. There's nobody in the industry in North America that really knows how to pull all this together.

Riggs: Why do you think that is?

Dan: Well, because it is, it's a funky, it is a funky industry, and it's funky in that the current service providers and the vendors that supply equipment to it, they will supply just parts and pieces. There may be a company supplies a pump skid. There's another company that supplies the filter packages and it doesn't follow, it doesn't follow the traditional equipment supply market in that the mainstays in the water treatment and the wastewater treatment industry, they don't target this industry.

They don't go after the water feature market for whatever reason, it has been routinely served by mom and pop organizations, vendors that have some integration capability and some design capability. But there's nobody out there really that we are, that we've seen over the last 18 months that knows how to pull all of this together.

Riggs: Fascinating. How big do you think the market is?

Dan: Oh, it's huge. It is a huge addressable market. Probably not as big as like the EveraMOD pump station market or the or the EveraTREAT wastewater treatment product line market, but very, very sizable. It's easily it's easily in the 100, $100 million a year range, if not more. Just in North America. Just in North America. Case in point, Riggs, where you're currently quoting a system through one of our strategic partners, and it'll be $1,000,000 equipment order, just in one system. So that's not, that is not uncommon to see purchase orders in that scope, in that price range.

Riggs: Essentially you're you're purifying water that is not waste water. It's just you're keeping it from getting algae and mold and all that stuff, right? Probably. Probably chlorinated at some point, I'm guessing.

Dan: Correct. Chlorination. Disinfection. UV disinfection. You have water chemistry monitoring systems. This is a, the best, the best analogy that I would use for this particular product line is that this is a closed loop zero liquid discharge recycling system is what this is.

Riggs: Like we've been doing.

Dan: It really is it. Exactly. They don't want, water is precious. They don't want to keep buying and replacing water and throwing and discharging old water and replacing the clean water. So it's just imperative and incumbent upon the users for them to implement these recycling, these treatment and recycling systems so they can maintain their water features.

Riggs: Is this basically just a big version of a pool system?

Dan: Yeah, it is. It is. It would be the industrial grade version of a pool system, whether you have it in your backyard or the local community pool, which you clean every day or the country club.

Riggs: Interesting. Well, this is fascinating and we're looking forward to seeing that develop. Let's, let's briefly visit the your EveraMOD Pump Station business. It's really taking off. I've covered how it's a big proportion of what you're bidding and I heard Monday that you, that this big national account is continuing to progress.

Dan: It is, as we had hoped and as we had predicted, we are starting to see an uptick with each progressing month with new opportunities coming in. So the volume of business that we are seeing continues to grow month over month. Right now we have at least four more orders from the single national account. Those are right at our door.

Two of them, we've actually received the verbal last week. We're just waiting for the paperwork to come through. And there are two more right behind that. So where I've been predicting this monthly sales close rate of, say, 4 to 5 units per month from this one account. We are on track to do that. I would say by the end of the year, we'll be at that. We'll be at that run rate with this particular single customer.

Riggs: And this is roughly $100,000 system, something like that.

Dan: On the low end, $100,000. We're the most recent ones. We've quoted 125. That's the $125,000 is the average. We do have one that is a much, much larger system. It could be about a quarter of a million.

Riggs: Interesting, very interesting. Well, you know, pump stations are this under-recognized part of the market where if they're, if they're breaking down the stuff, the sewage doesn't flow. But if they just degrade and start leaking now you're starting to pollute the aquifer and so forth, right?

Dan: Exactly. Exactly. It is a mission critical, mission critical piece of of wastewater infrastructure and utility infrastructure that we all have to rely upon on a day to day basis. Out of sight, out of mind. But it is absolutely intrinsically important to daily function in daily life.

Riggs: Now, the mix of government versus private is roughly what right now for you?

Dan: It is I think it's 60/40 public to private. It could be 70/30 just depends. But it's, it generally follows that break out right now. When I look at our pipeline and forecast over the next 12 months, I would say it's it's 65/35. That would be a good guess.

Riggs: Interesting. Well, so the 35% is, of course, businesses that have to do it because they're remote or whatever and they have to sort of take care of themselves, right?

Dan: Exactly. Yep, They are t,hey don't have access to public sewer, don't have gravity, access to public sewer. And they may have to pump it offsite to public sewer or they have to collect their wastewater at a central facility, at a central location, at their development, and maybe pump it to their own decentralized wastewater treatment facility that they may own and operate.

Riggs: Excellent. Well, now this brings me to a topic that's that's been in the headlines. That is supply chain. How is the supply chain working for you? Is it are there major issues? What's happening?

Dan: Supply chain disruption and supply chain impacts were a really, really big issue for Modular Water Systems back in January, February, March. In Q1 of this year, they were, well, it's been an impact all year long for that matter. It has recently gotten somewhat better. We have seen a, we saw a huge spike in prices and we saw a, it's an, it's a supply and demand model is what you're looking at. We're just dealing with what it is. We have seen a, we are seeing a correction and a return to some sense of normalcy. But it's going to take us at least another, I think, another 6 to 8 months maybe to get back to, close to where we were, say, 15 months ago. But it has been a huge impact.

Riggs: So I'm glad that it's flowing again. But you brought up prices and it must be really hard to manage quotations bids where, you know, it takes 6 to 8 months, maybe a year, and then all of a sudden they order and your prices have gone wild. Do you are you taking special initiatives to make sure you don't get caught?

Dan: We do. We do. In all of our purchase agreements, in all of our contract proposals, we tender to our customers. We do, we have made specific provisions and establish certain conditions in our contracts that notify the customer that due to inflationary pressures and supply chain disruptions with customer or with supply chain invoking force majeure, those types of conditions, we have made it readily apparent or made it abundantly clear to our customers that if we run into a situation, and we, are quotes are only good for 14, maybe 30 days.

If there is a pricing escalation, we we pass that along to them. They're responsible for picking that up and covering that cost. We have, we have closed several contracts by arbitrarily and actually unilaterally. We have imposed certain pricing escalation, escalation conditions on deliveries and orders that may take place another six or eight months from now, meaning that we have projected we think there could be a 10 to 12% increase in inflationary increase. And we've been, we've already rolled in the price and notified the customer said, "Hey, this is what we're expecting, we will hold and honor that. And that's made everybody comfortable.

Riggs: Now, how healthy is the the water treatment management economy right now? How is it how is it going?

Dan: Overall. It still, it still doesn't meet my expectations. If you're asking from a professional standpoint, my professional opinion. The infrastructure world that we live in, especially here in the US, I mean, the American Society of Civil Engineers has graded our utilities, our water and wastewater utilities with a grade D. So if you're in school, you are just barely passing. Yeah, it's pretty bad.

There are trends and emerging trends. I think there is a lot more understanding and there's a lot more education in the marketplace. Now. People understand that, especially with climate change and water scarcity issues, especially out in the southwestern United States, where water is a precious resource.

Understanding of our dependency upon water resources, the importance of water in our daily lives, where it comes from, how we use it, how we recycle and conserve it. Those things are I've seen a huge increase in that over the last five years. I think everybody is much, much more aware of the importance of this and how we are utterly and totally dependent upon in our daily lives.

Riggs: But as you say, the central utilities tend to be underfunded still. And it's, I've never quite understood why it's, but it is a fact. And, you know. We have this idea, of course, that you've lived for 20 years, which is to take it to the margins and to treat it where it's, where it's made, where it's made dirty. Right? Right.

And and we're increasingly saying, look, business and industrial, industrial and agriculture is 89% of total water demand. How about we pull these and make them self-sufficient? And then the specialties can focus on the 11% who are actual people and deliver because, you know, Jackson, Mississippi, Flint, Compton, all these horror stories, they're going to continue going. Why?

Because the municipalities are being so bombarded by business needs, which are legitimate. But the businesses, as we've learned and as we're as we're proposing, can have a great life taking care of their stuff. And they actually do better because they can recycle, etc..

And let's let's take care of the people. And, you know, many, many people tell me what is a right. And first I was like, wow, why are they saying that? Right? Well, it's true. If the municipalities weren't overburdened with all this corporate work, they would have a pretty easy time taking care of the the families of the single family residences, the apartments, etc..

Dan: You're correct about that. It's tragic. And it's just, it's a travesty as well that here in the United States, especially over the last 40 years. We had, we had great funding back in the seventies with the Clean Water Act and the federal government plowing all this grant money and low interest loan money into water infrastructure.

And it really showed if you go back and look at movies and videos and documentaries of what the United States civil infrastructure in the water world looked like, just in commercial applications, you can see, you can tell that we were on top of our game 50 years ago. With that huge decline, with that huge decline or lack of investment over the last half century, especially in the last 20 years the proverbial chickens have come home to roost in this instance.

And just trying to catch up to meet all these demands, at these public sector levels. The funding is just not there, the investment is just not there. And it has to be, that has to change. If we're plowing all this money into all these other programs around the United States and sending money overseas, we've got to keep it here at home and we've got to plow it back into these water and wastewater utilities. Jackson, Mississippi, and Flint, Michigan. They're going to have a lot more. You're gonna see a lot more of those issues in the next 10 to 15 years if we don't get on top of this.

Riggs: Well, you know, it's something that, yes, we need the money needs to be allocated to the central facilities, but it's not being done. And, you know, we are, we're living the definition of insanity in Washington and Lord knows what's happening over there. But the reality is, it is underserved. The central water treatment is in trouble. It's deficient in terms of what it should be doing.

And so, you know, it makes sense to just go, "OK,you know, what? Businesses and farms can install their own systems." And that is a solution. It's maybe, it's even a very elegant solution because businesses then have control of their own existence. And with the Water On Demand funding, they don't have to put money in up front.

Essentially, we're replacing the city with our meter. We're becoming the city for those customers. And why the heck not, Right? This is, this is why we don't have high speed trains. We just have roads, because it seems that we, in America, we've sort of dropped down to the less structured solution and a more of an ad hoc. And decentralization, it seems, works for that.

Dan: It does. It does and with the inability for public sector to provide adequate drinking water and proper wastewater collection and treatment services and utilities to go with thosem, that actually is a huge opportunity for the private sector, and that's what we do. That's what Modular Water Systems and OriginClear and Progressive, that's what we all do on a daily basis.

The Water On dDmand model, as we have been promoting and have been pushing that model forward, it is poised perfectly to help bridge this gap, this gap that we will see for the next 20 to 25 years. And that is where we can come in as private sector. There's always going to be a need. There's always a huge demand for water. It's going to be there. It's always going to be.

And so in order to service that demand programs and business models and funding models like Water On Demand and decentralized applications, and these single point of use or point of use and disposal type applications, that is going to be the norm. And it has to be. There's no other way for it to happen. Just the public sector and just the enormity and the size of those facilities, the money needed to do those things.

A an upgrade, a public sector upgrade project can be measured in decades. And most business people, business minded individuals, whether it's companies, developers, manufacturing entities, they can't wait ten, 15 and 20 years. They need to make decisions in two to five months, six months, implement their own decentralized water utilities to service their needs for the near term.

Riggs: Well, it's, I really, I'm wondering how the big guys are keeping up. We know that they're out there, but so far, it seems to me like they've been just essentially still focusing on the big projects and not stepping up to the plate. Are you seeing some movement towards publics, sort of the established companies doing more and more of this decentralization, or is it still pretty neglected?

Dan: It's very neglected. Still very, very neglected. The big companies, the big major water companies that, name brand companies that we see both nationally and internationally, their models are set up for, they're in the billion dollar projects. That's what they want to see. They want, they want to commit and invest and leverage their resources for those types of water infrastructure projects. And that's fine and dandy.

I mean, you go to a major metropolitan region and you can have a $1 billion wastewater treatment facility that'll last ten years — the engineering, construction and commissioning. Fact of the matter is the overwhelming bulk of the market is going to be in these regional and much smaller utilities, which is probably, I would say, 50% of the demand, at least in the United States.

And they're never, the big players, the big companies are not geared, their business model, their mindset, they're not geared to go after and service that type of customer. That is a huge opportunity. It is it allows us to get technologies deployed, systems implemented and to solve these problems much, much more rapidly because they're smaller and our models work for that.

Riggs: I did one of these quadrant type analyses and it shows that, I don't know if you can see it on your phone. Okay.

Dan: I can, yes.

Riggs: And so investor accessibility meaning that, you know, can any investor invest in these? Of course, the top left you have the big public companies. But they in terms of managed services, they are more to the left. Fluence is pretty good at that, Evoqua. But the big dogs I think are still sticking with a lot of the public stuff. And then down right we've got Cambrian and Seven Seas which are, which are in managed services but not accessible to the ordinary investor.

And magically we're the one over here, top right. This is about Water On Demand, but it's also about Modular Water services. This happens to be a Water On Demand presentation, but it's also true of Modular Water Systems and even to a certain extent Progressive Water, right? With that hotel system we're doing. So, it's pretty astonishing just what huge opportunity is opening up because, we were there, the crazy people. I remember you were doing it for ages. I started doing it in 2016 and we were the crazy people. Like, what? Why? What is this all about? Businesses doing their own? Now, it's become a reality. And I'm really astonished that we have this opportunity. What can I say?

Dan: Yeah, I agree with what you're saying Riggs. A good analogy and a good comparison would be like the, if you look at the solar energy market right now, there is a big push for residential, decentralized solar applications. So you put your solar panels and your lithium ion battery backup units in your garage, you're still connected to the major power grid.

The decentralised water market, both in wastewater and in drinking water, potable water, actually will work exactly the same way. You can still be interconnected to the public utility, but when you have concerns, like in Jackson, Mississippi, and Flint, Michigan, about the quality of your water, you can treat directly at your point of use.

If you are in an urban area and you're developing and you cannot get access to public sewer, you can still use the public water, but treat your own wastewater on site, have a closed loop, zero liquid discharge. So the same, this big, huge push on energy for solar, we are doing, Water On Demand, Progressive Water, Modular Water Systems, the OriginClear vision is doing the exact same thing that you see with the solar market. It's just applying it in a different method with different utility applications.

Riggs: Well, I think you've said it very well. I'm astonished at where we stand. It's been a long patient road for you, Dan, so don't don't chuckle too much about being the top dog at this point because lots of work ahead. But I love the progress you're making, that you're, by leaps and bounds. We see it happening in the figures and the wins. So carry on, sir. You're doing an amazing job. And to your to your team as well.

Dan: Will do. We will keep rocking Riggs. It's fun. We keep doing it on a daily basis.

Riggs: Thanks. And again, have a great week ahead and I appreciate what you do.

Dan: You're very welcome. My pleasure. Be safe.

Riggs: Thank you.

End of presentation

Demand Destruction in Assets

Ken: Okay. So Dan mentioned a number of things here. And it takes me into like what's going on with assets. The slide that we're enduring right now in our infrastructure is something that will only speed up. Flint, Jackson, they're a preview of what becomes the norm. So to come out at this time and be a pioneer in this thing is really I mean, it's serendipitous.

Hopefully there was a little bit of precedence to it, but I think that we're going to enjoy being at the front of the wave of this thing. And I want to get into how water on demand as an asset, as an asset class.

I mentioned I was going to mention doom and gloom. Well, I'm going to just touch it because anybody who's turned on the television in the last couple of days has had heartburn. Myself and Riggs are talking about what the heck do we do with our money? Except we didn't use the word heck.

And I want to go over what's going on with assets and to kind of give the general audience a view as to what we're experiencing in the world and how water cannot see, will never see demand destruction. What we're seeing right now in assets is a process of demand destruction. I'll get into that.

Real Estate

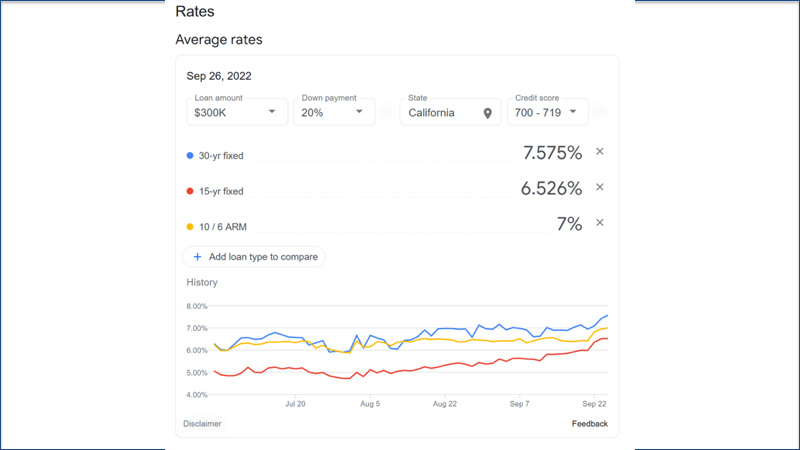

So one of my favorite assets in the whole world, and I am a genuine real estate lover. I'm flying down next week, down by Riggs. I'm going to be buying some condos. Hopefully I'll have lunch with Riggs in between. But buying real estate is something I truly love. Real estate as an investment, but you can see that the 30 year fixed rate is 7.5. Now, my broker has told me, look, you're going to be you're going to be in the eights by the time early next year rolls around.

So the investor that may have been buying higher property value, the guy who could just squeeze out a six or 700,000 home at 3%, that's not happening anymore. So those homes are largely removed from that tremendous demand that they were able to enjoy. And I think that's going to have a big effect on the number of, first of all, refis are done. So that's a whole industry that's going to get kind of hobbled for a while. But I also think turnover in existing homes, high priced existing homes are also going to suffer dramatically as are lower priced homes.

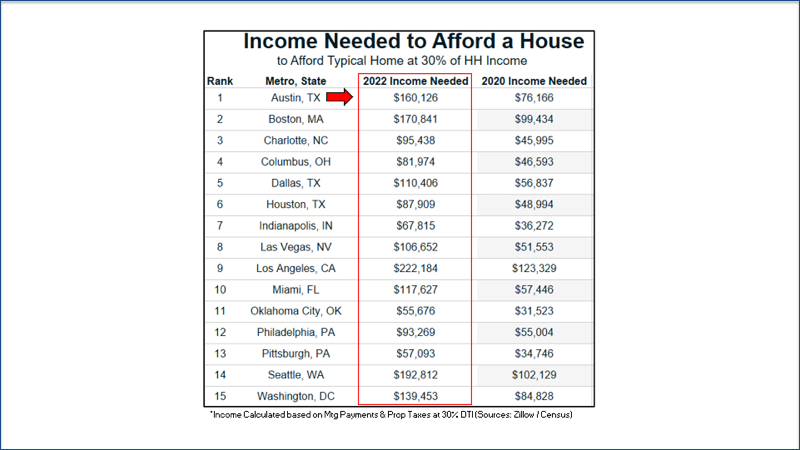

Affording a Home

Which brings me to something I sent to Riggs the other day and I was happy to see him use it. So in 2020, if you wanted to buy a home in Washington DC, you could earn 84,000 a year and have enough income for your 30%. Your debt service has to be 30% of your income in order to be able to afford a home. Well, in less than two years time, that has almost doubled.

Seattle, Washington, almost doubled. Even my town in Pittsburgh. Now, the reason I love Pittsburgh is you can buy real estate all day because it was a very modest, home prices were very modest. Even that has nearly doubled. And then you can get into some of the big examples where you're going up $100,000 a year. Here you're more than doubling in Austin, Texas.

So I think the real pain that's being felt by not not so much by US accredited investors, but middle America, which bleeds up and down to both areas, is that if you think that the average American has had a 100% increase in income in the last year and a half, well then you're dreaming. So the American dream of owning a home or buying reasonably priced investor properties, it's just it's no longer attainable.

And I think that this could be an asset. This is a business that relies on constant turnover, constant movement of inventory for it to thrive. And I think an interruption in that movement could be, could be very painful, right? So it's something to really watch.

Declining GDP

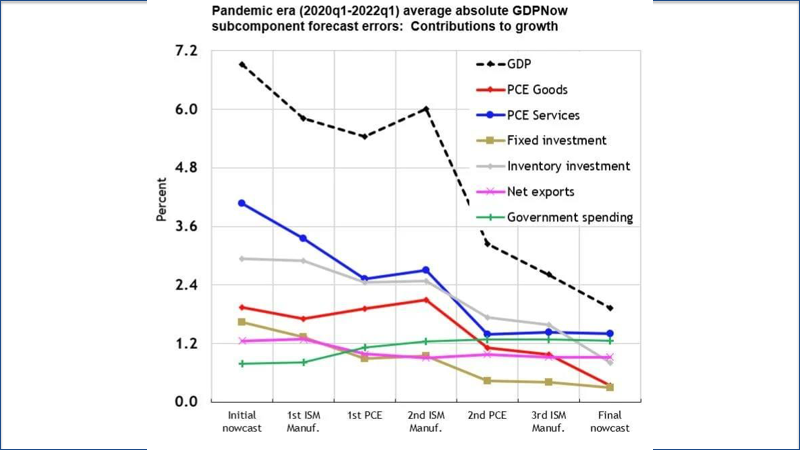

And so here's something else we were talking about today was announced maybe yesterday, 0.6% decline in GDP. So if you look here, they were predicting 7.2% GDP growth. I don't know where they got that from, but you can see they keep revising it down. Revising it down. Oh, crap. No, revising it down again.

So it ended in the first quarter of 2022 at about 2%. Well, if this graph continued to now, it would be here down below zero. That is a, I mean, that is a ski slope decline in GDP. And if you notice, all of these other metrics have declined, obviously not as fast as GDP, but now with GDP declining so rapidly, we may see these things really start to turn sharply lower in the coming quarters.

The only thing that has managed to increase during this tremendous slowdown of productivity in the US is government spending. So, America has such a large economy that we put six some odd trillion dollars out there into the money supply and we're experiencing about 20%, 20 or 30% year, per year erosion of our buying power. So, all right.

So I don't want to go into real estate necessarily, as I have the bulk of my money there. I don't want to have it in metals. I don't want to have it in some of these other traditional assets. Oil and gas is at the mercy of what's going on. You saw a pipeline explode in Nord Stream. So seeking out water as an asset is uniquely special. And because going to cash really isn't a very good option, but we're experiencing in the dollar decline or a dollar devaluation, I should say, is serious and it's significant.

Pound Plummets

But look what they saw in Europe, in England. So this is a single day graph for the pound. So while we were jumping up and down and crying about losing 20% over a year in our buying power, these folks lost a major portion of that in an hour. This is a combination of tremendous amount of printing of money, followed by immediately by a terrible slowdown in economic prosperity. And you're starting to see this now. This can be become the norm in Europe and America. If this if we don't start to make some changes from from the bottom up. But this is this is a little spooky, right?

So the poor folks in England have lost about 20% of their buying power in a matter of weeks where we were worried about it over the course of a year. So that's, again, so I'm talking about the problems. It's really just a quick pass. I don't want to harp on it because there are solutions. There are ways.

The Good News

The good news is we can avoid all of this stuff. It's by solving the problem that exists with centralized water. So Dan touched on a lot of things. He touched on the fact that the chickens are coming home to roost. I think that, that graph you saw last is the chickens coming home to roost economically. The printing of money, the slowing down of the economy. What you saw with Jackson, Mississippi, and Flint, Michigan, are the chickens coming home to roost in our infrastructure and how it affects humanity.

Real estate is experiencing demand destruction. Certain durable goods are experiencing demand destruction. That's causing these slowdowns in the economy. Water cannot ever really have a demand for destruction as long as our population keeps growing and scarcity continues. The demand for water will increase, and that's why it's increased so beautifully against inflation at about 4 to 1.

So coming out with an asset class that defends the investor that delivers a no cash upfront solution to a decentralized customer is valuable in and of itself. But when that actually solves the centralized water problem. You've really checked all the boxes. And I think that that is really, really exciting.

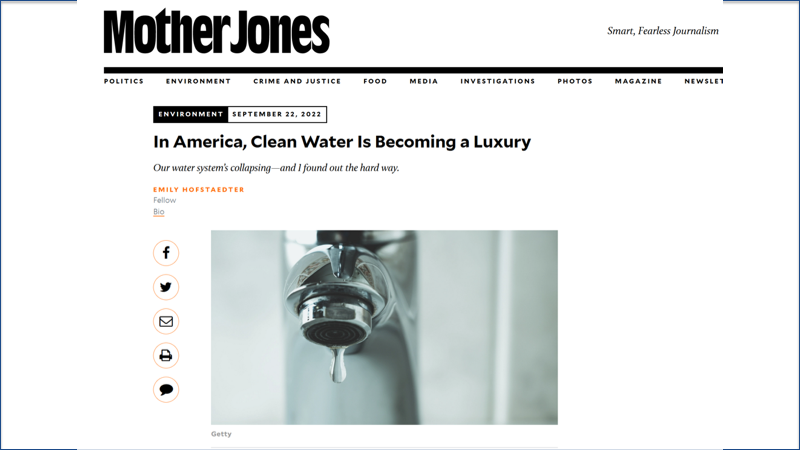

Water Becoming a Luxury

There's an article that came out and Riggs put it in here, by Mother Jones. Now, Mother Jones, if you're not familiar with it, it's not The Wall Street Journal. They started as a kind of an environmental publication, pretty, leans pretty strongly to the left. And they're talking about how clean water is becoming a luxury. And the truth is, it's a luxury that we cannot afford for many of us in America, but it's one that we cannot afford not to have because clean water is directly tied to human health and the lack of clean water creates catastrophic health concerns.

The Urgent Need for Deentralization

So this is a group or a group of authors that are heavily aligned with the Biden administration. And you see that they're trying to fill the holes. So this is highlighting what Riggs and I have talked about for many, many months since the infrastructure bill came through, where it talked about $50 billion. I think the $55 Billion was devoted to water in the last infrastructure bill.

This talks about $50 Billion over a five year period. That is so inadequate because we're literally, our infrastructure is sliding down a hill with the breaks locked, down a slippery hill, and it's accelerating at $75 Billion per year in degradation. So these companies like Veolia and American Waterworks, which you showed on that previous slide, that's their domain. But without the funding, they're not going to build a system.

So decentralizing really is the key. And it basically says we're going to go with safe drinking water. There's another $15 Billion to replace lead pipes. Even that pales next to some of the bills spending. It's a drop in the well or a drop in the bucket, pardon the water pun. We have been ignoring the water infrastructure problem for decades, and as Dan put it, the chickens are coming home to roost. So from a timing standpoint, I don't think Water On Demand could have been more serendipitous. And with that. I'm going to bring in my partner, Ken Berenger, for our free wheeling discussion.

Freewheeling Discussion

Riggs: That's very good. You grew some hair all of a sudden.

Ken: I did. I did. I'll send you the link. We have some, we have some chats. And I was, while the video was going, I didn't want to touch them. But you want to, you want to have that, you want to kind of talk about that for a second and address the chats, or...

Not a Partisan Issue

Riggs: Right. So let's get into it here. First of all, what was interesting about that Mother Jones article is that a Biden administration allied publication was saying, hey, we've been, it's a drop in the bucket well, whatever, and it's been neglected for decades. For that admission to occur is stunning, in my opinion, because it means.

Ken: Makes a man hopeful.

Riggs: But it also means this is not a partisan issue. This is not a political issue when both the administration supporters and everyone else is saying this is a problem and it's not being solved by what was put into the infrastructure bill, then we have a universal issue that can unite us because we're looking for those. We're not looking for the division. We're looking, we want to actually solve problems, we've got to do something that everybody agrees is important. And I think we've achieved that.

Ken: A little tongue in cheek, though, when both sides agree you're either in big trouble or, because it's usually like we're going to pass this huge tax bill, we all agree, right? When politicians agree on both sides of the aisle. But when both sides of an ideological now, look, the right would have their reasons as to why decentralize water has to be in place, people that are looking at it from a, from an economic and from a business opportunity type thing. And maybe the folks that read Mother Jones are going to be looking at it as a human right and a human health. I think both are right. And when both sides of a very, very divided ideological world can agree on something, and we're at the heart of it. That puts us in a really good spot.

Audience Participation

Riggs: Well, exactly. So I wanted to address. Thank you very much. You're absolutely right. I want to address what Keith wrote and said at the very beginning. And thank you, Keith. We are all safe and I appreciate you thinking of us. The whole Tampa Bay area, I think, was very, very lucky this time around, seeing the destruction that occurred down in the Fort Myers area.

Keith's question, you're saying, "With what is happening in the market, the fact that you've been transparent and honest with everything and very accurate with your forecast or OriginClear is the only company I trust to invest with." And I really appreciate that.

So what we're seeing is that couldn't talk about it much with them because we have to be careful with our forecasts. You know, we can only do them in an official sense. But he was talking about what was it, four or five a month with this national account. And these are $100,00, $125,000 just for the pump stations, right? So $600,000 a month just for pump stations.

Ken: Right.

Riggs: So that's turned into an amazing $7 million a year potentially for Modular Water Systems, which started from zero in 2018. And how much pain did we go through? And that's why we're so grateful for investors like Keith Roeten, because we went through a period of just grinding through Modular Water, getting its feet, and finally we hit the inflection point. All right. Steven Davis says, "It's not political. It's a basic human need. Stay neutral politically."

Riggs: We absolutely, look, we're focused on well-being of humans. And I have not seen anybody on any side of the aisle disagree with any part of this. Now, the fact remains that and this is across all administrations, as Dan was saying in the seventies, we had a high point of investment.

And there's a graph that Ken likes to show in his presentation. It was really, really high. And it's gone down ever since through consecutive administrations, including the Reagan administration, including everybody. So, this is simply a baked in problem that...

We're very fortunate to be there with the financial technology, Water On Demand (WOD), and the water technology, Modular Water Systems to address this problem, be the right people at the point. So David Johnson asked, "What do you expect will be the first WOD project and when will it occur?" That's a very good question. We keep stacking up the projects that are imminent, but I have to say that we are continuing the usual contractual thing.

So, even though it's easier than when asking people to pay for it, there's still these permitting and consulting engineers and so forth getting in the picture. So, we have multiple projects and my feeling is, is that coming out the other end, they'll start happening.

Keeping the Money Working

Meanwhile, we are lending money internally to, on a secured basis, with a very high rate of return. And I've made a decision that when we do that, then we want the investors to get 100% of the proceeds, not 25%.

Ken: So, the while you wait, the while you wait. Sure.

Riggs: Because, because we're making, we're making what's called factoring loans, where you factor or you're helping with accounts receivable. And when we do that, it's a nice percentage rate of return, but we don't want to ourselves benefit from that. We want to give it all to the investors.

Ken: And to explain the factoring part is that whatever's purchased, the securitization is on the, on the goods. Right. So that is a...

Riggs: Right right.

Ken: It's not just like here you go PWT there's going to be there's going to be equipment bought and that equipment has inherent value and the security will be held against that equipment until it's paid back. And last time there was a very quick turnaround, wasn't it Riggs? About sixty days.

Riggs: Exactly. And so now we're going to work the same thing. And as you say, it's backed by the coming business, the business that has been written already, whether it's a Modular Water Systems, which is now under control of OriginClear, directly corporate, as well as the pipe, the pump station business, which is now taking off and will soon be its own business unit and OriginClear corporate.

All of these are secured lending that has high rate of return. I don't think people can get a 15% return on their money even now in the marketplace. And so it's, it's a nice solid return. It's short term lending. And this is kind of a news flash that I will be allowing the investors to get 100% of it because there's no work involved for us. We're not building water systems with this.

We're simply keeping the money working and earning money for our investors. So that's going to do some short term benefit, get some checks going out. So people got checks early on in the year from this very quick factoring we did that worked so well. Well, now the checks are going to get bigger, but we're keeping our pump primed for the actual water deals. And we have ample funds to do that.

Non-Controversial Asset

Ken: Right. And to greater Stevan's point, water is not political because it's responsible for all life on Earth. So you can't afford to be political. But look at other assets, we were talking about other assets, you know, there's a left and a right argument to every other asset, right.

If you want to drill for oil or gas, the Left opposes it, the Right is all for it. So, there's always a fight. This is the one asset where both sides of the ideological spectrum agree 100%. It'd be like us fighting over air. Right?

So that's a dynamic that I don't know that we fully have fleshed out and discussed with the audience, but the fact that all life on, the fact that, the fact of the quality of our water as a planet is degrading rapidly. The fact that we actually have a way to begin to bend that curve, if you will, and provide an asset class that will pay people for generations and solve a human health crisis that's on a massive scale.

A Stable Investment

The fact that both sides agree, yeah, you do that thing. Different point of views about housing. Is housing a right? Is housing a this?. You know, there is no argument here. Both sides are going to be pushing in our favor to make this happen. That puts us in a very, very unique position, in my view.

Riggs: Yeah. And, you know, the investment of last recourse, which is gold historically has been seized in the past that was done in the Roosevelt administration. So, it too is in parallel. But nobody's going to seize a water system that's purifying water. It's just not going to happen. It's a piece of industrial equipment that's doing a job that is being paid for.

Ken: And it's not a readily portable asset. It's not something you can just take. Right.

Bringing Your Portfolio Right Side Up

Riggs: So, so I think that it's really emerging. And one of the things that we're going to produce as a tool is to put a portfolio. Here's all your portfolio stuff and you can put in your numbers and then compare. And then here comes what your Water On Demand investment and let's see how it brings it right side up and we're going to make it a calculator.

Ken: I was going to say, and I think, look, if you look at Water On Demand's return over the last 120 days and compare it to any other asset class, we truly shine. And I believe based on everything, the momentum that we're gathering, what's going on on the WOD deal front, right? On going up with Castle this week, on all of our megaphone initiatives, right. Of making sure the world knows that the tree fell in the woods.

I believe that that performance could do really, really even better than it has in the past couple of months. But compared in a slice of time over the last 120 days, Water On Demand, I think, really, really shines against every and any other asset class.

And we, and that's something that we need to be able to demonstrate because while we're on the phone with our our key supporters, people that have believed in us all along, it's now time to turn this over to the rest of the world who doesn't even know what they're missing. And I think that'll be a very powerful and persuasive discussion.

Factoring Loans

Riggs: Yeah, because people want to know where to find a safe haven for their money. Quickly, because we're going to wrap it up for us, Horace Smith says, "Are you saying that you are lending to investors?" No, the investors, our Investors, our Water On Demand Investors, are going to get all the proceeds from lending that is done to the people we trust, us!

We're not going to go lending to... This is going to be something where our CFO, Prasad Tare, who is an amazing CFO, will be in charge. There'll be security agreements all across so that there is recourse on these things. And then we're charging 15% per annum, which is a good rate, and we have now made that commitment.

It's the first time you're hearing it, that 100% of that 15% will go to our investors. I hope they've made that clear Horace and James Wright quickly because we're out of time. "Put GPS trackers on the module parts just in case." Very well put.

Ken: We got a LoJack.

Riggs: Get a LoJack. But they are network connected. So that answers your question. All right, take it away. Horace Smith says, "I need a call."

Call Ken

Ken: So, Horace, all you need to do is go to oc.gold/ken. You'll speak with my staff, they'll put you directly on my calendar. That's oc.gold/ken, You can email, invest@originclear.com. My staff will pick it up and they'll, they'll contact you to put you on the calendar. Or you can dial 877-440-4603 ext 201. Best bet though, considering I'm constantly on these zoom calls, go to my calendar book an appointment to speak with staff. They'll get you on my calendar so I can lay it all out for you in in detail.

Riggs: Thank you, Ken. Well, listen, you had a good maiden voyage. I'm like, I'm laughing because you're.

Ken: Just a couple of fender benders. Nothing. No, no major. No major wrecks, right?

Riggs: Yeah, well, you experienced what I lived through, so.

Ken: I'm a believer. I know.

Thank You

Riggs: Thank you, everyone. It's been a really great talking we're so excited about, you're going to love the numbers coming out quarterly. I can't say more than that, but we're super happy with how things are going with the numbers. We're happy with the progress and Water On Demand. We love how people are investing.

We love the support we get from PhilanthroInvestors, where Ivan Anz, as you know, is doing a Latin America tour and killing it on national TV in Colombia. So we are going to be. We're actually going to go ahead and wrap it up. But thank you very much, everyone. And I think I'm going to wrap this up. How about that?

Ken: Okay. Have a great night.

Riggs: Thank you, everyone. Be there next week. We will have another exciting episode.

Ken: Goodnight folks.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)