The incredible Manuel Suarez broadened our horizons on how to go about the business of changing the world! What he had to say about collaboration as a new currency really resonated… But we also took a hard look at what is going on with the world economy and the growing role commodities are playing. Considering that water is arguably the most precious, and rapidly becoming the most valuable puts us in a very powerful position… Find out about it in the replay!

Transcript from recording:

Opening

It's going to be a competition for people to fund these things. It allows us to really give people a very targeted investment in water, which is the emerging asset class. People are starting to realize, wait a minute, government monopoly is falling apart. More and more commercial work is being done in water. And where is the funding? Well, the funding comes from all different places but we're providing funding from regular investors coming in. For example, Water on Demand, etc.

And people from regular accredited investors all the way up to family offices, ultra high net worth individuals and eventually funds will be able to have a targeted role in an asset class that hasn't topped out like real estate has or like commodities have, you know. Oil and gas is great, but knows it's going to crash tomorrow, it's terrible. So whereas water is very stable. It's actually at the beginning of its run.

Introduction

I love these little clips that we're building. It's a great thing because one of the issues with the CEO briefing is it's long. So these clips allow us to get these things out on a digestible basis.

Anyway, I would like to welcome all to the CEO briefing tonight. It's going to be really, really, really interesting. And as people are arriving, I'm just going to cover the basics here. There we go. And. Water is the New Gold. Thursday September 8th and it is the 177th briefing. And really we have an emerging situation of a new beneficial income asset. And Neil Castillo says, "Hello." Hello, Neal.

All right. And of course, that's the usual Safe Harbor statement.

Manuel Suarez Then

And I'm going to now get us into the amazing Manuel Suarez. So first, I wanted to play a little clip from a while ago, kind of give us our history with Manuel and then we'll have the current interview, which I think you'll find interesting. So here we go.

Start of presentation

Manuel: How are been?

Riggs: Man! Is it nonstop or what?

Manuel: Oh, wow. What a world, man. What a world.

Riggs: But I remember I was in LA during the Christmas holiday and I went, "I've got to get people into the CEO briefing, which is proven to really, you know, galvanize people and get them excited." And I just called you out of the blue like the December 28th or something like that.

Manuel: Yeah.

Riggs: And I said, "What can we do?" And you said, "No problem, we can do this thing." And from that point on, things went completely, insanely crazy nuts and huge amount of people came in as a result of all the activities you had. It was just the best.

Riggs: We have 65 people in the room and the number is growing. So it's been our biggest yet. And Manuel, I have to thank you because you did it. It's. It's you. Thank you, sir.

Manuel: Well, we got an important message. We've got an important message to share to the world, that's for sure.

Riggs: At the turn of the year, I said, we've got to find a way to, in a sense, enter the world stage. And I called the only person I knew who really was a master at that, Manuel. I called him up. And what did we do? We decided to make these briefings, the focus of our communication line to the world. And then, of course, the virus happened. And digital has become the new thing, right?

Manuel: It is the other gold, right? We got water and then we got digital marketing and we're uniting these two. And if you don't mind me saying, Riggs, I have bought into your business.

Wow, what an incredible ride. 2020. It's been something else, because I remember you were about to jump on a plane and come over here, and around that time, things started unfolding aggressively and everything started getting cancelled. And while looking back at it, that's already like eight months ago. Whoa. What happened with those eight months? They're gone, right?

So it's been it's been crazy. But I went all in and I really believed in the mission. And I think it's something that is unique. You found the niche market that it's quite massive, but at the same time nobody's doing a good job on it. So that for me smelled opportunity and I really wanted to get your message out there.

We have this massive world. Three quarters of it is filled with this thing that we call water. But nobody knows how to protect that water or keep it clean or recycle it or re-use it or make it something that we can continue putting in our bodies.

So that that by itself was an aha moment. Once I understood that and looking at the different ideas that OriginClear has for fixing the problems that are widespread around the world, it became quite real to me. It really did, helping you guys help spread that message.

End of presentation

Riggs: So that was the previous report. Let's see where things look now and let's take a look at the latest podcast. So here's what we recorded on the Social Marketing Hour, which Manuel has. This was recorded Monday before last and it's now out. You can listen to the whole thing. One hour and 8 minutes. We've done a small excerpt. This is an audio podcast. Now we have the video. It's a rough video. It's really just there for doing clips and stuff like that. Basically, it's just a video grab, but it's better than to listen to audio, in my opinion. But as you can tell, it's a very complimentary positioning. Manuel and team are just amazing and we have really good memories of having worked with them. Currently our marketing agency is Monarchy and they are amazing. So really I've got no complaints, but we had a great time with AGM Marketing and Manuel Suarez.

Start of presentation

Manuel: All right. So we're here now in another social marketing hour. And this is also a very awesome one because I have a good friend of mine, also an AGM former client that I was able to help with his business for quite a while and it was a lot of fun to work with and he has a lot of value to share.

And without further ado, Mr. Riggs Eckelberry, he is the CEO and founder of a company called OriginClear. Originclear is a company that I'm a big fan. I'm an investor in myself. They are creating a revolution in a very important subject, and that is a subject of water. But water is absolutely essential and they are going through a massive, massive, massive business evolution. So let's get into it. Riggs, it's a pleasure to have you here, man.

Riggs: Well, such a pleasure. Likewise.

Manuel: So, Riggs going back into the subject of business, how did you guys come up with this concept? Like a lot of people, that's a very unique concept. And it's hard to say that you have a lot of competitors because I don't think you have a lot of competitors, but it's a revolutionary model. How did you guys come up with an idea on "Here's what we're gonna do, here's how we're going to change the world?" Because, you know, you know me enough to know that I'm into changing the world, making the world a better place through our message and our businesses. How did that start, that idea with changing the water in this world or giving people a solution to this enormous problem?

Riggs: You know, it's interesting because for us, COVID was a real game changer for us because many, many businesses during COVID had to assess their business model. I remember you made that course free at the time. It was huge. And it transformed your model, too, right? So for us, we're like we had been building these business units in Dallas, Texas, and also in Virginia, but it wasn't moving fast. It was growing so slowly.

It's like, what's going on? And it took us a while to go, Wait a minute, it's the money, stupid. And we realized, Wait a minute, if we can front end all these deals by providing the capital and the full support, so when there's a problem, somebody shows up, fixes it, it's all outsourced, right? So that's the vision because everything is going into a service more and more. Look at Microsoft Office. We used to pay $180 for Microsoft Office.

Manuel: Now it's like $10 a month for like something like that.

Riggs: But you know what? Even though it's more over time, I get more value.

Manuel: The lifetime value dramatically increases, which I love that you're mentioning this Riggs, because this is the one thing that a lot of businesses fail to understand.

Riggs: Yes.

Manuel: The value on acquisition of a customer. When you have a model like what you have, somebody puts one of those modules in their terrain. I mean, they're not taking that thing off, right? You're going to keep on getting them to buy water from you for like who knows how long.

Riggs: You've become the municipality, you've become the actual water provider. It's done. You're right.

Manuel: And that's like, wealth, long term because you have that, that... So the value of you guys acquiring one of these guys and putting that system in place, is infinite. You know that you're going to provide enough value to that person that came in or that business that you keep them buying from you over and over again with good products and services. Is that basically what you guys are trying to do?

Riggs: That was the situation we're looking at. In our industry and similar industries is initials DBOO design, build, own, operate right. Most companies in the water industry just do design and build. They sell the widget, send it out. Goodbye. And like you said, there's no lifetime value. Right? And maybe a few years later they might get a repeat order or whatever. But it's... And meanwhile, those deals took forever to do and probably somebody tries to rip them off and there's all this competition. It's terrible.

There's a few companies in the industry that do the full DBOO, which is what we're talking about with this Water on Demand. But they've tended to do it for very large installations, like desalination for an entire island. Why? Because it's easy. You know, you do one system and it takes care of 50,000 people. Everybody's happy, right? But the real business is in the middle class, right? The number of installations that are a little bit smaller than that is far greater than the number of islands.

Manuel: Absolutely.

Riggs: So we have a million, 2 million businesses in America that really could use their own water treatment. That's a far greater business. So we decided to go after that, that middle ground, because we invested in a technology called Modular Water Systems™. You've heard about that. So we have a tech for these drop in place systems that's doing incredibly well. And so with that tech, we're able to do it without losing money. And now we've got that revenue stream.

Manuel: So it's a monthly bill based on their usage. Basically, that water is being connected to the modular system. The water runs through the system, they drink it inside and it gets measured, just like you get the water measured at your home and a bill is sent out.

Riggs: Correct. Now, there's three phases to water. One is the incoming. The other one, the next one is the treatment to make it clean. And the third one is the reuse, the recycling. You want to do all three.

Now, sometimes we get people who want to treat the dirty water or we, right now we have a major hotel that was going to do the clean water. Why? They want to get rid of the forever chemicals. That's starting to become big, big news. And they want to get ahead of the problem. So this whole chain is adopting our technology on the front end. Now, eventually they'll do the middle and the back because you want to do it all, eventually. But we're happy to start any way. Somebody just wants to do recycling, maybe. Great. Will do your irrigation. That's fine.

The point is that we want to be as flexible as possible to deal with this middle ground. Half a million to $2 million systems at our cost, that then generate that revenue. And then we want to, over time, just grow that business. And we made a strategic decision and I'm a strong believer in focus, meaning sacrifice. Don't try to do everything. And there's is a book called literally, called Focus, that tells that story.

And you say, okay, we were looking at, we're able to raise money, we're good at that. We can build a fund — great. Now, building those systems it'll take forever, much slower than actually raising the money. So what we decided to do was delegate the building and maintaining of the systems to regional water companies. Now, that does a couple of things. Number one, it enables us to go massively parallel. Boom, boom, boom, boom, boom, boom. Everything in parallel.

Manuel: So you're kind of like the sales engine.

Riggs: We're the finance guys. We're capital. And we're the contract managers. We own the customer contract and we own the asset. We give it. Let's say Manuel is in Atlanta. He's got a water company. We say, well, I've got a job for you. He goes, okay, thank you.

Manuel: Here's a quote. Go ahead and get it done.

Riggs: Right. So now he's super happy. It was a blue bird for him. What that does also is it creates a loyalty network who after a while we got 30, 40 of these all over America and everywhere else, it's hard for others to come in. So by actually being willing to give the job to Manuel and not make that money, we've actually built what I call our supercharger network, just like Tesla has the supercharger network, very similar. It's a barrier to entry for other people. And I think it's super important.

Manuel: I'll add to that particular thing, which there's another word that describes what you're talking about right now, and it's collaboration. And if you hear a lot of the things being talked about in entrepreneurship right now is collaboration is the new currency. This is the way it is.

If you really want to scale. Stop trying to do everything and delegate those things that are going to free you up so you can actually focus on the thing that you know how to do the best. And you have all these other areas being done by other groups internally or externally, and you can really focus on expanding.

A lot of entrepreneurs historically have focused too much on doing everything themselves because they have pride in their ability to do it themselves, and they miss out on the possible collaborations of connecting with these people, organizations that they can do more together. Together as better, together is not something that shows weakness, it's something that shows that you want to empower others while they empower you and you guys want to grow together.

So you guys have collaborated with 30 or 40 of these companies around there, giving them a lot of life. Maybe they have weaknesses in the whole area that you guys are really good at finances, sales, talking to people, using social media, engaging, spreading the message. That's not something they know how to do. Maybe they believe in the model. They believe in the importance of water. They believe in what you guys are doing. They're passionate about it. They could probably go home every day to talk about their success of putting a water system in place.

And they love what they do, but they don't have a clue to do what you do. So you end up collaborating and you can accomplish more together. And I think that's powerful. And that's an obsession that I have. I have over the years been obsessed with collaborating with people, not necessarily being a number two for anybody, because I'm the number one and the only one that bothers me around is my wife.

Riggs: That's a partnership.

Manuel: Yeah, that's the way it is. But I have a partnership with a lot of different people. And just like I provide a value to you, you know, I look for collaborating and providing value to people and try to lift them up and make them do even better. Right. So that collaboration is amazing.

For anybody that's watching this. I really, really strongly suggest that you look for other people in your area that can make you stronger, not that you will lose power, but simply you make them stronger, they make you stronger. And it's something that is an a great combination of power for sure.

Riggs: There's a saying that I learned at the dotcom, which is a very good one, very similar to what you're saying, which is 'Never compete with your natural partners.' Right. So if you've got a natural partner. Don't try and blow him away, use him.

Now, I think a lot of reason why entrepreneurs try to hold on to everything is not just pride, it's also because they want to get every last dollar, right? They don't want to leave money on the table. Wait a minute, like for us, well we could, we could build that system and make an extra $100,000 there. Yeah, but then we get buried in the execution, right?

Manuel: Mm hmm.

Riggs: And so, it's important to, that's why focus is a coin. On the back side of the focus coin is sacrifice. You've got to be willing to sacrifice. Now...

Manuel: I like that.

Riggs: Right? Now, it took us one level up. Now we're doing the finance, the contract management, the enforcement, a whole bunch of stuff. But now we can expand Water on Demand to other finance centers in the world. That's interesting. So now we're already starting to look at who in Dubai can be our partner for financing water systems in the Middle East region. And we don't have to build a company in over there. No, we simply create this network that is using the same system. And we've empowered these people to use our system and we're very free with it. Yeah, go ahead. Use use our secret sauce. Go for it. Have fun. There was a very good book called Microsoft Secrets written back in the day. And this writer was allowed to hang around Microsoft for a year. And they said, "Open door. You can know everything. There's no secrets. Anything you want to know, you can know" And he goes, How can that be? They said, "By the time you've published your book, we'll be four or five years ahead of you."

Manuel: Absolutely.

Riggs: Right? So what do we care? If you're confident about being a leader, you will share your knowledge.

Manuel: 100%.

Riggs: That's what you do.

Manuel: 100%. I tell everybody exactly what I do, what the name of my brands are. What am I doing with my brands? How am I doing it? Good luck trying to repeat what OriginClear has done. Taking that company from where it was to where it is right now, which, by the way, I am. This is not a paid promotion, but I am an investor and I have been an investor for, I think now, three years or so. And you guys have never let me down, not one time.

That check keeps on coming. Every quarter. Every quarter is always there. Yeah, it's always, always there. And I don't have to worry about it too much. I don't have to email you guys and ask you where is my check for my investment? It just always is magically there. So I appreciate that because when you're investing in a company that's, you know, there's a certain level of risk. But you guys have proven yourself over the years. And not only am I a big, big fan of what you guys are doing, it's an investment opportunity.

A lot of successful business owners out there, they don't know what to do with their money. They really don't know what to do with it. And it's something that is very comforting to have a company that you can give money to and they're going to do something good with it and you're going to get a return on that. So it's something good. So if somebody wanted to invest with OriginClear, are you guys still take taking money? That's still something that you guys are still pushing?

Riggs: People are being given a chance to get involved with Water on Demand, so they have an asset based investment, which is there's a security agreement. It's great, it's a tangible thing and all they do is go to www.originclear.com. There's an invest now button and you get to do one of two things. Number one, join my CEO briefing every Thursday night. This week will be 176th.

And number two, get to talk to Ken Berenger, who is the most amazing businessman, the co-creator of Water on Demand. We built it together and he's so helpful to help people understand what's going on that people go, Oh, wow, I get it. And once they get it, he doesn't have to sell them, right? He's enlightening. He's enlightening them like, "Listen, this is how it works." And before you know it. If they are qualified, they generally invest.

So, and if they don't, they hang around the CEO briefing and we like to say we're the most transparent public company in America. The other day, I put on my show a recording of the board meeting with the auditors about the quarterly filing. Literally no company does that. But I say here. This was, and the auditors are saying, yeah, and, you know, we certified no fraud. What about if they said there had been fraud? There's always that danger, right? Well, we know we're cool, so why wouldn't we tell everything? Right. I mean, the best thing to be is highly transparent and to be proud of what you do. Right.

Manuel: Be open. Be open. Yeah. Like sometimes in the social media world, people can be and companies can be very fake and they can hide the realities of who they are and what they do. But I like the whole concept of just showing people what you're doing every day and just being very transparent and showing the customer journey.

So when you look at and I can tell you something that for me is great about OriginClear is when you're looking to invest into a company, you want to look into the jockey that's riding that company, right? I liked investing in you guys because your energy is pretty much unstoppable. Right. You just said right now that you've done 170. What?

Riggs: 176.

Manuel: 176 and these are every week. Right?

Riggs: Right.

Manuel: Every single week you put a CEO briefing in which, I've actually been on it myself, I've been a guest on it, and you talk about what's happening in the world of water and you talk about what's happening in the company. So imagine how cool is it that you get to hear from the CEO of a publicly traded company every single week? And I want you to talk about that for a second, because one of those things that really is a major factor to an individual's lack of success in business is their lack of consistency and persistence. They don't repeat the process over and over and over and over again, and repetition is the key to success.

Riggs: Here's an additional part of the numbers game. I hate, you know, appealing marketing to accredited investors. Why they're the 1%. They're a minority. Number two, everybody's after them. And number three is unfair.

Manuel: And just to clarify, an accredited investor is somebody somebody anybody can Google somebody that's making a quarter million dollars a year?

Riggs: $200,000 individual, $300,000 with a cohabitant — wife or significant other, or they have $1,000,000 net worth excluding their primary home.

Manuel: Correct.

Riggs: Most people make it on the on the income side. $200,000 is achievable for a lot of people. But still, it's a minority.

Manuel: It's a minority. I mean, I know I think 200 grand a year, it's about 4% of the population something like that.

Riggs: About.

Manuel: It's a small minority.

Riggs: And so it's hard work getting to those people and there's a lot of wastage. Right. But it's also, I think, socially unfair. Why should you or I get the opportunity to do these cool investments and everybody else doesn't? And that's why I became a strong believer in what we call these unaccredited, it's called Regulation A investments, and Regulation A was was invented by some very smart people to democratize investment.

Manuel: So it's not only for the high class people, it's more like anybody that wants to put some money to work.

Riggs: Exactly. And so it took a while. This was invented in 2013 and it took a while for it to mature. And today you can capitalize an entire company by appealing to everybody. Our friend Grant Cardone does a wonderful job of that. You know, there's a place called StartEngine that specializes in doing it. Howard Marks at StartEngine is brilliant at that.

Manuel: Well, it's inclusiveness, right? You take something that is supposed to be very unique for some people only, and you turn it into a broad vehicle for everybody that wants to be a part of it. So your audience goes from the 2% or the 4% to like everybody. That's the way it is.

Riggs: They can invest up to 10% of their annual income, which is okay, let's say it's four or 5000. Great. 500 doesn't matter. And what it does, it makes your marketing much, your marketing is much simpler, everybody. And also you're creating supporters. These people are invested. I put in $500. I'm interested, right?

Manuel: They're brand ambassadors now. They feel like I own a little piece of this. It doesn't matter how small the piece is, they own a little piece of it. They feel like they're a part of it.

Riggs: Yes. It's also turned into, I believe, the best path to taking a company public. We've reorganized OriginClear to be more of a launch platform because we have so many good things going. We were stuck with, the problem when you have a lot of good things going is, it's like The Sound of Music — there's one kid who's not going to be taken care of, right? The red headed stepchild. Well, how about we turn it into a launch platform and shoot these companies out, and each one of them eventually becomes public through this highly democratic process of Regulation A.

All these companies we're going to spin out as these targeted cruise missiles into the water industry doing one or another function. They're all going to be raising money from everybody. And they'll go on to the Nasdaq, proper stock exchange, through that process. It keeps it simple. It's democratic, it's wide open, it's high speed.

And it also, you know, these days it's all about creating large online communities. If you have a large online community, you're set. And in each case, you've gotten people through your marketing process to put some money in, and now they're invested and they spread the word. And so you literally are becoming a self-fulfilling prophecy.

Manuel: That's awesome. Awesome. That's the way to do it. Okay Rigs, we're going to be wrapping it up in a second, but I have an important question to ask you. If you were to be able to go back in time, would you still go public on OriginClear or would you like to stay as a private company? What would you do?

Riggs: I like public, and here's why. Well, you've got a decision to make if you're private, and I've been a private company before, like in the eighties, and you always have a problem with capital. So you have to think about you can't outstrip your cash situation because you can't go upside down. Last thing you want to do is go in debt. That sucks. And so you're kind of running a machine that is going to organically grow and that's fine. There's nothing wrong with it. But think about if you have the capital to work with to really accomplish your dreams.

Manuel: So is it applicable for anybody?

Riggs: Well, let's take an example that we can look at. Let's take, for example, Airbnb right? Now, Airbnb was built at a certain level in order to scale, they needed capital. Why? Because in order to kind of create that network effect and dominate, they needed to move fast. And so there was, and what they were doing was they were creating a product, so that Airbnb became a thing. Now there's other players like VRBO that are out there that never got that capital. OK, they're bumping along, they're fine, but Airbnb just dominated.

Manuel: Just dominate it, right?

Riggs: So what do they what do they need to do?

Manuel: And they're profitable company at this point, right?

Riggs: Yeah. But they were unprofitable for a long time.

Manuel: Correct.

Riggs: Right.

Manuel: Because it's marketing, right? Like they have to put a lot of money into marketing, into strategies, into distribution.

Riggs: Customer acquisition.

Manuel: Customer acquisition.

Riggs: They were going to operate virtual hotels. Well, how do you acquire all those people and the landlord experience, and there's a... Believe me, Airbnb is very smart and they they got their act together, they're one of the companies I admire a lot. But here's what, they grew through the venture capital process. So you have a choice. You've got three ways, one is organic, which is what you've done. There's nothing wrong with it. But let's say you decided you want to...

Manuel: Organic equals bootstrap.

Riggs: Exactly. Totally fine. Nothing wrong with it. The second one is you decide you want to dominate your industry and you need to get some capital. You've got two ways to go. You can go with venture capitalists, right? Or you can go public early on and get out there and not have a boss, right? Just market the company to the world and they invest. The venture capital route is predictable, but it's very controlling.

Manuel: So that's the second one, the venture capital way. So you're not really public like New York Stock Exchange, proper.

Riggs: Yeah, but you're on the path.

Manuel: On the path.

Riggs: Because the VC wants, is going to get their payout from you going public. You've got to really be willing to be dominated. I was not a big lover of venture capital. The third option is this option of going public early on. And it's really done best by doing, as I say, this Regulation A process.

Manuel: Which is like people that are, anybody.

Riggs: Anybody.

Manuel: That wants to give money.

Riggs: Exactly.

Manuel: Regulation A.

Riggs: So, I think it's vital for people to realize that you're going to have to, in a way, network. And this is where the most important thing of all, in my opinion is, is what's your team? You need to think about, go beyond being an individual. You have built a team, it's clear. My life got a million times better starting basically in 2018, 2015, 2018, when I started bringing in people that were world class, world class people.

And you know people are world class when you don't have to give them orders. That's the number one thing that they, they call you up, they're like, "I just had this bright idea. We should just.." You're like, let's do it, right? As opposed to, "When are you gonna to do it? When are you gonna to do it? When are you gonna do it?" So, it's true about finance, you know raising capital, it's true about building a company. Is who are you going to get teamed up with? Who are you going to get to know? And it's what creates great companies, I think,

Manuel: Right. Now, does anybody, can anybody go public at any stage? Is that something that, it's, there's a process for that?

Riggs: If you're using IPOs as a payoff, remember that the early people, they're going to make like, for example, Airbnb, the incubator that started them, put in $20,000, they made 440,000% on their money. So, somebody is going to make a lot of money from you from that payoff process.

The alternative is to go public early and raise money from everyday people. And these days with regulation A, you can do it democratically and you can take care of people. And if you execute well, they'll do fine and you'll be, you'll build a currency. Our stock is a currency, it trades, I don't know, 3 million shares a day, whatever it is.

That creates a currency that enables us to make decisions that over time are right. Are we always right? No, but over time. And it enables us to basically fund our activities by being responsive to the market. And that's why over time, we figured out this whole Water on Demand thing because, hey, I'm going to raise money to create assets, not just to spend money on salaries, but to create these assets that are then productive. That was the breakthrough for us because it was a productive way to raise money, right? It would not have been possible if we hadn't been public, in my opinion.

Manuel: That's amazing. Riggs, thank you for being here. We'll have to do it again.

Riggs: Manuel, it's such a pleasure. And I really appreciated the the opportunity and the fun.

Manuel: Awesome.

End of presentation

Riggs: Manuel is such a cool dude. He's such a cool dude. And I must say, he has built an amazing operation. I'm going to make a little bit of commentary here. We have a little bit of time. We're watching things happen in the world. And I'm going to preface this by saying this is not a political segment. We're strictly dealing with economics and what an investor should do. Remember last week I got deeply into that. Well, I'm going to follow up on that right now. Here we go.

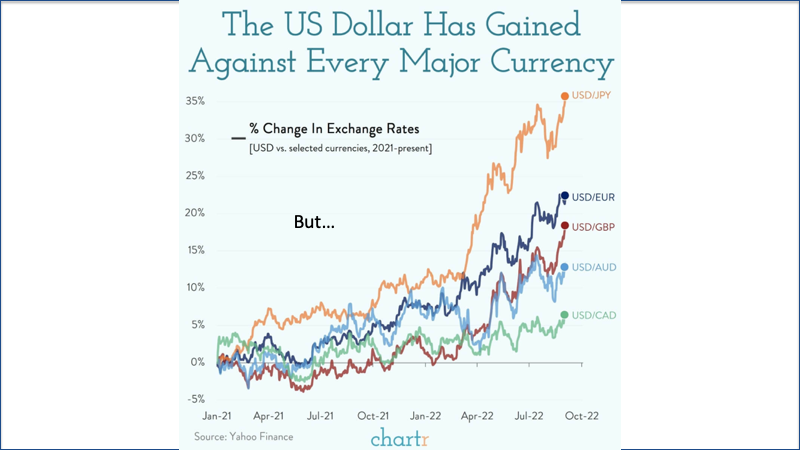

What the value of the dollar tells us.

Now is it strong or is it weak? It apparently is doing better than every other major currency. But what are these currencies? The Japanese yen, the euro, the UK pound. The Great Britain pound. The Australian dollar. The Canadian dollar. It's doing better. And I think that we're very lucky with that.

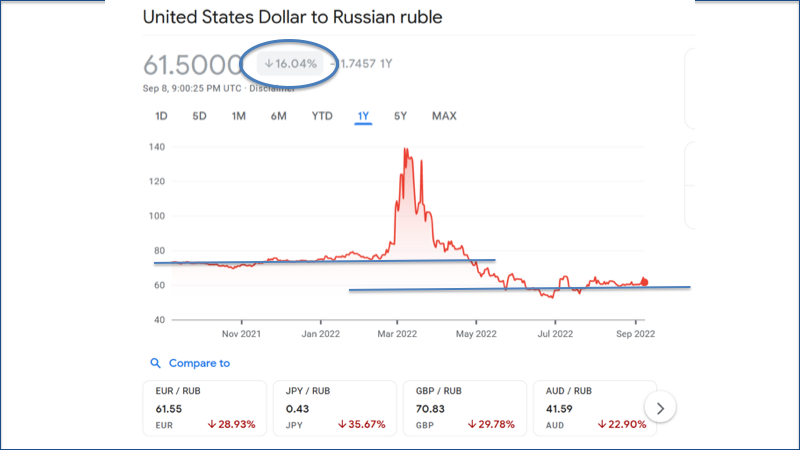

Ruble is stronger

But. It's not doing great compared to the Russian ruble. And look at the bottom here. The euro against the ruble, 30% Japanese yen. 36% down. The pound, 30% down, etc.. Now. Again, I'm not commenting on Russia, this and that, I'm talking about, why is there a difference?

Commodity Based

Because the Russian economy is basically benefiting from commodities. They're a huge commodity, especially energy provider. Now this really to my mind, we are moving away from paper money which can be just printed away to commodity based finance. You are wealthy if you have something tangible. Now I have gold, I have silver. They haven't done much. I have no idea why. And it seems to me that the best commodities are the commodities that earn money, that don't just sit there. So industrial commodities. Right. And water now is becoming one.

Interest Ballooning

But let me come back to this point here. So while commodities generally are very good to back a currency, interest rates in the US are ballooning. We're at 31 trillion now. Interest rates are rising. Guess what? When the interest rate rises, which is the Fed is doing right now, guess what happens to these interest payments, they'll become a trillion, $2 trillion a year just in interest.

We talk about we're spending too much money. Our interest payments are really the real problem, obviously. And this Inflation Reduction Act actually adds to deficits. So and $25 billion in deficits through the next four years. So what we're running is a deficit. And we're not the only ones. We're doing better than other countries for sure.

Self Sufficiency

I personally think the US is going to weather the storm far better than other economies. Far better, you know you're going to have to watch the stock market. You're going to watch all kinds of things. But, I believe that we will work our way through it. We are a functioning economy. We have a lot of good things going on and we're also self-sufficient.

We have our own agriculture, our own energy. We have some very productive people. All these things are strengths, but our paper money is a problem and that is going to continue to be an issue because that drives inflation.

So with that, I'm going to go ahead and play a quick clip from CNBC, which kind of makes that point a little bit.

Start of news segment

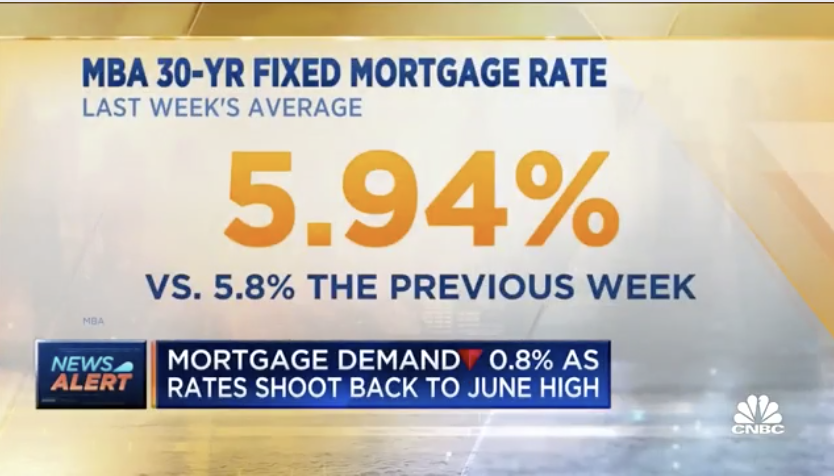

Joe: News on the housing front, mortgage applicants, just hitting the wires. Diana Olick joins us with the data. Hey, Diana.

Diana: Hey, Joe. Yeah, mortgage rates are shooting higher yet again after a brief reprieve through much of August. And so the bleeding in mortgage demand continues. Last week, the rate on the 30 year fixed for loans with 20% down increased to 5.94% from 5.80% the previous week. That according to the Mortgage Bankers Association.

And that was the weekly average. But there were a few days when the rate rose above 6%. On another survey from Mortgage News Daily and yesterday, that rate hit 6.25%.

And it's all because investors now see the Fed as being more aggressive on inflation than initially thought. So big surprise mortgage applications to refinance a home loan fell another 1% for the week and were 83% lower than the same week. One year ago, mortgage rates were around 3% or even lower for all of last year. So really, there's about nobody who could benefit now from a refi. Mortgage applications to purchase a home fell 1% for the week and were 23% lower than the same week one year ago. Given today's higher rates, a person buying a 400,000 home would pay close to $700 more per month than they did one year ago, Joe.

End of segment

Inflationary Period

Riggs: So, here we are. We're in an inflationary period. The Fed is raising interest rates. They have to, to control inflation. But this is hurting the real estate market, it's hurting a number of markets, a number of businesses will suffer, if you don't have already cheap money. So the investor has really got to think about where is he going to put it, he or she, going to put their money.

So, I'm going to go ahead and this is the last word before Ken comes on. You've been hearing about Jackson, Mississippi. I reported on Jackson, Mississippi, last week, basically a complete breakdown of the municipal strategy. I'm going to quote from an email I sent today to a friend and hopefully we can help. Let's take a look at what we said.

Social Injustice

So everyone's trying to get the utility, meaning the city, the municipality to do a better job. But let's face it, they're overwhelmed and underfunded and it takes years to fix. Now, in 89% of all water use is by industry and agriculture. Well, wait a minute, what about the people? So why don't we just make industry and agriculture treat their own water and only send treated water to the city?

Now, that actually helps industry and agriculture. Why? They get to control their costs, which are inflating like crazy. They can recycle, therefore, they get more water that's free, they didn't have to pay for. These modular systems, you know, roll on and plug in and finally they don't have to pay up front with the maintenance taken care of.

Now the city can focus on the 11% who are consumers. This to me is a huge social justice issue and nobody has figured it out yet. 89% is being handled with industry and agriculture. If the cities didn't have to deal with that, then we would have good water for people. And people are suffering right now. Now, I'm getting pretty heated up about it. So with that, I'm going to invite Ken and we have a lot to discuss and just a few minutes to do it in. So jump on in, my friend.

Beginning of a New Asset Class

Ken: So you pull me on when you're all fired up.

Riggs: Roarrrr.

Ken: Hello, everybody. What you were getting into earlier, I've been following per your kind of suggestion, Peter Zeihan, and America is going to do fine because we really are, I mean, we could operate.

Riggs: Relatively fine.

Ken: Right, right. We could literally run our society by, we have all the resources to run our society. China, as it exists today, won't exist, he says, in 25 years. And Europe is going to go through a very tough time. So, while things are going to get rough here, we will get through it, thankfully, because we do have productive people and we have great natural resources. The ability to commoditize the resource that we've now identified as what's essential for life, I think is indispensable. And that's exciting.

Riggs: Well, you know, I was talking earlier about economics, and as a lot of my discussion with Manuel was about economics, he's very, he's very smart that way. He's got a number of amazing clients, who, each of his clients does like $100 million. These are big, big players. It's amazing we lasted eight months or whatever it was with him. Oh my God. And it was super high speed. The point is that he gets it, too, and that's, this is why he invested twice in OriginClear and he's a super supporter, as you saw. It's because he gets that this is the beginning of this new asset class, water.

Ken: What I loved about him is this is a guy who is not a water guy. He's an entrepreneur, he's a marketing guy. He put it in terms that someone who has never heard of water as an investment opportunity gets, right? You've got this utility that lasts forever. You've got an income stream that lasts forever. You know, we've said that, we use these fancy financial words, right? You know, we talk about pay streams and that.

But he put it in a way, he was very colloquial and extremely effective, I believe, for talking to the guy who just picked up the, picked up the story for the first second. I think, I think Manuel is a, he's an amazing natural resource. Honestly, I would love to chat with him for a while just to kind of collect his take on what we're doing, because I think his choice of language is not so financially centered, it's more common sense. And I think that, I think that's great.

Riggs: Yes. And so, it's very rare that you have a vendor who then invests, so rare.

Ken: Twice,

Riggs: Twice. And he's like, yeah, no, this is great. I want to invest. And even after we stopped with him. In fact, the investments happened after, I believe after we stopped, right? No, the first one while we were in contract and the second one after.

Ken: Yeah.

It's an Asset World

Riggs: So that means a lot. So, here's the thing that I wanted to take away from this briefing. Number one is that it's an asset world.

Ken: Yes.

Riggs: And it's a productive asset world. I'm glad we have some gold coins in my safe. What? They're not doing much good. They're sitting there and I don't know if I'm going to buy bread with a with a Krugerrand. I don't know how to do that. But whatever. It's you know, I was told I have to have them. I have them. But that does not make me have an income and I'm not helping the world. How am I helping the world with that Krugerrand ?

Ken: You're not getting paid to own it, right? You can't, you can't take two thirds of your wealth and say, I'm sitting on a pile of gold like a dragon. You know, you just can't do that. And I explain that to a lot of people. I say, look, generational wealth and retirees are particularly affected in this environment because their money has to be productive. Their income, whether it's the trust fund kids, as part of the family office wealth, the generation of wealth, or if it's the retiree is living off his income, off his assets, that has to be productive year in and year out.

The reason Russia is doing so well is Russia owns everything in assets. They own tons of gold, they own tons of rare earth, they own tons of energy. And they've been hoarding this stuff. They look, this thing with Ukraine didn't happen overnight in his mind. He's been planning this thing for years. And you can tell by his stockpiling of what he's done that he's been doing it. Where we have gone to paper and Fiat, where we've gone to printing and borrowing, they've gotten very old school.

Riggs: Right, but I want to make it clear, Russia is not a large economy, right?

Ken: No, it's the size of Italy.

Riggs: Very small economy. But they are not, they don't have heavy debt and they have those, the energy, the agriculture, the phosphates, all these critical things. And as a result, again, I don't want to get to the geopolitics of it because that's a whole other story and we try to be agnostic around here because there's a lot of heated rhetoric going around. But I'm trying to stay focused on this commodity story. But the problem with all these assets, gold, today I saw gold go down. I'm like, why is gold going down? I don't get it.

Ken: That makes, it makes no sense.

Riggs: OK, I have XOP, the Oil Exploration Exchange Traded Fund ETF. It's like, what? I thought that energy was doing great. It's because of the risks and is because it's already pushed so high.

Ken: And it's so uncertain. So, here's the thing. If the war ends tomorrow, oil... So, the thing that's the greatest for the world economy crushes your portfolio, right? So you have to almost root, you don't want to root against the world, but that's what you, that's 'cause you end up, you have to be, I mean, you have to be an agnostic player in that thing, you have to say, "Look, I'm doing this for the financial benefit." But, playing the oil market, hoping for higher oil prices, at this level, from 40 to 50, it doesn't really impact the world economy. From 150 to 160 it certainly does.

The other thing I was thinking of while you were speaking is because currencies are really no longer trusted, because they're not backed by anything, the entire world is turning to commodities. He who owns commodities, and here's the thing, we hear these stories about the wealthiest people on earth buying up all our farmland, China buying up our farmland. And wealthy, I mean uber wealthy people, buying up farmland. You know, if you control the food supply, you control the population. We we want to democratize water.

Citizens Paying for Corporate Water

Riggs: But also farmland equals water.

Ken: Right.

Riggs: You know, Michael Burry, he was going to do water after the big short.

Ken: Couldn't do it.

Riggs: Couldn't do it in the water industry. But he went into agriculture as a water play. Bill Gates and Jeff Bezos owning a lot of land. Yes, it's about food, but it's also about water. These are huge water, the US uses about 42% of its fresh water is used for agriculture and the other half is industrial. And then the remaining 11%, as I said, is people. And I think that is a scandal. It's a scandal that we're making all the cities do all this work, supported by the taxes, paid by people to treat the water of these industries that are doing most of the use of the water. And I think it's a scandal and I'm starting to get heated up, as you can tell.

Ken: In a way, it's almost an indirect corporate welfare.

Riggs: 100% it is.

Ken: So, they tax the citizens in the cities to live in the cities. They tax them for this, they tax that. Oh, and by the way, you're footing the bill really for this huge downstream problem. Right? So, the point is we're lifting the burden off of the human consumption of water, placing the appropriate, not burden, but placing the responsibility for treatment at the site of discharge where it's being made dirty. But we're providing this tremendous financial benefit because it's still, listen, feel bad for the farmer, too. It's super expensive for him to run his farm profitably as well. So the the problem is it's still monopolized to a certain extent.

The Good News — Water on Demand

Riggs: But here's the good news, Water on Demand, and we're going to wrap up, Water on Demand actually is good for these businesses. We're not going to force them to do it. We're going to say, hey, here's a better deal. So, then it offloads the burden from the city.

Ken: Oh, and you get to save 50%, by the way. And look, if his only motivation, if he's got no, if he's got no environmental or humanitarian goal in mind, if his only mind is I get I save money, guess what? That's okay, too. it's also the investment capital.

Riggs: It won't work without it. We cannot mandate these people to do it. We've got to make it attractive. So we've made it attractive. So now there's this big pull of businesses being decentralized and doing their own thing, and this will naturally free up the cities to do better, buy their populations, serve better. The Flint, Michigan's and the Jackson, Mississippi's of the world will have better water, Amen.

With that, I'm going to wrap it up. It's been another interesting show. I want to cover our fast growing pump station business. This is one of the breakout stories of OriginClear in the Module Water business. And it has actually some municipal part of partly municipal play. It's very interesting business. So that would probably be next week's focus.

Call Ken

I'm just going to flash on screen the last disclaimer, of course. oc.gold/ken gets you to talking to Ken or email and visit originclear.com.

And here is the disclaimer on the raising of the money. And yes, we are working hard to get that regulation A unaccredited round going, because I love it. We're going to have so much fun helping people become part of the family.

Ken: I think when our megaphone, when the volume is turned up dramatically in the next week or two with Castle, I think that we've had relatively small audience to tell the story to. When that audience opens up, I think is going to be tremendous. I'm very excited about that.

Riggs: Well, I'm actually even more excited about us. Our team is so cool. Our marketing team, Josh Summers, that whole Monarchy team are amazing. With that everyone, I'm going to thank you all and I'll see you next week. We're going to cover the fascinating growing business of bolting water systems together for fun and profit. So thank you all and have a great weekend. Remember that Water is the New Gold and we are here to help you prosper with it. Thank you, Ken. Thank you, everyone.

Ken: Goodnight, folks.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)