My interview with Dan Early demonstrated not only his stature in the industry, but some vital, major trends… Why is adoption of Modular Water Systems snowballing across the country? And what amazing fact did he relay about Water on Demand™? Plus more and more the News is covering us and our Mission! How so? And why? Find out here!

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

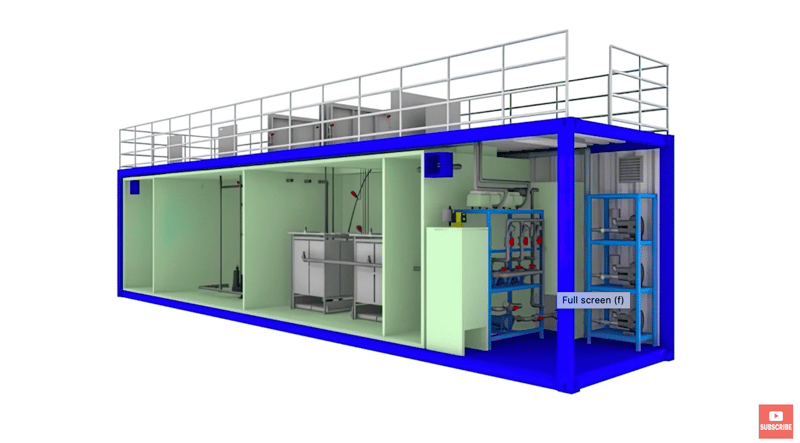

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

Welcome to the CEO briefing gentlemen.

Andrea: Hello everyone, it's a pleasure.

Riggs: Ken is our...

Ken: Don't mind my lighting, I was experimenting.

Riggs: Ghost man!

Ken: It was a failure. We're gonna talk to the, what is it the gaffer? Or the lighting guy. He's gonna hear it, he's gonna hear it from me.

Riggs: Yeah right? Stephen's going to fly up from Clearwater to help you because....

Ken: No, I'm the lighting guy so that's the problem.

Riggs: Exactly, that's why we're going to move to a professional. Well welcome aboard. I'm going to go ahead and run, we have some fantastic stuff lined up and we're even going to comment on current events and it's actually good news. So we like to emphasize where things are going to go positively because after all, that is the, you know, plenty of people are focusing on the negative. So let's let's go with the positive.

All right. Here we are March 10th and our vital mission is our five year mission is to help the world invest in water, the new stable inflation fund, inflation friendly asset class.

And of course, we always qualify our statements with anticipate, believe, et cetera. But we do fix it as quickly as we can.

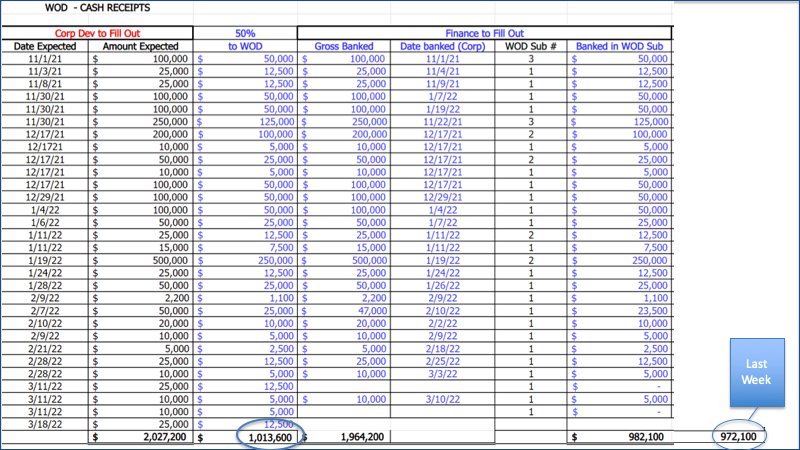

Current Capital Status

Ok. Current capital status and we are inching forward like we were, we added another ten thousand like we're literally just inching into the million dollar mark. And this is important because we have an announcement in mind.

And when that announcement happens, Tom Marchesello will come brief us on the project that we have lined up to use that money. So we already have a project that's identified. We're going to get into it. I'm quite sure it'll be next week, but for now, we're just going to go ahead and tell you it happens when it happens. That's just how it is.

Dan Early Report — Troy, Alabama

Start of presentation

Pondster Moves Beyond Pilot

Ok, so Dan Early in Troy, Alabama. Pondster™, the Pondster moves beyond the pilot. Can you believe we call this thing a pond monster? I think we are, we are very sophisticated. You can tell. Anyway, but it's a beautiful thing. You know, I like I like wacky names because people remember them, right? Like Yahoo and stuff like that.

Dan: Good morning, Riggs. Welcome to Sunny Southern Troy, Alabama. Yes, that's where we are today.

Riggs: Well, what are you up to?

Dan: I am down here on site at the at the mobile home park that we've been working on, going back about a year now and we are adding a some additional equipment and upgrading some of the treatment capability for the Pondster unit that we delivered back in September of last year. Doing that in response to lessons, learned and some data that we acquired over last, or through the first ninety days of operation,

Riggs: I'm glad you're really doing a lot of product development here, and it's a fine client, very patient and superb client really, who has enabled us to do this work. Now, this is, I think, expandable to probably many thousands of trailer parks throughout the well, mostly the southeast, but also in the rest of America, right?

Dan: It is. The treatment system that we have is very simple. It's not overly complex and it has tremendous applications in old existing lagoon, wastewater lagoon treatment systems for mobile home parks, RV campground, small municipal utilities all across the Southeast and the Midwest in the Upper Upper Plains.

Riggs: Wow, you're talking about municipal utilities as well. So in other words, any kind of lagoon where this passive sanitation going on can be accelerated, the process of neutralizing the bacteria and the toxins can be sped up with this.

Dan: Yeah, the way the Pondster unit works, it is a supplement to the existing treatment capability that you have with lagoons. Lagoons usually are looked at and frowned upon because they only have a certain treatment functionality and certain treatment capability. However, they have a tremendous asset. They're great at pretreatment, great at settling, great at primary removal of carbon and nitrogen. But they can only go but so far.

What we are doing is we are taking and building and supplying these Pondster units so that they can complement the existing capability and provide a polishing treatment function. And this is really important because instead of having to completely dewater and decommission the lagoon that you may see over my shoulder, the owner of this utility gets to realize that asset value and they can choose and implement a much less costly, less expensive treatment function.

Riggs: So if we think of lagoon treatment being this one particular level, and I'm holding my hand kind of low, what we're doing is we're popping it up a level and which in turn makes the later treatment steps even easier and and perhaps save some money with the more expensive stuff that happens later.

Dan: That's exactly right. That's the true goal of what we're trying to accomplish with the lagoon treatment system that we developed. The only other option that exists for this particular customer, they have a fifteen thousand gallons a day lagoon treatment system, If they were, if they were forced to dewater and decommission and replace this thing with a true electromechanical, complex, advanced wastewater treatment system, that could easily be a half a million to three quarters of a million dollars of equipment installation and they can't afford that.

Riggs: Whoa, Destroys it the pro forma for a mobile home park,

Dan: And it just ruins everything. They just can't afford it.

Riggs: Oh, quickly wanted to cover this new new thing that we're that we've got here at OriginClear, which is Water on Demand™. What the water industry calls design, build, own, operate DBOO. And of course, up till now, including this unit, we've been doing D and B, the design and build and leaving, you know, customers to essentially operate their own units and also to buy them. Now we're moving into customers not having to purchase and also not having to maintain, which is a whole new level. Now, do you think this has, this has potential commercially for these thousands of operators of these mobile home parks?

Dan: They do have tremendous applications. These existing, a lot of these existing utilities that need upgrades to get into compliance with, with more stringent regulatory permits. That gives us a wonderful opportunity to supply that capability, and it eliminates, it just eliminates a lot of the hassle that the owners are forced to... They have to go find a consulting engineer and they have to find a vendor and then they have to go find a contractor. And so when you leverage this turnkey design, build, own, operate model complemented by Water on Demand financing capability, you've just got tremendous capability and tremendous upside.

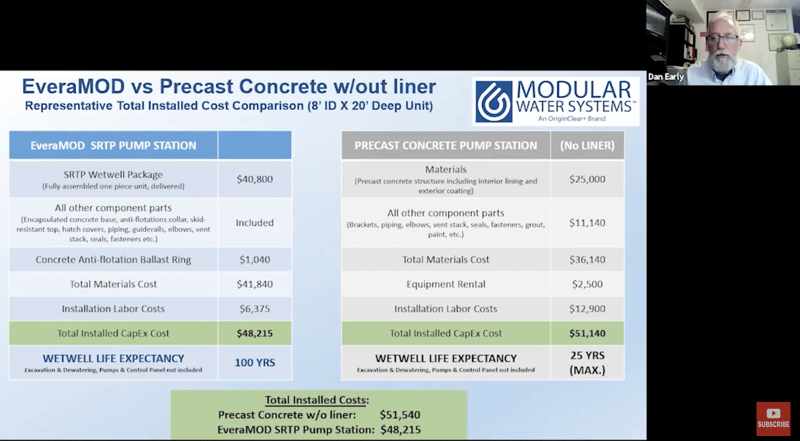

Riggs: Well, yes, and we've been discussing this, for example, very large opportunity for a lift station network that's something like a thousand units. And, you know, one by one, they're they're relatively cheap, you know, a thousands a lot. Normally we'd be looking at a multi-year rolling replenishment of, let's say, a thousand lift stations, according to the capital budget of the end user, which might be a city or a large institution of some kind.

I think with Water on Demand and DBOO we're able to just go, "Listen, sign the service contract here and we will install it as fast as we can produce these, and since it's modular, the production would be rapid." Do you see this having potential, for example, in unusual areas like lift stations?

Dan: I do Riggs, and I can give you a quick analogy. A lot of public works departments and a lot of municipal utilities. It's not uncommon for them to lease their vehicle equipment, their trucks, and their maintenance equipment they use. This lease model, that is a unique delivery model, they get the equipment and they pay for it over time, and then they can replace it later with new equipment, continue to lease or buy it out or whatever they want to do.

With the Water on Demand model and with this particular product line that we have created and we've developed for retrofits to existing wastewater infrastructure systems for pump stations, that same model would apply and for a number of reasons, the dollar value for some of these stuff are going to be about the same as if you went out and purchased at Ford F-250 maintenance truck or a utility truck.

So that model right there, if we can come in and they can leverage our in-house engineering. We partner with their in-house engineering team at the utility level. We develop this. We propose and recommend the technical solution. We put a price tag on it and then we can finance that. I mean, it's a win win. They will, they will beat a path to your door for that every single day.

Riggs: Well, Dan what's interesting here is, of course, we could do the full-throated Water on Demand model, which is, you know, we own it, we operate it, the whole thing, and they simply pay, you know, a fee for consumption or they could procure it and then have the full support. So it'd be the best of both worlds for certain operators out there like like cities.

Dan: That's absolutely correct, Riggs. The old school design, procure and delivery models using the old pumping technologies, especially when it relates to wastewater pump stations, those models that they still exist and they will they still work at certain levels. But when you get into replacement and you're trying to manage budgets, having the flexibility like you just described having it where it's turnkey and you just pay by the gallon or you have the owner, maybe the end user may purchase the equipment outright. All of those things are hugely important to sustaining wastewater infrastructure looking into the future.

Riggs: As we've reported before, there is a what we call silver tsunami going on in one industry where, you know, three million skilled jobs are retiring as we as we speak and they're not easily replaced. So we have to go to these managed services in order for these municipalities to keep operating.

Dan: Correct. It is these folks that are hitting retirement age, it's going to place a huge drain. There's going be a huge loss of talent across the board. It was a problem pre-COVID, but COVID just accelerated that. A lot of people just went ahead and said, "Hey, I'm done, I'm retiring, I'm riding off into the sunset." So now looking what appears to be post-COVID as we were coming out of this, the demand for talent, skilled operators at the utility level, but even more so across the board.

So having turnkey services, managed services like what we're proposing with the DBOO model and with the financing model, with Water on Demand, those are bridgers. Those will bridge and help overcome some of these limitations because right, wrong or different, we cannot lose our water and wastewater infrastructure systems just because we don't have people to push buttons into and to pull levers. I mean, we have to have the ability to service and continue to provide reliable service to the customer base.

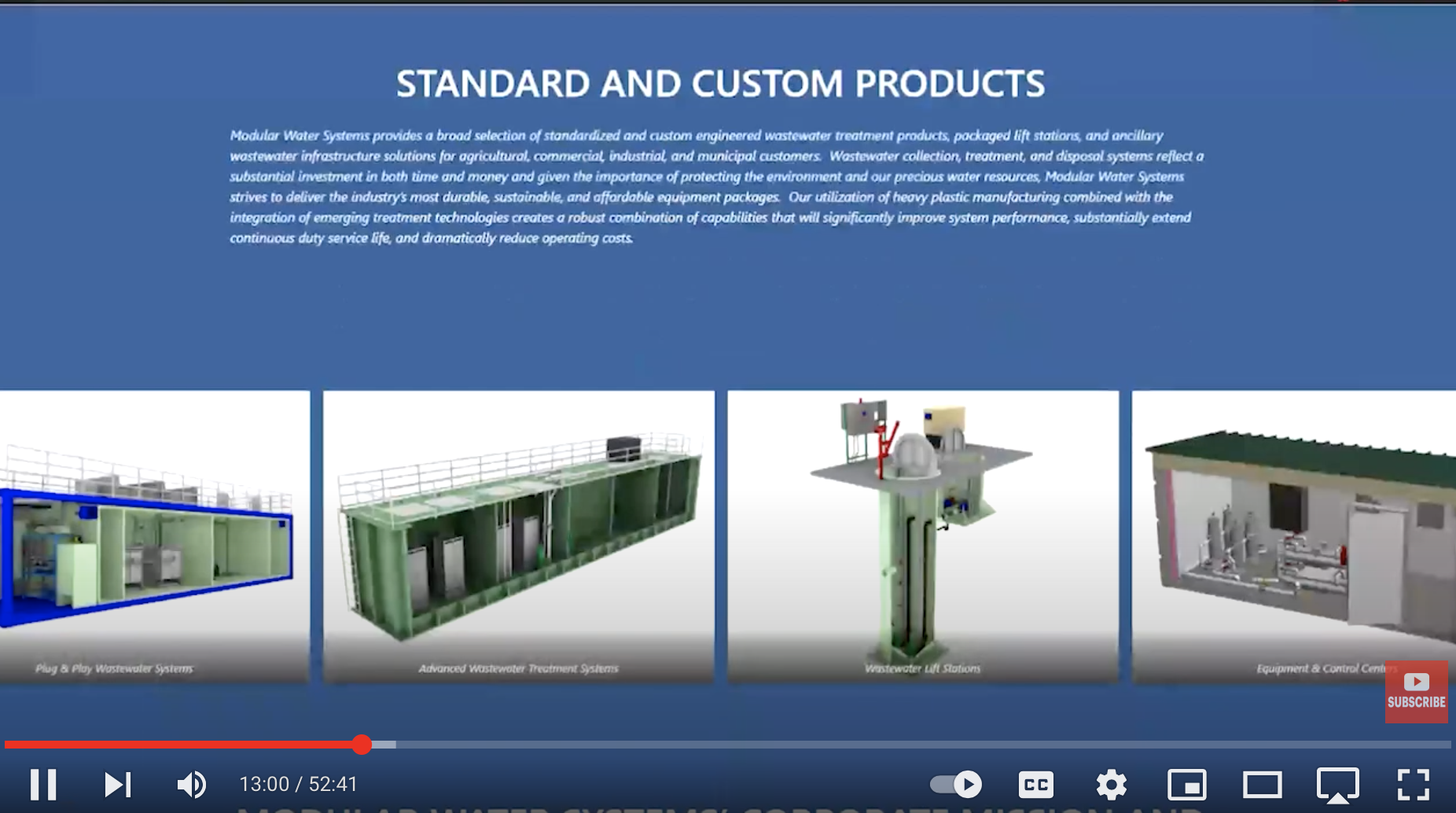

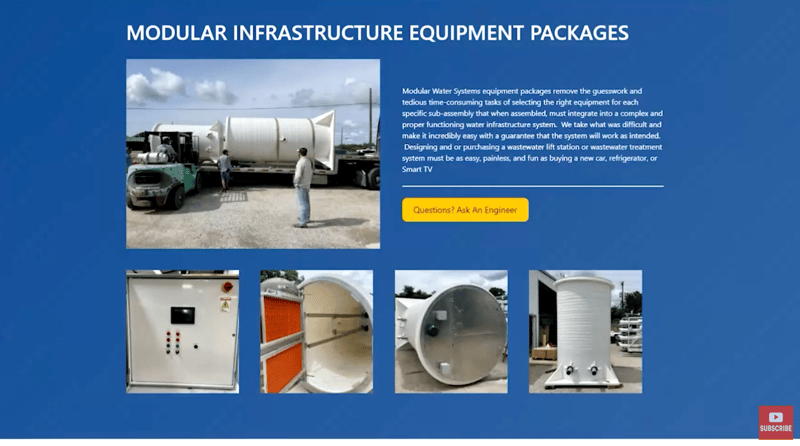

Riggs: Well Dan, here we've got this amazing, you know, standardized product line, which I think is essential to scaling this up. Part of the reason why I think you've achieved such a great standard has been the two years of webinars you've been giving throughout COVID to the water industry.

Those things are phenomenal because they do two things they educate. They specify an engineer. They learn about, they learn about our capabilities.

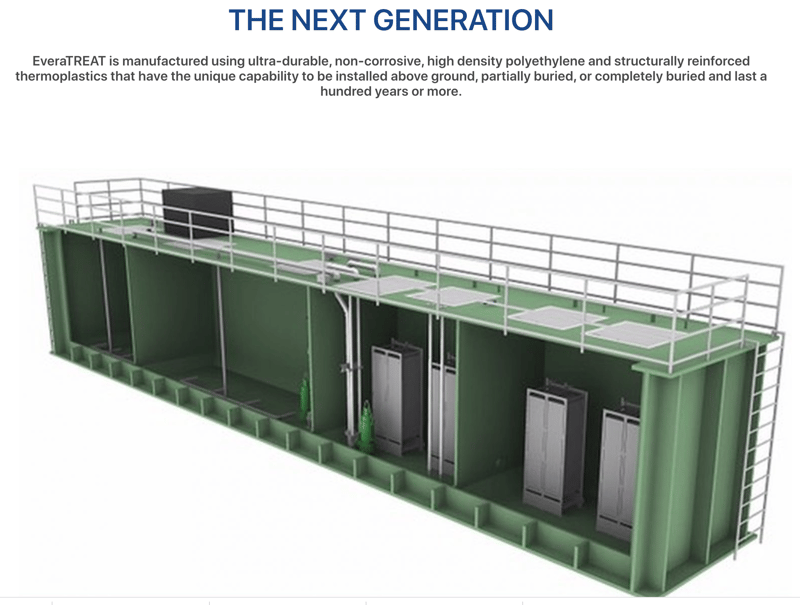

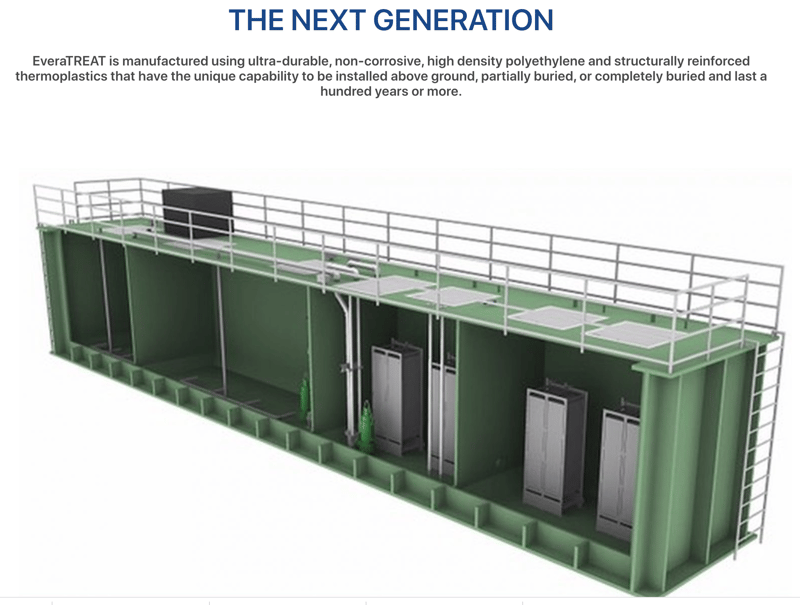

Dan: They learn about the value proposition that is the EveraMOD™ pump station or the EveraTREAT™ packaged wastewater treatment system. The engineers recognize the superior product and the value proposition that is the Modular Water Systems™ program. They see where it is better and it is next generation type technology or an evolution of of current technologies, and it represents a tremendous value for their customer. They like the standardization that we have.

They're starting to recognize that the big picture that we are promoting is that we are trying to vertically integrate all the manufacturing and that eliminates a lot of the subcontract to the field subcontract vendor support. Subcontract field installation capability, which has plagued the water and wastewater infrastructure marketplace for years.

We are getting rapid adoption. We're getting an accelerated acceptance of basis of design. And basis of design, that means we are specified as the preferred product, which means we are permitted and approved that way, and it makes it really, really ultra successful for us to deliver the equipment to the customer.

Riggs: Well, and now of course, we've got the additional factor of relieving these customers from need to raise capital by letting them have this fully supported design, build, own, operate. Are you starting to talk about that in these webinars?

Dan: We are. We are. Just two weeks ago, you asked a fantastic question. So two weeks ago we were in a conversation. We were in a video conference call with one of our strategic partners out in the central United States. This partner has got, is working with a lot of the major architectural engineering firms here in the U.S. and also in the same region there are a lot of existing wastewater utilities that have pump station systems that are 50-60 years old, older technologies.

With these webinars, we were able to present some of our standardized solutions, and I've introduced this Water on Demand and this equipment financing function. And what we are seeing is that at the municipal level, because of the dollar value of the solution we have created, there is significant interest because if you are the chairman of a public utility and you may be in a little small town, you may only have a customer base of 500 customers and you've got a capital procurement budget that's very limited. And along comes a vendor, like Modular Water Systems, and lo and behold, they've got this great capability, this great technology, but they also have this funding mechanism that rapidly accelerates the contracting method.

Then we can get into a financing option where they can use their cash flow from their customer base to pay for this new equipment. So if they can take a technology that they would only get 40 years of service out of it, replace it with another one. They can get 80 years, effectively doubling the life cycle. And there's this funding mechanism where they can pay as you go and pay over time. It is a wonderful thing, and they will. This is really going to change the way you'll see pumping equipment, technologies and infrastructure products delivered to the marketplace.

Riggs: Well, that is, you know, fantastic what you're doing. Of course, we have these mobile home parks. What are some of these, what are some of the ideal applications that you and Tom Marchesello have come up with.

Dan: Campgrounds and RV parks. That's one. They like the EveraSKID model. The other one would be permanent single family residential development. And this is huge in states like Texas and Florida, where there is a huge immigration component of people, even the Northeast and leaving the West Coast and moving to Texas and Florida. Public utilities can't keep up. Decentralized utilities are the answer.

And our EveraTREAT package and the Water on Demand DBOO model is finding huge, huge interest there. We currently I'm working with a number of, probably at least three to five in the Texas region, where the DBOO and the Water on Demand model will probably be the final selection criteria that they'll push us over the edge to successfully land these contracts.

Riggs: Wow. Well, that is amazing. And once again, a COVID mega-trend is joining itself to the general decentralization mega-trend that you've been, you know, talking about for so long, long before it was fashionable, long before I came along. And it seems like being a prophet eventually does pay off. So Dan, I'm so proud of the work you're doing. Being on the ground there, making this product line.

You know, through better sanitation, we save lives. You know, the untold story of the early, early 20th century is that all these diseases, you know, they were helped by, you know, public health, you know, doctors and so forth. But the big heroes were the sanitation engineers and it saves lives. So keep up the great work, then I'm super proud of what you're doing and look forward to hearing more great news as we move into really helping many, many, ultimately thousands of Sites throughout North America and elsewhere,

Dan: Well, Riggs, thank you for the compliment. Thank you for the, thank you for the confidence.

End of presentation

The Trio — Executive Roundtable

Riggs: That is an amazing little report, I mean, there's so much to unpack about that. And you know, it was interesting to me. He was really looking again at the COVID driven changes. Retirement like people have accelerated their retirements. This has been happening all over America in the world is the trained people have said, "Oh, you know what? I'm going to take early retirement." And then moving to the country, right?

So that you're moving away from sewage. And that's, these are not minor things, right? All of a sudden you have you have a need for instant infrastructure and there's nobody to do it. That's where Water on Demand comes in and you notice the last thing he said, which is that he's got several deals cooking right now. These are six, six or seven figure deals that the final selection criteria would be. The financing capability.

Andrea: Yeah, huge.

Audience Participation

Riggs: I'm going to continue because we've got more ground to cover. We will have the the fabulous, fabulous trio. I mean, just check this out here. So people chatting, let's see what people are coming up with here.

Ken: Oh, hello, Dave.

Riggs: All right. Dave Johnson has a really great question, "Who in OriginClear is responsible for developing the network of partners that will maintain and service the WOD facilities." This is brilliant. And this is a key part of our model. We do not want to try and build everything ourselves. That's a big mistake, because we'll take forever, right? In fact, we'd prefer to delegate it. You know, and imagine being a water company in you know, Austin, all of a sudden, "Oh, here's a half million dollars for this project." You know, all you've got to do is run it and make sure you're qualified and so forth.

We compare it to the Tesla Supercharger network. Right? Because Tesla's got the supercharger network. But now it's Fiat going to do it or, you know, BMW it, it's hard after the first one. So we want to put in place these these partners, and that is day one. And one of the reasons that we got to this was we didn't even do it on purpose. Our building operations got maxed out. You know, McKinney, Texas, and and up in Virginia are both completely maxed out. And so we kind of had to do this and we think it's a strong point. All right.

And then Michael Hardison, "Since they're performing monthly testing has ADECA commented on Pondster performance?" Yes, there is testing happening right now and we will be reporting further on that. There's going to be objective testing. That's what we're moving into. One of the issues was that it's very hard to control the environment you're going into. You can't just move a box in and start doing stuff. You know what's going to happen with the the medium, right? How murky is it, how messed up is it and so forth? And so those variables we've had to control.

And the final question before we go on is Terry Johnston says, "How is fundraising going?" Well, fantastic milestone we're edging up to, which is a million dollars in Water on Demand, which means $2 million raised overall, right? So the million dollars in Water on Demand is dedicated to water asset development. And then the other side of it is this. And and by the way, we intend to ramp up from here. You know, this is a $300 million offering for good reason. Ok, so thank you for all those comments. And of course, Terry, you can always talk to Ken. Ken, we'll be happy to tell you about how well it's going. Yes, right?

Ken: Yes, I talk for a living. So sure.

Interview with Bill Cummings

Riggs: Right on, right on. Ok. Bill Cummings is a wonderful guy, and he reinvested recently, and so I did a short interview with him which you're going to enjoy. Here we go.

Start of interview

Riggs: Bill Cummings, welcome to a short interview with your happy servant, Riggs Eckelberry, because I understand that you just reinvested in OriginClear,

Bill: I have indeed. Thank you very much. Yeah, I'm excited about it. This is it's a fascinating company and I'm really pleased to be part of it.

Riggs: Well, it brings me back to, you invested a long, long time ago.

Bill: The story there was my middle school aged son at the time was doing a science fair project, and he chose to try to make a fuel from algae. And we both looked at each other and said, "We don't know how to do this. We know how to grow the algae. We don't know how to do that last part." And I found y'all online and got some help from your technical experts, for which I was grateful. And his project turned out quite well and sort of an appreciation for that, as well as enthusiasm for the growth prospects of the company. I went ahead and invested a relatively small amount at the time and have followed your progress since.

Riggs: Right. And of course, some interesting things happened along the way. We were faced with the crash of, price of crude, which kind of made algae into a science experiment.

Bill: Right.

Riggs: And as a result, we had to do something. And how did you view our pivot into water treatment?

Bill: I thought that was really innovative in that, clearly, things were shifting, both in the petroleum world and alternate fuel world as well as it must have become, must have become clear to you that the need for clean water was sort of, relatively local treatments of it, was of growing importance around the world. And I thought it was innovative and insightful of you all to shift a growing technology into another application. And clean water is clearly a growing and important thing around the world.

Riggs: Well, thank you, Bill. So fast forward to today. Now, obviously, we had a lot of dilution of the company I was before this interview. I was talking a bit about our wonderful experience in 2009, where we were being shepherded into a very strong institutional round that was going to eventually take us to the to the Moon. And that firm Rodman Renshaw in 2009 went belly up as a result of the recession. And we found ourselves scrambling. And that was even before we made the pivot to water. You had by then invested, you saw dilution, but then you came back. And how has this affected your portfolio, you're coming back in?

Bill: Even though I'm a relatively small investor. I have remained appreciative for how adroitly you all have moved as needs have arisen and changed. And I'm excited about where you're going with clean water. And you know, it's funny.

I used to work for Rolls Royce, I've just recently retired and our chief medical officer wrote about the COVID pandemic. Of course, we didn't even know there was a chief medical officer until that happened. And he wrote that among, there are three key things, my takeaway, three key things that he wrote about, in human health that have happened in the last roughly hundred years. One being vaccines, one being penicillin and the third one being clean water.

And it's just such a fundamental human need and you all seem to be addressing it in a very clever and forward-looking way. And so I'm quite enthused about the company. Maybe my resources are such that I'm not able to be one of your big investors, but I'm really pleased to be at least among those trying to help your company carry forward.

Riggs: Well, I actually wanted to address that because we actually have no problem with smaller investors. Unfortunately, currently we can only take accredited investors. And but nevertheless, if it's a small investment, it's perfectly fine because as you and I were discussing before this interview, you know, you get dependent on big investors and it turns into this sort of, you know, it takes all the air out of the room, so to speak.

And what we prefer is just a good, predictable flow of investment from a broad base of investors. We have almost 10000 general investors and about 500 private investors like you, and to have that, that broad bench. In fact, that's what's been allowing us to raise this capital phase. Your new investment. Half of it is going into what equipment not you know, my salary. As important as it is, I don't want to understate the importance of my salary.

Bill: Absolutely.

Riggs: But half of everything raise now goes into capital that is put into these Water on Demand systems. And so to do that, we have to have an even flow. And frankly, a lot of companies envy us the ability to have, you know, a loyalists like you. And one thing that has been wonderful for us, I call it the time machine, which is beginning a couple of years ago, we were able to start fixing people's old investments, bring them up to current and then price protecting them if they made a comparative investment today. And that has done wonders for people's portfolio. I'm guessing that you're in pretty good shape now after that got done.

Bill: Yeah, of course. I certainly was pleasantly surprised to learn of that. And I'll confess, I was a little bit skeptical at first, didn't bite when the hook was first passed in front of my face, but that was only because when I had invested early on, when my son was doing his science fair project, of course, the value had tapered off through some of the things you described as I was a little bit guarded. But the arrangement that you all have come up with, of course, put me at ease to see my value restored. And I remain enthusiastic about the company and I'm pleased by both the prospects of growth of my investment but on top of that, being able to support you in what you're trying to do here.

Riggs: Yes. And I think in what we've been talking about you've also really, discussed a very important thing for us, which is water treatments becoming local, right? So more and more, we can't depend on the big central infrastructure, it's falling apart, and so local water treatment really is going to save the day, but there's no funding mechanism. And so our mission has become really, really important.

And because it's the only way forward, water quality in this country is going downhill fast. Flint, Michigan, is only the tip of the iceberg and we can't just have, you know, five $20 billion projects. First of all, they'll never get built. But secondly, they'll take forever. And meanwhile, people are having very bad water.

So, it's really good to be able to go to the edges; these smaller projects, fund them for people, so they don't, they can just pay on the meter. And we're calling it the democratization of investment in water because it truly is that. We're making it possible for investors like you for the very first time to directly invest in water assets and that's kind of cool.

Bill: It really is.

Riggs: So, it's great that you've come in. I'm grateful for your resurgence.

Bill: You bet.

Riggs: You're coming back in the fold, so to speak.

Bill: Well, equally, I'm grateful for the work that you... I'm sure it was not easy to arrange for the program that you've put together, and obviously it helped me feel more comfortable reinvesting in the company.

Riggs: Yes, you know, I'm reminded of that there's an article once about a gourmet restaurant in Paris that had the very small dining room on the top and the kitchen below, and the entire night, the four-man team was there. It was like they were in the middle of DEFCOM three the whole time for eight hours straight, just (makes sound representing intense activity) And then (calmly), "Here's your food," you know?

No, no idea of what we went through. And primarily, it was Ken Berenger and myself, with support from others like Tom Marchesello, And we reinvented, you know, really, I think, how water treatment is financed. And that was, as you say, it was it was not simple. And fortunately, we have wonderful investors like you. So again, I want to thank you, Bill.

Bill: Thank you very much.

Riggs: Don't be a stranger next time you come down to Clearwater. Let's have a cup of coffee.

Bill: You bet. I'll take you up on that. It'll be great.

End of interview

More Chats

Ken: What a great guy huh? He's super.

Andrea: A beautiful interview. Wow, what a motivation. Yes. It's really, really in on the mission. It's beautiful,

Riggs: Right? And I promise I didn't pay him. It was all him. Quickly, Darrell Polston asks, "Do those partners that are the operator required to have water treatment licenses like utility workers for cities are required to have such as Class D level of water certification Level C?" Yes, in general, the water service companies do a lot of work with and on behalf of local utilities. So they have all the qualifications required. We're dealing with companies that are doing multiple millions of dollars of business as we do in McKinney, Texas. And so, and there's many of them. So no question they have to be good and they have to be good at what's called operation and maintenance, which means not just throwing out the machine and letting people have it, but rather... Ken, you look so white is scary!

Ken: I'm going to star in the sequel of Ghost. I get to play the ghost.

Riggs: Sorry, Keith want to know, "Do cities have to annually test and report the quality of municipal water?" Yes. And Keith, if you go to ewg.org/tapwater, you will see, put in your zip code. It will tell you what the city does. It's always legal. They're always following the law. But that law is way behind the times.

We're In the News

So with that, I'm going to continue because I have a little bit more. I want to show you guys and gals some cool press that we've had. So hold on here and so quickly, I'm going to show you. That's better. Yeah, you're much better.

Ken: I just gave up. I was like, Yeah, it's much better. I'll deal with it next week.

Grit Daily

Riggs: No worries. It's all good. It's all good. Ok, so and then all right. So Grit Daily, which is a premier, the premier startup news hub and gives you an idea of this is the kind of stuff they have acquisition news and and you know, basically what's happening in the world of venture capital business? It's great. It's a great magazine and we got we got featured in it.

Here we are talking about how we can solve the looming American shortage, water shortage. So we're talking about scarcity and of course, a little bit of background on how I came into this and then demand rising all the time. But we're falling behind in terms of water infrastructure needs. So rising demand and and infrastructure spending going down is a perfect storm, right?

Vulnerability to Cyber Attacks

And then of course, this hurts all kinds of things and this commission, identifies the nation's water and wastewater utilities, is one of the top three most vulnerable to cyber attacks, along with the electrical grid in the financial system. So what do we do about it? Well, here's the thing if you can become distributed, then you're much... Centralized is always vulnerable. If you go distributed, then if a node of the network has taken out, it's only one node. That's the whole concept of the internet, right? So and then of course, they talk about this whole Water on Demand thing. They do a good job of talking about that.

Water Online Article

And we have another one. This is super cool because this is actually the top water industry magazine. The paper version or the publication version is called Water Innovations, and in fact, I have right here, I'm going to go ahead to show you what it looks like in reality. If you look at the actual publication.

Cybersecurity

And so here we get, there we go. There's 100 days and many ways to cybersecurity, a Q&A with myself. And that was the editor. So that's there's a lot of interest in the whole cybersecurity issue. And so if we go back, obviously it's too small to read. But I have it right here in the PowerPoint. And I want to get out of the PDF and get back to the PowerPoint. There we go. And so again, cyber attacks. This new water sector action plan got to shore up operations within 100 days. And then, you know, this is going to work.

Make Water Treatment Sexy

And, you know, we have to think about points of greatest vulnerability and again, centralized is bad, problems with vulnerability to hackers. And I make the point here down below that the greatest harm could occur at a choke point, such as tertiary treatment, which is where you take the nitrates out. And because you can't, you kind of have to do that in one place, right? When decentralized water treatment happens, let's say, at a brewery and they send the treated water to the city, the city is still going to do the third stage, the tertiary treatment. And so that is a point of vulnerability.

Also upgrading controls to current technology. Also letting... Please, let's not have the government try to do things. Let's remember the Affordable Care Act, where finally Silicon Valley had to come in and help. Similar thing here with water, and I make the point here that we actually need to make water treatment, water management more high profile and even sexy, which is a challenge because people don't think of water, sewage as sexy.

Ken: Really?

Riggs: But you know, hey, it's all in your taste, right?

Andrea: That's why that's why we have you as the face of the company. We're trying to compensate.

Riggs: Oh, you're so sweet, but you help to my friend because Italians are inherently sexy, done.

Ken: He's trying to say, you make sewage sexy.

Ken: Wow. I mean that is...

Andrea: Go back to the picture. Go back to the picture that you were showing before Riggs a second ago. One second ago, there was a picture of you sitting. Yeah. Ok, come on.

Riggs: What?

Andrea: That's power.

Riggs: Well, I had a very good photographer. That's what it was anyway.

Instagram Live

Riggs: Now, next week, this is. We did our first Instagram Live IG Live, and that was really interesting. It was an hour. It's going to be very, very much shortened, but it's really, really interesting. He asked great questions and it was great to have all of this, you know, people commenting in real time. That's that's fun stuff. I mean, it's kind of addictive.

Ken: Good interviewer too, actually,

Riggs: We're going to have a lot more of that, OK? And here it is. There is the host of the show, and it was really, really interesting.

Open Discussion

And now we come to the famous open discussion. I'm going to quickly also, before we go on here, so we have a lot of good comments. Bob Roos wants to know, "News on the hotel in Nashville with the deluxe water?" That hotel is going to have a formal opening in April. And so we're coordinating everything happening at once. The system is in, it works, but the hotel is not open. So, we're kind of like all dovetailing and I didn't, did I say it was a Nashville? No, no, no, it's in Memphis. But no, actually, it did get leaked. So leaked. Get it, Dave says, "Ken come to Arizona, get some sun."

Ken: Thanks. That's it. Pile on Dave. I appreciate that.

Riggs: And then William wants to read these great articles, which is a great idea. They are on our website. Go to originclear.com news section. Boom, they're right there. And then our friends at PhilanthroInvestors® participated in two events. One was, Uncommon Event, and the other one was called, Lunch Squad. These are Puerto Rican events and there's a lot of, you know, interesting forward looking people in Puerto Rico. So we appreciate the support.

Ken: At 60 people, right? At 60 he mentioned.

Riggs: 60 people, I guess,

Ken: At 60, yes, that's the...

Riggs: High net worth individuals. Thank you, Ivan. H.N.W.I. Thank you. All right. So you see!

How Do Current Geopolitical Events Effect the Market?

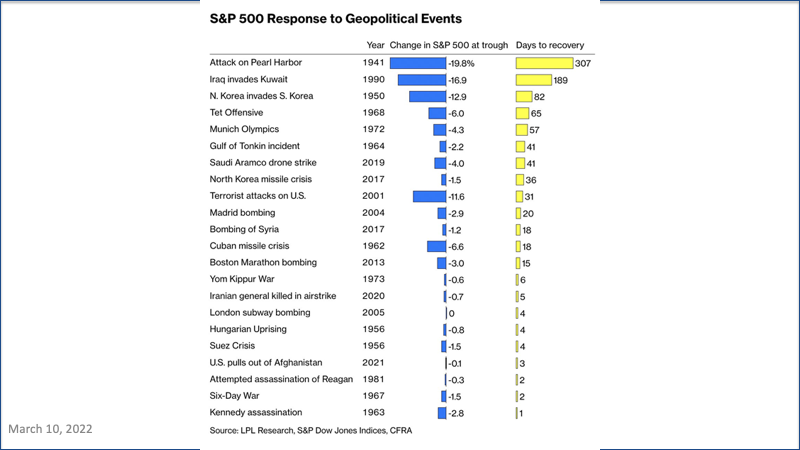

I wanted to bring up a slide. And because this is, I think, going to be a good discussion point. What's going to happen next, right? Well, the fact is, is that we forget how fast the the stock market and economy recover from shocks. In my opinion, things people get really freaked out and they get all upset and they miss the recovery's, right. And so what we're going to get is... I have a brother who is very, very highly placed, and he claims that things are being worked out already. Who knows?

But the point is this, the noise is a lot greater than the actuality of what's going on. A lot of people have a vested interest in making people freaked out. But look at these charts here. It shows you that, you know, things happen. Look, they tried to kill Ronald Reagan, and the stock market didn't change at all. So the worst was, of course, the attack on Pearl Harbor, because that's when we really thought that the Japanese were going to invade the mainland, which never happened.

So I wanted to kind of open it up a little bit on the economic front and where people are, where we think people are going economy wise. Inflation seems to be baked in. So. Ken, what's your thought?

Shift to Assets

Ken: It's less an observation and more kind of collaboration. I've spoken with a lot of people. You know, I have my own personal leads. I try not to paint what I think, right? But...

Riggs: Well, you're an ultra leftist. Of course we know that.

Ken: Yeah. Ok. What is the Fed? All right. So the general sense is, there's a, I just got a long time investor of ours. I won't give his name, former pilot, airline pilot, just finished talking with. He goes, "I just bought into an oil well. This is on private land and, you know, at 150 bucks a barrel, we're killing it," I said, "You understand that oil is going to average $50 dollars a barrel during the time..." He goes, "I know that." He goes, "It's just fun right now."

But he's he's shifted everything. He's taken a lot of money out of, he's bought a lot of gold. He bought, he bought into an oil well. So we had a lengthy discussion on Water on Demand, how it relates to an oil. And you know, when I, you know, when you first say, you know, "an oil well for water," people go, huh? But then when you point to the kind of the high points of why people invest in oil wells and then you say, Well, this has got that accept. Look, oil at some point, like you mentioned in a conversation, oil is going to go away at one point. You know, maybe off in the distance,

Riggs: What goes up comes down, right? And so people jumping into oil now are jumping in late, it's obvious.

Ken: Exactly right. And and he said, "I had a really, really hard time trying to buy into assets." You know, I had another fellow that said I had a hard time. It wasn't. It wasn't Jim. Actually, I had a hard time buying it, trying to find an asset that, you know, I wasn't paying a premium for it. You know, so that's I think that's kind of what people are finding really attractive, but there is a there's a pretty strong unease.

People don't know what, they don't know. People don't trust what they're reading a lot of times about what's going on in the world. There's a there's a genuine, genuine mistrust about that. They're getting the full story. Wall Street tells you, keep buying. It's fine. Right. So there's there's a lot, but there's a significant shift in the people, and again, I'm talking about just a section of the population. This is a significant shift out of kind of more traditional Wall Street stuff and into assets. Right. I'm seeing that more and more.

Riggs: Well, so two things I'm taking away from that is assets and try not to pay too much for assets, right?

Finding Investment Assets with Unrealized Growth Potential

Ken: Well, that's the trick. That's the trick. And I've had a lot of, you know, look, I've raised the question a couple of times. Where else are you going to find an asset that hasn't taken a run yet? You know, there are few and far between, so I also think that's probably why people who know assets find this so attractive.

Riggs: Andrea, you're talking to...

Andrea: I would think that there is...Sorry.

Riggs: No, no, I was. Go ahead, please. I was going to ask you a question, but please.

Andrea: I also think that, I believe that what's interesting in our project is that it is really set up to succeed. Let me explain what I mean by that. For anyone to know the story of very well known Tesla, for instance, but there are many companies as such pharma cliques and many others. They wanted to accomplish something relevant and they went through hell and high water to do so.

Strong Purpose and Mission

It wasn't like everything is just like all fine, all they didn't have to work. Things just happened, right? It didn't happen as such. And if you know the story of Tesla, Tesla was like went through rough patches, that is for sure, right? And we did the same. We went through rough patches. We went in and out, left and right because we have a strong purpose.

And so I think that parts of what people perceive when it comes to our business is that aside from any like things go well or things win and become powerful because of the people, not because of the condition of the market, not because of that, because of the people that makes it happen and because of a mission that is strong and powerful enough and the desire of these people to do whatever it takes to make it happen.

So, I think that people perceive that, and I do believe that that's one of the elements that really appeal that are very appealing of of the company and Ken conveys this message beautifully when it speaks with investors. There is an incredible pathos and energy that can, gives and gives with this perception. And obviously Riggs does it with the role of the CEO in his public announcement and communication. But I think that that is one of the components, aside from the fact that the demand is higher than ever for water treatments like people don't know this, but we do know that.

A Mission Driven Investment

Riggs: The demand is crazy. Our guys in Texas are starting to get mad and angry, like I got too much. I want to go home, you know, literally, they're just overwhelmed with work. It's not easy to train water people. And so we're constantly hiring, hiring, hiring. It's very hard to do. So you make a very good point. We were working on the tagline "Mission driven" right? "Mission driven." We are mission driven. This is mission driven investment. And I think that's very important.

So we are obviously having to be evangelists for Water on Demand and decentralized water treatment, of course, because a lot of people don't know it yet. But this also means it's early in the game and it's an opportunity to pick up, you know, royalty bearing assets with a huge stock upside while it's still inexpensive, right? It's a beautiful thing.

The Safety of Assets

Ken: And it's still an asset. At its heart, it's still an asset. It's not that, you know, OK, hope this, you know, it's not that right? There was a time for that. We were that at one point. So, interesting point that Andrea just made is, you know, water treatment is in higher demand than ever, but so is seeking assets, seeking the safety of assets. Because one thing we know, the one thing we know for sure is we don't know anything, right? In other words, you know, the market is always one invasion away from absolute, you know, tumult.

Something also interesting that Andrea mentioned and I wanted to extend on the thought is most of these massive, gigantic success stories that we talk about is if you talk about Tesla and Apple as if they were always these juggernauts like, you know, Tesla. But Tesla wasn't Tesla. At one point it was, huh. You know what I mean? So. So I remember as a retail stockbroker opening, I was speaking with investors and Apple was eighteen dollars a share and I had guys going, "What a piece of crap," you know, just like, OK. Right. So and I told you the story time I won't use the exact, I won't use the exact language. But the point is that most of these major world, you know, world renowned success stories were a decade in the making.

And here's what happened during that decade. There were wars, there were market crashes, there were, you know, you know what I'm saying? We had two two Iraq wars during Apples and Tesla's rise. We had, you know, we had all kinds of...

Riggs: We had a Great Recession.

Ken: We had a Great Recession, right? Yet to Andrea's point, they just kept... They just kept one foot in front of the other, right? How do you eat an elephant? One bite at a time, right?! So that's what they did. They just kept, they just kept, you know, swinging, kept throwing punches. And I think that, you know, to our credit, that's one thing we certainly have been with.

But I like I like the fact that we've graduated out of that scrappy kind of, you know, Bill Cummings used a very great word, by the way, Bill, Good job, "Adroit." You're right, we handled it very adroitly. It's a wonderful description of what we've had. We've moved with alacrity. We've been nimble, we've been flexible. But now that we've gotten into an asset class, it's going to be nice to be able to settle down into just expanding people's ownership of water assets, you know what I mean, and kind of build that oil well type of paradigm, which I'm really excited about.

Riggs: And with that I'm going to...

Andrea: I'm very excited as well. Sorry.

Riggs: No, no, please go ahead, Andrea. I wanted to give everybody the...

Executing at Scale

Andrea: I'm agreeing, I'm very excited as well, and this is the part where I want to tell to our investors and I'm going to be more thorough with this communication. But the fact that you invested your message is what makes us going is what motivates us on one end. But also, you are the ones that believe you saw the mission the way we saw it.

So you talking to others and creating the opportunity for others to participate is what is needed because those type of missions, what where we're trying to accomplish, require for you to really win when I say, you mean our investors, for you guys to really win, we need to have enough resources to execute at scale, not just a little bit, but at scale. So that's why we are a public company and that's the mission, so your help is really instrumental for the success of the organization.

If you have one or two individuals that you know that have a big heart, so then they want to do something, not just speculation, but to do something that creates an impact in society and they want to be in for the long run. Please connect them with Ken because you will be doing them a favor. I promise.

Evangelism

Riggs: Thank you, Andrea.

Ken: Evangelism is the word, right? Evangelism.

Riggs: Evangelism is the word, and you know that Instagram Live had eleven hundred people watching and most of them were unaccredited, and I said, Guys, you might want to just buy the stock on the open market in your Robinhood. And that is, you know, something that we forget is super important is everyday people investing.

Call Ken

But for those of you who would like to invest privately can, here's Ken's contact information. This has been a very, relatively long show, and I am amazed just about everyone stuck in there. It's amazing. Thank you. It's really an honor, but we've gone almost an hour, which is very unusual.

But next week, in fact, we will have that first. IG Live is going to be shortened up beautifully and you're going to be very interested in the stuff that's discussed in that IG live. We're getting the actual raw video, so it's going to be very high quality and a lot of fun. So with that, I wanted to thank our panelists, Ken and Andrea. Thank you, gentlemen, for being on board,

Thank You!

And I want to thank everyone who stuck right through to the end. We love you guys and you know we. Tom Liakos says, "Thank you." Thank you to all of you. It's always a great pleasure. Join us next week. I think you'll enjoy that and remember that the minute we announce the million dollar milestone, then we're going to have Tom Marchesello telling us about the actual project that is being planned to spend that money. You will love it.

Ken: I'm going to leave, I'm going to leave a cliffhanger, there's a couple of other things we can be talking about upon that announcement, too.

Riggs: You're making me hang. All right. All right. everyone. Thank you all.

Andrea: Thank you very much, bye guys.

Riggs: Thank you for the events in Puerto Rico. And Bob Roos says, "Exciting." And I say, Good night.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)