So how about those soaring commodities… Yes, water is one of them but what does it have to do with our own "Killer App"? And this fact — that App is just ONE of Water On Demand's game-changing programs! So, what are the others and what do they have to do with OriginClear's Clean Water Innovation strategy? HINT: the "NASDAQ-traded resource" WOD just announced a stake in today might have something to do with it… Find out how in the replay!

Transcript from recording

Opening

Riggs: We did some financial analysis that showed that Water On Demand really is the gorilla in the room. You know, we're launching all these companies and it's fantastic. But Water On Demand is like, Whoa! It's powerful.

Introduction

Riggs: And good evening, everyone. That was the shortest intro clip yet, but it said something that I think is very, very true and is going to become even more real as we go into this briefing. Now, because people tend to arrive slowly. I've saved the best for last. It is shockingly cool news. So stick around. Water — The Blue Gold. That's our new trademark for the overall business we're in. December 29, 2022. The last briefing of the year. And here we go.

We jump into the couple of disclaimers.

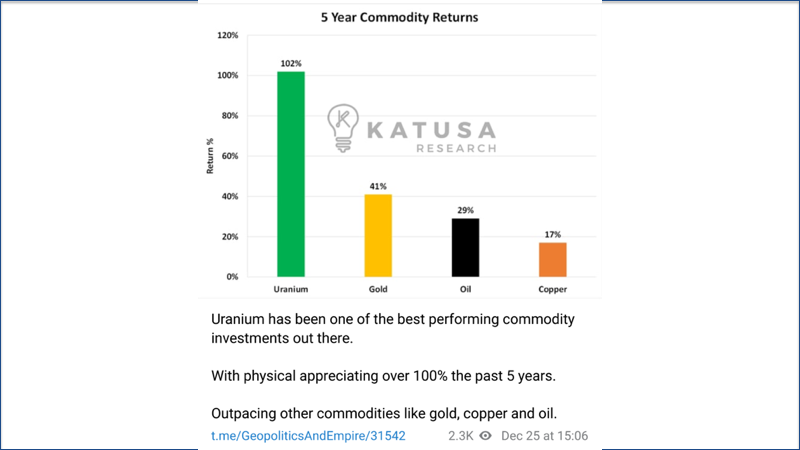

And now let's discuss soaring commodities. That was today's CEO update if you caught it. So there are some commodities that not a lot of people pay attention to.

Uranium

For example, look at uranium. It's been hugely performing. People haven't even paid attention to it. 100% growth over the last five years and outpacing gold, copper and oil. Frankly, I don't get why gold hasn't gone greater, but actually gold is starting to move. But uranium is doing fantastic.OK, great. Look in the rearview mirror, it's doing great.

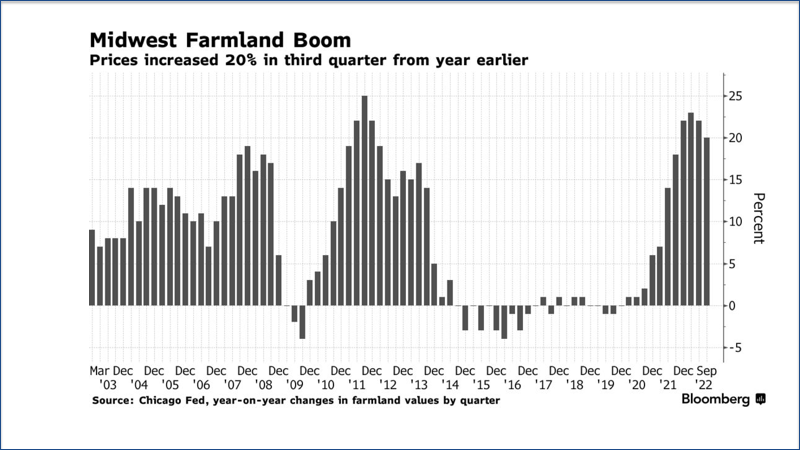

Farmland

Another one is this from a Bloomberg story. U.S. Farmland is going crazy. And what are some of the reasons? Well, rising commodity prices so that farms themselves are highly profitable. Also, as I've been pointing out, people fleeing to the countryside during the pandemic for more friendly places, shall we say.

Here's the stat.

So as you can see, there was coming out of the 2009 recession, there was a huge growth. And then we're seeing that again coming out of the 2020 pandemic situation. And it just took off. So even though there wasn't really a recession prior to that. Not much anyway, in 2019. So. It's good. It's fantastic. The private equity people love it. They're happy what they got going. They think they've got a big trend going on. That's great.

Also, there was, all the supplies of produce like corn, wheat, etc., have been choked off because Russia, of course, supplies a lot of these. So the US is benefiting from the conflict as it is benefiting from selling natural gas to Europe at four times the price they used to get from Russia. The US, as it did in World War Two, is financially doing very well from the conflict.

Population Shift

All right, here's that with that shift in population I was talking about, people moving. First time the growth in rural population outpaced that of urban areas since the mid 1990s, according to USDA.

Real Asset

So that's really interesting because that's very much what we're talking about. So rural America picking up population and that's really people working from home. So growing global population coupled with a changing climate, makes the Midwest land super important. Remember, California is in a terrible drought, right? They got a big problem. So here was a nasty little snarky remark, "Do you want to own a piece of dirt or cryptocurrency?" Oops. Yeah, yeah, yeah. It's been tough. Crypto has been tough.

Already High

What's the common denominator? Well, they're already high. All of these are already doing well. And here's a page from our strategic presentation talking about how Water On Demand™ is actually serving the same trend already from our existing paid customers, people who pay up front. We have housing developments. We have some great projects: mobile home parks, RV campgrounds, travel stops, hotels. All these projects are human communities, right?

What Water On Demand can do is basically help that go faster. So not only is it a great trend, what's happening with farmland and so forth, price wise, we're seeing growth in people escaping to secondary cities or the country. So what does that mean? That means that we have this water asset, which is at the beginning. And of course it too is in the same perfect storm.

I was in LA last week staying with my brother Mark, who has a blog called Ahead of the News.com. He's excellent technical analyst. And so he drew me some charts and he shared them with me. You're free to sign up on it for his newsletter. He's incredibly good and a lot of people swear by him. So let's take a look at what's happening here.

Forward Rates

On this chart we have interest rates, the forward rate, and it's very hard to see but there's a blue one, which is the average. And then there's a thin orange line stair stepping down. At the very top you see he bracketed on screen, he bracketed March to September, and that is flat. And so March 2023 to September 2023 is flat. Then it starts to go down, December on down. So that is what the markets are expecting. This is the options market. Right. And so that's really interesting. What does that mean?

Volatility

Well, let's take a look at the volatility. Again, 2022. This is January and we're going into this is very high rising volatility, December 2022 into January. And we have a short term drop in volatility here, which is really interesting because that means the market, let's go back to the page here, the market is seeing this flat, this flattening happening. So we have some dropping volatility. What does this all mean?

Well, as you explain it to me, this means that we're looking at coming out of this bear market, whatever you call it, March, April, May, June, around that period, towards the end of the second quarter. And I think that I think he's right. I think that's where we're going with that. So that's kind of interesting. I thought it was kind of cool.

Tough Times Ahead

Basically, it's always driven by the Fed, right? So Fed is basically stopping its rises and the market here, this is not the Fed saying it, the market is saying this is what's going to happen. It's going to flatten out between March and September. We gonna spend the whole year just sitting there and very, very, very tough time. People are going to have a tough time. The market's going to be kind of all over the place. But already people are expecting this to be a softening and that's baked into it. So that was kind of fun and different.

Short Term Stock Opportunities

And I like this short term volatility drop, which is just going to fuel some short term good news for the stock market. It's going right into what is that, January 20th. So the first month of the year, we're going to see lowered volatility before it goes up again. And then the historical volatility, the jagged line is the implied volatility. And the historical volatility is that, is that very faint gray line you see, which is essentially an average, right. So interesting.

Reason For Stability

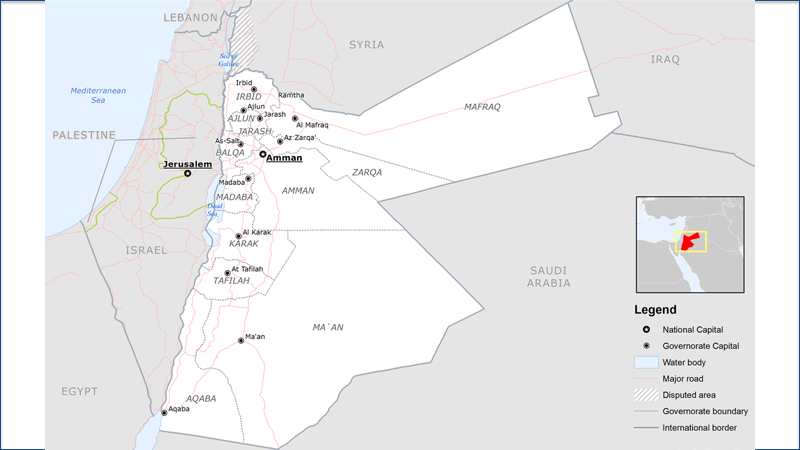

All right. Now, I've been talking about, we hear about water wars, but we have not heard much about peace through water. And sure enough, as I've been saying on various podcasts. Israel and Jordan have just renewed their solar for desal plan. And here is the map of the area. And I'm guessing that they're going to bring water up from Aqaba. Let's see what they're going to see do here. So, yes, Mediterranean Sea water. So actually, it's going to be pipeline from the Mediterranean. Dead Sea is way too salty, too much work.

Renewed Agreement

So Mediterranean water coming across into Jordan. And 600 megawatt solar plant. So Jordan is going to export clean energy to Israel and Israel is going to send water to, 200 million cubic meters to Jordan. This is cool. Israel is not enough land for the big central solar stuff. Just like I've been saying, people don't have a lot of land for big water plants either, right? Well, Jordan does not, is land bound. If you look at Jordan, they have a little bit of access down here in the Red Sea, the Gulf of Aqaba, actually, and that's it. So they have a tough situation, much shorter to go from the Mediterranean Sea straight over to Amman.

Israel's Mediterranean coast is 100 kilometers versus more than 300 kilometers for the Gulf of Aqaba. So what does this say? Basically, currently, this is, Jordanians have very low capability and it's depleting its aquifers. Jordan must have the water being talked about. And this came out of the Abraham Accords, you see at the bottom August 2020. And that is a good reason why we have stability in that part of the world.

And here we go. Implementation time for COP 28, Copenhagen 28, which is in the UAE next November. So in a year, the next climate change conference. And this will dovetail with that. So it's all very nice.

Estrella Nouri

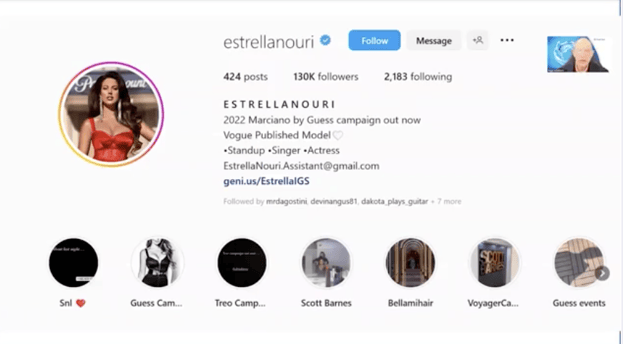

So also, while I was in LA, I spent last Saturday an entire day working with an influencer called Estrella Nouri. And here's her Instagram page. She has about 130,000 followers. She goes three times a year to Europe to model for Guess. She's currently in a Guess Marciano campaign. You can still see her on billboards right now.

Simplifying What We Do

Here's a picture of her on my brother's deck as she was being set up by Josh Summers or VP Marketing. And I'm taking the picture here. Now, why was this valuable? Estrella did a great job of simplifying what we do. We go, Oh well, wastewater treatment, blah, blah, blah. We go, "Oh, you're helping businesses recycle water." Thank you very much. And she did a beautiful job of simplifying it. This is going to be the basis for a lot of our regulation A offering, marketing, videos, etc. Of course, she's going to turn her followers onto this.

But more importantly, she's going to change us from a, somewhat of a geeky water, water people, water guys. Very few women in water and one of the reason is that were such geeks. To communicate the problem and the solution to the outside world, we need somebody like her who's very good at translating these stories. Now. Let me tell you about this regulation A offering. I can't tell you the exact status, but we are in good shape to launch it soon. So that's going to be very powerful for us.

USA Today

All right. Latest news coverage. Well, we got into USA Today just literally today, 1 p.m. ET. And here we are. It's a short article, but right here I've been making the point that global industry and agriculture combined for 88% of fresh water, while 12% is used for people. Right. Well, that's why I said we're beating up people, but we really need to hold industry and agriculture more accountable. And that is our job. So nice little hit we got from USA Today Today.

Top Fintech trends

20 days ago, we got a end of year roundup on the top trends in fintech. Now, we've been saying for quite a while that we are a fintech and aquatech, right? And so actually, Andre said, "That's cool."

=Marshall says, "I have to say, looking at Estrella on the screen beats looking at the usual two guys." Exactly my point. We need more, more good looking people rather than, I mean, my wife thinks I'm good looking, but I think that Estrella has a very, very smart woman and she is obviously not hard on the eyes.

What Andre Said

So let's see what Andre said. There's been a fast change with financial service organizations, and we are actually seeing digital platforms making great change. So what's happening? So I'm not going to go through all of these. It's a great article, but it talks about AI and you guys saw how chat GPT took off in the last few days chat bots, voice recognition, robotic process automation, banking as a service, more open banking growth, more transition to mobile banking, banks that are digital only, decentralized finance and regulatory technology.

And number nine, to top it all out was us. And I'm basically making the point like, look, let's look beyond just fintech, migration off the grid, as I've been saying, decentralization. And so we created a way to turn a CapEx which makes things very slow into an OpEx. And sure enough, that is a fintech solution in water. So I think that was a successful pitch and our agency was very successful in doing that.

All right. I'm going to do a quick clip. The second part of that commodity discussion, and it's going to be more of this discussion about commodities. Here we go.

Start of presentation

Paul: So will market forces solve this more? You know, as those rates go up, more and more people need more and more industry needs to treat its own, its own water. There's opportunities like with OriginClear your business on doing it at a smaller scale. You don't have to be big industrial scale or, you know, I mean, does this also require, you know, it sounds like sewage has no constituents. I mean, does it also require some political oversight as well and emphasis to say, actually this is going to be you know, the news is being dominated by California, you know, the Colorado River Basin running out of water and, you know, and the insanity in some senses of trying to grow almonds in the desert. You know, is this getting any political attention now? Is it, does the whole thing need a bit of a rethink?

Riggs: Tigers don't change their stripes. If something doesn't work now, I'm not going to I'm not going to pretend it's going to work in the future. But what we've done and we really started thinking this through in 2020 when, because COVID was a wonderful way to have to reanalyze everything, like confront everything in your business. And we were finding that, yes, there was a tremendous backlog of potential customers way more than than our current business. And we like, well, how come these people aren't feeding through? And we concluded it that "it's the money, stupid."

We concluded that if you want to take the, make it frictionless, then don't ask for the capital. Say, okay, these people are accustomed to getting their water on the meter from the city. Well, then just give them their water treatment, let them have their water, their sewage treatment on the meter the same way. And that is very attractive because businesses can much easier approve operating expenses. And for example, in a housing development, the developer can pass on the ongoing expense to the house, the homeowners association.

So basically people paying as they go is very attractive and it tends to speed these deals up. So we created something called Water on Demand, which is our version of what you might call water as a service, which is we're not the only ones doing it, but we're certainly the only ones doing it at this scale. And with, enabling regular investors to come in and get involved. We like to think it's a lot like how oil wells are, partnerships are created or solar pools are created. Well, now there's water investments that are possible through this Water On Demand thing, and we even have a possibility now for the unaccredited investor get it to get involved.

So funding has been flowing in very nicely into this. And now we're starting to provide that fund, that funding to enable people to just sign on the dotted line and they get a service contract that just takes care of the problem. And I think that is a big part of the solution.

Paul: Yeah. And, you know, so is the problem there is sort of zooming back out, you know, we'll put links to OriginClear and your business in this show notes. But while we've got you talking about this is the problem one of you know, it's a twin issue, right, of overconsumption and of lack of not treating and then reusing that water. You know, I mean, which of those, I mean, does if we treated all the water we use, would that solve the problem or are we still generally overconsuming? We're over-consuming water in the wrong places because it's always being treated as free and an endless resource.

Riggs: Right? No, I think we have we have a supply issue. We're definitely wasteful on the inbound and we need to do more. There's no question about it. But what, unfortunately. The limited amount I can do about it. That's a political solution. What I can do is once the water is in the business or in the housing division. I can ensure that it's treated and recycled on the spot and get more turns out of it. Two, three, four more turns. Well, that's going to make a massive difference ultimately in the.

When I was growing up in Europe, you know, we used to bring our water bottles back to the, to the recycling, the consigne as they called it. We'd turn it in and and you'd get your ten francs or whatever it was, you know, for your little bottle. Well, how come that went away? I mean, everything. And don't tell me that recycling of that. It's a scandal. What's going on with plastics recycling, because we know that doesn't really happen.

But we need to return to the idea of husbanding these resources and reusing it. It's economically much better. And I think we have to rely on the economic argument. We can't, this, Washington is besieged with causes, things to be fixed. And, you know, the list is long. So yes, they should do something about it. But we don't, we can't wait. I'll give you an example. The very specifically in Miami-Dade County, which was developed on a very helter skelter basis, they kind of just, the real estate developers were in charge and they just built.

As a result, there's over 100,000 septic tanks. These are individual homes very spread out. And the semi-rural environment that have septic tanks and of course, those are leaking. Plus you have water seepage, water rise, which is pushing fecal matter onto lawns. It's a very pleasant thing for a multimillion dollar home to have fecal matter on the lawn. But we've got to get rid of those septic tanks.

And the city is saying, the county is saying, well, we'll just spend $6 billion and put sewage lines in everywhere. OK. A they can find a 6 billion. B, it'll probably be 16 billion by the time they're done. And C, it'll take 20 years of tearing up the streets. Why not just have a rebate programme to let those homes convert to a black water recirculation system, where they take care of their own black water and the sludge goes into a holding tank and once a year it gets emptied out. It's, that's mature technology. It's been around for a long time.

Fuji Water has an excellent blackwater recirculation system. We don't, we don't compete in the single home space. It's very commoditized. But it's a simple solution. But cities don't yet think that way. Cities are well, we'll solve it. We'll fix it. Why, well they love to make, they love to do this municipal bonds and and they like to be taken out to dinner by the Veolia rep and all that good stuff. It's kind of how it is. But that's where it should go is to incentivise self treatment.

Paul: And just in that example, though, because again I feel quite at sea at this one. That blackwater is not going back into the household taps to be used for drinking water. Blackwater can be used for irrigating those lovely lawns covered in fecal matter and whatever it might be. Right? It's those types.

Riggs: Well it's no longer black of course. It's blackwater coming out of the toilet. What you have is your blackwater coming out of the toilet, gray water coming out of the shower. Most homes don't separate the two. So let's think of it as one thing. It's treated by an in-house system. The sludge goes into a holding tank, and what's left is typically good enough for irrigation. And that's what it's used for.

Paul: Right. I always just, I always kind of marveled, this is a bit of an aside, when you're, you know, sprinkler starts going that it's using exactly the same water that we drink. And it just seems if you could separate the two, it might be, might make some more sense. Okay. So, talk staying on economics. So and, you know, it is in a sense, sorting itself out as these rates rise, as pressure on treatment facilities in the cities, you know, etc., Rates are rising. It's a pretty regressive tax, I have to say, on people, You know, when you start throwing into those rates are caused by industry and agriculture.

But that is that is solving itself in the sense that technologies like yours, modules that can come on site at a medium sized scale and treat water makes all sense. Should we also you know, for years now, water has been hailed as a potential commodity, a potential traded commodity. You know, and people have been buying water rights here and there and there's been various attempts. What about on that supply side? Are you're starting to see people trying to better economically value, you know, the water, water tables, etc..

Riggs: It's starting there's what's called the Veles water index, which is traded on the Chicago board, and that is been functioning for some time dealing with California water rights. And it's pretty decent. It's a good start. Also, my good friend Ravi Mehta has a company called Water Ledger that resells. It'll take people's unused water rights and resells them to a secondary market.

Which is good because otherwise these farmers would, they won't, they won't reduce their rights. They're going to jealously hold on to their rights, but then they'll waste the water. This is a way to monetize that unused water. There's good things like that happening. I don't think it's happening very quickly, but, it's happening. You know, it's a little bit like carbon credits. It's one of these markets that is sort of needs a needs a push, basically.

Paul: Yeah. Because that would, you know, when things start getting properly economically valued, you usually get quicker movement. So where, where does this, we've been very much US centric and that's obviously where your business is based, where on a broader scale in the developing world is water treatment at I mean, you know, is this just as you say, it doesn't have many constituents in the United States? I mean, is it pretty much the last thing on the rung of development in Africa, in developing world and Asia and so forth?

Riggs: It's a pretty sad situation. We have, we know about Mexico, for example, where basically the rivers run rainbow. They're very polluted. I have a good friend in Puebla who treats the water of the Anglo companies who have to report to their American parents. So they have to maintain standards. They're the only ones who are like doing anything about their water. The rest are like, "Oh, just send it down into the river." The lack of enforcement in Mexico and Mexico's relatively advanced country, I consider it a second world country.

Look at India. No infrastructure at all. They have men in the, in the sewage tunnels, digging the stuff out and dying from the sewage gases. It's unfortunate. So you have a zero infrastructure in a place like India. So what's the solution? It's not going to be to find $200 Billion for water infrastructure. Instead, ultimately, it's going to be this unitary self treatment by homes, housing developments, factories, etc.. Over time, that's going to have to be how it is. But we have to have some enforcement. There is, we have corruption in those areas, and it's, there's a long ways to go before these areas become properly serviced. It's a very sad situation, frankly.

Paul: Do you think I mean, there's going to be a necessity at some point when there's a realization. I mean, we've spoken often about batteries and critical metals and so forth, and those supply chains have moved to China, you know, as ultimately the initial driver was that it was NIMBYism like he mentioned earlier on, right? You know, we wanted to outsource the pollution of the manufacturing of these various minerals and components and so on. And China was willing to do that. And, you know, there is a growing recognition, you know, at least, and understanding that there's been catastrophic pollution of their aquifers and water tables as a result of that. You know, is this, you know, is this a growing environmental catastrophe that's happening when we suddenly realize we're running out of.

Riggs: Well, it's been that way for a long time. Look, do you realize that just a few weeks ago, the lower Hackensack River in New Jersey was designated a Superfund site? An additional polluted river. In other words, we're not we're not reducing polluted rivers, we're increasing them. So, no, it's not a great situation. The Clean Water Act was a good time, but that was 50 plus years ago. And we haven't done better.

We have also in places that are like the Carolinas where you have a lot of chicken farms, a lot of the runoff of nitrates is choking rivers and creating algae problems. That's, look at Florida with its sugar cane plantations generating, again, algae. And you have powerful interests who are able to pay some bills at the local state capital who are saying, no, no, no, it's okay. These are not the droids you're looking for. So it's I could get very exercised about it.

But let's just not be, let's not pretend that things are good. Even in America, there are still polluted waterways better than they were. There's a whole story about how the Ohio River at Cleveland was literally on fire in the seventy's. It caught fire. It's not that bad anymore. It's gotten better. But you have pollutants like the nitrates, which are sort of, they don't look like pollutants. It doesn't look like sewage, but it does cause these algae overgrowth because, frankly, algae is a great curative. It'll it'll it'll suck up anything that has a lot of nutrients. And then you get these choked up waterways which kill fish, etc..

Paul: So just just, I guess, taking that opportunity to talk. Algae while we've got you because I doubt I'm going to do an episode on. But I remember back, you know, ten, 15 years ago there was obviously a lot of effort and emphasis going in even from the oil majors in algae itself, talking about the potential to generate alternative fuels and so forth. If we love you just to get I don't know if you'd have time, but lovely just to get a sort of a five minute snapshot of that. And, you know, whether you think that there was the scientific breakthrough there, just the levelized cost of energy was so high, it made it untenable. And actually in a run up of of fuel prices today and also the potentially the the California fuel standards, etc., you know, there is the opportunity for that to become a potential industry again.

Riggs: True. I mean, it's ironic that the price of oil is coming back up to a point where it could be. When I started this company in 2006, 2007, we had a mandate to make biofuels from algae. And it makes a lot of sense. Why? Because petroleum is fossilized algae. It's not all of these it's not all these dinosaurs. It's actually no, there's not enough dinosaurs, believe me.

But huge lakes of algae grew to suck up all of the CO2 that was in the atmosphere at the time to make the planet livable. And of course, it's ironic that we're now putting all that carbon back in the atmosphere. But it's a logical best fuel. Why? Because we have internal combustion engines today, so it's a plug compatible fuel. There was lots of promise. There were breakthroughs occurring. We had a proprietary harvesting technology to, because it's very hard to take the microalgae out of the water. We had that electrical bunching thing. Technology that we had. I'm being very technical, as you can tell. And, but that was going fine and we were having a great time. We were on all the best shows. Varney on Fox called me Algaeman, "I'll call you Algaeman." You know, it was a lot of fun. That was great.

The only problem is, of course, fracking came along, price of fuel went down to below $50 and stayed there, which actually was a good thing for the economies because it had been maintained at $120 artificially in order to foster renewables. Well, that is happening again. It could happen. The only reason why we had to stop was because we don't have algae as a fuel has no subsidies. It has no real, unlike petroleum, it is not a subsidized activity. You don't get this.

We have master limited partnerships in fossil fuels which get a tax benefit. We have no such thing for a biofuel. So a lot of work to be done. I do believe there's a lot of promise. I think it's very exciting. What we did, of course, once we had to to pivot is we moved. We used that same extraction technology to apply it to sewage. And that was our transition into water. Water is a very important space. I'm glad I'm in it, but I'm a little nostalgic for the times when we, the heady times when we were making biofuels and I was forcing the head of the National Algae Association to taste some of it and almost killed him.

Paul: You know, And well, biofuels at the moment is obviously, again, a hot topic. And we're currently, you know, taking crops from the Midwest and used fats and oils from restaurants and and turn them into very lucrative renewable diesel to sell into the California markets and sustainable aviation. So it's maybe it's one to dust off the old playbook.

Before we before we wrap up, I know we've sort of alluded to it you know, the so with OriginClear this idea of actually, you know, there's an economic reason for now, not just the very large size consumers of water, but midsize businesses to bring in their own treatment to avoid rates. You know, what is I mean, is this something that is, I mean, what is the uptake on that? Is this actually going to provide a solution or is it going to remain sort of just those certain businesses that are, you know, ESG conscious and unconscious and all that sort of things? I mean, is this going to be, do you think, transformative and is this going to be a, you know, a bit of a revolution in in how businesses, agriculture, really approach water usage and treatment?

Riggs: Right. Well, first of all, I'm not a strong believer in putting a sort of an ESG paint job on something to market it, you've got to have the fundamentals to drive it. And the end of the day, things have got to make sense commercially for especially midsize businesses. Large corporations will play the ESG game and they love to sort of get, you know, marked up on the rankings and so forth. But, you know, small to midsize businesses have much more close to home concerns, i.e. profit and loss. And and they've had a hard time during the pandemic and they still not great for to be a smaller business today. So it has to make financial sense.

Now, our challenge is this we have an ordinary business which is doing very well. In fact, we just announced that our business tripled from last year to this year. The ordinary business of designing and building systems that people pay for. And we thought we'd go to those people and say, "Hey, by the way, you don't have to pay." But we've gotten to them too late on the chain. They're like, No, no, no, please don't bring it up. We already figured it out. It took us forever, but we figured out the capital.

And so these are not people that are open to novel financing. We've got to go earlier. So what we've learned is go early, early into companies that are just starting to try and figure out a solution. It's a different audience, but it's, I think, potentially much larger. Right. Because these are the people who have not solved the problem. And if we can make it very frictionless, then we can start moving faster.

Paul: And is there potential for this technology, similar technology to go to the developing world as well? I mean, that seems to be like, you know, as you said at the very start of the episode, you're skipping kind of the the landline phase of telecommunications and going straight to the mobile. I mean, you know, is this something that, you know, you see developing world looking at as well?

Riggs: Eventually, of course, you know, every individual in the world loves a smartphone. Every individual world does not love a sewage plant. So those are two different things altogether. Yeah, but having said so, here's our plan. Water On Demand is a financial network. In other words, we are delegating when we finance a system on this pay per gallon basis, we then delegate its installation to a local water company.

And what we want to focus on is creating a financial network that then as. Let's do it right in America. But let's say we do it right in America. Then affiliate with a financial organization in Dubai, in Singapore and Tokyo and so forth to do the same thing for their regional water needs. And that is where it will start happening. And then it'll happen with the Indias and Bangladeshis of the world.

But, you know, we have to start where the money is. I mean, it's, that's the nature of it and make it a good financial proposition, scale it up, make it something that is well recognized and it will start changing things. I've always said that a single company like OriginClear can't just change things. It takes, not even more multiple companies, it takes a movement, it takes a lot of players moving towards this.

Fortunately, decentralization is happening organically already. It started 15, 20 years ago and it's actually starting to gain momentum and we're putting our backs to the wheel to speed it up. I think it's exciting. I'm having fun with it. Investors love it because they go, "Oh, I got a piece of a water system." They just think, it's so much better than having a piece of an oil well, you know, because it's beneficial. So people it's very popular. We're having fun with it.

Paul: Excellent. Well, I you know, I think it's a, it's a fascinating area, as you say. You know, it's one day it might also be a market that operates like other commodity markets, right? Because people are recognizing the the value of both the supply, but also, you know, that would encourage, re-use, etc.. So, Riggs, I thank you very much for your time and look forward to watching the the OriginClear story.

Riggs: Paul, thank you for your kind words and yes, I appreciate it. And perhaps we'll talk again in a few months to see where we've gotten.

End of presentation

Riggs: Indeed, since that was done, a lot of things have changed. I'm going to give you this is what we've been leading up to all through this briefing. And that is the SPAC project, right? What is a SPAC? Well, remember, back in November 7th, we retained a law firm to explore a merger with a Special Purpose Acquisition Corporation.

Now, as we know, there's lots of these. There's still almost 500 left and they're running out of time. You could say that the SPAC boom has, the bubble is burst. They, right now, they're trying to like, it's kind of like closing time at the bar. Like, okay, we're running out of potential dates, shall we say. So what, what is happening is that there are these SPACs.

And so we retained Basile and we went ahead and, we said at the time we have not identified one. And today, however, we announced that our Water On Demand subsidiary closed on an acquisition of the Fortune Rise Sponsor LLC. Does that mean? We purchased this, the sponsor of Fortune Rise acquisition. Nasdaq FRLA. So, and it basically cost us about a half million dollars plus, we assumed some obligations related to the extension of their time in which to complete the merger. And so this thing says no more than that.

Here is the FRLA site.

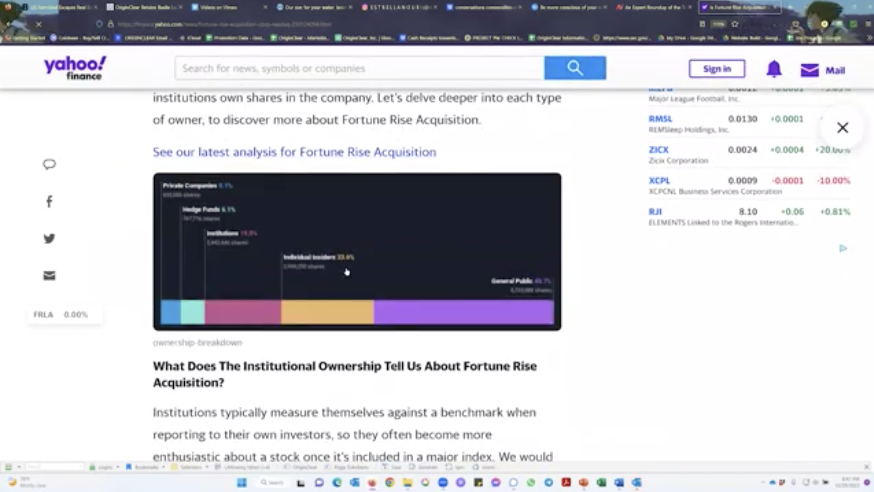

And if you look here, there is our little announcement right there. We're on the Nasdaq page and here's back in November when they extended their period. That's when we first started talking to them. So, they had spent a year and then each three month period after that, they had to pay $1,000,000. So they paid that. But let's take a look at, here's a little article that shows who makes it up.

The Whiz Kid

And if you look here on this graph, it'll show you who's who. Well, the individual insiders, 23.6%. That's now Water On Demand. Now, why isn't it OriginClear? Well, it's very simple. Water On Demand is our whiz kid. Water On Demand is huge. And it is, it's got a regulation A offering, which means we can potentially raise a lot of money. Remember that over at Start Engine, there was a startup called Knightscope Robotics Startup that raised $110 Million from General Public. And so we have the ability to really make Water On Demand a good player.

Now, I'm not saying that Water On Demand is going to be the acquisition of the SPAC. I'm not saying that at all. Simply saying that we have acquired 23.6% of a corporation, that has $100 million in the bank. What's going to happen from that? I tell you, it will not, at the end of the day, there's a whole process where these mergers happen. It does not end up being $100 Million, but it is however strategic. And why is that? It's strategic because it's a Nasdaq corporation, So there's much, much more to come.

Acquisition Strategy

I unfortunately am very limited in what I can say. I can say nothing more than this. You can, however, look at this page and get some ideas of this. What their market cap is et cetera, etc. They trade, steadily going upwards from the $10 range where they started, $10 and now they're $10.30. Nothing much. It's just a nice little company. What we do with it, we cannot disclose at this time. But I can tell you we will be able to tell you soon. Much more to come. Water On Demand needs to make acquisitions, and this is a very strategic acquisition for Water On Demand. So, have I been tantalizing enough Ken?

Freewheeling Discussion

Ken: Yeah, I would say so. Here we are.

Riggs: I am dressed in the clothes that I wore this morning when I was down at the Don Cesar, the Pink Palace, the Pink Paradise. That was our anniversary.

Ken: Happy Anniversary.

Riggs: Thank you. Here's what, Obviously, we are tantalizing people, but this is a major move, I have to say here and now that the investors who helped us make this happen, they are angels. They are unbelievable. Ken you made made marvels happen, but...

Ken: It was a team effort, right? Yeah.

Riggs: You have to be blown away Ken by how ready our investors were to work with this and they, and by the way it's not over, to hear more you're going to have to sign a non-disclosure agreement with Ken. And you have to be qualified. We only really go after existing investors right now for the involvement in this. That could change depending how much you beg Ken.

Ken: Or just ask nice you know.

Riggs: That's nice. But this is a whole different game. I can tell you this: regardless of what happens with the actual specifics of this transaction, we are now dealing in a world of Nasdaq.

Ken: It's, it's Major League Baseball now, right? It's not triple-A ball. It's not, it's not Little League.

Riggs: Moneyball.

Nasdaq Traded Entity

Ken: What I found, what made me smile was that our participation in this thing comes up on the news story of a Nasdaq traded entity that has 20% institutional ownership currently. So, in other words, our message is so broadly more magnified now. These institutional, these current institutional holders are going to, they have front row seats. Well no, they have second row seats.

Our, I think the people that are speaking to me under NDA have front row seats, but they have second row seats. But they're institutional players and they're going to see execution upon execution as we... And I think that, I think, I honestly believe that when they understand the nature of what Water On Demand is, Fintech for water as a service, I think we're going to entice. I really do, I think we're going to entice a lot.

Riggs: We're getting over our skis here because we're not implying that Water On Demand is going to be involved with.

Ken: No, but I think, I think they're going to love our story here.

E.F.Hutton Backed

Riggs: OK, but again, the more we speculate, the more we sort of start walking into the weeds. Here's, so what I'm basically saying is, EF Hutton is the bank behind this SPAC. EF Hutton has 51 SPACs and this is one of them. And now we're talking to an investment bank that's got some real legs. And it is a different world. It's a different world. So, which is wonderful because, you know.

Call Ken

Right now what you're doing with the series Y round, which I'm going to put up on screen for everyone, is really good for investors and, but it's not great finance. It's super rich. And so that's why it's limited to $20 million of which we've already raised seven. So the last 13 million and that's it. After that, it's going to be the unaccredited investors will be pulling will be doing the heavy lifting and the institutional money that we get through the stuff that we do. So all that we can say as just to recap this and we can talk more specifics is that Water On Demand has made an acquisition. It's a piece of a Nasdaq company. What we will put in a Nasdaq company that is... More to follow, more to follow. I've not said enough.

Ken: Right? No, I am afraid to say anything else. No, it's look, I'm excited. Obviously, I was just very pleased to see our news story up with a bigger company because we've had this goal of being able to reach a broader audience. And I believe that this is extremely helpful in that regard.

WOD and Acquisitions

Riggs: Yeah. And the reason why Water On Demand is doing this is just to make it clear it is going to have an acquisition in the regulation, a filing that we made that is public already. We're saying we're going to make acquisitions and this is one of those acquisitions and I think we'll leave it at that. Oh, James Wright, "Who listens when EF Hutton talks?" Yeah, you're showing your age. What happened was E.F. Hutton, the bank went out of business many decades ago, and the investment bank, a very good one, purchased the name and they're actually really good. I really like them. They're great people. They have lots of resources.

Ken: Which is, which is really very timely. I'm very happy. You know, this past week has been kind of a whirlwind, a lot of things going on.I'm happy but I'm obviously excited. I think we'll be able to kind of continue this in the coming short period of time and be able to extend our ability to communicate on this. But just from our discussions and discussions with the experts that we've been talking to about this, it's exciting times. It really is. It really is. So.

Riggs: Well, that's fantastic. So, Ken, thank you to you and all the investors who jumped in again, because we have the most amazingly loyal group you could possibly think of. If you want to know more about that, just go to Oc.gold/ken to book time on his busy schedule and then or email invest@originclear.com.

Ken: Two caveats. We have to get an NDA signed prior to my appointment, prior to even booking the appointment. And please, for now, this is only for accredited investors and we'll need to verify that because this is a very special situation, right? So it's not something that... Fortunately, the time of segregating the public is almost come to a close.

Riggs: Right. Right. But I want to say this. Even if a person invests only in series Y, the current offering, they're getting a piece of Water On Demand.

Ken: Of course. Absolutely.

Riggs: It's a win win.

Ken: Oh, absolutely, absolutely. And you know, I'm, for reasons that you and I have talked about, the amount of leverage that exists in series Y. This was designed when we, when none of this was here, right? So, it really doesn't match our current reality, but it's too much trouble and too expensive right now to change, to change it. So we're just going to let it run to the end and we'll just make some minor...

Group Pilot

Riggs: We need the $20 million group as our pilot group. We've got to have them.

Ken: Agreed.

Riggs: We're gonna have pilot projects. We have four pilot projects we're in discussions about. I'll do more next week on that because we need to.

Ken: People want to know about that too.

Riggs: The $20 Million is strategic. Once we're done with the 20 million, then we're done with that. And we move to institutional and the regulation A offering. And 2023 is going to be amazing. Everyone, I want to wish you guys and gals an amazing year ahead. You've, the last few weeks have been so exciting. Ken you're a rock star and don't let it go to your head. You can have coffee now. That's it.

Ken: Thank you. I can't have coffee this late. I'm old now. It keeps me up, so.

Riggs: All right.

Ken: All right.

Riggs: Do a coupon.

Ken: There you go. Have a good evening. Happy New Year, everybody.

Riggs: Here's to a great year ahead. And do stay in touch. And stay tuned next week. I guarantee you it will be a very exciting briefing. No more than that can be said. Ciao guys.

Ken: Bye bye.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)