We went into detail on what "inside the tornado" means and how it applies to Water on Demand™. It has to do with technology adoption and exactly what has made the Stripe IPO so hot. So, we looked at how its early investors and those in things like Airbnb made out, and WHEN the best time was for them to jump in... Guess what that has to do with Water on Demand, why we call it a pureplay and a factor that could make it a once in a century event? EVERYTHING! Find out HOW here in the replay!

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

And welcome everyone to the the CEO briefing. Robert Baxter. "Hello. How are you?" He's in New Jersey and it's wonderful. Boy, there is so much going on and we're going to get right to it. And I'm on a brand-new machine, which means all kinds of fun and different and interesting things are happening. But, you know, it wouldn't be technology if we didn't get to do wild things all the time.

So, with that said, today is Thursday, March 31st. Tomorrow is the 1st of April, the day the annual report is due, and I'll be briefing you on that shortly. As always, our vital mission is to help the world invest in water, which is the new stable inflation friendly asset class.

With that said, of course, we have the usual Safe Harbor statement that says we say what we can when we can, and we try and get it right. And when we don't, we fix it. That's how we do it.

All right. So what is up with the 10-K? Well, it was due tomorrow. We had our board meeting today and the whole process was very satisfactory. They're very happy with how the team is working, as opposed to last year when we basically suffered tremendous delays, as you might remember, if you were around. But we had one small last task. We needed to do some warrant calculations.

Warrants are basically a right to buy a stock at a future date on a certain price. There were some missing calculations, so rather than just let it go, we decided to handle it. And there's a standard 15 day extension, but we think we'll file in the next few days and there'll be a press release and review the numbers. So there'll be a full review next week and be there or be square. Right.

Build Your Network

All right. So quick excerpt from an excellent podcast that I was on called Build Your Network. As you can see, it's had leaders like John Maxwell, Grant Cardone, a number of people, and yours truly was part of it. Ivan says, "Good evening, everyone." And Keith says the same. And it's happy campers. It's a wonderful thing.

Start of presentation

Eric: Hey, everybody, welcome back to the Build Your Network podcast. Today's guest is Riggs Eckelberry. He's the CEO and founder of the innovative water technology company OriginClear and disruptor of the trillion dollar big water industry, which has fallen behind the times and is affecting the health of millions. Simply, our current billion dollar centralized water systems aren't coping with demand, and water quality is getting worse.

Too often, there's simply no money to fix these problems as water is inflating at three times the core inflation rate. The answer is to treat water like an oil well. Riggs goal is decentralized investment community that could vote on needed projects anywhere in the world and fund them, allowing the investors who have been left out of water for so long to get their hands wet. He's using innovation and his entrepreneurial spirit to help solve the world's water crisis and getting America's investors involved to help solve the problem. Got a lot of great questions for you today, but welcome to the show.

Riggs: Eric. It's a great pleasure. Thank you.

Eric: Yeah, really excited to have you on. And we always like to start these conversations way back at the very beginning. So tell me a little bit about where you came from. Take me back to maybe middle school, what was on your radar? Because I can't imagine solving the world's water crisis was the the dream on the horizon.

Riggs: It's interesting because, of course, I'm a baby boomer. And in the postwar era, my dad, if you ever watched Mad Men, he was Jon Hamm and he was that guy and Top of the world. You know, it was really the era when if you were an exec with an American company and we were raised abroad. So in various countries, we were by far the most affluent people there. And it, I think, made me and my brothers fairly transatlantic, but also homeless in a way. We never really grew up in one single place, so it has its pluses and minuses. But we did have, I think, a good appreciation of the world beyond Cleveland, Ohio, which is where my dad was supposed to be with Procter and Gamble, but ended up being international, which the issue really is, is that people say, well, who were your schoolmates? I don't have any schoolmates. Maybe that's a good thing.

Eric: Yeah, maybe. I mean, it's always hard, right? Because nobody can experience two different lives. So the people that grew up traveling the world without a bunch of people around them would say one thing. The people who grew up in a totally different context would say the other, and nobody really knows which side is the best. But yeah, tell me a little bit about what that exposure to other cultures and other areas really did for you growing up because travel is one of the best educations I think anyone can get. How did that kind of influence you?

Riggs: Well, I grew up at a time when. Um, you know, Europe was really, it was coming out the common market experience, which is just, you know, removal of customs as all it was, was morphing into this vision of the European Union. I mean, that was really the whole transition and there was a lot of optimism. One of the interesting things that I noticed as a kid in Belgium was, wait a minute, where all these German cars there were German cars everywhere. The people who were the biggest tourists in postwar Europe were the Germans. They were the ones. And I was like, this is interesting.

The German economy rebounded enormously postwar, and they were kind of driving, I think, all of Europe with France and Belgium being a lot more behind the times. So we were keenly aware of sort of the it was almost a end of century kind of feeling. Right? Fantastic. Now, my dad at one point said, "Riggs, we're going to have to Americanize you." You know, and he sent me to high school in the States and I was like, whoa, that was I landed in Princeton High School where it was all, you know, 57 Bel Airs being drag raced up and down the street and Fonzi types. I was like, What is this now?

And it was a it was a it was a real culture shock for me and what, but then again, the world was changing. This was 65, 66, right, when everything was changing from very, you know, Bobby Sox kind of world to this breakup of all these societal restraints. Right. And the new era of question everything. And is this really good? Is it not? And I landed by the end of high school, I landed in New York City. A lot of things happening there. And I ended up working for several years in a nonprofit that formed I think a lot of my thinking of got to do something for the world. You can't just work for the mortgage. Right. And you may or may not be effective at it, but that you got to try to try doing something about the way things are. Right.

Eric: Right. Looking at improving the world that we're in, you know, whatever drives that, you know, there's people who are trying to tackle this. You're tackling something that is not only a local issue or national issue, it's a global issue. Water is something that is our most precious resource, really, when you get down to it. What got you interested in this mission in particular and how do you get started tackling something like this? Because it's so, I mean, it's so essential that we don't think of it. You know, it's like it's just we turn on the faucet, there's water, we go to the store, there's water. We don't tend to think about where it comes from or what to do with it.

Riggs: It is taken for granted and I in fact, didn't plan on being in water. You know, I went fast, fast forward to when I was in the dotcom era in the nineties and it was a transformative experience for me. I fell in love with the speed and transformation of the dotcom era. To me it was, oh my gosh, the day that I realized, because in the eighties I was in computing for the purpose of general ledger accounting order-entry, running warehouses and stuff like that. And in the nineties it became computing for communication. How, how different was that?

And I got super excited about that and all the early e-commerce things that were happening and so forth. And so I learned to operate at the speed of disruption in the early 2000s. I helped take a software company public on the Nasdaq, and then at that point I was like, okay, I feel I'm ready to be a CEO and a fund that I was close to said, "Well, Riggs, yeah, we think you could be a CEO, but it's not going to be tech. We've decided to go into green." Remember Green early 2000. We decided to go into green and we think algae is going to be the next biofuel. And I went.Okay, sure, sure, I knew nothing about it.

Eric: Right?

Riggs: Fortunately, I have a brother who had done some work literally in that area and had technology for helping the algae to grow. We launched a company into as a public company with the help of this fund that was tackling algae as a biofuel. And we were making great progress until the price of oil crashed and it had been artificially maintained at $120 a barrel for a long, long time. Artificially maintained in order to encourage renewables like us. But the oil industry figured out that they could vastly increase production through this thing called fracking. And I guess the 50,000 scientists at Exxon. They had something in mind and they this guy, Mitchell, and a bunch of other people invented this technology which transformed energy.

And all of a sudden made algae into a science experiment as far as biofuels go. Now, ironically, today, it could be algae time again because of what's going on, right? But at the time, we're like, you know what? We can't make algae work at $35 a barrel or even $50. It's not going to work. What do we do? And failure was not an option. So we took this technology that my brother had come up with of pulling the algae out of the water, which is actually a big challenge, de-watering algae and said, "You know what, we can use this to clean water," get the suspended solids out of the water. And that was the genesis.

So we literally pivoted into the water industry. And the funny thing is. You know, Eric, I was I was a media darling in algae you know, I was, you know, considered a really interesting topic. And I was on Fox Business and I was interviewed on Bloomberg and debated Jim Rogers and I was called Algae man, you know, all these things all of a sudden I'm in water and I like disappeared, but nobody cared because water, as you say, is taken for granted. And so then we started trying to figure out, well, how do we move the needle on water.

Because one of the early things I learned is that 80% of all the sewage that's created is never treated at all in the world. Now. This is not true of America. It's the opposite. We treat most of our sewage. But if you go to Bangladesh, you go to go to a places in Africa, raw sewage into the ocean, the rivers, etc.. And that is that's the nature of water in the world today, is that we are polluting this goldfish bowl we live in. And so it's a $1 trillion worldwide industry that, by the math of it, should be really a $5 trillion industry. But it's not. How do you transform it? Well. Something very interesting started happening in the seventies, which was the high point of water infrastructure funding, is that the federal government started spending less and less on water for reasons we won't get into.

But basically they started starving our 150,000 municipal water systems of money. And inevitably, this resulted in things like Flint, Michigan and much, much more. Flint is only the tip of the iceberg. And so we have a failure of the central infrastructure that's been growing for decades now. And the Biden administration came up with the multi trillion dollar infrastructure bill. Well, it only had $55 billion for water and do you realize that we fall behind every year by $75 Billion in needed infrastructure. So the big infrastructure bill took care of less than one year of backlog.

Eric: Yeah,

Riggs: Better than nothing, but the truth is that we're not going to fix the infrastructure of America. A. Because of lack of funding. B. Because places are all built up. Where are you going to put the water treatment plants? C. It takes time to build a big central system. And so the natural thing is, you know, I like to say that California is not going to get a bullet train. It's just going to get a self-driving car. Why? Because we have freeways. So it's going to become decentralized to the most simple thing possible. So early on, by 2015, I was a big, big advocate for decentralization of water treatment. I saw this as a trend. And let me tell you something. I was a prophet in the wilderness. Nobody was listening. Yeah.

But yet it has turned into the big trend as the infrastructure falls apart. Because one of the great things about decentralization is we've seen this in PCs. Used to be mainframes. I'm old enough to have been booking time on a mainframe. Right? Whereas we went to PCs, took the load away from the mainframes, and now the cloud sits there and background and everybody's happy. Well, we need to do the same thing in water, because when you start treating the dirty water at the edge, then the infrastructure requirements are much easier, right? All of a sudden your central needs are, you're treating water that's been halfway treated already, so you're just polishing it, really? It changes the whole dynamic.

Eric: Yeah.

Riggs: Right. So decentralization is essential and the next problem occurred and this is one we really had to tackle big time, which is OK, everybody now wants to treat their own water, but it's not happening. Why? And we arrived at the first week of February 2020. And saw the inklings of the crash that occurred that week when oil prices crashed because Wuhan had been out of business for a month. Thought, Oh, what's going on here? And we realize we had to solve this problem right away because we fund the company from the public markets. So the public markets started going crazy. We were like, Uh-Oh, and we went into a very intense period. We're like, What is going on? What is the solution? How do we fix this? And we came up with the realization that, "It's the money, stupid."

If you're a brewery and now you're expanding your operations and all of a sudden local city says, Well, we don't have capacity, we can't take anymore, you're going to have to build your own water treatment system. Well, you're funded to make beer, not to treat water, right. So it's a capital issue. And so we realized if we fix the capital problem, decentralization is a done deal. And then the second thing we realized is that America's investors would love to invest in water systems "like an oil well." They haven't been able to because it's always been the city has been...

Eric: Bonds.

Riggs: Municipal bonds, all that stuff. Now direct investment and people are like, "Sounds good to me." And now this is this thing we call Water on Demand.

End of presentation

Riggs: Well, that was really, really good. Obviously, Eric asks some wonderful questions and part two is going to be even more interesting. We'll continue that next week along with a lot of other good coverage.

Water on Demand Summit in Clearwater

So now another excerpt from the summit two weeks ago that you're going to enjoy. And so let's get this party started. Here we go.

Start of presentation

More Summit Coverage

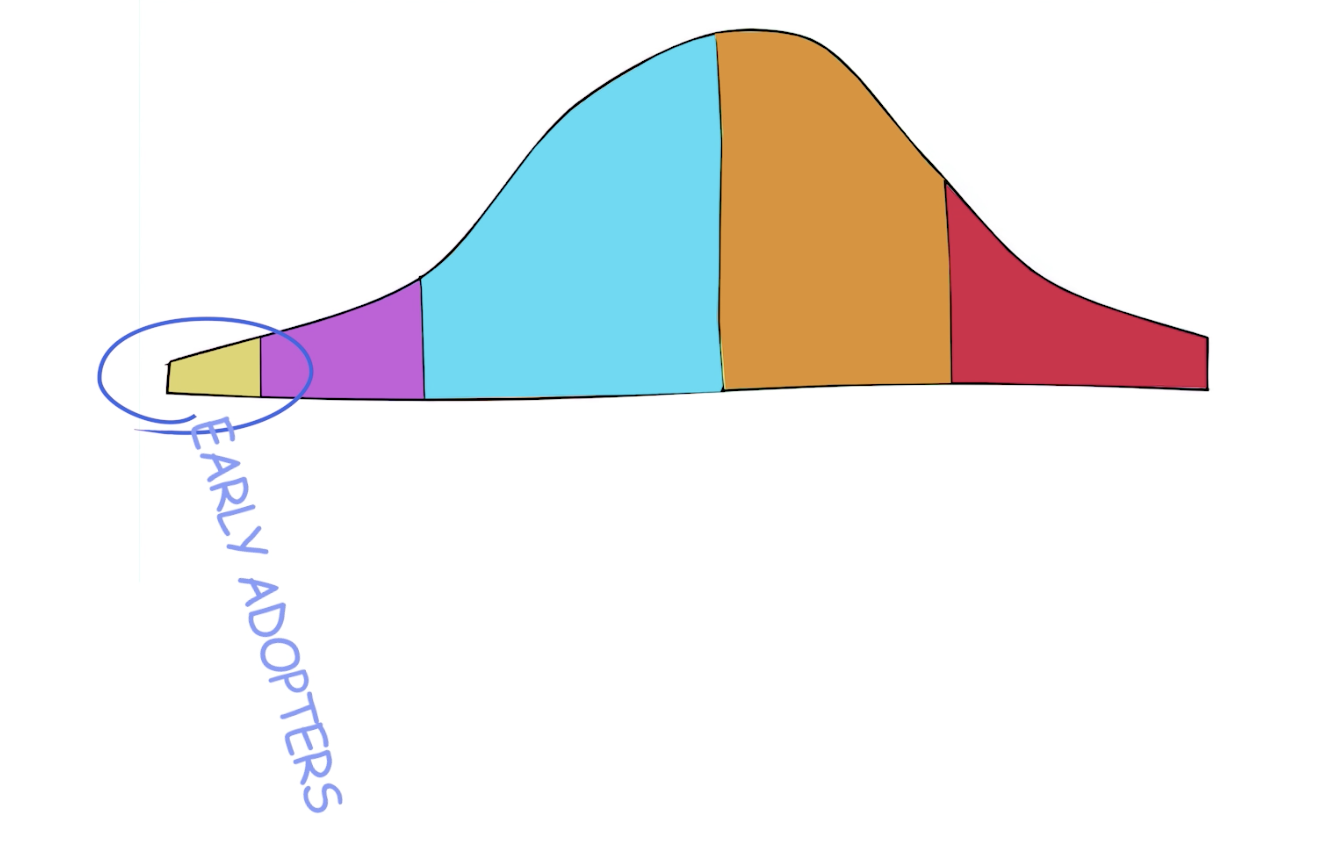

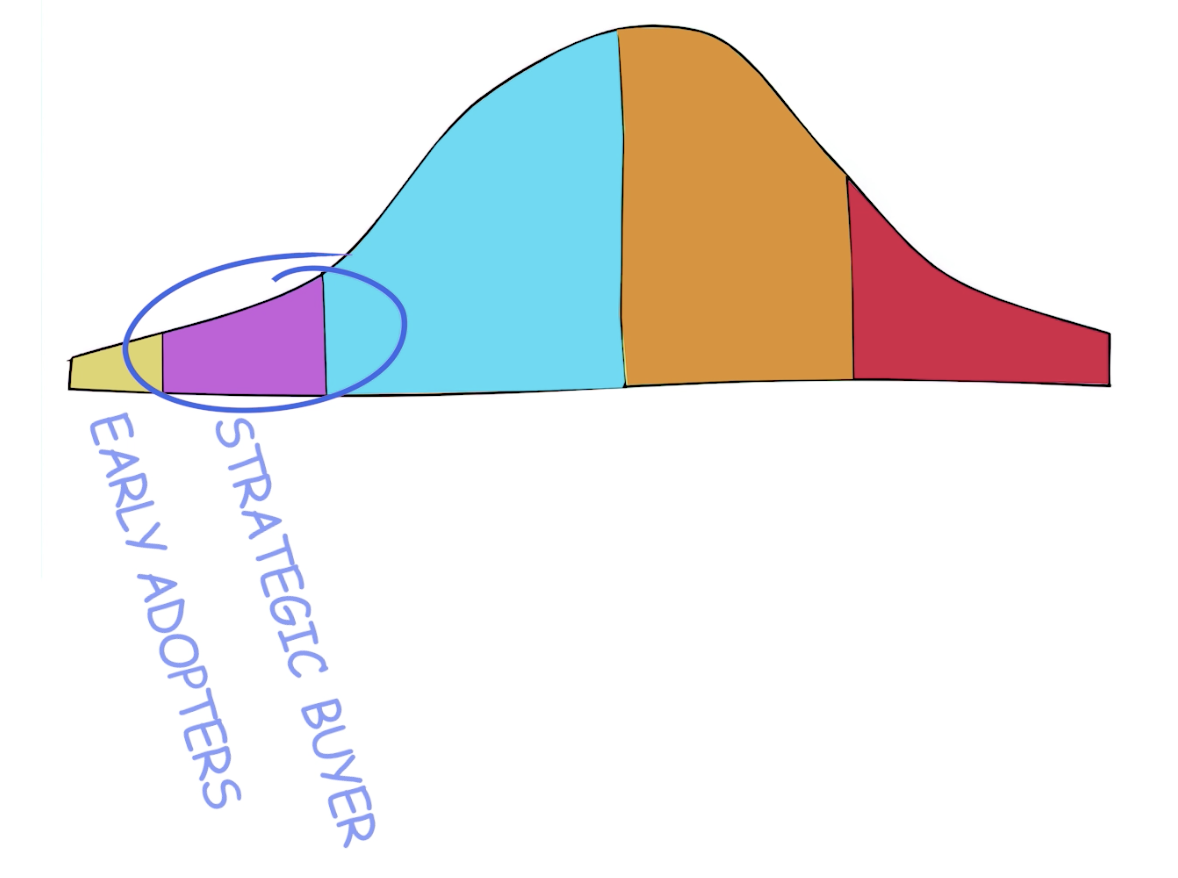

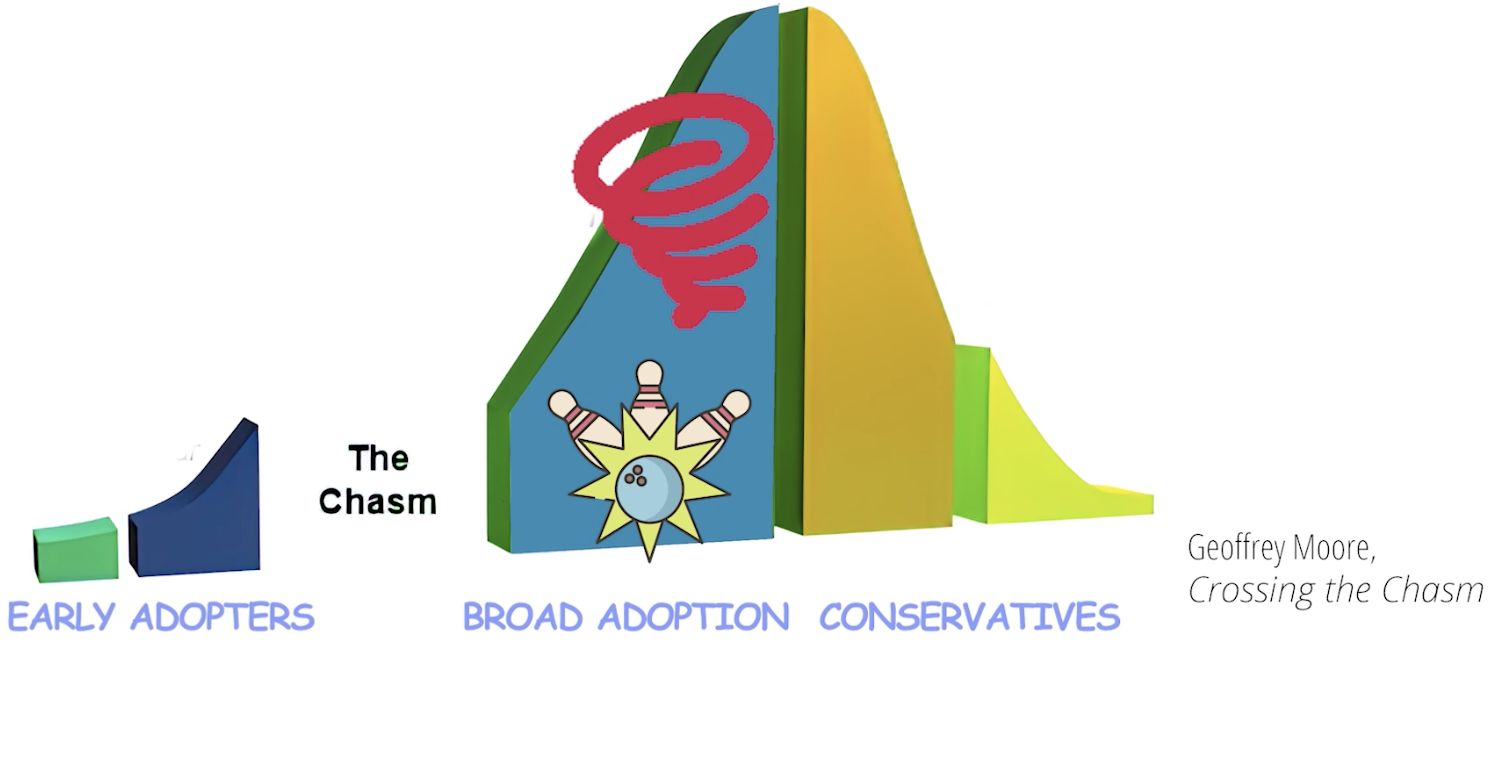

Riggs: I wanted to talk briefly about customer types. Right now there's a paradigm which is in a book called Inside the Tornado. That book and vision is basically, imagine a snake who's in the middle of eating a big rat. Right? So the nose, the nose, the snake, and it gets really, really big and then it gets small again, right?

Technology Lifecycle

That is the technology lifecycle. All right. Now, at the very mouth of the snake is the beginning of the adoption of the technology. And it's with these early adopters. Generally, they do it for reasons that are not always obvious. You know, like maybe they want to be first on the block, do it or whatever, but these are pioneers. All right. And you market to them a certain way and then it gets a bit bigger.

Strategic Buyers

And now you get to what's called a strategic buyer. This is a buyer who is buying into that technology to get a strategic advantage over their competition. They're investing in this because, and there's many examples out there, but I won't get into them, but so now the marketing shifts to the strategic buyer because he wants he or she wants validation, ROI, you know, lifecycle computations, all those things are important to the strategic buyer.

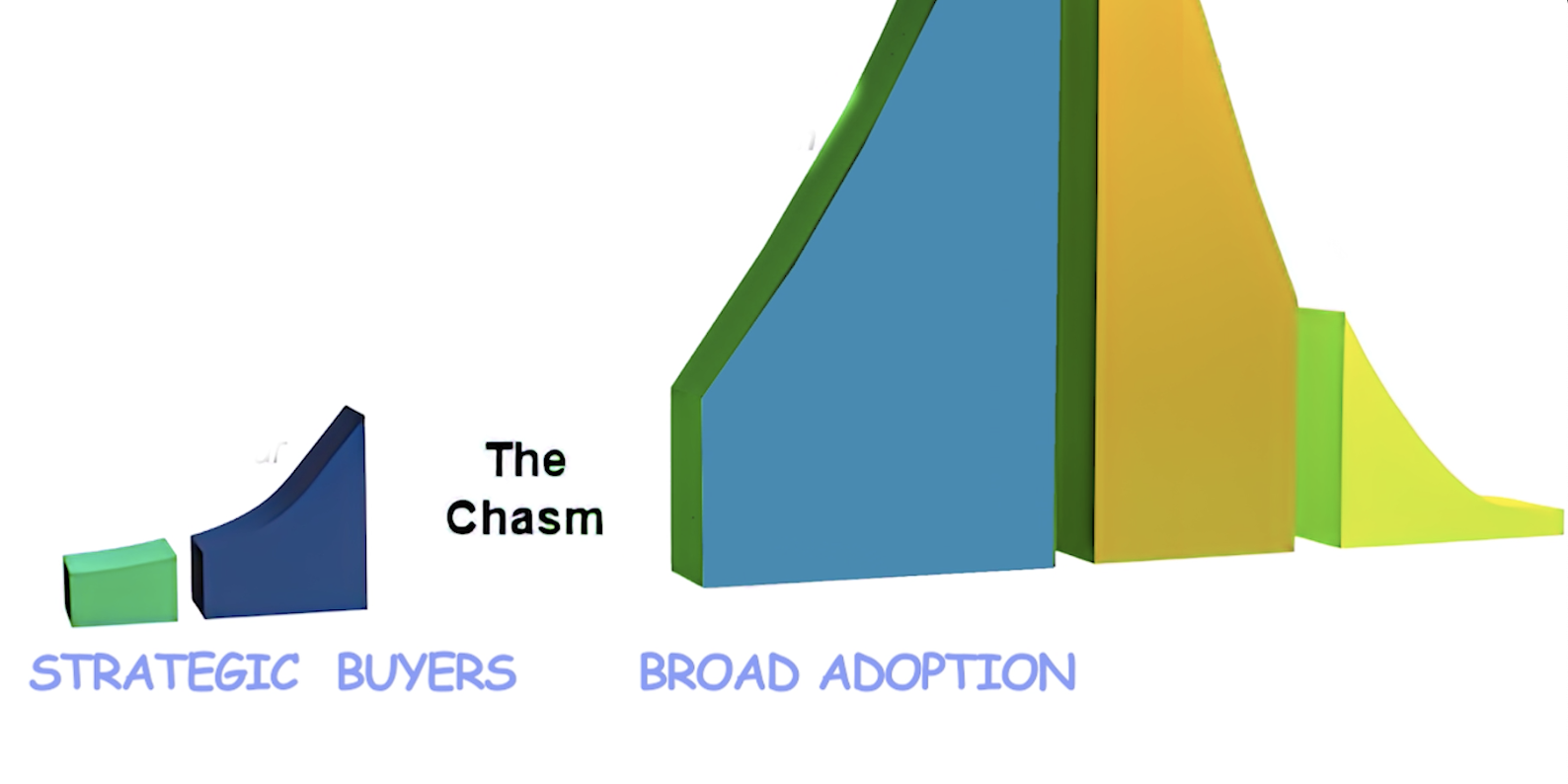

The Chasm

Then you before you start going up into that slope, you have what's called the chasm. This is that Crossing the Chasm is the previous book in that series. But that chasm is where you somehow have to leap from strategic buyers buying occasionally to broad adoption. And the key to doing that, I believe, for us, is going to be that network of operators. Right? Because that makes us more than just a single vendor to a single set of people.

The Bowling Alley

You cross the chasm, now the bottom of that chasm is something that the author calls the bowling alley. The bowling alley. It was very well illustrated by a company called Documentum that was doing document management before document management existed, and they couldn't find an application. And they finally figured out that there was one, which was the FDA drug approval process was 600,000 documents. Boom, they had an application. The drug companies really needed it because keep track of 600,000 documents.

Josh: Good luck.

Riggs: Right. So they got a foothold in the drug companies for document management. And then, so they started spreading, bowling alley, right? And then, of course, they started doing other applications in those same companies. Okay. Now we got the FDA drug approval. What about archiving double blind tests or whatever, you know, different applications. So they both went from company to company, but also from application applications.

The Tornado

This creates enough critical mass that you then go into what's called the tornado, which is that steep slope of adoption where adoption is occurring without anybody questioning it. I was in the computer industry in late eighties when Oracle came along and every new Oracle didn't work. It did not work. If you want to send them to work, you've got Informix, you know, or you got Ingress, but you never got Oracle.

But they did such a good job of getting adopted that. Well, Andrea's got it, Ken's got it. Josh has got it. Well, I'm safe because we're all in this together. And and it becomes, at that point, a race for seats. We're just grabbing seats. The vendor at that point, you're competing with others who by now have started to catch up and you just grab, grab, grab. And that's, again, what Larry Ellison did so well is grab seats, regardless of whether it worked, Just grab, grab, grab. And and it became the dominant database in that case. So that phase is a crazy phase.

Conservatives

And then once you get to the top there, you level out and you enter what's called the conservatives. So the last half of that high tech lifecycle is the people who finally go huh, what? There's something going on, and only then do you market to them.

This is when, for example, the HP laser printer went through this process and then when it got to the top, it was, you know, a portable one, you know, a a green one, a red one, various just different product iterations to just mop up the conservatives. And you get way to the end. And it's like the last adopter is the skeptics. Like, I'll never do this.

Where We Are

And what we are at, I think very much so, is where at the very mouth of the snake. Right? We're right there with the early adopters with, and we need to seek out people who are not themselves conservative. We don't go, well, I don't know. It's like, no, we'll get to you, right? So that we do triage ourselves as to who we go after and then will, us getting to strategic adopters alone is our home run, long before we get into the chasm. Right.

But the idea here, in order to get to the strategic buyer, we've got to have what the definition of a strategic buyer is, whole product. There must be a whole product complete. They won't buy anything less. So that's going to be our goal is, is eat off of the early adopters, like that trailer park, right? People who are willing to experiment and live through it and you know, you need those people to do pilots, right?

And then get past those people and have a whole product that is not defined. It's got the configurator on the website. It's got the, you know, how do we handle the insurance and the risk and the contract and what if this happened? All these things have been worked out.

And I think that that is our horizon. I can't even look past that horizon right now to what could happen later? What could happen later would be amazing. So that's what excites me.

And I recommend the book, by the way. It's a very good read, Inside the Tornado.

Andrea: Thank you.

End of presentation

A Different Company

Riggs: So that was cool. And you know, what's interesting about the whole "inside the tornado" concept is each one of these stages. For each one of these stages, you have to be a different company. You have to literally change the character for the company, for example. We start out with these early adopters who are the the people who buy the latest thing, and they're excited about new, new things. And they're willing to be guinea pigs, right? These are really, really necessary. And for them, you want to be very innovative and give them special, you know, like, you know, front row seats kind of thing. So that's, you know, they like status and so forth.

Complete Product

Now you then move to the strategic buyer. Now you've got to be an organization that produces a complete product. And this is the stage where we're at today with Water on Demand. We've gotten to the point where, actually we're coming out of the early adopters because, you know, we've been playing with, for example, this Pondster™ customer who was very, very helpful. And in fact, we had a big success with them. And they got, believe me, more than the money's worth. And we got a good product out of it that's proven.

And actually, the back story on this is that initially, because it's a very gunked-up lagoon that they have there in Troy and we just couldn't get it cleared up. It was like it wasn't happening. And then so Dan doubled the amount of this extraordinary ceramic material that he uses. And it went boom. It just was mind blowing and it created a whole new standard for cleanliness. And so, yes, we got, I can tell you now, we passed the Department of Environmental Management. The test got passed and it's all good.

Moving Fast

But even more so, we have something world class. So now let's take the Pondster, for example, now this now moves into strategic buyers. Who are the people going to buy this? And they will buy it, as I say — a whole product does it have the, everything working, is all of the different scenarios worked out and so forth. All these things are built into this and that really builds the integrity of the product and its reputation. And this is what's happening with Water on Demand right now. We are in the middle, and I can't get into it, but we're very, very, moving very fast with a partner who is going to help us deliver these water as a service projects.

Remember that currently we only design and build. We're not a service organization inherently. So we're partnering with an organization that does that. We got the cash, we got this organization and we have some potential contracts that were negotiated. So it's all kind of coming together. So I would say that Water on Demand is still in the early adopter stage if you if you want to look at it that way because it's a pilot, but the implementation will put us into the field with something real.

And then Manuel, who you saw at the very left end of that couch, is responsible for building the whole processes in the organization. And he'll, you'll get a chance to hear from him some more. And then that will turn into a real organization. Your investments are making it possible for us to build that. Okay, so that's what that's about.

Three Books

And I personally love that book. And thank you, Keith, "Best explanation ever." Very kind of you to say so. But I really am a strong believer in it. Now, there are three books, I mentioned this in my CEO update that I sent out the newsletter. There's three books that I think are amazing. And the other one that is amazing is the Innovator's Dilemma. Innovator's Dilemma is an amazing book. Clayton Christensen revolutionized how tech companies looked at these things and and I'll get into the third one some other time.

So I'm now going to start talking a little bit about. And Ken, why don't you join me? Because I think this is now going to get us into what you just sent me today. Zero Hedge. Welcome.

Ken: That's my, that's my, my 5 a.m. reading. I opened the thing and I because they usually they usually nail it right out of the gate first thing in the morning.

An Inflation Issue

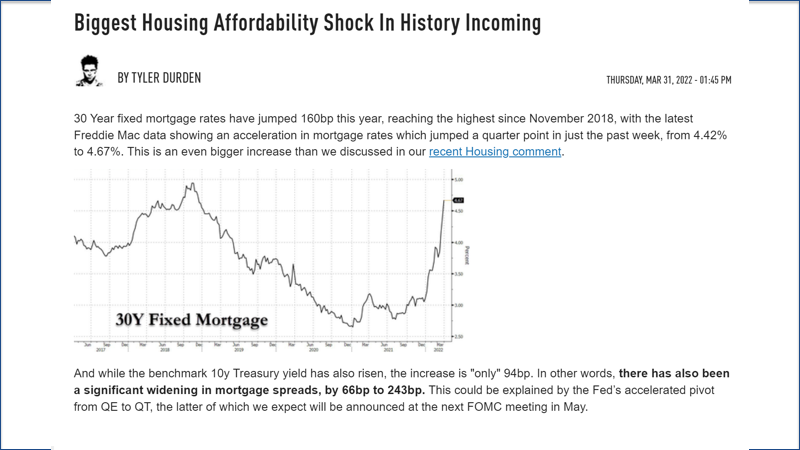

Riggs: So let's take a quick look at this article here that you sent me. So we all know that the mortgage rates have jumped astonishingly and this is getting it really started. You can see right around just before Labor Day, right around August they started taking off and they they escaped the previous high, which had been in April a year ago. And so by December 31st, we were on our way.

Now, what does this mean? First of all, it means that this is an inflation issue. And before anybody says it's the Russians, this was before Ukraine. So Ukraine did not happen until the end of February. So this is clearly something that happened before. Now there is a basically a situation which I'll show in the next page.

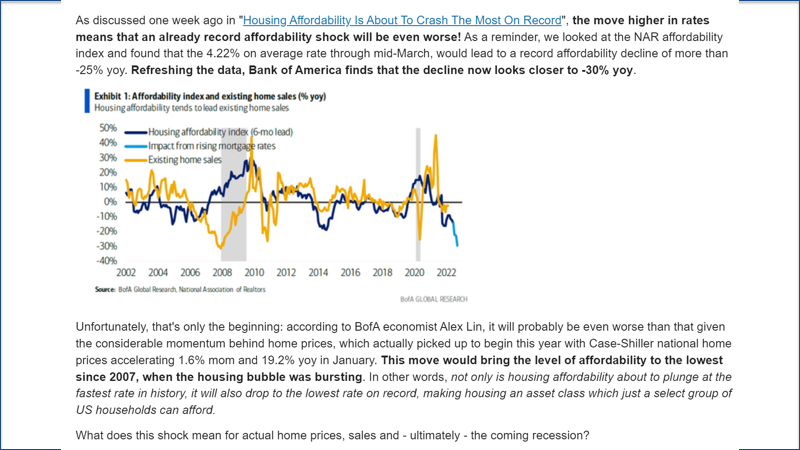

Dramatic Affordability Decrease

This is a scary, scary graph. The far right, you see that light blue trend. There is the impact from rising mortgage rates because you have two problems. Number one, it's not as affordable, right? And number two, the people who are in homes that have cheap mortgages are not going to leave. Right. I scored a cheap mortgage. 2.7 some I think 2.78%, which is actually higher than I wanted. But I got in by November of 2021. And I'm like, okay, I'm good.

Ken: And we both financed like within a couple of weeks of each other, right? And it was like 2.78 and and then we were like, oh, and then you hear it goes down, it goes down a tick. The next week you watch a 160 basis points. I don't know that a lot of people realize. I mean, that's you know, that's dramatic in what a month? And they were planning on as many as, what, six or eight additional rate hikes.

Riggs: That's not even going to happen. Let's not even...

Ken: I hope not.

Trajectory

Riggs: Okay. So this is where this expert talks about the trajectory of existing home sales. So that is going to, existing home sales matches affordability, then we're in real trouble. And now also the share of buyers that were previous homeowners, as I said, slid to 35% from 42%. So it's dropping fast. Now there are positive offsets. In other words, move higher and rates could lead to a pull forward of demand, which I don't get that. But okay, fine. Also shift towards remote work, which means that people are moving from, let's say, New York out to Bergen County and which is lower cost and okay, fine, I accept that.

Land Poor

Now, the other thing is that balance sheets are very high. Net worth is, my God, 800% of disposable income. So people are what did they used to say, land poor. Right. In other words, the English nobility used to be land poor. They had these big old castles, but they have no money. And this is what's happening is people have very high valued properties. But if you can't resell them because, you know, real estate sales are completely dependent upon mortgage rates and. And of course, labor markets booming, etc.. Demographic tailwinds with millennials now in their prime home-buying years. Okay, fair enough.

At the Top

So personally, I think that here's we are essentially at a top we're at a top for real estate. Gold went sky high, but now it's noodling around 2000. It's not taking off. It's like, well, what's going on here? And then we have oil is also kind of like stumbling a little bit. There's so much uncertainty in the markets right now. And, you know, I'm going to be putting my neck out and say that I think that Ukraine will resolve. And I think the reason is that the Biden administration is continuing to see its polls crash. They're like, well, that didn't work. So I guess we'll just kind of wrap that up. So, you know, I think that there's going to be a stabilizing of the world situation soon.

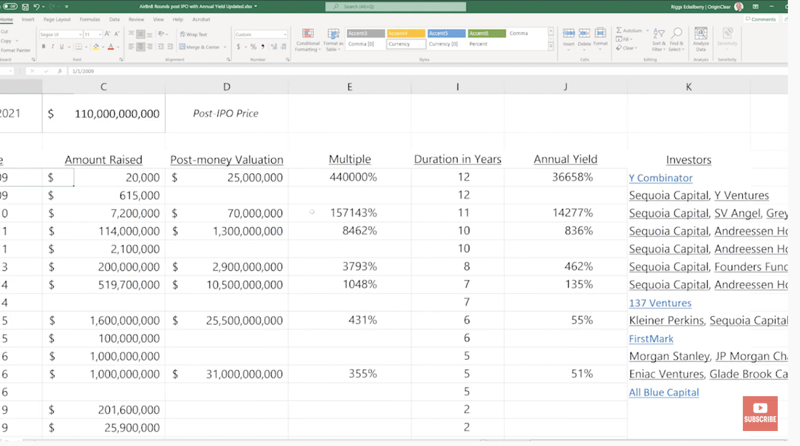

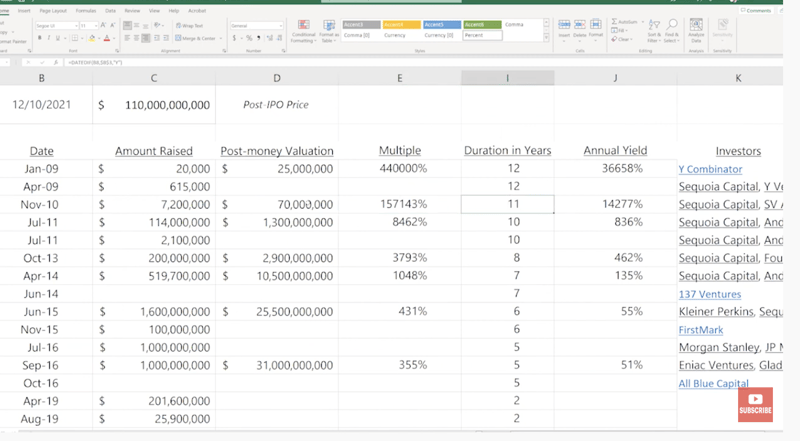

Airbnb Funding

But if people are trying to move from dollars to assets, the question is what do they go into? And that is where we have this Water on Demand, the water asset for the first time. And we I wanted to pull up this spreadsheet. We have two spreadsheets. One is, you guys have seen this before, which is Airbnb funding rounds which I'm going to pull out a bit and then pull back so that you guys can see. Right here, 12 years ago who came in Y Combinator, they came in with $20,000. And these guys this is at a time when Airbnb was literally air mattresses. That's why it was called Airbnb, air mattress.

Ken: They weren't even at the cereal boxes yet, you mean?

Riggs: And then they had this idea of, somebody convinced them to get through to make a bunch of branded, Airbnb branded cereal boxes. And they were touring all of the VCs. And this was more in the the phase when Ashton Kutcher had come in. I don't want to make things too small for people. But if you look here, you've got Ashton Kutcher coming in. What I'm actually going to do here is I'm going to take some of these here and hide them so that they'll come together a bit more. But, so these guys here got an annual yield of 14,000% per year for 11 years. That was the series A.

157,000% Return!

So you have this, the very small seed round of 20,000, which is Y Combinator. Then you have Y Ventures, which obviously is part of the Y Combinator thing and Sequoia Capital coming in. And these guys, it's not shown what they did, but they did very well. The one that we focused on here is where Ashton Kutcher came in because, you know, basically $7 million was raised for 10% of the company. $70 million valuation that was dramatically good, 157,000% multiple. So, you know, that's where you want to come in early.

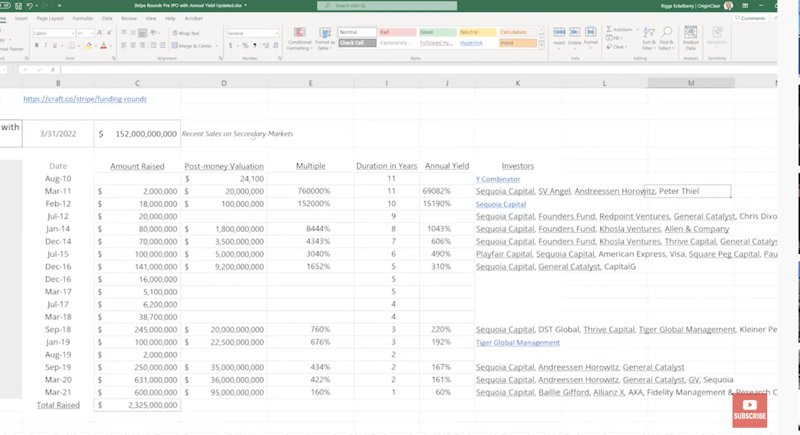

Stripe IPO

Let's take a look at a current hot IPO, which is the Stripe IPO. And again, I'm going to take, get rid of these columns. And this one here, they've been selling stock in this thing at $152 Billion in the secondary markets. It has not gone public yet. And again, Y Combinator came in with 24,000. I mean, think about it. These guys come in with tiny amounts of money and Lord have mercy.

Ken: I mean usurious, absolutely usurious multiples.

Riggs: No, it's capital. It's capitalism, my friend. But look,

Ken: I get it, I get it.

Riggs: In this case, we had Peter Thiel come in or Thiel. And this was, this seed was very, very strong. $2 million. But here again is the series A, Sequoia took all of this. Notice how Sequoia is in both of these. And then we get into a lot of others down the road. Now the multiple. Go ahead.

Venture Capital Rounds

Ken: But, the Thiel round was the first VC round that wasn't some immediate like, like jumpstart incubator. It was kind of real money, right? It was. It was $2 million. Right.

Riggs: For 10%. Exactly. Very similar to the $7 Million for 10% of Airbnb.

Ken: Right. And I believe that the Thiel round will be $750 million 759, I'm sorry, $15 billion, isn't it? Right.

Riggs: So it's 760,000%. And let's take a look here. One second.

Ken: Well, you have the column. You just hid it.

Riggs: Exactly. I'm trying to bring it up here. Yeah, I know. I'm trying to bring it up. There it is. So, yeah, you know, just 15 billion. No biggie.

Ken: $15 billion.

Riggs: From 2 million!

Life Altering Event

Ken: Essentially what that is, here's what I say. Look, Peter Thiel probably is a third partner in this thing. And look, truth be told, Peter Thiel was a billionaire before he did this. So making $5 billion on this, I mean, it's absolutely wonderful. I'm sure he's happy, but it actually didn't change his life. Right. This is what he does at this point. But look at it like this. If guys like you and I or guys like, you know, the investors out there that we talk to, if they would, there's a reason they didn't let us in, right?

But if they took, if they said, look, I have $1,000,000, I have 100, I have 100,000. Take my 100,000, please? Right? It would be $750 million right now. So whereas it doesn't change Thiel's life. 100,000 turned into 750 million is life altering. Doesn't matter who you are. The problem is the reason they go for these kind of big money is $2 million is a rounding error to Peter Thiel, you know.

This is at a time when fintech, it was really an idea. I mean, none of the processes that are in place today, the technology processes were in place back then for Airbnb or fintech. So it really was kind of a jump start thing, right? So they could have lost it all. But the idea is that getting involved in the VC round, if you actually can get access, is the one where you could confidently do ten of them and one has to work and it just changes your life.

OriginClear as an Incubator

Riggs: So let's, let's, let's really recognize and this is a realization we were having, like at the Water on Demand summit, that OriginClear really is an incubator, right? It is Y Combinator. And it puts, what it's been doing now, and it puts in context my many efforts to make something go, because in an incubator, you're not going to get 100% wins as part of the deal. Right? So if we think of OriginClear as an incubator, then what it is launching as a world brand and sending out to the world is this Water on Demand thing.

I can't say more than that, but we then would want to do the same thing for the crypto ($H2O®) and the same thing for Modular Water Systems™ and even for Progressive Water, which it turns out has patentability for some of their technologies. Right? So we could turn into an assembly line and people owning OriginClear stock would get the benefit of all of these rollouts.

Now, of course, after a while, let's say a company has rolled out, it's spun off, then OriginClear remains with X percent, it's not 100%, but let's say it's 30%, but it's 30%, let's say, and it's totally theoretical and only the same as a spinoff. But in that scenario, you've got a whole bunch of these, each of which you have, let's say, a third of it. It's like when Yahoo! was saved by its 1/3 ownership of Alibaba.

Ken: An Alibaba, right.

Pureplays

There's hundreds of billions of dollars. Right. That saved Yahoo! So I think that's the thing to look at. And this is where it's going to go from now on, is this concept of thinking of OriginClear as an incubator and doing what we call pureplays. Water on Demand is a pureplay, and I think that that's the way to look at it. And it also makes it vastly easier to attract legitimate institutional money because it's not complicated. An incubator is very hard for institutions to look at because it's like a, it's like a shop. It's got a bunch of stuff on the walls and there's some projects over in the corner.

Ken: Something's pulled apart in the corner. No one knows what it is, right?

Secular Opportunity

Riggs: Right. And it's like very messy, but it's, it's giving birth to things. And those things it gives birth to those are going to be institutional grade. Right. And what's even more exciting is as we're rolling out Water on Demand, it is what I would call a secular opportunity, meaning that it is secular in this context means, literally, once in a century. Why? Because how often does a major asset come into being? Probably the last one that came into being was Bitcoin, but that was 30 years ago, right? So now we're...

Ken: That's worked out okay so far.

Riggs: Bitcoin not too bad. Not too shabby.

Ken: Okay. So, here's a good point though, Riggs. Buying Bitcoin at 65,000 people go "bleeh". We're talking about, what about the people who owned Bitcoin at the inception? Do they care that it's 40,000 or 60,000? No. Airbnb, the IPO investors own it like $141 a share. I think that's where it went public, if I'm not mistaken. So it's like 137 right now. So they haven't made any money. Do you think Ashton Kutcher gives a damn who's buying it today at 130? You know what I mean? So those rounds, they forgive all sins, those rounds.

Riggs: So and here's the other thing. Bitcoin had no, nobody believed in it. I mean, I think one guy bought a pizza for what is now worth $160 Million worth of Bitcoin. And because it was 40 Bitcoin, I think it was, yeah, 40 bitcoin for one pizza and it was the very beginning and it was nothing. Right. Well that is where these things start. And if you relate it back to this technology lifecycle, you have an idea of what this could be.

Call Ken

So once again, we're getting a little bit of the late side. I don't like to go much past quarter till the hour, but Ken has a lot more to talk about with respect to this, a lot more. And I'm going to leave it to your imagination.

Ken: No pressure.

Riggs: Chris Worth says, "I can think of 30 to 50 systems in New Mexico." Excellent. Go ahead and send a note to me Chris at ceo@originclear.com and I'll get the team rolling on that.

But to talk to Ken just book. oc.gold/Ken.

Next Week

And next week, we will have that finally that Money Show presentation. Also, you're going to get the the annual report results and it's going to be packed full of information. So don't miss next week. And let's see. Yes, I think it's time to it's time to say goodbye.

Ken: No singing though.

Riggs: Goodbye.

Ken: So I did. I did want to mention that I've had several conversations today where I've really provided a lot more color on this. And I don't want to share too much, but I shared with you the level of enthusiasm. I mean, it's through the roof, right? We had three or four significant new investments in Water on Demand today. Just by having a conversation, you know, they're really getting it. So I'm excited. I'm really excited about the direction we're going.

Riggs: Well, it is going to be a single thing, single brand, what we call a pureplay. And I will let your imagination take you where it will go and Ken will be happy to imagine with you. Let's put it that way.

Ken: Or validate.

Riggs: Good. Anyway, so thank you all. Thank you, Ken. It's been a pleasure, Andrea. As as I noted, is in Italy and, you know, he's. And David Dickerson sent us his name, which is wonderful. But with that, we need a message from David if you want.

Ken: Give him a second to send it, hang on.

Riggs: But no. Andrea is is seeing family in Italy and working night and day, of course, because of the time zone. He's doing a fine job. He hasn't stopped working. All right, everyone, have a great weekend.

Ken: Goodnight folks.

Riggs: We'll definitely see you again very soon. Cheers.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)