Well Michael Burry (The Big Short) didn't figure out how to disrupt Big Water but we did! Hint: It involves a FinTech for Good, with a greater purpose than pure profit… And opens the door to water as an income bearing asset for the everyday investor. With investment banking giant, Castle Placement, as our exclusive placement agent for offerings, can we shift Water as an Asset™ from a government monopoly to the man on the street? Find out in the briefing!

Transcript from recording

Opener

I'm Riggs Eckelberry co-founder, chairman, CEO of OriginClear. The government needs to continue to provide a lot of abundant clean water, but what happens to it after it's used when it's dirty? Do you know that 80% of all sewage is never treated, it's just dumped? That leads to water scarcity, but it also leads to a lot of disease and pollution, the ocean turning into something horrible.

The same time, the cities and counties are not getting the funding they need to really treat the water and so they can't keep up. The solution is let the people who use the water clean the water. Water on demand is investment in actual capital assets that earn income. Sign up to hear my weekly briefing every Thursday night. 5 p.m. Pacific, 8 p.m. eastern. Just put Oc.gold/ceo in your browser register for the briefing and I look forward to hearing more from you.

Introduction

Riggs: Welcome everyone to the Thursday night briefing. It's a super exciting one and I'm happy to see so many people joining right now. I'm going to go right on into it and get this party started.

Water is the New Gold and it is August the fourth. August the fourth already? Yes. There's a new beneficial income asset and it's called water. And that is becoming more and more clear every day that we are the people on the planet who are creating water as an investible asset for everyone. They say, wait a minute, Riggs, aren't you just offering it for accredited investors? Well, well, well, we have plans and we'll be talking about that a bit later when Ken and I get together. But let me get on with it.

In The News

What to Buy

First of all, hey, guess what? New York Post. We were in the New York Post last week and this was an article about what to buy during a recession. And just for fun, I'll show you some of the things that people thought. Walmart because there's always a demand for bare necessities. Apparently Walmart and Marlborough's OC.

So things like Coca-Cola and I don't know when I drink Coca-Cola, it makes me fall asleep. So I don't know why I would buy that. But nonetheless, then the interesting thing is, even though fewer Americans are smoking, they have run a very tight ship.

I don't know. I don't know if I'd buy a smoking stock. But hey. And then the things like CVS. ketchup, things like that. Defensive firms like Procter Gamble, Kraft, Heinz, UnitedHealth, Coca-Cola, CVS, of course. I'm not a big blue tech, blue chip tech stock fan right now, even though it's doing rather well. Airbnb, Netflix and a research firm in the farm industry called AbbVie.

Riggs Quote

But let's take a look at oh, Riggs Eckelberry. We recommended utility stocks, water utility stocks as a great investment option. As we know, water continues to do well. I don't think that utilities, quote unquote, which is our municipals, are in the very long term going to be powerful because we think it's a shrinking space, relatively speaking, but it's still huge and it is also very, very stable. So I made a couple of recommendations. Okay.

FinTech for Good

Moving on, we got into the fintech times as a fintech, as a fintech for good. In fact, and this is one of the most amazing things is that I never thought when we got into water that I would be doing a fintech, like I don't think so. And yet that's how it's worked out. Last two years have been amazing in that respect. Ken and I eventually figure it out? It's the money, stupid.

And as a result, we're listed here, along with Milken Institute, OriginClear, First Wealth. Et cetera. And here's the part that I was quoted as saying, "A fintech for good has a greater purpose than one that is purely for profit. We're not just lending money. We are actually helping businesses and communities take matters into their own hands by giving them that capital. And that's why we have we became the very first water fintech. We want it to take care of the funding and contract management, not just for us, but for the water industry as a whole."

Because, as you know, we're delegating the building and maintaining of these systems to local water companies. This is something that a water company in his right mind would never do. Why? Because they want to build things. The problem is it takes a lifetime to build a global water company. And we got plans to make changes happen faster.

So why not just harness the strength of the existing water industry and be the finance end? And that's why we think it's and by the way, this opens the door to incredible world changing technologies, not words changing and technologies. Although that can be fun, too. It is a fintech for good. All right.

An Income Bearing Asset

And then just this morning, Grit Daily came through. That's a publication for startups. And we talked about our water treatment technology, talking about the 1% recycling issue, which is ridiculous. And then how we are supporting water scarce regions. Water is an income bearing asset. "It became very clear to us that the problem with the water industry, which is worth some trillion dollars yet incredibly slow to adopt new technology, was lack of capital, strangely enough."

Money Shot

And here's the money shot as millions of Americans continue to fight for clean water, advanced technologies remain a key factor for water companies that seek to make an impact. Disruption has come to the water industry and it's high time. Ok, Premier Startup News Hub.

Moving Water West

Let's take a look at a really interesting story that was sent to me by one of our shareholders. The idea of pumping water from the water rich Mississippi over the hump of the continental divide and into the West, it's actually feasible. I don't think it's going to happen. I don't think that we have, we don't, I don't see Washington doing big projects of any kind. It's kind of over.

They they're more about bandwidth or something, I don't know. But the idea of diverting only about 5% of the flow in the lower Mississippi that only flows to the Gulf of Mexico and a flow of 125,000 gallons per second would take 2 to 3 years to fill Lake Powell in Mead, which is pretty decent.

4000 Foot Lift

However, it would be at a minimum 4000 foot lift. That would take care of that gravity push. That's a lot. But, you know, 4000 feet is doable. For example, California to aqueduct lifts the water. If any of you have been in L.A. driving north on the five and there's a big water ladder coming down from the mountain, that is the water that got lifted 2000 feet up over the Tehachapi into the and ends up in the L.A. Basin, which is 2000 feet.

So theoretically, why not? Again, I don't think it's going to happen. There's going to be people complaining, people suing, whatever. Unfortunately, it's a good it's a good idea. But I don't think it's going to happen. We'll muddle our way through some other way and we'll be helping with the recycling. All right.

About Michael Burry

Well, I promised you to tell you about Michael Burry of the Great Short, the Big Short, and that's in this interview. So why don't I go ahead and tee it up for you? I think you'll find it very entertaining. And also it'll give you some good answers as to what's going on. So with that, let me tune it in.

Start of presentation

Mark: Hey, it's Mark the Land with your favorite real estate website, the legacy.com. And my guest today is Riggs Eckelberry. Now not familiar with Riggs. He was once a happy tech executive, taking a software company public and achieving several tech exits during the dot com boom. He has always had a passion for the most abundant but threatened resource on the planet, water.

Now Riggs is the CEO of a public company working to disrupt industrial water. A huge but slow moving trillion dollar global market. He is at the forefront of sustainably transforming the water industry with tech forward solutions, like investing to offset one of the biggest threats to our economy inflation. Riggs is uniquely qualified to disrupt this industry, having learned management, the nonprofit space, captained oceangoing ships and a personal passion for rowing crew. So he really likes water. Riggs Eckelberry. Welcome.

Riggs: Thank you, Mark. It's a great pleasure to be on board.

Mark: Okay. Let's just rewind the tape. What's going on with you and these tech exits. And then you woke up one day you're like, you know what? Let's just disrupt the one thing that keeps us alive. So it's you know, they always think of like the big market. Is there a bigger market than water?

Riggs: There's no bigger market than water and there's no more slow flowing market than water. Everybody thinks water is important, but they're not too interested in the details of sewage.

Mark: Like, why? Why is that? I think sewage would be fascinating.

Riggs: Like, that's that concrete cement thing down by the river that does mysterious things with the water. And so people just flush the toilet and move on. And that actually reflects in the neglect of water infrastructure by our federal government for many years now. It started in 1961 that we started spending more money on operations and maintenance than on building new water systems. And we're falling behind every year.

One research organization Lux Research estimates that it's around $75 billion right now every single year that we fall behind in America alone. Which brings about the problems with Flint, Michigan, and Compton, California, and all kinds of different places. So it was kind of like, well, maybe if we wish for better, there was just no real solution.

Well, we came along and say, okay, there's got to be a solution. And I was eventually converted to this idea that all water treatment is going to go to the edge. People are going to treat their own water. I'm talking about businesses, mostly housing developments, businesses less so individual homes. That's, that's kind of a stretch. The city can take care of that, but it has a hard time dealing because of the broken down infrastructure, has a hard time dealing with breweries that all of a sudden are generating vast amounts of effluent.

And they literally say, no, we don't want your dirty water. It's got to be treated. And all of a sudden that brewery is in the water treatment business, which is that was not in their business plan. So there's a decentralization process going on that's forced by the underfunding of central water.

And what's great about this is if we start having more treatment by the people who make the water dirty, which is logical, then the central systems don't have to do as much. They don't have to do as much heavy lifting. When you think about it, this whole idea of giant central systems is a sort of a fifties Army Corps of Engineer concept.

Hoover Dam, big stuff, right? Those giant empty rivers in LA. Right. Concrete monstrosities. That is passé. You know, they've been talking about building a high speed bullet train in California for years now. It'll never happen. Why? We already have freeways, we'll just have the Google self-driving car and that'll be that, right? Right. Because we have freeways, so. And it's convenient because you can go from your home to your home and that's that.

So, you know, there's a new trend which is away from the huge more towards the edge towards the self help mode. And it actually works really well because you've noticed I think, we've all noticed that there's a trend towards this myth of the global economy is kind of falling apart, right? So the deglobalization is happening and there's a wonderful thinker called Peter Zeihan, who gets it very straight, in my opinion. He wrote a book recently called The Beginning of the End of the World, which is out on Kindle and Amazon.

And he says, look, inevitably things are going to go back to take care of your own self. And so that's happening on a macro basis, planet wide, but it's also happening in cities. We're seeing, for example, that trend by people leaving the mega-cities toward more towards secondary states and cities where life is a bit more manageable, where they can know their friends.

I'm speaking to you from Clearwater, Florida. We moved here in June 2020 from LA because it was not working. La was not coping well with what was going on. And now we have a community, we have friends, we have access to. Somehow, the the food supply chain falls apart. Well, there's fields around here with people selling food directly to us, so it feels more survivable. So there's a trend, I think, in general, of people wanting to have more security, be more survivable. And it also includes water.

Mark: Yeah. Yeah. I mean, you're really preaching to the choir here because we're a land community and we buy and sell our land and we make it a cash flow. But worst case, we could go and do something else on that land and survive on it. So that personal responsibility piece, the decentralization piece, these trends are very interesting and I think ultimately more positive, not just for the individual, but also the the global community. So this is a hot topic and I would just call it the I-word because it's affecting everyone. Inflation. So where is inflation going and what are the threats in your industry with water?

Riggs: Well, because water has been a government monopoly, mostly, that's changing, but water rates and sewage rates have been rising much faster than the rate of inflation, which was already rising. And so it's people don't realize that the water rates are not really regulated and the municipality can set whatever prices they want. And then some in some cities, that's growing quite high as a percentage of people's take home pay.

Now, businesses really are aware of the problem and they well, I'll give you a concrete example. There was a brewery called Russian River Brewery in Sonoma County, very good brewery. And they were being completely taken hostage by the local county, which was demanding huge fees and not really serving them, so forth. And they said, well, the heck with it, we're just going to get our own water treatment system. And they eventually got one that takes care of it all. And now they have control over their water treatment.

And what's especially important about it is they get more than one turn out of their water. Because in America we don't recycle water. And yet we complain about running out of water, but we throw it away. The reason is we have a very antiquated water infrastructure grid that only goes one way from my business or home to the treatment plant to the river or ocean.

Treated, it's not dirty anymore, but it's wasted. America's recycling rate reuse of water is around 1%. Israel is around 90%. So how do we get better recycling rates? Well, we're not going to change the LA sewage system to run back uphill to Glendale to be reused. No, the place to reuse it is right where you're treating it. You have it. You paid for it. You have to clean it. Well, now it comes right back.

For example, in that case of a brewery. They can easily reuse 50% of their water even without reusing it for beer. You know, to wash down equipment for steam vessels, all the usual secondary uses. So that improves their bottom line tremendously. And it also helps with the big water problem which is growing in America.

You know, look at what's happening with the Hoover Dam. The Lake Mead levels are just plummeting. And, you know, it's I don't know if you're old enough to remember that that cartoon where it goes right down to and there's a sign last drop. Right. You know, last drop.

Mark: I do remember that. And unfortunately.

Riggs: So we're coming down to the last drop and there are things that can be done, such as recycling that are not being done. The other big elephant in the room in a place like California, of course, is the big users are not people. The big users are agriculture and industry. And especially in California, you have a $20 billion industry called agriculture, which I think is something like five gallons of water to make one almond or something crazy.

So you have huge amounts of water being used and unfortunately it's a cash crop and it influences Sacramento and kind of stuck in that mode. What can we do about it? Well, we can bring about this revolution of decentralization. Literally this morning we put out a brag announcement. We were bragging because it turns out that several cities in America are legislating, that large new buildings have to recycle their own water. And we're like, Yes.

Mark: Yeah.

Riggs: And we've been doing it and we've been doing this for a long time. So the real thing here is to continue to push decentralization. What are the the weapons we have at our disposal? The first one is we have a product line called Modular Water Systems™, which is these drop in place Water Systems in a Box™. Thank you very much. So that brewery, for example, does not have to have some vast excavation project. They just receive something from a semi-trailer, plug it in and a problem was handled. That's number one.

Number two is something that we started realizing during COVID because we had our moment of truth with COVID. We're like, we've got to figure something out here, because everything, everything was we sort of accelerated. And COVID, every single chronic problem became acute. And if you're going to go out of business, you're going to do it in COVID, right? So we looked at all this we this huge backlog of business and what's going on here, how come it's not going through so slow and turned out it's the money, stupid.

If you can make it possible for Marc, the owner of a brewery to get a water system just by signing a piece of paper. No capital, comes with water experts, fully maintained. I'm like, okay, thank you very much. Next problem, right? So we came up with over time this program called Water on Demand™, which is water as a service. Which is you're now treating your own water. Well, you'd rather just keep paying on the meter, right? Why not? So we'll make it possible for you to have a water system of your own, but you're still paying on the meter, and people are loving it. And it's become a big win for us.

Mark: I love it. I love it. Is Water the New Gold? I mean, why should investors? You know, invest in this because I don't I don't think you can invest directly in water projects, can you?

Riggs: Well, this is exactly the problem. And how many people have talked to me about the big short, you know, and Mike Burry at the end of the Big Short. What's the next thing is going to do? Water. Very few people know the rest of the story. He went on to water. And found that big water is highly politicized, very entrenched. And he bailed.

He went, actually, if you look at what he's done since, he's gone into agriculture, which is an indirect water use, and he's done very well, but he just said, you know what, I can't handle it. So there's this big the world of big water is highly centralized and resistant to change. And it's also a dwindling world because, again, of being infrastructure dollar starved.

The recent $1.2 trillion Biden infrastructure program only gave $55 Billion to Water. That's less than one year's backlog. So it's just not happening. And so water is the new gold, if you think about the coming trend, which is a lot like what Uber did and Airbnb did, which was leverage the asset in a new and interesting way by bypassing the way it's done.

Nobody is going to spend, you know, here in Pinellas County, $2 billion on a new water treatment plant. First of all, there's no land for it. Secondly, what neighbor wants to have a water treatment plant next to them? And thirdly, where is the money? So instead, there's a lot of this self-help going on. And that is that is the new thing.

And what's so cool about it is the big water companies. They're not structured to do it. For them, $1,000,000 project is too cheap. They can't make money. They're structured for these big overhead projects. And so more nimble players like OriginClear. And there's a number of us out there.

The company that did that Russian River project, for example, Cambrian Innovation, is another company like us that does these investor funded water systems that people pay for on a service contract. So we have this new breed of water company that actually solves the whole problem for the user himself. And that, as you say, until now, people could not invest in a water project as they can. Now, with Water on Demand, they can.

Mark: That's amazing. Well, Riggs, this is fascinating. But we are at that point now in the podcast where, and your mentorship has been invaluable, like, I'm really interested in water now. Not that I wasn't ever interested in water because it's just such a big part of our lives. But I was just in Bali and you don't even appreciate just the infrastructure, which granted is not great in the United States, but how much worse it could be and how it could be trending to that point when you go to a third world country.

Riggs: So it's terrible in those third world countries. Forget about it.

Mark: Oh, it's terrible. So. But I do I do want to ask you for your tip of the week. Like a website, a resource of books, something else actionable, the art of passive income, visitors to go improve their businesses, improve their lives. What have you got?

Riggs: You know, there's a great book called The Innovator's Dilemma, which is fantastic. Why? Because it shows how new things arise from the belly of the legacy businesses that basically have blown it off. Clayton Christensen was brilliant. In fact, the CEO of Intel, Andy Grove, read that book and out of that came the Celeron chip because he realized that he was missing the boat. And unlike many, many CEOs, he really did internalize that lesson.

Look at what happened with Airbnb, for example. They did the rounds endlessly in all these VCs said,"Ah, hell with it, mattresses in a loft. Big deal." Right? A few got it. The Y Combinator people made was at 400,000% on their money. It's ridiculous because they said, "Oh, yeah, this is cool." So if you can like see the next trend and go, Yeah, that's something new.

Water, water has been a governmental asset. It's been managed by the government and the big water companies serve the government. It's a whole big mafia. Now it's being broken up and it's falling. It's kind of like going the way landlines became cell phones. It's all being pulled apart and becoming very decentralized. So now it's becoming an asset that can be monetized and that ordinary investors can invest in. Well, guess what? If there's anything that's going to beat inflation, it's going to be a hard asset, not a risk asset.

A hard asset that earns money on money. That's going to be it. And the good news is water is just beginning. It's not way up there like oil and gas is. I can't invest in oil and gas. The slightest news about Gazprom and it crashes. I can't not invest in things like oil and gas that's so politicized. Right. This is true of most commodities. Another problem, right. They were going up, up, up and then demand destruction cut in and all of a sudden they're down.

So why not go with an asset that's not going to crash? Water is always going to be more dirty, it's how it is and it's at the beginning of its run. OriginClear, I'm going to tout OriginClear. We're a penny stock. Not a bad choice if you're going to invest in something is to either invest in the penny stock itself through Ameritrade or whatever. OCLN is the stock symbol or if you're accredited, click on that invest now button on originclear.com and and learn about an asset protected investment that you can make in this new on demand thing. It's this is the beginning of something really kind of cool.

Mark: I love it. It's so cool. And I really like the analogy because you've seen it in so many different places from. From taxis to hotels to. I mean, even just your local UPS store. How long is that? I mean, everything is getting decentralized from the government and or, you know, all these older industries.

And the Innovators Dilemma is a great book to read in a classic and rest in peace, Clayton Christensen, he was absolutely brilliant. So my tip of the week, though, is unlike the innovator's dilemma. Possibly going to make you a lot of money, which is originclear.com. Check it out. And Riggs is really generous with his time and information. Riggs, what do you what do you do on the website with your your talks like a fireside chat about water.

Riggs: So every week, every Thursday night, 5 p.m. Pacific, 8 p.m. Eastern, we do a Zoom briefing. It's about 40 minutes long. You sign up for it. The shorthand is oc.gold/ceo or just go to OriginClear dot com and find the CEO briefing and go ahead and sign up for that. If you can't make that timeslot, of course we send you the replay and every single week we tell it like it is.

I put stats up, I interview people from our organization and I also we do commentary on what's happening out there. We think it's, of course, we think it's a good show, but it's a lot of our investors follow it because as I like to say, we're the most transparent public company in America. This Thursday is going to be number 171 in the series. And, you know, we put a lot of work into it.

You know, there's an interesting thing when you have to talk about the company, you tend to figure things out. I don't know if you've noticed, but when you have to express ideas, you learn things like, Wow, you know what? I just said something that wasn't half bad. Put things together. So we actually ourselves learn a lot from it.

And when I interview people from my from my organization, Dan Early, the brilliant chief engineer of Modular Water, you know, and about that did that a couple of weeks ago. And he showed how those things work is fascinating. We make water fun and and we think it's going to be incredibly profitable. People coming in now are the founders. It's the early stage. So it's I think it's a no brainer. But again, again, I'm the CEO, so.

Mark: Yeah, of course. Of course. Well, you know, obviously do your due diligence, but I do think that it has tremendous potential in the future and whenever you can get access or just awareness of something at the ground floor, and it makes sense to you, it's really a tremendous opportunity. So, Riggs, thank you so much for taking time out of your. I know, extremely busy schedule.

Riggs: Yeah. Do you know who I am? I mean, come on.

Mark: Exactly. Exactly.

Riggs: So it's been such a pleasure, Mark. I love having these great conversations. So thank you.

Mark: Thank you so much. And before we end, is there anything I should have asked you? I didn't ask you.

Riggs: Um. Well, you know, I think we've covered it pretty well. The the interesting thing is that. It really is important for people to look to the things that have not changed a lot. Right, because they will change. Everything is set to change. And I think that's that's the example. One of the things that popped up at us during the COVID was human migration.

We started getting a lot of contracts for housing developments off the grid, trailer parks, etc.. And that, I think is a trend. And we're serving it so that a housing developer can have a community without paying millions of dollars in sewage. And I think that's going to be a megatrend. I think the trend to follow is people moving away from the big cities. Not just water, but all kinds of other things will come out of it, in my opinion.

Mark: Absolutely. And as people move away from the big cities, you, dear listener, in the land investment business, are also going to profit from it.

Riggs: Marc, it's such a pleasure. Thank you. And you know, let's check in in six months or so, see how it's been going.

Mark: Absolutely. Thank you. And let freedom ring. Thanks, everybody.

End of presentation

Riggs: That was a fun show. A very fun show. Mark was a very smart interviewer, and I do well with people who ask good questions. So really appreciate what he did there. I'm going to go ahead and discuss the news of the week and then we're going to kick in the fireside chat between myself and Ken.

A Major New Platform

So here we go with this fascinating thing about a major new platform we named Investment Bank Castle Placement for the Water on Demand offering and what's great about Castle. You see, we're doing really well right now with telling our story. You can tell I mean, on that podcast, I'm saying things that make sense. It took a long time for things to start making sense. And so we tell the story well.

And we just liked the platform because Castle, they're currently raising like $55 Billion right now. This very second, if you go to castle placement, you can look at all the investments and they have a ton of institutional and accredited investors. So they are going to help us fund Water on Demand asset investments.

Potential Long Term Royalties

And here's Richard Luftig, the managing partner. And you can see he's excited to help OriginClear implement our revolutionary pay per gallon water recycling. And investors can invest in water equipment with potential long term royalties, etc.

So Castle is a true broker dealer, which means that we can feed all kinds, this doesn't mean that we can't take investments from our existing investors through other channels. We just send it through Castle, pay a small fee. It's really nothing at all, but it adds a tremendous amount of value in terms of the power of a strong platform that's fully regulatory compliant. And so with that, I'm going to ask Ken to join me. Hold on.

Freewheeling Discussion

Ken: So I am, I thought the interview was great. I don't know. Can you hear me okay?

Riggs: Absolutely.

Ken: Okay. All right. Yeah. I thought the interview was great. I, like the way the interviewer kind of asked questions. He used very colloquial language. Very, very matter of fact. I think that helps. A lot of times finance guys when they do interviews, they, you know, you put on business channels, they use these terms that, all but, except it's basically, look at me, I'm a financial expert, you know. They kind of do that thing and it's like, people like, "What?". You know. So I like the way he conducted that.

What I would also say. What excited me and I'm getting tremendously positive feedback about the castle thing is is that we are now, like you said our story we've always known what we want to do. The ability to explain it to somebody else in a few minutes or less was always the challenge because it was very complex. And we've distilled this down to this pure water, Water as an Oil Well™, you know, basically the The Clean Water Innovation Hub™.

Transmitting Our Voice

And I honestly think that later that becomes a bigger deal. Right. Right now, it's there. We've got to focus on job one, Water on Demand. But that innovation, that water innovation hub becomes all it's about in a couple of years, especially once we've gotten that first one in, kind of, in the slot. I got a lot of very, very positive feedback. What I would also say is the thing that I find most exciting is there's only one of me.

So being able to talk to an investing audience and start from, you know, "On the first day God created..." And you're literally starting at Genesis in the Bible and then you're going through this whole thing and it's a very, very long process, right? So it becomes a very lengthy back and forth over multiple times and folks love it. Once they get it, they love it.

We now have qualified people that can do 90% of the interpretation for us. They're qualified to discuss this. Platforms are usually like, "No, no, no, no, we're not a broker dealer. You can't talk to us about it. We can't give advice." You know, it's regulatory thing. I get it. It's perfectly fine. We love you.

But it's like I think that investors get discouraged by that. They're like, What do you mean? What do you mean? You can't talk about it, you know? So the fact that we can get professionals engaged in a conversation. Yeah, let me give you a couple of high points for it. Boom, boom, boom, boom, boom.

And what we'll be able to do is basically transmit our voice, what we've developed over this past two now, two long years and be able to deliver about 90% of that message to the entire public, where then engagement with management will be just answer a few final questions. It will enable us to be extremely efficient in being able to enroll the early players into this founder's round, and I think it gobbles up the founders around.

Founder's Round Will Go Quickly

Riggs: 20 million is going to go very, very fast.

Ken: Much faster, right.

Riggs: Like we're going to be able to start devoting more and more percentage to the water equipment capital, because what we're doing right now in order to take the percentage for ourselves is we're actually giving up profits to the investors in order for them to get 25% of the entire investment. Right. We're actually literally giving them our share of the profits. Well, we don't want that to go on for a long time. The good news is that rapidly it's going to be become primarily about the capital investment. I wanted to share an example of one of the pages.

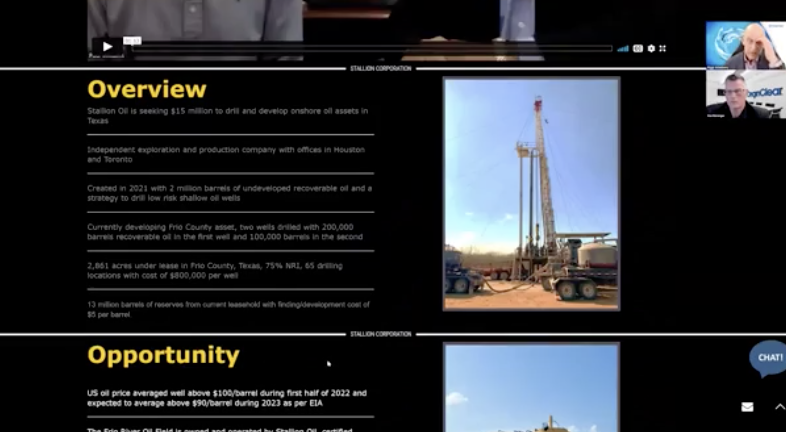

Here is Stallion Corporation.

Ken: Yeah, I love this one,

Riggs: There's a data room so you can schedule management call. That's where you would come in. There's the data room is behind firewall, which means you have to sign that NDA, etc., etc..

So and then just, you know, there's a front video here, there's a whole overview. This is very well organized, very, very professional. It's cleanly done and in a flash you get an idea of what it's about. So they've done a good job. We like them very much. And in fact, weirdly enough, I knew one of the founders, right?

Ken: Margolis Yeah, yeah. That was very.

Riggs: Margolis In the dot com. We were part of the what was called in the Old Timers Network. Yeah. You realize I'm an old timer, right?

Ken: You know who I am, right?

Riggs: And I'm an old timer.

Massive Audience

Ken: Yeah. Right. So so to that point, what I, you got to remember, everyone sees things through their own lens. I go, wait a minute. I don't have to do every single bit of lifting every minute of every day. That was exciting to me. But the efficiency of being able to deliver this message to a broad based audience of advanced and sophisticated investors, 600,000 accredited investors is more than even I can talk to. I mean, and I can talk, right? So that's, you know, that's fun.

But it's it's this massive audience. And and I think that we'll quickly go beyond the sophisticated high net worth investor to the I think the 64,000 institutional investors is really where I think this ends us up much, much quicker. We're already talking to them from the London Forum, and I believe that as this gets going, here's what I also like. Did we talk about the regulation A you did mention it?

Regulation A Offering

Riggs: Well, I teased it. Let me just fill you guys in, because Castle will also host the Regulation A offering. We are now working fast. We have a draft of the Form one A, which is the registration form. We've cut out a lot, there was a lot of noise around the audit and this and it, the usual noise. So the audit is going to get done in the second half of the month because 15 August is when we file our Q, we're on schedule to do it and some very good news coming. I can't say more on that.

But in the second half of the month we'll get the audit done on Water On Demand. So, I expect to be able to file the Reg A in the first part of September. Hopefully the SEC will give it a rapid pass and we'll be up and running in September. That's going to be huge because it's going to make things much more efficient. And it's also my dream is to let everyone participate.

Ken: Sure. Sure. And you know what else it does? Because the Reg A can run in parallel, we can get to a place where all of the capital we collect in our Regulation D offering can be capital equipment. All of it. Right. The Reg A, I mean, look. KnightScope funded the entire company without a single rich guy. Right. It was it was just it was Regulation A.

Riggs: It was everybody and anybody.

Ken: I think their average interest was $800 or something like that.

Riggs: The best political campaigns are small investors. And this is the strength. And the more small people get involved, the stronger it gets for the stock. I'm very happy with how the stock is going, but I think it'll dramatic, do dramatic things in Q4 once we start really getting a lot of people participating.

Accredited Investors

Ken: And I and I also believe in your outreach to the average person is much easier to do when you're specifically trying to target an investment opportunities and you're casting a net. And two out of 100 are your, are your audience. There's a lot, there's a lot of overkill there, right? When everybody can participate, it'll allow us to actually reach that accredited investor audience far more efficiently.

And I think with Castle's help, they already have an existing book of 600,000 people that they can have broker dealers, they can have investment bankers say, look, I want you to take a look at this opportunity. All right? I'm going to take you through 90% of it and then we'll put you on the phone with management. That'll be a, that'll be a great process. I mean, that'll be a lot of fun.

Multiplier Less Rich

Riggs: And warning, fair warning to all. Because I want to wrap it up. Is that multiplier, that's really rich right now, the 165%, which normally would only be for people investing 5 million or more. It's going away.

Ken: Yeah, I kind of told a couple of people that we were going to try to wrap that up next week.

Riggs: Well, Castle, what we're going to put on Castle is not going to be 165. Castle is 150, and then over time, it goes down to 100 over time. So now's the time. You know, I'm going to just give everyone the contact info for Ken and then we'll wrap it up. Here you go.

Call Ken

Ken: Oc.gold/callken.

Riggs: Thank you all. It's been amazing, as usual.

Ken: Goodnight.

Riggs: And I'll see you next week, I promise you another exciting briefing. Don't miss it. Have a good night, everyone. Thank you, Ken.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)