With rising water rates forcing businesses to treat their own water and supply chain disruptions driving demand for Made in USA… Where does Water on Demand fit into the picture? Morgan Stanley's deep dive into water was alarming…what can we do about it?

And are those other companies, like us, competitors…or are they actually potential partners? Find out here in the replay!

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

And welcome everyone to the CEO briefing and. I have with me the infamous Andrea and Ken. JRW, "Hey, greetings, everyone. Looking forward to more good info tonight. Thanks for your good work." Well, thank you very much. Water is the New Gold Thursday, February 24th, and we have this water is becoming more and more interesting, I've been getting interviewed for various publications. It appears that water and war is a topic and who knew, right?

And my main opinion about the dangers of water and war is, we know the physical dangers. But there's a new 21st century danger and that is cyber attacks, which I covered last week, and I'm continuing to comment on that in the press. And Michael Kyle says Thanks and thank you.

Of course, you have the ability to listen in Spanish. Just click on the globe symbol.

Let's continue. Yes, the forward looking statements mean that we are always have to hedge our statements because we're a public company. But we do our very best to get it right and we correct it when we don't.

Current Capital Status

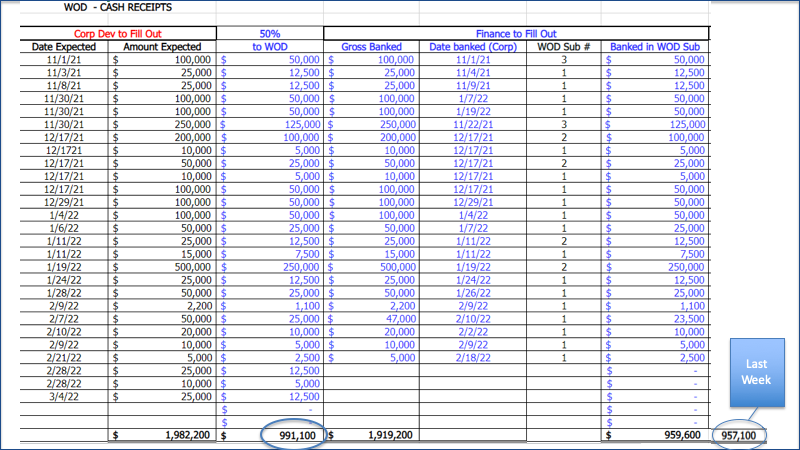

All right. So where are we with capital status? We are inching closer. We are like eight thousand nine hundred dollars away from being in a million dollars.

Actual banked is nine hundred fifty nine thousand six hundred. So we're clicking along here. There is some larger stuff coming, but it appears that we will be very shortly at the million dollars, in which case we will be announcing that, as you can tell, we're, you know, we've made it very challenging for ourselves, but rightly so because for every dollar that we raise, 50 percent goes into water equipment. And so that is very powerful because as we continue to scale up, we'll end up with all these investable assets. So it's really, really powerful and it's something that we could only do really once we got really, really strong.

Ok, now today I talked about supply chain delays. What's up with that? So let's take a look at what Morgan Stanley is saying about that and this is the link right here. Slash ideas, slash supply chain disruption. So you can always take a look at it yourself. So what's going on with global supply chains?

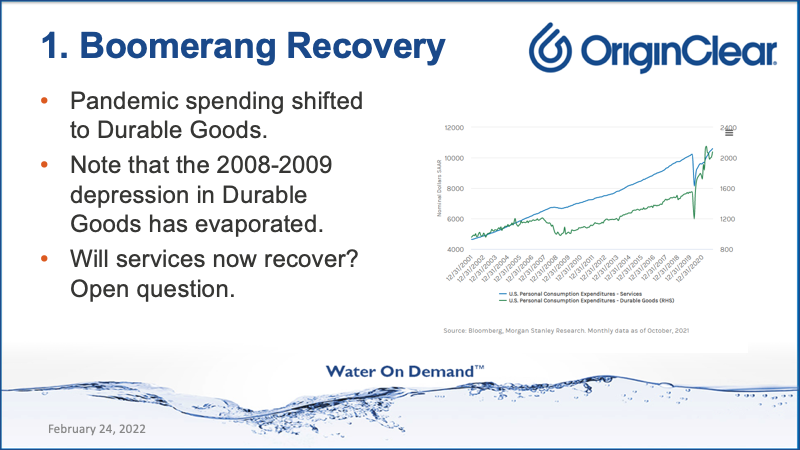

Well, the first thing we know is that there is a boomerang recovery, and this is a really interesting graph because you notice how pandemic spending shifted to durable goods and it actually overtook services for a while, obviously, because, you know, closed restaurants and so forth. But here's what's interesting. Durable goods kind of separated from services during the Great Recession and never really recovered until we changed our buying habits in the pandemic.

And that's a really interesting thing. Now our service is going to recover. I think it's a long haul, but it does mean that we are in a durable, durable goods era. And it's certainly reflected in the amount of business that OriginClear is doing with water systems. It's pretty amazing.

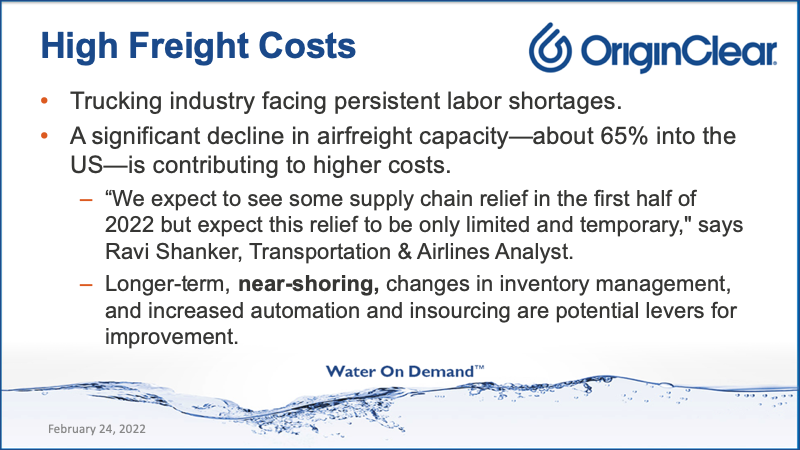

Ok, The second thing is high freight costs, lots of labor shortages. Obviously the price of gas, right? Diesel also airfreight capacity is way down. I have no idea why, and there is supposedly some supply chain relief just by some catch-up happening. Here's the long term interesting thing, and I emphasize near-shoring. We need to stop outsourcing our manufacturing and we're seeing this happen for us. A lot of customers are coming to us because we are made in USA. And as a result, they find it to be more controllable situation.

For those of you who are interesting in the earnings cycle, it's strange because right now it's it's going to be very strange to have not enough inventory, too much inventory. And in this article, it talks about how semiconductors and tech hardware are the most exposed, industrials are better off. All right. Ellen, thanks for raising your hand but the best thing to do is chat, do a chat and then we'll be happy to address your questions.

Supply Chain Disruption

Ok, what's our experience? Well, at the Monday meeting, Marc Stevens told us, he's the president of our division in Dallas, and pumps are now 17 weeks for certain key models, the longest he's ever seen.

So we're actually, said, "OK, guys, let's help you buy do some advance buying." Now this is the ironic part. Obviously, if everybody starts squirreling away inventory, it's actually going to worse and worse supply chain disruption. It's kind of like a game of musical chairs, right? But now the strength of this business that we have, and we just literally looked up the booked orders as of Monday and as combined Progressive Water treatment and Modular Water Systems, we have a bit over a month left to go and we're well ahead of our normal quarterly run.

So we think that it's because people have a use it or lose it kind of attitude. Things are going to get more expensive. They got their budgets. Do it now. And I do want to make it clear that booked orders are not revenue. It does take several months to fulfill. I believe we will have some good news for you from the annual report, but I do not have final numbers. Still waiting for that? But it is starting to reflect. I told you that last year we went over $12 million in booked orders. How much of that reflected in the same year? I really can't say, but it's most of it will start reflecting in 2022 and 2023. So that's the situation with supply chain.

I would say that we are in trouble for supply chains because now of course, we have war or we don't know what's going on. I don't have a position on the war, but what's for sure is that Russia is a very large exporter of oil and gas. And know if Germany stops getting gas or oil, then it affects all supplies because oil is what they call fungible. You can interchange an oil scarcity, and Singapore is reflected in New York, and this is how it is.

So I think that we're going to see a lot more inflationary pressure and that is going to lead to more people getting into assets. It's going to drive short term. Obviously, the stock market will love it because apparent sales will continue to grow, but it's also going to hit earnings because life will get more expensive for these. And what's going to be hit, of course, is the consumer's pocket. So as I covered a couple of weekends weeks ago, we're going to have a combination of inflation with deflation because the actual demand will not be as strong due to historically very low growth in population over the pandemic.

All right, enough of that, let's talk about the deep dive that I promised you again based on the Morgan and other Morgan Stanley article. And basically, there is a gap between the water that is available and what is needed. A. 40 percent difference is huge. This is going to a be a big problem and B. Is going to push a lot of demand for water. And behind that, of course, is water infrastructure.

Rising Rates Driving Businesses

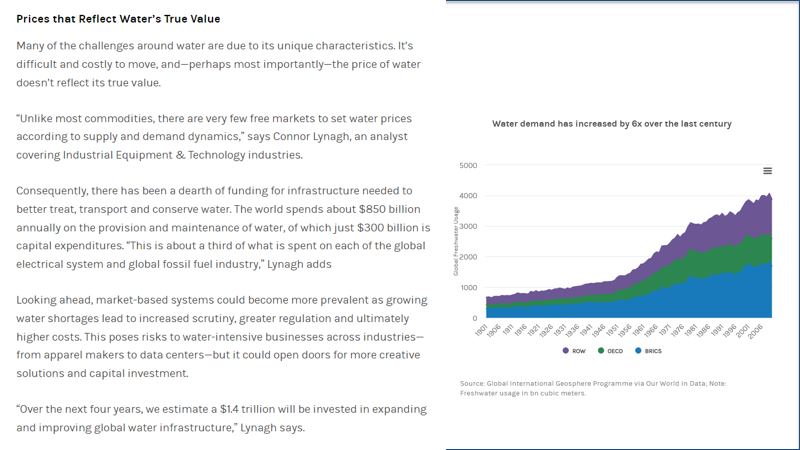

Now let's take a look at it now. First of all, water demand has increased tremendously. And you know, we have the various parts of the world that, you know, definitely the blue is is the strongest growth and. That is, of course, Brazil, Russia, India, China and South Africa. And so they seem to have a lot of growth.

Obviously, China is the big one. Now here's the thing, as it says in his article, there are very few free markets to set water prices, and this has led to a lot of distortions because as lack of free markets, water prices are not being priced, proper water rates are not being priced right. There's a lack of infrastructure spending.

Now we're going to see market based systems that are the next to last paragraph here. Market-based systems could become more prevalent as growing water shortages lead to increased scrutiny, greater regulation and ultimately higher costs, and that will lead to risks for businesses. And this is what we've been saying all along is that water, rising water rates are driving business users to do their own water treatment, which is the business we're in. One point four trillion dollars over the next four years will be invested in expanding and improving global water infrastructure. Very interesting. Ok. So it's a growth. We're in a growth business for sure.

Huge Industrial

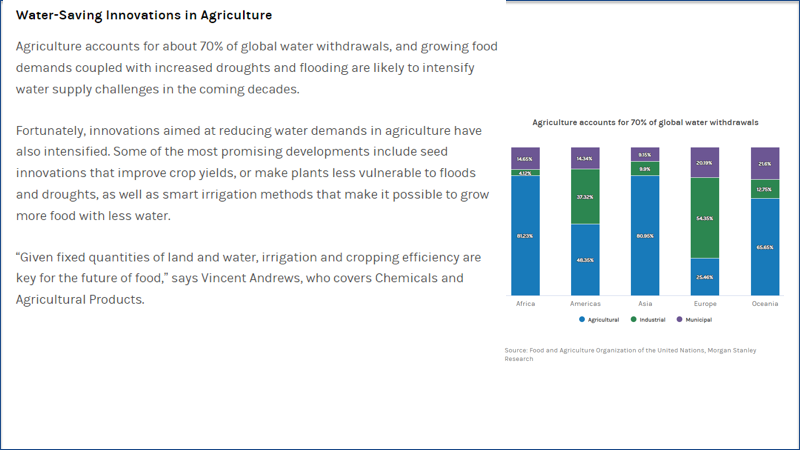

Water saving innovations in agriculture now, 70 percent of all water is agriculture. And then, as you can see on the graph on the right, obviously Africa leads in terms of agricultural use. But the municipal that is you and me, that's people just using personal stuff, you know, homes, apartment buildings, et cetera. If we look at, for example, the Americas, we see that actually agriculture and industrial are almost the same about, you know, eighty five percent something like that. So but agriculture overall is huge.

And what is being done is we're going to see a lot of smart irrigation methods with internet controls and so forth. That's simply of interest, but it's surprising. We always think of agriculture as being, you know, by far the biggest. But that's only true in Africa and to a certain extent in Asia. The Americas, Europe and Oceania, well, I really I would say the Americas is the one that has a huge amount of of industrial and Europe even more. Ok, so I guess the more developed you are, the more the greater percentage of industrial usage of water you have.

The Space We're In

Ok, and they mentioned a couple more areas of benefit modern metering to track water use. And we've seen that happen a lot and that is directly related to our Water on Demand initiative. And I think desalination of seawater is also going to be vital.

Robert Baxter says, "Can I review and send to a friend?" Absolutely. You will get a link for the replay, and you can share that replay, please do. And Darryl wants to know, "How is OriginClear poised to capitalize on urban vertical farming, it can be combined with urban wastewater issues for a double win."

Wow, that is very powerful. And I would say that we are not currently playing in that game but I think it's really, what you've got there is really, really interesting. There's some very innovative techniques for treating wastewater combined with the, you know, creating, for example, fertilizer and so forth for the farming. So interesting stuff. We're not currently in the space, but we're looking at it for sure.

The spaces we are in are, you know, more in the area of local businesses. That's the number one thing where there's, you know, businesses that have a need, for example, RV campgrounds. Perfect example of a business that tends to be disconnected from the sewer. And we do a lot of that. We also have been doing a lot of small cities. We're very good with that.

Bottom line now, this is very interesting because businesses are rethinking their water use. Agriculture may be one of the biggest uses of fresh water, but the growing water crisis will no doubt require virtually all industries to rethink their water use. So what that means is watch out for the water pricing, and this is again why we believe that you need to, that businesses need to control their own water pricing by doing it yourself, and they are going to have to get serious about water recycling, which is us.

We don't really get into desal. We do desalination on order, but we don't have a formal product line for it. All right. So pharmaceuticals, beverages, semiconductors, apparel and data centers are big users, and they're very affected by that water supply.

Reviewing Our Competitors

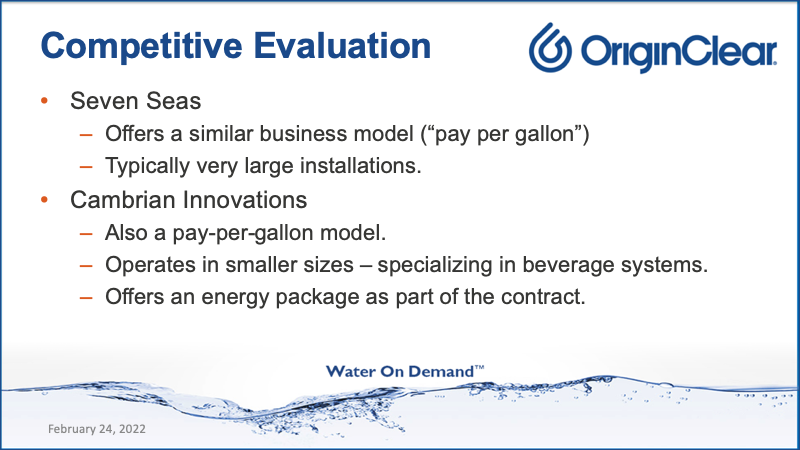

Ok. The next thing I want to go over was, you know, when you're doing something new. The worst thing you can be is the only one in the space. It really helps to have competitors. So we have competitors, and I thought I would spend some time taking a look at who they are. There's basically two major competitors that we know about.

Now, every water company does things called DBOO — Design, Build, Own, Operate. But these are the big, the big specialized players, the ones that do only that. Ok. The original was Seven Seas, and they were they were acquired by Aquaventure Holdings, sold to Culligan for a billion dollars. And they like to do the big desalination plants for the Bahamas, Bermuda and so forth.

And what they are is basically a large scale private utility. And what are their selling points while here they say right here, no upfront capital, the end user can get rid of the existing stuff and rebuild with water as a service, much more reliable, simplify and reduce costs. So the same thing that we're saying we can do for customers is what they can do.

Now, they have a very handy comparison matrix, which I think you'll enjoy. And Yen Chang says, "Please email me the links for today's and some previous talks." Absolutely. We will be happy to take care of that. Kevin will take care of that.

Competitive Matrix

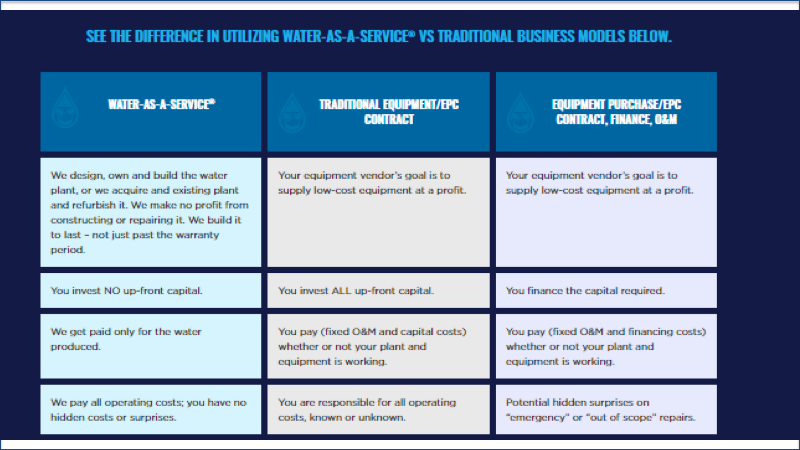

Ok. Let's take a look here, then at that competitive matrix. So far, left is Water as a Service, which is what we do, Obviously. And you know, we design, own, build, et cetera,.

EPC is engineer, procure, construct. I had to look that up. But what you've got here is we design, own and build, whereas a traditional engineer procures and constructs. The equipment vendors goal is basically at odds with yours because they're trying to make a profit. Same thing for, even with where they do the outsourced treatment of operations and maintenance. They're supposed to service you, but they also are trying to make money.

All right. Water as a service; no upfront capital, we get paid only for the water produced, we pay all operating costs, you have no hidden costs or surprises. And then we have also guaranteed performance, responsible for all safety, environmental and regulatory compliance. You sleep easier and our design and operations ensure low lifecycle costs that are stable and predictable. This is exactly what we're saying also.

Ok. This is the water as a service model. You notice we never say Water as a Service® because it is a registered trademark of Seven Seas. So that's why we do Water on Demand. That's our brand. Ok, so that covers, you know, Seven Seas. But also the general category of this water is a service versus these other things, which are pretty obvious. Basically, these other two categories, you're basically on your own.

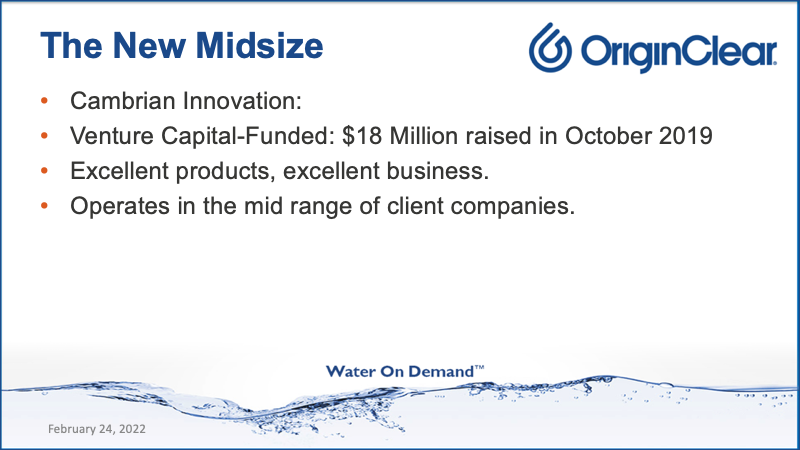

All right now, we have a new mid-sized player, Cambrian Innovation, they're venture capital funded, and they're really a great player. We admire them tremendously. They run a good business and they operate in a mid range, for example, breweries.

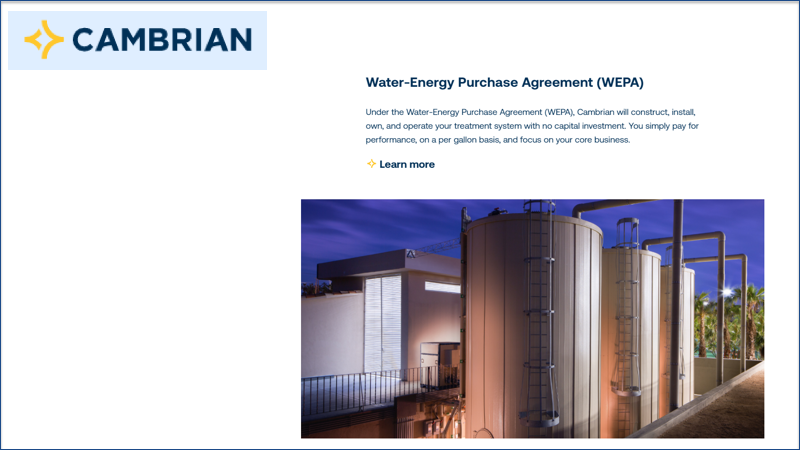

And just like what we said here with Seven Seas and Water on Demand; construct, install, own and operate your treatment system with no capital investment, you simply pay for performance on a per gallon basis and focus on your core business.

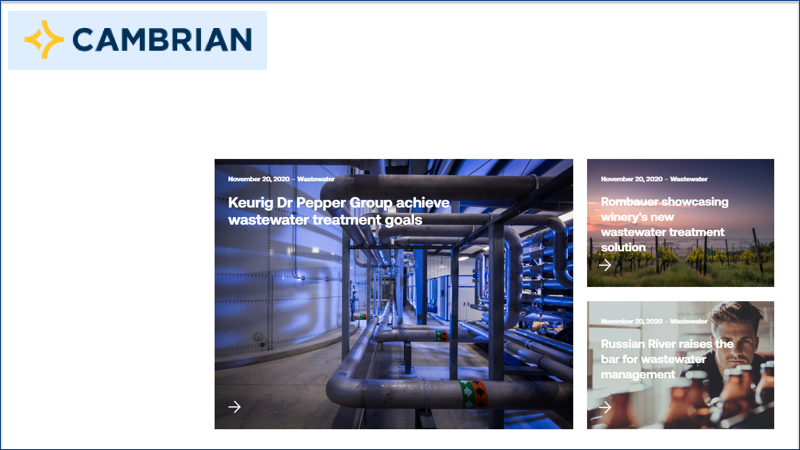

Now what's this Water Energy Purchase Agreement? Well, that's actually a special thing that Cambrian does, but as you can see right here, here's some of their successes with wastewater treatment for mostly beverage companies, winery, beer and a, I guess, soda beverages. Ok.

So the evaluation basically is Seven Seas offers, again pay per gallon, very large systems, Cambridge Innovations pay per gallon specializing in beverage systems, and they offer an energy package.

What they do is they basically have to generate energy. Which I'm not sure how many of these they actually do, but they offer it on the product line. We think that is going a little bit too far because it's a focus problem and you just want to do the water treatment, right? My opinion. But that's just a difference in approaches. All right.

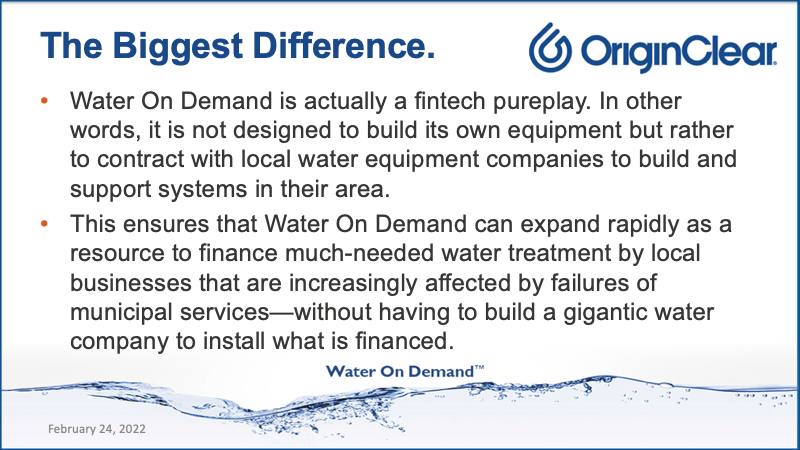

FinTech Pureplay

So this here, what's the biggest difference? Well, I wrote this today for an article so you can see we're a fintech, pure play. Fintech is any startup that is financial technology and pure play means it's only that. We're not designed to build our own equipment. Our plan is to contract with local water equipment companies that can build and support systems and that allows us to expand because we don't have to build a gigantic water company to install what we financed.

You can finance things a lot faster than you can build them. That's the truth. So what we do is we're going to do a lot of financing and we already are, and just farm things out like crazy.

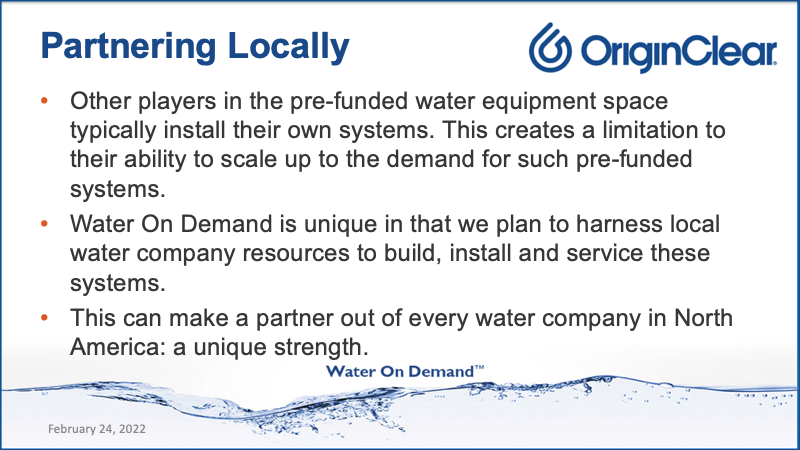

Never Compete With Your Natural Partner

Local partnering, we plan to harness local water company resources to build, install and service these systems. This can make a partner out of every water company in North America, and we think that is a winning thing. One of the things I learned in the .com era was, an important rule, never compete with your natural partner. So if you've got a partner in the channel, don't try and undercut them, and we think that this is a positive thing to do.

Our Space

All right. And I have some more on the chat line here. Ok. Yen Chang wants to know about home water purification, and we actually are do not operate in home water purification because that is a completely different scale. We stay in business, which is actually, you know, business and agricultural use is eighty seven percent of all water treatment. So we don't need the remaining 13 percent.

We're good with staying in business and not having to compete with the guys like like Fuji and other major players. So that's what that's about. We're very happy with our positioning in that we have other players who are very good players, but they always want to do it themselves, and we actually would prefer mostly to farm this out.

Now, one of the big reasons we did this was because our Dallas and Virginia operations were just completely slammed and they are just booming and they're barely keeping up with the demand. But even after they catch up and and we continue to build them out, I'm sure we'll give them some work, but we'll treat them on an arm's length basis as just being another water company. We don't want to try and keep things in-house because I think we'll miss out on the big expansion.

SEC Crackdown — What's the Issue?

Now, I also mentioned in the CEO update that is an SEC crackdown going on on crypto, and I wanted to talk about what this is. This is very interesting and it highlights where we have a strength. SEC, This is came from Jeff Brown, the Bleeding Edge, Brownstone Research. Basically, they came down hard against Block Five for offering nine point five percent interest on crypto and Coinbase tried to do the same thing. Because of what the SEC said, it's not available in the U.S..

Here's the deal. Way at the bottom there. It's a security, the Securities Exchange Commission wants to think of things as a security. Why? Because they are the U.S. Securities and Exchange Commission, so therefore that's what they do. So it's obvious now here's why it's a strength for us. Our water coin $H2O®, which is steadily being registered very successfully as a trademark and we're about to do a permanent patent application, et cetera.

We have the provisional right now, is intended to be a security. Why? Because it carries dividends. And there's no question that dividends are a security and we're completely reconciled with that. So that's the plan. We're very comfortable with that. And you'll be hearing more about this as we develop it.

Open Discussion

So with that, I'm going to flip into the trio, the notorious, the notorious three. So guys, it just I was all over the place this time with my topics, you could tell, right?

Andrea: I think it was very interesting.

Riggs: Yeah, this fascinating thing is happening. And I think especially the inflation bear is, not to make a pun about the Russians, but the inflation bear is about to attack us with a lot of disruption from what's happening. And I don't think it's stopping anybody in government. They seem to be quite happy to be spending our money, in the cause, the cause of a distant country. But what it does mean is that energy prices are on the way up and we're going to, you know, this is, I believe, driving more and more use of water systems by their self ownership.

Andrea: You know that during, two things that I believe are interesting for us, when the whole situation of the pandemic occurred quite some time ago, Italy was one of the first countries to close and then followed soon the rest of the world and so on and so forth. Right now in Italy, the index that measures the cost of energy and so on is three times what it was before, so it's at three hundred percent up, just right there.

Riggs: Three hundred percent, the inflation?

Andrea: Yep, it's 300 percent up in the cost of energy. So people saw their bill multiplied by three. Um, so and that's just and it's occurring right now, it's very easy to find out if you just go online and check. The specific name of the index is called PUN, but you can just check the complaints and you will find out a lot about it. So it's clear that this wave of information is coming our way. And for those of you that have stocks, you see what occurred in the stock market.

So you know what? It's happening, it's foolish not to act and not to be prepared with an asset class that will, definitely will definitely be a very interesting asset class like water and probably water is the one that is really still, you can still enter, try to invest in the power plant right now, and it doesn't exist as an investment, but you would love to have a power plant as an investment right this second. So right now, water is probably one of the only asset class available, utilities available, like correct me if I'm wrong Ken, but I think that's one of the other ones.

Ken: I would think that trying to chase energy right now is probably not the way to go. You know, I remember I remember when the pandemic first hit and I believe that oil actually went negative. Riggs remember we discussed that.

Riggs: Oh yeah, that was during the pandemic. And then it went into recently into what's called backwardation, which is the opposite example. But the point, the point about water is that it's a category that has not been available for investment. Every other...

Andrea: Yeah.

Riggs: Yeah, I went ahead and put some money into XOP because it's, it's the index, but it's it's already so high, right? You know, we're not going to make tons of money on these things. Because why? Because Wall Street's way ahead.

Ken: That was my point.

Riggs: This is the only one that's wide open for investors and we're making it democratic.

Ken: Right? Yeah, the point was that you now you have to become a world, you have to become a global energy analyst to know how to time the market, right? Who's going to do that? So the average guy is going, OK, I'm still, I'm still stuck, right? And they really don't have access, these traditional asset classes that were affected by hyperinflation and things like, you know, even great things like commercial real estate. You know, IRRs that have been historically in the 10s and 15s aren't going to be that for a couple of years.

Energy is so insane. You know, it's always one invasion away from being a calamity, right?

Andrea: Yeah.

Ken: But here's water, that for the first time, people have the actual ability to invest in, as in, not as an institution, not as a city or a governmental body, but individual accredited investors the way they did with oil for so many years. You know, it was interesting when you pointed out, you know, people that you would view as our competitors, there's actually, they're only competitors in the sense they do something kind of similar, but we do it in a completely different way, right? I mean, Cambrian Innovations raised $18 million in 2019 Riggs.

They're still eating off the $18 million that they raised. In other words, that's how slow you grow when you're self-funding. We could do $18 million in a quarter if we wanted to, right? Because there's that much desire out there for folks like us, accredited investors that go, "What the heck am I going to do with my money?"

So, I think that once this opens up more broadly to the public and the public is aware that there's a safe haven to put your, the money that needs to be generational, and needs the kind of assets... Never go to zero is the thing, right? It needs to be generational type money, but also the excitement of being kind of first. And also having that tremendous upside that comes with being an angel or an early adopter. I think that this is going to, as Andrea very reservedly put it, it will be a very interesting asset class.

Riggs: That's a beautiful thing. Well, so with with that, I mean, we see that water on a macro basis, this whole Morgan Stanley story, is really interesting because it's being recognized that water is becoming a major risk for corporate users. Prices will be going up as as it becomes more market driven. And so therefore, there's going to be absolutely a move towards self-management. I remember a story from the 80s when New York University wanted to do their own power generation because it was going be so much cheaper, and the New York City said, No, you can't.

Ken: Right. It is verboten, right? I know.

Riggs: That's right. And in the, I was an analyst in the the early 90s at a very high voltage electro-power firm. I did a study of the Tallahassee, all the 16 federal, I mean state buildings in Tallahassee and putting in place one of those cogeneration systems so that they could heat and cool those buildings. And with the steam coming off of it? Cool all of the the Florida State University. Free air conditioning for FSU, wow. Again, forbidden by the municipal utility, not can't do it, and it got shot down.

So fortunately in water, we don't have that kind of problem. There's less dog in the manger going on because the water supplies are overstressed and they don't have money. It's like, OK, fine. Do your own treatment. Can you just give us clean water? And so that problem does not occur in water. We just don't see a problem with that. And as I mentioned, we're actually helping some small cities with Modular Water Treatment™ systems.

Ken: So the excitement, what I hear from that is, I hear we have an opportunity to enter at a moment where we can prevent that elite stranglehold. You know, like so energy, energy producers have almost a stranglehold on their respective industries, right? We have a chance to actually disrupt that, that stranglehold from being established and allow. Like you said, the democratization of just individual accredited investors to do this and you know, look, that's exciting stuff. I read somewhere, I don't know, maybe we'll share it in another CEO briefing, but I shared with you some reports that came out on all this PPP [Paycheck Protection Program] money where that ended up.

Andrea: Oh, tell me about it. No. Oh yeah, it's very interesting.

Ken: Should I bring that up or am I going to get struck by lightening?

Riggs: Sure, why not? I mean, go, go go.

Ken: I'll have to pull down the shades on my window, so I don't get sniped. Seventy two percent of the PPP money went to the top 20 percent earners in the country. Right? So what it ended up being, this pandemic response and the government recklessly printing money, It ended up simply being the largest transfer of, I coined that phrase, the largest transfer of wealth in the history, you know, Twenty-five years, I put that in the OriginClear thing.

But the real largest transfer of wealth in human history occurred from the middle class and the lower middle class, the working class to the upper class. Most of these people didn't need it to survive. Some did. It probably saved some businesses. But the reality is that when government gets involved, things can get complicated. By keeping this centrally, centrally focused on the small to midsize businesses we actually become the networked to use your, your high tech terminology, we become a networked micro utility enterprise.

Andrea: A distributed utility, yeah.

Ken: Where's my pen? Where's my pen? Ok.

Riggs: Yeah, you're right.

Ken: Networked micro utilities.

Riggs: The worst thing is when I'm talking to Ken while he's in the car and he goes, What did I? He arrives at home. What did I say?

Ken: What did I just say? I didn't have a pen, either. I know it's awful.

But here. But here's the thing, so there's big plays and for example, Amazon, Jeff Bezos made his billions, etc. We're taking a big, big play, and it's not going to be one of Jeff Bezos. It's going to be that divided by ten thousand investors. Right?

Ken: Right.

Riggs: That is better than stupid PPP that got done, which fortunately, we got something. But you're right. I mean, it was pretty sad. What we're doing here is we're bringing about democratization. Now, remember this number of one point four trillion dollars being spent on infrastructure. Some of that is going to go to distributed infrastructure, not central.

Why? Because there's no, where's the, this photo behind me of of my front porch, where is the land to put giant water treatment systems, right? It's not available and the money's not available, etc. So it's going to be small, localized stuff. And so that money is going to flow increasingly. The opportunity is to be an early mover in this and have a big piece of OriginClear, which is what you are irresponsibly giving away. Ken.

Ken: Yes, I am. I'm recklessly giving away the farm here. Exactly.

Riggs: But it's it's really, really good. It's really good because it recognizes that the people who are able to get off the dime and and go into Water on Demand are going to get, you know, properly, a proper piece of the pie. And it's only right. It's only fair.

Ken: And I think, look, I think velocity, I think speed is really where we're going to end up becoming so broad, so appealing to the global, to the globalized look at this solution. Look, a multimillion dollar point of pollution issue, major issue at a location can be resolved in 90 days, whereas a power, a water plant would take what, a decade to build?

Riggs: That's it. Exactly a decade. Well, you've got all the permitting and then not in my back yard.

Ken: Nobody can live here. Nobody can live here till we put this thing in, right? There's no building permitting until we have the capacity. So the cart before the horse, right? You can't... Look at all these residential and commercial zonings. They won't permit new buildings because they don't have capacity. That's what I was saying. But don't worry, we're going to have this thing built in like a decade. The good news is you get to fund it up front.

Riggs: It's more like 20 or more years. So you're absolutely right. I mean, you know, the famous example is Miami-Dade County with over 100000 septic tanks, and now they want to fix it because it's poop ending up on the lawns. And so, it's...

Ken: I hate it when that happens.

Riggs: Yeah, I know. The county. Yeah. You know, live high, live on a hill.

Ken: There are no hills in Miami, by the way.

Riggs: But so the city, the county, wants to do a $6 billion project. First of all, they don't have the money. Secondly, it's going to take a while to spend that money. They're going to tear up streets all over the county to get to all these individual, "thousand points of light" kind of septic tanks. And instead, you just put in a rebate program to just give people a tax break to put in their own systems. Thank you very much it's over.

Ken: It would be what, twenty or thirty thousand a house? Twenty or thirty thousand dollars a house for a localized system?

Riggs: That's one tenth of the cost.

Ken: I was going to say yes, I was going to say 20th because I didn't do the math as well in my head as you did. But right, it's a fraction. But see, I think that once we, once we tap into the consciousness, you see, America is not aware that there's a water problem you tell, we joke all the time, you know, I turn on the water it runs or we joke that what the water's not going to kill you right away. Right? Just spoke with someone today said, Look, we just put in a whole house system because I got my water tested, he goes, It's literally not fit for human consumption yet. My local municipality says, No, it's fine. And he goes, Well, no, it's not right. So he spent a couple of thousand dollars on a system.

That's a systemic issue. What I think one of our missions needs to be and this is this are our intrepid Andrea's job is to really raise the awareness to the American public that this is a crisis that no one actually, this is the crash that no one hears, right? There's a car wreck going on here and you know, you're unable to actually hear it. Not only is people's health being affected, but the opportunity loss, the capital loss, because of regulation and unneeded spending for the local business is here. It's got a number in the hundreds of billions of dollars, right? I couldn't even do the math, but it's got to be massive.

Riggs: And businesses, it may be invisible to the general public, but businesses are well aware of the problem.

Ken: The businesses do know it.

Andrea: Yeah, it's coming and it's actually it's already here. And from the standpoint of the execution, I think, well, first of all, just the sheer quantity of things and evolution occurred in the past. I am here almost a month and three weeks almost. So it's a relatively short period of time. It's staggering. The amount of evolution that is occurring is staggering.

I think we can become a really big player in this game, a big player in this game. And I think that Ken's support is incredible. My support is obviously 100 percent dedicated, Riggs support to this cause, this movement that we are creating is, it's very important.

And I would like it, you guys, to consider this; first of all, the demand that is there is mind blowing, the demand that is there to the point that Riggs sometimes mentioned how our regular business is flooded with requests, like flooded with requests. So the demand is there and then it's a matter of having enough, let's say, bullets — ammo to be able to take advantage of this particular condition of the market. Right?

Right now, not in the next 10 years. Right now, it's happening right now. What we need is that you guys consider this activity like a movement like, think it like a Tesla, but in the water space, because we have technology, we have delivery, we have production, creating an ecosystem that will control everything from the financing to the production to the continuation.

And we are creating these distributed utilities, if you will, distributed because there are all these machines placed in different areas, but they are part of the same network, which is our network. And the bigger the network, the better, the more it's helping and the more it will produce money. So your participation to the movement is really key right now because it's growing and it's coming, and it's occurring right now.

If you want your money to keep growing in value, invite other friends to come invest because that will enable us to build this distributed utility. So it's always open. And actually, guys, I would want to if you want to, I would love to chat with you guys and have your friends and maybe do some presentation for your friends because what we are doing here will really make the difference. Like I can tell you, it will make the difference in our society and our market,

Ken: You mentioned Tesla.

Riggs: Ok, wait, wait, guys, guys, guys, we're going, we love, we're loving how we're talking, but it's eight fifty.

Ken: Oh, time flies!

Riggs: So, I'm going to, you know, we want to make sure that our wonderful thoughts don't invade people's nights, but keep the Tesla thought for next week. It's a really good one to get into. I just wanted to mention...

Ken: I'll ask you next week, "What was I talking about?"

Riggs: Yeah, exactly. But talk to Ken about it. Go to oc.gold/ken. Is that still correct, I believe it is.

Ken: oc.gold/callken.

Riggs: OK, but Ken also works. It goes to call Ken. So it's all good. invest@originclear.com and the phone number. Please talk to Ken. He is a maestro. And thank you for an excellent meeting. It's been very interesting.

And next week there will be, I recorded a really great interview on a podcast called The Millionaire's Choice TMC, Tony Bradshaw. Great interviewer and I will be featuring excerpts from that and a lot more really interesting news, and I hope that I can give you more tangible information about what's happening with the economy.

So that's the picture. Thank you everyone for coming on board, and we are the trio. So with that? Have a great evening. And as always, thank you for being on board. We love your support.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)