Insider Briefing of 17 September 2020

Helping you thrive in the world’s ONLY vital, scarce and recession-proof market

Watch the best parts of our CEO’s interview with the famous Ty Crandall…All the details of our Water As A Career™ career-builder program right on screen! Find out why you need to get into a high-yield investment now.

COVERED IN THIS BRIEFING — QUICK LINKS

- How you can immediately earn double digit yield with unlimited longterm potential.

- Is there a structure that shelters your investment, yields a high return AND has upside potential?

- What your investment in OriginClear is funding.

- What "whole-building" purification is, and OriginClear's innovative new application.

- What is the OriginClear technology stack?

- OriginClear's internal funding capability and how it's creating revenue and building an asset base.

- Best parts of the CEO's interview with the famous Ty Crandall.

- How the service model is flipping in water and what instant infrastructure has to do with that.

- Why it makes sense for entrepreneurs to invest in OriginClear's corporate bond program.

- A way to shelter your assets in the coming dollar crash.

- How do investors make a return in the water marketplace OriginClear is building?

- Water As A Career's end-to-end business in a box biz-op.

- OriginClear's new regulation A offering.

Transcript from recording:

Introduction

Riggs Eckelberry:

And hello everyone. It is the 17th of September.

Water Is The New Gold™

"Helping you thrive in the world's ONLY vital, scarce and recession-proof market."

Safe Harbor Statement

We have, of course always the upcoming events are believed .So, forward looking statements. We are not gods. We do our very best.

3 Minutes on AirDeck

All right, so what's new. Well, first of all, I wanted to play you a presentation by Ken Berenger on what's on the AirDeck application. This is a new way to make presentations. And I thought it was especially good. So let's take a look at that

Start of presentation

The OriginClear Wave

Ken Berenger: In the next three minutes, we're going to explore how you can immediately earn double digit yield with unlimited longterm potential. Put thousands of entrepreneurs back to work. We can together launch an Airbnb for asset backed high yield water projects that will create a whole new asset class for better protection against the dollar crash. We can create millions of micro utilities and help disrupt a trillion dollar industry all before impact funds get involved.

So it's not if, but when the dollar crashes from all this printing, how solid are the usual safe havens?Will they preserve your dollar and make you money?

Let's Examine a Few

Firstly, it's always going to be gold. Gold is great, but even if it goes to $3,000 an ounce, but the dollar loses a third of its expected value. All you did was hold your own. You didn't make money.

So let's Look at Commercial Real Estate

It's taken a huge hit recently, normally a real buying opportunity, no? Between retail ice age and the mass exodus from major cities. We have no idea the type of impact that'll have on commercial real estate.

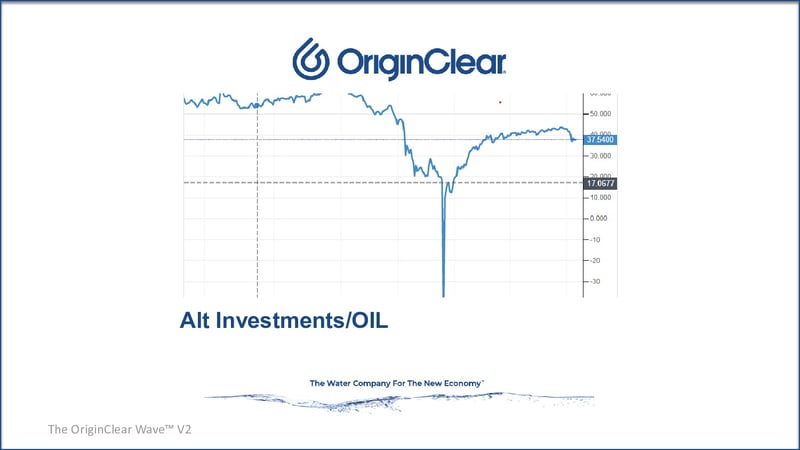

What About Oil and Gas?

Well at minus $37 a barrel, it was sure a home run, but now we've got longterm shutdowns, remote working, electric vehicles and renewables, both on the rise. Traditional energy could be very uncertain for a long time. Okay. So far, nothing too exciting out there.

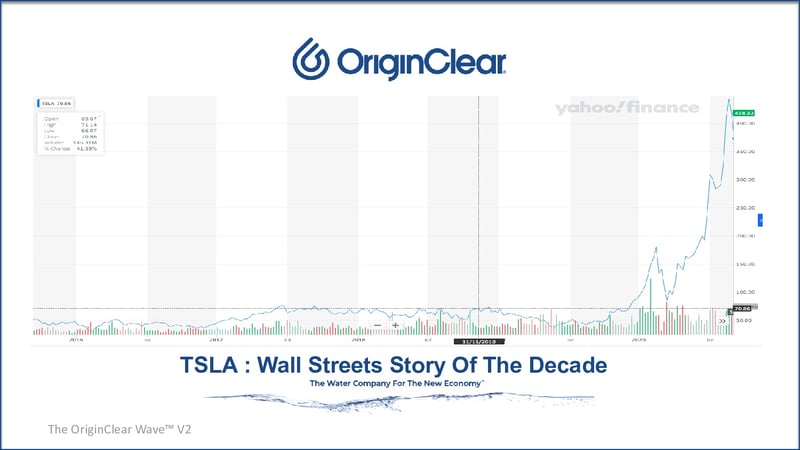

The Next Tesla

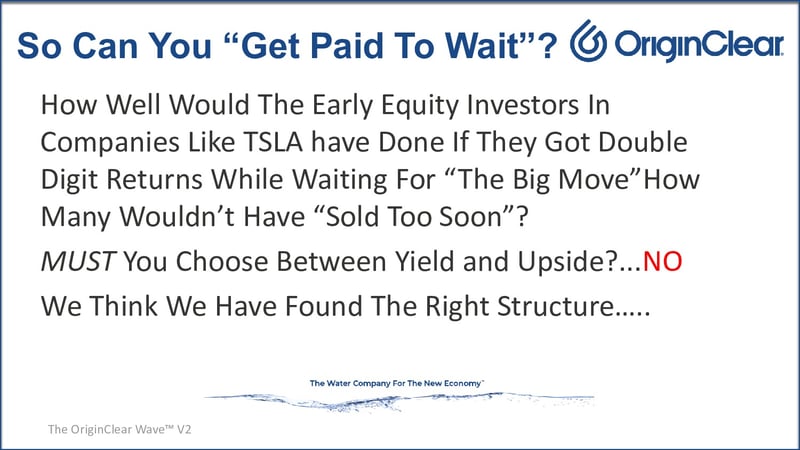

That has us looking back at the market. Everyone wants to be in the next Tesla. The problem is until last year, only the bond holders made money consistently in Tesla, stock holders, not so much and most sold way too soon. Without 2020 hindsight equity holders, truthfully could have lost it all.

Here's a Question

How well would the early equity investors in companies like Tesla have done, if they got double digit returns while waiting for the big move? Another question, how many wouldn't have sold too soon? Must you always choose between yield and upside? No. We think we found the right structure.

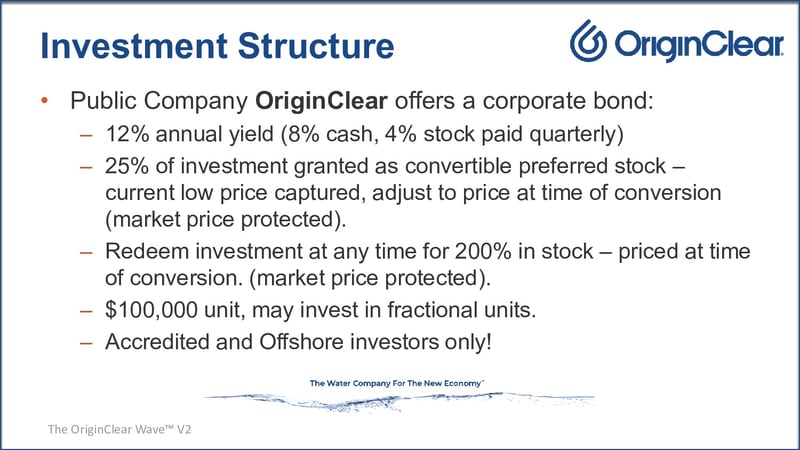

The Right Structure

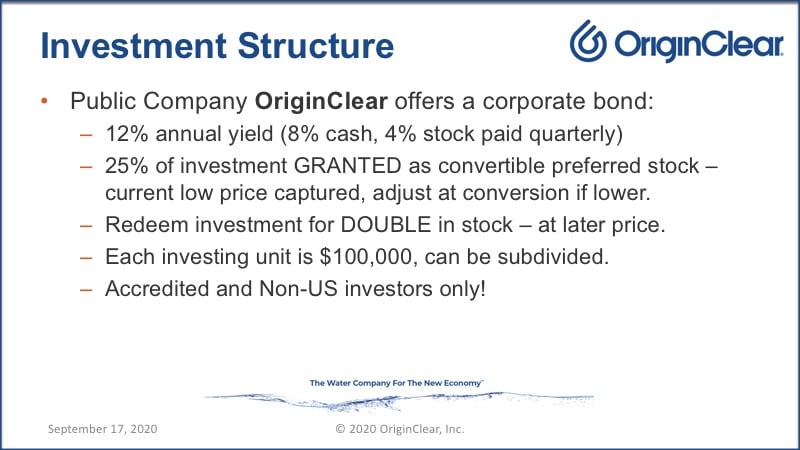

As a public company Origin Clear's corporate bond pays a 12% annual yield so you can get paid to wait, but once the stock out performs that yield, simply convert it. And you're doing so at a 200% premium to your principle investment. So you get the best of both worlds.

What's It Funding?

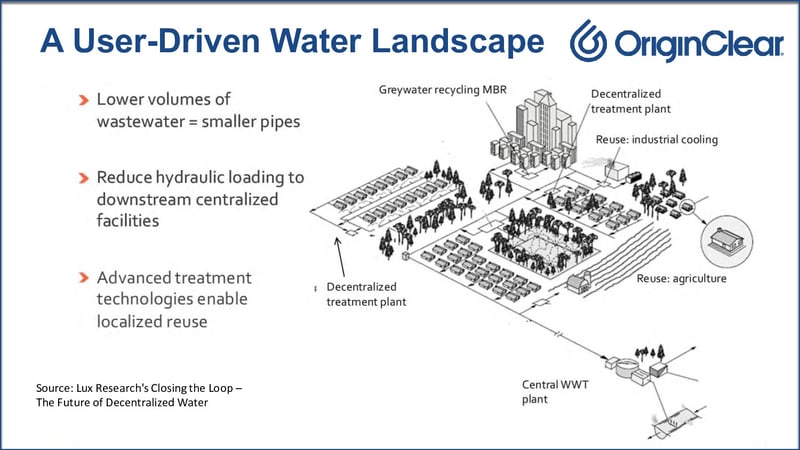

This raise can start to potentially fund millions of self contained micro utilities treating trillions of gallons of water at every point of use, that's decentralized water and we can do to water what cellular did to telecom.

Power of E-Commerce

This in turn helps us launch a global Airbnb style marketplace of independently owned high-yield water assets. We can utilize the power of e-commerce to replicate tremendous disruptions like Uber, Airbnb, Amazon, and Lyft.

Doing Well While Doing Good

Asset backed yields, global marketplace, real property, all great stuff, but you are also treating trillions of gallons of water, which is good for the planet. That attracts ESG investment.

Join Me

If I've gotten your curiosity, please join me to our CEO briefing. Thursday nights, 8:00 PM eastern. OC.gold/CEO is how you register or you can call me direct +1 800-445-7493 is my team's number. Or you can just register to speak with me @OC.gold/callKen, thank you so much for your time.

End of presentation

Riggs: Al right. So that's the AirDeck thing, which is cool. I'll move right into the Ellis Martin report.

The Ellis Martin Report

Start of presentation

Ellis: Riggs, welcome back to the program. Nice to see you today. Bad water, hard water is very, very difficult for the scalp isn't it?

Whole-Building Purification

Riggs: Well, absolutely. And you know, this is a breakthrough we've made where a luxury hotel chain, which we cannot disclose right now has made a purchase commitment to put crystal pure water everywhere in the hotel. Be it the showers, the kitchen faucets, you name it. And it's 200 plus rooms. It's a new opportunity for us really to help commercial buildings, apartment buildings, churches, what remains of the office buildings in the world, hotels, et cetera, to be just, embracively, whole building water purification.

Ellis: Let's talk about what your goal is currently.

Built in Layers

Riggs: Well, Ellis, you right that we are built in layers. And that's really what we spent more than 10 years and millions of dollars developing. First layer being our core technology, which we licensed to key partners. And it's very, very limited. Primarily because we found the technology alone does not really accomplish change. You have to have a business model. The second layer is our custom fabrication factory in McKinney, Texas near Dallas, that can build everything from $50,000 projects to $2 million plus, and then the third layer being the Modular Water Systems™ product line, which is growing like that.

Another layer is corporate sales of highly standardized products. So for example, we'll talk about it some more, this Pool Preserver™ product. Now this incoming whole commercial building water purification. These are all at the corporate level going to be standardized products. And then a layer above that is super exciting, which is we call Water As A Career™.

Relevant Technology Stack

Ellis: Regarding the Pool Preserver, to actually watch an individual talk about it, and then there was some animation in there too, that really explained it. I found that as a paid journalist here, I found it very moving. Because I like to know that the companies I'm involved with they're actually doing what they say they're doing

Riggs: That machine that Ryan Koistra is now using to build his entrepreneurial career was originally built by the McKinney custom fabrication operation. So the technology stack, you might say that we have is employed and it's all of it relevant at all times.

Internal Funding Capability

Ellis: How is this funded? I don't imagine that that gentlemen is investing in that particular unit as a new business owner, a former business owner that has perhaps been destroyed during COVID looking for something else new to do. You don't necessarily have the capital to purchase one of these devices. So explain how that works.

Riggs: These days to get a lease, you've got to have two years in business. And so many people are starting new businesses. So what do you do? That's where we have our rental program. That is the new model. It's kind of like what we call an Airbnb model, where it's being short term rented out. Very profitable. And what we're doing is we're building internal funding capability for this. So I've been talking about the amazing story of GMAC now called GM Financial, which even today is running more than 10% profits. Whereas the regular GM is actually now negative.

Funding, Revenue and Building an Asset Base

Financing is a very, very profitable business. So we are adopting that by doing our own funding. Eventually we want to bring in other people, other investors to fund these units, but we like being the finance company. We need to learn those lessons ourselves without some freaked out lender going, "What are you doing? I want to go in and seize the asset." We don't want that. We want to be able to control it ourselves.

Number two, we want the revenue as opposed to getting just a little piece as a broker, we want all of the revenue. So that's number two, number three, we want the asset. Why do we want the asset? Because we have an ambition to get onto the NASDAQ and getting onto the NASDAQ requires $4 million dollars in assets. Bob's your uncle. So our goal here is to to build an asset base, to build financing revenue, which is highly profitable and also to work all the bugs and tweaks out of this rental program, which eventually I hope we will export to the world.

Who Finances Your Financing?

Ellis: Okay. Money has to from somewhere. So My next question to you is who's financing the GMAC aspect of your financing? So who's financing, what you're financing?

Riggs: Correct. So we have a corporate bond that we offer, and it's extremely advantageous for these times. In Thursday nights briefing, as you saw, I went through all the different ways you can invest these days and make no money or lose money. And it's a tough time, right? So we offer a double digit annual yield plus the ability to convert to stock when and if you want to we really have a good funding system that is bringing capital in and all we got to do is keep growing it. That's really what it's about.

Offering For Almost Everyone

Ellis: Let's say I'm an accredited investor. And yet my daughter wants to invest in this company and she's not. So how do we handle that?

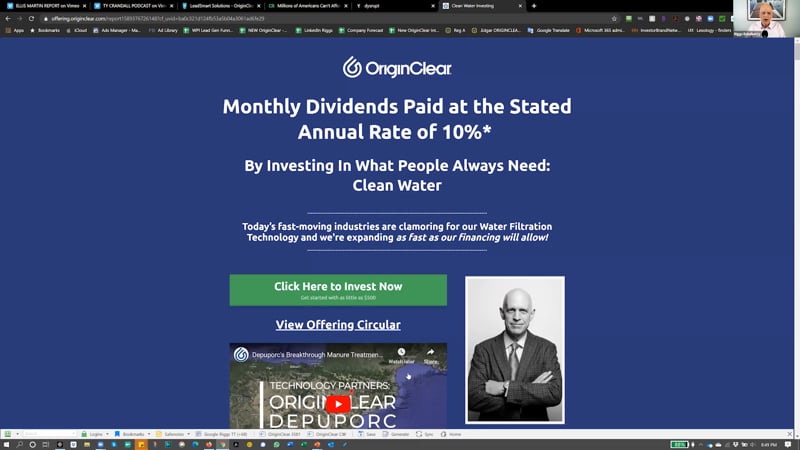

Riggs: Well, we actually have received approval from the SEC this year, Securities and Exchange Commission for what's called a regulation A offering. That's the kind of offering that people like Grant Cardone do, where anybody can put in money. Our minimum is $500 and they get 10% per year paid monthly and then a big upside at the end. If and when we decide to redeem it, it's our discretion.

You Get 150% When We Redeem

Then we have to do 150%. So imagine you invest a thousand dollars. It grows at the rate of a hundred dollars a year, 10 years later, you have $2,000 and then you get back. Let's say at that point, we do decide to pay you back, you get $1,500 back. So you actually have $2,500 that you received back from your original investment. So that's quite exciting.

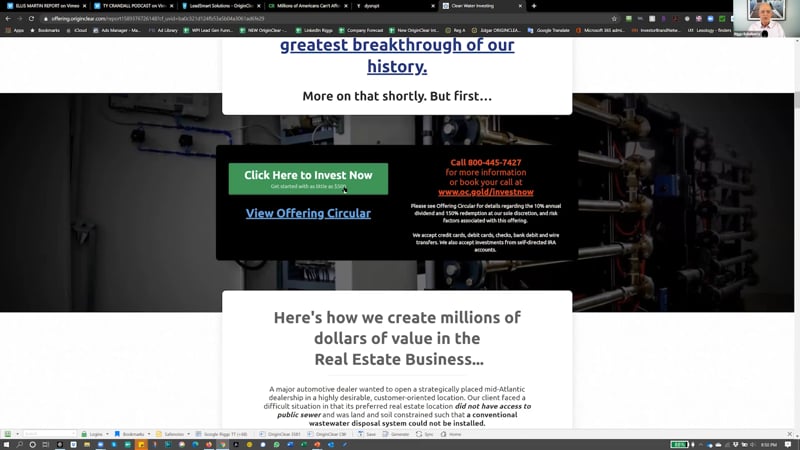

And we're rolling. We're ramping up with an online marketing agency that's amazing, amazing team that has been with... it came out of Facebook and they're super insiders. They're going to ramp us up so that we raise, we believe, we intend to raise $20 million in a period of a year that will provide most certainly the capital needed for Water As A Career.

You Must Read The Offering Circular

And in the case of the regulation, A offering, it's very important for people to go to the offering, circular, which is OC.gold/offering. And that will take them to the SEC circular, which is very important to read because the SEC wants to make sure that the small investors of the world don't get hurt and full disclosure is essential.

Not a Registered Offering

Same thing for regulation D which is the accredited investors. They should know that this is not a registered offering. A SEC has not approved the offering. And of course, there's a risk. Now you're right. We're working very hard to reduce the risk by making it a yield product. And then we're not, since 2018, we have not offered private stock to accredited investors because, you don't know. It's better to be parked off to the side in a dividend flow and then go, "Oh, stocks taken off. I'm going to give up that dividend flow and turn it into shares." But you don't have to. And that's the beauty of this formula.

Ellis: Riggs, it's always great to see you and speak with you. Thanks so much for joining me today on the program.

Riggs: Thank you, Ellis.

End of presentation

Riggs: Well, that was interesting. A bit long, I realize and a bit repetitive, but this one should be very, very interesting.

Ty Crandall's Credit Suite

Start of presentation:

The Business, Credit and Financing Show

Program Announcer: Welcome to the business credit and financing show. Each week, we talk about the growth strategies that matter most to entrepreneurs. And now to introduce the host of our show, financial expert and award winning author, Ty Crandall.

Diving Into Water

Ty: Hello everybody. And thanks for tuning in today. Today, we're diving into a really interesting topic that we've never discussed before, and it has to do with something that's vital to all of us, which is water. And with us today is Riggs Eckelberry.

Now Riggs actually doesn't look like a bomb thrower, and yet he's driving disruption of a trillion dollar industry that has fallen behind the times and is affecting the health of millions of us across the globe. In the United States we typically kind of think our government has this handled. But what you're saying is that maybe that's the case, but not doing a very good job.

Service Model Flipped

Riggs: I grew up at a time when mainframes were King and you bought, you reserved time on the mainframe and you had to show up at 8:00 AM for your one hour on the mainframe. And that was considered efficient for the mainframe, not for you. So then it moved in the eighties, as I was in the industry at the time, towards the edge. And now people had their own computers, theoretically, less efficient. That computer, most of the day isn't doing much, but it's 100% there for you.

So it flipped the service model from servicing the big high priest central system to servicing you and me. That happened all over the place. And it was happening in energy big time with the rise of the micro grid and so forth. And energy is a great example. The central grid is really dumb and it can only do electricity one direction. It's not a two way system, it never will be. And so we're building micro grids to kind of patch around it and just use the central thing as a trunk.

Well, similar thing in water, what we're able to do in water is, "Hey, I'm treating the water. I might as well reuse it. Hey."

Why Instant Infrastructure?

Ty: And you say some things that I'm not familiar with. You talk about instant infrastructure. So what is that?

Riggs: Well, instant infrastructure is basically, we're accustomed to, let me give you a perfect example: Miami Dade has 100,000 septic tanks. Why? Because developers in Florida just went ahead and rolled out housing tracks without any kind of sewage infrastructure. Now, as the water table rises, all those septic tanks are failing and the County wants to spend $6 billion on putting sewage lines out to every one of those.

Small problem, number one, where is the $6 billion dollars? Number two, it's going to take 20 years. And number three, do you really want those streets ripped up for the entire 20 years? No. Instead you can put self-sufficient units at each one of those homes for a 10th of the price, not disrupt anything and have it happen much faster, that's instance infrastructure.

Does It Make Sense For Entrepreneurs to Invest?

Ty: Why is this something you think makes a lot of sense for entrepreneurs to invest in?

Riggs: Well, first of all, there's two things that entrepreneurs can invest in. Number one is of course the people building the marketplace ourselves. In other words, the first investment that Airbnb had was not in the units. It was in Airbnb itself, right? So Ashton Kutcher in 2009 was part of a group that invested $7.2 million in Airbnb and got 10% of it. Pretty good deal. They got about 50,000% return on their money. The point is that the first investment in Airbnb was not in a "bnb". It was in the people building the marketplace.

Corporate Bond That Leads to a "Zillow"?

So, that's number one is we have a corporate bond program that good accredited investors can get into and just go to originclear.com - the big red banner, plain as day. Number two is you can eventually, as we sort out all the regulatory issues, you'll be able to invest by looking in the listings. And it's just like Zillow.

"Oh, this is interesting. Right price point and I kind of like a 200 home subdivision in Alpharetta, Georgia that wants to build off the grid and they need to have a reflush system that will also water the golf course, and it's $350,000. And it's syndicated so I only have to do 75,000. Okay. I'm in." Simple.

Where's the Shelter?

Here's the deal. The stock market is insane. There is a dollar crash coming. The dollar will suffer the consequences of $20 trillion - $30 trillion being given away. And we are looking at the need for people to find shelter. The shelter will be in cash generating assets.

Goldman Sachs has told us that water is the petroleum of the 21st century. So we like to say "Water Is The New Gold" only because A, stable asset. It does not, it's not really affected by economy because you're going to have to treat the water no matter what.

And it's a tangible asset, it's for real, it's there. It's a lot like gold in that sense. And it's hard to make more. You can make more water, but it costs money to do it. So again, it's just like mining for gold, has a lot of similarities, but it has more value than gold because it's literally life. And so that's what's interesting about it.

COVID Made it Happen

Ty: What do you think is going to be in that marketplace?

Riggs: We're an important player in terms of making sure this new water marketplace, and you'll look back on this interview and you will [say], "There was a water marketplace being talked about in July of 2020, and the CEO told us that it was COVID that made it happen." Because, we found ourselves January 29th, when all hell started breaking loose with Wuhan, we went, "Uh-oh. World's changed." And we had to think about a way to take all these chronic problems and resolve them in real time. We've worked very hard and I'm proud of the work so far.

Classic Rent-Roll

Ty: How are investors in it making a return, making their money?

Riggs: Well, it's a classic rent roll. So, depending on the duration, some end users want a very short-term thing, just solve my problem for the time being. Others want a longterm thing. So, we have, we're not wedded to any given model, but it goes all the way from the rent-a-center, "I'll rent you a TV," model, all the way to a lease or lease purchase.

The financial instruments are pretty flexible and they're all out there already. We're not reinventing the wheel for the financial. All we're doing is applying them to this. But the key is that you, as an investor need to get that section 179 first year accelerated depreciation.

You invest $50,000. You get $50,000 tax credit, year one, and that spices up the returns beautifully. Do it now while we know that the current administration is doing it because who knows about the next one. And then there's a great ROI along the way. And it's secured. It's your machine. That's key.

Solving a Massive Problem

Ty: I love what you're doing. I mean, congratulations on your success Riggs. I think you're solving a massive problem. And I just, as we do this interview, I think about so many things.

I think about stories that I've heard, where people are defecating outside their homes, et cetera, and then all the illnesses that's caused. I mean, there's so much death in this world, that's caused by the problem you are trying to solve. So just hats off to you and OriginClear for everything you guys are doing. I mean, you're really making a big impact in this world.

Riggs: Ty, Thank you. It means a lot to me and I appreciate it. We'll get right back to work.

End of presentation

Okay. So we've covered Ellis Martin. We covered Ty Crandall with the credit suite podcast. Now I wanted to quickly show you the Water As A Career project proposal that has just been approved for the continuation of the development of this career-building system.

LEADsmart Solutions

An End-to-End System

So here's a proposal from LEADsmart Solutions, and they're telling us how they want to build this. You've seen parts of this before, but this is the final. What this is all about is to build an end-to-end marketing and certification system.

It's changed slightly since then. It was going to be called the Pool Preserver Academy. But we're really thinking of calling it the Water As A Career Builder or Water As A Career Academy. We'll figure that out. I don't want to have a weird name like WAAC Academy!

So we have to figure out the name, but I wanted to have an overall kind of program and then have specific verticals. And that way we standardize it.

Business-in-a-Box

So there's a business in a box course, there's marketing playbooks, there's resource centers, Facebook's centers, door hangers, the usual stuff, sales page, and then various marketing programs that they can choose. Traffic and lead generation activities. That is the statement of work. And the work is now begun.

They Can't Afford Water

Now let me show you something that's really shocking. And I talked about it a little bit on the Ty Crandall show, which is that now water is not a regulated commodity. So they can raise the price of water, all they want. And this is pretty intense.

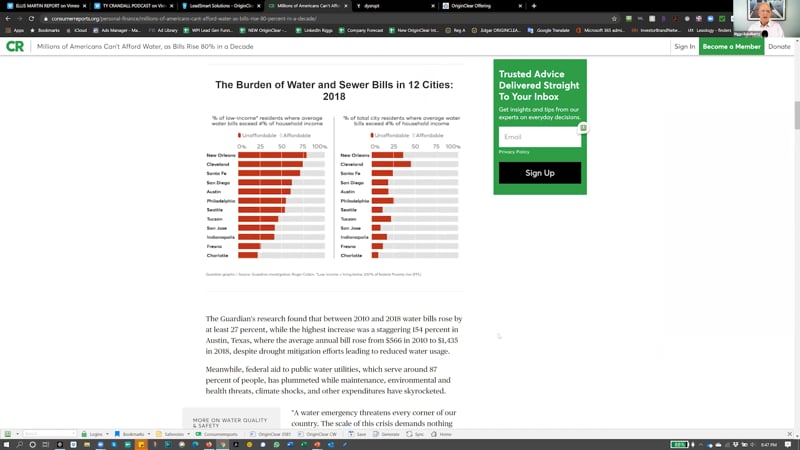

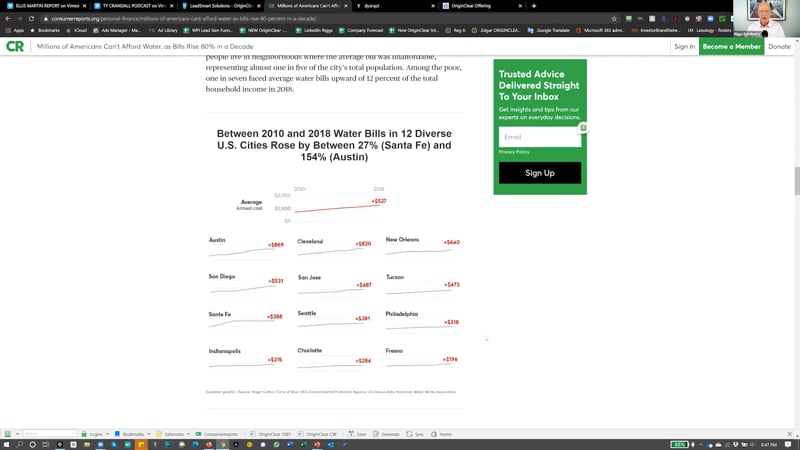

Bills Exceed 4%

I'm going to go down here and percentage of low income residents where average water bills exceed 4% of household income. Look at New Orleans, it's horrendous.

Why is This Happening?

And then over here, we've got the increases have increased between 27% and 154%. Now, why is this happening? Well, part of the problem is that there's been federal funding for water systems has fallen over the years by 77%. Local utilities are trying to raise the money, but they don't, and of course, standards are rising.

They're supposed to comply with all these new requirements, arsenic, this, that, and the other thing. And it's very hard. They deferred, as I've been saying now for four years now, that maintenance and cleanup are deferred, which now creates this crisis, loss of water to leaks, et cetera. The EPA is telling us what has to be spent.

How Can We ACTUALLY Help?

Now, the point here is that it is not going to happen, right? Water rates have gone up dramatically and we're not getting the quality. Poor people are not being treated right, businesses are being orphaned and so we have a real responsibility here.

We ourselves, can't go to Washington and change things. We can't go to Cleveland and fix their algae for them, whatever, but we can help enable people to get their own water treatment systems. We can deploy these Water As A Career business people as "little micro utilities," as Ken Berenger calls them, so that they in turn can solve the problem. So this is a really important story and it has now become a real story with COVID. It's pretty horrendous.

New Regulation A

The last item is to discuss the new regulation A funnel with the new marketing agency. So if you go to our offering.originclear.com, or just go to the big red sign at the top of originclear.com and say, you're not accredited. You will receive this screen with this big brother picture of me.

New Offering Page

And we have updated this offering page, which is quite good. I'm not going to go through it because it's been a long evening and you've been very, very patient, but I invite you to go take a look at this now, it's super cool.

Our New Agency

Now what about this agency? Well, the agency is called Dysrupt. These are people, the management were six years at Facebook management themselves. They know unbelievable amounts of technical things. We're incredibly honored to have them be on board to drive the $20 million raise for our regulation A offering, which we will use to capitalize the Water's As A Career equipment. So we're spending a lot of money with one of the very best agencies around for this kind of thing. And we're very proud of that.

The Best Way To Do It

Well, that's it for the what's new section. And of course you've heard so much about this but I'm not going to discuss it again, but these are the numbers. The best way to do is just type OC.gold/ken in your browser. And boom, you'll talking to Ken and he is so brilliant.

Contact Us

He is far from an order taker. He is a designer of our capital programs. I'm very proud to have him on board. Thank you again. I hope that you will have a wonderful, wonderful weekend. That you are not being too aggravated by COVID. And I just have one more thing to add before I leave you.

Disclaimers

And that is that there is a regulation D disclaimer, and also to find out about the regulation A offering, the legal of that, just go to, just type in your browser, OC.gold/offering. Go do it right now. OC.gold/offering. And that will take you to the securities exchange filing of this offering. And I strongly recommend that you go see it. So thank you again. Enjoy your weekend. I hope you're doing well in this tough time. Thank you everyone. Thank you. Thank you, for sticking around you are the best audience known to man.

Thank You!

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)