Insider Briefing of 17 June 2021

Advisor Ricardo Garcia stole the show when he minted a demo $H2O™ coin live! Come see that, and hear our impressive new CFO Prasad Tare's view on our biggest challenge and opportunity for achieving our vision..Along with the report on Dan Early's outsourced water projects and big wins in our core business! You'll see where Water on Demand™ and Total Outsourced Water™ connect with $H2O and their very real future potential.

FEATURED OR COVERED IN THIS VIDEO — QUICK LINKS

- Greg Hunter's interview with BTC miner Clif High and the its revealing info on cryptocurrencies and economies.

- Non-fungible tokens and the 8 reasons to add one to your assets.

- OriginClear's impressive new CFO, Prasad Tare, and his initial views on the company's biggest challenges and opportunity.

- Ricardo Garcia mints an demo $H2O NFT crypto live on the show!

- The minted coin and summary submission — final result.

- Why the $H2O coin could end up being a "social coin."

- How $H2O is like a bond and the way it functions.

- OriginClear's core business and how the $H2O coin relates to it.

- Dan Early's Evera Series Modular Water Systems™ . What they are and what they do.

- OriginClear's investment offerings and how to participate.

Transcript from recording

Introduction

Riggs Eckelberry:

Good evening everyone. It is the 17th of June, and we're going to go through some of the formalities while everybody arrives. It's going to be... This is going to be a death-defying stunt because we're going to build a coin live on screen and the death-defying Ricardo, who I'm going to make him a cohost now so that he will be able to have his video. But not yet. Ricardo, I'm enabling your video and same thing to Prasad, enabling your video, but you'll be able to... When you feature, you can turn on your video.

All right, so thank you everyone. Everybody's coming on board. Let's do a quick share from Ron to panelists, hello, and likewise hello. So let's jump right in. I'm going to go straight into the video optimize mode because we have a.. Well, actually, no, I think I'll stay. It's so fuzzy when it's video optimized. So I'm just going to go ahead and start like this. All right.

So it is Thursday, June 17th, briefing number 115. And it's increasingly clear that water is by far the world's only vital, scarce and recession-proof market as water problems continue to mount and water rates continue to inflate, and we are doing our very best to supply the demand.

Forward Looking Statements

So let's jump right into it. We've got the usual safe harbor statement, which we essentially tell it like it is, but of course, things might not work out the way we want them to.

All right, now what's going to follow is an excerpt from a video on USAWatchdog. Now this is a political video, but nothing in the excerpt that I am playing has to do with politics. I think it's very, very important to hear what this gentleman Clif High says to do, because aside from whatever his opinions are about politics, and you can get them on Greg Hunter's channel, you will be interested in his ability to predict through his data mining what's going to happen economically. And that I think is very, very important. So, let's go ahead and play that. I'm going to change the share to video optimized, and we'll jump on it right away.

Start of video presentation

Bitcoin Will go Higher

Greg: Yeah. So the dollar is already dead. And then Bitcoin, they're already... Listen, a friend of mine said Bitcoin is going to go way up. Well, actually Bill Coney told me this. And I was like, what? And it was 8,000. And I was like, it gonna get to 2-300,000. It's going to go way... He told me this privately. He said that on the air now also too, do you think...

And now you hear all these fund managers, it's going to be a half a million, 300,000. I think JPMorgan Chase was out. It's going to top out at 140, 50, 60,000. All of them are into it. All the big banks are in, everybody's got a trading desk. Jamie Dimon trashed Bitcoin for years and oh, they're trading, I think he's going to... I had one fund manager say, "It's got to go to $500,000." Tell me, where is Bitcoin going price-wise in 2021.

As High as $234,000

Clif: I'm glad you qualified the time. Because all of these things are... That's what you have to ask is, what time are they talking about? So at the end of 2021, or are we talking about at its peak in '21, because those are not necessarily the same. So, I suspect that there's reason to think that Bitcoin will exceed 100,000 before the end of the year. If we get to a particular point where we're just kicking over 120,000, we may reach a trading pattern that in the past has popped up, that would propel us up to about 234,000 in a maximal amount this year.

Greg: Wow.

Sovereign Settlement

Clif: But it's not going to hold there at this point, because of the other factors. So now bear in mind, it's still the same Bitcoin. It's still the same digital currency, so to speak. And so, what makes it worth that, is that you've got now 234,000 worthless dollars that are being offered for it. And so, we're going to get to this point where Bitcoin will become essentially used for the settlement of sovereign debt over time. It might take four or five years.

In that sense, maybe Bitcoin will be multi-million dollars per individual Bitcoin. All right. So that maybe the individual Satoshi's will have value at the level of thousands of dollars on their own.

So at that level, that's what the data suggested over time, that Bitcoin would evolve into a sovereign settlement vehicle to the point where the governing coalitions of nations will go to the citizens that have Bitcoin, and they will plead with them at times to purchase a Bitcoin from them that their nation might be able to settle some debt somewhere with some other nation. So that's the kind of linguistic hints we got as to the future of Bitcoin as a currency.

Now, in the phase of this year, if we were to reach those highs of say in the 200,000 range, then I would also suggest that you should be prepared as a Bitcoin holder for the next phase of that, which would be a very large reduction or crash as people sell off the Bitcoin into new hands and thus turn it into other things.

Sound Money

Because here's the thing guys, this is sound money in the same sense as gold. If you have gold and say that you had an ounce of gold, and you're living in a little village of 200 people, and the rest of the world has a money system collapse. And so you're the only guy in that village that has any real money and the rest of the village, because they didn't have any gold they're reduced to using wooden money.

They make a little round wooden nickels kind of thing. Well, your gold is worth how many bazillions of their wooden nickels, but it doesn't do you any good at all because you can't trade with them. So, the only way you can deal with this is that you must spend that out in order to either acquire bazillions of little wooden nickels or do some other mechanism such that you are achieving the value of that in the relative environment you find yourself.

So what will happen with sound money over time, as it is introduced, as currencies are introduced, you will see, and we saw this by the way in the Americas with the introduction of the colonists and the native people, and the subsuming of the wampum system to the currency system backed by metals that the colonists introduced. It had the same effect within the natives.

Circulate Into the Economy

And that is that as they acquired the hard money, the solid money in this case, we would be talking about Bitcoin. They would spend it out, bust it up and spread it out throughout the economy.

And so that is how gold system works. At first one person has some gold and then they bust it up and they spend it out to people and then it starts circulating. And this is the basis for economics. And we're going to have to go through and learn that all over again in a much more sophisticated fashion with the cryptocurrencies, because they will become a sound money, not able to be deluded by the evil rat bastard, power elite that are at war with us.

Greg: And I will say this is just another one of your many calls that I personally heard years ago. They said, "Hey, Bitcoin is going to go way up." And I think it was a couple of hundred dollars or... And I was like, really, it's going to go way up. Bitcoin... This is one of your many spot on, I think, what are we at? 40, $37,000 Bitcoin is down to that and you're talking... And I'm now looking at this, and going, or you just do 1,000. You know what, I believe em. With all these big banks involved, somebody is going to take it higher, right?

End of video presentation

Crypto Becoming the New $

Riggs: The reason why I played this is not... Obviously they have their own political agenda, but what is blowing my mind is how we really have to recognize that there is a new generation of cryptocurrency. The cryptocurrency is becoming the new money. We heard about Latin American countries starting to adopt Bitcoin itself. Now I'm no Bitcoin fan. I'm really all about the utility of these various coins.

But this is a really big reason why we at the... With our Water on Demand™, Total Outsourced Water™ concept are planning a coin, because we literally need to have water being monetized with a coin. That's the truth. Now it's going to take time. And meanwhile, we're going to build the underlying outsourcing.

Current Model

So, the coin is in the future, how it is right now is currently we Design and Build, DB, and then as we're raising capital, we're going to move it to Own. And then we're going to go to Operate, DBOO. Operate means fully outsourcing. So, as water treatment becomes privatized, dirty water treatment, not Nestle grabbing water from the California watershed. We're talking about privatizing wastewater treatment. A brewery can then sign up with us, and we just take care of their water treatment. Okay, now that's what we're building now, that's the business.

Coin to Streamline Payments

Down the road, we've got this design of a coin, which we're going to explain further, which is going to help to streamline the payments to the investors in these water systems, to the various partners and so forth that we're involved with. And it will create this market. That's very interesting.

Now, before I go on, I see there's a couple of comments. Tony B says the average person is trading Satoshi, is not Bitcoin. A Satoshi is a fraction of a Bitcoin, is like a penny to a dollar. It's much smaller than that. But you're right, Tony, if you want to buy a Bitcoin is 37,000 or whatever right now. I can tell you how much it is exactly. It is 37,986.40 at the moment. How many Bitcoins are you going to trade?

But it's fractions. Here's the important part. We're not talking here about trading, but we're talking about a new reality for the advent of cryptocurrency. Okay, well, that's enough soap box from me.

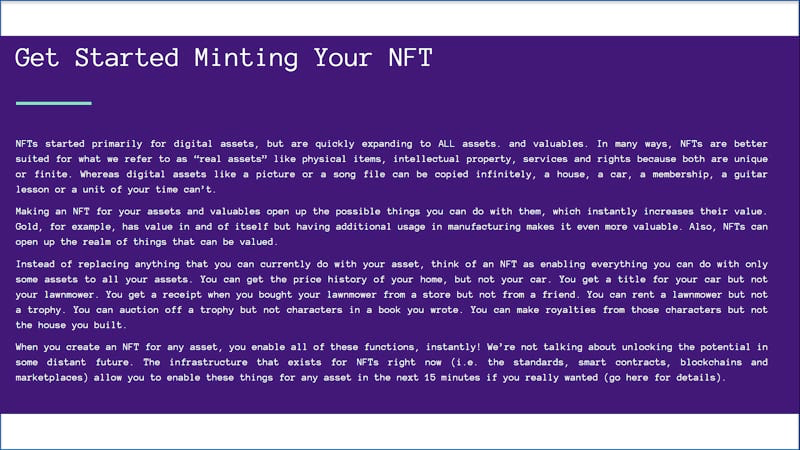

Non-Fungible Tokens

We're going to move to the next phase in the discussion, which is that OriginClear sees itself as doing more of a... And I don't want to start that video again. We see ourselves more as doing what's called a non-fungible token, and I wish they had come up with a better word. The non-fungible token, NFT. Very simply fungible means that you can swap it.

It's a non-swappable token, which means that...Because of Bitcoin, one Bitcoin is the same as the next Bitcoin, whatever a dollar bill - dollar bill, but NFT is a specific kind of coin, which puts a tag on an asset.

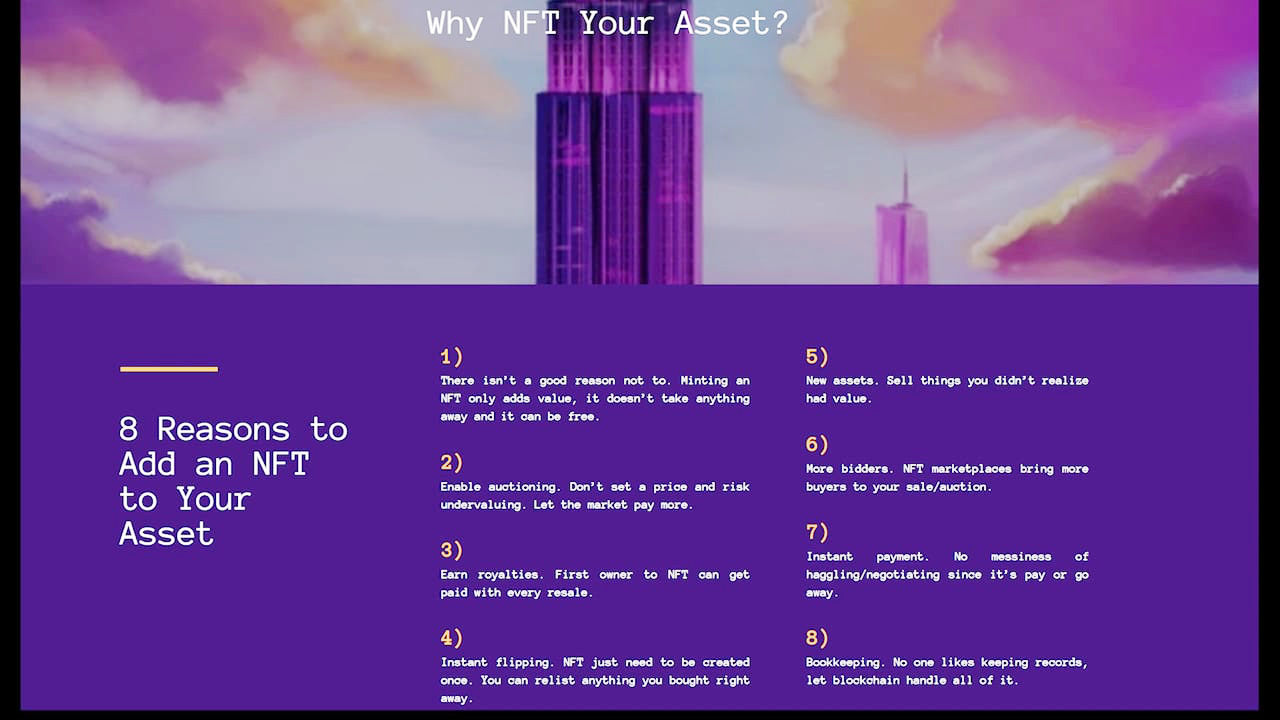

Eight Reasons to Add an NFT to Your Asset

And here's a very good article, in real nifty, "Eight reasons to add an NFT to your asset." Number one, of course, it's easy to do. You'll see, number two, you can set, you can have a market in it. Number three, you can have royalties. And that's why we're really interested in it because that's where we put the payment streams. Number four, you can Quote unquote, flip them.

You just create them once and you can keep selling, reselling, and then you create value for things you know, that you didn't think have had value. Number six, there's a marketplace, a growing world marketplace. Remember there was $2 billion in NFT transactions in the first quarter. It's gone down a bit since, but it's becoming very serious. Instant payment because it's all done with crypto. And finally the bookkeeping is built in so that these are all great things. And this is a big reason why the world is moving to this kind of digital tracking of assets.

Moving to Real Assets

All right. So then, we're talking a little bit more about why would you do assets? And really it started primarily for digital assets like music and pictures, but it's moving to all real assets, things like intellectual property, patents, various rights house, car, membership, guitar lessons, et cetera, a unit of your time, all these things. What we're looking at is creating a time stream of payments for these water systems that are packaged into these NFTs.

The Benefits

Okay. Now, finally, what are the biggest benefits? Number one, you can have auctions, which we're not really interested in that. Number two, secondary market, meaning I sell something to you, but then you can start trading it to others. The listing is very efficient. Also it opens up all these categories of assets, including the one that we're working on which is water, and this asset can be created into marketplace. In other way, people can pay you. It's not just PayPal. And finally, there's a receipt system to your asset. Everything is tracked with the blockchain.

Okay. With that, I'm going to ask Ricardo to join us.Tony you're right. Each Bitcoin is different on the blockchain, but you can use them interchangeably. If I give you one Bitcoin and go, no. Let me give you a different Bitcoin. I've still given you a Bitcoin. So that's my point about that. You're right. That Bitcoins are unique, but not functionally. So Ricardo, are you able to turn on your video? Boom.

The Coordinator

Ric: Yes I am Riggs, here I am

Riggs: How are you?

Ric: I'm doing very well. Thanks for having me.

Riggs: That's very exciting. Well for everyone who's new to this, Ricardo Garcia is a senior program engineer at a company called Red Hat, which is a big deal. He's also an advisor to the company and he, and I think with full disclosure, he's not a crypto expert. What he is, is an expert program manager. So he knows how to herd cats. That's his primary job.

So we will end up having a tech team, but he is essentially the coordinator. And what he's been doing is he has been making himself a little bit more knowledgeable about NFTs, and he's actually daring to create an NFT on this show.

So, and I love this. Tony B says I would like Ricardo to make me an NFT of a screenshot of Riggs here on the zoom call, that's cute. We can do that. Absolutely. But let's start with your example. So you go ahead and grab the screen. You can share your screen and get to it. I will let you do it.

Minting an NFT

Ric: Absolutely. So before going there, I wanted to give a little bit of an opening. So hello, everyone. I hope you've all had, or are having a fine day, depending on where you are in the world.

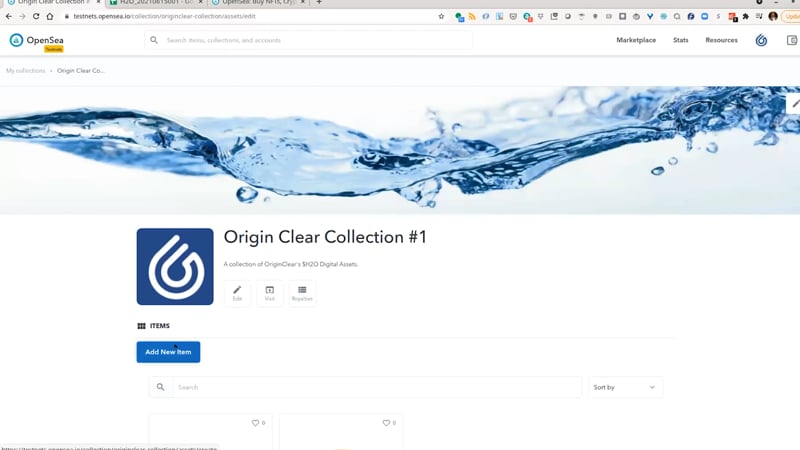

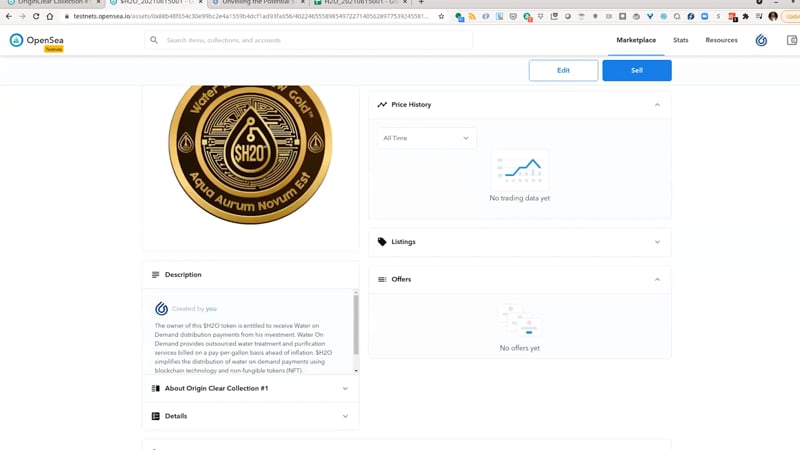

So like Riggs said today, we're going to be creating an NFT, which is like you said, a non fungible token, which will be representing the $H2O coin or token that we have talked about in the past couple of weeks.

So creating an NFT is essentially the first in our approach to simplify payment distributions to our partners and investors taking advantage of the blockchain technology. So, for today's demonstration, we will create, or also known mint an NFT in opensea, which is a peer to peer marketplace for digital items and crypto collectibles. The main thing a NFT involves in transaction fee. For this demonstration, we're going to be using a test network. No real crypto will be spent. Don't panic. You know, if you feel nervous.

Riggs: We want to spend your money, come on.

Ric: Yeah, well we will, we'll get to the money. Whoa. I wish I had known that earlier. Don't worry. We can take care of that. All right, basically the demonstration is going to involve two steps. The first part we will be minting an H2O token. And in the second part, we'll be putting up our newly minted, $H2O token up for sale. And hopefully in the future demo, we can explore the experience of buying these newly minted dollar H2O token. But this is as far as we're willing to take it for today, everybody with me.

Riggs: Rock and roll.

Ric: Great. Can you see my screen?

Riggs: Yes.

Dominant Market

Ric: All right. So the first thing that we will do is that we are going to navigate the origin clear test collection number one in the open sea test net interface. From there, we will select add new item and this should bring a screen. Uh-huh great. Live demo. Okay. Let's try again. Okay. I have to sign into my wallet. Let's do that. Okay. Let me just do this. It was working earlier.

Riggs: Yeah. Yeah. Well, this is why you have to fake, all demos need to be fake.

Ric: Yeah, exactly. Okay. So I'll go back to my collection. I'm going to sign in to my wallet. Worst case, I may have to restart my browser. Let me just do that. That way. It can start from scratch.

Riggs: So OpenSea is the dominant. Tony, that is a metamask wallet, yes. And we're quickly going to hack everything in it while we're here.

Ric: Yeah. It looks like it's blocking my popups. Maybe. No, it's not.

Riggs: But OpenSea is the dominant market for NFTs. So that's why we, why we selected it.

Ric: Okay. Riggs can we move on to the next topic and then.

Riggs: I'm going to let you do your thing. And what I'm going to do is I'm going to flip the agenda around and we're going to talk to Prasad while.

Ric: Let's do that.

Meet Prasad

Riggs: And I just realized that I was showing everything very blurry to you guys. I apologize in the previous NFT screens, but let's say hi to Prasad. Prasad turn on your video. And then Ricardo, you can turn off your video so that you can scramble.

Ric: Yes. I'll do that.

Background

Prasad: Good evening everybody.

Riggs: Prasad. How are you, my friend?

Prasad: How are you?

Riggs: I'm doing fine. Well, you landed with a bang this week, meeting with the team. And before we talk about what you've been doing, tell us a little bit about your background, where you came from in India and all that good stuff.

Prasad: Sure. So Riggs I grew up in a small town, by the name of Akola, smack in the middle of India, which is central India, and I completed my college and everything in the same town. But, then I moved to the west coast and I did my general accountancy certification where you have to work at the firm for the three years while you take the exams. So it's a different format than the CPA in the U S.

Professional Career

I was with one of the local firms. I interned with them. And then I started my professional career with PWC, where I was leading external audit engagements, as well as internal audit engagements. And I was part of, quite a bit of multinational companies at that time. And in 2004 is when the Sarbanes Oxley era kind of like exploded in the US because of the Enron debacle and control over financial reporting needed to be tightened up and stuff like that.

And I got pretty fortunate to land a job in New York city with a top regional accounting firm back in 2004, I started there as a senior, and then I rose up the ranks as a senior manager leading a pretty large public accounting, sorry, public company clients like Steve Madden, United Retail group, Double-Take software, and so on, so forth.

And since then, I have that quite a bit of engagement teams, not only in the auditing of the public company side, but also the internal audit risk advisory aspects of it, leading teams, making sure that the client's internal control environment is strong, implemented properly. And mainly I've also worked with a lot of C-level executives as a part of SOX implementation for public companies, small and large.

Risk Assessment and Management

Riggs: And so you were most recently a CFO at a group called Vertical Global Investments, which means you've actually done risk assessment for companies with revenues ranging well over $1 billion.

Prasad: Yeah. I mean, what we've typically found that companies, you are a CEO Riggs. So, a lot of stuff is your vision, it's in your head. But what we found is that executives tend to miss out on conducting a formal exercise of assessing the risks, which the company faces, both external and internal, which is actually a threat to their overall strategy.

So I led quite a bit of engagements in that area as well, where we analyzed and help the companies and the management yo identify the risks. And not only identify, but do something about it. In other words, to create an environment and manage those risks proactively so that you mitigate those risks eventually as you go along.

Focus

Riggs: Yes. And now let's talk a little bit about what your focus has been for these first few days, because of course you're expected to walk on water from the beginning.

Prasad: Yeah. My focus has been basically speaking to getting introduced to all of the executives across the company. We're obviously working with the finance team and understanding what are the immediate challenges we need to tackle and while doing this, I'm actually keeping the overall vision in mind where I know our goal is to be NASDAQ compliant.

So focusing on the foundation of the company in terms of internal controls, processes, and procedures is of absolute importance. So that's what I've been doing, talking to people, trying to understand the financials, reading the 10-K, footnotes, understanding the equity grants, and so forth.

Biggest Challenge

Riggs: Good. Okay. So just from the first few days, what do you think is the biggest challenge that we face immediately here at OriginClear?

Prasad: I would say the immediate challenge is that establishing and implementing formal processes and controls. Going the NASDAQ route, we want to be looked at by the shareholders to be very robust and strong in the inter-controls environment.

We need to have proper processes in place, proper segregation of duties, somebody prepares something, somebody else reviews it, which then gives the confidence for the users of financial statements. So I would say that will be the single most focused. And I think that would be the most important area to focus on.

Riggs: Well, I'm so happy that you're on board. I've been the quote unquote acting CFO. Since I was never trained as one, it was definitely an area where we need the expertise. So I'm so proud to have you on board. Thank you.

Passion Infectious

Prasad: Thank you. I'm happy and really excited. I know my conversations go back with you a few weeks ago Riggs and just for the panelists and all of the attendees. The excitement and the passion which Riggs shared with me, it was pretty infectious, actually. So, I'm pretty excited to be on board and helping out each other, and yeah.

Riggs: I'm super excited myself. So thank you. All right. So, I'm going to go ahead and let you go Prasad and Ricardo, you can just come on screen when you're ready. Do you feel ready to...

Ric: Okay.

Riggs: Are you jamming?

Ric: I am ready. I hope OpenSea is ready.

Riggs: Good. Well, then what I'm going to do is I'm going to go ahead and thank you so much to Prasad and we're so proud to have him, and you can go ahead and share your screen, my friend.

Back to OpenSea

Ric: Excellent. Okay, let's do that. Third time is the charm. Great. So this is where I left off at the opensea.io website. This is like I said, a peer-to-peer marketplace for crypto assets or digital assets. So here's our collection for OriginClear. This is a test collection. So you won't see it in the life or production site, but for the sake of our exercise today. This is just as good.

Okay, so once we're there, then the next thing we need to do is click on, add new item. I preloaded the tab to avoid any surprises. So basically this is the beginning of the minting process for our H2O token.

$H2O Coin

All right, so the first thing that it asks us is to add essentially the file that represents the digital token. So in our case, we already have a picture of the coin. So this is what I'm going to be using as our example, how representative – there it is.

Okay, then we need to give this baby a name. So basically, we can choose a name that is representative. Remember that the H2O is essentially tied to a performing contract under the Water on Demand™ service. So we'll basically give it H2O and then a fictional representation of a contract ID.

So, then we can add a link, an external link that basically would give the person interested in buying this $H2O token, more information about it. Basically we are in the business of full disclosure, so you want to give people as much information as you can for them to make an informed decision about the investment. So, what better source of information than Unveiling, the CEO briefing, where we unveiled the $H2O water coin, a couple of weeks ago. But in production, this would have a more tailored content to be shown to the person that will be buying this asset.

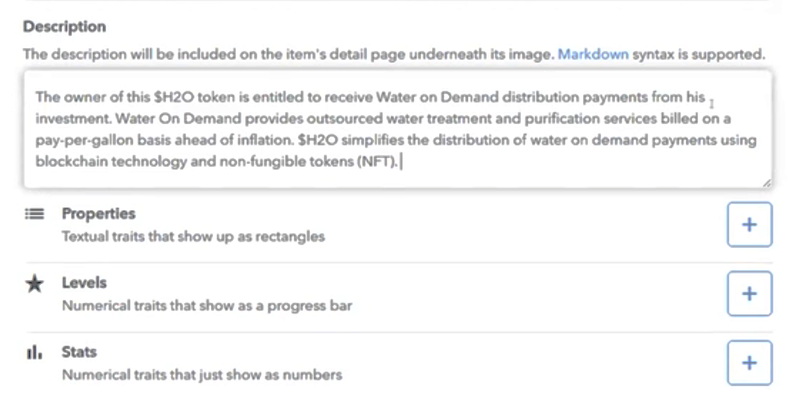

Summary Description

After that, then we'll add a description to give a summary of the information that the person that is buying the asset needs to know. And this is something that they'll be able to see in the marketplace itself so that they can basically...

They're not just buying an image, they're actually buying a performing asset. So, I've done the best I can to tell them what they're getting into." The owner of this $H2O token is entitled to receive water on demand distribution payments from his investment and water on demand provides what outsourced water treatment and purification services built on a gallon basis ahead of inflation. And what this $H2O token does is to simplify the distribution of Water on Demand payments using blockchain technology and non-fungible tokens.

So fairly they'll get more information in the external link, with this kind of a preview of what they can find there. You were going to say, Riggs?

Riggs: No, no, I'm just acknowledging. Go ahead.

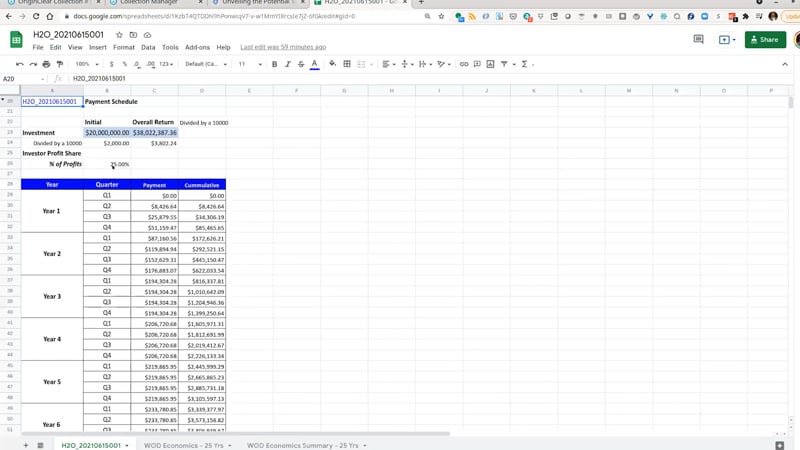

NFT payment stream sample attachment

NFT payment stream sample attachment

Special Feature

Ric: Okay. Great. So far so good. All right. Then one very special feature that NFTs have, is that the person that owns this asset can have access to exclusive content. So if I click here on explicit and sensitive content... Great, it should allow me to provide a URL where I can basically link to something of interest. In this case, it would be a link for example to the contract or actually to the payment flows.

Riggs: Interesting.

Ric: Yeah. So the person can see basically what is it that they're getting in return when they purchase these H2O token?

Riggs: Wow. Very cool. Very cool. So this is from the model that we've built and you've extracted this payment stream?

Ric: Correct.

Riggs: Right.

Ric: Exactly.

Riggs: And of course, this is the payment stream for the entire 20 million. So it'd be some slice of it representing that investors share?

Ric: Correct. Exactly. I didn't want to... I basically wanted to use an example that was representative of something we had shared in the past.

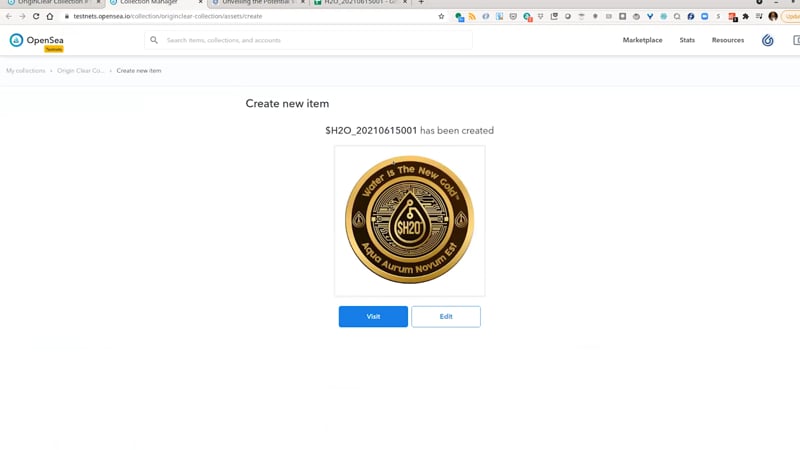

The Minted Coin

Riggs: Cool, 100%. Wow, this is amazing. Okay, good. All right. So let's go ahead and mint the thing.

Ric: Okay. So then to mint the thing, all we have to do is... Actually, let's see. That's not working. We just say create, and then after a few seconds... There you go, it's already been created.

Riggs: Fantastic.

Ric: That means that this exists. It's been registered in a blockchain and it has a unique ID. So this represents something that is unique.

Riggs: So let's visit it.

Submission Summary

Ric: Right. So then let's check it out. When we click visit, we'll basically see the information we provided, the image, the description.

Riggs: Oh my God, this is so exciting.

Ric: Right. And the nice thing is that now we get to sell it. We created this asset, so we can go ahead and sell it.

About NFTs

Riggs: So Tony B asks, can you mine and, or a stake NFT tokens like crypto?

Ric: That's a very good question. Well, actually NFT is... How can I say? H2O is an NFT, so whenever the NFT is registered in a blockchain, whoever is mining for Ethereum and will be registering that transaction would be doing the mining.

Riggs: Correct. So basically it's... What we like about this, remember that in 2018, we were working on a coin but we had to create back then an entire coin hierarchy, a whole coin. Well, here we're able to sit on top of with one of the Ethereum standards. We can sit on top of Ethereum and take advantage of the existing blockchain activities that are going on.

We can play... There's actually ways we could play with staking as well. For example, here's some of our early thinking about it. Currently, this $H2O is there only to contain money, which is a future payment stream. Great. But that's only going to be for now accredited investors. Well, accredited investors represents only about less than 1% of the American population.

Social Coin

So what we're thinking of doing is having a wider definition of $H2O as a social coin to support the development of water so people can trade it and in by doing so, maybe they feed some beneficial project with charity water or whatever. This is still preliminary.

And then which creates a lot of people in $H2O. And then when we start having monetized projects, we drop the actual pay per gallon NFTs in there, and they have monetary value as internal class in the larger one. That's what we're thinking of. I'm freelancing right now to tell you guys just where we're going with this.

Like a Bond

Now, BC wants to know, will you create different coins of different rates for different projects? Okay. Or can they be a partner, what labeled coins? The answer is yes. There's going to be all kinds of interesting things we're doing. The core concept here is that the coin, the $H2O is like a bond.

you, Ricardo, you invested $100,000 in a $20 million total capitalization. So you have one-two hundredth of the total profits. Your share of the total... So, you get 25% of the profits. You're getting 25% of the profits on one-two hundredth of the project. And then we issue you an NFT that represents all of your future earnings, all in one package.

Now it's an obligation to pay that. Now, you can take that and go, okay, that represents... I invested 100,000, maybe my profits will be... I don't know, $100,000, fine. But I want all the money now. So I'm going to sell it to Ken Berenger for 25,000 or 10,000. So, t creates a market.

Why Accredited?

Tony B wants to know... I'm a little confused. The idea of crypto... One second here, we're just... People are commenting at rapid rates. This is very exciting. The idea of crypto NFT blockchain, smart contracts, and the like is to be decentralized and unregulated. Why then require or only open it up to accredit investors? Very good question. And here's the answer.

If you try to do a registered offering today with the securities and exchange commission, which we want to do, involving a coin, we'll see you next year. We'll see you in 2023. It's very, very delicate, but we can do it with accredited investors. That's the safe ground. And that's why we're starting with accredited investors.

Now it's still decentralized. It's still unregulated. It's just that we have to apply a know-your-customer, KYC, so that we know that the person who gets it is the person who invested, right? They are the investor and they get their coin.

Roadmap

So that's as much as I can get into it right now. The plan over time is for the entire world. Some grandmother in Korea Is able to put, I forget what the local currency is in Korea, but they can spend some money on her Samsung to invest in a project in Louisiana.

And it can only be, it can be the equivalent of a hundred dollars. The point I'm making is that's when this is going to get really exciting, but we have to have a roadmap. And this brings us back to Ricardo who is in charge of the roadmap. And now I get to delegate the whole thing.

Ric: Exactly.

Core Business

Riggs: Don't you feel great. That's where it's at. Anyway, Tony, I didn't want to get too deep into it, but there's a lot going on with this. Here's the bottom line, the main, and I'm going to jump back into the regular presentation cause we're wrapping up soon, while we're doing our DBOO, which is design, build, own, operate, which is Total Outsourced Water.

That's the core business that we're building up with capital, with expertise, with software, with all that good stuff. And in background Ricardo, and eventually his tech team will be building this to dovetail down the road. We don't have to worry about this coin right now.

This is right now. It's a pretty Christmas tree ornament is what it is, but it's important to put it out there because remember that video you saw earlier, I think it's very true that we are moving to a digital currency world and water deserves to be represented by a digital currency.

Thank you Tony, for saying you understand, because now you've let me off the hook. I'm going to go ahead and Ricardo, I'm going to thank you for your demonstration and do you-

Ric: You're welcome.

Dan's Update

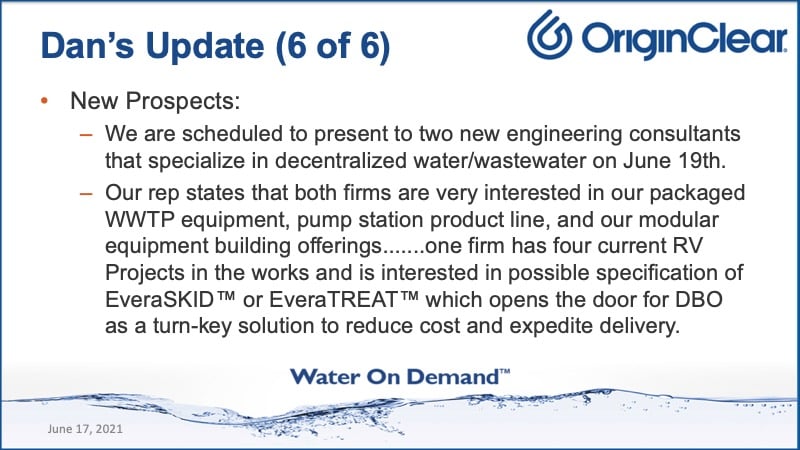

Riggs: You did it. That's brilliant. I'm going to go ahead and move to the demo. I'm sorry. The update from Dan Early. Remember that Dan is working on a number of potential DBOO projects. He calls it DBO, but that's design, build, operate, but the own part is optional.

So this MH, mobile home park, customer in Pennsylvania is moving along quickly. And so he's saying DBO, why? Because we haven't told him he's got capital to put into this. So he's going to do design, build, operate, which means outsourced operation. But in this case, the MHP customer will buy it. Full DBOO is when we do the purchasing and the MHP customer, or whoever, just pays by the gallon. Just like they'd pay their bill for water right now. Okay. The craft brewing customer, no change. RV park, no change.

Now we have this new DB prospect. We had an Ag customer and that's ongoing. That's happening. We have our campground prospect in the Midwest making formal for submission, June 19th video conference. We are well within their budget. So that's actually going very, very well.

Hot Right Now

Now we have some new prospects, two new engineering consultants being presented to. Both are very interested in our packaged waste water treatment, plant equipment, et cetera, et cetera. They have four current RV projects. RV campgrounds are hot right now. Why? Because they are by definition, they are disconnected from sewage that's. They tend to be out in the middle of nowhere. So that's why they like it. Now, DBO will be a turnkey or outsource solution to reduce costs and expedite delivery.

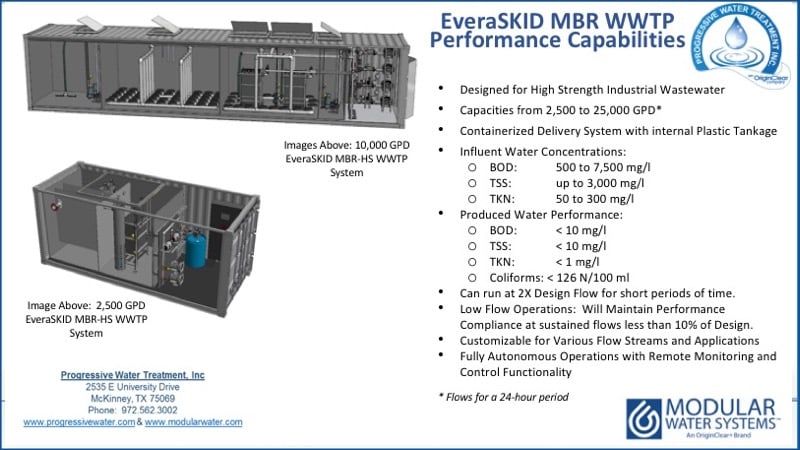

Advanced Systems

Now, what is EveraSKID™and EveraTREAT™? So I thought I would let you know, EveraSKID is basically a very powerful containerized system that we designed for heavy concentrations of wastewater, so dirty, really dirty stuff.

And it's fully remote monitoring, et cetera. It's a very cool. So the lower image there is 2,500 gallons per day. The upper one is 10,000 gallons per day. It's fully scalable all the way up to the 25,000 gallon per day range. Over 24 hours.

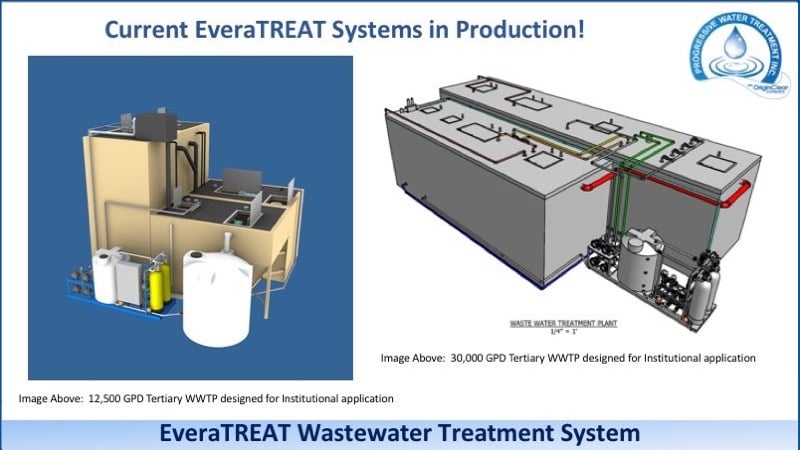

EveraTREAT is in this case, it's tertiary, which means third stage wastewater treatment plant. And third stage is typically the removal of nitrates. So, that's what a EveraTREAT. Now EveraTREAT has other applications, but this is one of them.

Okay. So now bing-ba-da-boom. We just made a big sale. We just sold about a $600,000 package. We, this is verbal right now. We don't, we expect to receive the purchase order next week. And so Dan is very happy to report that this morning. So that is so wonderful.

Pump and Lift Stations

He started to really started to kick it in gear. His engineer, Robb Litos is also doing very well with the EveraMOD™, which is pump stations. You see pictures of these pump stations and these things are, it looks like we're about to sell another one to a national account. And we're actually selling a lot of these pump stations, even though it's not our core business, it's good business.

Offerings

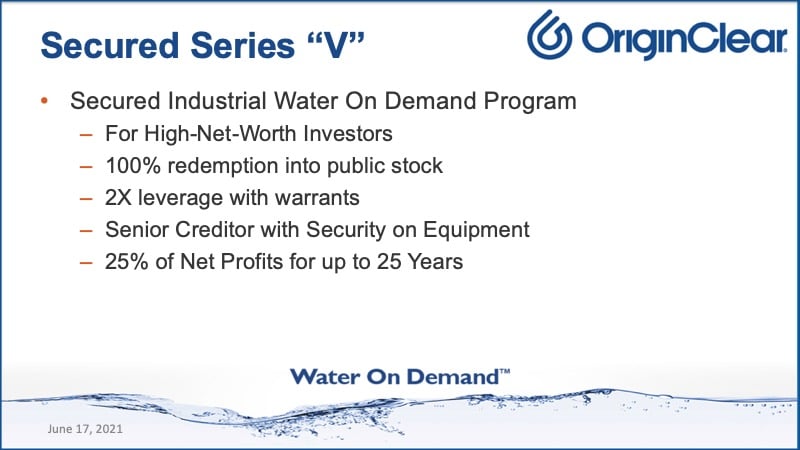

So wonderful things happening with our product lines, with developing design, build, operate. And then as we get into the funding of these, which is my final few minutes here, I'll jump over to V and come back to U.

Where the Rubber Meets the Road

Secure the series V, what is that? That is for the people investing in the Water on Demand subsidiary, which gives them stock, gives them warrant leverage, et cetera, makes them a senior secured creditor. And they also have a security agreement on the equipment that goes out. But here's, what's very important.

They get 25% of the net profits from these machines being operated out in the field for up to 25 years. And that is what turns into these quote unquote bonds, which are packaged as non-fungible tokens. That's where the rubber meets the road. So, that's the security. So obviously again, as Tony said, it starts with a very small club, but it will grow wider and wider as regulation permits.

Standard Accredited Offering

Now, going back to Series U, that is for smaller investors. You know, Series V is really for a million dollar investors, Series U is for smaller than that. Hundred thousand range, you could even invest less, but you must be accredited. And it has some excellent terms, which I won't get into here because our outstanding, Mr. KB. Has the full picture and will be able to brief you.

Call Ken

This is a very exciting time for us. He's nonstop all day. So get on his calendar oc.gold/ken and Ken is going to make sure that he answers all your questions. And with that, I want to thank you for sticking around. We put our neck on the line and, oh, well, it wasn't my neck. It was Ricardo's. It was, it was fantastic.

Ric: Thank you, Riggs.

Riggs: Victor says, how can we get this equipment? Well, we'll make sure you get that. And I want to thank Ricardo for having been brave enough to do this on screen. Now, a future time, we're going to go ahead and tie it into an actual monetary transaction. That's going to be fun, but remember, this is not our core business right now.

Our core business is doing what Dan reported on. Selling these equipment on an outsource mean, turnkey basis. And if you turn the key and it's yours, that's turnkey. And eventually where we own and operate it as the capital comes in.

And I want to thank all the people, helping us, especially Ivan Anz of Philanthroinvestors who was doing a marvelous job. Arte Maren, Vendy Rios are all doing wonderful jobs.

Okay. And then, wow. Okay. So BC says projects. Okay. Will the original coins value on first offering to be greater or greatest value and will values fluctuate? Okay. It's very simple. I'm not going to get into the details of this, but speaking to BC here, each of these NFTs represents a slice of an actual piece of equipment or a package of equipment that got put in the field and it's done. It will never change. That equipment will stay stable.

Now, later we do another round with Wall Street and we do partnerships with this that and the other thing, these are different projects. So each NFT will have its own slice of payment streams.

There's a little bit more about this on originclear.com. If you click on the presentation, it gets into it. I'm not going to spend a huge amount of time on it, but I'm absolutely so happy that people have questions. People have stuck around you guys are the best we're going to keep on trucking each week. I guarantee a fun, exciting briefing.

Thank you all for being here. Thank you to Prasad for being on board. Thank you to Ricardo for his courage. And we are going to rock. Thank you all and have a good night. Enjoy your weekend.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)