David Lynch said the first trillionaire entrepreneur will be in water, but why not tens of thousands of millionaires instead? With a potentiality that great, we believe there's great benefit possible for those who truly work to create a stable future for water. Then how do we accomplish this? Our CEO shared our new company presentation which clearly demonstrates not only HOW, but also the strength of our position… And how strong is that? See for yourself in the replay!

Transcript from recording

Opening

Ken: Hi, I'm Ken Berenger executive vice president and co-founder of Water On Demand, and I can't begin to tell you how excited I am about everything Water On Demand can do for the world, for water and human health. But most importantly, while you're on with me, is the impact it can have on your asset portfolio. Now, time is something we don't get back. So before you do more due diligence, let's figure out if you're the right profile. And I'll do that by asking three questions.

Question number one. Am I sick and tired of investing in opportunities that institutions have already run up? Question number two is what's happening in our with our currency, with the banking system, with the volatility in the market? Is that putting my future generations wealth at risk? Last question. Would I even recognize $1 trillion opportunity if it was in front of me? If the institutions hadn't already told me that it was a good idea. So if the answer to those questions are all yes, then you're ready to go a little bit deeper. Take a look at this video and then book a call with me.

Jane King: With me is Ken Berenger, the executive vice president of OriginClear and also co-creator of Water On Demand. So let's start with I saw that you had a nearly triple revenue increase year over year. I mean, that's something to be commended, especially as the economy slowed down a little bit.

Ken: We released a couple of different numbers. Our revenue was nearly tripled at 250%, which in the water business, I mean, they're popping champagne if you're up 10% year over year. Right. It's very slow moving, right?

Jane King: Yes, Right. It's utility.

Ken: Right, Exactly. So that's kind of a stunning number. Our gross profit for the company was up 262% and again, another near triple.

Jane King: So these are year over year numbers.

Ken: Year over year 21 through 22. We just released the final year end number. What we're really proud of is the team. They have consistently delivered results for us. And what I think is probably the most exciting part is we just announced the transfer of our Modular Water Systems to our holistic water as a service division, Water On Demand.

And what this allows for us to do is combine both the technology and the finance to deliver unlimited scalability in the water business. This is $1 trillion problem. Okay? So trillion dollar problems are not going to be solved by any one single company or probably any 100 companies. The ability to integrate finance, total service, kind of a holistic view with actual technology that is kind of drop and go and can be removed. We think that's the key to being able to scale this globally eventually.

Jane King: So let's back up for a second and talk a little bit about what OriginClear does. So and I mentioned decentralization. So you're essentially providing small businesses, other entities, their own water system where they can recycle the water. You provide financing for them if they need that.

Ken: It's more than finance. So yeah, that is the core of it. And that's that makes it very easy to kind of digest. But 90% of the water in the world goes untreated. Most of our polluted water is not coming from Nestle, it's not coming from Pepsi, it's not coming from Anheuser-Busch, who are massive companies who can install $10 million systems and basically staff them on a 24 hour basis. Okay.

Most of the pollution is coming from the edges, from from kind of the outskirts in smaller businesses, businesses that are extremely capital limited. If you're Anheuser-Busch or you're Pepsi, you have the money, you have the staff, you've basically got your own private utility. 99% of small businesses don't have the capital. They don't have the expertise and they don't have the bandwidth to be in the water business.

They need to make beer. They need to be a farm. They need to manufacture chips, whatever it is. So the total outsourcing of water treatment allows us to say to a end user chip maker, don't worry about the million dollar system. We're going to put it right on your site. Okay. Now we're going to provide expert 24 hour a day monitoring. We're going to service it. It's all in your pay by the gallon. It's $1 million system that you now do not have to pay $1 million for.

The business model is exciting, and we think that the street's going to be very excited about it because Water On Demand owns the asset that 20 or 25 year contract. We own that. And instead of having a one and done type of, you know, great, I sold $1 million piece of equipment, now I'm out of business again type thing. It's now a multi decade relationship to the end user and the revenue generated off a system is many, many, many, many times that of a one time sale. So it's a great model. It's almost like owning real estate in a way. You're going to get rent rolls, you're going to get turnover on property forever.

Jane King: And you're investing $500,000 a month?

Ken: We had great revenue growth, great profit growth. We're still investing about a half $1 million a month in the company. But those investments, as you can see are paying off.

Jane King: You've just incubated your first water company. Explain that.

Ken: What OriginClear did was it fashioned itself as a clean water incubation hub or Clean Water Innovation Hub™. What we wanted to do, we had a bunch of really valuable properties Modular Water Systems™, Progressive Water Systems, Water On Demand™. What we wanted to do is, is nurture them, get them strong enough, and then have them also, you know, maybe go to a national market or whatever.

So our first successful incubation is Modular Water Systems. This is a company that we started from scratch five years ago. I mean, literally Dan Early walked in the door and we built a company around him and his patents and his ideas. So from literally zero, we were able to transfer Modular Water Systems to our other division, Water On Demand, which is the water as a service company for many, many times what our investment was, I would call that the benchmark for successful incubation. Buy it cheap. Sell it or transfer it for a lot more.

Jane King: Well, that's an interesting aspect of your business as you grow. You might be able to also incubate other water, innovative water companies.

Ken: Water is a technology based business. It's not pipes and valves, and there is no incubator for water technology or aquatech as they refer to it now. We set out to be the world's first incubator for water technology.

Jane King: It's such a problem with water and cleanliness of it and lack of it, and you're really trying to address that.

Ken: It's an upstream problem. Right now we treat it downstream, right? Everything flows downstream to a centralized water plant here in New York City. You know, I grew up in New York City. Water was the best water. Not so much anymore. Right. Because everything's coming up from upstream down to downstream. They're doing their best.

But you've got 80 million different contaminants in your water. How can one centralized system possibly address that? If you treat the water at the place, it's being contaminated and you address those specific contaminants with a private, decentralized water utility? The quality of that water coming to the centralized system is better. And if you charge the polluter right, you and I are paying for water. Okay, We're paying the same as the guy who produces millions of gallons a month. Okay. That's crazy, right? And he's the one polluting it. We're not. Okay.

So if you charge the end user, you're actually saving that business a fortune. Okay, so he's happy, but the quality of what comes down to the end user is much, much better. And potentially we can start to deliver water in decades to come, cheaper or even free.

So what happens when you combine world class technology with finance and end to end service in $1 trillion asset class that has not yet been funded? Well, you can find out by booking a one on one call with me. I will walk you through it. I will answer your questions. David Lynch has already identified this water as the investment that will create the world's first trillionaire. Speak with me one on one to find out why he feels that way and why I agree. I hope to speak to you soon.

Introduction

Riggs: Well, here we go. Thank you for joining us. We have a nice crowd today. I thought I would start with what we are working on here as our tip of the spear where Ken is explaining the business model. And then we are following up with an amazing interview that he did at the Nasdaq market site, which I think explains tremendously well. And the illustrations, the graphics that illustrated it by Steven Eckelberry, my brother and the great videographer, I think were brilliant as well. So all around, we are very happy with this. So with that, I'm going to get into the actual presentation. So here we go.

All right. May 18th and May is a very important month for us for reasons that I can't really get into. But it is the time is marching on and really interesting things are happening. And it's something that we can only discuss under very severe confidentiality agreements. Briefing number 211. So we're moving on here. All right.

So the usual safe harbor statements.

And the disclaimer about the offerings that we're making here.

Story that is heartbreaking about cancer from contaminated water is this story here is about a mother who is unbelievably careful about toxins for her son. And yet the runoff from three M's medical chemical company. Which had these, these forever chemicals, fluorochemical products which are used at fire training facilities and fire departments, etcetera. And these are now in the drinking water.

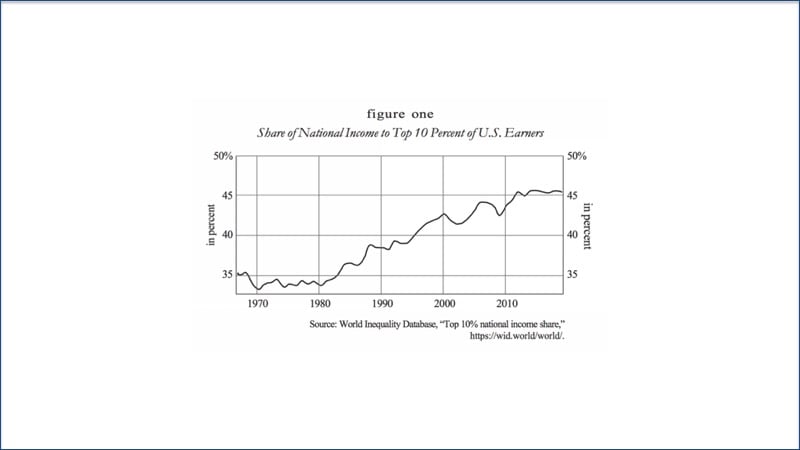

All right. Now, here's something very interesting trends and wealth disparity. This comes from a Twitter post that gets into three different graphs. Let me show you the first one. This is the actual Twitter post.

And the first one here shows that in the 70s and 80s, we were really in the low 30 percentile range. So roughly the 10% of US earners were less were around a third of all US earners. And so that left room for the middle class. Since then we have gone more than 10%, about 12% change, and that is directly attacking the middle class.

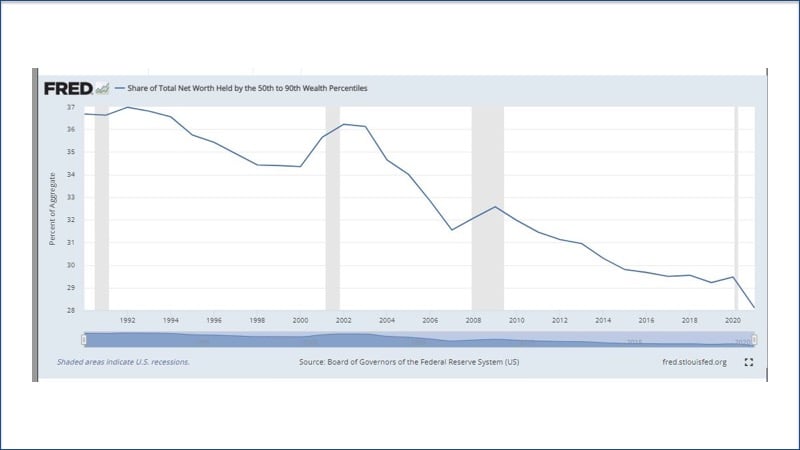

And then here from Fred, which is the Federal Reserve, shows the share of total net worth held by the 50th to 90th wealth percentiles. So again, we're talking about the middle class here, right? The people who are not in the 10%, their share of wealth has dropped from the high 30 percentile range all the way down on a steady trend to the high 20s. This is very alarming.

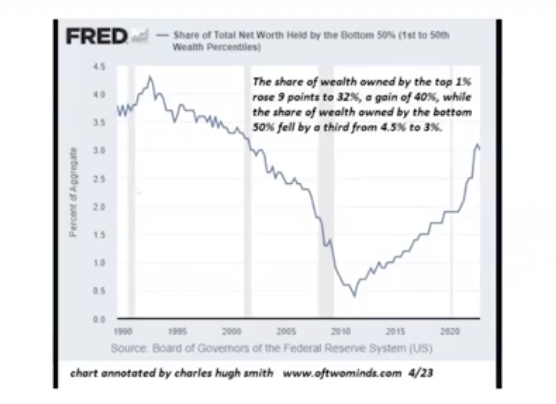

Share of total net worth held by the bottom 50%. Actually the bottom 50% has been doing better. All right. So the share of wealth owned by the top 1% rose 9%, a gain of 40% while the share of wealth owned by the bottom 50% fell by a third from 4.5 to 3%. All right. So we have a trend where basically the top 1% are really consolidating wealth. What does this tell us? What we learned from this is complacency is dangerous.

You can't just assume that you've got a job and you're in the middle class and you're doing your thing and you're looking forward to retirement. That's a very dangerous point of view, and investors need to find a way to upgrade into the upper class, i.e. the 1%. It's not going to be everybody. So you need to be thinking like it's going to be you because it's not. It's you or someone else. Unfortunately, it is where it's at. So that is what this tells us. And this is why it's very, very important that investors look at assets and especially assets that return residuals. Right. All right. Let's take a look at another trend. You know, we I keep coming back to decentralization.

And one big story that's coming out of decentralization of centralization is our energy grid. And what's happening in our energy grid, first of all, is because of deglobalization, there's a lot of liquid natural gas being shipped around the world. Now, don't tell me that that is logical or proper. Pipelines are far, far cheaper and safer. You don't want to ship with a bunch of LNG to run aground on Cape Horn or anywhere in the world, really. But that's what's going on. So liquid liquefied natural gas is booming and now Mexico is jumping in. We have Canada, of course. United States remains the top and then Australia and Qatar. So that is a problem with what's going on here in the energy world, energy grid outages.

Decarbonizing the Electric Grid

And there's a story in the Epoch Times now, the Epoch Times is political. They're going to make political points again. We don't care about the freaking political points. We just want to make a point about the fact that the power grid is dealing with outages. And that's because centralization is subject to a whole lot of, you know, mad, um, uh, you know, arbitrary decisions and so forth. Right? Whereas decentralization is much more independent.

And so I'm not going to, I posted all this because it's a paywalled article and it's good to have this, but basically there's a push to decarbonize the US electrical grid by 2035. And again, Epoch Times is making comments here, moving from oil, gas and natural gas to renewable energies. And the concern here is that there's going to be a gap between the current. Bad mean. There's no question that fossil fuels are bad. They're bad for people's health and so forth. No question about it. Climate change issues, all that stuff. And then there's the new thing. The problem is the gap. And it's especially true last week I reported on the problem with EVs at the industrial level. At the commercial level. You put in a fleet of trucks and you just about take down a grid. That is the problem we're talking about. So we need to have more reliability and there will apparently be summer outages as a result.

Risk Assessment

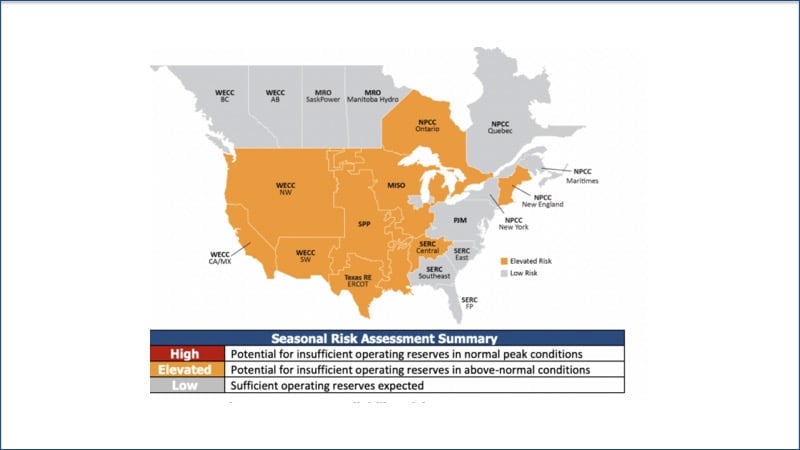

I'm going to flip through this really fast and come to this image here, which is going to tell you the elevated risk for outages. Fortunately, we don't see the red in the game. We see a lot of yellows and we have a a lot of elevated dangers from California to northwest Texas through the Midwest into Canada and New England being in trouble. Um, the Southeast is in pretty decent shape. So and then, of course, the far north Canada is in good shape, too. So that's what we're looking at as a situation.

Keith Roeten, "Definitely middle class vanishing. Have to decide now where you will be in 10 to 15 years." It's exactly right. You need to do your planning. And obviously we are there to help the investor benefit from access to this. You know, the first water, the first trillionaire will be in water. Well, we don't want to have one trillionaire. We want to have, you know, tens of thousands of millionaires. And that's what the potential is in water. That's the power of it.

All right. So and then again, we get it gets into discussing that map I just showed you. And the problem with fires creating problems. And I'm not going to get into all the politics. All right.

Water On Demand's New Presentation

The the goal for today that I want to get into was a presentation of our new we announced this on May 16th, which was Tuesday, that we transferred, of course, Modular Water into Water On Demand. And we've also now have a roadmap for prospective acquisitions. So I'm going to do now is I'm going to shift to the presentation and I'm going to run you through it.

Start of presentation

Welcome to the third quarter presentation. What are the next major asset class where industry solves the water problem? And now we've evolved from the second quarter where we were talking about the merger of Modular Water Systems with Water On Demand, and now we're going to start talking about where we go with acquisitions. Safe Harbor statement, of course, about how things could differ materially from our forecasts.

Now, very important slide here. This was the trillion dollar future for water where the world's first trillionaire will be in water. Well, that's David Lynch, who has a digital solution to network water network management, which is very important. But we don't see this as 1 trillion trillionaire. We want to make tens of thousands of millionaires. That's far more healthy. We're not interested in this pooling of the 0.0001% being super wealthy and everybody else serving them we want to restore. Wealth to innovative investors, and that's where water is happening.

Let me talk about this some more. Government infrastructure is failing where we have not only what was predicted in 2016 by LUX Research, which already is $100 billion a year gap now in 2022 and 2023. We are seeing a trend towards Deglobalization where it's no longer viable to operate a factory in China, and many manufacturers are pulling back into the North American complex from Canada to the United States to Mexico.

And for example, Tesla are doing a great job operating in Texas, and they don't need to be in China. Now, if they're going to sell cars in China, of course they'll have a factory there, but there's no need for them to build in China for the US market. They're building here and that is going to happen more and more. Well, the question is, as there's going to be a boom in these state of the art factories that are highly automated and very intelligently developed, whereas the water treatment is going to be this. There won't be time to build central utilities. And so they will have to come with integrated water treatment.

And this is a big reason why Progressive Water Treatment and Modular Water Systems saw tremendous increases last year in their business, nearly tripling. Why? Because more and more businesses are having to do their own water treatment as they are expanding into the North American market. All right.

So here we have the funding. Even a fivefold increase in federal funding would leave a 22% shortfall of capital. So that tells us that many commercial users will have to do their own thing. They will no longer be able to send their wastewater to a central location.

And we have a problem here with households not being able to cover. And by the way, the households are only 10% of the load. So if they are being made to pay more and more, they're going to start defaulting on bills. Almost a third of all utilities doubt their ability to cover their cost of services. And the far right here, we see more than half of all use water. Utilities have a problem with customer non-payment. So again, our solution is private water treatment to reduce the load so that the utilities are not stuck with this impossible problem.

And again, municipalities are charging more and more for water. And sewer service. You see on the right, what Americans pay for water and sewer service has increased much faster than inflation or the price of food. This was published by CBS News, but it quotes the Consumer Price Index and we see water and sewer rates skyrocketing. This gives a triple incentive to businesses to cut the cord by number one, sending only treated water to the city, which the city loves.

Number two, recycling their treated water, using it more than once for wash downs for irrigation, whatever. And three, not having to have a sewage line at all, which means they can locate anywhere they want. And that's very useful in booming locations like North Texas, where from Dallas on north to the Oklahoma border, you have a boom situation where, again, sewage is not keeping up. What do you do? You can go off grid. So that is the solution that Modular Water Systems has been reporting on. They have a wonderful video where they show an installation that was done in Denison in northern Texas that we'll be showing you more and more as we go along. Okay.

So Aqua Tech's next phase. We are now privatizing a government monopoly. So here's where we go this. Anytime you have a monopoly and you break it up, look what happened with AT&T. It created vast amounts of wealth, even to the point of giving us the Internet today, If AT&T had remained a monopoly, we wouldn't have an Internet. It just wouldn't happen because it was restraining trade. Okay, So now we have a fast growing space here where mergers and acquisitions transactions, which basically is the lifeblood of water activity. This is how the big water companies grow.

Well, the number of completed M&A transactions was for utilities, which is the black is very high between 2000 and 2020. But if you look to the right, the actual dollar value of utilities transaction was very low and it was the bigger number was services and equipment deals growing faster. What I'm saying here is it's clear that private sector initiatives, not central government programs, have the momentum. And anybody who's smart in the water planning is going to recognize that's where it's at.

So why would a business go private? Cost controls if you if you have clearly defined cost indexing instead of unpredictable municipal rate increases. Now a business can plan its future for ten, 15 years, 20 years, even. It can recycle the water, which reduces their water expenses, but also saves water. Places like California control over waste. Many breweries, for example, are having to truck their water from one county to the next because the local utility just refuses to take it.

But this requires a two part solution and really going private. This makes the point here that by putting these treatment points at these remote points gives us at the bottom less burden equals a smaller central plant. Therefore reducing the burden on the 150 000 plus water systems that we have in America.

Well, there's a two part solution, as I was saying, requires two parts. Number one is technology scaling down from the large central systems to the on site businesses with a management network. And this is a very important software cloud management that we're going to get into. Secondly, is helping with capital so that businesses can get going with their water treatment.

So you need to handle your water treatment. Capital is not a problem. Water On Demand therefore, is the answer. With technology to fit on site locations and eliminating capital expense. Here again, back to LUX Research the future of decentralized water back in 2016, he said, Look, we have a problem. We need modular construction. That's since 2018 we've had Modular Water Systems assemble our methods again, our company that our division Modular Water Systems is now part of Water On Demand.

Plug and play on site. Literally, we have videos showing how these machines in their 40 foot containers with the full built in controls, etcetera. We're brought on a truck to a location, put on to a pad plugged in. A six hours later, we're operating plug and play on site. And finally, remote management, which is a key remote monitoring and control, are very, very critical.

And finally, Greenbiz itself recognizes that the upfront capital expenditures are holding back water technology startups, and that's very important. All right.

So let's take a look at the how Water On Demand does the total management water management game. The top right, we have investors. We're putting money into Water On Demand. Which then creates an operating contract with the customer going down to the left. We have Modular Water Systems building the systems and delivering it. Bought way. Bottom left, there's something new planned manufacturing acquisitions. Dan Early has plans for acquiring more fabrication. We have plans also to build dedicated manufacturing capital. We plan to raise for the purpose south of the border, a lot of it south of the border, but also in the US.

And then it goes over to a sensor array and now you're managing the network. And we are in discussions with a company that is already profitably handling what's called middleware, the connection between a user and a cloud based database. And in the middle you have software that operates in the cloud and they are already doing that very well. And this is exactly what we need. We are in discussions and this is disclosed very shortly.

So the main steps are these. Number one, as we were saying, investing in a subsidiary. Number two, the contract. Number three, building the system with Modular Water systems. Number four, a cloud connected network bottom right there. And then five, managing and billing and then finally returning shares, profit shares to investors and partners. That is a recipe for a in my opinion, a world dominating system. And we are making the arrangements for having the operating capital to make all this happen, but also for the getting the expertise. We're not going to grow expertise in house. I came from high tech. I know what it takes to build a software company. It is royally painful.

Instead, we can acquire a, and I don't want to get into too many details here beyond what is on the on the on this presentation, but basically, we're talking about a leveraging an existing expert business to have them create our network. And then this network, of course, can expand into multiple Water On Demand networks throughout the world. Super exciting. I couldn't tell you more about how excited I am.

Okay, so. The new power play then is Water On Demand with Modular Water Systems. And sure enough, we've paired technology in the left. Modular Water Systems again was created from scratch in 2018. We have invested well over $1 million over the years in developing this. We licensed a set of patents by Dan Early. His reputation has been growing fast and many of his deals are called basis of design, which means that the customer has specified that Modular Water Systems is the basis of design and nothing else. On the right we created Water On Demand in 2021 to accelerate business adoption by replacing capital expense with operating expense as a service. And now we have the beginnings of a team that is pursuing pilot projects.

Now you say, Well, where are the pilot projects? Here's very simple. You don't want to go after customers that have already fixed their capital problem because as you know, it's like bringing ice to an Eskimo. It's like I'm good, right? So what we learned is we have to go early in the process.

And with Modular Water Systems now being part of Water On Demand, we can have Dan Early and his team propose a Water On Demand solution water as a service, right at the beginning when they're first talking to the specifying engineer, when the thing is just in the design phase, long before it goes out to bid, long before they start talking about capital needs and leasing and this and that, they get to be, "Oh, you mean I can just sign a contract and I'll be on the meter and they'll be taken care of?" Yes. So that's why we're really focused on Modular Water Systems doing its job because it will organically bring about the Water On Demand pilot projects.

With this network, we have businesses that get water treated and managed on the meter. No capital required long term service contract. It includes a unique patented technology prefabricated, durable, already developed. It's profitable. And remember, it almost tripled between 2021 and 2022. I'll show you that graph in a second. And now it's been transferred to Water On Demand in a deal that was very advantageous for OriginClear.

Now we are planning to add a network management acquisition, as I've been discussing, and acquisitions in the wastewater service and manufacturing business. Those are two major things that we'll be pursuing. However, it is not our plan to do local support, right? We're not ServPro. We're not here to do that stuff. There's plenty of local water companies that would be delighted to handle the local service contracts. And so when we, when we're managing a long term service contract with a customer and the customer is in Seattle and we're in Texas, well, we'll just have a contract with a local maintainer in Seattle, and that is how it works. There's it's really very synergistic.

I compared it to how Tesla did the brilliant move of creating a supercharger network. And now. I have a brother who purchased a Mercedes electric vehicle and he told me, "I have Tesla envy." Why? Well, every day he goes from Clearwater to Sarasota. 1.5 hours there and back and he's ready. He's like plugging into the local Whole Foods charger. He's like a he's like a gypsy electric car. And it's a beautiful Mercedes. It's a stunning car, but without the supercharger network. You're dead in the water. And so it's very important to have a network on the ground that assures that service. And that is part of our initiative. And you can call it our supercharger network. All right.

What about the competition? Well, I'm not going to get into this table because it's really well summarized by this quadrant. So the top left, we have the conventional players that have some degree of managed services. Fluents, for example, does a good job with that. Evoqua Also, American Water Works and Veolia are more in the centralized utilities business that they operate a lot of city systems and so forth. So they tend to be, you know, in that. But they're there, believe me. American Water spends $1 billion a year on acquisitions, so you better believe that they are moving into order to service.

Now, on the bottom right, we have some excellent competitors to us, Seven Seas, which actually owns the water as a service trademark, focuses on very, very large installations doing desalination for islands, for example. But you can't invest in seven seas. Why? Because it's operated by JP Morgan, by sorry, by Morgan Stanley Infrastructure Partners. And they got their money. They're good. Cambrian again is also a very good company. It's in the beverage industry. It does a lot of breweries, but guess what? It's venture capital funded. You can't put money into it.

Water On Demand is a subsidiary of public company, and since 2021 you've been able to invest in a Water Like an Oil Well™. In other words, systems going out there, which we retain ownership of, and the investor can actually place a lien on the equipment to make sure that his or her royalty is paid by royalty. I mean share of net profits. And so it's a it creates a revenue stream. It's secured by an asset base and it's long term, it's very stable.

And in addition, because it's early stage, we've done a lot of wonderful things to give people a share of both OriginClear and Water On Demand as part of the package. Well worth reviewing with Ken Berenger because it's been highly successful in raising money. And however, we're going to limit it to $20 million, we've raised about 7 million plus. We're not going beyond $20 million in this round. And after that, we have to take a fresh look at everything. So if you want to get into a residual asset and investable asset, then you might want to consider the investment in Water On Demand that OriginClear is has been running for a couple of years now to support the new Water On Demand startup. Okay.

Now let's talk about Modular Water Systems. Here is that patent that is so, the set of five patents is so important and these basically have this structure that ensures a long term solution to operating systems under rain, snow, corrosion, whatever. This stuff keeps on running and therefore it means that you have a portable, integrated, transportable plug and play system that can be matched or manufactured in series, standardized, just like Ford's assembly line is more durable and has proprietary configuration of software. So there's that.

Now, there was a recent evaluation done of the patents by a company named GHB Intellect. That's what they do, and they valued the patents at nominal value, which means without taking inflation or the factors into account between 26 and $53 million, the available market here, if you look at, for example, 2030 is $12 billion, not a bad available market to go into. So that was a very powerful evaluation we had done in February.

Modular Water already delivers its systems to remote users. They already do it with breweries, with housing developments, with farms, home, mobile, home parks. Et cetera. The difference is, it does it, people pay. So they're paying up front and Modular Water Systems delivers it. By uniting Modular Water systems with Water On Demand, Now we will have the ability to let these customers not have to pay up front. And we'll do it, as I was saying, early on in the cycle when they are still looking at their solutions. But the important thing to remember here is we are already in that business and doing extremely well.

I'm not going to get deeply into this, but basically what you're looking at is a plastic enclosure inside a 40 foot container and so one inside the other. The plastic enclosure is fully waterproof and very high security and lots of important elements. But because you've got a 40 foot container and the plastic waterproof system, tanks are smaller, you have then an equipment room that enables you to operate things and have various system components and do your maintenance. So it works. You don't have to have a separate, for example, a separate maintenance house or whatever. It's all built in. It all gets trucked in, dropped in.

And as you've seen in videos in the past, and we're going to keep showing you the videos, all the end user has to have is a pad with electrical and water connections. In comes the truck, drops it in. Screw them in. An installation can be done in as little as six hours. Up and running. Treating the water and it's coming out Clear. Amazing.

Now pump stations is a business that really is not being, people don't realize how important it is, but there are literally millions of pump stations. Every, every time a pipeline, a water pipeline has to go up. And then back down. You have a pump station and the accepted difference is pump station is clean water, lift station is dirty water. There's a lot of debate about that. I'm not going to get into it.

But the point is you're doing it with both sewage and with clean water, and they leak. When they leak you have two problems. Number one, if it's clean water, then you're losing revenue because this is water you that's going into the ground. And if it's sewage, you're actually contaminating the groundwater. The solution here, which is called a EveraMOD™ from Modular Water Systems, gives you a completely robust and durable pump station that is not going to leak, and it could last 75 to 100 years. That is taking the pump station networks by storm. We are seeing a tremendous amount of, we're winning national accounts because they're going, okay, you know what? No muss, no fuss. We drop these things in place and we don't have to worry again.

Here in my condo. We have a lift station by the side of the street. And literally they have to keep, you know, people cars from parking and right where the lift station is because we they might have to come in with a crane and pump it out because it breaks the reliability factor of EveraMOD is far greater. And that is appreciated with these municipalities, but also these regular commercial accounts that just don't want to have a problem.

Okay. Now, 2022 revenues as forecast were nearly triple 2021, about $1 million in 2021 and we achieved nearly triple and that shows that we are highly scalable and in rapid adoption,

We bring these together and this is this is where it really starts to work. And back last last month we transferred Modular Water over. Now we have this combination of GM and GM Financial, right? So you have a captive financing organization supporting. And believe me, GM does a lot more deals because GM Financial is there like, hey, I'll give you three points less. You know, you pay $300 less a month. Do a deal with us. People say, okay, right.

Revenue and profitability growing again. We actually delivered three times the revenues in 2022 over 2021. And Water On Demand revenue in the future will add a tremendous amount more scale. Why? Because it's money. Money is a far more scalable thing than building equipment. And so you have scalability and profitability and it's reflected in the graphs.

Now before I move on to the graphs, again on the left, we have initial discussions with a profitable digital cloud software company that has long term large tech customers in place. The idea is to maintain their existing profitable business and to build our digital water network with that team. And as I say, we are in discussions with this company and I can't say more than what you see right here on the right.

We're going to establish manufacturing centers, Dan Early says, "Listen, if you can get me more fabrication centers, I could get to 20 or 30 million." From where I'm doing $1 million a quarter right now, that's, you'll see in a second that's how it's working out. Well, that's only 4 million. How about ten times as much? Well, that requires manufacturing centers and then supporting the reshoring trend, bringing factories back to the North American complex with new factories, with integrated wastewater treatment. That is a boom in the making. All right.

Let's take a look at charting the integrated whole. And we have Water On Demand with Modular Water Systems. Now, this has no effect from possible acquisitions. Why? Because they're not, they're still in the early stage, and we just can't forecast it properly. But what we have done here by adding Modular Water the light blue is we've added current revenue. As you can see, it was quite small. We lived through hell, as Ken will testify. We lived through hell in 2018, 2019, 2020.

And 2021 things started to move. $1 million was booked. And these are revenues, which means it was not just booked. It was delivered. Right. The milestones were delivered. 2022 we had a jump from a million to close to 3 million. And now in 2023, we're looking at $4 million, which is $1 million a quarter. And I'm not able to comment at this time on this, but we are very satisfied with the performance in 2023 against the forecast. So we believe this forecast is accurate.

Now as Modular Water Systems continues to grow. Water On Demand starts to generate revenue and that's where you get your hockey stick for the combination of the two. Because remember, it's easier to work with money than to build things. This is why there are so many people in finance relative to people actually building apartment buildings and so forth. It's so much easier to do the financing. So that is the combination that we believe is highly synergistic.

Let's take a look at the gross profits. And the gross profits, again, are tremendously enhanced by Modular Water being in business. They again, literally $1,000 gross profit in 2019, actually -22,000 negative in 2020. You know, again, that was the whole COVID period. This is when Ken and I really started looking at what eventually became Water On Demand because we were seeing that. Things weren't going nowhere at the time. Well, what we didn't count on was the bounce back factor, because in 2021, gross profit became a half a million, 2022. 800,000. And now we believe that gross profits will exceed $1 million in 2023 and again in 2024 onward, you see gross profits from Water On Demand start to kick in.

Here's where the investment shows up. This is on net profits. And so you have Modular Water noodling along here and operating profitably. We have no complaints about how they're operating. By the way, these these reflect it was difficult to generate these numbers because Modular Water and Progressive Water were one for a long time. But they reflect a rough estimate of the net profits. And as you can see in 2023, we foresee that there's profitability with Modular Water and but Water On Demand is it requires investment and so you see it being negative.

But overall we see 98,000, so roughly $100,000 positive in the combination. Now then it becomes really intense in 2024 where Water On Demand is very negative. You see 724,000 negative, but Modular Water generating almost $1 million in net profits. These are all forecasts. This remember, subject to safe harbor statement. But from there on out you get this tremendous hockey stick.

And this is the power of the model because not only you have reasonable growth, in fact, on net profits, we didn't even show growth from 2025 to 2026 on Modular Water. Why? Because lots of investment in staffs and equipment and so forth and lots of lots of overhead being built. But that's okay because Water On Demand starts to really cook. And so we end up in 2026 with an estimated $7.5 package from the two.

Now, should it be much more? Absolutely. We're trying to be as conservative as possible and not to go crazy with ourselves, but this reflects a rational look at the business. Our CFO, Prasad Tare, was instrumental in modeling this, and he took a very sober approach to this forecasting, and so far it's working out great.

Okay. Let's talk quickly about the operating plan. Number one, as I was saying, Modular Water Systems engineers will introduce Water On Demand early on to specifying engineers, and that's where they have that in. Right. Number two, aggressive acquisitions of both digital. Remember, digital is hot, right? And manufacturing resources with the goal of growing well beyond the forecasts you see on the previous pages.

We intend to file more patents because obviously there's been a lot of development since 2018 that we own and we transferred that that capability to Water On Demand. So it has the ability to file these, working with Dan Early, who is now part of Water On Demand. And finally, of course, we got to develop a strong team, the tech high quality to support this high quality nearshoring manufacturing that we're talking about and continuous quality improvement. Lots of work to be done, but we have an excellent team.

All right. Technology plan is to establish network operating centers with continuous quality management and service level agreement enforcement. And that's where the prospective acquisition comes in. Develop that network of local support companies that we were talking about creating a barrier to entry for competitors. And finally, we're going to create more lily pads, shall we say, of Water On Demand and other financial capitals that duplicate the same thing. We start replicating something that we've already built, and that starts to become a really interesting business.

Now, on the capital side, we've been raising money from accredited investors, and that's this program that I was talking about that generates residuals. Roughly 7.5 million raised so far. It is expensive money, so we're limiting it to $20 million. We're not going to be as generous in the future. Now's the time to get very good stock grants in both the parent company and Water On Demand.

Now, this has offered the 25% share, which is tremendously popular, very similar to how master limited partnerships work in the Water Like an Oil Well business. It's the only water service program that's open to accredited investors. And finally, we can expand this after this $20 Million round, but it will be done differently.

All right. We also in 2023, we opened a crowdfunding round, which is going to be paused as we move into something that and I can't say when this might happen, but remember that in January we announced a letter of intent for a merger with a Special Purpose Acquisition Corporation (SPAC). And so this crowdfunding is very powerful for bringing in everyday investors, earning straight common stock and Water On Demand and build a movement behind the company. But as I say, when and if we move into merger that was originally discussed in the letter of intent, when and if it happens, we're not making any representations here, it will be paused. So that's why it's good, ff people are interested, they should jump in and do it. But again, we can't get into how soon it might happen or if it will happen at all.

Now, of course, we intend to pursue institutional funding. And what's great about this is because we retain ownership of the assets. It's called hard money lending. And so that funding can be extremely cost efficient, just like basically like a house mortgage, right? They have a right to the House. Therefore, the percentage is going to be very, very low. We think a very similar situation can exist, but that's in the future at some time.

Okay, Let's finally let's jump into the team. Obviously, I've been in high tech and I've had my share of experiences running ships. And I love of course, my love of water extends to skiing and sailing. And this is our plan to really revolutionize water. And I'm so proud of the team that's helping us make it happen.

Here is Ken, who is really the key man who has been really developing the concept with me of this Water On Demand concept. He has a tremendous background in finance. He can talk mano a mano, man to man, woman to woman with, you know, real concern investors who want to try and figure things out. And he's going to give us straight. And that's, I think, what a lot of people appreciate with Ken. All right.

Daniel Early is the guru who has brought us into Modular Water Systems. They live in the in Roanoke, Virginia area. And he, too, has a family. And they're just wonderful people. And they are actually close to Virginia Tech. So that's kind of his area in terms of where he hangs out. But he's in Texas a lot with a lot of the business that we're doing there, as well as other parts of the country.

Prasad Tare was brought in due to tremendous amount of experience in public accounting. Et cetera. And he has done wonders to improve our governance and our timeliness of filing and really super happy with how he has been revolutionizing in the company.

Finally, Colin Sherman joined us a couple of months ago and he has built literally billion dollar systems for infrastructure based projects, primarily in Australia, the Sydney transport system. And to this day they still use that electronic travel card that he helped introduce and now his talents are being used to help Dan Early really organize a high speed flow and we're privileged to have him on board.

End of presentation

So here we are. In the normal scheme of things, if I was presenting this, I would ask questions and the only question is that I see so far is from Jean Tully. What's my best time in the slalom? Which that's a confidential answer. I won't get into it.

Freewheeling Discussion

But nonetheless, I'm very proud of the state of the company as it's been laid out in Q3 of this year. And we believe that we're going to have a tremendous time going forward. We arrived at the free wheeling discussion. Bring in the man, the myth, the legend.

Ken: So what I really I love exploring the network management aspect of this. It's been the piece that we've known we needed to you know, we had to get there, right. And all of a sudden, boom, It was just, you know, it's great when, you know, I remember years ago when I joined the company, you guys had to go out and like seek to buy things, right? Can we buy? And now it's just like, boom, do you want to buy us?

Riggs: I was literally propositioned, like —.

Ken: No, no, I got it. Yeah, I Know. It's like —.

Riggs: Wow.

Ken: You want us or not? You know that that's exciting. Also, I wanted to just mention to the folks that were watching that hockey stick that you saw. Now you saw that it was you know, it was it was a big chunk of of manufacturing and just a little finance. And then boom, the next year. And then it was like, it was 80% finance in 2026. So if you put that if you went out further, what's going to end up happening is you're going to see it's so lopsided on the finance. BMW, one of the guys at BMW said something very interesting. He said, "We're a finance company that also makes cars." That's all you need to know.

Riggs: In addition, there is the service revenue. And our friend in Mexico told us, he operates the service business, He says, "Riggs, my margins are 80%." Right?

Ken: 80 plus, right. Yeah.

Riggs: So.

Ken: Exactly.

Riggs: That is built into the Water On Demand contract, is service revenue. So not only do you have the financing side, but you also have the quote unquote extended warranty business. So that's part of the whole thing that if I'm trying to make a comparison with the car business.

Ken: I'm just addressing Joseph's question. Joseph, if you, when we get into those subjects, that's probably best discussed in a confidential briefing under NDA.

Riggs: Yeah.

Ken: So, I will have Larry, Larry, if you're not on, we'll have Larry forward you, just put in your, put in the chat, your email address. We can send you a non-disclosure agreement and then we can we can discuss those subjects offline. But as I was saying, so, you know, the two most profitable aspects of the car business are service and finance. Right? And nobody was doing that in the water business. You had independent, small, independent service companies basically doing it right, just burning man hours. That's what they were doing. You're just paying for the man hours, right?

So to bring those two, overwhelmingly the most profitable features in this industry, into you know, kind of one envelope, it was that, it was that really magic aha moment. So we're, you know, we're pretty happy. And now to have this technology piece and again, let's hope it happens. Right. But we don't know if it will, but we feel pretty good about it, right? Um, you know, adding that piece and if it's not them, it's certainly another.

Riggs: No, no, no. It's going to be buy versus build. There's plenty of resources. I happen to have an end because I have I've actually known this particular company for many years personally, so I know the players, etcetera. But, you know, because, you know, as Ronald Reagan says, you got to work with the people, you know. Right. When because, he appointed some zany guy as as secretary of the interior and this I forget the guy's name, but they're like, what did you hire him? It's like, well, you got to go with the people you know,

That doesn't mean that we can't shop companies. We've had a tech downturn where this tech companies are like, Oh, we gotta make payroll. Oh, well, how about, you know, we combine what you got going here, which is maybe even a unicorn with a business, but we like it when they like us. I just want to take you back to what has been publicly, because this is what.

And Joe Washington was talking about and he gave us his email address, is that there was a letter of intent signed in January with a special purpose acquisition corporation, which means a company whose sole purpose is to take money and buy a company. Right? Now, the LOI is not binding on the parties. It's only intended to guide good faith negotiations. And if you want to know more about that, you've got to go under non-disclosure. All right. And then, what are the three investor links?

Ken: Can we invest if we are outside the US too? Yes, absolutely. Yes, Christine, you can. And you would go to Oc.gold/ken. Are you going to show it on the screen or. I'll just Oc.gold/ken Yeah. Oc.gold/Ken. I'll ad lib it till then. There you go. Oc.gold/Ken, you will get scheduled with my staff who will put you on my calendar and we can, I can kind of give you the full measure of what's happening. And now the three investor links. I'm not really sure. What they mean. Let's see. I'm not sure what the three investor links are. I don't know what they mean by that.

Riggs: If you could just tell us a little bit more about these three investor links. The bottom line is, I think that he was that we were talking about different ways that we're funding the company. But here's the bottom line. We are continuing the $20 million round, which has been very successful so far. But again, limiting. It's so generous. But that ends at the $20 Million mark and we're already $7.5 million in. So that's super important for people to remember.

And number two, we have the crowd funding round, which is available on www.waterondemand.net so go to originclear.com and click on invest now for the investment in the what we call series y, which is this investment in the water assets. But if you're interested in the crowd funding investment, go over to Water On Demand dot net and click. There's an investment thing there and that will take you to that. Those are the two links that you'll be able to use. I don't know about a third, but that's where that's at.

All right. With that, I wanted to make a request and that is when you wrap up, there's a Zoom survey. We like the information. It really helps us do spend a couple of moments filling it out. It's really helpful. So I think I enjoyed this. I know that it was long. I know that I had an abortive sort of false start at the wrong presentation, which the team is going to have to edit out.

But it was I think it shows how fast we're moving and I want everyone to remember that we are part of a huge effort to truly change water the way no one else is doing. No one else is thinking this way. They're thinking centralized. They're thinking big money. They're thinking big customers. They are not thinking about letting retail, retail, quote unquote, retail investors in. And so, therefore, it's going to be the big cats, you know, like, for example. Morgan Stanley Infrastructure Partners making out as usual. Well, we are different. We're unique.

Ken: They go right to the institutional bond offering type of funding, which, you know. Not. It's not real. It's not Main Street for sure. It's not really Wall Street either, you know?

Who makes the money is not the investors. Anyway, Christina, "Where can we already invest?" Go to originclear.com and click on INVEST NOW. That is. But really what you really want to do, in my opinion, is you just need to, do not pass go. Do not collect $200. Just go back to, just schedule with oc.gold/ken and you'll get a consultation and things will go great. So Christina, we look forward to hearing from you.

Thank you very much, everyone. We spent a chunk of time on this, but I think it was well worth it. So with that, I'm going to thank you all for spending the time with us tonight. We, of course, extract a lot of important material from this, but it's also allowed me to really think through how we communicate our story. And I love it. I'm frankly, in love with our story. And so, Ken. You are creating as like you're like the Mad Hatter. You're creating so fast. So keep it up.

Ken: No, I'm good. We we made it to 9:19. Nobody turned into a pumpkin. It was good. Joseph, if you have another question, I saw you raise your hand. Just email invest@originclear.com.

Riggs: And thank you. Stevan Davis, "Great presentation, gentlemen." Thank you everyone. It's been a pleasure. Have a good night and stay tuned. Big things are happening fast. We can't get into the details if you're interested as —.

Ken: Well, not here anyway.

Riggs: If you're interested as an accredited investor, contact us. As I was saying through oc.gold/ken or visit originclear.com and the rest will happen. So do be in touch. Thank you very much everyone. Have a great evening and good night.

Ken: Good night.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)