Water on Demand's General Manager, Manuel Vianna, gave us a new view of this disruptive innovation! Why does he say we are making good progress toward the Design, Build, Own and Operate model? What is milestone financing and how can Water on Demand use it? And why are Engineering Consulting firms eager to work with us? Find out in the replay.

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

And welcome aboard. It's a pleasure to have you. Let me just see. Timothy Meltons, "Blessings." And Keith Roeten says, "Happy birthday." Well, you're right. I mean, because my birthday is on the 8th, it will fall by by next Thursday. It'll be gone. It'll be over. I'll be much, much, much older. So but that's OK because you guys make me feel young all the time. So thank you, Keith, for your kind wishes. And Akus says, "Hi." And yes, we can see your texts. The texts only go to us, but I faithfully repeat them so you don't have to worry about me trying to suppress them or anything. But this is going to be very exciting one. Now I promised to do crypto this week. Sorry, not going to happen. It's going to be exciting. The crypto thing is still being pulled together, but you will love it now.

Let me go ahead and jump right in, and it's going to be a very interesting report about Water on Demand interim services. All right. So of course, today is February the 3rd and we are helping you thrive in the world's only vital, scarce and recession-proof market, and that is proving to be for real.

And as always, you can listen in Spanish. Thank you, Heather, for interpreting so well as you have been. And we welcome all Spanish speakers.

The Safe Harbor statement, as usual, says that we'll do our very, very best to get it right. It may not come out that way, but we are certainly, you know, we do our very best to tell you exactly how it is and we correct that as it goes.

All right now, I wanted to look back on 30 January 2020. What was happening? Ken's going to laugh about this one because, oh my gosh, I was watching my own video. My own sorry. We've gotten much better. What can I say? But it was interesting. These are a couple of the things that were going on.

In India

Of course, coronavirus is accelerating. And there was I had been invited to the the This Indian Membrane Society IMS conference in Chennai, India, on the February 14th, and it was canceled along with my keynote speech. Now the keynote speech was about India. India is a tale of two cities. On the one hand, $90 billion hydro hydrologic, which means big water projects up in the Himalayas to try and deal with the effects of deforestation up there.

All kinds of issues at the same time, no money at all for the sewers in the cities and so forth, and people dying and that kind of stuff. And my idea, which of course, is the trend, is to simply encourage people to do their own water treatment and therefore deliver treated water to these sewers. That is something that is well in the future. But the solution we come up with after this really was the enabler. We'll talk about that some more.

Crude Oil Prices Crashing

Recession fears at that time. If you want to take a look at the crude oil prices there, they were right there. January 31st. Twenty twenty. Just teetering a little bit that had been kind of like, yeah, and then of course, it just went to, I think, a negative at that time. You can go to macro trends and look at this really interesting. So it didn't take long, I think by my birthday, it was already like dramatically down. And that's when Ken and I really started looking at, well, what's what's going on here? And how can we make sure that because we didn't know what was going to happen, right? And out of that lengthy effort came what we're doing today.

Elon and Disruption

So now in that briefing, I discussed disruption and there was a picture of Elon Musk repairing his own car window and 1995. So you see that that gives hope to the rest of us, that we too may be billionaires someday. Who's chatting here? Oh, Timothy "My dad's birth is the eighth. Happy miracle day mister. Glad to be here." Well, thank you. Likewise, my friend. So, Timothy Meltons. All right. So watch out for the ugly duckling, it might just eat your lunch. That was on the 31st of January 2020.

He Did the Right Thing

And I also talked about how Tesla started with a terrible car, and this was a car that was cobbled together from a Lotus Elise. And they use the AC propulsion electrical power unit, which didn't scale well. It was good in the small units, and they also had a huge stack of laptop batteries, I believe literally laptop batteries. And they then had to stretch the chassis, which made it they couldn't get the safety certification. They basically had to start fresh. A friend of mine was driving one of these around. It was white, I remember. And he was quite proud of it. But you know, it was because it was a Hollywood dude. He got it for free.

But essentially, what Elon Musk did right is he went ahead and created a prototype. He did it. He did not wait to, you know. As he said later in his in a USC commencement speech, anyone can build a PowerPoint. But he went ahead and built a... Thank you, Timothy. You'll be a zillionaire. I like that. But, you know, he went ahead and built a car. As bad as it was, he built a car, and that's the key.

Disruptive Innovation

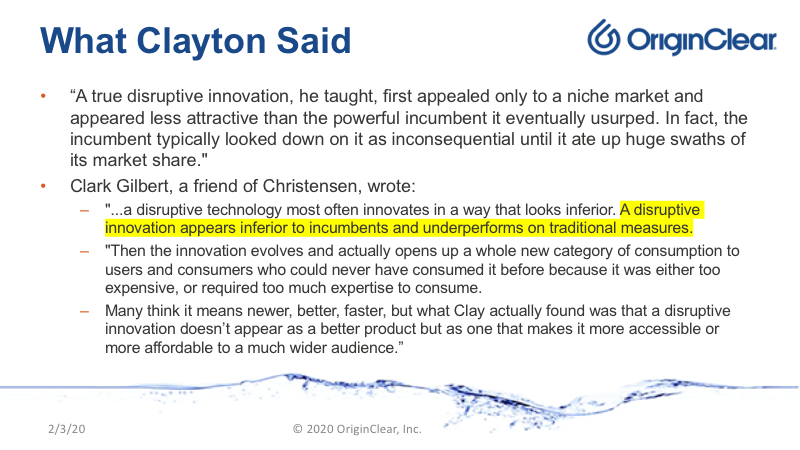

Now, my one of my very people I admire the most in the world is Clayton Christensen, who passed away in 2019, actually, perhaps even in January 2020, I think it was. And he invented the term "disruptive innovation," and he had huge effects on people like, for example, Andy Grove took his book and distributed to everyone in Intel, and they came up with the Celeron chip at the time, which revolutionized Intel back into the consumer space. They were losing ground, and Intel kind of came back from a very bad spin.

More Accessible or Affordable

Now in his book. This is interesting. "A true disruptive innovation first appealed only to a niche market and appeared less attractive than the powerful incumbent it eventually usurped. In fact, the incumbent typically looked down on it as inconsequential until it ate up huge swaths of its market share." So this little disruptive thing starts out and your, "Oh yeah, whatever, it's fine." And it starts eating lunch.

"A disruptive innovation appears inferior to incumbents," meaning the companies in place, "and underperforms on traditional measures. But it opens up a whole new category of consumption to users and consumers who would never have consumed it before because it was either too expensive or required too much expertise to consume. Many think it means newer, better, faster," but what Clay actually found was that "a disruptive innovation doesn't appear as a better product, but as one that makes it more accessible or more affordable to a much wider audience."

Speeding up Adoption

Ladies and gentlemen, this is Water on Demand. Water on Demand, which, believe me, we did not have that vision at that time. It took us a long time to form it. We're not perfect. It took us a long time. But out of that sort of constant process, we came up with something that. You know, speeds up the adoption of decentralized water, of water being done by industry at the point of use, by dealing with the financial issue and making it just a pure, "Here, sign a contract, and it's done, fully outsourced." And that is the disruptive innovation here. So that's what was cool. And and of course, since then we have gone ahead and as of November 1st, we started to bring in capital.

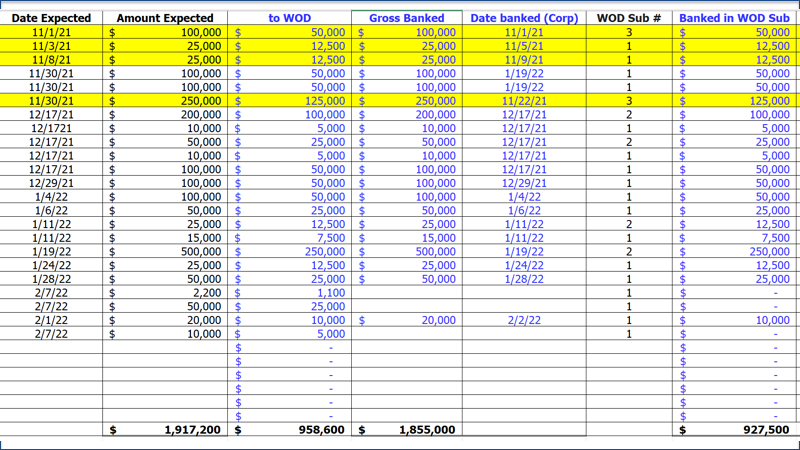

So where are we at with the capital status of Water on Demand? And I went ahead and grabbed a screenshot tonight of the live spreadsheet. We'll show you exactly what's going on.

Water on Demand Spreadsheet

So here we go. It shows on the left hand side what's expected and on the right hand side what actually came in. And you can see there's we don't have it all in. We're coming, but at the bottom right, you see nine hundred twenty seven thousand five hundred. We are closing in on that million dollars. As you can see, though, the amount banked is basically double.

What goes into the sub, because the structure of the investment is that OriginClear gives up its share of profits, half of half of the profits it expects in order to get basically an advance on the earnings in order to fund current innovation. So out of $100,000 raised, $50,000 goes into Water on Demand and $50,000 goes into building the systems and so forth. And we give the investor 50 percent on the 50000, which gives them 25 percent overall, which is the deal that they get in perpetuity until that Water on Demand subsidiary is closed out, which could be 25 years or whatever.

PhilanthroInvestors Help

And so it works out very well and everything is secured either with the assets or with the company. And so it does mean, however, that we have to run twice as fast just to stand still because we have to raise twice as much money in order to continue to operate, which I'm very pleased to say that between the efforts of the amazing, amazing contribution of PhilanthroInvestors®, who really came through for us in recent years as our channel partner and just it's so rare that finders actually perform.

Existing Investors

And then, you know, our existing investor base coming back again and again this time is not a high risk investment quite as much because it's got that asset built in. And so between those two and some more marketing avenues opening up, for example, Facebook, we're definitely making it happen. So I don't quite worry as much. I actually don't need melatonin to sleep at night, which is good news and we're, you know, really rolling along. So we're going to end up with a million dollars.

And Bob Roos says, "Sometime please mention the location and name of the hotel with the super water." Ha ha ha ha ha. Well, I'm not going to give you the name yet, but it is in Nashville, Tennessee. Brand new hotel and we're going to have video and opening, et cetera. And there's more jobs coming from that same premium chain, so you can have some fun looking for that.

Cleaning up Cap Table

And Timothy says, "Good job team. Bless this project sevenfold. Let one hundred million be banked." I know. Well, in fact, we're going for 300 million because starting with the current retail accredited investors, as you know, Andrea Agostini came on board. Sorry, Andrea d'Agostini came on board and has the specific mandate of upsizing the company to be worthy of this amazing vehicle we've built. We've put together these subsidiaries, which are really partially autonomous, so that they can operate on their own without being affected by the parent. But we want the parent to be in great shape too, you know, all of the cap table cleaned up and so forth. Cap table means all this shareholder ownership, all that is in the works and you're going to see amazing things happen so that ultimately we can do institutional investments. And that is obviously what we're trying to do.

So let's take a look at the next slide because. My interview this afternoon, Manuel Vianna, the general manager of Water on Demand, he's been doing a fabulous job. He's overworked and underpaid. So with that? I'm going to go ahead and play that. Here we go.

Start of Presentation

Riggs: Manuel, it's a pleasure to talk to you with this wonderful background that...you are really, you know, a man after my own heart.

Manuel: Oh yeah, it is in your honor that I chose this background, Riggs. Lone Mountain, Big Sky.

Riggs: Big Sky rocks for sure, with that fifty-degree couloir right there at the top that you can go, what's it called, Goat Run or something like that, that's like this (angles arm steeply down).

Manuel: I have not tried it, I confess.

Riggs: Neither have I, to be fair. Well, OK. So a lot has been going on. A couple of weeks ago, we had Dan Early came up with some bright ideas and this has opened up the field because, you know, the concept of Water on Demand has been, we're going to do pay per gallon deals and so forth and so on. But it requires a whole contract management set up, which we're working on, you know, a lot of stuff.

Meanwhile, what do we do? We were going to do some lending but it turned out that Progressive Water Treatment was doing too well and they have too much money and they're like, "We don't need your money." So then we turned to some other ideas and tell me a little bit about about what you, Tom and Dan, have been coming up with in the interim.

Manuel: Well, I mean, exactly as you said, we are building the business. We know the path we want to take, which is towards the DBO0, design, build, own and operate. Obviously, that requires a whole portfolio of skills and relationships and resources that we don't yet have. So we are approaching it on a, on a gradient, on a step by step basis. But that's where we're headed. So we started looking and we see that there are opportunities to do part of it.

You know, traditionally OriginClear, of course, has been both PWT and MWS have been doing the design and build part of it not the own and operate. Well what we're looking at now are opportunities to do that own part. There are opportunities, as you've talked about before, great opportunity, the sales pipeline that are stuck because of lack of financing. And so we think of actually helping the customers with that by renting equipment.

So kind of what we're going rent to own and this is basically not a rental business forever in many cases is customers who have the financing lined up, but there's a lag between the financing being awarded and them getting their hands on the money. Therefore, there's a lag on them placing the order. We're going to make it easier for them to actually get started because we're actually going to rent the equipment to them. Install it, charge their rents and then provide them with an option to buy or a contract to buy depending on the case, right?

Riggs: That's great. And of course, we maintain the, Water on Demand model, which is we continue to own the machine until it's bought out, which is perfect, right?

Manuel: That's exactly right. And we and we see other opportunities as well with... You and I have talked about this with Tom. And then there's also many situations where the customers are a little bit stuck because they have to make milestone payments ahead of being able to get the equipment installed and benefiting from the operation of the equipment.

So we're also presenting a program to basically provide milestone financing. Again, the financing will go to the customer, so the milestone payments are made and we have the security of the equipment. We have the security of the equipment without you know leaving that out as an unsecured loan. It's secured and you know, we just bridge them to the point where they can actually benefit from the operation.

Riggs: Yeah, I was hearing anecdotally that it's especially a problem when one of our reps is dealing with the federal government, which is slow on making payments, and then the rep is kind of squeezed because they have a commitment to us. So if we can loosen it up, then of course we become a favorite vendor for the revenue because, hey, you know, we're giving him something others can't give. And I think more and more, you know, he who you know, the golden rule he who has the gold makes the rules right?

Adding capital to an already good reputation, good technology firm Modular Water Systems and the really the ability to just be flexible. And I think what you're saying is we'll do whatever works, we need to rent for a while. And it's a milestone on accelerated, milestone deferral, I guess you could say, right? What do they need to make it work? And with the ability to do that, then come. And Tom and Dan and Marc can go out there and offer these things up and you can kind of be the mediator is what I'm seeing, right?

Manuel: That's right. And if you think about it, I mean, it's exciting because we're actually making good progress towards the DBOO model, right? We're adding the O part of DBO, the first O, and we are actually starting to work more closely with engineering consultants. And in fact, we have been talking about making sure that in all of our sales processes, we have an engineering consultant involved as a channel partner, if you will, which provides more help to the customer, more credibility to our offering as well.

And and that's one of the ways we're building the business. We're doing that, we're looking at the pipeline of opportunities we have that may be stuck because of financing, you've talked a lot about it before and we're looking for those opportunities that can be converted into a rental or Water on Demand model. And then we have some verticals that we have identified already, some niches that seem perfectly custom made or Water on Demand should be custom made for them I mean and we're actually investigating those opportunities as well.

Riggs: So, one of them is pump stations, right?

Manuel: Yeah, pump stations, we're looking at a few verticals: pump stations, breweries and wineries, truck stops, you know, RV parks and campgrounds. So these are all opportunities that there's a lot out there. The scale of them seems appropriate for us. You know, the big players are never going to go there. And importantly, for the whole business model to work, we can employ standardized equipment. And again, we're not set on, you know, making... you know, we will be looking at, make by decisions if we have all the time, but we'll be happy to partner with other people. You know, we don't, it doesn't have to be our own equipment because, you know, we're very limited in our capacity to supply that now.

Riggs: We're so maxed out. It's kind of ironic that something we adopted starting in 2020 to accelerate sales and then sales accelerated organically. And here we are like, OK, we have more business. Oh, I guess we'll just have to find other resources, which is a wonderful problem to have.

Manuel: It is a wonderful problem. You know, as long as we keep that customer relationship. We manage, we administer, manage the contract, if you will. You know, we can start and we are starting to develop relationships with different vendors and potential partners to fill in the portfolio of functions that needs to be performed. And the glue, if you will, is the customer relationship. It's the kind of the management of the whole, like the general contractor role, if you will, then the management of the contract and the financing and that's the glue. And that's where, those are the three functions that we see ourselves playing all the time and then we'll fill in and work with other people as needed for the customers situation.

Riggs: So from a, basically our partners are the consulting engineers, which is what Dan is very excited about doing, the manufacturing sales reps that we have, who we, the more flexible we are, the more they tend to favor us. And then the third is other water companies which may have their own contracts that we can then finance and do the Water on Demand thing with. And you're saying that we've begun some of those talks.

Manuel: Yes, we have. And we're starting to pitch, for example, our Water on Demand potential capabilities and services to engineering consulting firms. And we're learning as we start doing that we get the feedback and we'll fine tune the offering and we'll understand better. And they become then a tremendous salesforce for us, if you will, because they're exposed to many situations and situations where they're scratching their heads together with their customers because they don't have the financing or they don't have the ability to put it all together. And that's where we can come in and partner with them. So I think there's a lot of potential there.

Riggs: Well, that is where I think we start really scaling up and becoming more of a financing company as opposed to building stuff. I mean, we love to build stuff, but it's a slow expansion as we know and can't help but think that the more we can broaden our footprint, shall we say, the the more will have this ability to, you know, it's like a 16 lane highway versus a two lane, right? You've got this ability to run parallel on so many lines. I find that really exciting. I mean, are we overwhelming you yet? I mean, are you sleeping?

Manuel: It's busy, it's busy let me tell you. Let's face it, it's not like we have a big team. We have a very good team, but not a very large team. And so there's a lot to be done. And quite frankly, if we, the only way to get this done is to have this kind of network approach to the business where we know which parts of the value chain we want to play in, and we're willing and happy to work with other people, let some other people come in on the business as well. And, you know, do some of the fabrication, some of the installation and definitely on the operation side of the business where we do not have the capability in-house fully yet. So it's going to take a while. You know,

Riggs: Yes, there's well, that's where we are obviously going to do, buy versus build, because building takes too long. So we contract things out. And Dan has been very good about it, Dan has been using fabricators already, extensively, whereas, you know, PWT does so much custom work, they tend to do things in-house. Dan has worked hard to standardize and to have, especially for plastic housings, use the fabricator. So I think that that is the right philosophy. And what it means for you, of course, is you have to be very good at procurement managing, contract managing, contract enforcement. I mean, this is where we're going to have to really invest in good in-house resources. You know, green eyeshade people, people who will stay on top of it right?

Manuel: Absolutely.

Riggs: And that's, that's scalable. I mean, there's a lot of good investment banker types that, and analyst types that can do this stuff much easier than getting experienced water types because one of the problems we have in the water industry, as you know, is a silver tsunami where the water industry's aging out. Now the good news is the water companies servicing the smaller, distributed water players tend to be younger. You know, they tend to be more in their 50s. The really older ones are in the municipal environment, but still, I think that it's going to be easier to buy financial know-how than water engineering know-how on an expansion basis, so we contract the water engineering know-how and then staff up with the analysts and inspector general's and all that stuff that we need to make sure, you know, people running the Network Operations Center will have sensors. I mean, that stuff is, it's almost a high tech play, really.

Manuel: It is. It is. I mean, if you think about the business, I mean, philosophically, it's about asset management, it's about project management and then the operations management. And we don't have to be doing it all in-house. And you know, that's the way we're going to be able to scale this. And at the root of it is understanding the needs of these smaller and medium size customers that are kind of not well-served by the big players. And quite frankly, the standard, standardized approach to equipment and service that's essential for us to be able to scale up. So it's almost like an industrial engineering meets economics kind of a situation.

Riggs: Well, that's the interesting part. What we're talking about as we go down the road when, let's say, a water company in Atlanta is doing a contract that maybe they've brought and we're just basically financing, but then we can license to them our Modular Water tech as a sort of a preferred gold seal because we know how it works and we have confidence in so it can be part of, well, you know, this is a gold seal certified set up. If you run that, then we'll be able to provide... Again, you know, golden rule, right? So you want the financing, then let's have you adopt that.

And so now people will have a reason to license this technology, and that will make it more and more of an industry standard, which I think starts the ball rolling because the water industry, like any industry, it's all about, you know, the network effect, right? Adoption leads to adoption leads to adoption leads to adoption. And if you can get that sort of cumulative effect going then all of a sudden, it's like it becomes well we're using this tech because blah blah. And I think that finally is a way that we can essentially, you know, by being a financier... I mean, look, if I'm a businessman and Bank of America is willing to lend me money, but they specify that it has to be a,b or c. You see this a lot in real estate development, for example, right? Then I'm going to use it because hey, that's the condition for the money. So that I think is going to be very, very key. Well, Manuel, I'm really glad that you got your hands full and that you're, you know, working too hard. I like that.

Manuel: I didn't go skiing there this year.

Riggs: Oh no, no, you got to go ski, OK. Exceptions to every rule. Let me tell you something, going skiing in Steamboat Springs was judt, it really, really was great. And I recommend it because you know, you get this well, you know, you get this wonderful feeling of space, you know? And I'm a strong believer and that, work hard, play hard.

Manuel: Well, thank you for having me in your briefing.

Riggs: It's been such a pleasure Manuel, continue the hard work. I really appreciate it. And we're going to hopefully get another briefing in a month or so. And this time maybe we'll bring in Tom and Dan we'll sort of make a little roundtable and have some fun with it and hopefully they'll behave!

Manuel: And they will that with advance notice. They will.

Riggs: Okay, that's fine. Well, thank you. Have a good night and appreciate coming on.

Manuel: Thank you. Bye bye.

Riggs: Cheers.

Manuel: Cheers.

End of presentation

Riggs: Ok, I'm going to quickly wrap up here. This is a couple more slides to go, and then I'm going to tell you what's happening next week, which is going to be incredibly exciting because we will discuss finally what's happening with the long awaited coin crypto plan, and it is beyond exciting. I know that Ken was filling in a little bit on what's planned, but it's going to be a lot more. Andrea has been working very hard on this and we're going to have some preliminary look at it.

Call Ken

Meanwhile, talk to Ken about investing in Water on Demand. It is an asset play. Water like an Oil Well™, you're going to find it really amazing. So just go to oc.gold/Ken on your browser or call him or email him invest@originclear.com and he will be happy to talk to you.

Next week we will go with crypto. I hope this session was useful to you. Thank you all. Have a wonderful evening. Great weekend. Have a good night.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)