Insider Briefing of 9 July 2020

Helping You Thrive in the World's ONLY Vital, Scarce and Recession-Proof Market

What are the five most important things I can do to protect my family in the turbulent times ahead? What does that have to do with water? What's our latest breakthrough to fix unhealthy waste ponds in the American South? How’s the Investor Water lab program going? Find out in this briefing!

COVERED IN THIS BRIEFING — QUICK LINKS

The Pondster™ - trailer park and animal farm pond water recycling machine.

Transcript from recording:

Introduction

Riggs Eckelberry:

Good afternoon. This is Riggs Eckelberry, and we are once again on Water Is the New Gold. I've got Tom Marchesello and Dan Early is lurking in the background and he's passing the webcam test right now. But Tom, show us what's that on the wall there right next to you to your left?

Tom: Oh, that's my Penn State stadium. 110,000 people strong baby. White Owls. My wife got this for me for my birthday. I thought it was pretty sick. I'm a big Penn State fan. What do you do?

Riggs: Well, I have nostalgia for full stadiums because we're not going to see those for a while.

Tom: I know, it's kind of weird, right? I'm getting used to this weird new life of Corona afterlife. It's like, blah,

Riggs: Indeed so. This is what COVID has done to the clean-shaven, relatively clean-shaven Dan Early. We're waiting to see how long it will grow [commenting on Dan’s beard], because it's interesting.

Ladies and gentlemen, we have a trio here. Top left is Tom Marchesello, Chief Operating Officer at the bottom, depending on how your screen is laid out is Dan Early, our Chief Engineer.

Tom: Otherwise known as ZZ Top. Sorry.

Riggs: Or [mimicking Scotty the engineer from Star Trek] “Captain. She cannot handle it, the [inaudible] pistols, they cannot do it.” Anyway. Without further ado, I'm going to cut to on our slide show and then we'll get into a very interesting call today. As people are still joining us, nevertheless, I'm going to start because that's how we roll.

All right. Water Is The New Gold. “Helping you thrive in the world's ONLY vital scarce and recession proof market.” It is Thursday, July 9th, and things are moving along in this summer. I'm speaking to you now from Florida. We've made our move and I'm still surrounded by boxes, which is why I've got a nice virtual screen behind me because it's chaotic. Now of course, I'm going to give you guys and gals the disclaimers of course, that we're not gods, although we try very hard.

Important Notices

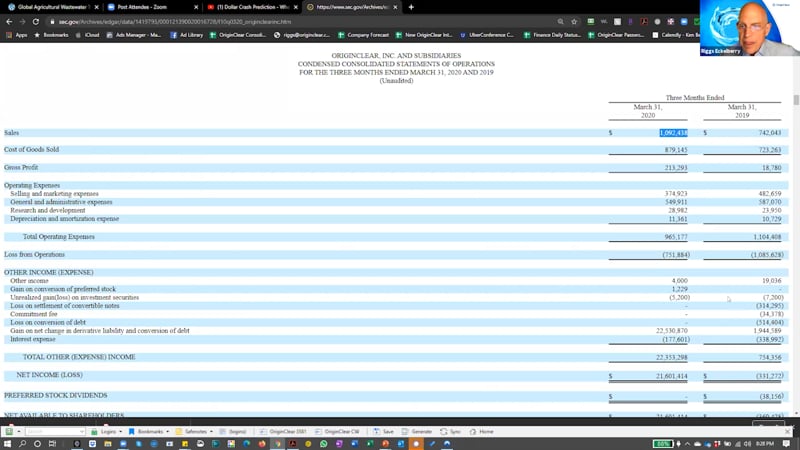

Riggs: The SEC, Securities Exchange Commission, they basically put our reports up and by the way, we've come out with both our annual report and the first quarter report. May I add that we have some great news for the quarter, which was that numbers were up. Q1 was well over a million dollars compared to Q1 of 2019, which was a little bit under a million dollars. So that was good news. That's a good job to you and your team, Tom.

Tom: Thanks. Guys worked hard.

Riggs: They did indeed. I really should have a graph up, but I don't. But what we're going to go right into, is something technical, the Pondster™. Tom, I'm going to let you take over. So, I'm going to turn off this chair and let you take over and run a little deck. This is a shortened version of the big geek, water geek deck, but this is a new product that is revolutionary.

Pond Water Recycling Machines

Tom: All right. Pondster. Hey, it's the Pondster, the pond monster. Yes, I like it. Yes, I actually drew it myself by hand. It's true. Yeah. I drew it purple and pink because it represents the whole concept of recycling water, which you'll often see purple pipe or pink pipe out there in the irrigation world. It's owed to the whole concept of pond water recycling. I say that affectionately, because there's tons and tons and tons of these ponds everywhere.

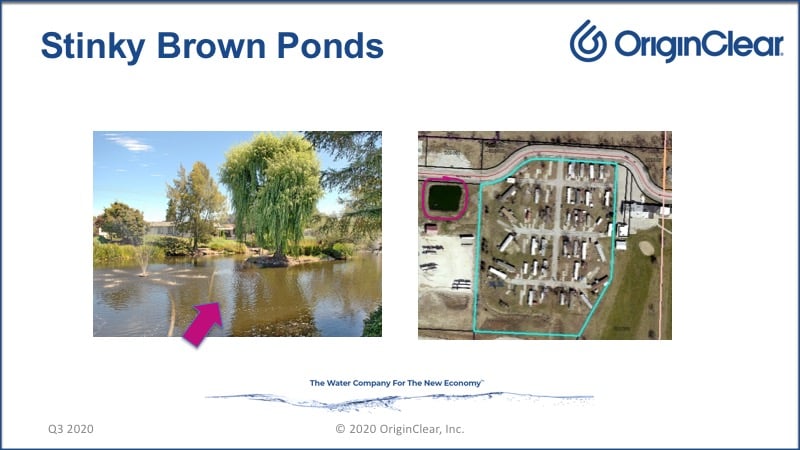

What you'll notice is no matter where you go, especially in the South, or from Florida or Texas or wherever, you'll see these big gigantic open pond lagoons all the time with water sitting on, and you're thinking to yourself, "Hey, can I swim in that? Can I drink that? Is that clean or not?" It's circling through your head. What you'll notice in most of the industry is that pond water gets recycled. Pond water does get cleaned. It gets treated, whether it's chlorine or aeration or all these other things, but then there's other wonderful situations where ponds are used as wastewater cisterns. Ponds are used as holding tanks. Ponds are used in industrial agriculture or even sewage treatment. You start thinking, going, wait, there's actually more ponds that contain more than just some rainwater. There's other stuff floating around in these ponds. So, sometimes, you'll get a situation where we encountered.

Mobile Home Sewage Ponds

Where there is these things called mobile home parks in the South, which literally just dumped their raw wastewater into a pond that sits out in the back 40 of these mobile home parks. It's pretty nasty actually, and it's really not treated. This is a bit of a throwback to the years ago treatment of having septic tanks and open pond aeration, where essentially you were allowed to do this stuff for a while, but with new laws, new regulations coming about, there's a lot more crackdown on that industries using the pond as a sewage treatment facility. Now you really do have to put it onsite treatment capability on that.

Stinky Ponds

Working with Dan and the team, we came up with concepts around stuff we already did. Which is a mobile containerized treatment idea for this, because we thought, well, rather than having this dirty little mess out there with a smelly brown pond, you can clean it up and meet regulatory requirements and do a better job.

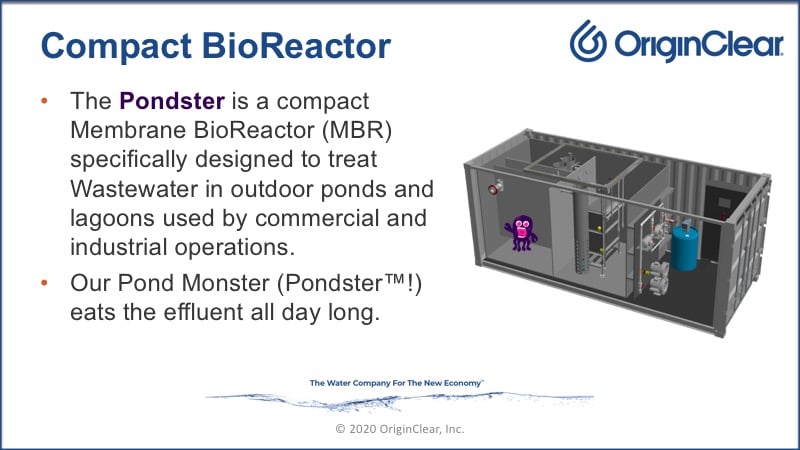

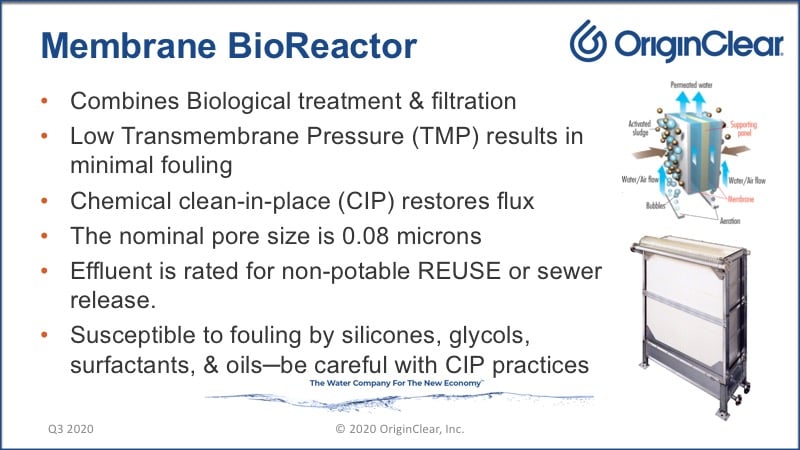

Membrane Bioreactor

Thus, comes the Pondster, which is an MBR, membrane bioreactor, and it uses some really ingenious, organic and bio-capable organisms to eat the effluent. That's what it does. It just eats effluent all day long. Mmh-mmh Delicious. Basically turns that brown water into much less brown water. Hopefully clear, clean, less stinky water.

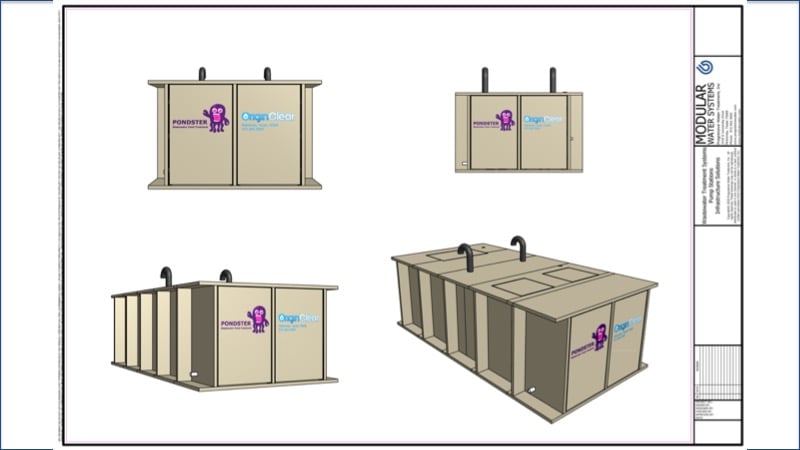

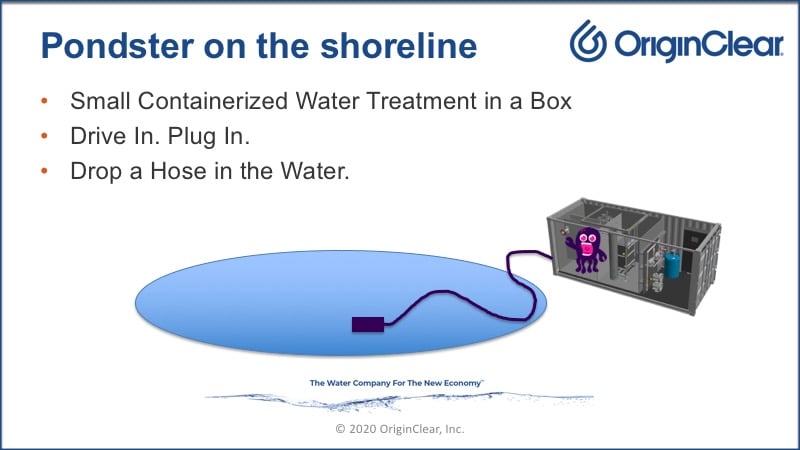

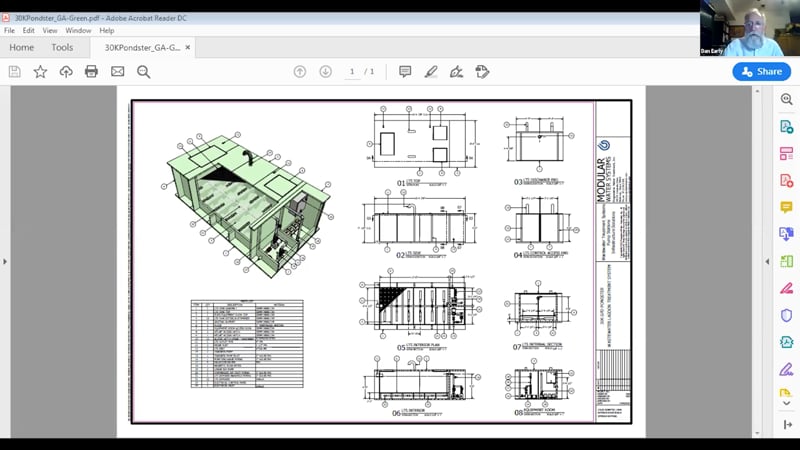

Pondster CAD

Dan and the team did some beautiful CAD update drawings with our little Pondster, and a cool enclosure, containerized, ready to just, drive in and drop off and plug in the connections. You toss the hose in the lake and let it go.

That's essentially how this thing works. It's built for the concept about an acre wide pond, generally speaking, and it should work pretty good.

Dan would be much more astute to describe the mechanics of how a bioreactor works and MBR. I'll leave that part to him, but you get the general gist of how it's set up to work.

How Does an MBR Work

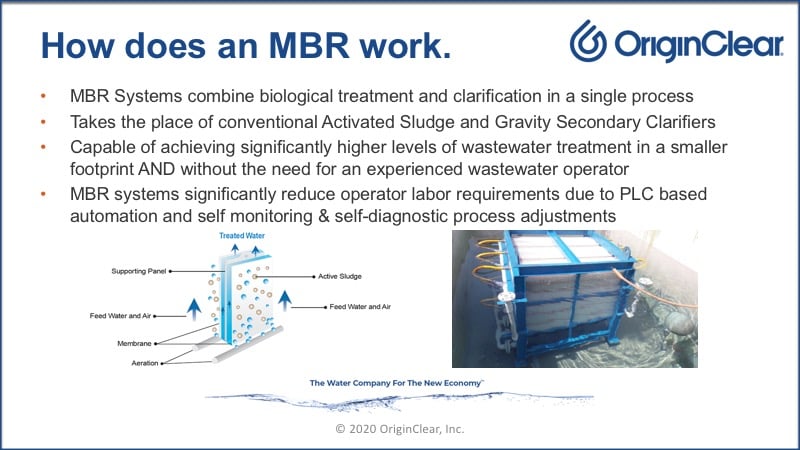

I'll finish my share with just how does an MBR work, because we talked about it and as we said, it's a biological treatment methodology. It really allows for clarification in one process. So when you take that stinky brown water and you're running it through the MBR methodologies, it captures all the dirty little molecules in there and grabs them. Then separates the nice clean water from the dirty stuff and allows you to basically biologically do that clarification and returns the nice clean water back to the pond so that it basically freshens up the pond. Also produces, lets the pond be a lot healthier, a lot more oxygen in it, a lot more able to use the natural processes that allow nature to clean those things up. It's a really cool thing. It's something we can do at scale or in small batches, and it's very cost efficient. I think that just gets into, we do it because we're awesome.

Conclusion

I really do think it's a game changer for us. I'm excited about this one that we're doing for the mobile home park environment. Then obviously the Pondster has other applications and other verticals, because we'll be able to do a very similar concept, for this whole roll-in roll-out deployment model. That's about where we're at. I will say thanks. You can go back to Dan.

Dan: Okay, thank you, Tom. Thank you Riggs.

Riggs: Geekville.

A Living Machine

Dan: Now this one is for the geeks in the audience. For all you engineers out there that rock the world. This is for you. Tom did a good job. Tom did an excellent job of describing the membrane bioreactor, which is, it is one of our leading technologies that we use for wastewater treatment. It does accomplish liquid-solids clarification in a single step process. It is a biological process.

A lot of things that we do on the Modular Water™ equipment side is wastewater treatment related projects and living machines. The key term is a living machine. A biological treatment is extremely efficient. We're able to leverage the biological aspects of natural occurring, bacterial capabilities that exist in the environment. It gives us the ability to build machines that can do really phenomenal things. Tom described our membrane bioreactor, which is a living machine that uses the ultra-filtration liquid-solid separation technology.

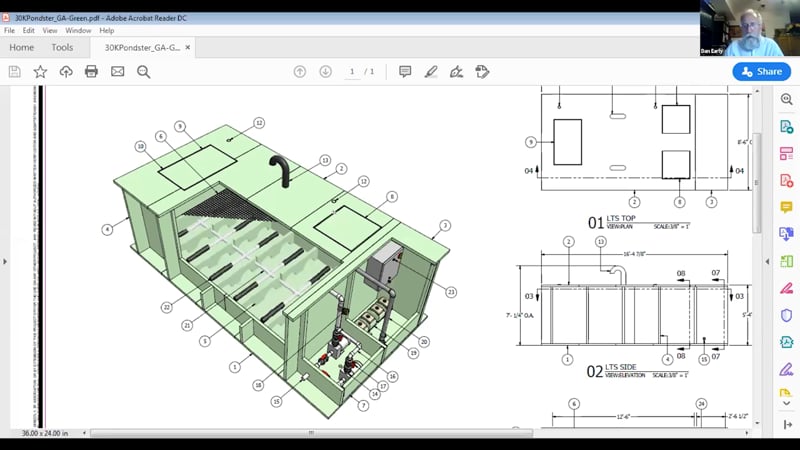

That allows us to reuse water for a whole lot of different things. What we have on the screen in front of you tonight is a variant of the Pondster. This one is designed for lagoon systems, wastement systems, where you want to augment or provide some form of a supplemental treatment process, where you might not be able to try to achieve all of your treatment with an existing lagoon system. I'm going to zoom in so everybody can see this thing a little closer.

Details

In this instance, right here, this system, it's a new product that we've created. We have three different versions of this. This one that you're looking at on the screen is rated at 30,000 gallons per day. It's not a big flow, but with the Modular Water Systems™ product lines were all about decentralization, and in decentralization we typically see smaller treatment systems and smaller applications. And that's exactly what we have now that we're showing to you tonight.

So to give you some sense of what the dimensions are, this is a structurally reinforced thermoplastic box. It's not all that big. It's about 16 and a half feet long. It is about five feet tall and it's about eight and a half feet wide. So it's fairly small. It's not a very big system. It does have inside of it, a really nifty enclosed equipment room. This truly is what we consider a plug-and-play technology. So, this system where it's made out of structural plastic, it's corrosion resistant, it's designed to receive water from the pond, it's pumped through into the bioreactor chamber. And that would be this space that you see in the cutout right here.

Stationary Fixed Film

And so this system right here utilizes a different version of a living machine. We are using what we refer to as a stationary fixed film. What is really nifty about this variation of the Pondster treatment system is that we're using an extremely porous ceramic media, which fosters the development of a very robust, highly capable biofilm. That's just a fancy word for saying a sticky bacteria, natural microorganisms that would live within the porous media. And so we will take and pump our water through this wastewater treatment facility through the Pondster unit. It's under aeration, so we have diffused aeration systems that are underway providing atmospheric oxygen. We have nutrients in the form of the wastewater pollutants that are in the lagoon. And when we put the biofilm technology in the reactor, as you see it there on the screen, we're just providing a perfect environment for the biology and for the bacteria to provide the wastewater treatment process.

Consumption of Nutrients

And what it does, it consumes the carbon and oxidizes the carbon by natural metabolic activity. It will consume and readily address nutrients in the form of nitrogen and phosphorus. This is one of the beautiful things about a very robust, next-order type biofilm process. So, that is a quick overview of what this system is designed to do, very energy-efficient for a 30,000 gallon per day process. Our peak instant power demand would be about one kilowatt of total power at any time. So it's very, very energy efficient.

Riggs: Thank you, that's amazing.

Dan: So there you go, Riggs, Tom, that's the nerdy term of the day is Pondster and biofilm. So, back over to you.

Riggs: Well, the secret sauce in here, which is a mesh of a very special ceramic that is material, that you control the source and it's actually trade secret, and it makes this whole thing extremely efficient. Am I right?

True Game Changer

Dan: That is correct. It's a process that I've been working on with several strategic partners of ours, been working on this now for about four or five years, and having been in the industry now for about 20 years to a little bit over 25, 22 years now in the wastewater industry, this is a technology that has never had its application before. This is the next generation. This is a true game changer. This is a market disruptor technology capability. I'm very excited about what we're about to do with this technology.

Riggs: So, basically for about 10 light bulbs, you can just keep cleaning 30,000 gallons a day, basically.

Dan: That is correct. Yep. That's a good analogy. 10 light bulbs would be generally equivalent to the power demand that we would use to treat 30,000 gallons per day.

Riggs: Scary good. Thank you. That is truly a breakthrough. So we're actually moving into application on this, and I wanted to give you all an update because one of these Pondster units is actually, as you know, going into the world in a location in Troy, Alabama.

Pilot #2

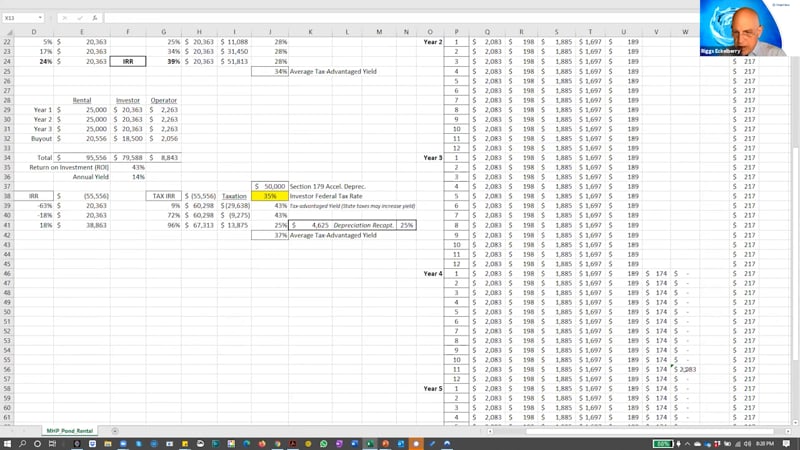

And so I'm going to go ahead and show you a spreadsheet with the latest rental model. I've anonymized it, so we don't have to protect the guilty, but this is now a mobile home park rental model. It's our pilot number two in the Investor Water™ marketplace lab.

Latest Rental Model

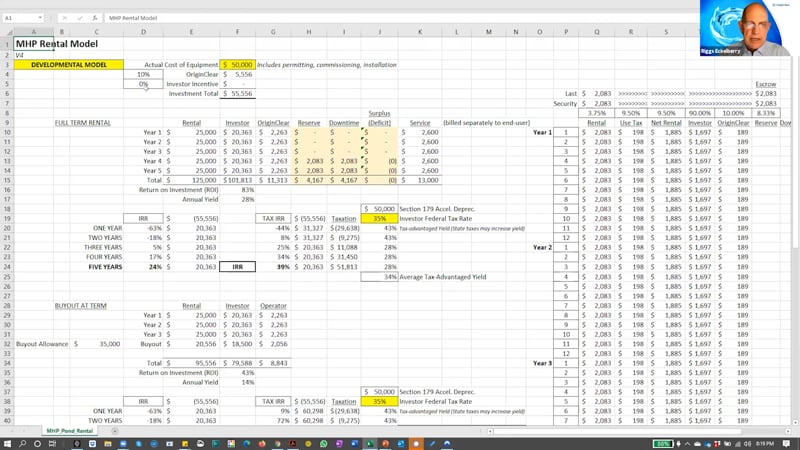

And so if I look here at this spreadsheet, and I'm going to go ahead and get rid of the ribbon here, there we go. So what do we have here? This is by the way, a developmental model, do not take this as real. And remember in the first one, the pool preserver, that was us doing our own little financial magic. We did a deal basically, and we had no investor. We made it happen by ourselves with both cash and stock.

This is the next step where we're moving towards a true rental model where a machine goes out and then gets rotated. But the good part is, is that we're starting with a three-year commitment by the first end user, so that we have at least have three years of stability. So if we, and as you can see, there's no downtime for years 1 through 3, because we have a contractual lock from that end user. But then that user goes away, they do have an opportunity to buy it out and I'll show you that in a second. And once they go away, we're going to start putting it into circulation as a fleet machine.

Downtime Reserve

And if we look over here at the months, right all the way down here, the 11 month of year 4, we lose a month. We're just saying, "Hey, this is going to be a month of downtime out of the 12, in both years 4 and 5." When we take the machine back, find a new trailer park to put it in and so forth. So that means that we're creating a downtime reserve. We're taking money off the table so that we allocate for it.

Now here's what the investor's looking at. The equipment that we just discussed, the 30,000 gallon unit's about $50,000, but that is a raw cost that OriginClear has negotiated from a provider. And to that is added OriginClear's management fee, which really should be 20%, but we're still playing with that. Or we want to make sure things work out for everybody. If this is 20%, then we have to fiddle a little bit with some of the numbers. I think we have it negotiated. There we go. That pulls it together.

The Power of a Life Cycle

Okay. So what does this look like? For the full-term rental, the investor is seeing... And I'm going to go ahead and I'm going to give this investor back that little upfront, because we're nice guys. So now the investor is paying essentially what we negotiated the price for, and we're taking just the 20% on the backend. Okay. But now month by month, here it goes. At the end of five years, the investor has made $81,000 and we've made $20,000, which is, the power of a life cycle, this continuing money. Now the fun doesn't stop at five years for us. This is the magic that I'm going to show you in a minute.

Internal Rate of Return

Internal rate of return. What that basically means is, is if you take 50, -50, and you add 16,000 to it, you're still making -67%. But if you go ahead and you start stacking these up, eventually this turns into, right here, this is roughly $50,000, which means we're right there at the breakeven in three years, years 4 and 5 are gravy. So total rate of return basically stacks the gains of each year against the prior year. So the fifth year you see, stacks them altogether. That's kind of how it works. Now, here's the real magic. Over here, the investor continues to own the item. So therefore, the investor can take the first-year accelerated depreciation. That can depreciate, that is, take advantage in a taxation system of the full cost of that system year 1. And here it is being paid for. And sure enough, it results in a much higher yield. We had an annual yield of 21% per year here.

Well, now it's 32% and overall ends up being about 28%. And the internal rate of return goes from 19% to 36%, which is very rich indeed. So, this is the kind of stuff we like. Moving forward, let's say the end user has the right to buy this out at the end of year 3, this particular end user that is prepared to commit to three years of lease, they can purchase at the end of three years. Well we still make money, not quite as much, but still tax-advantaged 28%, even after paying back the IRS for part of the cost there. So things do work out here and we just turn it over. Now here's the magic. We believe that, see the investor now has made all his or her money in five years and is happy.

A Fleet With Zero Cost Basis?

And now has fully depreciated the unit, et cetera, and now OriginClear receives that unit for a dollar. Now, this unit that Dan has designed has a 25 to 30 year life cycle. So if we can last through five years of making money, good money, we can actually end up with having fleets at the end. And when we go to lease out or rent out a unit with zero cost basis, how profitable is that?

I had a business in the 80's where I was computerizing all these businesses in New York City, and it was really tough. Each one of them was a whole new thing and it was very discouraging. And I wound up giving the business to my best salesman. Well, he became a millionaire off of what? The continuing life cycle of all those customers that I created in New York in the 80's, because, and he literally told me a few years later, "I still have some of the customers you got me back in the 80's."

So if you can just stay with customers, it develops an amazing return on investment with completely lost expense. So that becomes really interesting. Now, as you notice, there's no market here, right? There's no "market," because what we're doing is, we're doing this for ourselves. This is a gimme for OriginClear. We are being the water company, and also we're being the "property manager for the investor." And we're also making sure that the machine works. Separately, there is a service contract way over here that is billed separately to the end user, and by the way that's way too much. I need to adjust that, big time. There we go, thank you. That's more like it. So, there's cash being paid for service.

5-Year, 20-30% IRR

It's not a high amount of money because this is a very low maintenance type item, changing the occasional consumable, and so forth. This does nothing but sweeten up the returns for our investor. I guarantee you that a five-year IRR that's in the high 20s, let alone in the 30% range. Regardless of tax, Rick Keller will tell you, this is pretty amazing. You can tell I'm still fiddling with things, I'm still moving things around. We have not presented this. We've presented a number to the end user, but the investor will be seeing this on Monday. We're putting in the final touches on it. You're seeing this as it is in progress. Remember it is a developmental model.

Q1 Report

Okay. I'm going to save this and we are going to go into the next thing, which is, I was mentioning, by the way, how we did in the first quarter, and here it is. We did really well compared to last year. Last year, Q1 was 742,000. This year, it was a million dollars. Tom, well done to you and your team. Gross profit was significant, and if we go all the way down, here's the amazing part, we actually had a huge net income, $21 million. Well, that's the magic of accounting, because that was just some black magic that occurred. It really was because of some exchanges in the conversion of debt. These are numbers that we just call black magic.

We like to concentrate more on the upper numbers here, because that reflects what we're actually getting done. We still have some loss from operations, and why is that? That is because we're doing things like developing this marketplace. Just like anybody else who's doing a zero to one, that is, there was nothing before, and now there's something. Like Airbnb, Uber, Tesla. Versus a one plus. A one plus is, there was already something there, and I make another one of them. That's all the car companies in the world copying each other, and so forth. You're always expected to make money much earlier, but when you're making something new, that's when you have to invest.

Shareholder Letter

Okay. I'm done with that part, and I just wanted to also mention that we have a shareholder letter going out very shortly. With an excellent article that appeared in the Boca Raton Tribune. Those of you who are on the shareholder list will be receiving this as well as an update from me. In fact, here it is.

All The Cool Stuff

This update gets into all the cool stuff. Talking about how 2020 has changed everything. Things are better than they were in 1918, but still not great. Water industry is stable, needs more people, needs to do a better job because we need to prevent public health problems.

And then I talk about what's been happening in-house, and how are we going to help the water industry expand.

First Time

That's where I talk about, for the first time, broadly, about this marketplace, the three labs that we're doing. We're on number two right now. And how you could invest in the offering. Imagine you're an investor in the company that pioneered this. Well, actually you are. You helped us make it happen, so give yourself a hand. That's going out to a bit over 8,000 people and it will also be on the website, and it will be in the transcript of this briefing on, originclear.com/ceo. All right.

Entrepreneur TV

Well, we're at 8:31 now, and I wanted to get into a really, really important next topic. Which is your survival and mine. All right. My friend, Roger James Hamilton has a show called Entrepreneur TV, and I strongly recommend that you subscribe to it on YouTube. He wants to talk to us about how...

Quick Question

Just real fast before we go on, we have a question here, whether the Pondster can be patented. And the answer is that, we are relying more on trade secrets for it. As we've been disclosing in our annual reports, we've begun to believe that patents are a great way for actors like China to game the whole show. And so, we've moved over to trade secrets. We have the basic patents that we licensed from Dan Early, but these derivative products we're maintaining under a trade secret.

Back to Roger

The Dollar Crash

Back to Roger James Hamilton, and when is the dollar crash happening? How and why is the dollar crash happening? And the five things you can do for protection and profit as a result of this crash.

Dangerous Volatility Index

First of all, he points out that the VIX, which is the Volatility Index, is sky high. Now, this is really important, because volatility is a very dangerous indicator. The last two weeks have seen volatility go sky high. That tells us that the stock market is not in a great place. And if I were you, I'd be investing in things like gold, not whatever. Not Proctor and gamble. But again, I don't give stock advice, but that's what he's pointing to.

Virtually Inevitable

What does that mean? Well, Stephen Roach, Asia expert, tells us that a dollar crash is virtually inevitable. With the stock market potentially crashing, we also have a dollar crash coming along, and that is a very dangerous thing.

Lethal Combination

As he says, "The national savings rate is probably going to go deeper into negative territory," so we're going to save less and less because Americans have not been making money. Also, we've been isolating ourselves away from globalization, and that, he thinks, is a bad thing. Now, I personally think that it's a good thing that we're starting to manufacture more in the United States, that were less dependent, but that's a matter of opinion.

Cash is Trash

Ray Dalio says, "Cash is trash." Who is Ray Dalio? He's only the most successful hedge fund partner in the world. He's got the largest hedge fund. He is personally worth $16 billion. Why is he saying, cash is trash? Well, we'll talk about that some more. I'm taking you quickly through his YouTube, which I will give you a link to in a bit.

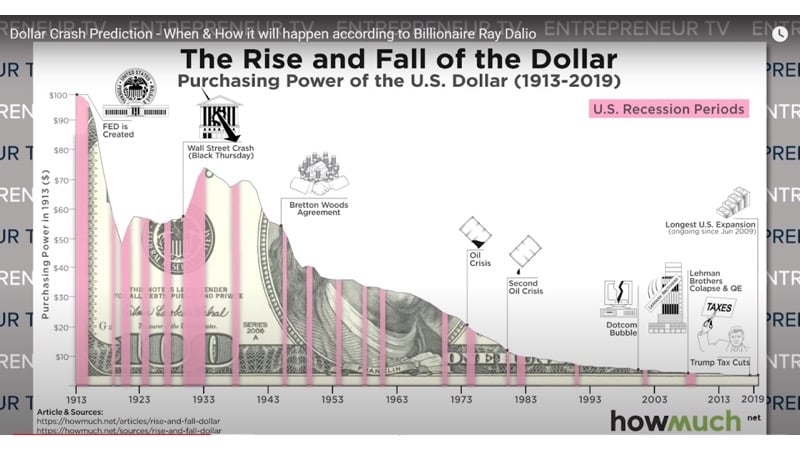

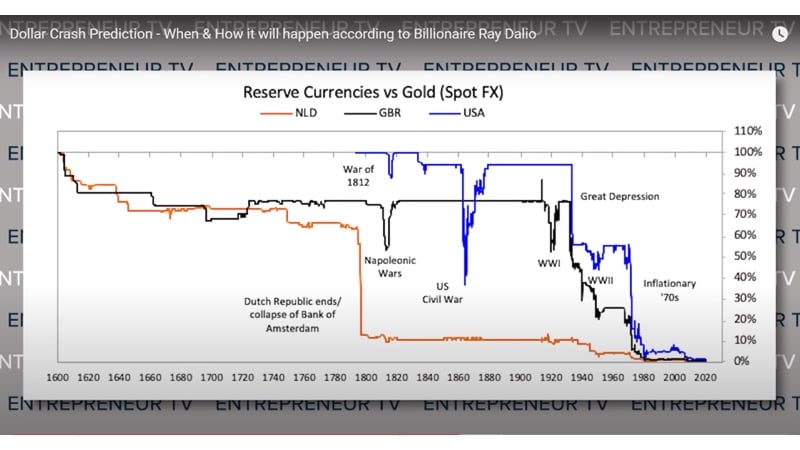

Rise And Fall of the Dollar

But let's talk a little bit about the dollar. The dollar is basically going right there down to the bottom. Essentially, what was worth $100 is now worth less than $1 today. We are right there, in fact, ever since 2008 was the last gasp of the dollar value. You could argue that really it started with the postwar Bretton Woods agreement, which put in place what's called the new world order today. All right. Ray Dalio says this, "All reserve currencies in the past have ceased to be reserve currencies, often coming to traumatic ends for the countries that enjoyed this special privilege." So, why the dollar will decline, but how will it change the world? Et cetera.

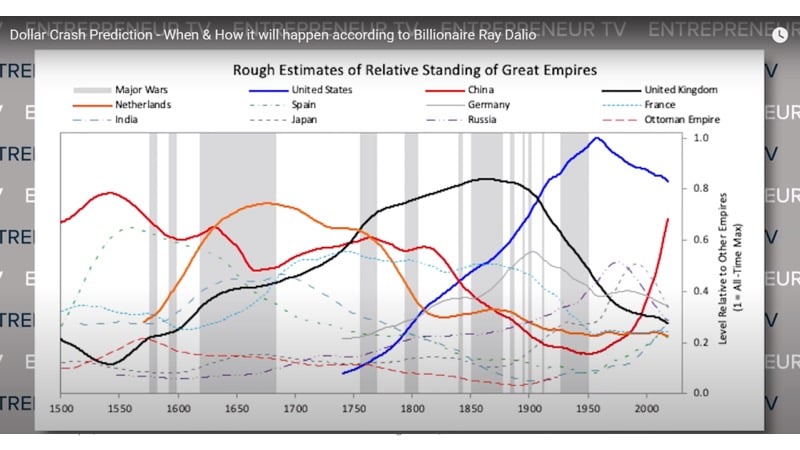

Rise and Fall of Great Empires

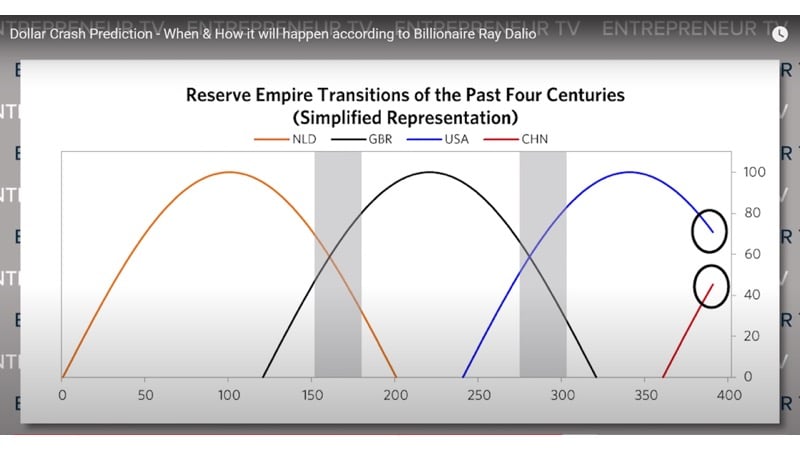

Then he gets into these very interesting things about great empires. I'm not going to go too deeply into it, but look at China. The bright blue there is the US declining since the early '50s, in terms of, relative standing. United Kingdom fell as the US was rising. United Kingdom was bankrupted by World War 1, and New York Wall Street took over. And we have some other players, like the Netherlands, which basically has been dying since 1650. But we really see the rise of China from a very deep trough back in 1950. That indicates quite a bit to me. All right.

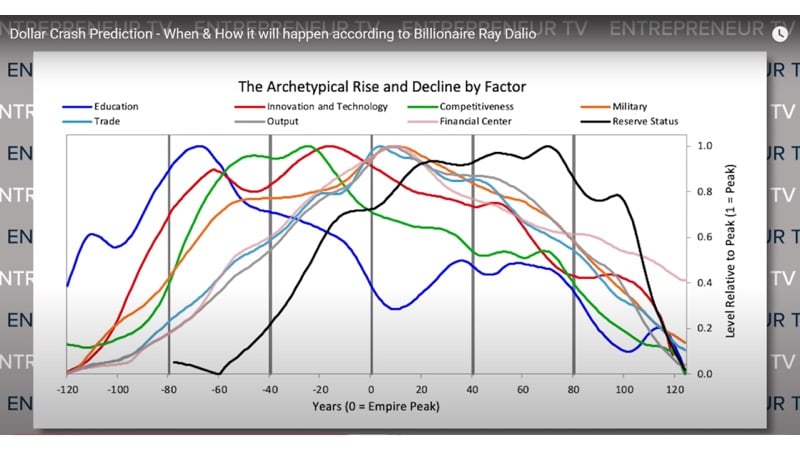

Rise and Decline by Factor

Then the various factors that talk about rise and decline, for example, and the last to go is financial center, but also reserve status remains high for a long time. Basically, reserve status, the status of a currency as the world's reserve, is the last to die. And when it does, it's pretty much toast for the rest.

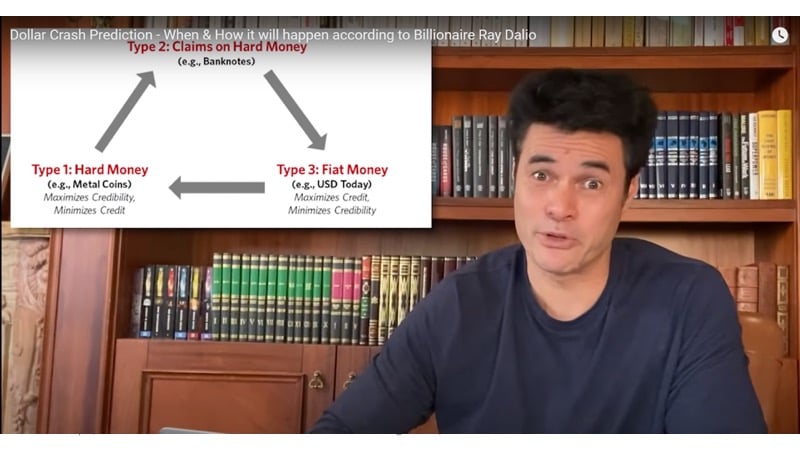

Hard Money ⇒ Claims ⇒ Fiat Money

What happens is, you start out with hard money on the left. Maximizes credibility, means it minimizes credit. It's very credible but it's very hard to borrow against, and that tends to limit an economy. Then you go to claims on hard money, meaning somebody gives you a note that says, "I'm a banker and I've got a bunch of gold, and here's a note that says you've got X amount of gold." Then it turns into type three, which is fiat money. Fiat means, let it be. "Make it so," as you would say in Star Trek. Make it so money, you can make as much as you want. Maximizes credit, minimizes credibility. That's what we have today. Where are we going? Back to hard money.

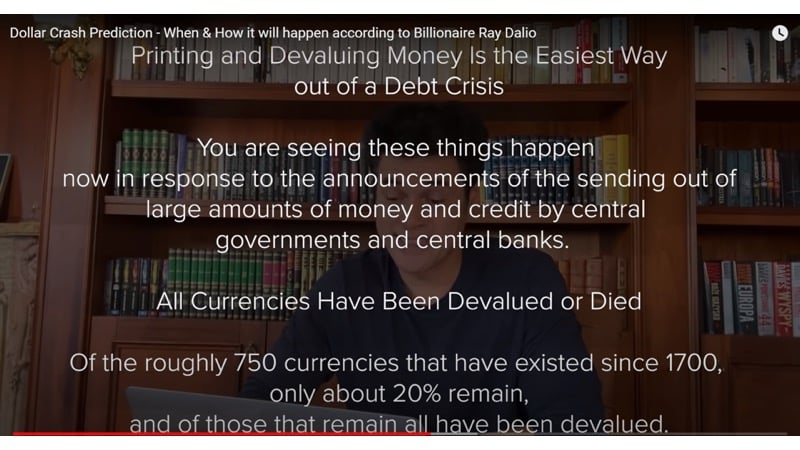

Printing & Devaluing Money

Okay. Printing and devaluing money is the easiest way to have a debt crisis. You are seeing these things now in response to the sending out of large amounts of money. All currencies have been devalued or died of the roughly 750 currencies that have existed since 1700. Only about 20% remain and all have been devalued.

Reserve Currencies vs Gold

This is another very interesting one about how the US basically is already devalued as a currency. Because we saw back in, just about 1790, the collapse of the Dutch Republic. Well, we can say that we've basically collapsed as of the inflationary '70s. But we remain this reserve currency. I'm not going to get into that. Large and growing debts, et cetera. You now know the drill.

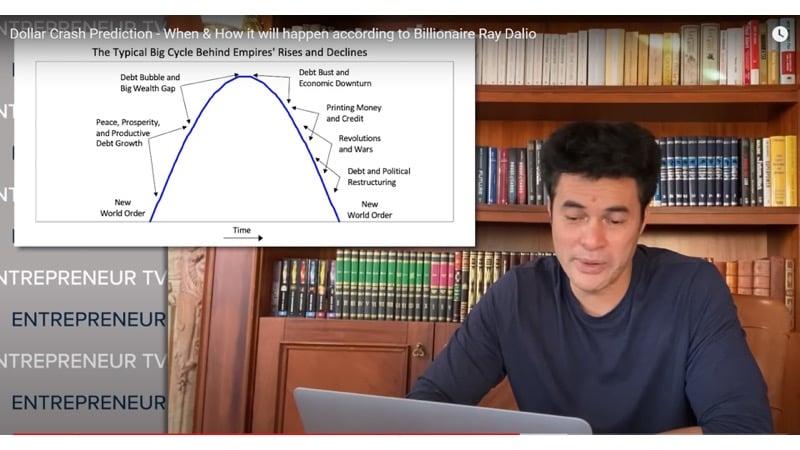

Typical Big Cycle

This is the typical big cycle. You have a new world order that then grows, grows, grows, and then gets a debt dust, and goes into another new world order. The next new world order. And what is it? China.

Chinese Digital Currency

China is, as I've discussed before on the show, using its digital currency to compete with US dollars. It's basically a Chinese Bitcoin that they will control. And believe me, it's powerful, because there's zero cost in sending it around. They're already piloting it in a couple of provinces in China.

Empire Transition

Here's a simplified representation. The Netherlands had a 200-year life cycle, similar for Great Britain, and similar for the US. And now we have this, the lines will cross, we believe. All right.

What You Can Do

What you can do. And with that, I'm going to actually play Roger James Hamilton's video, because I think that's very, very telling. I'm going to flip over to the video and we are going to get into it. This, here we go. And I'm going to stop the share long enough to optimize the screen sharing for video clip, share the computer sound. And here we go.

Roger James Hamilton Episode :013

Transcription from audio clip:

Roger James Hamilton: As a digital currency, it can bypass banks. It can be passed directly from one person to another and be fully tracked. It has zero transaction costs, and it can be transferred far faster than current fiat currency because it doesn't need a bank as a clearing agent. Now, whether or not you believe all this is going to happen or not, it's better to be safe than sorry. So here's five things that you can do right now to be able to protect yourself and profit from the coming crash. The first thing is that diversify your cash itself. There are many banks out there you can go to now that would actually set up multiple currency accounts, for both of my companies and also personally, I have accounts in US dollars, in Euros, in Yen, in Australian dollars and Singapore dollars. By spending your cash, it allows you to make sure that if one side to go down, then you're still hedging your money against those that might still be going up.

The second thing is where your cash actually is stored. Do not be in a country where there's a chance that the banking system itself is going to collapse. Smaller countries with stable systems actually are better. We've set up all of our accounts in Singapore because Singapore has been controlling, not just the Coronavirus, but actually its entire economic system all through this crisis. It's surprisingly easy to set up an account in Singapore or even set up a company in Singapore as well. That's all you need to do. Just Google it, look for it. And just don't assume that you have to keep all your money in your own country.

The third thing obviously is to diversify into assets, which are hedged against the dollar. That includes gold, silver, Bitcoin, and any asset where you know that if the dollar drops that these assets are going to grow in value. The fourth step, even more so than those assets are cash generating assets. As many of you know, right now we are focusing at an acquisition strategy where we are buying cashflow driven companies. What that does is allow us to make sure no matter what's happening to asset values, we always are going to be growing our cashflow.

And the final thing is that itself, when you know the currency is going down, taking more debt actually is a good thing. If I have money in Yuan and I have debt in US dollars, and the US dollar drops against Yuan, it means relatively I owe less. And ultimately with whatever strategy you choose, the most important thing is answering this question, "Would I be okay if the US dollar halved in value]. Once you've got a strategy where that works for you, then you can just get on with your life, knowing that even with the crash you're going to be okay. Everything I've done, everything we've done in the company has been set up for exactly that scenario.

The way to be crisis proof is to know you're going to be okay in the crisis, and the way to be crash proof is know you're going to be okay in a crash. I'm with Ray Dalio on this. I believe there's going to be a two or three year thing before we see this happening. Maybe faster, maybe slower. And if it doesn't happen at all, well we've lost nothing. Always better to be prepared for the worst and hoping for the best. Now, by the way, I've dropped all the links below to Ray’s chapters if you'd like to go and read them. If you like this video, if you have, please click like and do subscribe so that I can keep you up to date with all the latest that's happening as we go through this crisis.

And by the way, if you're interested in more, I've done this video, which allows you to see exactly how this crash is part of a three way crisis. From first of all, consumer debt, then corporate debt and then finally sovereign debt. And another video about how this was all predicted in The Fourth Turning and exactly what we can be expecting in the coming years. And with that, I'm going to leave you with this Ray Dalio quote, which is about thinking about the big picture. He said, "It's more important to do big things well than small things perfectly”

End of Roger James Hamilton audio clip

Riggs: That to me is a very powerful video. It's Roger James Hamilton, Dollar Crash Prediction is the name of the video. And as I say, we will publish what it is. Okay.

Caring For Your Family

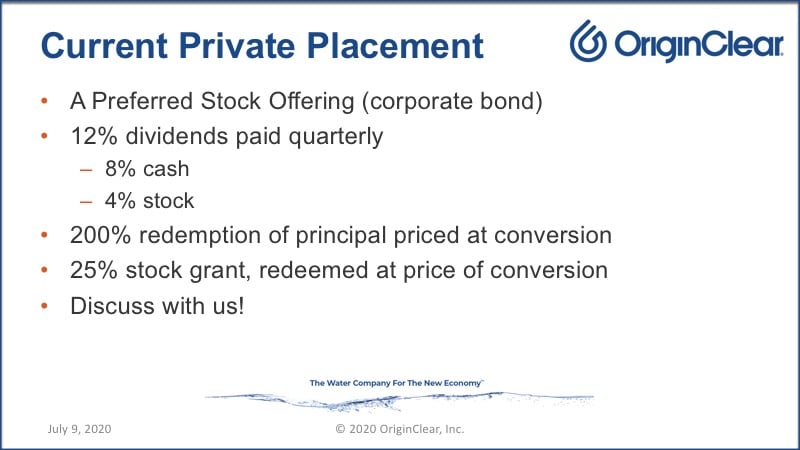

So why did we show this? Of course, I care about my family. I know you care about yours. And so we have something here that we think responds to number four, which is this whole idea of having a cash flow investment. Now what's interesting is here, we're offering, we're developing a marketplace so that people can invest in water equipment, which itself will be a cash flow asset, right? An asset that generates cash, which is one of the five things that Hamilton proposes.

So here is what we call a corporate bond or not offering stock. It's not dependent upon the stock market. Why? Because when you redeem the principal and when you redeem the stock grant, it's priced at the time you convert, whatever the stock has done up or down, it is what it is. You're in a corporate bond where you're paid 12% cash and stock and you get this backend. What you're also doing is, here's what's important. You're building a thing itself, that is a cash generating asset system, which is the water marketplace. And that to us is what you might call a double value here. I don't think it's the only one in the marketplace today. You can make 12% on your money and there's this huge backend.

If you want to do the math on two years, it would work out to about 75% gains if you liquidate it after two years, which I'm not going to say you would. And then of course this we can't guarantee that there'll be the liquidity for it, but it works out to about 75% per year. All in, everything included. If you cashed out after two years and that's without the stock doing anything with the stock going up, it's a whole other game. So why are we doing this? It's because you are the most important factor right now. If you're an accredited investor or you are a foreign investor, then you can get this offering and do very well with it.

We’ll Walk You Through It

To discuss it further, I would like to propose that you speak to Ken Berenger our amazing architect of all this. I blame him for everything. And of course, Devin Angus is the shareholder relations manager who is also my assistant and is a direct line to me. You can email invest@originclear.com and you can type oc.gold/ken for a call with Ken to beat him up about everything we've said here. Ken Berenger just says, please, don't hesitate to set up a Zoom call with me at oc.gold/ken. I will walk you through how you can participate.

A person who's named Note. It's probably a real person, “note” is not who they are. “I am from Chile I would like to look into this. I like it to look into more details.” We can certainly help you. And what's great about you from Chile is that you don't have to qualify as an accredited investor, which is a great thing. Well, that is all. Thank you very much.

Questions?

Pondster's Max Salinity?

And we have Rowe Michaels, “What is maximum salinity the Pondster can handle for no scaling compatibility with microbes?” Salinity will probably require, Dan, I think I'm right in saying, adding reverse osmosis to handle the total dissolved solids.

System Will Work

Dan: The system will work in certain saline situations and seawater situations. It will have an application goes due to natural biological processes in ocean environments. Where right now everything we do is geared primarily towards fresh water. So that's where our focus has been. Time will tell, we'll probably have some experience later on down the road when we have applications with high-saline environments.

Riggs: Right now we're dealing with organic waste, sewage. And that is the environment we're in right now, ponds with algae or like retention ponds. It's going to have a future dealing with things like red algae and green algae, but also it is going to be primarily used for a hog farm manure, very nasty stuff, but generally organic with only trace amounts of minerals and so forth.

Dan: That is correct.

Riggs: Good. Well, thank you very much, everyone. I really appreciate it. We're going to wrap it up now as I'm starting to lose people. It's been wonderful once again. I love these shows and love talking to you all. Thank you, Tom, for joining us as well. And Dan, it's been a pleasure. Have a great week. Enjoy your weekend. Stay safe for everyone.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)