Insider Briefing of 13 May 2021

I had the honor tonight of introducing Ricardo Garcia to the audience. He is a major OriginClear investor who happens to be a highly experienced senior engineering product manager. He’s now the Water Coin Product manager! (I can’t wait to have the real name of this coin trademarked… you will fall in love!) And… a sneak peek at our new website. Great show!

FEATURED/COVERED IN THIS BRIEFING — QUICK LINKS

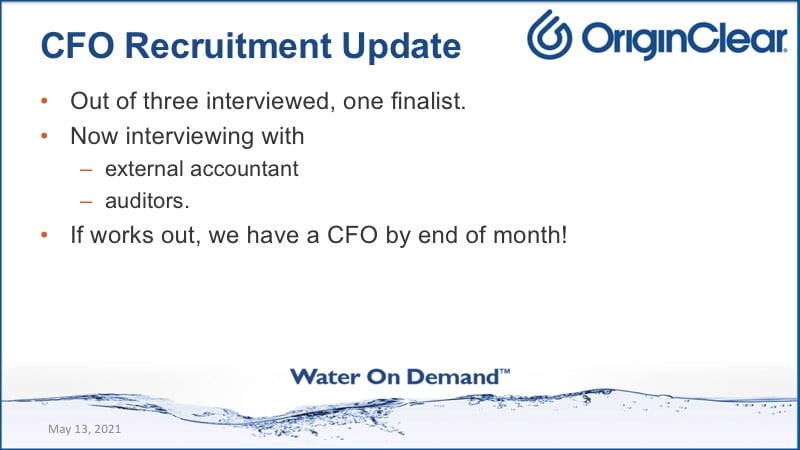

- Update on getting a CFO and a finalist candidate.

- Interview with early OriginClear investor Charles Jeannel and a story that goes with it!

- Introduction to and interview with Water Coin Product Manager Ricardo Garcia.

- A step by step graphic presentation of how Water on Demand and the Water Coin NTF platform are structured and designed to interact to revolutionize water.

- More on NFTs, smart contracts and creating a marketplace that grows organically.

- A sneak peek at the new Water on Demand website under construction.

- The Water Coin and ESG.

- How Water on Demand is indexed to local water rates and like JP Morgan is creating an electronic currency, except for water.

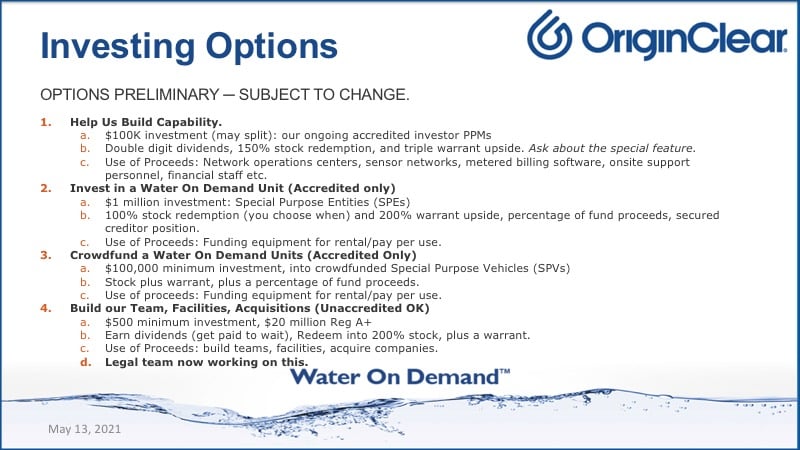

- A brief summary of OriginClear investment options and offers.

- A look at public market funding and what it means in terms or potential future capital.

- How to get a personal briefing on our programs or participate in them.

Transcript from recording:

Introduction

Riggs Eckelberry:

And hello everyone. It is Water is the New Gold: "Helping you thrive in the world's ONLY vital, scarce and recession proof market." We've had a very exciting week. I'm going to bring you up to date on everything that's going on. It is briefing number 110.

Forward Looking Statements

Okay. So as usual, we have our usual safe harbor statement, which says that we qualify our statements as needed. And we do our very best to tell you the way it is, but of course the end result might be very different. And none of this is of course approved by the Securities and Exchange Commission. We are on our own with respect to that.

Annual Report

Okay. So quickly, I'm going to update you on where we stand. Only thing I can tell you about the annual report, which I'm trying not to have an ulcer about is that we are now with the auditors. And so there's been the issue really had to do with the complexity of the equity issuances, but really the underlying issue was that we needed a CFO. So let me tell you about that.

Finalist

We have a finalist. We have somebody we feel is excellent. And this person's now interviewing with our wonderful external accountant and also with the auditors. And we have an offer in place and if the final interviews work out, which I believe they will, then we'll have a CFO by the end a month and we'll be able to start putting in the process and the controls and never miss a filing again. That's what we intend to do.

Early Investor

All right. So Charles Jeannel, if there's one person who knows me from earlier than Arte Maren it is Charles Jeannel. Literally, we knew him as a family in 1968 as an architect in Paris. And of course he invested, I'm going to go ahead and play the little video, Charles Jeannel, my old friend, how he talks about his investment.

Start of video presentation

Riggs: Charles, it's such a pleasure to have you on the Zoom from France and you've been a long time investor, haven't you?

Charles: Yeah, I've been a very long time investor. I think you are doing a great job to always find a new avenue, to try to push this water system. And so I think we have a lot of chance that finally, we get to some, better price and better return. I think the pay... people to not buy the equipment, but pay like a rental. That is a great idea.

Riggs: 2020, 2021 has been a time of progress. Finally, as they say in the venture capital world, we're moving the needle.

Charles: Yeah. There's a lot of progress. And so one of these days, this thing is going to start and you will have a good price and probably will be on the NASDAQ or whatever.

Riggs: Thank you.

Charles: Stock exchange.

Riggs: Well, Charles, thank you. I appreciate your support. I know that it's been a long, long road, but I'm glad you're interim happy and then for the final success. And that is exactly the best we can hope for.

Charles: Okay. Very good. Nice talking with you Riggs.

Riggs: Thank you, sir. Bye-bye.

End of video presentation

Revolution

Riggs: There, the person who probably knows me best in my past history, 1968. There was a revolution in Paris in 1968. Some of you know your history know that there was a revolution that had to be stamped out and I arrived in June and it was a communist revolution. I was in prep school in Massachusetts and my family was living in Paris. And so I come in June and I wear a red scarf inside my shirt, every single policemen at every corner looked at me and was about to shoot me. I had no idea. I was clueless, of course.

Introducing Ricardo Garcia

Okay. So without further ado, I'd like to introduce you to someone who's been on the show before, and it is Ricardo Fabiano Garcia. Hello, my friend.

Ricardo: Hello, Riggs. How are you?

Riggs: I'm great. I'm actually going to turn off the share just so everybody can see you on screen like that. But the last time you were on the show, where we'd left the green screen on so you looked like the Blue Phantom. It was wild. I was like, "Whoa, dude." But it was excellent testimonial you made as an investor, you're a major investor in the company, and I really appreciate that. But you're also a tech dude. So tell us what you do in your real life.

Cat Herder

Ricardo: Well, in my real life, I'm called a cat herder. Basically I work with people that are very smart and they have great ideas and I just help them channel the ideas and their energies in order to bring products to fruition.

Riggs: You are an engineering product manager, senior engineer product manager.

Ricardo: That's correct.

Riggs: With a major tech company, which we won't get into. But what's interesting is that in in your background, you built a managed services system for HP's collaborative network, right?

Ricardo: That's correct. Yes. That was the largest video collaboration network in the world at the time.

Building Two Sides

Riggs: Amazing. So this is a big reason why you're on board. Now we have two sides of what we're building right now, technically. And one is the Water on Demand™, which is the manage services and the other is the Water Coin.

Because we don't want everyone working on everything at the same time, we've chosen to make you the product manager for the Water Coin. And I like calling it the Water Coin because it's not its name. It has a fabulous name, just a great, great, great, great name. But I'm still trademarking it. And so we're using Water Coin, which is somebody else's brand. So it's generic.

And then Tom Marchesello, our COO owns the Water on Demand development. And of course you guys will be working with each other. He was with me on WaterChain™ back in 2018, he was in crypto, et cetera. So we've got a lot of mutual knowledge here.

MRD and Development

But what I thought we do here is while you're here is to review a little bit of what is going on. But I think the important thing to say is that right now we're focusing on pulling together the marketing requirements document, the MRD.

I'm an old product manager so, been there done that, and I love it. Favorite job I ever had in the world, cat herding is actually fun in my opinion. You can leave your video on. And secondly is to get the patent firmed up, trademarked and then move of course into development quickly.

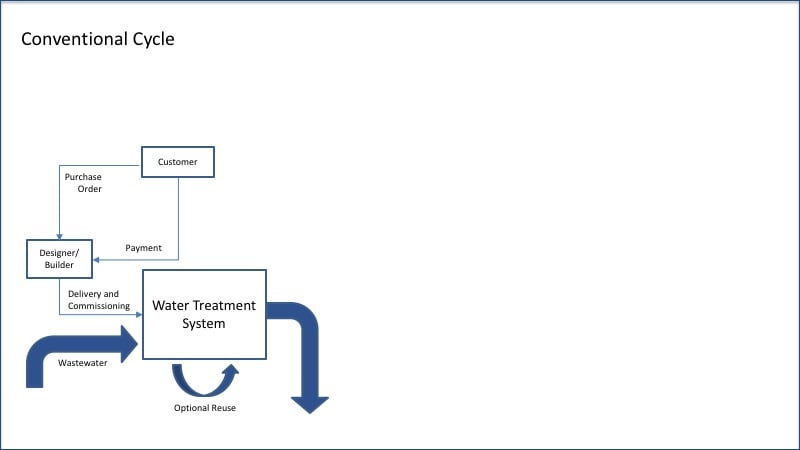

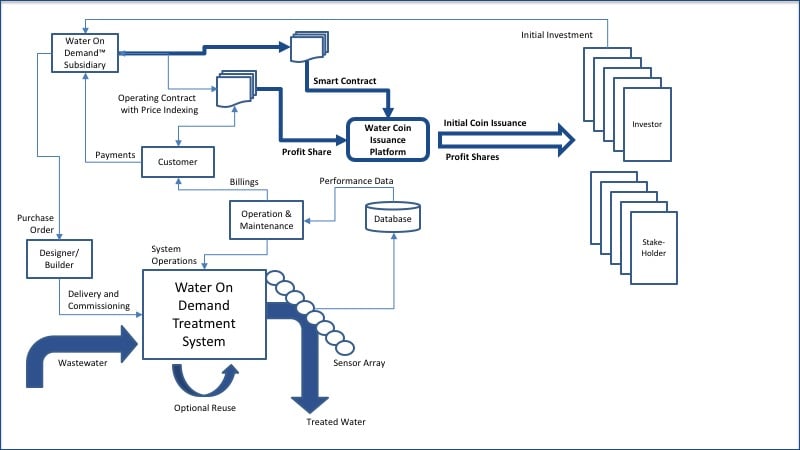

Conventional Cycle

So that's what we're all about. And so what are we talking about here? There's been some updating of these slides that I presented last week. So let's, obviously the conventional cycle selling a system to a customer, bada bing bada boom. And they get a water treatment system and we move on and that's it, selling widgets. E-commerce for big $200,000 to $2 million systems.

Now the new model Water on Demand, well, how does that work?

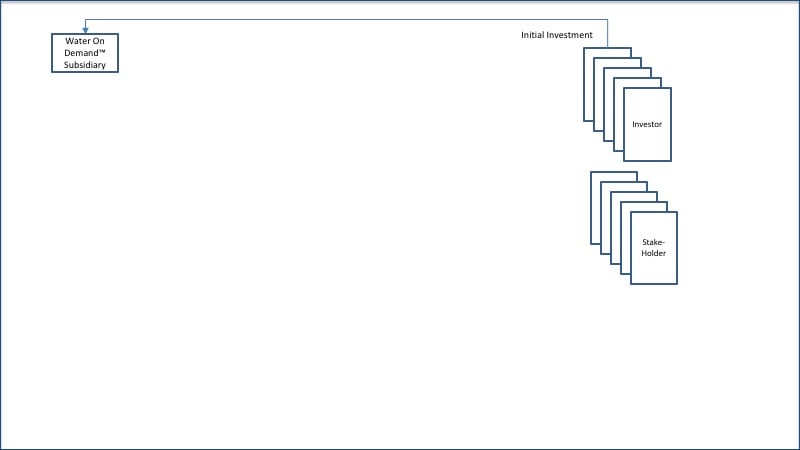

Subsidiary and Secured Basis

As we've covered, it starts with investors, stakeholders, meaning partners of various kinds who are involved in pulling these thing together. And we've created a Water on Demand subsidiary, and we are bringing investors in on a senior secured basis. If you're interested, it's a wonderful way to invest, because you are in a separate part of the company, and you're a senior secured creditor, and you have a security agreement on all the equipment that is sent out on service contracts.

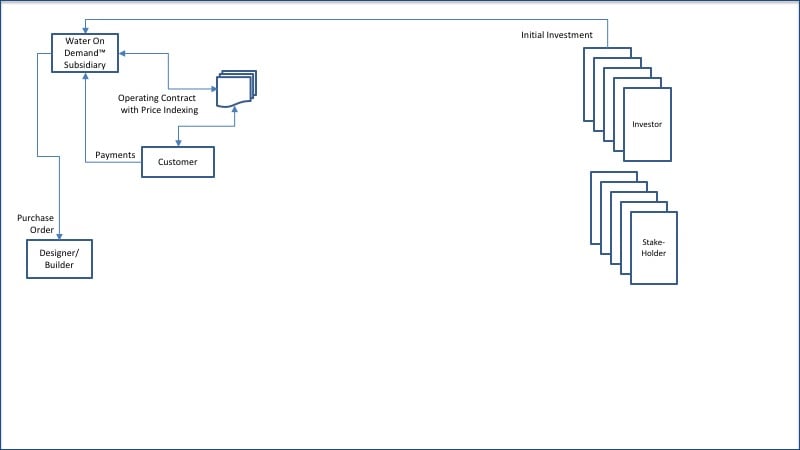

Indexed to Water Rates

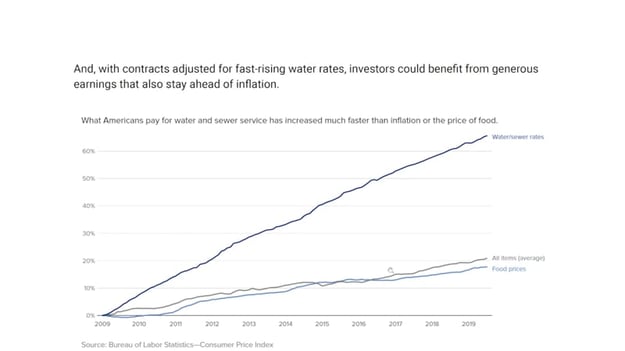

But that's a secondary issue because let's talk about what happens once the money is in the subsidiary, it gets spent. So, the purchase order is sent to the designer/builder, who builds. And meanwhile, the customer starts making payments on an operating contract. It is very important to recognize that, we want to index to water rates, very, very important. Because water rates are inflating much faster than inflation, which is already going super fast.

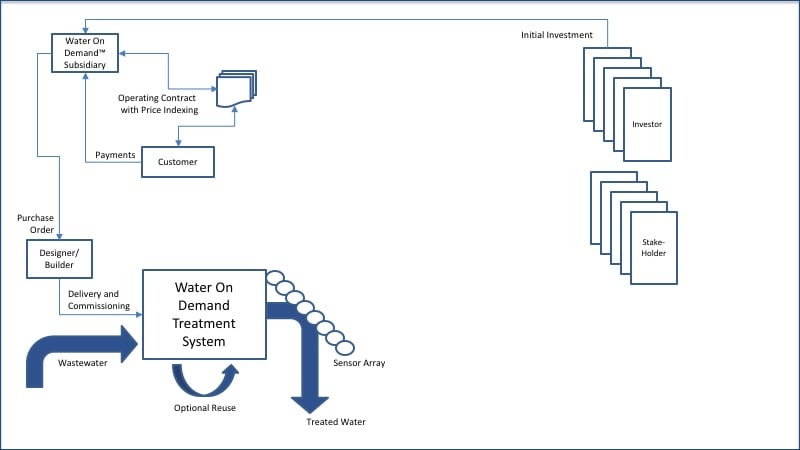

Sensor Array

Okay. And then, we of course build the Water on Demand treatment system, which has a sensor array.

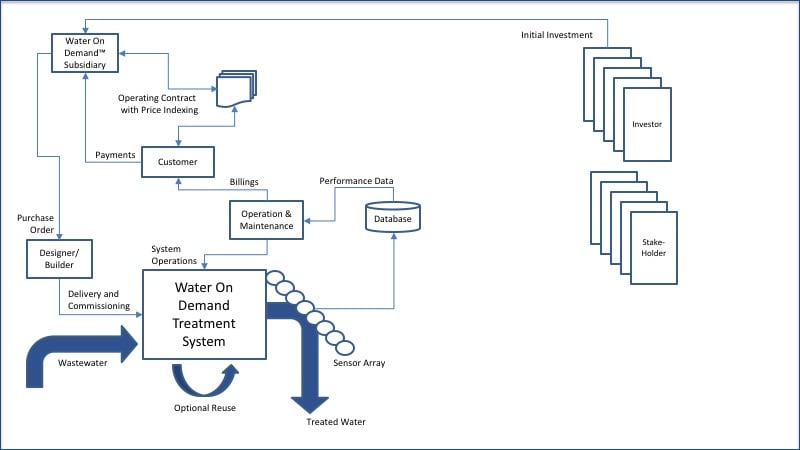

Operation and Maintenance

We add in the operation and maintenance, which can be done internally or with a partner. And as you can see, the data comes from the sensor to the database. We can call it a network operation center "NOC" because we're being very hip, but it's still basically a database and it goes to the O&M people who run the system. They have a local person in wherever location is, Chattanooga Tennessee, take care of the system. So the O&M people can be anywhere. And of course, billings go out to the customer.

Scalability

Okay. So far so good. This model works. It works well. The question is, does it scale? And we're very interested in how things scale. We've learned we've been paying dividends on preferred shares now for well over a, Oh, it's coming on three years now.

And it's a pain, the banking information changes, people's address changes. You know, they were sent something using deluxe payment exchange, but then the email went into spam and this and that it's a lot. And this, you know, this is only a couple hundred, 300 investors. Think about when it becomes 3000 or 20,000.

Smart Contract and Coin

So this is why we really felt we needed to step into this phase, which is, sorry I was doing the wrong button, which is putting in place the smart contract that says, okay, we're going to issue a coin.

Now, what is this coin? This coin carries in it, the entire lifecycle of payments for that sliver of that piece of water equipment that that investor invested in. If the investor invested in 10% of the water equipment and gets a, let's say 25% share, then it is a 2.5% share of the revenue, which we're calling here, profit share. And then you stack up all the years of issuance's (which the product could last 25, maybe in 50 years) and you build in inflation, that is, actually the 2.5% is a lot of money. That is the value of that water coin.

Now people, you know, some people want to be paid in money, what we call Fiat, which is regular currency, and they can be, but there'll be a way for people to do better by using tokens and that's a whole game that we know well in the crypto world.

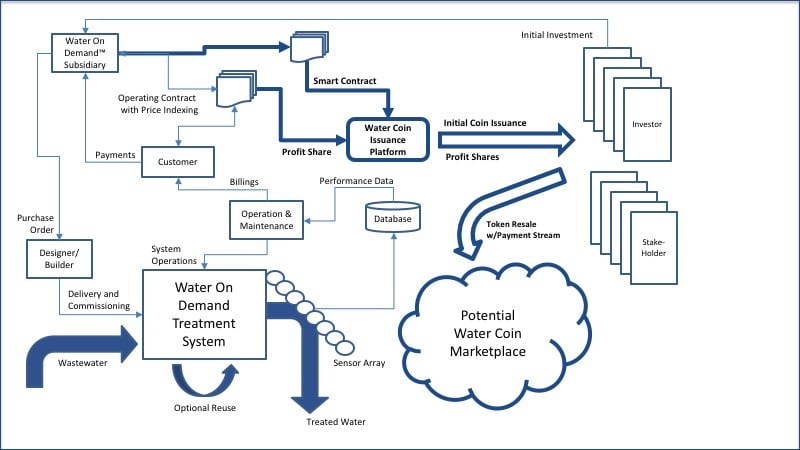

Initial Coin Issuance

So, we move into the initial coin issuance and this Ricardo, I think it's very interesting when we move into the next phase, which if we do it right, it happens organically without us creating a, this is the; we've been round and round in circles about marketplaces.

Natural Transfer

We don't want to be Airbnb in the end because we don't want to be the people building the Airbnb. You know, there's a whole lot of management. They raised billions. Instead, what we want to do is, is set it up in such a way that it's a natural transfer. The way people are doing it right now with tokenized art, videos, even houses, et cetera, it happens naturally.

Questions from Audience in Chat

Now I'm getting chat questions. Let's see what's going on before I go on, because...

Keith: "If we're interested in the water coin do we call Ricardo, and about how far out is it before it becomes reality?"

Riggs: Very good question. I'll answer it shortly.

Thomas: "Brilliant it is a blockchain accounting of all activity and productivity all verified, certified, and authenticated."

Riggs: Yes.

Mr. or Mrs. T Schryver: "Are you implying this as an NFT play?"

An NFT Play

Riggs: Well, I'm more than implying it. We believe, you know, in 2018, I did this, this token, but at the time we, we would have had to go through an entire initial coin offering and we were a ROR (Return on Revenue) company. And one of the issues was, scope.

Well, the good thing about non fungible tokens, meaning tokens that cannot, fungible means swappable, right? Two dollar bills are fungible. So non-fungible means you can't swap them. This thing is unique. Issuing these coins as non fungible tokens means as existing platform. When I say water coin issuance platform, I'm talking about an NFT platform like Proton, for example, that already has in place.

Organic Marketplace — Like Ethereum

It is basically a, a custom token development platform. And it, and it has a natural marketplace already. So Thomas likes that. All right, good. So then this is why I say there's potentially a water coin marketplace that is organic because, NFT'S have this organic marketplace thing.

Now, yes, they, it's artwork. It's movies. It's a baseball cards, but Hey, the other day, somebody listed a house for sale as an NFT. So now it's starting to become industrial, commercial industrial. And because NFTs have the smart contract capability, they're basically a, am I right? They're basically an Ethereum instrument, am I right Ricardo?

Ricardo: Yes, definitely. There's a back-end relationship to it.

Riggs: Yeah. I think, I think there's Ethereum. Now people are building stuff three and four generations away from Ethereum. So, but nonetheless has got that same smart contract capability.

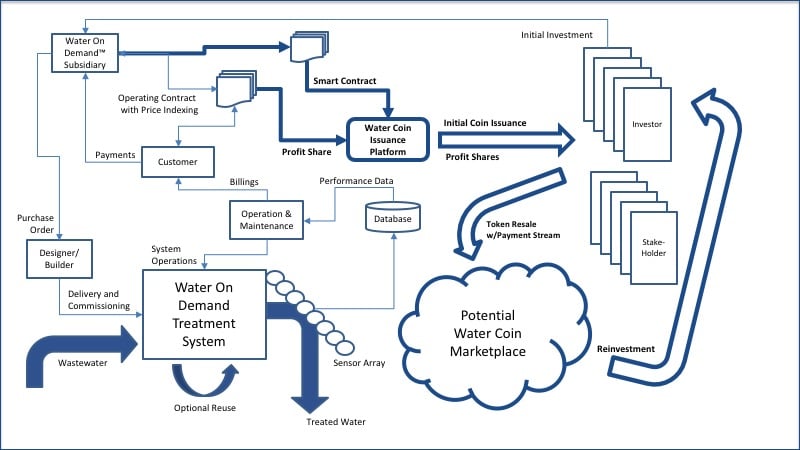

Reinvestment Incentive

Now here's the interesting thing. That is a really, really, really future thing. We don't know. We think it will happen. We want to incentivize people to reinvest, right? So they take their token and we give them a way to put that token back into system through some beneficial reinvestment.

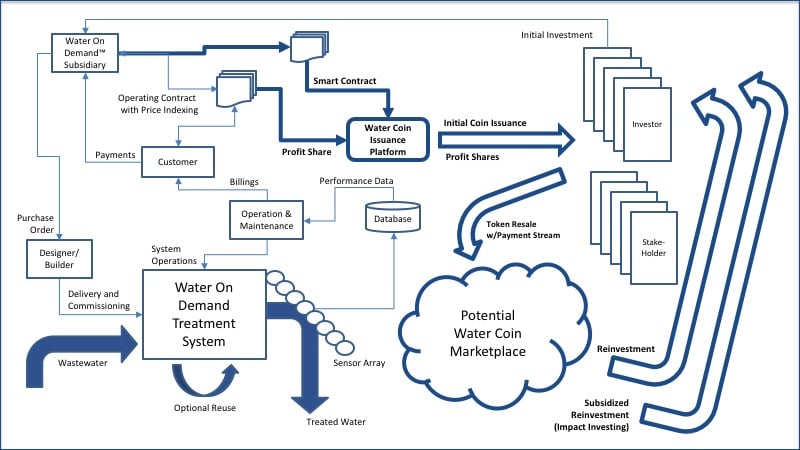

Subsidized Reinvestment

Now that starts to be really interesting. We start creating a virtuous circle and on top of it, we can even do reinvestment, subsidized reinvestment to save cities by having a nonprofit ".org" type strategy.

So that's the, that's the vision. And it's really doable. Why? Because the NFT revolution means that you can create a token or coin that you drop into a natural marketplace, that people are already building.

More Chats

Chat: "Power it with a renewable energy wind platform patent."

Riggs: Well, that's a very good idea. I want to say that energy generation from water treatment is an exciting concept, which we have not visited yet, but all water treatment has potential energy from the, from digesting the organic waste or using various other parts of the energy circle. So yes. And of course that can turn into...

Thomas wants to have a chat with you, Ricardo, you're going to, you're going to be very, very popular. And Keith Roeten, yes, what's going to happen is we're going to be publishing more and more about this. You'll see.

And we're going to be able to give you access, but we're going to try and inform. I don't want Ricardo to have to talk to everybody. We're going to publish this stuff. And that way the talking is minimal and the documentation is there because we do we document everything. Am I right? Ricardo?

Ricardo: That's correct. Got to make it reproducible.

Riggs: Right on, right on. That's the way it is.

Okay. Now, in order to give you guys a sneak peek at the new website, and this is a, this is going to be fun because we have ourselves a website we're working on.

Sitemap and Home Page

And what I'm going to do is I'm first going to give you the site map. Now, here's where things are going. All of the technology stuff is going into originclear.tech and these Corporate. So, these two are going to be big fat buttons on the homepage. And the homepage itself is going to have this...you're going to see the homepage, the draft home page, you're going to see it shortly.

And it's going to have other items like the news, learn more, and the network. So, the network being all our partners, currently, one of our amazing anchor partners you invested through, through a Philanthroinvestors® recommendation, and you are yourself a Philanthroinvestor Ambassador. Am I right, Ricardo?

Ricardo: Yes, sir.

Riggs: So, Philanthroinvestors is a great network for us and there'll be more.

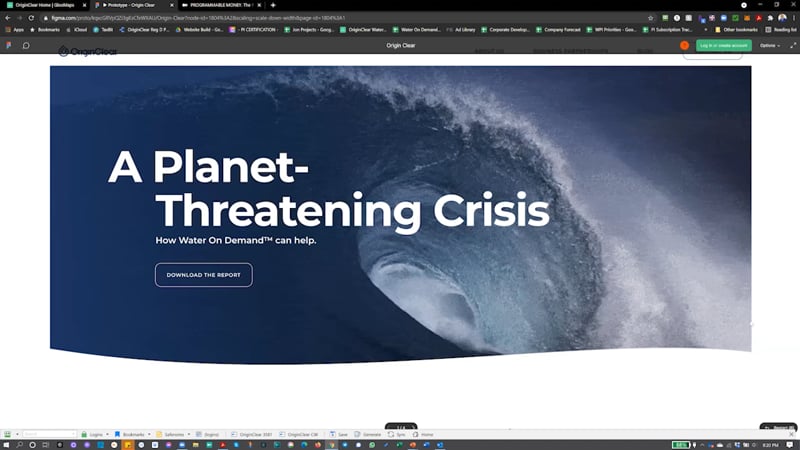

Home Page Draft

All right. So, well then this thing looks like this. Now, kind of give you the home page, of course water, ocean, et cetera. We're looking at doing something like having a coin on the screen, maybe, maybe not. We'll see. We don't want it to become hokey, but at the same time we got to tell it like it is.

Audience Comments

I do have some comments that are very interesting, so I'm going to take these comments

"Riggs. If this makes sense, make a comparison two NFT water coin contracts. One investor has a contract for a million dollar machine, making 25K a month. Another investor has a contract for a $100,000 machine, making $2,500 a month."

Well yeah. So, the NFTs all have individual values. And that $2,500 a month, multiplied out by the years, ends up being whatever it is, $1,500,000, whatever it ends up being, a lot of money, but then there's also the inflation. I'm not going to get into it on the fly because I'm not a mathematician, for starters. This is why I love Excel so much.

Water Coin and ESG

"How does the water..." Darrell wants to know, "How does a water coin play in ESG?" That's in environmental sustainable [social] governance. And what that is, is a set of standards that corporations adhere to. And then, people invest in companies that are ESG compliant. And my answer to you is, I don't know yet. It's very early to say. I believe that Water on Demand, combined with the Water Coin, is going to make a very good ESG compliant play, but we shall see. And Ken thinks, "Yes, it will be very attractive to the ESG world."

Technologically Agnostic

So... And Thomas wants to know about a technology creating water from the air. We're starting to get off into technologies here. And one of the things we want to do here is we want to be on top of water technologies. We want to be in the technology of building the whatever. We want to be agnostic. We want to be a Switzerland for technology.

Now, we have our own technology for the packaging of these water systems, so that they're portable, and they're very good for these use type contracts. But at the same time, we don't want to get into, "Well, we want to do bio-reactor this, that, energy for..." No. We don't want to take sides, I believe, because we're going to be working with a lot of water companies.

Horace Smith says, "I'm heavily involved in defy projects, and have a team that consults and develops blockchain solutions." Fantastic. This is cool. Horace, send me email. ceo@originclear.com. All right.

Planet Threatening

And I'm now going to continue with the website. All right. So basically, this... obviously planet threatening in terms of the quality of the water, which is a problem, people being in severe water stress, et cetera, and also agricultural industry using up most of the available fresh water. This is a problem.

Inflation

Now, inflation is a big story. Why? Because we believe that all the money in the world thrown at this problem is not going to get a solution. Why? Let me make this bigger for you guys. Because if you're doing long-term multi-year projects, how do you keep up with the price of things? It just doesn't work. So, no relief. 254% rise, from here, not great. The $2 trillion that have been proposed are already expected to cost $17 trillion. And that's without factoring in the inflation of the dollar.

Water on Demand

Now, main street businesses stepping in. You know this story, so I won't stick on it. But this is basically what we're talking about here, and no capital expense. So, we're talking about Water on Demand here. And then, we get into how it's done. So obviously, pictures are beautiful. There'll be more pictures

Indexed to Local Rates

Decades of monthly payments, and this has all these benefits. And now, we get onto contracts adjusted for the fast rising water rates. And this is water inflation, which is a big problem. It's inflating faster than other things and the other things are already.

Like JP Morgan

And then, we talk about streamlining electronic payments, electronic currency. We're not getting into a whole lot of mumbo jumbo about NFTs and so forth. But we do want to talk about the fact that good old Jamie Dimon talks out of one side about how bad crypto is. And his own bank has built a coin called JPM coin to facilitate instantaneous payments, which is exactly what we want to do with this water coin. So, we're doing precisely what JP Morgan wants to do. Okay.

Swappable

So, what is electronic currency? We get into it. I won't go too deep on it. And swap ability, reinvest, potential, et cetera, et cetera. And talking about who we are.

"Outsourced water treatment can make life easier for industry and could also improve the lives of millions."

Focus

And of course, there's various forms and downloadable reports and all that good stuff. So, that gives you a quick look at what this new website is going to look like, very focused on Water on Demand, and with light coverage of the water coin.

And the reason is because there's been...I was talking to somebody the other day, a big real estate investor. And I started talking about this and his eyes got bigger, and bigger, and bigger. And he was like, "I don't know." And the fact that people have made 80,000% on their investments does not make people happy who have not done it.

But the truth is, is people understand that, that this is something like, for example, JP Morgan is doing as a way of facilitating payments, then it starts to make sense. Okay. So, that's covering the website part of things.

No Update This Week

Normally every week, I give you an update on these design-build-own-operate projects, but Dan is on staycation this week in Virginia. And so we won't have the update, but next week, of course we will.

New Offering

Let's continue then. Now, this is the part where I start talking about potential investment, and I'm just going to update it a little bit where we're going with this. We have a new offering, which is 150% of stock redemption. In other words, you... Correction, there's I think that we're eliminate the dividends, but we have the warrants, but there's also a very special feature, which is super important, which you have to ask about.

Private Placement

Then, we're doing, this is the big $20 million private placement we've already opened. And on Monday, I'm meeting with one of the investors who's bringing his... For some reason, we're taking in a lot of real estate. I know, painful, but you know what, it's capital. It works well for these real estate investors. It allows them to diversify easily. I have a consultant working only on that. It's primarily real estate stuff coming in.

Series of Crowd Funded Units

And then I'm working with a portal, a good friend of mine who has an excellent portal and do a series of crowdfunded, one of the man units. And that is something that is happening, also accredit only.

Regulation A

We continue to be committed to relaunching our standard Regulation A plus with an additional feature of redeeming into stock. So we're not sure there'll be a warrant. We're not sure about the terms, but it's something like this.

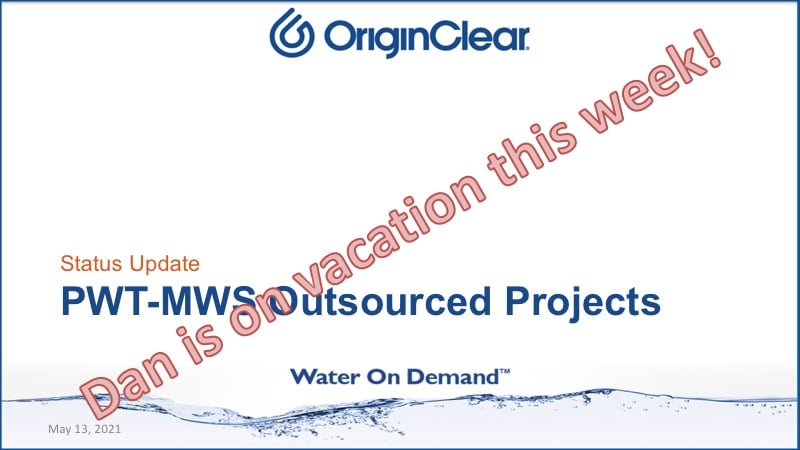

Public Market Funding

Now I want to mention something, this, these are all ways to raise money, but they're relatively expensive. We don't want, we start scaling up to the tens of millions and gosh, a hundred million dollars. I think we need to start talking about public market funding, which has this year boomed.

And what we have is public markets. And we know this because our sister companies have been raising money this way, and this is a way to pursue institutional fundings. It scales very well. There's lots of money on wall street and the cost of money is greatly improved. So if you want to get a really good position as an investor in this company now is the time because ultimately we will become funded institutionally .

Call Ken

And Ken, the partner in crime... I say that jokingly because he and I starting in February of 2020, went into deep strategic mode to fix the business model, and he is as much to credit for this new Water on Demand and Water Coin model. In fact, he is a co-inventor on the patent. So he's been a, a deep collaborator. He knows a lot about this and you know, we have, we share a brain as he says, oc.gold/ken gets you there.

Contact Us

Let's see if we have a, Thomas would like to have a chat again. If you don't hear from us because we didn't get your email somehow: ceo@originclear.com or invest@originclear.com is even better. And it goes straight to Devin.

Treating Water at the Edge

Horace wants to know, "How would these systems address an issue with the magnitude of a place like Flint, Michigan?" Very good question. And the answer is we're not going to try and replace the central systems, but for example, Flint, Michigan has a lot of problem at the edge.

All the businesses out there have the lead problem and they, the broken down water systems. And so they have to start treating water. We're there to help because the big water companies, they got the multi-billion dollar projects, they got that. They own it. They got their lobbyists in Washington, et cetera, but they are not interested in doing quarter million, half million, million dollar deals.

They're well below their radar, especially if you know these finance deals. So we believe that we'll develop a network in the local business category, and that's really our, strength.

And then Thomas also says, "Bring in of course, a more efficient..." and Horace is saying, "It's like edge computing." Very, very true, resources at the edge, decentralization of everything and now water. Absolutely true.

Existing Platforms and White Paper

So with that, I'm going to start to wrap up and I think that Ricardo, you're going to end up being a co-inventor, right? Because we're still very, very early on the water coin, but we're very sure we can do it. And here's why; the beauty of the existing platforms that we can take advantage of. That's a beautiful thing.

And it dramatically, now it's still hard work, but we don't have to create a coin white paper. We can simply do the white paper around the actual use case and application. So we'll be able to, I believe roll it out much sooner.

I don't want to make less of the amount of hard work involved and we should talk to Mr. Horace. And I have a number of friends from my 2018 efforts. Most of them were in Puerto Rico, actually. So living in Puerto Rico, living the life, and it's going to be a pleasure connecting up with them again, getting their help. One of them actually, a friend of mine is... (Horace Smith, Thank you) in Dubai actually.

Thank You

All right. Not that it matters these days with that. I'm going to thank you for being with us tonight. It's been a great pleasure. And I look forward to seeing you guys next guys and gals next week, Ricardo, it's nice having you on board in a new role as water coin product manager.

Direct Briefing

And Ken is pointing out to get a direct briefing, book to oc.gold/ken. Please be an accredited investor if you talk to Ken, because his day is filled with lots of meetings. And of course, if you're an existing investor, he's always happy to talk to you anyway. So thank you all.

So thank you all. I appreciate it. It's been wonderful tune in next week. I guarantee you it's going to be fun and interesting. And by the end of the month, I hope to bring you an interview with our new CFO. And that's very exciting. So thank you and Ricardo. Pasar beuna noche. (Have a good night)

Ricardo: Thank you, sir.

Riggs: All right. Seniór, be good.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)