AND NOW! ALL TOGETHER FOR THE FIRST TIME… and LIVE FROM THE STUDIO! Team OriginClear tackles important issues… Is tap water safe? And is there anything we can do about it? Water on Demand offers investors a first-ever opportunity, but why are water industry operators reaching for it? Can forming channel relationships with them enable us to scale? Find out in the briefing!

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

And welcome everyone to another CEO briefing. As you notice, there's no green screen behind me for a very, very special reason. You're seeing it as it is in my office. But what's going on here is that we are in the middle of some, a series of multi-day meetings to work out exactly where Water on Demand is going. It's super exciting. I'm going to quickly run through. We have a video which I'm going to run some excerpts, which is the Sustainability Champions Podcast, which was wonderful.

And I want to thank my brother Steven for doing a wonderful job here, of editing it down to where it was actually, you could actually live through it because a full hour of this, well, you had to be dedicated. So thank you to Steven for that. So with that, I'm going to flip over to the, I'm just going to share screen quickly to do the regular stuff, as you know, where we talk about all the things we don't we're not supposed to say and all that good stuff.

So let me take care of that really fast and. OriginClear is not taking care of... I'm not going to talk about other things. I'm talking about water here. So how do we rescue water? We let the regular people of the world invest in water. And this will ultimately mean, this is something I'm going to tell you today, here and now, it will ultimately also the unaccredited investor, not just accredited investors, thank God, because it pains me to have to tell people that they cannot invest in Origin clear directly. That will come.

But as an asset, water is virtually untouched. This is the very first time people can invest in water. And it is also the, because it hasn't been invested in it hasn't started to run. Gold is above 2000. Oil, this that and the other thing, it's all gone up. How do you get in? Well, you don't get into those anymore, but water is at the beginning of its run and we believe we have the key to it.

So with having said that a little bit, I'm going to just tell you that we always tell you what we think is going to happen as best we can and we always correct it. Obviously, what actually happens could differ materially.

Current Capital Status

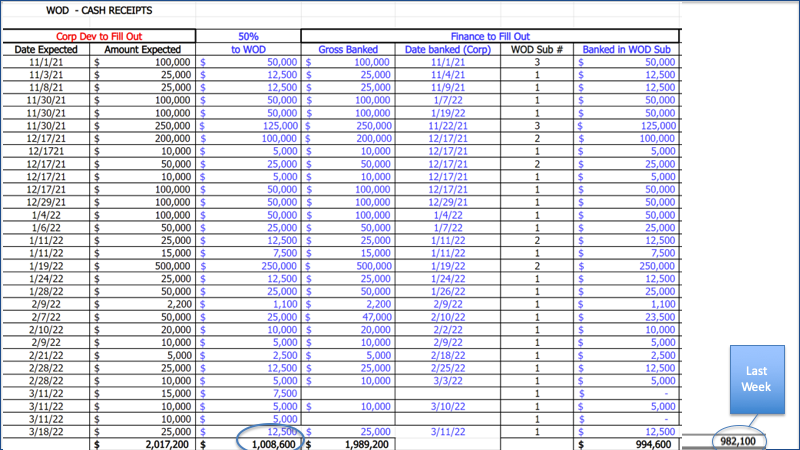

I always like to tell you the current capital status, we are inching closer to that million dollars. Lord have mercy. We were at 982. 982,100 last week now where 994,600 inching away. We have a couple more investments and we will finally hit that million dollars. So which is a milestone, an important milestone for us. So good work is done by the corporate development team headed by Ken Berenger. All right. So with that, I'm now going to go to the Sustainability Champions Podcast.

Sustainability Champions

Daniel Hartz: Did you know, Americans drink more than 1 Billion glasses of tap water per day? That's a lot of tap water and that's just tap water. I was thinking about this. That's not bottled water. That's specifically tap water and as water scarcity continues, because of climate change and our constantly changing climate and where water is moving to and from, this can pose some really big challenges to our water supply in the future and that is exactly why I'm speaking today with sustainability champion Riggs Eckelberry, who is the president and CEO Of OriginClear.

Riggs: Well, we were in the middle of this cool thing recording me.

Andrea: Yeah.

Riggs: But what the heck? Let's do a live thing.

Andrea: Yep, I agree. Why not? We're all here.

Riggs: Just to explain what just happened is I lost Zoom. My Zoom crashed, and so we had this separate, cool thing set up with my good friends right here, you know? So you know what? Instagram, who cares?

Andrea: Who cares?

Riggs: Right.

Andrea: Let's go. We're going to show you next time, because it was actually a very, very, very interesting piece.

Riggs: All right. Well, thank you. Thank you. I appreciate it. I think I'm good, too.

Andrea: All right. I like that.

Ken: That's the wrong person.

Riggs: That's all right. Well, just to introduce everyone and I've got Josh Sommers here, who is our VP marketing. It's nice to have you to keep the many people on board. Andrea d'Agostini.

Andrea: Hey, guys.

What We Are Doing

Riggs: President Chief Strategic Officer over here. Ken Berenger Executive Vice President and Co Founder, Co Creator of Water on Demand. And what we've been doing here today in our home here is discussing the, the thing, the thing that is happening that is so exciting that's going forward here, which is Water on Demand™ coming into its own. Now, I can't discuss specifically what we're doing about it because that would be getting way ahead of ourselves. But suffice it to say this. We're making it possible to really accelerate the capitalization of what we believe is going to ultimately save water as we know it. Why? Because industrial agricultural water treatment is 87% of all water.

And it's being trashed and the quality is going down. And there's a very interesting clip that I that I probably show next, next week. Where this person was reporting on the fact that a child had lost her life through lack of water in Ukraine last week. Well, and we kind of accept that it happens in Africa, but that it happened in Europe was shocking to that person. I would say that if you are shocked that people are having poor water in the first world, you're probably living in a bubble because water quality is bad in a lot of places.

How Safe is Tap Water?

Andrea: Totally, Riggs, We were in a meeting and before he was saying, "How many of you are drinking water from, like tap water? We were outside. Who is drinking tap water? And it's like no one. No one is because we kind of became accustomed to the idea that that water is not good. It became normal that the water is not good. And I think that Riggs sometimes, you know, when we when we do a meeting, he brings to our attention the fact that it's just not publicized, not communicated, but the water infrastructure in our country is not doing well like at all.

So I would say the water is the, in my personal opinion, is probably one of the last, if not the only asset, asset class, that is still not only still available for people to invest into and to and to create into. And I think it's a it's the right time to jump in because that infrastructure is going down. Like if you are if you're living Compton, you know that the water comes brown out of your facet and it's a fact, you know, so it's coming down.

Josh: And imagine if the water is terrible here, what it looks like in other countries.

Andrea: Oh, God.

What Asset Investment Still has Big Growth Potential

Riggs: Please. Well Ken, why assets? Why are we, why does everybody need to worry about assets?

Ken: Because we're always one invasion away from total chaos in the financial markets. You mean other than that? Right. Other than that. Well, we can get into this.

Riggs: How is the dollar doing?

Ken: Last time I checked was about 5 minutes ago. Really, really poorly.

Riggs: Okay. So we have a situation where currency is a bad thing to own. You should have you should have money in your safe. Of course.

Ken: There used to be a cash is king thing, but it's like, is it really?

Riggs: So yeah, you should own gold, etc. But the problem is of course gold is over $2,000. It's heading maybe to 10,000, who knows, etc.. So if, if you're trying to get into these assets now, you're kind of behind.

Ken: Isn't the, isn't the question what asset can I get involved in that hasn't already, isn't already at an all time high.

Riggs: Well, let's think about it. Not oil.

Andrea: No, no.

Riggs: The stock market is probably is going to drop or whatever, whatever is happening.

Ken: Seven interest rate hikes is what they're predicting.

What About Real Estate?

Riggs: So that's a problem. We think that residential real estate is interesting, but that's already boomed. You know, you were you were talking about getting a place here in Florida. And I was thinking privately, Ken is going to be buying at the top of the market.

Ken: Oh, I didn't say today.

Riggs: Okay.

Ken: I'm waiting for after the bubble.

Riggs: Oh, I see. Okay. Well, so you.

Ken: Be like next week.

Riggs: Residential real estate is good, but it's already topped.

Ken: Yes, absolutely.

Riggs: Office real estate is in trouble and not and not getting better.

Ken: And so as an asset class, that's a cash flow issue. Right?

Riggs: Right.

Ken: You can buy you could buy a piece of commercial realty. And I've spoken to a lot of larger asset investors that are in large commercial real estate assets. They're not worried that it's going away. In fact, if the dollar continues to get obliterated, they know that real estate in terms of its sell price, down here.

Riggs: In value.

Dead Money and Cash Flow

Ken: Will be fine. But they've got dead money until whenever commercial real estate figures out how to get rentals and cash flows going again. Now is that two years, three years, five years? The consensus I'm hearing from people that are smarter about this stuff than me because I'm not an expert is they think it's four or five years. So 2026.

Riggs: There's going to be I believe we know this is a permanent change in behavior. So maybe condo conversions of a lot of office building, etc., strip malls have been turned into, I don't know what, but big zoom rooms.

Ken: You know what they're doing now? Shopping malls, big shopping malls, multi million square foot things that are all boarded up. So they're turning it into casinos. Well, that's the only way they can monetize.

Andrea: The square footage.

Ken: Millions and millions of square feet and every other stores closed. I went through a local mall by me, Westmoreland Mall, and it's this massive thing. And they were dead. They opened up a casino. They're doing great. So they figured it out. What are you going to do with multi million square feet of retail space? You turn it into or you incorporate it.

Riggs: If you're Indian lands.

Ken: No, this is...

Riggs: Is this is in Pennsylvania. They allow gambling?

Ken: It was, it was quite a battle. It was a pitched battle. Yeah, but it happened. So what you said was with the condo conversions, with finding ways of making that office space cashflow positive, again, that's a process that's going to take a couple of years. A lot of people don't have five years of no cash flow on, these are not small investments. These are ten, 20, 50, 100 million dollar assets that they're kind of land locked in and that's got people nervous.

It's the Money, Stupid!

So the question is, what asset can I buy that isn't already topped out? That's, let's see, being monetized for the first time in human history. Oh, and by the way, is responsible for all life on earth.

Riggs: But how come all of a sudden it's an investable asset?

Ken: If I understand your question, how come is because we've created a individual financial instrument that allows an everyday accredited investor to be a direct investor the way they have in energy.

Riggs: Sure. But prior to that, of course, was the abdication by government of its responsibility for treating water.

Ken: So what led to this? What was this holy cow moment?

Riggs: Right,

Ken: Right. When you you often describe it and I think it's best when we describe it to the audience in very colloquial terms. It's, you have pollution being, basically being emitted at the point of pollution. So whether it's a manufacturing plant, a farm, whatever that flows downstream. Local utilities, city based utilities are ill equipped to deal with that type of effluent. They're dealing with what goes down our our drains or toilets or whatever, and that's it.

So what happens is the cities beg the state for money. They can't get the money. So you get brown water in Compton and they say, "Well, guys, this is, we're not, this isn't a surprise. We've been we've been begging you for money."

Andrea: It's not able to sustain the demand.

Ken: The abdication of responsibility, as Riggs put it, all comes back down to what? "It's the money, stupid."

Josh: Government at its finest.

Riggs: Which creates the opportunity we're talking about. In other words, now business is going to have to take care of itself. Where there is good service rates are very high and rising and we have that problem. For example, that wonderful case study of the Russian River Brewery in Sonoma County, which found itself with skyrocketing water rates. And they were expanding and one of our friendly competitors, Cambrian Innovation, went to them and said, "You can have a system, no money up front." And they were like, okay. And not only that, even more important in a way was that Cambrian was going to do all the maintenance, so they didn't have to have a water expert in the brewery.

Andrea: On board.

Riggs: Because all of a sudden you're now taking responsibility for water treatment, but you're not in the water business and you don't want to hire a water expert. There's a scarcity of those as it is. And so by having this complete problem taken off my hands, I'm like, "Okay, I can focus on my beer." And then it's turning into a movement. This is why we saw in the early... Ken and I saw in early 2020, $47 million worth of business lined up of people who needed systems. But it wasn't happening.

They knew they needed to do it. They were stuck with it. They had to do it, and yet it wasn't happening. And we figured out after a few months, as you said, money. "It's the money, stupid," right? We provide the money. It loosens it up and it goes.

Shortening the Sales Cycle

Last week you and I called one of my longtime friends from back in the day when we were actually working in the fracking space. And it was like Old Home Week. And then we explained what we wanted him to do for us, which was to help us run these systems. And he said, "Yeah, I actually have a golf course, that, the only thing stopping them is the money. Will you handle it?" I'm like, okay.

Ken: A little more backstory on that. So, what this company has been doing, for the audience's sake, they've been doing the the business part; that we want to incorporate right away, is the operations and maintenance, for three decades. Both a local, national and international footprint. What was really fascinating and I listened on this thing and I'm going to continue to hound him. "You need to do that. You need to do that one." It was a clinic. It was a perfect example of what the typical water company is experiencing. And they've had nobody to talk...

Like, it's like a bunch of guys in a room all complaining about the same problem. Right? But no one's really fixing it. Right? So he was basically saying, you know, to give you an idea about the sales cycle and why Water on Demand became like a lightning bolt moment. What did he say? "I've been working on this golf course for ten years."

Josh: Wow.

Ken: It was just about to close. They were self-financing and it fell apart. And they said to him, "Well, we're going to wait a couple years." So you're talking a 14 year sale cycle. He said, and I'm paraphrasing "If we could get the money angle solved, they would close in a minute and there's a couple dozen behind it."

Riggs: Full golf courses, right?

Modular Water Products and DBOO

Ken: Right. Then he mentions you have that wonderful HDPE stuff.

Riggs: High density polyethylene.

Ken: Sorry, high density poly. Sorry, Dan. High, yeah, that wonderful HDPE — high density polyethylene stuff. "You know, we would really be interested, could we? Could we use that?"

Riggs: Modular Water™.

Ken: And we were like, Yeah, let me think about that. Sure, you want to license our stuff, right? So what it displayed to me is: Riggs and I have been back in the lab mixing, mixing chemicals going like this. And we've come up with this, It's finally taken, with the help of you and with the help of Andrea, we now can do what we need to do and have other folks help us organize all this thing. But that phone call being, you know, kind of talking to a guy in the industry. The need and the desire, there was no there was no, skepticism. DBOO? Sure, we'll do the DBOO for you.

Riggs: Design, build, own, operate.

Ken: We've only done that 50 times. I figured the audience knew that. So anyway, it's going to, I'm going to be the straight man next week.

Riggs: Okay. Thank you.

Ken: All right. Okay. So the point I was making was that it was blatant and obvious that this is just a small example of the need out there,

Andrea: The demand, yeah?

Enormous Market and Channel Partners

Ken: Wait a minute. You got money? You could. You could, actually fund? So this guy that's stuck in the mud. Right. If we had this financing capability, what, a year and a half ago, we had another $40 million in business. Could have been done like that. Right. So, and we're one tiny, MWS (Modular Water Systems) and PWT (Progressive Water Treatment) we are one tiny little company in an ocean, pardon the water pun, of these water companies that represent hundreds of billions of dollars of business across the country. If this is one example of the desire to have money solving pipeline problems, the total market on this thing is enormous.

Andrea: Enormous.

Riggs: So what this validated for us was our decision to do two things. First of all, to delegate the building and maintenance of these systems, number one. And number two, to look to those companies for deal flow, which, in fact, Josh, you don't have a job anymore.

Josh: Dang it, already? I just got here!

Riggs: But the truth is, that through these channel relationships, we're going to be able to scale because now we're operating as a finance operation.

Controlling Operation and Maintenance

Now, is that easy? No. Why? Because we have to do contract management, project management, contract enforcement. We have to make sure that let's say that, Josh, you're the water company and Ken, you're the client. We're in the middle. We have a contract with both. Well, if you screw up, then I still have a contract, and I've got a real problem. So making sure that you work and probably that's redundancy so that Andrea is behind you in case you screw up. All these things have to be done by us at Command Central.

Josh: Yeah,

Riggs: But that's still allows us to go in parallel operation and have multiple projects and a lot of clients coming to us through these water companies. And here's the final thing that I realized. This is our supercharger network.

Josh: Yeah?

Competitive Advantage

Riggs: This is Tesla. Right now, Tesla's supercharger network is very hard for competitors to overcome. They're like, well, maybe we'll put chargers at gas stations and they're still talking about it.

Josh: Yeah,

Riggs: Right. Tesla just did it and we're doing the same thing. So we're putting in place this network of water companies that know how to do operation maintenance and O&M, in other words, that know how to do the continuing work. And once we've got them, it's going to be hard for others to break in. It's going to create a club. And so this is really the it's we're going to rename it Club Water.

Ken: Club Water.

Riggs: No forget Water on Demand, it's Club Water, not Club Med.

Ken: If you're going to say it. Right. So now it's Club Water.

Andrea: Wadda.

Riggs: Club Water.

Josh: Yeah, there you go.

Ken: But the process that Riggs described because you're not reliant. So the world is your manufacturer.

Josh: Yeah.

Ken: The world is your sales rep, the world is your consulting engineer. You've got the entire world pitching on your behalf. Why? Because this guy gets to accelerate my sales cycle from two years to two months.

Josh: Yeah,

Ken: That is stunningly scalable, right.

Josh: At the end of the day, it's about production, right? Getting this stuff in there.

Leveraging Operating Capital

Ken: Well, here's the thing. So we we wanted to grow through acquisition at one point because we felt that was a way to get really good, solid growth. But then when you when you think about the money required to buy a company that's turning at a five or 6% margin, you go, oh my God, you know, $100 million. And I get to do 100, 100 million in revenue or $10 Million. I get to do 100 million in revenue, whatever the heck it is. But I'm making two or three, four or $5 Million a year. It's really not a very good use money that same $100 million put into capability to let the world be your man. I could. Instead of buying that company, I could actually I can actually contract with 50 just like it for the same amount of capital.

Riggs: Which means that we don't have to acquire companies. Right. Which makes our life easier. Now, if I may, I'm going to tell my Il Fornito story.

Ken: Sure.

Riggs: Which is the early nineties. I was actually my brother Steven was busy helping me get into the film industry.

Ken: This is a great story.

Riggs: I was very excited and I met at Il Fornito on La Brea, I think near near Fountain. And I meet with this lady and I'm saying, okay, so how can I break in? How, what can I do? And she goes, It's really impossible. It's super hard, you know, it's going to take you forever and nobody wants it, as I said. Well, what if I brought the money? Because you. Get anything you want. It's all good. Like, all right. It's the money, stupid.

Ken: Lesson learned. And it's funny, because in this one call, this was a perfect. To me, it was a perfect reality, it was perfect, it was a validation and it was a reality check at just how obvious the need is out there. It was a seamless, comfortable, congenial conversation. He was thrilled. And he said, you know, I got this deal. It's three and a half million dollars. You want more financing?

Riggs: And here's a cool thing we don't have as we accumulate capital, we can leverage that capital. We don't have to do one for one, right? There's ways to to make your capital be leveraged right, through the magic of the finance world. And so now we get into multiplication of capital, and this further stretches the capabilities that our investors are giving us.

Ken: I wonder...

Assembling a Team

Andrea: And today it was like, was this like summit, which is which gets us all together with also.

Riggs: With my sourdough bread.

Andrea: Which is amazing. We made it like Italians. So it was amazing and Maya was here and Dustin was here. And tomorrow we're going to continue because like Riggs assembled a team. Now the team is probably, I would say, one of the best products that will accomplish the mission you need to have the right crew to.

Riggs: It's always the team.

Andrea: To drive the ship, right? So I think it was a very special and we wanted to be all together to...

Riggs: Actually be together, actually be actually.

Ken: And in fairness, I think we accomplished more in 3 hours than we could have in three months, because, "I got to take a phone call. I got to talk to so-and-so." So the group is never locked, you know? Lock them in a room and make sure that, you know... In 3 hours, And we did we worked it out.

Riggs: Fewer walked out. But, you know, that's like...

Ken: Well, you should have listened. You shouldn't have ate the bread. All right.

Riggs: Thank you.

Investor Benefit

Ken: I wonder if the leverage of that capital, the, it's a magnification, really. I wonder if there is a function in that magnification strategy that could actually potentially even create greater rewards in terms of pay streams?

Riggs: Well, here's exactly let's take a look at...

Ken: See?

Riggs: Water on Demand subsidiary. Water on Demand subsidiary has, let's say, ten investors, 100,000 each, a million dollars. Keep it simple. All right. Now they get 25% on that investment, $1,000,000, which, let's say over time, just to keep it simple, it's 100,000 split ten ways. So you should get 10,000 in royalties. But now we leverage it into $10 million. They get ten times as much royalty because we've.

Ken: Still the subsidiary, isn't it?

Riggs: The same subsidiary. We've created ten times as much net profits.

Ken: Correct.

Riggs: Out of the same original stake.

Ken: Right. So so even the model, even this model that we're working with could be incredibly modest when when once applied to a real world with the delights of of banking.

Hedging Assets and Rate of Return

Riggs: Right. Exactly. Now, you have to hedge your bets, right? When you do that kind of stuff, you then have to to like buy contra positions. And all you have to...

Ken: There's ways of securitizing it.

Riggs: Absolutely. You buy counter positions, etc., and you make sure it's all okay. And you know, there's insurance products to buy and all kinds of interesting...

Ken: Like airlines buy fuel futures, oil futures. Yeah. When so it would be in a bad market if they go along a bunch of we could do the same thing with similar instruments with the equipment being secured. Securitized, right?

Riggs: Exactly.

Ken: Very exciting stuff.

Riggs: So, so all that good stuff is really interesting, but it means that we're going to have to add a lot of sophistication to our operation. And, you know, Manuel, of course, is brilliant, but he's really kind of like the boy with the finger in the dike because like already he's overloaded and he's not even full time. So that is something that is why we are continuing to not only put capital to work, but also use some of that capital to build the capabilities that we need to put in the systems, software, the sensory networks, the network operation centers, all those things.

At the end of the day, where are we ten years from now? Right. It's an interesting thought exercise. Where are we ten years from now? Well, assuming that we've reached our goals, which are let's say, let's say that we raise the $300 million we're talking about, which is some progress, half of which goes to Water on Demand, which is then leverage in some magical way. Now you've got.

Ken: So are we talking 5 to 1 leverage, ten.

Riggs: We talk about half a billion dollars ultimately. Let's say you're working with half a billion dollars, which is throwing off a ton of cash.

Ken: Well, even at the 10 to 1 model and by the way, the 10 to 1 model that you were talking about, that's a little on the modest side. But let's just say you're right. You said $5 Billion.

Riggs: A half a billion.

Ken: Half a billion. That means it throws off about $5 billion. Right?

Riggs: So and then out of that, what it throws off, 25% goes to the investors. Not a bad outcome.

Ken: Well, it's a billion and a quarter, if my math is right.

Riggs: Well, that's that's why you have the math the money job.

Andrea: Because pick a math.

Ken: Carry the one.

Riggs: Right. I remember once I made I made did a big announcement. It turned out I had made a math mistake and my backers, went, well, you weren't hired for your money skills.

Ken: Good presentation, but yeah, let's stick to a calculator.

Riggs: Right. That's why we have a good CFO. So we we're actually. It's 40 minutes in.

Ken: Think about that one second though. I want to, I want to focus back because again, right away the gears turn with the money. I half a $billion of actual investable capital could create just to the investors one and a quarter billion.

Riggs: Over time.

Ken: Over time.

Josh: Amazing.

Riggs: And of course, currently, we give these investors stock, which they will not have in the future. In the future, once there's established program, they'll just get the royalties and it's lots of money, but 25% of that profits, very good.

Ken: If you if you ask an MLPs investor...

Riggs: Master limited partnership.

Ken: Master ok, master limited partnership. Thank you. If you ask that investor if he expected stock in Shell, you know, because they were drilling for Shell or they were drilling for for BP, if he was expecting stock in the... "Of course not. I did this to make sure that my million dollars is still $1,000,000 in ten years, that I'm buoyed against inflation." That really is the expectation for an inflation hedge in asset, right. The fact that we're doing this now to the extent that we're doing we're providing real kind of that exciting what was the word we were using before we'll founder type of potential leverage. It's a window that is, it's short but I think you know I think the people I think the people that get it require very little explanation.

Call Ken

Riggs: Okay. Well, I'd like to tell our friends tonight that Ken here has a briefing for you that will blow your mind. And if you haven't had it already, you need to get it, because he is going to impart stuff that is still, not material, non nonpublic information, because we don't do that. But still it's not the kind of stuff that we broadcast widely. It is a confidential briefing.

Ken: On possibilities.

Riggs: Totally. He's very good at disclaiming. I trust him implicitly in that respect, but it's very important to have a little bit more time spent on it. And as an OriginClear investor and unfortunately, you need to be accredited right now to participate. We hope that will change. You definitely need to put oc.gold/Ken in your browser schedule a call with Ken and it's going to be a very rewarding discussion, I'm quite sure with that.

I wanted to thank you for joining us. It was interesting, this little crash that we had, but it's a good thing that we had to fall back. It's really cool.

Ken: You know what's a good thing? We were all sitting on your couch when it happened.

Riggs: Exactly. And we had a film crew ready to go.

Ken: And, like, if it weren't the four of us, plus an entire camera crew in the room.

Andrea: It would have been a problem.

Riggs: I would have been like restart computer anyway. So with that, thank you all and thank you for joining us. It's been a great pleasure having you tonight.

Andrea: Thank you, everyone.

Josh: Thank you.

Riggs: And next week you'll see that Sustainability Live podcast. But they'll also be more I've got some interesting stuff to show you that you will enjoy. Join me next week.

Ken: Goodnight.

Andrea: Good night guys.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)