Insider Briefing of 29 July 2021

Both Progressive Water and Modular Water are ON FIRE! What's coming

ahead on the horizon and how will it affect them? And how does it relate to those pay-as-you-go Outsourced Water projects? Our audience got the scoop on ClearAqua™ and a community coin network. Wanna know how it works? We covered it and how the $H2O™ coin would interact to make a two-coin universe. Find out how here in the replay!

Transcript from recording

Introduction

Riggs Eckelberry:

Good evening everyone, and welcome to the Thursday night briefing. Another fantastic briefing is in store, you will love it. Let me get on to it while people are arriving.

First of all, I'll just do the honors here, it is Thursday, the 29th briefing number 121, so we're well into the 2 years and more and counting. This has kind of become a regular thing and it's great, because it allows us to really kind of have a publication day each Thursday it's very productive.

(click image for Spanish replay video)

(click image for Spanish replay video)

So, of course, as you know, [speaking Spanish] in Espanol and there's a globe symbol at the bottom of your dialogue, and you can simply hear Spanish, it's kind of cool. It's being recorded in both languages. Well, of course the wonderful Heather is speaking Spanish and I understand that she understands me all too well, which is a good thing. All right.

Anyway, we've got the usual safe Harbor statement with the fact that we're... We have to make forward-looking statements, but they are the best we can make. And there are risks and uncertainties that we try and spell out. And of course we always correct ourselves when we figure out that it was not right. So that's what we... That's our undertaking to you.

Mind Bending!

Okay. So first of all, I wanted to cover. Whoa! Major commercial news, as you know, Modular Water Systems™ scored sales of over a million dollars in the first half. And that is more... much more than the entire year for that division, last year. Progressive Water Treatment has 28 projects simultaneously in the shop right now, I think it's 28, perhaps 27, and they scored sales at 1.6 million in the first half with modular water, there's 2.6 million or more than 5 million annually.

Now, remember, these are orders. They're not revenue, takes much longer for orders to become revenue. I'll show you that in a second. Now, we also received an authorization for expenditure from major power utility just today, for projects totaling about $5 million, which is mind-bending, because we were competing with major, major water companies.

So that's huge and POS are expected next month. I'll let you know more. Probably I'll cover more detail next Thursday, the first Thursday of August. In other words, our core business is on fire. Even while we're developing the whole, Water on Demand™, design-build, own-operate, which by the way, we won't have a report tonight, because Dan Early is on be on vacation, but it's even while we're building this new capital based, pay per gallon model, that's so modern, our existing businesses doing great. So it's... I'm so proud of the team.

How it Works

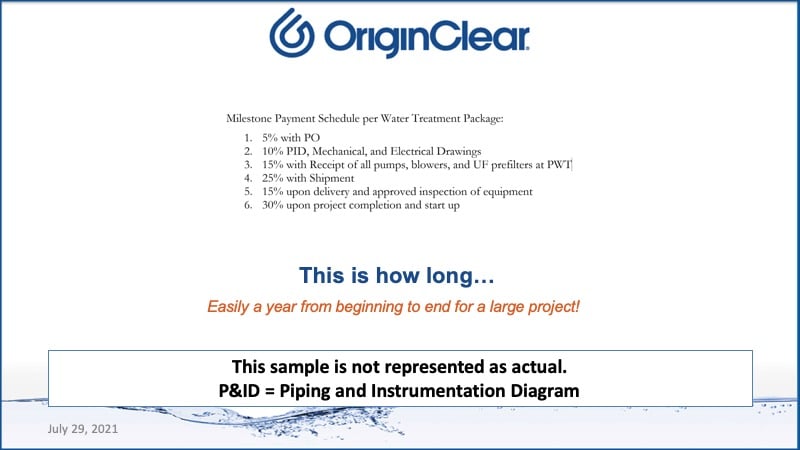

Now I wanted to show you what I mean by time, this is a typical milestone payment schedule. We can only count the revenue when each milestone is made. Now it's odd, but you don't actually have to have collected it. Let's say that we've gotten. And by the way, P&ID means Piping and Instrumentation Diagram.

Let's say you get... You deliver the PID mechanical and electrical drawings, you get to book that 10%, even if you are not paid that it becomes a receivable, but this is how a recognized revenue works. Each milestone is recognized revenue. So, that's a typical schedule and it gives you an idea.

Now for a large project, like the one I was just talking about easily a year, $5 million project, no question about that. So just to give you a sense of how it works and how we kind of have to keep adding on in the back, because the front is so slow and the pipeline fills from the back, shall we say?

Quarterly Filing

Okay, now, and finally I wanted to mention real fast, that the quarterly filing is about to happen. I've seen the final draft and we are circulating into the board. So I can't say it will be tomorrow, but it will be very, very soon. So stay tuned on that. I thank you for being patient.

Our CFO, Prasad Tare has been in there streamlining things like you wouldn't believe. He's found all kinds of inefficiencies. Eric Sandler, our controller, John Peraza, our head of administration have done their best, but frankly, they got overwhelmed and the administrative systems were not in place stupid, but true. And that's what's there. We have a CFO for now.

I do believe the second quarter filing, which is due. I believe on the 19th of August with the normal extension, should be on schedule if not very closely to the schedule. So we are getting better and better as this goes along. Okay. That covers what's going on. And like I say, the business is doing well. We're improving our processes and we're doing all kinds of new stuff.

Now I want to... I'm going to now focus a little bit on what's going on with... We've talked about inflation before now. Why is inflation important to us? It has to do with the money to get stuff done. It also has to do with Crypto, as I'll show you in a bit.

So there is a very good GoldSilver.com video, which you just can Google is higher inflation, temporary or structural, and you'll see that video, but I'm going to play a short excerpt from it to kind of make the point that I'm trying to make here. And one second, I have a... JRW, "I love it already. Greeting everyone, and thanks for your information and entertainment."

We do our best to entertain and also inform, all right, so I'm going to re-share, but in video mode so that you can catch this. This is a grab that I did from the YouTube. So you don't have to look at the whole thing.

Start of video presentation

Mike Maloney and Ronnie Stoeferle address the issue of inflation.

Mike Maloney and Ronnie Stoeferle address the issue of inflation.

Big Government is Back

Ronnie: So I think now, as we are seeing the economy kind of weakening, at least for most of the indicators that we watch, I think at some point we will see even more aggressive fiscal policy. I think that big government is back not only in the U S, but all over the world. I think people are accepting now that politicians want, or try to fine tune the economic cycle.

This is well accepted and I think therefore there will be more package, more fiscal packages for infrastructure, for a greener economy for education whatever. So, I think this is really here to stay. And I think the market will still be surprised by the aggressiveness of fiscal policy that will be ahead.

Micromanaging the Economy

Mike: Yeah., for our viewers, the difference... Some people haven't really gotten the difference between monetary and fiscal policy. Monetary policy, is set by all of the world's central banks. And it's basically, how much currency is there going to be? And what is the cost of that currency? The interest rate? That's monetary policy.

Fiscal policy is what the government does. Are we going to do a bunch of deficit spending? Are we going to take on a bunch more debt? Are we going to pass this bill for roads, and this bill for bridges, and this bill for schools, and this bill for aid... stimulus checks?

All of that's all fiscal policy. And Ronnie was it?... I believe that chairman Powell made a statement or wrote, I can't remember, saying that the government needs to spend as much as possible, "Spend all you want, the Federal Reserve will support it." Didn't he put something like that either in writing or in a speech?

Ronnie: Yes. Yes.

Mike: Yeah. That's like, there's going to be inflation. That's what he's saying.

Ronnie: And he said in, I think it was in 2018, and I think this was really one of the most profound statements that any Fed Chairman ever made, he said, "We would like to smooth out the wild swings of past economic cycles by fine tuning monetary policy."

So, I think, it is... There is no discussion going on how much the Federal Reserve should influence markets. I think they see it as their job basically to micromanage the economy and the inflation, and especially, financial markets. And I think, everybody is talking about tapering now and the Fed going on a more hawkish path, although, I don't really see that, but I think, we should not forget that, probably, the most important, let's say, invisible, voting member in the FOMC is the stock market.

Slaves to Their Bubbles

So, everybody thinks that, "Okay, at some point we will see some tapering. It will be announced at the Jackson Hole meeting probably, we will see rising interest rates, end of 2022, or perhaps, likely, later." But, as soon as we see some volatility in equity markets, as soon as we see the S&P being down five or 10%, they will, of course, become more hawkish, more dovish again. And they will say, "Well, we will continue being on this accommodative path, and..."

Therefore, I think, actually, the Fed is, I would say that the Federal Reserve is trapped, they are being basically, slaves to the bubbles that they blow, and there is no way out. And everybody who thought, "Okay, Jay Powell is different because he's not an economist, he's not an academic." I think, we learned over the last couple of months, that it is just more of the same and that we shouldn't expect anything new coming out of the Federal Reserve.

Mike: Right. And he's definitely taking a page right out of the Ben Bernanke playbook. Whenever anything happens, the solution is create currency. I want to thank you so much for the time that you've given me. And this interview is going to be continued.

End of video presentation

Riggs: There we are. So that, it basically says there's not going to be... Every time that they try to push interest up, they get... They'll get pushed back from the stock market and it won't happen.

Keith Roeten, "Riggs, is there any chance that you might run for president United States in 2022?"

Riggs: No! First of all, that's an off year, so that would be like, forget about it, but... Let me see. And then... But thank you.

Wait a minute. Okay. Robert. Robert. Robert. Okay. Okay. You... All right. Robert is concerned about trade-ability of shares and that's entirely related to our filings. And all we need to do is get current. So, I covered earlier in this call, but please send a message to invest@originclear.com. We'll be happy to answer your questions and help you out. And as, if you're an accredited investor, we can also do things about your cost basis.

All right. So, with having said that, I'm going to move on to... There we go. And this is now back to regular non video. And this is a very interesting tweetstorm that I thought could be helpful, because it leads to...How does inflation relate to crypto? The monetary climate and so forth. So, I'm going to flip through these slides really fast for this tweetstorm.

King Bingo Tweetstorm

Okay. So, this King Bingo, at King Bingo underscore, is a UK Twitterer, and he... I'm not going to get political about this, but you want to know why the elites to destroy your lives.

Well, there's a story in the Daily Mail, which talks about this gentleman who was the Chancellor of the Exchequer, which is the, basically, the secretary of the treasury. And he wants to replace our cash, British cash, with official digital currency. Okay. So, what does that mean?

Of course, in the last video, we were listening to how the Fed Chairman wants to smooth out the boom and bust while that was tried by Gordon Brown. It does not really work. And each time we have a boom and bust, we'd come out of it with lower sustainable interest rates, we don't seem to ever get out of that.

Of course, 8% on a regular bank street account, a high street bank account. High street means like Park Avenue, top level.

And Ray Dalio has a great video about this. I won't get into it, but it's basically a one-way process. Now, 2008 took us to the end of the road in terms of inflation rates. And I love inflation rates. I just did a mortgage, and I'm like... I don't mind right now.

But here's what this K bingo guy says, an average age of a Fiat currency...Fiat means, it's Latin for, let it be so, and that's a paper currency. He says it's only 27 years. Now, the decimalized GFP... What is decimalized? Well, basically, the pound used to be 20 Shillings or 240 Pennies. It was decimalized, meaning it was turned into a Pounds and P, a hundred P per Pound. And that's where it is today.

Interestingly enough, the decimalization occurred in 71. What?... Which also, was when the US Dollar was taken off the gold standard. So, these quote, unquote, reforms, probably, weakened these currencies.

Central Bank Digital Currencies

All right. Now... Obvious alternative, electronic money, that's the obvious thing. The problem is, is that, the current standard, Bitcoin, is not under anybody's control, that alone, yours and mine.

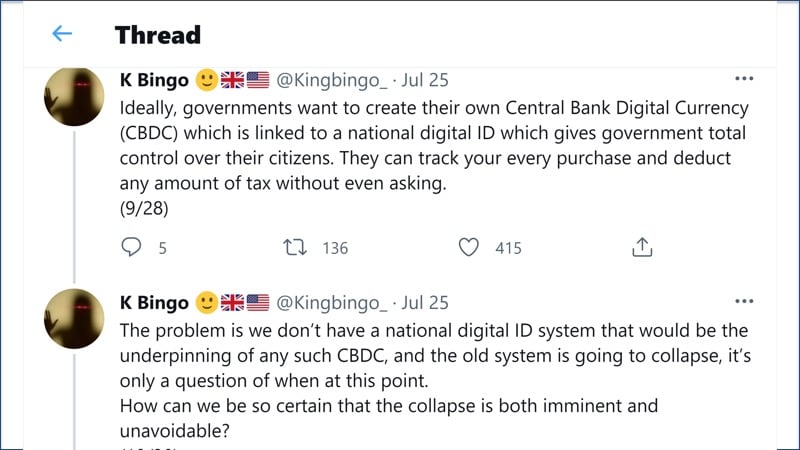

So, what does it mean? Well, they'd like to create a central bank digital currency, and we don't have the kind of national ID system anywhere, really. And so, how can we do that? C, B, D, C. That's the real question.

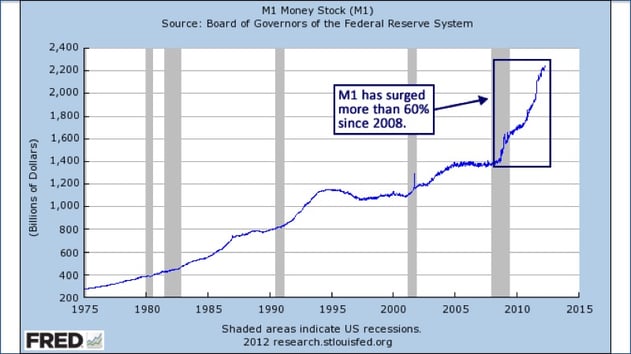

Can't lower the interest rates, print more money, and of course, the money printing has become absurd. There it is. And one, the number one measure of money in circulation has surged unbelievably since 2008. No one in sight. That's just until... You saw that, it's only until like 2014. It's gone way beyond that since, but unfortunately, they've stopped tracking it. So for good reasons, so they can't allow the stock market to collapse. Why? And here's a reason that you don't hear very much.

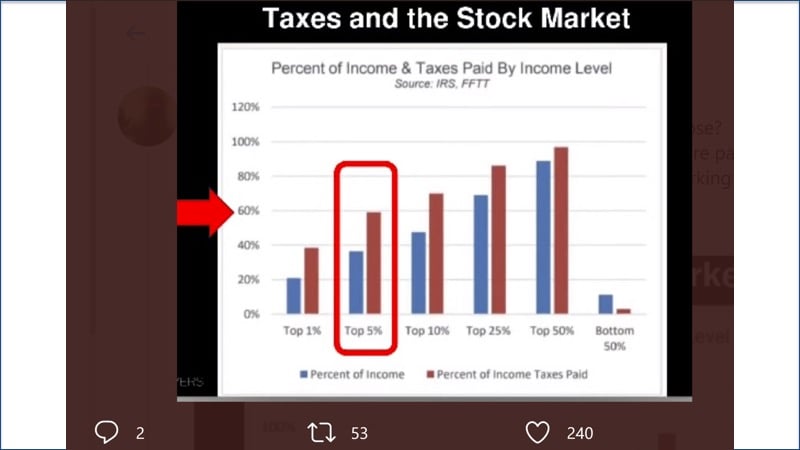

Stocks and Taxes

Most of the taxes are paid by the 5%. 60% of all taxes are paid by 5%. The bottom 50% pays about 2% of the taxes. So, the people who are at the high-end live off of stocks. Stocks crash, you know what happens. So not a good picture.

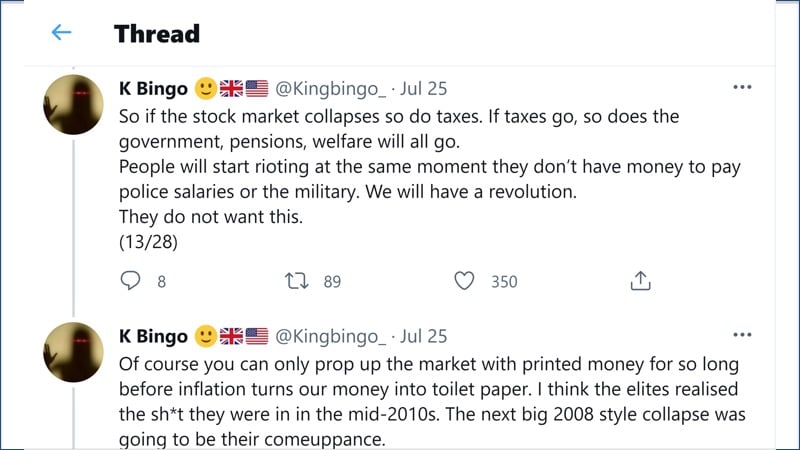

So if the stock market collapses, so do taxes, but frankly, the government doesn't need taxes. They can just print money, but that's a separate story. Now, you can only prop up the money, the market from the printing of money for so long, and this, they believed according to K-Bingo, that the next big collapse was going to be their comeuppance, comeuppance. Their well-deserved karma.

Transition to Bitcoin

So, what's the transition? Logically it's Bitcoin. Unfortunately, it's stateless, meaning that nobody can control it. The Chinese figured it out, but they have an existing national ID system, and it's completely controlled. So they have to have either a digital ID system and then a CBDC.

Now, problem number one, you know that people are claiming that there's going to be a digital ID system coming out of all this COVID stuff, whatever, but he's not relying on that happening.

I'll show you. Is it too late? Well, here's what's going on here. It's moving so fast that strangely enough, it's actually, Bitcoin is actually the plan B for Western governments, and I'll show you why.

So China's way ahead, banned Bitcoin because, "Hey, they're set." I don't think they really can, but it makes it very hard for the Chinese to trade Bitcoin. And now they have a huge amount of gold, all that stuff.

So China is well-prepared because they're centrally controlled, and they've been waiting to get to the end of where US dollar fades away, and it's lasted much longer than they expected. Digital money is... Their plan is to smash the dominance of the US dollar and Western elites...

This is a very important slide. They want their own CBDC, but they will take the stateless Bitcoin if the only alternative is a China digital UN as the new global reserve currency. This is why China has banned Bitcoin, but the West don't dare yet. It's their plan B. I think that's very smart statement, by the way.

So where are we going with this, two feet, two futures. One is freedom. The other one is Chinese style social credit, and CBDC in the West as well. Or we could have somewhere in the middle, which is also, I think, the most likely. But, existing money system falling apart, West not ready, and so we get this big clash. All right. Now...

To Quote K-Bingo, "If you want to be free, simply you need to slow them down long enough." And here's his thought about... And he says, good luck.

So I... This is it's an interesting time, but in the future, with the CBDC future, Bitcoin won't be worth much at all, but in the freedom future, it could be where something like $14 million each.

My personal opinion, it'll be somewhere in the middle again. I don't think we'll have a full-on social credit system. I don't think we'll have a full-on Bitcoin system. I think we'll be somewhere in the middle, but it does say that cryptocurrency is emerging as the real game. As literally a major pillar of our future economy.

Consumers and Cryptocurrency

Now, what to consumers say about all this? It turns out that consumers facing inflation, and there's... This is a nationalreview.com June article. As the spectrum of inflation looms, consumer consider cryptocurrency. There's the link at the bottom.

And so what we have is we have a situation where the consumers who frankly, most consumers were not into crypto. It was a millennial thing and so forth. Well, that's changing. Why?

Crypto Factors

Well, great volatility surrounding cryptocurrency, which actually right now is attractive. People like that that's something could go up or down 30%, and they actually consider crypto less risky. Many do, than the US Treasury. We see this is their a problem in Venezuela. But the writer goes into all the reasons why lack of ties to world economies, et cetera, security. These are all reasons, and this is why cryptocurrencies have done well.

Demographics

Okay. Now demographics are centered mainly around millennials, but 18 to 34, but it's... I believe it's broadening where Ken and I are noticing, talking to investors who have an opportunity to get allocations of our crypto in the future that they're getting it. Older investors are getting it. Crypto is finite supply is also very attractive. Okay.

So what is our solution? And that is where I'm going to play again a video that we just created. And so let me just check chats here. All right. "I'm glad I was able to help you, Robert." Okay. So here we go. I'm going to turn you on to this video that we made with the excellent help of the man with too many cameras, Steven Eckelberry.

Start of video presentation

Riggs: At the end of the day, water is what we care about, all of us. We better care about it because without water, three days later, you're dead. A lot of water is dirty, creating illnesses, viruses, long-term chronic illness, you name it. So we need to be, all of us, working in water, not just a select few and many, many people feel that way. I get constant emails from people saying, "What can you do about water? How can you do things for Flint, Michigan," and all these things, right?

That is the mission of all of us is to do something about water. Well, we've come up with an idea to involve everybody and to empower everybody. And it uses this cool new thing called cryptocurrency.

Why cryptocurrency? Because crypto has no boundaries.

If you have a cryptocurrency network, a grandmother in Korea could have an effect on a mobile home park in Alabama, no boundaries, frictionless, and it really means that everyone could get involved. So what are we talking about here?

Community Coin and Crypto Network

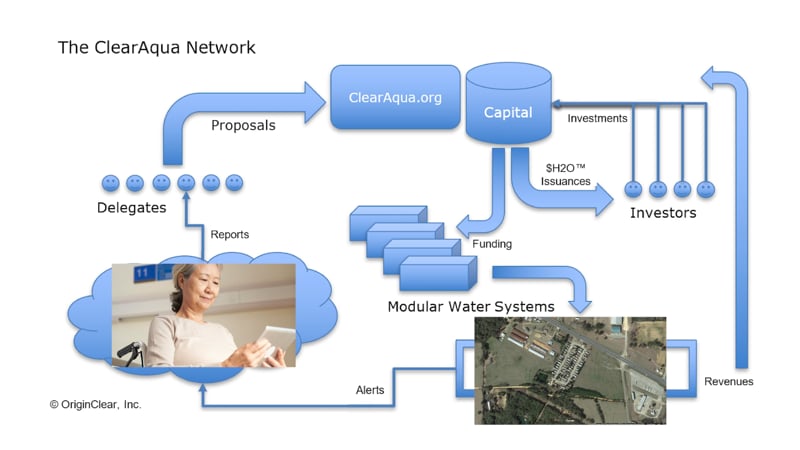

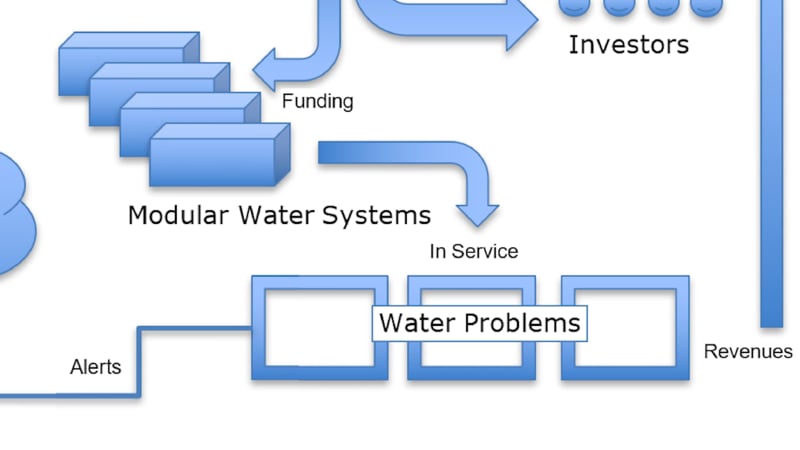

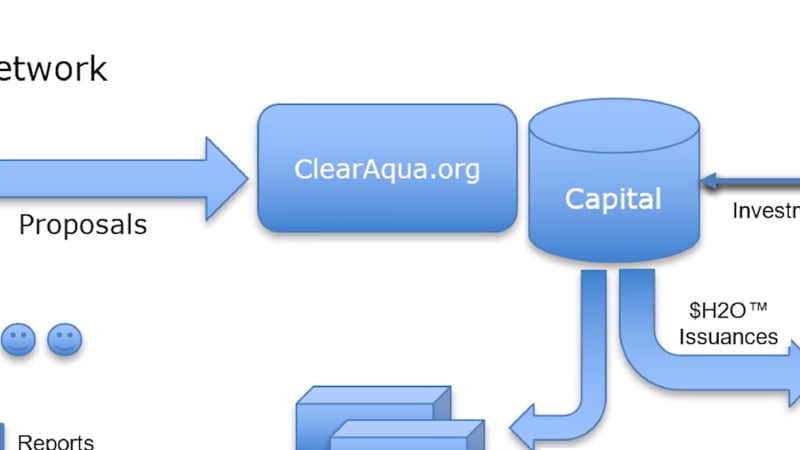

We are looking at a basic community coin, a water coin that we've called ClearAqua. People like you and me will notice problems and go, "Wow, we've got to do something about that trailer park in Alabama." Right? Let's do something about that.

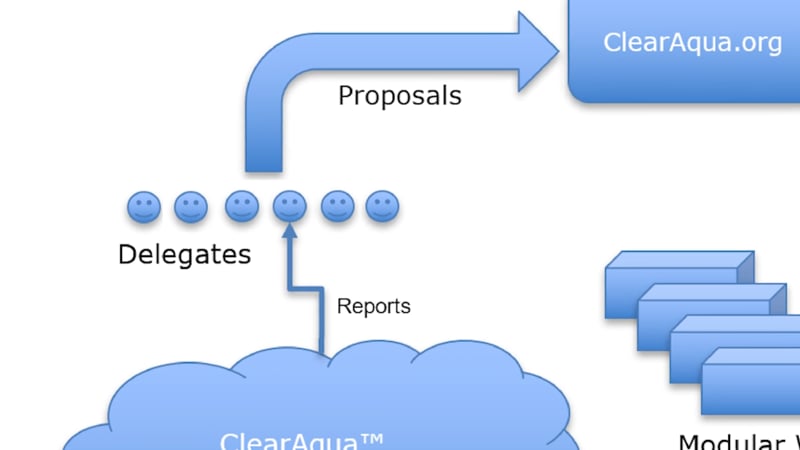

Clear Aqua is a representative democracy. You don't want the entire planet to be speaking, kind of overwhelming the system. So there's a very good way that certain very successful cryptos have already adopted, which is a delegate system.

These are called delegates or witnesses and what these people do is just like the US Congress or the British parliament. These people represent the membership. And now these delegates, these, what we call witnesses, take these concerns and work with the governing body to create proposals.

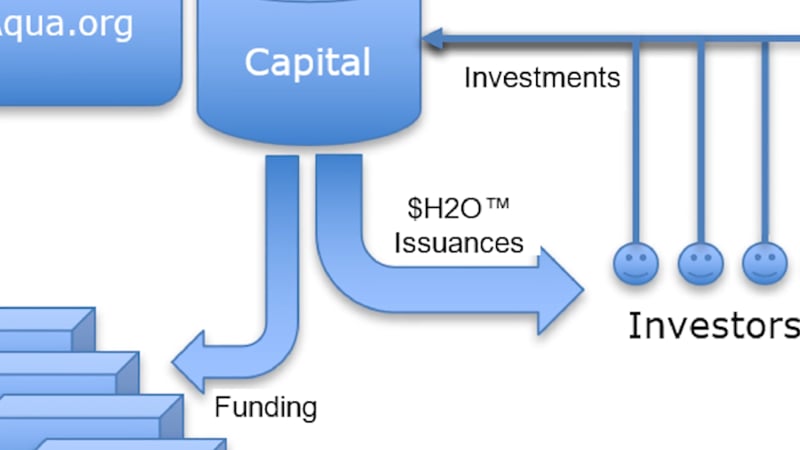

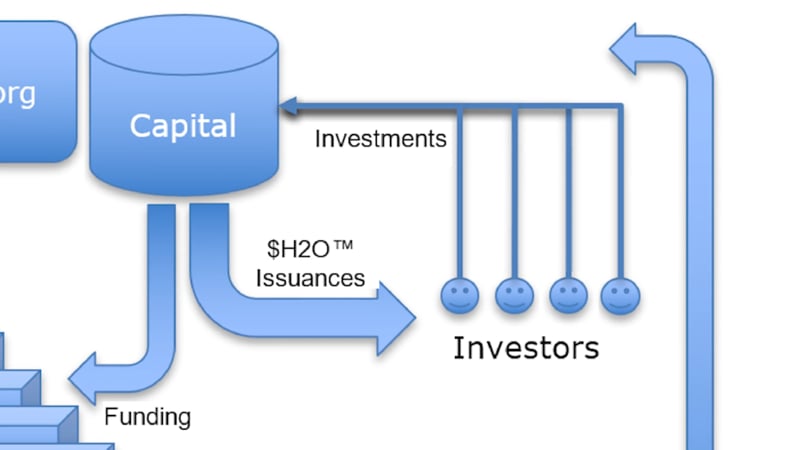

Now, at the same time, you need the money. So where does the money come from? There's a second coin we call $H2O. Now that coin is a purely investment coin.

Accredited investors, meaning people who meet a certain threshold of wealth, invest in this coin, that then gets put into these water projects that get delivered.

These water projects make money and they return dividends to the same investors in the form of a coin that is really pure money. It is an investment grade token and that's the other side of it.

Two Token Universe

So we have a two token universe. So on one hand the Water Coin for the world. Everybody plays with ClearAqua and it's a consensus coin and it lets people do something about the state of the water in the world and then on the other side, the capital for it, which is really unlimited and in the middle of it, you have the governing body, which is a trustee to make sure it's all done right.

Now this governing body is an interesting thing. It is there to be the trustee for all these projects and it also licenses some of the best technology so that it can, in turn, make it available for the use of many water companies. So it's not just one water company that's got the dominant thing. Remember, we're talking about the entire planet here.

There is no way that one company or even 20 is going to change a trillion dollar water industry in any meaningful way, unless we widely spread the burden, the help, the resources, the investment, so all these things add up to where we're dramatically improving the state of the water by helping businesses cut the cord in doing their own water treatment. I strongly believe in this, many, many people do and I'd like you to join us too. Thank you.

End of video presentation

Crypto not Required

Riggs: So there we are. We've been working super hard to flesh this out and as you can see, literally, this is your scoop. You are the first people seeing this new vision as we develop it and a lot of people are working hard on this and I'm super excited.

Now, as you can tell though, this is not what we're focusing on 100%, right? In fact, the crypto is a small project that's in my office. Why? Because the main company is busy building systems, those 28 projects of Progressive Water, the booming deals, the developing of Water On Demand, the building capital for that, Philanthroinvestors® helping us out to bring in these larger investors. All these things are the major job that we're doing for ourselves.

This crypto thing is a project happening on the sideline with spare bandwidth that is, we think, going to make a difference in the months to come, but it is not, as I pointed out in the disclaimer there, it is not strategic. It's not something we have to have to succeed, but I personally think it's very, very promising.

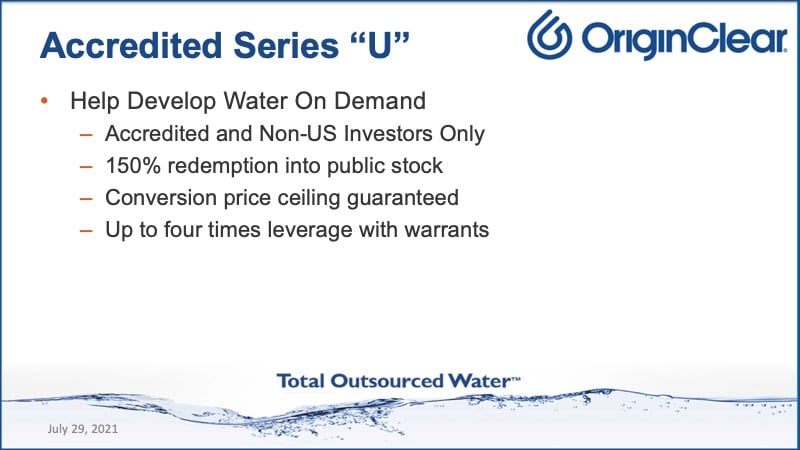

Series U

Okay. So with having said that, there are a couple of ways you can participate in doing so. You can help develop Water On Demand and the crypto, by the way. And this has excellent, up to four times leverage etc. And there's a way that you can also get involved with some future crypto allocations. It's very, very tentative right now, but you should certainly talk to Ken Berenger about this.

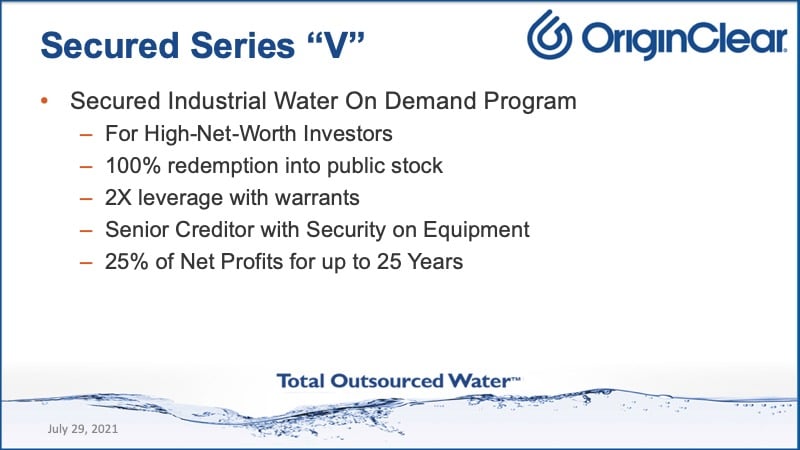

Series V

=Series V is the one where it's secured by the shares in the subsidiary of Water On Demand. We worked it all out. It's very strong. And these investors, it's a million dollar requirement, get leverage, but they also get a good deal of security and 25% of the net profits.

So it really adds up, get your personal briefing. Ken is on vacation this week, but he will be in next week and I'm trying to keep him from showing up. He showed up in tonight's briefing. He's not supposed to. He's supposed to be chilling out, taking care of his family.

Anyway, so next week we're going to be covering this new business that I told you about. If we do get the POs that I expect, I'll be able to speak about it more specifically, maybe Tom will come on and explain it all. And we'll also give you updates about the design build own operate stuff, which is the paper gallon, which is what we're funding. Very exciting. So we're layering on, the basic business is booming. We've got the new stuff happening, being funded and, in background, we have this exciting crypto stuff.

So with that, it's been relatively short, but Ivan is pointing out that you can become an ambassador for Philanthroinvestors. What does that mean? Philanthroinvestors is a network of, I believe 19 countries, mostly in South America, but elsewhere as well. And they are happy to make you a Water Philanthroinvestors Ambassador.

What that means is that you will be able to spread the word and Philanthroinvestors does a great job of educating people and bringing them in. and you can help water in the world with your time.

This is separate from this whole crypto thing. This is our own world with our own pay per gallon systems that we're building and so forth, which I believe is going to turn us into a big success all by itself and Philanthroinvestors is extending that out into almost 20 countries. We're very, very appreciative of that. Thank you Ivan for bringing that up. We think we have an amazing, just an amazing relationship here with this strategic partner and it's done a lot of good for us.

So thank you. I'm going to tune out now. Thank you for coming. It's been wonderful. Next week we'll zero in on some of the basic businesses taking off. So good night, enjoy your weekend and try to relax.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)