We took a deep dive into cybersecurity and our country's vulnerability to cyber attacks… How does Water on Demand™ embrace the actual underlying problem? And why are we aligning ALL our actions under its single brand?! Find out in the replay!

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

Welcome to Water is the New Gold, and it is Thursday the 17th or unlike my CEO update, which called it February 1Y. And briefing number 147. We are in the world's only vital, scarce and recession-proof market, and we are learning that every day. Lots of exciting things to discuss in this update. Let's move quickly into the rest of it.

Obviously, we are still real time interpreting into Spanish, and as we gain more listeners in other countries like Italy, we will add that as well. We have expansion going on in other countries of Europe, and perhaps we'll have Russia all kinds of fun stuff.

Ok. And of course, as always, we do our very best to tell you how it is. Of course, the actual results could differ materially from those contemplated.

And with that, I am now going to play a podcast.

Start of presentation

Nelson: Welcome to another episode of Young Entrepreneurs with the Green Room Team. My name is Nelson Fernandes and we're here today with Riggs Eckelberry. How are you doing today?

Riggs: Nelson, I'm doing great and it's really so great to be on your show. I love your mission and what you're trying to do there.

Nelson: Um for the past two, three years now, I've been working for a liquefied natural gas company, so we try and do as much work as we can on site, especially when it comes into play with the surrounding water areas like, for example, there's a swamp-like area nearby that was destroyed many years ago, but then the facility we put in the money to be able to revitalize it. And now we make sure it's maintained because we want to make sure that we keep the public happy. It's near beaches.

But then also it's our more so like responsibility to make sure we keep the area better. So it's amazing work and I'm excited you keep on hearing about it, especially how it affects the local areas. My cousin actually lives in Fort Lauderdale and every time I visit him we never drink out of the tap. You always have things like jugs.

Riggs: I know it's pretty sad, but you know, it sounds like you have a good situation where you are. But it's unfortunately not the rule that there's...you know like Fort Lauderdale has these problems with sewer mains breaking and poop ending up on the lawns and all kinds of stories and the water quality. So you know that you can invest in an oil well right and you get royalties. You can't do that with the water system. You can't invest in a water system.

And we thought that was really strange because if the water industry needs money, why don't we open it up to regular investors to invest it? And so that's what we did is something called Water on Demand. And basically, if a business wants a water system, they get it. They just start paying by the gallon just like they did with the city. And then the investor gets a royalty and people love investing in water, much more than an oil. I mean, they think it's great, right? Because it's sustainable. We're raising money very quickly on that to specifically pay for these water as a service type projects.

Nelson: So then once an industry or area, they use a water treatment system does it stay within the utility company, so then are you sending the clean water back to the utility company?

Riggs: Correct. The utilities are perfectly happy to get treated water back, you know, so they just don't want the dirty water. And you talk about sustainability, you know, you know that Israel recycles almost 90 percent of its water. The second in the world is Spain, at 20 percent. The U.S. one percent. Now the reason for it is a design reason. None of these. We have older water systems that were designed, you know, Israel designed everything post-World War Two, right? That's when they were created.

Nelson: Quite recent compared to the Americas and Europe,

Riggs: Right? It's kind of like the same way with stuck with old phone lines, right? So here we have old water systems that only go one way. Like I used to live in L.A. and if you flush the toilet in Beverly Hills, the water goes all the way down to the ocean gets treated and it goes in the ocean. It's clean, but it doesn't go back to Beverly Hills, it's over. But if you're in Beverly Hills and you treat it yourself, you can keep reusing it right. And so that's where the recycling can occur is at the point of use.

Now, the infrastructure doesn't have all that load, it's been unburdened and the users have control. And by the way, water rates are inflating at a rate three times the rate of normal inflation. So as it is, it's a really bad situation that hopefully we can help mitigate, but also return a good investment that's inflation friendly to the investor.

So all in all, OriginClear is providing an inflation friendly way to invest in an asset water, which is very beneficial and increases sustainability through promoting recycling and control of the process by the user. And we think that's the future, not just in America, but in North America and the world eventually.

Nelson: Amazing. So touching upon more the financial side of Water on Demand?

Riggs: Yes.

Nelson: How does your company be able to generate revenue?

Riggs: Well, I'll give you a good example. It used to be you bought Microsoft Office for like 130 bucks one time, but now you pay for it like nineteen dollars a month. And if you do the math, you're paying more, right, over time, but you're getting a better product. You've got OneDrive, the cloud. You've got a real time, everything. Microsoft Office is a, it's a live managed product, right? And so you don't mind spending that money because you do all kinds of cool things in there. And, you know, all of a sudden some feature shows up.

But you know, that is what we're trying to bring to water. In other words, moving from, "Here's your water system, have fun — goodbye," to, "Here's a service. We're going to take care of your water and you won't have to worry. You don't have [to be] experts. We'll just make sure it runs and make sure through remote management that the proper treatment is done. And you just pay us x amount per gallon on a long term contract." And everybody is happy.

Nelson: So it's more of a subscription purchase where you continual maintenance available and services than just a one time, here you go.

Riggs: You know, I was talking to a brewery owner and literally while I was talking to him, this guy shows up. "Who are you?" "Oh, I'm the guy, your chiller showed an alert on our network and I've come to fix it." The brewer didn't even know it was broken and the guy shows up to fix it. That's called service! All his chillers were being handled by the firm under contract, and he didn't have to worry about it. It's like, "Oh, you know what? That's fine. They got it." It really allows you to focus on your core business. And I think at the end of the day, the more you can do that and delegate all the things that are not core focus the better you'll do.

Nelson: So thinking about a company as a whole, how do you go about ensuring that areas of the company that you're not well versed in is successful?

Riggs: Bill Gates once said, "Try to hire people who are smarter than you." And that is the case, obviously, smarter in their specialty, right? So, I have a COO who is much smarter than me in operations and I have a CFO is much smarter than me in finance and so forth and so on. So we started doing well when I started getting good people around me who I didn't have to tell them what to do. They're like, OK, "Hey Riggs, I just figured this whole thing out." And I'm like, "Great, carry on," right?

It's almost a synchronicity concept, right? 2018 we were like running out of conventional financing options and then this amazing guy Ken Berenger showed up who's now executive vice president and my co-strategist on Water on Demand. And somehow, magically, he became available. And it's been amazing ever since. This is true of our Chief Strategic Officer and President, Andrea d'Agostini, we hired him just a couple of months ago and he magically became available. So I think that you sort of progress your own organization to a point where it's the right fit for the right person to come in. Get a good team, that's super important.

Nelson: Definitely, I agree. How did you see changes in the mission of the company and the direction you're going?

Riggs: Well, this company Nelson was built in the public markets. It's kind of how we got ourselves funded. But during the time, during the 14 years we've been in business, the over the counter market, the penny stock market has really gone down the drain, because there have been a lot of abuses, a lot of people have taken people for a ride. And so, so we've made that our big goal now.

To get on the Nasdaq there's certain requirements and we we have a roadmap to get to them. I think that is the most critical thing we could do is to be a Nasdaq company and really define this new water as a managed service concept for the marketplace and be a market leader, you know, sort of be the Amazon of water. And that to me is, we've got to do it. We got to move up to that level. We have a superb investor base, great team, got the right business model, we have good technologies. At this point, it's just, you know, work night and day and get there, right?

Nelson: What are some ways that your company moves forward to be able to invite new investors and new clients in?

Riggs: I think now it's moving more like, you know, it's an attractive concept of Water like an Oil Well™ and the invest-ability and so forth and making it a cool new thing for investors to do. But now, we just need to get a lot of visibility for it and just get a lot, a lot of... And we don't care if they're going to invest. We just want people to like the concept and be interested and that will build its own, you know, virality in a way, right? Because people use word of mouth, et cetera.

That's really our next step is to not be the best kept secret. We're pretty good, we have good visibility and so forth, but I'm talking about Water on Demand becoming a word of the business world, shall we say, right? That needs to happen because then we can really start to take our ideas and share them, and we don't want to hold on to it all, right? Like, hey, you know, let's have a bunch of water companies doing this.

One company doesn't change an industry now that 20 companies don't, but a hundred or a thousand companies that starts to make change. And so that's really where, you know, by having a tremendous amount of visibility and documented wins, you know, investors winning at making good, you know generational money from royalties, et cetera, then it starts to all kind of become like something people are excited about and the word gets around and then you become hopefully a household word in the business investing world.

Nelson: Amazing. Sounds great. Well, thank you again, Mr. Eckelberry, for joining me today and discussing clear origin, sustainability and technology.

Riggs: Nelson, it's been such a pleasure. I wish you luck with your projects. Sounds like you've got a good thing going, and let's check in on each other in a few months and see how we're doing. Peace out. Thank you.

End of presentation

Riggs: Nelson is a cool guy, definitely a cool guy, and that was a great interview, I was able to discuss a lot of what's happening, what we're trying to do, what's important to us and to be very frank, what we need to do to succeed. I see that people are raising their hands. And Linda, thank you.

Andrea: Yeah, it's a very nice comments she made.

Riggs: Yes, she goes, "Wow, you explained the company and its objectives so clearly and simply, awesome." Linda, thank you for being so supportive as an investor, but also understanding us. And I saw that somebody raised their hand. We don't typically take raised hands. It's better if you chat to us and then we'll answer in the chat. So what I'm going to do now is I'm going to continue because the next big topic is water cyber attacks, which is a big deal.

Water on Demand Capital Status

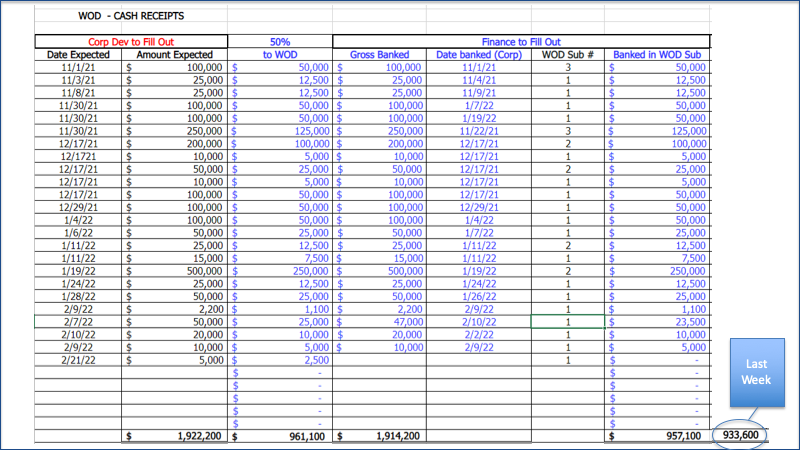

Oh, and of course, as always, I want to report on the status of Water on Demand capital, we are inching along, we are so close, and Ken tells me we're about to get some, some big, big leaps forward.

This is, it was $933,600 last week. It's now $957,000. Again, remember, that only 50 percent of what's come in is what goes into these subsidiaries. The rest of it is used to build the subsidiary and so forth. And we actually sacrifice profits. We hand them over to the investors in order to be able to do that, that growth part. So I'm predicting that this is going to flip over and that we will have a public announcement next week because I know what's... I have a clue what's coming in. Am I right, Ken?

Ken: You do. I have not been, I have not been keeping it a secret, but we've we've been coordinating pretty regularly and I've had a very busy week. So now we've had a really, really, really productive week this week and next week, I think as we start to kind of put some reality out there, what we're doing, I think that'll accelerate quite a bit.

Riggs: Excellent, excellent. So, Joseph Odima just actually chatted with everyone saying, "In case a person wants to invest in this project, what do they need to do?" And I'm sure you'll pick up on him. I'll let you do a response on that while I continue. So, doing very well in Water on Demand and we will keep going here now. What's going on with water cyber security?

You know that I used to be the manager general manager of a worldwide software company called Panda Software, Spanish based. And I had and of course, I took, helped take the company public onto the Nasdaq that was in the cyberspace, so I know a little bit about it. But let's take a look at what's happening in water.

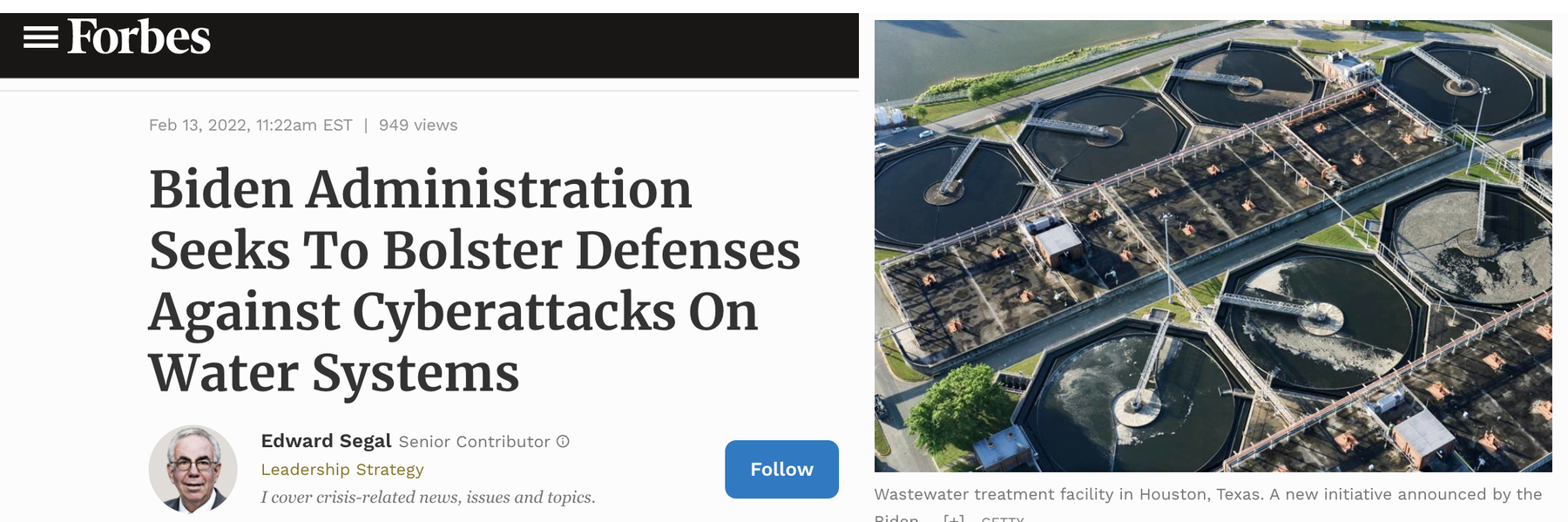

Featured in Forbes

We actually got a we got featured in a Forbes article about this. Here's what we said about it. And basically that Washington is basically not funding the one hundred fifty thousand municipal water systems. And so we are quite unprepared and there are few reservoirs of clean water outside of the water districts and that is dangerous. Ok, well, let me go ahead and do a deeper dove because of course, they featured a very small piece of what I responded to them.

Let's do a Deeper Dive

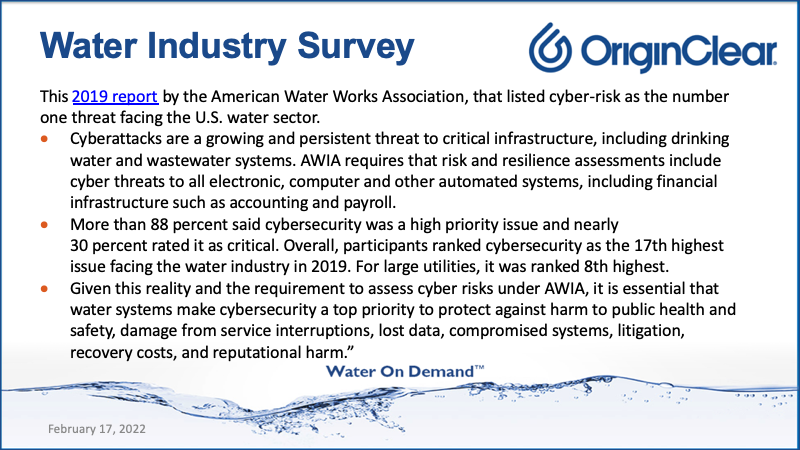

First of all, in terms of background, there is a July 21st of last year there was a hearing about cyber threats and that there is, actually the top threat facing the U.S. water sector, according to the American Water Works Association. There's also multi-stage intrusion campaigns by who knows, Russian government, the next door neighbor, dude with a computer, whatever it is, because I'll tell you something, water systems are not well protected, so that's important.

And in fact, it was a water industry survey that said that 88 percent of water professionals said that it was a high priority issue. Now, I do not know why. Let me just see here. So somehow. Well, anyway, here is the top threat, but here it's ranked ranked much lower, but nonetheless 88 percent said it was a high priority issue, so it's very, very important.

Most Vulnerable

Now, also, there's a commission that works on this, and they've identified the water and wastewater utilities as comprising one of the components most vulnerable to cyberattacks.

Andrea: Wow.

Riggs: In fact, there have been multiple attacks to date, according to CPO Magazine, which is a cyber professional organization magazine. Last June they reported there have been a total of four of these. And so how could this happen? How are they possible?

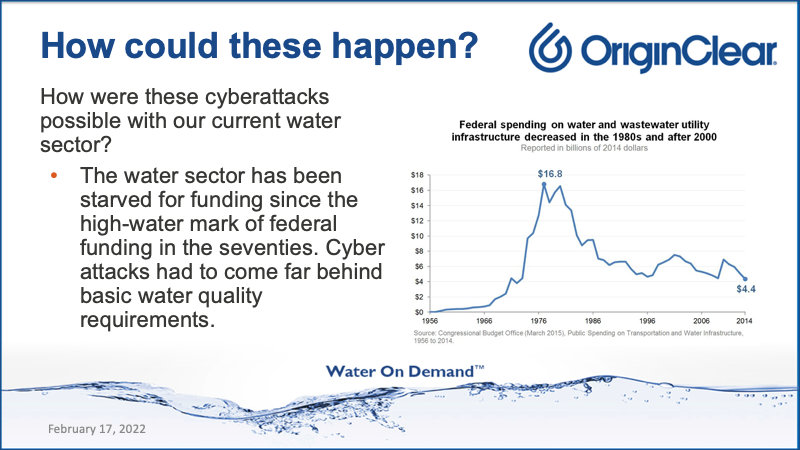

Well, here's the problem The water sector has been starved for funding since the mid to late 70s, and the money has basically just gone away.

Not Supporting Central Facilities

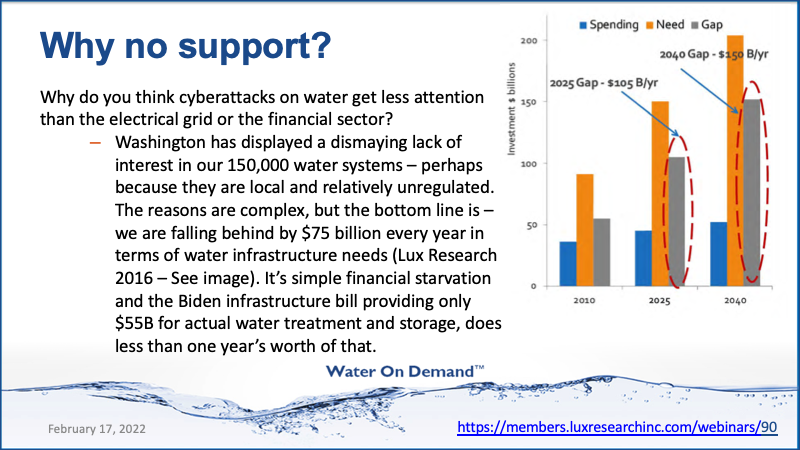

Now here's what's interesting we have a, I'm going to go ahead and bring up, Why is it that water gets less attention than the electrical grid?. Well, it's simply very simple for reasons that I don't quite understand. And there's a graph right there that shows you we're on our way to 100, right now we're about $75 billion a year falling behind every year. And the big infrastructure bill, multi-trillion dollars? Well that provided less than a year of catch up.

So, the central water systems are in trouble. They're not being helped and it's not changing. So when something you know, a definition of insanity doing the same thing, expecting a different result. The central utilities are not going to get the support. What could happen?

What's the Answer?

Well, of course, as I mentioned in the Forbes article, that there's there's problems because it's clean water does not really exist out of the municipal water districts. All right, now, here's the answer.

It is redundancy. We need to make sure that and this is where we're coming into what we think is going to make a difference is decentralization. If people at the edge, you know, the internet was built this way where it was built by the defense advanced research, DARPA, they built the internet as a way to survive nuclear attacks by having redundancy and distributed networks. And that's the power of the internet to this day.

Decentralization

Well, we need to do the same thing for water and the survival of the water grid will happen by making the businesses themselves clean the water, and of course, they can now control their costs and reuse the same water. Thus, they make, it's a better financial deal for them. And of course, that's Water on Demand.

Security is always best carried out in layers, this is what I learned in the security industry. And I really do see the trend towards decentralization of water treatment and conveyance, meaning transporting water as being the best scenario.

Open Discussion

Ok, so that brings us to our open section. And what I'm going to do, first of all, is I see a couple of chats and softwater4life says, "Hello." Well, hello, softwater4life. It's a pleasure. Robert Baxter, nice to hear from you. And so we are in a fascinating stage right now where we have basically that million dollars. I'm telling everyone that the numbers coming in for 2021 are superb,

I'm super pleased with the Texas and Virginia teams, so our conventional business is taking off. As we discussed last week while I was fiddling with my machine, we've got a partner that we're putting together a relationship with very, very soon. And what's great about that is instantly benefit from 10 years of experience with those guys. So Ken, what are you hearing from the people you're talking to on the investment calls?

Performance Record vs Pro Forma

Ken: So the conversations that I'm having right now, how this is finally all clicking together, people are kind of, you know, there's a great deal of kind of mutual agreement that this was really ultimately the...Kind of like, "I was hoping you'd take this path," right? Look, I think everybody understood that, you know, building, you know, the design, the build, the own, we could do that. We have been doing that for decades, but it was that last component [Operate] that could have had a logistical, you know, could have been kind of a bit of a marathon.

And the ability, the excitement that I hear in people's voices when I say, Look, we can basically adopt a ten year track record where this has been enormously successful already. So we can now go to much larger investors, a whole different type of investor, and instead of saying, "Well, here's what we hope that we can do." "Here's what us, us and our team who does the building and the management, right? Here's what our 10 year performance record speaks," right?

Performance record is a way different conversation than a pro forma right. And I think it just brings us into a whole new level, and I'm getting a lot of that feedback from our, from the folks that I'm speaking to. And the skeptics are turning into fans and the fans are turning into stalkers, which is great.

Riggs: Stalkers? you have your stalkers?

Ken: Yeah.

Focus on Fundamentals

Riggs: Well, in fact, you know, one of the issues, in fact, Bob Roos just brought up is like, OK, is, "Someday will the stock price take off?" And we don't, of course, manage by stock price if I try and push the stock price up, guess what? It's like pushing string. What works is by getting fundamentals going, by building the asset base and putting it to work and generating business. While our conventional business literally potentially doubles. And I didn't say that, I didn't say nothing about nothing doubling. So there will be more

Building a Team

Ken: To add to that Riggs, you know, you said something earlier in your interview with the young man, Nelson about, you know, Microsoft with your experience in high tech. Well, everyone says, Well, you know, Microsoft is a multi... Amazon is a multi-billion... Well, within Amazon, within Microsoft, they're not islands, there are thousands and thousands and thousands of companies that feed that economy, right? There's you know, there's the economy of Amazon, right?

Well, the Amazon economy is fed by trucking companies, logistics companies, you know, thousands of operators within that. We are at that point now where we're starting to adopt really competent partners and vendors to be like, like you said, you built a great team around you. Thank you, by the way, I'm flattered, but no, but that's what we're doing as a company now. We're building a team.

You know, we were in island. We were, you know, on our own trying to push this rock up this hill and we were able to do that for a number of years. But now we're at a stage now we're able to bring, talent is actually, this is now coming through laws of attraction. People are finding us and saying, Look, I love what you're doing, I want to be part of it. And we're able now to incorporate some of these different businesses and companies to greatly accelerate what would have been a much longer slog for us. Does that make sense?

Just a Marketplace

Riggs: No question about it. In fact, you know, Jack Ma, when he first proposed, Alibaba could get nobody behind it. He could not get funding for it. It was like, what? What? Yeah, and Alibaba is a very similar model to ours. They actually are just a market they don't try. Amazon does a lot more. Amazon does the shipping, and they carried a lot of brands themselves and so forth. Alibaba is like, No, no, no, no, we just put you guys together and you do your stuff, and it's actually.

Ken: Much lower risk.

Near Future

Riggs: It's bigger model, right? At lower risk, exactly. That's really, really good point. So we will be... Here's what I expect to have happen in terms of announcements: next week, I expect to be able to announce that we have the Water on Demand, the Magic Million Dollar mark hit and blown past it. I know that's going to happen. You're you've got some amazing stuff coming.

We hope to have the Permionics® relationship in place and that will instantly enable us to internalize. It will no longer be fictional numbers. These will be real numbers based on their ten years of actual experience with systems that they currently manage, which is fantastic. And you know, we're we're going to continue to build things.

Becoming Highly Visible

Now. Bob and I are having a little dialog here separately. He, you know, why? Why stock price? And I have to tell you, it's very simple. The thing that you don't drive stock price, you drive volume of people looking at the stock, and this is why Andrea has come on board. I can tell that you're a little bit under the weather there Andrea. You're very brave to come into this.

Andrea: Thank you. Just a headache. It's just a headache, it's OK.

Riggs: He's like, I'm good, I'm good. He like stumbles into the room and goes on live because he's a brave guy. But the truth is, is that this is why Andrea and the brilliant new VP marketing Josh Summers have come on board. We want to bring him, Josh, into one of these CEO briefings.

So we have just an amazing team which is now going to help me make this, as I said in the, in that podcast, I just did, we're no longer, we will no longer be the best kept secret because this thing is world changing. So that's what I'm thinking about that.

The Right Time

I also have the, there's going to be a, I wanted to mention this and I didn't want to put it in this particular session, but Morgan Stanley did an amazing deep dive into the water crisis as an investing, you know, the scarcity of the problems and how what it implies for investing in some of the solutions. And this is going to be next week. I want to really look at how the investing world is seeing water, and I have to tell you it's the right time. It is the right time for us to step into water and do what we're saying.

And what I'm so amazed about is my mind is still kind of blown that we're actually doing that. Ken you started bringing in capital that is being devoted to these projects, right? This is shocking. It's amazing.

Ken: And to become a brand associated with the recycling and reusing of water. To become that new...Look, being first we can't overstate the importance of that, we just can't.

Riggs: Agreed.

Accelerating Disruption by Leveraging Interest

Ken: People often ask me, Ken, why hasn't anybody done this before? And it's because, you know, they were able to operate in this massive trillion dollar business quite successfully. You know, there was plenty of business to be, to be had. But it was looking at what, all the stuff, you know, maybe because we weren't traditional water guys. You know, you didn't, you didn't have to basically, you know, if you're a hammer, everything is a nail, right?

You know, maybe we, "Hey look, 80 percent of the world's doing nothing." And that became our focus. And with the brilliance of Dan Early, you know, technology being able to, you know, make these things portable and drop and go. It opened up that market really for the first time and creating it as an MLP style model.

Riggs: Master limited partnership.

Ken: Yeah. Right, right. So right. In other words. It took so many decades, it takes so many decades to completely disrupt massive industries, but if you have the leverage of the entire world's interest that, their interest could be purely on an ecological basis, you know, making the world a better place, that could be the only reason that they want to be involved. And that's great.

But there were also people that have worked their whole lives that are afraid of, you know, they want to do some wealth preservation, they want to do inflation, you know, inflation protection stuff and creating a vehicle that actually accommodates both. There's a real chance that this could be done much more rapidly than kind of a traditional disruption, which I think is probably one of the more exciting aspects of what we're doing.

What Makes us Different

Riggs: Yes. And one of the things I plan to do next week also is, I'm going to... One of the wonderful things is we are not alone. We're not the only people in this space, right? The design, build, own, operate space, "Water as a Service", has some key players and I'm going to review how we position. I did a little piece internally on this. Ok? Here's one company. Here's us. Here's the other company pros and cons where they are, where we are and how we're different.

And I can tell you in a nutshell, the number one reason we're different is that we're not trying to do everything ourselves. We are happy to delegate it. We're happy to give up the profit from building a machine in order A. To make a water company in Tacoma, Washington, really, really happy, but in addition, we don't have to build it, we don't have to run it, we don't have to service it. It's all being done remotely and we just have to make sure that it runs right. Not a small task because if we don't make sure it runs right, then we'd get in trouble. But at least the big, heavy lifting is not being done.

More of a FinTech

We're more of a fintech. Remember, we literally called Water on Demand a fintech. That was one of the very first things we called it, and it's literally what we're doing here is a fintech.

Ken: And really, the thing is that this is, you know, the profit of building one yourself. I'd rather have the efforts of, I'd rather have one percent of the efforts of one hundred men than get 100 percent of the efforts of myself. That's a fleeting moment. You get, "Great, I sold it. Now I'm out of business again. Now what do I do?" But having a thousand operators out there and collecting money for decades, I mean, that's obviously a hundred times more scalable.

Riggs: Exactly. You know, it's the master limited partnerships are exactly that, they're an assembly of independently operated pipelines and wells, et cetera. And that's the same concept. It's a very, very distributed concept. And we're going to have a lot more fun with this as we go forward and basically be willing to share the work.

Single Focus

Now, one of the things we can do from a focus point of view is we've been very concerned about branding like we do Water on Demand. But hey, also we have these...So we're moving towards it's Water on Demand, OriginClear's Water on Demand and we have Water on Demand Engineering, which is Progressive Water treatment in Dallas and Water on Demand Technology, which is that modular stuff that is so perfect for the Water on Demand. So it's everything becomes Water on Demand related, and that's going to have to be it because it's going to simplify Andrea and Josh's job if they're talking about one thing Water on Demand all the time. So are you happy about that, Andrea?

Andrea: I'm very happy about it. And actually the branding that is coming out is quite, it's quite something. Like when you will see how it comes out, it's going to be a really nice. You haven't seen it yet, but I can show it to you afterwards. We're already working on the branding and the messaging, and it's quite exciting. This thing is going to hunt because there is a real demand and it's real help.

So it brings, I'm not going to say it's easy to do because it's a tough endeavor, but it's really worth it. So when you're working on these things, when they're hard, it makes you happy. You know, that's why you're pouring our heart into it. And we are some amazing relationships getting crafted and built, and I'm very happy.

Riggs: Well, as I mentioned on the podcast, I've got, we've got a team here that does not have to be told what to do, and I'm so grateful. Like literally, Andrea, you're telling me, "I got stuff you haven't even seen." I'm like, I like that. I like that. Usually, I'm the guy herding cats. This is so good.

Andrea: I got it.

Call Ken

Riggs: Well, good. Well, this has been great. I'm going to go ahead and put on screen the contact info for for Ken. Even though many of you have it, I think it's important to let you have it. He is very, very sophisticated. Just go to oc.gold/Ken, email invest@originclear.com or call this 800 number ext. 201. 877-440-4603 X201. Who calls the phone anymore? It's crazy, but oc.gold will put you directly into a scheduled call on Ken's calendar. So simply,

Share With Your Friends!

Andrea: And even if you if you do have the connection, the contacts of Ken, maybe some of your friends don't. And as we were saying before, this is a common effort to something that we were doing together. So share it with your friends and share it with those people that you have around and know that could create a positive impact in life because that's a way to do it. It's a real way to do it, and it's a very profitable one. So he has the best of both worlds, you know what I mean?

So don't be shy to talk about it. Your word means a lot. There is nothing better than word of mouth when it comes to explaining to someone, I believe in this thing. Just go and speak with Ken, and Ken will do the rest. So I would love to know that you have done it and please write us when you've done it and when you've created a connection. We really appreciate that. That's something that we need to do together.

Riggs: And one easy way to write to me is simply replied to my CEO update, and it goes straight into my inbox and I love to hear from you guys.

Recap of What's Coming

So just to recap the coming news, we're going to have this Water on Demand milestone. We expect to announce an agreement with Permionics®, and I'm planning to give guidance on the full year 2021.

Prasad, our CFO has done an amazing job. We had big problems last year, as everyone knows, with late filings. And boy, that is done and Gwen Duffy, our heroic external bookkeeper, said that, you know, she's just super happy with how... I can't find it just offhand, but she wrote me to say how happy she was and everything is running early and so forth.

What that means is I'm going to be able to give everyone public guidance on what the numbers are, and I think we're going to be very happy. So with that, I want to thank everyone for coming on board. Andrea, you know go back and rest and continue to make yourself stronger and Ken, keep up the good work you are rocking, bro.

Talking About Us

Ken: And yeah, and I and look, I appreciate everybody taking the time to attend what we often, what we often communicate kind of sounds like a kind of a long explanation of it. But really, if anyone you know, to Andrea's point, when you're communicating our message, OK, you're doing, you're doing whoever you're communicating to an amazing favor and you're doing the mission a favor. Basically, you just say,

"Look, I know a company that's literally changing the world in a way that's more important than cellular changed telecom.

If they're successful, we could prevent millions of illnesses and death and create one of the largest transformations of wealth of our lifetime."

Now that should create some curiosity, then just tell them to go to oc.gold/ken.

Riggs: Love that. Bob Baxter wants to know, "How can I help you sell your product in my state?" And Bob simply sent an email to water@originclear.com. Water@originclear.com. That goes to the top execs in the company. They see it in real time. Tom Marchesello will be happy to respond to you. He's doing an amazing job of building a partner channel. So thank you, everyone again. It's been great. Have a good night,

Andrea: OK, everyone. Bye bye.

Riggs: Have a great weekend.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)