The Pandemic has upset society—what could a “cyber pandemic” do? Water is an essential service: what if we lost water services? Watch this replay for the answer. Rod Turner, CEO of Manhattan Street Capital briefed us on how capital raising could make it all possible. Find out in the replay!

Transcript from recording

Introduction

Riggs Eckelberry:

Good evening, everyone and welcome to the CEO briefing. I'm excited to have a very important guest tonight, mystery guest, and you'll be finding out about it in a few moments. So while people are arriving,

I'm going to do the honors here and quickly show you the usual. Here we are with Water Is The New Gold, "Helping you thrive in the world's ONLY vital, scarce and recession proof market." And that's even more so based on some of the information that I'm going to give you tonight, very, very, very critical stuff.

Okay so, we have of course the ability with our excellent interpreter, Heather, real time speaking what I'm saying in Spanish and all you have to do is click on the globe below and you'll be able to switch languages.

Forward Looking StatementS

Of course, we have a forward-looking statement here where things we say are to our best of our ability, but of course the results or achievements may differ materially. We will constantly try to correct things and to make it as exact as possible, we like to say we are the most transparent public company in America. Okay.

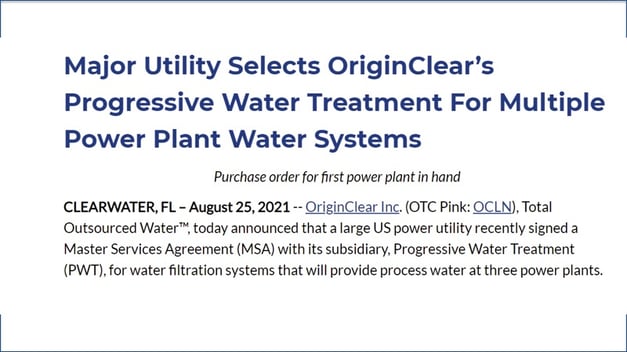

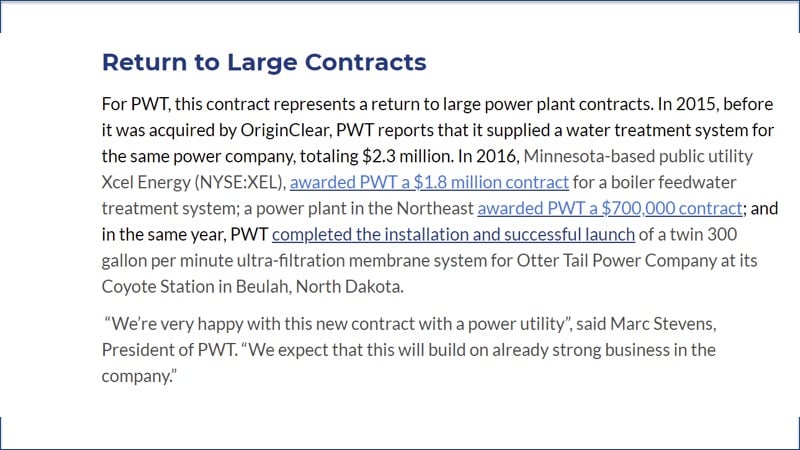

Big news of the week, of course, a major utility and I would love to tell you which one it is, but we can't do it until things have been installed, recently signed a master services agreement for three power plants. And it's massive, you know already that it is a total of about $5 million because you've been hearing about it on this show and the first purchase order for the first power plant for $1.8 million has now been issued and we are rolling.

This is a picture of a very similar setup at I believe the Xcel Energy power plant that we built to give you an idea of what these things look like.

Modular Water Success & Chemical Free Process

Of course at the same time, Modular Water Systems™ achieved far more in one week in June alone than it did in the entirety of last year. So that is completely incremental to what Progressive Water is doing, so that's excellent.

There's a little bit of technical stuff, basically power plants need ultra clean water, it means that they go through ultra-filtration, the reverse osmosis, which is done to remove all possible minerals and so forth. Then electrodeionization is a way to achieve ultra pure water, for example when you're making pharmaceuticals.

Not New to Large Projects

So that's what we have here and PWT was doing a lot of these power plants before, the same utility was serviced in 2015 for $2.3 million. Then in 2016, we did the Xcel energy contract and then it was a power plant also in the Northeast, as well as the Otter Tail Power Company at its Coyote Station in Beulah, North Dakota. So we're back to this and in a big way, which is really great news.

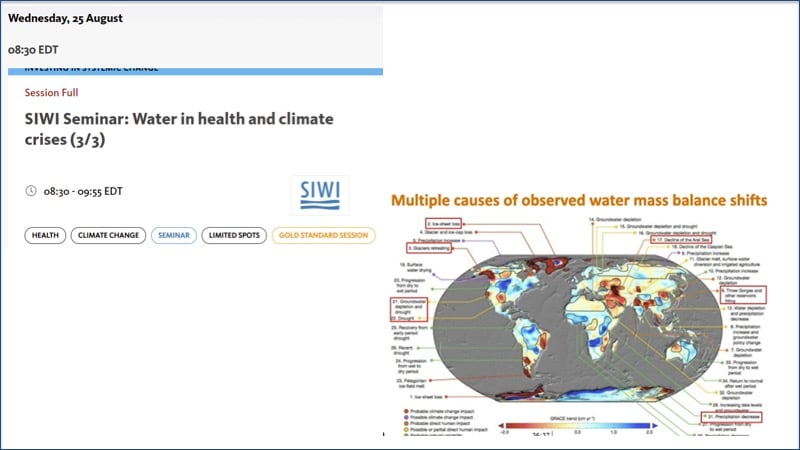

Presentation at World Water Week Conference

Water Imbalances

Okay. So quickly I'm going to cover on Wednesday, I was on a seminar at World Water Week, it was a water in health and climate crises. At the bottom right you see, I'm not going to get into it very much, but this is from the plenary session where there is so much going on in water imbalances, so too much water in one place, not enough water in another, ice sheet loss occurring in the north and the south, groundwater depletion, recovering from drought, surface water drying, I'm reading all these different things, decline of the Caspian Sea. There's just a tremendous number of problems that are being dealt with and that is of course what's the big deal.

Microsoft Presentation

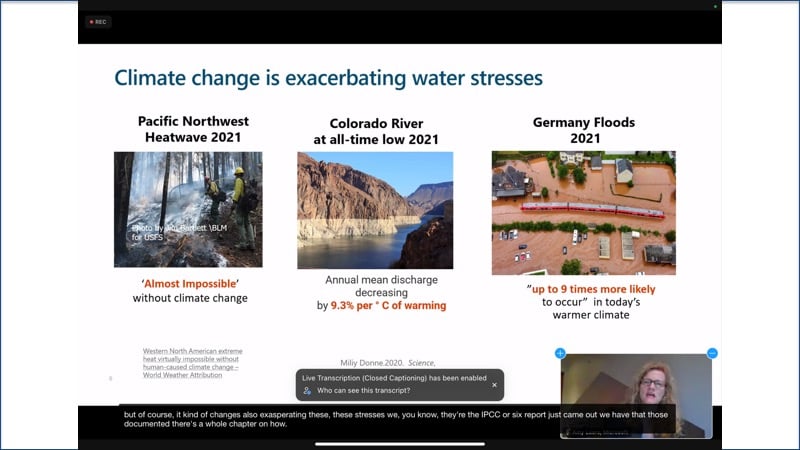

This is me on the show, I made about a 10 minute presentation and we're going to excerpt it once I get the recording from World Water Week, but here are a couple of slides.

Climate Change

Microsoft presented some highlights of what's going on, and we know this, is that almost impossible heat wave in the Pacific Northwest, Colorado River at an all time low and Germany with floods and up to nine times more likely to occur because of today's climate. So that's the problem,

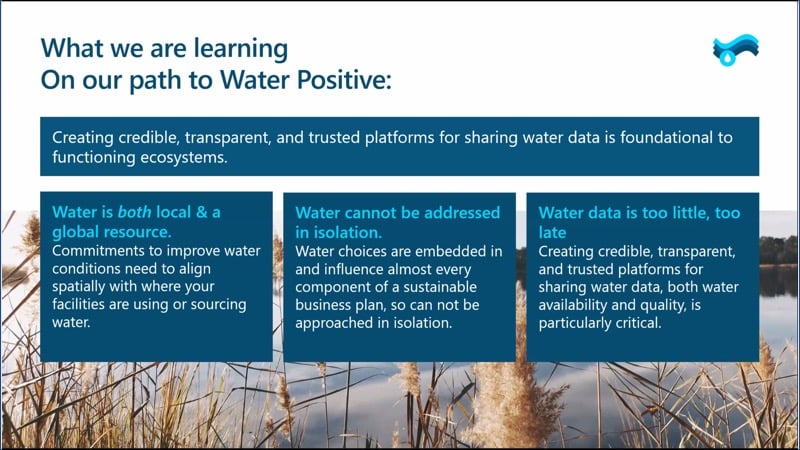

Sharing Water Data

Microsoft, again, talked about how we want to create really good platforms to share water data and that we have to do it in a sustainable collaborative business plan and then also there has to be real-time credible water data. So that was very important.

Transformative Grants

Now I want to also show you some slides from a presentation by the CEO of Arghyam and they're a great non-governmental organization in India that puts out small grants to allow local Indians to do things like build check dams in rice paddies and so forth, which transformed the local villages' economics.

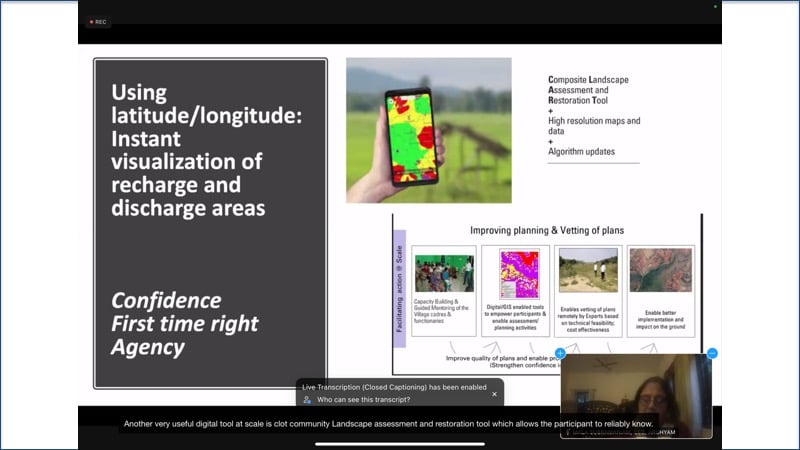

Digital Assets

They're using all these digital tools, basically the plans get made, then they get vetted and approved and then funded.

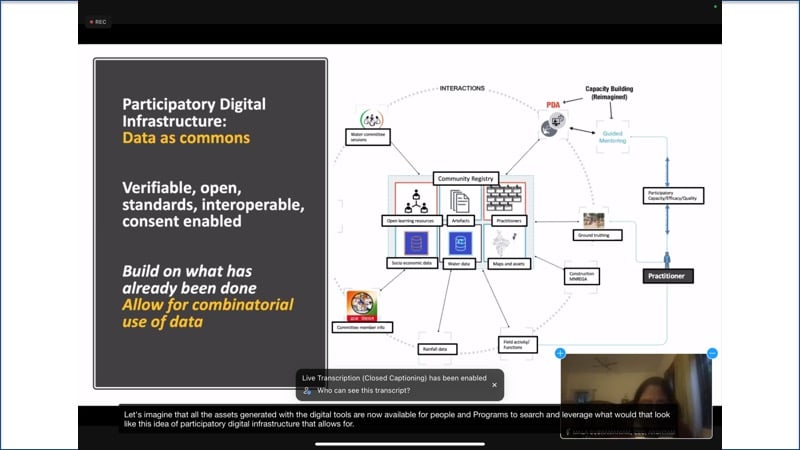

Workable Process

There's a whole process here where they are working together to get these things done and this is very much digitized.

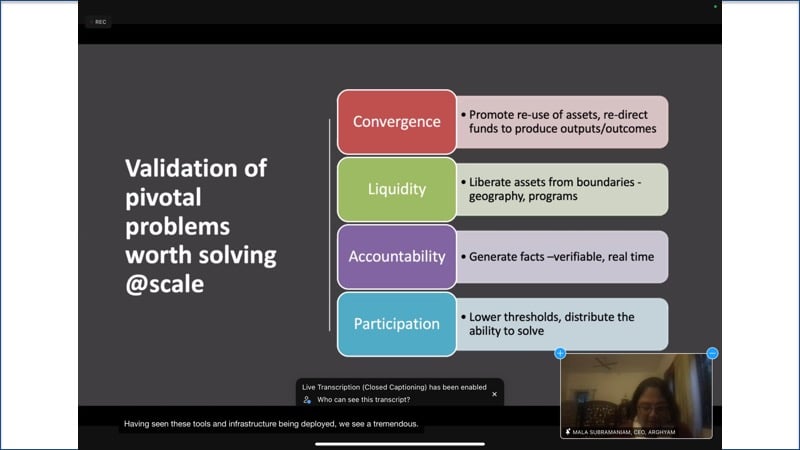

They have this whole thing about how they made a really good job of reusing assets, of what they call liquidity, which is not a pun, but basically to allow assets to move around and also to be very accountable, which is a big problem in non-governmental organizations.

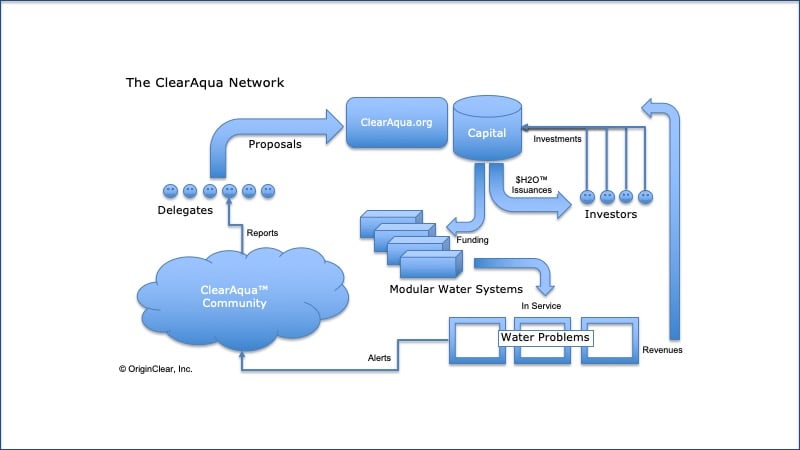

Participation and ClearAqua

Finally participation. And participation is what we're talking about here with Clear Aqua, which is we want to be able to integrate Arghyam into the ClearAqua™ community. So we don't want to be building all of the networks in the world, we want to be having an open door to them all. And so that is the exciting thing.

End of WWW presentation

Before I go on to our mystery guest, Ric Garcia says, very great news indeed. And thank you, Ric, for joining us.

Mystery Guest — Rod Turner, CEO Manhattan Street Capital

All right. So I'm going to ask Mr. Rod Turner to join us, he is the CEO and founder of Manhattan Street Capital. I'm going to go off share for a moment and he's going to pop in with his video.

Rod: Yeah I'm looking for the right button to press. Turn on the video, Rod, where has it gone? Oh, I know where it is, it's very obvious, it's in the same place. That's very helpful.

Riggs: Rod, welcome to the show.

Rod: Thank you.

Riggs: And in fact, Rod and I have known each other for some time, I think I even interviewed for a job at Mobile Automation, was it?

Rod: Yes, yes. That was probably 2000 or something, right around there.

Riggs: Yeah. Yeah, exactly. And I think, you've become a kinder, gentler gentlemen, you know that, yes you have, you've become kinder and gentler.

Rod: Good. I think that was probably necessary. Yeah.

#1 Growth Capital Service

Riggs: Rod is now the CEO and founder of Manhattan Street Capital. They're based, as the name does not indicate, they're based in San Diego, I'm going to do a couple of slides to run through some of the things that they've been responsible for and then we'll talk about what they might have to do with OriginClear. So here they are, the number one growth capital service for startup and mid-sized companies. What is this SPAC (Special Purpose Acquisition Company) matchmaker?

Rod: Essentially, I did a favor for a friend to check out options around the SPAC space. And I found that today's internet is nothing like as good as it used to be eight or 10 years ago to find stuff. So I looked at it from both sides of the table, companies looking to be acquired companies that have funded SPACs to help them. And it was obvious that there's a serious need.

So, I did a quick survey of some of our CEOs got a resounding yes, please, so then we built the SPAC, find a matchmaker. So it basically makes it easy to find funded SPACs. We have over 300 of them now in the system. It makes it easier to find target companies for the SPACs the funded SPACs. It makes it easier for companies that would like to be acquired to find the SPAC, to buy them.

Riggs: So SPAC is a special purpose acquisition corporation. And they're basically a blank check company that they're just sitting there with a pile of money and as you know, as you said, there's way too many of them and there's a glut and of course they're looking for deals.

Media Coverage

That's a cool thing you've got, I also noticed that you've had some good coverage in a variety of media, so that's excellent. Small, small publication, like The Wall Street Journal I've, heard about that one. And then, here's a very cool thing you did with the Impossible Foods. How did this project go?

Surprisingly Successful

Rod: So it was surprisingly much more successful than I thought. Essentially, there was a small fund put together to buy shares from investors that are shareholders in Impossible Foods, but wanted to diversify and assemble enough money in a little venture fund to buy those shares and then essentially wait and hope for an IPO, which given the scale of the company is, one would think, rather likely. So, what was interesting was for us, this was the highest market cap we've raised money at $3 billion pre-money.

And that was the price that the latest round of private equity money came in at. So you could justify going with a higher price actually, if you were trying hard. It was entertaining. The thing that was really interesting was that they really didn't have very much money or hardly any money. Just a good idea.

Regulation D Offering

We put together an arrangement where all we did was promoted to our member base and I told them going in that this is high risk, it's reg D we don't know if It's going to catch on. And it caught on big, I mean, relative to what I thought. I thought we would be lucky to raise half a million dollars, but I think we raised 2.6 or something in six weeks. So I was very pleased with that and frankly surprised.

Riggs: Well, it's a beautiful thing. So that was a reg D now that's for accredited investors, only, regulation D. You do a lot of Regulation A's I've noticed. I've watched Golf Suites and that's been a very successful watch hasn't it?

About Rod Turner

Rod: Yes. So, let me sort of put us in perspective and maybe put myself in perspective here too. I was an electrical engineer on a nuclear power station in the UK, having served an apprenticeship to do that and then I got out of that field into computers because I wanted to progress more rapidly. Then I came here because I wanted better weather and progress more rapidly. And then I got into startup companies.

I've had the good fortune to build seven successful startup companies of which I'm counting Manhattan Street Capital as one. We haven't tried to sell it or anything, but it's a successful business. The prior six all had liquid outcomes, two IPO's to the NASDAQ. One of those was Symantec, the Norton antivirus company. I ran the largest mergers in to Symantec, which is the hardest part of making a deal is relatively easy.

Anyway, so I've got a lot of interesting experience, I did my own venture fund with a good friend of mine. We did it, our own venture fund and incubator during the first internet bubble. So a lot of relevant experience.

Regulation A +

So when reg A plus was announced in may, actually in April of 2015, it's a really well-written regulation. And there's a whole host of companies that this regulation. And in my view, reg A plus will over time reach 50, $60 billion a year capital raised scale.

It's happening more slowly than I hoped and expected, but it is happening. It's growing nicely, especially this year. All crowd investing online has accelerated because of COVID people getting bored, et cetera.

So we've gone from a, from about two years with no reg A plus IPO's to three of our clients doing reg A plus IPO. So we may be the first to reopen that flood gate, which will be lovely, not the most important thing, but the caliber of companies that are working with us now is just so much better.

OriginClear and Innovation

I mean that a year ago, then two years ago, it's just a wonderful thing. That's what I've been aspiring to the whole time, but we're so fortunate to have fantastic companies signing up with us who are really making huge differences and I count OriginClear as one.

I mean, the deal the arrangement, the plan that you've built here, young man, Riggs is super impressive. And I say young man in a affectionate way, my younger brother used to do that. Still does that with me. So it sort of stuck.

We are, we're a bit innovative in a regulated space, we figure out ways to do things better and differently than are being done elsewhere. We're more of the boutique. We're not interested in scale for its own sake, we're interested in great successes for our companies and for the investors.

Two Goals

That's it, those two goals, everything else is subsidiary to those two goals. It's fun, I enjoy innovating where I'm allowed to add value, which Riggs has been fantastic to work with in that regard. It's his company and I've just been able to add value here and there, which makes it fun.

Sort of gets more ego in the game, I suppose. But I think we're going to be doing some really nifty stuff together with the company, with Riggs company. I count this as a phenomenal opportunity for us to make positive change. I can't pitch any single investment so I'm not.

Riggs: Of course, and we're not asking you to be a pitcher.

Rod: This isn't a pitch.

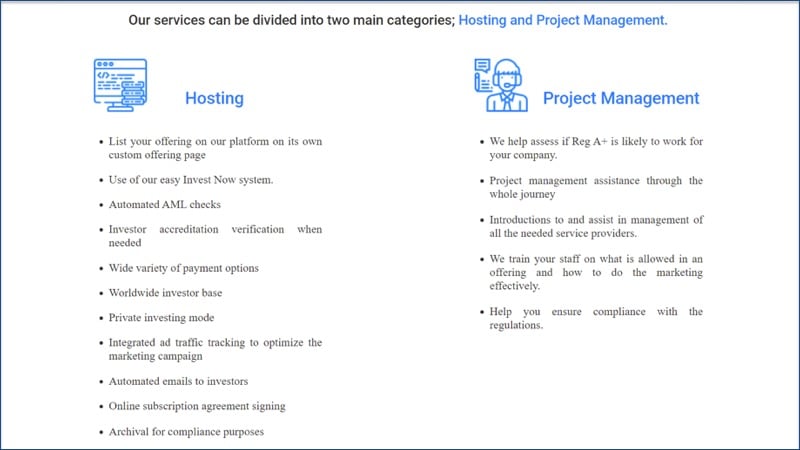

Hosting Offerings & Project Management

Riggs: This is why I brought up the page of what you do. You host the offerings and then you project manage. And this is why now the, reason why we came to you Rod. And initially we were thinking of having you do a regulation A offering, which is unaccredited investors and we really realized that what we're trying to do here is the, actually should be regulation D because we're trying to build these funded vehicles.

Supporting Water on Demand

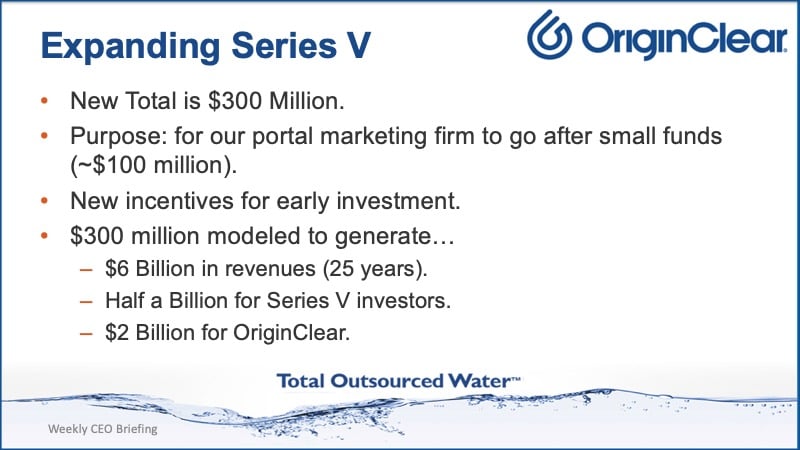

They're almost SPACS themselves in a way, what they are is little subsidiaries that ultimately we could add up to about $300 million, at least that's what we've had set up as a plan.

And what we're now we realized is that if we're going to do this to support the Water on Demand project, then probably we need to do it with accredited investors, higher net worth investors and then of course you have align into small funds, which are family offices, home office. I mean, not home offices, family offices, and small funds that would be able to invest several million, 10, 20 million at a time as opposed to much smaller. So I think that's... I'm looking back. I think that was the reason we went after reg D am I right?

Rod: Yeah. You know, there's a lot to this that you're not disclosing yet, which is good, probably and appropriate, cause you know what you're doing. But the market's changed dramatically. I think I touched on it earlier. We have a Reg A Plus offering where an institution approached them to put in 26 million. That happened in January or February. There's no way that would have happened a year before. It's no chance.

COVID-Forced Involvement

So what's happened is that COVID has forced a lot of professionals who were really looking down their noses at this online investing game, to get involved and see that it's actually a lot better than they realized. To now start to play actively in this space.

Raising larger amounts of money online is now feasible, when, before it was really a stretch. It's always difficult, not to say it's a walk in the park, now is much much more realistic to do so. We build that into the plan.

Alternative Investments that Resonate

I said we, our clients build those things into their plan. We advise them to make sure that the institutions are motivated and are treated specially because they need to be, in order to make it more likely that they'll engage.

But right now, especially, because there's so much extra money floating about in the hands of big institutions, courtesy of all the liquidity The Fed has been pumping into the market. This is a good time to make a large raise as long as it resonates, as long as it has the scale and potential to make it real.

If you think about it from their point of view, they can see like all of us, the market's getting over hot and there's likely to be either a sideways period that's unbelievably long or a crash; one or the other. Probably the crash, because that seems to be the way that a market tends to go.

They're putting more money into alternative investments, which will grow rapidly because of the nature of the investment uncorrelated to the state of the market. They have allocations for that, which are rather large because they are themselves exceptionally rich in the first place. Now they have excessive money floating around to deploy.

Audience Feedback

Riggs: Wow. And in fact, Keith Routen, one of our stalwart investors says, "With everything happening now, it's apparent that OriginClear has burst onto the scene in the most important way, with the best forward-looking ideas imaginable."

I could not write that copy myself. Beautiful. Thank you, Keith and Stephen Davis says, "In addition to a OCLN, I am also an early pre IPO investor in Impossible Foods."

Rock on. A lot of intersection of our investors here.

Asset Type Investments

Rod: Well they have a competitor beyond me. Who, I haven't checked lately, but last time I did their market cap was 13 billion. Then these companies are "much of a much" [comparable] in terms of market penetration, scale, product, family. That 3 billion market cap for that brand, you could justify it as being undervalued or relative to an IPO, but of course that's the only reason that we could carry such a valuation in that case.

Riggs: Good little project you did there. So, I agree. There is this concern about, where the market is going in terms of so much money floating out there and so forth and what's going to happen. This is why I think the market is moving towards asset type investments, right? Assets at least have some...

Rod: Material value.

Tangible Security

Riggs: This is why real estate is doing well. We have our own offering here, which is focused, not so much on paying our bills, building the company per se, but rather buying water equipment that was then going to go out there and create a usage revenues. That's the modeling down below here where you put out these machines on a pay per gallon basis and over 25 years and make a lot of money and return a lot of money to the series, the investors, which is the ones that were involving us.

What's beautiful about this is that these subsidiaries allow the investor to capture the asset in case something goes wrong, which it will never will, of course, but these days you want to plan for the worst to get the least. Obviously.

Rod: I was describing to a good friend of mine. Who's been involved with my company for some time, quick update, and I was describing some of the amazing companies that we're working with that are not yet large. Therefore, we don't disclose the situation publicly.

The three I told them about are radically great, really great companies. And the one that he latched on to with the most interest was a company that's making a hard product for which there's a huge need and they have the exclusive rights and patents and so forth. In its own way, it's very similar thing to what I think we're doing here with, with OriginClear. He's dealing in the capital markets all the time. He likes the fact that it's more tangible.

He doesn't see the risk. I'm not looking at these companies the way he is with the same skepticism because I'm dealing with the people. And I know whether really acts and how deep they are, but it's easy to see how a dinky startup do something amazing technology-wise which says has the rights or the opportunity to really be revolutionary.

Institutions and Individuals

Some institutions don't want to play with that until it's actually proven a bit further. They want to see it a little bit more meat on the bone as it were. They're looking for the material needs are put lots of money into resources that are going to be assets, and that are going to have a long life. And for which the markets are growing nicely uncorrelated to... The need, the need for water, isn't going to reduce anytime soon, it's going to grow because of a climate change situation. One hopes that that gets under control, but until it does...

Riggs: Well, I fear that it's going to get worse before it's going to get better.

Rod: It will for sure.

Riggs: Because of inertia because of momentum. We have odd things for example, the air travel was actually creating a kind of a screen for greenhouse gases with less air travel we've actually had an increase in global temperatures. It's one of those counter-intuitive things. We know that there is a climate effect. We know that there's pollution, we know there's issues.

What I like about what you're doing, you're talking about how often institutions don't want to get involved, but you, because you're a crowdfunding platform are bringing the ordinary investor into institutional grade opportunities like impossible foods. I think that's beautiful thing that you're doing.

Personal Involvement and Success

By the way, you have taken a big haircut and your compensation in order to be an equity player. That is tremendously appreciated, that way we're, able to redirect.

Rod: We're on the same team even more than we would have been.

Riggs: It's unbelievable. So appreciated. Thank you. What I'm going to do Rod is I'm going to play, feel free to stick around, or as you wish, I have a fascinating little short video to play from the World Economic Foundation that is going to freak people's minds. We are going to discuss what it means for the water industry.

Rod: I'm going to leave because I'm not feeling too good today. I'm not at my best. I need to get some things done and relax, frankly, but thank you. Thank you for involving me with you, it's been fun already. We're going to have fun with this, and I think we'll probably have great success. So it'll all unfold over time. You guys on the call, will know what we mean in a more complete manner at the right time. Thank you. Thanks Riggs.

Riggs: And already we've done amazing things bringing in the crypto developers and now there's going to be a crypto focused agency. Great things so far, you go relax. Thank you, Rod. I appreciate you coming on the show.

Rod: Thank you.

Riggs: Goodnight

Rod: I hope this has been helpful to everyone.

Riggs: Really cool. Thank you.

Rod: Thank you, bye.

Riggs: We're going to continue now. That was a wonderful thing. Now what I'm going to play is a little video that I think it's going to blow your mind, every time I watch it, it sends chills through me for reasons that you'll see after the COVID pandemic, what could happen. What could happen after the COVID pandemic? Let's take a look.

Start of video presentation

Commentator: The COVID-19 pandemic has shaken our economies and society to the core. He shown us how vulnerable we are to biological threats. In the digital world, similar risks are being overlooked right now, a cyber attack with COVID like characteristics would spread faster and further than any biological virus.

Its reproductive rate would be around 10 times greater than what we've experienced with the Coronavirus. To give you an idea. One of the fastest worms in history, the 2003 Slammer/Sapphire Worm, doubled in size approximately every 8.5 seconds infecting over 75,000 devices in 10 minutes and almost 11 million devices in 24 hours.

Fortunately, at least until now, cyber attacks have not impacted our health the way pandemics have, but the economic damages and therefore the impact they have had on our daily lives have been equal and sometimes even greater.

You see, the only way to stop the exponential propagation of a COVID-like cyber threat is to fully disconnect the millions of vulnerable devices from one another and from the internet, all of this in a matter of days.

A single day without the internet would cost our economies more than 50 billion US dollars, and that's before considering the economic and societal damages should these devices be linked to essential services such as transport or healthcare.

As the digital realm increasingly merges with our physical world, the ripple effects of cyber attacks on our safety just keep on expanding at a faster pace than what we're preparing for. COVID-19 was known as an anticipated risk. So is the digital equivalent. Let's be better prepared for that one. The time is now.

End of video presentation

Essential Services

Riggs: So that... Oops, I went a little bit too far out there and I'm going to come back. That was a pretty strong message to me, and let's break down what this means. Let me just go into text mode so it won't be as fuzzy, but what we have here is, I don't know about you but this COVID pandemic has changed so much in my life and everyone else's.

Thinking a little bit about the digital pandemic that could occur, it won't kill people per se, but imagine, we're so busy connecting everyone and we're all busy working virtually, and now we're going to, what, not have it? It's horrendous, but here's what's even more important, and that is should these devices be linked to essential services, and of course, I include water in that, right?

As the digital realm increasingly emerges with our physical world, the ripple effects of cyber attacks on our safety just keep on expanding at a faster pace than what we are preparing for.

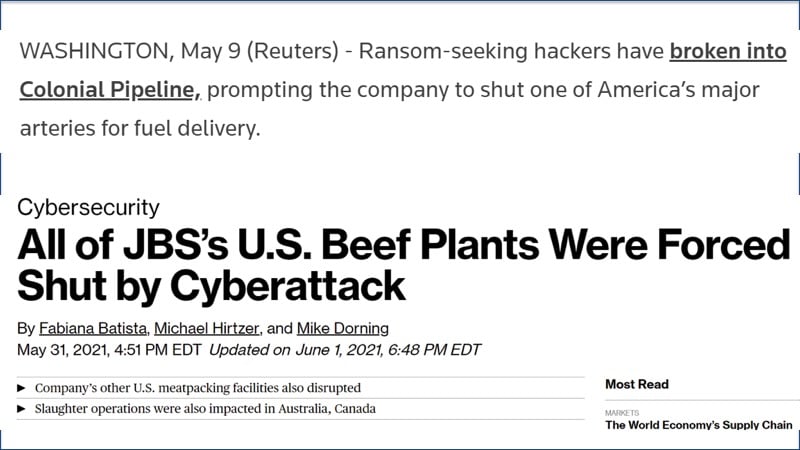

And we've already seen this with the colonial pipeline in May, and also the same month, the largest beef packer in the world was forced shut by a cyber attack, so we know it's there.

Reducing the Risk

So what does this mean for water? Because water is an essential infrastructure. And frankly, if water goes south, we got a real problem. Well, it means essential infrastructure is at risk. Imagine potential water system breakdowns.

The good news is that decentralization will reduce the risk. People don't realize that when DARPA, the defense research agency originally created the internet in the 70s, it was a way to survive nuclear war by having separated nodes. But in order to commercialize the internet, we connected all those nodes, we made it highly centralized. So we need to move back to that decentralization, both with the internet, but also here.

Many, many points of water treatment will reduce the reliance on big central systems, which is why water demand is a strategic initiative to improve the safety of essential water services.

So what it means really is that what we're doing here by working with people like Rod Turner, to create this large capital pool to fund systems that people don't have to pay for upfront and they can just start paying for on a subscription basis, and they are not relying on the municipality and doing their own water treatment and their own water purification, it means that this will dramatically make the water infrastructure more safe.

Being Prepared

'So I think that that for me made me feel better about where things are going. Of course, we're all going to have to start thinking about what if we were a week or two without power, internet, et cetera?

And that is a separate conversation that you probably want to have with your family and get a generator and all that good stuff, but we here at OriginClear, what where we're thinking about is, okay, how is the water grid going to survive? And the water grid of course these days is vulnerable to cyber attack unfortunately. We've become technological right? By decentralizing, we will reduce the risk. Okay, enough said about that.

Call Ken

'm going to just wrap it up quickly by saying that your personal briefing is available from Ken Berenger, who is amazingly talented. We speak constantly about our initiatives. He is also who the investors speak to so I get a lot of feedback from investors from him and also from Devin Angus, the amazing Devin Angus and now, Larry Judge, who's joined us in digital marketing. So we have a lot of touch points with investors and tell us what you think. But also, I want you to find out what options are available to you, both in these secured funds as well as the other general investing opportunities.

Next Week

So next week we will have the ability to play the cool little presentation that I made a world water week. They said it was a breath of fresh air. Let me tell you something. I love these people but man, they're not Elon Musk or they, they are. They're just kind of... Well, they talk in a very measured way, very reliable way. And we like to say that we've been putting a little spice in the soup.

About Filings

So that's kind of our part and hopefully you'll enjoy that next week. So as we're moving into September, I just wanted to cover that we are very, very close to finally filing that second quarter filing. And as I keep saying, thanks to Prasad, our new CFO, Q3 is expected to be fully on time. So we're reducing the lag again, and this was the year of our equity systems being completely balled up, but that, thank God, is changing.

Thank You & Goodnight

=A quick word from our partner, Ivan, who by the way, his article in Forbes Argentina Online was printed in the magazine and it gave heavy mentioned to us, which I thank the PhilanthroInvestors® for, and he says vegan foods need higher quality agriculture, and the OriginClear systems can deliver better water to the agriculture as a foundation for good vegan food, and that's absolutely true.

With that, I'm going to thank you all for being on board. It's been fantastic. Don't be a stranger. I want to see you next week, and I hope you had a little bit of insight today into what's happening with our funding partners and background.

So I'm going to go ahead and turn off the video so that Heather can catch up on the translation. Again. Good night. Bob, we're not changing briefing times. What we're doing is we're doing organizing replays. I'll talk about that next week. Stephan, Davis, great update. Thank you very much. Everyone have a good evening and I'll see you next week.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)