We got a glimpse at OriginClear…before water! How did we get to where we are now? Can Water on Demand's — Water Like an Oil Well™ propel us to World Class? Find out in the replay!

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

And hello, everyone, welcome to the CEO briefing, and I see we have a lot of people arriving, so that's excellent. I'm going to jump right in with some of the formalities. This is going to be very fast paced, lots to cover. This is what I'm calling The State of the Company — 2022. It is January 27, 2022, and it is not briefing number 14, it's like 144. Helping you thrive in the world's only vital, scarce and recession-proof market.

And we are also, as always, in Spanish. Just click on the globe in your dialog or window, whatever you call it.

Safe harbor statement. You know the drill. We do our very best to tell you how it is, and things may differ materially from what we express in these forward looking statements, but we try and correct them as fast as we can. And of course, the Securities and Exchange Commission has not passed on all these statements. It's all in our filed reports, quarterly and annual.

Ok, so state of the company OriginClear 2022.

Now I basically divided this review into five sections. One is before water. It's like before the flood, right? And then, by the way, Rhett, If you're raising your hand, just do a chat. We don't actually open up live conversations. Just do a chat. Anybody who raises their hand. Nothing will happen. You just need to do a little chat thing, and I'll answer that.

Origin Oil

Ok, so before water and then, you know, four very important stages which you can see right here. All right. Well, let's covered before water.

And that was algae is a biofuel, and I think you're going to just dig this. This is a video from back in the day and I'm going to go ahead, old video on Bloomberg, but let's see how it comes across here.

Start of video presentation

Pimm: This is taking stock on Bloomberg, I'm Pimm Fox. Origin Oil, founded in 2007, is developed technology that is used to convert algae into renewable crude oil. All right, what kind of role will algae play in the future of U.S. energy policy? Let's put that question to Riggs Eckelberry.

He is the chief executive of Origin Oil. He joins me now for our CEO sit down and he wants to learn about algae and renewable biofuels.

We also have Jim Rogers. He's the chairman of Rogers Holding. Good to have you with us. Thanks for coming. Explain what is Riggs? What is this whole thing about turning algae into some kind of biofuel?

Riggs: Well, first of all, algae is old petrol. I mean, petroleum is old algae. So let's just settle that right now, algae and petroleum are the same thing. So what does that mean? It means we can make vast amounts of algae right now in a beneficial way that can be the petroleum of the future.

Pimm: But go ahead. Go ahead, Jim.

Jim R: Thank do. What is it? What does it cost to make a barrel of oil from from algae?

Riggs: Well, glad you asked, because we just completed a study that showed with all the new technologies at a proper footprint, you're talking two dollars and twenty eight cents per gallon for an algae blended fuel for diesel or gasoline right there, made at the algae plantation.

Jim R: Wait for a gallon of gasoline. If I can go into the gas station and for two dollars and 20 cents per gallon, I can fill up my tank.

Riggs: Well, that's the production cost. You got a marketing and distribution costs on top of it, but it's not a lot more so. It really is a profitable way to go now.

Jim R: It's competitive. In other words, it's very competitive with oil.

Riggs: Now, Jim, as we were talking about earlier, we're talking about a blend of various fillers with algae. If you talk about pure algae, it's around five dollars and forty four cents. Not quite. But you know, that's a big leap from what it was, which was 20 or 30 dollars a gallon not too long ago,

End of presentation

Achilles Heel

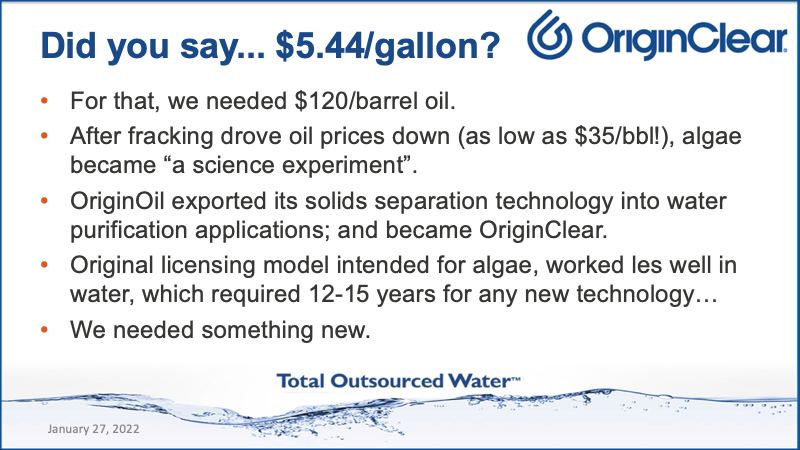

Right there. That was the Achilles heel. You can just look up Eckelberry, Rogers, Bloomberg and you'll be have a chance to to see this. But let's come back to that. I'm not going to play the entire clip. But this was the achilles heel of the program, which was.

Darwinian Moment

Five. Forty four a gallon. And for that, we needed one hundred twenty dollars a barrel of oil. But the oil industry got creative and developed something called fracking, which completely exploded oil production in the United States. And oil prices went way down. And that's when we realized that we needed to, you know, basically adapt or die.

It was a Darwinian moment for us, so we exported our technology to clean up water and became OriginClear. Now we started with the licensing model, which was fine for algae. But the water industry is not... Algae, of course, was high change. Why? Because there was nothing there. Water is highly established, has been around for hundreds of years, et cetera, et cetera. And they're not big on adopting new technologies, and they themselves have stated that it takes 12 to 15 years for a new technology to be adopted. So with that, you know, the licensing of technology model was going to take way too long.

So with that, I'm going to show you quickly our new site, we because that's kind of what this is about. It's going to form the the basis for our presentation because it's got a timeline. So this is a quick look at our site here.

Focus on Oil & Gas Comparison

And let's see, it's got a cool. Terminator kind of cool thing going on. I just think it's kind of cute. There's nothing at the top because none of that has been built yet. This is just a rough so very much focused on the oil and gas comparison.

Videos

That video that we're talking about that there'll be more, obviously.

How we can finally invest directly in water programs. Some of the features of the of this program.

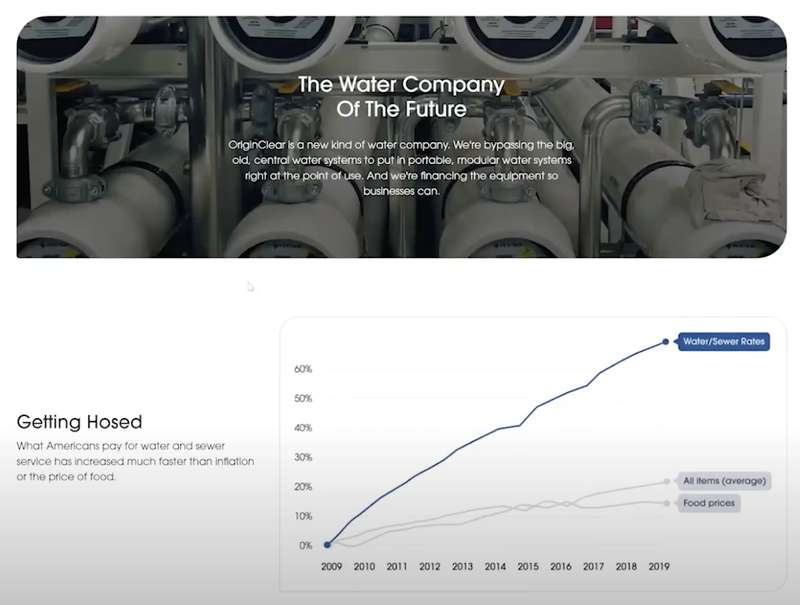

What is the water company of the future? Water rates, how this punitive.

Timeline

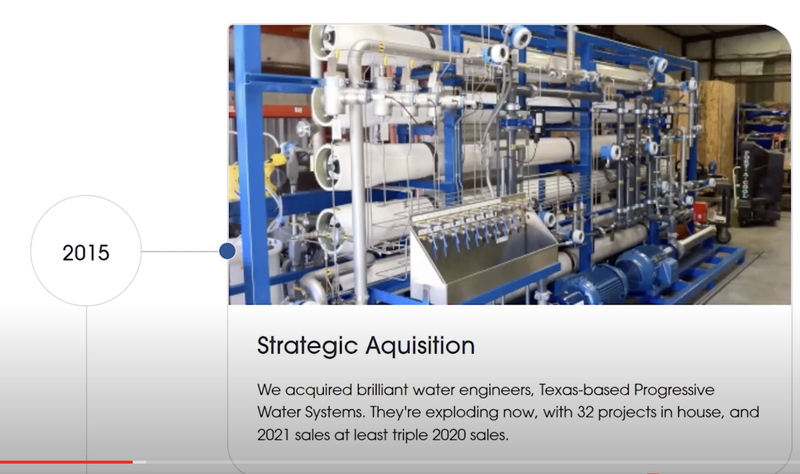

Shift to Revenue Generating Operation

And then it gets into a timeline. Ok, so what I'm going to do is I'm going to flip now to that timeline and get into it. All right. I think that's a good structure. So that first and forget it, there's this typos here because this is a rough page, like acquisition. I realize this a typo, but basically this is a fully responsive website which is about to be put into our own. 2015 was a big change for us. We'd been doing licensing and all of a sudden this shifted over to actual revenue generating operation. And this year, twenty twenty one, or just just recently as of 2021, they had a huge amount of projects. Still do and tripled sales.

PWT Accomplishments

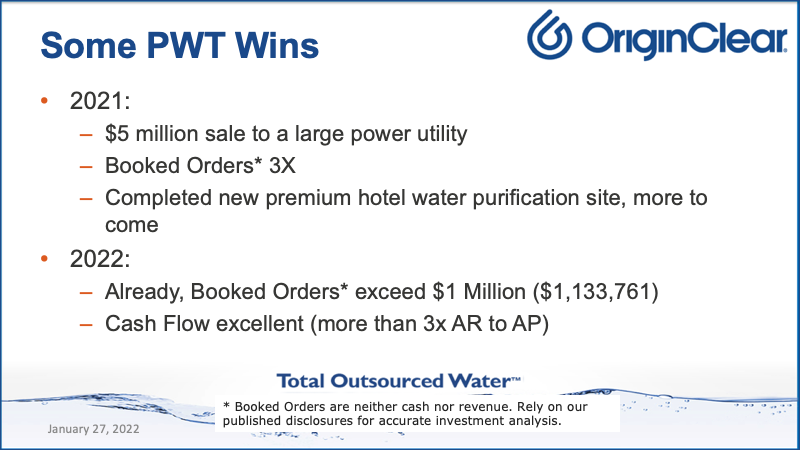

Ok, so what does that mean? Well, first of all, in twenty twenty one, there was a huge sale to a large power utility, which is going to take quite a while to absorb. And so we can't really say who it is, but they're very recognizable. As I mentioned, we have more than 3x to our booked orders compared to the normal thing, and remember that booked orders are not revenue. It takes a while for booked orders to become revenue, which is why it's not going to be reflected overnight. But it's a really good, shall we say, canary in the coal mine.

Ok. And a lot of you have asked about that premium hotel water purification site that is completed, and we will be doing a video and a big coverage of it. And we've been asked to supply more to the same premium hotel chain that is building more hotels as we speak, and it will become a standard product.

What's going to be great about that is we're going to get a lot of PR out of it because we'll have a cool enclosure and maybe even some videos playing in the lobby and that kind of cool stuff. So it should be a lot of fun.

So twenty twenty two. They're doing extremely well. We're more than a million dollars so far in booked orders. Which is just shocking, in fact, just the consumables are at least a quarter million dollars. I think they'll end up at about $300000 for the month. I mean, that's a that's a run rate that's very close to what the entire company used to do. And this just the consumables, just the membranes and stuff like that. The filters and cash flow is excellent.

There was some help in the fourth quarter from our Water on Demand capital, which I'll talk about in a bit, which enabled them to start collecting and more than three times what's owed to what we owe. So that's very good because it allows us to do a lot of economical buying and so forth.

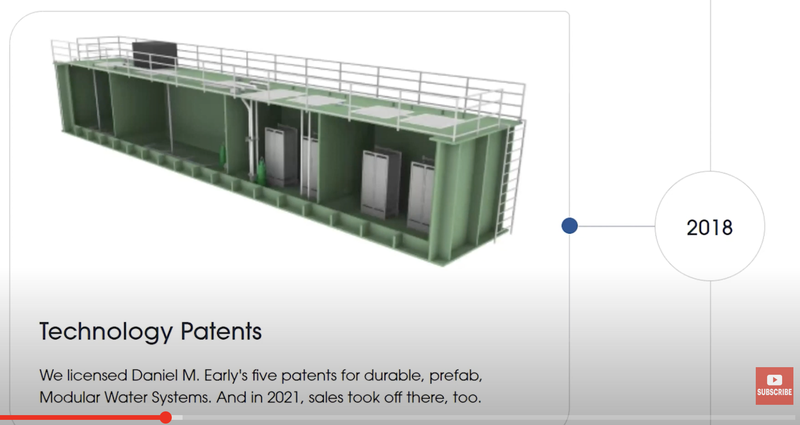

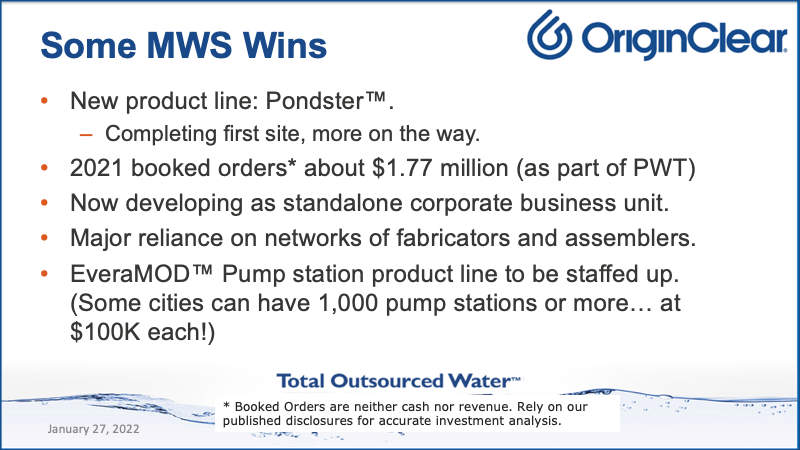

Modular Water Systems

Ok, so the next phase is 2018, when Dan Early came in and you heard the story we told last last week about how he came on board and we created a company called a division called Modular Water Systems, which has been embedded inside Progressive Water treatment and sales took off there, too.

Pondster

So one cool thing was that product line Pondster™, which is still being, you know, tweaked and so forth. And but we already have more mobile home parks that are being that are being completed. I mean, the the bidding is being completed and we're close to order on them. So that is continuing to roll out in the usual slow water way. Mean you're not going to get you three hundred of these in a year, it's just going to gradually grow.

Hopefully, we will be able to resell it in the channel. It is a very needed product by trailer parks. Ok. And as part of Progressive Water, they contributed almost $2 million in booked orders. They contributed about seven hundred fifty thousand in revenue in 2020. Remember, there's a difference, but it's still indicates that they popped a tremendous amount of expansion, which is great news.

Stand Alone Unit

Ok. And here's the cool news that we are developing them as we're going to pull them out of PWT and Tom Marchesello our chief operating officer is going to be developing it as its own line of business unit at corporate with more personnel. Dan is completely overloaded with Robb, and now we're getting more people to help them so that more much more project management and so forth so that they can continue to expand and they will have to, in order to do that, they're not going to rely on the team of Progressive Water because Progressive Water is jammed and totally...

See. Progressive Water sells the custom systems, whereas Modular Water sells packaged systems that tend to be standardized well. Since Progressive Water is slammed and is nonstop building, Modular Water is actually going to be more of a, use fabrication and assembling network, which they already did with their plastic enclosures already. And that's going to be increased. So a lot more job control, and this is going to enable a lot more scale for the unit. So this is very exciting how that's going.

Pump Stations

Now. the pump station product line is called EveraMOD™ is also very important. It's been quietly building in the background. Now, what's great about pump stations is you tend to get a chunk of them at a time. For example, we're talking to a specific small city that needs to replace one thousand pump stations. And as you can see a hundred thousand dollars times a thousand pump stations, that's a hundred million dollars.

So it can add up. I'm not saying we got that order, but what's great about a pump station is it's literally a vertical tube with a pump at the bottom, because pump stations are used to take water, dirty or clean, from one level up to another, right?

So it's a water management or water conveyance product. So pump station is really going to be its own product line. It's going to have a team on it because it's highly profitable. We have a winning design that especially works for small cities so that we have a we actually have quite a bit of business with small cities.

Water on Demand

Ok, so now here we move to the Water on Demand thing, and many of you have heard the story about how Water on Demand came about. Well, it came about beginning at the beginning of COVID. Right about this time in 2020, when we saw the prices of crude oil crash because Wuhan had been shut down for a month and investors freaked out and we realized that we really needed to adapt again, adapt or die, right?

And that's when we, you know, looked at this huge backlog of business that Progressive Water and Modular Water had, you know, about 40 some million dollars and kind of constipated. Like, why isn't this stuff moving? Because Ken Berenger had been talking to a lot of investors about how great that was, and throughout 2019, it was like, yeah, super excited.

And it was like, Come on, you know, it's like the play Waiting for Godot, which if you guys know you spend the entire play waiting for Godot and never shows up. Well, that was what the danger was in 2020. So what we did was we focused intensely on what what would liberate this problem. And we came to realize that it's the money stupid, right? If we could fix the money, then everything else would flow. And that is the program that came to life now. Let's talk about some wins.

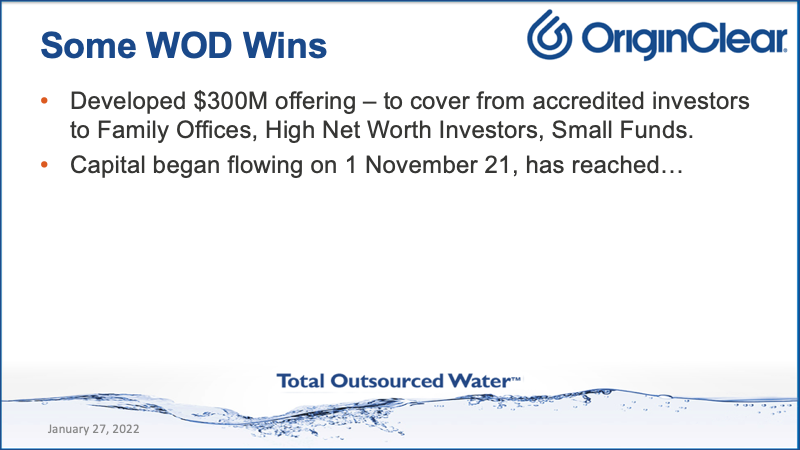

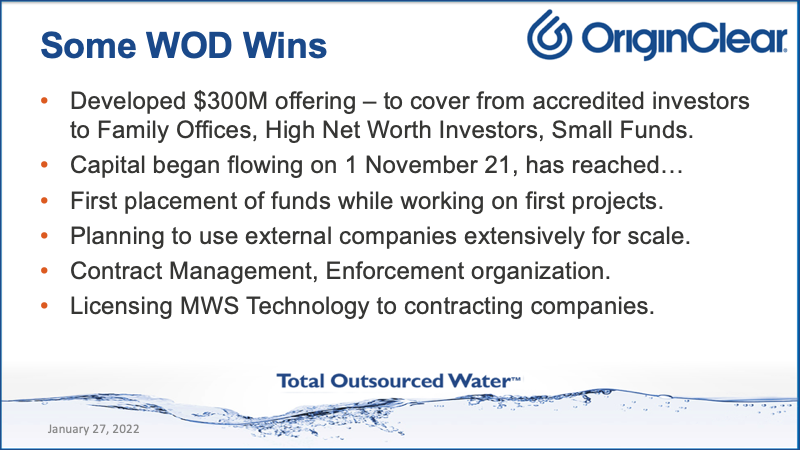

Some Wins

We've. Put together the three hundred million dollar offering, and that allows us to go, it's designed with different tiers so that in the same offering, we can work with our core retail accredited investors who are who have helped us build the company. But then scaling up to the larger level stuff. And to be to do that, we have to become much more institutional in character. There's going to be a transformation of the company.

And that's one of the reasons why Andrea d'Agostini has joined us as chief strategic officer, and he's bringing on some other assets to dramatically upscale or upgrade our structure so that we are, you know, can properly appeal because we have this wonderful world class, quote unquote unicorn thing, (a unicorn is a billion dollar company) It's kind of used, that as shorthand to say it's an amazing world class offering, but it's a penny stock company.

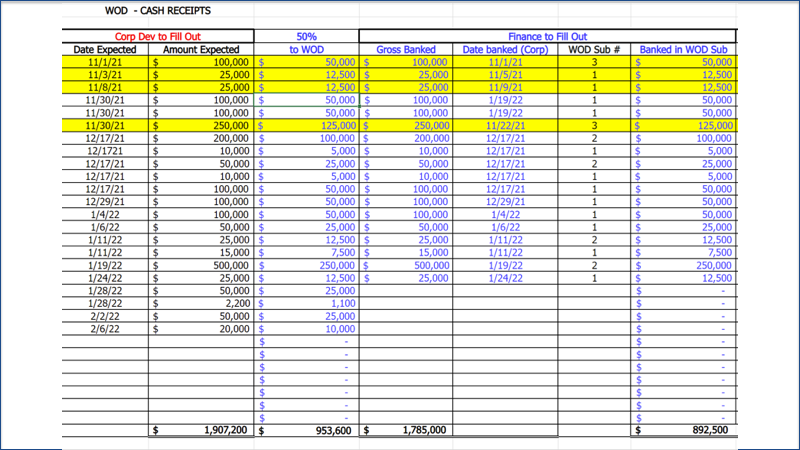

So we need to basically reconfigure the company in a way that appeals to these institutional investors and also is ready for the Nasdaq. Ok, capital began flowing, began flowing on one November, and now you're going to get a look at the actual entries in the ledger that have occurred.

Close to a Million

So what you're looking at here is money that came in. On the left it was the amount expected, on the right it's what actually came in and what got banked. Again, 50 percent goes to Water on Demand, 50 percent to company building. And you can see at the bottom here that we're looking. We're very close to a million dollars actual receipts are $892,500, bottom right, down middle the bottom, it's $953,600. So that tells you the whole story.

When we hit the million, it's going to be a really great milestone and it shows just how devoted because most of these are existing investors. Some of them are new, but they. A lot of this is our, you know, loyal investor base who are just there, they're there for us. They're amazing, we love them. But some of them are new and that's fine, too. Of course, we've got to have new. All right.

More WOD Wins

So continuing here. We had oh, so so here's the problem that I saw, which is that if you're going to do managed Water on Demand, which is, you know, pay per gallon and it's very complex, it takes a while to get get these things done and structured and so forth. So we wanted to put the money to work, and we did. So we we loaned some money to Progressive Water treatment.

And I'm happy to report that Progressive Water treatment repaid the loan. It was a secured loan because everything we do in Water on Demand is secured right and generated a small amount of dividends, which we will be paying out to these investors. It's by no means the full game, but it was nice to actually, you know, break the glass and you know, when you baptize the ship and the champagne bottle hits the ship and cracks. But we did that and the money started flowing and we are going to do much more besides which I'll talk about.

OK, now one of the things that we know again is that our own companies are overloaded, right? So we want to be more of a contract management and enforcement organization. And so a Manuel Vianna who is just an amazing manager and he's the general manager of Water on Demand. He is being charged with OK, putting together these contracts so that when we say, "There's an Atlanta client and our friends over at AdEdge in Atlanta," which is a water company we admire very much, we tell them, "OK, you've got the contract."

The client remains ours. The asset remains ours and the contract is ours. But we're using that external water company to deliver the product and do the local support. That way, believe me, it's really painful having to do direct support of a distant site, and it's a specialty all of its own. So you want to use local water companies and that's how it will scale up.

And our Modular Water Systems technology is perfect for these sites and we want to license it to the contracting companies because we know how that works and we know that it is world class and we have a chief engineer who is a guru in it. So that's where the licensing finally comes in, in an environment that we control fully.

Ok, now I wanted to quickly flip over here to how we tell our story. And you know, this is how Ken tells it, and I'm going to just flip over right here.

Start of presentation

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(1).png)

Useful Comparison

So concept is and this is, by the way, slightly out of date, but it's it's pretty good this concept of Water Like an Oil Well™ works. Why? Because we don't have to go through all this explaining about how businesses are starting to do their own water treatment and why, and nobody really believes it. It's like, look, water should be like an oil well. You should be able to invest in a water treatment system the same way you can invest in an oil well. And that has been very, very useful comparisons. Really, really, you know has, it's been a home run for us.

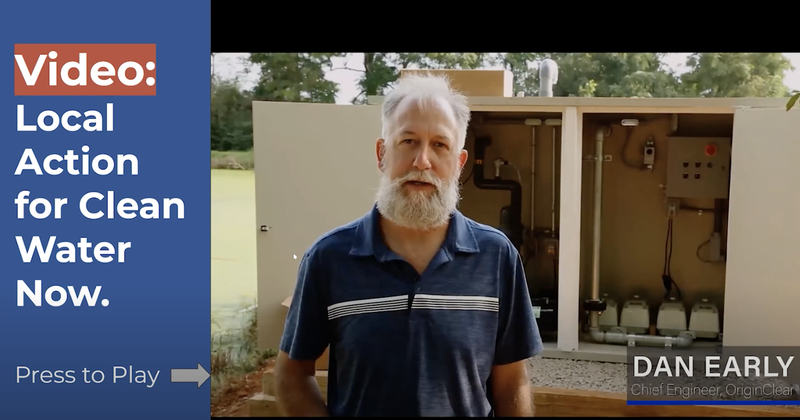

And so I'm not going to play this. Its that Alabama Mobile Home Park.

Dan E: We are outside the Mobile Home Park and we are installing the Pondster 30K biofilm, bioreactor system as part of an upgrade to the lagoon treatment system that's been in service here for over 50 years.

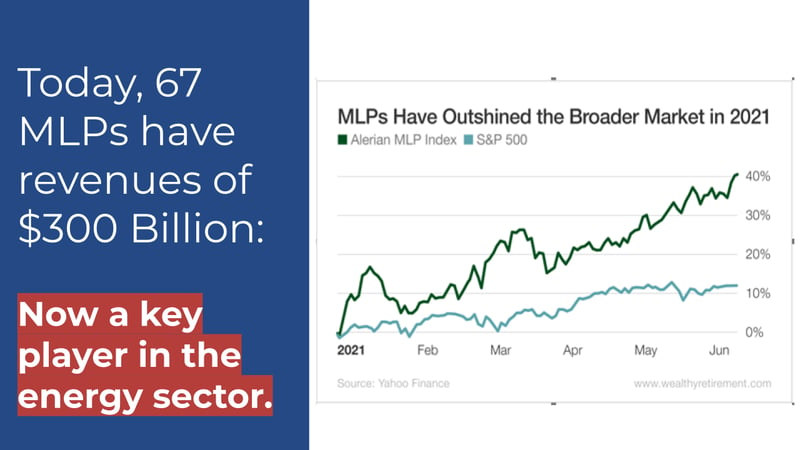

MLPs are Huge

Riggs: So I won't go on with this, but this is part of the presentation and it's up on our website, of course. Now we're basically saying, look, master limited partnerships in oil are huge, 300 billion plus, key player. They do not replace the oil companies, they complement them. The same way we want a similar structure, Water on Demand, to complement the big water companies, but not replace them.

.png?width=1280&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(2).png)

A Better Way?

And of course, this is these are stats seen before about how agriculture industries is most of the available freshwater, and they are the ones who are being forced to do their own treatment increasingly. And of course, the federal government is giving less and less. Can't fix it centrally, is there a better way?

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(3).png)

Proven Model

Yes, it is the proven model of the master limited partnership. And there was this thing was invented again and not going to get into it because you've heard the story. But the master limited partnership has proven to be a durable model, and we realized we could do the same thing in productive water assets.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(4).png)

And of course, it's not like oil which goes up and down like crazy. I mean, right now it's way up. Who knows, right? But water assets are, the demand is constantly rising because people are making water dirtier all the time and climate change is not helping. And so water assets are a wonderfully stable, inflation friendly product.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(5).png)

Private Municipality

Ok. Now, Water on Demand, what is it? Pay as you go program, the client doesn't pay a bunch upfront, basically, we become the private utility. We become the water, the municipality, but on a private basis. And of course, we don't have to ask for that million dollars that million dollar investment. Because, if you're a brewery and you are trying to make beer, you don't really want to spend a million dollars on a water system.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(6).png)

Service Model

And of course, we keep the title to these systems, and it's very important. So again, the client assigns one of these water purchase agreements. We monitor water and there's a subscription model, and it's a long, profitable service model, not just selling and going away, which is what we've been doing.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(7).png)

Asset Base

It's an excellent financial model. I'm not going to go into it. Ken is very, very good at walking anyone through it who is interested. But the important thing is by retaining ownership of the equipment, we keep the asset base, and that's super important. Why? Because getting on the Nasdaq requires assets.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(8).png)

All right, and then here's an interesting part where we are planning to package dividends. Now we don't have to, but it's a benefit and the reason there's a benefit is because, number one, water rates already inflate higher than regular rate of inflation. So this makes it a very inflation friendly investment. But on top of it, if you receive your investments in a digital currency, it further protects it from inflation, we believe, because you're outside of the dollar. All right. And by the way, $H2O is, I believe, is now a registered trademark, I think we can put an R on that thing. It's basically a digital bearer bond not going to get into it again, Ken is excellent with that.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(9).png)

There's a dual currency model.

And by the way, I'm going to get into that in next week's CEO briefing, by the way, but I'm getting ahead of myself.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(10).png)

Environmental, Social, Governance Market

So Water on Demand as direct investment. So basically, the global water crisis is caused by a lack of funding for water. So therefore, we let the world's investors invest in water, which adds a whole bunch of new money. It is a very inflation friendly and stable asset class. You'll be able to track and profit from production.

You'll have, investors eventually will have a dashboard where they'll see, you know little wheels turning, no not wheels, but little, you know, numbers of like how many gallons are being treated that you're being paid for, right? And then the total and you and it's going to be very fun.

That can be part of the environmental, social and governance market, which is already 37 trillion dollars of assets under management and. Because we're not doing it all based on one company where the multiple companies deliver it, the financial model does not depend on that single one and it can create these secure investments.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(11).png)

Indexed Against Water Rates

Ok. Again, because I don't want to take forever at this, the bottom line is that the features of the investment are to be part of, that these water contracts, we plan to index them, index them for inflation. The investor gets 25 percent of the profits of the what's called generally accepted accounting practices profits, for the life of the program. You can enforce your royalties with these assets that you can attach. Potential digital currency, which we'll talk about. Its preferred stock in a public company. That's good because you're not subject to whatever dilution might happen in the common stock. And finally, this double equity leverage through what we call warrants. So very nice thing.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(12).png)

Stock Plus Dividends

Now here's a comparison that we like to make to cellular, because cellular bypassed, in places like Africa, completely bypassed the landlines, and it became a very, very powerful investment. Now, the thing is, that these investments in a cell phone towers did not give dividends, it was just stock. We have a combination of stock and dividends.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(13).png)

Here's those soaring rates that are really very, very important in these inflation times.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(14).png)

Like MLPs

And comparison to the master limited partnership Water on Demand has been really built in a very similar way. Clusters of water systems under the management of a Water on Demand subsidiary and the accredited investors participate in the dividends from the basket of water systems and again not relying on a single water system because that was the strength and is the strength of the master limited partnership in energy, which is that its many oil wells and gas production and pipelines also in one partnership. So it's not depending on the fortunes of a single one, which is very good. It's very similar for Water on Demand.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(15).png)

Four Stages

All right, so again, we call it our four stages of water company 2.0, the stage one is Progressive Water treatment build anything 50000 to five million to stage two, the Modular Water Systems. Water Systems in a Box™, quote unquote. And then stage three is this Water on Demand, the stage four our digital currencies that someday may even create a water marketplace.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(16).png)

Here's what this looks like. Again, I want Ken to have a chance to show this off is very, very powerful.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(17).png)

Taken Over the World

Let's take a look at some of the planning here, and I see somebody has piped up here. Paul says, "The cost of cellular has dropped over time, initially a dollar a minute." Boy, don't we remember that, don't we? Oh Lord, I remember first getting a phone in my car in the 80's. It was like 85 or something like 86, and the first month bill was $600 like, whoa, get down, like, no more chatter in the car! So what happened with cell towers, of course, is that yes, the price of cell phone minutes has dropped.

But of course, the entire world has taken over has taken over. So it's been a, I believe that this is also going to contribute to improving a lot of the pricing. I mean, who knows what's going to happen in a period of 20 or 30 years on Water on Demand? We're getting way ahead of ourselves, but for sure, it is needed and it can be profitable. Remember how about three weeks ago we had an executive from Toyota who does a similar thing in on demand cars, and he says that it improves margins by 30 or 40 percent, going from a sale to a service.

What's Been Done

Ok. Let's quickly talk about what what things have been getting done and what's coming. Phase one, of course, was last quarter tripling the book sales. We launched Water on Demand. We started using the funds to generate dividends. We started building white papers for the crypto again, which I'll cover next week. I don't want to get into it this week. It's rather we'll get we'll get into the weeds, and I don't want to do that on this overview. Ok?

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(18).png)

Expansion

And then 2020 to boom. Great start. A million dollars from Progressive Water. We're launching actively right now with Manhattan Street Capital. We have a candidate website that is getting getting ready to go, and these Water on Demand programs begin to generate assets in 2022. We'll talk. There's a secret second stage for the crypto, which we'll be talking about next week, so it won't be secret then and then we'll be choosing additional water companies. Finally, our friends over at PhilanthroInvestors® will continue to generate international participation.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(19).png)

Global

Ok. 2023. This is where we start getting close to this 300 million dollars in capital. If, look, if we get a fraction of that, it'll be a win because that's a lot of money. But it does lead to the ability to have an asset base sufficient for the Nasdaq uplist. And so we combining these accredited and the smaller institutional investors. And it's a new global asset class.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(20).png)

Suppositional

Here is what an investment can do in this offering, as you can see, because some of the what we call warrants or options are priced at twenty five cents. Things really take off at that point. But even without them, you can see that there is a roughly tripling of investment. And remember, these are all suppositional, and you must consult the term sheet. These are just, they suppose a bunch of variables which Ken will be happy to go into. And remember that things are fine as long as you're in the safe harbor of those preferred shares. And you must make the decision of when to go to common stock and take the risk of the market.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(21).png)

American Tower - 100X

Ok, so here's an example of what happened with American Tower, the cell phone play that went from, you know, gosh, it was right down there at, you know, three dollars and eventually ended up 100 times more. So, and as I said, this is pure stock. We also add to that the dividends from the actual water production.

Call Ken

Now lots of have it covered and this is where my man Ken will be able to discuss it. And he is the co-creator of Water on Demand. He was recently promoted to executive vice president for his amazing work in the last three years, and he can answer so many questions.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(23).png)

Of course, you must, must, must stay tuned on our CEO briefings because we are America's most transparent public company.

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(24).png)

Disclaimer

And of course, we have a disclaimer that we've been talking about and offering that is only for accredited investors and the SEC has not passed on the merits of these securities. And of course, investing in securities involves risk, and you should be able to bear the loss of your investment.

End of presentation

[editor note - There is a short gap in the video recording at this point]

Water Crypto

So that brings us back to our story. The water cryptocurrency thing is really interesting and it deserves an entire briefing. So without further ado, I'm going to pass on to give you again Ken's information.

Call Ken!

And we keep talking to accredited investors, and that is wonderful. But many people are not accredited investors. So what are your options? And frankly, your options are to buy our stock on the open market. Go to your brokerage firm Schwab, Ameritrade. Yeah, Yahoo Finance, et cetera, and feel free to buy some shares. And you know, I wanted to cover something about the stock price, right?

Managing a Public Company

I'm going to go off share here for a bit because this one of the things that's annoying is this thumbnail is so small that you hardly see me throughout these briefings. But you know. A public company CEO, public company does not manage by the stock price. Seems weird, but it's true.

What do I manage by? Obviously, the fundamentals, the fundamentals drive the stock over time. But if we're looking at the stock, you really need to look at how much it trades, how many trades there are every day.

The more, it's called liquidity right, the more a currency like the US dollar is bought and sold, the more value it has independent of its price. Of course, the more liquidity it has, the better the price is. But in other words, the lever to pull is not push the price up, push the price up.

The lever to pull is to get the company succeeding, get more and more people noticing it. And then naturally, people tend to buy it and that creates volume, and over time, it can create price. So all this to say that we are keenly aware of the fact that there's not enough volume in the stock, and right now it's around 250-300000 shares a day. An ideal amount of trades would be like 10 million shares a day.

That would be appropriate, and that would give the stock a lot more ability to absorb sales and so forth. Because at the end of the day, you know, you should be able to be able to buy and sell a currency easily. This is one of the big reasons why I committed to bringing in a world class executive like Andrea d'Agostini, and he, in turn, is helping to bring in other resources to repackage the company to be that kind of world class company that can be operating at that level of trades and ultimately price.

Aware of Weaknesses

So we're well aware again of the weakness of the company in this public market. I mean, it's not bad. It's not, it's not in danger, but it's low, you know, and it's just like, Come on, let's start, let's start being noticed. Another thing that we're going to do a lot is a lot more PR, a lot more visibility. You know, there's very interesting plans there, so stay tuned for that.

Now, I just wanted to make sure that, you know, you guys. Aside from Paul, I don't see a lot of people posting chats, I guess I've covered a lot in this thing and it's a great thing. So I'm going to bring you back here to this page to get to find out about...

Yes, JRW, You're right, it bounces around a lot. And the reason it bounces around a lot in its price range is, again, because when you have low volume, somebody buys or sells 50000 shares, that moves the stock price, and it shouldn't that that kind of thing just should not. So that's my answer. It's about trading volume. And believe me, that has a lot of our attention internally. But know this, we know that stock price is in liquidity at the end of the day comes from fundamentals, and we believe that is what will be reflected in the end.

I mean, we just added a million dollars in assets. I mean, almost a million dollars in assets. This is money we don't touch. We it's either left in cash in the Water on Demand subsidiaries or it's put to work in machines that we own. It's one or the other.

So, you know, and Ken wants to chime in, he says, "Our first obligation is to build a company. We've done that and we think we've done it very well. So if we're able to raise tens, if not hundreds of millions of dollars of assets in this wonderful new platform, then you would ask yourself, what do you think happens to the price of the stock?"

Well, that's even more direct than I would say it. All I know is a lot of people come to us and a lot of people come to us because they're interested and some invest. And that creates a lot of liquidity and we say, OK, so JRW says, "Thanks for the answer. At least I can slowly accumulate." And I think it's a very wise answer to just, you know, have an accumulation strategy because it's impossible to tell where you found a bottom. But you know, if we're adding, if we're adding assets predictably, then that that creates more better and better book value over time. That'll all by itself is a huge fundamental. All right. And then Robert Baxter says, "He sold in home water softener rain off big dollars." Well, right on. I love people in the water industry. They're super cool. Ok. oc.gold/Ken. He has a fascinating way to expand on everything I've said.

About Crypto

I've spent enough time already, but I want to tell you that next week we will be discussing where we're going with crypto, and you will find that really, really interesting. Now you go, Well, bitcoin is down on Ethereum's down. I don't even look, I've got a crypto portfolio. I'm like, Please don't even I don't even want to know. I'll just leave it alone because. Whatever we do in cryptos has got nothing to do with the current market. It has to do with the market a year out longer and it's really a long term thing, but it's fundamentally important for our own investors to have this packaging of dividends.

And I'll be discussing that in proper detail with the help of some, probably Andrea will come in because he's leading the charge on that. So I think you'll find that very, very important. And I do hope you'll join us. It's going to be a great show. I thank all of you who've stuck around for for this recap. It's been kind of fun going down memory lane and showing you that preposterous Bloomberg video that was kind of cute.

But here we are, and I think we have. I know we have just a world class vision that is becoming real, that we actually are coming close to a million dollars of capital. And that only only took about three months, right? We started November 1st. So incredibly well done to Ken and to all my investors, our investors who jumped in and believed you are just the best investors that a CEO could hope for.

So Bob Roos says, "OCLN shares are a bargain now, and thanks for the great job." Well, thank you, Bob, for being so supportive of us all this time. And you're one of the golden ones, so thank you. All right, everyone, I'm going to switch it off. It's been great.

And remember, if you're not accredited by some OCLN shares can't hurt. And I'm not going to say they're going to go up or down, but we're doing a good job. So thanks again. Good night and enjoy your weekend.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)

.png?width=800&name=KB%20RE%20MPL%20New%20asset%20class%20presentation%20(22).png)