We revealed the mystery graph, Fed Funds, and its effect on the markets, as well as reviewing other scary stuff! Fortunately, our production divisions are booming, which we announced as the EveraMOD Pump Station business blasting off. What's behind the boom? COO, Tom Marchesello, filled us in on that and how it connects to Water On Demand… Is this novel asset that's still below the radar not only safe, but also have the power to right tanking portfolios? Find out in the replay!

Transcript from recording

Opening

Riggs Eckelberry

We're looking at using your technology to standardize these pre funded Water On Demand™ service contract systems so that we have a consistent fleet across the country. And that should finally get us into the licensing business, right?

Dan: It does. The EveraMOD™ or the Modular Water Systems™ program, the wastewater treatment plants, the EveraSKID™ systems, the EveraTREAT™ systems that we are actively selling and delivering to the marketplace. They really set up the Water On Demand™ model.

And the reason for that is, is that the owner, these customers that commit to the Water On Demand program, their engineering teams, their construction teams, the owner — end users, they know the quality and the type of equipment that they're going to get. And it's really huge on the OpEx side, on the operations and maintenance side. And so when they know that they're going to get a really durable, well manufactured piece of equipment, it really makes it makes the Water On Demand model turn and move much faster, much more effectively.

Introduction

Riggs: Welcome, everyone, to the Thursday night briefing. Water is the New Gold. These clips that are being produced out of marketing, Kevin Pruett, Stephen Eckelberry, Josh Summers and the Monarchy marketing team are just fantastic. There is literally dozens of them and they are mining these CEO briefings and other interviews, turning them into very short clips that are being sent out. So I'm very proud of how that's going and I think we should applaud that. I love great tight content.

All right. So I can certainly tell you that Water is the New Gold. There is the October 20th briefing number 183, and yes, a new beneficial income asset. And it is out, believe me, it is. We've been showing that it can counterbalance a lot of bad news out there in the markets.

As usual, our Safe Harbor statement

and our disclaimer for the fundraising that we do.

Company News — EveraMOD Expands

All right. So we announced this week, fantastic, EveraMOD has just taken off. And whereas for the first half of the year, they're only about 10% of our total sales. October, the quoted systems were about half pump stations, which is fantastic. Now, the reason it's fantastic is because they're so standardized. These are standardized sleeves essentially that then have a pump at the bottom and Bob's your uncle, so that's some very nice stuff there.

Dan Early was telling us about how right there there's a potentially $5 Million a year customer, just one customer next year, which is wonderful news and we're staffing it up as its own division and we're looking to spin it off. This is what Tom Marchesello is working on. As here Tom is talking about how these are being quoted so fast. So really great news.

Up to 30% Lost

What's happening out there in the world with water being conveyed is that it is either lost in pipes, but even more through the pump stations, because that's the connection point. Right. And they're losing up to 30% of their revenue, which is huge, because not only they lose money and it makes the water cost more, but it makes this big impact on water scarcity. And we don't have that kind of water to save.

So. Like I said, this is a really, really great project and I look forward to once, now that we're rolling out Water On Demand, EveraMOD looks like our next incubated launch. Here's a typical look at a pump station. You can see the on the far right. It's looking inside it down through the manhole. On the middle is the control system with the manhole and then left is the same thing with the showing the manhole and how it goes deep. So that's this is a small one, but it shows how it works.

Leveraging Superior Materials

Okay. Size of market. We're looking at potentially at $220 Billion market. And we really are strong in this area. Why? Number one, inherent corrosion resistance, the leakage problem just goes away. Number two, so I have to tell you that not a lot of people care that something is going to last 100 years, except when the price is pretty good. So when you can save money and also because of these materials not being so subject to the problems with supply chains, people can get it sooner.

We've taken off on that basis alone that we're much more affordable. We're competitive, in other words, and we are also much more available. And by the way, it lasts 100 years instead of 20 or 30. So that's a really good selling argument. All right. And again, consulting engineers love it. That's kind of how we're getting all that business.

Dan: Good afternoon. I am coming to you live from one of our strategic manufacturing facilities located in Virginia. It is Wednesday, October the 19th at about 3 p.m.

And what you'll see behind me is one of our Modular Water Systems, EveraTREAT wastewater treatment systems. This is tank one of a two tank system. This system is rated at 17,500 gallons per day, and it's designed for a municipal application for a small, a little small town in West Virginia.

It is complimented by our EveraBOX™ wastewater treatment, modular equipment building. Which, you've seen that in a previous video where I was documenting that. It also includes our Modular Headworks building, flooring, contact system and our flow meter vault system. So this gives you an example of what this technology looks like. Just to give you a sense of size and scale, it is about ten feet tall. This tank one is about 25 feet long, two compartments.

Inside it is a sludge digester for sludge holding. The other chamber is going to be a flow equalization chamber. That houses duplex lead lag, alternating pump systems. And this is part of the pre treatment in the first steps of the wastewater treatment process. I'm going to flip the screen or flip the camera and then we'll do a walk around and give you a sense of some of the outside features.

So continuing on with my ugly mug out of the face, out of everybody's facing off the screen. So now you see the see the what is going to be the right hand side of the tank system. You see some of the electrical boxes. This tank is designed to, for a partial burial. And that means it will be buried about seven feet in the ground with three feet coming out of the ground. So we have a three foot reveal, gives really good operational access to the system to give everybody a sense of how we would set this tank in the ground.

If you'll notice at the bottom, we have an anti flotation collar. This will engage a 36 inch thick, about a four foot wide reinforced concrete, anti buoyancy, anti flotation collar. Inlet piping, located right there at the top for inlets and outlets. I think we have flow EQ discharge actually, this is pumping to tank number two. The six inch high water gravity overflow. Again to give you another sense of the size and the scale of the system, the materials of construction are UV resistant, virgin resin, polypropylene, plastic.

We have a finite elemental analysis design used to design the tank system and the structural members, and that ensures that we have a very robust tank for final installation. And this here is the end of the unit. While you can't see it, we do have a skid resistant top with all the access hatches, vents and electrical penetrations. So again, tank number one with tank number one of our EveraTREAT wastewater treatment package, 17,500 gallons per day system.

Start of interview

Riggs: That is very nice. Yeah, a lot of technical terms there, but I thought you would still appreciate it. This is just the tank for a 17,500 gallon per day system. All right. Let's jump back in here and talk a little bit about Tom Marchesello. I interviewed him earlier this week and he gave me an update on OriginClear operations. Mr. Tom Marchesello, how are you doing today, sir?

Tom: I'm great. How about yourself?

Riggs: You know what? I'm actually super, super excited about how things are going. It turns out that we are the answer to people's portfolios because everything that's pre-existing stocks, bonds, commodities, everything is in this weird mode where it's gaining, losing. You don't know what's going to happen next. Nobody knows what to invest in Staying in cash. You lose all your, you lose everything to inflation and it, but a novel asset doesn't have the baggage. And so we can actually create gains for people day one by being founders in Water On Demand. So Ken and I are having a great time doing this and so you're, of course, on the side that has to deal with all the heavy promises that we make.

Tom: Thanks a lot. Yeah. No, no, it's actually funny. You know, we're like victims of our own success. As you, as you succeed and you get more interest, and we have to build the business and grow it. You got to work harder. So I'm like, Oh, yay, We got to work really hard. But then you kind of laugh about a little bit because that's the kind of success problem you want to have, right?

And those are the kinds of things you can manage your way through or hire your way into better support and staff. So it's interesting. It's challenging, it's ironic. It's, a lot of it goes back to like MBA school like, you know, you read about it in the book like, "Oh, we're going to go through this experience" and you're like, "Oh, I'm actually living that for real. Oh, my God,"

Riggs: It's so amazing, huh? No, believe me, by now, I'm like, Oh, this is a new adventure.

Tom: That's true.

Riggs: So let's dig into it. You've got basically three activities that you're on top of these days, Progressive, Modular Water and the new Water On Demand line. So let's start with what's going on over at Progressive and how those guys are doing in Dallas.

Tom: Yeah, Dallas guys are crushing it. They, tell you what, that business, we had a incredibly strong year last year where we're building the business up and getting all the sales line up. And then of course all that work really hit this year. So this year has been just heads down, jamming constantly, really since the beginning of the year, since February, all the way now. And we had one of the busiest summers we've ever had down there where we literally ran out of shop space.

We had no more floor space to actually put another piece of equipment for a while. And we're just in the process of just trying to get projects done and out the door and shipped out so we can then drop the next project sequence in. And that's really what we've been doing. So it's been a lot of very hands on stuff. Had do even switch a couple of the roles of the guys just to put them really on production, just to get those projects done and get the next wave of projects through the cycle.

Riggs: Well, and also you've got supply chain issues, which means you've got some half assembled thing waiting for a particular part.

Tom: It's been very frustrating. We, the guys really take it personal too, because they're so personally driven to succeed and do a good job for the customers. And we, we hate to call and be like, look, we're late on a project by a couple of weeks because this part simply didn't come in. You can have $100,000 worth of equipment and we're waiting on $2,000 worth of this little tiny part. And it's really just, just gets at you, you know, kind of.

Riggs: But so far, I've been hearing that the supply chain issues, while they're a pain, they're not, they're not unsolvable. I mean, they're kind of being handled.

Tom: They resolve themselves over time. Like everything else. You know, we've reached out to new vendors and new supply chain partners. We've switched some parts out. We re-engineer a few things to make it work efficiently with some other type of vendors. A lot of this is just a reflection of the markets and the time you know, you're still dealing with all the overhanging effects of the past. It did get better. This summer, though. We did see some lightening of some of the process. We've seen some better pricing on some commodities.

Riggs: Really? Wow.

Tom: Yeah, things were getting a little bit better in a couple of areas. We actually found things like filters. We buy a lot of filters and membranes. Those got better. We got better pricing, we saw more volume of those things. We didn't see the lag time as much. So some of that's been improving.

Riggs: Well, that's good news. And then now Modular Water has been on a tear. We just announced how well we're doing with pump stations. It's now become a significant piece of our, of our quotation backlog. So looks like Dan is having fun with that. What else is happening? There's been some hires, right?

Tom: Yeah. Yeah, we did really good. We built more of a team around Dan and the business model there. So we had the engineering really tightened up. We had Dan really leading properly. We provided more support, not just on the engineering side, but also on the administrative side, on finance. And now what we have is, we've added Mark and Robb and Bill to Dan's team.

So now I've got really established engineers and project managers who are very organized. We improved our process for how we move products into production and we monitor all the tasks and activities from procuring the parts to building the product. We have a really nice project management tool kit now so we can quote the products better, so we're more tight on our margins as well as our expenditures and then get that all into the finance department. So we send our bills out and collect our AR, AP balances. That's always a work in progress.

Riggs: It's a busy times over at Finance. I think Prasad is like a one arm paper hanger right now.

Tom: I feel bad for him because I'm always like, Hey, I got more work for you. He's like, No, really? Like, yeah, it's like, but it's good. Like we just literally booked in a very big project the other day. I mean, it was a really lovely upwards of 200,000 project and it's a good win for us and it's a good customer and they're solid and strong and that's the kind of work we want.

Riggs: Yes. And it's, we've been able to actually, it's always been the problem of dealing with hard money lenders because they're really rapacious is the word. But now that we've got an internal facility and we know, our Water On Demand investors are going to be very happy that we're generating revenue from lending internally. And I think that's, it's a good way to go. It's fair market rates. Everybody's being treated right all around. But we don't have that that horrible sort of, you feel like you just covered by a blanket when you have some lender, right?

Tom: Yeah. You know, borrowing money is always a tough thing, right? Yeah, you don't want to take bad money. So, in the way that you've placed this facility in place, we have good money to work with and friendly money to deal with. But the key on borrowing any money is you never take money you can't pay back.

Riggs: Right.

Tom: So in this case, as an operating business, we know we're collecting our money. We know we have the sales, we know we have the ability to cash flow dollars in and pay the money back. So when we're borrowing this money, we feel good about it only so much because I know it's backed by actual real projects and real invoices and things will be happening. This is just time. How long will it take? Will it be two months or four months on collecting that, right?

Riggs: Exactly. So that's, that's the intention for this internal lending facility. And I'm glad it's helping. I wanted to share screen and move over to Water On Demand itself. This is a memo you wrote, gosh, over a month ago. But I saved it because it was really the first time we sketched out a standardized product line. Would you like to just briefly tell us what we're looking at here?

Tom: Sure. Yeah. So at the time we were talking about just growing the Water On Demand program and how best to position this in the marketplace. What we knew is that a lot of the work that you had originally done would bring in Modular Water and Dan, and standardizing our products then had to get into, which is our best products that we have within that category that will be most likely to be a perfect Water On Demand fit.

And so we we saw that as an issue of sizing and price, right? It's usually the balance point. So I was saying, hey, let's go lead in the market with our MVP, our most valuable product concept. And that would be kind of this wastewater product that sits in 100,000, 200,000 price range and deals with the 5000 gallons or 10,000 gallon treatment systems.

These are things that we sell often, and they're easier to put together. They're easier to get out the door. And we've been actually having success selling them and they've been going to commercial and real estate oriented kind of end markets, just like that campground process or some of the other ones that we put in place, great containerized systems.

What we saw there was as we were working with the rest of the team, it's then how do you put that into the financial package to make this offering really enticing, really good as a Water On Demand financing package? And then we were saying, well, then the next step up from that is your bigger version of this essentially. This is our core waste wastewater product. That's kind of where we started, right? Because that core wastewater product was, we're so darn good at.

And that's the stuff that from the market standpoint, when you really go out to customers and you talk with engineering firms with these good sized projects. They're really looking for these 10,000, 30,000 gallons a day water treatment systems. This is going to hit the majority of those commercial real estate developments and or small industrial commercial markets. And it's really what they need very desperately in the market.

The good news is you can price these efficiently in the price point we have here, or you can even really scale these things up because you want more treatment, you want to deal with more toxic stuff. I mean, these can scale up in price, which gives us the opportunity to make more money in a Water On Demand business model by adding pre filtration or post polishing or something of that nature. Yeah.

Riggs: And then there's that third one, which is really that new product that we're putting together, pioneering with that hotel chain.

Tom: That one I'm was excited about.

Riggs: How many years ago, you and I?

Tom: You and I were sitting in Hollywood at that cool hotel having, having lunch with the team there, and we're like, "This would be great. We're really excited about this." And to have really marshaled it all the way through the system to where we've installed one. Now, we're working on the second one and there's a third one in the mix. It's awesome. I'm so happy about the the pure drinking water system.

Riggs: What's interesting is the evolution of the market. Of course, forever chemicals have become hugely important. The project that we installed earlier this year did not have that module, but now the second hotel does and will probably end up retrofitting the first hotel because everybody's concerned about the PFAS, right?

Tom: I read about all the time. Forever chemicals are forever and they're forever scary, you know, It's even like even at a home level. Like my wife is always talking about, "Have you heard about this, these forever chemicals? Should we have water filtration?" I'm like, laughing. I'm like, we do this professionally and like, having to talk about it at the dinner table is entertaining. But the truth is, it's so, it really is important.

And whether it's taking those chemicals out or other, other microscopic chemicals like arsenic or mercury or whatever, it's like, I don't want to be drinking weird stuff, right? However, I can protect myself, I'm interested in. To be able to offer that now on scale to an entire building, a hotel. So when people are visiting these hotels, they feel happy, safe and confident that they're drinking the best clean, purified water. That's like a peace of mind. I mean, what's that worth?

Riggs: It's really, it's worth it's worth peace of mind. And that's priceless, of course.

Tom: Exactly.

Riggs: Right on. Well, that's great. So that's, that's the DBOO, design, build, own, operate activity, which is how it's known in the trades, which we've brought on.

Tom: The teams really been working incredibly hard. As a matter of fact. Like, you know, it's we've got to keep building a little bit more around them. I've got a couple of hires out to get a job. Breaks out there to build up another product manager, another production manager. Got to get some improvement in procurement. So there's definitely some key, key roles we're trying to fill. And a lot of this is also in preparation for next year, right? Because you not have been talking about plans, got big plans, and now it's time to get to the juice, right? Ready to squeeze those oranges.

Riggs: Oh, yeah. And as I was telling you before the interview, I'm, I really think it's time to do some more mergers and acquisitions in order to kind of control our own network of fabrication. And in fact, you were also going to relate how, because of how our our node in Dallas is so packed up, you're actually diversifying fabrication, right?

Tom: Yeah, we've actually taken a few different steps. Like there are certain things that we're fantastic at in Dallas and then there are certain things that we're like, they weren't really our core capability. So what we did is we looked at that and said, you know, there are other specialty third party manufacturing spots that have some specialization, whether it was control panels or plastic fab or steel framing.

And so I was able to reach out to some other fabricators to enhance our ability to do other work in other locations. So I know it sounds simple. It's like, of course, your third party sub, but why this matters so much for us is because it also means that internally we had to be at a stage where our engineering was so good and our documentation is so good that we can hand that engineering package over to a third party and their engineers can look at it go, I can make that, and then they're able to take it in, give us a quote and actually produce it and send it back the way we want. And I can tell you, we are that good. Our materials are that organized now.

Riggs: Wow.

Tom: We can get quotes back and we get the. Work done properly. So it's a really good spot for us to be in right now.

Riggs: Well, this is how the car industry grew and basically everything was subbed out and the assembly plants are just that too, just assembling components that come from all over the world, really.

Tom: Yeah.

Riggs: I love that you're doing that. It's excellent. So I'm glad you're overworked. It's really good news.

Tom: Thanks, not much sleep. But you know. No, no, this is what we want. In order for us to grow, to make money at the scale and get better margins and supply chain, all that stuff. And you get you got to do some things different, right? You can grind it out in one spot or you can try to specialize a little bit and tap into some more resources. And we're going to have to continue to do this. We have to continue to grow. We have other things we're trying to do.

I went on a bit of a a biz dev track where I started identifying partners who we really wanted to work more closely with, who had great skills and a little bit more capacity. And we're right now we're actually about to place another order into one of those locations where we're going to really test out how good that third party production is to get a couple of our key pieces made right. And a lot of that stuff eventually comes back to Dallas for final upfit and so forth. But some of the materials, we're almost at the point now where you can produce it at the third party site, put on a truck and drive it straight to the location. Not have to bring it back in house.

Riggs: That's really good news.

Tom: It does take a little travel on our part, though. I've had to send my engineers onsite a little bit, but that's okay. They actually like it. I think they have a good time. Test out different barbecue in different cities so I think they're for it.

Riggs: Very important. You know what the, it sounds like all over the Midwest, you got to try out the different barbecues, right?

Tom: Yeah, I went to Kansas. They had some good barbecue out there.

Riggs: Ooh Yeah. Oh, yeah, for sure. Well, young man, thank you. I think it's very exciting what's going on. I know that it's a constant battle, but I think you're doing a great job. So, Tom, thank you very much and look forward to getting another update. I think probably around the time of the quarterly filing, which is the 15th of November, less than, less than a month away. We're anticipating that, you know. It's getting pretty good and so we'll touch base on that.

I think, I think we know because Prasad's done a great job of getting the numbers month by month as opposed to finding out literally on the day of the quarterly filing. So now we have a good, we have good insight. And so we'll have another discussion right around that time and report to everyone how we've done.

Tom: That Sounds exciting. I appreciate it. Have fun. Be safe down there.

Riggs: Thank you. We work on it. Fortunely, I think that the hurricane season is over. Pretty much.

Tom: So. It was super, super weird. I swear that thing was coming straight at you, man. It was coming to Tampa. I was like, uh-oh!

Riggs: Wasn't it? I was like...

Tom: It just turned and went south, I was like, "Oh, man, that was bad."

Riggs: And then, what I saw happened to Fort Myers and Sanibel and all that I was like. Oh, Lord.

Tom: So we knew a lot of people that were impacted, friends, family, even, even people who we work with. They were all like...

Riggs: Well, you lived there before, before you moved to Charlotte.

Tom: Well I did, I lived down by Venice, you know, Sarasota area. And like, literally like, my parents stayed. I don't know why they did. But they were out of power for like a week straight. Luckily, their house didn't get hit or nothing. They were fine. But, there were days where we were like, just calling and texting and nothing. It was like eerie silence. It was like, "Are they there? We don't know." But then when we started hearing back, as people were, finally, like some of our friends that were down in Bonita and and Fort Myers and Naples completely lost their houses, apparently like nine foot storm surge thing just came in, flooded that thing out and took it away.

Riggs: Oh, my God. That's crazy.

Tom: Yeah, Super bad.

Riggs: Well, I'm glad you made the move out of town just in time. So I think you must be counting your lucky stars.

Tom: Yeah. Knock on wood.

Riggs: Right on, right on. Well, Tom, again, thank you very much. And have a great rest of the month of October, which is the first month of Q four, and let's see how we're doing on November 15th.

Tom: All right. Looking forward to it. Bye.

End of interview

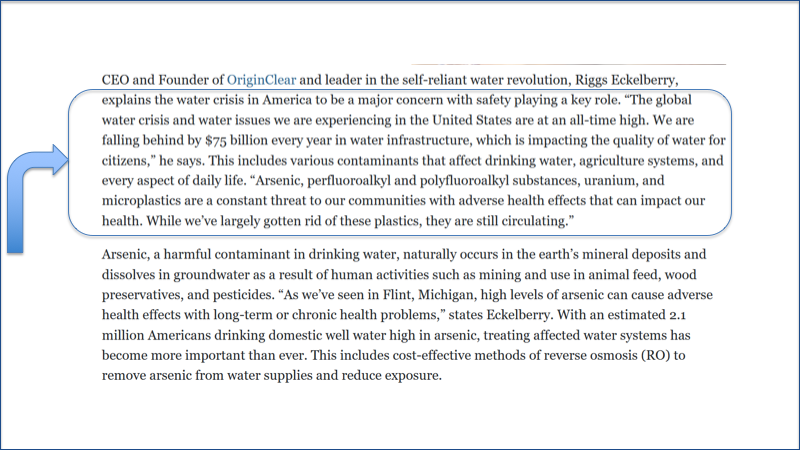

Riggs: Because Tom mentioned the Forever Chemicals issue that we're now dealing with and incorporating in the new pure water product I thought I'd bring back, this was back in September that we were extensively quoted in the premier water trade, Water Online, talking about the quality of the water being affected by these forever chemicals.

Uranium is one of them, by the way. Arsenic is a big problem and 2.1 million Americans actually drink domestic, wellwater, which people don't realize can be high in arsenic. And PFAS, and what these things are like Teflon, carpet treatments and so forth, dental floss, I mean, come on. Anyway, so that all has to be taken out and we now have that ability.

So with that, I'm just going to jump into some commentary here. First of all, I tease this a little bit with the CEO update.

Fed Induced

First of all, let's take a look at what The New York Times has to say. Yesterday, I picked up this copy when I was at the grocery store, and they are saying with that the Fed is not letting up and policymakers are alarmed by rapid price increases which are being fed by the Fed. Hello.

And sure enough, here is the story that basically they're actually going to go higher than previously forecast. They're going to just kill it till it's dead. Right.

Keith Roeten, "The Ford Motor Company of clean water." I like that. Very nice. I think you got the picture with the assembly line stuff happening in Modular Water. Coletta Sharp, "Peace King." Thank you. Thank you. All right,

Now, here's an article that's very interesting. It's in ZeroHedge. And Kathryn Austin Fitts was the assistant secretary of housing for the first Bush. And she's been sounding the alarm. Very smart lady. And here's some of the things she's saying.

"The Fed will defend the dollar and the world reserve currency status, no matter how hard the stock market crashes, no matter how much the economy crashes, no matter how much the bond market crashes, and no matter how much the housing market crashes."

Look for Novel Assets

Well, there's not a whole lot of other markets once you take care of that. So what I'm saying about that is, in the scenario, of course, no existing asset is safe and even cash gets inflated. And this is why investors should look for novel assets that are still below the radar. And that's where I'm talking about, the emerging wastewater treatment market, which is being done on service contracts using the water of the service concept, which have some big players like JP morgan Capital and VC's, but uniquely and only in OriginClear can you invest directly without being JP Morgan Capital or a VC. So that is very interesting.

Tracking the Fed

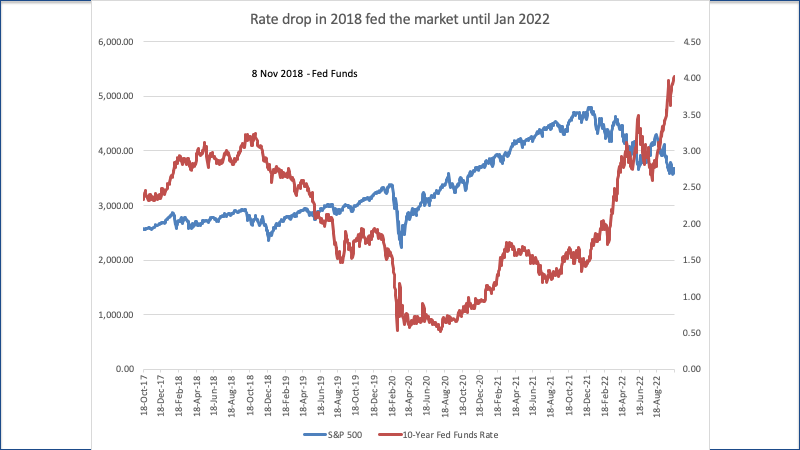

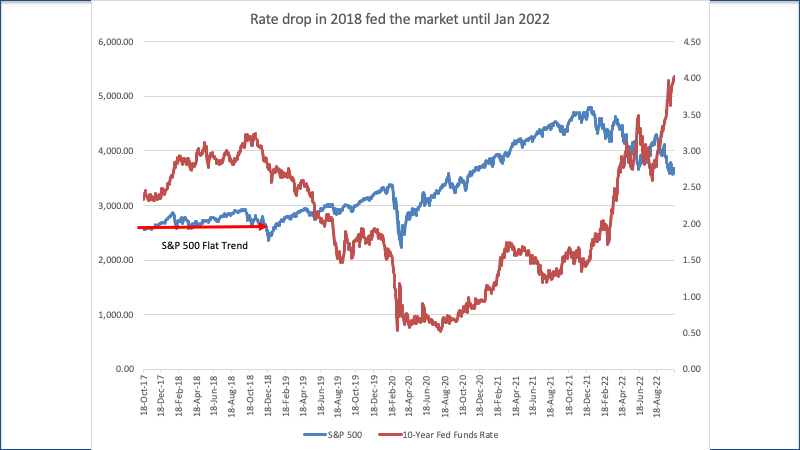

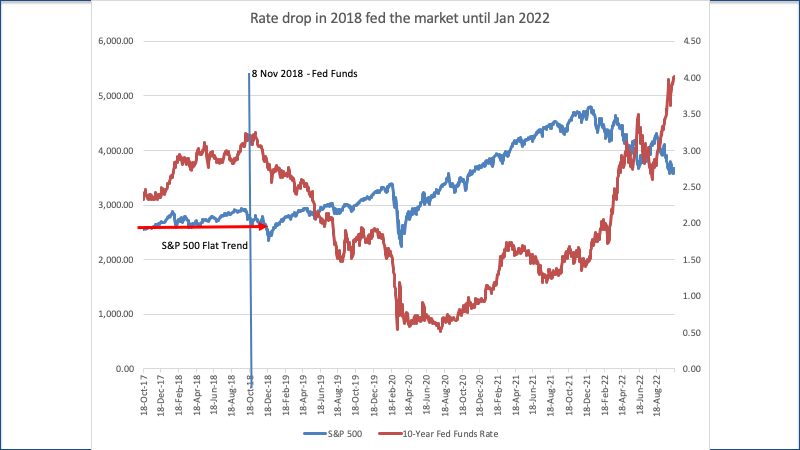

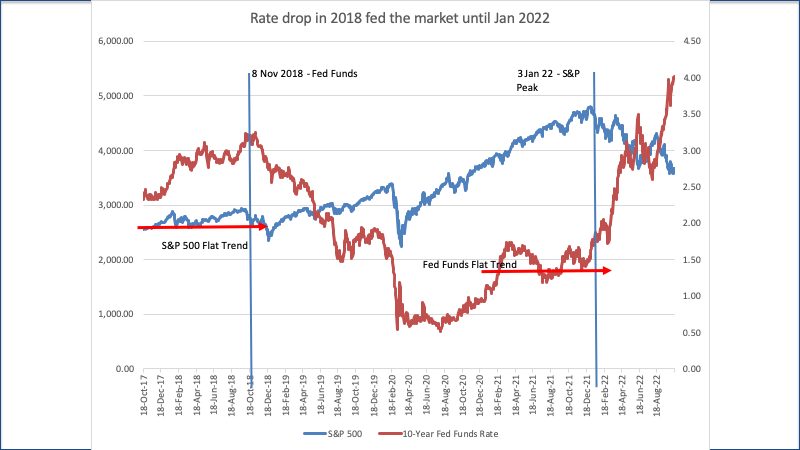

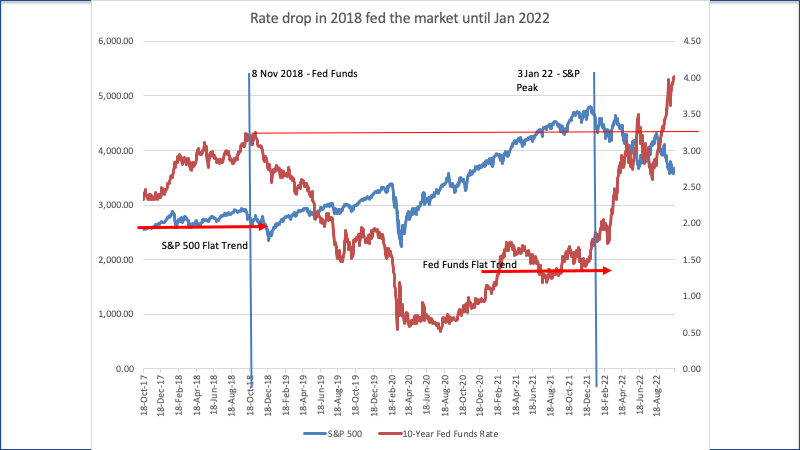

Now what is the elephant in the middle of the room? I'm going to take a look here. So we have here the red is the Fed funds rate and it topped out right there.

It was flat up until about October 2018. Well, November and Thanksgiving, really.

And that was also the high point of the Fed funds. I remember very well there was a lot of commentary about it because there was pressure on President Trump to do something about it. And he tried. But nonetheless, the Fed funds started going way down. And at the same time as they went down, the S&P 500 went from a flat to an up going trend.

And then we see it once again. The Fed funds go flat, which starting in basically early February. Maybe January. It just went flat and then they started taking off big time. So that was February of 21.

February 22. They started really taking off right there. Three Jan 22 That was the S&P peak. And it was also when the Fed funds came out of that flat trend and started taking off.

And right here you have the high of 8th November 2018 being reached somewhere in June of this year and taking off beyond. So we're just in a whole new world. And of course, the S&P 500 is showing that going down. So we know that the stock market is very, very sensitive to the Fed funds.

Defending the Dollar

And what we know is that the Federal Reserve is determined to defend the dollar. This is, we're seeing all kinds of actions worldwide to basically suppress other currencies. I know the British pound is in deep trouble and the euro has flipped from being worth more than a dollar to being far less than a dollar. And again, that's due to the induced energy scarcity that's occurred. Whatever you think of the war in Ukraine, it's pretty self inflicted wound to actually cut your own throat. But that's actually intended. I'll show you that in a second.

More Scary Stuff

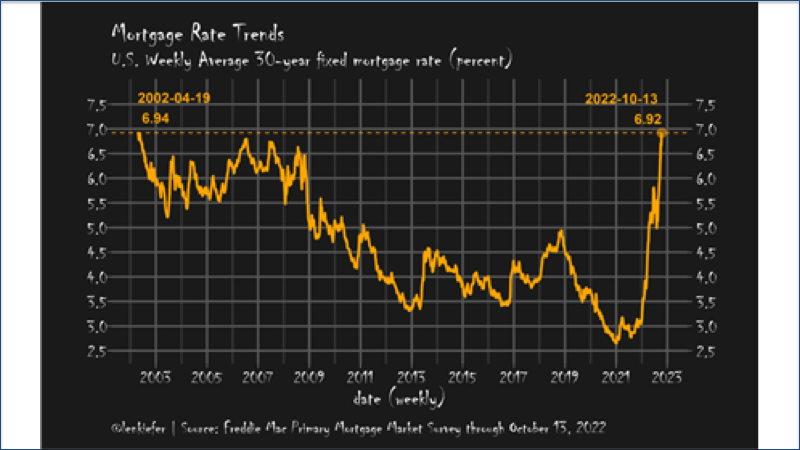

So here we have more more scary stuff. Mortgage rate trends are now on the 13th. They hit 6.92%. It hasn't been that way since like 2002. Looks like 2000. April 19, 2002 is 6.94. So we've gone the full route. We went all the way down, down, down, down, down. But what's scary is how fast it's rising, right?

Renters Surpass Homeowners

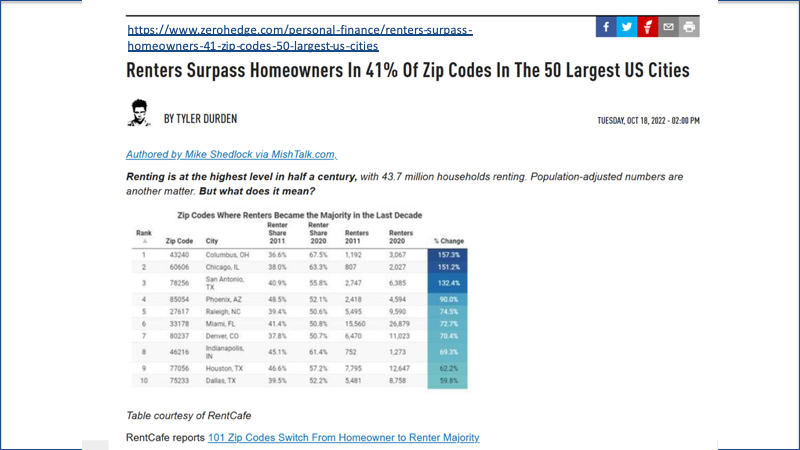

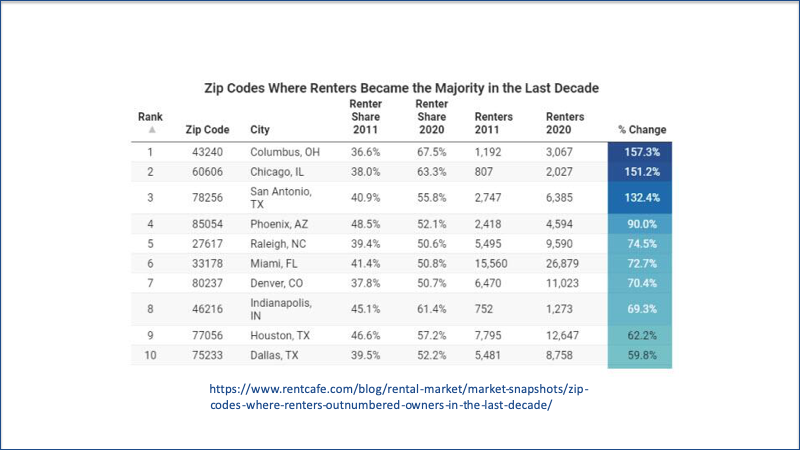

This is an interesting stat. Renters surpass homeowners in 41% of zip codes in the 50 largest US cities. So zip codes all over the country, really. Miami, Denver, Houston, Phoenix, Chicago, everywhere really. And taking a closer look at it, you can see that the percent change in renters is crazy.

Look at those percentages. So we've had a boom in renting, which means people are not able to buy, right? It's been going on for some time.

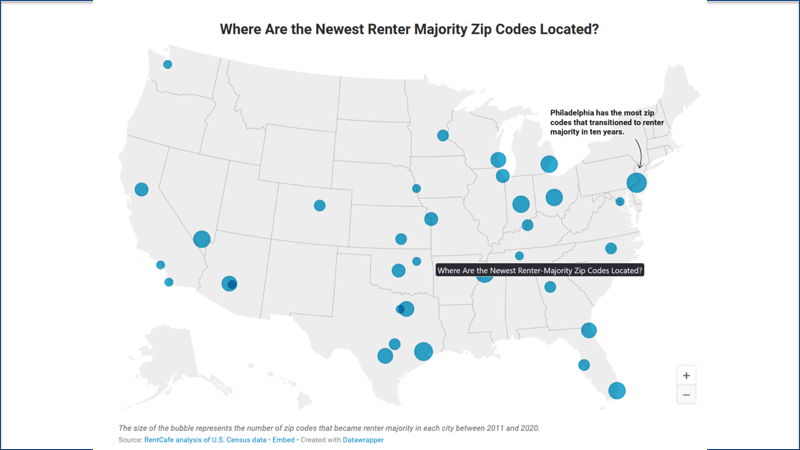

There are the newest renter majority zip codes. Philadelphia has the most. The transition to renter. But notice, in fact, even the area where where I live, right here at Tampa Bay, it's it's got that, too. So it's pretty much all over the country. But we can see the big bubbles is where it's really happening. For example, Las Vegas, Houston, Jacksonville. Iowa and Illinois. Not pretty. Not pretty.

Elites' Agenda

Now, meanwhile, Bill Gates says it's really too bad about the global energy crisis, but it's good in the long run. Well, thank you very much for that. What they're saying is, well, it's really bad that the energy picture is hurting people, etc., but we have to go there anyway. So we kind of have to stick with it. Clearly, he is not somebody who is having to put on extra layers of sweaters to stay alive. Personally, I think it's mad to use the politics of scarcity to bring about this change because it's being done by hurting people. But it is what's happening and it's going to continue. That is what the policy is of elites that are trying to move us beyond fossil fuels.

Now, remember, I this company used to be in the business of replacing fossil fuels with algae as a biofuel. And I strongly support getting rid of fossil fuels. But you do it by replacement, not by just getting rid of of energy and just shutting everything down. So that's kind of how it's going. And I don't think it's going to stop. We have to be well aware of that.

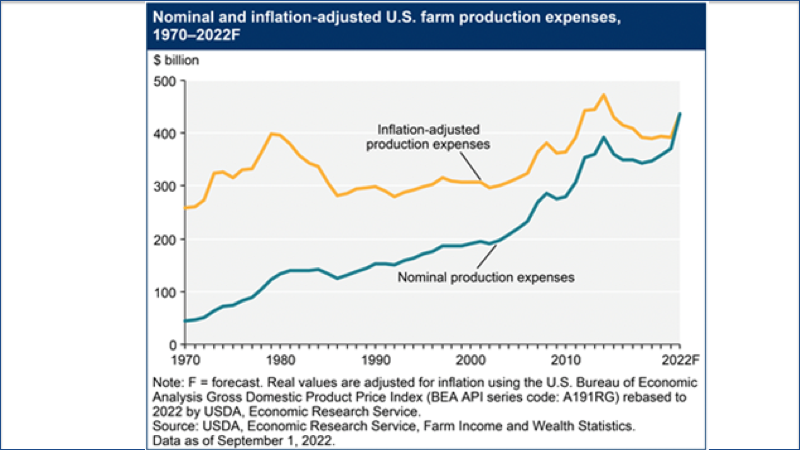

Decrease in Profitability

Now, here's a really fascinating, this is a scary stat. It looks like farms are no longer making money. Look, the nominal production expenses is just showing how they're rising. And then there's a second one which shows how it is inflation adjusted, meaning that it's being overcome by price increases. The problem is, is that they can only charge so much and people start buying. So they're kind of stuck, right? Like if I go to the grocery store, yeah, I'll find a dozen eggs at $7, but I'll also find them at 250 on deal. So shoppers are looking for those deals and that's kind of how the supply chain is staying alive. So I don't think it's a great trend myself.

Crashing Retirement Plans

And finally, we have a problem with retirement plans, which are really at a bad place. So 401Ks, by the way, 135,000, not a lot, but that's what people had. And now it's worth a lot less because of stock market going down and also inflation. And so the combination is harming the value of 401Ks. Well, I'm going to invite the man himself on board to discuss these trends and not a pretty sight.

Freewheeling Discussion

Ken: I suppose you were talking about me being not a pretty safe. That's okay. I turn the camera on anyway.

Riggs: No, You're a pretty sight.

Ken: Thank you. See, I was fishing. Thank you.

Riggs: Jesus. Let Amanda do that. You know I'm not here to, to give you...

Ken: Why would she do that? I'm married to her.

Hedging One's Losses

Riggs: Anyway, but you know, the thing is, all this depressing stuff really says that a lot of hurt is baked in. And what I think we know is that all this stuff eventually recovers. But in the meantime, you have to somehow make your way through it. And that's why last week we showed that great spreadsheet with the the comparison, the portfolio comparison.

And for those of us who are new to this, who haven't seen it. Here it is again. And so making a few assumptions there, kind of like drew a picture of what it would be like. And this comparison uses artificial assumptions. Artifical, as I spelled it, Please rely on your own calculations and forecasting. So looking at overall, I think a loss overall by one year from today of 34% is fair overall.

Ken: I'd love to have lost 34% so far.

Riggs: Right. No, I'm trying to be conservative here.

Ken: Of course.

Riggs: The overall loss from inception, -19%. Now, if you factor in the series Y investment of 100,000 against that, then we have roughly a tripling of the price, 200% increase, and then a further 100%, which makes it from 100,000 to roughly, basically six times. And that makes it so it's not -19, it's positive 25. And even if the price remains the same as the present, a year from today, which nobody plans for it, but if it remains at $0.03, we will still be ahead. Well ahead. And so, and taking a -19% to just -1%. So it's a really good hedge. I guess you might say, that Water On Demand is a hedge fund.

Ken: It's a hedge. Yeah. There you go. Okay. So I actually walked a couple of people through this week. And believe it or not, it's funny because the scenario, their personal scenarios were very, very close. That I said, "Does that look about right?" He goes, "Oh my God." He goes, "Yeah, it looks really..." So just by kind of using your best guesstimate, you know, the portfolio size, what they were down. These were conservative investors. And what we averaged was about 11 or 12% in Water On Demand actually got them ahead.

Now, the preferred aspect of the OriginClear grant also assures that no worse than stock price today, right? So in other words, it's not like, well, what if I go on the market and it's... No, that doesn't happen, right? We keep it in preferred until we see the positive movement. So what I was able to do is take two guys with $1,000,000 portfolios that were down about $300,000. And with one action just they will hold. Oh my gosh, they were, they were very happy. And the way we're going to be designing this in our site with that, with that beautiful online, that online calculator, I think will allow a lot of people who are all thinking the same thing as us. Where the heck do we put our money?

Immune to Demand Destruction

Look, $4 trillion of wealth was lost. That's an insane amount of money to lose. And some people at a certain age don't get to recover from that. Right. So what we're going to do is, we're going to make sure that we, look, Ed Dowd was saying, and I think Ed Dowd is brilliant, he basically said, "Look, even when there's blood in the streets, there's always some opportunity." And I extended that comment by saying everything that is dying right now is suffering from what? Demand destruction.

Riggs: Right.

Ken: Right. Find the one asset that can, that's immune to demand destruction. And you and you were listing off all of these. You said stock market, well what Ms. Fitts had said. You said something along the lines, let's see, I think I wrote it down. Oh, there's not a lot more markets out there than I know of. Well, I do know one. Water as an asset, water as a service.

Singular Wealth Opportunity

Riggs: Right. Because it's just, you know what it reminds me of is when, at one time, AT&T was the entire telephone market, 100%.

Ken: Right.

Riggs: And then what, what got pulled out of it made huge gains for the people like, remember MCI, all these companies, just.

Ken: the baby bells. You had Ma Bell and then you had the baby bells.

Riggs: Yeah, exactly. So they're the Baby bells. And but also that was regulatory. So, but in addition, there were commercial businesses and of course the mobiles, so forth came out of the AT&T breakup. So, when you have a breakup like this, there's tremendous gains to be had.

Ken: Right. So, AT&T could never grow at 1000 fold in the next decade. However, splitting up the individual business units that have unique areas in the market and making them and they're tiny by comparison, all of them can grow at 1,000% in the same time, in that same time period, Right? So it becomes almost like a like a magnifier. And I think that that's what, with our business unit spinoff strategy. I think that that's part of what we're trying to bring to the market.

Riggs: Who was it was McCaw. He built a private line in Texas at the private telephone line, and that became a court case that he won. And that was the beginning of the end for AT&T's Monopoly.

More on Farmers

By the way, Paul Fetscher says, "Piece on Today magazine," I assume it's USA Today, "Farmers margin has been wiped out by increased energy costs." I just pulled it up. But it's a YouTube. I don't want to play it right now.

Ken: So, the only farms that are surviving are the small local, kind of locally based farms.

Riggs: Wow.

Ken: Because the transit costs. Right. Transporting large. That's, that's killing, that's killing margins.

Riggs: But I blueberries yesterday they came from Peru. I don't know what's going on. What you have is they won't be coming from Peru. What's happening is you have locked in contracts that are still bringing those blueberries.

Ken: Was probably purchased months ago right? At a vastly different.

Riggs: Right.

Ken: Like a futures market. Right. So if you bought fuel a month ago and it's delivered now, you think you paid less, but it's actually you paid the market at the time. Just like gas stations are pricing in replacement cost of fuel. That's why prices go up and gas station prices go up even though they go, well, the gas that's in there. They have to they have to price in replacements. The same thing with meat.

Riggs: So I also, as Paul says, "Running the tractors still costs money." Right?

Scarcity to Come

Ken: All of that, So all of the all of the concentrated animal farm beef that you're seeing right now is last year's harvest. They have slaughtered all their herds because it was too expensive to feed them with fertilizer and feed and diesel. Alright? It was just too expensive. So there's going to be, you know, you have this right now and then you're going to have that major drop in available beef. And that's just going to be one of the things.

Then it becomes super real to people. You know, a lot of people are still able to go to the supermarket, like you said, find the, find the steak on sale, find the eggs on sale. I think those those opportunities are going to be fewer and far between. At the end of the day, all of this is whether it's organic or mechanical. The demand destruction is what created all of this. Water, as long as there's life on Earth, demand for water can only go up.

Saving Your Portfolio

Riggs: Indeed. So, you know, in terms of our strategy, we are really taking this story, this online calculator concept, and we're rolling it out widely so that really we are the saving grace for investors. People need an exit door so that they can go, you know what, I'm just going to put this other stuff like under a Chernobyl cap, you know, it's just going to be capped. I'll just leave it alone like what I've done with my crypto. I'm like, "I'll revisit crypto in a couple of years." So but it's okay if you're making money elsewhere, your average is good, so you're not worried. It's like, okay, fine, whatever.

Ken: Here's the thing people want to average down in the market, but they don't know how to find the bottom and they don't know when the bottom is. Or maybe they've exhausted all of the risk capital that they want to. By essentially averaging down your entire portfolio and bringing it whole today. But with one, that's why I got a I got a lot of, "Thank you. Thank you." I was like, "No, thank you." It's like, "No, thank you." Because what we're able to do is the way this thing is structured, it's it's multiplied already by virtue of how it's structured. It's very, very unusual. So $100,000 investment, I think you showed in the calculator, it was like $300,000.

Riggs: Sure.

Ken: Right. So you're just adding 200,000 to your portfolio without putting in the capital. And that's a breath of fresh air, which is...

Riggs: That's the immediate one. That's without counting...

Ken: Forget about the long term, right?

Riggs: Yeah,

Ken: Right. That's today. That's, and that's in stone because of the structure and the preferred with the price protection, right?

Riggs: But this is how hedge funds work right?

Ken: Yes.

Riggs: Because they bring countering investments, they say, "Well one things going this way," let's say for example, energy prices go up so it hurts farms, "But hey, let's jump into an energy producer." Right? And so the hedge fund takes advantage of the tide running the other way for other sectors of the same thing. And that's what we're doing here. We're basically hedging people's portfolios.

Ken: It's why airlines buy fuel, fuel futures, Right. I mean, so they can they can you can buy a ticket and still pay that amount even if fuel doubles because they've made it up in their futures. So we're essentially doing that.

Riggs: No, no. Delta bought a rest stop operator on the freeways as a counter, right? Because everybody is driving. Everybody is driving.

Ken: That's true. That's true.

Riggs: You buy something completely offsetting. Kind of what I'm getting at.

Tom: Yeah.

Getting the Word Out

Riggs: Good. Well, fascinating. I'm very excited about this new direction. I think that we are the answer. We just got to get the word out and we're getting good at that. We're getting really good. I'm very pleased with how we're doing now.

Ken: Our marketing team is killing it. Very, very pleased. Hopefully we'll have some we'll have a large megaphone next week,

Riggs: Correct. Correct.

Ken: That'll, that'll get, that'll get traction.

Riggs: Castle Placement is going to be putting its system up and also I hope to be filing the Regulation A offering by the end of the month. What we've been working on is, is really the God is in the details at this point. They know how to price. It turns out it's harder to price a private company than a public company.

Ken: Because the market price is the private or the public company. Right. The you want to read Jamie's or.

Audience Participation

Riggs: That's too funny. James Wright says, "I'm waiting for water to be so scarce that the plants expand their consciousness and start capturing humans to use as their water source. Finally getting back at the humans for all the planetary destruction." I think it's poetic.

Ken: That's like, it's like a science, that's like a Soylent Green science fiction thing.

Riggs: No, it's the Day of the Triffids. Day of the Triffids.

Ken: Yeah, right, Right.

Riggs: That was the book.

Novel Asset Class

Ken: So. Put to put it plainly. If you're like me and you're wondering, you have that analysis paralysis, right? You want to make a move. You don't want to make a move. By entering this novel asset class at a time where it has the maximum built in upside, it's really, really timely.

Riggs: Right on. I'm not going to say this person's name because he's saying something that I don't want to quote him on, "I would like to say I truly believe in what you guys are doing. I see a lot of things online on people trying to contradict what you're trying to do. Like, water will always be there. Sure, of course. But they don't realize water can be polluted." And as I pointed out, 30% losses in through leakage, etc. "And it has to be cleansed or cleaned. Keep up the good work. And I'm also looking to invest in this company by the end of the month or early November." Bravo, sir.

Ken: Outstanding.

Next Week

Riggs: With that, I'm going to thank everyone. We have a report next week from Ivan Anz, who's touring South America getting huge mainstream media down there. And by the way, South America is a place that I believe has tremendous potential. I think the whole global South has tremendous potential. But we're going to hear from him. The point I'm making is that Ivan is truly spreading the word. The video I shot yesterday with him is going to be published next week. So we're going to wrap it up. Thank you. Everyone it's briefing again.

Call Ken

Ken: invest@originclear.com Marcus.

Riggs: Or simply talk to Ken, which is just to repeat oc.gold/ken.

"If or when it really goes global with the company, or may I stay with us because I'm going to be an investor, how do you see the stocks that will rise? Only because I'm looking to invest not myself, but for my children and my children's children." Very good.

Well, sir, we will cover that next week, which is the basket of stocks that will be sensational. I think it's gonna be fascinating. So thank you. We'll cover that next week. And in the meantime, if anybody wants to talk to Ken, this is how you do it. Again, thank you, everyone. I'm going to shut it off now because I never like to go over an hour. Peace out. Love you all.

Ken: Goodnight.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)