Insider Briefing of 20 February, 2020

Helping You Thrive in the World's ONLY Vital, Scarce and Recession-Proof Market

In this first audio insider briefing CEO OriginClear shares an informative look inside the company, vital information on the industrywide shift that is taking place in water, and why OriginClear is expanding its already successful water services and equipment initiatives.

Transcript from recording:

Introduction To The New Insider Briefing

Riggs: Okay, everyone, this is Riggs Eckelberry and this is a brand-new experiment that we're doing here, which is an audio insider briefing.

The purpose really is to go back to the old-school briefings we used to do. We did about 45, 46 of them over the last year and a half or so. They're much more informal. They allow me to basically brief you in a very personalized way. Then we decided to our webinar once a month, first Thursday of every month, but to do it properly.

What I found was that for the last three or four webinars that we've been doing since we started trying to do this, it was just every single week the burden of producing it meant that we weren't really, really giving it the focus it needed. So this way, I'll be able to bring in other panelists, I'll be able to do what I want on these, but this weekly briefing is going to be much more intimate insider and fresh.

About Tom Marchesello

Tom Marchesello was a big hit last week, chief operating officer. He gave us all kinds of details. If you go to OriginClear.com and click on CEO, look at the right-hand side, you'll see there's a transcript and a recording of that webinar. It was very, very successful because Tom is extremely real.

His background is pretty amazing. He was in the US Air Force Space Command, came out of it as a Captain with a disability and he subsequently had a stellar career in two areas. One was with large corporate companies in product and product marketing areas, brand director kind of positions. Then also he spent a lot of time in investment banks on the buy side doing acquisitions and looking at hundreds, thousands of pitches and so forth.

Our WaterChain Initiative

How he joined us was very simple and this was the best thing that came out of the WaterChain™ project, which began in early 2018 at the height of the crypto craze and with WaterChain. All of a sudden, I was able to reconnect with all my dotcom buddies who became cryptocurrency millionaires or billionaires, in some cases. Through that process, all of a sudden, I was in the 1% and it was just amazing to be there in that space. I went to Puerto Rico, had all these experiences and it was a very exciting time. Tom got to know me and he really saw the value of what we were doing.

Now WaterChain itself ran smack dab into the Crypto Winter of 2018, as it's called, which is the equivalent of the dotcom crash that occurred in year 2000. So, in the year 2018, by mid-2018 we were like, okay, this thing has become too hard to overcome, legal issues, this that and the other thing. But it still very much remains in the background and something that we're going to be working with going forward.

But meanwhile, Tom, when I put this thing on the shelf, he said, "Well, you're doing the product, so why not just go ahead and play with this?" That's how it came about. So since then he has taken full command of the operations areas.

Integration of Modular Water Systems & Progressive Water

We had acquired in mid-2018 the amazing talents of Dan Early, a guru of these prefabricated Modular Water Systems™. Tom focused on that first and bringing that into order. He was doing so well that he became the chief operating officer of the company very quickly.

Then he came to me in the fourth quarter of 2019 and said, "Listen, these Modular Water Systems and Progressive Water have got to be united." On the one hand, Marc Stevens at Progressive Water and Mike Jenkins the VP sales there do a fantastic job, but they really could use design services, really, really good high-end design. On the Dan Early side with his engineer, Robb Litos, they needed to have arms and legs to execute on things. So, it was a natural to bring them together.

What Tom achieved was that Modular Water Systems stopped being a burden to corporate. It is now fully part of the Progressive Water Treatment profit center. Marc Stevens has always shown amazing acumen in managing cashflow. His bank balance is quite healthy and he has shown that he can ride the ups and downs because his business, sometimes you do a million-dollar deal, but then it takes forever to collect on it. So, cash flow is always an adventure and he has always, always, managed things on his own. With the help of Tom and our controller, Eric, he managed to completely integrate Modular Water System so that now it is one integrated environment. That is a really strong operating base near Dallas, Texas in McKinney, Texas.

Since then, Tom has been working to just do a whole lot of other stuff. By the way he actively sells. He and I went and pitched a premium hotel chain that is in the final phases of becoming a customer. Again, I have to always disclaim that these things may not happen. But nonetheless, he really developed a close working relationship with this hotel chain and has shown just an amazing capability of working with these high-level, corporate-level people because he's one of them. It's really fantastic.

So he's very good at sales. He has done a lot to clean up our marketing. He's brought in Keith Kaplan who is actually a mutual friend. I've known Keith from years ago during the dotcom era. So, he brought in Keith to work on the website and our content. We are growing up, OriginClear is growing up into a real water company. What does that mean? That means that all the case studies are in one place and the story is clear and all these things because for the longest time we were simply in development. Well, now we are growing up and Tom is really helping us with that.

Water is the New Gold

I strongly recommend that you do join the next full live CEO briefing, Water is the New Gold, which will happen, as I say, every first Thursday of every month. The 5th of March is the next one. [Register Here Now!]

Tom is a permanent panelist on this because he brings a very valuable insight into what is really going on. Whereas, I tend to be about the big picture, he's really about the specifics, so it is a good balance and that is going to continue.

I also intend to bring in other panelists either on this insider briefing or on the full webinar. People who are you amazing people like Ken Berenger, Michael Mann. Dan Early has been a repeat panelist. I'd like to bring in Marc Stevens, Mike Jenkins. His son Derek Jenkins is doing an amazing job in McKinney of building up our consumables business, which is a very important business because it's very repeat. That number has been rising with Derek's help and he's really been apprenticing in the business. So, all kinds of interesting people in the company.

I would even like to bring in our amazing marketing agency, which is AGM Agency. The head of it is Manuel Suarez who is a real figure in the online marketing scene, specifically focusing on this very, very targeted Facebook social media marketing. He has been working with us to really make us highly visible.

What About Stock Price?

I was asked recently, "What are you doing about the stock price?" This is always something that people worry about, rightly so. I've learned over the years that throwing money at "shareholder awareness people," is not a winning game. It's just basically trying to buy your way out of lack of visibility. The solution is to become visible, right?

There's really two things that raise the stock price and that is number, one, executing on a plan. I say I'm going to do it and then I do it and reflection on numbers. The numbers improve and the fundamentals are doing better and that's super important.

Company Awareness

The second thing is to have a lot of people becoming aware of your company. You know, Elon Musk does not spend a dime on advertising. I mean he's done website stuff and so forth, but he has not spent money on paid advertising. Instead, he has been the spokesperson for Tesla and, of course, SpaceX and SolarCity. That is his strength. He's a master at it.

Manuel Suarez and his team are working to do the same thing for us to get that kind of visibility. I mean, Elon Musk was billions of dollars in the red before the Model 3 really started pulling things around to where now he's dominating the market. So, during that time, somebody had to put the vision there and Elon, of course, is very talented at that. I would never compare myself to Elon. For one thing, he's an amazing engineer and I'm not. I'm many things, but I'm not a trained engineer.

So what he did is really what we're trying to emulate here which is to really get a lot of interest. A lot of people looking at OriginClear and the stock responds to that kind of visibility in indirect ways. Not, “You must go buy stock,” but rather a lot of people look at the company and then they go, hmm, that's interesting and I'll go to E-Trade or whatever.

Friendly Money

So that is the second thing. The third thing really, I said there were two, but there's really three. The third thing is to get out of getting professional money. Wall Street money is not friendly money. It responds well to, if you're in a strong position then they'll give you a good deal. But if you need money then they'll basically take care of themselves and not you and that tends to harm the stock as well.

So what has been wonderful about the last year and a half is we have not had to do that. We've been able to rely on our amazing loyalist investor base, accredited investor base. That is, I think one of the biggest pillars of OriginClear is that we have such fanatic supporters and we do our best to do right by them and they help us with funding that does not destroy the stock. They are just amazing like that. So these are the elements. Now what are we focusing on right now is that second element. Well first element of course, and I'll be talking more about performance, but the second element has been a big focus for me in the first couple months of this year as we've been ramping up these weekly briefings, making them more professional and we're going to keep doing that. AGM agency is the same agency that's been promoting the famous Dr. Berg of Keto fame and they do an amazing job with him.

So I think we're going to do well with them and I would hope to bring them on board as well. Lots of interesting things happening with personnel that will enrich these briefings and I really hope you stick around for them. If you miss any, there's always a transcript and a replay on our website and we circulate the replays as well.

Economic Cool-down

Today I was on Money TV and I was discussing the thing that I issued a CEO update last night on, and this morning again. If some of you got caught in the changes of links for the zoom call, I hope that you were able to make it work. We were simply moving very quickly to change over. But now we have basically two streams. One is the insider briefings which are phone only and then the webinars which are full audio, video.

So what I was reporting on was I think something that's becoming clearer and clearer, which is the economy was already cooling down. It was on its way. Apple warned on the iPhone sales in January and the other day I was watching a report by a major trading group on Wall Street that is amazingly good at calling these trends. Even“pre-virus” as they say, they were saying things are slowing down. Now we've had this coronavirus and as I said in the update, it is not the dreaded plague or whatever. It is a flu. It's a flu and there's this very small percentage of people dying, but they're generally 80 years and over. So if you have a strong immune system, it will be like a flu.

But here's the issue. China has basically gone into shutdown mode and we've managed to make ourselves highly dependent on China, which is not great. I see a lot of ripple effects from this, what they call knock on effects, which is one thing knocks the other, knocks the other, knocks the other, kind like a domino. So we're going to see knock on effects. I've seen the price of copper is dropping. Why? Because see, the factories are shut down. So we're going to see a cooling off of the economy. At this point, I don't see a recession. Why? Because the central banks are already taking huge steps to just pile on the resources and make sure this doesn't happen. But definitely we are moving to a phase where people are going to become more conservative with their capital expenses. What that means is that the big projects will tend to get delayed.

Webinar: Closing the Loop: The Future of Decentralized Water (Lux Research. JUNE 26, 2016)

Webinar: Closing the Loop: The Future of Decentralized Water (Lux Research. JUNE 26, 2016)

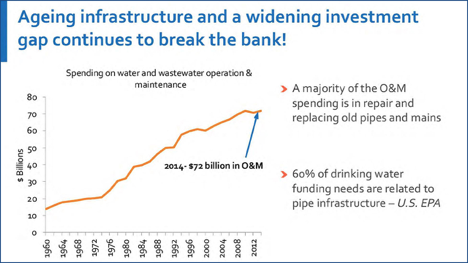

Aging Infrastructure

What I showed was a graph which was published by Lux Research on this webinar that I've referred to again and again from 2016 and in fact I'm pulling it up right now and looking at it, “aging infrastructure and a widening investment gap continues to break the bank”. So spending on water and wastewater Operation and Maintenance has gone from about $12 billion a year in 1960, and these are inflation adjusted dollars, up to $72 billion, roughly seven times increase by 2014. Why has this gotten worse and worse? And it's going to get even worse beyond that because: Number one, we have not spent on water infrastructure. It hasn't happened. So, operation and maintenance. You don't invest in a new car, you try and keep your old car going. Well guess what, your repair bills are going to rise.

Operation And Maintenance

I've been there and sometimes you get an older car, especially a luxury car, do not go without an extended warranty because you're just got to be paying through the nose. That's what happens. At some point you're spending far more than if you just bought another car. But the problem is, is that let's say you don't have the down payment and you don't have the credit, so you just keep owning the old car. You're actually spending more. A lot of people who are in a poverty cycle spend more money because they don't have the means to buy well. That right there is America as an infrastructure investment. We just don't quite get ahead of ourselves and we go to war in the Middle East and all that wonderful stuff. I'm being very sarcastic of course.

Move Towards Self-Treatment

And we're not doing the infrastructure work. Majority of the O and M, operation and maintenance expense is in repair and replacing of old pipes and mains. They're not putting in proper stuff. Now again, this long-term trend is why we know without a shadow of a doubt because we're experiencing it, why there is a move towards self-treatment by industry and businesses in general where more and more operators of companies, factories, commercial buildings, agriculture, et cetera, are forced to do their own treatment. There are these case studies again and again. For example, of breweries, where they have doubled their capacity. Local municipality won't do it and so they have to do it themselves [case study]. This is constant and I'm going to circle back to that trailer park story, which is a very good example. But in any case that is a long-term trend. What is happening now with 2020 economy is going to dramatically speed that up.

Budget Acceleration

So we see a dramatic acceleration of the operation and maintenance budget, which is going to continue to drive the treatment of water to the periphery, to the edge, to the treatment of water on premises by businesses and industry and agriculture as opposed to the central treatment plants that are going to focus more and more on the bare bones providing clean water to consumers. One thing they just cannot do without, is you’ve got to get clean water in your tap and you have got to be able to flush your toilet. Everybody else is going more and more to their own treatment and that is a fact. The other thing that this means is that the business of water service as a category is taking off and it's already very healthy. You know, take a look at membranes, for example, that's a $22 billion market in membranes alone worldwide.

Cleaning And Refurbishing

And probably about 10% of that is the cleaning of membranes. So that's a pretty substantial business and it's a very simple business. The cleaning and refurbishing of membranes is going to grow. Why? Because with tight budgets you go, well, I could just buy new and a lot of people just bought new. Let's say you're operating a dialysis machines in a building and it requires a lot of clean water and the thing starts getting dirty. It used to be you would get new ones. Well now we are going to try and refurbish the ones we've got, but we still have got to have super clean water. Or if you have a chip fab, there's chip fabs all over the place and they have to have water that's beyond pure. It has to be super clean water and then not have any silica and not have any of the minerals that could damage the production of circuit boards and chips.

So what you have is very demanding applications. Even there they go, well if we can go with 99 point… our standard is 99.8% cleaning. That membrane is able to deliver 99.8% clean water. It can’t drop to 99.7%. Why? That's a 50% decrease of the purity of the water. So it's 50% worse. It doesn't seem like a lot, but that right there, you just shut down your operation. So that stuff is mission critical. Yet what is happening is there is increasing demand for refurbishing these membranes, for example. But there you have to have very high-quality providers. So, if you're going to compete with new, when you go to a computer store and you get, you get that refurbished computer, it had better work exactly like a new one or else it's not worth the trouble. So that's where there's a growth in the marketplace of maximizing what you've got.

Field Service Market

Now, it's not just membrane cleaning, that's a really interesting space, but going further out there's field service. Now, the big corporations like Evoqua, they charge a lot for a field service technician to come out $160 an hour is the rate. Not as much as a paralegal, and believe me, that tech is not being paid anywhere close to that, that tech's probably being paid, in the 20s per hour, if he or she is very good.

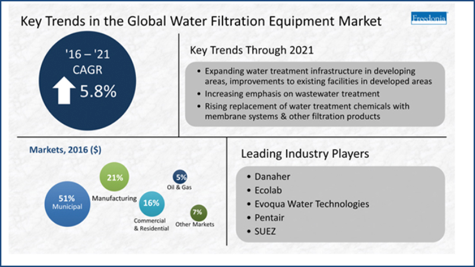

Water Filtration Products in Municipal Markets to Grow 5.8% Annually Worldwide

Water Filtration Products in Municipal Markets to Grow 5.8% Annually Worldwide

(Water News Wire, DECEMBER 14, 2017)

So there's rampant overcharging in field service and there are opportunities in each one of these, but they're highly vertical. You've got health care, treatment of water for healthcare, treatment of water for, as I was saying, chip fabs, that's a place that fabricates chips. Beverage, the beverage industry has specific requirements. So, they all have very specific requirements and expertise, but it's a very, very profitable business.

Company Focus

OriginClear is not planning to go into all of these activities. Just, "Oh, I think we'll just do that." No, we don't intend to learn that way. We've successfully brought in Dan Early and he brought us all this capability with Modular Water Systems from day one. We didn't have to go through his 25-year apprenticeship. Similarly, we believe that we can connect with partners in this space and do extremely well and that is what I was working on this week with Bill Charneski and Michael Mann who are the M&A team.

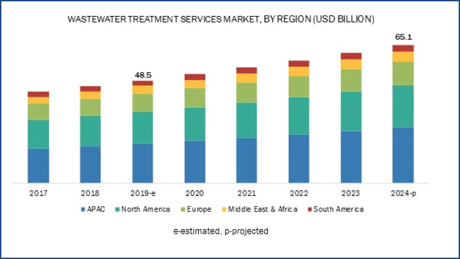

Wastewater Treatment Services Market by Type and Region - Global Forecast to 2024

Wastewater Treatment Services Market by Type and Region - Global Forecast to 2024

(Markets and Markets. SEPTEMBER 26, 2019)

Increasing Service Activities

So, long and short of it is, number one, we're playing in a decentralized space with these Modular Water Systems and that is directly in line with this growth in the degradation of infrastructure. And number two, we are busy getting more and more into the service side of the business. Here's what's interesting about it, I was visiting a partner this week and this partner has been consistently giving business to Progressive Water Treatment, very much similar to how Permionics has been sending business to Progressive Water Treatment.

This other prospective partner, who's in a city in the West, has been a steady source of business to our Texas water company. What I'm saying is that these service activities directly drive opportunities for three, 400, 500,000, $600,000 systems even more because when we have got a service guy on the spot, already making good money, he is also in the relationship and can hear about opportunities to make these big projects happen. So, this is a fantastic way I believe, for us to build a footprint across the US and even internationally, make very, very good money at it with high margins because unlike equipment, equipment has relatively low margins. Service has high margins if you can be good at it.

So these service activities, I can't get more specific than that at this time, but we're going to have some interesting news coming along about how we do there and that's going to dramatically create the growth of, I believe, the growth of the revenue on a rapid, scalable basis and will also drive business for our water business in Dallas and others. So, that's where that stands and it's a good trend, that is on our side.

The Trailer Park Story

America's trailer parks: the residents may be poor but the owners are getting rich

(The Guardian. MAY 3, 2015)

I wanted to spend the last few minutes of this briefing just to talk a little bit about this fantastic Alabama trailer park story. Why am I bringing it up? Because a water trade magazine got very interested in it and wants us to write an article for them, et cetera. Unfortunately, we're not quite ready yet because the ink was not dry on the contract, but the trailer park space is quite interesting. It's actually huge. 20 million people live in trailer parks, 6% of our population.

Tornados

Rare North Dakota tornado hits 120 mph (USA Today. MAY 27, 2014)

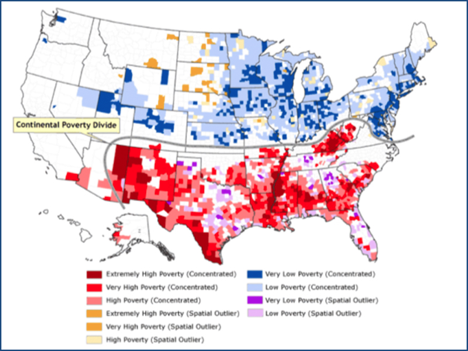

By the way, only 6% of the population but 18% of all tornado deaths occur in trailer parks, residents. Concentration is very much in, it's called the poverty divide and it's below the Mason-Dixon line essentially.

The Continental Poverty Divide

The Changing Geography of Poverty in The United States (Geocurrents Info.SEPTEMBER 11, 2015)

Septic Tanks And Lagoons

They have two ways that they treat water. One is the septic tank and the other one is a lagoon and sometimes the septic tank going into a lagoon, that's the proper thing. The reason why people use lagoons is, they are half the price of the septic tank and they basically take no maintenance. It just, goes into a pond and this stuff stinks, and that's just how it is. But as I was pointing out, that is changing fast and we came up with an elegant solution that is going to be very, very interesting for these trailer parks.

America's trailer parks: the residents may be poor but the owners are getting rich (The Guardian. MAY 3, 2015)

America's trailer parks: the residents may be poor but the owners are getting rich (The Guardian. MAY 3, 2015)

Trailer Parks – Big Business

Now, I might add that, trailer parks are big business. Sam Zell alone has controlling interest in nearly 140,000 parks in America. That company made almost a billion dollars in revenue and helped makes Sam Zell about a $5 billion man. And of course, Warren buffet, owns the biggest mobile home manufacturer, and he's got the biggest mobile home lenders. So, it's a big business.

OriginClear’s Elegant Solution

What happens very quickly is that if you have a solution, an elegant, inexpensive solution to the trailer park lagoon problem, then a lot of very deep pocketed people are interested. So, expect to hear more about this, but I really loved how simple it was. No excavation, no local permitting approvals, no expensive plumbing or electrical subcontractors, no storm water control permits, no long construction. Just drop a buoy in the middle of the lagoon and let it do its thing. So that's the kind of elegant solution that Dan Early comes up with.

What I can tell you is that I'm very, very happy with how we are moving along and I love seeing the developing business in the service area. There is also a lot of opportunity to do great things in the continuing business of Modular Water Systems. I am getting more and more happy with how things are clicking. What is making it all possible and the reason we're able to literally say we're going into this incredibly interesting market that is going to boom because of the economy slowing down, which is the service side of the water industry, is because of our ability to get good beneficial funding from our supporters, our accredited investors.

The current funding round I've been saying it's going to wrap up for some time. I really recommend if you are accredited to speak to Ken Berenger extension 201, Michael Mann extension 206, Devin Angus, always a great way to get to me, extension 116, and always the email invest@originclear.com is a great way to get to us.

I hope that you stay registered for these insider briefings. Make sure that you're registered. We're moving very quickly. I really appreciate your excitement and interest and as always, I wish you a good weekend and stay tuned. I'll see you guys next Thursday, 5:00 PM Pacific, 8:00 PM Eastern, and then remember that on the 5th of March, we've got the big webinar and that is going to be a lot of fun because we'll have the time to do it right. Water Is The New Gold. Thank you very much and good evening.

Register for the next Water Is The New Gold episode: HERE

Important Disclaimer

The securities referred to in this presentation may be sold only to accredited investors, which for natural persons, are investors who meet certain minimum annual income or net worth thresholds. These securities are being offered in reliance on an exemption from the registration requirements of the Securities Act and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The Securities and Exchange Commission has not passed on the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials. The securities are subject to legal restrictions on transfer and resale and investors should not assume that they will be able to resell their securities. Investing in securities involves risk, and investors should be able to bear the loss of their investment.

![]()

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)