Advisor, Ivan Anz, is truly special and the interview with him gave a peek behind the curtain at the full potential of Water on Demand™. If it and our Water4Us™ initiative can unburden the decaying network of national water treatment systems… And unlock the unrealized value of off-grid properties for business and human communities by spearheading self-reliant water, How valuable does that make them? Find out in the replay!

Transcript from recording

Opening

Start of video presentation

Our role is evolving into what we call an innovation hub. You can tell that we are a changing organization because of course we're trying to make change happen in the water industry, which is not easy. But our previous historical model was to constantly build value. Of course, we started in algae transition to water tech, acquired PWT, in 2018, we launched Modular Water™. There was an abortive crypto which is now being planned as $H2O™ and then adding Water On Demand™ and then the Water4Us™ program and finally EveraMOD™ pump stations.

The problem with it is it was a bulky model and it was also constant burn. About a month ago we moved to a different point of view where we successfully launched Water On Demand with Water4Us program. And we said, "Well, wait a minute, let's make that what we do." So, in this model, Water On Demand being, of course, the water as a service prefunded systems that enable end users to just sign a piece of paper, and get their water taken care of on a per gallon basis.

Water4Us is focused on human communities. We've had a lot of action with freeway travel stops, hotels, RV campgrounds, trailer parks and also housing developments. We put that in a separate category because it's a huge megatrend of people moving to areas that are much more spread out, more rural, less sewage service, and thus needing a freestanding water treatment capability along with maybe even energy independence and so forth. Very exciting trend.

And in this model, OriginClear offers the management support so that Water On Demand Inc, with its Water4Us program is an independent company, but it doesn't have to replicate HR, legal, finance, etc. That all is handled by OriginClear. And as we move forward in time, we have the prospect next year of doing something. $H2O is the asset wrapper using blockchain that we're looking at.

And exciting is that we might be taking EveraMOD, it's going to be early 2023. We're going to make it its own little business unit. Crowdfunding has become so packaged and productized that you can deploy a marketing campaign and fund a company prospectively, it being a public company and the key players in each one of these companies get a tremendous equity share and thus they get more directly rewarded. It's very targeted.

Moving on to 2025, we're looking at your own organization potentially becoming a spun out company and finally Progressive Water Treatment, which itself has some trade secrets that are worthwhile. But these five properties Water on Demand, $H2O, EveraMOD, Modular Water and Progressive are the jewels in the crown that we're going to roll out.

And in this model OriginClear again, is the mothership that enables each one of these to be very tactical, very focused, and OriginClear gets management fees, which enables it as a mothership to be profitable and itself go on to the Nasdaq. It creates this cool launchpad role for OriginClear, which is very unique in the water industry. We have them in Silicon Valley we don't really have them in water.

So OriginClear has that role and eventually gets monetized as such and has a big chunk of each one of these companies for its pains. And we end up with half a dozen public companies, of which OriginClear has a big piece. So OriginClear investors and sweat equity players are rewarded.

End of video presentation

Introduction

And good evening. That is one of the fabulous clips that the marketing department is creating. They're great because they're digestible and they pack a very concentrated message. So let's go ahead and do the honors. Here we are, September 22nd. I believe we're doing very well this quarter. I won't telegraph much more than that, but we're doing extremely well. All right.

Let's take a look. Of course, you got the Safe Harbor statement.

And the disclaimer on the investment offering.

Company Announcement

Yesterday we announced a project with a real estate pioneer called Ivan Anz. Ivan came up with the bright idea of bringing investors directly to help people who could never buy a home, actually purchase their own home. And very exciting. Essentially, it's a revolution for people that they can actually be part of this. Right. And he got on the Inc 500 three years in a row, beautiful.

And he created PhilanthroInvestors®, which we now are associated with. And it's been very, very good for all parties. And what he's looking at now, he was doing single family homes.

Now he's moving to housing communities and he's very excited about making them self sufficient. On top of it. He's now in talks for these housing developments in Utah and Florida, and he'll be talking about that in a minute.

And there he is, Equity and Help, Inc 500, etc. And he is, of course, one of our OriginClear Advisors. So with that, I'm going to go ahead and play the interview that I already recorded with Ivan. Here we go,

Start of video presentation

Riggs: Mr. Ivan. And how are you, sir?

Ivan: Very good, Riggs. Thank you for having me in this interview today. And you, how's it going today?

Riggs: Oh, well, I've been on actually. It's been a zoom day, of course, just like same for you. Our life is on zoom. You're doing an amazing job of somehow staying connected, even though you're in Puerto Rico where there's no power.

Ivan: That's right.

Riggs: Congratulations to you for sticking sticking around. And we'll try and get through this interview without your Internet shutting down. But, what I, I wanted to, first of all, just discuss the big picture, how we're working together, what we're working on, perhaps maybe set the stage because we started back in May of 2020. And you and I kind of resonated with each other about our goals, kind of being idealistic. But idealism without pragmatism doesn't work. So it's great to have big goals, but you better execute.

And we spend a lot of time since then working on ways to tangibly change the state of water. And at the same time that we're working on this stuff, we're seeing increasing disasters. Jackson, Mississippi with the brown water. Flint with the lead in the water. Compton with the brown water. Fort Lauderdale with the sewage mains breaking. People are starting to see a lot of central systems fall apart, and there's no apparent solution. But I think we have one right.

Ivan: That's right. And I'm so excited about it.

Riggs: Because, I realized one day that, you know, underfunding of water districts all over the country and 150,000 water systems, and most of them are underfunded. And since apparently money is not going to flow toward them, I don't know why, but water doesn't get funded in this country. What's a better solution? Take the load off. Unburden them. And I realized that 89% of water use in this country is by industry and agriculture. Roughly half and half. And we are overwhelming the cities with these industrial and agriculture users.

But the cities, when you think about it, it really should be serving the residential people first. People come first, in my opinion, always. So we're, our mission, really, is to pull those businesses away from the burden on the central facilities. And over time, the central facilities are able to serve the people more.

In my opinion, what they're doing in Ireland right now with, in Ireland, water is free. You don't have to pay for water if you're an individual. Well, we should be doing the same thing here. And we could, if the burden was not, was reduced by 89%, down to 11%. No problem. It would not be an issue. So that seems to be an elegant solution. And you and I have been really preaching that, the whole decentralization idea about getting people into self-reliance. And you've been touring a lot lately, haven't you?

Ivan: Yes, I've been touring the entire West Coast Riggs. I've been showing PhilanthroInvestors and of course showing OriginClear as part of our water investing initiative. I was in Colorado and I was also in Utah, and I also participated in a in a huge event that was put together in Alabama. And then I also did Kansas and I also did Orlando, and I also did Sarasota. And I think I went to. Let me see if I'm missing any state or not. Yes, I did Nashville also.

Riggs: And these are generally entrepreneurs, high level business people, right?

Ivan: Yeah. These are high level business people and entrepreneurs that are looking for different ways on how not only, how not only to improve to their companies, but at the same time, what do they do with their hard earned dollars that they have? And also how do they take responsibility for the planet at the same time? So that that has been the majority of the people that is surrounding us.

And we've been also establishing what I call the Founders because we want to, the way that PhilanthroInvestors is going to continue helping more OriginClear and helping more the companies that are in our universe is through highly qualified individuals that are very specifically with certain level of profile that are able and willing to do what Ivan does in different parts of the world. So in that way, we can we can expand the mission and the vision and also set the space for the companies to have a base of already relations of people that are interacting and open space for the companies per se, right?

Riggs: Well, I mean, you're really talking to people who are successful but they're also aware of the conditions out there, of the inequality in of course, residential and energy and water and health and education and so forth. And you're right, they want to do something about it. And also, like, how do we invest my money?

I look at my portfolio on Ameritrade and I go, I don't know what to do. I have no idea. You know, my 401k it's like, well, I'm happy if it's not, if I'm happy if it's breaking even, but with inflation, that's useless. So I agree that all of us need to think about. How to survive, but also how to help others survive, right?

Ivan: Yes, hundred percent Riggs. And that brings me to a point of conversation that we start having on email at the beginning of the year, which is the fact that. If it's not about it's not about the water, it's about the people and the fact that the water produced in the people and where is the people? The people is a lot of time in the commercial space. Right. But a lot of time in the residential space.

But also there is a lot of people that is not, has not the ability to get the water quality that they need in their home because the city systems and the municipality systems are already too much concentrated where they need to serve more people than what they can. And that's when we start talking about the self-sustainable communities right in January or February or so and then, oh my gosh, remember when we started talking about that and it was like, oh my gosh, yes, this is the path.

Riggs: I always know that that excuse me, but for one second there's a trend. You know, a trend is happening when it is coming on your lines already. You're not having to create it. It's showing up. And for us, a lot of this stuff was showing up in our regular business, not the Water On Demand. Our regular business was seeing housing developments like those that tiny homes development in Texas that you know about, like RV campgrounds, freeway travel stops, hotels. When it's happening already then you can build on it, right?

Ivan: Yeah, totally right Riggs. And it reminds me because you were asking me about the tours also, that I am going to be speaking on Tuesday and Wednesday next week. I will be speaking about PhilanthroInvestors and OriginClear in Bogota.

Riggs: Hmm.

Ivan: So there is a lot of people that is, I have a press meeting, a press breakfast where all the press from Bogota camps and they interview me and so on. Then after the press breakfast is, a cocktail and dinner with presentation and the next day and then another, another day to basically interview potential founders for Colombia. Well, we will have, kind of, you know, in the corporate world, you have the president position, right?

But imagine that you have presidents across the globe representing PhilanthroInvestors and sharing the message of our companies in what they include in education, housing and so on. And then I'm going to Argentina and I'm doing the same, and then I'm going to Ecuador and then doing the same and then Chile and I'm doing the same. So this quarter is Latin America mission, basically, let's call it that way for PhilanthroInvestors.

And it brings me to the point that in Latin America they have already advanced some of the self-sustainable communities in some areas, like if you research in Colombia specifically and we need to in the US also there is a movement like that. But in my research, they haven't included the water or found a way to include the water at the level that the OriginClear technology can and the Water On Demand system. And the very innovative concept of Water On Demand. With the FDA level, water approval for the people to take shower and drink their soup and their coffee, not just the the pure water. And put their...you know.

Riggs: Brush their teeth, exactly.

Ivan: But brush their teeth. So that's the excitement and the self-sustainable communities is something that I am so happy that we have serious entrepreneurs that are developers that are already in talks and with the support that OriginClear is giving me on this, because for PhilanthroInvestors itself. You see, I launched Equity and Help in 2014 after starting housing investment in 2009 in Argentina and doing it for five years in Argentina with developments with real estate developments. It was not houses. But in Equity and Help, we are doing it saving neighborhoods by saving one house at a time.

Riggs: Sure.

Ivan: And this is old houses. This is houses that were abandoned and now are bring back to life. But with this self-sustainable community, which, you know, that is very smart to let the company do what it's doing and not interrupt the operation, but me as the founder exploring a potential future with something different. This is where I personally love this idea that we already started exploring with OriginClear of creating huge developments through the support of my connections that we are doing in Utah and Florida now, and then connecting and making OriginClear technology with the Water On Demand the key, one of the key components of the self-sustainable community.

Riggs: So, I think you're right that you can't do this very easily one house at a time. It's easier to do it as a community. And more and more people are being aware of the need for self-reliance on water, on energy and on food. Because, people think, "Well, I'm not so sure things are going great. Wait a minute." It's a, it's a problem, what's going on, right? So, but they don't have solutions. They don't have easy solutions.

So what I like about, it's really funny because at the same time that we were establishing the program we call Water4Us, which is self-sufficient housing developments, simultaneously you were shooting out into these programs that you're busy developing for self-sustaining housing. And now we're able to connect up because the truth is, is that you only get anywhere through powerful partnerships. That's the only way to get these things done. So, I'm super excited. Now you can't tell me about them, but you've got something going in Florida. You've got something going in Utah, right?

Ivan: Yes, and and we've been doing connections with part of the OriginClear team already. And that's rolling for the, the Utah seems to be the more closest one that is going to get the water rights and they are rolling through that process. And then Florida is another one that we are in conversations, so far. So yeah, I am also super excited about that and looking to make it to the point where you know Water On Demand actually can officially send the official proposal and it becomes an MOU (Memorandum Of Understanding) and so on between the development and the and the company.

I think it will be for us a next stage and take, I perceive that it's going to take us to another level in that area, that then we can show to entrepreneurs or to developers in other areas of the, of the, of the country. And why not the world and then have the Housing PhilanthroInvestors also be able to support housing developments at, you know, majority of quantity of houses, not one house at a time. Right.

Riggs: True. Now, the one concern I have, of course, is when you're starting with fresh development, it's going to take a long time. It takes years, of course. We saw Goldman Sachs purchase an entire neighborhood and just, I think, $65 million. They bought all the houses in the neighborhood and then they're flipping them into rentals. Now, if you were smart while doing that flip, you also make it self-sufficient. That might be interesting.

Ivan: Yeah, actually, yes, two thousand percent. Now, if you're think in this for a moment. Remember that our vision is basically that the self-sustainable community, the families will be homeowners.

Riggs: That is the improvement on the Goldman Sachs, Goldman Sachs is just going to become the spider who's taking the rents, which nobody likes.

Ivan: Capitalism.

Riggs: So you and I are on the same page that we are totally about ownership. But let's take an idea that they had, which is they went and bought these. They sort of did a financed takeover of a community. And then you could rehab the community and then re, and then do what Equity and Help does with with helping people own these through your investor network. And it might be faster than starting fresh with these like, okay, this is a project that's going to start from scratch and it's going to take how many years?

Ivan: That's totally right on that sense. And you know what? Because the families can also, there is something that we are exploring, which is another innovation that I am going to be applying in housing PhilanthroInvesting, and that is the families doing a pre-registration for houses in the area that they want and putting a deposit ahead before the house it becomes available.

Riggs: Mm hmm.

Ivan: So in that sense, the community can say, okay, this is the self-sustainable community is going to be deliver in two years from now. But you can own one of these homes. Just show us your interest. Give us five, 10,000 or something like that. Right. And for the more low income families, let's say two or $3,000, and this is part of the future down payment for them. And they yeah, it's I think it will be great. It will be going to the next level.

Riggs: Fascinating. So you're playing in housing, but you're playing in other areas than housing, right?

Ivan: Yes.

Riggs: So you're playing in energy as well?

Ivan: Well, we have now housing philanthroinvesting. And then, as I always say to you, that I will be forever thankful because water opened the door to all the other ones and to the dream with OriginClear and the opportunity you gave us. And that opened the door to what is this business model, to this vision that PhilanthroInvestors has of, let's call it that ideal world.

You know, where there is water, clean for everybody, clean water for everybody, food, organic for everybody, and housing where people there is less tenants and more homeowners and more family stability and there is less waste going to the oceans and the forest and the illiteracy in the world is decreasing and the diseases in the world is decreasing. For example, we have Riggs the dream, which is a disease free world, and we have another blame, which is an illiteracy, a litery world, a literate world,

Riggs: Literate.

Ivan: Literate world. So with that, with that dreams and goals, our idea is find a unicorn or a potential unicorn and put all our energy in that industry towards one company only, and then help that company with our resources, our contacts, our ideas, our methodologies, everything that we can to make it the Tesla of that industry, to make it the Amazon of that industry, to make it the Apple of that industry.

So, the goal is ten unicorns by 2030. So with that, we have Housing PhilanthroInvesting with Equity and Help. We have OriginClear, that's Water PhilanthroInvestoring. And we've been supporting you guys for two years and with the mutual support. Then we have a company in Environment PhilanthroInvesting that is in Dubai. We have another company now in Health PhilanthroInvesting, which is based in Utah. And then we have another now launching another company in Education PhilanthroInvesting based in California.

But all these companies like the education philanthroinvesting, for example, is going it has a technology, it's a technology company, that literally will change the way people learn.

Riggs: Wow.

Ivan: Expanding worldwide. I will say that if it's not one of, I think it's the only methodology of learning that exists in the planet that can make sure that someone duplicates the knowledge and is not a blank space in their mind that they don't remember. So, yeah.

Riggs: They make it their own, basically.

Ivan: Yes, exactly. They make it their own. And this technology has been around for 50 plus years, but this company is making it available to everyone in the world. And it's just amazing. And these people have like 35 years of experience on this and then with the health p;hilanthroinvesting company in Utah is preventing the top ten diseases in the world to happen. And it's already clear Riggs, the top place in the world to create unicorns is technology companies. And you know.

Riggs: Always, technology is the great accelerator, right? That's how you make geometric change happen. It's obvious. So we have, we've got this thing that, I like leverage, right? You can make things happen with a key thing that's at the right place to make change happen. And I've become convinced that the more, I was just doing a podcast, literally 40 minutes ago and they wanted to know about cybersecurity.

And I say, "Well, you're not going to insure cybersecurity of 150,000 city water systems, but you can, when you make a business, go offline and go off grid, it will have automatically the most modern system and it will be protected." So let's break up the big mass of outdated, badly maintained, underfunded water systems by modernizing the fleet away from the centrals.

And to me, it's so exciting because we can literally make change happen now and not try and get Washington to pay billions of dollars that they won't pay. Let those people alone. We can act right now on the ground. And investors love it. You and I know that investors love being able to do something about water. They have this pent up energy like want to help with water, right. So amazing. So the combination of Water On Demand, the water as a service with our Modular Water technology. It's kind of the magic key to making that, modernizing the fleet, improving water quality and through recycling, improving the amount of water available, literally helping the scarcity problem, too.

Ivan: That's great.

Riggs: I'm so excited that you're helping with this. I love that you're going on tour like this through Latin America, which I know has tremendous pent up energy, there's a lot of potential energy, I believe, in South America that is looking for ways to really come out on the world stage. Places like Colombia, Chile are just ready to explode, I believe, as top players. So I'm excited that you're going to do that. And then where are you going after Latin America?

Ivan: After Latin America? I am doing well. I need to shift a little bit some of the things, because we now have a founder in Nevada that wants to put an event in Nevada in January. So we have seen if Vendy, our president, is going to Nevada and then we have our founder in Colorado doing an event in Colorado, and then we have a founder in Utah interested.

This entrepreneur, which they are the founders of PhilanthroInvestors in that area, they are opening an office for PhilanthroInvestors in that area. So we are going to be like, having to, going from the events to office, from office to the companies and so on. But so Vendy is going to do that and then I am going to Norway, UK, Spain, French and Switzerland. And then, and then after the Europe tour is the Asia Tour.

Riggs: Oh, my God. You're the frequent flyer Lord. That's amazing.

Ivan: So that's my 2023 plan.

Riggs: Well, Ivan, this is really what's great about our partnership, is that you are helping us put the network out there. Remember that our vision for Water On Demand is we're going to have more Water On Demand financial centers, doing, replicating the Water On Demand vision for Dubai, Tokyo, London, etc. and handling the water in those regions. And I look forward to coordinating with you on that and doing the fintech in those countries. I think we'll get a lot of people on board. And so I'm so grateful for what you're doing. You're really you're a soldier in the cause, so thank you.

Ivan: Yeah, you're welcome amigo. Yes, I have already an entrepreneur in Dubai that is willing to move with this. And then remember that because of the Toyota dealership that I own in my family office, I have a lot of connections to Japan. So that's why after Europe is Asia.

Riggs: I'm so jealous. I love Japan. What a great place.

Ivan: I love there, it's beautiful. Yes. The food is so good. Amazing, amazing. The food also. And you know, what is amazing about Japan is the treatment that the people give to the visitors. Yes. I just, I was blown away with how they treat us. Doesn't matter the culture we have, doesn't matter from the color of our skin, doesn't matter whatever we have is like being another brother for them all the time and being family. And so it's very important.

Riggs: Well, thank you for the dedication. I appreciate it. I know that you're working very, very hard Mr. Million Miles and good luck to you. Let us know how we can help and let's forge ahead with these residential projects. So exciting.

Ivan: Thank you, Riggs. Have a wonderful rest of the day. And this, the entire audience that is hearing us, have a wonderful weekend ahead and let's save water for the people.

Riggs: 100% agreed. Peace and water and love.

End of video presentation

Riggs: Ivan Anz really, we're kind of like in sync, right? When he came along in 2020, he literally, his model at Equity and Help is literally what we're doing with Water On Demand, enabling regular investors to invest in housing and homes. And it's a program to make the homes work for these people. So, we're opening up water treatment, decentralized water treatment investing opportunities in this same way. Very, very similar.

In The News

Modern Professional

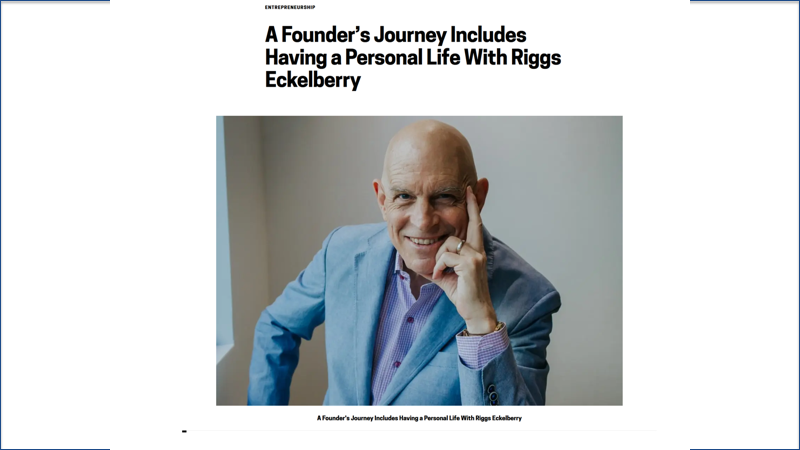

So with that, wow, there's a lot of chatting going on. So a Ken and crew have been chatting away. I have a couple more things to cover. Let's go ahead and take a look. Well, we're in the news and they were kind enough to think of me as a professional. And this particular article is about the founders journey, about how I got into the dotcom. This article, of course, is on the OriginClear site under News.

What have I learned?

And of course, what I learned about myself, "I'm fast. This is good. It's also bad why? Because if you don't make sure your team is on board, then you carry the whole burden yourself." And that's really the biggest thing I've learned in the 14 years at OriginClear has been to really learn to be in sync with the people I'm working with. And that has been, of course, the quality of the people I'm working with is astonishing. Again, talking about team for the original, from my original eighties, very lonely startup and of course relationship partner, my wife.

And what do I fear?

Well, I watched Elon Musk talking about speaking at this all in summit, which is really interesting. It's worth watching. And he still worries about funding of Tesla and this is you know they have I don't know billions and yet he still thinks about the money horizon. So, that is always the number one thing as an entrepreneur, as we all know that.

The second thing is being wrong. I tell the story about how we ended up having one of those quote unquote, interviews with regulators because we didn't double check something that was claimed was sort of a fanciful claim. And unfortunately, we ran with it. I've learned that and we've added an amazing CFO, Prasad, who is really making sure things are done right. So again, this is really a good idea.

And then finally, what do we fear not leaving our mark? And I think we are learning to leave our mark. So mistakes made as an entrepreneur? Yes. Going into an industry that I knew nothing about, which was in 1983, also in that same company, I did not understand all the strategic finance that I know today, and I've got lots more to go. And I didn't realize that I could use financial leverage to create wealth and success. So importance of a team respond to public needs. Remember to have a life. For example, I do get to ski.

Insurmountable obstacles

Well, fixing our business model. I've often talked about how, just like the CEO of Airbnb compressed ten years of change in ten weeks, we had to work out a solution to the incredible slowness of water projects. And persistence, learned that lesson. And finally, combining technology,

I'm very happy that I live in a safe place that's not likely to be. This is like a little piece of therapy that I got in this article. Moving from LA was wonderful. Learn to relax, adopt the right workflow tools. We're implementing an amazing customer relationship management system. Devin Angus is the captain of that and Josh Summers is on the marketing side and I'm so grateful that we're putting that in place.

This is a very, very important thing number two. Avoid the big deal just around the corner. I can't tell you how often I've had people go, Oh my gosh, this is a $4 million deal. And then, of course, it doesn't happen. And meanwhile, you've thrown away your regular business. Delegate the grind and that is the end of that.

Water Online

More usefully perhaps is an article in Industry Trade magazine Water Online, which talks about the dangers of drinking water. I won't go too deeply into this, but basically 71% of people still drink water from the tap. And there's all kinds of interesting things such as arsenic, the forever chemicals, uranium, etc., they're in the water. So this was basically an article about this. And as you know, we're starting to move into Ultrapure water. There'll be a big announcement coming.

Toilet to Tap

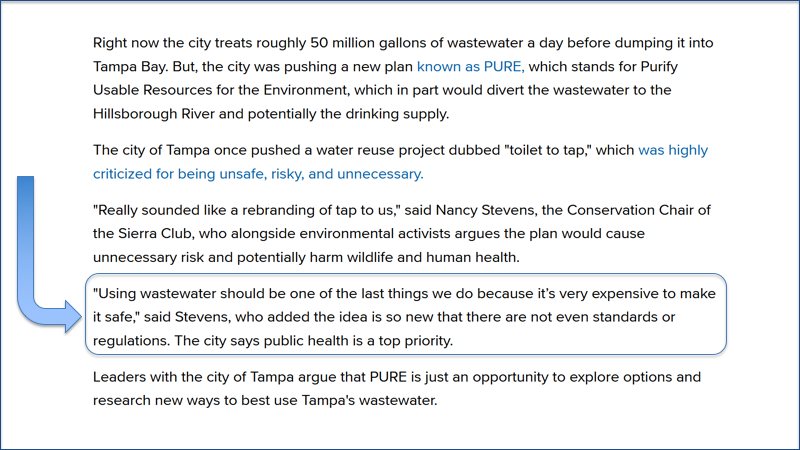

And then finally, this is not an article about me, but is I've been often saying that the city water districts, county, city, whatever it is, have a very hard time doing recycling. And one of the reasons is that people do not like to hear about toilet to tap.

And so, sure enough, Tampa voted to kill this wastewater reuse plan. I'm not going to play this clip. But it's interesting that environmental activists are critical of the plan to move treated wastewater to the drinking supply. I think recycling is so important.

Reuse Possibilities

Why? And here's why. I'm going to go ahead forward here. Some of the options, recharging the aquifer, right. Reloading the reservoir, you know, sending it deep underground, all these things you could do. One of the most important challenges we have in America is that our aquifers, even ones in the Midwest, which rains all the time, are being overdrawn. And so why not recharge? Right.

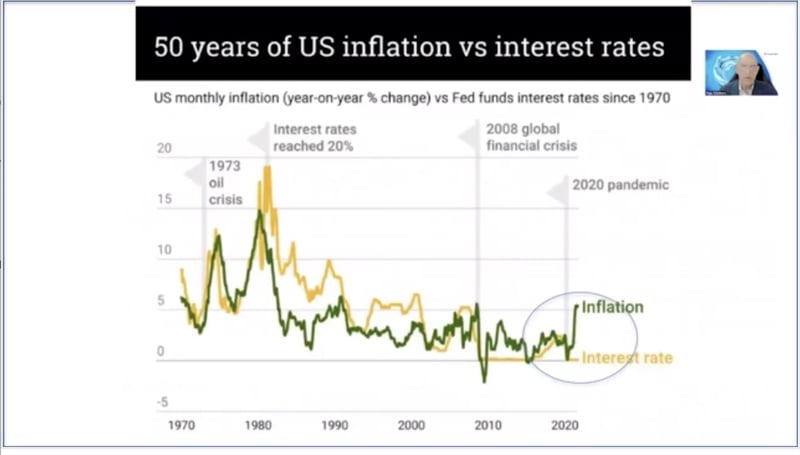

Interest vs Inflation

Anyway, the next topic that it's kind of jumped out at me here, a fascinating graph that shows how we have let interest rates stay low while inflation starts to take off. And that is not such a great thing. You can see that it hasn't happened often, the difference between inflation and interest rates. Now, of course, our federal, Fed chairman is catching things up. And so, therefore, I'm going to ask Ken to come on board and kibitz about this.

Freewheeling Discussion

Ken: We're going to schmooze.

Riggs: So we're going to kibitz.

Ken: Kibitz, we're schmoozing.

Riggs: Yeah. So that is a startling graph.

Ken: Yes.

Riggs: Now, now they're playing catch up and they're going to do it too much. So instead of using a brake, they're putting up a wall and slamming us into it.

Ken: Well, it's the lesson that if you, at least if you're going to do it too late, at least overdo it when you do it. I mean.

Where to Invest

Riggs: So once again, a stock market is proving to be a disaster, of course. So again, the problem of where do I put my money is it's top in my mind, every day.

Ken: You and I actually type about it, about like every other morning. Geez, Louise, you know, so it's, folks, this is not, we don't just play this guy on TV. We are this guy. I get a lot of it from when I mention, you know, "Are you an asset investor?" And yeah, "How's that going?" And it's just like, you know, there's, there's this kind of like this, gulp.

It's the next 6 to 9 months, the thing that markets hate, the thing that investors hate is if you know it's going to be bad, you know what to do. You know, it's going to be good, you know what to do. If you don't know what the heck is going to happen, not knowing is actually dangerous, right? Because there's a cost to doing nothing in this environment. Sitting in cash cost you 20% a year, right? So there's, there's kind of a cost whether you do or don't. And I think that's very frustrating.

Fintech for Water

I like what you spoke about. I took a couple of notes here because this is stuff that you and I have gone over. Ivan mentioned the next Amazon, right? I talk about, I talk about how Water on Demand is essentially doing... So Amazon is Amazon is what? It's a member of a, it's a company within a century old, multi century old industry, which is retail.

Retail operated the same way up to the Sears catalog in the 1980s, right? I mean, it was and Sears was, they were everywhere, right? But, because Sears, Sears is out of business today because they didn't, they didn't change.

So what Amazon did was they became a fintech for retail. To this day, they don't own anything. Right. You know what I mean? But that's what makes it because we have the benefit of having seen what places like Airbnb and Amazon have done. We, we have this road map now to develop Water On Demand. Do you want to answer that? You want to answer that question?

Audience Participation

Riggs: Well, there's a ton of these questions that I'm seeing here.

Ken: Virtually all of them, except for the last two.

Riggs: Okay. Fair enough. So just looking at the very end, well, James Wright says, "Can I have some money so I can know what it is like to have to worry about it?" That's cute. But Bob Roos wants to know about the Reg A status and that's moving along quickly. We are at the audit stage, so there is a Reg A coming. The audit is being completed. It's required by law for these new companies. You'd think it'd be simple. It's like, what is this four month old company that's done nothing. But nonetheless, it's got to be done.

Then we once that's done, we submit the form 1A, it's called to the SEC and then 4 to 8 weeks later we're effective. So it will happen, I'm quite confident this year. I would like it to happen earlier in Q4 than later because it's, we've often talked about how much more justice there is in an offering for everyone.

Unlocking Property Value

Ken: I figured you'd want to have a comment or two on Ivan's interview, which I found very enlightening. The property development angle of this is something that you and I talked about excitedly for a while. Before we really spoke about it we kind of discussed it internally. But the car dealership that you did up in Mars or Cranberry, which is about 30 minutes from me, that land is like 800 bucks an acre, you know, so you could buy this huge, huge lot and the reason you could buy it is there's absolutely no way to bring sewer in.

So, while things are really ugly right now, they're going to be ugly for nine months or a year. There's going to be bargains out there in a couple of years. And I think that where Water On Demand and Water4Us will be a absolute juggernaut is exactly what I was doing in my, in my own, in my own community. That 50 acre lot, by the way, it's still for sale. I pulled back because interest rates went crazy and I said, "Oh my God, the debt service will be ridiculous. It'll take me a year or two. Let me get a little bit, a little bit, see what they'll do with interest rates, because I don't want to use cash, I want to use bank's money."

But the reality is, is that property is not going to sell. It's enormously valuable, but only to the person who can unlock that water component. To a traditional developer, it's going to be it'll be $1.6 or $1.7 million to perk the property. So anyone who knows about development, perking is basically putting sand mounds in or and that's the cheap way. The expensive way is to dig under all the surrounding developments and get and get them permission to rip up their yards, which is never going to happen. right? And dig maybe a mile of pipe or so to the tune of hundreds and hundreds of thousands of dollars.

So, no matter how you slice it, to make this thing ready for water would be 2 million, two and a half million dollars. This property can be bought for $400,000. And our solution would be we figured about three, $350,000. Now going to the Water4Us thing you just go to the developer and go, "Look, don't worry about it. Don't worry about it. You don't even don't worry about the 350. It's ready for you."

Developers and Water On Demand

Riggs: Well, the developer likes it because he gets to make the HOA pay for it.

Ken: Not only that, not only that, you can't break ground on building homes until your water is dealt with, right? So you can't do anything. You have to spend the money up front. You have to choke up, 100, 1.6 million, right?

So I think Ivan is going to have a hell of a time with these property developers, because I think they're going to, they're going to recognize very, very quickly the insane amount of discount they can get on beautiful quality property.

I myself, I'm still, I'm just you know, I'm waiting for the next 75 basis point hike before I, before I decide to, you know. I figured and I figured early next year, I'll get off my duff. I get an email from him like every, I don't know, a week. "Hey, Ken, how's it going?" I go, "It's still going." You know, but I think from my own personal experience, these inexpensive properties that especially the ones that, if you're a cash buyer right now, on this type of raw land, you're the king of the world, right?

If you're not using the bank and waiting for an interest rate drop. If you're a cash buyer and there are many people that went to cash, you are absolutely king of the world right now. So I think it's going to be very, very successful. And I'm excited at the type of expansion we can offer these really smart developers. It's just one aspect of the Water on Demand project.

Call Ken

Riggs: Well, it is exciting. And of course we are working on other Water On Demand verticals, but I think it's very, very promising. I'm going to go ahead and let everyone know just how they can contact you. So Oc.gold/ken is the simplest way to do it, put in your browser. You're killing it on bringing investors into the Water On Demand asset. So, thank you very much. So we're going to wrap it up. It was really interesting talking to Ivan, who's really been talking about us to a lot of people. And is going to continue. So thank you, everyone. And I wanted to make it a bit shorter this time and I think we've succeeded.

Ken: To Eric Parlee, please email invest@originclear.com. Lay out what you're looking for and I'll have my staff or myself direct you to the right party.

Riggs: Excellent message from Tom Liakos and Tom is a huge loyalist, but he's not accredited. But that's where the regulation A offering will come in. So, have faith Tom Liakos. I love people who are who are this loyal. And I hate the fact that we're limited to accredited investors. We're fixing that. Thank you, everyone. Have a great night and weekend. And I promise you another wonderful briefing next time. Thank you very much, Ken, for showing up. And thank you to Ivan for sharing what he's going through in support of OriginClear.

Ken: Good night.

Riggs: Good night everyone.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)