The 2014 AREDay debate with T. Boone Pickens was prophetic. Even way back then we were evangelizing off-grid and point of use water treatment and recycling… So, have things changed? Unfortunately, standards for municipal water haven't been upgraded in years and pollutants like forever chemicals are on the rise… But we CAN revolutionize water in time if we have the right focus, and we've found it! Get the details in the replay

Transcript from recording

Opening

We created something brand new by essentially applying a fintech application to a centuries old industry, by creating a decentralized water, water as a service, funding it like an MLP. These are things that all people know, but it's never been done this way. We've now become an industry, we've kind of become an industry standard. That national account, along with another household name, massive company, right? Trillion dollar company. They bypassed the bidding process and went right to our design because it was like, "No we need that."

Other companies, you know, they look to these industry leaders and they go, wait a minute, what do they do? Why are they, why are they doing it? So what happens is we become the Q-Tip®. In other words, you become the brand. Q-tip was the name of the brand. It wasn't Cotton swab. So, it becomes the brand. And there's literally, you know, it runs in the billions and billions and billions of dollars. So not only are we going to be innovating and providing a Water4Us™ decentralized water model, but we can have an amazing impact on this gargantuan existing water infrastructure business that we constantly say is archaic and we can modernize it.

Introduction

Riggs: And hello, everyone. Welcome to the CEO briefing and we'll get right into it. Greetings, Robert Baxter. Hello. All right. We got a nice group tonight. Let's keep on trucking. All right. What is the New Gold. And we are in November 3rd. Oh, Thanksgiving coming. Briefing number 185. Water like an Oil Well™ is the emerging income asset.

All right. Usual disclaimers.

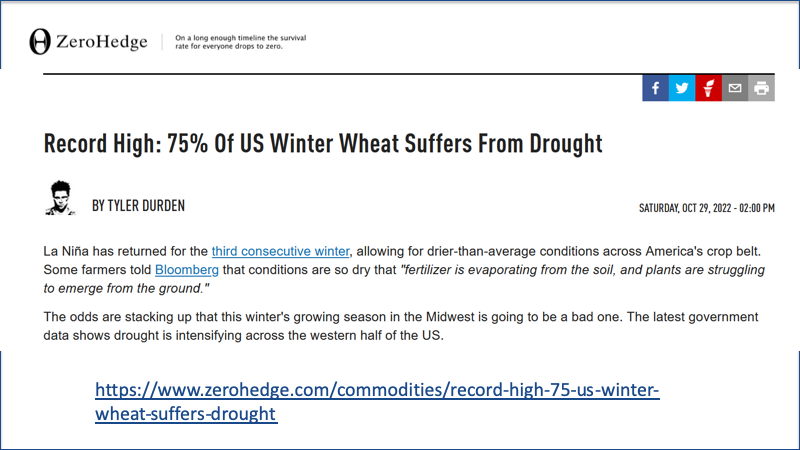

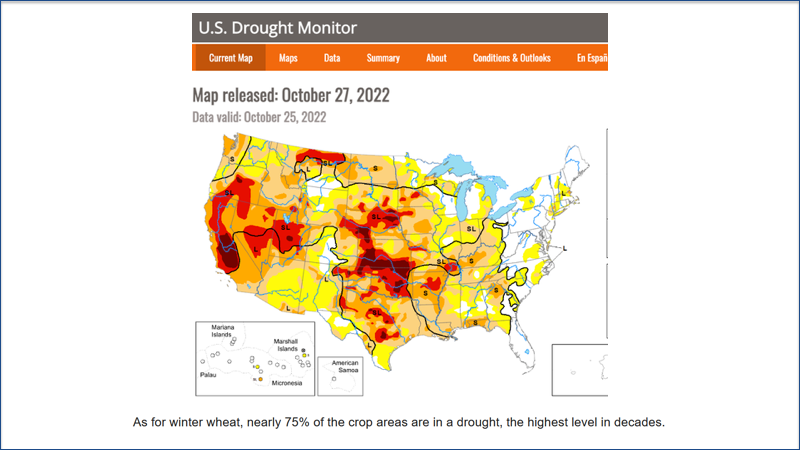

And let's get right into it with mega droughts, these things are in the news and let's see what's going on here.

Record High

ZeroHedge. Record high: 75% of US winter wheat suffers from drought, so third consecutive winter of La Nina. Now, La Nina is very important to me because I'm a skier, so it means that the snow is in the north, not in places so much like California. We do manage, but it's a challenge.

Drought Monitor

Anyway, but more seriously is that we have a bad growing season this winter. This is the drought monitor and you can see there's some serious drought going on. Winter wheat, nearly 75% of the crop areas are in a drought and that's not a pretty picture. So I guess you could look down there at Micronesia, they've got some droughts, but more importantly, California, Utah, the Central Midwest area, they're all in a drought.

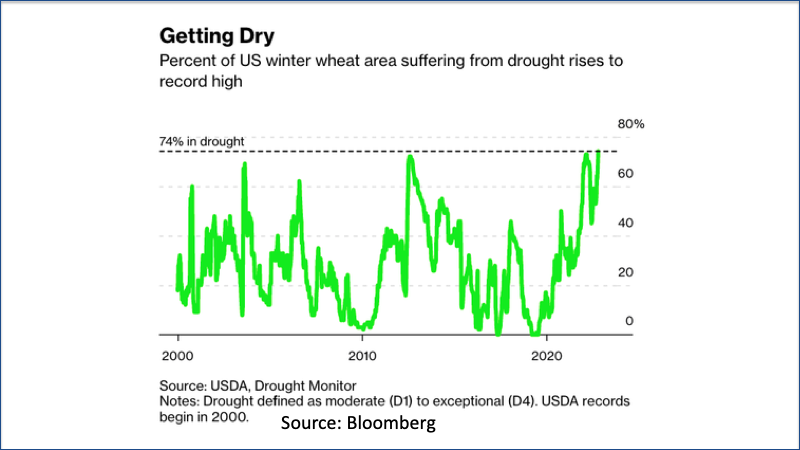

Areas Suffering

Here's a percentage of winter wheat areas suffering from drought up to 74% there. It's been there before. But anyway, it's not doing great. And they're worried about literally not being able to harvest enough. That's less than half of this particular guy. So that's not a good picture.

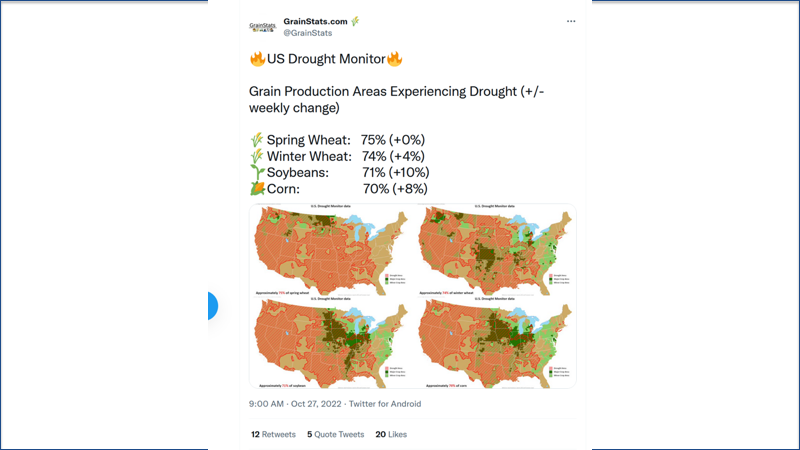

These are the grain production areas experiencing drought, spring wheat, 75%, 74%, 71%, 70%. So that, again, is a problem. And we have here the problem with spreading the fertilizers.

Harvesting Rain

Tucson, Arizona, has done a great job, speaking of solutions, because they started having a megadrought and what they did is they started harvesting rain. Now it turns out that enough rain falls on Tucson to supply everyone with water if you just collect it. But it's been, you know, what you might call "old water". Old Water has always been like, well, this is how we do it, you know. And so the purpose of the streets was to channel the water down to the drains, not going over into people's properties and so forth.

12 Inches of Rain in an Average Year

So this is not like they are really in a megadrought per se. But here's the problem is here's a picture, pretty picture of Tucson. Here's the problem. They get most of their water from the Central Arizona project, which the water comes from the Colorado River. And it's not like Tucson is in more of a drought than it was. It's that has been basically overpumping and a drought for the Colorado River. That means that there's a shortage and that's the problem.

So climate change is expected to cause snowpack at the headwaters to decline and brings hotter temperatures that further decrease stream flow. They've put in a number of things like desert landscaping, tiered water supply system, pricing system. And so on.

Curb Cuts

It talks about Brad Lancaster, who's a pretty cool guy. Let's see if we can pull that up. Here we go. Well, so what Brad Lancaster did is started breaking the law by basically channeling water into, off the streets, into properties.

And he learned this from having gone to South Africa and met with a farmer, Zephaniah Phiri Maseko, who had turned his family's plot into a beautiful one. But here's the thing. His government had outlawed what he called curb cuts. Curb cuts is when you cut the curb to let the water escape into gardens, into sidewalk gardens. And sure enough, the city officials didn't like it, but eventually it happened. So this is a really great article. It's worth reading. It's from BBC.com. And they've done a great job.

Solutions

So what have we learned from this? Well, we've learned that there is a solution. We, of course, work very much on potential recycling because once you treat your own water, then you can recycle your water. In this case, it's all about whether or not you can recapture water that's falling already. These two areas are very, very important. And, you know, if we did a lot of this, it would add up and we wouldn't have these big problems, the over pumping problems. And if you have if you have a drought, you have a drought, but at least you'd be able to survive it. All right. So that's a pretty cool story.

Now, what does fracking have to do with all this? And I thought I would go back on the time machine and take us to a discussion that I had with the late T. Boone Pickens. 2014 at the American Renewable Energy Day in Aspen, Colorado. And so let's take a look at this. And I gave some surprising information to Mr. Pickens. Here we go.

Start of presentation

Chip: We're just going to invite a couple more guys to join us up here and expand the conversation into water and some best practices. So if, Bill, if you would introduce.

Bill: So we're going to be joined by Riggs Eckelberry Origin Oil Inc and David Trickett of the Jefferson Circle. Please come up and join the conversation to expand it.

Chip: Riggs, Riggs Eckelberry has a company called OriginOil and they've come up with a very unique technology that basically takes the 5 million gallons per well that we drill. And I'm going to say that we have about 100,000 wells in the state of Colorado. I'm probably off a little bit, but but pretty close. And a lot of them have been drilled in the last eight or ten years. Some of them right over here in Rifle, Colorado, near where we live. And we use about 5 million gallons, I believe correct me if I'm wrong, per well. And then apparently that water comes back out and it's full of heavy metals and all kinds of stuff, and it gets carted off at about $8 a barrel. Is that right?

Riggs: It varies by region, but it's expensive.

Chip: So your technology basically takes that water, removes those metals, etc., and then they reuse it. Is that right?

Riggs: Right. So there's of course, a range of options. Sometimes in Colorado it's got to be returned to fully potable or it can be cleaned up to the level that it can be reused in the next frack job, for example. And so theoretically, especially if you're getting water coming out of the formation, you can actually make that well independent of outside water supplies, because as you know, there's, there's often plentiful water that comes out of the aquifers as well. Now, I have a presentation I thought I would make today,

T. Boone: And you say out of the aquifer.

Riggs: Out of formation, out of formation. Thank you.

Chip: Well, on that issue of of 5 million gallons per well in a water constrained west where drought is upon us in California, etc., it seems like a pretty good idea to try to conserve as much water as we can.

T. Boone: When you were talking about conserving water, you know, Kastner just said, Andy did, was talking about how much of our energy that we lose. And when you look around, pardon me for interrupting you, but I mean, it's a good idea to conserve everything, all resources. I mean, that should be axiomatic.

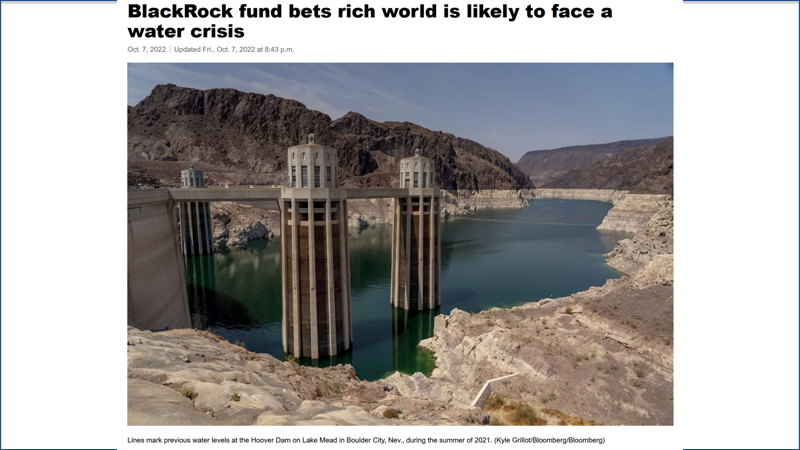

Riggs: Well, the reason I bring it up and I think that David can speak to this, is there's I think a lot of friction between the parties around this fracking issue. And people tend to dig in on their various positions and so forth. And it's our position that if the oil industry can address this proactively, there's going to actually be perhaps a lowering of the temperature and the ability to work together. As you may know, the Hoover Dam has been dropping down. This is just in one year. Now. Here's what it looks like. That's in June 16, 2013. And this is just one year later.

T. Boone: Are you fracking out of that?

Riggs: Oh, no. This is just to show where the Colorado watershed is going. So the thank God we're not fracking out of Lake Mead. But so what we have here is a 13 month drop and of course it's from a low level already. So there's clearly troubles with the Colorado watershed.

And the Ogallala, as you know Boone, is threatened as well because there's the big drought of 2012 and it has not been alleviated. We have parts of the Ogallala that are getting quite low and it is not recharging fast enough. So groundwater is an issue in the West, but also in the Midwest.

Now, here's the interesting slide by Seres where they show that so many of our fracking operations are in stressed environments. A stressed environment is one that already has 80% of the water being used for other uses. So it makes for competition. So fracking is competing in these various areas with other users, and many of these areas, like the grey ones, are arid to start with. We also know that overall fracking use is low as a percentile. Here's Colorado and it shows that hydraulic fracturing is 0.08% of total use, agriculture being the biggest at 85%. Now the issue...

T. Boone: Does that take in metropolitan.

Riggs: It's Colorado overall. Yes, sir. Here's the issue. And we see this in Texas. Local stress can be very high. We have Karnes, for example, 213% proportion of fracturing fracturing use to domestic. We have at Arion county, small population, of course, but they're at almost 3,000%. So this can create local stresses. And why is this important? Well, there's people live there and they get concerned. Um Texas is pro fracking of course, but I think we have to be mindful of the stresses on the population.

And here's another one where populations are growing in the arid regions. All these circled areas are major growth areas for population in the very same areas.

T. Boone: Tell you why they're growing...

Riggs: Well, they're growing because it's a great climate, for starters.

T. Boone: It's growing because of oil and gas. And those areas are so active and employing so many people.

Chip: Yeah, that's a good point.

Riggs: That's a very good point.

T. Boone: You've been to Midland, Texas, lately. You wouldn't believe it if you hadn't been there in ten years.

Riggs: We have an office in Houston, and I agree that Texas is doing very well. But for example, California, which has not yet had a fracking boom, is growing. The point is fracking is a boom, but so is the weather in Florida, the weather in California. These people are migrating to nice places.

Chip: That's right.

Riggs: Okay. Now, this is the point. If you have a growing population and stressed aquifers, fracking operators are under what I call a perfect storm, right? It's a PR situation that they have to recognize. And and our experience at OriginOil has been that operators would just rather it just go away. So it's not going to I think we need to be proactive. All right. So the good news is recycling with a whole new generation of technologies like ours is becoming chemical free and much more efficient. We can save on truck trips.

There's excess water that can be piped to farmers. It's happening in Imperial Valley right now where Chevron is piping water into. That's not regulated Colorado water. And finally, there is more and more waterless fracking, which can do about a third of the job and their savings available. This is a spreadsheet which you can get from our company, which, depending on the scenario, you can save a lot of money on your water if you recycle. That's a win win. Conclusion is, of course, is that we can dramatically mitigate the perceived impact of fracking on stressed water supplies with these proactive measures. And that's my point.

T. Boone: What's the name of your company in oil? What's a symbol?

Riggs: OOIL, thank you.

T. Boone: What it selling for?

Riggs: Oh, we're a microcap. We're a microcap and we're a technology company. So we're freely licensing our technology to all comers. We're kind of like Android versus iOS. You know, you don't have to buy the platform. You can have the technology and pay for it on the back end.

End of presentation

The Problem in Energy

Riggs: Well. That was a very, very interesting presentation. This is back when we were called OriginOil and as you know, we shifted to OriginClear and changed our ticker to OCLN because here's a couple of things that we learned. First of all, as I mentioned it there, the oil industry would rather the problem just go away. And that's what we ran into. We ran into a lot of oil operators who were just trying to buy time and just kind of push it off.

Also, at the same time, this is when the price of oil really crashed which forced us out of our original game of algae. Those of you who have been around for a long time know that we started as an algae company, making biofuels out of algae, and then we moved into this technology for cleaning up frack water and found that the oil industry was just not, we're just, we're just going to like, not invest.

Unfortunately, that continues to be the problem in energy because of the fact that it's a policy of the US administration to encourage renewables and discourage fossil fuels. So it's not easy to sell in that space. And ultimately we made a decision to broaden our horizons and move into general water treatment.

Decentralization and Recycling

But check out that stat that we that we generated from our models. You can save up to 80% of your water costs through recycling. That stat remains true, and that is exactly what we're doing today with decentralized water for everybody; breweries, apartment complexes, factories, etc..

So that car dealership near where Ken lives in Pennsylvania was able to locate off the grid by having one of our, what we call black water recycling systems. So we've continued and we've executed. One thing that we learned is that the water industry is also very anti new technology. And that was hard. What we found was a technology, Dan Early's Modular Water, that was very acceptable.

Why? It was simply a new way to package the water treatment system. And as a result, we tend to be basis of design for about 80% of the projects that Dan does. He's basis of design. What does that mean? No one else can have the bid because it requires the patented Modular Water Systems™ technology and the product itself. And that's really, I think, a stronger position to take than the one we were trying back then.

But here's what's interesting. Fracking, in actual fact, was only 0.8% of total water usage in Colorado. What was the biggest agriculture at 83%. And we keep running into this again and again and again where agriculture really is the biggest user. Now I'm all for rice paddies in places that have lots of rain, but rice paddies in a desert environment like California, I don't think so. And so that's really a problem.

Unfortunately, it's not one that's going to be solved soon. And so agriculture just has to get much, much more efficient. So does industry. Start recycling, doing it's, taking care of it's, taking out its own wash, shall we say. Okay. So that was my my little homily, as you might say. And Keith Roeten, "You were way ahead of your time." That is indeed true.

All right. So we're now going to talk about an interesting topic here, which is how is big water doing with investments? Investing in big water. And a shareholder forwarded me this. It was very, very interesting.

This is BlackRock is investing and bets the rich world is likely to face a water crisis. Yeah, well, there's water crisis everywhere. And remember in that video I showed a picture of the water levels in Lake Mead. Well, that was much higher than it is today. I mean, it was only that first bathtub ring. Of course, has come down ever since. And it just keeps on going. Right.

ETF

But what BlackRock has done is they've created an exchange traded fund called iShares Global Water ETF, a ticker DH20@LN. And I went ahead and looked it up. Now, here's what's interesting. Since 2021. It's gone up, up, up, up, up. And it's gone down, down, down. There was no reason the market wasn't crashing in in early 2022. And so these are the holdings of American Waterworks, which is the largest, largest water company in America, Xylem, etc.. And so these are companies that are working very closely with central water systems, and it's obviously not a growth area, right? So the. The performance of this so far this year is down about 27%. And that was obviously before things started crashing most recently.

Investment Sources

So what I'm saying is that we have you can't just say water, water's great, because there's increasingly a division between big central water, which is increasingly underfunded. And the big water companies are fighting over a dwindling pool of city, state and federal funds and decentralised water, which is funded by investors. In our case, regular investors and then other competitors of ours are funded by venture capitalists, or in the case of one very large one, the Morgan Stanley Infrastructure Partners.

So that is private sector funding of the solution, and we think it's essential that we move into that in order to so these central systems can continue to operate, but they're supported by a lot more. It's kind of like bring in the reserves, the Army reserves to so that we don't lose the battle, so shall we say. Okay. So that's an interesting story.

Now, here's another aspect. I was interviewed for a podcast, and the reason why J. LaGuardia was interested in this was because he liked the health aspect. Dr. J LaGuardia is really about health and fitness and success. The combination of the two and he was intrigued by what we were talking about. And so here's some excerpts from the interview.

Start of presentation

Jay LaGuardia: Hey, welcome back Triple P Nation, as I mentioned this week my guest is Riggs Eckelberry, who is the founder and CEO of Water Technology Company. And when I got the promotional email from his media team about Riggs and his company and what they do, I immediately found myself very interested because, you know, we talk often about the importance of lifestyle and the healthy life choices. And hydration is one of the simple things that that we can focus on as far as a positive daily habit to enhance our overall wellness.

But there's more than just drinking water, right? It's the quality of the hydration. And I think Riggs is going to give us some real great insight to what our water system, where it's at as a nation and where we're falling short and maybe other solutions, how we can uplevel our hydration and do it in a proper and a healthy way. So Riggs, welcome to the show.

Riggs: It's my great pleasure, Jay. Thank you.

Jay LaGuardia: Yeah, absolutely. So tell us, first of all, about the company, about you in particular, and how you got started with this company. Specifically, what was your motivation and mission with starting your company?

Riggs: You know, 80% of all the sewage in the world is just thrown away. It's not treated now. It's not, it's not that bad here in the United States, but it's really bad in developing countries. So kind of balancing it out. We have only about 20% of that filthy water is reused. And you have some very, very bad streams out there, including I just saw another river designated as a toxic Superfund site in New Jersey. You know, the lower Hackensack River just became another Superfund site. So we have our problems now that affects health. But it also means that we're throwing a lot of water, we use the water, we throw it away. We have this disposable culture, but water is becoming scarce.

We have problems throughout America, not just in the West. The Ogallala Aquifer down the middle is also down about 150 feet, and it takes a long time to recharge. So, we're not really husbanding our resources. So when we moved into the water industry, we tried to figure out what, how can we really change things? And we eventually realized that there's a long term underfunding of water districts all over the country. Right now it runs about $75 billion negative each year. Imagine losing $75 billion each year. That's what's going on.

And so you get these things that happened in Jackson, Mississippi, recently. They just got overwhelmed by a storm runoff and all of a sudden the water ran brown. Well, that was because of neglect of infrastructure needs and the problem really is that, we're in Clearwater, well, you know Clearwater Beach, right? Clearwater, where are you going to put a massive treatment plant? It's fully built out. And so the central solution to the problem is kind of falling apart.

Now. 89% of all water demand is by industry and agriculture. In this country it's about even. And the water districts would be doing a wonderful job giving us residential users wonderful water if the business people weren't completely overloading it. So we made it our mission to help decentralize water treatment, help businesses do their own treatment. Get off the grid. And that actually is a very good deal for them because they control their costs, they can recycle, they can get more use out of the water. And the water districts love it because they're overloaded.

And so it's a really win win for everybody where increasingly, let's say you're a brewery, you're expanding local water district won't take your water anymore. Fine. Put in a system of your own. And that's becoming a really, kind of a revolution where more and more of this water, making water clean is happening at the place where it's made dirty. Which makes sense, right?

Jay LaGuardia: Sure.

Riggs: Like you're making it dirty. We'll clean it before you pass it on. So that's really what's happening now. Of course, we took it the next step, which is, well, how about if these people didn't have to pay money up front? And so we created this water as a service so that if you're that brewery, you adopt a machine in your own location, you can pay for it just the same way you were paying the city, you're just paying us. So we're really privatising water treatment and that is very, very popular. And investors are super excited because for the first time they can invest in water assets and make money and it's a new asset class. It's very, very interesting thing. Now, that doesn't really address directly the purity of the water that your listeners are into and we can talk about that to.

Jay LaGuardia: So it's interesting you say privatizing the water treatment for businesses and so on and so forth. What's the quality of that water compared to the current quality that municipalities are putting out? I mean, you read so much that the current water quality, I know it's different by district or by community or municipality, but they're laden with heavy metals or drugs. I mean, I saw a report in our local paper about a couple of years ago. There was 64 trace elements of of pharmaceuticals. Yeah. I mean, it's crazy almost.

Riggs: Exactly.

Jay LaGuardia: Exactly. And of course, that's having a tremendous impact on our overall health and being and I'm sure it's similar in other municipalities as well, too. So it's awesome, A, that they can privatize it and clean up their own water. So the first part of the question is the quality of the water that they're able to filter and treat themselves. Is it better or the same? And then the second part of that question, Riggs, is what about to the end user, the consumer? Because as your math, it's only 11% of the water that's consumed.

Riggs: Yes. And it's interesting because in California, they're really piling on to the residential users like you got to save water, you can't take long showers and so forth. But they have a pretty small effect overall. The big effect is the especially agricultural in California, it's $20 Billion market and they have their lobbyists, of course.

Jay LaGuardia: Oh.

Riggs: It'd be great if they all were required to, I don't know, grow barley or kale. But no, the real money is in avocados and almonds, so. And rice, things like that. So. The fact is, is that if we unburdened the central central system, then then the water districts could really spend a lot of they have the ability to handle 11% of the total load they get. Right. They could do that really well. Now, when a business starts doing its own treatment, it generally just gives the water back to the city. So it's not trying to get to a high degree of affordability and the city gets treated water great. They run it through a polishing step and out it goes.

So that generally, there's three phases to water treatment. The first phase, of course, is treating the incoming water so it's clean and we can talk about that. Second is treating the dirty water. So it's at least treated to a certain level. And the third is potentially using recycling it for sprinkling the golf course or whatever the requirement is. So incoming the wastewater and then the irrigation uses or various industrial uses for the water. Generally, people don't try to take it all the way up to potable onsite because they don't need to. They can just return it to the city.

Now let's let's address the problem that the cities have. Or that we have with city water, which is that the standards have not been updated for a very long time. If you go to the Environmental Working group dot org, ewg.org/tapwater and you'll get a chance to put in your zip code. Find out what's the water in your zip code. And almost uniformly they say, oh, it's fully compliant with the law, but it's 600% too much arsenic, 300% too much uranium. By, by ordinary current scientific standards.

EWG is a very good organization and they're just quoting like, Hey, by the way, your city water is fully compliant. They're not breaking the law, but the law is way out of date. And so water's coming in to our homes that has got things, for example, forever chemicals. Right? Which are these chemicals that get into the system and just never get out. For example, the stuff that makes Teflon pans, right? That's a forever chemical or that roundup stuff called glyphosate.

And so here we get into a problem of class society because I've invested in a water system for my home. But who's got the cash? Right? And so a lot of people in America are living from tap water and they don't have much choice about it. At the very least, I would say put in an under sink system. And it'll be eight $900. That is well worth it. We do this. We don't work at the residential level. We work at the industrial level. We just installed a a purification system for a major hotel. Second one's coming along. We do the industrial ones. And I'll tell you, this is something very interesting. This first hotel contract was actually designed a couple of years ago before it finally got into use. And it did not have the forever chemical module. The second hotel we're doing. All of a sudden it does.

What I did in my house, in which I think makes sense. First of all, you want to invest in an under sink water treatment system. That's essential. And that would be something which purifies everything the chemicals, all of it. Such generally, it's reverse osmosis with carbon filters as well, and also remineralized system to make it healthy again. And as some people also like to invest in a module that brings the PH back up. That's, that's really optional. So that's, that's what we did in our house. And then we for the showers and stuff, we just did a 0.2 micron general cleaning up system and then have special filters in the showerheads to remove the glyphosate.

Well, who does that, right? I mean, you and I do it and we're health conscious, but we also have the budget for it. And so we have a problem, which is that regular people are drinking the tap water and we don't have much choice about it. So the Environmental Working Group has, you know, points out all these various toxins in the water that are not. Well, here's the funny thing. It'd be nice to update the water standards in the law. But again, the water districts don't have the funds to do it. And so we're basically running suboptimal. And that's just the way it is.

Jay LaGuardia: You know, recently there was a huge infrastructure bill that was just passed by the Biden administration where resources set aside to help update and kind of remodel the water systems around the country. Do you know if that was a part of it?

Riggs: Yes, but it was a grand total of $55 billion, which sounds like a lot of money, except that we are getting worse by 75 billion each year. So it's less than one year's catch up. So even though it was $1.2 trillion, for some reason, Washington doesn't see water as a priority. It's a strange situation. It is what it is. You know, bandwidth for underserved places like where you live. Sure. They have high priority on that. But, you know, the most vital thing around which is the water. It doesn't get the attention. And maybe it's not sexy, I don't know. But I consider it important.

Jay LaGuardia: Well, I mean, you literally can't survive without proper hydration. I mean, it's all right. Maybe not up there with air. If the air is gone, we're in trouble. But in a short period of time, without proper hydration, I think 72 hours, you know you're going to have some serious system defects. You said something earlier that really piqued my interest. As an entrepreneur, as a business person, you said that water is becoming the next asset class. So that might my ears went up when you said that. And it makes total sense, right? Anything that's a finite resource that's required for 100% use of everybody. You know, there's got to be really good marketplace in there. So excuse me, explain that a bit. And particularly why is it that you know. You know, major investors are now looking at this as as a play for them.

Riggs: It's very interesting because what we're dealing with right now in the current American and world economy is a lot of assets that are just doing strange things. Why? Because of politics. For example, energy. I can't I can't tell if energy's going up or down sideways because various decisions are being made at a geopolitical level that are way beyond my pay grade. Similarly, real estate is a strange thing where it seems like, there's you know, people are renting more and more. Fewer people are buying, the interest rates.

So I'm not going to go through the catalog, but it's a whole bunch of assets in your portfolio that are kind of not doing that great. And bless you if they're doing great. But a lot of people are stuck with a 401K that doesn't look very good. Water is coming out of a government monopoly. And so it doesn't have that history. It's not it doesn't have a geopolitical, nobody's been like, "We're going to make sure that the water..." No, none of that's going on yet. It's pretty much considered a politics free zone.

So we've been able to build something called Water On Demand™, which is a way that businesses can commission a water system and not pay for it up front. They simply sign a service contract and they pay by the gallon. And so it's a water is a service. And our investors are able to we create a bucket of of properties and then our investors get residuals from that, just like oil wells or solar properties. It's very similar. But here's the kicker, because it's very early, these investors are coming in at the outset and it's extremely, they're being treated extremely well. And we like to say that we're going to make your portfolio okay for a while because you're going to do so well with this new asset, we believe, anyway, that it's going to overcome a lot of the bad stuff and your spouse is going to like you more. That's what we say.

Jay LaGuardia: So then, is that a potential investment play for small investors or only large players in the future?

Riggs: Well, water as, we're not the only player in what is a service. It's a growing business. And there there's a lot of players that are operating in the space. The only people that are welcoming regular investors is OriginClear. We've chosen to make it just like oil well, master limited partnerships anybody can invest in. We're making it the same way. And so you can invest in this Water On Demand into through OriginClear and we are rolling out these programs.

It's very early. And as a result, as I was saying, it's very, very generous. It does require that you be accredited. Which means you make 200,000 a year individually or 300,000 with your co habitant or you have $1,000,000 in net worth outside of your primary home. But the good news is, because I hate that with a passion, I am so against it. It's so elitist. I mean, God, fortunately in the fourth quarter we expect to have an offering for unaccredited investors so you can take whatever amount you want, 1000, 5000, whatever you feel you can you can you can handle and invest it in the stock of this company. And I think that's a wonderful thing. So people can invest in the asset or they can invest in the stock.

But whatever. I think that this is, this is what it's time. You know, it's funny because I know, I was, I loved the dotcom going through all the really fast moving stuff. And I and I love the speed of high tech. And these old, then in the 2000s it became okay, what about the taxi industry? What about the hotel industry? All these old school businesses got revolutionized and it's time for it to happen to water, which is, by the way, $1,000,000,000,000 market.

Jay LaGuardia: This is a serious problem. You know, maybe water is, like you said, isn't as sexy as is petroleum and oil and so on and so forth. You know, from an economic standpoint. But it perhaps it's just as important, if not even more so. So specifically, the work you do, is it primarily with larger corporations or is there a use in smaller businesses as well too?

Riggs: As a water company, we have an existing business that's old school and that does work with very large companies. For example, we do large electrical utilities, we have big projects with them, but that's on the they pay us — we do the work, kind of thing. That's the old school business. The new business that we're building with this decentralizing down to the level of local brewery, car dealership, whatever is much smaller. Part of the problem has been all these until recently is getting systems that would that would miniaturize down to that level so that you can have something going to a brewery and fit into the back corner. It would be a gigantic thing, right?

We have that. We've developed our division Modular Water systems, which has patents on these Water Systems in a Box™, and that works very well. So it's been a technological issue which is being solved by us and others. It's also been a financial issue because many, many companies and now of course, we're seeing money becoming much harder. The interest rates are rising, rising, and it's harder to get the loans, both.

Jay LaGuardia: Of course, right. Yeah.

Riggs: So, increasingly they're like, "Okay, I need to do something, but I don't have the capital." We go, "That's fine." Those tend to be smaller, $500,000 to $2 million type systems versus, you know, a electrical utility might need 5 million plus worth of work. So it kind of spans the range. I believe the revolution is going to be in the small to medium businesses that are going to be equipped over the next few years with compact onsite systems that are fully managed electronically and in real time. And that's going to be the bulk of the users out there.

Jay LaGuardia: In our area. We have a ton of microbreweries here. So what would typically be the ROI in making an investment and putting this into something like a brewery where they can expect a return on that over X amount of years or so on and so forth. Do you have any kind of figures on that?

Riggs: The base deal is that there's an annuity of percentage of net profits, which is 25% of net profits, so that we've got long term forecasts of that. But what we've done is we really sweeten the pot with equity so investors get a piece of the public company and also of the new Water On Demand Inc start up. And that really creates a very, very strong return on investment.

Jay LaGuardia: Okay, very good. Last question I have for you today is again, in the some of the content in which you shared with me. You made a statement about inflation.

Riggs: I'm not an economist, but I think inflation is here to stay. All I got to say is you need to be in something solid. I think we're going to see a lot of loss of value in assets. And let me give you an example. Energy is getting really good prices right now, but at the same time, we have political pressure to not invest in energy.

Jay LaGuardia: Correct.

Riggs: So it's being talked down. So what investors right mind is going to make a 20 or 25 year investment in an energy like an oil well? They're not doing it. So it's this odd situation of, wow, lots of demand, prices rising and yet it's not a safe investment for the long term. That's crazy situation, in my opinion.

Jay LaGuardia: Yeah, I mean, just by the very nature of of how the Fed is being aggressive in raising rates, it's to tamp down demand. So this way people spend less money, there's less liquidity in the market. Prices, hopefully in their mind then will start to stabilize and inflation will start to normalize, whatever that looks like. I mean, historic rates is two and one half to 3% per year, but I'm not sure we're going to see that again for a really, really long time. You can only print so much money and devalue the currency so long at zero interest rates. And, you know, and from a political standpoint, it's great for the economy when it's soaring like that because they get re-elected very easily. But eventually that runs its course. And we're at that point now and some really smart people are saying we're just at the tipping point here. It's the next 6 to 9 months, maybe maybe much more difficult than where we're at right now.

Riggs: Yeah, Well, I mean, again, that's why I'm tooting my own horn, because I think that water is, it's kind of like when, I remember when, you're not old enough, but I remember when AT&T was a monopoly and then it got broken up. And the amount of wealth that was generated from breaking up AT&T was far beyond the original value of AT&T. Right. I think this was going to happen in water. The pent up value of all these systems that have been primarily governmental as they as they become commercialized, then we're going to see more and more value created.

Now, I want to make something very clear. A lot of people think that I'm saying the fresh water itself should be privatized and so forth. I actually don't think so at all. I think it's a big problem. We saw that happen in England. Great Britain went ahead and privatized all its reservoirs. Guess what? They've got no more reservoirs. They just got, it got that short term profit incentive and... I believe that fresh water needs to be in the hands of government because private interests will tend to skimp.

And so what I'm in favor of is is taking the load off of, the amount of work that the water districts have to do is so intense and it's being caused by corporate entities. Get those corporations off of the water districts, start treating the residential users. In Ireland they don't charge a dime for fresh water. We could we could actually have that in this country if we took the corporate users off the grid and had them do their thing. And then the cities would only have to worry about residential needs for which they're well equipped. So that's my little political thing.

Jay LaGuardia: That's a brilliant plan. I'm excited to see how you guys progress over time. Riggs, I really appreciate you taking the time coming on today, kind of enlighten us about this topic. Like you said, it was very fascinating when I saw it because I know this is an issue and yes, it may not be on the front burner for most people, but I think that enlightening them to this issue, perhaps more awareness is going to push the needle forward in the public square, which needs to happen.

Riggs: Well, thank you, Dr. Jay and I really look forward to your audience is obviously enlightened about health issues, and we'd love to have them join the OriginClear family.

Jay LaGuardia:Thank you so much. Triple P Nation, that's our show today. Appreciate you guys joining us. As always, remember, you be you, just be the best you and you will always empower your dreams, ignite your passion and accelerate your prosperity. Have a great week, guys. Talk to you soon.

End of presentation

Riggs: That was a really great interview because Dr. Jay asked all the right questions. We got into a lot of the political issues and we kind of, really, I got a chance to say a lot of good things. By the way, this is an excerpt of much longer. I try not to completely dominate these these briefings with the podcast, but this was some good stuff, I thought. Okay, so we have come to that time of night when it is almost the top of the hour, and therefore we are going to get into the free wheeling discussion. So I put it up on screen.

Ken Berenger: So great interview. Clearly he did his homework. You know, when I speak, I speak to investors all day. And you can tell they're engaged by the questions they ask, right? So these were just like super smart questions.

Providing Clean Water

A couple of things, when he talked about, and this kind of gets into Barb's question as well, and he talked about I like what you said about the clean water. The distribution of clean water to the public through their homes will be handled by the municipality, by government taking the load off.

So the reason we have all of these chemicals, the reason we have the PFAS and all this stuff is because the upstream, it's all, it's all feeding to one centralized location and it's not a one size fits all prospect. Now, this was, these things were built where there was one type of effluent, right? Human waste, it was household waste, right? And that was easy to handle. And now with businesses dumping their water, it's kind of mucked up the water or mucked up the works, if you will.

What I don't know that and you probably got into the economics of it with Dr. [Jay] during the thing is that right now a guy who's dumping 5 million gallons of really nasty water, industrial waste water to the main facility is paying the same per gallon price as me and Barb. Right. So I'm trying to answer Barb's question with our free wheeling discussion. I'm trying to try to keep a couple plates spinning here. So we're paying the same rate and the further you are from where it's resold, the more you pay. So poorer people actually pay more for clean water than people closer to the action because it goes through resellers.

Right. So clean water should be free. The only way that can happen, however, charge the people who dirty the water to clean the water. Then what you can do is, first of all, because it's now, it's not a longer, it's no longer a one size fits all idea anymore. Barb, this specific device on this specific location, if this specific business is catered to deal with that specific type of effluent. So the water that comes out of there is a better quality. And because he's paying it there and because he's paying a a operational expense that actually reduces the cost to run his business, he's thrilled, right, Because there is a load right now, a financial load on these guys to offload water.

Improved Water Quality

Now, what happens is the downstream effect is that water gets better. And there's a point where, if this is scaled enough, this can be delivered to the end user, the finished product, which is really good, high quality drinking water, removed of all those chemicals from various different sources with their own specific system that's suitable for that. The downstream effect is it gets to us as consumers and we're only using 11%, but it gets to us consumers cheap, maybe even free. So I hope that addressed some of your, some of your questions. And I and I hope it engaged the audience in our free wheeling discussion. I think the doctor covered that. But I like I liked his entrepreneurial kind of quasi spiritual view of it. I really did enjoy that.

Upcoming Events and News

Riggs: That life is integrated that way. I wanted to talk a little bit about the coming schedule. Now, when, I did not play tonight, because I ran out of time, there was a big meeting of all the ambassadors of the PhilanthroInvestors network, which are in Latin America and elsewhere, and Latin South and North America. And it was really good, and I'm going to play that next week. But here's what's more important. We've got something very exciting coming that we'll be announcing early in the week, which I think is going to be really thrilling in terms of the direction we're taking. I'm trying to be as general as possible.

Ken Berenger: But pretty general. I think you're safe. I'm the only one who actually knows what you're talking about right now. And it's only because I know what you're talking about. That's good.

Riggs: Exactly. But this is some might call it a game changer. And then a week after, of course, is the week of our quarterly filing, which is due on the 14th, 15th Tuesday. I think we have a three day grace, but I don't know if we'll have to take it. So by Thursday I should be able to on the 17th, I should be able to discuss the results which I believe are going to be again, really great. And remember that the annual report doesn't occur until all the way in the spring of next year. So we so this will be the last major report on our performance for the year. So I encourage you all to come back next, as I say, next week, it's going to be a thriller. The Thriller in Manila is going to be amazing.

Parting Comments

Ken Berenger: Going to be a thriller and killer, when I meet the Gorilla in Manila.

Riggs: Boom, nice work.

Ken Berenger: 72, The Thrilla in Manila. Joe Frazier.

Riggs: You weren't even born, dude.

Ken Berenger: I was. I was. I was quite young, but my dad was a boxing fan. Listen, I grew up on it. I grew up on Muhammad Ali. I watched Muhammad Ali fights. Howard Cosell. Wide world of sports. You know, that's when we watched, that's when they'd fight, that's when you didn't have to pay to watch a fight.

Riggs: That's right.

Ken Berenger: Stay up late, you had to stay up late on a Saturday. That's all.

Riggs: Well, so it's going to be a thriller. And then the week after, as I say, it's going to be the quarterly report. So thank you all for joining us. Eugene Tully says, "Do a beer commercial, replace Snoop Dogg." Thank you very much. You guys are all great.

Ken Berenger: I don't quite know how to respond to that, so.

Riggs: No, Just.

Ken Berenger: Just don't. Right. Right.

Riggs: And anyway, so there's all kinds of great input on the comments, which I unfortunately don't have time to handle. But Barb Retson, "Thank you for all your input. It's been really interesting." Robert Baxter, "It's a pleasure." Of course, Keith Roeten is always very encouraging. Charlie DeVanzo gave us the, like that. So we've made the grade. Happy campers. So stay tuned. It's going to be exciting, more exciting times ahead. I love what we're doing. Paul Fetscher says. "Yeah." And with that, I bid you ado.

Ken Berenger: It's 9:00. We have to go. We turn into pumpkins.

Riggs: Thank you all. Stay cool.

Ken Berenger: Goodnight

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)