I finally got a chance to unveil our new institutional deck, and it shows exactly how we're developing inflation-friendly clean water assets. But, continued inflation and life-security concerns are also driving an economic shift from currency to commodities… So, wouldn't it be great to have a commodities basket for securitized water? Well we do! Find out about it in this briefing.

Introduction

Riggs Eckelberry:

I'm Riggs Eckelberry, co-founder, chairman, CEO of OriginClear. The government needs to continue to provide a lot of abundant clean water, but what happens to it after it's used when it's dirty? Do you know that 80% of all sewage is never treated, it's just dumped? That leads to water scarcity, but it also leads to a lot of disease and pollution and the ocean turning into something horrible.

At the same time, the cities and counties are not getting the funding they need to really treat the water and so they can't keep up. The solution is let the people who use the water clean the water. Water on Demand™ is investment in actual capital assets that earn income. Sign up to hear my weekly briefing every Thursday night. 5 p.m. Pacific, 8 p.m. eastern. Just put oc.gold/CEO in your browser. Register for the briefing and I look forward to hearing more from you.

Hello everyone, and welcome to the first briefing of June 2022 and I see people arriving rapidly. Water is the New Gold and it is June the second. Take a look at this because we're going to be revisiting this OriginClear develops high growth clean water assets. That comes out of the institutional pitch deck, which we'll be reviewing today. Meanwhile, I'd like to take you right into a show that we did around crypto, and I think you'll enjoy it as we delve into some of the crypto implications for what's happening.

Now yes, I hear the crypto is down and so forth, but we are many months away from doing anything in crypto and I think long term crypto is here to stay. We saw the end of the world in 2018 and it roared back and it's kind of how the game goes. I guess in crypto it is what it is, right? All right. Let's go ahead and play this little show and then we'll continue.

Inside Crypto by Amun

Crian: Today we are joined by Riggs Eckelberry, the CEO of OrigenClear. OriginClear has developed and licensed a decentralized system, crypto people, decentralized! That treats industrial and agricultural waste water worldwide with very little energy use and no chemicals. It also allows industrial users to treat their water right where they use it, putting control back in the hands of the consumers. That is a mouthful. Guys, I know you're not used to that. We're going to talk about that just now. And let me tell you, it'll be worth the wait.

Riggs: Crian, it's interesting that you bring up crypto first because we know that we're moving away from a currency based system to more of a commodity based system. And so even though crypto can be considered a currency, it's really an asset class. But I'll get to that. And it's even better when it's underpinned by real assets such as monetized water, for example, which happened.

Early on it was technology. We had this breakthrough technology, as I was saying. But the problem in the water industry again is technology adoption is very slow, takes 12 to 15 years for any technology to be adopted in the water industry. And we didn't have that kind of time. So we realized the technology per se say. Is not the solution. It's an enabler, but it's not. It doesn't break through.

We then started to acquire companies, which we've been doing well and we've been building properties. And then in 2018 I had a crypto experience, which I'll discuss later. And finally we came to the COVID era when we realized we really had to do something to change the entire basis on which water treatment is done. And that led to this current thing called Water on Demand, which is water as a managed service. And of course we can dive deeper, but that kind of takes us to the present.

Crian: That's really an important point. Coming from South Africa and growing up pre apartheid and post-apartheid. And even now after Mandela's passed, so many years later, there are still lots of water issues in South Africa. There are even water issues here in Taiwan where I consider it very advanced. But we'll get into that and our listeners tune in for crypto. So we could to start off with the crypto stuff first needs to mention 2018. So what happened in 2018?

Riggs: Okay. So just to backtrack, a couple of years in 2016, I read a Lux research study. It was a webinar on decentralization and it basically said, look, all the centralized systems are failing in America alone. We are falling at the time $50 Billion a year behind on needed infrastructure upgrades. And by the way, the Biden administration, they did a huge multi-trillion dollar infrastructure bill and it was only 55 billion for water. So that did nothing. Right.

So the federal government funding less and less; cities not being helped, also standards being raised, so more and more demands and more and more industrialization. And it said, look, the trend is clear, it's moving to the edge. And I had an epiphany. I like, this is it, this is what's happening. And I started talking about it and I got absolutely nowhere. Decentralization of water? What the heck you talking about? I flush my toilet, it goes away. What's my problem?

Talk to the industries whose waste is not being taken by the city because it can't. And unfortunately that is not... What industry goes through is often just not visible to the general public. But it led to a realization in the fall of 2017 that crypto could be a very important component in this decentralization. And I've always been looking for a lever to accomplish change in the water industry.

And I went, What? This could be a very interesting way to go. And I started to theorize a coin at the time called WaterChain, and it was basically a way to monetize water. And I spoke, for example, at the d-10E conference that year, which is a decentralization conference, and spoke in Puerto Rico at the restart week, that year and so forth. And two things happened. The first thing, of course, we had crypto winter, which made it very hard to continue, but that that wouldn't have stopped us.

The more important thing was that we realized there is no single price of water. In oil you have Brent crude and you have West Texas crude. These are prices that are known and everything is based on that. There's no such barometer in water, so you can't build a market if you don't have a price. And that's when we realize, look, this isn't working. And we pulled back and started working on some of the fundamentals. The first thing, piece was, if you're going to have decentralized systems, then you have to have the delivery systems for it. But I'm getting ahead of myself. That was phase one of crypto and now we're going into phase two.

Crian: Very interesting a water coin, fascinating and pulling back and I love what you said. You can't build a market if there's no price. And it's, that is definitely a pearl of wisdom. Pulling back and talking about things at the moment, right, because you are someone who has global experience and a lot of years of experience, a lot of people are in disarray, not just with the traditional stock market or with the crypto market as well.

And I want to get your take and especially I think our users would love to get your experience. Why do you think the market is coming down so often and coming down so heavily? Is it, I love that you mentioned the phrase de-globalization. Is a factor of that? And what do you think the reason is behind the way things are existing economically and globally at the moment?

Riggs: We're now looking at self sufficiency is the new slogan, and we've seen this in our water business. We operate two production facilities, one out of Texas and one in Virginia. And what we've seen is an influx of demand for self sufficient water treatment in housing developments, RV campgrounds, trailer parks, travel stops, the kind of hotels, human communities that need to make sure that their humans are doing okay.

And we realize that this is a trend that is only going to amplify. The overall trend is self sufficiency, and I think that's going to be a growing trend and it reinforces this idea of self sufficient. Water, which brings us to some of the enabling ventures that we've put in place. And I would say that it's related to the decentralization thing because, again, you're not going to rely on a municipality. You may not even get clean water. You may have to have your own well. These are all considerations that people are thinking about now.

Crian: Would you say what you're trying to do at OriginClear; the idea of decentralized water, is it very analogous to the idea of more and more people in the places we can get it? With solar and like Tesla power walls where they control the electricity and if they generate more, they get to sell it back to the electricity company. So you are no longer relying on the centralized electricity provider. You are creating your own electricity from the sun and you're selling it back to the centralized provider. And is what OriginClear is maybe the long term goal is for when it comes to consumers that you are responsible for your own water.

Riggs: And the energy analogy is very good because we're moving away from a big central grid which is very vulnerable. I was interviewed for a publication recently about cyber attacks on water. I'm like, Look, if water treatment goes local, you don't have a cyberattack. That was the original idea for the Internet until they decided it... As originally designed, it was hardened against nuclear war. Today it's not. You can take out the internet like that.

But back then, the way DARPA, the Defense Advanced Research Program, designed it, each node was completely independent. And that's a good strategy to have. That's the strategy that the world is following with this, quote unquote, de-globalization. OriginClear, we are a clean water innovation hub. By that I mean that we develop these very useful properties and we're, now we have five that are at various stages of development. And we've currently launched one, which is this Water on Demand initiative.

And that one demand issue is very important because in early 2020, when the world stopped, we realized that we had to do something to enable financial transactions in water to happen for these new decentralized users who couldn't just do a municipal bond offering as utilities do. They just had to take out a loan. And if you're a brewery and you need a water system, you want to invest in brewery systems, not $1,000,000 to treat the water. That's not your priority. And so we say, that's fine, just sign here, you'll get your machine and it's fully managed. Don't worry about it.

That's a boon to the decentralized user because they never intended to get into the water treatment business. None of us planned to take care of our own water. So when it comes along because we have to, then it makes sense to make it frictionless by creating an investment vehicle. And so Water on Demand, we call it Water Like an Oil Well™, meaning that investors can invest in a water system. And it's actually a basket of water systems, very much like what is known as master limited partnerships in the oil industry where they have a basket of properties.

So that one one oil well can fail. It doesn't matter. Essentially it's a commodities basket and it generates royalties. We're doing the same thing now. For the very first time, ordinary investors can come in and invest in water systems and receive a residual, and the users at the other end don't have to come up with the capital and they pay by performance, which is very ethical in my opinion. So that is what we're working on to enable all this. Now, the next step is the crypto step, because now we're paying out residuals and we're paying it out for a long time. These are systems that are going to last at least 25 years, more likely 50 years. And so it's generational residuals.

And some people are not interested in waiting 50 years for their money. So what do you do? It's like that NFL player who put his contract into a coin and then people were able to buy pieces of the contract at a discount. And he got his money now and they wagered that he would actually not get hurt. This is, insurance companies do this for example, where you are able to get net present value out of a future income stream.

And so what we decided to do was to wrap these dividends in an NFT or asset coin. It people say, is it an NFT? Is it an asset coin? Now that's TBD. To me, the structure is less important than the function, but let's assume it's an NFT for now. We call it $H2O®, Dollar Sign, H2O. We've already trademarked it and we've got it well worked out to where now there's a stream of revenue from these pay per gallon systems.

That means every gallon of water is paid for in the system. Now we have that magical price that we were looking for and then we wrap it in an NFT, a royalty generating NFT, and then you, Crian, who invested, I don't know, $20,000 in the system, you get your little residuals, 25% in net profits forever, and you go, okay, it built into this FTT is a smart contract. So the entire revenue stream, lifetime revenue stream from from this investment is built into the NFT.

I transfer it to Riggs and now Riggs has that and pays for it. Now you have this very low friction marketplace for water. Now for the very first time, people are able to trade water assets and that is what we're working on currently. We've had to separate it from Water on Demand because the United States, the SEC, is very picky about companies that play with crypto. And so we're doing it as its own thing, but it's imminent, it's being worked on.

So that is the vision there. The key part again is number one, it's actually based on if you imagine the future app, you will see the amount of gallons being treated by the system you've invested in and how much money is throwing off. And you will also have a known price for that water.

So for the very first time, I have a water risk in Northern California. I can offset it with options on Singapore water and now we have a global marketplace and that is the vision. We think it's high time that we had a water coin. And again, I believe the future in crypto is asset based because, putting aside bitcoin, which is its own special case, I believe that altcoins need to be more than a vapor. They need to be based on something real. Wow.

Crian: If I'm not mistaken, a regular person can put in capital into OriginClear.

Riggs: Correct. The breakthrough with Water on Demand is that we've enabled the regular investor to invest in water, something that could not be done before. You could only buy municipal bonds or EFTs or shares in Veolia, you couldn't actually invest in productive water assets directly. This is the breakthrough. Now, currently right now you need to be either a non US or an US accredited investor, one of the 1% to invest.

Now, we don't care how much you invest, but you have to prove if you're in the US, you have to show that you are making a certain amount of money and so forth. But this summer we do intend to roll out an unaccredited offering so that people can come in and invest at a much lower level and still get residuals on these systems. So we want to democratize it.

I have operated in the public space now for 14 years through the graces of accredited investors, and I think they're wonderful people. So much better than trying to work, every time I've tried to work with Wall Street they've been very predatory. Like, we'll help you, we'll help you. No they won't. They only help, they're there to help themselves. Come on. It works if you have scale, if you don't have scale, you work with these angels because they're patient. If you treat them right, they'll treat you right.

Anybody who stuck with us has done well. Even though you can look at our stock graph and we've had a history of losses because we been developing. But accredited investors have done well because we've made sure that they are protected from loss. And I also believe that we've now built enough value in the company that we are now turning into a series of crowdfunded properties that the common stock itself is now, I believe, going to be start to be worth something.

I think a regular investor today, even though he can't yet go into the water asset play, he or she can certainly invest in OCLN. I love cheap stocks because they go from $0.02 to $0.04 and you just doubled your money. It's fantastic. Whereas Tesla goes from 1200 to 1300, that's nothing. There's no change at all. And yet that's a lot of money.

It's something that I believe everyone should have in their portfolio, which is a nice little cheap stock. And because it's got that upside, of course it's got risk. But by now I think we've shown that we're very good at being a kind of an incubator for these interesting water plays that I believe are going to be real bricks in creating this new, self-sufficient, independent water independence world that we're moving to.

Crian: And I totally agree and thinking I think anyone, if they've been alive like the last 20 years or so, they would have seen emerging data about water crises in a particular country. But throughout the world, my parents are dual Irish, South African and in a place like Ireland with like rains all the time, Ireland has a water crisis. Irish people always joke if the government ever started charging for water, they'd be all right.

But at some point in the future, environmentalist friends of mine and they're like, Yeah, the government has to start charging for water because they have a problem with treating water and untreated water and giving clean water to people. And that's the trend that's it's going to expand to pretty much everywhere in the world. And and I think what you're doing is fantastic.

Riggs: Because I think that we should be able to survive what happens to government, because you can't just say, well, government will always be fine. China is living through tremendous disruptions that are highly arbitrary. And the poor people in these highly locked down cities are like going, wait a minute, and I'm really looking forward to rolling out a really solid water coin that enables this kind of liquidity. I'm going to use the word, and water marketplaces.

Crian: I mean, talking about like a blockchain and Ethereum and when you do roll out a water coin, not if, are you going to make your own blockchain, are you going to build it on top of something else? Is there any inkling towards that at the moment?

Riggs: That's why I like an NFTs, because you don't have to create a whole infrastructure. You don't have to like program down to the metal. You can sit on top of the NFT standards and basically just code a product. I lean towards that. I would say that it's an 80% NFT proposition.

Crian: Ricks I really appreciate your time. Is there any sort of like final thoughts you want to mention about OriginClear or crypto?

Riggs: No, it's been a real pleasure, Crian. And I would say this, that let's think about the long term. Let's not get excited about the day to day, about the noise that's happening and pandemics and conflicts and this and that and the supply chains. Let's try to think in longer, longer term, and let's try and build for what the world will be like in five or ten years, because it's going to happen faster than we think.

If we do plan, well, then we'll be helping to build this new world. And I think it'll end up being this hybrid world of self sustainability with a good modicum of government resources, and I think it will stabilize out that way, and I think that'll be a better world in the future. So that's my feeling is this work for the long term.

Crian: Riggs, thank you very much for your time. I appreciate it. I really hope we can get you on in a few months time or like maybe once you guys start doing the crypto thing and.

Riggs: Crian, I look forward to it. Let's check, eight, six months or so. I'd love to give you an update on where we are.

End of presentation

About the Reg A

Riggs: Right on. Right on. Well, that was very interesting, obviously. We're about to enter a Regulation A offering, which means a registered offering with the SEC, which means that we are. I'm going to be asking the Securities Exchange Commission to approve our offering, and they don't particularly like crypto. It's just how it is. So we've clearly separated it. It's going to be a separate, different initiative, and that's why it's not part of the current menu. But hopefully in this podcast it shows you some idea of what's going on and what's happening, and we'll be updating you soon.

All right. Well, that was our little show for the day. I see that there's a ton of chats been going on. When I'm playing a video, I can't reply to a chat because it stops the video. That's what I've learned. So, Ken's doing a great job of answering, so I'm going to keep on rocking.

Oil Prices

Oil prices. Hmm. Very interesting. Well, oil prices up and down. I believe they're overall going up. InvestorPlace Digest from yesterday. Obviously, we've been watching West Texas crude go close 120. Then it came back because theoretically now OPEC's going to take its stuff up, whatever. In general oil is going up and that's how it is. But let's let's keep looking. This is not really the point here. I have a point to make.

And by the way, here's that cool finding income in the oil patch where MLPs, which were creating a water MLPs structure is a very well, if you're looking for a way to make your dollars work harder in today's inflationary world, check out MLPs. Well, that's excellent. It's very good advice for energy. We are doing the same thing in water.

Price of Energy

Now, uptick in the CPI number. Now, CPI is generally, it went down a little bit, but the problem is, is that the price of energy is a big piece of the overall number. Now, what we're going to see here. Just, I'm going to have to take this off of the full screen because it does weird stuff. Let's take a look right here.

So this has been the price of. WTIC. And it goes higher and higher and higher. And it fell. But here's the situation, because oil is going up. Inflation is going up. But let's let's say this. You're going to see even though inflation continues to rise, the inflation number is going to drop. Why? Because it's like buying Tesla stock versus buying OriginClear stock. If you double Tesla stock, it goes from 1500 to 3000. Ridiculous. OriginClear goes from penny, a penny in half to three pennies. It's not a lot of dollar difference, but it's a huge percentage difference.

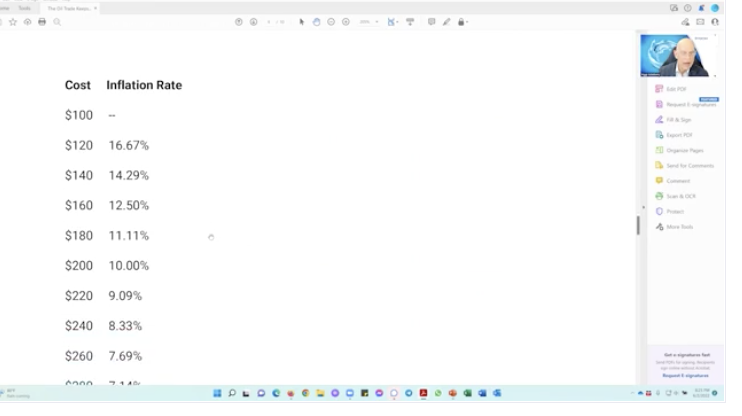

Inflation

Well, that's exactly what's happening here with inflation. Take a look at here. If you start at $100 and you keep inflating, here's the inflation rate. The inflation rate goes down, down, down, down, down. You still got from $100 to $400, right? Because the basket of goods began at 100 at the end of the period of cost, 400. Even though inflation appeared to have cooled. So as you prices go higher. The apparent inflation rate goes lower, but in dollar terms it's continuing to rise. So watch for that.

In this case, the price went up the same $20 every single month. But because of the math of numbers, a bigger number on a number on top of a bigger number. On top of a bigger number, you get a smaller percentage increase. That same increase is a smaller piece of a large number. So watch out. We're entering a period in which the starting values for our inflation calculations will be so high that headline inflation numbers should drop. But that's not going to affect your wallet.

Other Measures

Now, so that's why we've got to look at other measures. And this is a point where so 70% of the US gross product is the US consumer. Well, what's going on with that? Unfortunately, the US consumer is, by the way, is there's a bifurcation between high end consumer and low end consumer. High income consumers appear to be going along okay. Low income consumers are having a hard time. They're buying much cheaper. They're basically seeing a very big difference. So that is if we go keep scrolling along here, economic confidence is -45 and it's the lowest confidence has been since early 2009. And that is the thing to watch for.

So that kind of covers that a little bit. And the reason I bring this up is because we are entering an inflationary phase. We are in it. It's going to continue. It's going to apparently abate. But watch the actual real numbers. They will continue to rise. That's my thought of the day there. It's not a pleasant thought.

Press Coverage

On more pleasant topics, we got some press. Let's take a look at the press we got. Eat This, Not That. And so we got placement in a magazine that has very good coverage. And basically we talked about uranium in the water, which oh, yes, uranium represents an important risk factor for chronic diseases. And it turns out that these highest concentrations are unfortunately in certain communities. Government says it's okay, but it may not immediately kill you, but it can lead to long term health conditions.

So we got that. We got that coverage. And in fact, we got hits in Yahoo! Life and Yahoo! News with their big, unique readers. So that was very positive.

Economic Hurricane

You saw this. Most of you saw this. Jamie Dimon saying what is pretty obvious, that things are getting very interesting. And basically he's saying economic hurricane. The problem is everybody's going to cash, but cash is losing value. So the smart thing to do, of course, is to go to assets. We'll cover that in a little bit. And the institutional presentation.

Two factors, Fed's decision to reduce the amount of securities. So it's basically selling off in the stock market. And by the way, when you're selling $95 billion a month in the stock market, yeah, that can hurt. Of course, the war in Ukraine, sanctions on Russia are not well thought through and this is not a great time for us to be gambling away. But then again, that's kind of how it is.

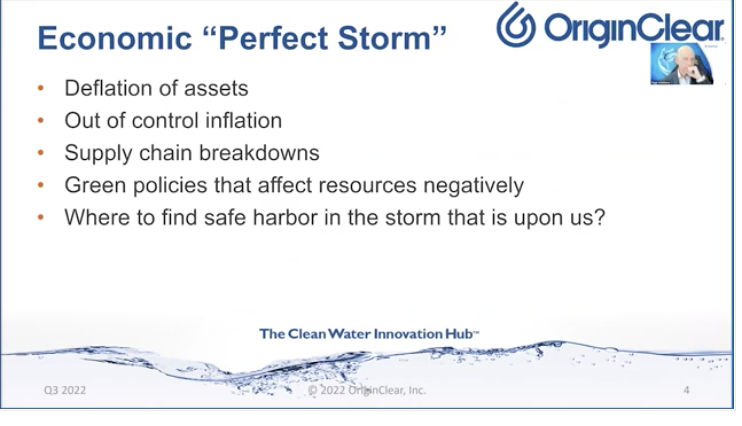

All right. I'm going to jump into the institutional pitch deck. I promise to do that. And so let me cover that really fast. So this opens it. Why? Because we have this huge jump of mortgage rates that obviously spells doom for the real estate market because real estate market is highly dependent upon debt. Now you say, well, yeah, but it's a safe asset, etc. And that's probably true. I'm not going to say you're in deep trouble if you're in real estate necessarily, but you're buying very expensive and you're paying big dollars for it. It's hard to sell more and more because of the high price and the debt. I mean, the interest problem, is there an alternative?

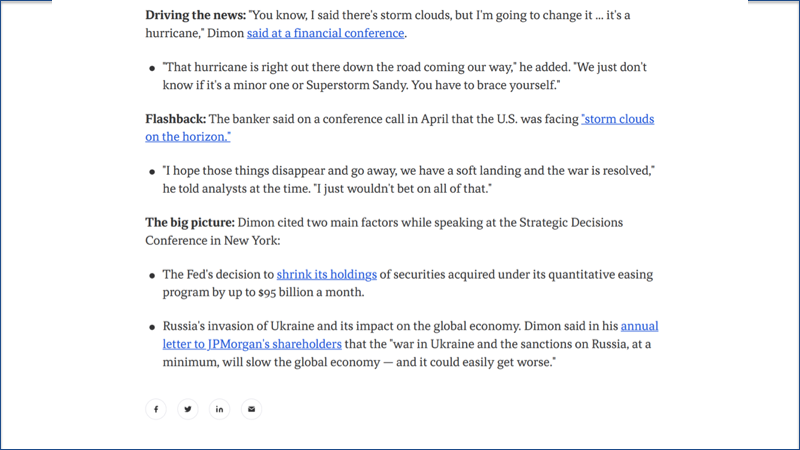

Well, obviously, what we think it is, we develop inflation friendly, clean water assets and we're entering an economic perfect storm. Deflation of assets. Meaning, for example. The stock market. Crypto and so forth. And also, for example, commercial real estate is in real trouble. Inflation is out of control. Supply chains breaking down. 1000 ships stuck outside of Shanghai.

That has what's called the bullwhip effect. When something happens way, way down the supply chain, by the time it gets to you. It's majorly amplified. It's literally called the bullwhip effect. Green policies that affect resources negatively. For example, water use affects the use of resources for green purposes or, for example, planting crops for biofuels and therefore humans not being able to have food. Things like that.

Safe Harbor?

Where do we find safe harbor in the storm? Well. Obviously, assets, real estate is vulnerable to these interest rates. Precious metals are already high priced. They don't generate income. I personally am still buying because still better than dollars. Commodities are already high priced. Stock market is turning down and unfortunately bitcoin moves with the stock market. And now we're looking at the exchanges like Coinbase, not necessarily guaranteeing our money. So not a fun game.

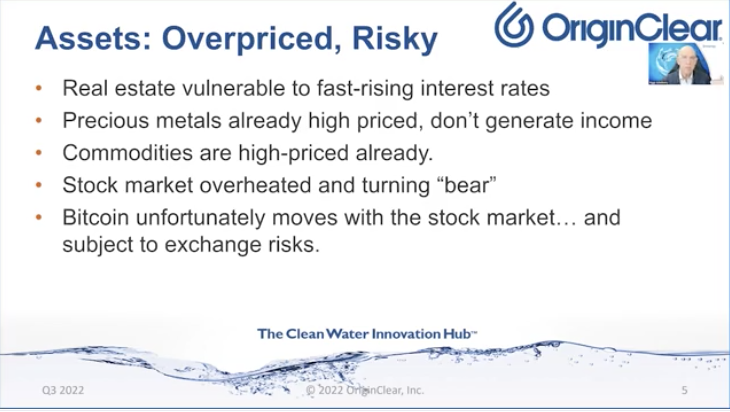

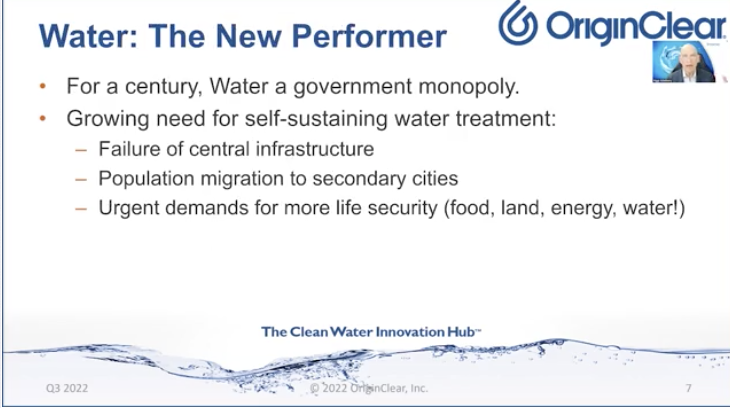

Better Asset Class

Is there a better asset class, financial shelter and stability, a green world changing benefit? Freedom from economic disruptions, large upside, potential? Water. It's been a government monopoly. However, there's a failure of central infrastructure. Migration to secondary cities. Cities like where I am, the Tampa Bay area, which means a load on those less developed water systems. And people want more life security, food, land, energy and water. Everybody's thinking about that if they are looking at the risks of their life. Now, Big Water is the old model? These giant players live on the municipal market. It takes a long time for new technologies to be adopted. People are still building water systems by hand, and these new private water systems don't have capital.

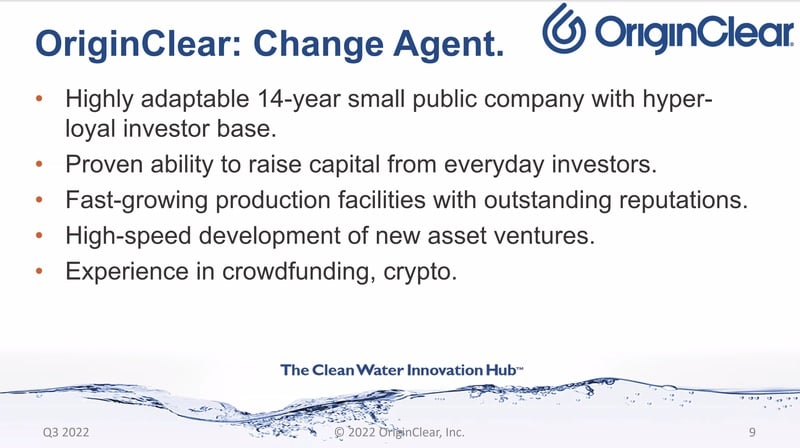

We need a new paradigm and we are the change agent. We're highly adaptable. We've proven we can raise capital from everyday investors. We're very good at that. We have fast growing production facilities. In Q1 alone, we were up 50% over Q1 2021, and that, for the water industry is ridiculous. Water companies don't grow 50%. We're building the new asset venture, which is Water our Demand and we have experience in crowdfunding. We did a reg back in 2020 and of course, crypto in 2018.

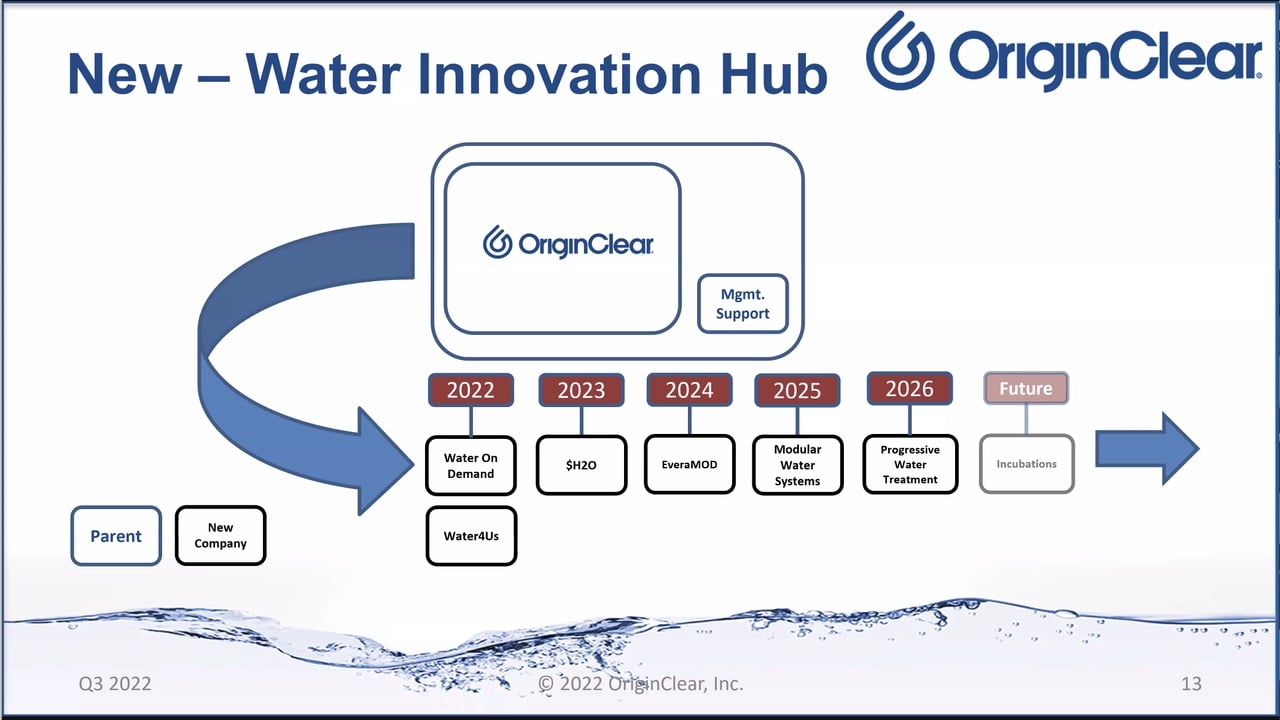

All right, we have a roadmap which I'll go into further so I won't get into this too much. OriginClear is the mothership.

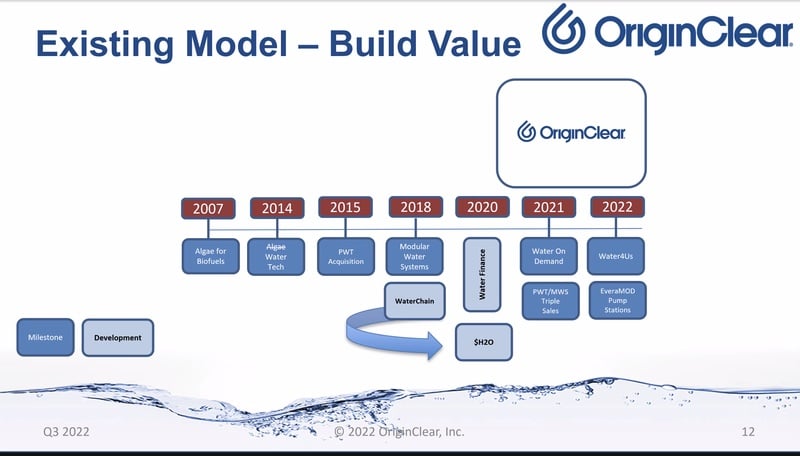

Existing Model

Here's the diagram I want to get to. Our existing model has been since 2007 to build value, to bulk up, to biggie up, biggie up, Burger King, right? Now that's nice. But it's like when you have a bunch of kids, some kids miss out and so it doesn't treat the individual properties well, you end up neglecting some. It tends to be a sort of focus on the latest, shall we say, now in this timeline. Of course, we started with algae. Then, of course we had to pivot to water tech because of price of crude dropped so much that algae was not feasible.

2015 acquired PWT, Progressive Water. We made Modular Water Systems™ in 2018. We worked on WaterChain™ in 2018, had to pause it, but that's eventually going to become this $H2O crypto. Also in 2020, we worked on developing water based finance with projects like Water as a Career, Investor Water and ultimately became Water on Demand.

Meanwhile, PWT and MWS came through by tripling their sales in 2021 and 2022. We started working on Water4Us™, which is a focus of Water on Demand for self sufficient communities. And finally, the pump station business exploded where we're seeing a huge amount of business there, which you'll be hearing about. That's the old model. Everything keeps stacking like a bunch of pancakes.

New Model

Here's the new model. We roll these things out. We've now accumulated five major properties that we're going to take one by one into the future. Obviously, we think, we think is going to do wonderful things for OriginClear. Why? Because we'll have a piece of every one of these and each one of these will actually ultimately become a public company. I've heard people be concerned like, hey, wait a minute, is OriginClear. not going to become a public company. I'll address that shortly. So right now, Water on Demand with Water4Us is up. Then we plan on the crypto, the pump stations, EveraMOD, Modular Water Systems, Progressive Water and that by then we'll be able to bring in more.

This is a very powerful company which OriginClear will be the mothership providing management support to all of these so they can remain specialized and they don't have to all have their own HR or their own IT, their own legal, finance. OriginClear will take care of all of that and of course, get management fees for it. All right. So that's the model.

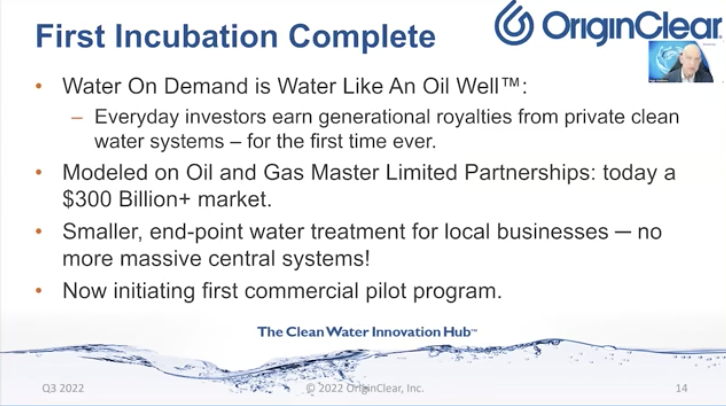

And the first incubation, of course, is complete, Water on Demand. You know, the story. It's based on the master limited partnership game and no more massive central systems, rather smaller end point water treatment. And now we are initiating our first commercial pilot. We have several candidates we are busy negotiating with. All right.

I'm not going to go too deep into this, but basically these are the key points of this that essentially make it a very low risk activity.

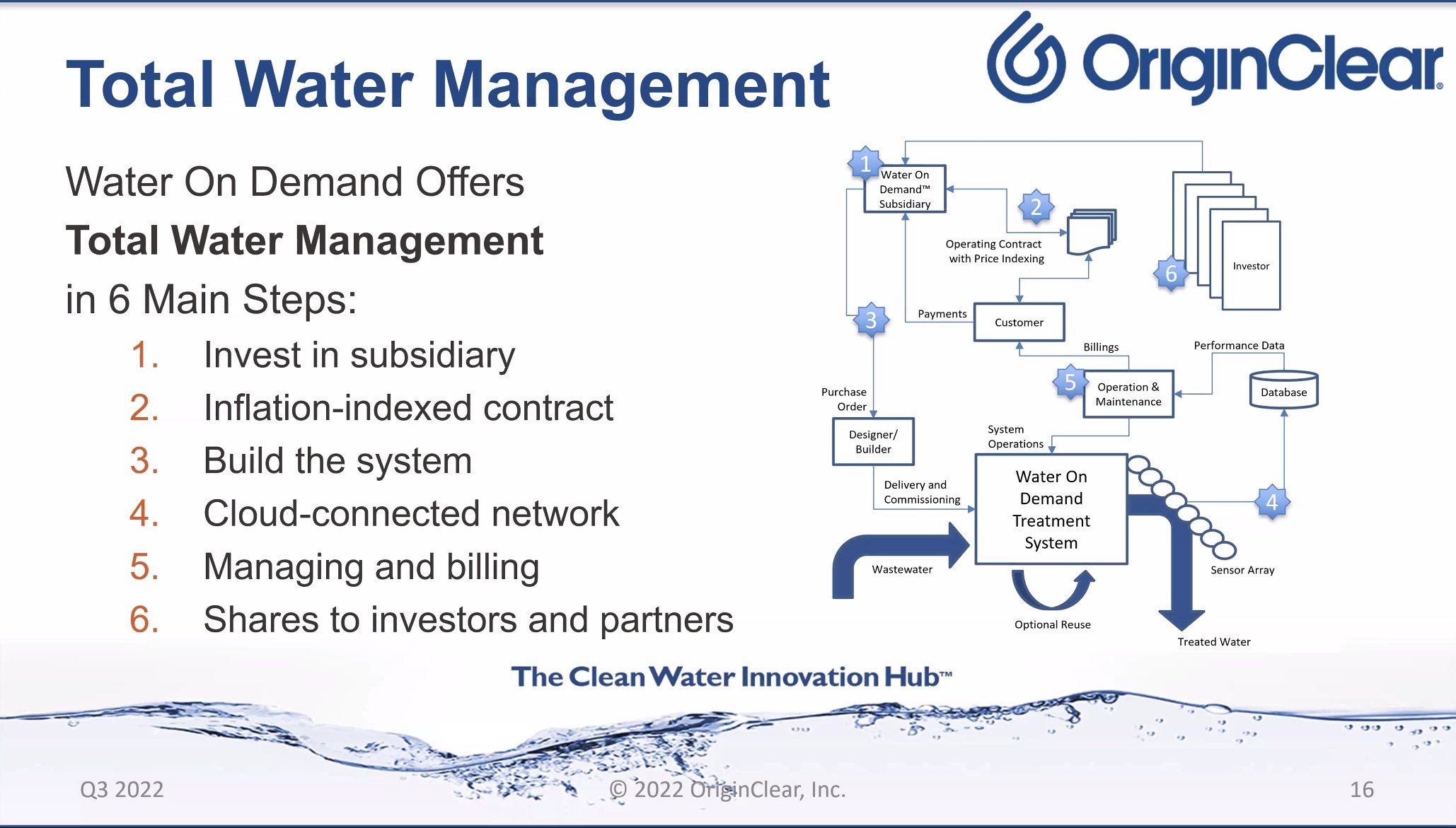

And again, this is a whole flowchart that I won't go into for lack of time, but it's a well defined program.

We eliminate capital expense for these business users, and we also eliminate the need for water experts. We do it ourselves now. We actually delegate building and maintenance to regional water companies, which means that we're strictly in finance. Therefore, we are a FinTech model for the water industry. What is a FinTech? A FinTech is any activity that tends to, in a way, cut the cord on a certain activities and do things more efficiently. In this case, financing of these water systems.

And this new Water4Us is coming out of the demand we're experiencing in housing developments, etc., and we are powering water independence for these customers.

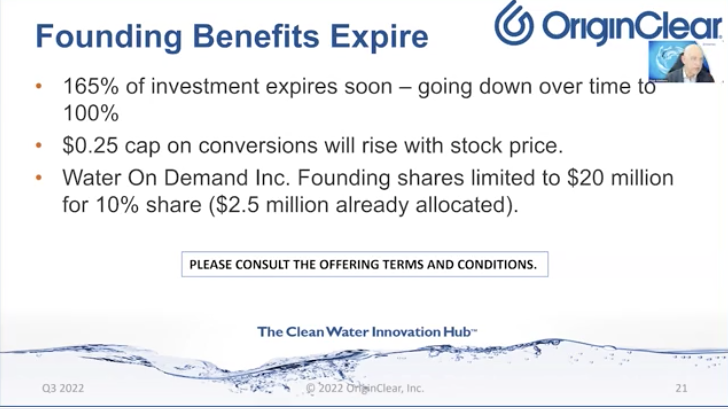

This is the offering, which I'm not going to get into right now. Feel free to discuss it with Ken. But long story short is the founding benefits are expiring on this whole program now. What do we find it founding benefits?

What I mean by founding benefits is all by itself Water on Demand is fantastic investment. 25% in net profits for decades. Great. But it's early. It's starting. We are still entering a pilot phase. So for that reason, you get a lot of extra stock.

Going back to here, you get your long term royalty, that's the orange part, but we're also giving you 10% of Water on Demand, split up among the people investing the first 20 million. And we're already down to only 17 and a half million dollars left. And then over here on the right, you get 150% of your, actually 165% of your investment in OriginClear stock and double warrants. So it's very powerful. Why? Because you are a founder.

So that kind of takes us through the very briefly through the institutional offering. I've covered it very rapidly, but Ken has a lot of details and Ken jump on in and let's....

Free Wheeling Discussion

Ken: Can you hear me? Can you?

Riggs: I hope I was sharing there.

Ken: Yeah, yeah, I saw everything came out great. Okay, great. You did a good job. What I would also add, and this is just spice for the sauce, this mechanism that we created, we kind of had MLPs in mind because it was something that kind of everybody knew. But I've been approached by multiple companies to invest. I ended up on an accredited investor list, so now I know how everyone feels, right. So I go, Do you know what I do for a living? No. Okay. Yeah. Anyway.

Comparative with Solar

Solar pools. So they're taking Regulation A jobs act offerings, and they're pooling smaller investors and larger investors. And what they're doing is they're taking millions of dollars and they're deploying solar systems in Africa and Asia. And they're actually creating royalty payments. Now, they're obviously not as, they're not as robust as water. There's still technology risk involved, you know, things like that.

But it's now it's now taken a kind of the solar industry from. Here you go, Mr. Jones. Here's your solar panels. Oh, I need 50,000, please. Right. That's. That's where the breakdown was. That's where they couldn't get rapid adoption. So now, they've got that same utility like aspect and it has exploded the solar industry. So we're simply following some very well-worn paths here by applying this. You know, it's funny, we we arrived at this without knowing about that and then you kind of spot it afterwards. So it was an interesting thing to get, I got pitched about three times this week.

Riggs: Solar is very interesting and of course the SolarCity model and all the stuff. But the reason the MLPs was very interesting is because it's that sort of a series of what we have, Water on Demand subsidiaries, each one of which is a basket of a bunch of properties, right? Each one of them generate income with royalties, but we can certainly get into the solar analogy and it's probably something we'll do, especially in the coming Regulation A offering, right?

Impact Investing

Ken: Yeah. No, I just think, I think small individual investors deploying capital into energy as a as an asset is the same model that Water on Demand represents. Now, Water on Demand is much more vital and it's also much larger as far as the total addressable market, which is exciting. Here's the thing. If you deploy energy in places like Africa, if you help, if your investment helps deploy energy in places like Africa, you're improving the quality of life in Africa, right? You're modernizing the quality of life for people.

But what we're doing literally saves human lives, you know, on on a potential massive scale in those same parts of the world. So, I think it's the definition of impact investing, you know what I mean? And I really think that that once we get in front of the folks that are really doing this for beneficial reasons, I think it'll be that combined with the incredible financial rewards, I think it will be irresistible. Look, green eco investors want to make money, too, right? They don't want to just keep donating money to new technology. They want to actually make, grow and preserve their wealth. And I think that we're a good vehicle for it.

Fixed Capital

Riggs: Well, this is the big change that occurred in the end of 2021 where we started putting at least half and it's soon going to be much more of all money raised into fixed capital. And so now investors are getting away from the roll the dice of the, the penny stock roll the dice. But they still have that upside, but they have this anchor of strong, solid assets. I wanted to mention a couple of things. By the way, Gene Tully wants to know, how is your project in PA coming along my friend?

Ken: We're doing the due diligence. Which means that, not hearing anything back right now. I sent people off to do due diligence. I'll know more.

Riggs: We're gonna talk to the developer, too. Right?

Ken: We're going to talk to the developer. There's a couple of items I have. Dan, you saw Dan's laundry list? So I sent it to the realtor and he was like, Well, maybe you need to make an offer before we do all this work. So...

Riggs: Yeah. Well, realtors don't like, yeah yeah, whatever.

Ken: I know, I know. So I basically got to make an offer and give him some hand money is what they refer to it as. So that may happen that.

Riggs: In other words quit being a tire kicker.

Ken: Yeah, right. Put up or shut up. Exactly.

Audience Feedback

Riggs: Gene says, "I'm a retired RE broker." So, he knows the drill. Yeah. And Keith says, "Constantly amazed at the organization and planning of this company. Thank you." That's Keith Roeten. And let me see. Okay. There's a bunch of questions about ROI and so forth which Ken addressed. I also wanted to mention Ivan for once, did not have a business dinner. And so he's actually, he was able to be here.

And I want to say that he was on a podcast last week or I think it was last week or whatever it was recently. And it is a beautiful podcast. We are going to be featuring Ivan next week where he is actually he's encompassed the entire concept beautifully. It's always nice to hear somebody else and the host is like, Whoa! So it's kind of cool. It's going to be very good to watch and get into next week.

So, Mike Todd. Mike Tond, "I just tried to buy some shares, but I get the message I need trading permission." That's strange.

Ken: Buy em on Ameritrade right now. Yeah.

Riggs: No, there's... Mike, check the settings on your trading profile somewhere. It's, we'd have to take a look at interactive brokers. Maybe we can have Devin take a look at this. What the issue might be with interactive brokers, IB, because they should, they should trade just fine. But yeah, I mean, you've been buying shares, Ken, right.

Ken: Yeah. Mean I have a TD account just, boom by em no problem.

Inflation and Spending

Riggs: Yeah. So yeah. So just looking at the overall situation here. We have of course this inflationary situation combined with a deflation of demand. So for example, the lower end consumer spending less and they're, they far outnumber the high end consumer. So if low end consumers are starting to watch their pennies, then that's going to have an effect on.

Ken: What is that, 30, 40% of the population spending less money.

Riggs: More than that, I would say that the lower half numerically is from.

Ken: 50, 60%?

Riggs: Yeah, I would say so. Yeah, exactly.

Ken: So I had dinner with a very good friend of mine last night who happens to be the CEO and essentially the owner of a very large hardware store chain in my region, you know, kind of Ohio. Pennsylvania, they own 24 hardware stores. These are big 50,000 square foot stores. Right. This is not a little mom and pop hardware thing. He said, Kenny. What's happening has me s-ing a brick, shitting a brick for anyone who doesn't know what that is. But he says, I went from an 8 to $9 Million CapEx run rate, CapEx run rate per year. He goes this year, I will do 2.1. He goes, I'm hoarding all my cash. He goes, I'm not going to hire. I'm not going to build. I'm not going to open new stores. He goes, and I'm one of a million businesses that's thinking the exact same way. So this is...

Riggs: Deep conservatism, people just like, you know what, I've got to weather the storm.

Ken: They cover up.

Water is Stable

Riggs: So this is why getting into a stable, productive asset that is, water just ticks along. Just. Bup bup bup bup bup. There's no crashes in water. What? People stop drinking water? No. In fact, it always gets worse because there's always more pollution, there's always more environmental issues, etc.. And also, the EPA keeps rising, raising the standards.

Ken: So it makes it more expensive to produce the product. When I discuss this with investors, I say, look, energy while being an international currency, which is why it's able to preserve wealth for so, so effectively for so many years, is also subject to the next war or the next move by OPEC. It's hostage to global events, right? So Russia invades Ukraine. We were told that's why oil went up. It was it was it had doubled before then.

But anyway, the point is, is that global events absolutely impact. However, water rates are based on each individual locality and are completely immune to international drama. Right. You know, Russia declares war with Ukraine, with Russia invades Ukraine. My water rates didn't go up, did yours? Right. So if I want to base my, if I want to base an income stream on an asset or commodity, I'd like it on an asset on commodity that maybe does this Riggs nice and slowly but doesn't do this right. This is this is not what you want to earn your money off because on those low points, as you know, energy production has to essentially stop. Water production, by the way, can't stop because the whole all life on earth thing.

Where Were At

Riggs: Yeah, I'm just making a note here for Devin to check out interactive brokers. We'd have to get into it, but I made a note. Okay, so. So these are all very good points. And so here's where we're at right now in terms of our track, and then we're going to wrap it up. Right now, Ken's team is working with the existing accredited investors, also with the larger group of common stock investors and finally getting new investors in fine. Next phase is the regulation A offering, which will be sometime this summer. Again, we can't predict when the SEC approves these things, but we're going to, in the next few days, I believe June 3rd, is when I will see a first draft of the form 1A.

Ken: Oh, good.

Riggs: Yes, I just got that update today.

Ken: That wasn't as of this afternoon.

Riggs: No, because Prasad's been sick, but he surfaced and our CFO was ill. But he had a cold anyway. So he surfaced and he said, no, no, no, it's timed for June 3rd. So that's going on there. Now let's allow more than two or three weeks to really get it in shape and finalized. Meanwhile, we're also choosing the platform. Either we do it ourselves or we have a couple other large platforms we're talking to. We'll see where that goes. Meanwhile, we file it with the SEC. Conservatively, I'd say early August. We might get as early as mid-July, who knows? But right around there we'll spend the summer, and this summer we'll have a regulation A offering, which is wonderful because it will democratize the whole thing. Everyone is going to be able to get a piece of water. How cool is that?

Ken: It won't be singling people out. Yeah. It won't be single. Like you can invest, you can't, you can invest, you can't. Because that's not what we, that was not the goal of this water on demand anyway. So this is essentially to deliver water investment to anyone who wanted to partake.

Institutional Investors

Riggs: Absolutely want to democratize it. And then we'll move. And of course, the regulation D offering will continue in parallel for the right investor. It will have for that. Remember that $20 million that takes that is going to get a 10% anti-dilutive piece of Water on Demand, in addition to all the other benefits. Then meanwhile, we're also launching Andrea d'Agostini, Dustin Muscato and myself are working flat out on working with institutional grade investors, and that's the beginning of that deck right there. And so we'll we'll be able to ramp that up. Now, that is a slow sale. Why? Because, due diligence and dadadee dadaduh. But that's why we're investing in it now. And we can start seeing some sophisticated investors come in later in the year. And that will help with Water on Demand capital.

Ken: Even in early next year, even in early next year, because I believe that I can, I believe that and I'm hopeful that I can wrap up the first 20 million, especially with the regulation A running in parallel. And there'll be $20 million of capital equipment that can be leveraged to a couple of times that. So the company at that point could go, could branch off, Water on Demand, could branch off and actually go public is a much smaller initial public offering at that point.

I think approaching institutional investors and offering them a stake for a much, much larger investment. So it's a much smaller ROI to them. If you notice how these founders rounds, they put in 1000000 to 20 million, right? That's what they look like. They 1 to $20 million. And they generally, when these things go public, they they'll they'll throw off anywhere from 100,000 to 700,000%, just insane amounts.

Now, the second round, however, is usually like 100 million for like 10,000%. When you tell, yeah, right. When you tell a guy you're going to make 10,000%, he doesn't stomp his feet. They understand that initial canary in the coal mine is completed and they're comfortable deploying. What's interesting is you'll see in some of these angel, in these fintech deals, the last round was $1,000,000,000. And it got like 60%.

Riggs: But it was a very reliable 60%.

Ken: Well, not with Airbnb. Airbnb, they almost shut right? When COVID hit. It was like $1,000,000,000, like, oops, we're not going public. "What do you mean, we're not going public?" So. So, Silverlake came in and bailed them out. We don't even know what those percentages are. Here's my point.

Riggs: Silverlake got its pound of flesh.

Early Adopters

Ken: Yeah, right. So. So the difference between the first round of investor and what's the difference between the two other than the tremendous difference in amount? Time, those first investors knew that they were going to make not...Look the early, the billionaires created by the Stripe deal and the billionaires created by the Airbnb deal knew going into it, it was going to be a decade of making, they made nothing. Now if those early, if those early founding investors had, and they could have lost it all by the way, we should mention. But if they had if they had securitization and they were paid for the entire decade, it would have been a very different story.

Riggs: And got liquid stock. Exactly.

Ken: And got liquid stock in addition. So what we're putting together, what we've have put together, I feel is far and away more attractive. And our timeline is to do this in a fifth the time because we are, unlike both of those issues, right. So Airbnb doesn't even own doesn't own a dog house. They don't own a dog house. Right. And Stripe doesn't have any assets. Amazon doesn't own anything really. It just processes people's payments,

Riggs: Warehouses.

Becoming Bankable

Ken: All right. Exactly. We're going to have assets and tons of them, so we're bankable. The reason Airbnb was still taking billion dollar slugs after five years is they were still unbankable. Right. We're going to be bankable, I believe, very, very rapidly because we'll have all of these rich, long, long tail income. Right. Banks love long tail, annuitized assets.

Riggs: Annuities with the assets, both.

Ken: Absolutely right. So we'll be able to go to more traditional assets. And the thing is, we can continue to allow investors even when this becomes where we can be exclusively bankable, right? We can still take in investment capital because that can leverage that banking capital.

Riggs: Well not only that then there's the future of getting into regional centers, etc. But now we're getting ahead of ourselves. It is almost top of the hour and we love it. It's wonderful.

Call Ken

Get your personal briefing from the man himself. oc.gold/Ken gets you talking to him and he will give you the full picture. You can also call him at our company number extension 201 or just email with that. I'm going to wrap it up. Everyone, bring this to a close. Next week is going to be another great briefing. Actually, we've had a really great audience tonight. I want to thank everyone for joining us. And this is getting more and more fun and exciting. I'm having a lot of fun. And despite the fact that I'm learning how to stand up, paddle out there every night, which means I fall in the water all the time, nonetheless, I'm having fun with my job. Thanks, everyone. Yeah. You were dumbstruck there. You're like, what?

Ken: I just know. I just.

Riggs: It's funny. All right.

Ken: I was also reading comments. I was trying to see if I wanted to address them...

Riggs: Oh, I get it.

Ken: Before we wrapped up. I can't chew gum and walk a straight line. Right. So what I would say is I think we've handled a lot of this stuff to answer Emil, no about the decentralized model. Decentralization is a necessity if you're going to deliver certain water services to the world. So I don't see it as, I see global warming or climate change accelerating, I see that accelerates the need actually, so we can discuss it more if you're interested and you want to get a more in-depth look, you can contact my team and they'll put you in touch with me.

Riggs: With that, talk to Ken. The answer to everything is talk to Ken. That's how it works. Everyone, have a great weekend. Thank you very much. And we'll see you next week.

Ken: Good night guys.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)