East Palestine is all over the news, but what may be missed is how representative the situation is of a bigger problem, failing infrastructure and habitual reliance on outsourced manufacturing. So, how bad is the position we're in? As it turns out, there is an accelerating trend that's not only reshoring manufacturing to America but also bringing our supply chain back stateside… And how beneficial is that for water and the OriginClear strategy? Find out in the replay!

Transcript from recording

Opening

Dan Early: Our model and delivery model is moving to that level, and that is important for the water and wastewater infrastructure world. These big large systems, people think that you might, could not commoditize them. But with the standardization program that we have underway, there are, there is the ability to inventory systems because of the standard models that we have.

Introduction

Riggs: And welcome everyone. I decided to be Mr. Rogers with my little sweater because we're pretending it's winter in Florida. That's how we like to do it. Pretending is good for the soul when it comes to the weather anyway. All right, let's. Let's get it on. Welcome, everyone. I see everyone's showing up. We're going to have a nice big audience. Water is the new gold, Blue Gold, because we had to rebrand. As you know, the new gold was actually registered by someone else. But I actually like this better. This is briefing 199, Get down. So that's almost four years. It's pretty cool. Water Like an Oil Well™ is the emerging income asset and this is a very popular vision.

All right. And as usual, our disclaimers.

In the News

So we are in the news. USA Today has a feature called Reviewed. And so they went into tap water and for some reason I've turned into a tap water expert talking about, yes, tap water is safe to drink thanks to national standards, blah, blah, blah. Right. Okay, whatever. Yes. I like to say that tap water will not kill you immediately. But there are contamination levels are, by law are, I think, not stringent enough. And it's I often send people to the EWG.org website under tap water and they can look up their zip code.

And so then it talks about plastic bottles filtering and then boom, here we go.

There's the risk of BPA that can leach into the water with the bottles. And then, of course, the problem with these sort of, you know, these water dispenser models that you have in offices and homes, that's kind of a lame model too.

And then it goes on to discuss other things, like home water filtration, actually something called Lifestraw, which is interesting and then gets into it actually suggests we do not reuse plastic water bottles at the store. But this is basically very simple stuff.

Mineral water, etc., etc.. And distilled water. You can drink it. It's not just that it won't taste very good, but that if you have no minerals, it's actually not very healthy.

And this got syndicated. It got a lot of pickup in a number of Yahoo! Visalia Times, Indystar, App.com, The Daily Journal, The Spectrum. So that was a good hit. Nice little piece of news.

Okay. Next week, I'm in Atlanta. The mainstream media wants us to start showing up in person again as opposed to zooming it in, which I actually like a lot. And so here's the data.

February 28th and we'll be live at 9 a.m. on Fox five. Of course, for those of you who are not in Atlanta, we will be getting it recorded and playing it on the subsequent Thursday, next Thursday's briefing. That should be a lot of fun.

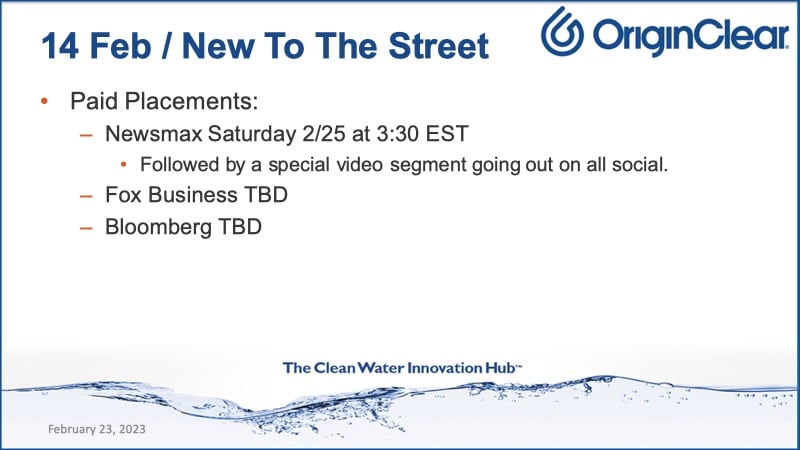

Okay. Now, New To The Street. That's our monthly Nasdaq marketsite hit. And so, as you know, it's a paid placement but is very effective. We're in Newsmax. The one date that I do have is 3:30 p.m. this coming Saturday, and we're recording a special half hour interview that's going to go directly after it that will go out on multiple social media. So that should be a lot of fun. And then Fox Business and Bloomberg. So and when I can get a hold of that, I will try and get it recorded. But we played it last week. It's just kind of cool to see it with all the network banners and so forth.

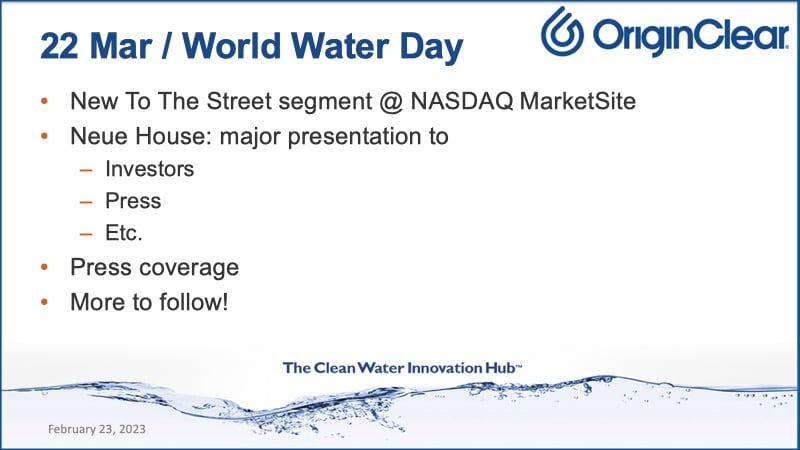

Okay, now. World Water Day 22 March. So we're going to do another New To The Street segment. There's a very upscale WeWork type place called Neue House. And we're setting up for a major presentation there on the 11th floor. And you are invited, Well, just send an email to invest@originclear.com if you're interested and we'll get you the information, invest@originclear.com. All right. I'll be talking about this more because it's 22 March, so there'll be more links. So you can maybe create a Facebook link or something like that. All right.

Quickly, I'm going to play the second part of this because it gets into this very interesting infrastructure story. So let's take a look at this.

Start of presentation

Andrew Frazier: You could say that you're changing the world, which is which is or at least the United States helping us change the world.

Riggs: We're starting with the US. But okay. So this is another interesting thing, Andrew, because you and I know that we are, the world is going through a process of globalization. The very good thinker called Peter Zeihan, who I've got his book, The Beginning of the End of the World. The Beginning of the End of the World Is Just Beginning is the name of his book. Very good book. And he was on Peter. Peter Rogan [Joe Rogun], very, very good interview of him there. And what he says is, "Look, the world is contracting. We went we were treating China like it was next door. Well, it's not. And as a geopolitical issue start to come up, it's going to be separated by a big moat."

So what does that mean? It means every region is going to start depending on itself. Well, in that new scenario, North America is a wonderful place. Why? America is self-sufficient for resources. And we have Mexico, which has better labor, more educated labor now cheaper than China. And it's right next door. And by the way, they're a democracy. So we have the whole North American continent. And you could argue that it stretches down into central Central America eventually. But I'm really talking Mexico. Us and Canada are powerhouses.

What he says we're going to see is a tremendous resurgence, a renaissance of manufacturing and rebuilding infrastructure in America as we retool to do things ourselves. We're going to, he says, we're going to have an enormous boom. We complained a lot about immigration, but one good thing about immigration is it means that we have a young workforce. And places like China, Russia, Japan, Italy are suffering from an aging workforce and they don't know what to do about it.

Well, we've got a lot of people streaming into America, not the right way. I'm not going to say it's the right way, but at least it's providing the energy, the power that any country needs, which is youth, right? It needs young people. Well, so here's what I'm getting at. If you're a small business person in America, you are going to see for the next 20 years are going to be unbelievable affluence.

Yes, we're going to have we're going through a recession. Yes, there's horrible things are going to happen to the dollars, blah, blah, blah. Yes, yes, yes. Be ready for disruption. But in the long scheme of things, I agree with Peter Zeihan that we have a big boom ahead. Our job is to enable that for the critical part, which is demands for water are going to only increase during that period. And we don't want industry and agriculture to keep crowding out people even more at the municipal level.

And that's our mission, is to pull you off, give you your own thing, you'll be self-sufficient, you'll be super happy, your contract will be well, will be indexed for inflation. So you'll know exactly what your costs are. And the investors investing it get their residuals. Everybody's happy. And it's a brave new world with great new technology. And this time, when we rebuild the water systems of America, they'll be brand new, newer, even than Israel's and will be the world leader again. I love that.

Andrew Frazier: No, that's excellent. And I think a couple of the things that you mentioned, the deglobalization. I work with a lot of manufacturers here in New Jersey, more of the smaller, medium sized ones. And one of the guys I work with, he was like, "If you can't make money in manufacturing now, you're never going to make money." So it is a good time and it's already showing up in that space.

Riggs: Wow, That's super cool.

Andrew Frazier: You know, the biggest challenge is the employees.

Riggs: Wow, you are so right. You know, not only employees, but good execs. Right? One of the big problems that I've had that I've eventually resolved starting in 2018 was having self sufficient executives who I didn't have to tell them what to do. In fact, I have to be the guy who says, "Dude, it's Saturday night. Turn off your phone. Go watch a movie with your wife on Netflix. Stop." Right, they're like, they're like, all over it. So but it took a long time and it was probably the toughest job I have is team building. I couldn't agree more with you.

Andrew Frazier: Okay, cool. So, yeah, so but definitely the other thing I think the, you talking about good times and affluence and this recession, I don't know if, I don't know if you would agree but it seems more like the corporate side and major financial organizations are hurting from the recession. We're having more trouble. We're going to have more trouble than the smaller businesses just because if you're $1,000,000,000 company, you're going to grow by 20%. Right? That's a lot. But as a small business, you could grow 100%. And so you've got a lot of room and you know, it's going to be harder and harder for them to make their growth targets.

Riggs: I think you're right. And also, there's a lot of tools that us smaller business people can use. You know, CRM, customer relationship management systems, you know, Facebook advertising. And there's a lot of knowledge out there that you can tap into. So I think the important thing is, is know your mission. We had a hard time kind of zeroing in on a mission for a while. And finally we figured it out in 2018.

We created a business called Modular Water Systems™, which has these, these shrunk down water systems for businesses. And we've now been building it for the last almost four and a half years now. And it's just taking off like crazy. And then the related thing, which is how to pay for them. And that's where the financial play comes in.

So now we found our our our are really our two legged stool that that is going to be what we absolutely have solidified with. And we love where we are. But it took a lot, it took a tremendous amount of hard work. But you're right, our core businesses that are based primarily in Dallas, they tripled their revenues last year between 21 and 22. That is like you say, it is a business expansion that's occurring in America at the same time that we're having all these crazy things happening with large corporations. I agree.

Andrew Frazier: So, yeah, so that's cool. So I'm going to go back to a couple of quick things because we had a couple of comments. So, you know, definitely Will agrees with the Flint. So as soon as you're ready, I'm sure Flint would be excited. And even Newark, New Jersey, we had some issues. So definitely it's important. And actually, Dr. Michelle Scott, you know, one of the debates or fights in America is climate change. But, you know, that's something that could help or hurt your business in some ways. But all the indicators is it's going to going to happen because there's going to be more and more need for it.

Riggs: 100 percent. Let me address the first comment about Flint. We actually have a lot of problems popping up all over the place. Let's take even an affluent place like Fort Lauderdale is having real troubles with its sewage systems. Miami-Dade County is confronted with, and it is I believe, climate change related. There's rising sea water intrusion into the, into the groundwater and literally septic tanks starting to fail because they're being drowned out. And so Miami Dade, when they first developed, they did a very unsatisfactory job of infrastructure. And they they allowed about 100,000 septic tanks in the county. And a big percentage of those, of course, are failing.

And as a result, they're polluting the groundwater and their solution is, okay, we're going to, we're going to build sewer lines to every one of those locations. Well, that's a $6 Billion project. And by the by the time they're done, it'll be 20 billion, I guarantee you. And it's going to take 20 years to tear up all the streets. Well, that's where our technology comes in. Guess what? You can have each of those homes simply swap out the septic tank for a self contained, what we called black water treatment system, which means that black water means the poop, treat the poop locally, and the residue goes into a sludge tank that gets pumped out once a year.

That's a self sufficient solution that could be implemented with simple rebates and you'd be done and you wouldn't be tearing up the streets, right? Take that same solution and it can be applied anywhere. The problem that Flint has is they're still thinking centrally, and I'm not going to be able to change Flint's way of thinking. It's not going to happen.

Let's take another example. India. India is spending $90 billion damming up their headwaters. They have to they have to do it. Big hydrologic project. Meanwhile, they have humans in the sewers, in the cities, Hyderabad and in New Delhi and you name it. Digging sewage and dying of sewage gas. It's horrendous. Well, are they going to put billions into that? No, they won't.

Instead, self-sufficient water treatment. So what we're saying is, look, we can't rush around and save the municipalities, what we can do is unburden them. Take the businesses that are choking these municipalities, pull them away to enable them to address their core their core constituency. You know that in Ireland, water is free. Well, why isn't it free for us? Why? Because 90% of the water use is by businesses who are basically hogging the whole system. So I have a big social justice button about this is like, okay, my job is to help those businesses pull away. They'll be happy. It's better for them.

Andrew Frazier: Mm hmm.

Riggs: By better technology and the capital help. And meanwhile, over time, this helps the city handle it. Now, let me take your climate change commentator. Now, what we have to do is remember that climate change is primarily solved by better technology. Look at when you update a refrigerator. It has vastly less energy footprint, right? When you put in a better water system, you're going to use much less nitrogen and all these greenhouse gases. So modern technology, I believe, is a number one way to attack climate change because the newer, newer technologies are inherently better. And I think that we have to think that way. Now, what's great about it is, guess what? It makes everybody rich. It's not a poverty right? It's not like we go to do less, go to do less. No, let's do more. Let's modernize. Right. And let's think of humans not as a problem, but as a solution. So that's really my point of view about that.

Andrew Frazier: Okay. Okay. No, great. So, yeah, I mean, definitely somewhat of disruption is a mindset and possibly a process. Is that something that you would that you have or you subscribe to or like, how could someone who's not thinking disruption or hasn't been thinking disruption, how can they think more like and be more of a disruptor?

Riggs: Disruption. First of all, there's two parts about disruption. First of all, it's hard because it's very hard to go against the way things are done, the way things are always done. But if you can master it, then it has this huge take off where all of a sudden you're like. You're "King of the hill," right? So the let's, let's say we're using the same idea of blinds, right? And you have a brand new idea for blinds and that, you have a new idea. Now, you've got to somehow evangelize it with perhaps condo developers and you've got to market it. Okay, great. But once you've done it, you're the king of the hill because you have this brand new thing that everybody loves. So I think it pays off to think disruption.

Now in the process of, let's take that brand new motorized blind idea that you had and you figured it out and you found a manufacturer and have a relationship, did all that work and now you start trying to market it. Well, now you're going to have to find all kinds of ways to do that mistake-based marketing. Let me try. You know, I'm going to do flyer drops throughout the throughout the neighborhood. I'm going to do I'm going to, you know, get relationships with contractors, developers, And at try radio, I'm going to try Facebook advertising. And the key is, is try it, keep you know, make sure that you didn't fail because you didn't do a good job. Right. So, you know, try it. Let's say I've had to do a lot of learning on Facebook advertising. It's a learning experience, believe me. But once it works, then it starts to really cook right?

And so make sure you do it right. But if it doesn't work for you, then, okay, that's done. I'm not going to do that. It works better for me to go to speeches at all the Rotary Clubs, whatever it is, right? So you find ways to innovativily get to your target audience and kind of pepper it, like death of a thousand cuts,. You know, just chew away at the problem. And pretty soon, if you're aware of what works and what doesn't work, you'll start getting some momentum and pretty soon you'll be rolling, right?

Let's take, for example, a simple way to market your company, which is Yelp. Yelp for small business is very powerful, but you've got to use it, right? You've got to be responsive. You've got to offer all the right offers. As a consumer, as a as a homeowner, I put out these plumbing requests and so forth. I see how people respond. Do they respond proactively? They say, "Okay, I'm coming over today. I'm coming over right now. Are you there in 2 hours?" Yes. Boom. Well, they just got my business. Thank you very much. So be aware that how fast you move is going to drive, how well you do, no matter what promotional method you use.

Andrew Frazier: All right. So that reminds me of back in my corporate days, we used to, we had an executive and he did a talk. He was the technology department and he was like, cheaper, faster, better. Basically, that's where everything is done. And, you know, we're sort of seeing that, you know, the cost to do a lot of things depending, is going almost zero in certain cases. And but you've got to be faster and responsive and you've got to be better. You know, you look at Amazon, you know.

Riggs: They are nonstop, those guys, aren't they? Amazing. These days what do you invest in? I look at the market and I go what? For example, the last few months I've been I've been jumping back and forth between gold and oil and then this and that. And I get nowhere. I'm working hard, getting nowhere. Right? And so what can you invest in these days? Well, I think that a good royalty generating asset, they're smart. Like gold is great, but it doesn't generate royalties, right?

So and yeah, oil is good, but it's being geopolitically manipulated, Right? So you never know what the latest administration is going to do, good or bad about oil. So that's kind of a trap that unfortunately we have to live with. Water, you know, is not very manipulated as a space, primarily because it's kind of sitting there. Nobody wants to know about sewage. It's great, right? Well, that's it. But by the same token, nobody's going to want to have a new sewage plant in their backyard, which means it's going to have to be decentralized. Right. So it's going to have to be based on the business versus some big central plant because nobody wants a central plant next to them.

Andrew Frazier: Yep. Yep. No, definitely.

Riggs: So that's the whole infrastructure story. And, you know, we've actually moved on from that because that was that was shot a little while ago.

So, Here's and interesting clip from an episode of Joe Rogun that was on February 4th. Now Krystal Ball and Saagar Enjeti, I hope I said it right, they're kind of like rational commentators, they're sort of middle of the road. They try to sort of straddle the two sides of the political spectrum.

First of all, it was very interesting talking about infrastructure requirements of clean energy. You know that a single hair getting into a chip fab can stop the entire thing. So water is critical. And all this infrastructure has been in Taiwan. A huge amount of chip manufacturing in Taiwan. That's all coming back to the US, to Canada and Mexico. And we will be doing those, we'll be doing that. We currently have some high-tech customers ourselves who need that kind of quality. So, we're seeing that there's going to be a tremendous amount of demand.

The second thing to remember is, "What has bipartisan support in Washington?" And we keep saying, "Hey guess what? We've stacked up a $trillion worth of unspent mandates for water and guess what, water is not getting the money!" They're talking about why are people homeless and why did this train derail and this that and the other thing.

Well again, what has the bipartisan support? And you know frankly the weapons manufacturers are probably the strongest lobby in America sad to say. It is what it is. Anyway I thought that was really, really interesting, very middle of the road viewpoint I thought I would share.

So with that, we come to the issue of the day, which is in fact East Palestine, Ohio, and I covered it last week, and there is obviously a lot going on with that. Let me just pull up the excellent Kenakoa who, if you go to Kanekoa, The Great Kanekoa is what he calls himself and this remains the best threat ever done about this.

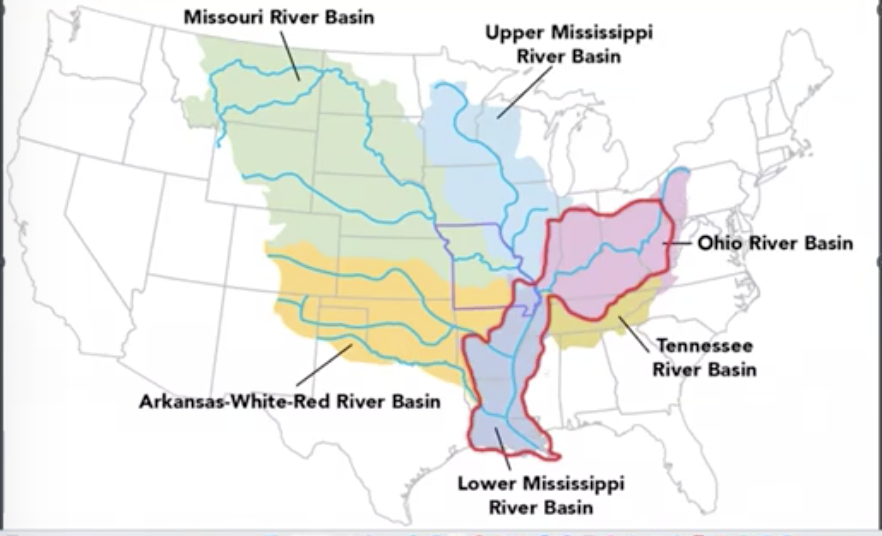

We have a real problem because we have a watershed that is starting up here. And in fact, as as Ken has pointed out, he is right there in the pink part in Pennsylvania. He's part of that, unfortunately. And by the way, the wind blows from the southwest to the northeast, which is why we have the dust in Maine that's shown up. So it's not a pretty picture. I don't know. Fortunately, Ken has bought a condo in in Clearwater, so maybe eventually he'll move, move here. Who knows? But anyway, it's a tough situation.

We went over this last week, so I won't, I won't recap the oil slicks in the water and so forth. But we have a long list of what's the contaminants, and they're well covered in this substack of chemicals, etc.. So here we go, three cars of dazzling light colored polypropylene. Look at all this crazy stuff. The chemicals are just unbelievable.

I was interviewed today on that and I will publish that interview, a radio interview when I get it. So that's what's been going on there. And so what does it illustrate? Well, first of all, I don't know if you guys saw the video of a train trying to go down the tracks and these really wiggly tracks. And it's going like five miles an hour because of the tracks wobble. And sure enough, we have a good friend, secretary, Buttigieg. What does he have to say?

Sec. Buttigieg: Look, real safety is something that has evolved a lot over the years. But there's clearly more that needs to be done because while this horrible situation has gotten a particularly high amount of attention, there are roughly 1000 cases a year of a train derailing. Obviously, they have levels of severity, but where all of that points us to is the need to continue to raise the bar on rail safety. And that's especially true when it comes to the rail that involves hazardous materials. Now, this train was subject to certain enhanced requirements because the hazardous materials on board, but obviously none of that prevented what happened in East Palestine. That's one of the reasons we're going to be paying very close attention to the findings that NTSB comes back with.

Newscaster: And so based on those findings, based on the findings of what the EPA is ultimately able to conclude around this, to, where is the liability? Where do you believe that in what we already know about the hazardous materials, what is taking place and the number of people impacted? I mean, the scope of this seems quite large when you think about the number of people who have been displaced from their homes trying to figure out how long some of this will continue to have longer impacts on the environment that they live in as well. And what accountability do you hold to Norfolk Southern?

Sec. Buttigieg: Well, EPA has already sent a letter notifying in a formal way, notifying Norfolk Southern of its responsibilities. Obviously, I can't get ahead of an investigation that is active and ongoing. But Norfolk Southern will have to answer to EPA for the environmental side and to our department if there were any violations of rules that were found that emerge in the NTSB process. And I do think they really need to be on the ground or just playing a role in making sure these folks get the information that they need.

People have been told based on the air quality testing, that the air is safe. They're continuing to ask a lot of questions about the water, about the soil. EPA is doing good work on the ground. So the state leadership I have spoken both to the governor of Ohio and the governor of Pennsylvania and their concerns and working on how we can be held in the long run. But the bottom line, the most urgent thing right now is to make sure that the residents are taken care of.

Newscaster: Do you believe that this should result in or might result in a redrawing of routes even to make sure that you are mitigating risk of exposure?

Failing Infrastructure

Riggs: Well, we're not going to go on and on because it's more blab. But the point I was making is there's a thousand derailments every year in America. Our train systems are a mess. So this should be a wake up call. We're well past it. And I don't even blame the current administration. Here's why. We've seen in water degradation of the water systems started in 1961. Here we are. So sixty years later, 60 plus years later. So how do we how do we deal with it? Well, it's not going to happen.

So I don't know how to deal with the railroad system. That's a whole other story. But one thing's for sure, I was, as I was interviewed today, is we're going to have to have a lot of in-home water purification and it's going to have to be paid for by these polluters. But that's a whole other story.

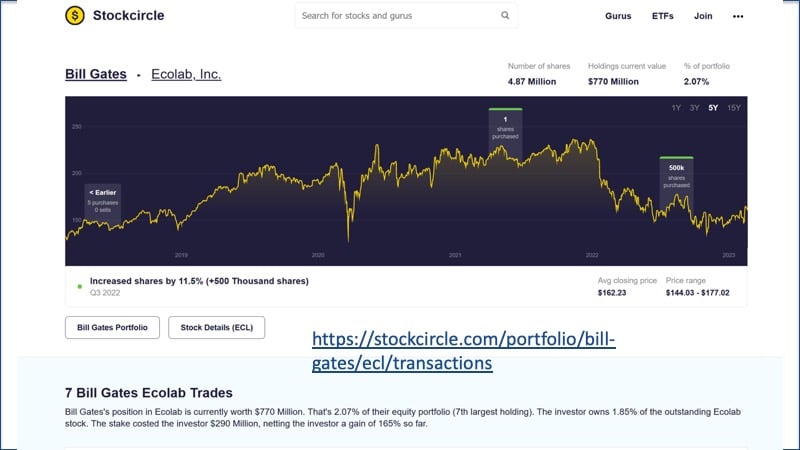

Speaking of environmental, here's our good friend Bill Gates. And turns out that he invests in water. This, I noticed this 20 Aug 2022 article where he bought up a bunch of Ecolab shares. Ecolab is a water company. Large water company. And the update on that is that he's actually made 165% on his portfolio.

And notice how Ecolab hasn't really gone up. So that's some very, very savvy trading, right? It's kind of been flat the whole time. So I would say that this is one very sophisticated investing group.

Emerging Category

But nonetheless, what does it say? It says that water is an emerging category. Those of us who are not day to day, incredible algorithm traders are going to have a hard time buying at the bottom and selling at the top. I never seem to be able to. And so what we have here, let me show you the the actual page.

Here it is. And so he, his fund purchased, all the way back here, well, since 2010, $46. So in the long term, starting way back when is how he's made his money. So the point I'm making is this is classic large water company investing, which is long term and requires some very savvy trading. Why? Because large water companies don't grow very fast. But it's very true that water is also a strategic investment.

Good Investment

Okay. I think I've made that point pretty clearly. Here he is. Why does he keep buying farmland? Well, actually, he buys farmland because it's good investment. And sure enough, right here, he owns equivalent to one third of the state of Rhode Island in terms of farmland. It's 1/4000, not 80%, but nonetheless. So it's basically about assets. Farmland is assets. And with that, I come to the end of the prerecorded section and I'll invite Ken to jump in from his new quarters that he's invested in.

Freewheeling Discussion

About the Spill

Ken: My new cell. They they redecorated. The guards came in and decorated my cell. So, yeah, no look. So a lot of, a lot of cool stuff there. The you know, and I wanted to point out to the crowd that not only is where I live, so every property I own except Clearwater is in that zone. I know my eastern Tennessee properties are on the other end of it. I was looking at the map just now going, Oh, good Lord. Right. And to your point, I went out and bought those shower filters. I have a whole house. I have a whole house carbon system. I got the additional filters.

Now I'm getting RO systems put under my children's bathroom. So when they're brushing. She said, "Well what about when they brush their teeth?" I said, okay, we'll put an RO system. You know, I get it right. I do. I get it. It's our babies right? It's the sense of helplessness that you get when you realize your environment's been poisoned. And these idiots are like, Oops. Now just the water is fine. And to hear these guys go, "Oh, I'll drink the water." I would be like, okay, I'm going to watch. Right.

Riggs: Well, no, no. They drink the water, but they're not going to drink the water for eight months, right?

Ken: Oh right. They'll drink the water. They'll drink the water whenever.

Riggs: One time. Like no big deal, right? I mean, it's like I drive through the exhaust from, bad exhaust from a truck. But if I'm behind that truck for three days.

Ken: Right. Right. You could barely taste the vinyl chloride. You can barely taste it.

Riggs: You know you get the rainbows in your little.

Team Building

Ken: Right. It's a little right. It's a little thing. Just a quick comment to about the team building thing. That was interesting also, because you've often said that to me when you had to do everything yourself, you couldn't find an executive that you didn't have to tell what to do. And I would say to our audience today, be careful what you wish for, because here I am. And he's like, I can't tell this guy anything.

Riggs: Well, no, I got to tell you to stop. You know, I don't dare send this guy an article at 11:00 PM or 2 a.m. because.

Ken: I'm commenting on it. Well, no, He goes, What are you doing up? And I go, Well, what are you doing up? Right? So it's, you know, misery loves company, right?

Deglobalization

I have been falling in love with the development of what Peter Zeihan has laid out, and I can't get his name. Glenn Beck called him Zion. I don't know what he calls himself, so I've been calling him Peter's Zeihan or Zeihan.

Riggs: I think it's Zeihan.

Ken: Zeihan. Okay. But when he talks about the explosion of America in, the next few years or going to be really tough, there's going to be a lot of inflation as we onshore and build all of this manufacturing, when we create this manufacturing renaissance. I think that's, I think because you have a 20 year explosion of economic growth behind that. I think that's all news that doesn't give anybody the shivers.

Serendipitous Timing

What I really enjoy, it's just the serendipitous timing of what we're doing. What we're doing accelerates that economic explosion at the small and mid-sized business level on two fronts. Who's manufacturing these systems inside of our design, small to midsize manufacturers. It's not going to be America Waterworks, right? It's not going to be Evoqua that just got to. It's going to be the smaller, you know, 10 to $100 million company, right? 50 employee company.

So imagine their entire pipeline being lifted out of "It's the money." Right? The whole pipeline is like, "Okay, go." Right! Unbelievable. And then secondly, we're also able to accelerate the explosive growth in the end user, why? They're no longer saddled with a CapEx and we're saving the business money. So, as an economic driver goes, unleashing the power, the asset power and the economic power that water, control of water, can give. I think we're only now starting to realize it.

Call Ken — Get Involved!

Riggs: It's very early right now. Right. And what we are never involved with, I discussed this in that podcast. We're not involved with the municipalities because it's the wrong model completely. What we're seeing is already our revenue has, is going crazy. I showed you the graphs the other day. You know we're nine $9 million plus, whereas the year before they were $4 million. So it's already happening. We're already really, 24/7 in Dallas and McKinney, Texas, and in Virginia. And we're staffing up as fast as we can. We're just throwing people into it as fast as we possibly can. So there's plenty of business.

But I, the problem with one of these emergencies is that generally you come along and it's like, "Oh, so what are you going to donate?" It's like, well, actually we weren't really planning to donate anything, so we'd rather just continue to work with businesses that see the writing on the wall and they have the need. What we're trying to say is we have a growing manufacturing story right now in America, and it needs infrastructure. It's going to need better rail. It's going to need much better safety rules. It's going to need better carriage of chemicals. We're going to have to have those pipelines all over again because it's so much safer. All these things are going to have to happen.

About Nuclear Power

Nuclear that, I so agree with that couple that was talking about nuclear. Oh, my God. It's a scandal that we haven't had a new nuclear power plant since 1974. And you know what? I blame gosh darn movie. The China Syndrome, man. Did that stop it in its tracks. It was horrendous.

Ken: Well, we we did have Three Mile Island on Long Island, too. That kind of that kind of.

Riggs: But what didn't happen was a realization that it's new technology. New technology is quite safe, but everything's been lumped together, Right. I think that there's been a very poor job of of telling the story.

Ken: Oh, their marketing is terrible, right? They're marketing was absolutely...

Riggs: I heard a rumor, a rumor that the oil industry actually underwrites environmental groups to go against nuclear because...

Ken: Oh, I'm sure. But, you know, the nuclear power people ought to hire the marketing people for cigarettes. They're like, here, they kill you, but buy them. And they're like, yeah, cool. I mean, so you have to have like that brazenness in your marketing. And no, nuclear is on hold. Probably one of the safest forms of energy.

Greatest Economic Growth

Kind of latching on to something that you had said earlier. Zeihan describes our growth as it's going to be the greatest economic growth in American history. This is an acute problem generated by the decades of neglect that we've talked about. Right? So it took decades for our, you know, our crap show of an infrastructure system to begin to really fail on a consistent basis, right? It will take decades to offload what I would call, what would you call a load, to kind of pull load away, whether it's whether it's rail and pipelines.

Riggs: Here's the good news. It's not going to be done in giant $50 Billion chunks.

Ken: Exactly right.

Riggs: It's going to be done $1 million at a time, which is great because you can chew away at the problem and build companies that way. And so that's why I like it so much, this new modern model, which is, hey, let's just, as the new plants get built, you know, for example, our, we have a good friend who's visiting from Mexico, he's going to be here in early March and he is super excited about helping with manufacturing in Mexico. He's a manufacturing specialist and he's also an investor. So he's just an amazing guy and he gets it. The point I'm making is we're going to have the ability to grow. As these new manufacturing plants get put in we will be speced into, we will be speced into it automatically.

Suited for the 21st Century

Ken: The problem is an elephant. So there's the saying, how do you eat an elephant? You eat it one bite at a time. And that's what we're actually, we're actually going to be able to generate over a shorter period of time, much more modest, but consistent gains on the problem. We're catching up and gaining on the problem. These big giant systems are, okay, the problem is just going to continue to get worse for the 12 years that this thing is being built. And then, okay, the elephant's gone, right? How many disasters occur in that time? Right.

So our model is really it's perfectly suited for the 21st century because it's embracing technology that ten years ago people didn't understand and really weren't comfortable with, and now they're entirely comfortable with it, which I think, again, there's a little bit of serendipity to the timing on this.

Riggs: The elephant is actually made of Lego blocks and we're pulling, and we're doing the... So it doesn't have to be a solid elephant. It can be a bunch of Lego blocks strewn around the table, and it's very easy to do one Lego block at a time. It's another way to look at it. So I think that it's super exciting. So there'll be more next week about the World Water Day event. We're building that fast.

About the Regulation A Offering

Also, I want to let you guys know the regulation A offering is fully effective. Now, why is it not happening? Very simple. We are testing, testing, testing all the machinery, making sure that things work. And so you will see an announcement this week, this coming week on the Reg A.

Actually, I'm going to tell you what's going to happen. We're going to start with the people who are in our databases who've been waiting for so long, and we're going to give them a first crack. That's number one. Number two is we're going to give the people who were in the 2020 Reg A a chance to convert into the new one. I still have to work that out. And meanwhile, in background, we're building for the hard launch of the Reg A going wide and it's going to be a lot of fun. Very, very cool.

So lots, lots of things going on. But the Reg A is official, it's live and we just have to make sure that the credit cards and all the e-commerce stuff works properly. The proper, they have to do background checks, all that crazy stuff, that's all built in.

Thank you everyone for sticking around so long, man. You guys, your guys and gals all stuck in there. I really appreciate it. As always we're super excited about what's going on. Keep up the great support and we are full speed ahead. Thank you very much.

Ken: Goodnight folks.

Riggs: Have a good night.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)