Insider Briefing of 13 August 2020

Helping you thrive in the world’s ONLY vital, scarce and recession-proof market

Congratulations to Philanthroinvestors, Inc. who intend to help get us on the Inc 5000 list too…

What does that have to do with us? Find out on this action-packed show…

Getting America back to work in water… a vital mission.

Transcript from recording

Introduction

Riggs Eckelberry:

All right. We have all our hosts. We have a number of amazing people here today, right now on screen, the inscrutable Dan Early, who no longer smiles apparently, and Tom Marchesello from a beach near there where he lives, the amazing Ivan Anz who is joining us from Argentina, where he is still stuck for months now. His colleague Arte Marin will join us shortly. So, without further ado, I'm going to share the screen.

Water Is The New Gold. “Helping you thrive in the world's ONLY vital, scarce and recession-proof market. I've been over this many times, if you don't know water's important, then you're not on this planet. But the truth is it's never really been monetized. There's no real way to invest directly in water equipment. We aim to change that. Also, the water industry needs at least 3 million people to replace retirees in the next decade. We want to help with that too. By the way, water does not recede. It keeps, well, except when it's the tide of course.

Important Notices

Anyway, I'm going to move on to our Safe Harbor Statement, which says that whatever we say is not prophecy, but we're doing our very, very best to tell you how it really is. If I mentioned an offering, it's our Regulation D offering, where this is a offering for accredited investors, and it is not been passed by the securities exchange commission. So, of course, all stock involves risk, even though we do our best to cushion you from that risk.

Thrive LOUD

Guess what? Lou Diamond, who's got a big podcast called Thrive Loud, interviewed me this week, the day before his 500th episode. He was really interesting. I'll be sharing that when I get it. Some of these guys ask me tough questions. It's definitely worth getting into, I will let you know when that shows.

Jon Dwoskin THINK BUSINESS Live

On Monday I get to be interviewed by Jon Dwoskin, who's a business coach, and that should be interesting too. We have a number of additional ones coming. Jeremy Ryan Slate is doing an amazing job getting me gigs and I really appreciate it. All right.

Now we also got published in Thrive Global, which was founded by Arianna Huffington, who also of course launched the Huffington Post and they get about two and a half million viewers per month.

Learn On The Fly

This was a republish from an original interview in Authority magazine. Basically, it talks about my tendency to learn on the fly. We don't claim to get it right the first time, but then again, we are really, really good at learning lessons. I think that's our saving grace. With that I'm going to now re-share.

Welcome Ivan Anz

Riggs: Hey, Ivan nice to see you on screen.

Ivan: Nice to see you my friend.

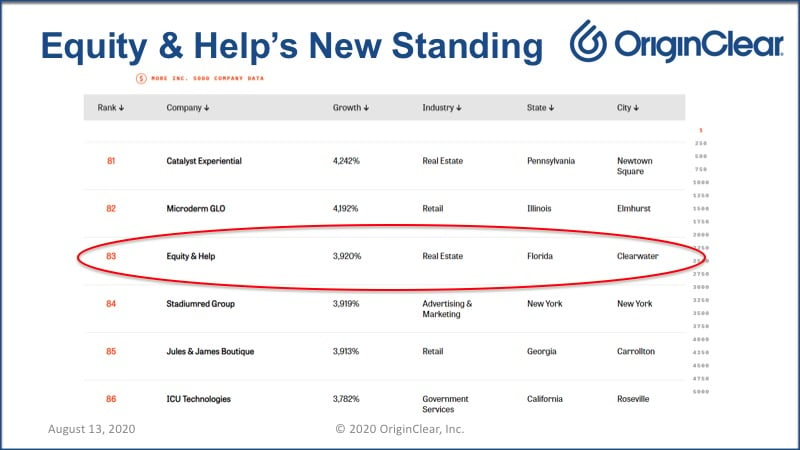

#83 on the Inc 500!

Riggs: Yeah, listen, I'm about to share some amazing news, because next up is a video, which is from you. It doesn't have any audio, but it has some amazing news. Equity and Help, your company, has now made it's second year in a row on the Inc. 500. It's 83 nationwide. So, it's Inc. 100 now. Number one in Clearwater, which is your headquarters and ours now. Number three in Tampa Bay. Number three of all real estate companies. That is some amazing news.

We're proud to be part of the water, of the philanthropic investors, invest with a purpose, family, developing Water Philanthroinvesting™. Thank you for that.

With that, I'm going to move to the next slide, which is in fact, here's the Inc. 5,000 list, showing Equity and Help. Almost 4000% growth. Ivan, you shock me.

Ivan: I know.

Riggs: Apparently you have now paid out in the past 12 months, a million dollars in proceeds to your investors.

Big Purpose and Amazing Team

Ivan: Yeah. To our real estate philanthroinvestors my friend, that's correct. We are so proud, because the growth of the company is, basically, because of two things. Number one, big purpose and supported by great philanthroinvestors and number two, an amazing team. We actually, I don't build businesses. I build people. People is the one that build the businesses. They fall in love with the purpose and the mission of the company and they are the one that have done it. 1% of this is me, 99% is Arte and his team.

Riggs: Wow. Well, in fact, Bob Roos wants to know how long before OriginClear is on the list?

Ivan: We will talk about that tomorrow in our meeting.

Riggs: In our weekly meeting, we are very actively working with Philanthroinvestors to roll out, Equity and Help, of course, is the real estate angle of that. I'm about to show a little slide from their own side show and parallel that with ours to give you an idea. But before I move on, Adrienne Mazzone from the excellent TransMedia Group PR agency says, "Great backgrounds, just wanted to pop on and say hi." So, thank you, Adrienne. Anybody who chats will get a shout out.

Why So Successful?

What's Equity and Help all about and why are they so successful? Well, they've chosen a particular place in the marketplace. They pick up foreclosed properties. By the way, there's some horrendous foreclosures happening right now. Equity and Help then buy the homes in bulk, place them in land trusts, and then the investor purchases properties. They're deeded over. Now the investor is the sole beneficiary of the trust. This is some very, very smart, legal work, which we actually have made arrangements to benefit from the same lawyers. Brilliant advice. Now, you guys are the trustees for $15 a month. That's a lot of money, Ivan. Cripes.

Now I don't expense this. Equity and Help does minimum basic repairs, because marketing them, then they go, and this is the real secret sauce is, they find people who would never be able to buy otherwise. They're basically going to get their home for less than they pay in rent. They covenant, they agree to be handy and to prepare the place and improve it, so that even if they end up losing the property, the property keeps being worth more. Of course, the intention is not for them to lose the property. The investor recovers his investment, doubling net worth. Of course, still own the asset, until it's fully bought out by the families and double digit returns, Beautiful model.

OriginClear’s Model

I went ahead and did a similar wheel. Let's take a look at that. In our model, we develop a new water treatment system that answers a need. Such as a brewery needs to expand its capacity. Local city won't take all of their dirty beer waters so they develop their own system. They commission us to do that. That's our Texas division, usually custom. We determined that there's a distribution market for the design as a product. We also look as to whether it could be an entrepreneurial product. It's a dual path at this point, because of course we have distribution channels.

Now the customer systems then turns into a standardized product. We achieve a lot of, this is what we're doing right now with the Pool Preserver™. It's becoming more and more efficient, price competitive, and so forth. Now, if we've determined that it's a career builder product, like the Pool Preserver, then we start to develop a package and add an envelope of services. The end users who have good credit, we just go ahead and line them up with standard leasing, because they can afford it and that's the simplest for them.

We've learned that these people obviously want a really good money factor. So, they can have it. People who don't qualify for standard financing, get qualified for alternative investments sources. Now, the alternative investors invest in the equipment and services package, and this is where we're still in development. I want to make it very clear. You cannot invest directly in water equipment through our program right now. A lot of people get confused about that. This is not an investment offer. You can invest in the company, that's developing it.

Like Airbnb

Just the same way that when Airbnb was being built, people like Ashton Kutcher invested early on, got 10% of the company for $7 million, not a bad deal. Only later were the chains of micro hotels built by entrepreneurs. Okay. OriginClear handles all support, placing equipment with new users in case of default. Finally, investors enjoy double digit returns, while fully owning a managed asset. Again, this is all prospective. It is in development and the packages need further legal work, but it's important to understand that.

Key Concepts

Now, Ken Berenger, I want to share the thoughts that he had about this. He believes the winning company in water is the one creating jobs in water. I'll cover that shortly. His concept of building an army of water professionals, very cool, make OriginClear water VARs (Value Added Reseller). Back in the eighties I was a computer VAR, as they say, building whole systems, and that's how I got into the industry myself. Great idea, but why now?

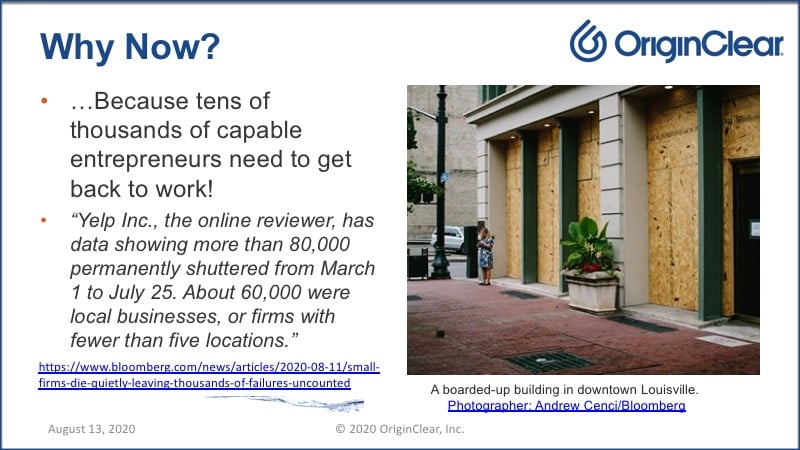

Why Now?

That's why, because oh, my God, so many people are out of business and out of jobs. It's an invisible trend because a lot of these people don't declare bankruptcy. They just close. So, this is a trend that's been picked up. I think it's really interesting to know the reason they've continued to absolutely explode and thrive in one of the worst economic downturns of the century, is they stayed the course, they focused on people that really desperately needed a home, rather than the broader market, which dries up much faster. That's the Equity and Help success story and that is the missing piece of the story for lots of us, which is, everything changed, right?

Career Building

Post-COVID career building. Whatever you think of COVID itself, it's pretty much done. It's happened. It's going to run its course. It's going to get worse. It's going to better, this, that, and the other thing, but we're talking about the economic impact. The economic impact is going to be worse, and worse, and worse. People are going to want to have careers and we can provide them in this business. So, they want training. We have the commercial data from our pilot program that we did in Phoenix. If you go to originclear.com/poolpreserver you'll get that data, and we're putting together this innovative program, Water as a Career, which is cool.

eCommerce Boom

Now, what helps is that actually, services has tripled. All of eCommerce has doubled, but services, including financial services, have tripled. So, really we are talking about a space that is the fastest growing, interestingly enough, in the eCommerce world. So, that's super cool.

“This is the Program.”

Now, we were talking to one of our longtime marketers and all of a sudden we were so surprised because our good man, Tom Burton, shared that he's been doing exactly the same thing that we wanted to roll out with Pool Preserver, build qualified candidates, business in a box package, business marketing, training, websites, social media presence, et cetera, CRM, which is customer relationship management, potential leads preloaded. This is, my gosh, When we heard about this we were like, "This is the program."

So, with that, we went ahead and had a little session with him to discuss it and the people who were in that session were Tom, myself, my assistant Devin, and Tom Burton. So, I'm going to play some video from that because I think it's really interesting.

Tom Burton video clip

Transcript from recording:

Tom B: Quick question on the pool part, who would be a target candidate for it?

Riggs: Well, there's obviously two different audiences. Pool cleaners are a good audience. Good thing about somebody in the water business is they already have something going, which is good, right?

Tom B: So, do they own the equipment or are they actually then financing it, but they actually own it?

Riggs: They're basically renting it with a buyout option. So, over time they'll be able to buy it out, right? There's probably two different deals. One is with deposits and they're credit worthy, they have a business. That's going to be the easy way to go. If they don't have that then it's a matter of a more in-depth interview and making them willing to actually go through the courses, and either way they got to go through the courses and apply the tech.

Tom M: What's the financing methodology that you're attempting to use as the primary? Are you using the third-party equipment lease financing here, or are we going to take this back internal again and try to use the internal network of investors here?

Riggs: The answer is yes. In other words, third party equipment leasing is easy and the manufacturer is good, and so forth, and everybody gets paid right up front. If that particular lead can do it, right, but if not, then we're looking at getting one of the private investors and doing that gig with the rent roll with the buyout option kind of model.

Tom M: The reason why is when you use a third party leasing methodology, essentially they do end up owning the equipment technically as long as they made all their payments to the end of the duration.

Riggs: Yeah, that's totally fine and then here's the good part. You can also include the service component in the lease. Typically, you can wrap it all around and so if he does qualify. Great. Go for it. Then everybody's happy. If he doesn't that's when the alternative investment comes in. I think that we're basically going to go two tier model here.

Tom B: So that the idea on this right is not. They can basically do a deep clean of a pool without emptying the pool. Correct. That's a key value proposition.

Tom M: That's a value proposition.

Tom B: Okay.

Tom M: It's more, the truth of that is there's three different things and it's very dependent on market you’re in. So, for example, in the Southwest United States where they're having water scarcity, they have problems on two fronts. One is water's expensive, and two, they have restrictions on dumping water. So, a service like this allows you to get around both the restriction issues, versus when you're on the East coast, then you have a different issue. You have temperature and weather conditions that makes pools really skanky, and there’s lots of funky stuff that gets in them. So, people then prefer to use an RO (Reverse Osmosis) system on it, because that allows them to purify and disinfect the water in one step.

Tom B: So I'm clear, the proposal you'd want from me is a program that would be available to those top-tier people that would help them market this new, the Pool Preserver for them, build their leads and build their business for that. Correct?

Riggs: Yeah. So, we want both. I think we want to have the program that is part of our product and we're going to include the lease package, the OEM on it.

Tom B: Then the other would be a program to get those top-tier people and get them through a funnel, get them qualified, and get them in a queue. So that we can move them into a sales process.

Riggs: Correct.

Tom B: Okay. All right. We can do that.

Riggs: Gentlemen. Thank you very much. This is exciting. I'm glad you came along. Good serendipity. Let’s do it.

End of video clip

Riggs: You get the general idea that this thing is now, we actually, I called it a good serendipity, because it is, it's pretty amazing.

Water commercial news, Tom and Dan are up and they're going to present what's going on. So, for starters, Tom, tell us what's going on in McKinney, Texas.

Really Busy

Tom M: Well, McKinney has been busy. The guys are busy. I always know that they're busier, because they get a little short with me on the phone. They're like, "I'm really busy right now, I’ve got to go." It's actually a good thing. It's just, you get a little bit of pressure because there's a lot going on and we've got a lot of phone calls to make. So, we've been keeping our management meeting short, so to speak in order for everybody to really focus on the work and really focus on the customers. It's very important right now that we get the products out the door. We have a good backlog of work that has to get completed. So, there's been a lot of ordering of equipment, building equipment, and the production guys are busy on the floor and they're getting stuff done.

Marc and I'm have been discussing trying to add about two more staff members on the production crew, because we have enough work to keep the guys very busy right now. We want to make sure we speed up and improve production a little bit. Then we also were looking at, we've been interviewing some engineers to assist with more workload on that. That'll help us close more of the deals in addition to completing the production. So there's some fundamental business things that we're doing there.

Balanced Deck of Projects

As far as actually sales activity. We've been really continuing on our path with obviously the industrial clients and the commercial clients. I like the quality of the mix that's been coming in. We've had, obviously our bread and butter stuff is really getting done properly with RO Systems [Reverse Osmosis], and EDI [Electro De-Ionization], and so forth. But we've also been getting a lot of new opportunities with wastewater treatment and drinking water systems as well. So, it's a nice balanced deck of projects and proposals that are coming in and out. The new change too was us completing some of the work for a couple of our key projects with some very, really high-end target clients. We've been invited to bid on a couple of projects from some, some really prestigious companies that are well known. So we're trying to get our foot in the door with a couple of those big projects as well.

In a Growth Spot

Then of course we're really pushing heavily on our standardized products and things that Dan's doing, which we'll talk about more, but yeah, it's been good. It's an interesting time with COVID and somebody had asked me the other day, I was on a call, they asked how we were doing, and I just frankly told them we've been really fundamentally busy since February, and March and April, May and June has just continued to increase. It's been really great. It's been a blessing we've maintained all of our employees. We have been now growing again. I think it's a nice testament to the business and our market that we're in a growth spot, so good for us. It's been really cool.

Riggs: Oh yeah, that's excellent and just to wrap up on the McKinney story. We've had an excellent Q1, the numbers, which we're reporting next week on Q2 are also solid and the first half of the year was definitely a move forward from 2019, but I think that Q3 is really starting to get some momentum. I think you would agree with that.

Strong Run Rate

Tom M: Yeah. I mean, our run rate is really strong right now. Obviously, we have to perform and we got to close. Closing is important, but the run rate's really strong. Definitely we're bidding more than we've ever done and we're winning more than we've ever done in recent times so it's pretty significant. It's noticeably different.

Riggs: So you've been dealing with a lot of Pool Preserver leads. Tell us a little bit of what's going on there, and what the flow is.

Our Kind of People

Tom M: I’m Mr. Pool Preserver, I feel very much like a swim. Look, no, it's been cool. Pool Preserver is an interesting product because it's based on some really fundamentally awesome technology that we do in reverse osmosis, because we designed this thing based on our industrial level technologies. To be able to provide it for pools was like yeah, we're going to crush this space. No big deal. So, it's interesting as we've been doing the marketing, as we've been doing the videos, and we put a little bit of attention on it, we had a pretty tremendous response just in a very short amount of time. We've had almost two dozen inbound leads. They just kept coming in. I was getting two a day, and I'm going, nah. I kept checking to see if they were repeats of some old email. They were just totally fresh guys.

As a matter of fact, I called a guy back today, came in this morning and I called him in the afternoon. He's telling me he wants multiple units. A very experienced industrial guy, has a whole mechanical and trucking based business. I'm sitting here going okay, totally worth talking to the gentlemen. He was great. He understood business very well. Very entrepreneurial minded and he just gets the business model that it makes money, and it's a great extension product line.

The gentleman I talked to yesterday, him and his wife ran a really good business as well. They see this as an extension to their existing business. The two people I talked to the day before, again. So, there was five people just in the last 48 hours I talked to who were all legit, hard-working guys and women who are just looking to find a way to make money, and run an entrepreneurial business. And they're our kind of people. They're exactly the people we like to talk to all the time. They're motivated and they're totally into it, so it was really cool.

Business in a Box

Then the stuff that you show with Tom Burton, it'd be a nice addition because they were asking really good business questions. How do you get clients? How many clients did you get? How do I do some marketing and advertising? I'm like well, we've got a little business in a box here. If we partner up with Tom and we can assist not just with a great piece of machinery, but also with the ability to run a business. So, they really liked the balanced approach to the biz op, opportunity, and I think it's a real positive conversation. Folks are interested. I'd say half are more than capable of just paying cash and buying the machine. It's not a real issue. The rest are interested in the financing because financing is pretty cheap right now and why not take advantage of it? So that's about where we're at.

So it's been interesting at least on the sales side. We've also made progress on the machine side itself, the actual production level of this thing with Dan’s assistance on looking at the technology we're using and then Marc and the team's ability to go source equipment for it, to make sure that we try to drive the price down a little bit better. We definitely see the ability to keep making improvements in our cost structure to make the machine more affordable. Obviously, as we produce more units and all it'll get better for us and for our tradesmen.

Not Trying to Get Leads

Riggs: Yes, and I think it's important. First of all, it's important to recognize that we are not trying to get leads right now. In fact, Adrienne knows that. She was like okay, we can put the word out. And I say yeah, then we'll get 10,000 people and we will be in deep trouble. So, we're on-purpose, not proactively promoting. These are people who are just hearing about it through our own just general marketing that we do. It really indicates that even with that small amount of marketing you're getting some serious business for these, call them hundred thousand-dollar systems, it varies according to the capacity. But that's not bad numbers remembering that McKinney, they do a million dollars a quarter, and here we are. It looks like you got half a million dollars right there in 48 hours so it's very powerful stuff.

What we're looking at here is to get our act together with Tom Burton and really package this thing so that when the flow hits it's not going to be Tom Marchesello dying on the vine. And then we're going to have this bifurcation where qualified buyers go right over to Crest Capital, get their good package and they're up and running the way we all know how to do, and then the biz op people get that new era. So, very interesting. Way to go, and thank you.

Informed Inquiries

Tom M: People are informed. It's an interesting topic. They're not uninformed inquiries. These are informed inquiries about people who understand equipment, equipment rental businesses, they get that part. They understand how to be entrepreneurs, and grow businesses. That's been nice. The other thing they were informed about is actually the market opportunities. They were sharing information that actually you and I had, but they were getting it from a different source just about the general pool market.

We were having really good conversations about well, are more people swimming? Are more swimming pools being installed? And the statistics about the industry itself showed growth because the actual pool market was growing and it's growing faster in the more recent years. Even COVID is driving additional growth of people putting in pools. So it's a really interesting trend in a really weird moment in history. It's very interesting to see. It's in our direction. It supports the goal that we have.

Riggs: Well, the word of the day is serendipity, because for those who don't know what the heck I'm saying, basically it's when things coincide in just the right way. Literally Pool Preserver started a couple of years ago for us as a custom product, but has really come to life in COVID and now we've got ourselves a business. It's happening organically, and it's really allowing us to build something interesting. Now let's have Dan tell us what's happening in his world. You've had some successful recent installations. Tell us about it.

Gen 2 Pool Preserver

Dan: That we have. I would want to comment on and I'm going to do a follow on with Tom. I did have the opportunity to speak with Marc Stevens down at McKinney today. The evolution of the Pool Preserver project is moving along splendidly. When we last spoke last week, we talked about the status of the gen two version of this unit and Mark indicated to me that he thinks that he is definitely 30 days away from having the next generation technology up and running. He actually has a couple of test sites already lined up that we're going to go out there and we'll get this thing some real-world field testing. So, I'm really, for me, being a technology guy and being chief engineer with the company, that's got me really, really excited because when we bring this next level technology together with the business development that we are seeing with Tom, I think we will see a lot of really good things happen with that particular product line. So, just wanted to add that little tidbit there as an update to the audience.

Tom M: For me Dan, because that basically while you're promoting how awesome it is, that helps me say, “Riggs, by the way, I spent some money buying some equipment the other day.” Oops, had to test something out. But anyway, hey, we've got to make this thing work.

Products and Installations

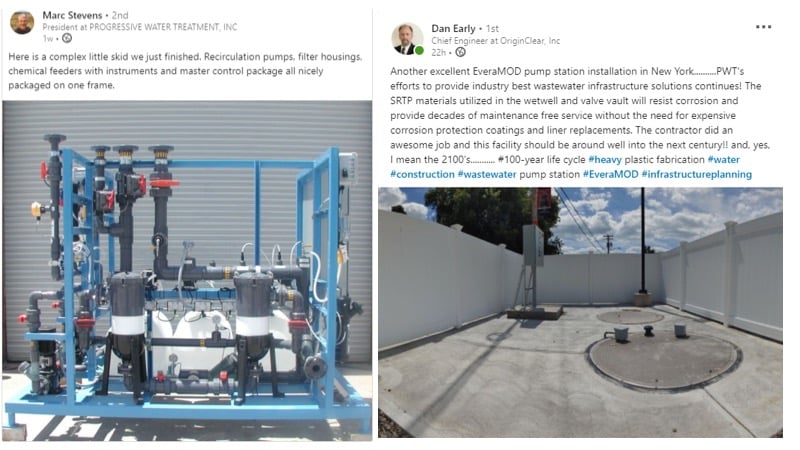

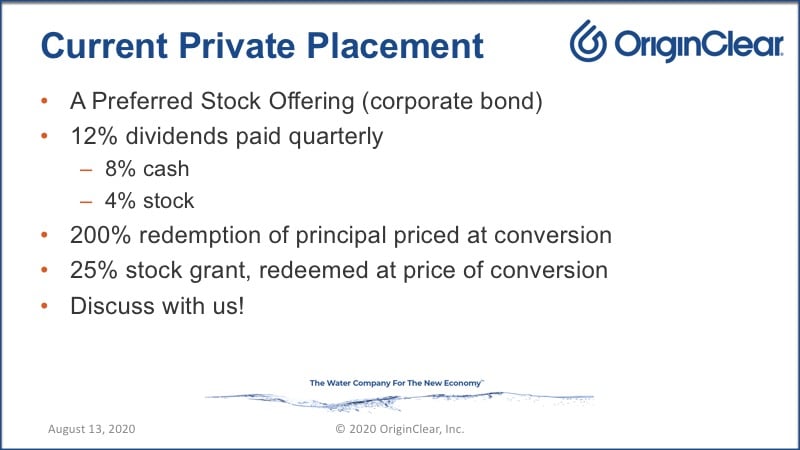

Dan: That's right. We've got to make it work. Got to make it work. Well, as far as installations go, Robb Litos, who's our technical project manager, he and I work hand in hand on a daily basis heading up the Modular Water Systems™ product line. This week he was up in New York working on just some last-minute punch list items on our most recent installation. That was a multi pump station project for a locality, a little small hamlet in New York. He sent me some site photos, that on the screen in front of us the photo to your right, while it may look rather boring to the viewer, that actually is a completed installation that utilizes one of our EveraMOD™ pump stations

When he sent me the photographs of this thing his text message was holy cow, I cannot believe what this thing looks like. When I opened it up on my phone and looked at it I was like holy cow, I can't believe it either. This is a boring conventional piece of civil infrastructure. But what is important about this is that this particular installation is another one of our EveraMOD pump station products where we're taking advantage of our heavy plastic manufacturing and our long lifecycle durability capability. I was just so, so pleased with it.

The contractor, when I spoke with him today just in a follow up, he was very, very pleased with the overall installation. So this is just more proof positive of the trend that we're seeing and the increased level of adoption of this technology by the specifying engineers, and more importantly, the end users that are out there in the marketplace.

1.5M in New Opportunities

Just this past week, just in a parallel to this story about this particular installation, just this past week we have had probably another at least 10 new pump station opportunities come in to us.

Riggs: Wow. This is that $1.5 million you were talking about?

Dan: In all, if you combine them all together, probably plus or minus, you're probably in that price range. And that again, it's the total package. It's the total solution, total package delivery model that we offer with the heavy plastic manufacturing being a key component to it.

Again, this week with regards to just our plain Jane pump station product line just I've been totally, totally just jazzed about the progress that we're seeing in the uptick in inquiries, real-world high probability inquiries that are coming in. It's very reaffirming to know that the civil infrastructure world, the engineers that work with this technology, that they know that this is where the world is heading for this type of application.

Wastewater Treatment Capabilities

So that's one thing. The other thing I'll share with you is we have just really started focusing on our packaged wastewater treatment capabilities. Again, with the Modular Water System product line. That is starting to really gain some traction too. I had a number of different phone calls this week with prospective clients and I would dare say that we're probably, by the end of the year, probably we want to add I would say at least three to four more major purchase orders to the current pipeline. I mean, closed deals, contract underway, moving forward.

Riggs: These are all six figure packages, seven figures sometimes?

Dan: Yes. The pump station's average right at six figures. All the wastewater treatment systems that we're doing, they are low six to mid six figure equipment offerings.

Riggs: Excellent. Dan, we're running short on time, but on the left there is a beautiful little package. I want to just showcase the fine engineering being done in Texas.

Dan: Yes, I am just totally, totally proud to be associated with the Progressive Water Treatment and Marc and his team down in McKinney. Their fabrication capabilities, the in-house skill sets that those guys have, it is second to none. They produce high-quality equipment.

Riggs: Love it. Dan, thank you. I couldn't tell you, I can't tell you how excited I am about how things are going, and it looks like you're just going to keep growing your darn beard. That's just how it is. Right?

Dan: I think there's a direct correlation.

How You Can Participate

Riggs: So true. So true. I'm going to quickly wrap up because we don't like to keep people too long. I love how people stuck around. We've talked about a lot of wonderful things. About how we want to bring jobs to America, and hopefully eventually the rest of the world. It's going to be a big job scaling it up. Now the game is to capitalize those efforts. We are a public company, and the question is how you can participate in that, but how you can participate is very simple.

We, OriginClear, I'm in the stock market. I'm not going to tell you how long I've been in the stock market. I can tell you this, I'm holding onto my OriginClear stock. It's sitting right there. You'll see it disclosed in the forthcoming quarterly filing, as I've been accumulating stock through our restricted stock plan. I'm leaving it with the transfer agent because that's the way it should be.

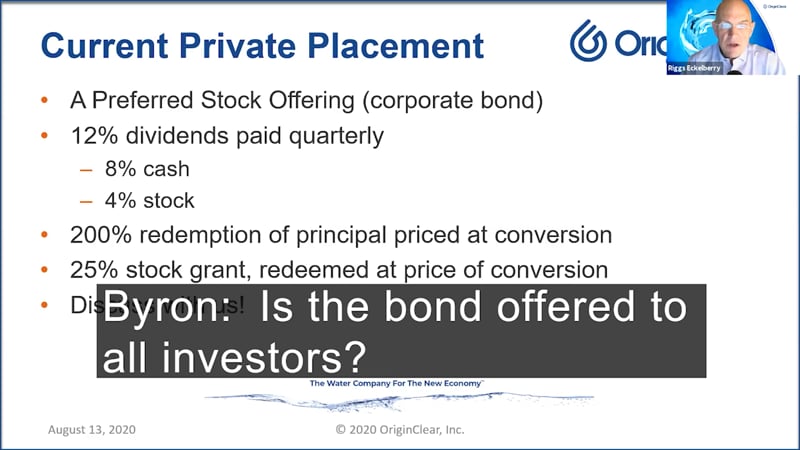

A Bond That Pays Excellent Dividends

I do think we have a great future, but we're not asking people to purchase common stock who are accredited investors. We put you into a bond that pays excellent dividends. Show me anybody who gives you 12% and you're probably talking about the local bookie. It's a lot these days, and your principal gets redeemed for double its value priced at the price at the time of conversion. So even if other people sell, price goes down, whatever, it doesn't matter.

The importance of all public companies is how much it trades. I think we're starting to trade very healthy numbers every week and every month. You get a free stock grant of a quarter of your investment. Again, you get to redeem that or convert it at the price of the time of conversion. So, you're in a safe bubble, so to speak, until you're ready to convert. You are in the meantime getting the dividends both on the cash and stock side.

Getting Ready

Paul Fetcher, "I would like to know, have we reached out to the Biden team to tell how we can help them achieve their goals?" It's very true that there's a lot, a big push for what's called the Big Reset, for a greener planet. If, as things ramp up again, and we think that we're going to do a great job with getting blue. We're blue, but blue is a big part of green, and we're staying out of the political. Apologies, but we're not going to get involved in the political game this season, but what we are doing is preparing our systems, getting ready.

Overall, we think this is the best way to invest in a small company that's public, because you've got that yield product and the ability, if we really do our job, which we totally believe we will, especially with the support of Philanthroinvestors, we think we're going to take off and be on the Inc 500, just like them. With that in mind, the stock might take off and then you would want to convert.

Q&As

Now, Byron wants to know if the bond is offered to all investors. It is offered to accredited investors. Now, we have filed an offering for unaccredited investors, which is a bond that pays a pure 10% cash, no conversion to stock. But when we redeem that bond, we have to pay you back 150%. Minimum is $500. We're going to make it possible for everyone to get an OriginClear bond, but accredited investors of course get rewarded in proportion to, of course, the size of their investment.

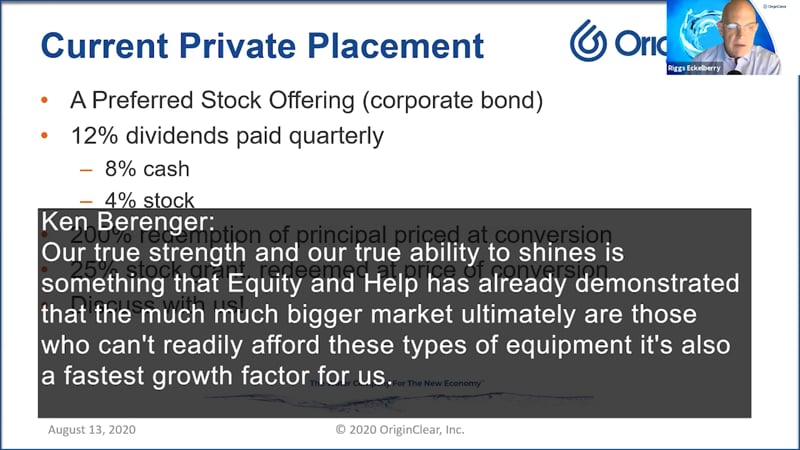

Ken was just saying, "Equity and Help has demonstrated the much, much bigger market, are those who can't readily afford these types of equipment. It's also the fastest growth factor for us. Investor-funded portion of the market will be far more recession-resistant part of the market. Something else that Equity and Help has demonstrated is that focusing on those who can't just snap their fingers and buy is a much, much bigger market, much richer, and it's the market ultimately does more good for all parties." That's a beautiful statement. Thank you, Ken.

I'm going to wrap it up. I thank you all for your time. It's been an excellent show. I love how everyone's stuck around. “How much does an accredited investor start with?” Bluerose, accredited investors make $200,000 a year personally, or 300,000 filing jointly, or they have a net worth of $1 million not including their primary home. That is not everyone, for sure, but this is why you will soon see, I would say within 30, 45 days, our offering for unaccredited investors will come back up. Arte, you've been very patient and quiet. Did you have any last words?

Helping and Belief

Arte: Yeah. I was just thinking about what you're doing and what we've been doing over the years to build our company. There's kind of an entrepreneurial goal in the sense of being able to make money while also... not to be trite... but making a difference. I think it's the real drive. People ask Ivan all along, or all the time, "How did you get these 1,000%, 2,000% growth? The answer's always the same. When you're pursuing help and you're doing it for the right reasons, it tends to come back to you. I realize it sounds over-simplified, but in our Philanthroinvestor program, we actually lay it out step by step, ethics and integrity and all that neat stuff, with the idea that it is coming back. Part of it's, I guess, a belief.

Riggs: That's beautiful. Thank you very much. Ivan, any last words before we wrap up?

Arte: …why we're also doing our work with you.

Riggs: Thank you, sir. Ivan, a couple of last words?

Proud of OriginClear

Ivan: Yes, my friend, that I am really proud of how OriginClear has taken now the Philanthroinvestor brand and knowledge and start expanding. Because it's really very powerful when you actually put now in the organization, the possibility of not only allowing your future investors to invest with the purpose, and deliver to them clear investment, clear results, to actually create the Airbnb for water. This power coming together, it's actually what's going to take us to the whole new level of the world, because I hate 6,000 children dying every day for water issues.

Riggs: Thank you. Thank you.

Ivan: I am so proud of you, Riggs, and the team.

A Very Good Question

Riggs: I appreciate it. Thank you, sir. A quick chat from Mansa, [who] asked, "Is the value proposition that the treated water is then able to be placed into the municipal water streams, or is the idea to treat the water for reuse by the same facility using the device?" It's an excellent question. The answer is both. In other words, if you have to treat your own water, then you're going to recycle it before you send it to the city. The city these days is demanding treated water.

You can do a couple of turns of the water yourself, save a lot of money, and that's what we call a virtuous cycle. Thank you, Mansa, for a great question. Thank you all for your patience. You've stuck around to the end. You are a wonderful audience. I'll see you again next week, next Thursday. Do sign up, oc.gold/ceo. Goodnight all, have a great weekend. Again, to Equity and Help and Philanthroinvestors, biggest congratulations on your amazing achievement.

Ivan: Thank you, my friend.

Arte: Thank you.

Riggs: Good night.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)