The insights from the Robert Kiyosaki and Adam Taggart conversations were quite relevant, And support just how vital our Water On Demand program really is. There were also some real gems from featured podcast segments highlighting OriginClear as an Innovation Hub… With economists issuing recessionary warnings and advocating flight to assets what does it all mean for our future? Find out in the replay!

Transcript from recording:

Opening

Riggs: Our role is evolving into what we call an innovation hub. You can tell that we are a changing organization because, of course we're trying to make change happen in the water industry, which is not easy. But our previous historical model was to constantly build value. Of course, we started an algae, transitioned to water tech, acquired PWT. 2018 we launched Modular Water. There was an abortive crypto which is now being planned as $H2O and then adding Water On Demand™ and then the Water4Us™ program and finally EveraMOD™ pump stations. The problem with it is it was a bulky model and it was also constant burn.

About a month ago we moved to a different point of view where we successfully launched Water On Demand with its Water4Us program and we said, "Well, wait a minute, let's make that what we do." So in this model, Water On Demand being of course the water is a service pre funded systems that enable end users to just sign a piece of paper, get their water taken care of on a per gallon basis. Water4Us is focused on human communities. We've had a lot of action with, with freeway travel stops, hotels, RV campgrounds, trailer parks and also housing developments.

We put that in a separate category because it's a huge mega-trend of people moving to areas that are much more spread out, more rural, less sewage service, and thus needing a free standing water treatment capability, along with maybe even energy independence and so forth. Very exciting trend. And in this model, OriginClear offers the management support so that Water On Demand Inc, with its Water4Us program, is an independent company, but it doesn't have to replicate HR, legal, finance, etc. That all is handled by OriginClear.

And as we move forward in time, we have the prospect next year of doing something. $H2O is the asset wrapper using blockchain that we're looking at. And exciting is that we might be taking EveraMOD™, it's going to be early 2023, we're going to make it its own little business unit. Crowdfunding has become so packaged and productized that you can deploy a marketing campaign and fund a company, prospectively, it being a public company and the key players in each one of these companies get a tremendous equity share and thus they get more directly rewarded. It's very targeted.

Moving on to 2025, we're looking at your own organization [Modular Water Systems™] potentially becoming a spun out company. And finally, Progressive Water Treatment, which itself has some trade secrets that are worthwhile. But these five properties Water On Demand, $H2O, EveraMOD, Modular Water and Progressive are the jewels in the crown that we're going to roll out.

And this model OriginClear again, is the mothership that enables each one of these to be very tactical, very focused, and OriginClear gets management fees, which enables it as a mothership to be profitable and itself go on to the Nasdaq, creates this cool launchpad role for OriginClear, which is very unique in the what industry. We have them in Silicon Valley, we don't really have in the water. So OriginClear has that role and eventually gets monetized as such and has a big chunk of each one of these companies for its pains. And we end up with half a dozen public companies, of which OriginClear has a big piece. So the OriginClear investors and sweat equity players are rewarded.

Introduction

Welcome everyone to Water — The Blue Gold™. Thursday, the 15th briefing number 190. Next week there will be no briefing the 22nd. I do expect we will have one the final Thursday of the year, which I think we'll do it. I don't like to miss two weeks in a row. Robert Baxter, "Good evening, gentlemen." And Charlie Davanzo, "Good here too." Thank you very much. Eugene Tully, "Good here." Okay, guys and gals, appreciate you letting me know. This is going to be a really great, fast paced briefing. So let's get it on.

Obviously, the usual disclaimers. All right.

So. Black Rock. So here's what Black Rock said "Central banks are deliberately causing recessions, warns of a downturn unlike any other."

Three shockproof assets to consider. Let's take a look at the actual article here and see what they have to say. I think we can do better than what has been advised here. So first of all, let's take a look.

Real Estate

Obviously, the first one, real estate. Yeah, no, no question that real estate works. However, you notice that rents are dropping fast. Well, I think there was an overreaction and rents got too high for a while. And even though there's inflation, you can only charge so much that people can pay. Otherwise they'll end up moving down to the next level into Mobile home parks, which by the way, are doing extremely well. So real estate, I think is a strong area, but there's big black holes in real estate. Certain categories are really tough. So it's kind of a checkerboard kind of situation. But no, no question that that real estate is strong.

Consumer Staples

Really? So yeah, people will still buy Quaker Oats and so forth. And Tide and Bounty. Maybe so. Personally, I think that there's going to be a lot of people saving on things that they don't really, really need. Do I really need to have a bounce fabric softener in my dryer? You know, things like that. Plus, people will tend to go to generics, they'll go to the Safeway brand as opposed to the big brands. So I really don't necessarily agree with that and I don't think it's an asset class anyway.

Wine

And then wine. I used to be in the wine industry. I was an importer. And there's no question that the wine industry is interesting, but it's not a big market. And yes, since 2005, Sotheby's fine wine index is up 116% and bottles of fine wine. Why not? But I don't see how they are going to generate ongoing income, right? Yes. There's platforms you can go to like Bill Coche and LeBron James, no question. But what kind of income do you get? And that's a different story. So I thought that Yahoo! could have done better with this story.

All right. So moving on here. ZeroHedge when went full on gnarly this week. Let's take a look.

White House Fantasy

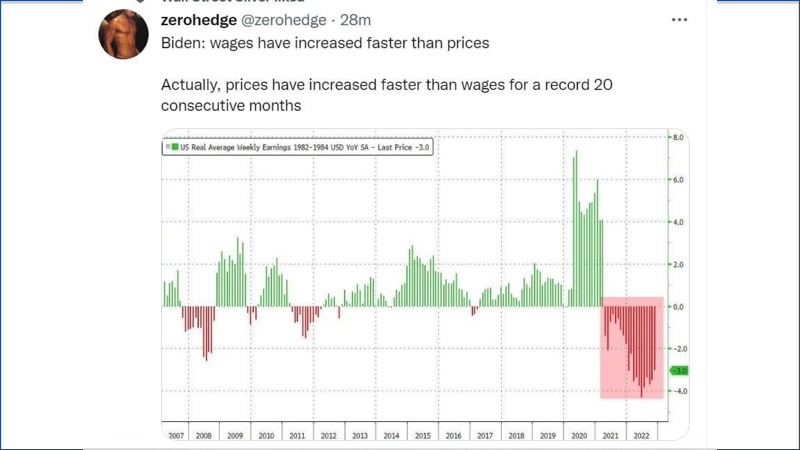

First of all, Biden wages have increased faster than prices. Well, that's a flat out fantasy. Somebody is, somebody flipped the graph upside down or something in the White House because since this administration came into office, prices have increased faster than wages for a record 20 consecutive months. And so what does that do?

Overstated Payrolls

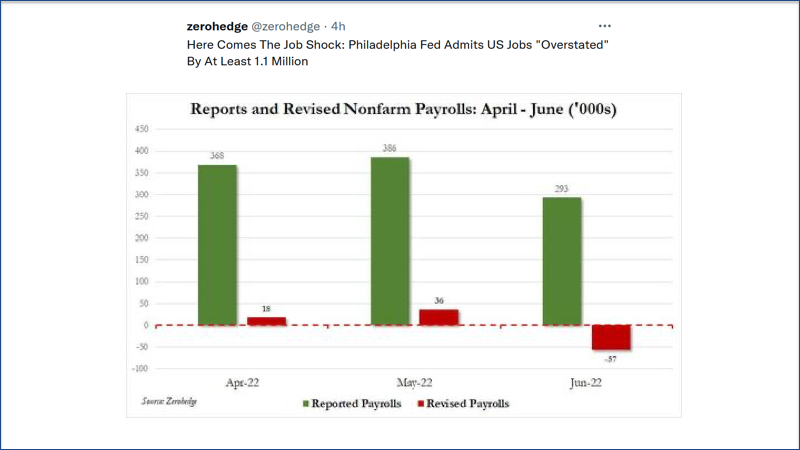

Well, it turns out that payrolls were overstated by at least 1.1 million. Look at this, April, May and June. They were madly overstated. They were, look at the June numbers, way positive... no, they were way negative. So there was a little creative reporting going on. And frankly, they're just saying whatever.

The Last Fed Hike?

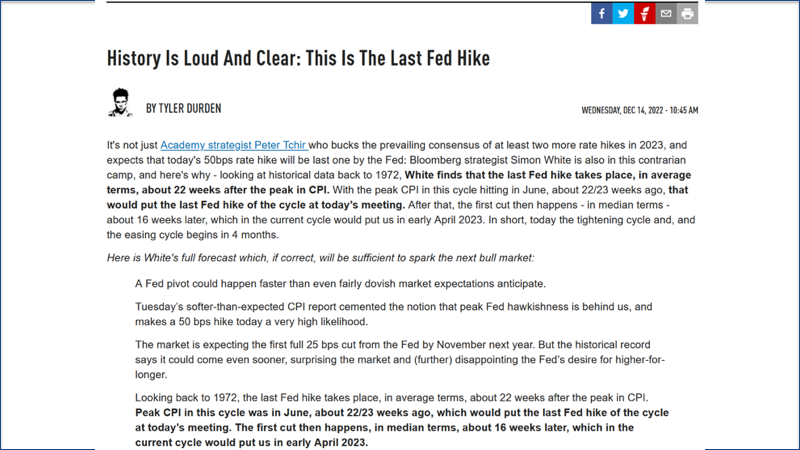

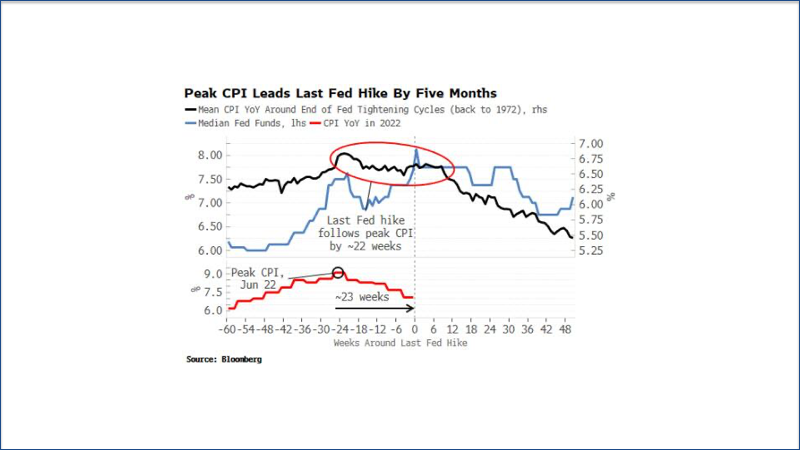

Hopefully the Fed knows what's going on because it's the next story here, which is ZeroHedge thinks that this is the last Fed hike. Why is this so?Well, it's a timing thing. Peak CPI essentially 23 weeks after a peak in CPI. Let's see the consumer price index, the hike goes down.

Demand Destruction

And here is the graph that supports that. This is good news. I think those of us who know what's going on, what's going on think it is completely insane to keep raising the Fed rates. It is murderous. But this is a contrarian view that right there, 23 weeks we should start seeing because of consumer price index having gone down for the last 23 weeks, That could signal and frankly, I have previously said that inflation was going to go hyper. Looks like it's not. And that's primarily because of demand destruction, which again, is very, very dangerous for any companies trying to market to consumers.

Okay, Let's continue here. Well, guess what, Rich Dad. Poor Dad had an idea about what to do. And I've done a quick excerpt here that I think you'll enjoy.

So let's take a look at what Robert Kiyosaki has to say. And this is an interview that he had with Adam Taggart of Wealth Iron. This is just a few minutes, but I think it makes a point. Here we go.

Start of presentation

Robert: I'm concerned if what I think is about to happen is going to happen, which is the demise of the US dollar, the hegemony of it and its power and this reserve status. The question is how safe are bonds? Because I have a friend. I mean, he has not a million, he has hundreds of millions in bonds. And yesterday I went out and bought some more silver and hid them in my secret mountain vault. But he says he won't touch silver. He says US treasuries are it.

So with that question, when he's got hundreds of millions stashed and they talked about the eyedropper of water and a football stadium. So I think that's a very good metaphor. The eye dropper of water. Eye drop of water an entire football stadium because I think the last eye drop is about to hit because that's football stadiums almost filled up. What's safe right now is a can of tuna. I got one for $0.20 the other day and there's no counterparty risk to my can of tuna, because if Safeway or Albertsons goes broke, I still own that tuna. But if I buy a share of Safeway stock and Safeway goes down or Albertsons goes down, my stock has gone too. So I think tuna fish are the safest of all investments.

To protect yourself against the abuse of currency and the rising cost of living, hard assets are, I think, one of the safest long term assets that you can invest in right now, particularly hard assets that create an income stream, because most hard asset income streams will adjust along with inflation. Right? So this can be real estate, this can be commodity producers. But to a certain extent, Robert, maybe you're saying it tongue in cheek, I don't know. But like stocking up on extra cans of tuna right now is not a bad thing given where food prices have been heading and can continue to head.

Robert: Yeah, and tuna is a derivative of diesel because it takes diesel to fill the shipping fleets up.

Adam: And most people don't understand the absolute essential role that energy plays in the economy because nothing happens. No economic activity happens without the energy to power it. And if you care about the pricing of things, you have to be aware of what the energy input costs are for that individual product. Most products require a lot of energy if you want to get a tuna, well, yeah, it's a fish in the ocean.

You would think no energy is involved at all, but you got to basically manufacture the boats to go out there and fish. You've got to put the diesel in for those boats. Then in most cases, most fish that's actually sold in America and caught off American shores is actually sent to China to be processed before it comes back here and is put in the can. There's just a ton of energy, embedded energy that goes into everything. You've got to really look at your vulnerability to energy costs. And again, they've gone bonkers over this past year given what's been going on with global supply chains, the war in Ukraine. Et cetera.

End of presentation

Riggs: I've just done a very short clip of this. But the first part is about this Eyedropper idea. You put an eyedropper of water in a football stadium and then it doubles once a minute. How long will it take to fill the football stadium? Most people think, Oh, I don't know, weeks? months? No. 45 minutes. And the last 2 minutes are from one quarter to one half to full. Because doubling, doubling, doubling. And so this is what happens is you get these effects. What Robert Kiyosaki is saying is this doubling effect is mathematically very powerful. And so it's not you don't hit that inflection point. And then when you hit it, it goes crazy.

And in the second part, which I cut to, was the idea that hard income assets are the place to go. Let's put aside the tuna idea, which is actually very smart. Why not? But you're not going to get income from buying tuna. You're going to get, put some tuna away, all good. But it's not an income asset. The income asset is, as he said, it's real estate and commodities. Those are the two areas that there will be hard income assets, income generating assets. Now, he mentions oil, which is a very good one. Obviously, water is still not fully on the radar because people still believe that water is a monopoly, whereas it's coming to light, that it's breaking up. And this is the trend that of course we are leading.

So I had a great conversation on HC Insider about commodities. So let's take a look because it covers this exact point. And this is, of course, part one.

Start of presentation

Paul: All right. Well, Riggs, welcome to the show.

Riggs: Paul, It's a great pleasure. Thank you.

Paul: So we're talking water, which in many ways, I guess, is the the essential commodity. Can you you know, this is certainly something I don't know very much about. Can you just start us off and kind of give us a big picture view of of how water is used and consumed, you know, around the world?

Riggs: Well, the first thing to know about water is that, strangely enough, and this was the stat that that really blew my mind when I first got into the water industry from the high tech industry, and that was that 80% of all sewage is never treated at all in the world. So only one fifth of all sewage, most of it in the developed world, is treated. The developing world is like it just goes away.

So it's actually first of all, it's a lot of waste, but it's also a tremendous amount of pollution of our rivers, our oceans, our groundwater and so forth. And that is the unfortunate state. It creates a lot of death and disease. 6000 children a day die from waterborne diseases in the world, and there's a billion or more who have diarrhea in any particular day. So. Water is a real problem. Years ago, Andy Young once said that if you put a pipeline through the Sahara, you would eliminate 50 diseases in one fell swoop.

Paul: Let's let's thank you for that. And, you know, and I guess that's so crucial to this narrative. Can you just help us I mean, a bit of terminology here. So, you know, the difference between treatment and recycling, you know, because I think, you know, if you grew up in London, you've got a very different experience of how many times someone has drunk that water before you. Versus, say, where I am in Houston. So differentiate that as well. And then and in particular, what do we mean by treatment? What is what are the different levels of treatment that are needed?

Riggs: Let's first of all, deal with the fact that America recycles very little water. Israel is the leader worldwide. Almost 90% of its water is reused. And then the number two in the world is Spain. At 20%, the US is at 1%. And the reason is, is that just like old in the phone, telecoms, we have landlines. So the people who had phones first had the most out of date systems with landlines. Similar thing with energy. Our energy grid in America is a uni directional grid. It just sends energy and it has no feedback loop.

Again, because it was started early. Well, the similar things going on with water in that we have an old infrastructure that was built with one purpose only, which is take the water, treat it and then discard it. There's no way for it to come back. If you're in Los Angeles and you're creating dirty water in uphill in Glendale and it goes all the way down to the Santa Monica Bay to be treated, then it goes into the ocean. It doesn't go back to Glendale. There's no there's no piping available for that.

Riggs: So that is the real problem now, there are, there is a solution. But basically, you have three phases of water treatment, the first one is, of course, purifying the incoming water, you get water from the water district or utility or from a well. You usually have to do something to it. And secondly, is the treatment of the water that's been used either by, for domestic use, which is called black water or industrial toxic waste or agricultural waste. And then the third is the reuse of some portion of the water that's treated.

Now, what do we mean by treated? It all depends what your end use is. For example, if you're just treating the water so that the municipality will accept it as treated water, meaning you won't have to pay for it to be cleaned. Then there's this very specific standard, it's not very high or you might be treating it for the purpose of recycling it into irrigation, to sprinkler your golf course or your lawns. Or you might want to recycle it for potable use, which is a very demanding standard. So that is really the third phase. How much you do with the water is really dependent on budget, scarcity. How much do you need that water to survive? And also the purpose, are you just trying to get rid of it or are you trying to reuse it, etc.?

Paul: So in the case of Israel, which obviously suffers from scarcity as a result of climate, but also I guess geopolitical insecurity, it doesn't share water reserves with its neighbors perhaps. You know, they're recycling 90% and that's potable water, right? They are, that's so essentially, I don't know how this is a surprise to people. You are drinking water that has been treated at a plant and previously used. Right?

Riggs: Well, all what in the world has been recycled and is the truth about water? You know, the question is how palatable it is. We have in San Diego. There was a program years ago, they're still trying to do it, of reusing water for potability. Unfortunately, somebody gave it the moniker of toilet to tap, which instantly destroyed the whole idea. And so there's a lot of opposition from municipalities doing it. There is a solution which is don't have the municipalities do it. But that's we'll get to that.

When we talk about Israel, the interesting part is, first of all, why does Israel have 90% reuse? It's because they have a newer infrastructure. It's designed that way. But it's a little known fact is that Israel provides water to Jordan and Egypt. And that is actually a source of, it's a reason why they're at peace. You know, I imagine if Ukraine had no water and Russia had all the water, there'd be peace. If Russia gave the water. It's much more important than gas or petroleum, right? Water is critical to survival. So a lot of you have a lot of water wars, but you have a lot of peace that comes as a result of sharing water.

Paul: Is a there's a tie up with the history of the United States. Right. The reason why sort of states had to get along was ultimately over water rights before anything else. Right. You know, how are they going to share these massive rivers that thread their way through the country?

Riggs: Yes, And we have in the West, we have the Colorado River Compact, as it's called, which is a system of sharing the water according to very old, old systems. So you have some people paying as little as $25 an acre foot. That's one acre of land, one foot deep, which is enough roughly for a family of four for a year. They're paying $25 for it. Whereas in San Diego, the marginal cost of water from basically, from their desalination plant is 1500 an acre foot.

So, tremendous disparity in costs of water caused by these old, old, really their deeds and they are outright ownership. It's very hard, they're dealing with it right now because they're looking at how to fix the problem. There's over there's there's overuse of the water. You know, there's a 1200 year drought going on and, you know, everything's running dry, not just in the West, but in, I just on my briefing I covered the Mississippi, which literally is turning into a mudflat.

So, you know, this is because we've allocated water based on plenty, not scarcity. If you say, look, let's assume there's scarcity, let's plan for that. And if there's more, there's more. No, we've done it the other way. We said, you know, we're going to have all the water in the world let's divvi it up and that's where we stand today. It's a really intractable problem. There are solutions. The first one is let's try and reuse the water, reusing.

Paul: Well, all of this is rooted in history. A lot of this is rooted in a misunderstanding or a sort of hopeful expectations of, you know, what the word I'm looking for here. Plenty over scarcity before we move into all this, where is most, so we've talked about how water is treated, Where does most water come from? And you know, who's who's using the most water. Can you give us some sense of scale on on that around the world, you know, households versus industry, etc.?

Riggs: Generally in the world, 89% of all fresh water demand is by industry and agriculture. The ratios vary. In the US it's roughly equal. In some countries like, let's say Somalia, it's more than 90% agricultural. So it varies according to how industrialized the country is. But generally in America there's roughly equal usage. Now, this is something that we need to confront. In California, for example, everybody is being exhorted to to save water, take short showers, etc.. But the and it's good. I'm not saying it's a bad thing, but the effect of it is going to be relatively minor compared to confronting the usage of water by industry and agriculture.

Now, the problem is, of course agriculture and in California is a $20 Billion a year market. And it's hard to say no to the lobbyists in Sacramento. But it's illogical to be growing avocados and almonds and so forth, which are water hungry crops when there could be crops that are barley, for example, that hemp is a wonderful crop for water. We should be adapting the crops to the, to the climate of that region, not the other way around.

Paul: And most of this water just to get it on tape, I guess, is it coming from rivers? Is it coming from aquifers? And is there a general state of depletion across the Western, the developed world and even the developing world, that these resources are ultimately being used faster than they can be replenished through rainfall and snowmelt, etc.?

Riggs: General aquifers are being depleted. Let's take a look at the Ogallala Aquifer, which is runs down the Midwest. A third of all produce created in America comes from the Ogallala Aquifer. It's also where all that fracking water comes from down in the Permian. It is down more than 150 feet. That is very hard to recapture. It takes generations to bring it back up because you don't just refill an aquifer. It sort of has to permeate over time. So this is a basically a permanent loss. We're seeing that happen also because of the Colorado River not being enough for requirements. It's also increasingly happening in the West. 20 to 30% of the usage is coming from the aquifer. The water used for fracking is also a factor, but less of a fact than people think.

Paul: Okay, so you've kind of got this and there's a little bit of I mean, there's a, it is a fascinating space because there's a bit of a tragedy of the commons going on. You've also got actually, you know, this idea of it being the ultimate commodity. You know, wars are going to start and, you know, society is very quickly impacted if the water stops running as we've experienced through various environmental disasters, you know, etc.. So let's move on to the economics of water and perhaps talk about, you know, this general global trend of public utilities becoming privatized. What was the what was the the emphasis, the origin behind that and what was the consequences?

Riggs: Well, you've got established economies which have generally a government monopoly on water treatment. In America, for example, we take it for granted. We open the faucet, the water comes out, we flush the toilet, the water goes away, and we don't give it a thought. Why? Because the government is taking care of it. And I know from experience, because I started out in a very sexy space called Algae for Biofuels, which is a, we can talk about fascinating space. And then because algae became non-viable due to the crashing price of petroleum, I had to move into water.

And I found that there's a high degree of disinterest in sewage. People think water is important, but they don't want to know about sewage. So it's kind of out of sight, out of mind. As a result, the federal government has been allocating less and less funds to water.You know, it was at a high level with the Clean Water Act and then in the seventies, and then it's been dwindling ever since. As a result, our infrastructure in America is running currently about $75 Billion a year behind. So unfunded infrastructure requirements, because there's no constituency that really cares about it and it's not going to change.

You can say, "Oh, that's terrible, we got allocate money and so forth." Well, the $1.2 trillion infrastructure bill that was passed a couple of years ago had a sum total of $55 Billion for Water, which is less than one year's catch up. So, you know and I think that broadband is hard to, in rural areas is very important. But I submit that water is more important and that's just not the reality in Washington. There is a lack of awareness.

So. Three factors that mean that central water will not be fixed. Number one, Washington is not funding it. It's not going to happen. Number two, there's a NIMBY, not in my backyard problem, which is who's going to allow a sewage plant next to them. And number three is the time it's going to take. It's going to take 20 or 30 years to install. I mean, I was in the eighties in New York City watching the West Side sewage plant being built at a crawl for years and years and years. That's just the way it's done. Water construction is typically very bespoke. It's not standardized.

So, the solution is very simple. Unburden the central system. Other words, if 89% of the load is coming from an industry and agriculture, then just pull industry and agriculture away from the center, which leaves only 11% for the for the residential users. And they now can get treated properly. I mean, Ireland, for example, water is free in Ireland. Why shouldn't it be free here? Because of the imposition of business and agriculture on a water system that is being paid for by everyone, which is resulting in these skyrocketing water rates and so forth.

So what that means now is this decentralization of water is actually very attractive for businesses. When they figure it out, they like it. They can control their water rates, they can reuse the water themselves. Remember that in the old system, the central system, that water is thrown away, the business can actually use it for, for example, in a brewery, you can re-use about 50% of the water for wash downs, the steam vessels and so forth without even thinking about using it to make beer. So they get a good deal out of it and they get control and there's less imposition of regulation and so forth. So they get it's a very beneficial deal for them. And the only issue is really capital. And that's where we come in.

Paul: I guess you've lost me a little bit there. So in the US you've got, you know, let's take it to the UK, which obviously I know from from my childhood, you know, you went from water boards publicly owned to being privatized.

Riggs: What's been privatized in the UK is not treatment. What's been privatized in the UK is the fresh water and disastrously so. For example, all the reservoirs got sold off and now we have a lack of reservoirs. So. The private is, I really sharply distinguish treatment, water treatment being privatized, in other words, let's have the people who make the water dirty, treat the water, which is only fair. Versus privatizing the source of the water, the clean water, which inevitably serves the public badly. Because in the UK we saw that there was a lot of scrimping, a lot of short term profit. And as a result today the UK has a big problem with inadequate reservoirs and is running dry. It's a big problem over there.

Paul: Okay, so in the US and say let's say Europe, help us understand. So is for the most part in the US and Europe, supply remains public of course, and in the US, treatment for the most part remains owned by the municipalities. You know, there's a push towards decentralisation of the treatment plant. And then can you contrast that against maybe Europe for example?

Riggs: Yeah, well, Europe is also moving towards decentralization. There's some good case studies over there. We're ourselves less focused on the European market only because you've got to start somewhere. But there is a similar need and benefit from decentralized water. You see, all along the big players have been doing their own water treatment, you know, Pepsi, Amazon, Tesla, big power utilities. They all do their own water treatment. And we've been having them as customers for a long time in our business. So we're accustomed to large customers doing their own water treatment. Just as often, they do their own their own power generation, right?

What it comes down to is when they are I mean, when there are smaller units, now you have a real challenge. Why? Because it's economically much more difficult for a large water company like Veolia. They'd rather do a $5 million installation for a power utility than a $500,000 installation for a brewery, and yet does far more breweries than power plants. And so there's a middle class here where all the growth is that's not really being served by the big water companies. And these are the users that can make the most difference. They are simply the most numerous. It's always the middle class. Taxation authorities always know that.

Paul: Yeah. How so? Just the economics. If you choose not to put your waste. If you can prove that your waste water is now of a sufficient category to go back, it's been treated and can now be flushed down, you know, out to sea or whatever. You do not have to pay water rates in that particular municipality.

Riggs: Right. You have to pay the sewage rates. Correct. So you save on sewage rates. You still pay for the incoming water, which I think is I don't think there's a problem with. Yes. If you need to go ahead and build a well or an artesian well if you want to go deep. But generally, incoming water should come from the municipality. I don't think that should change. But now you deal with your own water.

You see, when the water goes back to the city, if it's treated, it can go on a regular gravity line. If it's not treated, if it's sewage, it has to go on a high pressure line. And I don't know if you've heard, but mains have been breaking. Well, those are the high pressure lines and they don't get replaced. So you have a problem with conveyance of the sewage, which is partly why the cities are going. You treat your own water, just give us treated water.

Paul: All those sewage rates even set at the right economic level. I get it that companies will make a cost benefit analysis at some point and say we don't want to pay sewage rates because we were such a scale that we'll treat it ourselves. It makes sense to build that $5 Million plant from Viola. You know, just talking in the more the broader sense, you know, I kind of liken this perhaps to carbon emissions or something. I mean, are we actually even charging the correct rate for sewage given the I mean, what is the environmental destruction of just dumping this stuff straight into the ocean and so on? I mean, can you just sort of help us understand the kind of the current set up, you know, whether it's even we're even charging the right amount to households and even to companies?

Riggs: Water rates have been rising sharply for years. Because they're not regulated and they they greatly exceed inflation. They're actually a big burden in certain metropolitan areas. They're as much as 14% of somebody's take home pay, which is ridiculous. You should pay 14% of your pay on water. I mean, come on, water rates are a real problem, in part because you've got this industrial, industrial and agricultural load that's kind of choking the municipalities. And so, yes, there's a real benefit to getting off the municipality because for various reasons, their rates are skyrocketing.

End of presentation

That's a very cool and interesting viewpoint from a professional commodity podcast, Right. Which is a different point of view than most people's. It was actually very interesting and you'll see in part two, not next week, right week after that, we will be having more specific conversations around the commodity business. All right.

Now a whole different thing. Usually, "Tell me about your company," and you've heard this 80% thing many, many times. You're becoming an expert like me. But in this podcast, I was asked a very interesting question and it became a very interesting podcast. Let's hear it out.

"What is innovation?"

Start of presentation

Jared: Riggs. I am so excited to have you on the show today. I love the work that you're doing and I can't wait to to hear more about that and your thoughts on innovation.

Riggs: Jared It's a privilege. Thank you very much.

Jared: What in your mind is innovation?

Riggs: Well, innovation in my mind is literally the future, right? You are, you are blazing the future with innovation. Any time you fall back on complacency, then you're falling back a little bit behind the present. So ideally, I believe and a big influence in my life that I've talked to you about said the same thing is we should be living a little bit into the future. 20 minutes, half an hour, whatever it is. But in terms of mental strategies, could be weeks, months and years. But that is, you know, again, according to the same person, that the future is the only virgin territory there is. It's completely unclaimed. Nobody owns it, you know, And it's it's kind of our canvas to draw upon. And to me, that equates with innovation.

Jared: Oh, that's that's brilliant. I love the simplicity of it. And the, you know, the space there is in that definition to kind of explore different different aspects of what innovation is. When you think about the future, what terms, what kind of terms do you think about it in? What shape does it take?

Riggs: Well, the very first thing you have to understand about the future is you've got to harness yourself from the past. Too often we're stuck with genuine problems, like I'm going to be foreclosed on or whatever. So things that are literally holding us back and plunging us into a regressive mode. Or we have thinking that has become solidified. Right?

And there is a wonderful book by Clayton Christensen, which is The Innovator's Dilemma, and he talks about that very problem. And the organizations get into a business model. And he one of the case studies he used was the disk drive industry, which over time went from 28 inch platters all the way down to whatever it is now. And each generation, the new generation, did not come from the existing player. It came from insurgents in that company who were like blown away like "Nah nah, nah." And and they went and started their own shop and blew away the old people.

And there's a reason for it is because these big organizations are wedded to the sales model. Well, we make 350,000 per platter. We can make $250. It just doesn't work. It blows up. And so they cannot assimilate it. And so that's what it comes down to in the end, I think is, is you have to be willing to break the mold and go, you know what, the rules are changing. This very interesting man who runs this thing called a serious report SIRIUS and they are consultancy geopolitical.

And he pointed out, I listened to this interview yesterday. He pointed out that the West is kind of thinking in terms of unipolar world and it's become an outdated model. And as a result, they're having trouble making it work like we're going to sanction you, and then nothing happens or the reverse happens or whatever.

And he points out, look, we're moving towards a multipolar world and it's not a bad thing because it's a world of equilibrium, a world of hopefully collaboration. And so the sooner that the West, Europe, US, etc. recognizes this and and embraces it, the sooner they will benefit. And unfortunately, generally in large corporations and in government, you have to wait for people to literally age out right to change their minds. And unfortunately, I think that's how it's going to be.

Jared: That's an interesting thought that, you know, sort of the past and the future can't, that the past and the future can't really coexist in the same model, in the same construct, in the same mindset. And that first step being kind of the willingness to let go of what you what you've known because everything you've known is part of, part of the past by definition.

Riggs: Well, of course we need experience. Right? Right. But there's a saying experience is a great teacher, but she sends in big bills. One of the bills is that you are marked by your experience. You know, you go in and you attack the problem, you pull away and you have a lot of the debris associated with that experience you carry with you. Now you're like, oh, okay, I learned that lesson. Oh my God. And it's very important that and this is not easy, who you've got to keep engaging. You got to keep hitting it, but then somehow come away clean and go, okay, this was good, this was bad, and got it as opposed to it was all kind of a mess and I'm happy I'm done with it then. Unfortunately, I think that is the path toward becoming irrelevant, in my opinion.

Jared: The path toward irrelevance, that is, that's a dangerous path. And and we rarely know we're on it when we are. I wonder if. You know, as I think about talking about being marked by our experience, how do you take away the lessons from your experience without the scars and the baggage, bringing those along with it? How do you what's the how do you take advantage of the past without being sort of defined by it?

Riggs: Well, of course, I'm not going to get into personal processes. There's a number of ways.

Jared: Sure.

Riggs: We're not going to get into. We're really talking about what do we do as members of an organization. And the best way, in my opinion, is to have to talk it out with your collaborators. Right. Got it. This thing happened. Okay. Lessons learned. And I know if you know this, but the military has implemented a lessons learned department in the Pentagon where literally they are charged with OC. What lessons do we have to learn from this? And that's very smart, right?

So what you do is you go OC. Kind of how how, how perhaps in a therapeutic session you might go over an old experience and and figure out what happened. Whatever the process is, think of it in terms of an organizational way, like, okay, I talk with the guy who I have a new strategy with, and I go, okay, Ken, what did that teach us? Something happened there. What's going on? You know what? I think we learn this and this and this. No, I disagree. And through that process, it kind of rearranges the garage, so to speak. Right. Store your cars again. Not as cluttered as it was, right?

Jared: Right.

Riggs: It's. I think it's the only way is. Is you can't bottle it up. Sometimes I speak to my wife and she's different because she really doesn't. She's a schoolteacher. She knows nor cares about my world but she has great intuition. And she'll go. You know this, from the way you were talking, It didn't seem to be very healthy. And this seemed to be going well. And I go, You know, you're right. So if we if we kind of learn who our trusted thought partners are.

Jared: Yes.

Riggs: And there is that. And how do you nourish it? By giving thought as well as receiving like furnishing. Right. And mutual respect. I had experience recently with my CFO where about a week ago things got kind of harsh because I felt he was not willing to listen to my wonderful advice.

Jared: It's always wonderful on our side, isn't it?

Riggs: He took it harshly and so literally. Yesterday we sat down at a greasy spoon and we talked and talked and talked and worked our way through it to where he got it all out. I got it all out. We exchanged how great we are for each other. And in that context, what can we do to kind of connect better? And as a result, we came out ahead of it. So yeah, I wish we hadn't had that little interaction where it got kind of like browr! Things blew up, but it's okay if out of that we go. There was an underlying problem for him and for me that caused it. So we got to the and I thought that was first of all, it's a lot of fun. And I drank a lot of coffee, which I'm always makes me happy, you know. And and then so I felt like my life advanced a bit with that win. And I think his did too.

Jared: That's fantastic and what that illustrates to your point, everybody, every each individual has their own process of how they manage things and all that. But organizationally, just the mindset of having that conversation, driving that dialogue and making it part of the culture and not an exception that only certain certain people, you know, take advantage of, I think that's that's critically important. And it's something that isn't always tied to innovation from a from a reputational or sort of a when people think of innovation, they often think of either this big workshop room with glass, whiteboards and Post-its everywhere, or they think of some individual genius with a light bulb appearing over his or her head that, you know, comes up with this amazing idea.

Riggs: No, no, I think you're getting there, which is that it's not happening, doesn't happen in isolation. It happens with change. And this, I've been studying the lectures of this particular philosopher that I follow, and he did 12,000 lectures and so on. And he said, I figure things out in the middle of the lecture. I'll be talking and you'll be listening to me, you, the 24 people, whatever it is. And I'll go. And literally things will form in the process of my breaking it down and oh yeah, I get it. So things don't just, you know, you meditatively figure things out. I think that's very rare. I think it's done with the communication process. As that same philosopher said, communication is the universal solvent, meaning it breaks things down. If you and I communicate, it breaks down problems. So I'm a big believer in that.

Jared: So innovation is the future. What isn't innovation?

Riggs: Well, then, obviously being trapped in existing paradigm, which is the past. And, you know, look at how what happened to Rome. Rome got so impressed with their forums and the might of their armies and so forth. And they stopped kind of being the, you know, they stopped carrying a £60 pack, the soldiers to war. They, I know that's too hard. And they kind of got soft and they sort of abandoned things. They started riding on their their previous achievements.

And I think we have to realize that every moment of every day is. We are different. We're not the same. I'm not the same as I was at the beginning of this podcast, nor even 2 seconds ago. But that's a it's a very refreshing thing because I have an opportunity to create something new each moment. But also. I need to create something new. Otherwise it kind of loses the point. And I go into a decay spiral, right? I go, okay, you know what? I'll just kind of hang out and watch some Tik tok or whatever it is, right? Become a consumer.

I think the future is created by that kind of innovation in the face of people saying, "You're an idiot, you're a fool, you're on drugs." Whatever, right? And 99.9, 9% of the people, you know, groupthink is a real thing, right? So people, groupthink like individuals act creatively. Groups do not act creatively. It's important to remember that.

If the Democratic or Republican Party is good, it's not because of the party. It's because of the individuals within it. Right. That's what makes them good. And so these are individuals that are that came together under a particular ideal, and now they're forging ahead. Well, when you lose that, when you surrender to the identity of the group or party. Well, now you just got this dumb flock right then. Then they go over the cliff like the lemmings. Right.

Jared: That's fascinating. I think it makes a lot of sense. And your point about being willing to stand apart from the group, stand apart from convention and hold on to the thing that makes you different, not just hold on to it, but continue to talk about it, own it. That is a special trait. And it's not. It's a, it's a, I think it's a humanistic trait. I don't think it's a trait of an engineer or a scientist or a executive or I think there are people who do, who are willing to do that or have that mindset and then people who don't.

Riggs: Well, I think anyone can be.

Jared: Yeah. That's fair.

Riggs: I think. I think similar to mine. Someone has made the decision or allowed it to happen that they're like, You know what? I'm just kind of going to toe the line, whatever it is. Right? And often there are good reasons for it. They have insecurities about their finance or their family. I'm not saying it's not good reasons, But, you know, with regard to my last 14 years, I've been literally living this public company for 14 years, which is a long time for a company to be still a penny stock after 14 years that neither died nor made it into the big time. So what the heck? Right.

And that's a story really of having identified a really, really huge challenge and then trying to think, what the heck? How do we get, how do we get it, you know, and small wins. Small wins. And then, of course, there are the doubters, of course. But the good news is that there's two categories of people that I've found to be really helpful to me. And what is accumulating a core group of investors who are like, you know what? I get it. Keep me informed. I'll do my best to support you. Number one.

And number two is the bench of people in your organization that over time, kind of the aggregate, I don't I believe in a very organic way of hiring in a sense that. I don't I don't, like go out and conduct a big job search. I don't know how people do that. I think it's done more through relationships and connections and in the network, you know, and then you come to, you know, this person, for example, my COO came out of this adventure I had in 2018 in crypto, and he came out of the crypto world. He was working with me there and and he became a key guy in my company. So kind of like, we grow a group. At one point when I years and years ago I was I was in film production, worked on a film by Sam Raimi and Sam Raimi over years, built his portable group.

Jared: Okay.

Riggs: It's Mafia. You can't get you can't rebuild a team for every movie.

Jared: That makes perfect sense. I never thought about that, but it makes perfect sense.

Riggs: Yeah, it's got that light. That guy Jackson, who makes, you know, The Hobbit and all that again, he has his team, and so and I saw it. At the time I had the opportunity to join on to it. And really, that's when ,I this was the early nineties and I decided that it was I really loved tech and that was a different world. But the point is, is that if I'd done that, I would still be in his production team today.

Jared: I see.

Riggs: Because that the smart people like Sam Raimi, they cultivate that, they know the importance of having a really good team of equals, as Abraham Lincoln called it, that the equals were his enemies, but they were also very vital.

Jared: Right, right, right. Yeah, I, I think that makes, it makes so much sense. And, and I can see how it would create some efficiency and some and kind of reduce these sort of friction associated with learning new ways of working, you know, getting to know each other, developing, you know, that type of rapport and all of those things.

End or presentation

Base of Innovation

Riggs: That was something altogether new and it was a different kind of podcast, and I enjoyed it tremendously. It allowed me again, really to think things through as to where we are and where we're at and what's really interesting. And right now, there's so little I can say about what's happening due to the restrictions. Is that announcement we made a couple of weeks ago that we are investigating this potential merger with a Special Purpose Acquisition Corporation, which theoretically, if it happened and is, no, we're not saying it would happen or not happen. That's one of the things I was really, really warned about. Could create a Nasdaq company very quickly. But again, we cannot even say that we have such a thing actually happening.

And we've built such a great base. And I think this podcast really illustrated for me the base of innovation that we've built in our company through the, again, the investor base that we have, which are amazing, and also the managers like like Ken, like Tom, like Prasad, all these, these amazing people that have kind of joined and agreed, they've joined and agreed and they kind of... we're of one mind. But we're also very individual and we're like, No, I don't think so. So out of all that, I believe we are at an inflection point. And again, I can say so little, but I can only say, hey, you know what, if our revenues tripled on the last report, something's being done, right? And that's where we are going.

Freewheeling Discussion

Riggs: Okay, so with that, I am going to jump into the free wheeling discussion. Mr. Ken Berenger,

Ken: Good evening. So that was interesting. I like the, I like the discussion on innovation. I think I sat through the entire Kiyosaki article and it was Kiyosaki or the BlackRock. It also talked about something that you didn't touch on. And I think it's worth mentioning. Kind of a spooky thing that happened is that Saudi Arabia has agreed to take digital yuan for oil. And for those who don't understand the implications of that, that is super super. That is the dollarization of the planet.

Riggs: That was this SIRIUS report guy.

Relevance of Water On Demand

Ken: It was okay. So the if they did dollar rise, if they if they if they unhook or uncouple energy from the petro dollar, our standing is the dollar in the world. What it does is it creates an absolute necessity to flight to assets and you know. We were very fortunate that we discovered how to tool this thing to become a revenue producing asset.

The fact that we were insanely lucky, the fact that it's the only asset on the world and world, it's essential for all life. That's kind of important, right? And not yet spoiled. Well, right. Right. Exactly. There's not the elites or the the mega the mega party of people aren't already controlling it. I thought that that was very serendipity. You and I have talked about how we must have an angel on our shoulder.

Riggs: Well, you know, and it's a timing thing, because remember, way back in the seventies, there was...

Ken: I was very young back then,

Riggs: But go ahead. Some some people actually study history.

Ken: Oh, okay.

The Individual Makes the Difference

Riggs: But this guy McCall actually strung a wire between two locations in Texas and got sued by AT&T for doing that. And that case, he won.

Ken: That's right.

Riggs: And he became MCI.

Ken: Yes.

Riggs: That was the beginning of the breakup very early on. So the whole idea of this decentralized telecommunications started very small and very apparently minimal. But it it literally...

Ken: One disruptor, one guy broke the...One guy pushed back.

Riggs: Exactly.

Ken: One guy pushed the bully, right?

And this was what I went into. And that that conversation on the podcast is it's not a group thing. It is individuals that change things. And you and I really derive this by necessity, the same way McCall derived it. By necessity, he had to do this for whatever reason, and then he had to defend himself against this monster, AT&T And one thing led to the next. But the point I'm making is at that time it was a very virgin asset. It was AT&T, MCI, and then there was a big breakup into the Baby Bells. But it took a long time and it was a clean asset for a long time. And then it was the cell phone tower play. It was a clean asset.

So when you have these development phases of an asset, it's relatively immune to these big geopolitical things because people it hasn't become a massive enough business for people to try and like.

Right, tt hasn't been spoiled. One other key fact that I think really works in our favor tremendously is, again, getting back to the fact that there's nothing else that's essential. Also, it was interesting, you were talking about water wars. Wars being fought over water. The fact that water actually delivers peace in a place like Israel surrounded by enemies that want to destroy her. But I'll give you water. Oh, in that case, we're okay with you. I mean, we don't like you, but we'll take your water.

Global Impact of Water On Demand

Being able to do that on a global scale, I think about the geopolitical implications of being able to deliver that on a global scale. When I talk to people and I have that wild look in my eye, that's the things that I think of. I mean, not the big picture, but the huge picture. And yes, when we get back down to reality, we're on this little postage stamp in terms of our stake in the ground. Right. But the technology to globalize these things like MCI and AT&T and the Baby Bells and then cellular.

It took decades to develop, the technology to develop what we want to do is already built. So it's an exciting moment because the, and look, there were many bodies on the road that we will, we will pass the bodies on the side of the road that kind of died on the road building that road. Right. It was like that railroad. You know, a lot of guys didn't make it. They didn't make the trip. But now that that's a well-worn path.

And I think that a couple of things you mentioned with the gentleman on innovation, trusting your thought partners. I think that none of us would be where we are right now had we not had those heated discussions, right? No, that's a terrible idea. You know, and we just kept we just kept working it and working it, working it. I also think a couple of things that I think that I learned in working with you don't get stuck in my process. I have a process, my process.

But I also have to understand your process because I might learn something, you know, when you're, when you think you're smart, at least you may be smart, actually. But if you think you're smart, you think your process is the only process, or at least you get stuck there, you know? No, no, no, no, no. Let me tell you why you're wrong.

It's the converse, right? So the conversation turns into That's a great idea, but let me tell you why you're wrong instead of listening. Right? You have to listen. Otherwise you get stuck in your paradigm. Innovation is also constant on a personal level. Innovation is constant, constant, vigorous self appraisal. Right. Constantly correcting yourself and you.

Riggs: But. But very importantly, it must be based on acquiring outside facts. Too often we we internalize. We're like the washing machine.

Ken: Data. No, no, no. Constant self reflection based on data, not on your feelings.

Riggs: Right.

Ken: Because there's, you know, there's you're entitled to your, you're entitled to your feelings. You're just not entitled to your facts, right? But it has to be data driven. You know, we've even we've even had this thing where you're like, jeez, you know, you're awful hard on yourself. And you're like, I have to be, I have to constantly course correct. But I have to do it based on data.

Riggs: Well, you're the David Letterman of this company.

Ken: No, I'm not quite that bad, but I get it. I get it.

Riggs: David Letterman for the audience famously would listen to the entire show he just did after having taped it and criticize every microsecond. Fortunately, Ken is not quite there, but and I'm going to keep it from going there the same.

Ken: And I appreciate that. And I get charged for the therapy session. But the the point the point I'm making is, I think vigorous and constant self reflection, self correction is our own internal innovation.

Riggs: Oh, that's so good. I like that. I like that. Yeah.

Ken: Okay. Well, good. Good thing that we're recording it because I won't remember what I said.

Riggs: Yes. We have these Post-it moments for sure. Well, listen, I wanted to mention, because we're running out of time is...

Ken: We're already pumpkins.

Call Ken

Riggs: The concept of accredited investors getting this royalty is a phase that is going away. It's a $20 million phase that you've already managed to raise. About 8 million of it. So about 12 million to go. And then we stop for a while. And so then it's going to be the Regulation A offering, and it's going to be institutional money. We will come back to regular investors doing it, but it will not be as rich as today because we are essentially treating people like founders because we're still piloting Water On Demand.

Ken: The opportunity to and the really we would have and should have changed it a long time ago, but we didn't because we've had this other thing developing Riggs and it was still off in the... It was kind of like, all right, well, let's see how close we get to it, right? So, you know we never changed this thing. But I think over, over in very brief time, hopefully it'll be it'll be widely acknowledged that the need to do it this way really doesn't we don't have to keep doing this, which is which is much easier on my life span right? So it's all good.

No, look, I'm, I'm thrilled with where we are at. And I love discussions like the one you just had. You know, we used to have them every Friday night driving home. And I think, I think that's always good. I think, I think it keeps us in our own personal, constant self appraisal mode, which is good, and it keeps me sharp. So I'm grateful for that.

Riggs: Well, I'm not going to start singing the way we were. Okay.

Ken: You don't bring me flowers, okay.

Riggs: All right. Well, everyone, thank you very much. And remember, there is no CEO briefing next week, the 22nd. I wish everyone Happy holidays and Merry Christmas, Happy Hanukkah, Kwanzaa. Thursday the 29th will be the next one. So I wish everyone a wonderful break. And then on the 29th, I certainly hope we will have had some very interesting pieces of news behind us. And if you're interested, go sign an NDA with Ken, because he will brief you.

Ken: And if I don't speak to you, Merry Christmas. Happy holidays to all of you. But I will talk to you. But you got to sign an NDA. So.

Riggs: All right, everyone, thank you so much for your support and interest. It's been a pleasure so far. See you on the 29th.

Ken: Goodnight folks.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)