The Command Your Brand segment with Jeremy Ryan Slate was quite enlightening. It lays out how we're opening the door to world changing technology by making water an income bearing asset and fostering autonomous, self-sufficient communities. With the Fed out of the water-funding business SOMEBODY had to solve failing infrastructure… Well guess what? The Clean Water Innovation Hub™ and our pure plays starting with Water on Demand™ are doing it! See how here in the replay!

Transcript from recording

Opening

I'm Riggs Eckelberry co-founder, chairman, CEO of OriginClear. The government needs to continue to provide a lot of abundant clean water, but what happens to it after it's used when it's dirty? Do you know that 80% of all sewage is never treated, it's just dumped? That leads to water scarcity, but it also leads to a lot of disease and pollution, the ocean turning into something horrible. At the same time, the cities and counties are not getting the funding they need to really treat the water and so they can't keep up.

The solution is let the people who use the water clean the water. Water on demand is investment in actual capital assets that earn income. Sign up to hear my weekly briefing every Thursday night. 5 p.m. Pacific, 8 p.m. eastern. Just put oc.gold/ceo in your browser, register for the briefing and look forward to hearing more from you.

Introduction

Welcome everyone to another fantastic briefing. So much to cover and so little time. So I'm going to make it very efficient. We are we are chock a block full of news, really happy how things are going. And I hope you are all well. And Robert Baxter says, "Good evening, gentlemen." And good evening, sir.

173 Weekly Briefings

Can you believe it? It's become really it's become part of what defines us. And we have a channel to you every single week. And it's actually a privilege. I really appreciate it. 11th of August briefing number 173, A new beneficial income asset: Water. And that is becoming more and more reality. And James Rice says "Hello, hope all is well. Glad to see the stock price goes up." And Marcus Walker says, "I'm at work. I hope you don't hear it." No, we don't hear you. In the webinar mode. You're automatically muted. Thank you for your consideration.

Press Coverage

Forbes

So we're going to go right ahead here and we got some press in Forbes. This is very useful stuff. These little snippets that get put into the press. We are constantly asked these days we have excellent press representation with The Pontes Group in Miami, and they're constantly inserting and we're becoming more and more influencers in the sense that people are looking for us to fill in their columns, right?

And so, for example, here, sure enough, the same utility comment that got into New York Post last week made it into Forbes this week as an inflation related thing and gets the idea out there that we are in an idea lab for water innovation projects. Literally the only one in the water industry. Can you believe it? It's crazy.

New Haven Register

All right. So with that, I'm going to continue here. Oh, well, a investor, Robert Babcock, sent me a clipping from a Connecticut newspaper. And so it's all about spending for clean water, helps the state of Connecticut, etc., etc..

And here's the part that is just so obvious to me, but not to a lot of people, including Congress. Infrastructure work aimed at roads and bridges is important, just as improvements in our transit stations and airports must remain a priority. Broadband is infrastructure.

But what about the water? That does not get as much attention. And that's really sad since our health literally depends upon it. Now I'm all for broadband. But you won't lose your good health if you don't have broadband. I'm sorry. Water. It will affect you. That's just an important note. And sure enough,

And its not just America...

I picked up just today a piece in GB news that they have a problem in the UK with this to the very same infrastructure funding problem. So I had to take a look here.

Start of video

GB News

Mark Steyn: Leilani Dowding joins me from Europe. Once she heard we were all following Thames Water's advice and showering with slightly moistened cloths. She wanted to put some clear blue water between herself and the malodorous GB news presenter. So she's on the continent. Great to see you, Leilani. What do you make of the water crisis afflicting the UK?

Leilani: Well, it's great to be here. I'm in Spain. I'm missing that extreme English weather. There's some hotter, extremer Spanish weather. It's insane, isn't it? What's going on and the reports. Now they want to impose this hosepipe ban. But like you said, there's been no reservoirs built since 1991. 10 million population increase, also 3 billion litres of water leak per day. So we're losing that.

And all these utility companies have been selling off reservoirs for to developers to build houses on and what have you. So, you know, what do they expect when we don't have the infrastructure? Again, is these public companies putting shareholders and their CEOs and everyone first except for the consumer. So here we are, a hosepipe ban and it's just water, you know, worry people and get them scared about climate change and extreme heat and you know, 30 degree weather, which when when I was younger just used to be called summer.

Mark: Well, that's that's the point. Amazingly, when you're in Spain where you are, Leilani, or when you're in Greece or when you're in other parts of the Mediterranean, you have higher temperatures. And the British people so love those higher temperatures that they get on terrible airlines and fly to those places so they can enjoy those temperatures.

But uniquely, whenever they those temperatures start inching upwards in the British Isles themselves, then apparently it's a disaster. It's going to kill you. It's a public health emergency. They do always find a way, as you said, to blame. They're going to blame it now on climate change, global warming, and in fact, it's just gross mismanagement of an essential requirement for daily existence.

Leilani: This is typical Britain, isn't it? It's when, it's when it's hot. The trains can't run. I've got a weather warning on my weather app on my phone about extreme weather. I'm in Spain. The pool is full of water. There's irrigation systems all around to the plants and the trees and everything else. I'm not worried about some water. And, you know, when it's cold, if it was raining, it would be climate change as well.

You know, when it's cold, the trains can't run or there's leave on the trees, there's leaves on the tracks in autumn. There's always a problem in Britain when anything just goes slightly away from what's what's considered normal, you know? So it's no surprise. And it's just more fear mongering, mongering.

And you know, I go on about this climate change net-zero quite a lot. And I don't want anyone to think, you know, I don't care about the environment. I'm hugely passionate about the environment and trees and nature. When you hear things like 14 million trees in Scotland which absorb the carbon dioxide being cut down, wind turbines, you've got to think how green is this green, you know, agenda that they have? And to be quite honest, I think this whole net zero agenda that they have actually goes against nature.

End of video

Riggs: So that is, of course, our wonderful people over on the other side of the pond. And what Leilani is pointing out is that a lot of neglect and failure to properly fund these things and also reservoirs being sold off for profit, shareholder profit is being hidden as, oh, that's it's climate change. No, the literally causing droughts because of neglect of infrastructure.

So and I'd want to make it clear that I'm not, I don't think climate change isn't a vital thing. It's super vital. But let's not hide ordinary stupidity or greed and call it climate change, because that's wrong. It's simply wrong. So infrastructure is being neglected. We're not doing our jobs in UK and America and India all kinds of places, and that matters. In the end, it matters.

Proactive Network

Today we were covered: water as an investable asset. We were covered on the proactive network. "OriginClear recognizes water's value as an investable asset through its Clean Water Innovation Hub."

And this is a brief clip. And here we go with the interview.

Start of video presentation

Stephen G: Hello, thanks for watching Proactive, New York. I'm joined by Riggs Eckelberry. He's the CEO of OriginClear Riggs. Very good to meet you.

Riggs: Stephen. It's a great pleasure. Thank you for having me.

Stephen G: You're welcome. So, Riggs, for those viewers not familiar with the company, tell us more about OriginClear.

Riggs: Well, OriginClear has been a public company for 14 years and we started out early enough in a different space, which was algae for biofuels, which was basically torpedoed by the oil price crash of the 2014 era. And so we pivoted into water. And really what we've become is an innovator that launches successive properties into the water space, which is huge, as you know, but very hard to disrupt.

Stephen G: So what sets you apart from any competitors in the water space Riggs?

Riggs: Well, we're wonderful! But seriously, here's what we've done is we've figured out two major things. Number one is the world of water is decentralizing. What was once a government monopoly is becoming less and less so. So, for example, we used to just rely on those big central plants somewhere. You know in your New York background there over on the west side on the Hudson River, there's a big cement concrete plant that nobody wants to look at, and that's sewage.

Well, that's all very well. But it's not being well maintained in America. And more and more businesses are having to do their own water treatment. We call it water decentralization. And it's a major trend that not many people realize is happening, but business is feeling it. So the problem is, of course, they don't have funding. So the second major thing that we're focusing on is helping those businesses afford these water treatment plants by setting up water as a service, which we call Water on Demand™.

Stephen G: Do you license this to the company's Riggs?

Riggs: Well, we actually, they just sign a service contract. It's a use contract, just like Microsoft Office. And they just start paying by the usage. And we supply a machine that remains our property and it's fully maintained. And we simply provide gallons of water cleaned to whatever level of purity they need, and we price it accordingly.

And it's very popular because, you know, if you're a brewery and all of a sudden you're the municipality is saying, well, we won't take your dirty water anymore. And, you know, the brewery has generated about 170 litres of dirty water for every litre of beer created. Then what do you do? Well, you're not in the water business. You're in the brewery business. And so you just want to get rid of the problem.

And we come along, we say, just sign here and problem is taken care of. And we have a great technology called Modular Water Systems™, which is patented prefabricated machines that go in, plug them in. Problem goes away. And we've made it a very simple solution for these suddenly independent water treating companies.

Stephen G: So you then receive annual recurring revenue from the companies who are taking this technology then Riggs?

Riggs: Yes, not to be clear, this is just beginning. So our history has been to do the classic design and build. So and we've actually been doing very well with that. We announced earlier this year that our revenues had increased 50% over year before. We anticipate further increases. And that's just ordinary "selling the widgets." And it's a great business.

But the problem is, number one, it takes forever. This is the biggest reason why we really felt we had to help people with finances. These deals just go on and on. And we feel we can accelerate the adoption of great water treatment and recycling because remember, America only recycles 1% of its water.

So if we can do more of that and make the problem go away for businesses and also of course scale up our business and that. So existing business doing, it's been doing a steady million dollars a quarter for the longest time now. It's dramatically gone up and we expect this quarterly filing coming up to be very good news indeed. And so that business is going fine. And now we're kicking it up a notch by implementing this pre financed systems that we've been raising money for. And we're now negotiating our first commercial pilot for this fully self-funded, pre funded system.

Stephen G: So what extent is new legislation and particularly in large cities, helping, helping your projects? I mean, I read something in July where you big large buildings in US cities are mandated to have water treatment facilities. Is that going to spur on growth for you?

Riggs: Well, that's a very good sign. We acknowledged that development because we've been doing it for a long, long time. So we have been helping people be self sufficient for water treatment and recycling for years now, and we do it quite routinely. What we've noticed is that there's been a major uptrend in the number of opportunities to, like housing developments that want to be off the grid and you get much cheaper land if you don't have to have sewage, right? So things like that are big opportunities.

The real trend, Stephen, that we see is a super trend of migration from the big cities toward the secondary cities and states. So people, businesses and people moving even if only from New York to New Jersey. But it's in search of maybe more self-sufficiency, more safety.

People don't feel quite as well, the cities have lost their sheen, you might say, because a lot of strange things are happening that are outside of people's control. So we have gotten a lot of deal flow from communities that want to be self-sufficient. And so that's an existing business that is growing and we plan to further accelerate it, as I said, with Water on Demand.

Stephen G: Riggs are you also growing through acquisitions. So buying other water treatment companies?

Riggs: Actually, we've we've changed course on that. We had an acquisition plan. We've done two things. Number one, Water on Demand is set up to be a pure fintech. So when we get a client in Atlanta, Georgia, and we sign a contract, we'll get a local Atlanta, Georgia water company to do the building and maintaining so that it becomes scalable.

If we have to build and maintain every system we finance then it'll take 20 years. It's the conventional water thing which is very slow. So number one, we're literally creating a moat, a network of water companies, that rely on us and also send us deal flow and we're playing the pure financial game.

Secondly, we've repositioned OriginClear as The Clean Water Innovation Hub™. In other words, as an incubator to take interesting properties, develop them, and then roll them out through the crowdfunding sector. As public companies in their own right. We're doing that with Water on Demand.

We've already spun that off and we're planning to do that with our other four very, very strong properties that are already in revenue or potentially very much in revenue. And we want to do a lot of that. We think that it's not one company that's going to change the water industry. It's going to be dozens. And we want to be that continuous launch innovator.

Stephen G: You mentioned Water on Demand and the financing. And I read back in June that you launched a $300 million offering through crowdfunding. Is this a popular way to raise funds for projects like this?

Riggs: Well, quite so. I think there's been a revolution that's happened since the crowdfunding, since the Jobs Act was set up. There's two sides of it, as you know. One is accredited investors. And this is what this 300 million dollars is. It's what's called Regulation D 506 C, which enables open solicitation. And that's we know how to do that very well. We do it all the time.

Now, the bulk of that 300 million, to be clear, is going to be for capital assets, right? So it's, people go, oh my God, $300 million. How is a 20 or $30 million company going to do that? Well. Because it's assets, it will actually dramatically help the book valuation of the company.

But separately, we want to do a Regulation A crowdfunding, which is unaccredited investors. And we've seen tremendous successes where companies have literally raised more than $100 million and got on the Nasdaq strictly through an accredited investor funding. And that's going to be, I think, the secret weapon. People who do this, regulation, A, are going to do very, very well. And it's rapid. And you create instant public companies.

Stephen G: Riggs, what sorts of news flows should investors be looking out for? Any milestones coming up for OriginClear?

Riggs: Well, we we have continuous good news coming from our operational divisions, be they large new contracts, etc.. We anticipate to give more news about Water on Demand, which we think is revolutionary. And of course, we believe our fundamentals are increasing continuously. So the quarterly filing coming up on the 15th is very important to us. Then there's going to be a long drought until the annual report comes out in the spring.

But we believe that we're on a roll now with both our conventional and our innovative business. You're just going to see a lot of for example, we are very happy with our new ultrapure water systems for hotels. And we have a prospective announcement coming with a major, very well known hotel chain that is adopting this throughout their hotels. So it's going to be some very interesting and creative news coming out of OriginClear.

Stephen G: Well, I hope you'll keep us posted on that news as it occurs. Thank you very much for the introduction today.

Riggs: Steve. It's such a pleasure. And let's keep in touch. I'd love to keep talking whenever there's an opportunity.

Stephen G: Riggs Eckelberry is the CEO of OriginClear.

End of video presentation

Riggs: Those of you who are actually, were listening, I admitted the third quarter filing, which occurs, of course, 45 days after the beginning of Q four, in other words, November 15th. So then from November 15th there is a big lag until April 15th, which is the annual filing. So that's that lag where we don't get to really announce Q4 until we do the entire year.

But that was a slight omission, which I'm fully aware that I did it. So with that I'm going to keep on rocking here. The great Jeremy Slate. To give you an idea, let me go ahead and play Jeremy's interview, which is the third annual, and then I'm going to give you a sneak peek at some of the bookings. But this is a very productive program. It gets us on a lot of eyeballs throughout the year. So let's take a look here.

Command Your Brand — Jeremy Ryan Slate

Start of video presentation

Jeremy: Hey, what is up, everybody? Jeremy here. And guys, I'm very excited for the guest we have with us today. I've had the pleasure of actually having him on the show. This will be the third time. And I'm very interested, especially given the economy to look a little bit more at the world of water filtration and the asset class around it. So Riggs Eckelberry of OriginClear, thank you so much for hanging out with me today.

Riggs: Man Jeremy, it's such a great pleasure and it's always stimulating to be in your conversations, you know?

Jeremy: So here's what I find interesting. You and I were texting, I think about a week ago, and I had seen I was it I think it was Fidelity Investments or Bloomberg or one of those talked about like kind of why everybody should be investing in water. And I sent you a text. I'm like, Dude, they're finally catching on to what you've been talking about for years. I guess just kind of looking at the current economy, why are we seeing more investment and why should we see more investment in things like water and utilities and things like that?

Riggs: Well, first of all, of course, you know, in general, we have a move from a currency based finance system to a commodity based finance system. That's obvious from all the events going on. But at the same time, so many commodities are highly politicized. They're subject to a lot of wrenching disruptions. Look at what's oil and gas is up and down. Real estate, you know, who knows which way it's going up, down, sideways.

You know, gold and silver haven't even behaved particularly predictably so. So, you know, existing commodities are also in the tornado. And where's an investor going to go now, water is stable, there's always going to be more dirty water. It's kind of like we're we're going to make things worse. And what is a major factor, as you've noticed, is that there's a lot of water scarcity these days.

Jeremy: Right. The thing that's interesting about it is it's like that that thing that everybody needs the most of, but not only just getting it is difficult, but getting it clean is very difficult, right?

Like because you can't drink ocean water for the most part because of the salt content and things like that. And I think I had seen a video you had sent me. Was it like 80% of our sewage isn't even being treated, so like we're just losing this thing we really need right now?

Riggs: To be clear, the 80% is worldwide. The US treats most of its water, but then we throw it away, right? So we treat it like in LA. It goes from Glendale down to the Hyperion station in El Segundo and then goes in the ocean. So our recycling rate in this country is around 1%. Give you an idea, Israel is that almost 90%. Now that is a full turn of the same water being reused that we're just blowing off. And meanwhile we're going, Oh my God, we're out of water at the same time, which is so odd. Right?

Jeremy: So, let me ask you this, because I want to kind of for people that may not have experienced this before, OriginClear has a product line called Water on Demand, which is kind of what we've been alluding to here. What's different about this product? Because I think when we're used to water, right, we're used to, okay, the water comes into our house, we pay a utility bill, whether it's a business or whether it's, you know, the place we live, pay the utility bill. The public utility handles it, but in actuality, the public utility isn't able to actually even filter all the water. And that's where OriginClear comes in.

Riggs: Times are changing and this has been going on for a while. The, if you go way back all the way to 1961, we've been spending more and more on operations and maintenance, you know, trying to like fix your old Toyota versus properly replacing it. And so it's been worse and worse for decades. The federal government is basically out of the water funding business, and we have 150,000 plus water systems in this country and they are gasping for air.

Now, here's an interesting factor that you probably know about, which is huge migration trend. Primary cities like new york, chicago, l.a. To secondary cities where people feel they'll get a more predictable, perhaps safer lifestyle, less government intrusion, whatever.

Jeremy: It's killed commercial real estate for that reason, by the way.

Riggs: Yeah, that's what that's.

Jeremy: That's a whole nother argument. But yes, it's a, it's a big migration to places like Florida, Texas, other states that are more rural in a lot of ways.

Riggs: And even, you know, Bergen County, New Jersey, I mean, you know, not far from New York, you have some wonderful places that people can go. So as you well know now, what that means is, however, all these rural water systems are now being stressed right? And in addition, for example, here in Florida, where I'm located, there's a tremendous amount of a land rush going on where Pinellas County, where I'm located, is already the most populated county in Florida. And yet they're piling more in.

What does that mean? Developers are looking for water, for land that's off the water grid, that they don't have to put in sewage, right? And so all these things mean that there's less and less central service and more and more decentralization of water treatment and management..

Now, when you're treating your own water, let's let's just take a concrete example. I'm a brewery. I start anyway. It takes about 180 liters of beer to make one liter of beer. It's very, very water intensive. So I've got all this effluent and the city starts saying no, not going to take it, can't take it, etc. What do I do?

I didn't think I was in the water industry. I thought I was just getting the city to do it for me and all of a sudden I'm stuck with the problem. Now, the smart breweries, well, they do it, right? They have to deal with it. But it's happening so increasingly.

Now, here's the good part. Once I start treating my own water, I can reuse that water, right? And so I get more than one turn out of it, whereas the city doesn't, you know, both the energy and the water grid in this country are one directional, right? They go from the source to the to the to the use point and out.

Jeremy: And it's just by the nature of the number of people they have to service. Right. Like it would be.

Riggs: No, it's a design issue.

Jeremy: Yeah.

Riggs: It's a design issue. In other words, old school utility design is we push it out to you and that's it.

Jeremy: Right, you look at kind of the whole electric world, righ?. Like, you know, the reason Edison was successful versus Tesla because, you know, maybe Tesla's energy was a little bit better, but Edison's you could charge easier for it. So so, you know, it worked better.

Riggs: It always comes down to really raw simplicity. And our energy grid and our water grid have been setting up set up with a great deal of simplicity. But we need a lot more sophistication now. It's not going to come from the central water system. Why? Whereas the billions?

We had a $1.2 trillion infrastructure bill that was passed out of that water, the entire United States got $55 billion, which is like, pppht, that's less than one year's catch up for the water industry. So the government is just not paying attention to water and yet it's a major crying problem. The Lake Powell is draining out to nothing. Hoover Dam, you've seen all the stories.

Jeremy: Yeah.

Riggs: So there's just tremendous water scarcity at the same time, a tremendous amount of lack of change. So lack of funding for central systems also, where are you going to locate them? There's populations. Nimbys are going to say, not in my backyard. All that stuff says we're not going to see giant multibillion dollar centralized systems being built anymore.

What's the solution? Build them at the place where your you're using it and therefore you can reuse it and have control over your fate. Increasingly, people are understanding they need to control their own fate, and that goes for water, energy, you name it, food. There's this tremendous sense that, rightly or wrongly, that there's a security problem, right? So that extends to water.

Now, here's the issue. And this is what we ran into, because we've been promoting decentralized water since 2016. And we've been building a wonderful product line called Modular Water Systems, which are these Water Systems in a Box™, deploy them to a location, no expertise needed. All good. Right.

But we arrived at 2020 and like most people who had COVID, we had a day of reckoning, like, oh, my God, what's going on here? Right. And and we saw a huge amount of backlogged business and not a lot of deals are trickling through. Well, how do we speed it up?

And it took us a lot of work to figure out, "It's the money, stupid." If we helped finance these and say, "Oh, Jeremy, you're running an off the grid location," like we built one in Pennsylvania, a car dealership that went off the grid, sewage grid, and they saved a lot of money by buying cheap land. "Well, now you need that system. Well, don't worry. Sign here and you'll be on the meter, just as if you were being served by the city." And that's

Water on Demand.

Jeremy: So and so I want to kind of set this up too, for kind of the current economy we're living in as well. So we just had our our second down quarter of, you know, of economic growth in a row, which apparently in the new world we live in, means not a recession.

But anyway, so we're seeing that the economy is changing drastically. I think the inflation was at like, what, like 9.1% last month. So we're seeing big changes in how people spend money. The producer index is up, the consumer price index is up. And you know, when you're looking at it, the place to spend money now is in things that people have to use, right, like things people must use.

And that's why I think, like, you know, it's the right time to look at water and other investments now. And I guess when people are considering, you know, what they should be looking at now, how are we seeing kind of where investors are spending their money now based on how the economy is changing?

Riggs: Right. That's a very good point. Classically water investments have been either in municipal bonds, which have a tax benefit, but they don't earn a lot. Four or 5% sure. And they've been very conservative or buy stock in Veolia, American Waterworks, one of the big utility water stocks, which are a good investment. But again, slow growth, right?

There is no way for a regular investor to invest in water projects directly and that's weird. We have that in oil and gas, the what's called a master limited partnerships, which were created in the 1981 as buckets of energy properties, pipelines, gas and oil. And these have done phenomenally. It's a $300 billion marketplace with about 60 MLPs, as they call them.

And there's no such thing in water. Why? Because it's been governmental, right? Well, now that it's becoming, everyone has to kind of fend for themselves. It's creating a private market. And we realized we could do the equivalent of oil and gas or solar, but for water. And now that's the birth of a new investable asset that earns money. That's not going to go crashing because water is water and that's Water on Demand, again.

So we're so excited that that we're trailblazing is because we're not the only player doing water as a service as it's called. Right? I mean, it's an obvious thing and there's some great players doing it, but we're the only people who are accepting investments from everyday investors, just like the oil and gas master limited partnerships.

Jeremy: So let me ask you this, because, you know, I was kind of chatting with you before we got started here. I had to like readjust all my lights, my camera, because the power went out here for extended period of time and kind of mess some stuff up. And I'm somewhat off the grid out here, man, like we don't have cell phone service unless my Internet is on. So one of the things I'm curious about, do you see this as kind of being like a new trend in like decentralized utilities as a whole, like not just water? Do you see us kind of, you know, moving towards that in the future?

Riggs: Decentralized everything. I like to tell this story, which is you've noticed that the high speed train in California that's not been built. Well, it's never going to be built. In California we've got the freeways. What are we going to get? The self-driving car. We're not going to get a bullet train. Cars will just be made, made smart.

And this is what's going to happen at all levels. We're going to more and more self sufficiency, which is actually good because, think about it, just for water. If I take all my dirty water and I pipe it down to a central facility, it actually dramatically increases the greenhouse gas issues and so forth, the nitrogen being emitted in etc., as opposed to taking the water that's dirty and treating it right away, right where I am.

And furthermore, as I was saying, if I'm paying water rates, which by the way, are inflating far faster than that, inflation, right. I signed a service contract. That means my rates are capped and I can do this nice little loop de loop where I reuse the water, essentially at no cost to me. Well, that's a win win, right?

So it's a win win for the planet and it's a wonderful thing for sustainability in general. I don't know if you've read a thinker called Peter Zeihan. He written, he's put out a book called The Beginning of the End of the World. And what he's saying is, well, he's saying that it's that we're going through a process of deglobalization, right? But everythings going to be...

Jeremy: Man, he's going to make, to make Thomas Friedman mad man, he had the Lexus and the olive tree was like his big book.

Riggs: Right, that was good. As long as you could instantly transport from China to us. Right. We've, we've seen what happened. It's incredibly random. Who knows? You know, we in our Dallas operation, we've got parts that are on 120 plus day wait. And, you know, unfortunately, America lost its manufacturing base.

Now, Zeihan is actually optimistic about the US. Why? Because we have our own energy, our own resources are own water, our own everything. So, but everything is going back to more of a regional model where it's going to be America, Canada and Mexico and Europe and Asia? New, not so much, right? So and there's going to be losers. China is actually in a tough place.

So, Peter Zeihan, good thinker. And so that's where we're moving planetary wide is making smart systems that are autonomous, that take care of themselves. And we believe that, you know, it's the old story. Small is beautiful, right? We're here to help people take care of things right where they are, you know, a high degree of self sufficiency.

Now, we were talking earlier about these communities moving into secondary cities, places like Florida. They are looking for self sufficiency and there's going to be more and more of that. How do they achieve food, energy and water self-sufficiency? And so we're actually seeing that as a major trend in our existing conventional business. And again, that's something that Water on Demand can accelerate. So I believe that Water on Demand, here's what we see, Water on Demand is a concept that is bigger than us, for sure.

Jeremy: Yeah.

Riggs: Which is why we said, you know what, we're going to make it a fintech, meaning we're not going to try and build all those machines. We're going to bring in the investments into our, these buckets of properties, and asset protected, investors have royalties from that, it's all good. But then we're going to delegate the building and maintaining to local water companies and who will love it.

Like, hey, great, I get the business right. So we're consciously giving that up. Why? Because you can't expand fast enough if you have to build everything. And furthermore, it's a barrier to entry. More and more people being served by our capital means that other capital can't enter in so easily, because.

For example, our partner Envirogen®, which is a wonderful partner there, they're UK based company, they're all over Europe and America. Well, they're in a partnership with us to deliver these systems. They're not going to start dealing with somebody else so easily. I mean, you can't you can't do the sort of multi-dating thing. It doesn't work well in business. You kind of build your relationships. So we're building a moat around Water on Demand, which is all these industry relationships.

Now, how do we scale Water on Demand itself? By creating more Water on Demand finance units in other financial capitals of the world through affiliation. Now, are we going to own Water on Demand Dubai? Well, we'll have an interest, but we'll do it with a partnership, right? So I believe strongly in not competing with your natural partners.

Jeremy: It's like collaboration over competition. It's in my industry, like there's certain businesses we're great to work with, there are certain businesses we're not a fit for. So there's another company in my industry, Interview Valet. Tom's a good friend of mine. He's a Navy veteran, good guy. We tend to send him the business. That's not a fit for us. It's collaboration over competition.

Riggs: Exactly. And what that does is it builds a web of strength, right? So the more you do that, the more you have this power because you've been willing to give up the like, oh, you're not going to try and take every penny. No, it's like, let's say that you are in the city of London, you're in finance. Well we'll do a deal with you, then all of a sudden we have a Water on Demand center serving serving northern Europe. Done, right?

And so that's, we see this as something, you know, there's a great book called Inside the Tornado. And one of the things it says is that when something enters the tornado of adoption, meaning everybody's got to have it, a single company will not be able to service it by definition, right? Because,Instant uptic.

Well, in that case, what it means is you've got to be willing to give up huge amounts of of real estate, shall we say. Right. In order to remain on top. And players like Oracle over the years, Microsoft, they've all shown how to do it well by letting other people have pieces of the pie. And I think that this applies to what we're doing.

So we're super excited. Originclear has been a 14 year public company. We've been trying to figure things out and moving beyond Water on Demand. We figured out, Hey, wait a minute, we're not so much trying to build some kind of conglomerate, which is the conventional way of thinking. Water companies like to just pile things on. And when you look at a water company, what the hell do they do? Well, they do everything.

No, that's not the way. What we're turning into is more of an ideal where we launch consecutive hot properties and we have five, Water on Demand is just the first. And so now we're turning into The Clean Water Innovation Hub, which is also super exciting.

`Jeremy: Well, I have like a whole page of notes here. I'm like, I've like at least three books I have to read now, so thanks for that. But you mentioned Peter. Peter Zeihan and and kind of the the opposite of Thomas Friedman. Thomas Friedman's Lexus and Olive Tree was like the book, like I was forced to read in high school. And it was it was interesting.

But like, you know, in kind of globalization and the theory of the Golden Arches and two countries that have McDonald's, they're not going to fight each other. Whoops. I guess now they have. So we're we're looking at it. And I think there's a couple of different things to look at.

You know, we look at the pandemic and what happened and how there was a disruption in commerce. Right. That was huge. Like we couldn't get certain things we look at right now, if you're trying to get a used car, microchip shortage is a huge problem. You look at last year when this I think it's the city of Las Vegas buys their power from the state of California. So if they have a disruption there, they have a problem.

So I think the thing that's interesting is moving to more of like a localized level like we're talking about here with Water on Demand for utilities. I think in a lot of ways it makes us more resilient. Is that correct?

Riggs: Oh, absolutely. You know, the original theory of the Internet was the it was built for atomic war. DARPA, the Defense Advanced Research Program, basically developed this idea of like, if a bomb falls on New York or whatever, that's okay. Because there's disconnected centers.

Well, the Internet turned into, frankly, if a bomb fell in New York, then the more much more than the Internet would fall apart. But the point is that it was built for survivability, and that's very smart. Now, this is why mainframes turned into PCs. It's classic why my PC is isn't working to its maximum at all, right?

But it's it's got the most important mission of all, which is it's available for me. It serves. So it's standing by. Hi. I'm here to help you. Whereas mainframes, I'm old enough to remember, you know, queuing up for time slots on a mainframe. Right. And you were serving the mainframe because the mainframe had to run at 100%. Well, that's a totally different game today.

And so you flip it around, you go, it's about who's trying to use the service or product. At that point, you start realizing, wait a minute, you know, I have to have instant availability. And there's tremendous gains, as you say, in security. Here's another major issue. You know, we've been warned by the WEF that we're going to have cyber attacks in the fall. Right.

Jeremy: Hold on. Hold on. You have to. Okay. You got it. You got it. "It's a cyber pandemic." Thanks, Klaus. I appreciate it.

Riggs: It is very bad. Worse than the cold years.

Jeremy: He reminds me of Goldmember from the Austin Powers movies. But anyway.

Riggs: Well, that is so true. But, you know, if you go back, Sergeant.

Jeremy: Oh, yeah, yeah. Yeah. From. From was the F troop the show? Was that Hogan's Heroes?

Riggs: Yeah, it was a couple. Hogan's Heroes. Yes. Oh, my God. And I don't know if you realize how much of a cartoon he is, but nonetheless, we've been told this cyber attacks coming that's potentially going to affect water. Right. And there's been attacks on water systems. They've been foiled. So there's actually been good, good track record there. But, you know, you don't ever defend perfectly. Right. The Israel, Israel's Iron Dome does not stop all missiles.

Jeremy: You remember the pipeline issue we had down the East Coast where nobody could get like gasoline for like a week? Like that's that's a huge problem.

Riggs: Precisely. So you have either pollution of the water or breaking the water supplies, all because of cyber issues. Again, if you have local self sufficiency, then you're by definition more sustainable. You're safer.

You know, what we're telling people is, look, there's three parts to your water process. One is the incoming water. Number two is treating the dirty water. Number three is reusing that water for more turns. Well, the incoming water generally, you take it from the city because it's available.

But, more and more people are going, well, wait a minute, I need to make sure I can get it. So maybe I'll have a a well, perhaps as a backup, right? Because I just need to make sure. So there's that the middle part, which is the wastewater treatment, which people forget has to happen. I can't tell you how many people say Riggs, "The water, water must be free." I'm like, yeah, but you'd like it should be clean, right?

Jeremy: That costs something.

Riggs: Right? So, let's, you can have all the water you want, but I assume you want it to be free of toxins. Just sayin.

Jeremy: I drank some water when I was in Peru a couple of years ago and it took me two years to get the the the creatures out of my system. So water should be clean.

Riggs: And American water generally is not going to kill you right away. In other words, you can drink tap water, but over time it's bad. But putting those minor issues aside, the fact is that water treatment is critical. And whereas in the US we treat most of it, places like Bangladesh don't treat any of it. Even as close as Mexico there's terrible practices. Why? Because of lack of enforcement.

And so worldwide we have a big water treatment problem and finally reuse. You know, Israel, as I said, is almost 90% recycling. The next one down is Spain with 20%. So the most of the world is not recycling water. The US is at 1%. So we're talking about tremendous amount of wastage going on and I thought it was our most precious commodity.

Jeremy: Yeah.

Riggs: Hello. Right. The problem with water is it's too cheap. So water I can let my shower run. Who cares? Right, because whatever. Well, that stuff adds up. Now, we don't work in the single family space. Why? Because that's a mass market. We work with housing communities, with businesses, though, with agriculture, you know.

All those users we, you know, for example, showed we could do wonderful things. You've been hearing about those problems with the nitrogen and the ammonia and the agriculture in Holland and so forth. Well, actually, we showed that we could neutralize that with our electrolysis system in Spain, where they have hog farms. So all kinds of good things can be done if you put some value on it.

And the value is created by recognizing that water rates are skyrocketing, water is getting more and more expensive, and a businessman goes, wait a minute, I'm going to put a cap on those water rate increases by going into a contract. And I'm going to receive the water as a service. And if Water on Demand does not give me the water quality I need, I don't pay. And that's a beautiful thing.

Jeremy: Well, Riggs, this has been an awesome conversation. I always enjoy our conversations because you tend to see a future that's not there yet and plan for it which which I really like. So for people listening, if they want to connect with you, if they're interested in finding out more information about the company, how is going to be the best way for our listeners to go out there and find you?

Riggs: I think this Thursday is our 173rd weekly Zoom briefing that I do every week, Thursday nights, 5 p.m. Pacific, 8 p.m. Eastern and just put in your browser oc.gold/ceo or just go to originclear.com and it'll pop up an invitation. Join me on that briefing. If you don't have the time, we'll send you a replay.

But we tell you like it is every single week what's happening in the water industry, what's happening with people's lives, the company, where things are going. It's generally fascinating and we really think that's a great way to get to know the company. If you want to invest, there's a little green button on originclear.com. And I can tell you this, this is sort of a sort of a scoop. That we are planning an unaccredited offering for the fall where anybody can invest. Because there's one thing I hate is that only the 1% can invest in a promising new start ups and we're changing.

Jeremy: Very cool. Well, Riggs Eckelberry from OriginClear. Thank you so much for hanging out with me today, man.

Riggs: Jeremy, it's a great pleasure. Thank you.

End of video presentation

That was very enjoyable. Got a great podcast. So as you can tell, he had a lot of things to talk about and it's always very stimulating. You notice the difference between this sort of somewhat official thing that I did with the gentleman, with the New York background and then with Jeremy. It's kind of different, right? Kind of fun that way. So we like to mix it up.

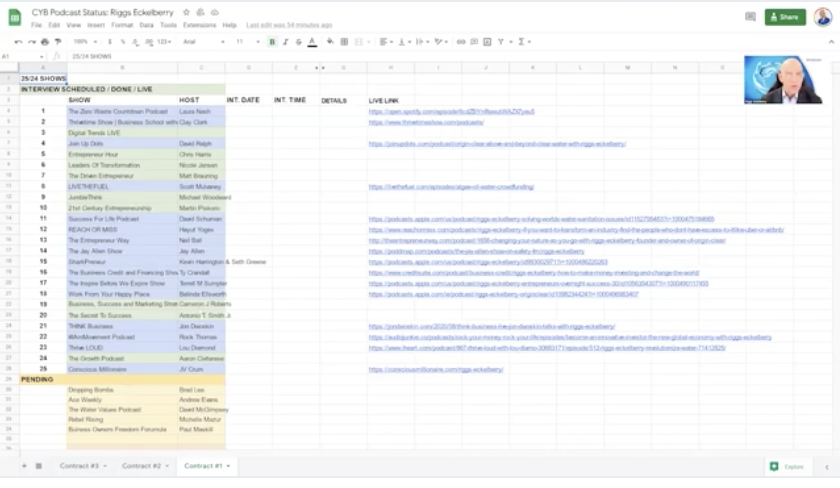

2020

So with that, I'm going to actually give you a sneak peek at the Command Your Brand roster directly online because that kind of thing is fun to show. So here was contract number one, which started in 2020 and zero Waste Countdown podcast Live, The Fuel. There was some great, great show SharkPreneur with Kevin Harrington, Seth Green, Think Business, Thrive Loud was excellent Conscious Millionaire, JV Crum, great guy, etc.

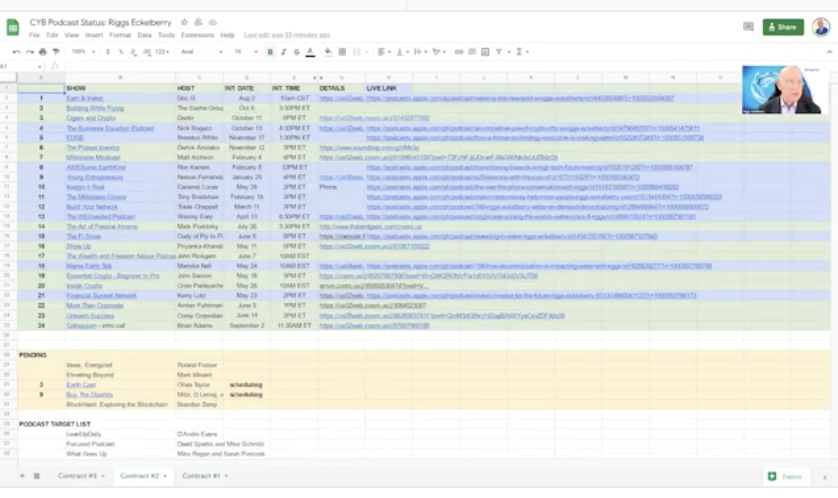

2021

And then the second year which just wrapped up. Much more crypto stuff because of course that got interesting but Millionaire Mindcast, Millionaire Choice, basically, Financial Survival, some great shows. Also the last one is actually showing on September 2nd.

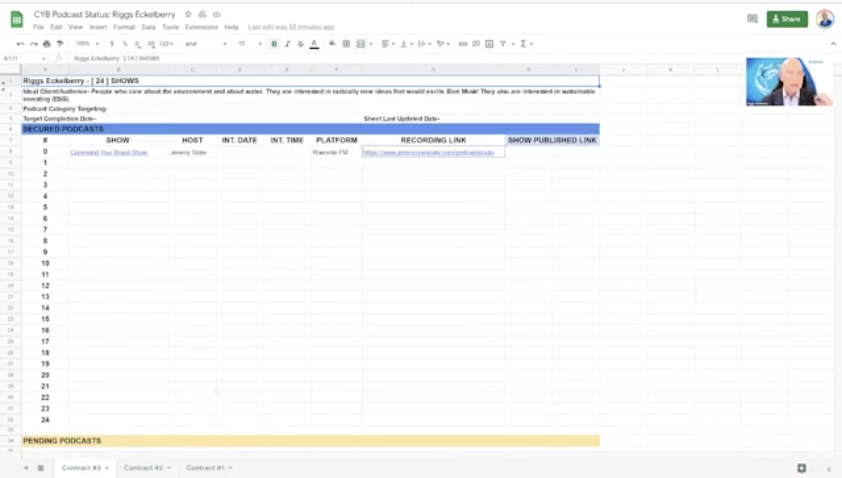

2022

So now what we've done is we've signed contract number three right here. It just started with that first show. This is 24 in six months. So we're accelerating it. And I think it's going to have a tremendous impact. And frankly, these are a bargain. So very pleased to be working with Command Your Brand to get our story out there.

Next Week

All right. Now we are out of time. Next week, we're going to cover the big problem of forever chemicals. Forget rainwater and other real problems. Our quarterly numbers are coming out next week. We're excited. We can't say more than that because I don't want to condition the market, as they say.

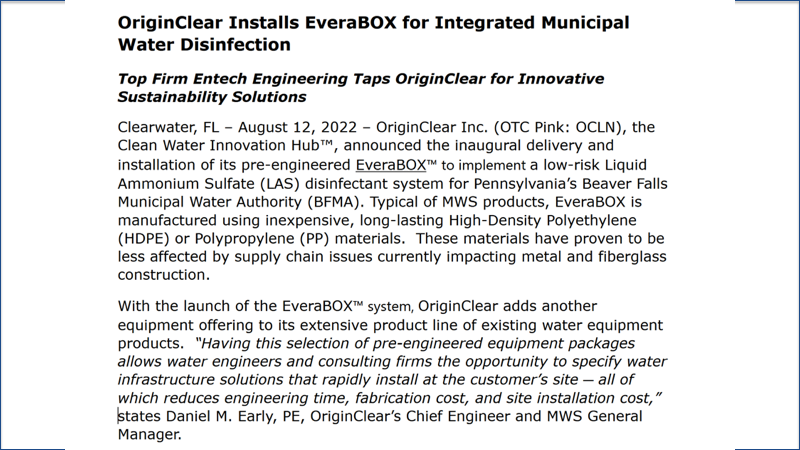

EveraBOX Announcement

Also, we have the EveraBOX™ release that's going out in the morning, sneak peek here where this is actually going out pre market tomorrow where we worked with a municipality to assist with disinfection for recycling of water, but cleaning of water in general and the average box product is just a great, again, Water System in a Box™ that we'll tell you more about.

Open Discussion

Okay. So I'm now going to tell Mr. Ken Berenger to come on and we have some comments also. So, really fast here. I'm just going to cover Marcus Walker has a question.

Ken: Yes, Marcus Marcus, I believe we got a phone call from you earlier. My staff, I think, has returned your call and we'll return it tomorrow. But if you have a question, please type it into the chat.

Riggs: Meanwhile, just scrolling back here, Paul Fetscher, "Greetings from the right coast." Yeah, meaning Long Beach.

Ken: Long Beach.

Riggs: Looong Beach. And James Wright, "I grew up in Bergen. Bergen County, New Jersey. How about that?" Candice wants to know how we invest. You've already given the information there. And then Paul Fetscher, of course, told us all about Hogan's Heroes, produced by the same guy. I didn't know this, Alan Ruddy, who did The Godfather, and he recommended the movie called "The Offer" on Paramount. The name of Jeremy's podcast is, of course, Command Your Brand if you go to Facebook. In fact, what I'll do is go ahead and pull up the Facebook Command Your Brand.

Ken: In the meantime, while you're doing that, Jeremy, you and I have joked about this. You know how people are talking about water now. And I was, I said we've been jumping up and down now. Frustrating. It's validating, but it's also a little frustrating because you're like, my God, you know, it took you guys so long. The fact that we were at the, at the cusp of it, at the head of it, is gratifying.

Riggs: Totally true. Anyway, you can go to Command Your Brand on Facebook, Facebook.com/commandyourbrand and you can see some of the cool shows that they have. There's one where I showed up on the FIShow. You guys saw that earlier on. They do just really great interviews and Jeremy is a great interviewer.

Call Ken

Ken: Marc, I want to answer Marc's question, he finally got it in. Marc, you can book a call with my staff, so, "How can I purchase stock? How can I invest in the company?" There's three ways to do it. If you're an unaccredited investor, you can purchase stock in the market. We will have an unaccredited offering available hopefully very soon. But you can we're going to hopefully have a reservation page put together for that soon. If you're an accredited investor, then I can break down the details of our current our current accredited offering by going to oc.gold/ken and you'll get on with my staff and they'll get you on my calendar.

Riggs: Fantastic. Well, we're out of time. I like to try and keep it under an hour, and we're literally up to it.

Ken: Barely right?

Thank You

Riggs: Yeah, yeah, right. But it's chock full of good stuff. More next week. Believe me, it's going to be well worth listening to. Q2 has been just very, very, the company is really firing on all cylinders. And it's a pleasure to see. And I've got one more chat. Marcus Walker again. You ask how to purchase stock so you know that.

Paul Fetscher, "The Long Beach without the symphony orchestra." You guys are the best. Thank you all for being on board tonight. It's been such a pleasure. Do show up next week. I think you're going to have a whole lot of fun and have a good night, everyone. Always a pleasure.

Stay cool, calm and collected and remember, water is what matters in this world. And Don Gauden says, "Thank you. Where are you?" Well, I am in Clearwater, Florida. Ken Berenger is near Pittsburgh. The company is based in Clearwater, Florida. With that, I'm going to bid you a good night.

Ken: Goodnight.

Riggs: Enjoy the weekend.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)